Introduction: Understanding Chat GPT's Shift to Advertising

OpenAI's decision to introduce advertisements into Chat GPT marks a significant turning point in how consumer AI services generate revenue. In February 2025, the company began rolling out ads to users on its Free and Go subscription tiers, creating what many see as an inevitable monetization strategy for a technology that has captured global attention and usage. This development represents more than a simple business decision—it reflects broader market dynamics, competitive pressures, and the fundamental challenge of building sustainable AI services that serve both paying customers and free users.

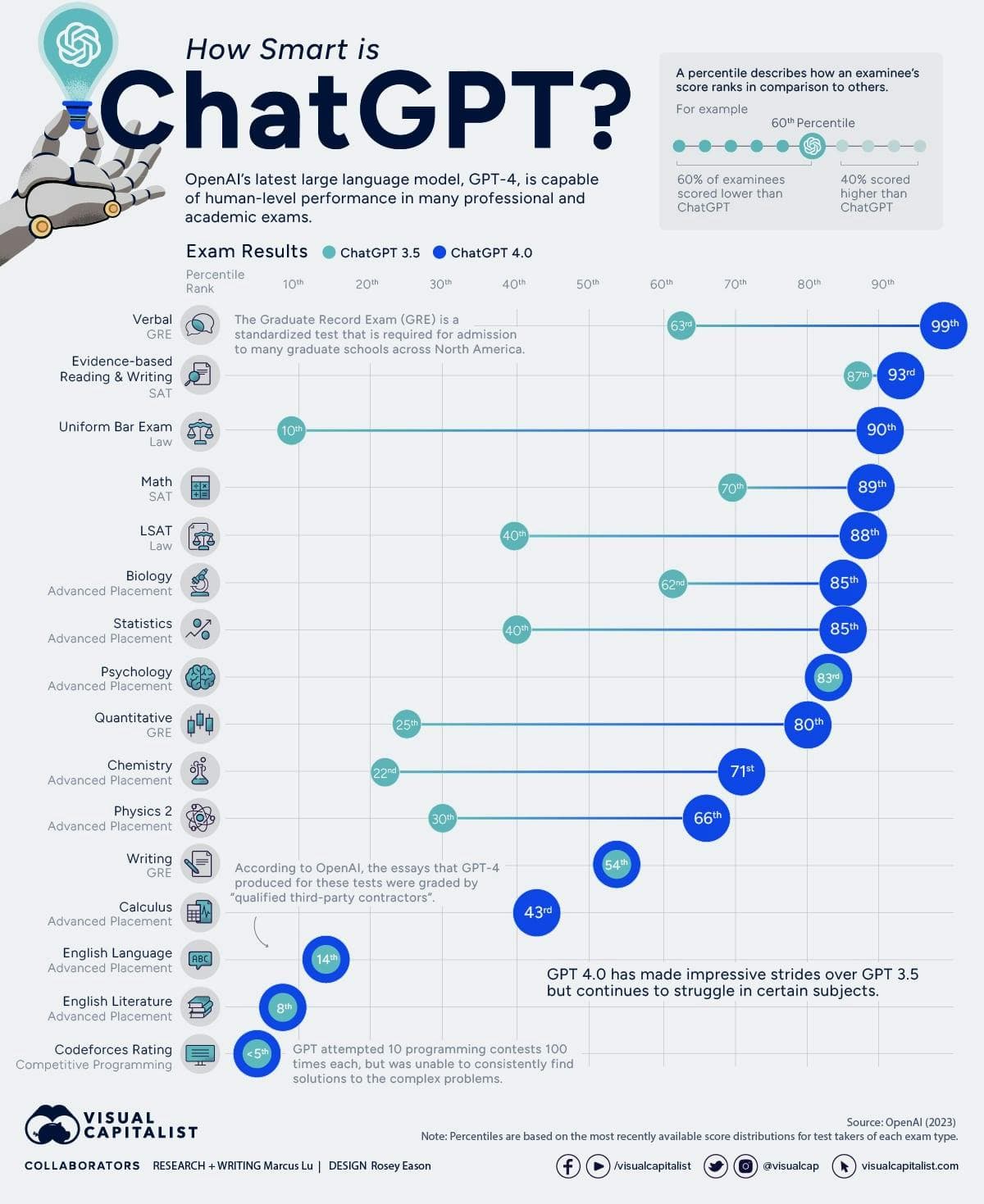

The move comes as OpenAI grapples with substantial operational costs. Training and running large language models requires enormous computational resources, with some estimates suggesting that each Chat GPT response costs the company between

This strategy wasn't invented by OpenAI—it's the same model that has sustained platforms like Google, Facebook, and YouTube for decades. However, advertising in AI chatbot responses presents unique challenges. Unlike displaying ads on a web page or social feed, inserting advertisements into AI-generated content risks undermining user trust and the perceived quality of responses. OpenAI has made significant commitments about keeping ads separate from organic content and ensuring that advertisements don't influence the factual accuracy of responses. Whether users find these assurances credible will largely determine the success of this monetization approach.

The competitive landscape also matters significantly here. Anthropic, OpenAI's primary competitor, publicly mocked the advertising plan through a series of Super Bowl advertisements that aired just days after OpenAI's announcement. These commercials depicted poorly integrated ads interrupting AI responses, raising precisely the concerns that OpenAI hoped to assuage. This competitive jab, combined with Sam Altman's defensive reaction, suggests that advertising in AI assistants remains a culturally contentious issue. Understanding how Chat GPT's advertising system works, what safeguards OpenAI has implemented, and what alternatives exist becomes essential for users trying to decide how to interact with AI tools in 2025.

The Business Case for AI Advertising: Why OpenAI Needs Revenue Beyond Subscriptions

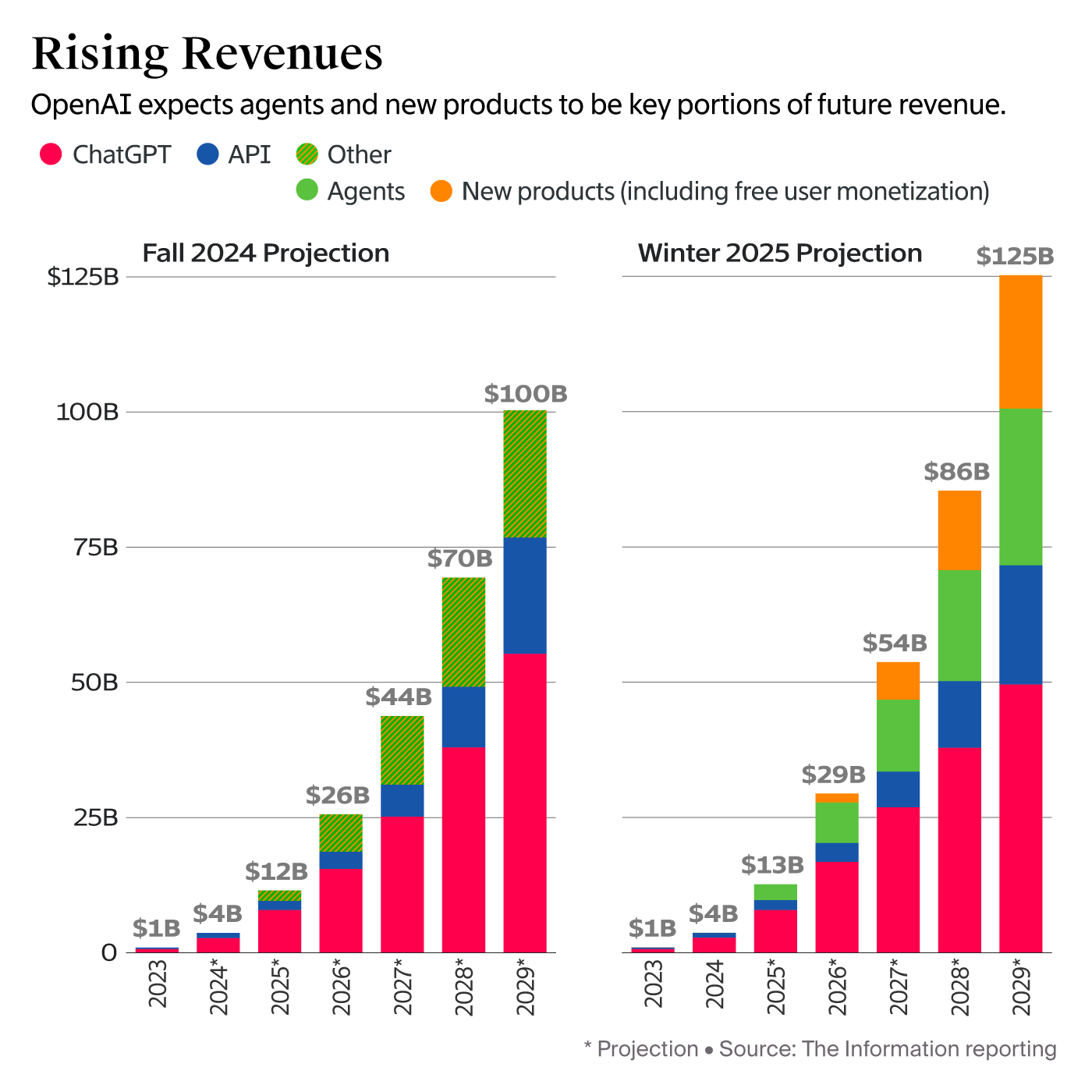

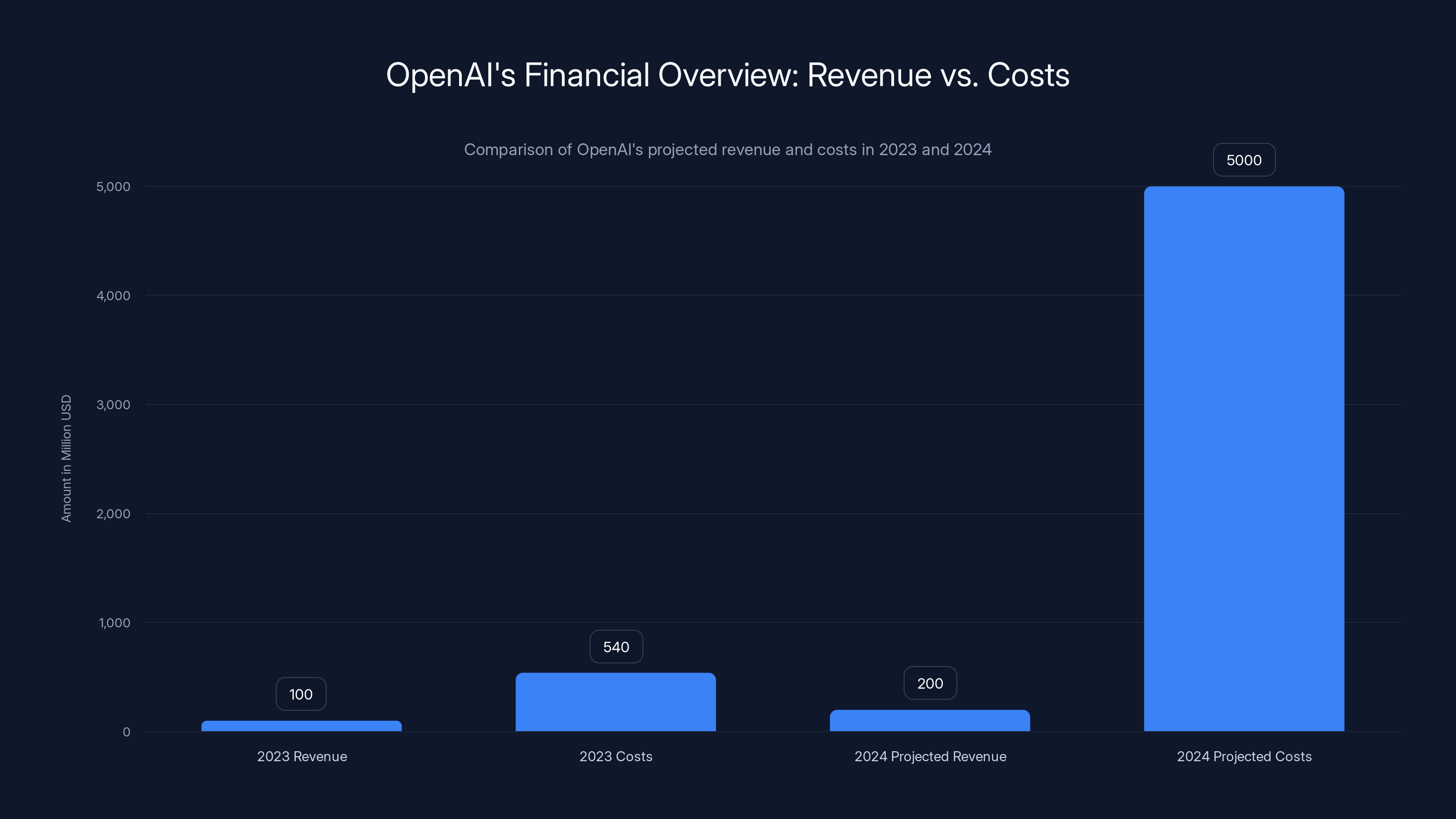

OpenAI's financial situation provides crucial context for understanding why advertising became necessary. The company has raised billions in funding—including a

These losses stem from the inherent economics of building and operating advanced AI models. The computational infrastructure required to train GPT-4, GPT-4o, and subsequent models involves thousands of high-end GPUs running continuously for weeks or months. A single training run for a frontier model can cost $10-100 million in compute resources alone. Beyond training, inference costs—the computation required to generate responses when users interact with Chat GPT—create ongoing operational expenses. With hundreds of millions of active users generating billions of queries monthly, inference costs accumulate rapidly.

Subscription revenue provides some offset to these expenses. Chat GPT Plus, the premium tier originally launched in February 2023, generates meaningful revenue at its

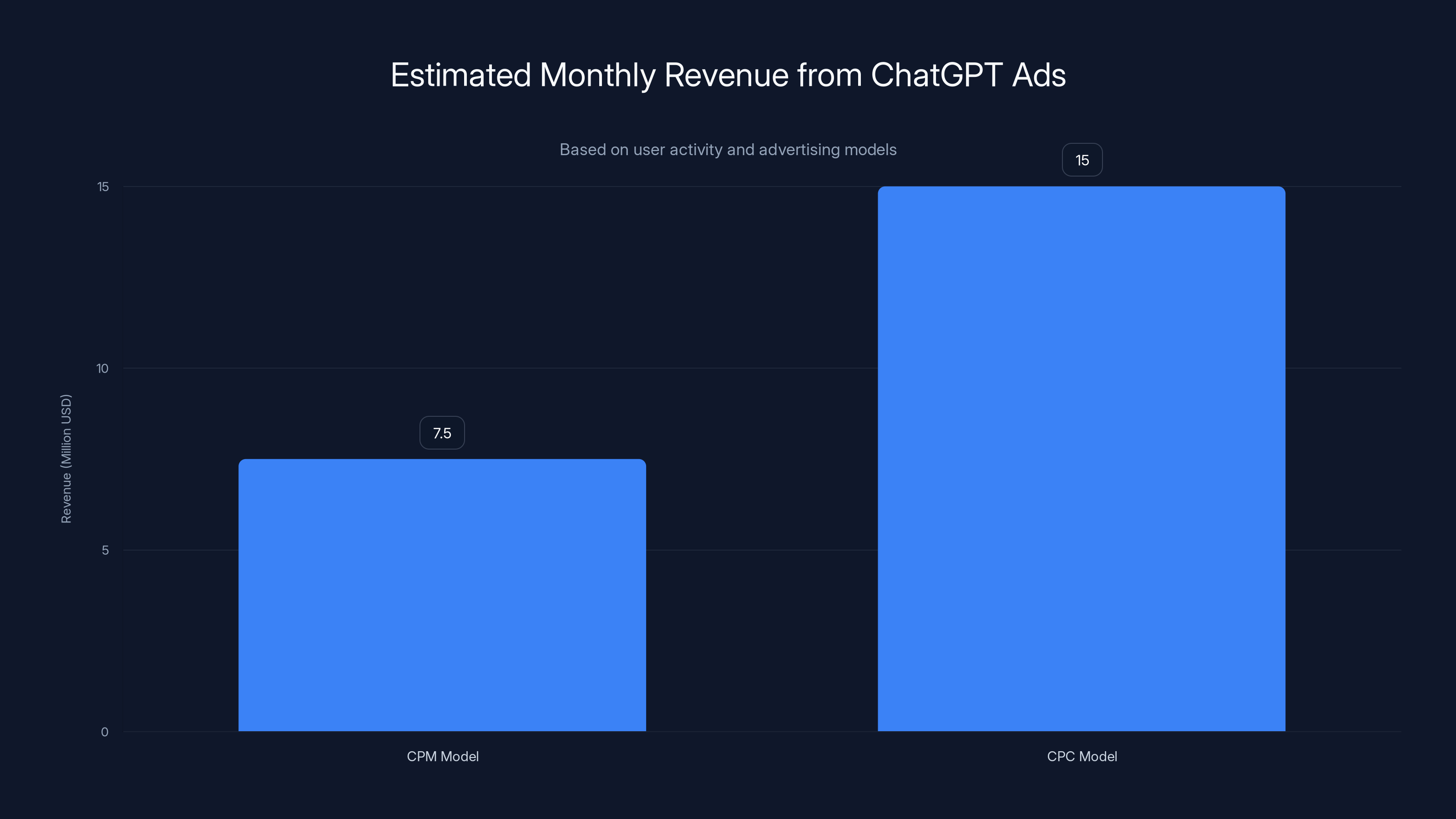

Advertising solves this revenue gap by monetizing free and low-cost tier users without blocking their access. A user who sees one relevant ad per session might generate

The competitive dimension reinforces this business logic. Claude (Anthropic's chatbot) remains free without ads, creating user pressure on OpenAI to maintain free access. By introducing ads rather than eliminating free access, OpenAI preserves its position as the most accessible frontier AI model. However, if Anthropic or Google's Gemini eventually introduce ads as well, the competitive differentiation erodes, and advertising becomes table stakes rather than a distinctive advantage.

Estimated data suggests ChatGPT could generate

How Chat GPT Ads Work: Technical Implementation and User Experience

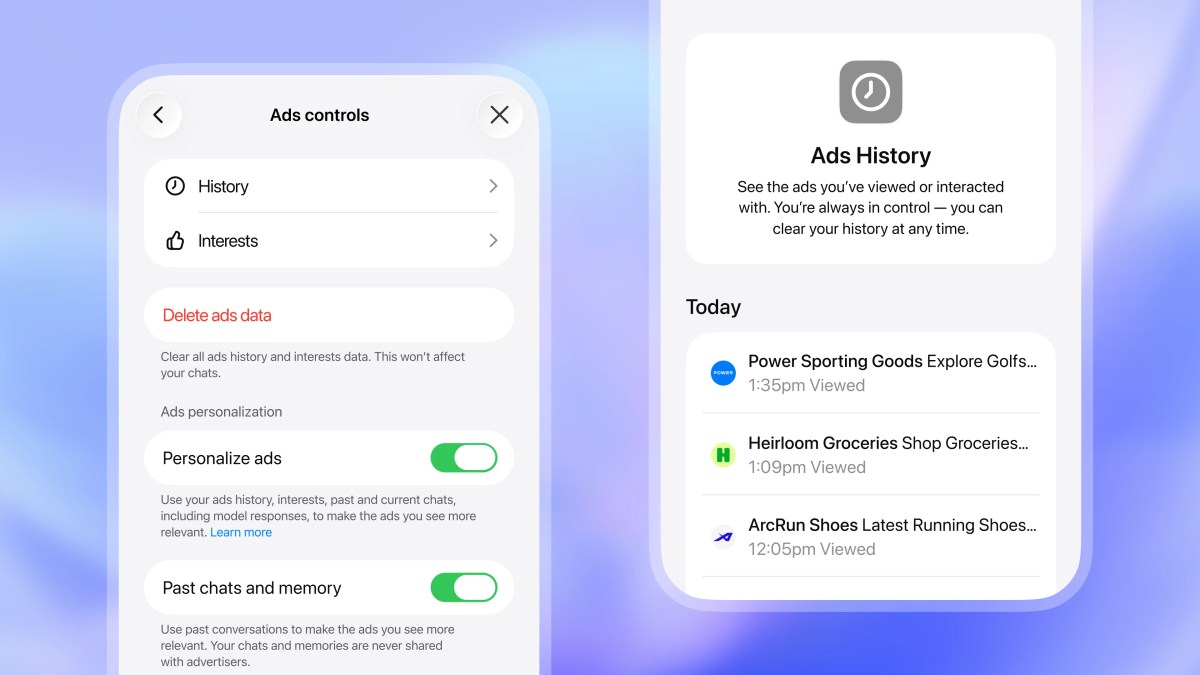

OpenAI's advertising system incorporates several technical components designed to integrate ads into the Chat GPT experience without disrupting core functionality. The implementation relies on what the company calls "contextual matching," where advertisements are selected based on conversation topics rather than user identity data. If a user asks Chat GPT for recipes, the system might display ads for meal kit delivery services or grocery delivery platforms. Someone researching travel destinations might see ads for airlines or hotel booking services.

This contextual approach contrasts with the behavioral targeting that dominates modern digital advertising. Facebook, Google, and most ad-driven platforms build detailed user profiles based on browsing history, location, demographic information, purchase history, and inferred interests. These profiles enable highly personalized ads that often feel eerily precise. OpenAI explicitly rejects this model for Chat GPT, claiming that advertisers receive only aggregate performance metrics (impressions, clicks, conversion rates) rather than individual-level user data.

The technical implementation uses several signals to determine which ads appear:

Conversation Topics: When a user asks about gardening, fitness, cooking, or technology, Chat GPT's backend systems recognize the topic and select relevant advertisements. This happens in real-time as conversations progress, allowing for dynamic ad selection across a single session.

Previous Chat History: OpenAI mentions using past conversations to inform ad selection, though with important caveats. The company states that users can clear their ad history at any time, suggesting some data retention. This creates a tension between personalization (which typically requires historical data) and privacy (which typically requires minimizing data collection).

Prior Ad Interactions: If a user has previously clicked ads from specific categories or advertisers, the system may show related ads in future sessions. This learning mechanism improves ad relevance over time but requires tracking individual user behavior.

Sensitive Topic Avoidance: Critically, OpenAI has stated that ads will NOT appear near sensitive content including health topics, mental health discussions, political content, or regulated sectors like financial services and pharmaceuticals. This guardrail prevents the most egregious advertising failures where ads undermine user trust or appear inappropriate.

The user experience design places ads in designated sponsored sections of the Chat GPT interface. Unlike traditional web advertising where ads might be embedded within content (creating ambiguity about where content ends and ads begin), OpenAI uses visual separation and clear labeling. Each ad includes a "Sponsored" label, distinguishing it from organic Chat GPT responses. Users can dismiss ads they don't find relevant, provide feedback about specific ads, and adjust personalization settings to control how much historical data influences ad selection.

One critical implementation detail involves the claim that "ads do not influence the answers Chat GPT gives you." This assertion requires technical safeguards ensuring that the advertising system cannot modify response generation. OpenAI likely implements this through architectural separation—the ad selection system operates independently from the language model itself, with no mechanism for ad data to influence the tokens that Chat GPT generates. However, verifying this claim requires either code inspection or third-party auditing, which the public has not conducted.

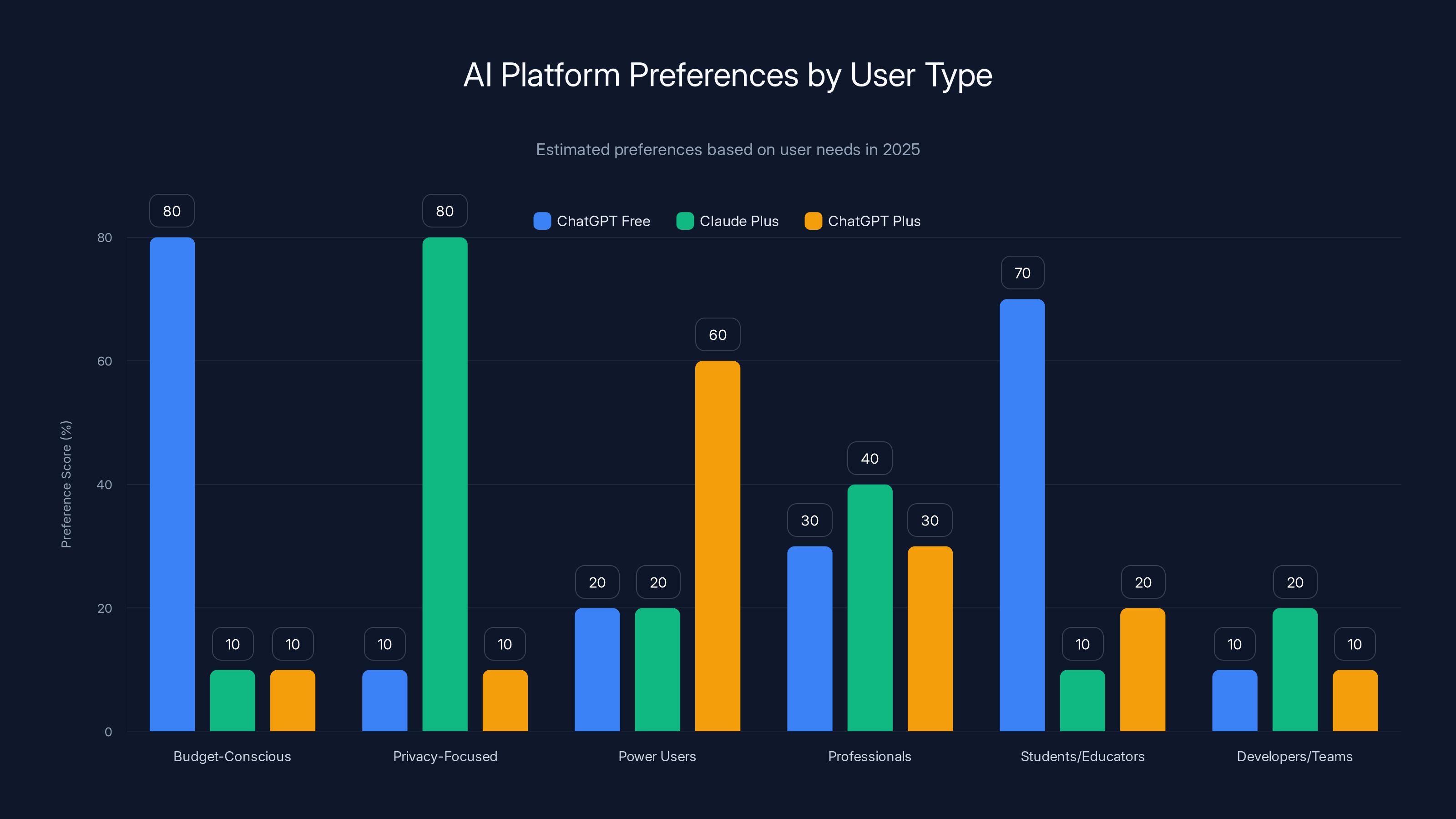

Estimated data shows ChatGPT Free is preferred by budget-conscious users and students, while Claude Plus appeals to privacy-focused users. ChatGPT Plus is favored by power users for its unlimited access.

Targeting Mechanisms: How OpenAI Selects Which Ads You See

Understanding the specific mechanisms OpenAI uses to select advertisements reveals both the sophistication and the potential pitfalls of ad-driven monetization. The company has disclosed several targeting dimensions that shape which ads appear for specific users.

Semantic Conversation Analysis: Chat GPT's backend analyzes the semantic meaning of user queries and assistant responses, not just keyword matching. When a user discusses "automotive" topics—whether asking about engine repair, car insurance, electric vehicles, or vintage restoration—the system recognizes the broader category and serves related ads. This semantic understanding allows OpenAI to target ads at meaningful topic clusters rather than simple keyword hits.

Temporal Patterns: Advertising systems traditionally consider when users engage with content. Someone researching vacation destinations on a Sunday afternoon might see different ads than someone researching the same topics on a Tuesday morning. OpenAI likely incorporates temporal signals, though the company hasn't explicitly discussed this dimension.

Aggregated Behavioral Cohorts: Rather than tracking individuals, OpenAI might create anonymized cohorts of users with similar conversation patterns and show ads to these cohorts. For example, users who frequently ask about productivity tools might form a "productivity-focused professional" cohort eligible for scheduling software ads, without OpenAI knowing individual identities within that cohort.

Query Refinement Within Sessions: As conversations progress, ads can be refined based on how a conversation develops. A user asking "Tell me about solar panels" might initially see energy company ads. If the conversation shifts to "solar panels for RVs," ads might switch to RV-specific energy solutions. This dynamic adjustment optimizes relevance without requiring historical profile data.

Frequency Capping: Advertising systems typically implement frequency caps, limiting how often the same user sees identical ads within a time period. OpenAI likely applies similar logic, showing variety in ad selection to avoid excessive repetition that causes user irritation.

A crucial distinction exists between what OpenAI claims about targeting and what other ad platforms do. Google, Facebook, and Amazon use extensive first-party data (your search history, clicks, location, demographics) to build predictive models of what ads you'll find relevant. OpenAI's stated approach relies more on immediate context—what you're asking right now—rather than comprehensive historical profiles. This "contextual but not behavioral" approach potentially offers users more privacy while sacrificing some ad relevance.

However, OpenAI's mention of using "previous ad interactions" and "past chats" suggests some historical tracking. The distinction between "contextual" and "behavioral" becomes blurry when systems retain historical conversation data and ad response data. A user who clicked ads about fitness equipment three weeks ago might be identified as fitness-interested when asking about nutrition today. Whether this constitutes "behavioral targeting" or merely "contextual targeting informed by reasonable historical context" is semantically ambiguous.

Privacy and Data Protection: What OpenAI Promises and Why It Matters

Privacy concerns loom largest in discussions of AI chatbot advertising. Users share deeply personal information with Chat GPT—health concerns, relationship problems, career anxiety, political views, financial situations—trusting that these conversations remain private. The introduction of advertising creates legitimate worries that personal information might be mined to sell targeted ads or that advertisers might gain insight into user behavior patterns.

OpenAI has made several explicit privacy commitments:

Advertiser Data Isolation: Advertisers cannot access individual-level user data. They receive only aggregate metrics: how many people saw the ad, how many clicked, basic geographic information, and device type. They cannot see user names, email addresses, conversation histories, or any personally identifiable information. This contrasts sharply with Facebook's ad system, where advertisers can create detailed targeting parameters based on user attributes.

Conversation Privacy from Advertisers: OpenAI states conversations remain private from advertisers. Your discussion with Chat GPT about health concerns or financial planning never reaches an advertiser's systems. Only the high-level fact that "someone searched for health-related content" might inform ad selection, without any specific details about what was discussed.

No Profile Sharing: Unlike some digital platforms that build detailed psychographic profiles of users and share components with advertisers, OpenAI doesn't create advertiser-accessible profiles. Advertisers cannot request "people interested in fitness" the way Facebook advertisers can segment audiences.

User Control Over Ad Personalization: OpenAI provides settings allowing users to adjust how much historical data influences ad selection. Users can presumably disable historical data usage and rely solely on contextual signals from the current conversation. This opt-down capability gives users granular control unavailable on many mainstream platforms.

Ad History Transparency and Deletion: Users can view their complete history of ad impressions and interactions, and delete this history at any time. This transparency allows users to understand what the system "knows" about their ad behavior and reset that knowledge when desired.

Age Restrictions: OpenAI will not show ads to users under 18, protecting minors from targeted advertising manipulation that research suggests is particularly effective on younger audiences.

Sensitive Content Protection: As previously mentioned, ads won't appear near health, mental health, political, or regulated financial content. This prevents scenarios where an ad for weight loss programs appears after discussing eating disorder recovery, or investment ads appear during discussions of financial hardship.

These commitments represent a more privacy-protective advertising model than mainstream alternatives. Google and Facebook conduct far more extensive data collection, build detailed user profiles, and share extensive targeting capabilities with advertisers. If OpenAI adheres to these stated commitments, Chat GPT's ads would be considerably less invasive than most digital advertising users encounter daily.

However, critical gaps exist between stated commitments and actual implementation. OpenAI's claims cannot be verified without auditing the actual system or conducting independent research. Several questions remain unanswered:

How is "context" actually extracted and used? While OpenAI claims ads are contextual, the boundary between analyzing conversation content to select ads and using conversation content for ad targeting seems permeable. If the system reads conversation text to identify relevant ads, has the advertiser effectively accessed that conversation content?

What happens with de-identified data? Even if advertiser access is restricted, OpenAI's own internal analytics teams might identify patterns in user behavior by conversation topic, enabling product decisions that indirectly depend on detailed behavioral knowledge.

How are privacy boundaries enforced? Without transparent technical documentation or third-party audit, users must trust OpenAI's implementation of these boundaries. Corporate policies have changed before; users have limited ability to verify current compliance.

What about data retention? While OpenAI mentions users can delete ad history, unclear is how long the company retains this data, which systems have access, and whether deletion is truly comprehensive or just cosmetic.

These remaining questions explain why even privacy-conscious users react skeptically to advertising claims. The commitments look good on paper, but implementation details that would prove genuine privacy protection remain opaque.

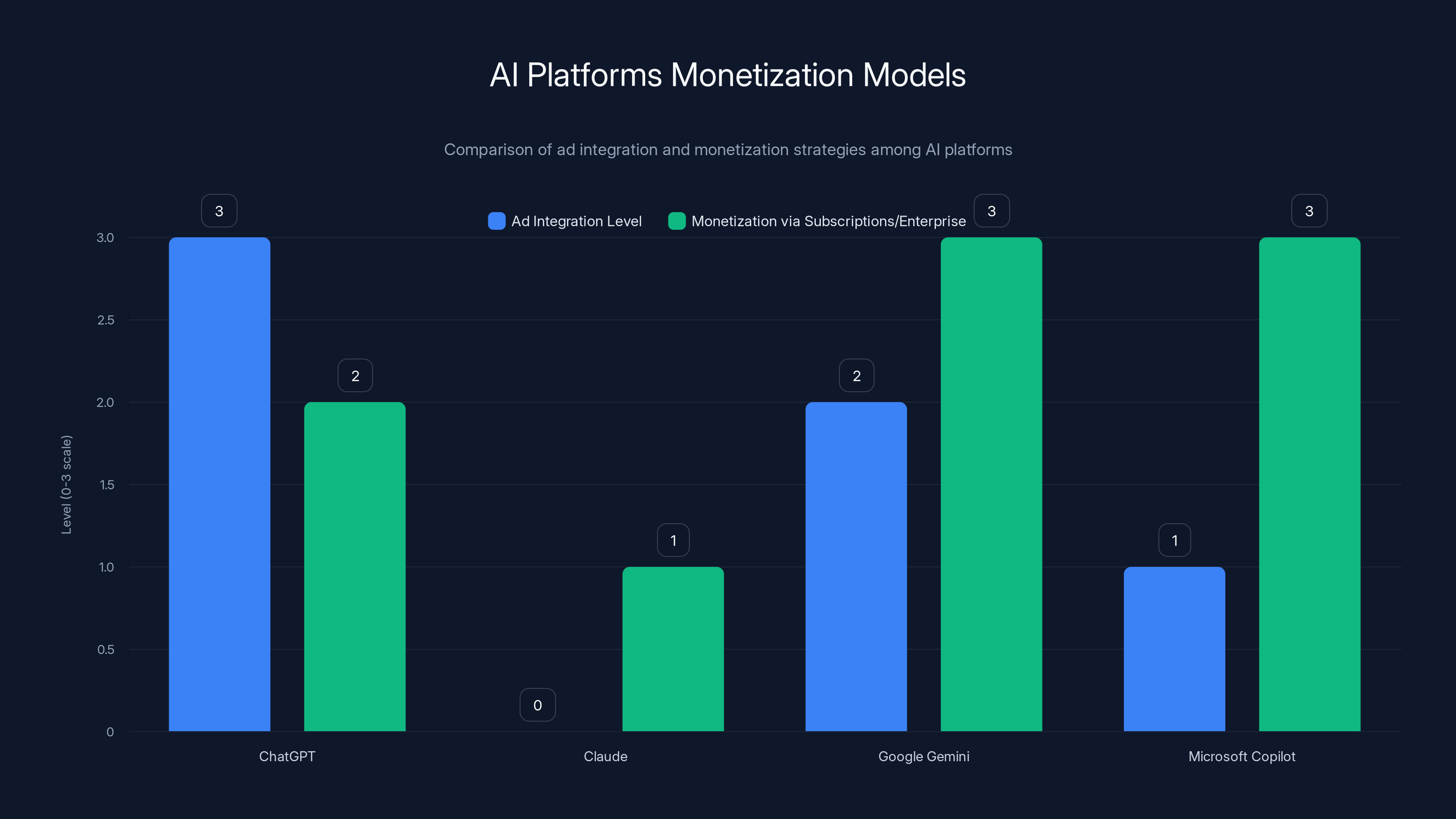

ChatGPT integrates ads moderately, unlike Claude which is ad-free. Google Gemini uses ads heavily in search but less in standalone apps, while Microsoft Copilot focuses on subscriptions.

Advertiser Onboarding and Campaign Management: Behind the Scenes

While users interact with the consumer-facing ad system, advertisers access a separate interface for creating and managing campaigns. Understanding how advertisers interact with Chat GPT's ad platform clarifies what data flows occur and what capabilities advertisers receive.

OpenAI has established an advertiser portal where eligible businesses create campaigns by specifying:

Target Topic Areas: Instead of demographic targeting, advertisers select which conversation topics make their ads eligible for display. A fitness equipment manufacturer might select "fitness," "exercise," "health," and "athletic performance" as topic areas. An accountant might select "tax," "small business," and "financial planning."

Budget and Bidding: Similar to Google Ads and Facebook Ads, advertisers likely set daily budgets and cost-per-click or cost-per-impression bids. Higher bids increase likelihood of ad placement in the most valuable moments.

Ad Creative: Advertisers submit ad content—headlines, descriptions, and links. OpenAI presumably reviews these for compliance with content policies, filtering out misleading or harmful ads.

Geographic Targeting: While OpenAI avoids extensive demographic targeting, geography remains a reasonable segmentation dimension. An advertiser with local service areas (HVAC repair, dental practices, legal services) needs to reach users in specific regions.

Performance Analytics: Advertisers access dashboards showing impressions, clicks, click-through rates, and conversions. These metrics enable optimization without revealing which specific users clicked or converted.

This setup positions OpenAI somewhere between privacy-protective and commercially pragmatic. Advertisers receive enough data to assess campaign performance and optimize spending, but not enough to conduct detailed behavioral targeting or user tracking. For large advertisers accustomed to Google and Facebook's extensive audience capabilities, this represents a meaningful limitation. For advertisers prioritizing brand safety and average user sentiment, contextual targeting might feel more appropriate.

The onboarding process itself suggests which advertisers OpenAI prioritizes and which it excludes. High-risk advertiser categories—payday lenders, tobacco products, dubious financial schemes—likely face higher approval barriers or complete exclusion. This curation reflects both advertiser demand (blue-chip brands want brand-safe environments) and OpenAI's recognition that certain advertisers would immediately undermine user trust in Chat GPT.

For users trying to understand advertising on Chat GPT, recognizing that OpenAI has made deliberate choices to restrict advertiser capabilities matters. These restrictions protect user privacy compared to mainstream advertising platforms, even if they don't eliminate all data collection or utilization.

Comparison With Competitors: How Chat GPT Ads Stack Up Against Other AI Platforms

Chat GPT's advertising approach should be evaluated not in isolation but against how competitors handle monetization and ad integration. The AI assistant market has fragmented into multiple platforms with different business models, each implying different user experiences and data practices.

Anthropic's Claude: Claude remains advertisement-free across all subscription tiers as of early 2025. This serves as Anthropic's primary competitive differentiation against Chat GPT, highlighted prominently in the Super Bowl campaign mocking Chat GPT's ads. However, Anthropic's business model remains unclear. The company could eventually introduce ads; maintaining ad-free status indefinitely requires either advertising revenue from elsewhere (API licensing, enterprise contracts) or continued acceptance of operating losses funded by investor capital. Claude's API business for developers provides meaningful revenue, suggesting Anthropic might sustain its ad-free position longer than OpenAI can.

Google Gemini: Google's generative AI assistant integrates directly into Google's existing ad-supported ecosystem. Gemini in Google Search displays ads alongside AI-generated summaries and traditional search results, following Google's established business model. However, the Gemini standalone app and Gemini Advanced (paid tier) maintain cleaner experiences with minimal direct ad interruption. Google's massive existing ad business means Gemini monetizes through general platform advertising rather than dedicated chatbot-specific ads.

Microsoft Copilot: Microsoft has positioned Copilot as AI-enhanced assistance across Office applications, Windows, and web browsing. Monetization comes primarily through Office 365 subscriptions and enterprise licensing rather than advertising. The integration of Copilot into paid products means Microsoft extracts value without ad-supported models, though this only applies to paying users. Free Copilot access remains limited and less capable.

Meta's Llama: Meta open-sourced its Llama language models, enabling third parties to build AI assistants without direct monetization from Meta. Companies using Llama might implement their own ads or subscriptions. This fragmented model makes monetization patterns inconsistent across implementations.

Perplexity AI: The search-focused AI assistant Perplexity runs on a freemium model with Perplexity Pro ($20/month) as the paid tier. The free tier has historically shown minimal ads, with monetization coming primarily from API usage and enterprise contracts. Perplexity's approach suggests that focused, specialized AI tools can achieve profitability differently than general-purpose assistants.

When comparing these platforms, several patterns emerge:

Freemium Tension: All platforms face the fundamental challenge that free users consume resources without generating direct revenue. OpenAI's ad solution is one approach; Anthropic's continued investment burn is another; Google's integration into existing ad platforms is a third. None represents a "correct" solution—each reflects different capital situations and competitive positioning.

User Trust and Branding: Platforms that introduce ads face potential user backlash, as OpenAI experienced even before launch. Companies with strong brand positioning (like Google, with its dominant search market share) can introduce ads with less user friction than newer platforms dependent on user goodwill. OpenAI's attempt to differentiate itself with privacy-protective advertising might be the best available option, but it still cedes positioning to ad-free competitors.

Enterprise vs. Consumer: Several competitors (Microsoft, Google, Anthropic) derive significant revenue from enterprise contracts and API licensing, reducing reliance on consumer monetization. OpenAI's enterprise business exists but hasn't reached the scale of these companies, making consumer monetization more urgent.

For users trying to choose between platforms, this context matters. Chat GPT's introduction of ads doesn't mean "AI assistants require ads"—it means OpenAI has chosen this path given its financial situation and competitive dynamics. Users prioritizing ad-free experiences have viable alternatives, though each alternative involves tradeoffs in capability, ease of access, or price.

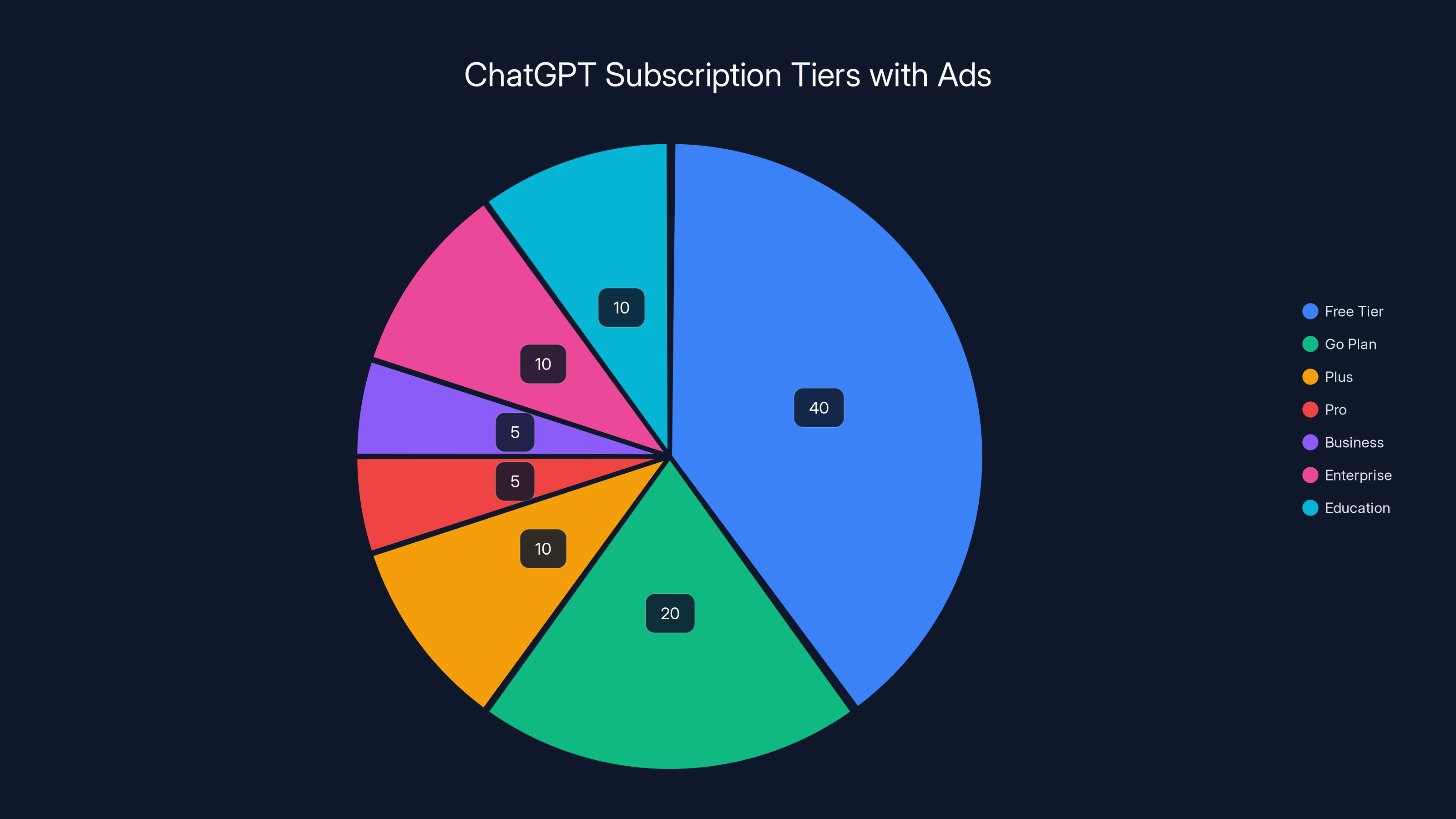

Estimated data shows that ads appear for Free and Go Plan users, while higher-tier subscriptions like Plus, Pro, Business, Enterprise, and Education remain ad-free. Estimated data.

User Reactions and Public Sentiment: How People Responded to Chat GPT Ads

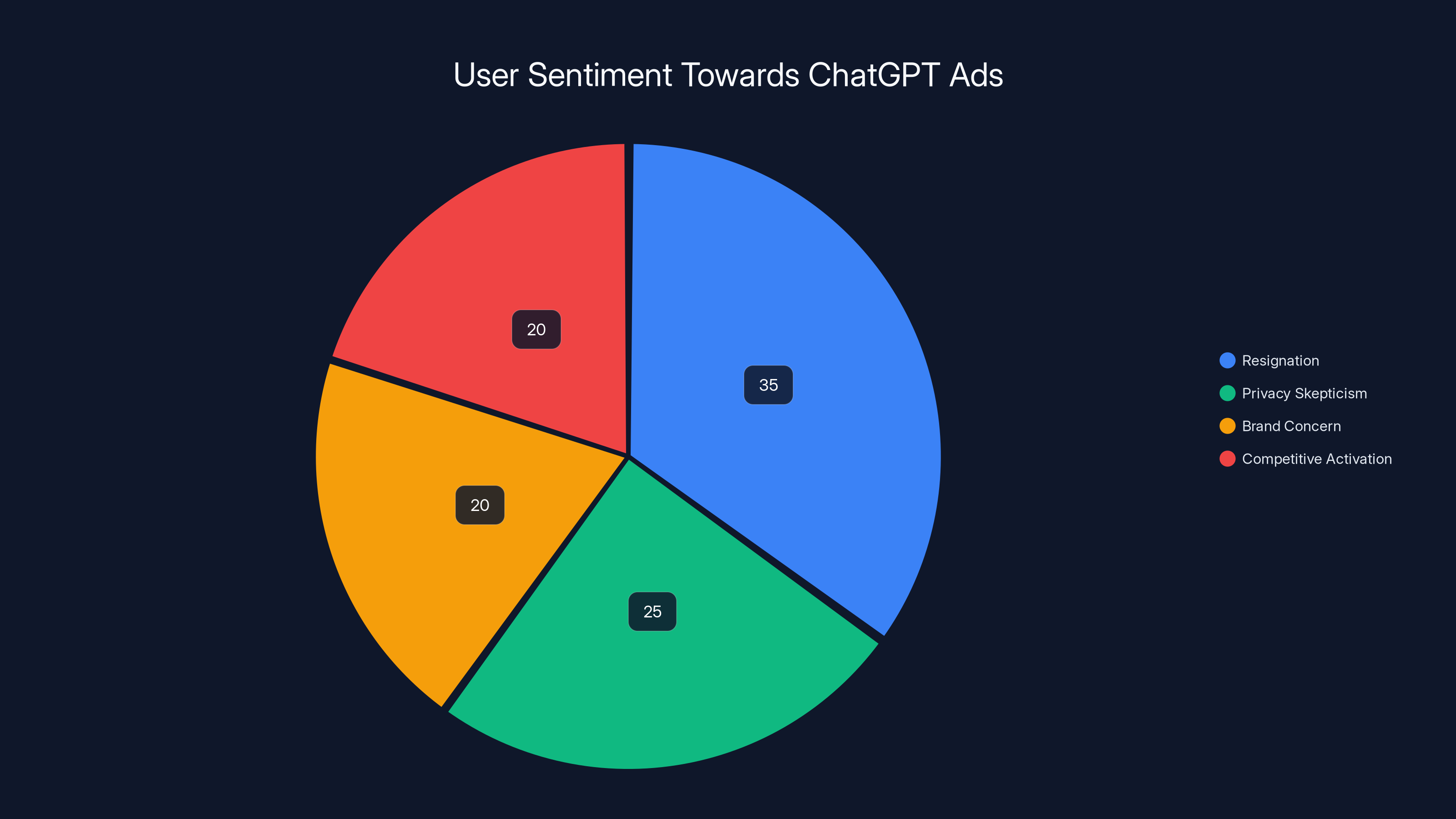

Initial user reactions to Chat GPT's advertising announcement ranged from resignation to outrage, with reactions varying significantly by user segment. Understanding these reactions illuminates what concerns matter most to users and whether OpenAI's privacy commitments successfully addressed core objections.

Resignation Among Heavy Users: Many heavy Chat GPT users who had come to depend on the platform acknowledged that "someone has to pay for this." These users recognized that frontier AI models involve substantial costs and that advertising represents an alternative to either much higher prices or restricted access. Among this group, sentiment focused less on anger and more on pragmatism about finding workarounds (paying for Plus, using the API instead of the web interface, switching between platforms).

Privacy Skepticism: More technical users raised concerns about the gap between stated privacy commitments and actual implementation. This group questioned whether conversational data truly remains invisible to advertisers, whether "aggregate" data might be disaggregated to identify individual users, and whether historical data retention undermines the promised privacy protections. These concerns couldn't be resolved through OpenAI's public statements alone—they require technical audits or code inspection.

Brand Concern Among Businesses: Companies that use Chat GPT to generate content for public audiences worried that ads appearing in Chat GPT-generated outputs might seem inappropriate or suggest endorsements. A marketing professional generating campaign copy would understandably object to ads appearing in the middle of polished prose. However, OpenAI's ad placement in the interface (rather than within the text output itself) mitigates some of this concern.

Competitive Activation: Anthropic's Super Bowl ads explicitly capitalized on user skepticism about Chat GPT ads. By making the issue visible and entertaining to general audiences (not just tech-savvy early adopters), Anthropic converted a potential user concern into brand awareness for Claude. This marketing effort likely influenced some marginal users to try Claude instead of remaining Chat GPT-exclusive.

Philosophical Concerns About AI: Some users objected to Chat GPT ads on principle, arguing that if AI is as powerful as OpenAI claims, teaching it to optimize toward advertising engagement creates problematic incentives. Even if current technical safeguards prevent ads from directly influencing responses, critics worry about institutional incentives shaping future development. This concern touches on fundamental questions about commercial incentives influencing AI development.

Resignation to Inevitability: Underneath these specific reactions exists a broader resignation among users who see advertising in AI as inevitable. Just as free internet services became ad-supported and just as social media monetized through advertising, frontier AI assistants probably will eventually rely on ads. Users might dislike this outcome, but most recognize it as likely and accept it.

The distribution of reactions suggests that OpenAI's most loyal users—those most dependent on Chat GPT—are least likely to abandon it due to ads. Marginal users, or those trying to decide between Chat GPT and competitors, represent the segment most likely to be influenced by ad concerns. For these users, Claude's ad-free status becomes a meaningful differentiation point.

Public sentiment also varies significantly by demographic and geography. In privacy-focused European contexts (with stronger data protection regulation), ad sentiment tends to be more negative. In the US, where ad-supported platforms dominate the digital landscape, acceptance of advertising seems higher. Developer communities, generally more privacy-conscious than average users, expressed more skepticism than mainstream consumer audiences.

The Financial Impact: How Much Revenue Will Ads Actually Generate?

Quantifying the revenue potential from Chat GPT advertising requires estimating several parameters: monthly active users on free/Go tiers, average ads per user session, click-through rates, and advertiser costs-per-click or costs-per-impression.

User Base Estimation: OpenAI has disclosed that Chat GPT reached 100 million weekly active users as of early 2024 (one of the fastest-growing applications ever). By 2025, monthly active users likely exceed 200 million. However, only a portion use free or Go tiers (the rest pay for Plus/Pro/Business/Enterprise). OpenAI hasn't disclosed the free/paid user split, but industry estimates suggest roughly 70-80% of users remain on free tiers. This implies 140-160 million free/Go tier monthly active users.

Advertising Frequency: How often does the average user see ads? This depends on usage patterns. Power users who engage with Chat GPT daily in multiple sessions might see 3-5 ads daily. Casual users who check in once weekly might see just 1-2 ads weekly. Average advertising frequency across all users might settle at 2-3 ad impressions per week per user, or roughly 8-12 per month.

CPM and CPC Calculations: The digital advertising market operates on two pricing models. Cost-per-thousand-impressions (CPM) typically ranges from

If we assume:

- 150 million monthly active free/Go users

- 10 monthly ad impressions per user

- 1.5 billion monthly impressions

- $5 average CPM

This yields: 1.5 billion impressions × (

Alternatively, assuming:

- 1% click-through rate (modest for a targeted advertising system)

- 15 million monthly clicks

- $1 average CPC

This yields: 15 million clicks ×

These rough calculations suggest monthly ad revenue in the

However, ads likely serve purposes beyond direct revenue. By monetizing free users, OpenAI can afford to maintain free access, preserving network effects and user growth that benefit the overall platform. Free users become future paid customers, platform evangelists, and sources of behavioral data that improve products. The strategic value of maintaining free access might exceed the direct ad revenue.

Advertiser demand represents another uncertainty. Will blue-chip brands accept Chat GPT's contextual advertising model without extensive behavioral targeting? Will OpenAI's advertiser policies attract enough demand to fill available ad inventory? Early Facebook, Google, and Amazon all struggled initially to attract sufficient advertiser volume to fill capacity, eventually building advertiser bases as the platforms scaled. OpenAI likely faces similar challenges.

Longterm, if OpenAI successfully establishes Chat GPT as the dominant consumer AI platform, advertising economics improve significantly. With 500 million+ users and higher advertiser demand as the platform matures, ad revenue could scale to $1 billion+ annually. At that level, advertising becomes material to overall company economics, though still unlikely to fully fund frontier AI research.

OpenAI's costs significantly exceed its revenue, with 2023 costs at

Advertiser Concerns: Will Brands Actually Want In?

Understanding OpenAI's advertising opportunity requires considering it from the advertiser perspective as well. Not every advertiser will view Chat GPT as an attractive advertising channel; some might actively avoid it. Several factors will determine advertiser demand.

Brand Safety Issues: The biggest advertiser concern involves their ads appearing in inappropriate contexts. If an ad for a product appears immediately after Chat GPT provides accurate information contradicting that product's claims, the advertiser suffers reputation damage. OpenAI's sensitive-topic exclusions (avoiding ads near mental health, health, political, financial content) mitigate some of these risks, but other problematic adjacencies could emerge. Advertisers will demand clear, transparent documentation of where ads can and cannot appear.

Audience Quality vs. Precision: While OpenAI's contextual targeting provides audience relevance, it's blunter than Google or Facebook's behavioral targeting. An advertiser selling specialty fitness equipment knows exactly which demographic to target on Facebook; on Chat GPT, they reach a broader audience of people discussing fitness without demographic precision. Whether this trade-off (broader reach but less precision) proves valuable depends on the advertiser's strategy and product.

Attribution and Measurement: Advertisers want to know whether Chat GPT ads actually drive conversions. Measuring this requires tracking whether users who saw ads later purchased products. Multi-touch attribution (understanding whether Chat GPT ads were the final touchpoint or just one of many) becomes complex. OpenAI will need to provide robust measurement frameworks and integrate with standard advertiser analytics systems.

Competitive Dynamics: Will competitors use Chat GPT advertising? If Coca-Cola advertises on Chat GPT but Pepsi doesn't, Coca-Cola gains advantage but might be seen as endorsing AI in ways Pepsi rejects. Competitors might engage in a prisoner's dilemma dynamic where none wants to advertise, but each fears losing if others do.

Regulatory Uncertainty: Advertisers face growing regulatory scrutiny around AI. Companies that advertise on AI platforms might face shareholder questions, customer backlash, or regulatory inquiries about their participation in AI monetization. Early advertisers bear reputational risk that later entrants avoid.

These considerations suggest that advertiser demand will depend heavily on how OpenAI addresses safety, measurement, and regulatory concerns. Savvy advertisers likely test modest campaigns before committing significant budgets. Premium brands might avoid Chat GPT entirely to protect brand image. Price-sensitive and direct-response advertisers (fitness apps, online courses, e-commerce) will likely embrace the platform earlier than premium brands.

Alternative AI Assistants Without Advertising: Comparing Options

For users wanting to avoid ads entirely, alternatives exist at various price points and capability levels. Understanding these options helps users make intentional choices aligned with their preferences.

Anthropic's Claude remains the most feature-rich ad-free alternative. Launched in 2023 and continuously improved, Claude can be accessed via a web interface, API, or through integrations into other platforms. Claude Plus ($20/month) provides faster responses and higher usage limits, but doesn't introduce ads. Claude's context window (the amount of text it can process in a single conversation) exceeds Chat GPT's in some scenarios, making it preferable for analyzing long documents. Claude's capabilities approach Chat GPT's across most dimensions, though some users perceive Chat GPT as slightly superior for specialized tasks. For users willing to pay for premium service, Claude offers a genuine ad-free alternative.

Google Gemini Advanced ($20/month) provides ad-free access to Google's most capable model. While Gemini Free remains available with minimal ads, Gemini Advanced removes ads entirely. Gemini's integration with Google's ecosystem (Gmail, Docs, Drive) offers workflow advantages that Claude and Chat GPT don't, particularly for users already in the Google ecosystem. However, Google's history with data collection and ad targeting creates trust concerns that persist even in ad-free tiers.

Microsoft Copilot Pro ($20/month) offers ad-free access to advanced models, though its positioning as a workflow assistant (integrated into Office, Windows, Edge) makes direct comparison to Chat GPT complex. Copilot specializes in productivity and creative tasks, with less emphasis on pure conversation and explanation than Chat GPT. For Microsoft ecosystem users, Copilot becomes a natural choice.

Local Language Models: Open-source language models like Llama 2, Mistral, and others can be run locally on user computers or accessed through privacy-focused services. Running models locally provides complete ad-free, cloud-independent operation but requires technical knowledge and adequate hardware. Services like Hugging Face offer cloud-based access to open models with varying privacy policies. These options appeal primarily to technically sophisticated users willing to accept potentially lower quality or outdated models for privacy guarantees.

Perplexity: While not a traditional chatbot, Perplexity AI provides conversational search without ads in its free tier. Perplexity Pro ($20/month) removes usage limitations. For users wanting conversational search more than general-purpose assistance, Perplexity offers a compelling alternative.

When comparing these alternatives to Chat GPT with ads, several tradeoffs emerge:

| Factor | Chat GPT Free (with ads) | Chat GPT Plus | Claude Plus | Gemini Advanced | Local Models |

|---|---|---|---|---|---|

| Cost | Free | $20/month | $20/month | $20/month | Free* |

| Ad-Free | No | Yes | Yes | Yes | Yes |

| Capability | High | Very High | Very High | High | Medium-High |

| Ease of Use | Very Easy | Very Easy | Very Easy | Easy | Hard |

| Privacy | Limited | Limited | Better | Questionable | Best* |

| Speed | Good | Better | Good | Good | Variable |

| Ecosystem Integration | Limited | Some | Minimal | Excellent | None |

*Local models require hardware investment and technical expertise

For most users, the practical choice comes down to: Can I afford $20/month for ad-free premium access? If yes, Claude Plus represents the strongest alternative. If no, accepting Chat GPT's ads on free tier, upgrading to Chat GPT Plus, or downgrading to Claude's free tier represent the main options. The right choice varies based on individual needs, budget, and privacy priorities.

Estimated data suggests that 35% of users showed resignation, while 25% were concerned about privacy. Brand concerns and competitive activation each accounted for 20% of user sentiment.

Looking Forward: Will AI Advertising Become Industry Standard?

Chat GPT's introduction of advertising likely represents a turning point for the entire AI industry. Understanding where this leads requires considering broader industry economics and user behavior trends.

Precedent Setting: OpenAI's success or failure with ads will influence every other AI company's monetization decisions. If Chat GPT users tolerate ads and advertisers embrace the platform, competitors face pressure to introduce ads. If users massively abandon Chat GPT, competitors learn that ads represent a significant competitive disadvantage. Given OpenAI's market position—Chat GPT remains the most popular AI assistant—other platforms watch closely.

Economic Pressure: Most AI companies operate at significant losses due to computational costs. As these companies scale and face shareholder pressure or investor demands for profitability, advertising becomes increasingly tempting. The only way to sustainably operate AI services without ads is to either charge high enough subscription prices or achieve revenue elsewhere (enterprise contracts, API licensing). Not all companies will manage either approach.

User Expectation Shifts: If a generation of users comes of age using ad-supported AI, their expectations adjust accordingly. Just as today's users accept ads on Facebook and YouTube as normal, future users might expect ads on free AI assistants. This normalization makes future platform differentiation harder—advertising becomes table stakes rather than differentiation.

Regulatory Developments: Governments are actively developing AI regulation. Some jurisdictions (like the EU) might impose requirements around advertising transparency, targeting limitations, or disclosure. These regulations could make AI advertising more privacy-protective but also more complex and expensive. Startups might avoid advertising entirely rather than navigate regulatory complexity.

Model Consolidation: As frontier AI development becomes increasingly expensive, only well-funded companies can compete. This consolidation might lead to fewer independent platforms and more advertising across platforms (OpenAI, Google, Meta). Users would face an advertising-dominant AI landscape with few ad-free alternatives.

Alternatively, open-source models might evolve rapidly enough to provide genuine alternatives to proprietary ad-supported models. If Llama, Mistral, or other open models approach closed-model capabilities, users could avoid advertising altogether by using open models. This would limit advertising's viability as a monetization strategy.

The outcome likely falls somewhere between these extremes. Frontier AI services will probably become increasingly ad-supported, while open-source alternatives remain available for privacy-conscious users willing to accept technical friction. Enterprise AI will remain ad-free (monetized through contracts), while consumer AI becomes predominantly ad-supported.

For Teams Seeking AI Automation Without Advertising Concerns

While discussing Chat GPT and competitors, it's worth noting that some organizations prioritize streamlined automation more than advanced conversational abilities. For teams building workflows, automating document generation, or creating AI-powered content at scale, specialized platforms serve different needs than general-purpose chatbots.

Platforms like Runable ($9/month) focus specifically on workflow automation and content generation tasks—creating slides, documents, reports, and presentations through AI. By specializing in automation rather than general conversation, such platforms can maintain lower prices while avoiding ads. Teams generating content programmatically or automating repetitive tasks might find such specialized tools more appropriate than general-purpose AI assistants, regardless of advertising policies.

For organizations choosing between Chat GPT, Claude, and specialized automation tools, the decision hinges on primary use case. If users need conversational assistance and broad knowledge access, Chat GPT or Claude fit best. If teams need reliable content generation or workflow automation without advertising distraction, specialized alternatives become worth evaluating.

Making Your Decision: Which Platform Aligns With Your Needs?

Choosing how to interact with AI assistants in 2025 requires weighing multiple factors beyond just "ads or no ads." A decision framework helps clarify the right choice for different users.

For Budget-Conscious Individual Users: Chat GPT's free tier with ads provides access to powerful AI without spending money. If you can tolerate ads and don't require premium features, free Chat GPT remains the most accessible frontier AI. Ads represent the cost of that free access.

For Privacy-Focused Users: Claude Plus ($20/month) offers strong privacy protections without ads. The subscription cost buys both premium capabilities and ad-free experience, making it the clear choice for users prioritizing privacy.

For Power Users Who Use AI Multiple Hours Daily: Chat GPT Plus ($20/month) removes both ads and usage limitations, providing unlimited access and faster responses. The investment pays off through eliminated friction and reduced time spent waiting for responses.

For Professionals Generating Content: If your work involves producing documents, presentations, or other content requiring AI assistance, your platform choice depends on specific features and workflow integration. Some professionals prefer Chat GPT for its breadth; others prefer Claude for specific capabilities. Ads become less of a factor if you're spending time crafting professional outputs.

For Students and Educators: Educational pricing or free access might be available depending on your institution. If you must choose between free Chat GPT with ads or paid alternatives, free Chat GPT likely suffices for learning purposes.

For Developers and Teams: Consider whether you need the conversational interface at all, or whether API access, specialized automation tools, or open-source models better serve your use case. Developer-focused pricing and different monetization models might eliminate ads entirely.

For Organizations and Enterprises: Negotiate enterprise contracts directly with OpenAI, Anthropic, or other providers. Enterprise solutions typically exclude ads and offer custom terms aligned with organizational needs.

The right choice depends on your specific situation, budget, privacy values, and use patterns. No single answer fits all users—the diversity of alternatives reflects the reality that different people have legitimately different preferences.

Conclusion: Navigating the Ads Era for AI Assistants

Chat GPT's introduction of advertising marks a significant but not surprising development in the evolution of consumer AI. The fundamental economics—that training and operating frontier AI models costs billions annually while free users generate zero direct revenue—made some monetization strategy inevitable. OpenAI chose advertising as its approach, attempting to balance revenue generation with privacy protection and user experience quality.

The success of this strategy remains uncertain. Initial user reactions mixed resignation with skepticism, while Anthropic's competitive response highlighted advertising as a potential differentiator. OpenAI's claims about privacy-protective advertising sound promising, but users have limited ability to verify implementation details. For the skeptical, alternatives exist, each involving different tradeoffs.

Looking forward, the advertising question will likely become less distinctive as more AI platforms introduce ads in response to economic pressures. The relevant distinction will shift from "ads or no ads" to "how much ad targeting and data collection." OpenAI's contextual approach might become the industry standard, or more aggressive advertising might emerge as competitors face similar pressures.

For users deciding how to interact with AI in 2025, the key insight is simple: you have options. You can accept ads on free Chat GPT, pay for ad-free premium access to Chat GPT or Claude, explore alternatives like Gemini or Perplexity, or use open-source models locally. Each choice involves tradeoffs. The right decision depends on your budget, privacy values, specific needs, and tolerance for ads.

As the AI industry matures, these questions will become increasingly relevant. Users who think carefully now about their preferences—and make intentional choices rather than defaulting to whatever platform they opened first—will likely be more satisfied with their AI experiences long-term. The transition to advertising-supported AI isn't inevitable; it's the result of economic and competitive decisions that could have been made differently. Understanding those decisions, their implications, and your alternatives empowers you to make choices aligned with your values.

FAQ

What exactly are the ads that will appear in Chat GPT?

OpenAI's ads are text-based sponsored content separated from regular Chat GPT responses and clearly labeled as "Sponsored." Ads appear in designated sections of the Chat GPT interface and are selected based on conversation topics. For example, someone discussing meal planning might see ads for meal kit delivery services or grocery apps. Importantly, ads appear in the interface around Chat GPT's responses, not within the actual text content that Chat GPT generates.

Will Chat GPT's answers change because of advertising?

OpenAI explicitly states that ads do not influence Chat GPT's responses. The company maintains that the advertising system is architecturally separate from the language model itself, meaning advertisers cannot directly or indirectly modify answers. However, this claim cannot be verified without auditing the actual system code. OpenAI's business incentives are aligned with maintaining answer quality (users would abandon the platform if ads degraded quality), suggesting truthfulness, but users must ultimately trust the company's implementation.

Which Chat GPT subscription tiers will have ads?

Ads will appear for users on the Free tier and the Go plan (

How does Open AI know what ads to show me without tracking my personal data?

OpenAI uses contextual matching, meaning ads are selected based on the topics you're discussing in the current conversation, your past conversation topics, and your previous interactions with ads. This differs from behavioral targeting used by Google or Facebook, which builds comprehensive profiles based on browsing history, location, demographics, and inferred interests. However, the distinction between "contextual" and "behavioral" becomes blurry when systems retain historical conversation data and ad interaction history.

Can I see which ads I've been shown and clear that history?

Yes, OpenAI provides an ad history feature allowing users to view all ads they've seen and interactions with those ads. Users can clear this history at any time through Chat GPT settings. This transparency is more than many other advertising platforms provide, giving users explicit control over what historical data influences ad selection.

What should I do if I want to avoid Chat GPT ads completely?

You have several options: (1) Upgrade to Chat GPT Plus (

Will my sensitive conversations be used for advertising purposes?

OpenAI states it will not place ads near sensitive topics including health, mental health, political, or regulated financial content. However, OpenAI itself (not advertisers) may still analyze conversation topics in these areas for its own product development, analytics, and research. The restriction applies to advertiser access, not OpenAI's internal use of conversation data.

Is Open AI's advertising model legal and compliant with privacy regulations?

OpenAI's ad system appears designed to comply with major privacy regulations including GDPR (Europe) and CCPA (California). The company's privacy commitments—limiting advertiser data access, providing user controls, restricting children's ads—align with regulatory expectations. However, compliance is an ongoing responsibility, and regulations continue evolving. Users in jurisdictions with strong data protection laws should verify compliance with local requirements.

How much revenue will Chat GPT ads generate for Open AI?

Based on available data about user numbers and advertising rates, Chat GPT ads likely generate

Will ads eventually become unavoidable across all AI platforms?

Likely, but not universally. As AI companies face pressure to achieve profitability and free-tier users scale, advertising will become increasingly common in consumer AI. However, enterprise solutions will likely remain ad-free (monetized through contracts), open-source alternatives will provide ad-free options for technical users, and some companies might maintain ad-free models funded through venture capital or alternative revenue sources. The future probably features a mixed landscape with prevalent but not ubiquitous advertising.

Key Takeaways

- OpenAI introduced ads to ChatGPT's free and Go tiers in February 2025 to monetize free users and cover substantial operational costs

- Ads use contextual targeting based on conversation topics, not personal behavioral data, distinguishing them from Google and Facebook advertising

- Privacy protections restrict advertiser access to user data and prevent ads from appearing near sensitive health, mental health, political, or financial content

- Estimated monthly ad revenue of $7-20 million helps offset costs but represents only 2-4% of OpenAI's projected annual operating expenses

- Ad-free alternatives include Claude Plus (20/month), and ChatGPT Plus ($20/month), or users can continue free ChatGPT with ads

- User sentiment ranges from resignation about inevitable monetization to skepticism about privacy claims and concerns about ad influence on quality

- Industry pattern suggests advertising will likely become standard across consumer AI platforms as companies face profitability pressure, though open-source alternatives may remain ad-free

- For teams prioritizing automation, specialized platforms like Runable offer lower-cost alternatives focused on workflow automation rather than general conversation

Related Articles

- OpenAI's ChatGPT Ads Strategy: What You Need to Know [2025]

- OpenAI's ChatGPT Ads: What It Means for AI's Future [2025]

- Anthropic's Ad-Free Claude vs ChatGPT: The Strategy Behind [2025]

- Reddit's Acquisition Strategy for 2025: Why Adtech & AI Matter [2025]

- AI Chatbot Dependency: The Mental Health Crisis Behind GPT-4o's Retirement [2025]

- ChatGPT Caricature Trend: How Well Does AI Really Know You? [2025]