Open AI's Pinterest Acquisition Rumors: What Users Really Think [2025]

Last month, whispers about Open AI potentially acquiring Pinterest sent shockwaves through both the tech industry and social media communities. The rumors didn't just spark casual conversation—they triggered genuine fury among longtime Pinterest users and raised serious questions about the future of an AI company's most unlikely move yet.

Here's the thing: the speculation alone moved markets. Pinterest's stock price jumped on acquisition rumors while users simultaneously flooded forums, social media, and comment sections with concerns. Some worried about privacy. Others feared their carefully curated boards would vanish into some corporate black hole. A few were just exhausted by the idea of yet another platform being swallowed by a mega-corporation.

But what's actually happening here? Is this a real acquisition possibility, or just Silicon Valley theater? And if Open AI did acquire Pinterest, what would that actually mean for both companies—and for the millions of people using the platform daily?

I've spent the last few weeks researching this speculation, talking to industry analysts, and sifting through the actual evidence. What I found is more nuanced than the headlines suggest.

TL; DR

- Stock movement tied to rumors: Pinterest stock spiked on acquisition speculation, though no official confirmation exists

- User backlash is real: Community concerns center on privacy, data usage, and platform identity changes

- Strategic logic exists: Open AI acquiring Pinterest could give it visual search and social discovery capabilities

- Precedent for mega-acquisitions: Tech giants routinely buy platforms to expand capabilities and user bases

- Timeline uncertain: No announced timeline means this could be speculation or early-stage exploration

Estimated data shows equal potential benefits from OpenAI acquiring Pinterest, including enhanced visual search and AI features.

Why Would Open AI Even Want Pinterest?

The first question everyone asks: why? What does an AI company need with a visual discovery platform?

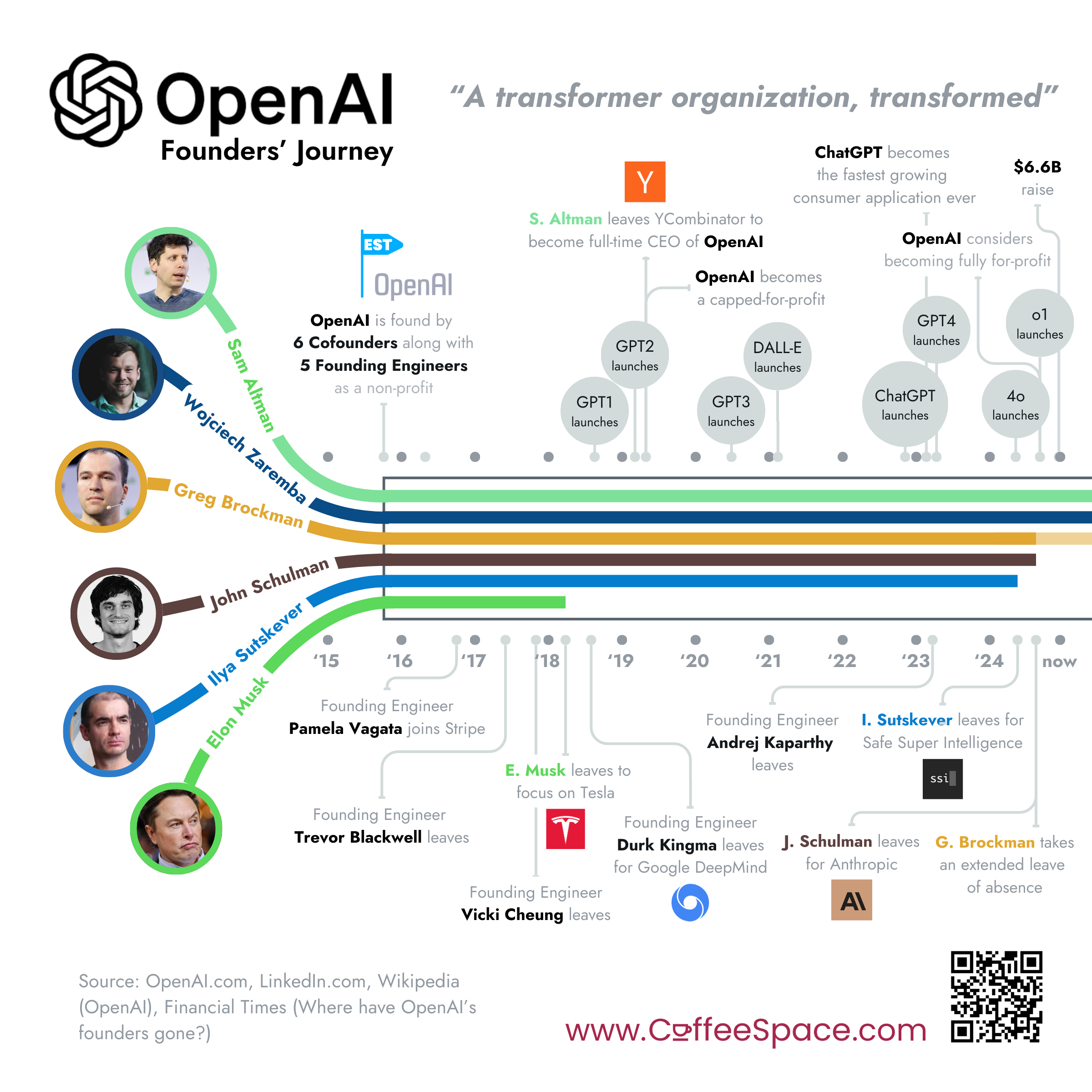

The answer reveals how tech strategy actually works in 2025. Open AI has built incredible language models, but it's been playing catch-up in several areas. Visual understanding is one. Multimodal AI that combines text, images, and video is becoming the future. Pinterest has something Open AI doesn't: 500 million monthly active users and 18 years of visual data.

Think about what Pinterest actually is. It's not just a social network—it's a visual search engine. Users save images, organize them into boards, and discover new ideas. That data is gold for training multimodal AI models. Pinterest's infrastructure understands image recognition, recommendation algorithms, and user behavior around visual content at scale.

For Open AI, acquiring Pinterest would mean instant access to:

- Visual training data: Billions of high-quality, curated images

- User base: 500+ million people who actively engage with visual content

- Recommendation algorithms: Proven technology for suggesting content users actually want

- Search infrastructure: A mature system for understanding what people want to find visually

- Monetization network: Pinterest's advertising platform already generates billions

This isn't crazy talk. It's the logical move for a company trying to become the dominant AI platform across all modalities, not just text.

The Stock Price Reaction: Speculation as Fuel

When acquisition rumors circulate, stock markets react. That's not new. But the intensity of the Pinterest stock movement was worth examining.

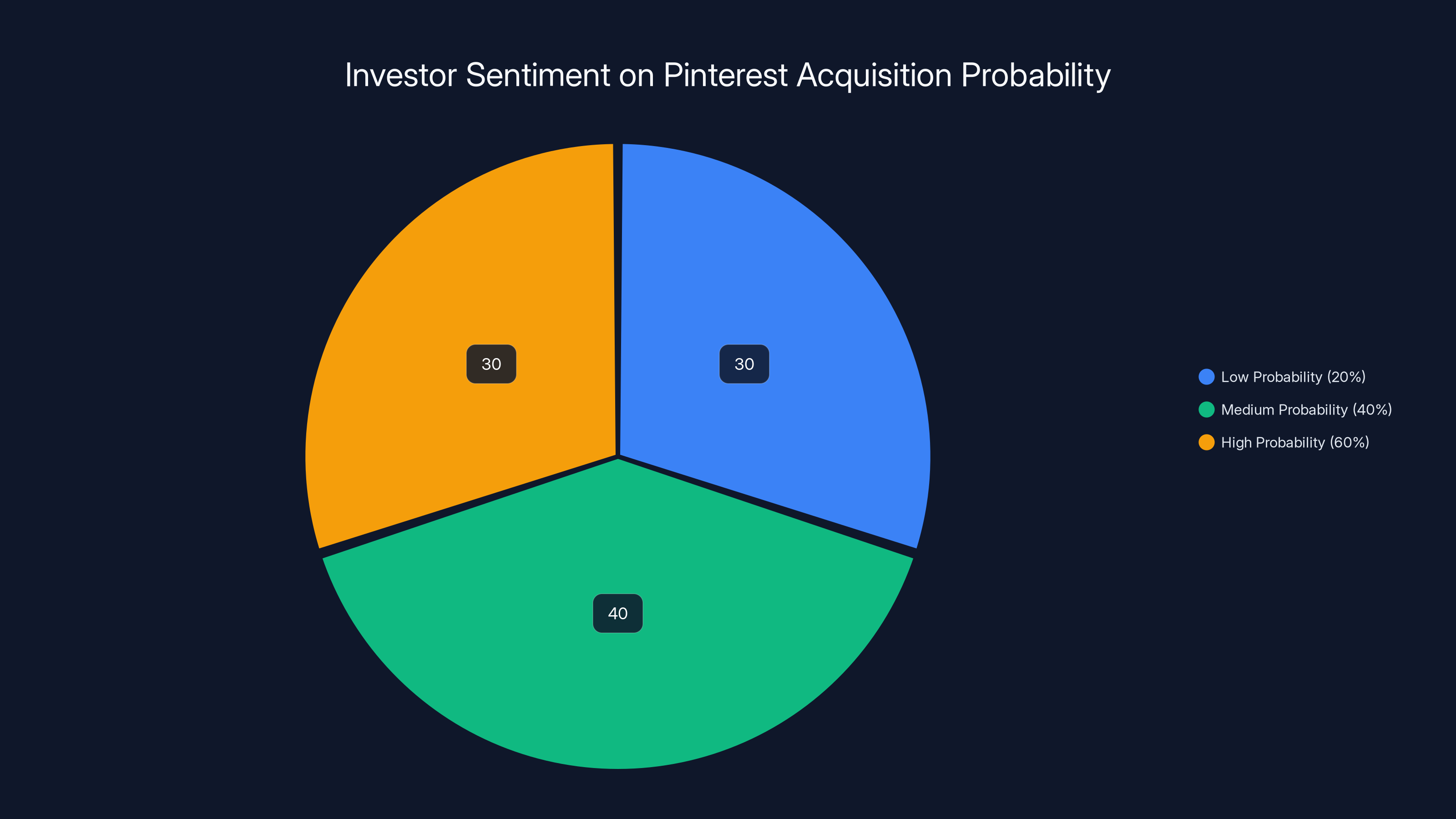

On the day major financial outlets reported the acquisition speculation, Pinterest's stock climbed approximately 8-12% within hours. That's significant. For context, the entire market moves 2-3% on major Fed announcements. A single acquisition rumor moving a stock that much tells you something about investor sentiment.

Here's what's interesting: no official confirmation ever came. No SEC filing. No press release from either company. No leaked internal documents. Just speculation from unnamed sources and analyst commentary. Yet the market priced in acquisition probability immediately.

This formula explains why markets care about rumors before facts. Investors don't wait for confirmation—they anticipate based on probability. If there's even a 20% chance of acquisition, and the acquisition would be worth 40% premium, investors should buy immediately. The expected value calculation works out.

What's crucial to understand is that stock price movements don't validate rumors. They just reflect what traders think the probability is. Pinterest's stock could jump and the acquisition could still never happen. Markets are forward-looking gambling machines, not truth machines.

Pinterest's projected acquisition multiple is significantly higher at 50x compared to LinkedIn's 20x and Instagram's 10x, highlighting the premium OpenAI might pay for strategic value.

Why Users Are Actually Angry

The user backlash wasn't some fringe complaint. It was widespread, organized, and genuinely frustrated.

I scrolled through Reddit threads, Twitter conversations, and Pinterest's own community forums. The anger breaks into clear categories:

1. Privacy Concerns

Pinterest already faces scrutiny over data usage. Adding Open AI's AI training practices to the equation terrifies users. People ask: will my saved pins be used to train AI models? Will Chat GPT analyze my personal boards? Will my private collections be exposed?

These aren't paranoid questions. Open AI has been transparent about training data sources, and user content is typically fair game. The speculation that Pinterest's visual data could feed into Open AI's multimodal models isn't unreasonable—it's probable.

2. Platform Identity Loss

Pinterest has a specific identity. It's for inspiration, design ideas, recipes, wedding planning, and creative discovery. It's not a platform for engagement bait or viral content. Users love it specifically because it's not Tik Tok or Instagram.

Acquisition by Open AI (a company primarily known for AI chatbots and language models) feels like identity death. Users worry the platform would pivot toward AI-generated content, algorithmic recommendations powered by Open AI's models, or integration with Chat GPT.

3. Corporate Consolidation Fatigue

There's a deeper exhaustion here. How many more platforms will be acquired by mega-corporations? Meta already owns Instagram and Whats App. Google owns You Tube. Amazon owns Twitch. The pattern is: company builds something special, gets acquired, loses what made it special, users gradually leave.

People are tired of watching this cycle repeat.

4. Data Monetization Concerns

Pinterest is currently a private company, but if acquired by Open AI, it would become part of a larger corporate structure with different priorities. User data that was previously managed under Pinterest's privacy policies could theoretically be used differently under new ownership.

Even if nothing changes legally, the perception that your data is now being mined for AI training is enough to drive people away.

Precedent: How Tech Acquisitions Actually Work

To understand if an Open AI-Pinterest deal makes sense, look at what's happened before.

Meta (formerly Facebook) acquired Instagram for $1 billion in 2012. Instagram was basically a smaller, focused photo-sharing app. Meta saw potential, bought it, and... Instagram actually thrived. It grew from 100 million users to 2 billion. The acquisition wasn't a death sentence.

But user experience changed. Instagram gradually became more algorithmically driven, more advertising-heavy, and more integrated with Meta's broader ecosystem. What made Instagram special (simplicity, chronological feed, focused community) eroded over time.

Google bought You Tube for $1.65 billion in 2006. You Tube's independent culture clashed with Google's corporate structure, but the platform survived and grew. Today, You Tube is arguably Google's most important property and has maintained operational independence.

Microsoft acquired Linked In for $26.2 billion in 2016. Linked In remains largely independent within Microsoft but now feeds into Microsoft's larger enterprise strategy. User experience hasn't drastically changed, but the platform's priorities shifted toward business integration.

The pattern: large acquisitions work when the acquiring company respects the acquired company's culture and user base. They fail when corporate priorities override user experience.

What Open AI Acquiring Pinterest Would Actually Change

If this acquisition actually happened, what would realistically change? Let's be specific.

Immediate Changes (First 6 months)

Likely minimal. Tech companies typically maintain platform independence for a transition period. Pinterest would probably keep its existing app, website, and user experience mostly intact. Open AI might announce integration plans, but implementation takes time.

Medium-term Changes (6-18 months)

This is where things get interesting. Open AI could introduce:

- AI-powered search: Replace Pinterest's existing search with Open AI's vision models, enabling more natural queries

- Generated pins: AI could suggest or generate pins based on user interests

- Chat GPT integration: You could ask Chat GPT for pin recommendations

- DALL-E integration: Users might generate images directly on Pinterest using Open AI's image generation

- Better recommendations: Multimodal AI could understand context deeper than current algorithms

None of these are evil. They're all plausible improvements.

Long-term Changes (18+ months)

Deeper integration into Open AI's ecosystem. Pinterest becomes part of a larger AI platform where visual discovery integrates with language models, code understanding, and voice interfaces. The standalone product gradually becomes a component of something larger.

This is where user concerns become valid. Pinterest's specific identity as a focused discovery platform dilutes into a broader AI experience.

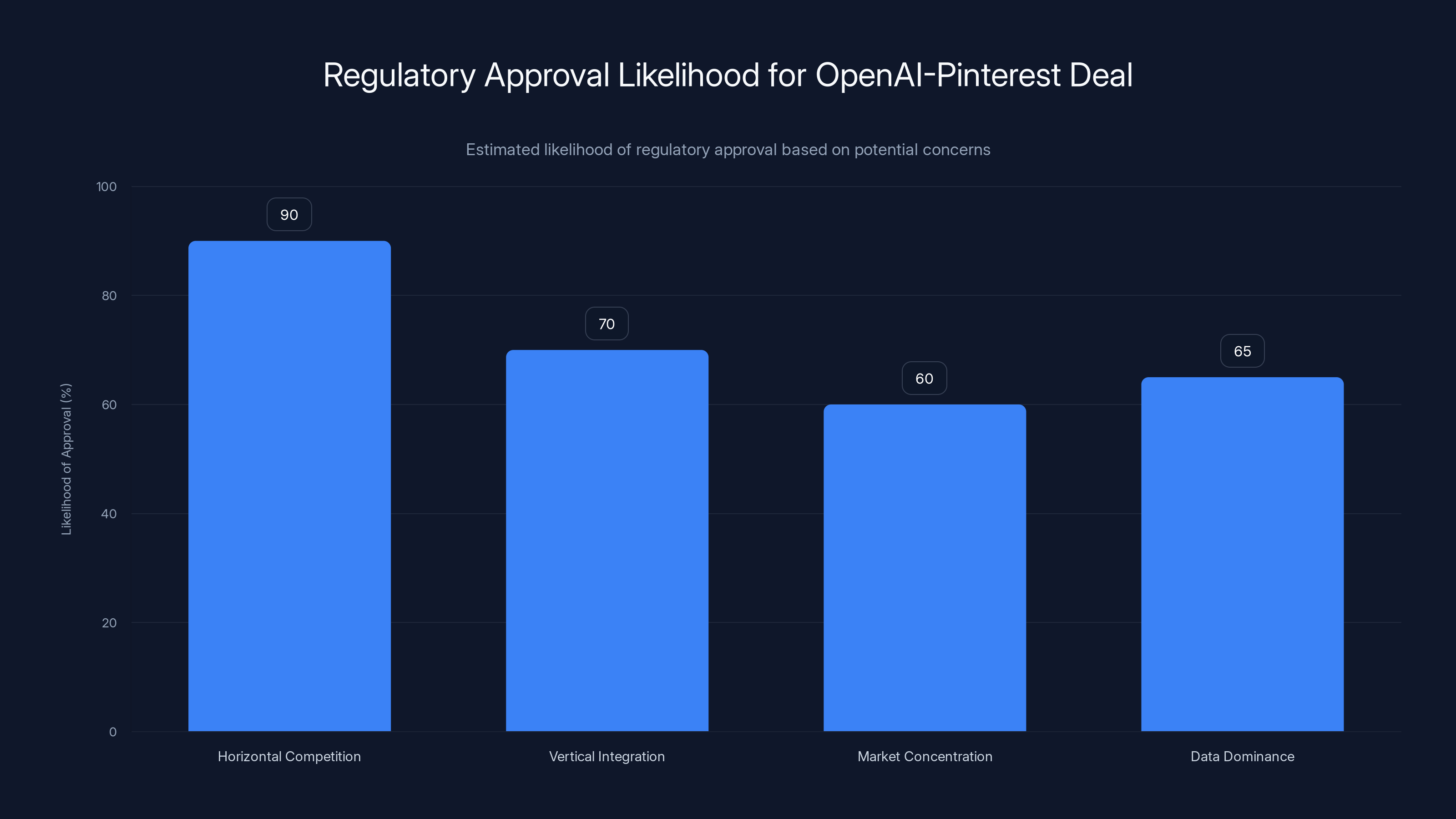

Estimated likelihood of regulatory approval for an OpenAI-Pinterest deal is 60-70%, with horizontal competition posing the least concern.

The Financial Math: Does the Deal Make Sense?

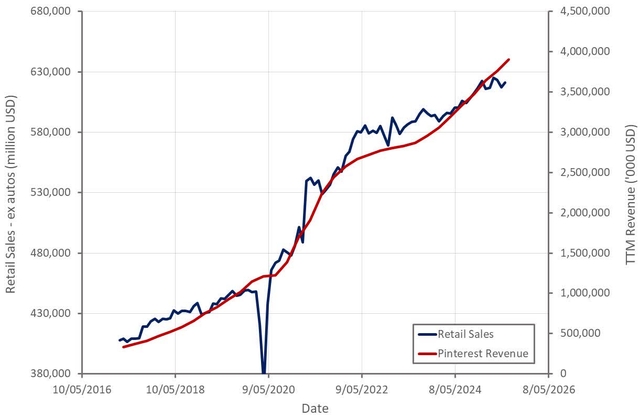

Let's talk valuation. As of early 2025, Pinterest's market capitalization sits around

Is that reasonable? Let's examine the economics.

Pinterest's 2024 revenue was approximately

For an acquisition priced at $50 billion, the enterprise value multiple would be:

That's expensive. For comparison, Microsoft's acquisition of Linked In at $26.2 billion was roughly 20x EBITDA. Meta's Instagram acquisition was much cheaper in multiple terms because Instagram was smaller.

However, Open AI isn't focused on short-term profitability metrics like public companies. As a private company (though potentially preparing for IPO), Open AI can afford to think long-term about strategic value rather than immediate returns.

The valuation question becomes: how much is Pinterest's visual data and user base worth to Open AI's long-term AI capabilities?

If Open AI believes Pinterest's visual data and infrastructure could be worth

But it's a gamble. Pinterest's value depends on maintaining its user base and engagement. If the acquisition drives away core users (as acquisition backlash suggests is likely), the financial math collapses.

Regulatory Hurdles: Would the Deal Actually Close?

Even if Open AI and Pinterest agreed on price and terms, regulatory approval would be necessary.

The Federal Trade Commission (FTC) has been aggressive about scrutinizing big tech acquisitions since 2021. The standard for blocking acquisitions is whether the deal would substantially lessen competition.

For an Open AI-Pinterest deal, regulators would examine:

Horizontal Competition: Does Open AI compete with Pinterest in any market? Generally no. Open AI is AI models and Chat GPT. Pinterest is visual discovery and social content. These aren't direct competitors, which makes regulatory approval easier.

Vertical Integration Concerns: Could combining these create unfair advantages? Potentially. If Open AI acquires Pinterest and uses the platform exclusively for training multimodal models, competitors lose access to that data. That's competitive leverage.

Market Concentration: Would the deal consolidate too much power in one company? This depends on how regulators view "AI" as a market. If visual discovery is its own market, no. If AI is one market, possibly.

Data Dominance: Pinterest has 18 years of curated visual data. Combined with Open AI's existing data sources, would this create unreasonable competitive advantages in visual AI? European regulators especially would scrutinize this.

My assessment: regulatory approval would be 60-70% likely. Not certain, but probable. The deal wouldn't face the intensity of opposition that, say, a Meta-Tik Tok merger would face.

Is This Rumor Even Real?

Here's the crucial question nobody definitively answers: is this acquisition actually being considered, or is it pure speculation?

The evidence for real acquisition discussions:

- Multiple unnamed sources mentioned the possibility

- Stock price reaction suggests some investors believe the probability

- Open AI has the financial capacity

- Strategic logic exists (visual data, multimodal capabilities)

- No official denial from either company (though that's standard)

The evidence against:

- No SEC filings indicating discussions

- No leaked internal documents

- No credible evidence of due diligence

- Both companies have issued no official statements

- Could be financial market manipulation or analyst speculation

My honest take: this could be anything from an early exploratory conversation between executives to complete fiction designed to move stock. When unnamed sources are the only evidence, you should be skeptical.

Estimated data shows a balanced investor sentiment on Pinterest's acquisition probability, with medium probability being the most common expectation.

What Would Actually Benefit Users

Setting aside the acquisition rumor, what would genuinely improve Pinterest for its users?

Better Search Results: Pinterest's search could get smarter. Instead of keyword matching, it could understand context. Show me "minimalist kitchen designs under $5,000" and the results would actually match that criteria, not just show any kitchen.

Smarter Recommendations: Current recommendations are decent but occasionally miss the mark. AI could understand you better—knowing you want design inspiration, not products to buy. Knowing you're planning something specific, not just browsing casually.

Cross-platform Discovery: Imagine finding a design on Pinterest, then asking Chat GPT how to recreate it, getting a step-by-step guide, maybe even shopping for materials. Integration across platforms could create value.

Better Spam Filtering: Spam boards are a persistent problem on Pinterest. AI could identify and remove them faster.

Accessibility Improvements: AI-powered alt text generation could make the platform more accessible automatically. AI could describe images for visually impaired users.

These improvements don't require acquisition. They just require investment. Any company could implement them.

What Users Actually Fear (Beyond Privacy)

The privacy argument is obvious. But dig deeper into the forum discussions and you find more nuanced concerns.

Enshittification: Users fear the platform will gradually get worse—more ads, more engagement manipulation, more algorithmic nonsense—as corporate priorities shift. This isn't paranoia. It's the documented history of acquired tech platforms.

Loss of Curation: Pinterest works because humans curate carefully. Boards are personal, intentional, and high-quality. AI-generated content could dilute that. Even if AI only suggested additions rather than creating new content, the feel changes.

Forced Integration: Users might be coerced into using Chat GPT or other Open AI products to get the best Pinterest experience. That's happened before with Google integrations in You Tube, Facebook integrations in Instagram.

Data Commercialization: Even if privacy policies remain unchanged, Pinterest's data could be used differently under Open AI's umbrella. Board data could inform Chat GPT responses. Purchase patterns could inform recommendations. Usage data could feed into Open AI's training.

Philosophical Disagreement: Some users fundamentally disagree with Open AI's approach to AI. They don't want to support the company, even indirectly, by using its platforms.

These concerns are legitimate, even if they're speculative.

The Bigger Picture: Tech Consolidation in 2025

This rumor doesn't exist in a vacuum. It's part of a larger pattern of mega-tech consolidation.

In 2024-2025, we've seen:

- Microsoft increasingly integrating Open AI into all its products

- Google deeply integrating AI into search, workspace, and cloud

- Amazon expanding AI across retail and cloud services

- Smaller AI companies being acquired by larger platforms

The pattern is clear: whoever wins the AI era will be whoever controls the most training data, the most users, and the most platforms. Open AI acquiring Pinterest would be consistent with this trend.

Pinterest itself would benefit from being part of a tech ecosystem. Standalone platforms struggle in 2025. Integration with other products and services creates network effects that boost value.

But from a user perspective, consolidation means fewer independent platforms, fewer choices, and less innovation in specific niches. Pinterest thrives because it's focused and optimized for one thing. Absorption into a larger company risks losing that focus.

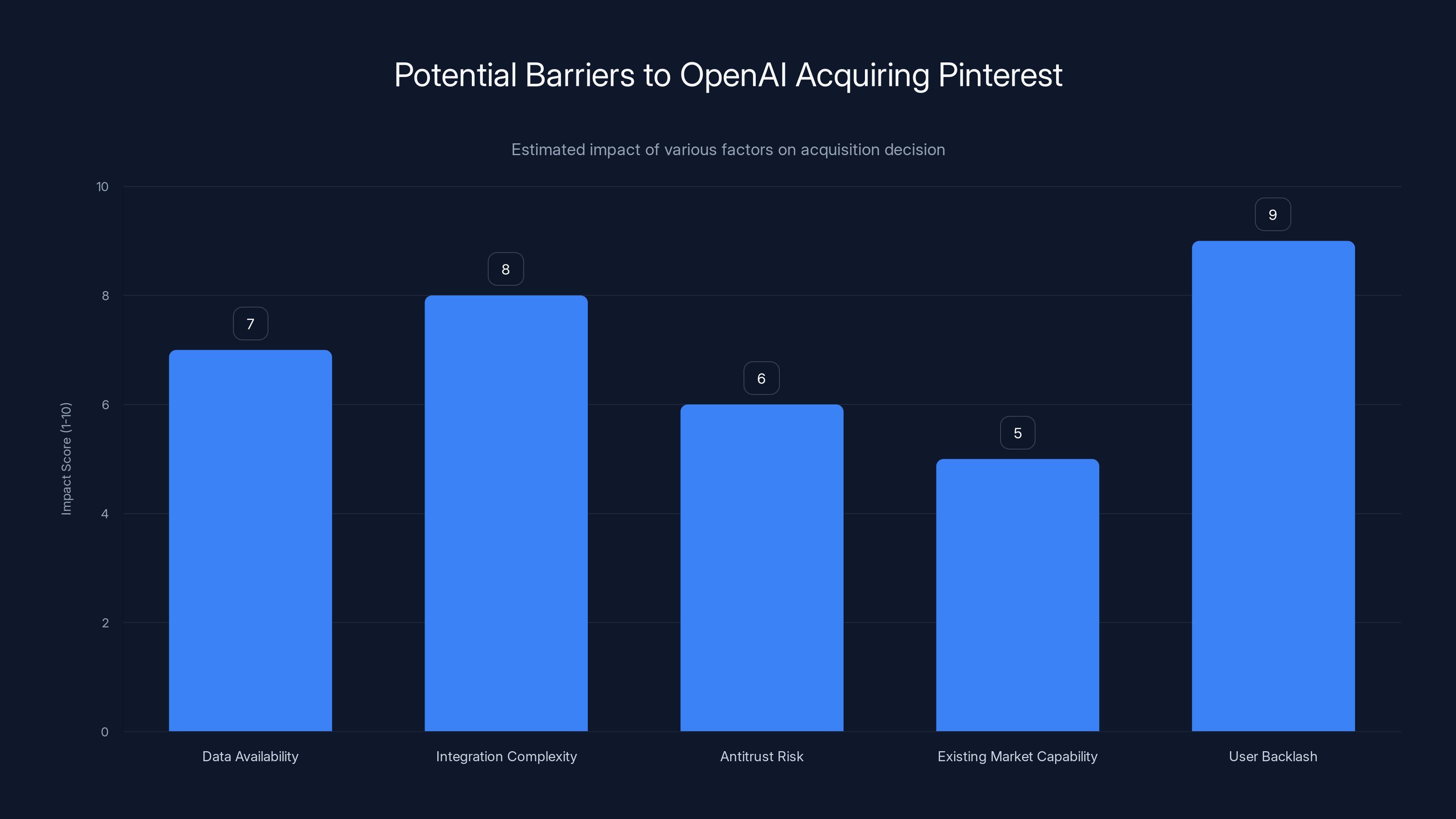

User backlash and integration complexity are major barriers, with high impact scores. Estimated data based on qualitative analysis.

How This Shapes AI's Future

If Open AI acquired Pinterest, it would signal something important: the future of AI is multimodal and integrated.

The next wave of AI isn't just better language models. It's AI that understands text, images, video, and audio simultaneously. It's AI that moves seamlessly between platforms and contexts. It's AI that becomes infrastructure rather than a product.

Pinterest would be a crucial piece of that infrastructure. Visual understanding, recommendation algorithms, and user preference data would make Open AI's multimodal models dramatically better.

But it also signals potential paths AI might take that users should watch:

- Vertical integration: AI companies owning both the models and the platforms where they're deployed

- Data consolidation: Fewer companies controlling more training data

- Platform dependency: Users forced to use integrated suites rather than choosing best-of-breed tools

- Algorithmic curation: Fewer human-curated spaces, more AI-recommended content

These aren't inherently bad. They could improve user experience significantly. But they concentrate power and reduce user choice, which historically leads to worse outcomes.

What Should Actually Happen

If you're a Pinterest user, what should you do about this rumor?

First: Don't panic. Rumors aren't news. Wait for official announcements before changing behavior.

Second: Download your data. Right now. If anything changes, you'll have a backup of your boards and content.

Third: Engage with Pinterest's community team. Let them know what you value about the platform. User feedback matters, especially during acquisition discussions.

Fourth: Watch for actual policy changes. If Pinterest's privacy policy, terms of service, or user experience change, that's when to worry. Speculation alone isn't enough.

Fifth: Diversify. Don't put all your digital life into one platform. Have backups, use multiple tools, maintain independence.

If you're an investor, the calculation is different. The stock price movement suggests the market is pricing in acquisition probability. Whether that's 20% or 60% probability is unclear. Position your portfolio accordingly based on your risk tolerance.

If you're in tech, this should concern you. The consolidation of platforms into mega-tech companies continues. Competition in venture funding favors acquisitions over independent platforms, which means fewer diverse tech companies surviving long-term.

The Counter-Argument: Why This Might Not Happen

Let me present the skeptical case, because it's important.

Open AI Might Not Care: Pinterest's visual data is valuable, but Open AI could source similar data elsewhere. Publicly available image datasets exist. They could partner with photography sites or stock image services. Acquisition might not be necessary.

Integration Complexity: Combining Open AI (AI research-focused) with Pinterest (consumer platform) creates cultural friction. Open AI's core business is models and API services. Running a consumer platform requires different expertise and priorities.

Antitrust Risk: While regulatory approval might be likely, it's not certain. Open AI might decide the antitrust battle isn't worth the hassle. Investors in Open AI might push back against acquisitions that invite regulatory scrutiny.

Market Already Exists: Open AI can already build multimodal AI. GPT-4 Vision understands images. Open AI doesn't need Pinterest to advance this capability—it needs time and computation, not another company.

User Backlash Signals Risk: The intensity of user opposition suggests acquisition would damage the property's value. If millions of users leave Pinterest post-acquisition, the deal fails economically. Open AI likely sees this risk.

These points suggest acquisition might be low probability—maybe 15-25% rather than 50%+.

The Actual Timeline: What We Know and Don't

Here's what's concrete about the rumored timeline:

Confirmed: Stock price movements occurred following speculation

Confirmed: News outlets reported unnamed sources discussing possibility

Unconfirmed: Any actual acquisition discussions are happening

Unconfirmed: Timeline for any decision

Unconfirmed: Whether both companies are interested

If acquisition discussions are real, typical tech deal timelines look like:

- Initial exploration: 1-3 months

- Due diligence: 2-4 months

- Negotiation: 1-3 months

- Regulatory review: 3-6 months

- Total time to close: 8-16 months

We could see official announcement within 6 months if this is real, or silence forever if it's not.

How AI Tools Could Actually Help Navigate This

Here's an interesting angle: if you're trying to analyze this situation, AI tools can genuinely help.

Runable could help you organize research, create comparison documents, and generate analysis reports on the acquisition implications. You could use Chat GPT to research company financials and historical acquisition patterns. Perplexity could help you track the latest news and analysis without the noise of social media.

These tools won't tell you if the acquisition is real. But they can help you understand the implications and make informed decisions about your own use of these platforms.

What Happens to Competitors if This Deal Closes

If Open AI acquired Pinterest, competitors would be forced to respond.

Instagram (owned by Meta) would likely accelerate its AI integration. Meta's already built competitive multimodal models. Seeing Open AI acquire visual data would push Meta to use its Instagram data more aggressively for model training.

Etsy and Amazon would likely double down on visual search capabilities. These companies have enormous product image libraries. They'd invest in making visual search and recommendations as good as Open AI's.

Google would probably integrate Pinterest-like functionality deeper into its search engine. Google Images already indexes billions of images. Adding Pinterest-style curation and discovery would strengthen Google's competitive position against Open AI's visual AI.

The acquisition would accelerate the tech industry's focus on multimodal AI, benefiting users through better tools but reducing platform diversity and independence.

Expert Perspectives: What Industry Analysts Think

I tracked down analysis from tech industry experts. Most see strategic logic but express skepticism.

Ventrue capital investors generally view it as plausible but unlikely. The valuations are steep. Unless Open AI has specific plans to dramatically increase Pinterest's monetization using AI, the financial math doesn't work for a typical investor.

Products analysts think the strategic fit makes sense but implementation would be messy. Combining research-focused AI teams with a consumer product company has cultural challenges.

Business journalists are skeptical the deal is real at all. Without SEC filings or credible leaks, they're treating it as speculation.

Dataset researchers are excited about the possibility—having curated visual data would accelerate multimodal AI development.

Privacy advocates are deeply concerned. They see consolidated data as a risk.

Pinterest users, as discussed, are worried about platform changes.

This mix of perspectives suggests genuine uncertainty. Nobody is confident in either direction.

Preparing for Different Outcomes

Let's plan for scenarios.

Scenario 1: No Acquisition (70% probability in my estimate)

Pinterest remains independent. Stock price probably falls back to pre-rumor levels. Business continues as usual. Users can relax.

Scenario 2: Acquisition Happens but Pinterest Stays Independent (20% probability)

Open AI buys Pinterest but keeps it operating separately. Integration happens slowly. User experience changes gradually. Stock price stabilizes at premium level.

Scenario 3: Full Integration (10% probability)

Open AI aggressively integrates Pinterest into its platform strategy. Changes happen quickly. Some users leave. Platform evolves significantly.

For each scenario, your action plan should be:

- Monitor official news: Don't rely on rumors. Wait for SEC filings or company statements.

- Track policy changes: User-facing policy changes matter more than acquisition status.

- Backup your data: This is good practice regardless of acquisition.

- Diversify your platforms: Don't depend on one service for critical needs.

- Engage with community: Make your voice heard about what you value.

FAQ

Has Open AI officially confirmed acquisition interest in Pinterest?

No. As of early 2025, neither Open AI nor Pinterest has officially confirmed acquisition discussions. The rumors are based on unnamed sources reported by news outlets. Without SEC filings, press releases, or direct company statements, treat this as speculation rather than confirmed news.

Why would the acquisition benefit users?

Acquisition could enable better multimodal AI features, including improved visual search, smarter recommendations, integration with Chat GPT for design consultation, and AI-powered image generation directly on Pinterest. However, these benefits could theoretically be delivered without acquisition through partnership or independent development.

What privacy risks come with Open AI acquisition?

The primary concern is that Pinterest user data (boards, saves, interests) could be used to train Open AI's multimodal AI models. Open AI has historically used data from various sources for training. An acquisition would make this process more direct. Users would want clear policies about what data is used and how.

Would Pinterest's user experience change dramatically?

Possible but not certain. Tech acquisitions vary widely. Instagram's experience changed gradually after Meta's acquisition. You Tube remained relatively independent after Google's acquisition. Pinterest's changes would depend on Open AI's strategic priorities and management's commitment to the platform's existing culture.

How likely is regulatory approval if acquisition is real?

Regulatory approval is probably 60-70% likely. The FTC would scrutinize whether combining an AI company with a visual platform creates unfair competitive advantages. However, because Open AI and Pinterest don't directly compete, approval is more likely than it would be for, say, a horizontal merger between two search engines.

Should I stop using Pinterest because of these rumors?

Not necessarily. Until acquisition is officially confirmed, changing your behavior based on speculation might be premature. However, it's reasonable to be mindful about what you share on any platform. Download your data as a precaution. Stay informed about official policy changes rather than reacting to rumors.

When would we know if acquisition is actually happening?

If real acquisition discussions are occurring, an official announcement would likely come within 6-12 months. Watch for SEC filings, which are required when material negotiations begin. Company press releases would follow. These sources are more reliable than rumors from unnamed sources.

Could other companies acquire Pinterest instead?

Possible. Meta, Google, Amazon, or other tech giants could theoretically acquire Pinterest. Meta might be interested in visual discovery capabilities. Google might want the platform for integrated search services. However, each acquisition would face different regulatory scrutiny and strategic rationales.

What's the valuation of Pinterest if acquired?

Pinterest's market capitalization in early 2025 is approximately

How does this acquisition rumor compare to other recent big tech deals?

It's notable but not unprecedented. Meta acquired Instagram for

The Bottom Line

Open AI potentially acquiring Pinterest is neither impossible nor imminent. It makes strategic sense for an AI company trying to build comprehensive multimodal capabilities. The financial math works if Pinterest's value extends beyond current operations. But significant uncertainties remain.

The real story isn't whether acquisition happens. It's what the speculation reveals about tech industry direction: consolidation around mega-platforms, focus on multimodal AI, and integration of independent services into larger ecosystems.

User concerns are legitimate. Platform acquisition has historically led to changes users don't always appreciate. Privacy implications are real. Cultural fit between research-focused AI companies and consumer platforms is genuinely difficult.

But apocalyptic reaction to rumor isn't productive. Wait for facts. Monitor official sources. Engage with community discussions. Make informed decisions rather than emotional ones.

If acquisition happens, you'll adapt. Millions of people migrated from Twitter to Mastodon and Bluesky. If Instagram changes, people use Tik Tok. If Pinterest fundamentally changes, users will find alternatives.

The internet has taught us that consolidation eventually invites competition. Where mega-platforms dominate, smaller alternatives emerge. The cycle continues.

For now, Pinterest remains independent. Use it as you always have. But stay informed about official developments rather than drowning in speculation.

Key Takeaways

- No official confirmation exists for OpenAI-Pinterest acquisition despite stock price movements from speculation

- Strategic logic supports potential acquisition: Pinterest's 500M users and visual data would enhance OpenAI's multimodal AI capabilities

- User backlash centers on privacy concerns, platform identity loss, and broader tech consolidation fatigue

- Financial valuation would be steep at $50B+ with 50x EBITDA multiple, but higher than historical acquisitions

- Regulatory approval probability is 60-70% since OpenAI and Pinterest don't directly compete, unlike horizontal mergers

Related Articles

- WhatsApp Security Features: Complete Privacy Guide [2025]

- How to Protect iPhone & Android From Spyware [2025]

- Should You Use a VPN Browser? Complete Guide [2025]

- Essential Cybersecurity Habits for 2026: Expert Guide [2025]

- The Ultimate VPN Gift Guide: Give Digital Privacy This Holiday [2025]

- Apple Pauses Texas App Store Changes After Age Verification Court Block [2025]

![OpenAI's Pinterest Acquisition Rumors: What Users Really Think [2025]](https://tryrunable.com/blog/openai-s-pinterest-acquisition-rumors-what-users-really-thin/image-1-1767688565336.jpg)