Introduction: The $14 Billion Bet on Robot Learning

Last month, a quiet startup called Skild AI did something remarkable. In less than seven months, its valuation tripled from

Here's the thing: robots are terrible at learning. Show a robot a new task, and it usually needs weeks of training before it can execute reliably. Want that same robot to do something slightly different? Start over. This fundamental problem has been the invisible ceiling on robot adoption for decades.

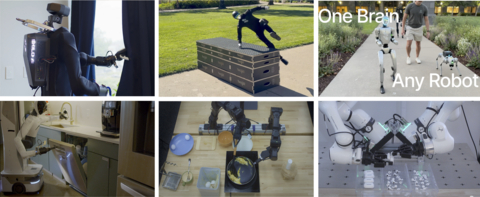

Skild AI is betting it can solve this with foundation models for robots. Not foundation models that describe the world in text or generate images, but models that teach robots to understand what they see, adapt to new situations, and learn from human examples without being reprogrammed from scratch.

If it works, the economics of automation change completely. If it doesn't, Skild AI becomes another cautionary tale about venture capital chasing hype.

Let's dig into what's actually happening here, why investors are so convinced, and what this means for the future of physical automation.

What Skild AI Actually Does

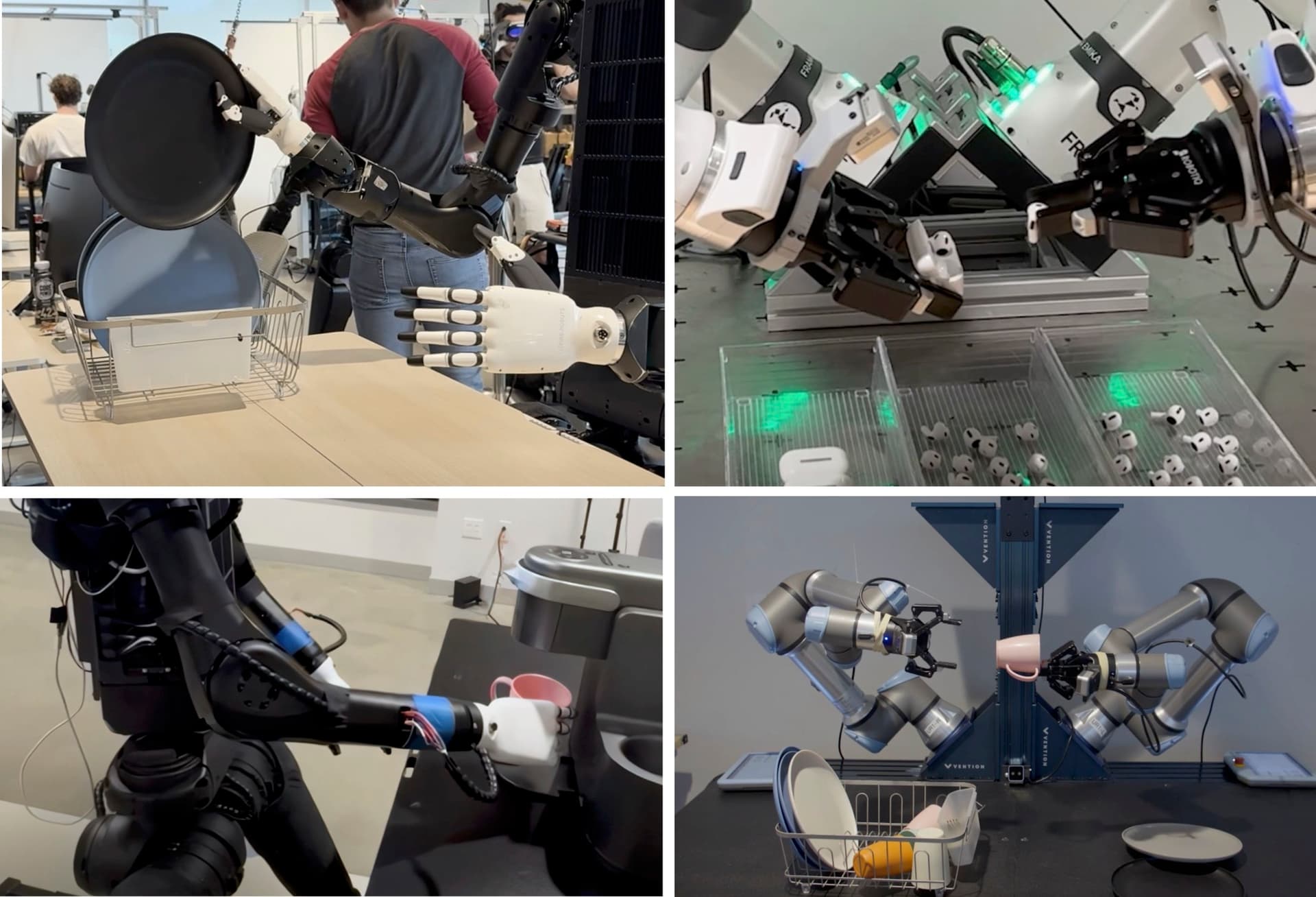

Skild AI builds foundation models specifically designed for robots. Forget your GPT-4 or Claude comparisons. This is different. The company's models are trained to process visual data, understand spatial relationships, predict outcomes of actions, and adapt to new tasks with minimal additional training.

Founded in 2023 by Deepak Pathak and his team, Skild AI focuses on the core problem: generalization. Most robot software today is task-specific and environment-specific. A robot trained to pick apples can't pick oranges without retraining. A robot trained in a factory in Ohio struggles in one in Texas because the lighting is different.

Skild AI's approach uses foundation models that abstract away these specificities. The models learn from diverse robotic data, observation of human tasks, and simulation. Once trained, these models can be deployed to different robots and tasks without requiring massive retraining efforts.

The company doesn't build physical robots. Instead, it creates the software layer that makes existing robots smarter. This is the licensing and software play that venture capital loves. Hardware capital is heavy. Software capital is light. And if your software works on multiple robot platforms, your addressable market explodes.

Deepak Pathak came from robotics research at Carnegie Mellon University, where he'd spent years working on robot learning. He saw the bottleneck clearly: the gap between what researchers could achieve in labs and what industry actually needed. Skild AI is his attempt to bridge that gap at scale.

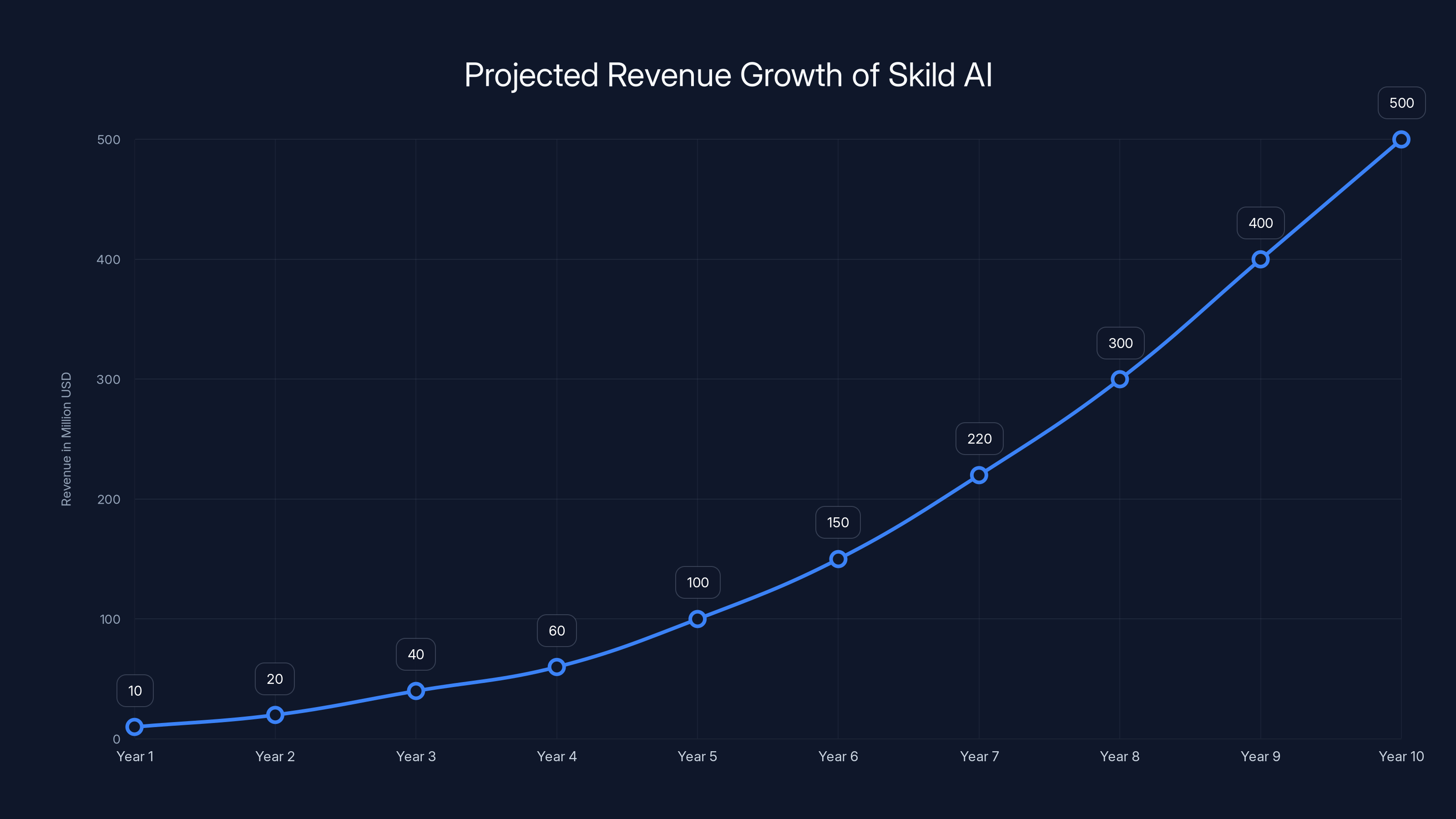

Skild AI could potentially reach $500 million in annual revenue within 10 years, assuming successful market adoption and integration. Estimated data.

The Problem Skild AI Is Solving

Let's talk about why this funding round matters by understanding the specific problems Skild AI attacks.

The Training Bottleneck

Robot training today is expensive and time-intensive. A manufacturing facility that wants to retool production for a new product line faces weeks of robot programming. Engineers need to specify every movement, every sensor reading, every conditional action. It's like writing code in the 1970s, but the consequences are that your production line sits idle.

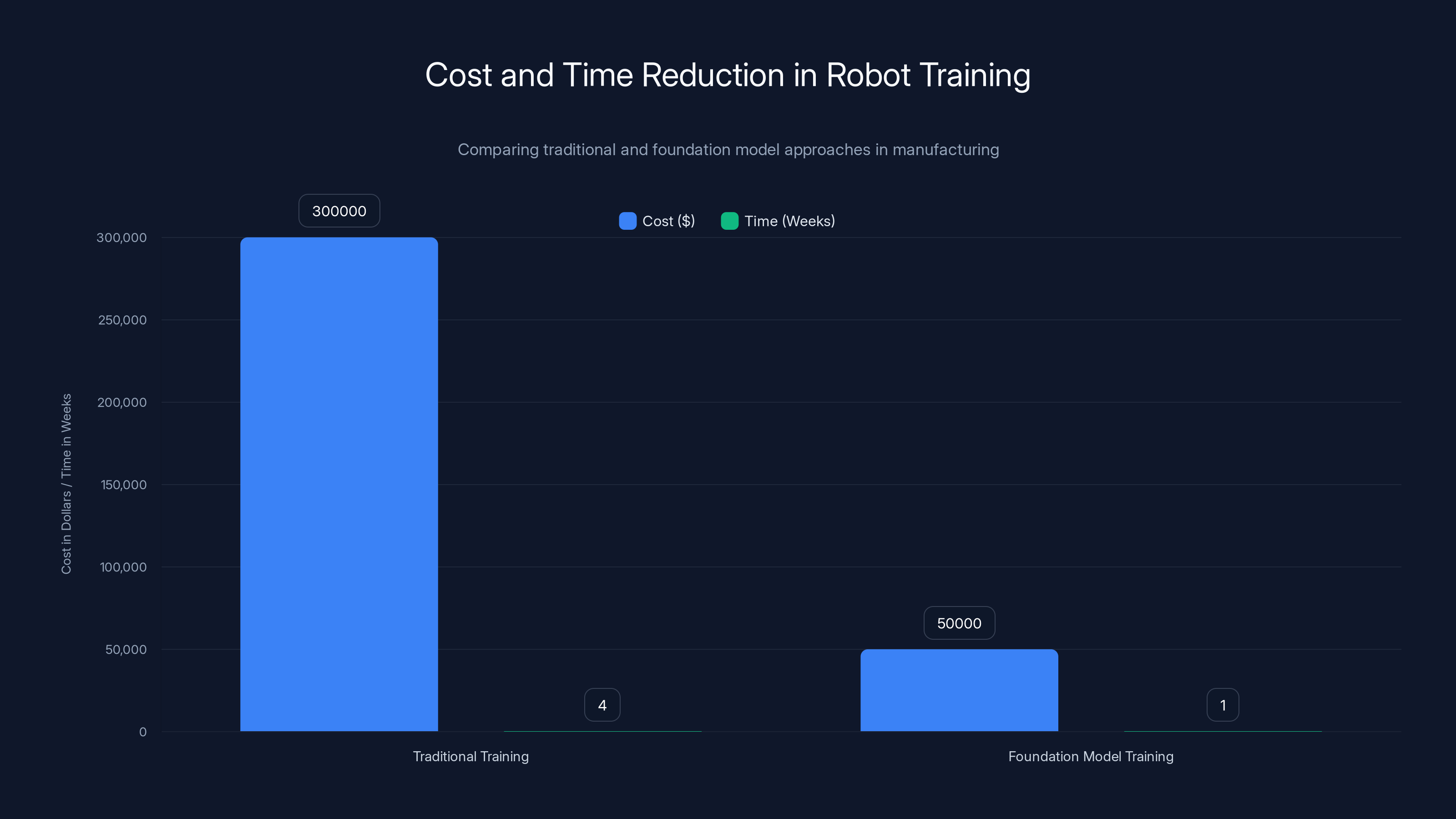

For pick-and-place operations, this might mean programming hundreds of specific movements. For more complex tasks, like sorting items by category or assembling components, the training complexity explodes. A factory might invest

Foundation models trained on diverse task data can dramatically compress this timeline. Instead of starting from zero, the robot comes with learned understanding of physics, visual recognition, and movement primitives. Retraining takes days instead of weeks.

The Generalization Problem

Robots trained in one environment often fail in slightly different ones. Lighting changes, surface textures vary, component dimensions shift slightly. Each of these variations might break a conventional robot's performance.

Foundation models address this by learning abstract representations rather than memorizing specific visual patterns or conditions. A model trained on varied pick-and-place tasks in 50 different factories can generalize to a new factory. It's learned the underlying principles, not just the specific instances.

This is where human-like learning becomes valuable. Humans don't need retraining every time the lighting changes. We adapt. Foundation models aim to give robots similar adaptability.

The Scale Problem

There are millions of robots in operation globally, but most run on proprietary software from different manufacturers. Getting a robot to learn from another manufacturer's data is nearly impossible with current approaches.

Skild AI's strategy is to create foundation models general enough to work across multiple robot platforms. An ABB robot, a Fanuc arm, a mobile manipulator, even humanoid platforms. The software layer abstracts away these differences.

If Skild AI achieves true cross-platform generality, it becomes essential infrastructure for the automation industry. That's the $14 billion bet.

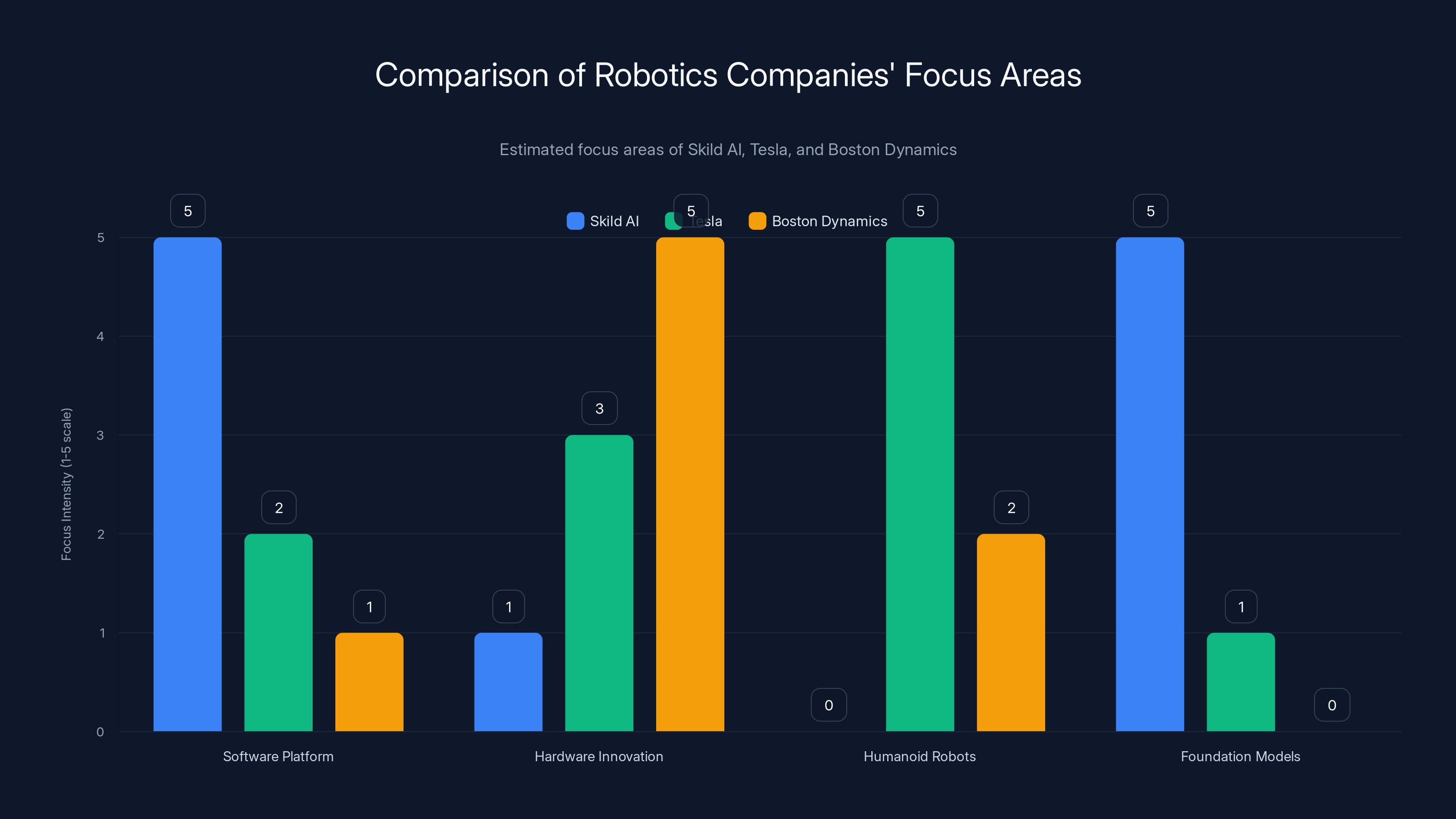

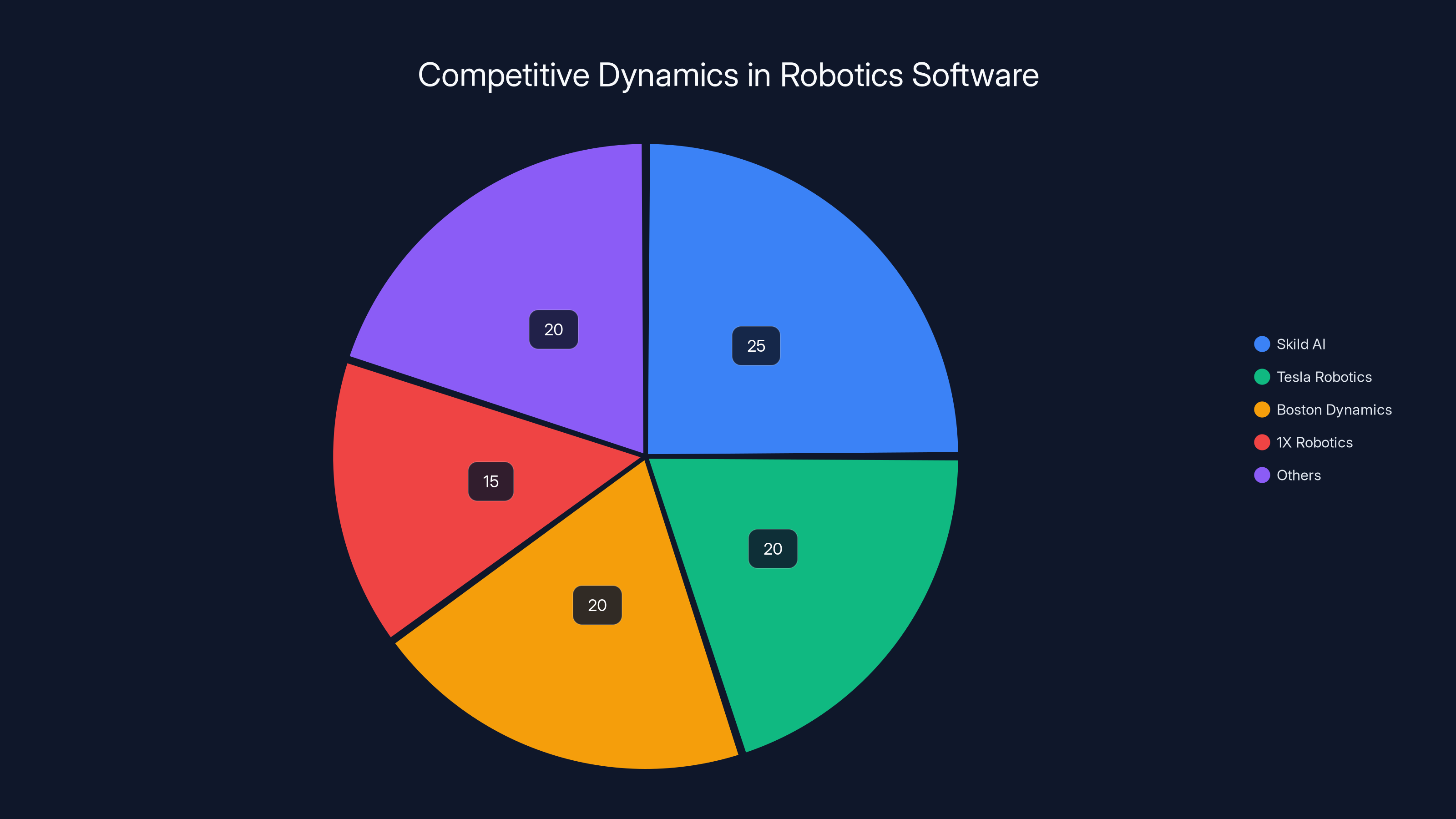

Skild AI focuses heavily on software platforms and foundation models, unlike Tesla and Boston Dynamics, which emphasize hardware and specific robot types. Estimated data.

Why Soft Bank Led a $1.4 Billion Round

Soft Bank investing $1.4 billion into a robotics software company tells you something important about where mega-capital sees future returns. Let's break down the investor logic.

Soft Bank's AI Infrastructure Thesis

Soft Bank CEO Masayoshi Son has been explicit about his vision: artificial intelligence will fundamentally reshape every industry. The company has invested heavily in AI infrastructure, AI-powered automation, and companies positioned to benefit from widespread AI adoption.

Skild AI fits directly into this thesis. If robot learning becomes commodified through foundation models, the adoption curve accelerates. More robots get deployed. More factories automate. More logistics operations run with less human labor.

Soft Bank has portfolio companies that would directly benefit from better robot software. Vision Robotics, for instance, which handles agricultural automation. The investment in Skild AI could drive adoption across Soft Bank's portfolio.

The Competitive Dynamics

Skild AI isn't operating in a vacuum. Tesla has been quietly building humanoid robots and training systems. Boston Dynamics, now part of Hyundai, continues advancing robot learning. 1X, which makes the Neo humanoid, just released its world model for robot learning.

Soft Bank's investment is partially a defensive move. It's making sure that if foundation models become critical infrastructure for robotics, Soft Bank has exposure to that layer.

But there's also genuine belief in Deepak Pathak's team and their approach. They recruited top talent from robotics research. Their technical approach differentiates from competitors. And they're solving a real problem that industry players are actively struggling with.

The Valuation Justification

A $14 billion valuation for a three-year-old company with no disclosed revenue sounds insane. But venture capital has a specific way of thinking about this.

The addressable market for robot software is genuinely massive. If you're adding software to millions of robots, at even modest per-unit pricing (

Compare this to GPT-4's impact. OpenAI's valuation has climbed because the model works across countless use cases and industries. If Skild AI's foundation models achieve similar applicability across robotics, the valuation becomes less absurd.

Of course, there's risk. Lots of it. More on that later.

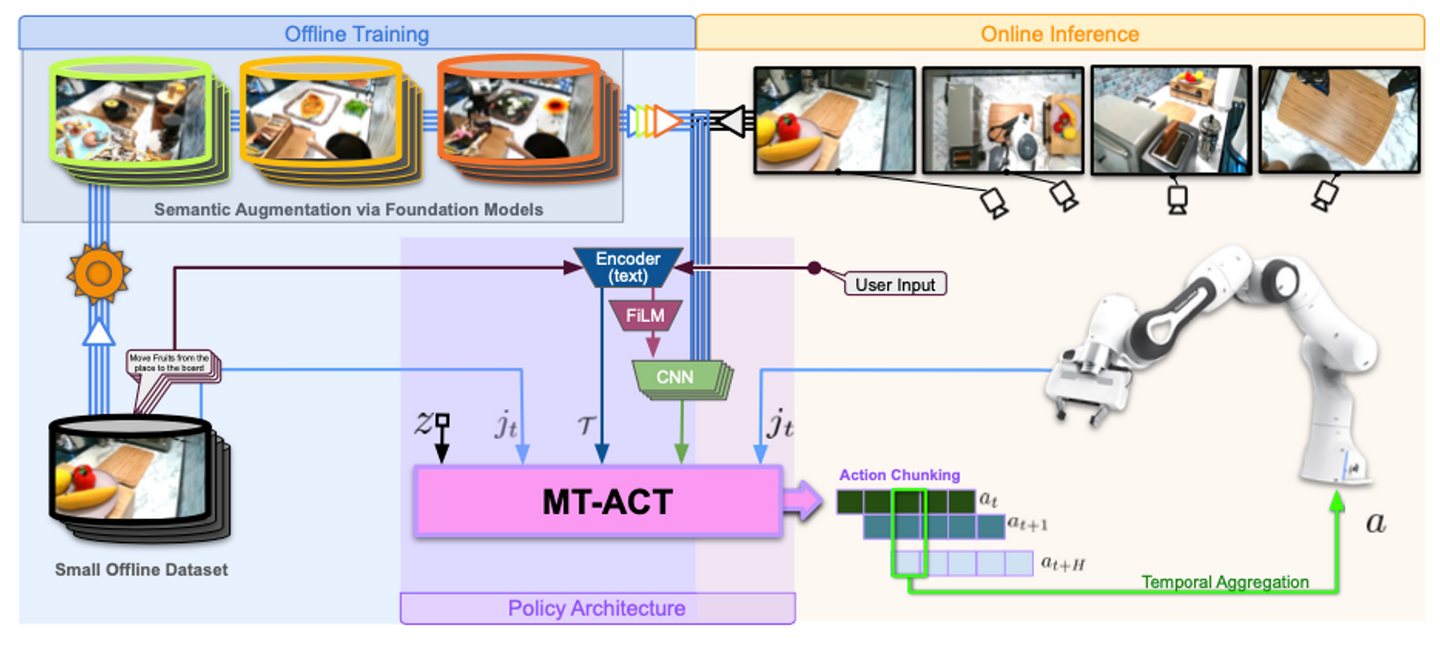

How Robot Foundation Models Work

Understanding the actual technology helps explain the valuation and investment thesis.

The Training Pipeline

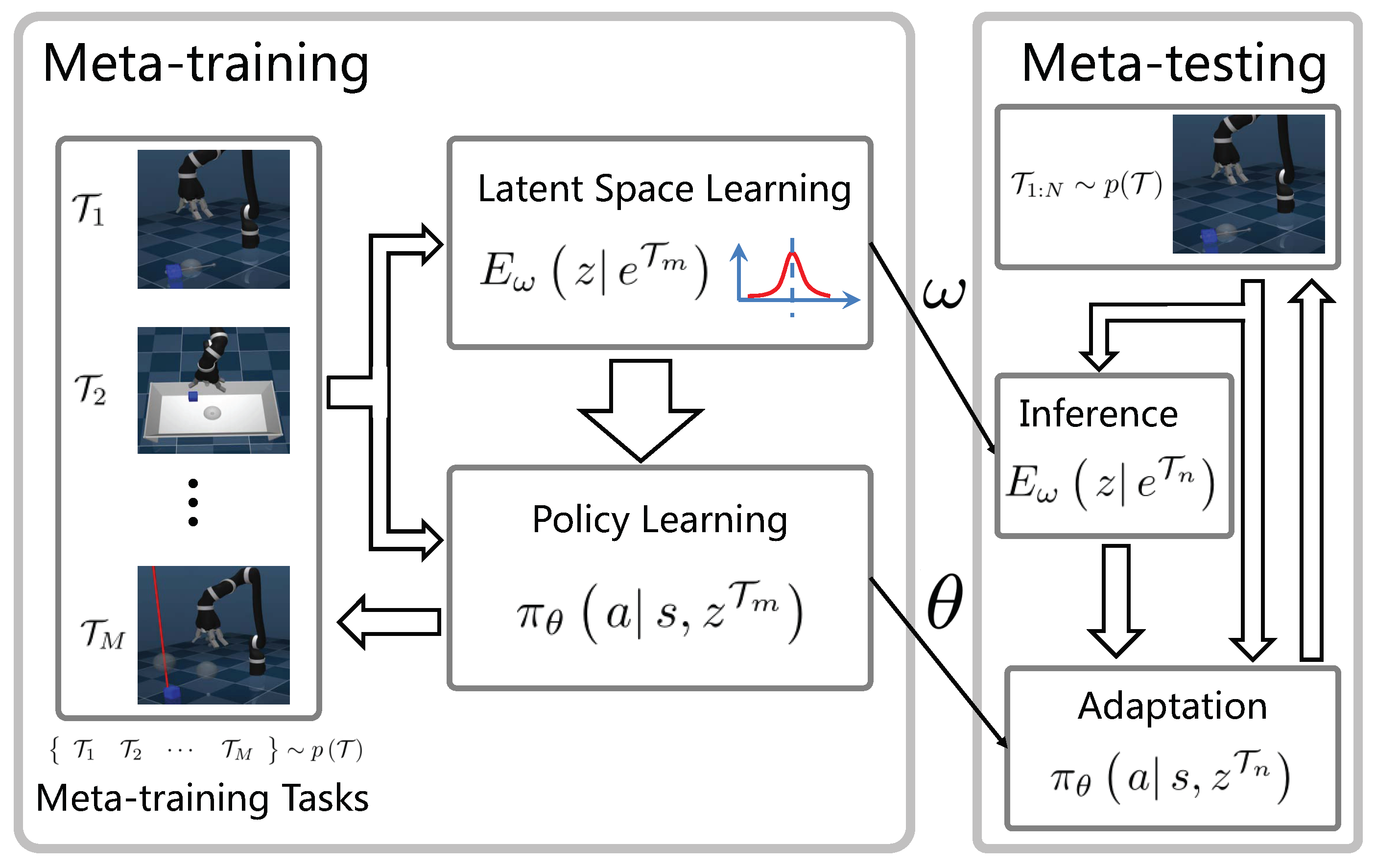

Skild AI builds foundation models using a combination of real robot data and simulation. This is crucial. You can't safely train a physical robot to attempt thousands of random actions. Simulation is where the actual learning happens.

The company likely uses physics simulation software to generate millions of training examples. A virtual robot in a simulated environment attempts tasks, fails, and learns. The foundation model learns to predict outcomes (if I execute this action in this state, what happens?) and optimize for task success.

Once the model shows promise in simulation, it gets validated on real robots. This transition from simulation to reality is notoriously difficult. The real world has friction, wear, unpredictable variations. Models trained on perfect simulation often fail on real hardware.

Skild AI's competitive advantage might lie in how effectively they've solved this "sim-to-real" problem. If their models transfer smoothly from simulation to actual robots, they've solved something that's plagued the field for years.

Multi-Task Learning

Instead of training separate models for picking, placing, sorting, or assembly, foundation models train on all of these tasks simultaneously. The model learns a shared representation where picking and placing are variations on a theme.

This multi-task learning is what enables generalization. When the robot encounters a new task (assemble this new component), it's not learning from scratch. It's applying learned representations from related tasks.

The mathematics here is grounded in transfer learning. Let's denote a task as

Learning from Human Demonstrations

Skild AI explicitly mentions the ability to learn from humans performing tasks. This is powerful. Instead of needing to program every movement, you can record a human completing a task, and the robot learns from that example.

This requires the model to understand human actions, abstract them into robot-executable primitives, and generalize from potentially imperfect demonstrations. It's harder than it sounds. Humans have hands. Robots might have grippers, suction cups, or specialized end-effectors.

But if you can get a robot to learn from watching humans, you've solved a major training bottleneck. New employees don't need to program robots. They just need to demonstrate tasks.

Foundation models significantly reduce both the cost and time required for robot training in manufacturing, with costs dropping from an average of

The Competitive Landscape

Skild AI isn't alone in this space. Understanding competitors helps contextualize the valuation and market opportunity.

1X and Neo's World Model

Norwegian robotics company 1X builds humanoid robots and just released its world model. Their approach is similar to Skild AI's: train a model that understands visual perception and physics, then use it to guide robot behavior.

1X has the advantage of controlling the robot hardware, so they can optimize everything end-to-end. But they're constrained to their own robot platform. Skild AI's multi-platform approach has broader reach.

Tesla's Optimus

Tesla is building humanoid robots and developing proprietary robot learning systems. With Elon Musk's resources and Tesla's manufacturing expertise, Tesla could compete directly with Skild AI.

But Tesla is focused on its own robots for now. Skild AI is positioning as the software layer that works across multiple platforms. These could be complementary rather than directly competitive.

Boston Dynamics

Boston Dynamics, now owned by Hyundai, has focused on pushing robot hardware capabilities to impressive limits. Their robots can do parkour and backflips. But they've been slower to commercialize learning capabilities.

Boston Dynamics has the research pedigree but less clear commercial strategy for robot learning as a product.

Field AI and Other Startups

There are a dozen other startups working on robot learning, adaptability, and foundation models. But Skild AI raised

This funding gap suggests either Skild AI's investors believe in superior technology or market position, or there's exuberance in the market for robotics AI. Probably both.

Market Size and Revenue Potential

Let's do some math on why Soft Bank thought $1.4 billion was reasonable.

Total Addressable Market

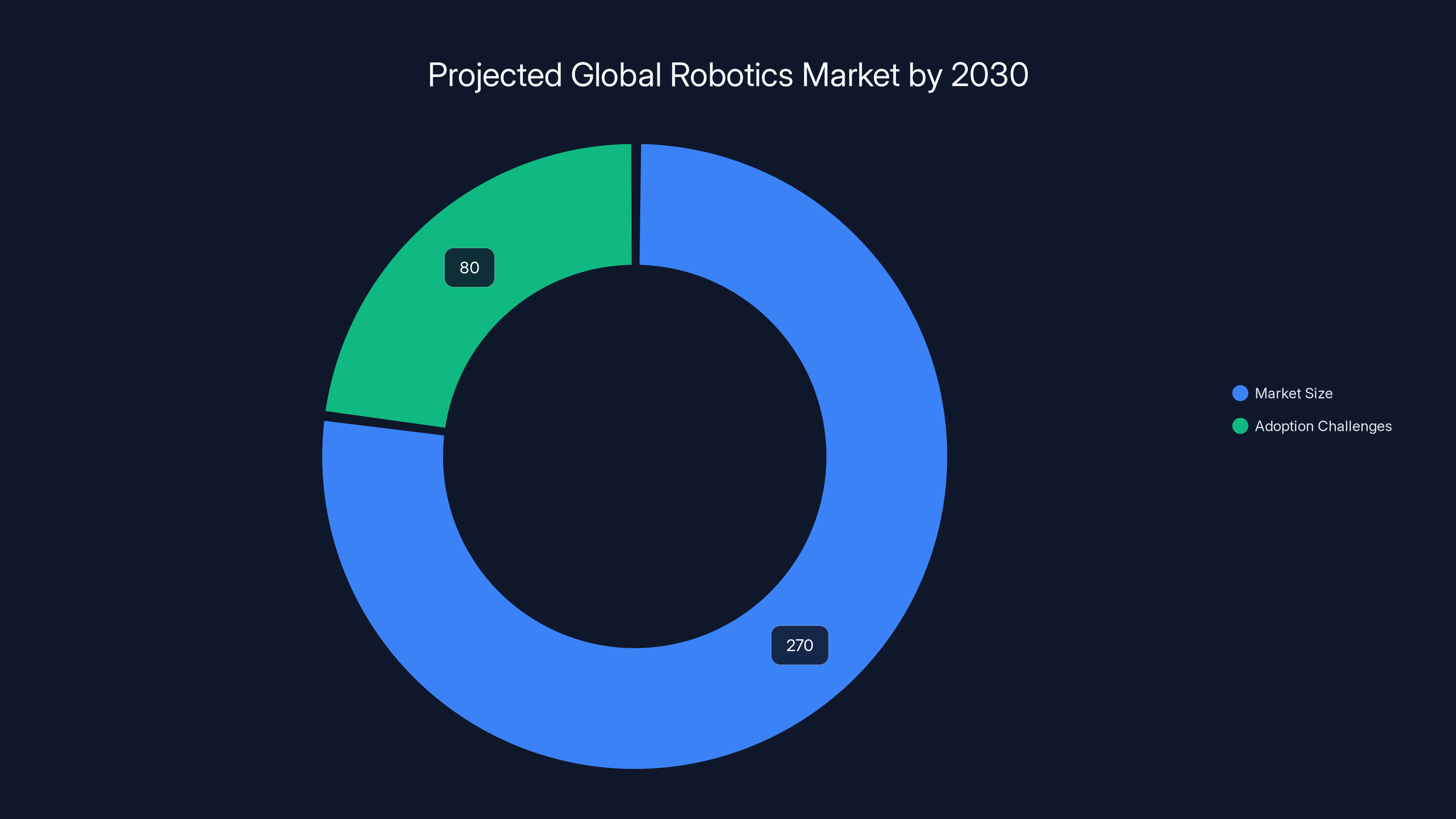

There are approximately 3 million industrial robots deployed globally. Plus millions more in logistics, warehousing, and emerging sectors. That number is growing at roughly 10-15% annually.

If Skild AI charges an average of

Of course, actual capture would be a fraction of this. Maybe 5-10% if they achieve market leadership. But even 5% of

At a 2x revenue multiple (common for high-growth software companies), that implies a $15 billion valuation. So the math, while optimistic, isn't absurd.

Pricing Models

Skild AI will likely use one of these pricing approaches:

- Per-robot licensing: Charge a fee for each robot using their software

- Subscription model: Monthly or annual fees based on usage

- Platform fees: Take a cut of automation efficiency gains

- OEM partnerships: Revenue share with robot manufacturers

The actual model will depend on how effectively they integrate with existing robot platforms and manufacturing workflows.

Path to Profitability

Here's the realistic timeline. Skild AI has raised over $2 billion to date. With that capital, they need to:

- Complete R&D and validation of foundation models

- Build integrations with major robot manufacturers

- Establish partnerships with system integrators

- Support initial customer deployments

- Handle support and iteration as real-world use cases emerge

In the best case scenario, they could reach

With $2 billion in capital, they have runway for 10+ years even if revenue never materializes. This gives them time to prove the concept.

The global robotics market is projected to reach $270 billion by 2030, but significant adoption challenges due to high costs and retraining time remain (Estimated data).

Technical Challenges Ahead

Let's be honest about what Skild AI still needs to prove.

Sim-to-Real Transfer

This is the hard problem. Simulation is perfect. Reality is messy. Robots experience wear, friction variations, imperfect sensor readings, and unexpected objects in their workspace.

Skild AI's models might perform at 95% accuracy in simulation but 70% in real factories. Closing that gap requires solving domain randomization, adversarial training, and real-world validation at scale.

Companies like Tesla have invested enormous resources into this problem. Skild AI will need to as well.

Safety and Liability

When a robot controlled by a foundation model makes a mistake, who's liable? The manufacturer? Skild AI? The factory?

This creates major friction in enterprise adoption. Customers will demand guarantees that Skild AI can't legally provide for novel learning systems. Insurance companies will be hesitant to cover accidents involving AI-controlled robots.

Skild AI will need to navigate these legal and insurance questions carefully.

Integration with Existing Systems

Every factory has its own control systems, safety protocols, and legacy software. Getting Skild AI's software to integrate smoothly is non-trivial.

You can't just drop in a new AI control system. You need to certify it, validate it against safety standards, get regulatory approval, and ensure it plays nicely with existing automation.

This integration work is expensive and slow. It's not flashy enough for marketing, but it's critical for commercial success.

Data Privacy and IP Concerns

Skild AI's models need to be trained on real-world robot data from customers. But customers are hesitant to share their proprietary factory data.

They need a solution that lets them learn from customer data without exposing that data to competitors. This requires federated learning or other privacy-preserving techniques. Building this infrastructure is complex.

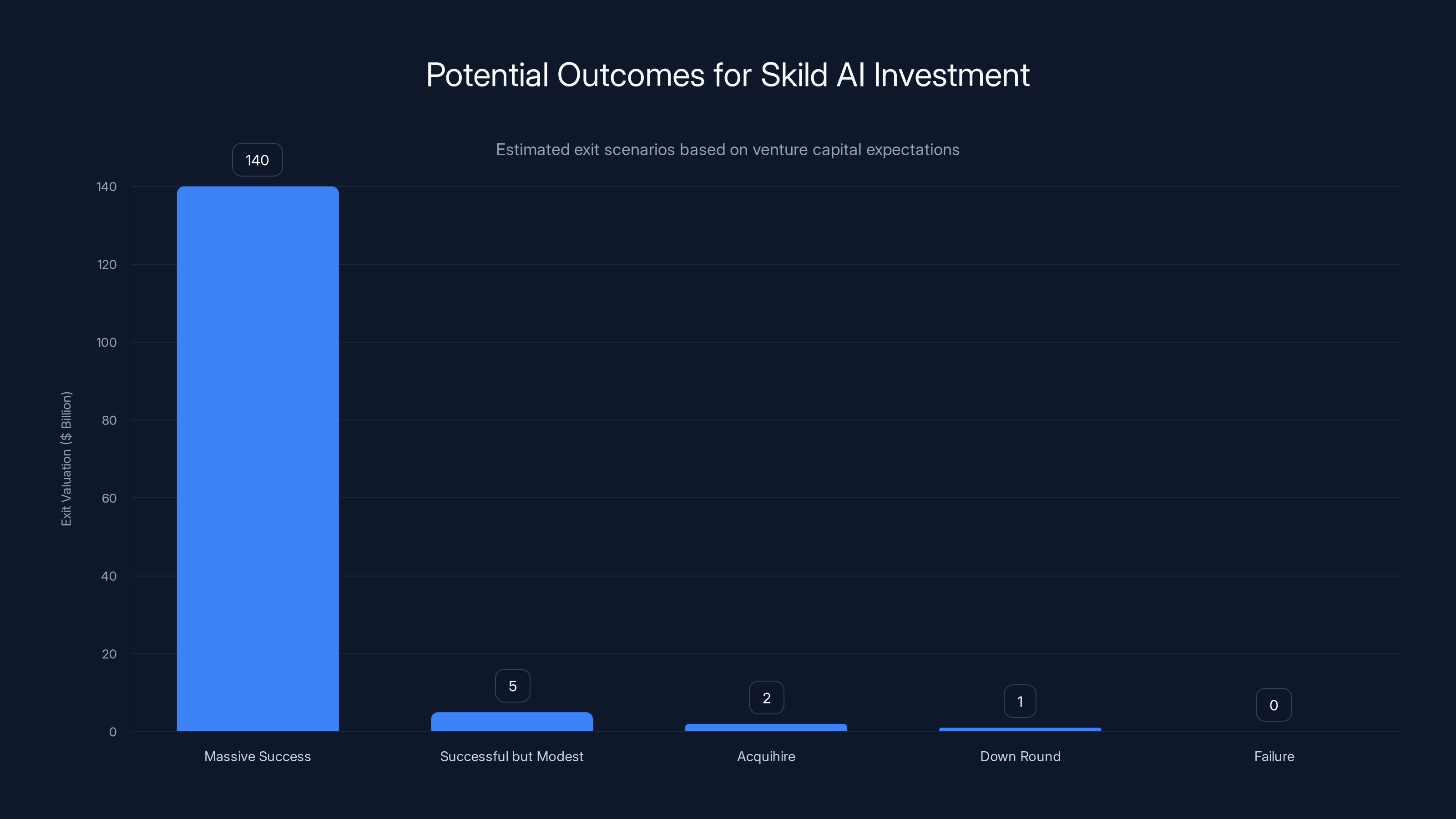

Investment Dynamics and Market Exuberance

Let's talk about the elephant in the room: is this valuation justified or are we seeing robotics hype similar to previous AI bubbles?

The Venture Capital Incentive Structure

Soft Bank and other large investors don't need Skild AI to become a

This might happen if Skild AI becomes critical infrastructure for robotics. But it's a best-case scenario. More likely outcomes are:

- Successful but not massive: $2-5 billion exit, modest return

- Acquihire: Robot manufacturer buys the team and talent

- Down round: Later funding at lower valuation

- Failure: Technology doesn't work as promised or market doesn't adopt

Venture capital has to price in these tail risks. The $14 billion valuation assumes a non-zero probability of massive success.

Historical Parallels

This feels similar to 2016-2018, when multiple robotics startups raised massive funding rounds based on promising technology and large TAM. Most didn't deliver. Some were acquired. Few became independent $10+ billion companies.

Robotic process automation (RPA) had a similar arc. Hype up, funding flowing, then underwhelming financial results. Blue Prism and Ui Path went public, but neither achieved the valuations investors had hoped for.

Why This Time Might Be Different

That said, there are genuine differences now. Foundation models have actually solved hard problems in other domains. LLMs work. Vision models work. The underlying technology is proven.

The question is whether it translates to robotics specifically. Robotics is harder than language or vision alone because it requires understanding physical consequences and interacting with a physical environment.

But if anyone can bridge this gap, it might be Deepak Pathak's team at Skild AI. The team's pedigree suggests genuine technical depth.

Estimated market share shows Skild AI as a leading player in robotics software, closely followed by Tesla Robotics and Boston Dynamics. Estimated data.

What Success Looks Like for Skild AI

If Skild AI executes, what does the next 5-10 years look like?

Year 1-2: Validation and Partnerships

Skild AI proves its foundation models work on real robots in controlled environments. They establish partnerships with ABB, Fanuc, or other robot manufacturers to integrate their software.

They sign first customer contracts with innovative manufacturers willing to take on the risk of new technology. These pilots validate the approach and generate case studies.

Year 3-4: Market Traction

Word spreads among system integrators and manufacturers. Adoption accelerates. Skild AI's software becomes available in standard robot configurations.

The company raises $3-5 billion in additional funding (if needed) based on early revenue success. They hire aggressively to scale customer support and platform development.

They might acquire complementary technology or companies that solve adjacent problems.

Year 5-10: Ecosystem Leadership

Skild AI becomes the standard foundation model layer for robotics. Most new robot deployments include their software. Industry standards emerge around their technology.

The company goes public or gets acquired at a $50-100+ billion valuation. Investors see 5-7x returns. Early employees become wealthy.

This is the success scenario. It requires excellent execution, favorable market conditions, and solving technical challenges that currently seem unsolved.

Failure Scenarios

What if things go wrong? Several failure modes exist:

- Technology doesn't transfer to real world: Models work in simulation but fail on real robots

- Adoption is slower than expected: Manufacturers prefer incrementally improving existing software

- Competition edges them out: Tesla, Boston Dynamics, or others execute better

- Economic downturn: Reduces automation investment

- Regulatory friction: Safety requirements make deployment difficult

In these scenarios, Skild AI might get acquired for $3-5 billion, or the company struggles to achieve the growth trajectory investors expect.

The Broader Implications for Automation

Beyond Skild AI's specific prospects, what does this funding round tell us about the future of work and automation?

Manufacturing Will Look Different

If robot learning becomes commodified, factories will look dramatically different within 15 years. Production lines will be more flexible. Factories can pivot between products faster. Small manufacturers can afford automation.

Labor dynamics will shift. Fewer low-skill manufacturing jobs, but more jobs in robot programming, maintenance, and oversight. The overall impact on employment is unclear and depends on how quickly adoption happens.

Automation Will Accelerate in Unexpected Sectors

Robotics has been concentrated in auto manufacturing, electronics, and pharmaceuticals. But easier-to-train robots could drive adoption in food processing, agriculture, logistics, construction, and healthcare.

We might see robots handling nursing assistant tasks, farm management, or warehouse optimization. These sectors have labor shortages, making them attractive for automation even if the robots aren't perfect.

Commercial Pressure Will Increase

Once foundation models prove viable, competitive pressure will force adoption even for companies uncomfortable with robotics. If your competitor can produce 20% faster with automation, you need to match them or lose market share.

This creates a classic arms race dynamic. Individual companies might prefer a world without automation-driven productivity pressure, but markets don't work that way.

The AI Infrastructure Play

Skild AI is fundamentally an AI infrastructure play. Like GPUs, like cloud computing, like APIs. If they succeed, they'll be critical infrastructure that other companies build on.

This is why the valuation might not be crazy. Critical infrastructure commands premium valuations.

Estimated data shows a range of potential outcomes for Skild AI, from massive success at $140 billion to failure. Most likely scenarios involve modest exits or acquihires.

Lessons for Other AI Startups

Skild AI's funding round offers lessons for entrepreneurs and investors in AI.

Pick Problems That Compound Value

Skild AI isn't trying to build a better robot. They're trying to make robot software dramatically better, which enables better robots, which enables broader adoption, which creates new applications.

Compounding value problems are more attractive to investors than incremental improvements. Pick a bottleneck that, if solved, enables multiple downstream applications.

Control Critical Infrastructure

Skild AI positioned itself as the software layer across multiple robot platforms. This is power. It's harder to displace a critical infrastructure layer than a feature in a product.

If you're building AI systems, try to position as infrastructure rather than application. Infrastructure commands higher valuations and switching costs.

Solve Real Problems for Paying Customers

Foundation models are cool. But Skild AI's actual value comes from solving specific problems for robot manufacturers and factories. The models are a means to that end.

Don't fall in love with your technology. Fall in love with your customer's problem. Skild AI understands that robot training is expensive and slow. That's their North Star, not the elegance of their models.

Build Deep Domain Expertise

Skild AI's team comes from robotics research and understands the field intimately. This credibility matters when raising $1.4 billion.

If you're building AI in a technical domain, hire domain experts. They understand the real constraints, the regulatory environment, and the competitive dynamics. General AI expertise isn't sufficient.

The Next Decade of Robotics

Assuming Skild AI or a competitor successfully deploys robot foundation models, what's the trajectory?

2025-2027: Proof of Concept Phase

Initial deployments validate the technology. News stories celebrate robots learning new tasks in weeks instead of months. Some robots fail spectacularly, which also makes news.

Robot manufacturers integrate foundation models into standard offerings. More companies start thinking about robot adoption.

2027-2030: Mainstream Adoption

Third-wave robotics emerges. The first wave was industrial robots bolted to the factory floor. The second wave was mobile robots. The third wave is adaptive robots that learn.

Utility and distribution companies start using robots for warehouse operations. Food processing plants automate previously labor-intensive tasks. Agriculture sees significant robotics adoption.

2030+: Robotics Becomes Ambient

Robots are everywhere in commercial and industrial settings. Every warehouse has multiple robot types working collaboratively. Many manufacturing processes are partially or fully automated.

The labor market adjusts. Some jobs disappear. New jobs emerge. Inequality potentially increases if wealth from automation concentrates. Governments grapple with UBI, retraining programs, and robot taxation.

This is not inevitable. It depends on Skild AI and competitors succeeding. But if they do, the changes will be profound.

Risk Factors and Realistic Assessment

Let's be honest about what could go wrong and why skepticism is warranted.

Hype Cycles Always Correct

We've seen this before. VR was going to change everything in 2016. Blockchain in 2018. Metaverse in 2022. Each time, venture capital flooded the space, valuations inflated, and then reality disappointed.

Robotics might follow the same pattern. The technology might work eventually, but the timeline could be 20 years instead of 5.

Organizational Inertia Is Powerful

Even if Skild AI's technology is superior, adoption faces friction. Factories have $10-50 million investments in existing automation. They're not rushing to rip and replace.

Risk-averse enterprises prefer incremental improvements to incumbent suppliers over bets on new startups. Skild AI will need to overcome this inertia with customer success stories and risk mitigation.

Regulatory Uncertainty

As robots become more autonomous and adaptive, regulatory bodies will step in. The EU is already thinking about AI regulations. Safety standards for autonomous robots will become more stringent.

This could slow adoption. Skild AI might need to invest heavily in compliance, certification, and insurance.

The Technology Might Not Generalize

Here's the uncomfortable truth: foundation models work remarkably well for language and images because these domains are well-explored and have massive amounts of training data.

Robotics is harder. Each robot is different. Each environment is unique. The physical world has unlimited edge cases. Skild AI's models might work for 80% of tasks but struggle with the long tail.

If true generalization remains elusive, they become a narrower, less valuable company.

Talent Scarcity

To execute at this level, Skild AI needs dozens of top-tier robotics and AI researchers. These people are in high demand and expensive.

Competition from Google, Meta, Tesla, and Chinese tech companies for talent is fierce. Skild AI might face a ceiling on how fast they can scale.

Why This Matters to You

You might be thinking: "This is interesting, but how does Skild AI funding affect my life?"

More than you think.

If You Work in Manufacturing

Your job might be affected. Not necessarily disappearing, but changing. If robots become easier to train and deploy, your factory might accelerate automation plans. You might transition from manual work to robot supervision and maintenance.

Companies should be investing in retraining programs now. Waiting until robots arrive is too late.

If You Run a Startup

Skild AI's funding shows that robotics is heating up again as an investment category. If you're building in adjacent areas (robot safety, fleet management, simulation, etc.), this is good news. Capital is flowing toward the space.

If You're an Investor

The Skild AI round suggests that mega-cap VCs (Soft Bank) see robotics as a meaningful opportunity. This might justify more speculative bets on earlier-stage robotics companies.

If You're Just Curious About Technology

Skild AI represents a specific bet: that artificial intelligence has advanced enough to generalize robot learning across diverse platforms and tasks. If true, it's a big deal. If false, it's a very expensive lesson.

The outcome will tell us a lot about the limits of current AI technology.

Conclusion: The Bet, the Risk, and What's Next

Skild AI raising

The vision is compelling: robots that learn like humans do, that adapt to new tasks without retraining, that work across different platforms and environments. If achieved, this unlocks automation opportunities across countless industries and transforms manufacturing, logistics, and labor.

But the risk is equally substantial. Foundation models might not generalize to robotics the way they did to language. Real-world deployment is messier than lab validation. Adoption might be slower than optimistic projections suggest.

We won't know for 3-5 years. By then, we'll either see Skild AI becoming the critical infrastructure layer they're positioning to be, or we'll see follow-on funding become scarce and the company struggle to prove its promises.

Most likely, the truth is somewhere in between. The technology probably works better than skeptics expect but worse than advocates hope. The company becomes valuable and influential without becoming a $100+ billion juggernaut.

What's certain is that someone will solve the robot learning problem eventually. The only question is whether it's Skild AI or a competitor. The $1.4 billion bet is Soft Bank's way of saying: we think it's Skild AI, and we're willing to put serious capital behind that conviction.

Time will tell if they were right.

FAQ

What is Skild AI?

Skild AI is a robotics software company founded in 2023 that builds foundation models specifically designed for robots. These foundation models enable robots to learn new tasks more efficiently, adapt to new environments, and generalize across different robot platforms without requiring extensive retraining for each new task.

How do foundation models work for robots?

Robot foundation models are trained on diverse robotic data from simulation and real-world examples to learn abstract representations of physics, visual perception, and task execution. Once trained, these models can be deployed to different robots and adapted to new tasks through minimal additional training or demonstrations, similar to how foundation models work in language and vision applications but applied to physical robot control and perception.

Why did Soft Bank invest $1.4 billion in Skild AI?

Soft Bank invested this massive amount because the company is solving a critical bottleneck in robot adoption: training robots for new tasks is expensive and time-consuming. If Skild AI successfully makes robot training faster and cheaper, it could unlock trillions in automation investment across manufacturing, logistics, and other industries. Additionally, the company positions itself as infrastructure that works across multiple robot platforms, making it valuable to the entire robotics ecosystem.

What makes Skild AI different from competitors like Tesla or Boston Dynamics?

Unlike Tesla (which focuses on its own humanoid robots) or Boston Dynamics (which focuses on hardware innovation), Skild AI is building software that works across multiple robot platforms from different manufacturers. This platform approach gives them broader addressable market reach. Additionally, Skild AI focuses specifically on foundation models and learning systems rather than building complete robot systems, positioning them as infrastructure rather than end-to-end solutions.

What problems does Skild AI actually solve?

Skild AI addresses three major problems in robotics: the training bottleneck (robots take weeks to train for new tasks), the generalization problem (robots trained in one environment often fail in slightly different conditions), and the scale problem (getting robots from different manufacturers to learn from shared data and models). By solving these problems, they enable faster automation deployment and broader robot adoption.

What is the addressable market for Skild AI?

Skild AI's potential market includes the approximately 3 million industrial robots already deployed globally plus millions more in emerging automation sectors like logistics, agriculture, and healthcare. If the company can charge

What could go wrong with Skild AI's technology?

Several risks exist: the foundation models might not transfer effectively from simulation to real-world environments (the "sim-to-real gap"), adoption might be slower than expected due to customer risk aversion, competing solutions from larger companies like Tesla might prove superior, regulatory and safety requirements might slow deployment, or the technology might only work for certain types of tasks rather than generalizing broadly across all robot applications.

When could we expect to see Skild AI's technology deployed in factories?

Based on typical venture capital timelines for deep-tech companies, we'll likely see proof-of-concept deployments within 1-2 years and broader market adoption within 5-10 years if the technology validates successfully. However, enterprise robotics deployments have long sales cycles, so widespread adoption could take 10-15 years even if the technology works perfectly.

How does this impact job displacement and manufacturing workers?

If Skild AI succeeds, manufacturing labor will shift rather than disappear immediately. Jobs in manual robot programming and training will decrease, but new jobs in robot supervision, maintenance, fleet management, and data analysis will emerge. The speed of transition matters enormously for workers. Companies should be investing in retraining programs now to help workers adapt proactively rather than reactively.

Is the $14 billion valuation justified?

That depends on your perspective. From a venture capital standpoint, the valuation assumes Skild AI captures a significant portion of a massive market and achieves substantial profitability within 10-15 years. This is plausible but far from certain. Skeptics would argue the valuation reflects exuberance in AI and robotics hype similar to previous cycles. Realistically, Skild AI will likely become a valuable company but probably not reach the heights the valuation assumes.

Key Takeaways

- Skild AI raised 14B valuation to build foundation models that teach robots to learn new tasks without extensive retraining

- The company addresses a real bottleneck: robot training is expensive and slow, limiting automation adoption in manufacturing and logistics

- Foundation models work because they enable generalization—robots learn abstract representations that transfer to new environments and tasks

- Competition is fierce from Tesla, Boston Dynamics, and 1X, but Skild AI's cross-platform approach gives it a different positioning as infrastructure

- Success would unlock trillions in automation investment, but risks remain: sim-to-real transfer challenges, slower-than-expected adoption, and regulatory friction

- The investment signals that mega-cap VCs believe robotics AI is reaching an inflection point, though valuation levels suggest significant exuberance

Related Articles

- CES 2026's Best and Weirdest Tech Products Explained [2026]

- CES 2026 Robots: The Good, Bad, and Revolutionary [2025]

- The Robots of CES 2026: Humanoids, Pets & Home Helpers [2025]

- VoiceRun's $5.5M Funding: Building the Voice Agent Factory [2025]

- Microsoft's Community-First Data Centers: Who Really Pays for AI Infrastructure [2025]

- Microsoft's Data Center Expansion: How Tech Giants Are Managing Energy Costs [2025]

![Skild AI Hits $14B Valuation: Robotics Foundation Models Explained [2025]](https://tryrunable.com/blog/skild-ai-hits-14b-valuation-robotics-foundation-models-expla/image-1-1768408818227.jpg)