The Moment Everything Changed: Open AI Brings Ads to Chat GPT

It happened quietly at first. A blog post. A product test rolling out to some users. But the moment Open AI announced it would start showing ads in Chat GPT, the entire conversation around AI shifted. This wasn't just another feature update or pricing tweak. This was the moment the world's most popular AI assistant became, officially, a commercial product in the truest sense.

For years, Open AI had positioned itself as the scrappy underdog. Chat GPT was free. Revolutionary. A tool that suddenly put powerful AI in everyone's hands. But free products don't scale forever. They don't pay server costs. They don't fund the next generation of models. And Open AI, despite its massive valuations and corporate backing, needed a new revenue stream.

So they built one. And they did it knowing full well the backlash was coming.

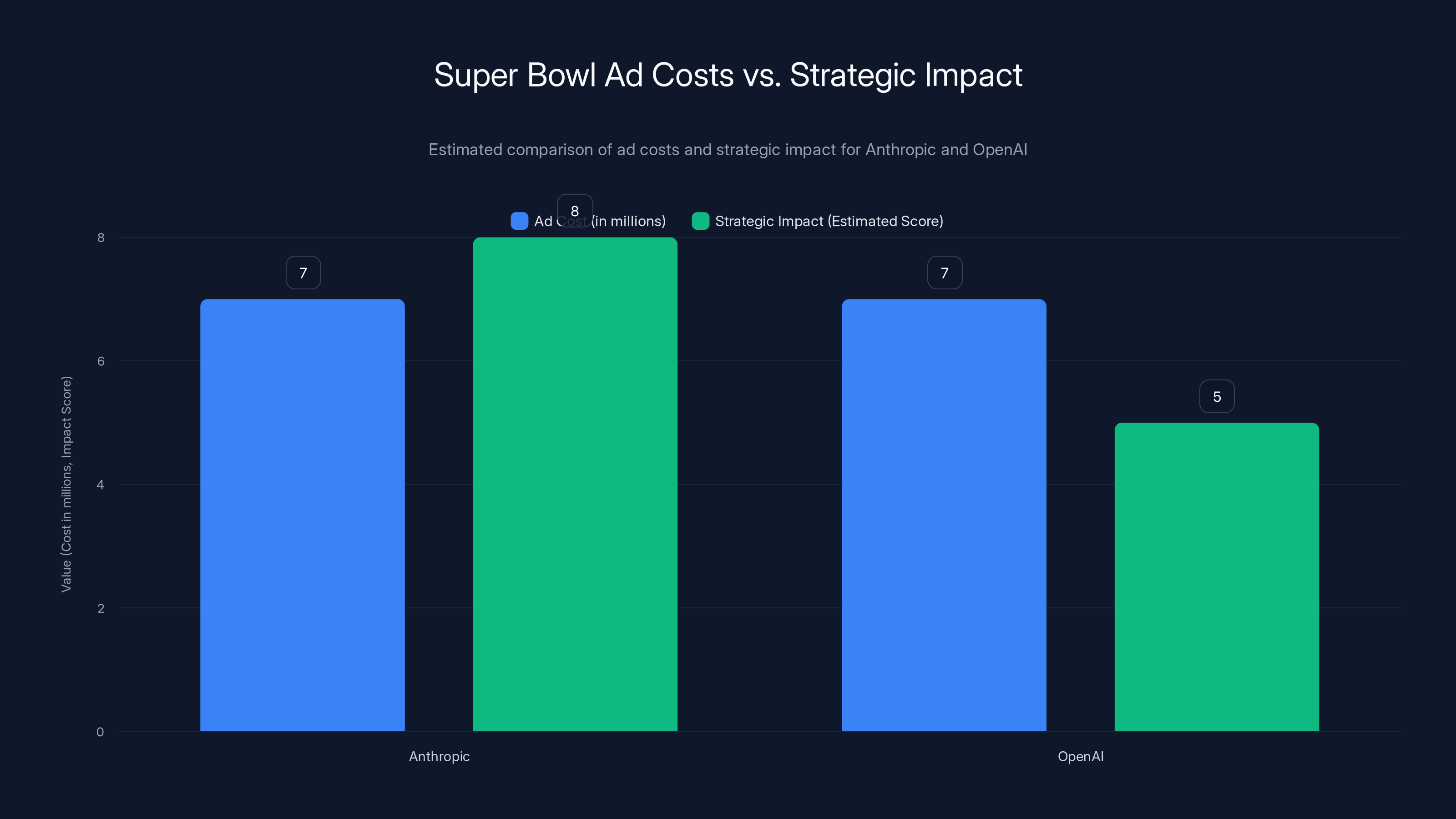

Within days, Anthropic, Open AI's fiercest competitor, launched a Super Bowl ad mocking the decision. During America's biggest advertising event, Anthropic essentially said: "We won't put ads in Claude." The message was simple but devastating. While Open AI was chasing ad dollars, Anthropic was positioning itself as the principled alternative. It was a masterclass in competitive timing.

But here's what matters: this isn't really a story about ads. It's a story about how artificial intelligence companies monetize at scale, how consumer expectations collide with business reality, and what happens when the product everyone thought was revolutionary starts looking like every other tech platform.

Let's unpack what's actually happening with Chat GPT's ads, why it matters more than you think, and what it tells us about where AI is headed.

Understanding Open AI's Ad Strategy: The Official Plan

Open AI wasn't secretive about this. The company laid out the approach clearly in a blog post: ads would appear in Chat GPT for users on free and Go plans in the United States. These aren't random advertisements. They're "relevant to the current conversations of logged-in users," which is corporate-speak for something more intrusive: personalized ads based on what you're talking about.

Imagine you're asking Chat GPT how to plan a wedding. Suddenly, you see ads for wedding vendors. You're researching laptop specifications. Ads appear for electronics retailers. This isn't accidental—it's precision targeting applied to conversational AI.

The ads appear below the chat conversation, clearly labeled and separated from Chat GPT's actual responses. Open AI claims they won't influence what the AI says. They won't appear during sensitive conversations about health, mental health, or politics. Users under 18 won't see them during testing. And here's what might matter most to privacy-conscious users: Open AI says it won't sell your conversation data to advertisers.

That last point deserves scrutiny though. Open AI isn't selling data. But it's still using data. It's analyzing what you're saying, categorizing your interests, building a profile of what ads might work on you. The fact that third parties aren't getting the raw conversations doesn't mean they're not getting the insights extracted from those conversations. This is the distinction between data sales and data exploitation—both happen, they're just different flavors of the same monetization game.

The company's framing is carefully chosen: "Our goal is for ads to support broader access to more powerful Chat GPT features." Translation: ads pay for free access to Chat GPT. You get a tool. Advertisers get your attention. Open AI gets paid from both sides. This is the ad-supported internet model that built Google, Facebook, and Twitter. Now it's coming to AI.

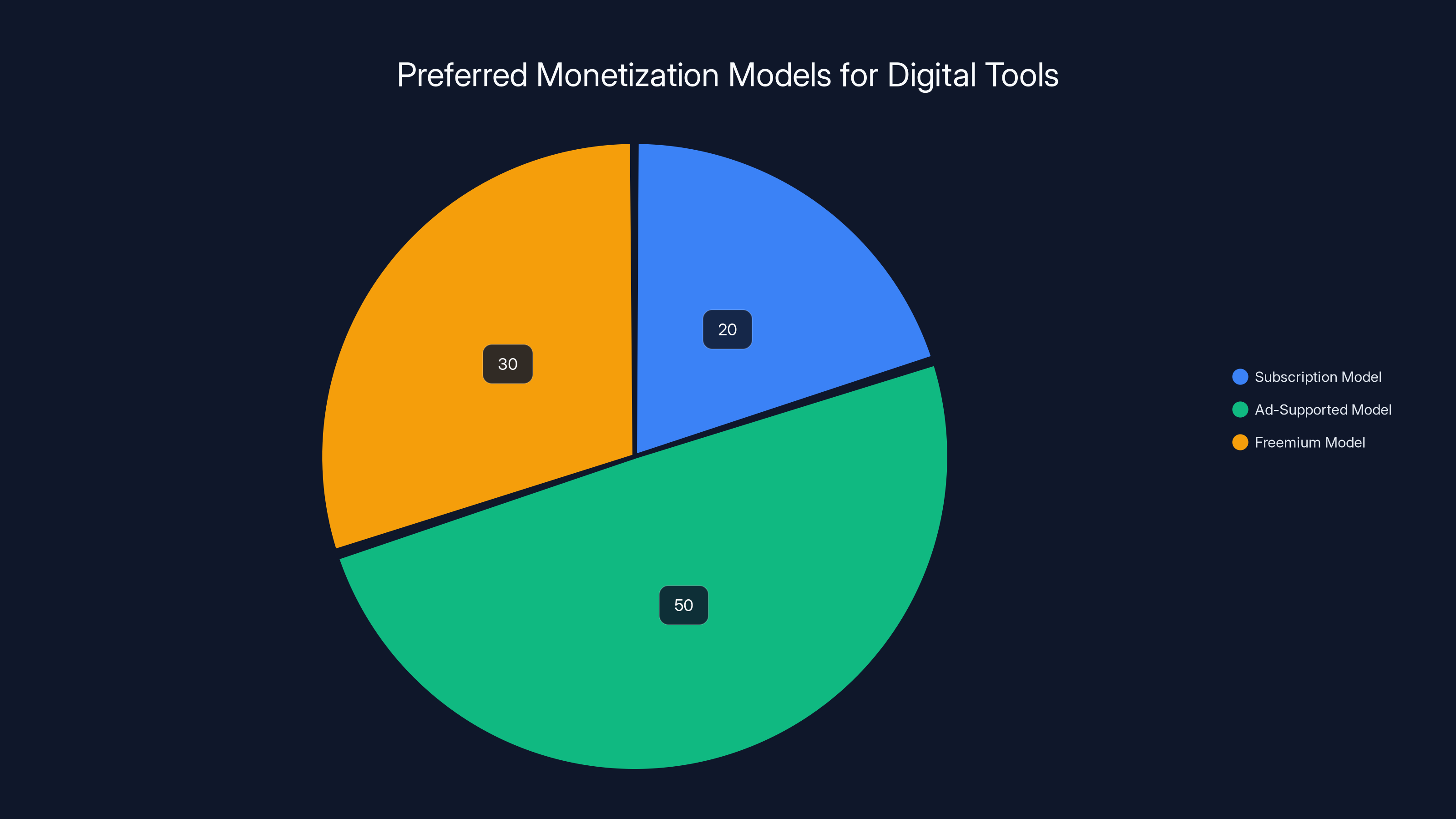

Estimated data suggests that consumers prefer ad-supported models (50%) over subscription (20%) and freemium models (30%) for digital tools.

The Business Reality: Why Open AI Needs This Revenue

Let's talk about the elephant in the room: Open AI is hemorrhaging money. Not in a "startup going through normal scaling" way, but in a "we're burning cash to provide a service" way that makes investors nervous.

Running Chat GPT costs millions per month. Every conversation, every query, every API call requires computational resources. The models aren't free to run. The infrastructure isn't free. The talent building new features isn't cheap. And while Open AI has raised over $10 billion in funding and maintains a multi-billion dollar valuation, venture money only goes so far before investors start asking uncomfortable questions about profitability.

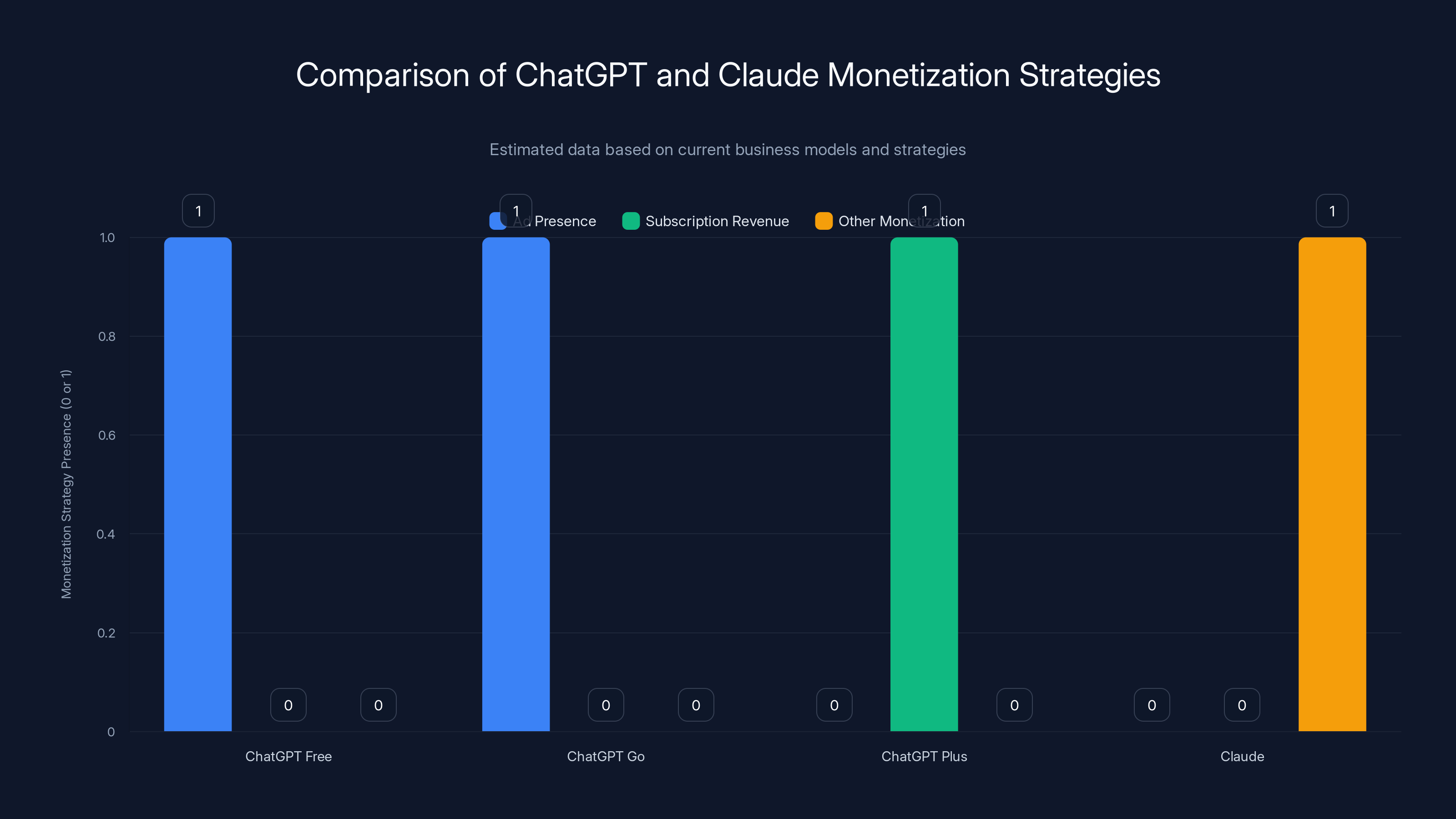

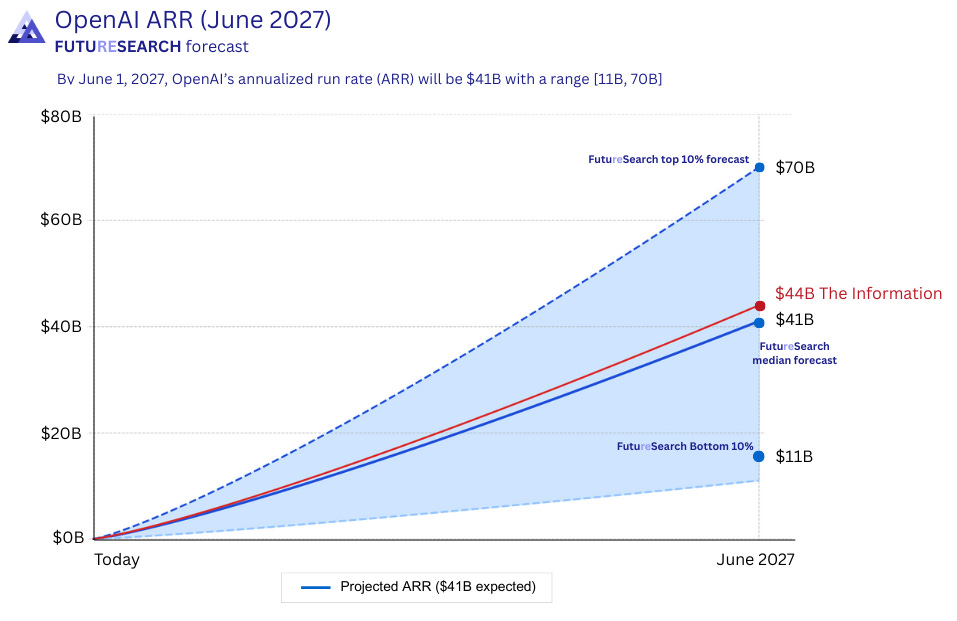

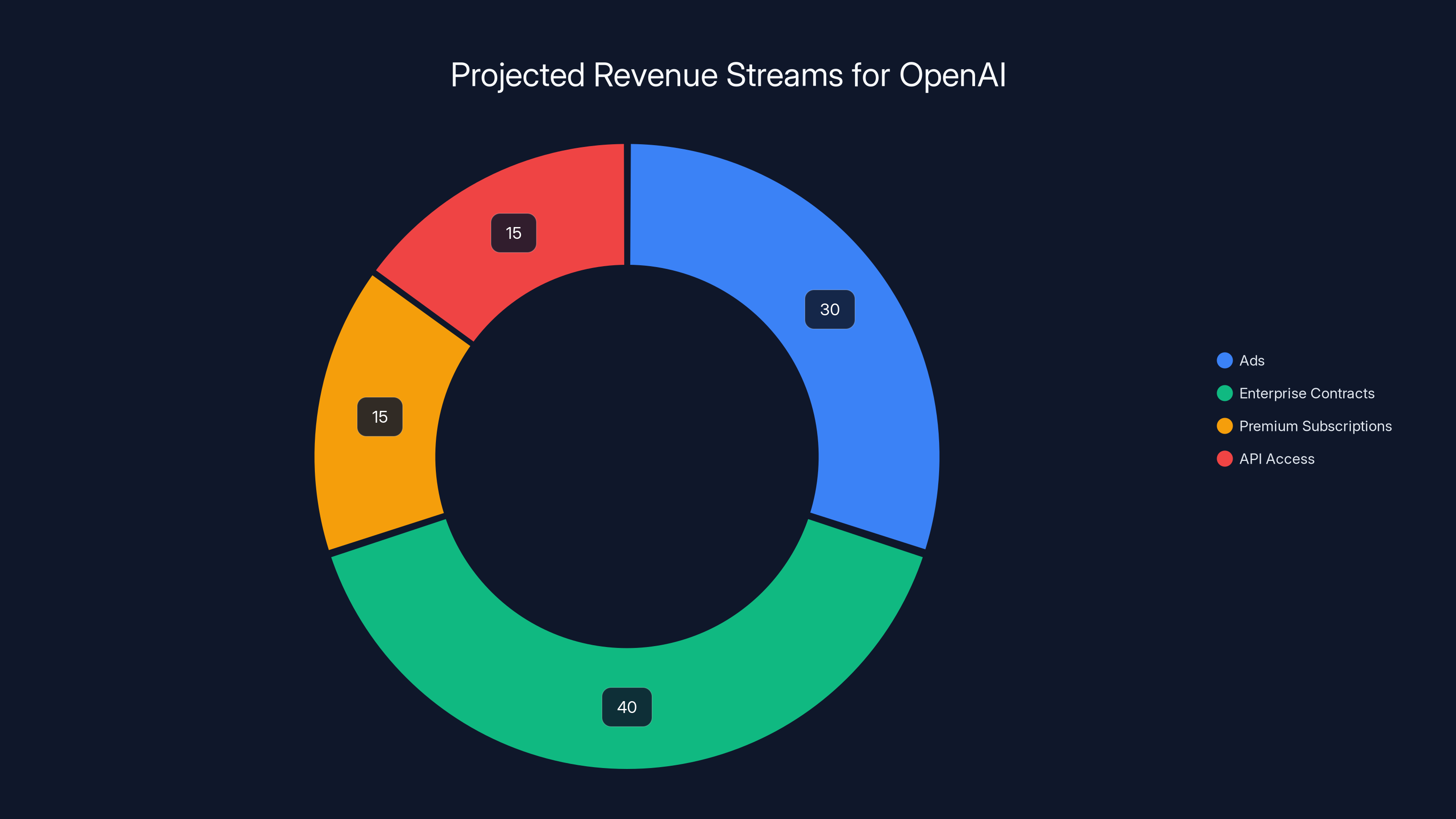

Currently, Open AI has a few revenue streams. Chat GPT Plus, the $20/month subscription, brings in money from users willing to pay. The API business, where developers integrate Chat GPT into their applications, generates revenue based on usage. And now, ads fill what some analysts estimate could be a significant gap.

Here's the math Open AI is likely doing: Chat GPT has over 200 million monthly active users. Even if only a fraction of them see ads, and even if each ad impression generates modest revenue, the scale is enormous. Traditional digital advertising makes pennies per thousand impressions—typically between

A source close to Open AI told industry reporters that the company expects ads to represent less than half of its long-term revenue. That's a telling statement. It means ads aren't the master plan. They're one tool among many. The real revenue, presumably, comes from enterprise contracts, premium subscriptions, and API access. But ads are the mechanism to capture casual users who won't pay for Chat GPT Plus but do generate valuable engagement metrics.

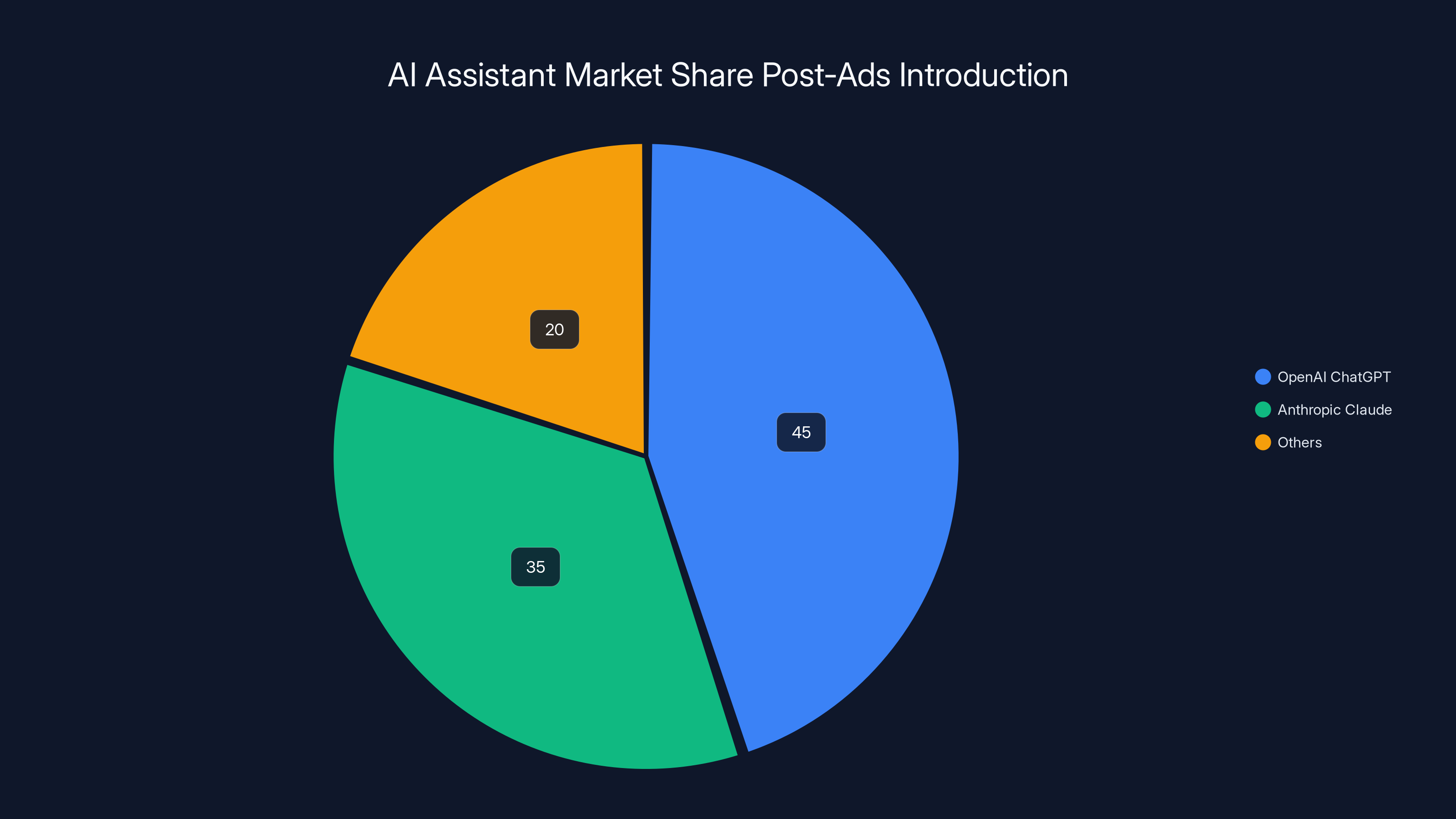

ChatGPT Free and Go plans include ads, while Plus is ad-free with subscription revenue. Claude remains ad-free, potentially focusing on other monetization strategies. Estimated data based on current business models.

The Anthropic Counter-Punch: When Super Bowl Ads Attack Ads

Let's rewind to the Super Bowl. Millions of Americans gather to watch football and advertisements that cost $7 million per thirty seconds. In that expensive arena, Anthropic bought time to tell the world something surprising: we're not putting ads in Claude.

It's a brilliant move for several reasons, and understanding them reveals a lot about where the AI market is heading.

First, the timing. Anthropic released this ad right as Open AI was rolling out its ad tests. The message hit when it would sting the most. Every tech journalist, every AI enthusiast, every casual observer would instantly connect the dots. Here were two companies. One was monetizing aggressively. One was promising not to. The choice seemed obvious to many observers.

Second, the positioning. Anthropic didn't say "Our ads are better." They said "We don't have ads." It's a purity play. A bet that in an increasingly ad-saturated digital world, users will seek out platforms that don't interrupt them. It's also somewhat misleading—Claude will eventually need revenue too. But that's not the current message.

Third, the competitive intelligence. Anthropic was watching Open AI's move before it happened. They had time to film, produce, and book Super Bowl spots. That suggests they saw this coming and planned the counter-narrative in advance. This wasn't reactive. It was premeditated strategic positioning.

The genius here is that Anthropic doesn't have to stick with this promise forever. They're not locked in. But right now, it's a powerful differentiator. In the short term, Claude becomes the "ad-free" option. Developers and companies that want to avoid tracking and personalized advertising might migrate. Free users frustrated with Chat GPT's new ad experience might try Claude instead.

For Open AI, the timing was terrible. They executed the ad launch right into a scheduled competitive attack. It's like announcing a price increase the same week your competitor drops their price. You're handing them the narrative.

Privacy Implications: What Open AI Says vs. What Actually Happens

Open AI made promises about privacy. They said conversations won't be shared with advertisers. They said users can disable personalization. They said you can clear data used for ads. These are nice statements. But let's look at what actually happens when ads get introduced to a platform with billions of interactions.

First, the basic mechanics. To show you a relevant ad, Open AI needs to understand what you're talking about. This requires analyzing your conversation. The system reads your prompts, understands context, categorizes your interests, and triggers appropriate ads. This isn't passive surveillance—it's active analysis of private conversations.

Now, here's where it gets complicated. Open AI promises not to share data with advertisers. But they're clearly sharing something. Otherwise, how would an advertiser know to show you an ad at the right moment? The answer is that Open AI is acting as the intermediary. You talk to Chat GPT. Chat GPT analyzes you. Open AI shows ads. The advertiser doesn't get your data, but they get the benefit of your data through the ads Open AI selects for you.

Second, consider what "disabling personalization" actually means. If you turn off personalized ads, you get non-personalized ads instead. You're not avoiding ads—you're just getting worse ads. In the advertising ecosystem, this is known as "contextual" advertising instead of "behavioral" advertising. Both involve showing you ads you might click on. One just uses your conversation directly. The other... also uses your conversation, just slightly less granularly.

Third, the regulatory angle. Various governments are tightening AI regulations. The EU's AI Act, for instance, has provisions about transparency and user rights. By implementing privacy controls and being transparent about how ads work, Open AI is building a fortress against regulatory criticism. They can point to their safeguards and say, "Look, we care about privacy." Whether the safeguards are effective is a separate question.

The real privacy concern isn't what Open AI does with your data. It's what gets stored in the first place. Every conversation with Chat GPT, if you're logged in, is now being analyzed for ad relevance. That data sits somewhere. It's indexed. It's categorized. And if there's one thing we've learned from tech history, it's that data kept for one purpose often gets used for other purposes down the line.

Estimated data suggests ads will account for less than half of OpenAI's revenue, with enterprise contracts expected to be the largest source.

The Monetization Treadmill: Subscription Fatigue and the Ad Alternative

Here's something worth thinking about: what would happen if Open AI tried to make Chat GPT paid-only?

Everyone would switch to a free alternative. Claude. Gemini. Perplexity. Or they'd just use the free tier of Chat GPT with its rate limits. The market has spoken repeatedly on this—consumers hate paying for digital tools they've gotten used to for free.

So companies face a choice. Charge everyone a subscription and watch usage crater. Or monetize with ads and keep the free users. The math usually points to ads.

But here's the problem with the subscription model for AI: it doesn't match how people use the product. With Chat GPT, there's no one-time transaction. There's no clear moment when you've paid for your "usage." A power user and a casual user might pay the same $20/month. One gets incredible value. The other barely breaks even. The pricing friction is high.

Ads sidestep this problem. Every time you use Chat GPT, you might see ads. Every ad impression generates a tiny amount of revenue. Heavy users see more ads, generating more revenue. Light users see fewer ads. The monetization distributes more smoothly across the user base.

This is why Google works. This is why You Tube (despite Premium) still runs ads to most users. The ad model scales with usage. It's invisible friction. Users don't think about how much they're "paying" because they're not writing a check. They're just seeing ads.

Of course, this has downsides. Ads incentivize keeping you on the platform longer. They incentivize showing you more content. They incentivize engagement metrics over actual product quality. You Tube's algorithm famously promotes outrage because angry people watch longer. Would Chat GPT's algorithm start promoting certain types of responses because advertisers prefer them? That's the question haunting the ad-supported future.

The User Experience Shift: From Revolutionary to Ordinary

There's a moment in every tech product's lifecycle when it stops being revolutionary and becomes ordinary. Chat GPT just had that moment.

When Chat GPT launched, it was genuinely new. It did something no consumer product had done before. It was free and powerful. The experience was clean. You opened it, asked a question, got an answer. No ads. No interruptions. No email collection. Just utility.

That's different now. Now there are ads. Now there's personalization happening in the background. Now the interface is more crowded, more optimized, more like every other digital platform you use.

This isn't necessarily bad from a business perspective. It's realistic. Every successful consumer product eventually needs to monetize. But from a user perspective, it's a shift from "revolutionary" to "standard." Chat GPT is becoming more like Google. Less like a discovery. More like an expected utility.

The experience of using Chat GPT with ads is fragmentary. Your conversation is interrupted at the bottom by unrelated commercial messages. The cognitive load increases. You're not just processing information from the AI anymore. You're processing ads too. That's not a massive friction point—we tolerate far worse on most websites—but it's a shift.

Power users will migrate to Chat GPT Plus or other paid/premium solutions. Free users will tolerate ads because the alternative is paying money. But there's a middle ground of users who might have used Chat GPT casually and now feel frustrated by the ad experience. Some might switch to Claude. Some might just use Chat GPT less.

Open AI is banking on the idea that most users will stay and tolerate ads. They're probably right. But they're also crossing a line in user experience that, once crossed, is hard to reverse.

Anthropic's ad strategy at the Super Bowl, costing $7 million, had a higher strategic impact compared to OpenAI's approach, as it capitalized on the timing and positioning of their message. Estimated data for strategic impact.

Regulatory Scrutiny: When Ads Meet AI Regulation

As Open AI rolled out ads, regulators were paying attention. Not just because of the ads themselves, but because of what ads in AI systems represent.

The EU's AI Act treats AI systems that process personal data differently than systems that don't. By introducing ads that depend on analyzing conversations, Open AI has moved Chat GPT into a different regulatory category. Suddenly, there are requirements around transparency, user consent, and data protection.

The FTC in the US has been increasingly scrutinizing big tech companies' data practices. The question of whether Open AI is sharing conversation data with advertisers (even indirectly) will eventually attract attention. If regulators determine that analyzing conversations for ads is a form of behavioral advertising, new rules might apply.

There's also the question of children. Open AI says users under 18 won't see ads during testing. But at some point, if ads become permanent, what's the policy for minors? In Europe, GDPR has strict rules about children's data. In the US, COPPA (Children's Online Privacy Protection Act) restricts how companies collect and use children's data. If Chat GPT becomes popular with teenagers (which it has), these regulations become real concerns.

Open AI is being careful here. They're rolling out ads gradually, in specific regions, with stated protections. This gives them room to adjust if regulators push back. But the broader principle is settled: when AI systems monetize through ads, they enter a different regulatory universe.

The Competitive Landscape: Who Else Is Monetizing?

Open AI isn't the only player thinking about ads. The entire AI industry is figuring out how to make money.

Google has integrated ads directly into Gemini, their AI assistant. But Google already has an advertising business with massive scale, so the move was natural. They're trying to capture search query monetization through AI responses instead of traditional search results.

Microsoft, through its investment in Open AI and integration with Copilot, is also exploring ad opportunities. They have Bing, which already runs ads, so integrating ads into Copilot makes sense from a business perspective.

Anthropic's Claude is currently ad-free, but that's a positioning choice, not a permanent stance. At some point, Claude will need to monetize. Whether it's through ads, subscriptions, API pricing, or enterprise contracts remains to be seen. For now, the "ad-free" positioning is valuable, and Anthropic is smart to maintain it.

Other players like Perplexity, Hugging Face, and open-source models are also figuring out revenue. Perplexity has experimented with pro versions and API pricing. Hugging Face has a hub for sharing models with monetization options. Open-source models avoid the monetization question entirely by letting users run the model themselves.

The broader trend is clear: every AI company needs revenue. The shape of that revenue varies. But ads are becoming a standard option because they work at scale.

Estimated data suggests OpenAI's market share remains strong at 45% despite ad integration, while Anthropic captures 35% by positioning as an ad-free alternative.

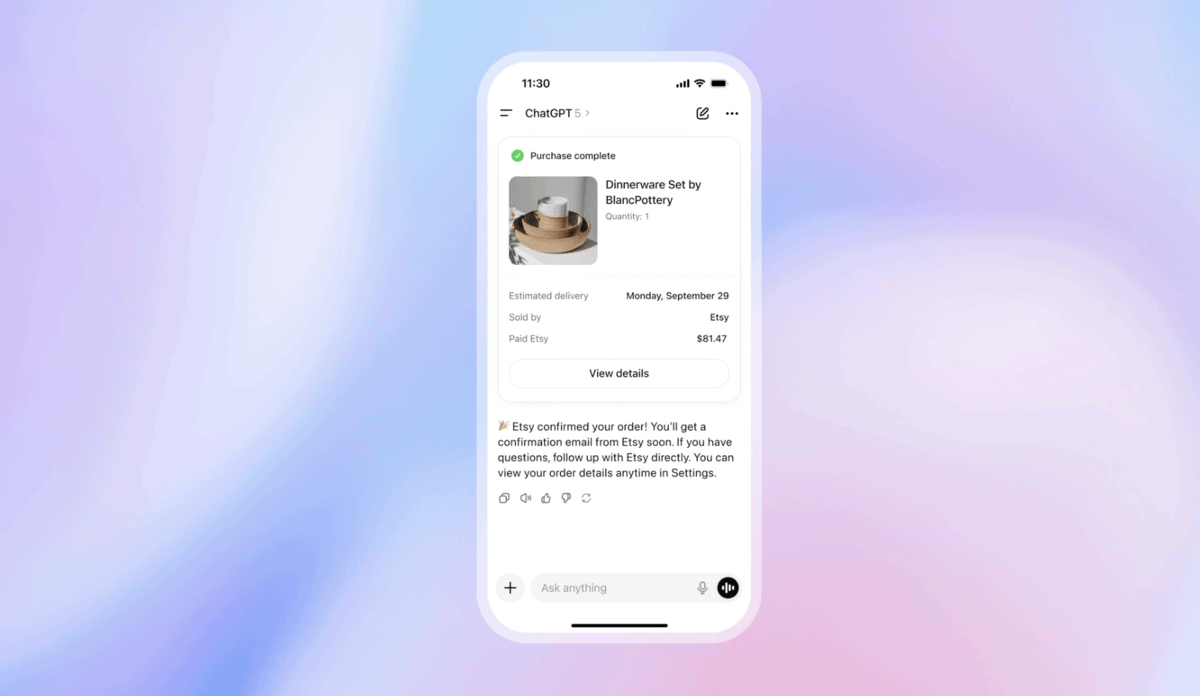

The Chat-to-Commerce Connection: Shopping Integration and Beyond

Here's something Open AI quietly mentioned that deserves more attention: the company already takes a cut from items bought through Chat GPT's shopping integration.

This is huge. It means Chat GPT isn't just showing ads. It's also acting as a commerce platform. When you ask Chat GPT for a product recommendation and then buy it through the integrated link, Open AI gets a commission. This is affiliate revenue, which is distinct from advertising revenue.

Think about the implications. Chat GPT can now:

- Recommend products to you

- Include shopping links that generate commissions

- Show ads for related products

- Potentially optimize recommendations based on advertiser preferences

The last point is crucial. In an affiliate model, there's an inherent conflict of interest. What if the AI recommends a product not because it's the best option, but because it generates the highest commission? Open AI says this doesn't happen, but the incentive structure is now in place.

This is why testing and gradual rollout matter. Open AI needs to prove that recommendations remain unbiased even as financial incentives are added. If users discover that Chat GPT's recommendations are driven by commissions rather than quality, trust collapses immediately.

The shopping integration also represents a broader shift: Chat GPT is becoming a platform, not just a tool. It's moving toward being a full-stack digital experience where you ask questions, get answers, see ads, discover products, and buy things. All within one interface.

The Model Training Question: Using Conversation Data for Improvement

Here's a question Open AI hasn't fully addressed: will conversation data from the ad-monetized version of Chat GPT be used to train future models?

Historically, Open AI has used some Chat GPT conversations to improve the model (with opt-out options). If that continues with the ad-supported version, it means your conversations are being used in three ways:

- To show you relevant ads

- To improve the AI model

- To create a personal data profile

That's a stacked value extraction process. You're providing free labor (your conversations) that's monetized in multiple directions. This isn't unique to Open AI—it's how most AI companies work—but it deserves acknowledgment.

The alternative would be to segregate conversations used for ads from conversations used for training. But that would reduce the utility of both. An AI trained on fewer conversations is worse. Ads shown without behavioral data are less relevant.

So there's a fundamental tension: better products require data. Monetizing data requires analysis. Analysis creates privacy concerns. Users tolerate it because the product is free. But as ads get more intrusive and data collection gets more intensive, that tolerance has limits.

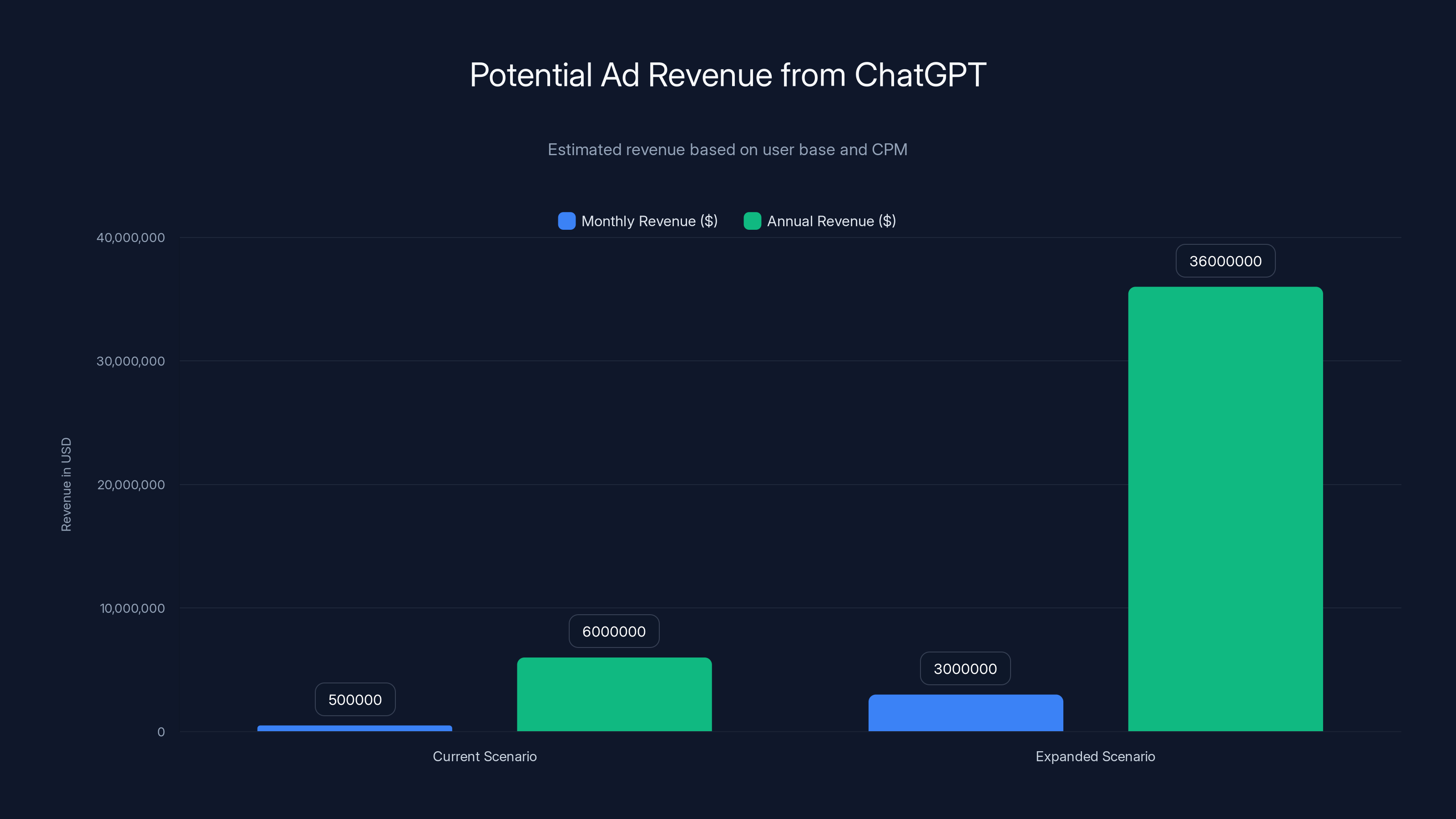

Estimated data shows that expanding ad reach could increase annual revenue from

The Global Rollout Question: Different Rules, Different Approaches

Open AI started ads in the US, but the question of international expansion is already being asked. Different regions have very different rules about ads and data.

Europe is the strictest. The GDPR gives users rights to know how their data is being used, to object to processing, and to delete their data. The Digital Markets Act, passed recently, has additional rules about how large platforms handle user data. If Open AI wants to roll out ads in Europe, they'll need to clear higher regulatory hurdles.

China doesn't really have a market for Chat GPT due to Great Firewall restrictions, but other countries in Asia do. India has growing digital advertising markets. Brazil and Latin America are emerging markets for tech. Each region will have different appetite for ads and different regulatory frameworks to navigate.

This isn't just compliance overhead. It's also a market segmentation strategy. Open AI could offer different experiences in different regions. Stricter privacy in Europe, more aggressive monetization in less-regulated markets. This happens constantly in tech, and it's often invisible to users.

The Long-Term Vision: What Happens to Chat GPT?

If you squint and look ahead five years, what does Chat GPT become?

Most likely, it becomes a hub. A place where you interact with AI, discover products, make purchases, and consume content. The ads are just the beginning. Over time, Open AI will probably add more commercial features. Maybe sponsored results that appear higher in responses. Maybe premium products that appear as recommendations. Maybe AI-generated ads that blend seamlessly into responses (the most dystopian scenario).

Open AI's leadership has always been ambitious. Sam Altman talks about building AGI (artificial general intelligence). But before you get there, you need to build a sustainable business. The ad play is part of that sustainability vision. It's not the whole picture, but it's a crucial piece.

The company is also betting on enterprise adoption. Most of Chat GPT's future value probably comes from businesses using it, not consumers. But consumer versions fund the R&D and create network effects that attract enterprise. So the ad-supported free version serves a purpose beyond direct monetization. It's a distribution channel for future enterprise products.

The Anthropic Counter-Model: Can "No Ads" Stay True?

Anthropic is making a bet that Claude can succeed without ads. It's an interesting bet because it's the opposite of the industry trend. But it has internal logic.

Anthropopic is funded by major institutions like Google, Amazon, and others who can afford to subsidize the company while it builds value through API access and enterprise contracts. They don't need ads right now. They can afford to build goodwill and trust by maintaining a cleaner product.

But eventually, Anthropic will face the same question Open AI did: how do we monetize free users at scale? Their answer might be:

- Don't. Focus on paid products (API, Claude Plus, enterprise).

- Subscriptions. Move more users to Claude Pro or Claude Teams.

- Affiliate/commerce. Like Open AI, take cuts from shopping.

- Data licensing. Sell access to Claude's capabilities to researchers and companies.

The most likely scenario is a combination. Anthropic probably never puts ads in Claude's free tier. That would contradict their positioning. But they might introduce other monetization methods that are less visible and less intrusive than ads.

This matters because Anthropic is proving a different model is possible. You can build a successful AI company without aggressive ad monetization. It requires different funding sources and different growth assumptions, but it's viable. This creates competitive pressure on Open AI. If users flock to Claude because it doesn't have ads, Open AI's ad strategy backfires.

The User Choice Angle: Why Some Will Stay, Why Others Will Leave

Open AI is making a bet on user inertia. They're assuming that most users, even with ads, will stay on Chat GPT because it's where they already are. Switching costs are real. You'd have to learn a new interface, test its capabilities, figure out if it meets your needs.

For some users, that's true. Power users of Chat GPT have probably integrated it into workflows, built custom GPTs, or developed dependent habits. Switching is expensive for them.

But for casual users, the cost of switching is zero. If you use Chat GPT occasionally and suddenly ads start appearing, trying Claude is a five-minute decision. You type the same question into Claude, compare results, and see if it's good enough. If it is, you migrate.

Open AI probably did research on this. They probably know what percentage of users will tolerate ads at different levels of intrusiveness. They're presumably rolling out ads at the level they believe is sustainable without triggering mass migration.

But there's variance in user preferences. Some users would rather pay for ad-free access than see ads. Some would rather switch products than deal with personalization. Open AI is optimizing for the median user, not the extreme outliers.

The Advertising Ecosystem Question: Who's Actually Buying These Ads?

Let's talk about the demand side. Who would want to advertise in Chat GPT?

The obvious answer is commerce: e-commerce sites, consumer goods companies, services. When you're talking about shopping, travel, or products, ads for those things make sense. A user asking about best running shoes would see ads for Nike, Adidas, and other brands.

But what about less obvious categories? Software companies might advertise to reach developers. Saa S tools might advertise to reach businesses. Courses and online education could advertise to people learning things (which is Chat GPT's prime use case).

The wild card is the advertisers themselves using Chat GPT. Companies would naturally want to advertise in spaces where their target audience is. If your target audience is using Chat GPT for research, recommendations, or learning, you want your ads there.

Open AI is probably offering competitive rates initially to attract advertisers. They'll run tests, learn what kinds of ads work, and optimize over time. Eventually, Chat GPT could become a premium advertising platform, like You Tube or Facebook. Not because of massive reach (though it has that), but because of the high-intent audience. People using Chat GPT are actively seeking information and solutions. That's worth money to advertisers.

The challenge is that Chat GPT's audience is different from Google's or Facebook's. It's more educated, more likely to think critically about ads, and potentially more ad-fatigued (since they're probably already consuming ads elsewhere). So CPMs might not reach the heights of premium platforms. But volume could make up for it.

The Revenue Math: What Ads Could Actually Generate

Let's do some math. Chat GPT has roughly 200 million monthly active users. Not all of them see ads (only free and Go plan users in the US, at least initially). Let's say that's 50 million users.

If each user generates five conversations per month (probably an underestimate), that's 250 million conversations. If each conversation generates one ad impression, that's 250 million impressions.

If the CPM (cost per thousand impressions) is $2 (reasonable for an advertising platform but lower than premium), that's:

250 million impressions ÷ 1,000 ×

That's $6 million per year from ads alone. Not trivial, but not transformative either. Open AI's annual costs are probably in the hundreds of millions.

Now scale that up. If Open AI eventually serves ads to 100 million users globally, with 10 ad impressions per user per month, and a CPM of $3:

100 million users × 10 impressions ×

That's better, but still not the bulk of Open AI's revenue. However, ads probably aren't meant to be the primary revenue source. They're supplementary. The primary revenue comes from API access, Chat GPT Plus, and enterprise contracts.

But here's what's important: ads at scale, combined with affiliate commissions from shopping, could generate hundreds of millions of dollars annually. That's meaningful even for a company with Open AI's burn rate.

The Path Forward: What Happens Next?

If we're being honest, Open AI's ad rollout is just the beginning. Over the coming months and years, expect:

Phase 1 (Current): Test ads in free Chat GPT for select regions. Measure user retention, engagement, and advertiser interest. Make small adjustments based on feedback.

Phase 2 (6-12 months): Expand to more regions and user segments. Possibly introduce different ad formats. Integrate ads more deeply with shopping and recommendations.

Phase 3 (1-2 years): Introduce premium ad-free options (already exist with Chat GPT Plus). Possibly introduce tiered ad experiences (lighter ads for $5/month, heavy ads for free).

Phase 4 (2+ years): Full integration of commerce, advertising, and AI recommendations. Chat GPT becomes a full-stack platform, not just a chatbot.

This is the trajectory most successful digital platforms follow. They start clean and simple. Monetization gets added gradually. Over time, the product becomes more complex and more commercial. Some users love it. Some leave. Most tolerate it.

The question is whether Chat GPT can navigate this transition without damaging the trust that made it successful. Open AI is gambling that it can. Anthropic is gambling that it can't. We'll find out.

FAQ

What exactly is Open AI testing with ads in Chat GPT?

Open AI is testing the display of targeted advertisements in Chat GPT for free and Go plan users in the United States. These ads appear below the chat conversation and are supposed to be relevant to the topics being discussed. The ads are labeled separately from Chat GPT's actual responses to make it clear they're commercial content.

How does Open AI decide which ads to show?

Open AI uses conversational context to determine which ads might be relevant to you. When you discuss a topic, Open AI's systems analyze what you're talking about and serve ads related to that subject. This is based on analyzing your conversation content, which is why it's considered personalized advertising. You can disable this personalization through your account settings.

Will ads appear on Chat GPT Plus subscriptions?

No, ads are only appearing on free and Go plan users. Chat GPT Plus subscribers ($20/month) do not see ads, which is one of the benefits of the paid subscription. This positioning makes the paid tier more attractive by removing the ad experience.

Can advertisers see my personal conversations?

Open AI states that it does not share or sell user conversations directly to advertisers. However, Open AI does analyze conversations to determine what ads to show you, and advertisers benefit from that analysis indirectly. Your actual chat content is not provided to third parties, but the insights derived from your content are used for ad targeting.

Why is Anthropic's Claude supposedly staying ad-free?

Anthropic, Claude's creator, ran a Super Bowl ad specifically stating that Claude would not include advertising. This is a competitive positioning move against Open AI's decision to introduce ads. However, Anthropic will eventually need to monetize Claude somehow, possibly through API pricing, enterprise contracts, or premium subscriptions. The current "ad-free" stance is a business choice, not necessarily a permanent guarantee.

What happens to my data used for ads?

Open AI says you can disable personalization and clear the data used for ads at any time. However, even with personalization disabled, you'll still see ads—they just won't be tailored to your conversations. The company uses conversation data to improve Chat GPT's responses, so some data retention happens regardless of the ad system.

Could ads eventually influence Chat GPT's responses?

Open AI claims ads won't influence its responses, and there's no current evidence they do. However, as advertising becomes a larger revenue source, the incentive structure could theoretically shift. If advertisers are paying premium rates for certain types of responses, there could be pressure to optimize for those responses. This is a future risk rather than a current problem.

How much money will Chat GPT's ads generate?

Open AI hasn't disclosed specific revenue targets, but industry analysts estimate that ad revenue could contribute tens to hundreds of millions of dollars annually at scale. However, ads are likely meant to be supplementary revenue, with the bulk coming from API access, Chat GPT Plus subscriptions, and enterprise contracts. A company source indicated ads should represent less than half of long-term revenue.

Will Chat GPT ads expand globally?

Eventually, yes, though the rollout will be gradual. Different regions have different advertising and privacy regulations. Europe's GDPR and Digital Markets Act impose stricter requirements than the US. Asia and emerging markets have different regulatory frameworks. Open AI will need to adapt its approach for each region, which will take time.

What's the difference between ads and affiliate commissions?

Ads are displays of third-party commercial content that generates revenue per impression or click. Affiliate commissions are payments Open AI receives when users buy products through links in Chat GPT. Open AI already participates in affiliate programs, taking a cut when users purchase through integrated shopping links. Both are monetization methods, but they work differently.

The Real Conversation We Should Be Having

At the end of the day, Open AI's ad strategy is neither shocking nor controversial in the grand scheme of tech industry practices. Google runs ads. Meta runs ads. Amazon runs ads. Most digital platforms funded by venture capital eventually move toward ads because they work and they scale.

What matters is not that Chat GPT is getting ads. What matters is that we're collectively deciding what kind of digital future we want. Do we want a world where the most powerful tools are optimized for maximum engagement and advertising effectiveness? Or do we want different models, where some tools stay simple and ad-free, supported by different business structures?

Anthropic's Super Bowl ad suggests there's market demand for ad-free AI. That's valuable information. It tells Open AI that they'll lose some users to ad-free competitors. It tells the market that privacy and simplicity are competitive differentiators. It tells investors that multiple monetization models are viable.

But it also reveals something about market dynamics: we end up with fragmentation. Chat GPT for people who tolerate ads. Claude for people who want something cleaner. Gemini for people embedded in Google's ecosystem. Perplexity for people who want real-time search. Each tool becoming a little different, each optimized for different user preferences and different monetization strategies.

That fragmentation isn't necessarily bad. Competition is healthy. Multiple approaches are good. But it also means we don't get a universally trusted, universally clean, universally simple AI assistant. We get a market. And in markets, the incentives that drive revenue often conflict with the incentives that drive trust.

Open AI's bet is that they can have both: revenue from ads and trust from users. They might be right. They might be wrong. But we'll know relatively soon. If users tolerate ads without switching to Claude, Open AI's strategy works. If Claude attracts significant migration because users prefer ad-free experiences, Anthropic's strategy works.

The real conversation is about which future you prefer. And that choice, ultimately, is yours to make. You're voting with your attention every time you choose which AI assistant to use.

Use Case: Automating your workflow analysis and decision-making documentation without handling tracking or personalization concerns

Try Runable For Free

Key Takeaways

- OpenAI is testing ads in ChatGPT's free and Go plans, marking a shift from revolutionary product to standard platform

- Ads appear below conversations and are personalized based on topic analysis, creating new privacy considerations

- Anthropic's Claude positions itself as ad-free, using a Super Bowl ad to attack OpenAI's strategy—proving market demand for alternatives

- Revenue from ads likely supplementary to API and subscription income, but could generate hundreds of millions annually at scale

- User experience shifts from clean interface to commercial platform, potentially driving some users to competitors like Claude

Related Articles

- OpenAI's ChatGPT Ads Strategy: What You Need to Know [2025]

- Anthropic's Ad-Free Claude vs ChatGPT: The Strategy Behind [2025]

- Google Hits $400B Revenue Milestone in 2025 [Full Analysis]

- How 16 Claude AI Agents Built a C Compiler Together [2025]

- Claude + WordPress Integration: AI Site Management [2025]

- Can AI Agents Really Become Lawyers? What New Benchmarks Reveal [2025]

![OpenAI's ChatGPT Ads: What It Means for AI's Future [2025]](https://tryrunable.com/blog/openai-s-chatgpt-ads-what-it-means-for-ai-s-future-2025/image-1-1770665776034.jpg)