Google's Historic $400 Billion Revenue Milestone Explained [2025]

Last Wednesday, Alphabet announced something that would've seemed impossible just a decade ago: the company breached the $400 billion annual revenue barrier for the first time in its history. This isn't just another earnings number. This is a watershed moment that reveals how fundamentally the internet economy has shifted, who's winning in AI, and what happens when a search monopoly starts printing money faster than governments.

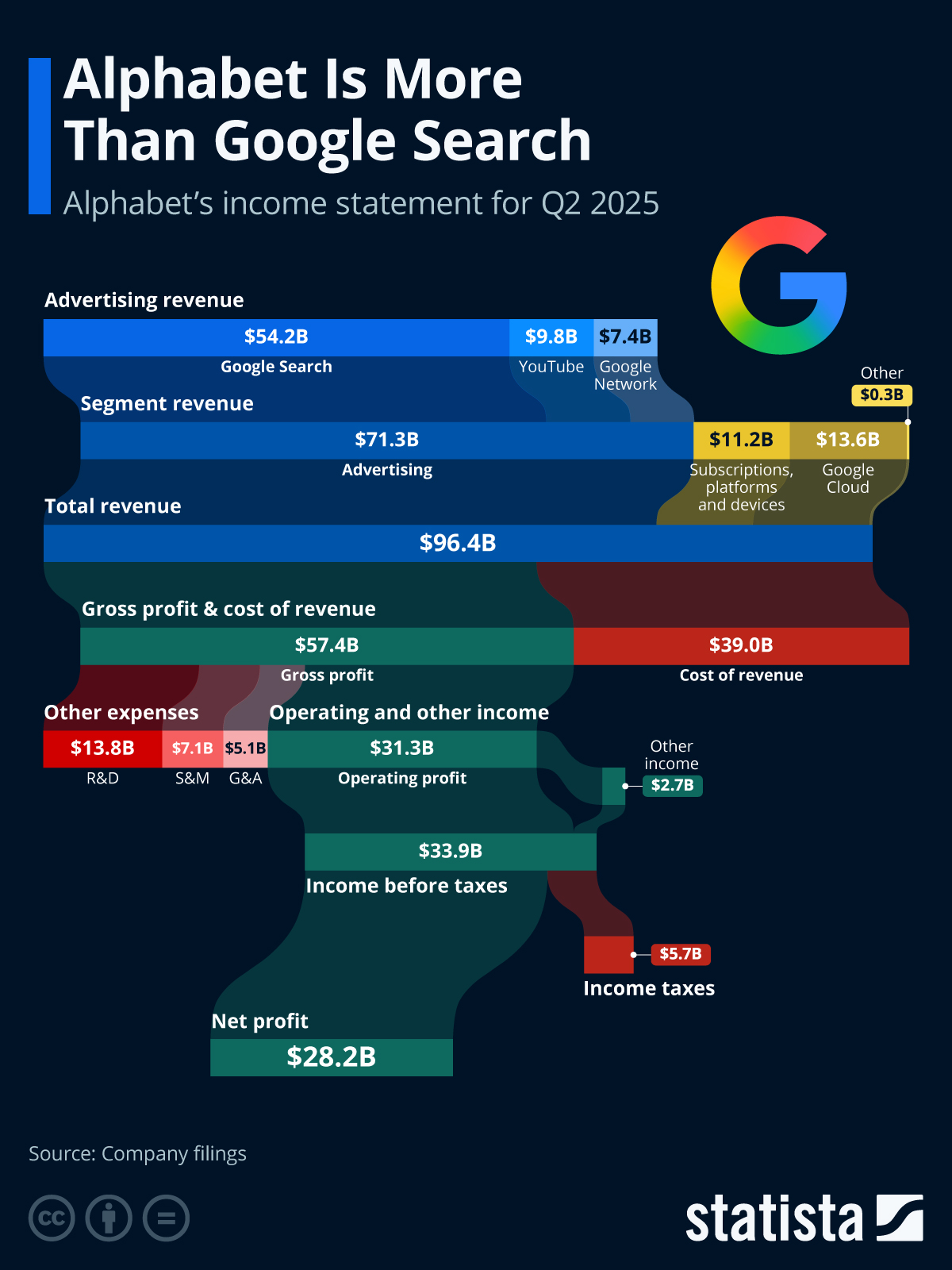

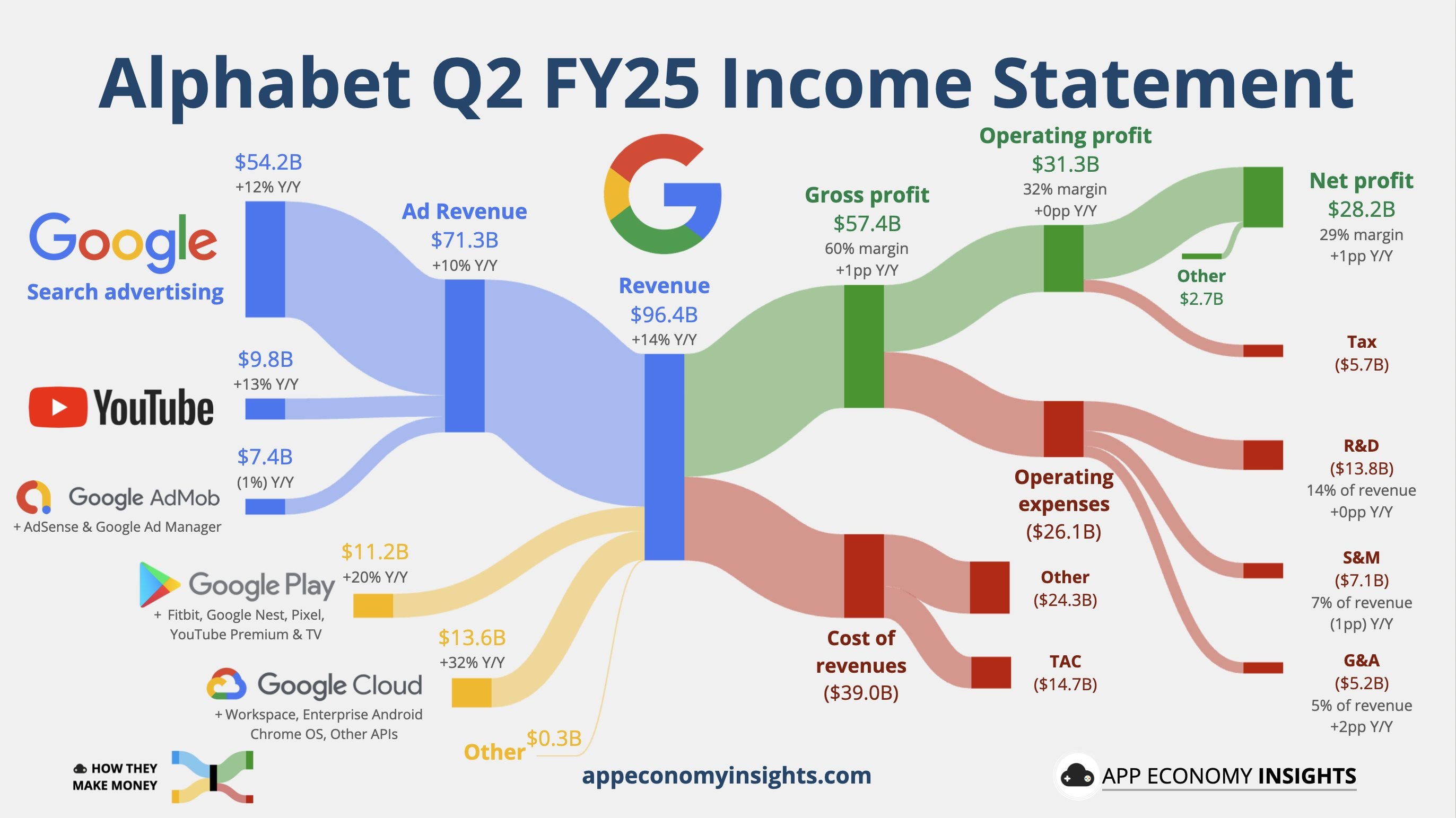

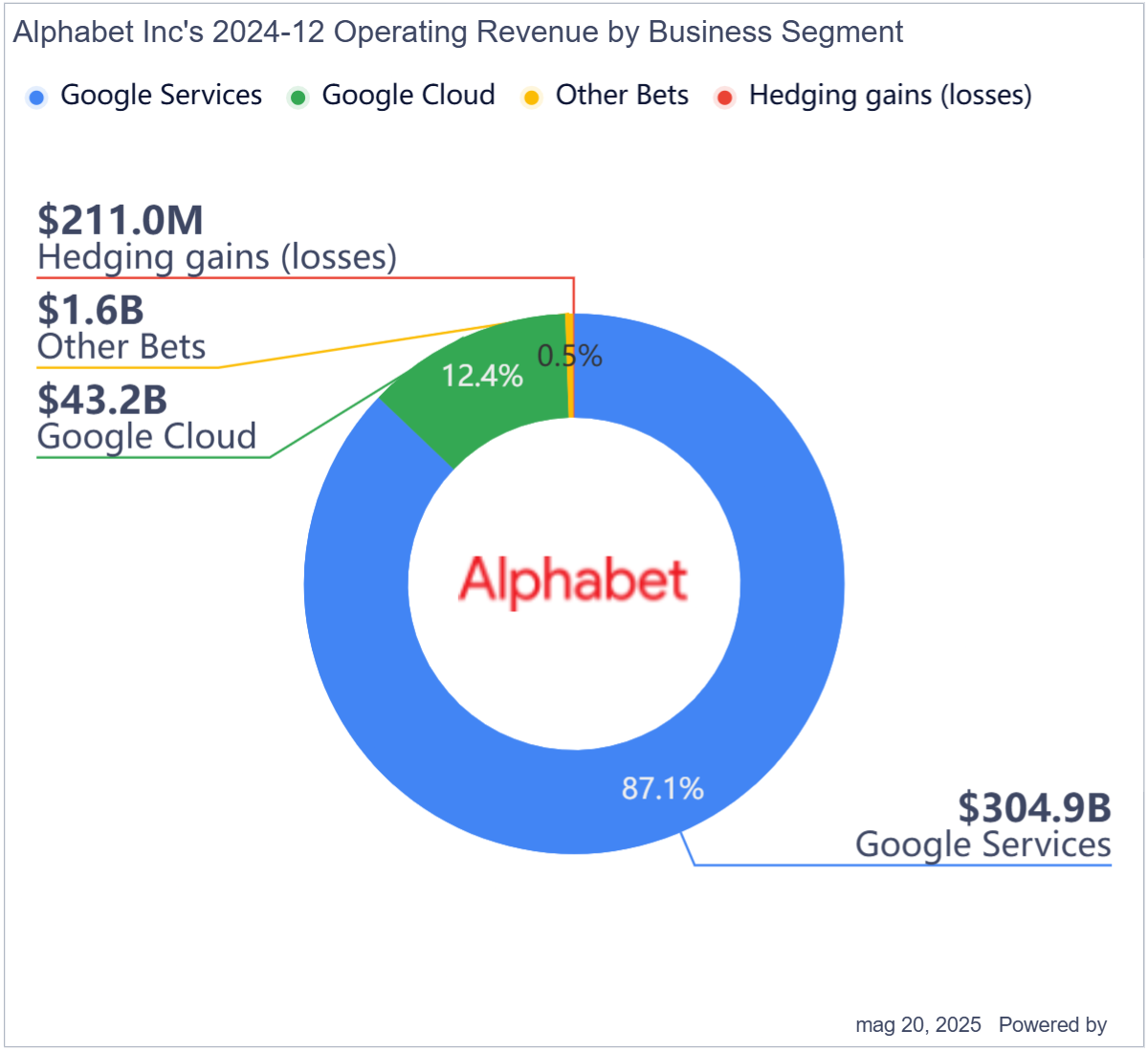

The milestone arrived during Alphabet's Q4 2025 earnings report, which revealed a stunning 15 percent year-over-year revenue increase. But the real story isn't the top-line number. It's what's happening underneath: Google Cloud hit a

Here's what makes this moment significant: in 2015, Alphabet pulled in roughly $75 billion. In 2025, they're doing that in the first quarter alone. The company has grown its revenue by more than 430 percent in a decade while managing regulatory scrutiny, emerging competition, and fundamental shifts in how people search for information. That's not just growth. That's an acceleration that most economists didn't predict possible at this scale.

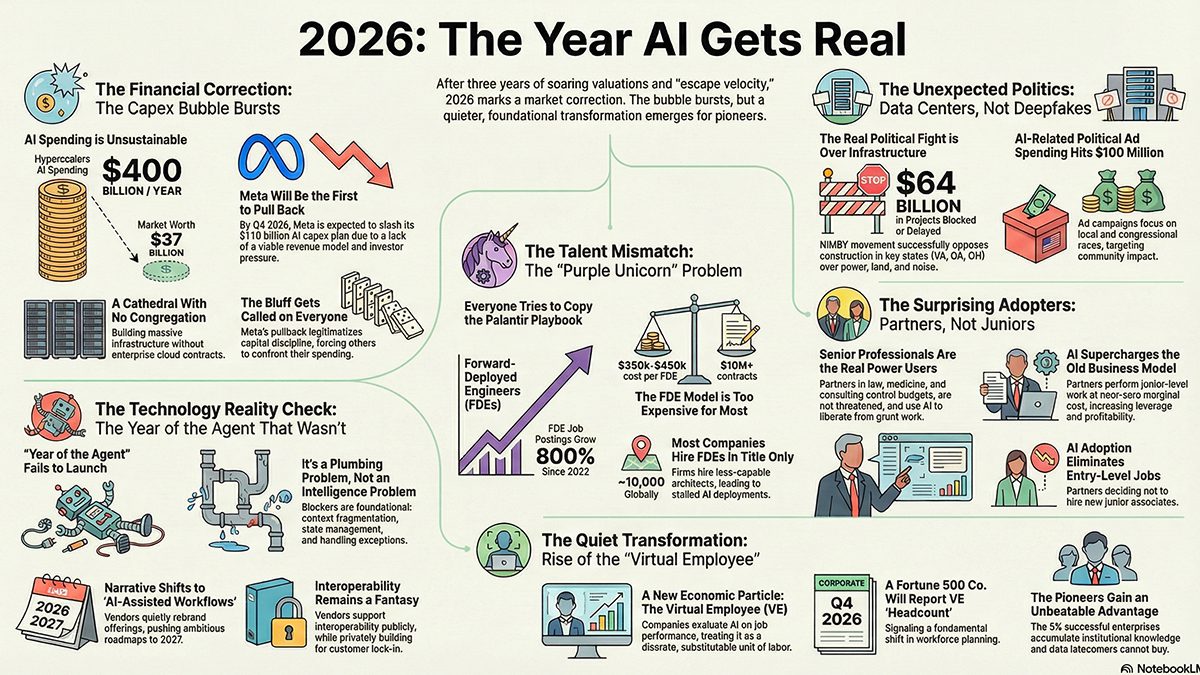

But before we crown Google as the eternal winner of tech, there's a catch. This revenue explosion is happening while the company faces unprecedented regulatory pressure, a genuine AI challenger in Anthropic's Claude, and serious questions about whether its core search business can maintain dominance in an AI-first world. The $400 billion is real. The threats are real too.

Let's break down what's actually happening with Google's business, why this matters for the tech industry, and what comes next.

TL; DR

- **400 billion in annual revenue for the first time, representing a 15% year-over-year increase

- YouTube dominance: YouTube revenue surged past $60 billion across ads and subscriptions, establishing it as the "number one streamer" globally

- Cloud acceleration: Google Cloud reached a $70 billion run rate in 2025, fueled by enterprise AI adoption

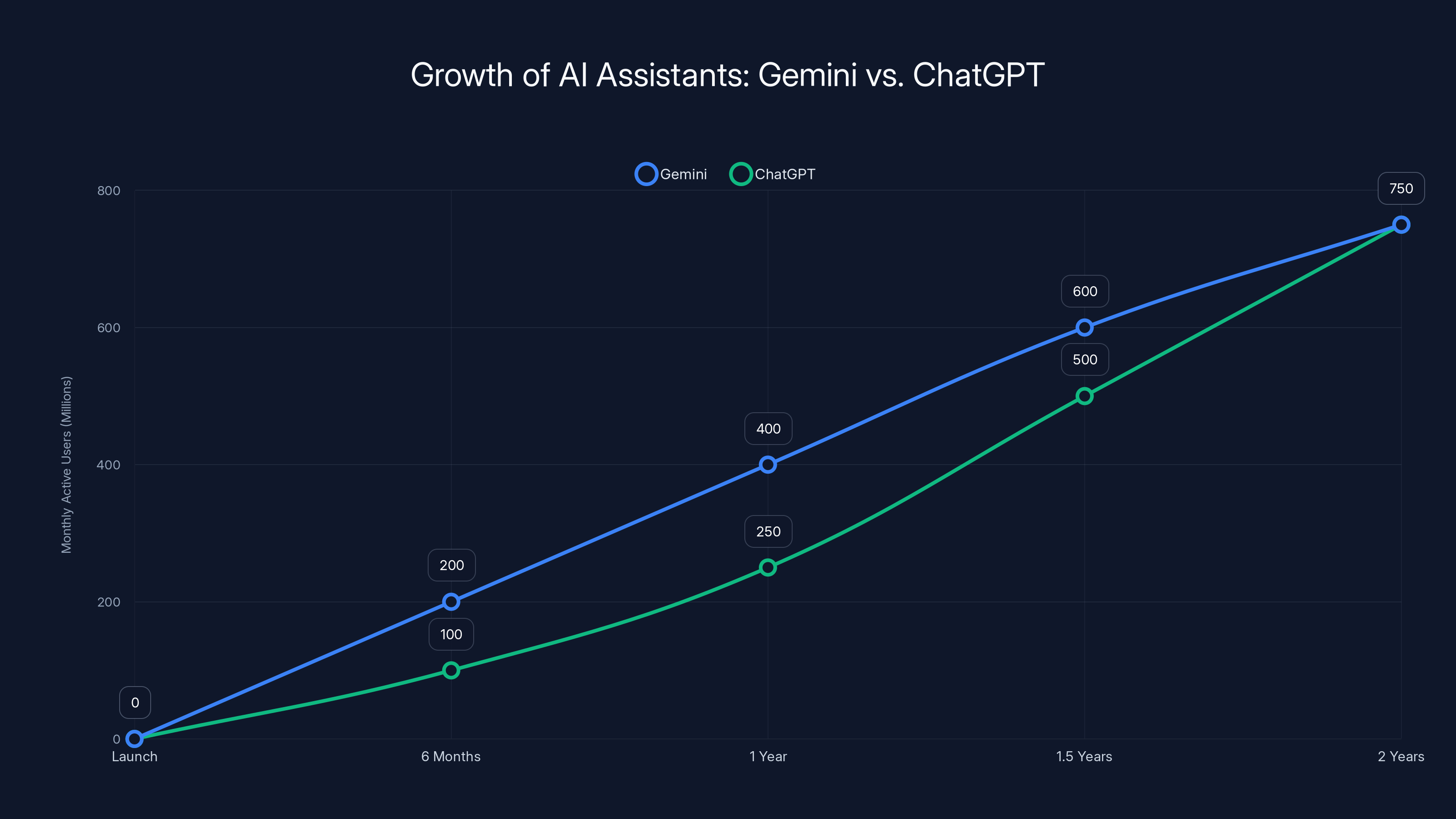

- Gemini momentum: Google's Gemini AI app surpassed 750 million users following the November 2025 Gemini 3 launch

- Search evolution: AI Mode queries in Google Search doubled since launch, indicating fundamental shifts in search behavior

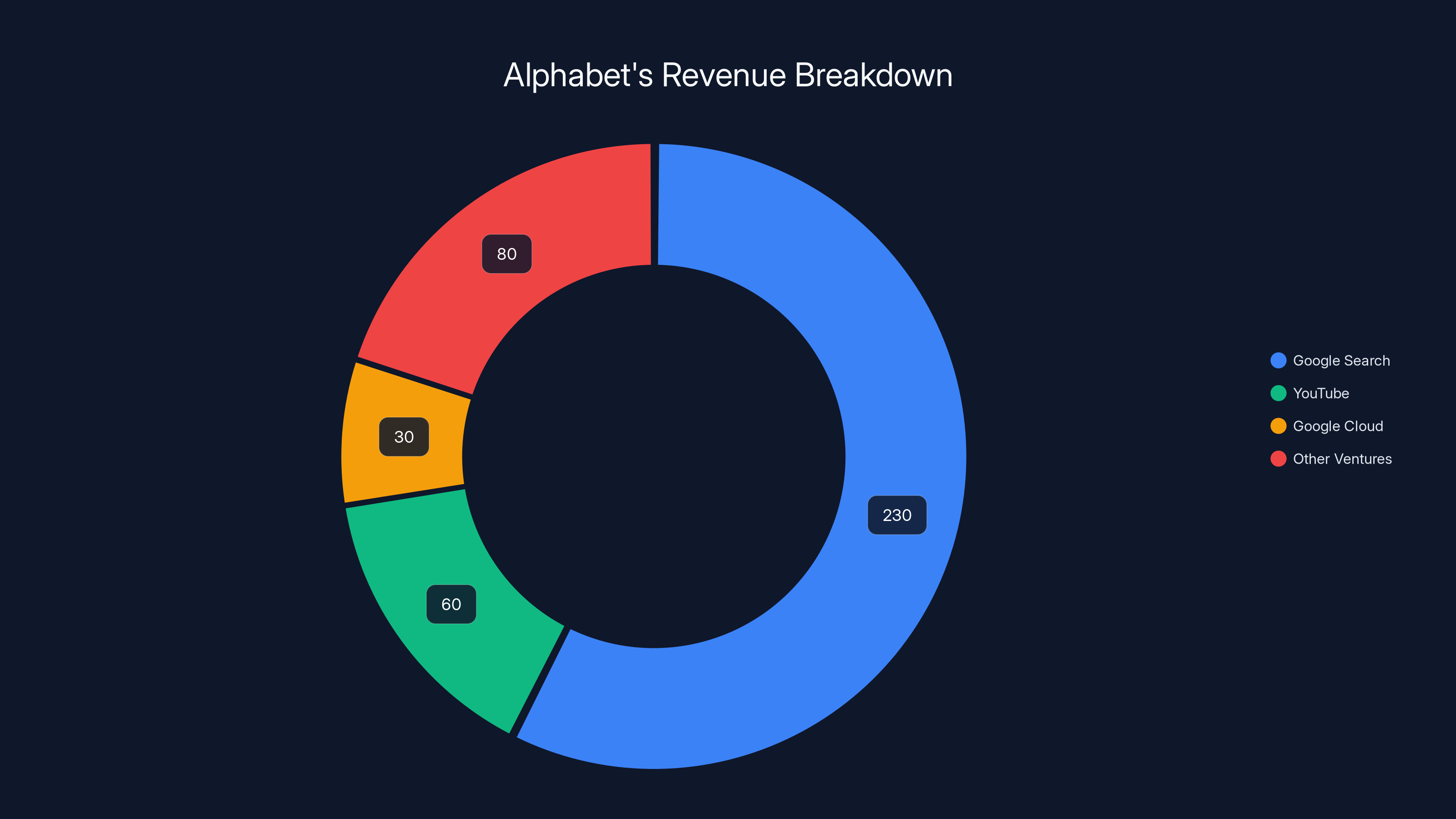

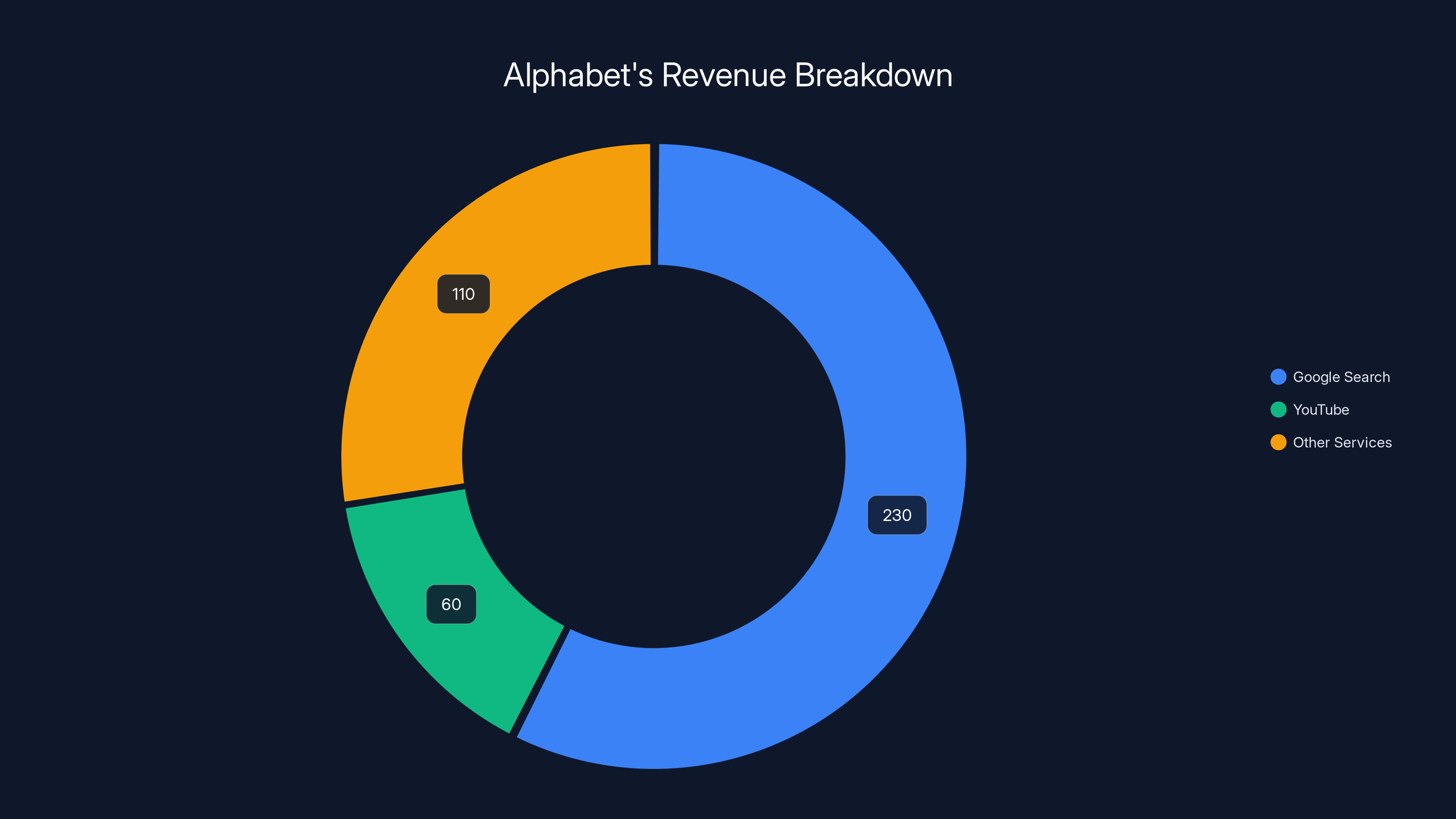

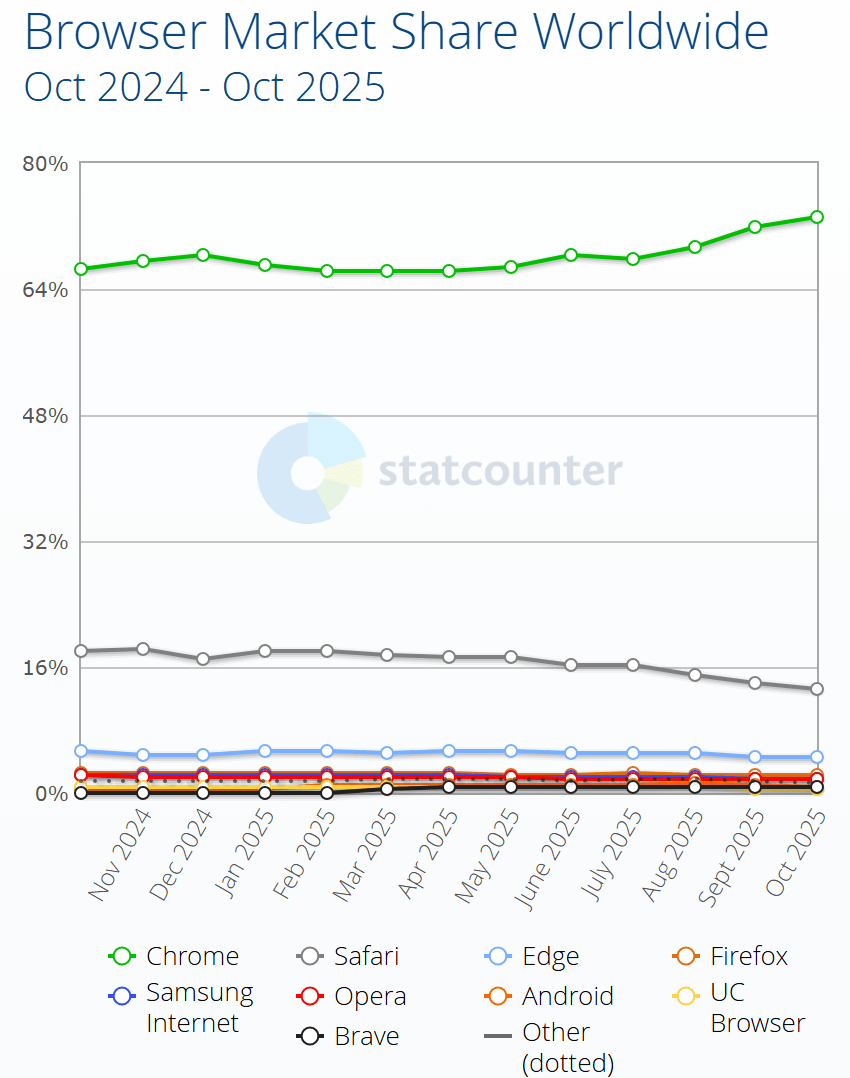

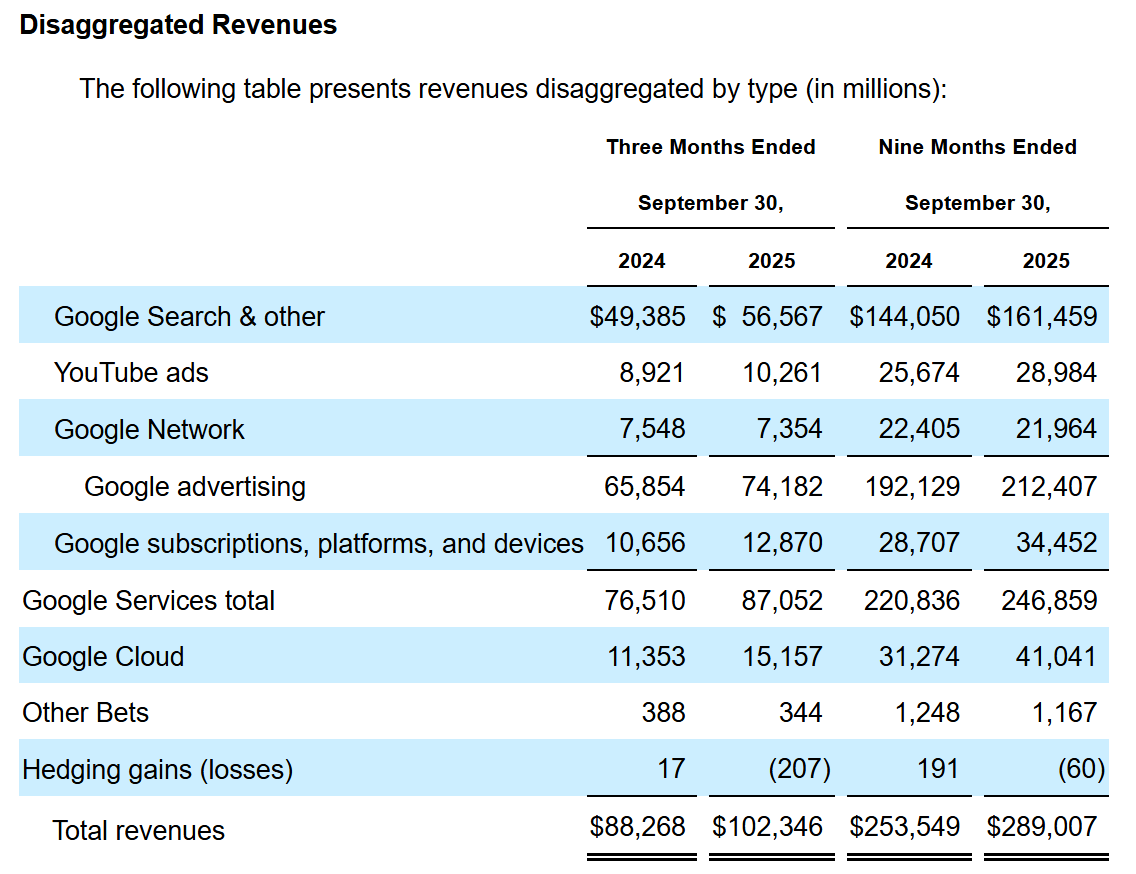

Google Search is the largest contributor to Alphabet's revenue, followed by YouTube and Google Cloud. Estimated data based on reported figures.

The Numbers That Actually Matter: Breaking Down the $400 Billion

When Alphabet hit $400 billion in annual revenue, the market moved. NASDAQ investors understood immediately: this isn't theoretical. This is real money from real users doing real things on Google's platforms.

Let's start with the math. A 15 percent year-over-year increase from 2024 to 2025 tells us Alphabet pulled in roughly

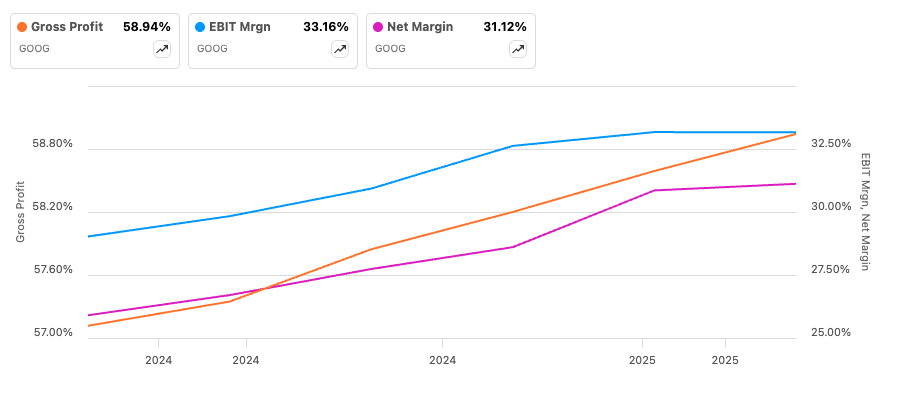

But raw revenue numbers lie. Operating margins matter more. Alphabet's ability to turn that $400 billion in revenue into profit tells us whether the company is still efficiently run or whether costs are spiraling out of control. The earnings report showed the company maintaining strong profitability despite heavy investment in AI infrastructure, suggesting Google's pricing power remains intact even as it scales.

Where the revenue actually comes from:

Google Search still dominates the portfolio. The company doesn't break out exact search revenue anymore, but Wall Street estimates suggest search represents roughly 55-60 percent of Alphabet's total revenue, which would put it at around $220-240 billion annually. That's roughly the GDP of entire nations, flowing primarily from search advertising.

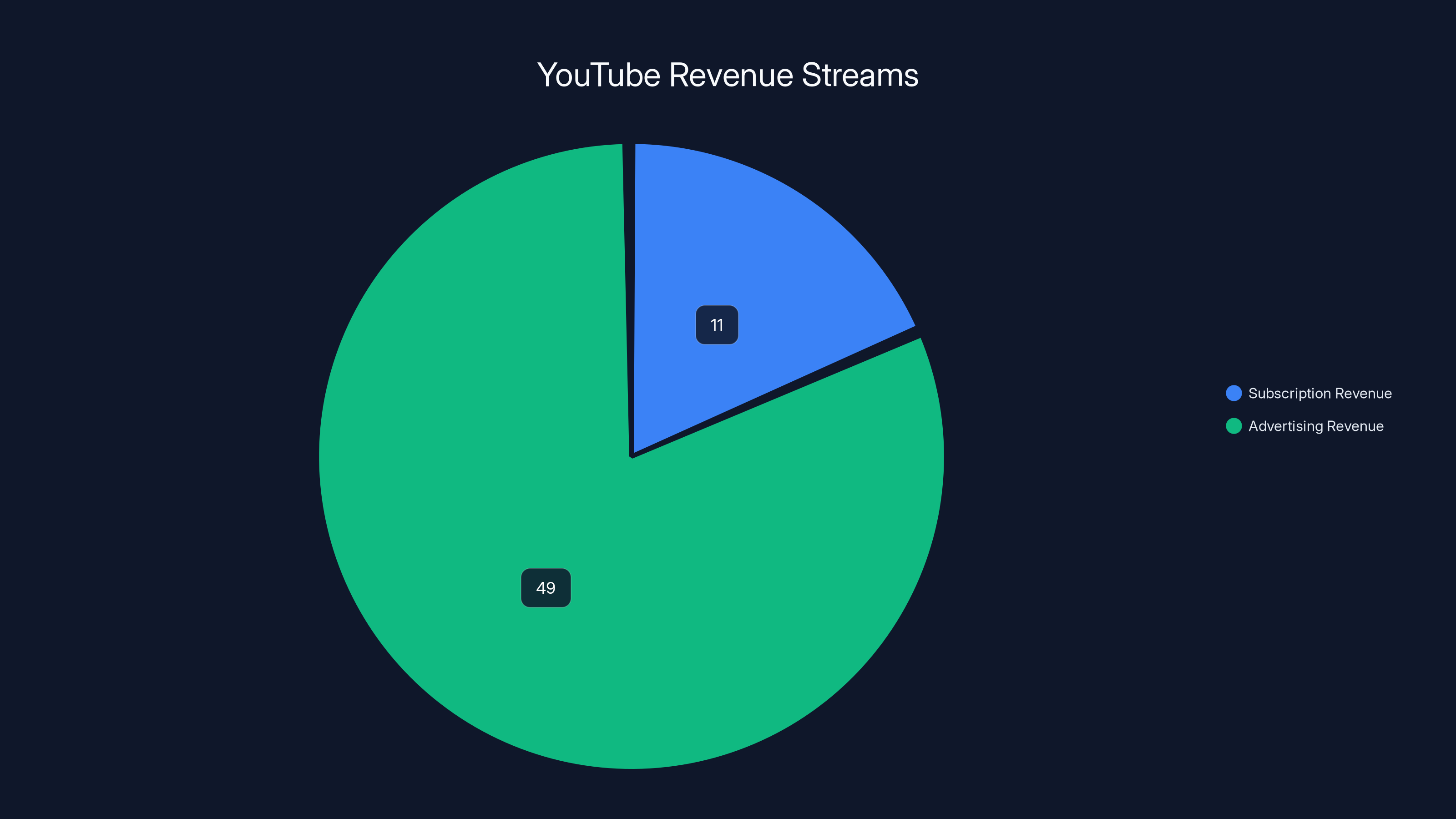

YouTube's contribution jumped dramatically. At

Google Cloud's trajectory matters most for the future. The

Google Search dominates Alphabet's revenue with an estimated

YouTube's Stunning $60 Billion Breakout: The Streaming Revolution Nobody Expected

YouTube hitting

Today, YouTube generates more annual revenue than every streaming service except Netflix. Think about what that means. YouTube has fewer original programming budgets than Netflix, doesn't need to produce expensive content like Prime Video, and still crushes them on total revenue. The business model works because it's advertising plus subscriptions, not subscriptions alone.

The

Why YouTube's growth matters for Alphabet's future:

YouTube represents the company's best hedge against search disruption. If AI search ever genuinely threatens Google's search dominance, YouTube's advertising network and subscription base provide a fallback revenue engine that few competitors can challenge. TikTok is larger by user count but hasn't monetized anywhere near YouTube's level. Twitch is niche by comparison.

The platform's dominance in streaming content creates a positive feedback loop. More users watch YouTube, attracting more creators. More creators produce more content, pulling in more users. Advertisers follow the users, driving up CPMs (cost per thousand impressions). With $60 billion in revenue, YouTube has enough cash to invest in creator tools, support systems, and platform improvements that smaller competitors can't match. Scale begets scale.

YouTube's subscription momentum also matters. CEO Sundar Pichai announced that Alphabet now has over 325 million paid subscribers across Google One, YouTube Premium, and YouTube Music. That's not subscriber count for YouTube specifically—it's across the entire ecosystem. But it shows Alphabet successfully converted casual users into paying customers across multiple services.

Google Cloud's $70 Billion Run Rate: The Underdog Story

When people think about cloud infrastructure, they typically imagine Amazon Web Services dominating the market. That's still technically true—AWS holds roughly 32 percent of the global cloud market. But Google Cloud's trajectory tells a more interesting story about how niches can become empires.

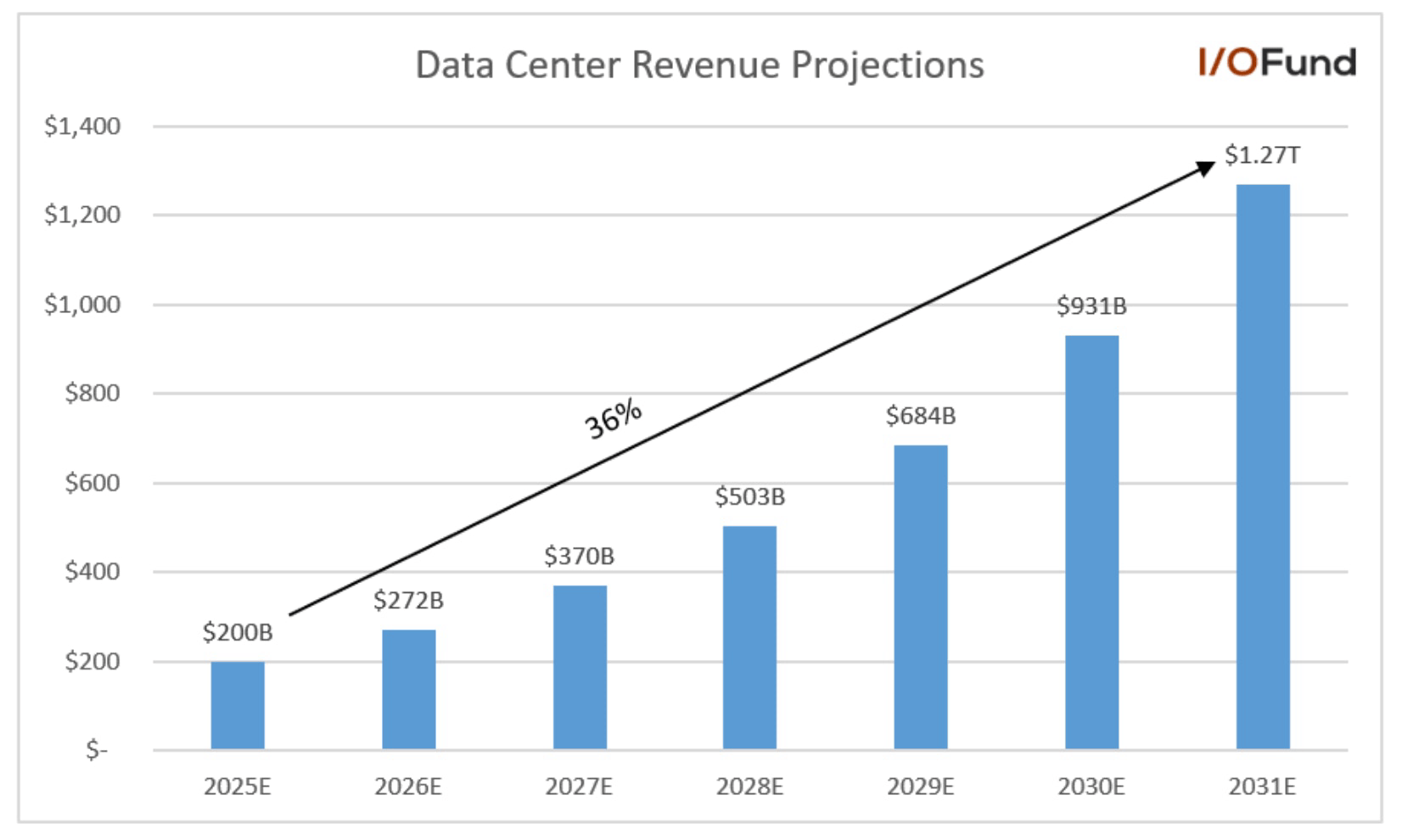

Google Cloud reached a

Why does Cloud matter so much for Alphabet's future? Two reasons: first, cloud infrastructure is where the real profit margins hide in tech. Second, cloud is the gateway to enterprise AI deals, and whoever controls enterprise AI will control the next decade of technology spending.

The enterprise AI angle:

Every enterprise customer Google Cloud acquires becomes a potential customer for Gemini AI, Google's large language model. Every organization running workloads on Google Cloud infrastructure becomes a test case for new AI products before they reach the general market. The companies are no longer separate. Cloud infrastructure is the delivery mechanism for AI products.

Microsoft understood this dynamic first, which is why Microsoft bundled OpenAI's technology directly into Azure. Companies pay for cloud infrastructure and get AI built into the experience. Google is executing the same playbook but with their own AI developed in-house.

Google Cloud's growth also signals something important about AI infrastructure demand. Organizations aren't just experimenting with AI anymore. They're committing to it, building it into production workloads, and requiring cloud infrastructure to scale those workloads. The $70 billion run rate proves that demand is real and sustainable.

Gemini reached 750 million users faster than ChatGPT, aided by integration into Google's ecosystem. Estimated data.

Gemini's 750 Million Users: What Happened When Google Got Serious About AI

When Alphabet announced that Gemini surpassed 750 million users, most tech observers nodded and moved on. Nobody parsed what that number actually represents. It's staggering.

Gemini, Google's AI assistant, reached 750 million monthly active users in 2025. For context, Chat GPT crossed 100 million users in approximately two months and took considerably longer to reach 750 million. Google's advantage: it bundled Gemini directly into Android, Gmail, Google Search, and YouTube. Friction disappeared. Adoption accelerated.

The November 2024 launch of Gemini 3 marked a turning point. Gemini 3 demonstrated capabilities that surprised even skeptics. The model could reason more effectively, handle longer context windows, and perform tasks that previously required multiple API calls. More importantly, average users noticed. The quality gap between Gemini and competitors compressed significantly.

Post-Gemini 3 launch, Alphabet reported a 100 million user increase, bringing the total to 750 million. That means the improved model converted casual users into engaged users at scale. They tried it, found it genuinely useful, and kept using it.

What this means for competition:

Anthropic's Claude and OpenAI's Chat GPT are fighting for users in a crowded market. Google's 750 million is fighting unfair odds because most of those users didn't make an active choice to use Gemini. They simply updated their phone or logged into Gmail and Gemini was there. That's distribution magic that smaller competitors cannot replicate.

But—and this is important—reach doesn't equal retention. Having 750 million monthly active users only matters if those users keep returning. Gemini's continued growth suggests the product is sticky. Users aren't downloading it and forgetting about it. They're integrating it into daily workflows.

The integration with Siri is particularly significant. Apple announced that a custom version of Gemini 3 would power a more personalized version of Siri. That's Apple's AI partner, effectively. When the most valuable consumer tech company on Earth picks your AI model to power their assistant, it signals confidence in your technology. It also means Gemini gets distribution to hundreds of millions of iPhone users.

Search's Evolution: AI Mode Queries Doubled, But Is This Cannibalizing Ads?

One detail buried in Alphabet's earnings report deserves more attention: AI Mode queries in Google Search doubled since launch. That's not an accident. That's evidence of a fundamental shift in how people search.

AI Mode in Google Search works differently than traditional search. Instead of showing a list of blue links, Google's AI synthesizes the top results into a natural language response, then shows the sources. It's faster for users. It's more useful. It's also less profitable for Google because it doesn't need as many ads.

Here's the tension that nobody's talking about openly: Alphabet is cannibalizing its most profitable business to improve its position in AI. Every user who switches from traditional search to AI Mode is a user who sees fewer ads. Every AI Mode query that pulls in results from three sources instead of ten is a query that shows fewer advertising opportunities.

Alphabet CEO Sundar Pichai publicly acknowledged this, stating that Google Search experienced more usage in recent months "than ever before," offsetting any per-query revenue decline. The company's thesis is that more total searches (from both traditional and AI modes) will increase total search advertising revenue, even if individual queries are less monetizable.

That thesis hasn't broken yet. Search still generates roughly

The competitive angle:

Perplexity, a startup search engine powered entirely by AI, is growing rapidly. It doesn't rely on ad revenue. Its business model is simpler: make search better, then charge users for premium features. Perplexity doesn't have Google's infrastructure costs, and it doesn't have an existing $220 billion search advertising business to protect.

Google has to balance protecting its cash cow while building the future. Smaller competitors like Perplexity only have to build the future. That's a structural disadvantage that even the smartest executives at Alphabet can't entirely overcome. Innovation at scale is always more difficult than innovation as a startup.

YouTube generates approximately

The AI Agent Checkout Feature: Where Gemini Makes Money

Alphabet's earnings announcement included a forward-looking detail that matters tremendously: the company plans to build "agentic checkout" features into both Gemini and Google Search's AI Mode.

What does "agentic checkout" mean? It means the AI will be able to complete transactions on behalf of the user. Instead of searching for a product, finding the best price, adding it to a cart, and checking out manually, the AI does all of that automatically. The user just confirms the purchase.

This is where Gemini transitions from an interesting research project to a revenue engine. Every transaction the AI facilitates could generate a commission for Google. If you ask Gemini to "find me a good running shoe under $150," and Gemini autonomously completes that purchase through an affiliate partner, Google captures a percentage of that sale.

The monetization potential is enormous. Approximately 20 percent of Alphabet's revenue comes from Google's advertising network (Ad Sense, Ad Mob, and other non-search properties). The agentic checkout feature could create an entirely new revenue stream that piggybacks on Gemini's 750 million user base.

But there's a trust problem. Would you allow an AI to purchase things on your behalf? The friction exists for good reasons. Purchasing is the moment of financial commitment. Users want to think carefully. Removing that friction could increase transaction volume but damage trust if something goes wrong. Alphabet will need to prove that agentic checkout is secure, accurate, and truly beneficial before users adopt it at scale.

Competitors are watching this closely. Amazon has Alexa, which can already complete voice-activated purchases. Microsoft and OpenAI are likely exploring similar features. The company that makes agentic checkout trustworthy and frictionless wins a new revenue stream worth potentially $10-20 billion annually within a decade.

Regulatory Pressure and the Antitrust Elephant in the Room

Alphabet's $400 billion milestone arrives during what might be the most serious regulatory scrutiny the company has faced since its IPO in 2004. The U. S. Department of Justice has made clear its intention to challenge Google's search dominance. Several states have sued. The European Union has already fined Google billions and imposed restrictions on its business practices.

Here's what most people miss: regulations don't destroy $400 billion revenue businesses overnight. They nibble at the edges. They slow growth. They force companies to change specific practices while the core business continues humming along.

The question regulators face is fundamentally hard: how do you break up a company that provides genuinely valuable free services to billions of people? Google Search is free. Gmail is free. YouTube is free. Google Maps is free. Consumers love these products. Breaking them up would fragment the experience without providing obvious consumer benefits.

What regulators could realistically force:

- Separating search from advertising: Forcing Google to sell its search business separately from its advertising business, eliminating conflicts of interest

- Restricting bundling: Preventing Google from defaulting Gemini into Android or giving preferential search placement to Gemini results

- Open APIs: Requiring Google to expose search data and ranking algorithms to competitors under licensing agreements

- Data portability: Allowing users to export their Google account data for use on competitors' platforms

Each of these would reduce Alphabet's revenue and profitability. None would necessarily make Google smaller. They'd just make the company's revenue streams more transparent and make it harder for Google to use its scale to crush smaller competitors.

Alphabet has already prepared for this scenario. The company maintains enormous legal teams, regularly publishes compliance reports, and has changed practices in response to regulatory pressure. The company also has enough profit margins to absorb regulatory costs that would bankrupt smaller competitors.

The real threat to Google isn't regulation. It's competition. If Anthropic, Perplexity, or some startup nobody's heard of yet genuinely creates a better search experience powered by AI, users will switch. Regulations might slow that shift. Quality won't.

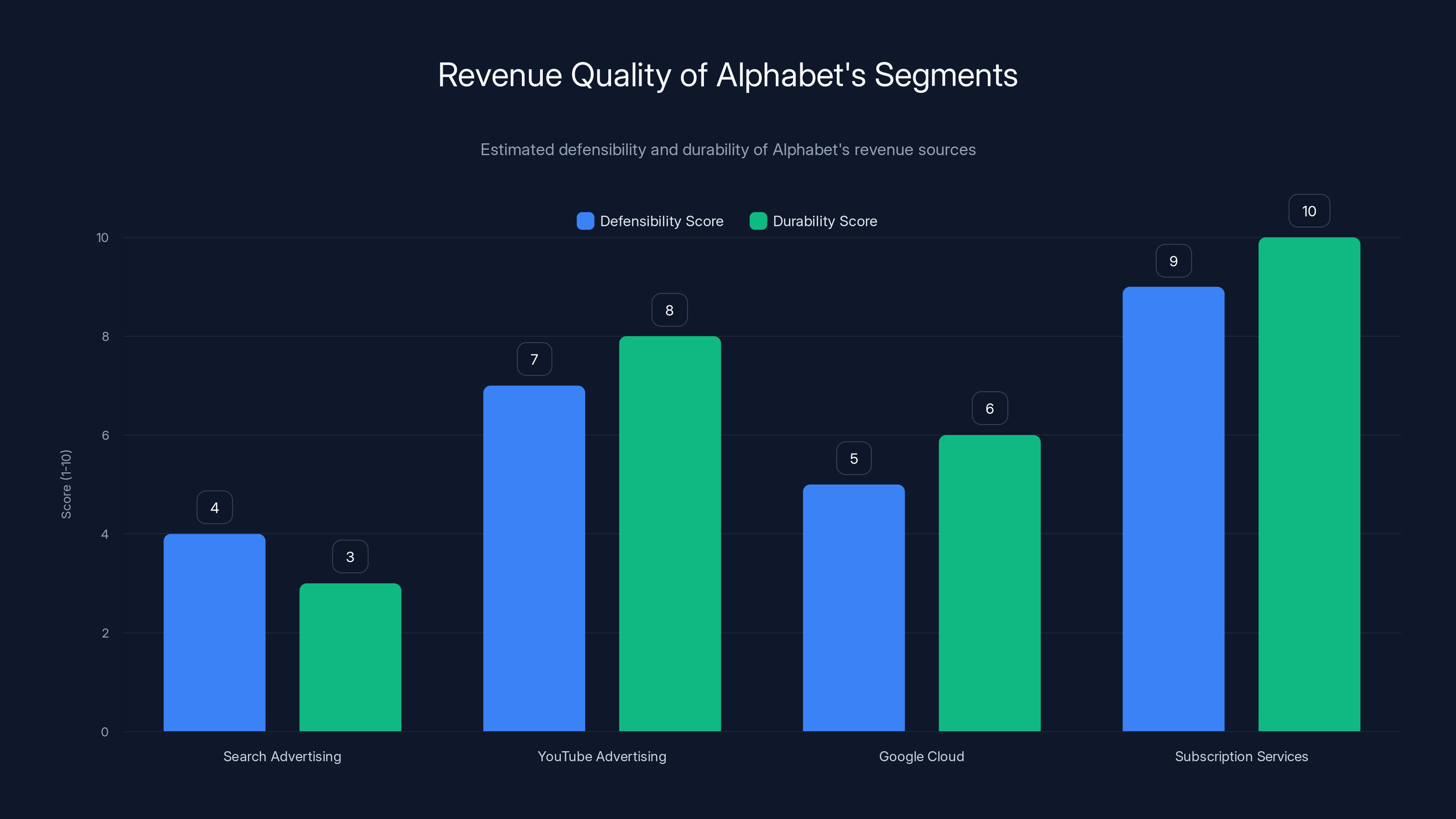

Subscription services are the most durable and defensible revenue source for Alphabet, while search advertising faces significant threats from AI alternatives. (Estimated data)

Alphabet's Profit Machine: Why Operating Margins Still Matter Most

Revenue is vanity. Profit is sanity. Alphabet's ability to convert $400 billion in revenue into substantial profit reveals why the company matters more than competitors with smaller revenue bases.

Wall Street estimates suggest Alphabet maintains operating margins around 25-30 percent when you exclude stock-based compensation and one-time charges. That means the company turns roughly

Compare that to competitors:

- Microsoft: Operating margins roughly 35 percent, but from a smaller revenue base ($245 billion annually)

- Amazon: Operating margins roughly 5-10 percent because AWS subsidizes unprofitable retail businesses

- Meta: Operating margins roughly 30-35 percent, but from a smaller revenue base ($135 billion annually)

- Apple: Operating margins roughly 30 percent, from a revenue base ($391 billion annually) similar to Alphabet

Alphabet's profit engine is essentially competitive with Apple's, comes from very different products, and requires less capital expenditure. The company doesn't need to manufacture hardware. It doesn't need to design chips. It just needs servers, cables, and talented engineers. The economics are beautiful.

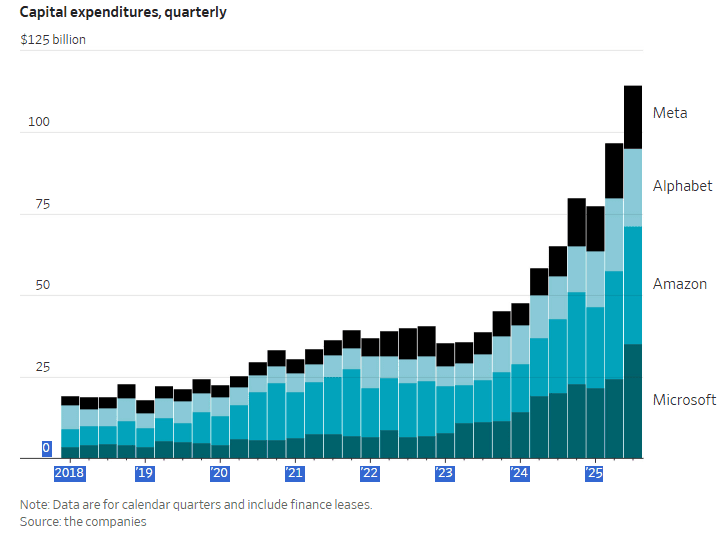

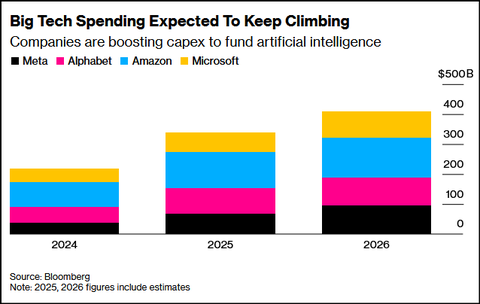

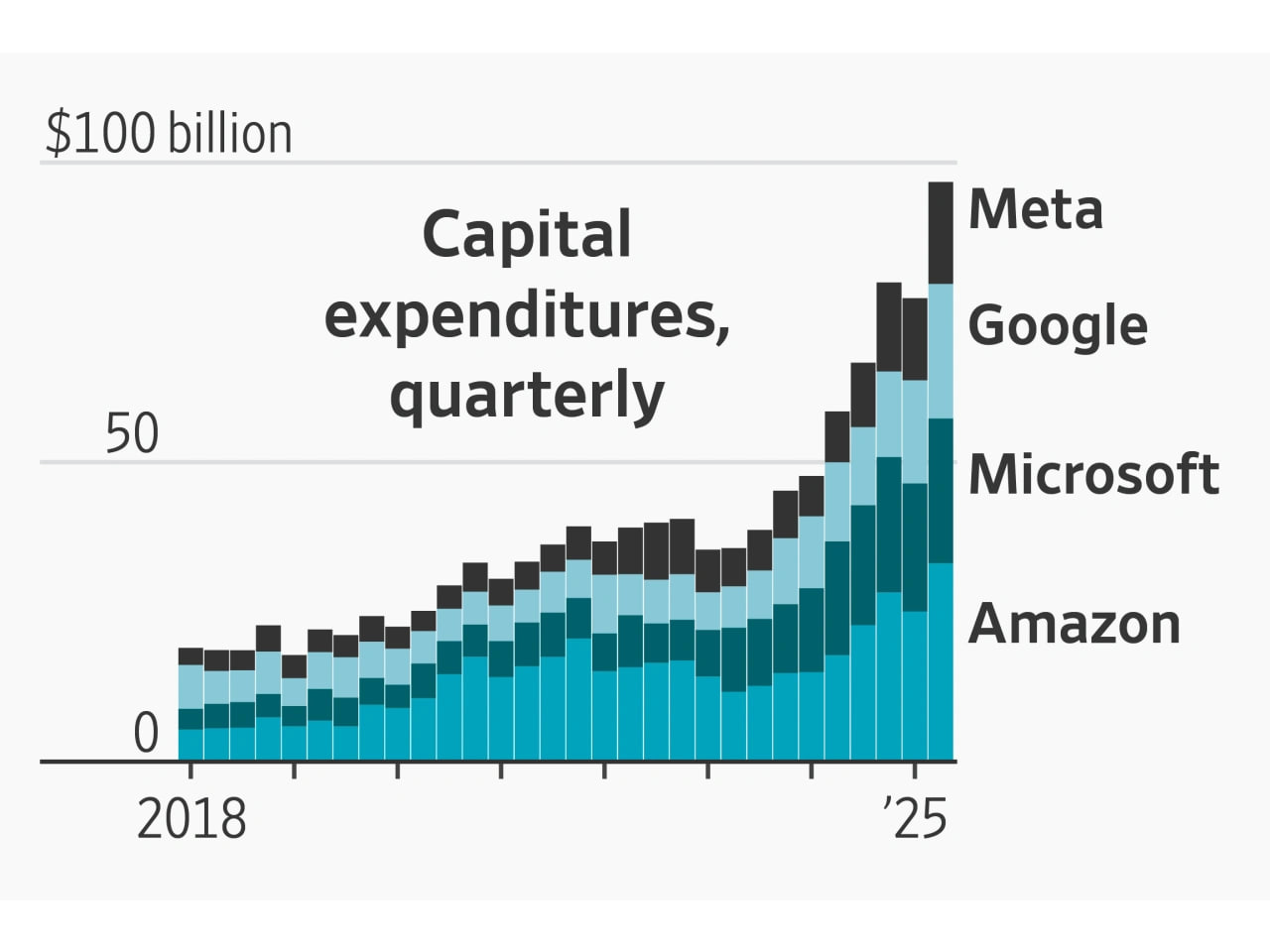

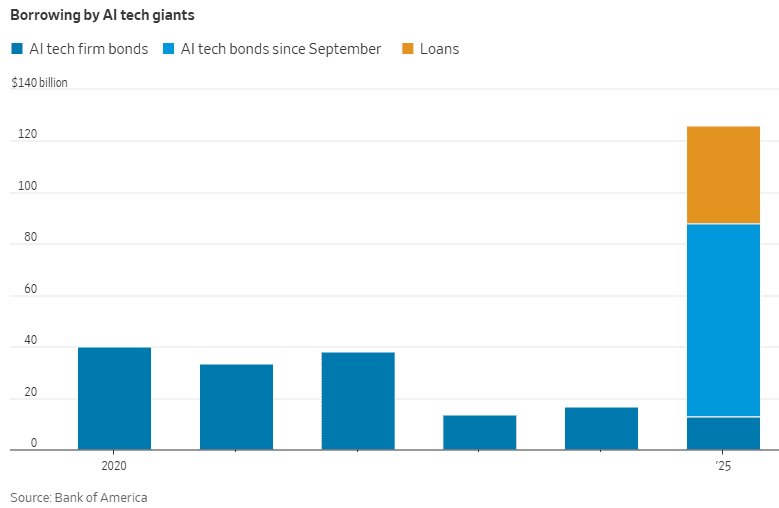

But cloud and AI are changing this equation. Google Cloud requires massive capital investment in data centers, which eats into margins. The company is reportedly spending $50+ billion annually on capital expenditure, much of it related to AI infrastructure. If those investments don't pay off through higher-margin AI products, Alphabet's operating margins compress.

That's the bet Alphabet is making with Gemini, with agentic checkout, and with enterprise AI features. The company is sacrificing current profitability for future dominance in the AI era. The $400 billion in revenue provides the cushion to make that bet.

The YouTube Subscription Strategy: Building Durable Revenue

YouTube Premium's role in the $60 billion revenue picture deserves closer examination. Subscriptions are more valuable than advertising in almost every business model because they're predictable, durable, and defensible.

When a user pays

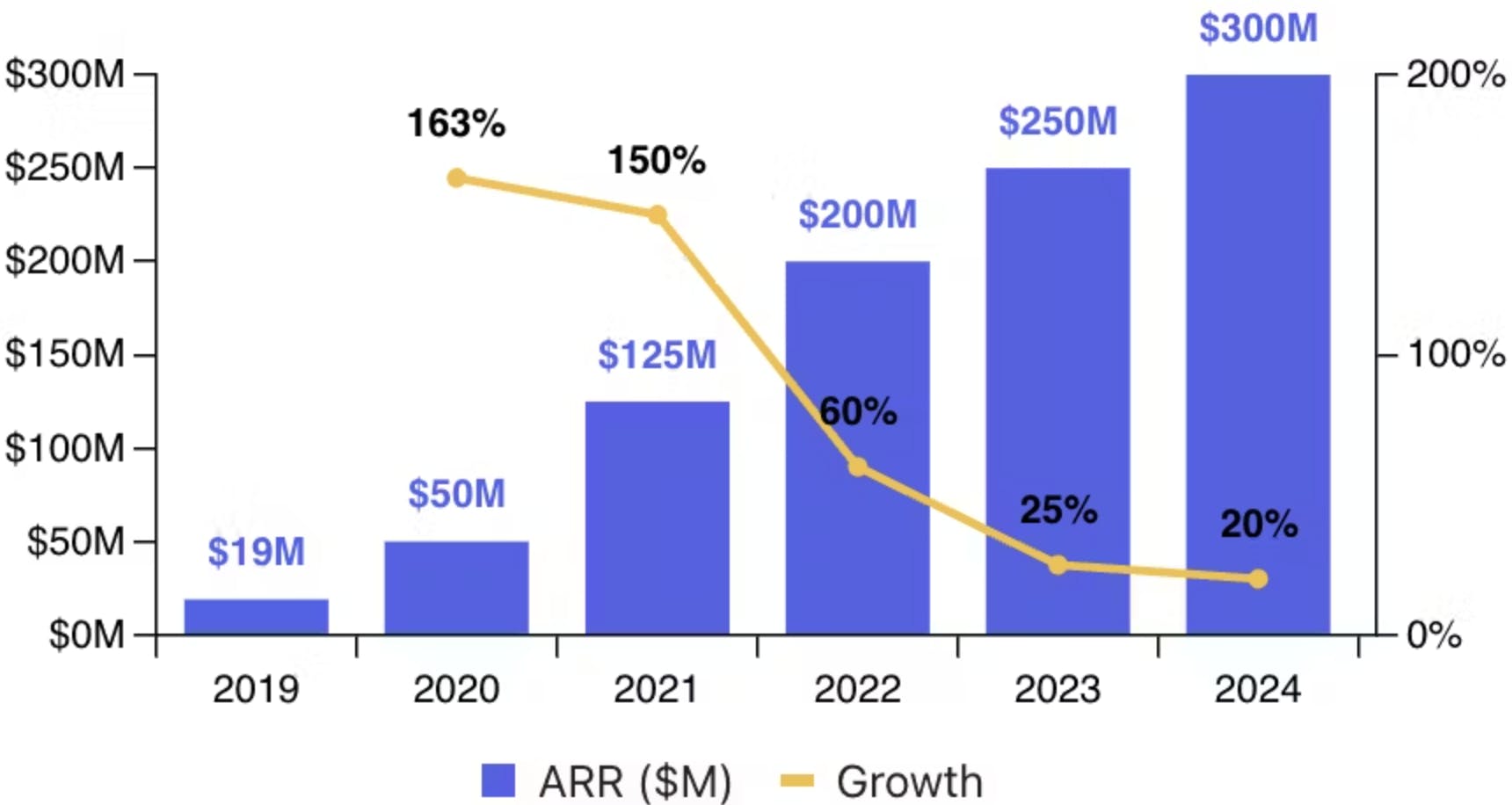

YouTube's 325 million paid subscribers across all services (YouTube Premium, YouTube Music, Google One) generates estimated annual recurring revenue of roughly $50-60 billion annually, with minimal cancellation rates. That's incredibly valuable for two reasons: first, it's predictable revenue, which means Alphabet can invest in YouTube improvements knowing the money will be there. Second, subscription revenue is typically valued higher by investors than advertising revenue because it's less risky.

The company's strategy appears focused on converting more free users to paying users. YouTube has experimented with paywalls, restricted ad-free benefits, and exclusive content. The fact that it's already at 325 million paid subscribers (considering YouTube has 2+ billion logged-in users monthly) suggests substantial headroom for subscription growth.

Comparison with Netflix is inevitable but misleading. Netflix has 300+ million subscribers at higher price points (

This is why the streaming wars narrative got it wrong. People asked, "Can YouTube compete with Netflix?" The real answer is, "YouTube doesn't need to. YouTube already dominates streaming." The platform generates more revenue than any competitor and does it while serving free content to massive audiences. Netflix needs to build an ad-supported tier just to approach YouTube's revenue diversity.

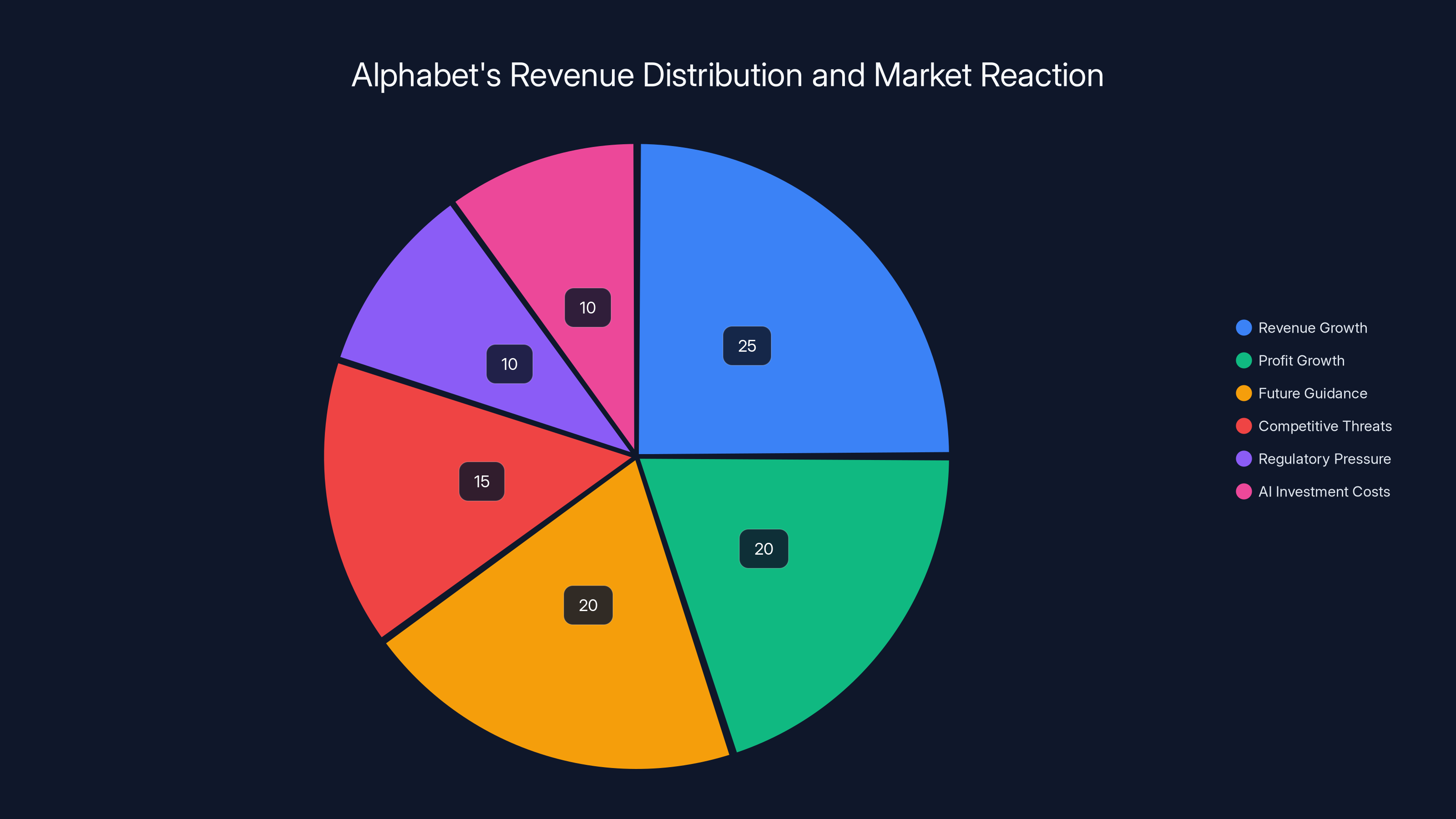

Alphabet's market reaction was primarily driven by strong revenue and profit growth, along with positive future guidance, despite concerns over competitive threats and regulatory pressure. (Estimated data)

Global Dominance and the China Question

Alphabet's

This matters for understanding Alphabet's true market opportunity. The company has achieved

That scenario seems unlikely in the near term. Chinese regulation has tightened, not loosened, over the past decade. Xi Jinping's government prefers domestic tech champions like Baidu and Tencent. Google's exit from mainland China was effectively permanent.

But the China question reveals something important: Alphabet achieved its dominance despite operating in only about 60 percent of the world's internet users. The company's technology is so valuable that even with massive geographic restrictions, it generates $400 billion annually. That speaks to the fundamental utility of search, video, and cloud infrastructure.

For investors, the China question also represents optionality. If geopolitical conditions ever change dramatically, Alphabet has enormous upside trapped by policy. Most companies would never have that possibility. Google does because it's been successful enough that regulators around the world view it as strategically important.

Artificial Intelligence's Impact on Revenue Quality

The $400 billion revenue figure hides an important debate about revenue quality. Not all revenue is created equal. Some revenue sources are more defensible, more durable, and more valuable than others.

Alphabet's search advertising revenue is under genuine threat from AI alternatives. If Perplexity or other AI search engines gain meaningful market share, they'll necessarily cannibalize Google's search revenue. Users who get their answers from Perplexity don't click Google ads.

YouTube advertising revenue is more defensible. Video content consumption is growing faster than overall internet usage. Advertisers need to reach video audiences. YouTube has no serious competitors at that scale. The revenue source is relatively protected.

Google Cloud revenue, meanwhile, is the most contestable. Companies can move workloads between cloud providers. Google Cloud's 30% growth rate is impressive but requires the company to continuously demonstrate superior technology and pricing. The moment competitors catch up, the growth rate might compress.

Subscription revenue (YouTube Premium, Google One, YouTube Music) is the most valuable because it's durable. Once users commit to paying, they stay unless the service degrades. Alphabet should be pushing harder to convert more users to these subscriptions.

The earnings report suggests Alphabet understands this hierarchy. The company is investing heavily in AI to protect search revenue. It's improving YouTube's experience to drive subscriptions. It's expanding Google Cloud's product depth. The $400 billion is real, but the quality of that revenue is under scrutiny.

The Investor Perspective: Why the Market Reacted

When Alphabet announced $400 billion in revenue with strong growth rates, the stock market moved. The company's valuation increased by roughly 2-3 percent on the earnings announcement, suggesting investors viewed the results positively.

Investors focus on three things: revenue growth, profit growth, and guidance about future performance. Alphabet delivered on all three. The 15% revenue growth exceeded analyst expectations. The company maintained healthy margins despite heavy AI investment. Management signaled that AI adoption would accelerate, suggesting future growth remains achievable.

But the stock market also factored in concerns. Google Search faces real competitive threats. Regulatory pressure is real. Capital expenditures are rising. Profit growth is slowing relative to revenue growth because of AI infrastructure costs. These are legitimate concerns that temper enthusiasm.

The consensus view from Wall Street seems to be: Alphabet is still a growth company despite its size. The company's early moves in AI position it well for the next decade. Search remains an incredibly valuable business. Cloud is growing faster than competitors. The $400 billion is real, and more is coming.

But that consensus could shift if any of several things happen: if AI search alternatives gain meaningful market share, if regulatory actions materially harm business operations, if cloud growth slows below 20% annually, or if profit margins compress below 20%. Investors are betting none of those scenarios materialize. Time will tell whether that bet is correct.

What Happens Next: The Five-Year Outlook

If Alphabet maintains its current trajectory, the company could approach

But several wildcard variables could accelerate or decelerate that growth:

Factors that could boost growth beyond $500 billion:

- AI agents become mainstream and agentic checkout captures even 1% of e-commerce, adding $10-15 billion annually

- Google Cloud becomes the default choice for AI workloads, capturing share from AWS and Azure

- YouTube Premium grows to 500+ million subscribers, adding another $20+ billion in subscription revenue

- New product categories (AI-powered enterprise software, personal AI assistants) generate $15-20 billion combined

Factors that could constrain growth below $500 billion:

- Regulatory actions force Google to separate search from advertising, fragmenting the business model

- AI search alternatives capture 10-20% of search volume, reducing search advertising revenue by $20-40 billion

- Capital expenditures spiral out of control due to AI infrastructure arms race, compressing margins

- Antitrust enforcement prevents bundling Gemini into Android and Search, restricting AI adoption

The most likely scenario is that Alphabet reaches somewhere between $450-550 billion in annual revenue by 2030, with strong profit growth driven by AI products maturing and becoming more efficiently monetized. The company's structural advantages in search, YouTube, and Cloud position it well to capture AI-related spending.

But the regulatory overhang cannot be ignored. The Department of Justice could move more aggressively against Google than anticipated. The European Union could impose restrictions that harm profitability. India, Brazil, or other major markets could implement policies that limit Google's business. Geopolitical risk exists that most investors underestimate.

Lessons for the Tech Industry: What $400 Billion Reveals About Power

Alphabet's $400 billion milestone reveals several uncomfortable truths about how modern technology businesses operate:

First, scale creates its own moat. Google Search is valuable because everyone uses it. YouTube is valuable because everyone watches it. More usage creates better products (because of more training data, more user feedback, more content). Better products attract more usage. The loop is unbreakable without external intervention. Competitors can't catch up through better technology alone. They need distribution advantages that match Google's, and nobody has that.

Second, advertising at scale is incredibly profitable. Google's ability to turn attention into money through targeted advertising is fundamentally different from other business models. When billions of people use your platform daily, you can extract meaningful advertising revenue per user without those users realizing what's happening. It's the most valuable discovery in internet history.

Third, consumer free products funded by business advertising is the dominant model. Google, Meta, YouTube, and most of the internet runs on this model. Consumers get free services. Businesses pay for attention. Governments struggle to regulate it because it provides genuine consumer value while generating enormous corporate profits. The model is remarkably durable.

Fourth, vertical integration matters enormously. Alphabet makes money from hardware (Pixels), operating systems (Android), search (Google), video (YouTube), cloud (Google Cloud), and AI (Gemini). Each segment feeds the others. Removing any piece reduces overall power. Regulators understand this but struggle to enforce separation without harming consumers.

Fifth, profit margins exceed anything older industries can achieve. Google's 25-30% operating margins are extraordinary. Manufacturing companies operate at 5-15% margins. Retail companies operate at 3-8% margins. Technology's lack of marginal costs (once built, serving another user costs nearly zero) enables margins that were previously impossible. This is why tech companies are worth more than entire industries combined.

Alphabet's $400 billion revenue is a monument to these truths. The company didn't succeed because of superior customer service or innovation alone. It succeeded because it understood network effects, built platforms that improved with scale, monetized attention efficiently, and invested relentlessly in retaining competitive advantage.

The Broader Context: Alphabet Versus the Tech Peer Group

Putting Alphabet's $400 billion in context requires comparing it to other global tech giants and understanding what that scale means relative to competitors.

Apple generated approximately $391 billion in revenue in its fiscal 2024, making it nearly identical in scale to Alphabet. But Apple's revenue comes from selling hardware at premium prices. Alphabet's revenue comes from digital services and advertising. Apple's business model requires continuous innovation in products. Alphabet's business model benefits from switching costs and network effects. They're different beasts.

Microsoft is approaching $250 billion in revenue but growing faster than Alphabet (closer to 20% annually). Microsoft's cloud business (Azure) is more profitable than Google Cloud, suggesting Microsoft might have the more attractive business model. But Microsoft's size relative to Alphabet means the company is still playing catch-up.

Amazon generates approximately $575 billion in revenue, making it larger than Alphabet. But Amazon's margins are substantially lower because retail is a low-margin business, and AWS (the profitable part) is competing against Google Cloud and Azure.

Meta (Facebook's parent) generates approximately $135 billion in revenue, less than one-third of Alphabet's size. Meta's advertising business is valuable but more challenged than Google's because of iOS privacy changes that limit data collection.

Alphabet's position in this hierarchy is remarkable. The company is among the largest in the world by revenue, second only to Amazon among pure-play tech companies. But Alphabet's profit margins exceed Amazon's. Alphabet's cloud business is growing faster than Microsoft's. Alphabet's search business has no genuine competitor. The company has somehow achieved both massive scale and sustainable competitive advantage, something most companies must choose between.

Conclusion: Understanding Alphabet's Unprecedented Moment

Alphabet's $400 billion annual revenue milestone matters because it reveals the ultimate success of a business model based on monetizing human attention and behavior. The company built a platform so valuable that billions of people use it daily. From that scale, everything flows.

The next $400 billion will be harder to earn than the first. The low-hanging fruit in search advertising is picked. YouTube's growth will eventually slow as penetration increases. Cloud competition will intensify as Microsoft and Amazon improve their offerings. Regulatory pressure will likely increase.

But Alphabet has demonstrated a rare ability to adapt. The company transitioned from pure search to include YouTube. It built a cloud business from scratch and made it competitive with entrenched rivals. It's investing billions in AI before the market demanded it, positioning the company to capture value as AI becomes central to technology.

The real question isn't whether Alphabet can maintain $400 billion revenue. It's whether the company can grow beyond that without fragmenting due to regulatory action. The next five years will be decisive. AI will either become a meaningful revenue source, or it will consume enormous capital without generating commensurate returns. YouTube will either continue growing subscriptions, or growth will plateau. Google Cloud will either challenge AWS for dominance, or it will remain a distant third.

Alphabet's executives believe all three will succeed. Wall Street mostly agrees. Users around the world certainly benefit from the company's products. But uncertainty exists, and that uncertainty is why Alphabet's stock hasn't simply become a bond-like holding. The company still has to execute. The $400 billion proves it can. What comes next will prove whether the company can continue.

FAQ

What does Alphabet's $400 billion revenue figure include?

Alphabet's

How did Alphabet achieve $400 billion in revenue despite being blocked from China?

Alphabet's dominance in markets outside China—including North America, Europe, India, Southeast Asia, and Latin America—proved sufficient to reach

What is the significance of YouTube surpassing $60 billion in annual revenue?

YouTube's $60 billion revenue milestone indicates that the platform has become more valuable than Netflix by total revenue. It demonstrates that advertising-supported video platforms combined with subscription services can generate enormous revenue. YouTube proves that you don't need an expensive content production budget to rival premium streaming services—distribution and user volume matter more than original programming investment.

Why does Gemini's 750 million user count matter if Google Search already has billions of users?

Gemini's 750 million users represents adoption of Google's AI product specifically. This is different from passive Google Search usage. Users actively choosing to use Gemini signals strong product-market fit and adoption beyond forced bundling. As Google integrates Gemini deeper into search results and expands AI capabilities, that 750 million active user base becomes the foundation for monetizing AI features like agentic checkout.

How does Google Cloud's $70 billion run rate compare to AWS and Azure?

Amazon Web Services maintains roughly

What regulatory threats could impact Alphabet's $400 billion revenue base?

Potential regulatory actions include separating search from advertising, preventing bundling of Gemini into Android and Search, restricting data collection for personalization, and mandating interoperability with competitors' platforms. Any of these could reduce revenue, but the most serious threat would be forcing Google to divest search—which could reduce annual revenue by $100-150 billion depending on how the separation is structured.

How long would it take Alphabet to reach $500 billion in annual revenue at current growth rates?

Assuming 15% year-over-year growth continues, Alphabet would reach roughly

Why is Google expanding into agentic AI checkout when search advertising is already so profitable?

Alphabet recognizes that search advertising faces long-term threats from AI search alternatives and regulatory pressure. Agentic checkout represents a new revenue stream that leverages Gemini's 750 million users. If the company can capture even 1-2% of e-commerce transactions through AI agents, it creates $10-20 billion in additional annual revenue that's more defensible than advertising because it's based on transaction value rather than attention capture.

What is the primary driver of Alphabet's current growth rate, and which segment will drive future growth?

Google Cloud and YouTube subscriptions are driving current growth acceleration. Search advertising remains the largest revenue source but is growing more slowly as the market matures. Future growth will depend on whether AI products (Gemini and agentic features) successfully monetize at scale. If AI becomes a meaningful revenue contributor (estimated $20-40 billion by 2030), Alphabet's overall growth rate could accelerate. If AI fails to monetize effectively, growth could slow to 8-10% annually.

How does Alphabet's profitability compare to its revenue, and why do margins matter more than raw revenue?

Alphabet maintains operating margins estimated at 25-30%, meaning the company converts roughly

Key Takeaways

- Alphabet broke through $400 billion in annual revenue for the first time, representing a 15% year-over-year increase and demonstrating sustained growth at massive scale

- YouTube surpassed $60 billion in combined advertising and subscription revenue, establishing itself as the world's leading streamer—more valuable by revenue than Netflix

- Google Cloud reached a $70 billion annualized run rate with 30%+ growth, competing directly with Microsoft Azure while AWS growth slowed to 16% annually

- Gemini AI surpassed 750 million users following the November Gemini 3 launch, with AI Mode searches doubling and indicating major shifts in how people consume information

- Agentic checkout features planned for Gemini and Google Search represent the next frontier for AI monetization, potentially adding $10-20 billion in new revenue streams

Related Articles

- Anthropic's Ad-Free Claude vs ChatGPT: The Strategy Behind [2025]

- Enterprise AI Race: Multi-Model Strategy Reshapes Competition [2025]

- Alexa+: Amazon's AI Assistant Now Available to Everyone [2025]

- Nvidia's $100B OpenAI Gamble: What's Really Happening Behind Closed Doors [2025]

- Intel's GPU Strategy: Can It Challenge Nvidia's Market Dominance? [2025]

- AI Safety by Design: What Experts Predict for 2026 [2025]

![Google Hits $400B Revenue Milestone in 2025 [Full Analysis]](https://tryrunable.com/blog/google-hits-400b-revenue-milestone-in-2025-full-analysis/image-1-1770246623341.jpg)