Space X Acquires x AI: Building the Universe's First AI-Powered Megastructure

When Elon Musk announced Space X's acquisition of x AI in early 2025, the tech world did what it always does: it split into two camps. One side saw visionary ambition. The other saw classic Musk overreach. Neither was entirely wrong.

What's happening here isn't just another corporate acquisition. It's a fundamental bet that the future of artificial intelligence won't be built in data centers on Earth. Instead, it'll be assembled in orbit, powered by a constellation so massive it makes today's Starlink seem quaint by comparison.

Let's break down what this deal actually means, why it matters, and whether it's genius or catastrophe waiting to happen.

The Deal: What Space X Just Acquired

On paper, the acquisition seems straightforward. Space X, the world's most successful commercial spaceflight company, acquired x AI, Elon Musk's artificial intelligence venture founded in 2023. The merged entity now operates as a single vertically integrated company spanning rockets, satellites, internet infrastructure, and AI models.

But the real story is much more ambitious than a simple merger. Space X didn't acquire x AI just to own the Grok chatbot or integrate it with X (formerly Twitter). The acquisition serves a singular, almost obsessive purpose: to build the computational backbone that Musk believes will dominate the AI industry for the next decade.

In a company-wide email to Space X employees, Musk outlined the vision with characteristic grandeur. The merged company, he wrote, represents "the most ambitious, vertically-integrated innovation engine on (and off) Earth." The phrase "on and off Earth" isn't flowery language. It's literal. Space X will use its launch capabilities, satellite manufacturing expertise, and orbital operations experience to deploy computing hardware directly into space.

The scale is staggering. Space X filed with the Federal Communications Commission for permission to launch up to 1 million satellites that will function as orbital data centers. These aren't traditional communications satellites. They're computing nodes deployed across multiple orbital altitudes between 500 and 2,000 kilometers, arranged in configurations optimized for power delivery and data throughput rather than ground coverage.

This isn't a quick side project. Musk expects Starship, Space X's next-generation super-heavy-lift rocket, to begin launching these new satellite types this year. The cadence matters enormously. Musk projects launching up to 1 million tons per year to orbit, which at 100 kilowatts of compute power per ton, would generate 100 gigawatts of additional AI computing capacity annually.

To put that in perspective, that's roughly equivalent to the total electricity consumption of a small country, delivered entirely through a constellation of satellites.

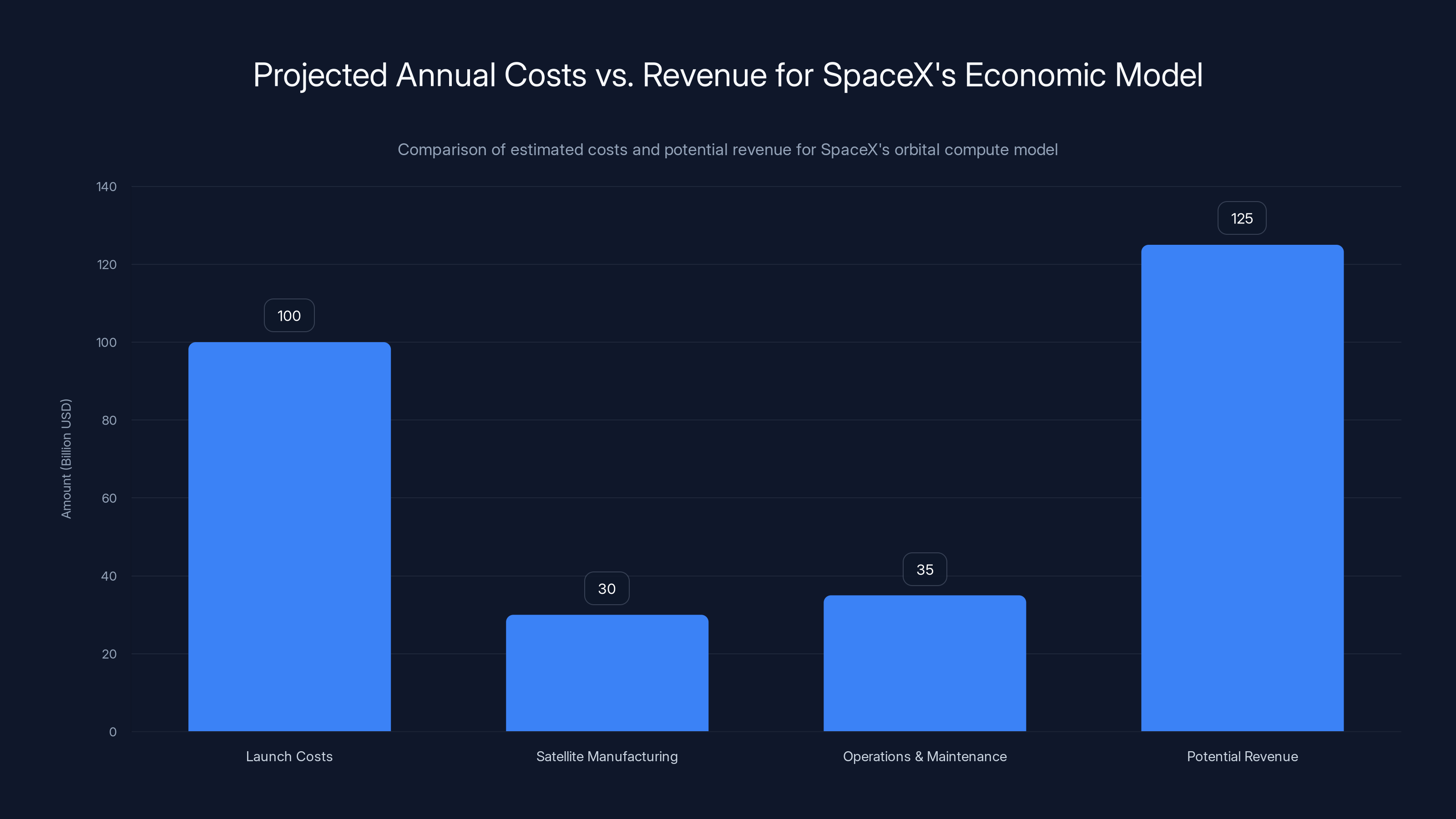

Estimated data shows potential revenue of

Why Orbital Data Centers? The Thermal Efficiency Argument

At first glance, the idea of building data centers in space sounds absurd. Ground-based infrastructure is proven, cheaper to build, and easier to maintain. Why would Space X or any rational company go to the trouble of launching hardware into orbit?

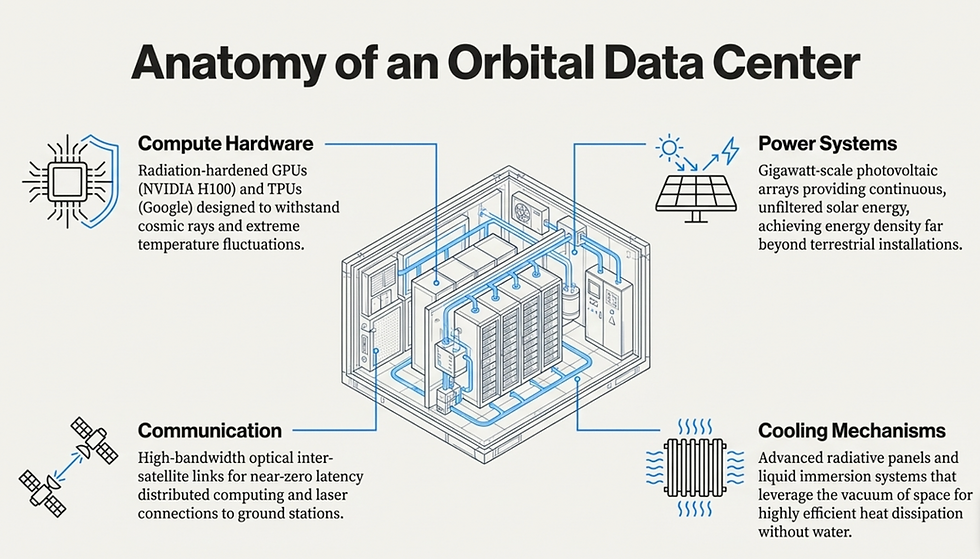

The answer comes down to physics and an AI industry constraint that's become increasingly obvious: heat dissipation.

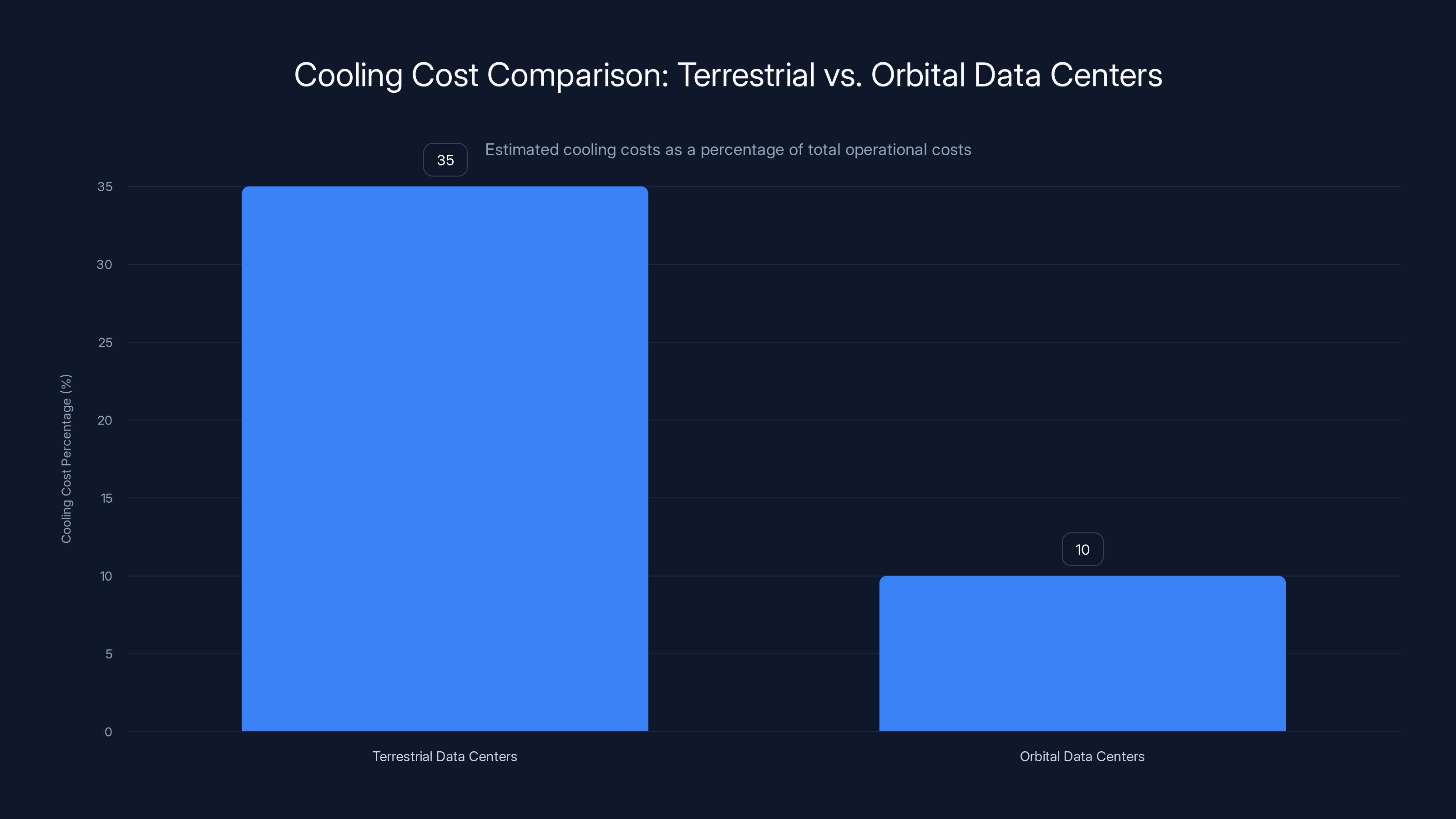

Modern AI models demand extraordinary amounts of electrical power. Training models like GPT-4 or competing systems requires running massive arrays of GPU clusters continuously, often for weeks or months. All that computation generates waste heat. In terrestrial data centers, cooling accounts for roughly 30-40% of total operational costs. You need massive cooling systems, water circulation, air handling, redundant systems. It adds up.

In space, there's a more efficient solution: you just point the radiators at the void of space and let the thermal radiation do the work. Space is approximately 2.7 Kelvin in background temperature. That's colder than any refrigeration system on Earth can possibly achieve. The heat differential is enormous, which means radiant cooling becomes dramatically more efficient.

Space X's calculations, as shared with employees, assume orbital data centers could reach operational efficiency that terrestrial facilities simply cannot match. Musk wrote that "within 2 to 3 years, the lowest cost way to generate AI compute will be in space." That's not a minor claim. That's saying orbital infrastructure beats Earth-based facilities on the primary metric that matters in the AI industry: cost per unit of compute.

If he's right—and that's a significant conditional—the advantage becomes recursive. Cheaper compute means companies can train larger models faster. Faster iteration means better products. Better products mean market dominance. Dominant players have resources to build more satellites. More satellites provide even more compute. And so on.

But the thermal argument alone doesn't fully explain the ambition. There's a secondary advantage that might be even more compelling.

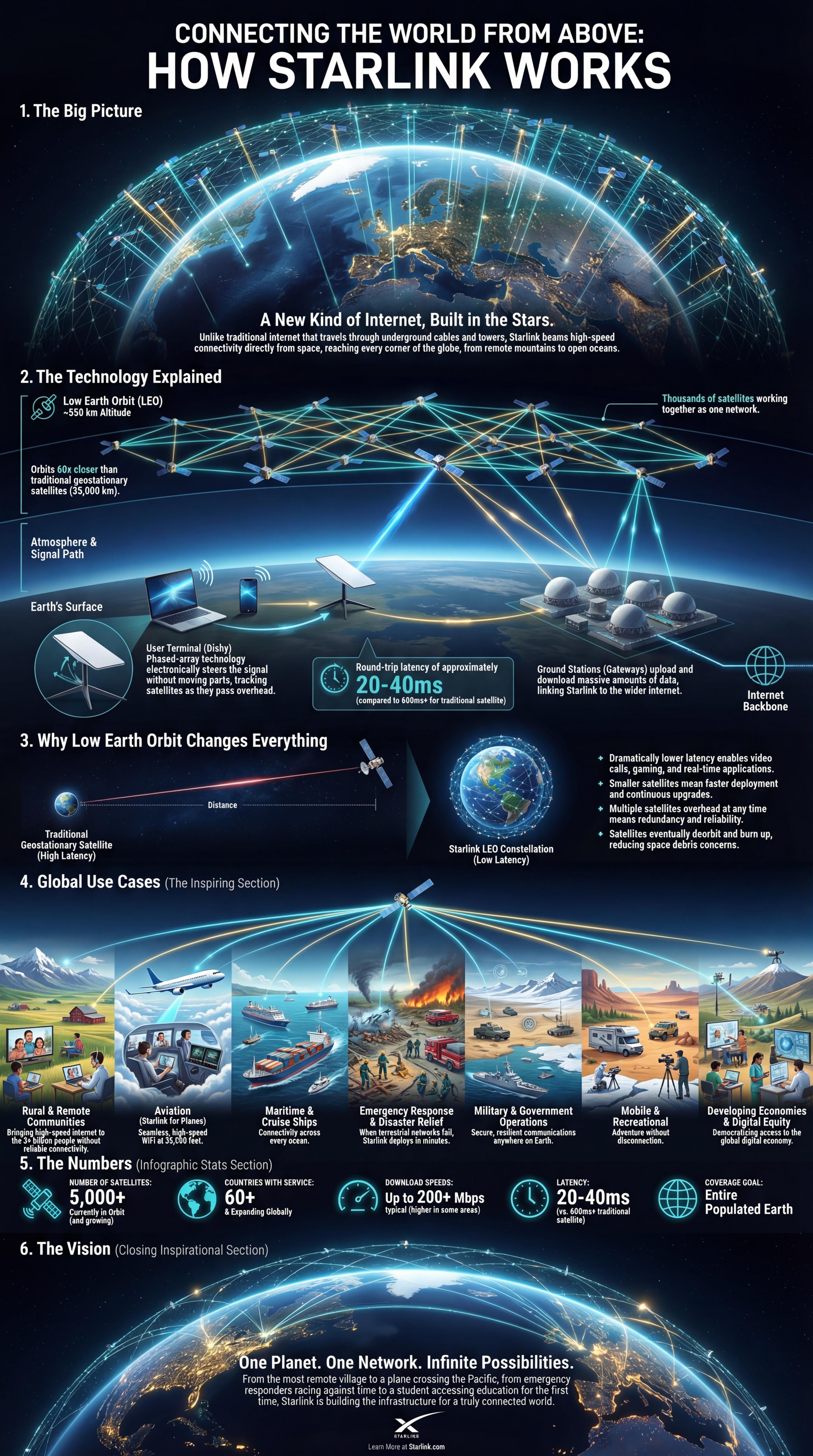

Direct Access to Global Audiences: The Starlink Integration

Space X doesn't just have launch capability. It also operates Starlink, the world's largest satellite internet constellation. This creates a unique advantage that no other company can replicate: an integrated path from AI computation to end users anywhere on Earth.

Think about how AI services work today. A user in rural Kenya sends a query to a data center in Virginia. The request travels through undersea cables, terrestrial fiber networks, and routing hubs, experiencing latency at each hop. The response travels the same path back. Depending on network conditions and routing, that round-trip could take anywhere from 100 milliseconds to several seconds.

With space-based AI infrastructure integrated into Starlink, the path changes dramatically. A user's request goes directly from their terminal to an orbital platform passing overhead. Latency collapses to milliseconds. Response times improve. And crucially, Space X owns the entire stack from satellite to ground terminal to backend compute.

This creates competitive advantages in several domains simultaneously:

Rural and remote connectivity: Regions without fiber infrastructure suddenly gain access to frontier AI services at comparable latency to urban centers. That's a potentially massive market in Africa, South Asia, and the developing world.

Direct-to-device AI: Space X is already developing direct-to-mobile satellite communications, which means users could access AI services without cellular networks entirely. Your phone talks directly to satellites. The satellites route to orbital data centers. You get responses without depending on terrestrial telecom infrastructure.

Real-time applications: Low-latency AI becomes possible for applications currently impractical on Earth. Financial trading, augmented reality, autonomous vehicle coordination, medical imaging analysis—anything sensitive to network delay becomes viable.

Platform lock-in: Once Space X has customers using Starlink-connected AI services, switching costs become enormous. You'd have to rip out hardware and shift to a competitor's services.

Musk's vision statement captured this integration explicitly: the merged company could provide "AI on demand, anywhere in the world, to any mobile device." That's not marketing fluff. That's a complete replacement of how AI services reach users.

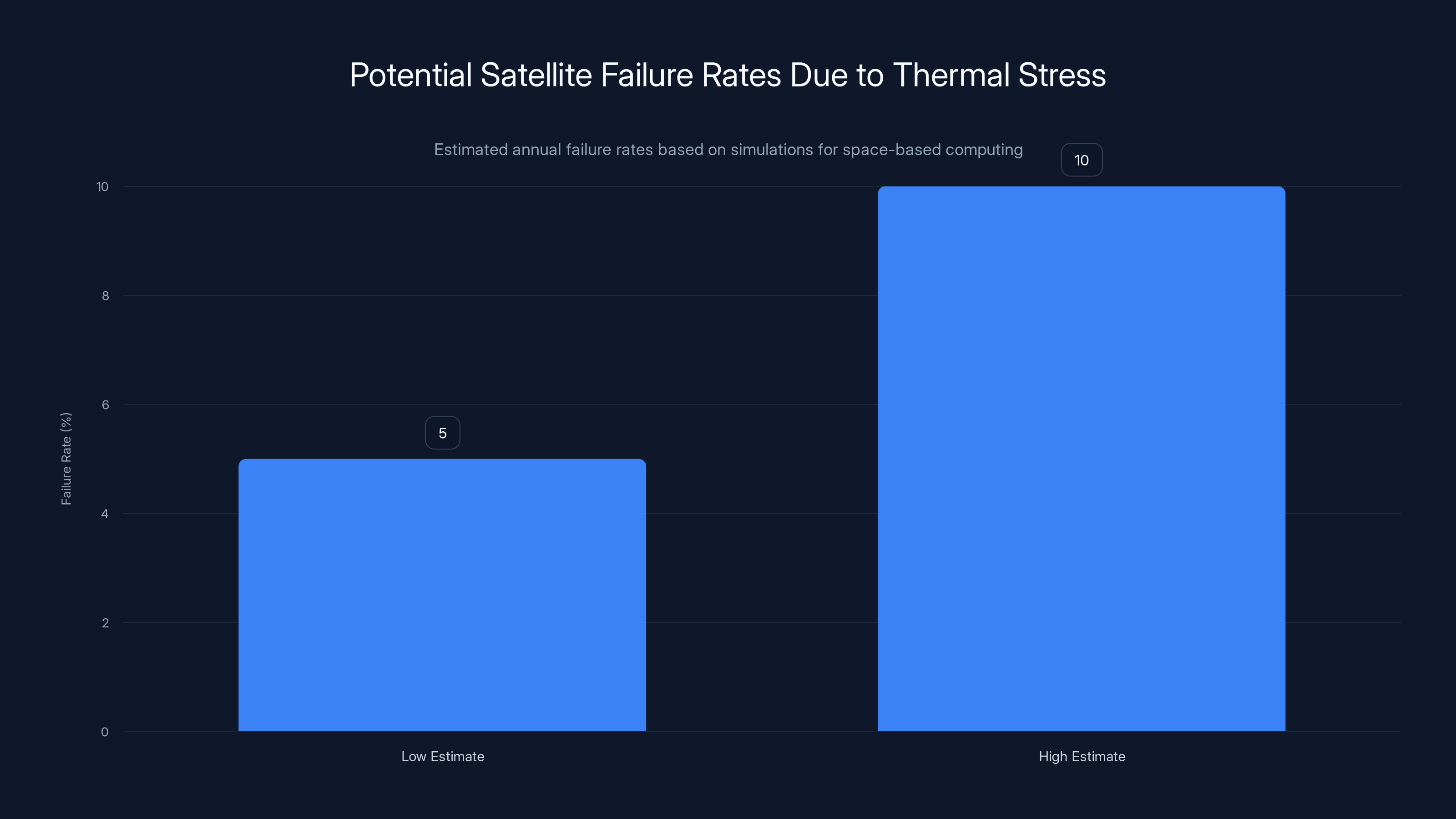

Simulations suggest that radiator failure rates could range from 5% to 10% annually, potentially requiring the replacement of 50,000 to 100,000 satellites each year. Estimated data.

The Vertical Integration Thesis: Why It Matters

One phrase kept appearing in Space X's announcement: "vertically integrated."

Vertical integration means controlling every layer of the value chain. Space X currently builds rockets, launches satellites, manufactures those satellites, operates the constellation, manages network traffic, and now trains and deploys AI models. It's almost absurd how complete the stack is.

Compare that to competitors:

Open AI depends on cloud providers for compute. It pays Microsoft or AWS billions for access to data center capacity. It has no control over hardware refresh cycles, cooling systems, or network routing. When its models scale, it's constrained by how fast hyperscalers can provision capacity.

Google owns data centers and compute infrastructure, but it doesn't own launch capability. The infrastructure is Earthbound. Thermal constraints still apply.

Meta same situation. Enormous data center operations, but no path to space-based compute.

Space X is proposing something different: a company that owns the rockets launching the hardware, manufactures the hardware, operates the satellite constellation, manages the network, and runs the AI models on top. At each layer, it captures margin. At each layer, it has direct control over optimization.

The economic implications are profound. If orbital data centers truly achieve lower cost-per-compute than terrestrial alternatives, then Space X's integrated model generates competitive moat. Competitors would have to either build their own constellation (extraordinarily capital intensive) or pay Space X for access (surrendering margin).

This is why the acquisition of x AI specifically matters. Musk needs an AI company to showcase the capability, to demonstrate that orbital compute is viable, and to generate the demand that justifies the infrastructure investment. x AI's Grok serves that purpose. It's the proof of concept for space-based AI infrastructure.

The Technical Challenges: What Could Go Wrong

Now, here's where the skepticism becomes justified. This plan is technically audacious, which means it's also technically risky. Several enormous problems need solving.

Orbital Debris and Collision Risk

Deploying 1 million satellites creates an unprecedented collision risk problem. Each satellite travels at 27,000 km/h relative to Earth. A collision with debris or another satellite generates thousands of additional debris fragments, each capable of destroying other satellites. This cascading effect, called Kessler Syndrome, could render entire orbital regions unusable within years.

Space X is aware of this danger. The company recently announced plans for a space situational awareness system called Stargaze, which uses star trackers to identify potential collisions and help deconflict satellite trajectories. But deploying a million satellites still represents an order-of-magnitude increase in collision risk.

Brian Weeden, director of civil and commercial policy at The Aerospace Corporation, noted that orbital safety advancement has matched rocketry progress over the past decade. But matching historical progress rates might not be enough for a million-satellite constellation. The problem scales nonlinearly.

Thermal Management at Scale

The thermal advantage of space-based computing assumes perfect radiator engineering. But satellites experience extreme temperature cycling. When a satellite passes over the daylight side of Earth, solar radiation heats it. During eclipse, it radiates heat into space and cools rapidly. Thermal stress causes fatigue. Materials crack. Coatings degrade.

Simulations suggest radiator failure rates could reach 5-10% annually for some satellite designs. If that holds true, Space X would need to replace 50,000-100,000 satellites per year just to maintain constellation capacity. That requires launching roughly 2,500-5,000 tons annually to orbit—ambitious but potentially feasible for Space X's projected Starship cadence.

Manufacturing and Launch Bottleneck

Building 1 million satellites isn't a trivial manufacturing problem. Starlink satellites are relatively simple, costing roughly

Space X has the foundries and expertise, but not instantly. The manufacturing ramp would likely take 5-7 years to reach full capacity. Concurrently, launch frequency needs to scale from roughly 50-70 launches per year to potentially 100-200+ launches annually. That requires Starship to achieve extraordinary operational reliability very quickly.

The company is confident but hasn't yet demonstrated the launch rates it's projecting.

Power Generation in Orbit

Satellites use solar panels for power, but solar output is limited. A 1-ton satellite with efficient solar panels might generate 10-15 kilowatts of power. At 100 kW per ton, the plan assumes either smaller tons of cargo or much more efficient power generation than current technology achieves.

Alternatively, some orbital data center concepts propose nuclear power sources. That immediately introduces regulatory complexity. International treaties govern weapons in space, and nuclear reactors exist in a gray area. Launching hundreds of nuclear reactors into orbit would require unprecedented international coordination and regulatory approval.

The Competitive Landscape: Who's Threatened?

If Space X pulls this off, the implications cascade across multiple industries.

Cloud Providers Under Pressure

Companies like Amazon (AWS), Microsoft (Azure), and Google Cloud depend on data center economics as a core business model. If orbital compute becomes cheaper, their advantage erodes. They can't simply launch satellites themselves—that requires launch capability they don't possess. They could potentially buy capacity from Space X, but that puts them in a dependent relationship with their competitor.

Microsoft has actually invested in Space X and Starlink, so the relationship is already complex. But the acquisition of x AI might signal that Space X intends to compete for AI compute revenue directly, not just provide infrastructure to others.

Traditional Satellite Operators

Companies like Intelsat, SES, and Eutelsat operate telecommunications satellites. They've invested billions in infrastructure over decades. A sudden shift to space-based computing could cannibalize their satellite communications revenue. But it also creates potential partnership opportunities if they can integrate with Space X's infrastructure.

The real threat is obsolescence. If Space X proves that constellation-scale operations are more profitable than traditional satellite businesses, investors will flood capital toward constellation plays and starve legacy operators.

Government and National Space Agencies

Governments have maintained privileged access to space through national space agencies. Space X changed that by proving commercial launch was viable. A space-based AI infrastructure controlled by Space X further shifts power toward private entities.

This creates geopolitical tension. Countries don't want their AI compute dependent on Space X infrastructure. China will almost certainly pursue its own orbital data center constellation. Europe might partner with Space X or develop independent capability. India is exploring options. The space domain is becoming directly tied to AI dominance, which ties to economic and military power.

Estimated data shows that orbital data centers could significantly reduce cooling costs compared to terrestrial centers, potentially lowering from 35% to 10% of total operational costs.

The Economic Model: Can It Actually Work?

Ignoring the technical challenges for a moment, does the unit economics make sense?

Musk's projection: launching 1 million tons per year to orbit at 100 kW per ton generates 100 gigawatts of compute annually. At current pricing for AI compute (roughly

However, costs are substantial:

Launch costs: Assuming Starship achieves

Satellite manufacturing: 1 million satellites at

Operations and maintenance: Constellation management, collision avoidance, debris mitigation, customer support, and software maintenance probably add another $20-50 billion annually.

Capital expenditure: The initial constellation deployment might require

When you model it out, the business barely makes sense unless:

- Launch costs drop below current projections (Starship achieves Musk's goals)

- AI compute demand grows dramatically beyond current rates

- Orbital compute truly achieves lower cost than terrestrial alternatives

- Space X captures dominant market share of space-based AI capacity

Each assumption is plausible. None is guaranteed.

Regulatory Obstacles: The Bureaucracy Question

Beyond technical challenges, Space X faces massive regulatory hurdles.

The FCC filing triggered concerns about spectrum allocation. Radio frequencies are finite resources. A million satellites all transmitting and receiving simultaneously creates interference risks. Space X will need to coordinate with international telecom bodies, other satellite operators, and government regulators in dozens of countries.

Orbital debris regulations are still developing. There's no established standard for acceptable constellation density. Space X's million-satellite plan might exceed thresholds that nations deem unsafe. The company will likely face pressure to self-police constellation density or face launch licenses being revoked.

Export control is another minefield. Advanced computing hardware and AI systems are restricted for national security reasons. Space X can't freely sell orbital compute to any customer. It might face pressure to prioritize American companies or exclude adversarial nations. That limits the addressable market.

The x AI Angle: Why This Matters Beyond Hardware

People often focus on Space X's launch and satellite expertise when discussing this deal. But acquiring x AI brings something equally important: a cutting-edge AI research organization.

Grok, x AI's chatbot, has generated controversy for inappropriate content (including sexualized AI-generated imagery of minors), but the underlying technology is competitive with Open AI and Anthropic models. The team includes talent like Yang Zhang (formerly from Open AI) and other accomplished researchers.

Why does Space X need this? Because satellite operations themselves generate enormous data streams that could feed AI training. Every ground station communicates with thousands of satellites. Every satellite transmits telemetry. Every network hop generates routing data. In aggregate, Space X operates one of the largest real-time data systems on Earth.

x AI's research team can build AI models specifically optimized for satellite constellation management, predictive maintenance, autonomous routing, and collision avoidance. The data advantage creates a virtuous cycle: better AI improves satellite operations, which generates better data, which trains better AI.

This is something Open AI or Google can't replicate. They don't own satellites. They don't have direct access to multi-terabyte streams of constellation telemetry. Space X + x AI creates a unique advantage in building AI systems optimized for space infrastructure.

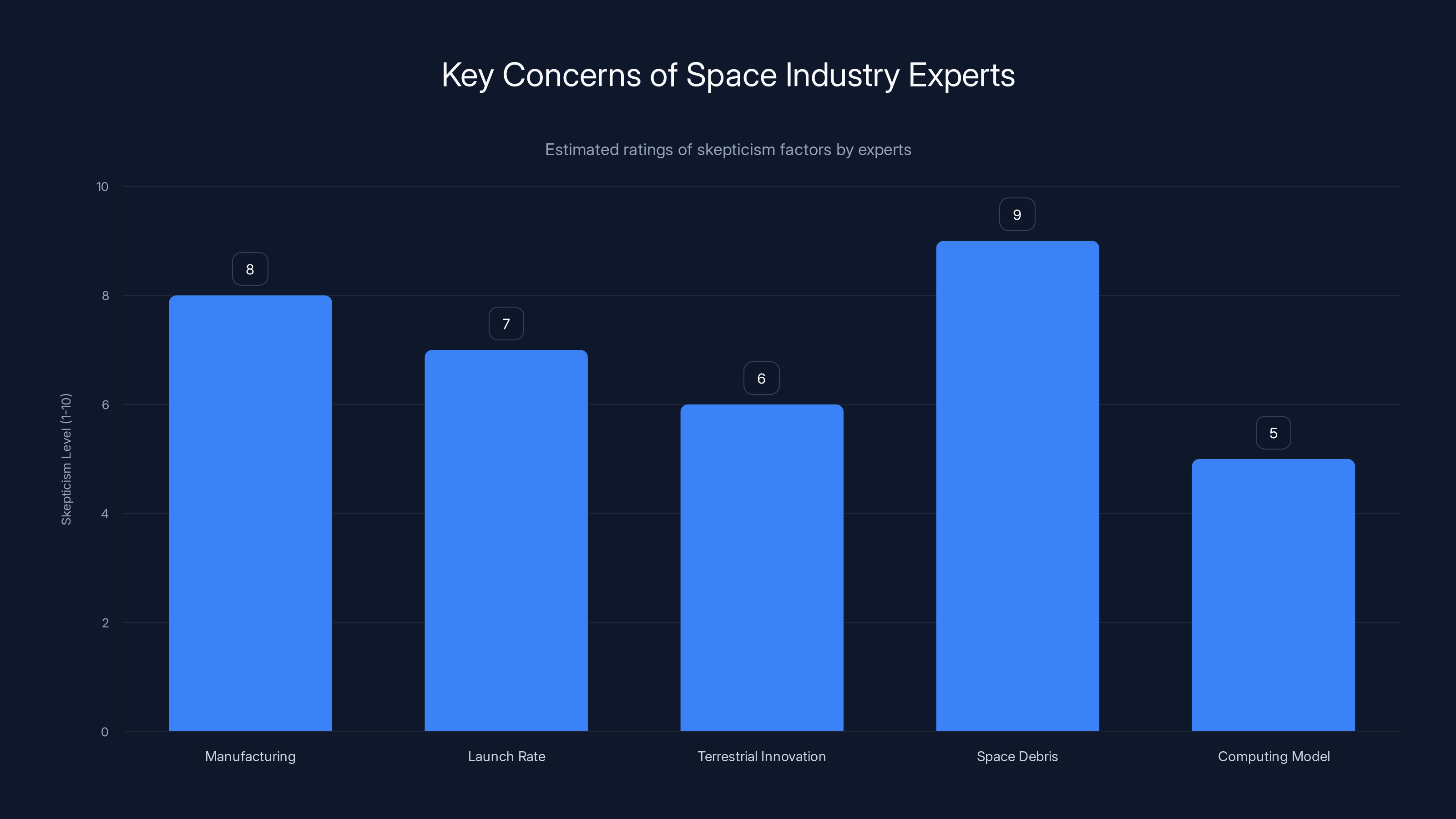

Experts express high skepticism about space debris and manufacturing capabilities, indicating significant concerns in these areas. (Estimated data)

Timeline and Feasibility: When Will This Actually Happen?

Musk's projections suggest aggressive timelines. In his email to employees, he indicated:

- 2025: Starship V3 Starlink satellites and direct-to-mobile satellites launching regularly

- 2026-2027: Ramping toward regular launches reaching 1 million tons annually

- 2027-2028: Orbital data center capacity becoming price-competitive with terrestrial alternatives

- 2028+: Dominance of AI compute market shifting toward space-based infrastructure

Historically, Musk's timelines are optimistic. Starship's development already took longer than initially projected. But Space X has a better track record of delivering on ambitious goals than most private companies.

A more realistic timeline probably adds 1-3 years to each milestone. So 2026-2027 becomes 2028-2029, and so forth. But even delayed, the trajectory is noteworthy. Within a decade, space-based AI compute could represent 10-30% of the global market. Within two decades, potentially dominant.

What This Means for the AI Industry

If Space X succeeds, the implications reshape artificial intelligence development itself.

Model size and capability explode: Cheaper compute means companies train larger models more frequently. That drives capability improvements. We'd see AI models that are dramatically more capable than current systems, arriving faster than current trajectory suggests.

Decentralization becomes possible: Currently, frontier AI is concentrated in a handful of companies with access to massive compute. Space-based infrastructure could democratize access, enabling smaller companies and international players to compete.

New applications become viable: Real-time AI for autonomous systems, medical imaging, financial trading, scientific simulation—applications currently impractical due to latency could become standard.

Geographic advantage shifts: Countries or regions with direct satellite access gain advantage. This might favor space-faring nations but could also benefit developing nations without terrestrial infrastructure. The geopolitics are genuinely unclear.

Safety and alignment research becomes more critical: More compute, larger models, faster iteration means AI systems change faster. The alignment and safety research community needs to keep pace or risk falling behind capability development.

The Skepticism: Why Smarter People Doubt This

Not everyone is convinced. Many accomplished technologists and space industry experts think this plan faces insurmountable obstacles.

The manufacturing argument: Producing 1 million satellites requires sustained manufacturing excellence. Defect rates must stay below 0.1%. Musk's companies have struggled with manufacturing scale (Tesla had notorious Model 3 production challenges). Satellite manufacturing at this scale is genuinely new territory.

The launch rate argument: Even with Starship, launching 100-200 times annually requires solving not just rocket reliability but also ground infrastructure, regulatory licensing, landing pad availability, and refurbishment cadence. It's not clear Space X can sustain that pace.

The terrestrial innovation argument: Ground-based data centers aren't static. Competition from companies like Lambda Labs, Core Weave, and others is driving down costs rapidly. Orbital infrastructure might not maintain a cost advantage if terrestrial improvements continue.

The space debris argument: Launching a million satellites into already-crowded orbital regions creates collision risks that might trigger regulatory action before the constellation reaches full deployment.

The computing model argument: AI models are increasingly shifting toward inference (running trained models) rather than training. Inference can be distributed across many smaller systems. Do you need orbital compute for inference, or just training? If just training, the addressable market shrinks.

These aren't trivial counterarguments. They represent genuine technical and economic concerns.

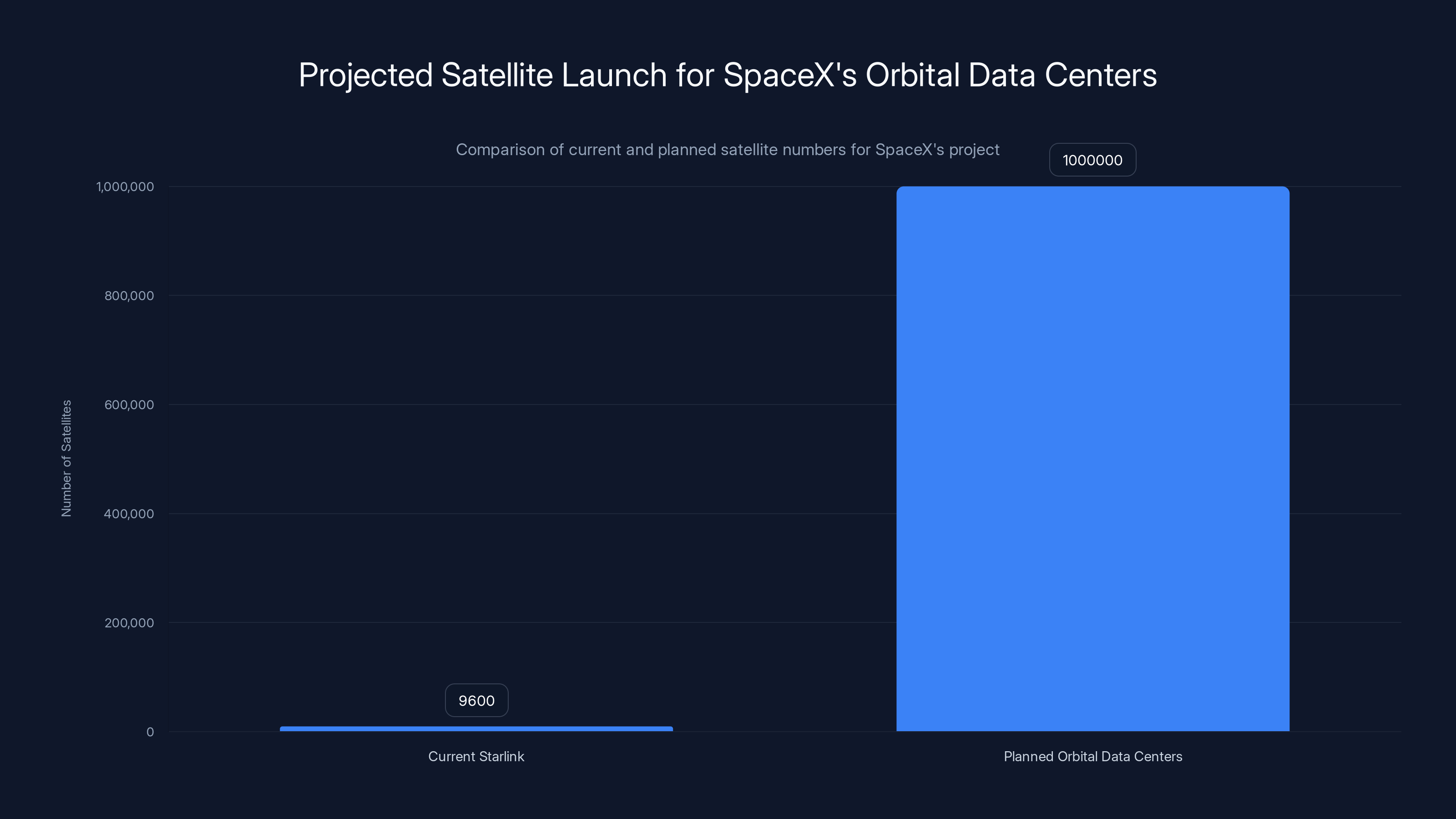

SpaceX plans to increase its satellite count by 100x from its current 9,600 to 1 million for its orbital data centers, significantly expanding its space-based infrastructure.

The Bigger Picture: What's Really at Stake

Step back from the orbital mechanics and economics for a moment.

Musk believes artificial intelligence is the defining technology of the coming century. He's bet his companies, reputation, and considerable wealth on that belief. The space venture is essentially a bet that AI will be so computationally intensive that terrestrial infrastructure can't support it.

If he's right, Space X becomes not just a space company but the infrastructure provider for the AI age. That's an extraordinary position to occupy.

If he's wrong, Space X wasted massive resources on a satellite constellation that serves no unique purpose. The infrastructure becomes marginally useful for satellite internet but fails to provide the compute advantage that justified the investment.

There's no middle ground here. Either orbital compute becomes essential infrastructure, or it's a sunk cost. The binary nature of the outcome is why the bet is so audacious.

Comparative Positions: Who Else Is Thinking About This?

Space X isn't the only organization considering space-based computing, though it's the furthest along in execution.

Jeff Bezos's Blue Origin has discussed orbital manufacturing and research, but hasn't committed to mega-constellation data centers. Amazon is more focused on terrestrial cloud infrastructure.

China's space program is likely thinking about this too. The strategic implications of orbital AI infrastructure are obvious to any country with space capability. Expect Chinese announcements about lunar computing or orbital research stations in coming years.

Virgin Galactic and Axiom Space focus on human spaceflight and space stations, not constellations. Different market approach entirely.

Relativity Space and Axiom Space are manufacturing innovations in space, but again, not pursuing constellation-scale deployment.

Space X is genuinely alone in combining (a) proven heavy-lift launch capability, (b) operational satellite constellation experience, (c) commitment to frontier AI research, and (d) explicit strategy to integrate all three. That uniqueness is the point.

The Path Forward: What Needs to Happen

For this plan to succeed, Space X needs to execute flawlessly on multiple fronts simultaneously:

Launch vehicles: Starship must achieve reliable reusability, high flight rates, and rapid turnaround times. This is hard engineering. The company is close but not quite there.

Satellite manufacturing: Production at million-unit scale while maintaining quality. Supply chain robustness for specialized components. Workforce training at unprecedented levels.

Network operations: Managing a million satellites' worth of traffic, collision avoidance, redundancy, and customer service. The operations complexity dwarfs anything Space X has done.

Regulatory approval: Dozens of countries need to permit operation. International coordination on spectrum usage and orbital safety standards.

Customer acquisition: Building demand for space-based AI compute. Currently, that's mostly theoretical. Proof-of-concept deployments need to demonstrate real advantages.

Financing: The capital requirements are immense. Space X would likely need to raise external capital or secure government contracts. Either path is politically and strategically complex.

Execute all of that flawlessly, and Space X transforms civilization's relationship with artificial intelligence and space. Fail at any single critical juncture, and the constellation becomes an expensive satellite internet upgrade with marginal AI benefits.

The Musk Factor: Betting on Execution Capability

One reason to take this plan seriously, despite skepticism, is Musk's track record. People doubted Falcon 9 would land and reuse boosters. It did. People doubted Tesla could manufacture profitably at scale. It did (eventually). People doubted Starlink would achieve thousands of satellites in orbit. It did.

Musk's projections are routinely optimistic, but his execution capability is real. He funds his own companies. He hires talent aggressively. He personally drives technical decisions. He's willing to tolerate massive losses to win markets.

That doesn't mean the orbital data center plan will succeed. But it means dismissing it out of hand is probably unwise. Musk has defied skeptics before.

Then again, Mars colonization and the Hyperloop remain aspirational rather than realized. Betting on Musk requires acknowledging both his successes and failures.

What This Means for You

If you work in AI, this development affects your industry's future infrastructure. If you work in cloud computing, it represents competitive threat. If you work in space technology, it's probably your next career opportunity. If you're an investor, it's a massive bet on both Space X and x AI.

More broadly, this is a case study in how technological ambition actually works. It's not about incremental improvements or established best practices. It's about someone with resources believing something is possible, assembling the best talent available, and committing capital to prove it.

Sometimes that fails spectacularly. Sometimes it reshapes civilization.

FAQ

What does it mean that Space X acquired x AI?

Space X formally purchased x AI, Elon Musk's artificial intelligence company, to create a vertically integrated organization spanning rockets, satellites, internet infrastructure, and AI models. The merger enables Space X to develop space-based AI computing infrastructure powered by orbital data centers rather than Earth-based facilities.

Why would Space X want to build data centers in space?

Orbital data centers offer potential advantages in thermal efficiency (space is cold, eliminating expensive cooling costs), integration with Starlink satellite internet (enabling direct-to-user AI services globally), and operational control over the entire computing stack from launch to software. If costs prove lower than terrestrial alternatives, this creates significant competitive advantage.

How many satellites does Space X plan to launch for this project?

Space X filed with the FCC seeking permission to launch up to 1 million satellites that will function as orbital data centers, deployed across multiple orbital altitudes between 500 and 2,000 kilometers. This represents a 100x increase from Space X's current Starlink constellation of approximately 9,600 satellites.

Is space-based AI compute actually cheaper than Earth data centers?

Musk projects that within 2-3 years, space-based compute will be the lowest-cost method for generating AI processing power. However, this assumption remains unproven and depends on successfully solving multiple technical challenges including launch costs, satellite manufacturing at scale, thermal management, and regulatory approval. Skeptical observers doubt these projections.

What are the main technical challenges to this plan?

Key obstacles include orbital debris and collision risk (1 million satellites dramatically increases conjunction risks), thermal management at scale (satellites experience extreme temperature cycling), manufacturing complexity (producing 1 million satellites requires unprecedented production volumes), launch rate requirements (needing 100+ launches annually), and power generation limitations (solar panels may not provide projected power density).

Could this actually reshape the AI industry?

If successful, space-based compute could accelerate AI capability development by reducing compute costs, enable new applications (real-time AI services, autonomous systems, medical imaging), democratize access to frontier AI research, and shift competitive advantages toward companies with space infrastructure. The scale of potential impact makes this one of the most significant technology bets of the current decade.

When could orbital data centers actually become operational?

Musk's timeline suggests regular launches of orbital compute infrastructure beginning in 2025-2026, with cost-competitiveness with terrestrial data centers potentially achieved by 2027-2028. Historically, such timelines are optimistic. A more realistic estimate might add 1-3 years to each milestone, suggesting meaningful orbital compute capacity in 2029-2031.

What about orbital debris and safety concerns?

Deploying 1 million satellites creates significant collision risk and debris generation risk. Space X is developing Stargaze, a space situational awareness system using star trackers for collision detection. However, regulatory standards for acceptable constellation density remain unclear, and international coordination on orbital safety is ongoing. These factors could potentially restrict deployment rates or constellation size.

Can other companies replicate this strategy?

Replicating Space X's approach requires combining proven heavy-lift launch capability, operational satellite constellation experience, frontier AI research, and strategic integration across all layers. Currently, no other company possesses all four capabilities simultaneously. Competitors would either need to build independently (extraordinarily capital intensive) or purchase services from Space X (creating dependence).

What happens if the plan fails?

If orbital data centers prove economically unviable, Space X would have invested hundreds of billions in satellite infrastructure with limited alternative uses. The constellation could still serve satellite internet purposes (similar to current Starlink) but wouldn't justify the extraordinary deployment scale. This represents a binary outcome: either transformative success or sunk costs.

The Verdict: Why This Matters

The Space X-x AI merger represents something more significant than a corporate acquisition. It's a fundamental bet on what artificial intelligence infrastructure will look like for the next two decades.

Musk believes compute is the bottleneck. If he's right, space becomes essential infrastructure. If he's wrong, the strategy becomes an expensive detour.

The technical challenges are real and severe. The regulatory obstacles are significant. The economic assumptions are aggressive. Skepticism is justified.

But so is taking the bet seriously. Musk has a track record of defying skeptics on technically ambitious projects. Space X has already proven capable of things the aerospace industry deemed impossible. And the competitive advantages of success are so enormous that even a probability-weighted analysis suggests the attempt is rational.

What we're watching unfold isn't science fiction. It's a real company with real resources attempting to deploy computing infrastructure that didn't exist a decade ago. In 5-10 years, we'll know whether it was visionary or catastrophic.

Either way, it'll reshape how we think about artificial intelligence, space, and the future of computing.

Key Takeaways

- SpaceX formally acquired xAI to merge its space launch and satellite expertise with frontier AI research, creating an integrated organization spanning rockets, satellites, internet, and AI models

- The company filed with the FCC to deploy up to 1 million orbital data centers across multiple altitude layers, representing a 100x increase from current Starlink constellation size

- Space-based computing offers potential thermal efficiency advantages (leveraging 2.7K background space temperature) and direct integration with Starlink satellite internet for global low-latency AI delivery

- Technical challenges are severe: orbital debris collision risk, thermal cycling stress, unprecedented manufacturing scale (1 million satellites annually), launch rate requirements (100+ per year), and power generation limitations

- If successful within 2-3 years, space-based compute could become the lowest-cost method for AI infrastructure, reshaping competitive dynamics across cloud providers, satellite operators, and AI companies globally

Related Articles

- SpaceX Acquires xAI: Building a 1 Million Satellite AI Powerhouse [2025]

- SpaceX Acquires xAI: Creating the World's Most Valuable Private Company [2025]

- SpaceX's Million-Satellite Network for AI: What This Means [2025]

- SpaceX's Million Satellite Data Centers: The Future of Cloud Computing [2025]

- SpaceX's 1 Million Satellite Data Centers: The Future of AI Computing [2025]

- Microsoft's Maia 200 AI Chip Strategy: Why Nvidia Isn't Going Away [2025]

![SpaceX Acquires xAI: The 1 Million Satellite Gambit for AI Compute [2025]](https://tryrunable.com/blog/spacex-acquires-xai-the-1-million-satellite-gambit-for-ai-co/image-1-1770077172509.jpg)