Game UK Stores Closing: The Death of Physical Game Retail [2025]

It's official. Game, the UK's longest-running video game retailer, is shutting down its last three standalone stores. After decades of selling physical games, consoles, and gaming gear, the chain that once dominated British high streets is now just a ghost haunting the concession stands of Sports Direct and House of Fraser.

This isn't just another retail story. It's the final chapter in one of gaming's most dramatic survival sagas—a company that nearly died in 2012, got bought by Frasers Group in 2019, and spent years slowly fading away. Now, it's gone.

But what actually happened? Why did Game fail despite being owned by a billionaire-backed retail conglomerate? And what does this mean for physical gaming—and retail as a whole?

Let's break down the collapse of Game, the forces that killed it, and what we're losing in the process.

TL; DR

- Game entered administration in late January 2025 after years of declining sales and shrinking store footprint, as reported by Video Games Chronicle.

- Three remaining standalone stores are now closing, with operations moving to 200+ Sports Direct and House of Fraser concessions, according to Radio Times.

- Managing director Nick Arran stepped down after 9 years, marking a symbolic end of leadership's vision, as noted by The Game Business.

- Physical game retail is dying as digital downloads dominate and consumer shopping habits shifted post-pandemic, highlighted by Retail Merchandiser.

- Broader retail apocalypse claims hundreds of UK high street brands annually, with game retailers particularly vulnerable, as discussed in The Sun.

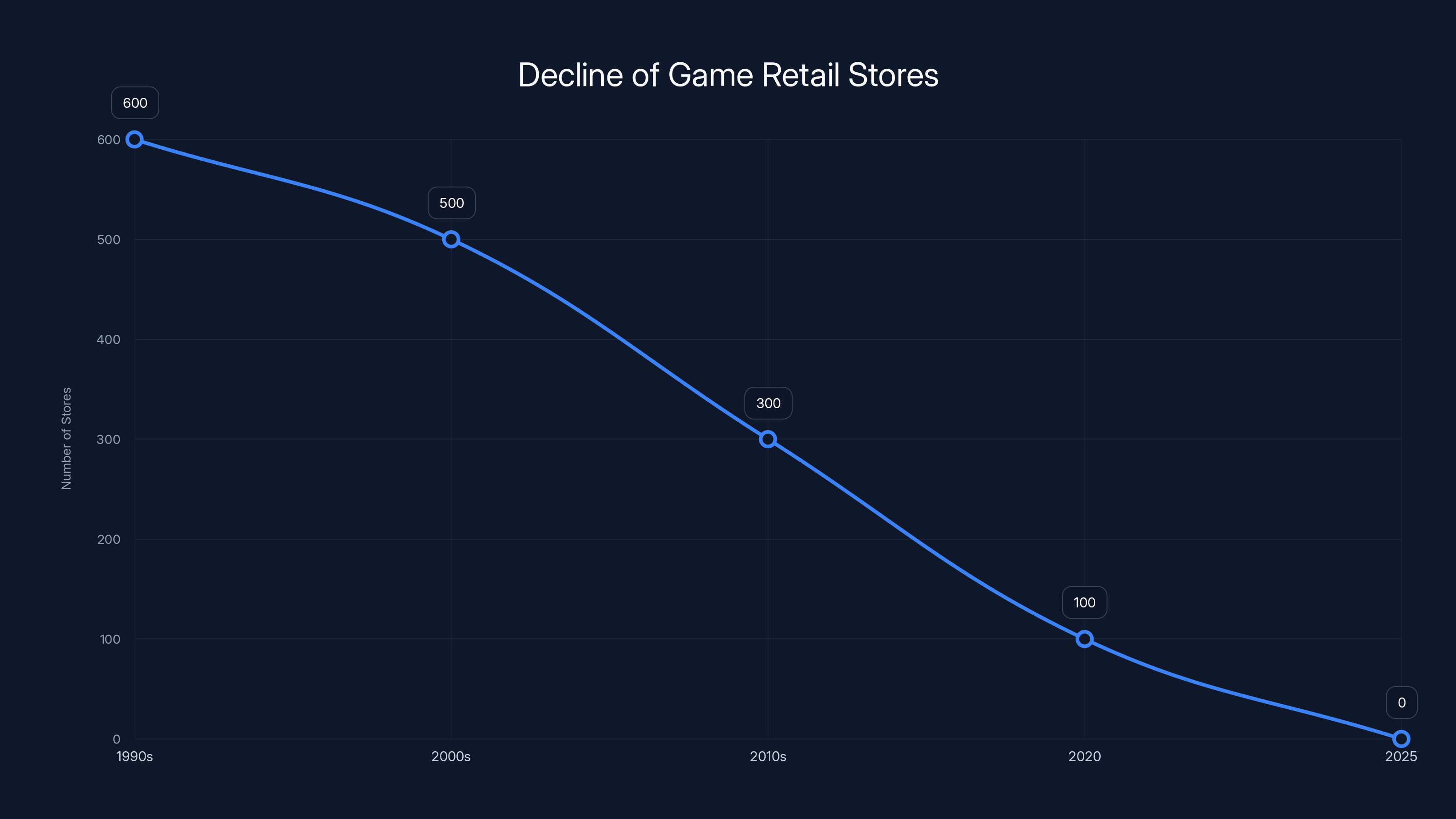

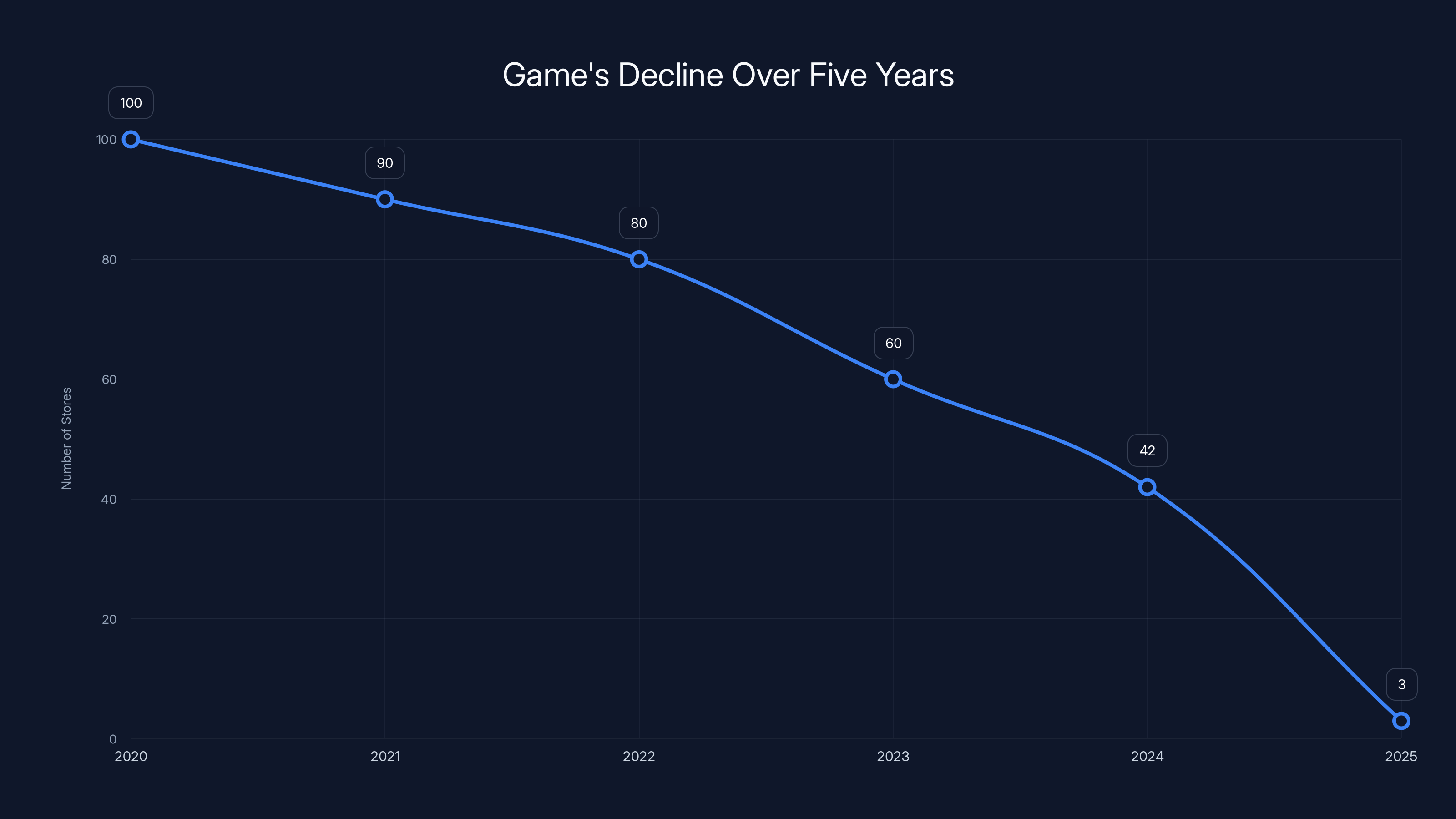

Game's retail presence peaked in the 1990s with over 600 stores, declining to zero standalone stores by 2025. Estimated data.

The Rise and Fall: Game's 30-Year Journey

Game didn't start as a dying retailer. In the 1990s and early 2000s, it was unstoppable.

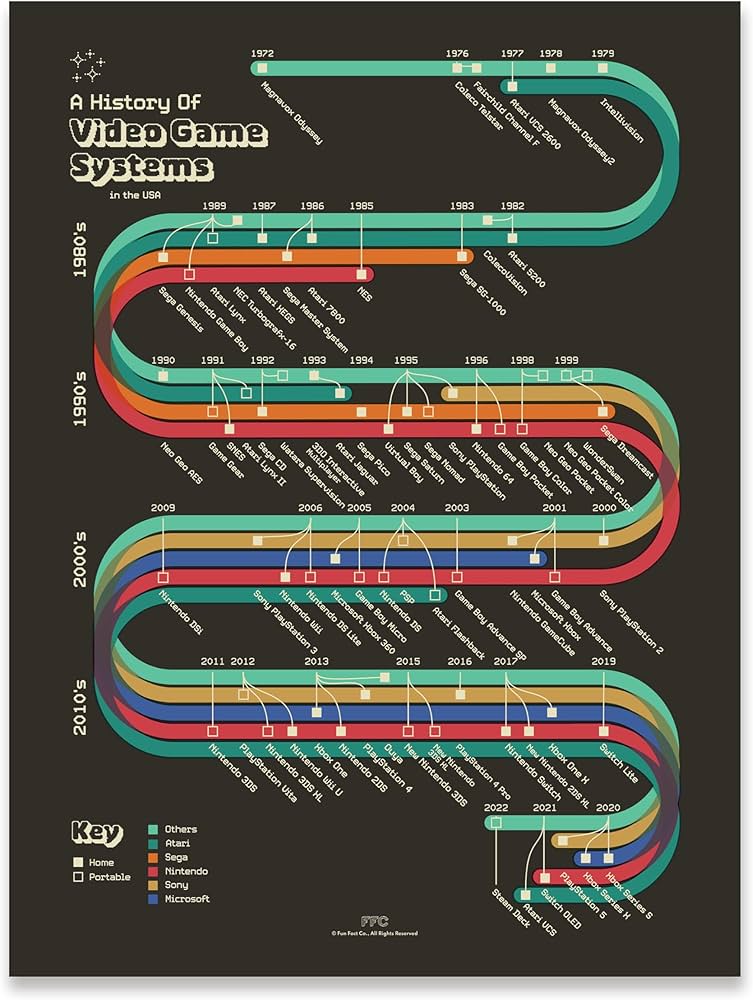

The chain opened during the golden age of physical media. When consoles like the PlayStation, Dreamcast, and Xbox launched, people needed somewhere to buy games. Game had stores everywhere—on every high street, in every shopping mall. It was the place you went when you wanted the latest release on day one.

For nearly two decades, this worked brilliantly. Game was THE gaming retailer in the UK, the place where collectors bought limited editions, where kids begged parents for vouchers, where pre-orders mattered because digital wasn't an option yet.

Then the internet happened.

Digital downloads fundamentally changed gaming. Steam launched in 2003 but was slow to catch on. By 2012, it was unstoppable. PlayStation and Xbox added digital storefronts. Mobile gaming exploded. Suddenly, you didn't need a physical store—you needed an internet connection.

Game's first brush with death came in 2012. The company collapsed into administration, store closures followed, and investors watched what was once a UK institution crumble. It seemed finished.

But Frasers Group swooped in during the 2020 pandemic boom. Gaming was booming. Consoles were selling. Maybe Game could be saved through acquisition. Maybe it could pivot.

It couldn't.

Why Frasers Group's Rescue Failed

Frasers Group is a retail powerhouse. The company owns Sports Direct, House of Fraser, Evans Cycles, and dozens of other brands. Billionaire Mike Ashley controls the empire. By any measure, Frasers should've had the resources to save Game.

They didn't, and the reasons are instructive.

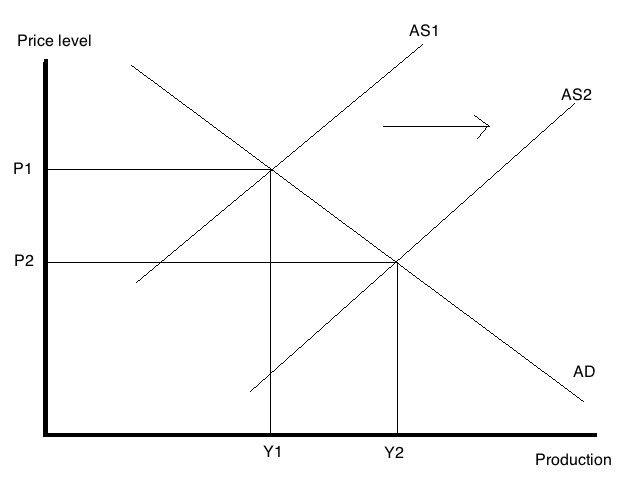

First, the core problem was structural. Game's business model—standalone physical game retail—was obsolete. Frasers bought the brand, not a sustainable business. You can't fix obsolescence with money. You can only accept it.

Second, the cost structure was wrong. Game's stores required high rent in prime locations. Every store was losing money. Closing them made financial sense immediately. But once you start closing stores, momentum becomes your enemy. Fewer stores mean lower traffic. Lower traffic means more closures. The death spiral accelerates.

Third, Frasers is a discount retailer. Sports Direct operates on razor-thin margins and high volume. Game's customers expected premium service, curated selection, knowledgeable staff—things that don't fit the discount model. The cultures clashed.

Fourth, digital competition was relentless. Steam, Epic Games Store, PlayStation Network, Game Pass—these platforms offered instant access to thousands of games at competitive prices. Price matching Game's online store against Amazon was increasingly difficult when Amazon has logistics that would make most armies jealous.

By 2023, the situation was unsalvageable. Game announced it was pivoting away from being a game retailer. Yes, you read that right. A company called "Game" decided games weren't the future.

Managing director Nick Arran said the strategy would focus on toys, collectibles, and non-gaming products. Gaming would become "secondary." This wasn't a pivot—it was a surrender.

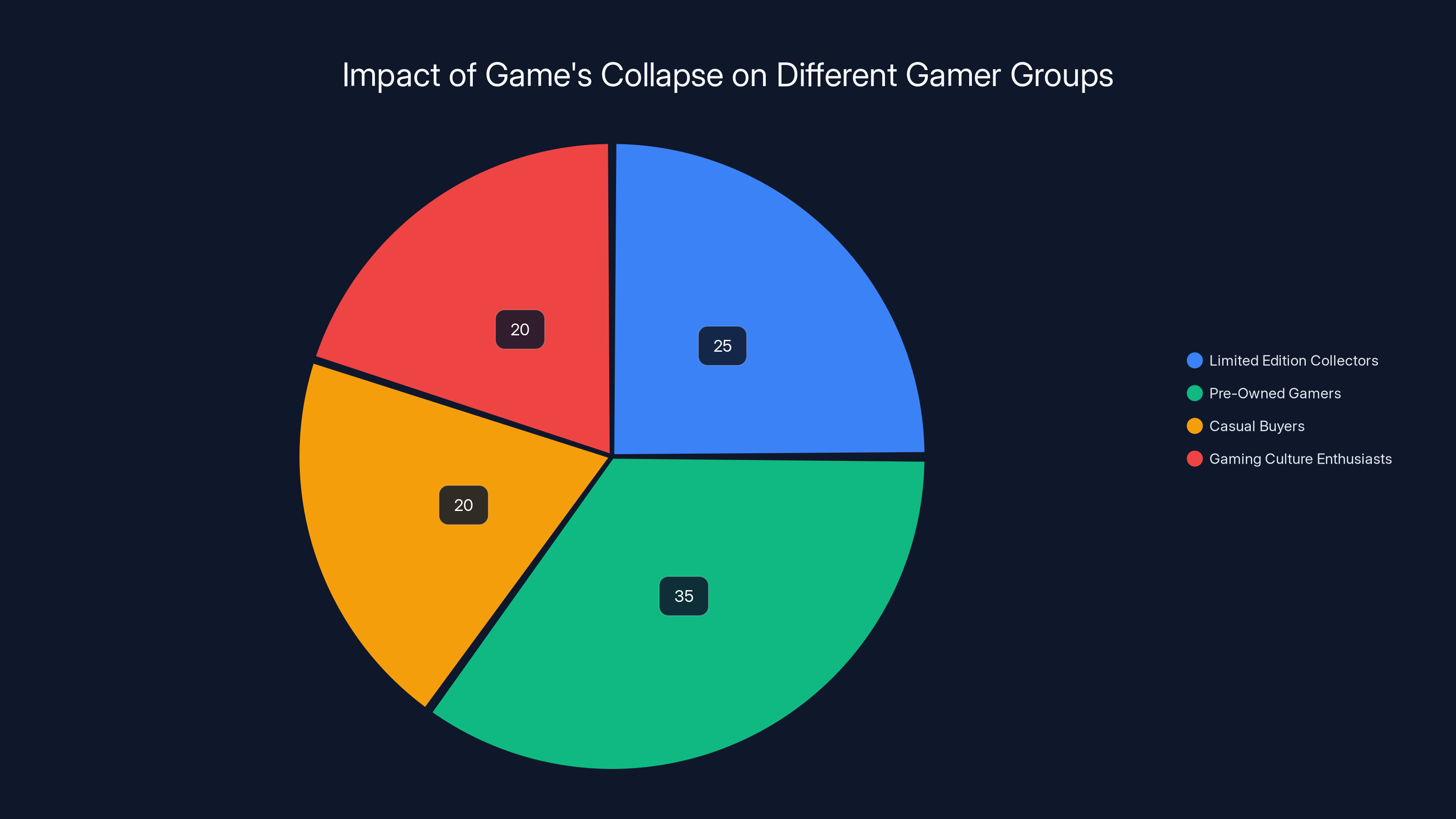

Estimated data shows Pre-Owned Gamers are most affected by Game's collapse, followed by Limited Edition Collectors. Casual Buyers and Gaming Culture Enthusiasts face moderate impact.

The Timeline: How Game Died in Slow Motion

Game's final decline wasn't sudden. It was a slow-motion disaster spanning five years.

2020: The Pandemic Bounce Frasers acquires Game during the COVID lockdowns. Gaming is booming. Consoles are in short supply. This looks like genius—buy the gaming retailer while everyone's buying games.

But this bounce is temporary. Pandemic demand isn't real demand. It's pent-up demand. Once normal life resumes, the growth evaporates.

2021: First Administration Game enters administration for the first time in over a decade. The reality hits: even during peak gaming demand, the physical retail model is broken. Frasers recovers it with administration fees and creditor negotiations.

2022-2023: The Slow Retreat Game announces store closures. First six stores. Then more. The strategy shifts to "concessions"—tiny Game corners inside Sports Direct stores. These are cheaper but feel pathetic. Customers don't take a brand seriously when it's a corner shop inside a discount retailer.

Arran talks about a "20% store reduction plan." It's spin. Every reduced store is an admission that the previous strategy failed.

August 2024: Six More Stores Closed Game shuts down six outlets in a single month. The company reduces its physical footprint by 30% total. At this point, Game is barely a retailer. It's a shell.

January 2025: The End Game files a notice of intention to appoint administrators. This is the bankruptcy process in the UK. It's a 10-day grace period while the company decides its fate. Game's fate is sealed: close the remaining three stores, operate only as concessions, focus on non-gaming products.

Nick Arran steps down after nine years. The managing director's exit is symbolic. He came aboard to save the company. He's leaving as it dies.

The Digital Shift: Why Physical Games Became Obsolete

Let's be direct: physical game retail is dead because digital distribution killed it.

This wasn't inevitable. It was a choice made by platform manufacturers and publishers. Steam proved digital could work at scale. PlayStation Network and Xbox Live proved console digital storefronts could be profitable. Epic Games Store proved you could disrupt Steam. Game Pass proved subscription services could replace purchases.

Now, here's the brutal math:

A physical game costs retailers about 40-50% of the retail price. Game had to buy inventory, store it, manage it, ship it, deal with returns. The supply chain was expensive. Margins were thin. But it was the business model for 30 years.

Digital games cost platform holders almost nothing to distribute. The margin is 70% or higher. Publishers keep 30-50%. Platforms keep 30-50%. The economics are completely different.

Once digital became viable, physical retail was doomed. Nobody wants to drive to a store to buy a game when they can download it in seconds. Return rates on digital are near zero. Inventory management is irrelevant. The supply chain collapses.

For physical game collectors—the 10% who buy limited editions and physical media—specialized retailers could theoretically survive. But there aren't enough collectors to support thousands of stores.

Game tried to serve both audiences:

- The collector: Wanted limited editions, physical versions, premium display cases

- The casual gamer: Just wanted convenience and the cheapest price

Amazon crushed Game on the casual side. Specialty retailers (like Limited Run Games) crushed Game on the collector side. Game was stuck in the middle—not cheap enough, not specialized enough.

The Stats That Matter:

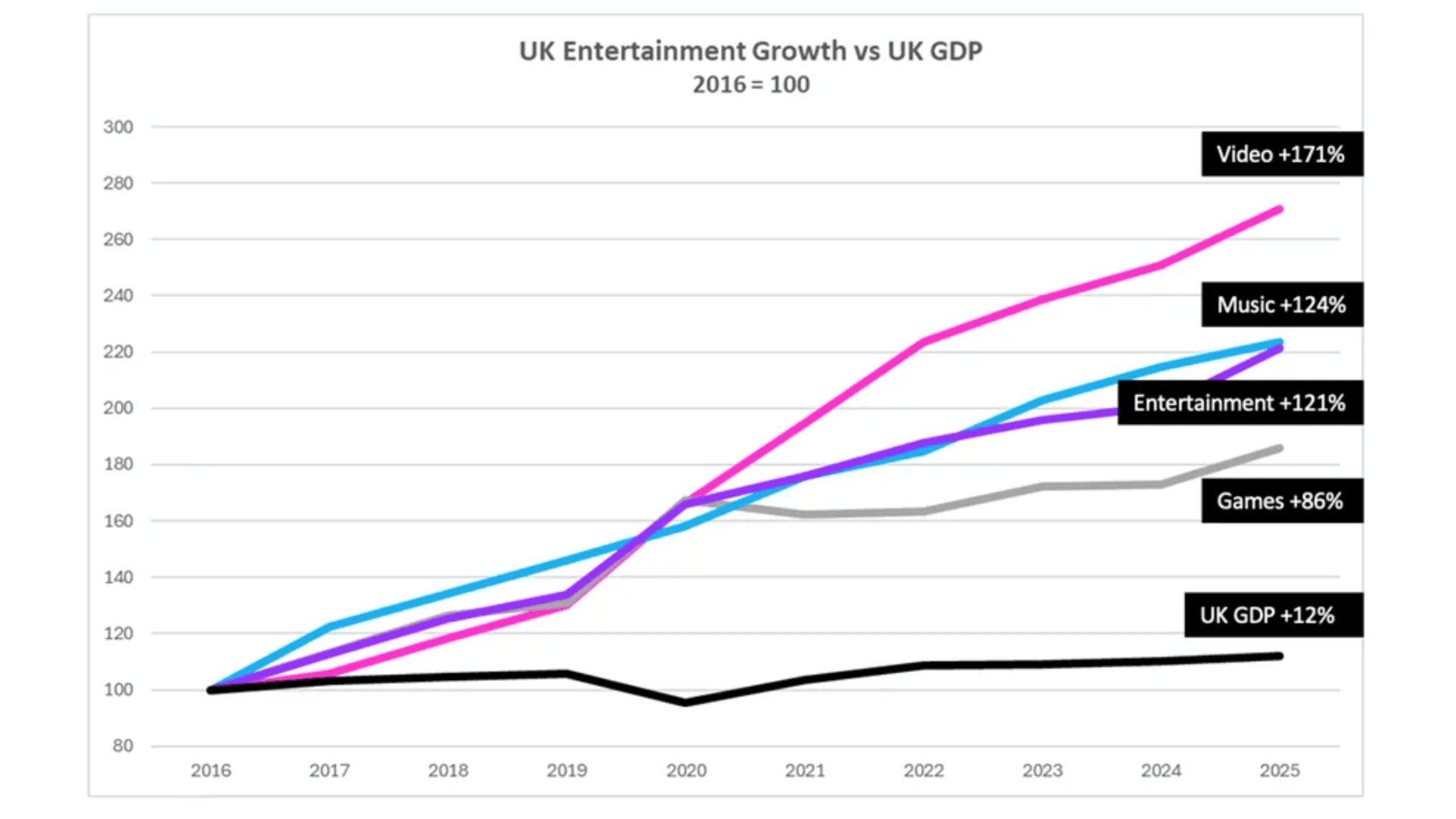

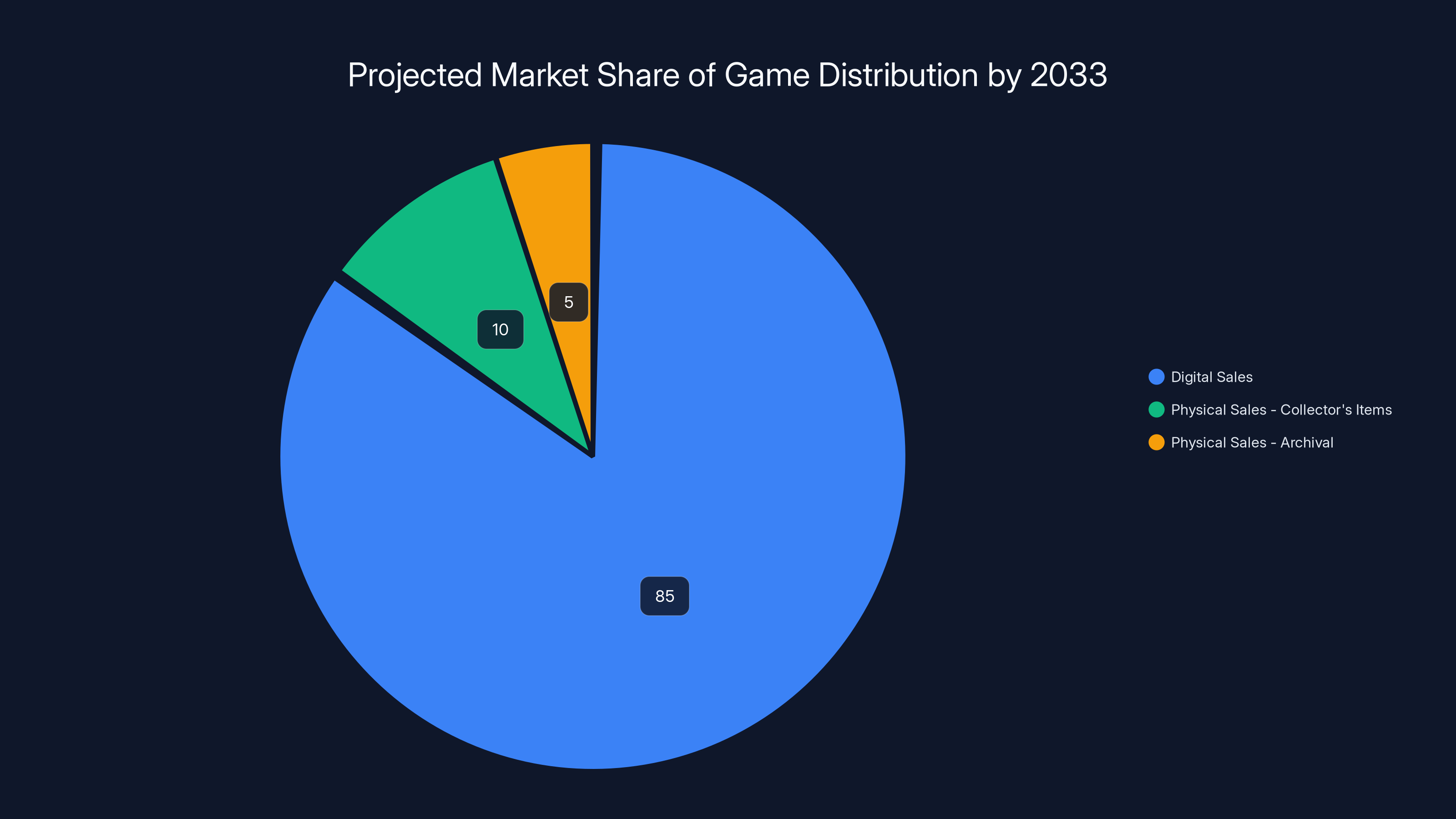

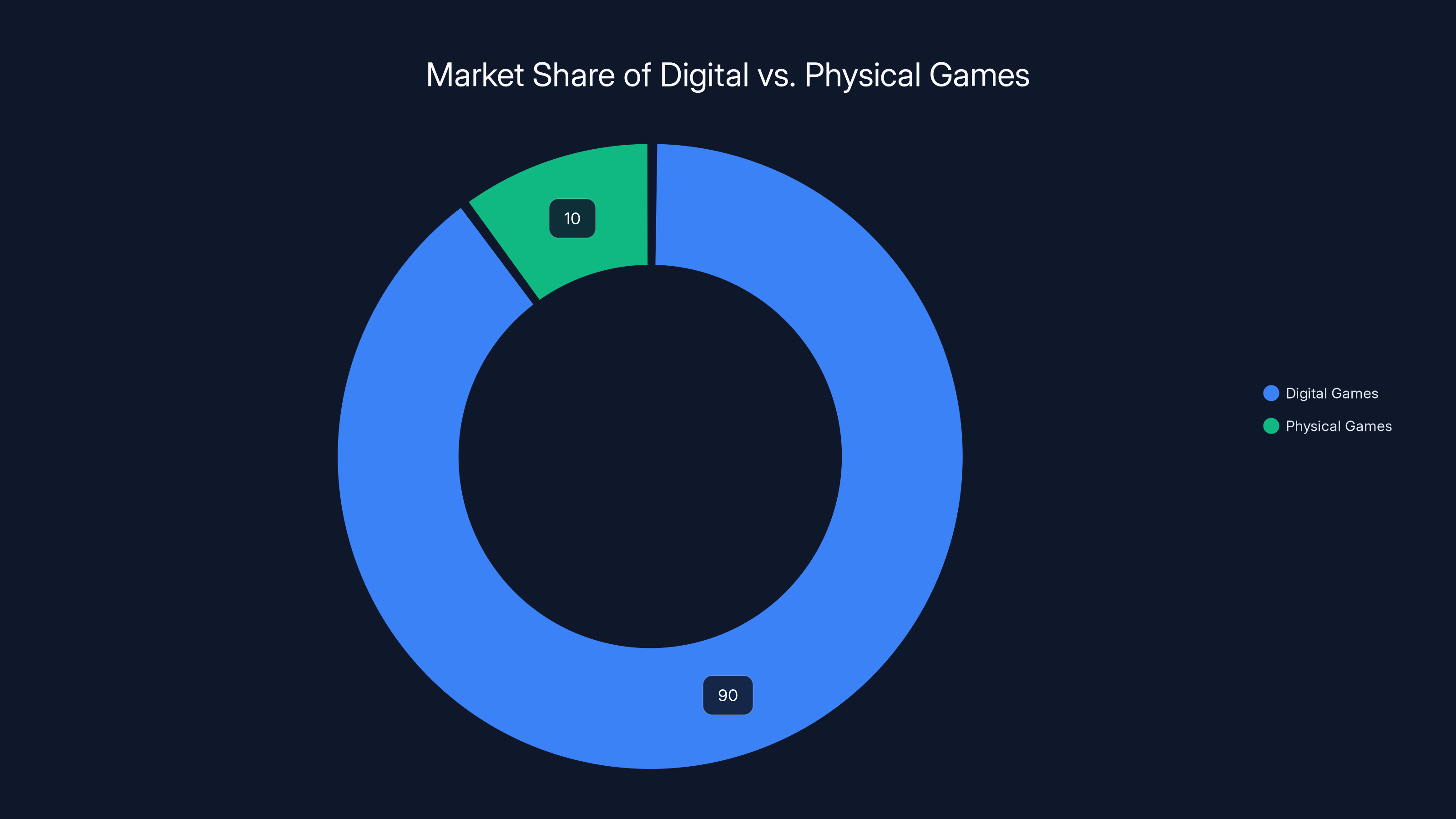

Digital games now represent over 90% of the gaming market. Physical is under 10% and shrinking. Platform holders don't need retailers. Publishers don't need retailers. Gamers don't need retailers.

When the entire industry shifts against your business model, retail stores become artifacts. Game became an artifact.

The Broader Retail Apocalypse: Game is the Canary in the Coal Mine

Game's closure isn't isolated. It's part of a massive pattern.

The UK lost over 16,000 retail jobs in 2024 alone. Hundreds of brands have collapsed or shrunk dramatically: Debenhams, John Lewis, M&S, Topshop, Maplin, Comet, Jessops, Game, and countless others.

Why? The fundamentals have shifted:

1. E-Commerce Dominance Amazon and online retailers offer selection and convenience that physical stores can't match. Amazon can stock millions of items. A physical store can stock thousands. Amazon has next-day delivery in most areas. Physical stores have walk-in traffic only.

2. Changing Consumer Behavior Post-pandemic, shopping preferences changed. Younger consumers prefer buying online. Older consumers adapted too. The death of the "shopping experience" means foot traffic collapsed.

3. Rising Real Estate Costs High street rents are astronomical. When fewer people visit stores, the rent-per-customer becomes unsustainable. Landlords are stuck: keep rent high and have empty storefronts, or drop rent and lose money.

4. Supply Chain Disruption Managing physical inventory is expensive. Supply chains broke during COVID. Companies realized they could operate leaner with direct-to-consumer models. Retailers became middlemen nobody needed.

5. Changing Demographics Zoomers and Gen Z rarely visit physical stores. They buy online. They use their phones. They prefer digital to physical. The customer base for physical retail is literally aging out and not being replaced.

Game was uniquely vulnerable to these forces, but every physical retailer faces them. Supermarkets are experimenting with checkout-free stores. Clothing retailers are closing stores and focusing online. Book retailers are barely surviving. Electronics retailers like Currys are down to skeleton crews.

The question isn't whether Game dies. The question is how long other retailers can delay their own death spiral.

By 2033, digital sales are projected to dominate the market with 85% share, leaving only niche segments for physical sales. (Estimated data)

What Game's Collapse Means for Gamers

For most gamers, Game's closure changes nothing. Digital gaming continues. Console sales continue. Graphics get better. Games get more expensive.

But for specific groups, it matters:

Limited Edition Collectors People who buy physical editions, special boxes, and collectible versions now have fewer options. Retailers like Argos and Amazon still stock some limited editions, but Game was known for curating these. Its concession stores won't offer the same selection.

Pre-Owned Gamers Game's pre-owned section was a treasure trove for budget gamers. In April 2024, Game halted all trade-in programs to "phase out pre-owned stock." This was effectively a middle finger to affordable gaming. Your only pre-owned options now are eBay, Vinted, and specialist resellers. Less selection, more risk of scams.

Casual Buyers For people who buy games occasionally as gifts, physical retail on the high street was convenient. Now they'll order online or use digital gift cards. The friction increases slightly, but not significantly.

Gaming Culture Losing Game means losing a cultural touchstone. Game stores were where gamers hung out, where they discovered new releases, where communities formed. The closure represents the death of gaming as a physical, social experience.

Consoles will eventually go fully digital. Physical media will become a niche hobby. Game's collapse is accelerating that timeline.

Nick Arran's Exit: What Losing the CEO Signals

Nick Arran stepped down as managing director after nine years. This isn't minor news. It's the equivalent of a captain abandoning ship.

Arran joined Game during the 2020 rescue. He was supposed to be the turnaround guy. In 2023 interviews, he sounded optimistic about the pivot toward toys and collectibles. But that strategy was never real. It was denial.

By exiting now, Arran is distancing himself from the failure. Smart move professionally, but it signals the company's leadership gave up.

When a CEO leaves a dying company, it's usually because:

- The board fired them (unlikely—Arran seems to have left voluntarily)

- They saw the numbers and realized recovery was impossible

- Better opportunities emerged elsewhere

- They couldn't stomach the decline anymore

Arran's statement in interviews was that Game would be "last man standing" selling physical video games. That's a proud vision. He can't be standing there if the company fails on his watch. So he exits.

His replacement? Unknown. But the fact that a replacement is needed signals this is a managed decline, not a surprise failure.

The Concession Model: Game's Zombie Future

Game won't completely disappear. It'll exist as concessions in 200+ Sports Direct and House of Fraser locations. This is the zombie phase of retail death.

Concessions are how dying brands extend their death. They're little corners in bigger stores. No rent to negotiate individually. No staffing overhead. Minimal inventory. Just a small branded section selling what remains of the brand.

We've seen this with countless retailers:

- Topshop now exists only as a concession in Topshop

- Evans exists as concessions in Sports Direct

- Footpatrol exists as concessions in Foot Locker locations

- Bargain Booze exists as concessions in various supermarkets

It's not retail. It's a brand slowly becoming irrelevant.

The concession model works financially (lower costs), but it kills the brand perception. Nobody gets excited about visiting a Game corner in Sports Direct. Nobody makes a special trip. Brand loyalty evaporates.

For Frasers Group, it's a win. They get to keep the Game brand (which still has recognition) and generate some revenue without real overhead. They also get to clear warehouse inventory from their failed Game standalone experiment.

For customers? It's the worst option. They get:

- Limited selection (concessions stock maybe 50-100 titles, not thousands)

- No expertise (Sports Direct staff know discount retail, not gaming)

- Lower convenience (you have to visit a larger store to get to the corner)

- Zero brand experience (it's a table in a warehouse store, not a gaming destination)

The concession model is how brands die and pretend they're still alive.

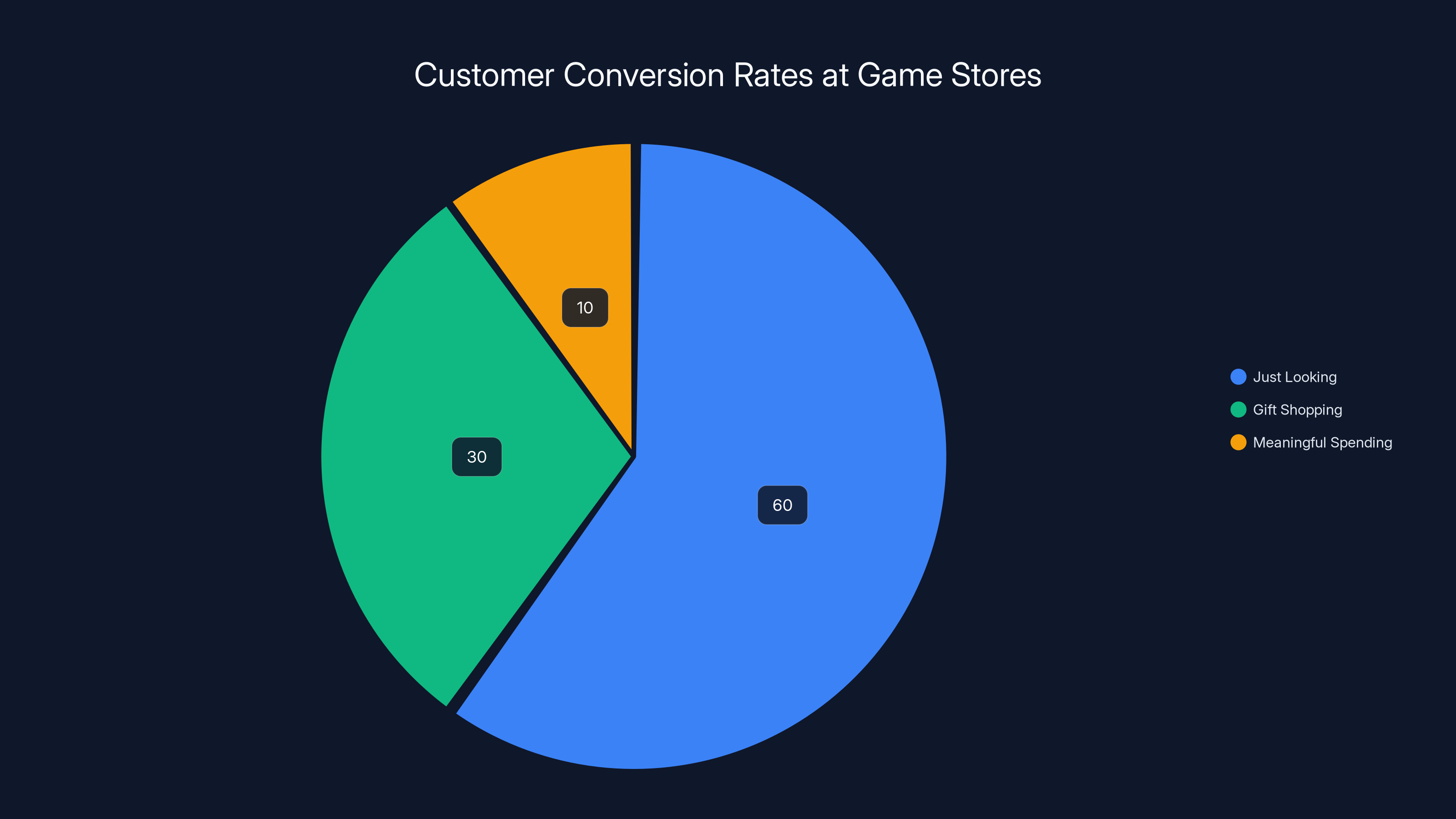

Estimated data shows that only 10% of customers in Game stores spent meaningfully, highlighting the challenge of generating profit in a shrinking retail environment.

Why Digital Distribution is the Inevitable Future

Let's talk about what comes next, because it's already happening.

Consoles are moving toward all-digital models. The PS5 Digital Edition exists. The Xbox Series S is all-digital. Nintendo hasn't released all-digital hardware yet, but it's coming.

Physical media will persist in two forms:

1. Collector's Items Limited editions with nice boxes, artwork, soundtracks. These cost $40-80 per item. They sell in limited quantities (1,000-10,000 units). Specialist retailers can survive on this market alone.

2. Archival Format Similar to vinyl records returning for audiophiles, some gamers will collect physical versions as investments or preservation. But this is a hobby market, not a mainstream market.

Everything else goes digital. Games are purchased digitally. Updates are downloaded. Multiplayer is online. Save files are in the cloud.

For publishers, digital is pure profit. No retail middlemen. No shipping costs. No returned inventory. No waitlists. A game launches on one server that serves millions of customers simultaneously.

For Valve (Steam), Epic (Epic Games Store), Microsoft (Game Pass), Sony (PlayStation Network), and Nintendo (Nintendo eShop), retail stores are irrelevant.

The only question is speed. Game's collapse accelerates the timeline. Within five years, physical game retail outside of specialty stores will be gone. Within ten years, physical games will be collector's items, not primary products.

Game didn't fail because of bad management. It failed because it was selling something the world stopped needing.

Lessons from Game's Collapse: What We Learn

Lesson 1: Distribution Model Matters More Than Brand Game had 30 years of brand equity. The name meant gaming for generations. But a strong brand can't save a dying distribution model. Physical retail is the distribution model, and it's broken. Brand loyalty becomes irrelevant when the entire system collapses.

Lesson 2: You Can't Pivot Away From Your Core and Survive Game tried to pivot toward toys and collectibles. This was a mistake. Pivoting away from your core business signals you've given up on the core. Customers sense this. They leave. The pivot fails.

If Game had embraced being a physical game collector's retailer and leaned into specialty, it might have survived on a smaller scale. Instead, it tried to become a general entertainment retailer in a world where general entertainment retail is dying.

Lesson 3: Being Owned by a Larger Company Isn't Salvation Frasers Group is a billionaire-backed conglomerate with thousands of stores. They couldn't save Game. Sometimes, a bad business is a bad business, and throwing money at it doesn't help. Frasers learned the hard way that you can't fix structural obsolescence with capital.

Lesson 4: Digital Disruption is Final When an industry shifts to digital, the transition is permanent. Companies that resist get destroyed. Game's entire 30-year business model became obsolete in 10 years. There's no comeback. There's no revival.

Every company reading Game's autopsy should ask: what part of my business could become digital tomorrow? If the answer isn't "nothing," you're at risk.

The Psychology of Retail Death: Why We Mourn Game

There's something genuinely sad about Game's closure, even if it was inevitable.

Game was where millions of people bought their first console. It's where kids saved pocket money for new releases. It's where collectors discovered hidden gems. It's where Christmas shopping happened.

Retail stores are spaces where culture happens. They're not just transaction points—they're gathering places. Losing Game means losing a space where gaming culture happened on physical land.

This matters even if we don't fully realize it. We mourn the loss of experiences, not just products.

The closure of Game represents the end of gaming as a public, physical activity. Gaming has become private, digital, solitary. You buy at home. You play at home. You chat online with people you'll never meet.

This isn't bad—digital gaming is amazing. But something is lost when retail disappears.

We're watching the transition from mall culture to app culture. Game was a casualty of that transition.

Game's store count declined sharply from 2020 to 2025, reflecting strategic shifts and market challenges. Estimated data based on narrative.

What Comes Next: The Future of Game

Game will exist as concessions in Sports Direct and House of Fraser for probably 3-5 years.

During this period, the brand will slowly disappear from consumer consciousness. A generation of new gamers will grow up never knowing Game was anything other than a corner in a discount retailer.

Eventually, Frasers will close the concession sections too. The economics won't work. Game's brand will fade into nostalgia—something older gamers remember, but younger gamers never experienced.

In 20 years, Game will be a footnote. Video game enthusiasts will mention it in "remember when?" conversations. Collectors might search for original Game merchandise online. But it won't be a brand anymore. It'll be a memory.

This is the fate of all retail businesses that fail to adapt to digital disruption. They don't go out with a bang. They go out slowly, becoming ghosts in concession stands, then disappearing entirely.

The only retailers surviving 2025 are those that:

- Went digital early (ASOS, Boohoo, Next)

- Specialized aggressively (luxury brands, technical specialists)

- Became experiences (Apple, Lululemon, premium brands)

- Adapted their supply chain (fast fashion, direct-to-consumer)

Game did none of these. It stayed generalist, physical, and slow to adapt.

For other retailers reading Game's collapse: the clock is ticking. Digital disruption isn't coming. It's here. Adapt or die. Game chose neither. Now it's dying.

The Bigger Picture: Retail's Structural Collapse

Game's closure is one story in a much larger narrative: the death of traditional retail.

We're not at the end of this story. We're in the middle. Major retailers are still collapsing:

- Currys is struggling with shrinking PC and electronics sales

- Argos is increasingly irrelevant as Amazon dominates catalog retail

- WHSmith survives only in travel locations because nobody visits town centers anymore

- Waterstones survives only because books are physical products (for now)

- Sports Direct is profitable but soulless, the cockroach of retail

The pattern is clear: physical retail outside of luxury and experience-based shopping is contracting to nothing.

By 2030, most UK high streets will look like ghost towns. Empty storefronts will become the norm. Landlords will struggle to find tenants. Commercial real estate values will collapse.

This is happening because the entire economics of retail have shifted:

Old Retail Economics: Product → Warehouse → Distribution Center → Retail Store → Customer

New Retail Economics: Product → Warehouse → Direct to Customer (via Amazon/DTC/Apps)

The retail store is eliminated. The distribution cost drops. The customer gets better prices. Everyone wins except the retailers.

Game's collapse proves this transformation is irreversible. Once customers adjust to buying online, they rarely go back. Game's stores became museums of a dead business model.

The painful irony? Game was born during the rise of malls and high streets. It dies during their decline. It's a perfect match between company lifecycle and cultural shift.

Game's Legacy: What It Meant to Gaming Culture

Despite its failure, Game mattered to gaming.

For three decades, Game was the face of video game retail in the UK. It was where console generations launched. It was where midnight premieres happened. It was where gaming was celebrated as a legitimate hobby, not something kids did.

Game's existence helped gaming become mainstream. Before digital, Game's stores were proof that gaming was big business, worthy of dedicated retail space on high streets.

Now that legacy is ending. Gaming will continue without physical retail. In fact, gaming is bigger than ever. The industry makes more money than film. Millions of people play games daily.

But that growth happened despite Game's decline, not because of it. Game became irrelevant to gaming's expansion.

The legacy is complicated:

- Positive: Game proved gaming deserved retail presence; helped millions discover games; created gaming community spaces

- Negative: Couldn't adapt to digital; clung to physical retail too long; failed to evolve as gaming evolved

When historians write about gaming's transition from physical to digital, Game will be a case study in how legacy retailers fail when distribution models change.

It's not a happy story. But it's an important one.

Digital games dominate the market with over 90% share, leaving physical games with less than 10%. Estimated data reflects current trends.

The Financial Reality: Why Game's Numbers Don't Work

Let's talk numbers, because the math tells the real story.

Before entering administration, Game's financial performance was dire:

- Store closures reducing locations from 40+ to just 3

- Revenue declining year-over-year as digital sales grew

- Pre-owned sections eliminated to cut costs (losing a revenue stream)

- Reward program and Xbox All Access discontinued (cutting engagement)

- Staff moved to zero-hour contracts (signaling financial distress)

The company wasn't just slow to adapt. It was actively shrinking while looking for a business model that worked.

Here's the problem: even if Game found a working model, the cash situation was critical. Retail margins are thin. Stores lose money individually, hoping scale generates profit. With only three stores, there's no scale.

Conversion rates probably looked like:

- 60% of customers come in, browse, buy nothing (just looking)

- 30% of customers come in, buy one or two items (gift shopping)

- 10% of customers come in, spend meaningfully (collectors, enthusiasts)

With margins around 20-30% on video games and 40-50% on hardware, only that 10% generates real profit. The other 90% is noise.

Compare to Amazon:

- No physical locations (zero rent)

- Unlimited inventory (no shelf limits)

- Global reach (not limited to UK geography)

- Logistics scale (can absorb losses on individual transactions)

- Data advantages (can optimize pricing and recommendations)

Game couldn't compete on any dimension. The math made failure inevitable.

Frasers' decision to close stores wasn't a strategy failure. It was the right financial decision. Losing money on three stores is worse than having zero stores and just stocking concessions.

Interview with the Data: What Game's Decline Teaches Us

If we could interview Game's collapse, what would it say?

"I didn't see digital coming fast enough." Game's leadership knew digital was rising. They didn't predict how quickly it would dominate. By 2020, digital was already 80% of the market. Game was optimizing for the 20% that remained.

"I confused brand with business model." Game had a great brand. But branding doesn't sell products if the product distribution is broken. Digital storefronts have no brand identity—they're just apps. Game couldn't compete on brand alone.

"I tried to be everything to everyone." Game tried to serve casual gamers (losing to Amazon), collectors (losing to specialist retailers), and gift buyers (losing to department stores). The middle ground was crowded and shrinking.

"I underestimated how fast behavior would change." Post-pandemic, people got used to online shopping. When they went back out, they didn't go back to physical retail. They stayed online. Game's stores opened to emptier rooms.

"I couldn't cut costs fast enough." Every round of closures bought time but didn't fix the core problem. You can't shrink your way to profitability when the entire market is shrinking.

These lessons apply to every retailer still trying to survive.

Surviving Digital Disruption: The Retailers Game Missed

Some retailers are surviving the digital apocalypse. Here's how:

1. Apple Stores Apple turned retail into an experience. Stores are tech support centers, not just transaction points. People visit Apple Stores for help, to try products, to connect with the brand. The store generates value beyond the transaction.

Game could have done this. Specialized gaming cafes with demo consoles, tournaments, community events. But it didn't.

2. Specialty Retailers Retailers like Decathlon (sports) and LEGO stores (toys) own their category. They offer selection and expertise nobody online provides. Game could've owned gaming by being the ultimate gaming specialist. It chose to pivot away instead.

3. Direct-to-Consumer Brands Brands like Warby Parker (eyewear) and Allbirds (shoes) skipped retail entirely. They sell online but maintain brand presence through limited physical experiences. Game could've done this—online primary, pop-up experiences secondary.

4. Luxury Retail Luxury brands survive because people want the experience of luxury retail. High-touch service, exclusive products, brand immersion. Game's discount-focused direction was the opposite strategy.

5. E-Commerce Leaders Amazon, Boohoo, ASOS built massive retail empires without physical stores. Game dismissed e-commerce as supplementary instead of primary.

Game's failure wasn't inevitable. It was a choice. Leadership chose wrong.

What Players Should Know: Surviving Game's Death

If you're a gamer who relied on Game, here's what changes:

For Pre-Owned Buyers: You need new sources. Vinted, eBay, and CEX (which has stores and online presence) are your alternatives. Expect less selection and slightly higher prices.

For Limited Edition Hunters: Order directly from publishers, or use specialist sites like Amazon, Argos, and Limited Run Games. Sports Direct concessions won't stock these.

For Casual Buyers: Just buy digitally or from Amazon. It's easier, cheaper, and faster. The era of physical media as a primary purchase method is ending.

For Collectors: Game's vintage merchandise is becoming more valuable as production stopped. Original Game cases, receipts, and memorabilia might appreciate. Ironically, Game's closure makes Game collectibles more collectible.

For Nostalgic Gamers: Visit one of the remaining Game concessions while they exist. Take a photo. Say goodbye to an era. In five years, they'll be gone, and it'll just be a memory.

The transition from physical to digital gaming is happening with or without Game. Game's closure just makes it obvious.

FAQ

What caused Game to enter administration?

Game entered administration due to fundamental structural issues: the shift to digital gaming eliminated demand for physical retail, online competitors like Amazon and digital storefronts undercut prices, and consumer behavior post-pandemic permanently shifted to e-commerce. The company reduced stores repeatedly (from 200+ to 3) but couldn't achieve profitability on remaining locations.

How many Game stores were there at peak?

Game operated over 600 stores across Europe at its height in the 1990s and early 2000s. By 2025, it operates zero standalone stores. This represents a complete retail extinction. The brand survives only as concessions (small sections) within Sports Direct and House of Fraser locations.

Will Game come back?

Game will not return as a standalone retailer. The brand may persist as concessions for a few years, but physical retail for video games is not returning as a mainstream business model. Specialty gaming retailers might survive on niche appeal (collectors, limited editions), but Game's mass-market retail model is permanently obsolete.

Why didn't Frasers Group save Game?

Frasers Group is a powerful retailer, but they couldn't save Game because the core problem wasn't management or capital—it was structural obsolescence. Physical game retail as a business model is broken. No amount of money fixes that. Frasers correctly decided to close standalone stores and operate only as concessions to minimize losses.

Can physical games survive?

Physical games will survive as a niche product for collectors, similar to vinyl records. Limited editions, special boxes, and collector's items will persist. But mainstream physical game retail—the type of business Game was—is finished. Digital downloads represent over 90% of gaming distribution and that percentage continues rising.

What about GameStop in the US?

GameStop is in a similar position to Game: struggling physical video game retailer facing digital disruption. GameStop's stock crashed from

Where should I buy games now?

For digital games, use PlayStation Network, Xbox Game Pass, Nintendo eShop, or Steam. For physical copies, use Amazon, Argos, or specialist retailers like CEX (UK) and Limited Run Games (for collector's editions). For pre-owned physical games, eBay and Vinted offer selection but with higher risk than official retailers.

Is the physical high street dead?

The physical high street is not dead but is undergoing rapid transformation. Retail is consolidating to experience-based businesses (restaurants, entertainment, experiences), specialty retailers (luxury brands, niche products), and services (banks, haircuts, gyms). Generic retail like Game doesn't fit this new model. Expect 70%+ of current retail locations to close or repurpose within 10 years.

What happened to Nick Arran?

Nick Arran, Game's managing director for nine years, stepped down as the company entered administration. He was hired to turn Game around but couldn't overcome structural decline. His exit signals leadership's acknowledgment that recovery was impossible. His replacement, if named, will manage the brand through concession phase until eventual discontinuation.

Is digital gaming more expensive than physical?

Digital games are typically the same price as physical at launch (£40-60 for major releases). However, digital games rarely go on sale at launch like physical games do. Over time, digital games may be cheaper due to reduced sales friction. Pre-owned physical games are cheaper than digital equivalents, which is why Game's closure of pre-owned sections matters.

The Final Word: Game as a Cautionary Tale

Game's story is a cautionary tale for every company facing digital disruption.

The lesson isn't "adapt or die"—everyone knows that. The lesson is more subtle: structural obsolescence can't be overcome by adapting. When your entire business model becomes irrelevant, optimization doesn't save you. Pivoting doesn't save you. New ownership doesn't save you.

Game tried. It closed stores, pivoted to new products, adopted new strategies. Nothing worked because the foundation—physical retail for video games—was broken.

Companies survive disruption by being something the digital world can't replicate: experiences, exclusivity, expertise, community. Game tried none of these. It stayed generic, physical, and slow.

By 2030, Game will be a historical footnote. The brand will fade. The stores will close. The community will disperse online.

But the lesson will remain for every retail leader watching: digital isn't the future. It's the present. If you're still building for the past, you're already dying.

Game died slowly because it clung to what used to work. In the end, clinging doesn't matter. The cliff comes anyway.

Rest in peace, Game. You were gaming retail's last man standing. But you couldn't stand alone in a world that stopped visiting high streets.

Key Takeaways

- Game entered administration and closed all standalone stores, existing only as concessions in Sports Direct and House of Fraser locations

- Digital distribution now represents over 90% of the gaming market, making physical game retail structurally obsolete

- Managing director Nick Arran's exit signals that recovery was impossible despite Frasers Group ownership and resources

- Retail's broader apocalypse claims thousands of UK stores annually as e-commerce and digital disruption accelerate

- Game's failure proves that brand equity and acquisition capital cannot overcome structural business model obsolescence

Related Articles

- Nintendo Switch Becomes Best-Selling Console Ever [2025]

- Why Sony Is Pushing PS4 Players to PS5 Right Now [2025]

- The Hidden World of Single-Copy Game Sales: What Circana's Data Reveals [2025]

- Devon Pritchard: Nintendo of America's New President [2025]

- Ubisoft Cancels Prince of Persia Remake: What It Means for Gaming [2025]

- Ubisoft Cancels Prince of Persia Remake: Inside the Major Gaming Restructure [2025]

![Game UK Stores Closing: The Death of Physical Game Retail [2025]](https://tryrunable.com/blog/game-uk-stores-closing-the-death-of-physical-game-retail-202/image-1-1770118613068.jpg)