Play Station 6 Release Delayed, Nintendo Switch 2 Getting Pricier: Inside the AI-Driven Memory Shortage That's Reshaping Gaming Hardware [2025]

Something strange is happening in the semiconductor world, and it's about to reshape gaming as we know it.

For decades, the console cycle was predictable. Sony releases a Play Station, it dominates for six to seven years, then the next generation launches right on schedule. Nintendo does something similar with handhelds. Consumers budget for the launches, developers plan their roadmaps around release dates, retailers stock accordingly.

But that orderly cycle is breaking down. And the culprit isn't what you'd expect.

It's not supply chain issues from geopolitics or a global pandemic. It's not manufacturing bottlenecks or factory fires. It's something far more abstract but infinitely more powerful: artificial intelligence is eating the world's memory chips, and gaming hardware makers are getting squeezed out.

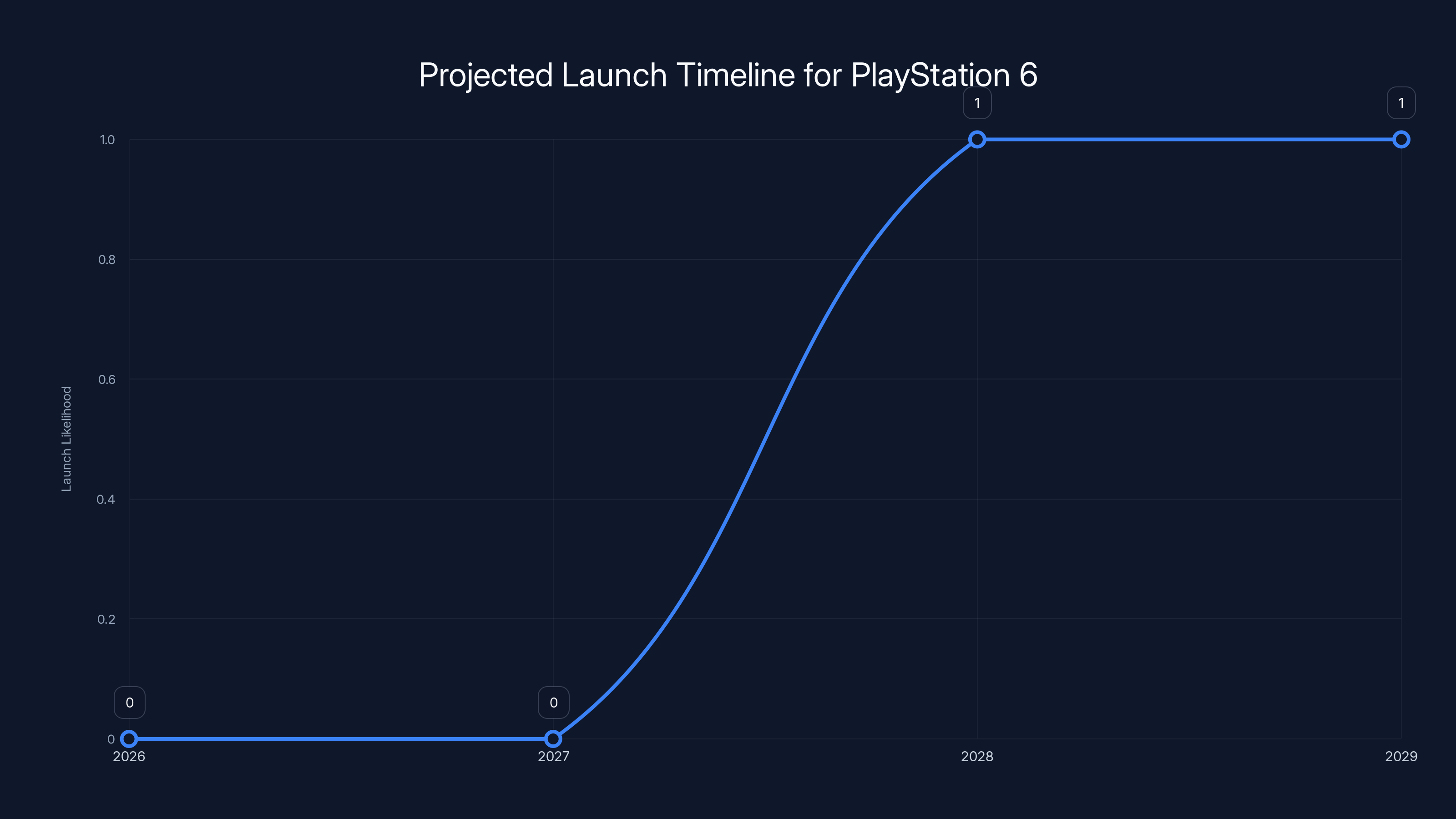

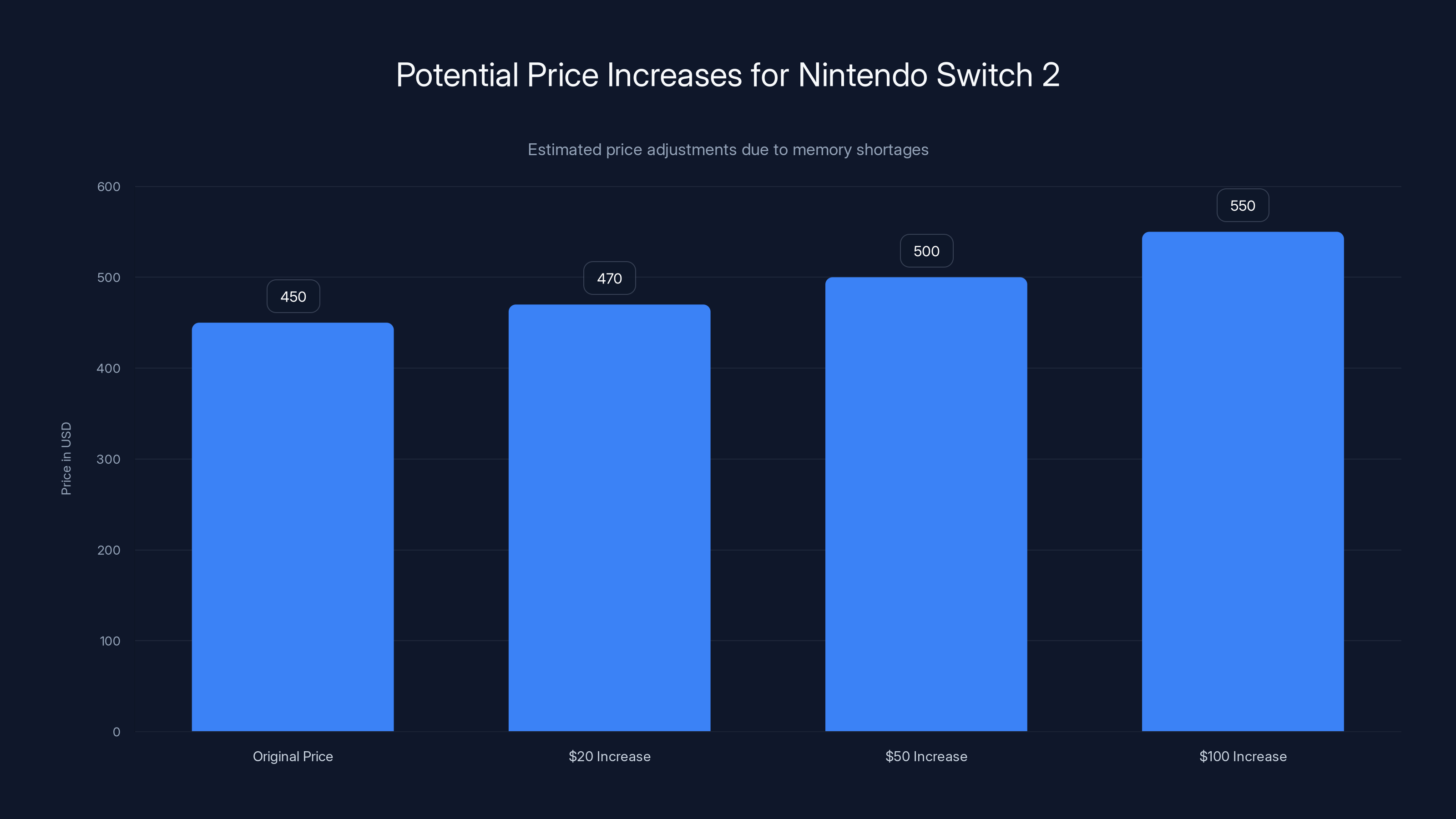

According to industry sources, Sony is considering pushing the Play Station 6 release back to 2028 or even 2029, potentially three years later than the traditional six-to-seven-year console cycle would suggest. Meanwhile, Nintendo is weighing a price increase for the Switch 2, despite having resisted hiking prices during the recent tariff era.

This isn't just a supply hiccup. It's a fundamental shift in how the semiconductor industry allocates its most constrained resource.

TL; DR

- PS6 Delayed: Sony may push Play Station 6 release to 2028-2029, breaking its traditional six-to-seven-year cycle

- Switch 2 Price Hike: Nintendo considering raising Switch 2 prices above the $450 launch point due to memory chip shortages

- AI Memory Crunch: Data centers training AI models are consuming an unprecedented share of DRAM and high-bandwidth memory production

- Industry Disruption: Gaming hardware makers now competing directly with cloud computing providers for limited memory capacity

- Long-term Impact: Console shortages could push players toward cloud gaming, mobile, and PC alternatives earlier than expected

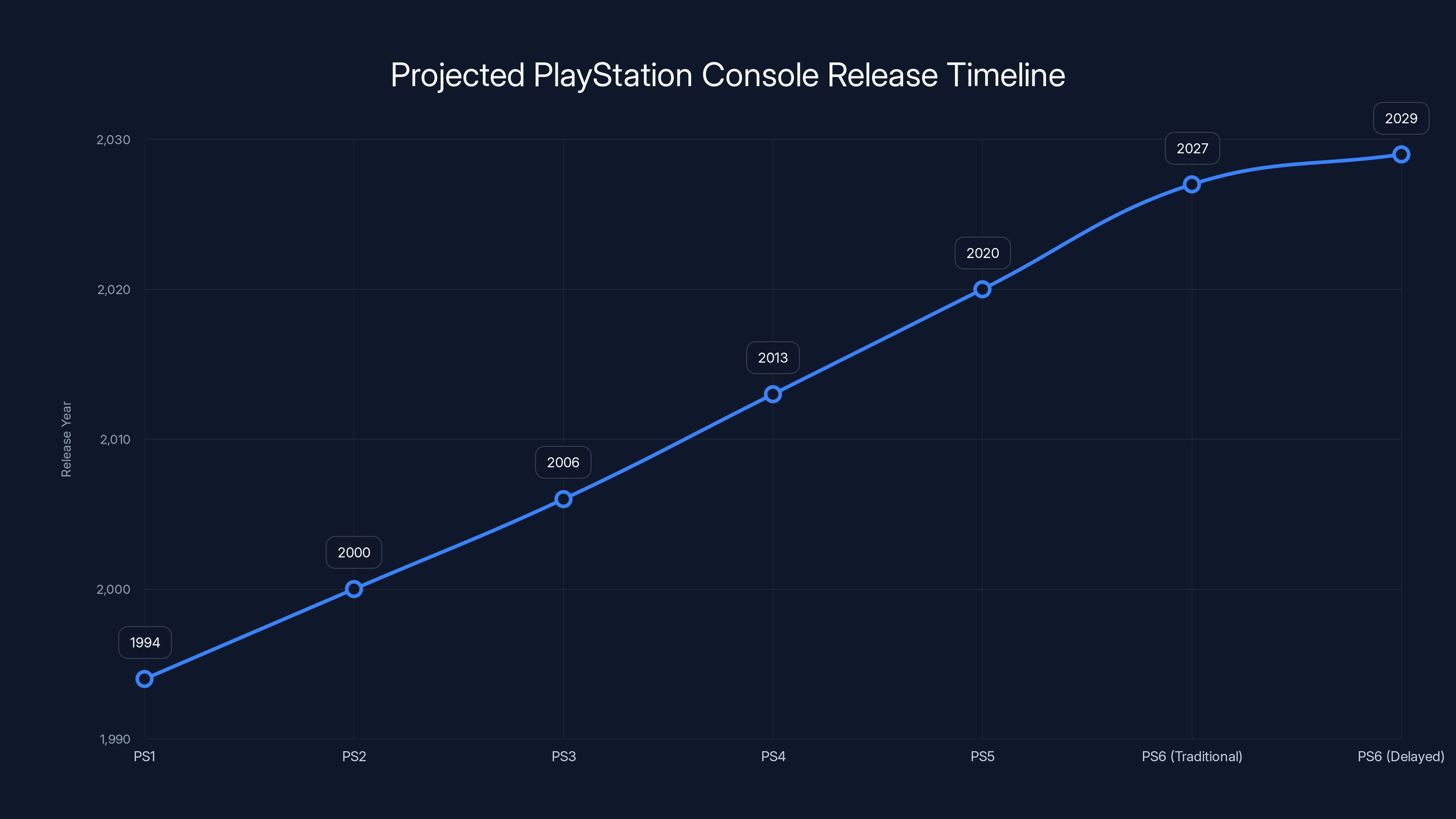

Sony's potential delay of the PS6 to 2028 or 2029 breaks from the traditional 7-year cycle. Estimated data shows a strategic shift to optimize memory costs and console features.

Why AI Is Eating All the Memory Chips (And Why That Matters for Gamers)

To understand why Sony and Nintendo are suddenly feeling the squeeze, you need to understand what's happening inside data centers.

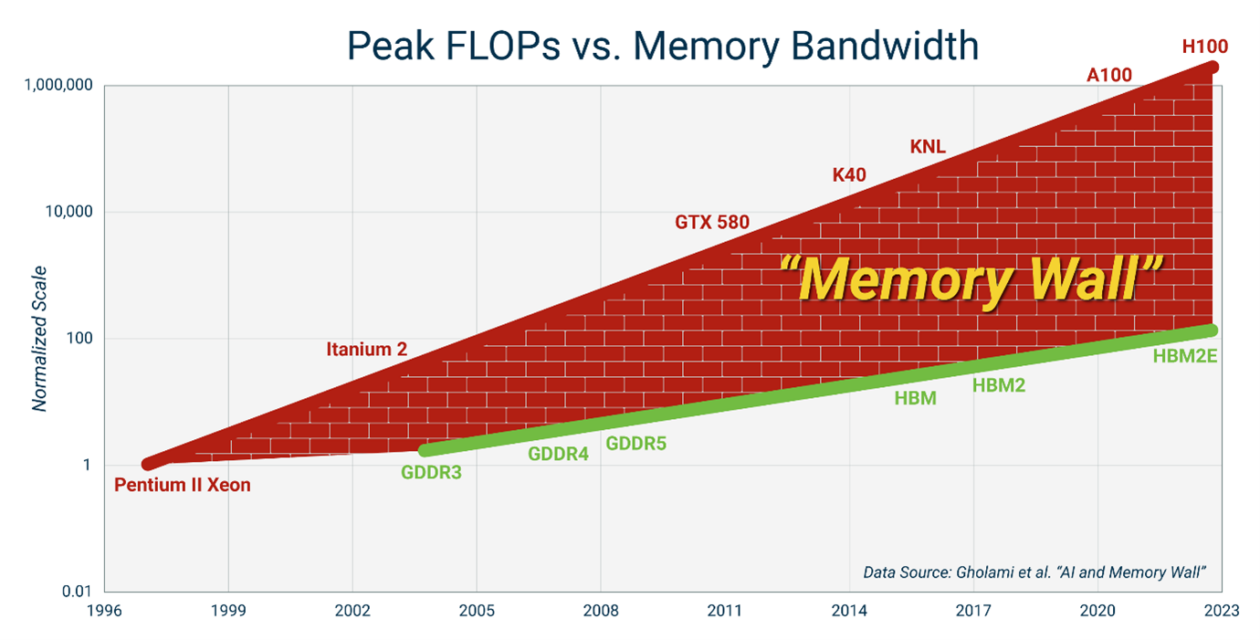

Artificial intelligence is voracious. It's not just voracious for computing power (GPUs, TPUs, tensor chips)—it's absolutely ravenous for memory. When Open AI trains GPT models, when Anthropic refines Claude, when Deep Mind develops AI assistants—they're moving massive amounts of data through memory subsystems at speeds that would have seemed impossible five years ago.

Here's the thing: memory chips come in different types, each with different uses. There's DRAM (the stuff in your laptop), which is relatively abundant. There's high-bandwidth memory (HBM), which is specialized, expensive, and specifically designed for the kind of parallel processing that AI systems demand. And there's regular VRAM, the video memory that goes into graphics cards.

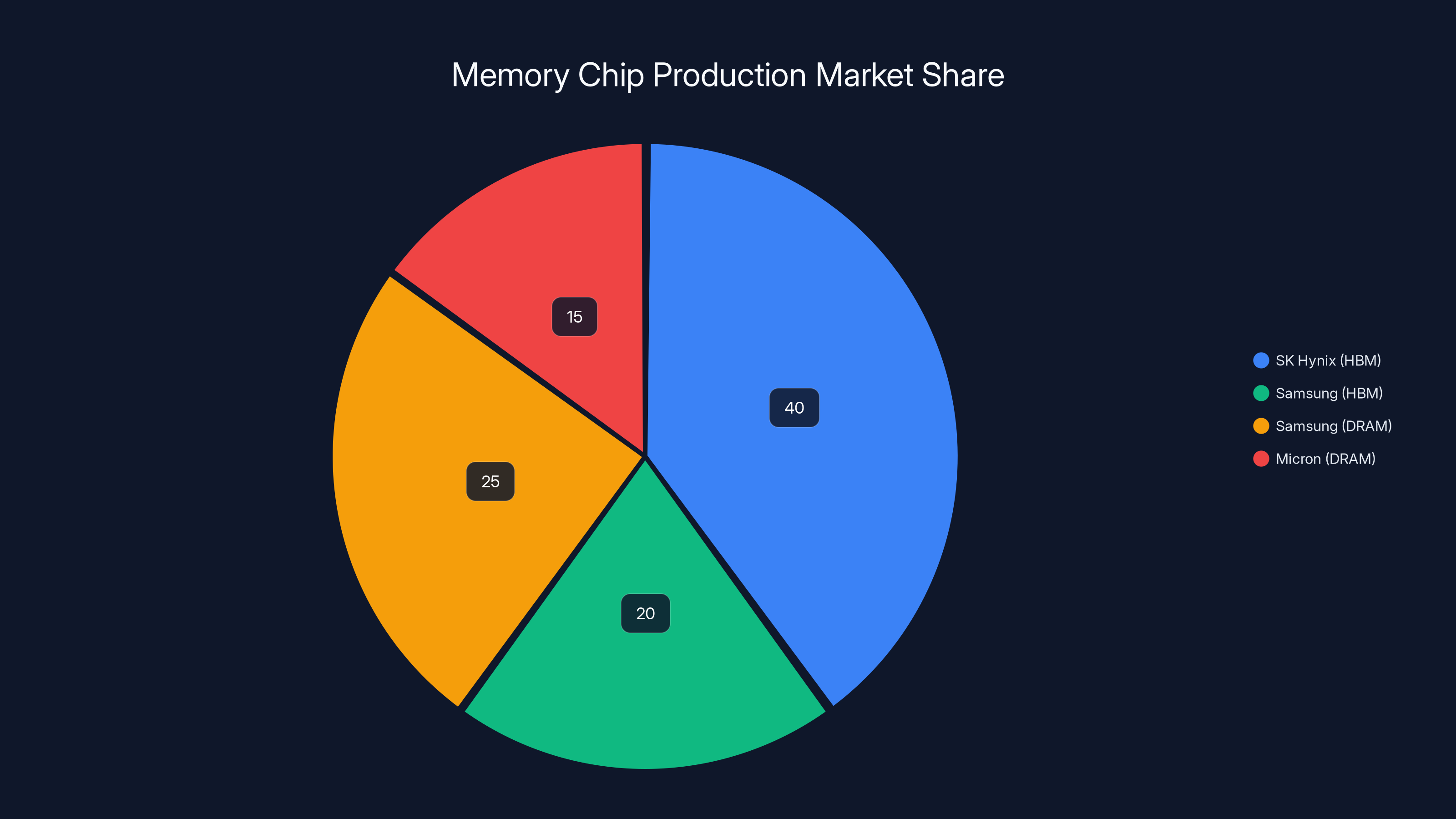

AI data centers want the premium stuff. They want HBM because it lets them move data faster, train models more efficiently, and squeeze more performance out of their silicon. And right now, every major chipmaker—Samsung, SK Hynix, Micron—is prioritizing those orders because they're extraordinarily profitable.

A data center willing to spend billions on GPUs and AI infrastructure isn't going to balk at memory prices. A console maker trying to sell hardware at $500 margins? They're far more price-sensitive.

The math is brutal. If you're a memory manufacturer and you can sell your HBM production to Nvidia customers at premium prices, or allocate it to console makers who need more memory but have tighter budgets, what's the rational choice?

You sell to Nvidia. And AMD. And everyone else building AI infrastructure.

This creates a cascading problem. Console makers can't get the memory they want at the prices they want. So either they delay launching new hardware (hoping memory prices come down or production increases), or they eat the higher costs and pass them to consumers.

Sony appears to be choosing the delay route. Nintendo appears to be choosing the price-increase route. Both are losing moves, but they're different kinds of losses.

The PlayStation 6 is projected to launch between 2028 and 2029, depending on memory availability and industry trends. Estimated data.

The Play Station 6 Delay: Why Sony Might Wait Until 2028 or 2029

Sony's reported thinking is actually pretty clever, even if it's disappointing for players who've been waiting for a PS5 successor.

The Play Station 5 launched in November 2020. That's now over four years ago. By traditional console cycle math, Sony should be announcing PS6 in 2026 and launching in late 2027. But memory constraints are messing with that timeline.

Here's why the delay makes sense from Sony's perspective:

First, waiting gives memory capacity time to increase. Chip manufacturers are ramping production in response to AI demand. Samsung, SK Hynix, and Micron all have expansion plans. If Sony waits two or three years, memory supply might catch up to demand, and prices could normalize. Launching into a memory shortage would mean either cutting features (bad PR) or raising the console price significantly (also bad PR).

Second, waiting lets Sony make a better console. Rather than being constrained by what memory is available and affordable right now, Sony can design the PS6 with the specs they actually want. If memory becomes cheaper and more abundant in 2028, they can include more VRAM, faster memory interfaces, and better support for complex graphics features.

Third, there's a perverse incentive game happening. If Sony launches in 2027 and charges

But here's the cost: a three-year delay is massive in gaming terms. That's an entire generation of game development. Studios making PS5 games right now will have to stretch those games across more years. Players might migrate to PC or cloud gaming during the gap.

It's also a break from Play Station tradition. Since the original Play Station launched in 1994, Sony has released new console generations roughly every six to seven years. That consistency became part of the brand identity. Players trusted that they knew roughly when the next generation would arrive.

A three-year delay, pushing the PS6 to 2028 or even 2029, breaks that covenant. It says the console cycle is no longer predictable. It's at the mercy of supply chain dynamics and semiconductor production capacity.

What makes this particularly frustrating for Sony is that it's a problem they can't solve by themselves. They can't force Samsung or SK Hynix to prioritize their memory orders. They can't undercut Amazon or Google's willingness to pay for premium memory. They're essentially hostage to the semiconductor industry's priorities.

Some observers argue Sony could mitigate this by designing the PS6 with less memory, keeping costs down and avoiding the shortage crunch. But that would mean compromising on raw performance. The PS5 was already known for its tight memory bandwidth compared to the Xbox Series X. Tightening it further would invite criticism that the console is underpowered.

So Sony faces a genuinely hard choice: launch late with a better console, or launch on time with limitations. They're apparently choosing the former.

Nintendo's Switch 2 Price Hike: The $450 Console Just Got Pricier

Nintendo's situation is slightly different, but ultimately stems from the same memory shortage problem.

The Switch 2 launched at

But memory shortages are apparently forcing their hand. Bloomberg reports that Nintendo is considering raising the Switch 2 price in 2025, but doesn't specify how much.

Even a

A

This is particularly frustrating because Nintendo was specifically trying to avoid this. They kept the

Nintendo's pricing dilemma also suggests something larger: if a company as efficient as Nintendo, with as much supply chain optimization as Nintendo possesses, can't avoid raising prices, the shortage must be genuinely severe.

Estimated data: Potential price increases for the Nintendo Switch 2 could range from

The Semiconductor Supply Chain: How AI Created a New Hierarchy

To understand why gaming is suffering while AI thrives, you need to understand how semiconductor production actually works.

It's not like car manufacturing, where a factory can switch from building Hondas to building Toyotas with some retooling. Chip manufacturing is specialized to the extreme. A fab that produces memory chips is optimized for that. Changing production would mean retooling, retraining, and long delays.

Memory production specifically is concentrated in just a few companies. Samsung, SK Hynix, and Micron produce the vast majority of DRAM. For HBM specifically, capacity is even more constrained. SK Hynix dominates HBM production, with Samsung as the distant second.

When demand for HBM exploded in 2024 because everyone wanted to build AI data centers, those companies faced a choice: produce more HBM (high margin, explosive demand), or continue producing regular DRAM and other memory types (lower margin, stable but less exciting demand).

The answer was obvious. Memory manufacturers shifted production capacity toward HBM. They prioritized orders from Nvidia, AMD, cloud providers, and AI infrastructure companies. Console makers got pushed down the priority list.

This created a weird economic hierarchy that looks something like this:

- Tier 1: Cloud AI companies (Open AI, Google Cloud, AWS) - willing to pay premium prices, ordering in bulk, long-term contracts

- Tier 2: Semiconductor companies (Nvidia, AMD) - need HBM for their chips, massive volumes

- Tier 3: Enterprise AI (corporations training models internally) - large orders, decent margins

- Tier 4: Gaming hardware makers (Sony, Nintendo, Microsoft) - smaller orders relative to tier 1-3, more price-sensitive

- Tier 5: Everything else - consumer products, Io T, automotive, etc.

Gaming used to be higher up that list. Not anymore.

The implication is sobering: unless demand for AI memory growth slows dramatically, gaming hardware makers will remain deprioritized. They'll keep getting squeezed on availability and pricing.

Memory Prices and the Economics of Console Design

Let's talk actual numbers, because this is where the pain becomes real.

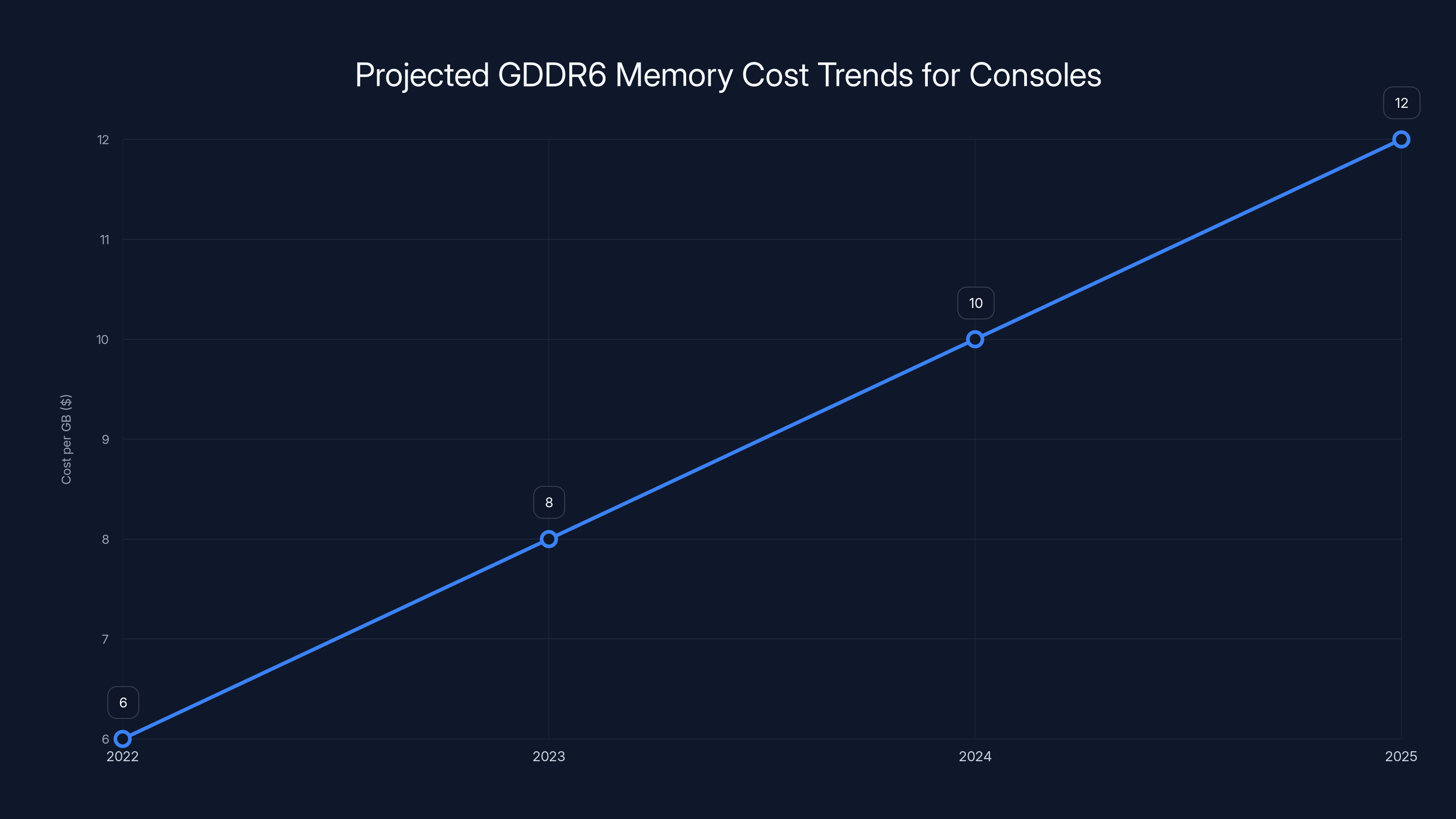

A Play Station 5 includes about 16GB of GDDR6 memory. That's standard gaming VRAM, not HBM, but it's still premium memory. Current market prices for GDDR6 are in the range of

That doesn't seem outrageous. But here's the thing: those prices are volatile. A year ago, prices were lower. If the shortage deepens, prices could spike to

On a console that retails for

- Absorb the cost (reduce profit margin from 10-15% to near-zero or negative)

- Raise the retail price (risk market rejection or negative PR)

- Reduce memory (compromise on console capabilities)

- Delay launch (hope prices come down)

Sony's apparently choosing option 4. Nintendo's apparently choosing option 2. Both are trying to avoid options 1 and 3.

This math gets worse if memory prices stay elevated. And the only way prices come down is if either:

- Demand for AI memory slows significantly (unlikely given current trajectory)

- New memory production capacity comes online (happening, but slowly)

- A breakthrough technology emerges (possible but not near-term)

None of these seem imminent. So gaming hardware makers are stuck in a tough spot.

Estimated data shows GDDR6 memory costs could rise from

How This Impacts Game Development and the Traditional Console Cycle

The console industry doesn't just rely on hardware release cycles for planning. Game developers plan their entire roadmaps around them.

When a new console generation launches, developers stop optimizing for the old hardware and start building for the new specs. Studios invest in learning new tools, new architectures, new capabilities. Publishers plan their release schedules years in advance, assuming they know roughly when consoles will arrive.

A three-year delay in the PS6 launch (from 2027 to 2028-2029) throws all of that into chaos.

Studios that expected to transition to PS6 development in 2026 now have to extend their PS5 support for years longer. That means:

- Resource allocation changes: Teams originally building PS6 launch titles get reassigned

- Long-tail support extends: PS5 game development continues longer, eating into studio budgets

- Technology stagnation: Developers can't leverage new hardware capabilities they've been anticipating

- Market migration: Players might shift to PC, mobile, or cloud gaming during the gap

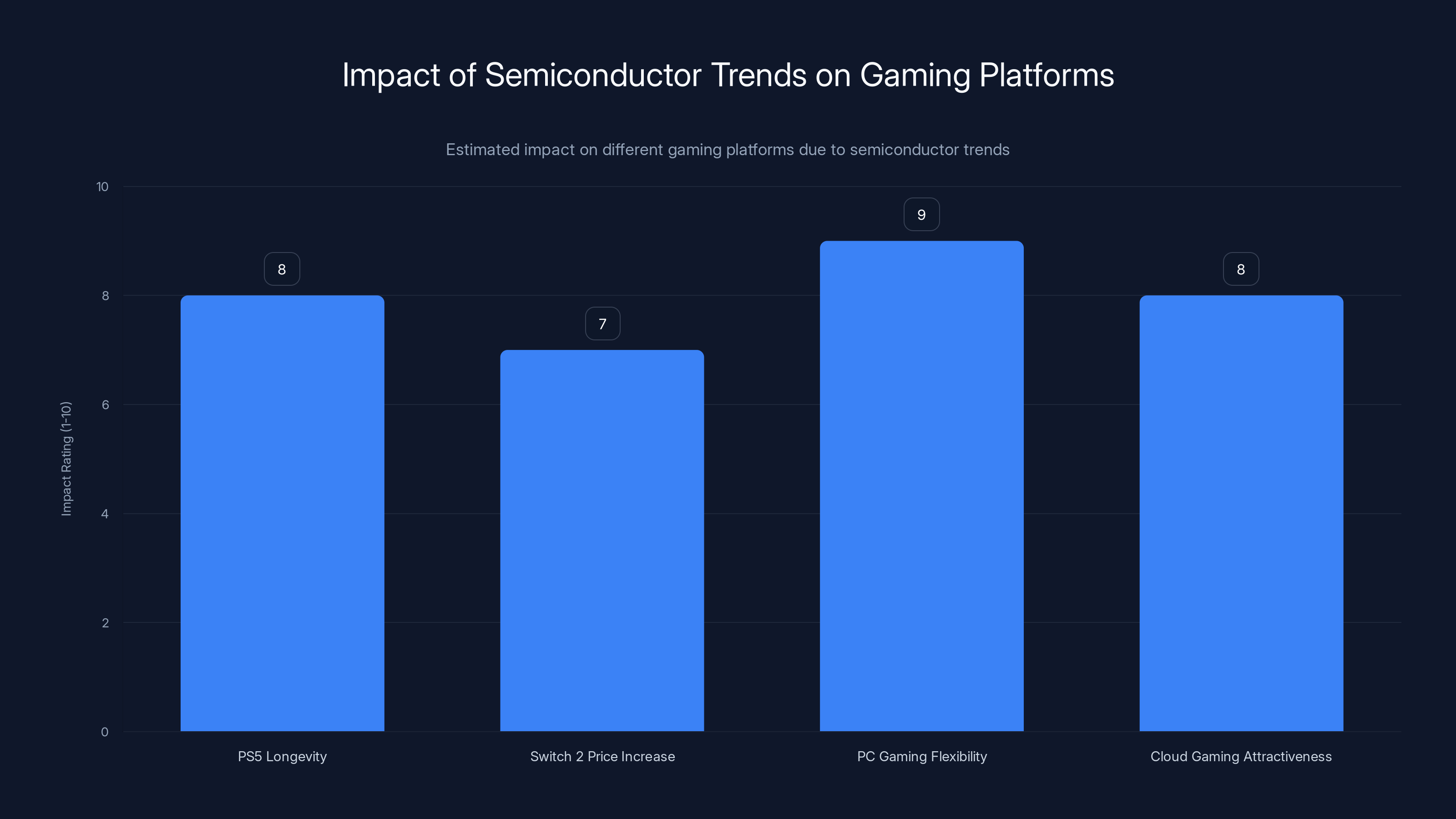

The last point is particularly interesting. If PS6 doesn't arrive until 2028-2029, players with gaming PCs might just build those instead. Mobile gaming (i OS, Android) continues to improve. Cloud gaming services like Ge Force Now, Xbox Cloud Gaming, and Play Station Plus Premium get more mature.

Sony's delay could accidentally accelerate the transition away from console hardware entirely, which would be ironic given that the delay is supposed to protect console viability.

Gamers are also affected. The PS5 launched in 2020. A three-year gap before PS6 (to 2028 or 2029) means eight to nine years on the same hardware generation. That's longer than PS4's lifecycle, which ran from 2013 to 2020 (seven years).

Will PS5 games in 2029 feel outdated? Probably not in terms of gameplay, but in terms of graphics fidelity, loading times, and ambition? Maybe. Developers might be stretching what the PS5 can do, but physics-based destruction, ray-tracing, and complex open worlds all suffer when hardware gets old.

The Competitive Implications: What About Xbox and Gaming PCs?

Interestingly, Xbox might not face the same memory shortage issues as Play Station and Switch.

Microsoft has been gradually transitioning toward a "hardware-agnostic" gaming strategy. Instead of obsessing over the next Xbox console generation, they've been investing heavily in Xbox Cloud Gaming and making their games available on PC, mobile, and other platforms.

This is actually brilliant strategy in light of the memory shortage. If memory is constrained, cloud gaming becomes more attractive because you don't need expensive hardware in every living room. You need powerful data center infrastructure, which uses different components and has different supply constraints.

Gaming PCs benefit from a different supply chain. Most gaming PCs use consumer-grade GPUs from Nvidia (Ge Force RTX series) and AMD (Radeon), which do use HBM or similar memory tech, but the memory is integrated into the GPU and less constrained than console memory orders.

This creates an interesting competitive dynamic: gaming PCs and cloud solutions could become relatively more attractive during the memory shortage period, potentially accelerating the shift away from traditional consoles.

The irony is delicious. Sony's trying to protect the console business by delaying PS6. But that delay might speed up the very market shift that threatens the console business in the long run.

SK Hynix dominates HBM production with an estimated 40% market share, while Samsung and Micron focus more on DRAM. Estimated data based on 2024 trends.

When Will Memory Prices Normalize? Looking at the Supply-Demand Curve

Here's the key question: when does this end?

Memory manufacturers are investing heavily in capacity. Samsung announced new HBM production lines. SK Hynix is ramping aggressively. Micron is expanding. These investments take time—typically 18-24 months from announcement to meaningful production increases—but they're coming.

At the same time, AI hardware demand is showing some signs of plateauing. The gold rush mentality around data center buildouts has cooled slightly from late 2023 levels. Some customers are becoming more selective about memory allocation.

But overall, the trajectory still points to tight memory through 2025 and probably into 2026. A normalization where gaming hardware makers get priority again? That's probably 2027-2028 minimum.

Which means Sony's timeline of 2028-2029 for PS6 might actually be optimal. If they launched in 2027, they'd still hit a memory shortage. Waiting until 2028-2029 gives production time to catch up.

Nintendo's price increase strategy is more about survivorship in the near term. They need to launch the Switch 2 now (they already have) to capture the market while the console cycle is still hot. So they're eating the memory cost and passing it to consumers.

It's a fundamentally different strategic approach: Sony is betting on patience, Nintendo is betting on execution.

What This Means for Console Gamers: The Realistic Outlook

Let's translate all this semiconductor economics into what it actually means for you if you're a gamer.

For PS5 owners: Your console just got a lot longer to stay relevant. If PS6 doesn't arrive until 2028-2029, that's eight to nine years of PS5 support. Games made for PS5 in 2028 and 2029 will be pushing the hardware harder than anything coming in 2025. This is actually good for longevity (your console keeps getting new games), but bad for technical progression (you might feel like you're playing last-gen games sooner).

For Switch 2 owners: Expect the price increase to land sometime in 2025, probably in the range of

For PC gamers: This is actually your sweet spot right now. PC gaming doesn't depend on a single hardware refresh cycle. You upgrade components gradually, and you have access to upcoming games that might not hit consoles for years. The memory shortage actually helps PC gaming relative to consoles because PC doesn't depend on coordinated hardware releases.

For cloud gaming enthusiasts: Services like Xbox Cloud Gaming and Play Station Plus Premium might actually become more attractive during the memory shortage era. You don't need to buy expensive hardware; you just need a subscription and decent internet.

For future console buyers: The predictability you're used to is gone. Don't assume PS6 arrives in 2027 or that Switch 3 follows historical timelines. The semiconductor supply chain is now more important than marketing cycles in determining when you get new hardware.

Estimated data suggests that PC gaming and cloud gaming are most positively impacted by current semiconductor trends, while PS5 longevity and Switch 2 price increases have moderate effects.

The Bigger Picture: When AI and Gaming Compete for the Same Resources

This entire situation—Sony delaying a console, Nintendo raising prices, both blaming memory shortages—reveals something fundamental about the computing industry in 2025.

We've crossed a threshold where artificial intelligence infrastructure demand exceeds available capacity for critical components. And AI gets priority.

This isn't because AI companies are more powerful or more vertically integrated. It's because they're willing to pay more and they're buying in bulk. They have clearer pathways to profitability and ROI. A data center spending a billion dollars on AI infrastructure will spend whatever it takes to get the memory to go with it.

Gaming is profitable, but it operates on much tighter margins. Console makers make money on software, subscriptions, and ecosystem lock-in—not on hardware sales. So they're more price-sensitive.

This creates an economic hierarchy where AI infrastructure wins resource allocation battles against everything else, including one of the largest entertainment industries on the planet.

It's a preview of what might happen with other constrained resources. If power consumption becomes critical (data centers use enormous amounts of electricity), gaming might face power allocation issues. If certain rare earth materials become bottlenecks, gaming could lose those too.

The semiconductor industry will eventually expand capacity to meet demand. But capacity expansion takes years. In the meantime, industries with higher profitability per unit volume—like AI—will keep winning resource battles against industries with lower margins—like gaming.

This is actually fine for the overall tech ecosystem. AI is creating value. But it does mean traditional gaming hardware cycles are broken, potentially for good.

Potential Solutions: How the Industry Could Respond

Given this problem, what are the actual solutions?

Increase memory production capacity: This is already happening, but it takes time. Memory manufacturers are investing in new fabs, which means capacity increases become available in 2026-2027, right around when Sony's PS6 launch window falls. This is probably why Sony set their timeline where they did.

Use different memory architectures: Gaming consoles could shift to using different types of memory that aren't as constrained. Instead of HBM, they could use alternative memory technologies that offer good performance with less competition from AI data centers. This requires redesign of the console's memory subsystem, but it's possible.

Increase memory efficiency: Console makers could design systems that do more with less memory. This is always happening anyway—engineers are always optimizing—but there's room for innovation. Better compression, smarter caching, more efficient data structures.

Vertical integration: A console maker could potentially invest in memory manufacturing directly or partner with manufacturers to guarantee capacity. Microsoft and Sony could both afford to do this. It would require significant capital investment, but it would guarantee supply.

Shift to cloud gaming: This is Microsoft's play. If you don't need expensive memory in every home, you only need memory in data centers. Cloud gaming infrastructure actually uses different memory prioritization (more bandwidth-optimized, less real-time constrained) than gaming consoles.

Accept smaller console generations: Nintendo's doing something interesting with Switch 2. It's not a massive generational leap from Switch 1. It's an iterative upgrade. Sony and Microsoft could adopt similar strategies—releasing incremental hardware updates instead of waiting for massive generational jumps. This spreads demand over time instead of creating bottlenecks around launch windows.

None of these solutions are instant fixes. But they're all more realistic than just wishing memory became more abundant.

Looking Ahead: What 2026-2029 Could Look Like for Gaming Hardware

Assuming memory capacity increases as planned and AI demand stabilizes (both reasonable assumptions), here's what the next few years might look like:

2025: Switch 2 sales ramp with potential price increases. PS5 continues strong. Xbox focuses on Game Pass and cloud gaming. Memory prices remain elevated.

2026: Memory capacity increases begin to bite. Prices stabilize but remain above pre-2024 levels. Developers intensify PS5 support as PS6 rumors grow louder. First hints that Xbox might announce a next-generation console strategy (probably cloud-focused).

2027: Memory production improvements accelerate. Prices normalize somewhat. Play Station rumors intensify as the traditional launch window approaches. Nintendo might hint at Switch 3 planning.

2028-2029: PS6 potentially launches (if Sony sticks to their timeline). Memory prices have likely normalized. But the console landscape has probably shifted—more cloud gaming, more PC crossover, less console-exclusive content.

The overall trend: console hardware becomes less central to the gaming ecosystem. It's not that consoles die, but they compete more with other platforms rather than dominating them.

This is probably good for players long-term (more options, less lock-in), but it's definitely a shift from the console-centric gaming world of the past 20 years.

The Semiconductor Industry's Role in Shaping Consumer Technology Futures

This entire situation highlights something critical about how technology gets built and distributed in the modern era: semiconductor supply chains are now a core business constraint, not just a cost factor.

Twenty years ago, if you wanted to build something, you designed it, found a manufacturer, and shipped it. The supply chain was a logistics problem, not a strategic problem.

Today, the supply chain is the strategy. The companies that can secure access to constrained components win. The companies that can't get squeezed out.

AI companies have understood this and invested accordingly. They've built relationships with chip manufacturers, signed long-term contracts, and invested in alternative supply chains. They're treating semiconductor supply as a strategic asset, not a commodity.

Traditional gaming companies haven't done this to the same degree. They assumed memory would always be available and affordable. The memory shortage is proving that assumption wrong.

This will likely force changes in how game hardware companies operate. Expect more vertical integration (owning or partnering with memory manufacturers), more strategic stockpiling, and more direct relationships with chip makers.

This also means that future gaming hardware cycles might be determined less by marketing strategy and more by what can actually be manufactured. That's a weird transition for an industry that's traditionally planned everything years in advance.

FAQ

Why is AI consuming so much memory?

AI systems, especially large language models and neural networks, process enormous amounts of data during training and inference. A single training run for a large model requires hundreds of terabytes of data to flow through memory subsystems. High-bandwidth memory (HBM) allows this data to move faster, making training more efficient and inference more responsive. Every major AI company (Open AI, Google, Microsoft) is competing to access this memory, and their willingness to pay premium prices has prioritized them over other industries.

When will Play Station 6 actually launch?

Based on industry reports, Sony is considering launching the PS6 in 2028 or even 2029, which would be three years later than the traditional console cycle would suggest. The exact timing depends on how quickly memory production capacity increases and whether memory prices stabilize. If memory becomes readily available by 2027, Sony might launch closer to that date. If shortages persist, they could push to 2029. Sony hasn't officially confirmed this timeline.

Should I buy Switch 2 now before the price increase?

If price increases are coming soon, buying now at the $450 launch price makes financial sense. However, consider waiting for a few months to see if Nintendo confirms pricing changes. If they announce price stability for the next 12 months, then there's no rush. If they hint at increases, buying immediately would lock in the current price.

How does memory shortage affect Xbox?

Microsoft has strategically shifted toward cloud gaming and software services rather than traditional console hardware cycles. This means they're less dependent on expensive console hardware launches and more dependent on data center infrastructure. This actually insulates them somewhat from gaming-specific memory shortages, since cloud gaming infrastructure uses different memory architectures and has higher margins that justify higher costs.

Could gaming companies just use cheaper memory instead?

Theoretically, yes. But cheaper memory typically means slower memory, which reduces console performance. Consoles are already known for using optimized memory hierarchies—they use the fastest memory for the most critical tasks. Switching to slower memory would require redesigning the entire console architecture and compromising on graphics quality and game load times. Most console makers consider this unacceptable.

Will this memory shortage eventually end?

Yes. Memory manufacturers are investing billions in new production capacity, which will come online in 2026-2027. As capacity increases, prices should normalize and availability should improve. However, even after the shortage ends, AI data centers will likely maintain priority access to premium memory because they can pay more. Gaming will probably be deprioritized even after the shortage resolves.

What's the difference between HBM and GDDR6 memory?

HBM (High-Bandwidth Memory) is specialized memory designed for AI and scientific computing. It's extremely fast and efficient but expensive. GDDR6 is optimized for gaming and graphics, with high bandwidth but different architecture. GDDR6 is what goes into gaming consoles. The shortage primarily affects HBM, but it creates spillover effects that make GDDR6 more expensive and scarce as manufacturers prioritize premium products.

Could cloud gaming replace consoles entirely?

Potentially, but there are barriers. Cloud gaming requires strong, stable internet connections, which not everyone has. It also introduces latency (the delay between input and response) that some competitive gamers find unacceptable. Console gaming will likely remain relevant alongside cloud gaming rather than being completely replaced. However, this memory shortage might accelerate the shift toward cloud gaming because it doesn't require expensive local hardware.

How will game developers adapt to delayed consoles?

Game studios will need to extend their PS5 support longer than planned, optimizing games that might otherwise have transitioned to PS6 development. Some developers might shift resources to PC or cloud gaming projects. Long-term, expect more cross-platform development (games made for multiple platforms simultaneously) and less reliance on exclusive console experiences tied to specific hardware launches.

Is my PS5 or Switch going to stop getting games?

No. Even with delayed PS6 announcements, PS5 and Switch will continue receiving new games for years. Sony and Nintendo make money from software and services, not just hardware sales. In fact, extended console lifecycles (longer time before the next generation) often result in more games being made for current hardware, not fewer.

Conclusion: The Year Gaming Hardware Met Its Match

What we're witnessing is a fundamental realignment of how technology resources get allocated in the computing industry.

For decades, gaming hardware was one of the most important drivers of semiconductor innovation. Console launches drove GPU development, pushed memory architectures forward, and motivated chip manufacturers to achieve new performance milestones. The Play Station and Xbox were customers that manufacturers actually cared about.

But in 2024-2025, something shifted. Artificial intelligence emerged as a customer with deeper pockets and faster growth. Data centers training models could pay whatever it took to get the memory they needed. And suddenly, gaming got demoted.

Sony is delaying the Play Station 6. Nintendo is raising prices on the Switch 2. These aren't marketing decisions or strategic choices. They're responses to a supply chain problem that's bigger than any single company can solve.

But here's the thing: this is actually okay. AI infrastructure is creating value. Cloud services, better language models, more efficient computing—these are genuinely important. If gaming has to take a backseat while AI capacity scales out, that's a reasonable tradeoff for society.

What it means for gamers is trickier. Longer console lifecycles mean extended support for current hardware, which is good. But it also means slower hardware progression and less generational innovation. The gap between PS5 and PS6 might be smaller than the gap between PS4 and PS5, just because the technology maturity curve is flattening.

For game developers, it means planning for longer production cycles and more platform flexibility. For game companies, it means rethinking how they compete. And for the industry overall, it means the console-centric gaming world of the last 20 years is gradually shifting toward something more fragmented—cloud, mobile, PC, and consoles all competing equally.

None of this is catastrophic. The gaming industry will adapt. Games will continue to get made and played. But the comfortable predictability of the console cycle is gone, replaced by something messier and more uncertain.

Somewhere in a Samsung or SK Hynix fab, engineers are prioritizing another batch of HBM destined for AI data centers. That decision—made dozens of times per day, thousands of times per year—is now more consequential for the gaming industry than any strategic decision Sony or Nintendo could make.

That's the real story here. Not that consoles are being delayed. But that semiconductor supply chains have become the ultimate arbiter of which industries get to grow and which have to wait.

For gaming, waiting just started. The next few years will tell us whether that wait drives innovation or stagnation.

Key Takeaways

- Sony may delay PlayStation 6 launch to 2028-2029 (three years later than traditional six-to-seven-year console cycle) due to memory chip shortages driven by AI data center demand

- Nintendo considering price increase for Switch 2 above $450 launch price as memory production capacity shifts toward higher-paying AI customers

- AI infrastructure (especially large language models and data centers) now outbids gaming hardware makers for constrained HBM and GDDR6 memory production

- Memory manufacturing capacity is constrained by fab limitations—new production lines take 3-5 years to plan and build, meaning shortages will persist through 2026-2027 minimum

- Console gaming may shift toward longer hardware lifecycles, cloud gaming, and PC alternatives as traditional console release cycles become unpredictable

Related Articles

- Best Nintendo Switch 2 Games on Sale Now [2025]

- AI Data Centers Hit Power Limits: How C2i is Solving the Energy Crisis [2025]

- Best Nintendo Switch 2 Party Games: 6 Essential Titles for Multiplayer Fun [2025]

- The Essential Tech Gear Every Professional Carries in 2025

- Metal Gear Solid 4 Leaves PS3: Console Exclusivity Death [2025]

- AI Data Centers & Electricity Costs: Who Pays [2025]

![PlayStation 6 Release Delayed, Switch 2 Pricing Hike: AI Memory Crisis [2025]](https://tryrunable.com/blog/playstation-6-release-delayed-switch-2-pricing-hike-ai-memor/image-1-1771250797257.jpg)