NYSE's 24/7 Tokenized Trading Platform: The Future of Markets

Imagine waking up at 3 AM with a market opportunity and actually being able to trade it. No waiting for the opening bell. No regulatory barriers based on arbitrary time zones. Just real money moving at digital speed.

That's not science fiction anymore.

The New York Stock Exchange, the world's oldest and most prestigious stock market, is reportedly building exactly that. According to Bloomberg, the parent company Intercontinental Exchange (ICE) is collaborating with heavyweight financial institutions like Citigroup and the Bank of New York Mellon to create a completely new kind of trading venue. One that operates 24/7. One that settles trades instantly. One that runs on blockchain technology, turning traditional stocks into digital tokens.

This isn't just an incremental update to existing systems. This is the kind of infrastructure overhaul that happens once a generation. And if it works, it could fundamentally reshape how trillions of dollars move through global markets.

But here's the thing: tokenized stocks aren't new. The concept has been floating around for years. What makes the NYSE's move genuinely significant is that they're not just experimenting in isolation. They're integrating tokenized assets directly with traditional market infrastructure. They're linking conventional stocks to blockchain networks. They're creating interoperability between old finance and new finance.

That's the bridge everyone's been waiting for.

Let me break down what's actually happening, why it matters, what could go wrong, and what it means for regular investors.

TL; DR

- NYSE is building a blockchain-based 24/7 trading platform for tokenized stocks and ETFs with instant settlement, eliminating the standard one-day clearing delay, as reported by The Wall Street Journal

- Key collaborators include Citigroup and Bank of New York Mellon, signaling serious institutional backing for the project

- Tokenized assets will maintain voting rights and dividend payments while settling instantly through blockchain networks

- Regulatory approval is still pending, and integration challenges with existing clearing and custody systems remain significant

- This represents a fundamental shift in market infrastructure from centralized order books to blockchain-based networks, potentially enabling 24/7 global trading

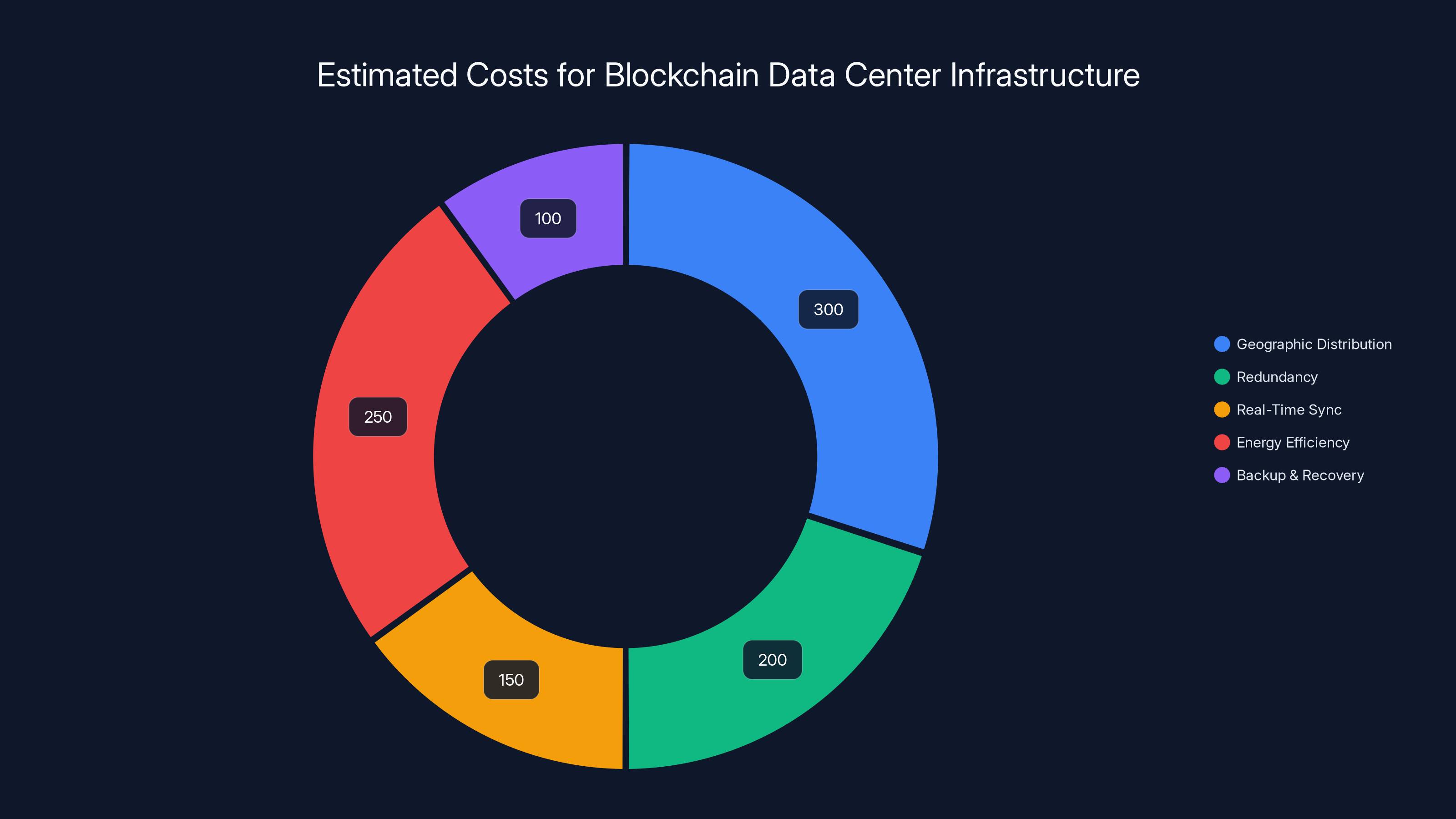

Estimated costs suggest a significant investment in geographic distribution and energy efficiency for blockchain data centers, totaling $1 billion. Estimated data.

The Core Innovation: What's Actually Being Built

Let's start with what the NYSE is actually building, because the marketing terms obscure some genuinely interesting technical architecture.

Traditional stock trading works like this: you place an order during market hours, it executes, and then it "settles" 24 hours later (called T+1 settlement, where T is the trade date). During those 24 hours, your money's in limbo. The stock certificate's in limbo. Technically, neither you nor the other party actually own anything yet. It's all a big IOU, backed by central counterparties and clearing houses.

This system worked fine in 1975. It's actually terrible in 2025.

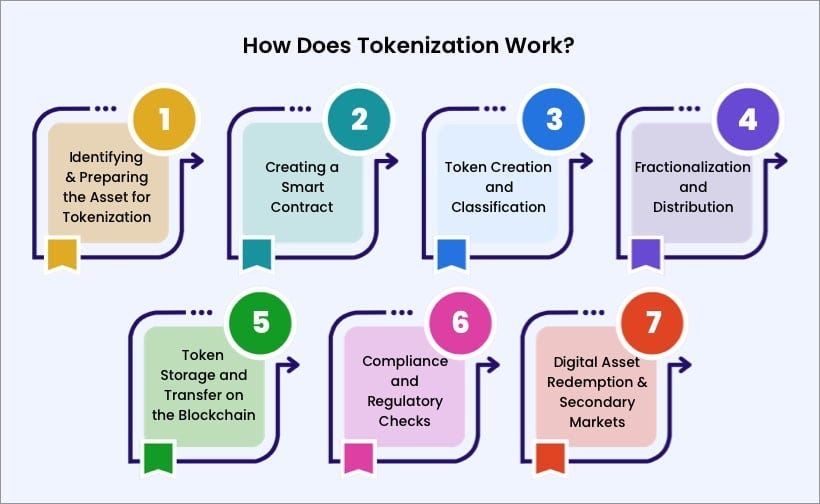

The NYSE's new platform would replace that entire flow with tokenization. Here's how it would work: stocks become digital tokens on a blockchain. When you buy a tokenized share of Apple, you don't get a certificate. You get a token that lives in a wallet. When you sell it, the token transfers directly to the buyer. Settlement is instant. Atomic. Irreversible. No counterparty risk. No central clearing house needed (though regulators will probably require one anyway).

The genius part: those tokens still represent fractional ownership of the company. You still get voting rights. You still receive dividends. The tokenized share of Apple is legally identical to a regular share of Apple. It's just... on a blockchain.

According to statements from Michael Blaugrund of Intercontinental Exchange, the system represents "a shift in market technology from trading floor, to electronic order-book, to blockchain." That's not hyperbole. That's literally three architectural paradigms evolving over 70 years, and this is the third transformation.

The platform integrates ICE's Pillar matching engine (the system that actually executes trades) with a blockchain network. Stablecoins backed by U.S. dollars would serve as the settlement mechanism. So instead of transferring fiat currency through the Federal Reserve, trades settle in USDC or a similar dollar-backed digital currency.

The architecture also enables connections to multiple blockchain networks, suggesting genuine interoperability. You could theoretically trade tokenized NYSE stocks on Ethereum, Solana, or custom private networks. That's a massive upgrade from the current siloed system where different exchanges can barely talk to each other.

Why ICE, Citigroup, and Bank of New York Mellon Are All In

You don't get institutional heavyweights collaborating on blockchain projects for fun. These banks represent trillions in assets. They move carefully. And they're all in on this.

Citigroup brings institutional custody and settlement expertise. They manage the actual cash and securities for pension funds, hedge funds, and endowments. If tokenized stocks are going to become real, someone has to actually hold the underlying assets and backstop the system. That's Citi's domain.

Bank of New York Mellon (BNY Mellon) is the world's largest custodian of securities. If you own a stock through any major fund, BNY Mellon probably holds it. They've actually been exploring blockchain for custody since 2020, so this isn't a cold start for them. They understand the technical requirements and the regulatory landmines.

Intercontinental Exchange owns the NYSE, but also owns data services, clearing operations, and derivatives markets. ICE's business model depends on market infrastructure staying robust. If tokenized assets fragment the market, ICE's revenue plummets. So they need to own the tokenized future or get destroyed by it.

These three organizations collaborating signals something important: this isn't a startup experiment. This is infrastructure-grade planning.

Think about it in terms of network effects. If Bank of New York Mellon—which custodies trillions—decides to support tokenized assets, every major asset manager has to pay attention. If Citigroup settles trades on a blockchain, the entire settlement ecosystem has to adapt. And if the NYSE offers 24/7 trading on tokenized stocks, all the other exchanges will have to follow or become irrelevant.

The collaboration is also a hedge against regulatory risk. When the SEC inevitably asks "who's backing this?" the answer is three of the most regulated, scrutinized, connected institutions in finance. That carries weight.

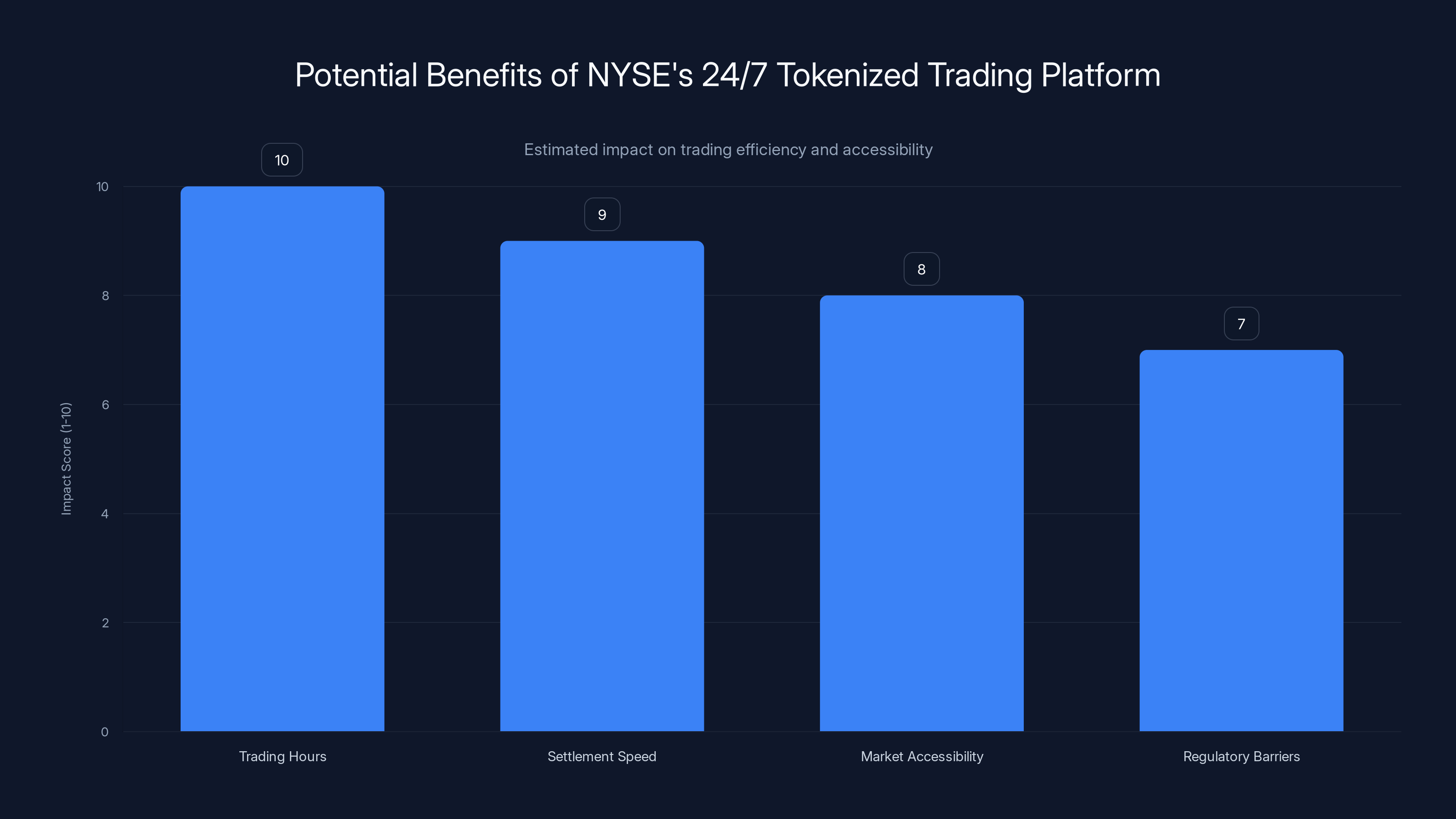

The NYSE's new platform could significantly enhance trading hours and settlement speed, while also improving market accessibility and reducing regulatory barriers. Estimated data.

The Technical Architecture: Blockchain Integration With Traditional Markets

Here's where it gets genuinely complex, and also where most people's understanding falls apart.

The NYSE's platform isn't just "putting stocks on the blockchain." That phrase is meaningless. They're building a hybrid system that bridges two incompatible worlds: centralized, regulated traditional finance and decentralized, programmable blockchain infrastructure.

The architecture works like this:

On the traditional side, there's the actual company (Apple, Microsoft, whatever). They have shares outstanding. Those shares have legal status. They carry rights. When you own Apple shares today, you own a claim on Apple's assets and profits, governed by Delaware corporate law (or wherever Apple's incorporated).

On the blockchain side, there's a token that represents those shares. The token is created in a 1:1 ratio with actual shares. Every token always has a corresponding actual share locked somewhere. That somewhere is the custody vault, probably held by BNY Mellon.

When you buy a tokenized share:

- You send stablecoins to a smart contract

- The smart contract verifies you're a legal investor (KYC/AML compliance)

- The smart contract releases a token to your wallet

- That token now represents a share, and somewhere in BNY Mellon's vault, an actual share is "locked" for you

If you want to exit and go back to traditional finance:

- You send the token back to the smart contract

- The smart contract burns it

- BNY Mellon releases the underlying share to a traditional broker

- You get standard equity settlement in fiat currency

The token and the underlying share are kept in perfect sync through custody agreements and legal contracts. You can't tokenize more shares than actually exist. You can't burn a token without destroying the custody relationship.

This dual-chain architecture is why the project is so technically complex. Most blockchain projects only have to worry about the blockchain. The NYSE project has to worry about blockchain AND traditional settlement AND custody AND corporate law AND regulatory compliance.

The Pillar matching engine is the interesting piece here. Pillar is the system that actually matches buy and sell orders for most US equities. It's incredibly sophisticated, designed for ultra-low latency (microseconds matter when you're executing millions of trades daily). The NYSE is now building an interface layer that lets Pillar work with blockchain-based orders and settlements.

That's not trivial. Pillar was built assuming traditional settlement. Adding blockchain settlement means adding new code paths, new failure modes, new edge cases. It means the matching engine has to handle orders that settle instantly instead of T+1, which changes the risk calculations for market makers.

24/7 Trading: Breaking the Time Zone Tyranny

Here's what nobody talks about enough: the current market hours are completely arbitrary.

The NYSE opens 9:30 AM ET and closes 4:00 PM ET. Why? Because in 1910, those were convenient hours for physical trading floors. Traders would show up, yell at each other, and go home. Literally nothing about that has to be true anymore. We have 24/7 electricity. We have servers that don't sleep. We have traders in Tokyo and London and Singapore who want to trade US stocks at 3 AM New York time.

Yet for 115 years, we've preserved the arbitrary time restriction.

The new platform would operate continuously. You could trade tokenized NYSE stocks at 2 AM on a Sunday. You could trade during holidays (except maybe critical financial holidays for clearing purposes). You could trade whenever the market moves, instead of waiting for New York to wake up.

This solves a real, expensive problem. If you're an Asian asset manager and you want to trade US stocks, you have to either:

- Stay awake during US market hours (brutal)

- Use overnight futures to hedge positions (expensive, not perfect hedges)

- Use options to gain exposure (more expensive, complex to manage)

- Accept that you can't react to news until tomorrow (terrible for risk management)

With 24/7 tokenized trading, you can just trade immediately when news breaks, any time of day.

The market structure implications are also significant. Currently, US equity prices get "stale" overnight because there's no continuous trading. Futures trade 24/5, but they're derivatives, not the actual stock. Premarket and after-hours trading exists, but it's fragmented, illiquid, and expensive. A continuous, liquid tokenized market would create much better price discovery globally.

For institutional investors managing global portfolios, this is genuinely transformative. You stop thinking in terms of US market hours and Asian market hours and European market hours. You think in terms of a single 24/7 global equity market.

The catch: 24/7 trading assumes 24/7 operational readiness. If the platform goes down, it goes down globally. You can't have downtime from 4 PM Friday to 9:30 AM Monday to do maintenance. That requires redundancy, failover systems, and monitoring infrastructure that's probably 2-3x as expensive as current systems.

How Tokenization Preserves Shareholder Rights

One of the smartest things about this architecture: tokenized shares aren't some weird cryptocurrency thing. They maintain all the legal rights of traditional shares.

You get dividend payments. When the company declares a dividend, the smart contract receives the dividend (usually in stablecoins or fiat currency converted to stablecoins), and redistributes it proportionally to all token holders. You might not get the dividend instantly (banks still need to process it), but the underlying economics are identical.

You get voting rights. Annual shareholder meetings? Proxy votes? All preserved. The custody documentation specifies that token holders are the beneficial owners of the underlying shares. When proxy votes occur, token holders get to vote just like traditional shareholders.

You get capital appreciation. If Apple stock goes from

This is radically different from cryptocurrency assets, which carry no corporate rights and no claim on any underlying asset (beyond whatever community decides). A tokenized Tesla share carries a legal claim on Tesla's assets. It's backed by Delaware corporate law, not by consensus.

The legal engineering here is actually quite elegant. The documentation probably works like this:

- The token is a record of ownership in a special custody arrangement

- The custody arrangement is a trust, with BNY Mellon as trustee

- The trustee holds the underlying shares in a vault

- Token holders are the beneficiaries of the trust

- All rights flow through the trust to the token holders

It's not revolutionary legally. It's a token that maps to a trust that maps to shares. But the token layer adds programmability. You can automate dividend distribution. You can enable conditional transfers. You can build derivatives on tokenized shares (options, futures) that settle directly on-chain.

This also creates a path for fractional ownership at scale. Today, fractional shares exist but they're administratively complex. Banks have to maintain ledgers. With tokenized shares, the token itself can be divided arbitrarily (down to 8 decimal places, like Bitcoin). You can own 0.001 shares of Apple if you want. That's genuinely useful for retirement accounts that want to build low-cost index funds.

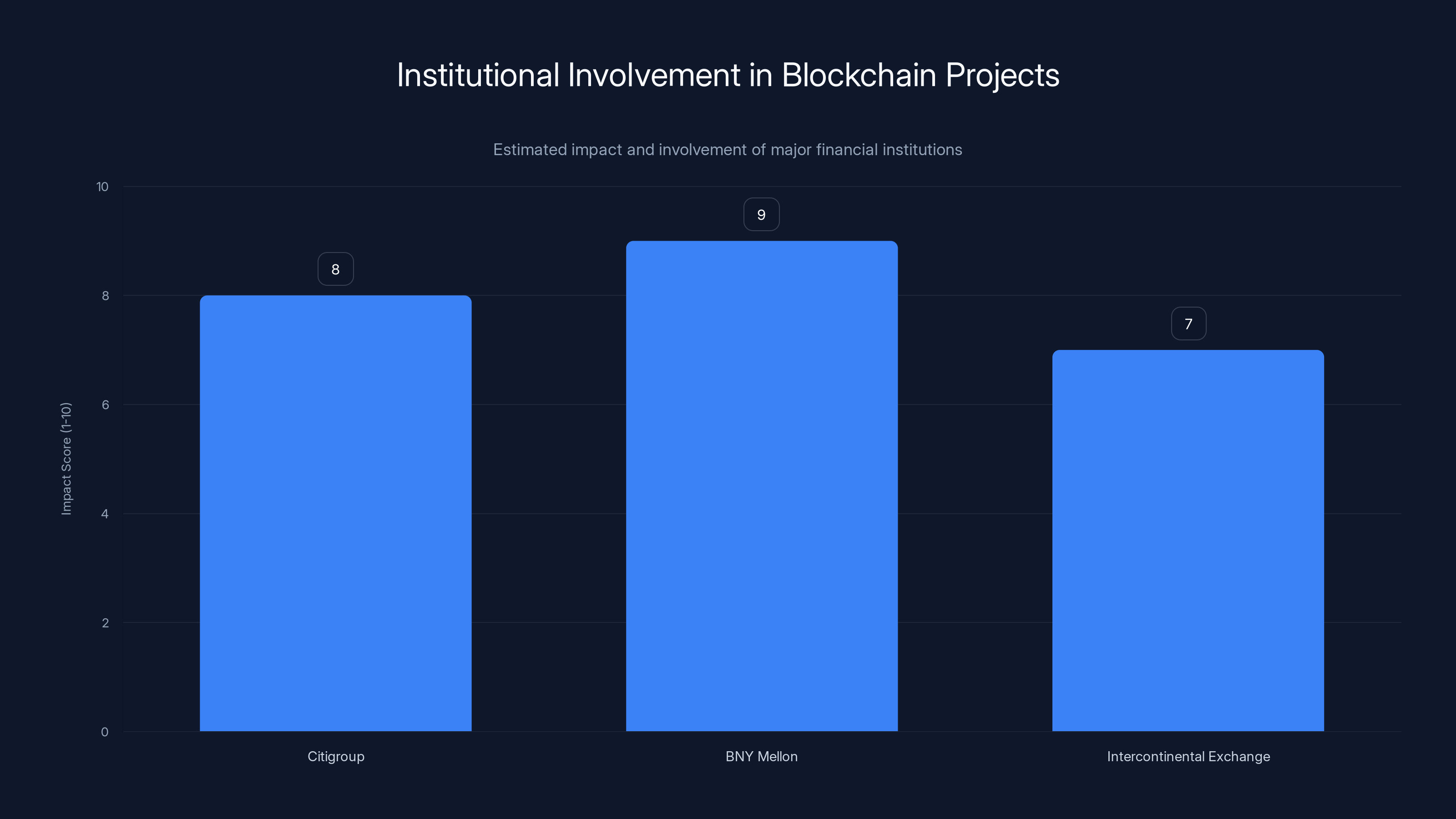

Estimated data shows BNY Mellon having the highest impact on blockchain projects due to its large custody operations, followed by Citigroup and Intercontinental Exchange.

Global Financial Infrastructure Integration

The real innovation isn't just the NYSE building a tokenized market. It's the implied integration with global financial infrastructure.

The statement about "connections to multiple networks" hints at something bigger: cross-border settlements. Right now, if you want to buy stock in Japan and stock in the US, you need separate accounts in separate clearing systems. Your Japanese stocks settle in yen through Japan Securities Clearing Corporation. Your US stocks settle in dollars through DTCC.

With a truly global tokenized infrastructure, you could theoretically settle both in stablecoins, on the same blockchain, in parallel. You'd need regulatory approval from both countries. You'd need tax treatment frameworks that work cross-border. You'd need custody arrangements that honor both Japanese and US law. But the technical substrate would support it.

This is why Bank of New York Mellon's involvement is so critical. They already have branches in 35+ countries. They already manage custody across different jurisdictions. They understand how to map different legal systems onto unified infrastructure.

The implications for emerging markets are also interesting. Plenty of investors in developing countries want to own US equities but struggle with the complexity and cost of international settlement. A 24/7 global tokenized market would democratize access. You could invest in any global stock market directly from your local stablecoin account.

That said, regulatory coordination required is probably 10x harder than the technical integration. Each country will want to tax tokenized assets. Each will want to maintain supervision. Cross-border settlement has to respect sanctions regimes, capital controls, and anti-money laundering rules.

The path forward probably isn't true global settlement but rather regional hubs that eventually interconnect. NYSE tokenized market in the US. Similar platforms in EU (maybe built on Euroclear). Similar platforms in Asia (maybe Singapore or Hong Kong). Eventually, these hubs can settle with each other.

The Regulatory Minefield: What Could Actually Block This

Let's be clear: this project is not happening in a regulatory vacuum.

The SEC has to approve it. The Fed has to assess it. The Treasury Department will have opinions. International regulators will ask questions about interoperability and capital flows. And every step of that approval process takes years.

The SEC's core concern will be investor protection. They want to know:

- How are tokens secured? Can they be stolen?

- How do we ensure 1:1 backing with underlying shares?

- What happens if BNY Mellon goes bankrupt?

- How do custody disputes get resolved?

- Can retail investors actually understand what they're buying?

These aren't trivial questions. Custody is genuinely complicated. If you own Apple shares today, they're held by a broker in your street name. If your broker goes bankrupt, your shares are protected by SIPC (Securities Investor Protection Corporation) up to $500,000 per account. Does that protection extend to tokenized shares? Probably, but the SEC will need to write new rules.

The Fed's concern will be financial stability. They want to know:

- Could 24/7 trading amplify systemic risk?

- How does stablecoin settlement affect monetary policy transmission?

- What happens in a flash crash that spans multiple time zones?

- Can the system handle the trading volumes without breaking?

The Fed is also increasingly skeptical of tokenization generally, especially anything that could undermine dollar supremacy. Stablecoins are still a flashpoint for Fed concern. Allowing settlement in stablecoins opens a whole debate about whether stablecoins are money, whether they need to be regulated as banks, whether they're systemic risks.

The Treasury will focus on sanctions compliance and tax reporting. If settlement happens on-chain, does that create holes in the sanctions system? How do we know if someone on a sanctions list is trading? Treasury will want continuous visibility into trading flows.

The compliance burden is real. This platform probably requires:

- Real-time transaction reporting to regulators

- Enhanced AML/KYC systems that work at blockchain speed

- Custody documentation approved by the SEC

- Risk frameworks reviewed by the Fed

- Tax reporting systems that work with stablecoins

Nobody should expect this to launch before 2026 at earliest, and more likely 2027 or 2028. That's not pessimism, it's realism about how regulatory processes work.

The Stablecoin Elephant in the Room

The whole project hinges on stablecoins working reliably. And right now, stablecoins are still a contentious technology.

USDC (the most likely settlement asset) is issued by Centre, a consortium that includes Coinbase and Circle. It's supposed to be backed 1:1 by actual US dollars in bank accounts. In theory, stablecoins are simple: just a unit of account on the blockchain that represents a dollar.

In practice, stablecoins introduce several new failure modes:

Reserve Risk: What if the bank holding the dollar reserves fails? Centre claims they use custodians (like BNY Mellon), and they publish monthly attestations of reserves, but there's always some timing lag. There's always some uncertainty.

Liquidity Risk: What if everyone tries to redeem USDC for dollars at the same time? Circle and Centre can theoretically handle this, but the mechanics are complex. It's not instant. There's a settlement delay.

Bridge Risk: What if the token bridge between different blockchains (USDC on Ethereum vs USDC on Solana) breaks or gets exploited? You could have divergent prices. Arbitrage breaks the 1:1 assumption.

Regulatory Risk: The SEC might decide stablecoins are securities and regulate them differently. Congress might pass stablecoin legislation that changes the rules. The Treasury might impose restrictions. Any of that would force a redesign.

The NYSE project partially addresses this by having BNY Mellon and Citigroup involved. These banks can probably secure custodial USDC through official channels and maintain high-quality reserves. But it still adds a layer of complexity and risk.

The more sophisticated approach might be a Fed CBDC (central bank digital currency). If the Fed issued a digital dollar on a blockchain, settlement would be even simpler. No stablecoin bridge risk. No reserve risk. Just digital dollars issued by the Federal Reserve.

But the Fed isn't ready for that yet. They're still in research phases. An official Fed digital dollar is probably 5-10 years away, if it ever happens.

So for the foreseeable future, tokenized NYSE trading would probably settle in USDC or a similar private stablecoin, with all the risks that entails.

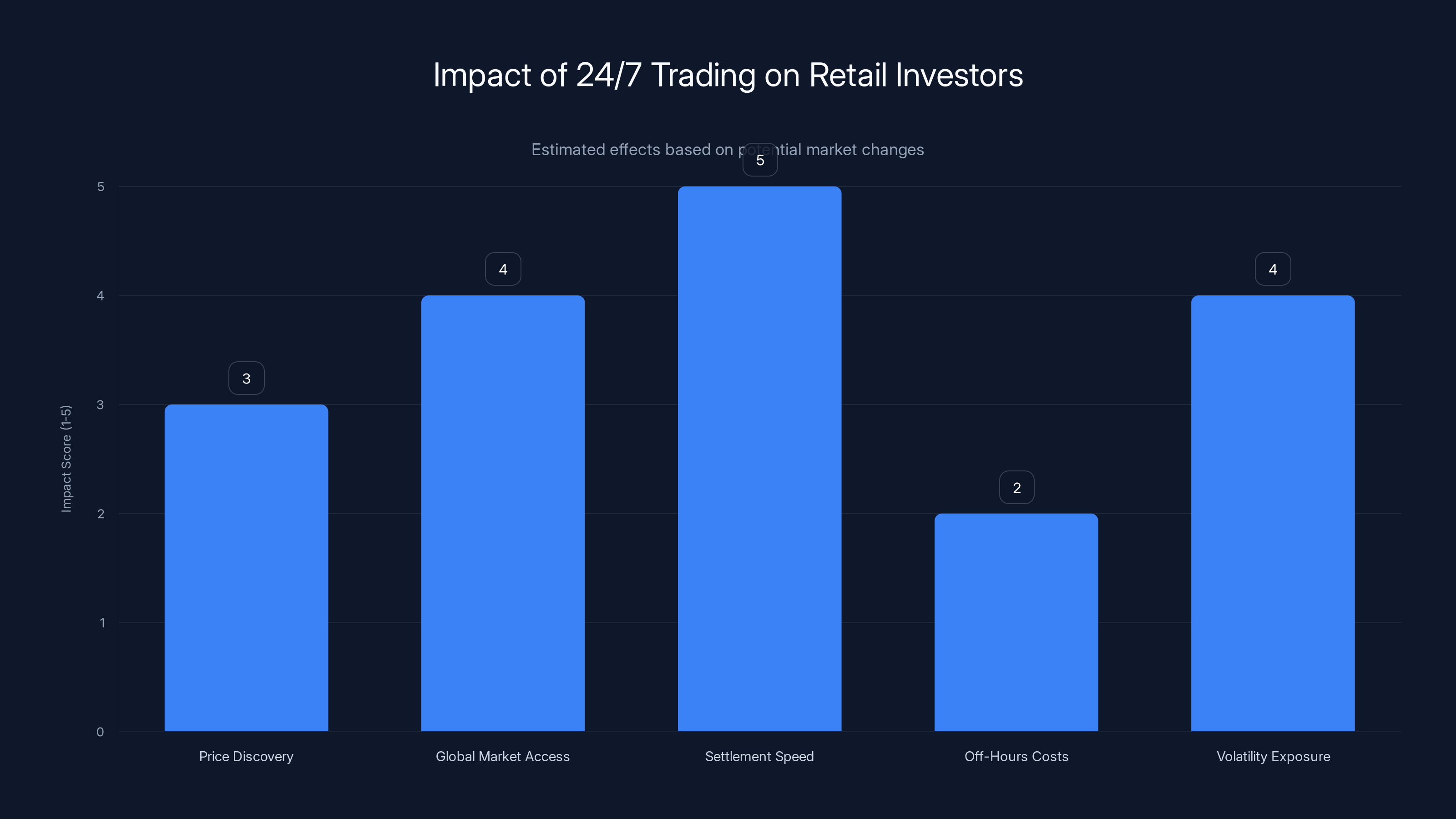

24/7 trading could enhance price discovery and market access, but may increase volatility and costs during off-hours. Estimated data.

Competitive Dynamics: Nasdaq, London Stock Exchange, and JPMorgan

The NYSE isn't alone in exploring tokenization. Competitors are already moving.

Nasdaq filed with the SEC to trade tokenized versions of equities. They're exploring tokenized offerings and possibly tokenized secondary market trading. They're probably 12-18 months behind the NYSE on execution, but they're serious.

The London Stock Exchange Group launched a digital private fund management platform. That's slightly different (focusing on private equity and private debt), but it demonstrates that major exchanges worldwide see tokenization as inevitable.

JPMorgan Chase unveiled JPM Coin, a stablecoin for institutional settlements, and built a tokenized money market fund on Ethereum in December 2024. JPMorgan is approaching this differently than the NYSE (building on public blockchains instead of private networks), but they're clearly moving in the same direction.

These competitive moves create a race dynamic. If NYSE launches a 24/7 tokenized market and it works, every other exchange has to offer similar products or fade into irrelevance. If Nasdaq launches first and builds better technology, NYSE loses first-mover advantage.

For the exchanges, this is existential. Exchanges make money from trading volume. If the trading infrastructure becomes commoditized (anyone can build a blockchain-based exchange), margins compress to nothing. So they need to own the infrastructure, build switching costs, and capture network effects.

The winner probably isn't the exchange with the best technology. It's the exchange that gets to critical mass first and establishes the largest liquidity pool. If the NYSE platform gets 80% of 24/7 tokenized equity trading volume, Nasdaq's competing platform becomes marginally useful.

This creates pressure to launch quickly, even if the product isn't perfect. The first-mover advantage in network effects is enormous.

Custody and Clearing: The Unsexy but Critical Piece

Here's what makes this project genuinely difficult: custody.

Right now, if you buy 100 shares of Apple, here's what happens:

- Your broker credits your account with 100 shares

- Your broker sends cash to the other broker

- The other broker sends an instruction to DTCC (Depository Trust & Clearing Corporation)

- DTCC moves shares from the seller's master account to the buyer's master account

- DTCC records the transfer in the share ledger

- Actual physical share certificates are long gone (dematerialized)

It's a 70+ year old system that's been digitized, but the underlying architecture is still "DTCC maintains the master ledger."

For tokenized shares, you'd need:

- Actual shares locked in BNY Mellon's vault (not virtual, not lent out, not used for something else)

- Tokens that represent those shares (on the blockchain)

- Continuous reconciliation between the physical shares and the tokens

- Insurance and custody agreements that protect token holders

The reconciliation piece is complex. What if a token gets created but the corresponding share doesn't exist? What if the share is lost but the token persists? What if the blockchain forked and now two different versions of the token exist?

These aren't hypothetical. They've happened in other blockchain systems. The answer is sophisticated auditing, cryptographic verification, and insurance policies that cover gaps. It all costs money and adds complexity.

The clearing piece (settlement confirmation and risk management) is also non-trivial. Today, DTCC clears trades, managing counterparty risk by becoming counterparty to both sides. Does the blockchain replace that role? Probably not entirely. You probably still need a clearing entity (maybe the NYSE itself) that takes on counterparty risk and guarantees settlement.

If you still need a central clearing house, you haven't actually decentralized settlement. You've just moved the clearing house's operations onto a blockchain, which gains you speed and auditability, but not the actual decentralization that blockchain enthusiasts talk about.

But that's fine. The goal isn't ideological purity. The goal is faster settlement, 24/7 trading, and better integration of global markets. A blockchain-based clearing house that's faster than the current system is a win, even if it's still centralized.

Market Structure Implications: What Happens to Market Making?

Market makers are the unsung heroes of financial markets. They continuously buy and sell stocks, providing liquidity that lets normal investors execute trades instantly.

In a traditional market, market makers quote prices continuously during 9:30 AM to 4:00 PM. They go home at 4 PM. The next morning, the market opens and they're ready again.

In a 24/7 market, market makers would need to operate continuously. Some would automate (using algorithms), but someone has to be willing to take on the inventory risk of holding shares overnight in all time zones.

This probably increases spreads and reduces liquidity at off-hours. A market maker quoting 100-share spreads during peak US hours might only quote 1,000-share spreads at 3 AM because there's less demand and more risk.

That's not necessarily bad. It's a trade-off. You get 24/7 access at the cost of slightly worse prices during off-hours. For institutional investors who want to hedge global positions, that's worth it.

For retail investors, the impact is more negative. If you're trying to sell 100 shares of Apple at 2 AM, you might pay a half-point spread instead of a quarter-point. That's real money.

But retail traders are probably a minority of trading volume on a 24/7 platform. Most volume would be institutional, flowing between asset managers in different time zones. The structure would optimize for that use case.

Another market structure change: the death of closed-end funds. Today, there are ETFs and closed-end funds that trade at disconnected prices because markets are closed. You might own a Korean stock ETF that trades in New York when Korean markets are closed. You pay a premium or discount.

With 24/7 tokenized markets, you'd just own the Korean stocks directly and trade them whenever you want. No intermediary. No premium/discount. This puts pressure on closed-end fund business models.

Similarly, derivatives markets might shrink as a percentage of total trading volume. If you can trade the underlying stock 24/7, you don't need as many options and futures for price discovery and hedging. The derivatives might continue to exist for leverage and specific strategies, but they become less essential.

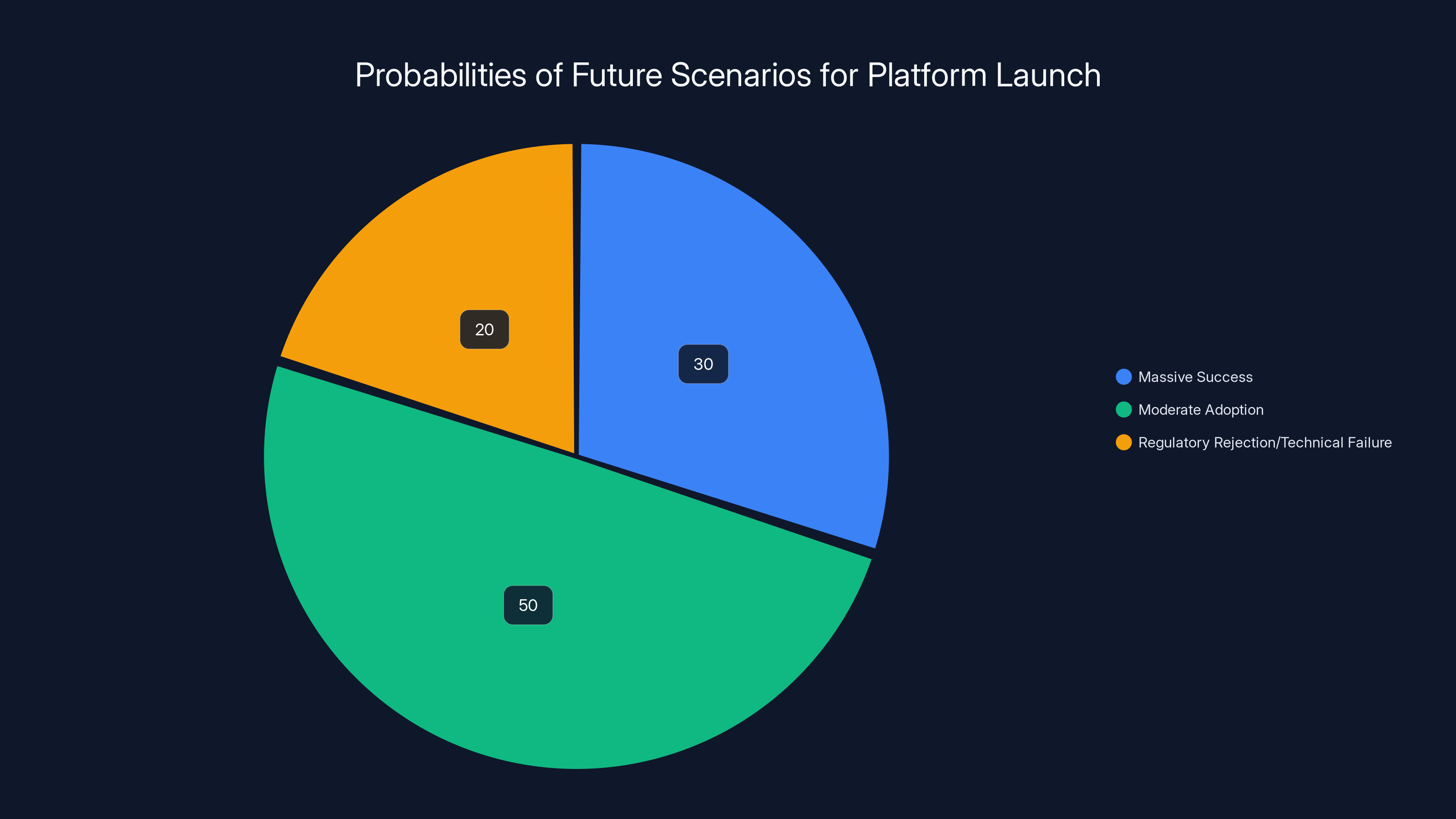

The most likely outcome is moderate adoption with a 50% probability, indicating a meaningful but not revolutionary impact. Estimated data.

Data Center Infrastructure: The Boring but Essential Foundation

You can't have a global 24/7 tokenized market without bulletproof infrastructure.

The NYSE has been building infrastructure for 230 years, but blockchain adds new requirements:

Geographic Distribution: You need data centers in multiple regions (US, Europe, Asia) so that validators and operators are geographically diverse. If one region's internet infrastructure breaks, trading continues. This probably means

Redundancy: Traditional exchanges have redundancy, but blockchain systems need even more. Every node must be able to handle the full load. Every validator must be able to create blocks independently. If one data center goes down, settlement continues without skipping a beat.

Real-Time Synchronization: Blockchain networks need consensus across all nodes. In a 24/7 system with millions of transactions per second, keeping all nodes synchronized is technically difficult. You probably need sub-second block times, which creates risks of divergent chains and orphaned blocks.

Energy Efficiency: Running a blockchain 24/7 is expensive. Proof-of-work systems (like Bitcoin) use enormous amounts of electricity. The NYSE would probably use Proof-of-Stake or a private consensus system, but even those consume significant power. Add 24/7 operation and you're looking at millions in annual energy costs.

Backup and Recovery: What if the blockchain gets corrupted? What if there's a bug in the consensus code? You need the ability to restore from backups, identify the exact point of failure, and recover without losing data. This requires serious infrastructure engineering.

The NYSE probably already has most of this. They run Pillar with extraordinary uptime and latency requirements. But extending that to blockchain is new territory.

The ambitious timeline (getting this live by 2027 or 2028) assumes a substantial engineering effort starting immediately. This isn't a "ship it in 18 months" project. This is a "we're investing hundreds of millions and expecting uncertainty" project.

Tax and Regulatory Reporting: The Compliance Burden

Once you enable 24/7 trading, tax authorities need to know about every single transaction for reporting and assessment.

Today's tax reporting is actually pretty clean. You file a tax return once a year. Your broker reports cost basis. The IRS matches returns to broker reports. Everyone's happy.

With 24/7 on-chain trading, transactions are immediately public (on the blockchain ledger). Tax authorities could theoretically monitor your trading in real-time. Is that good? Bad? Complex?

There's a philosophical question here: does real-time tax enforcement enable better compliance or just empower governments to overtax? Different countries will answer that differently.

The practical questions are simpler: how do you handle wash sales (selling at a loss and buying back within 30 days)? How do you track cost basis across multiple trading venues? How do you handle foreign exchange gains if you're trading in stablecoins?

For US tax purposes, the IRS will need updated guidance on:

- Whether tokenized shares are appreciated property for long-term capital gains

- Whether token holders owe tax on dividend streams immediately or only when received

- How stablecoin settlement affects foreign tax credits

- Whether trading is treated as a business activity (affecting income classification)

The IRS is slow to adapt. They're still figuring out cryptocurrency taxation. Tokenized securities are more integrated with traditional finance, so guidance might come faster. But don't expect clarity before 2026 or 2027.

International tax gets even messier. A US citizen trading 24/7 might be doing so from Asia or Europe. Does trading timezone affect tax residency? Can you trigger permanent establishment in a foreign country just by trading on a 24/7 platform?

These questions don't have answers yet. Regulatory bodies will need to coordinate and develop frameworks.

Risk Management: When Speed Creates New Dangers

Speed is powerful. It's also dangerous.

The 2010 flash crash saw $1 trillion in market value evaporate in 36 minutes because of a cascading algorithmic failure. If that happened on a 24/7 global blockchain, how would regulators halt trading? They'd need synchronized circuits breakers across all time zones, all maintained in real-time.

Actually, this is probably doable. The NYSE could encode circuit breaker logic in the smart contracts. If volatility exceeds X%, trading halts until human review. But building that into blockchain code is complex, and once it's deployed, changing it is slow and risky.

Another risk: liquidity dries up faster in a 24/7 market. If volatility spikes at 3 AM when fewer market makers are active, you get worse prices. If multiple volatility events happen across the global day, the psychological toll on traders (who now need to monitor markets 24/7) might amplify risk-taking.

Cyber risk is also elevated. A 24/7 system is a 24/7 target. Hackers have no downtime to exploit. They can attempt infiltration continuously. The operational security burden is immense. One breach could undermine trust in the entire market.

Counterparty risk with stablecoins: if the entity issuing stablecoins fails during trading, what happens? Theoretically, trades settle in stablecoins, so you own the stablecoins, not the issuer's promise. But if the stablecoin loses its peg (becomes worth less than $1), everyone holding it loses money.

These risks aren't insurmountable. But they require serious risk management frameworks that haven't been fully tested yet. The first failure will be educational (in a painful way).

Algorithmic failures and cyber risks are estimated to have the highest impact in a 24/7 trading environment, necessitating robust risk management frameworks. Estimated data.

The Institutional Reality: Regulatory Approval Takes Forever

Let me be direct: this project is probably not launching until late 2026 at earliest, and more realistically 2027 or 2028.

Here's why: the SEC approval process for novel financial market infrastructure is genuinely slow. When they approved Reg SHO (short selling regulations) it took years of public comment and back-and-forth.

The current timeline is probably:

- 2025: NYSE finishes prototype, does internal testing

- 2025-2026: Initial SEC meetings, describe the project, get preliminary guidance

- 2026: File formal approval request with SEC

- 2026-2027: Public comment period, SEC staff review, more meetings

- 2027: SEC issues approval (assuming no major objections)

- 2027-2028: Build out production infrastructure, test with select institutions

- 2028 or later: Limited launch with institutional investors

- 2029 or later: Retail access (if the system works)

That's aggressive. It assumes no major regulatory pushback and no technical setbacks. If the Fed objects or Congress gets involved, add 1-2 years.

Institutional investors will pressure the NYSE to move faster, but regulators won't be rushed. Systemic financial infrastructure doesn't get deployed on startup timelines.

That said, once approved, adoption could move quickly. If the technology works, if custody is solid, if regulations are clear, institutions will move fast to claim first-mover advantages in 24/7 trading strategies.

What This Means for Regular Investors

If you're a retail investor, the question is: does this affect you?

Honestly, not immediately. The initial platform will probably be available only to institutional investors and sophisticated traders. You probably won't be able to trade on it through your brokerage for several years.

When it does eventually reach retail, here's what changes:

Better Price Discovery: If your shares are tokenized and trade 24/7, you get updated prices continuously instead of just during market hours. That's a small advantage, but it compounds.

Access to Global Markets: Theoretically, you could trade global equities from your local brokerage at any time. Less friction. Lower costs. More opportunities.

Faster Settlement: You might eventually see settlement speed up from T+1 to T+0 (same-day) or even T+S (seconds). That means money moves faster, portfolio rebalancing is easier.

Higher Costs at Off-Hours: If you trade at 2 AM, you'll pay higher spreads. That's a real cost. You're paying for the privilege of trading when there's less liquidity.

More Volatility Exposure: 24/7 markets might be more volatile because news breaks continuously and there's no downtime to process it. You could wake up and find your portfolio down 5% because of overnight news.

Overall, it's probably positive for informed investors and neutral or slightly negative for passive investors who just buy and hold.

Competitive Advantages and Moats

If the NYSE launches this successfully, what prevents competitors from copying it?

Network effects. If 80% of 24/7 tokenized equity trading happens on the NYSE platform, starting a competing platform is nearly impossible. You need an order book with liquidity. You need institutional participants. You need regulatory approval. Once the NYSE has all of that, the competitive window closes.

Intellectual property might provide some protection, but honestly, most of the technology is either existing (blockchain, smart contracts, custody systems) or would be obvious to any capable engineering team.

The real moat is the institutional relationships. ICE owns Pillar, CBOE, and a bunch of other market infrastructure. Citigroup and BNY Mellon have custody relationships with every major asset manager. If these three institutions coordinate, competitors can't easily build an alternative.

Regulatory approval is another moat. If the SEC approves the NYSE's tokenized market, they'll probably want a single venue for a while before approving competitors. The reasoning would be: let's prove this works at one exchange before letting everyone build their own.

That regulatory protection probably lasts 2-3 years. After that, competitors can apply and probably get approved. But by then, the NYSE would have massive first-mover advantages in volume and liquidity.

Future Scenarios: Three Possible Outcomes

Scenario 1: Massive Success (30% probability) The platform launches in 2027-2028, institutional adoption is rapid, 24/7 trading becomes the norm for institutional equity trading within 5 years. Market structure transforms. This creates trillions in economic value through better capital allocation and lower trading costs. Competitors copy the model. Global equity markets gradually integrate into a 24/7 system.

Scenario 2: Moderate Adoption (50% probability) The platform launches, but adoption is slower than expected. Some institutions use it, but many stick with traditional trading because the benefits aren't worth the learning curve. It becomes a useful venue for certain trade types and certain times of day, but doesn't displace traditional markets. Competitors eventually build similar platforms, fragmenting the market. The innovation is real but incremental.

Scenario 3: Regulatory Rejection or Technical Failure (20% probability) Regulators express deep concerns about systemic risk and stablecoin exposure. SEC doesn't approve it, or approves it with so many restrictions that it's not economically viable. Or, the technical implementation has a serious flaw that gets discovered during testing. The project gets delayed indefinitely. Other exchanges learn from the experience and adapt their approaches. Traditional markets continue with incremental improvements to settlement speed.

Most likely? Scenario 2. This will work, but it'll be one major infrastructure upgrade among many. Not revolutionary, but meaningful.

The Deeper Trend: Finance Moving On-Chain

This isn't just about stocks. This is part of a larger trend of financial infrastructure moving onto blockchains.

Stablecoins for payments and settlement are already real. JPMorgan's JPM Coin is live. Circle's USDC is being used by major institutions. This infrastructure is building up.

Tokenized government bonds are coming. Several countries and central banks are exploring digital asset settlement for sovereign debt. When that launches, it'll use similar technology to what the NYSE is building.

Tokenized real estate is coming (though it's more hyped than real right now). Tokenized commodities (gold, oil, grains) will probably follow.

The pattern is clear: anything that's currently centrally settled (stocks, bonds, derivatives, real estate) is going to be gradually tokenized. The process will take 10-20 years, but it's inexorable.

Why? Because blockchain-based settlement is genuinely better along several dimensions: speed, 24/7 availability, programmability, auditability, cross-border integration.

The transition won't be clean. There will be multiple competing systems. Some blockchains will fail. Regulatory backlash will slow adoption in some jurisdictions. But the direction is clear.

In 20 years, it might feel weird that we ever had T+1 settlement and closed market hours. But we'll also discover new problems with 24/7 trading and find that certain aspects of the old system were surprisingly good (like the psychological reset that happens every night).

FAQ

What exactly is the NYSE tokenized market?

The NYSE is building a blockchain-based platform that converts traditional stocks into digital tokens while preserving all investor rights (dividends, voting). The platform would operate 24 hours a day, 7 days a week, with instant settlement instead of the current T+1 (one-day) delay. Trades settle in stablecoins instead of traditional fiat currency through banking networks.

How is this different from cryptocurrency trading?

Tokenized stocks represent actual equity ownership in real companies with legal status under corporate law. You get dividends and voting rights. Cryptocurrencies like Bitcoin have no underlying asset backing or corporate rights. A tokenized Apple share is still Apple equity, just on a blockchain. Cryptocurrency tokens are speculative assets backed by consensus and community.

When will this actually launch?

Realistically, 2027 or 2028 at the earliest. The SEC approval process takes years. Once approved, the NYSE needs to build and test production infrastructure, coordinate with custodians, and integrate with existing systems. Initial launch will probably be limited to institutional investors. Retail access would come later, possibly 2029 or 2030.

What does stablecoin settlement mean?

Instead of settlement in US dollars through the Federal Reserve banking network, trades would settle in stablecoins (like USDC), which are digital tokens backed 1:1 by actual dollar reserves. This enables instant settlement on a blockchain without waiting for banking system processing. It also introduces new risks around stablecoin reserve backing and regulatory changes.

Will this eliminate market makers and trading hours?

Market makers will likely continue to exist but operate differently. Some hours will have thinner spreads and less liquidity due to fewer active participants. The 9:30 AM-4:00 PM opening hours will effectively disappear, but some brokerages might still limit when individual customers can trade. Most trading volume will probably concentrate in overlapping US/European hours even with 24/7 availability.

What about taxes on 24/7 trading?

Tax treatment is still unclear and will require new IRS guidance. The core question is how wash sales, cost basis tracking, and foreign exchange treatment apply when trading happens continuously. Different jurisdictions will likely develop different rules. This remains a major unknown for the final implementation.

Could this system fail or break?

Yes. Potential failure modes include custodial issues (underlying shares missing or mismatched with tokens), stablecoin depegging (USDC losing its dollar backing), cyber attacks on blockchain infrastructure, regulatory changes that invalidate the legal framework, or technical bugs in the matching engine or smart contracts. The system is designed with redundancy and insurance, but novel financial infrastructure always has surprises.

Who benefits most from 24/7 tokenized trading?

Institutional investors managing global portfolios benefit most because they can hedge positions across time zones without complex derivatives strategies. Asset managers in Asia can trade US equities immediately when news breaks instead of waiting for New York hours. Retail investors benefit less initially due to wider spreads during off-hours, but eventually benefit from better global market integration and lower custody costs.

What happens to the current settlement system?

It probably doesn't go away quickly. Traditional T+1 settlement will continue for at least 10-15 years alongside the tokenized system. Gradually, institutional volume migrates to 24/7 trading. Legacy systems (DTCC, Euroclear) continue handling traditional settlement for investors who don't participate in the new platform. Eventually, they might be shut down when volumes become uneconomical.

Could other countries build competing tokenized markets?

Yes, and probably will. The EU might build a tokenized market on its own terms. Asian exchanges might create regional platforms. However, the USD-based nature of US equities and the depth of US markets give the NYSE a first-mover advantage that's hard to overcome. Competing platforms might serve regional purposes but are unlikely to fully replicate the NYSE's ecosystem.

The NYSE's move into 24/7 tokenized trading represents a genuine evolution in market infrastructure, not a revolution in market function. The core innovation is speed, availability, and programmability, not a fundamental change to how capital markets work.

But speed matters. Availability matters. And programmability matters more than most realize. A truly 24/7 global equity market, integrated with blockchain infrastructure and cryptocurrency settlement, is genuinely transformative over a 10-20 year horizon.

The next few years will determine whether this becomes reality or remains an interesting experiment that regulators ultimately constrain. Either way, it's a fascinating inflection point in financial market evolution. The outcome will shape how trillions move through global markets for decades.

Key Takeaways

- NYSE building 24/7 tokenized market with Citigroup and BNY Mellon eliminates T+1 delay and enables continuous global trading

- Tokenized shares maintain full legal rights (dividends, voting) while enabling blockchain-based instant settlement

- Stablecoin settlement introduces new risks but enables interoperability between traditional and digital finance

- Realistic launch timeline is 2027-2028 pending SEC approval and infrastructure buildout

- Success depends on custody frameworks, regulatory clarity, and institutional adoption exceeding the hurdle of learning new trading paradigms

Related Articles

- SpaceX's 7,500 New Starlink Satellites: What It Means [2025]

- Warner Bros. Discovery Rejects Paramount Skydance Bid: Why Netflix Won [2025]

- Polymarket's $408K Maduro Bet Exposes Prediction Market Insider Trading Problem [2025]

- How Arya.ag Stays Profitable While Commodity Prices Fall [2025]

- Trump's Mass Deportation Machine: How Federal Law Enforcement Replaced Militias [2025]

![NYSE's 24/7 Tokenized Trading Platform: The Future of Markets [2025]](https://tryrunable.com/blog/nyse-s-24-7-tokenized-trading-platform-the-future-of-markets/image-1-1769197134304.png)