Space X's $1.5 Trillion IPO Could Reshape the Space Industry Forever

Let me be straight with you: Space X is about to go public in a way that'll make every other tech IPO look small. We're talking about a company that's worth more than most countries' GDP, planning to raise at least

But here's where it gets weird. Reports suggest Elon Musk wants this all to happen in June, allegedly timed with his birthday on June 28th and—and I'm not making this up—a rare planetary alignment involving Mercury, Venus, and Jupiter. You can't write this stuff.

Whether you think the planetary alignment angle is genius marketing or pure eccentricity, one thing's certain: Space X's IPO will be the defining financial event in commercial spaceflight. The company has transformed from a scrappy startup nobody believed in to a government contractor launching satellites, managing space debris, and building rockets designed to reach Mars. As noted by Forbes, Space X's strategic moves have positioned it as a leader in the space industry.

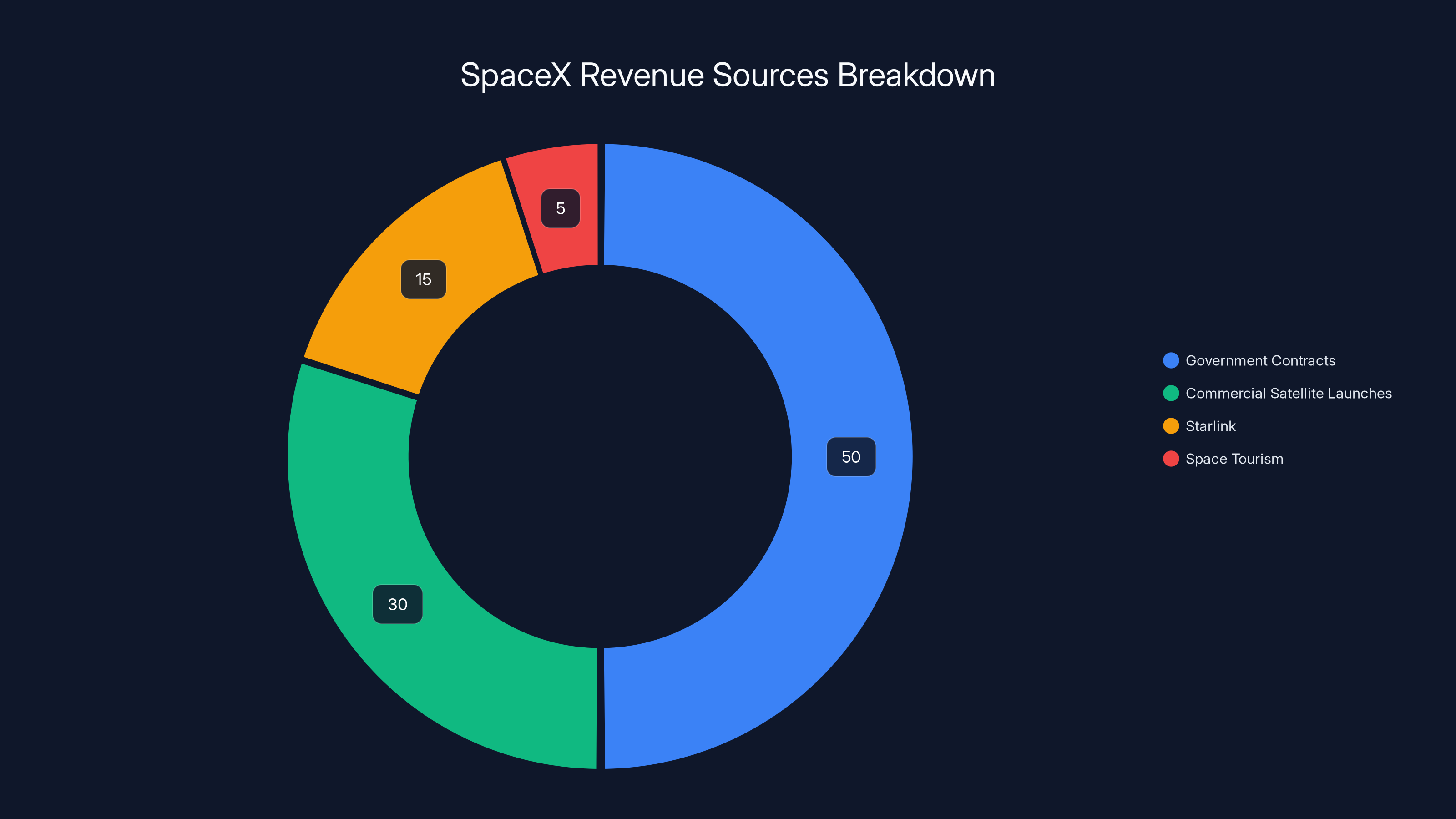

This isn't just another tech IPO. Space X operates differently. It doesn't have the ad-driven revenue model of Meta or the subscription base of Slack. Instead, it generates revenue from government contracts, commercial satellite launches, and soon hopefully space tourism. Understanding the valuation, the timing, and what comes next matters if you care about where space exploration is headed—or if you're watching how Musk's unconventional decision-making affects billion-dollar companies.

Let's dig into what's actually happening, what the numbers mean, and why June might be the perfect storm for going public—planets notwithstanding.

TL; DR

- Space X targets June 2026 IPO at a 50+ billion in what could be the largest IPO ever, as reported by Financial Times.

- Musk reportedly wants timing aligned with his June 28th birthday and a rare planetary alignment of Mercury, Venus, and Jupiter.

- Space X's valuation has exploded from 1.5 trillion, reflecting unprecedented investor demand.

- Revenue model differs from tech giants: Government contracts (NASA, Space Force), commercial satellite launches, and emerging space tourism revenue streams.

- Market timing is strategic: A June IPO could capitalize on Q2 funding trends, avoid summer trading doldrums, and position Space X for massive growth in Starship commercialization.

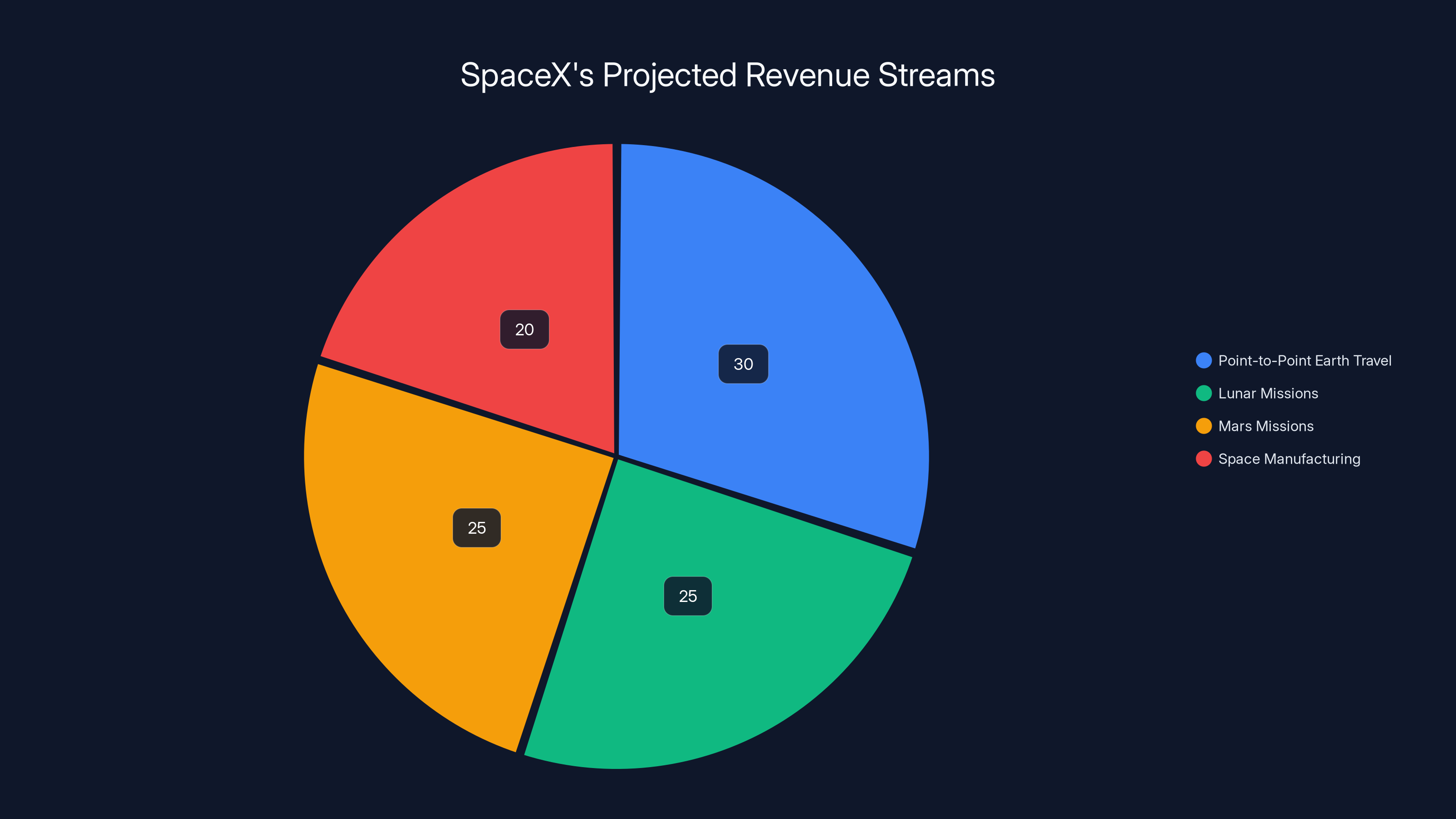

Estimated data suggests that SpaceX's future revenue will be diversified across several major streams, with point-to-point Earth travel and lunar missions being significant contributors.

The IPO Numbers That Sound Impossible But Are Real

Okay, let's talk money. Space X wants to raise

To put this in perspective, the largest IPO ever was Saudi Aramco at

But here's the thing: those numbers will probably change. The Financial Times—which broke the story—specifically noted that the

Still, even if the final numbers land at

What's wild is how fast Space X's valuation has moved. Just two months before these IPO rumors, Space X held a secondary sale in December that valued the company at

Why the jump? Starship. More on that in a minute.

Government contracts form the largest portion of SpaceX's revenue, followed by commercial satellite launches. Starlink and space tourism are emerging contributors. Estimated data.

Why June? The Planetary Alignment Marketing Angle

Okay, so we need to address the elephant in the room: Musk reportedly wants the IPO timed with his birthday (June 28th) and a rare planetary alignment. This is the kind of thing that makes business reporters do double-takes.

Let's separate fact from fiction here. The planetary alignment is real. In early June 2026, Mercury, Venus, and Jupiter will align in a visually striking way visible from Earth. It happens, it's kind of cool, but it has zero impact on stock prices or rocket launches.

Musk's birthday also happens to fall on June 28th. Again, real, but usually irrelevant to corporate strategy.

But here's where it gets interesting: while the planetary alignment is almost certainly meaningless from a financial standpoint, the June timing itself is actually smart for an IPO. Here's why:

Market seasonality: Q2 ends in June. Lots of institutional investors are fully deployed by June, having made their Q2 allocation decisions. Summer trading volume drops significantly after late June. Launching in early-to-mid June captures the Q2 momentum without hitting the summer doldrums.

Regulatory calendar: The SEC processes IPO filings on somewhat predictable timelines. Filing in late March/early April for a June IPO is doable and avoids the September-October crush when fiscal year companies launch offerings.

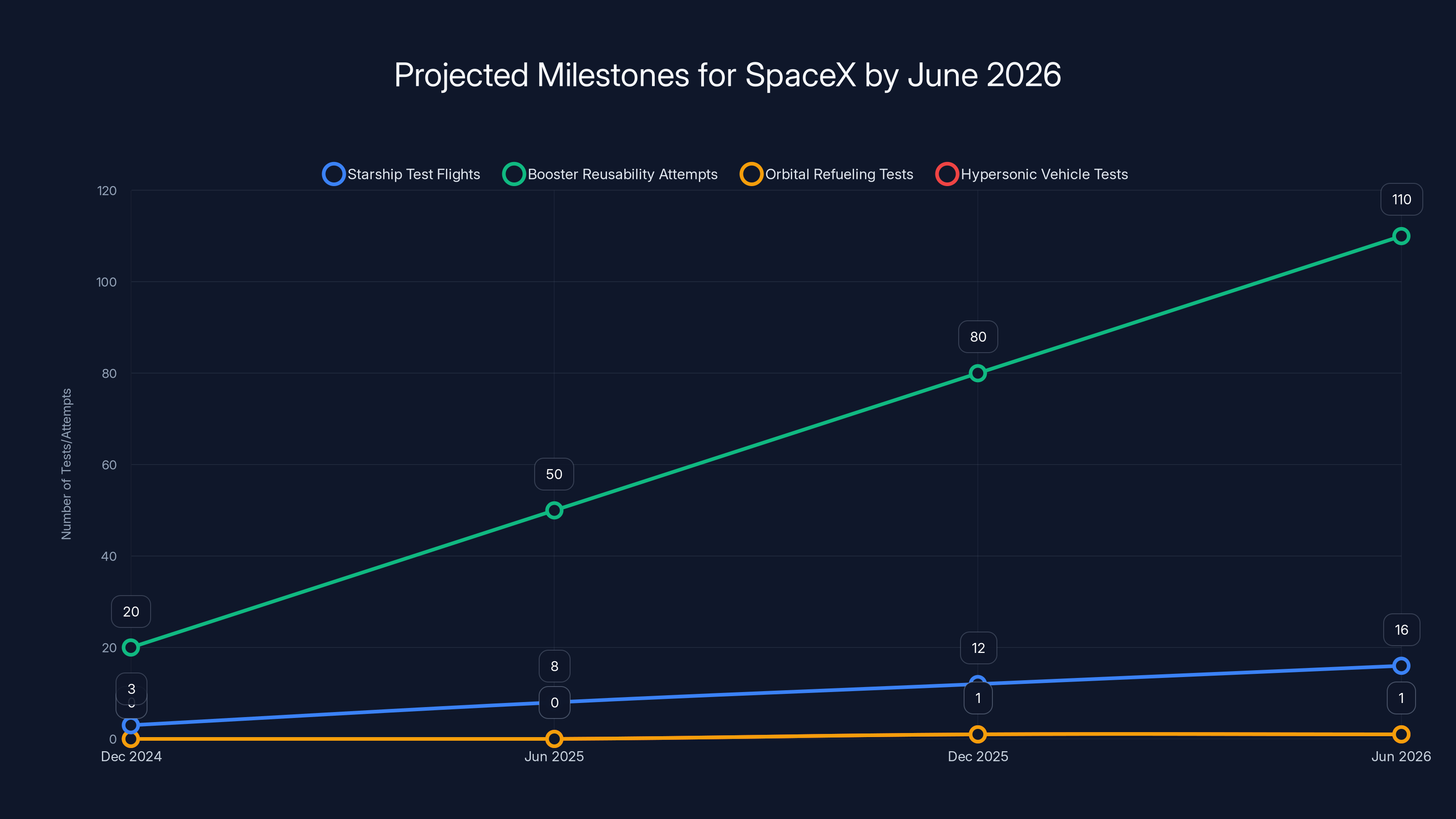

Starship momentum: By June 2026, Space X will have completed 12-18 more Starship test flights. Each successful flight increases investor confidence. Timing an IPO when test flight progress is demonstrably working? That's strategy.

Competition avoidance: Major tech IPOs tend to cluster. Going in June when fewer mega-offers are happening means Space X owns more of the investment mindshare.

So yeah, the planets don't matter. But June, specifically, probably does. And Musk's birthday? That's just the kind of weird detail that makes headlines and gets people talking about Space X's IPO. Which is free marketing. Which is very Musk.

Understanding Space X's Revenue Model: It's Nothing Like Google

Here's where a lot of people get confused about Space X's valuation. They compare it to Google or Meta, companies worth $1.5 trillion that print money through advertising.

Space X doesn't work that way. It's not a software company with scale economics. It's a hardware manufacturer with declining costs but real material expenses.

Space X makes money from:

Government contracts: This is the big one. NASA contracts Space X for cargo resupply to the International Space Station under the Commercial Resupply Services program. The U. S. Space Force contracts Space X's Falcon 9 for national security launches. The Department of Defense uses Space X for classified military missions. These contracts run into billions annually.

Commercial satellite launches: Companies like Viasat, Intelsat, and hundreds of smaller satellite operators pay Space X to launch their cargo to orbit. The Falcon 9 is the workhorse here, launching roughly 60-70 times per year at costs Space X has driven down below $62 million per launch—a price other launch providers can't match.

Starlink: This is the future growth engine. Starlink is Space X's own satellite internet constellation. It's not directly reflected in Space X's public financials as a separate company, but Starlink is valued independently at around $180 billion. Eventually, Space X could separate Starlink as a spinoff, but for now, Starlink's revenue (satellite internet service subscriptions) represents a massive recurring revenue stream.

Space tourism (emerging): Space X hasn't launched paying tourists yet, but the company has signed deals for private crewed missions. Axiom Space books these flights through Space X. This is emerging revenue, not material yet, but could grow significantly post-IPO.

Starship development: This is tricky. Starship isn't generating revenue yet—it's still in test phase. But NASA has already awarded Space X a $2.9 billion contract for Lunar lander development using Starship HLS (Human Landing System). That's guaranteed Starship revenue locked in.

Now, here's the valuation math that makes $1.5 trillion defensible:

If Space X generates ~

BUT—and this is crucial—investors aren't pricing current revenue. They're pricing future revenue. Starship could eventually enable:

- Point-to-point hypersonic flights (New York to Tokyo in under an hour)

- Mars missions with thousands of passengers per year

- In-space manufacturing and resource extraction

- Lunar base construction and resupply

- Deep space exploration contracts

If Starship even partially delivers on its potential, Space X's addressable market expands from billions to hundreds of billions annually. So the $1.5 trillion valuation is a bet on "Starship works at scale." That's not a crazy bet. It's an ambitious bet. But Musk has defied expectations before.

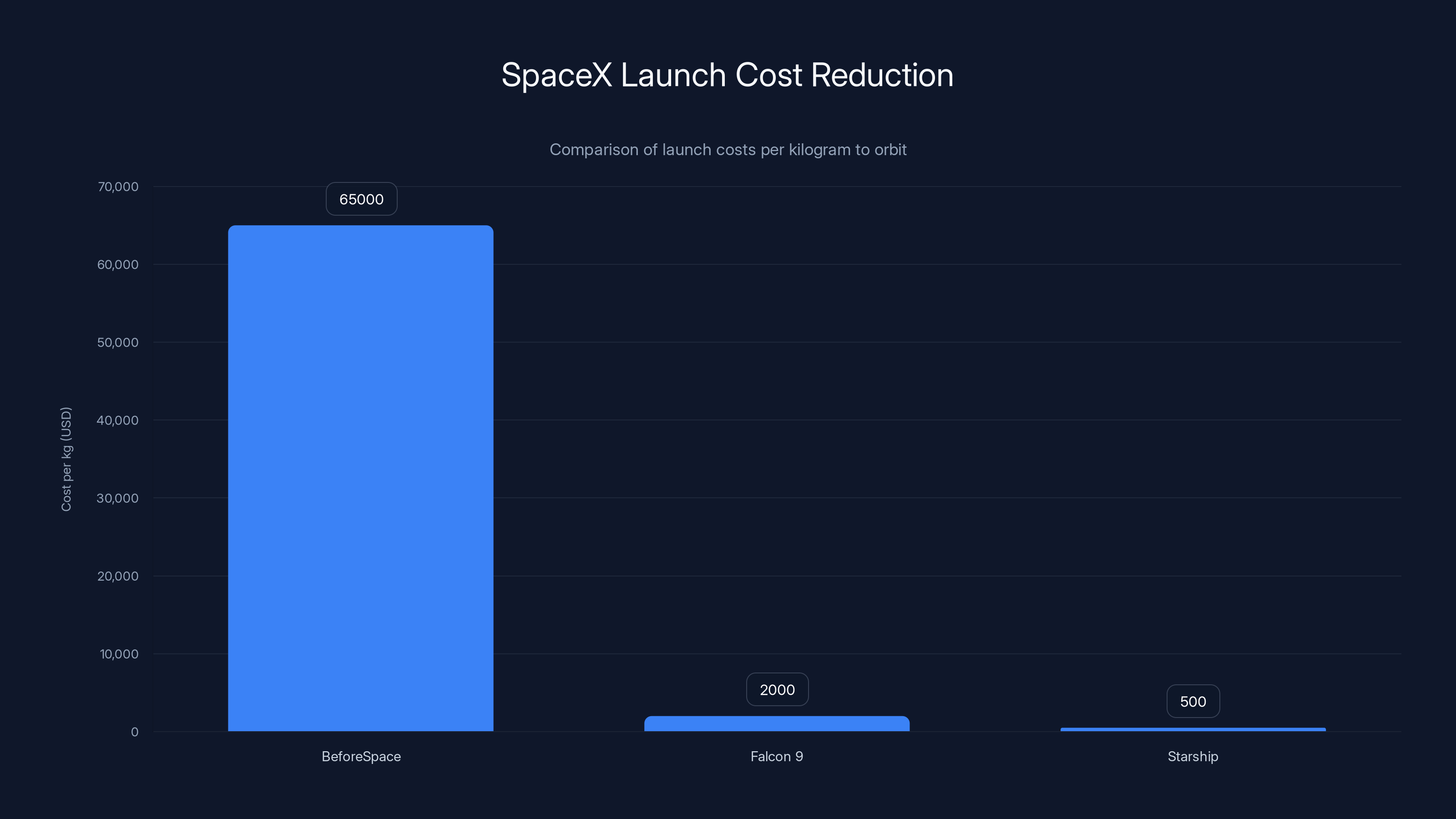

SpaceX has dramatically reduced the cost of launching payloads to orbit, from

The Starship Factor: Why Valuation Jumped 85% in Two Months

Space X's valuation didn't jump from

In October 2024, Space X successfully caught the Falcon 9's first-stage booster using "chopstick" arms (mechanical arms on the launch tower). That's not just a cool video. That's the hardest part of reusability solved. If you can reliably catch a falling booster, you can refly it dozens of times, dropping per-launch costs by 90%.

In September 2024, Starship completed its first integrated flight test (IFT-3) with a successful hot-stage separation and booster reignition in space. Each test flight incrementally proved that Starship's novel engineering approach actually works.

Investors watched this progress unfold. They saw Musk's 2024 promise of "accelerating Starship test flight cadence" actually happen. They saw the technical risks decreasing in real time.

Then came the secondary sale in December 2024. Major institutional investors (probably sovereign wealth funds, mega-funds, and space-dedicated venture firms) decided they needed to own Space X stock before the IPO. A company that can catch 70-ton rockets and refly them is not the same company it was 12 months prior.

The valuation jumped because the probability of Starship's commercial viability moved from "hopeful" to "likely." When that happens, the addressable market calculation changes overnight.

Let's do rough math. If Starship enables 50% reduction in launch costs over the next five years, Space X could own 80%+ of the commercial launch market (it already owns ~60%). More launches per year, lower costs, higher margins. Revenue could realistically hit $10-15 billion annually by 2030.

At a P/S ratio of 8-10x (which is reasonable for a high-growth aerospace company), that's a

So the $1.5 trillion valuation doesn't look insane when you model Starship's long-term impact.

Market Timing: Why June 2026 Makes Strategic Sense

The planetary alignment is fun noise. But the actual timing strategy is sharp.

IPO markets have rhythm. Late Q1 and Q2 tend to be when institutional investors have fresh capital. If you're planning a $50 billion offering, you want that capital available. By July, many funds have deployed their annual allocation and trading volume thins.

June 2026 timing also gives Musk a perfect narrative: "We're going public because Starship achieved critical milestones and we need capital for the next phase." By June, Space X will have:

- Completed 15+ Starship test flights (current cadence suggests one every 2-3 months)

- Demonstrated booster reusability consistently (100+ catch attempts by June)

- Probably achieved first successful orbital refueling test

- Likely completed first point-to-point hypersonic vehicle test (not Starship, but part of the narrative)

- Secured additional government contracts (Space X constantly wins awards)

Each of these milestones is an IPO roadshow talking point. "We went public because we proved the technology works." That's the narrative Space X wants.

Compare that to going public in, say, December when there's trading volume uncertainty and holiday distractions. Or April when every startup and their mom is filing S-1s. June is the sweet spot.

Another timing angle: government spending cycles. Space X's largest customer is the U. S. government. Fiscal year budgets get locked in by September-October. If Space X goes public in June, the company can use IPO proceeds to invest in capacity and facilities, then bid for FY2027 contracts with new capabilities. The government sees a public company (more stable, more transparent) bidding on contracts. That's actually a competitive advantage.

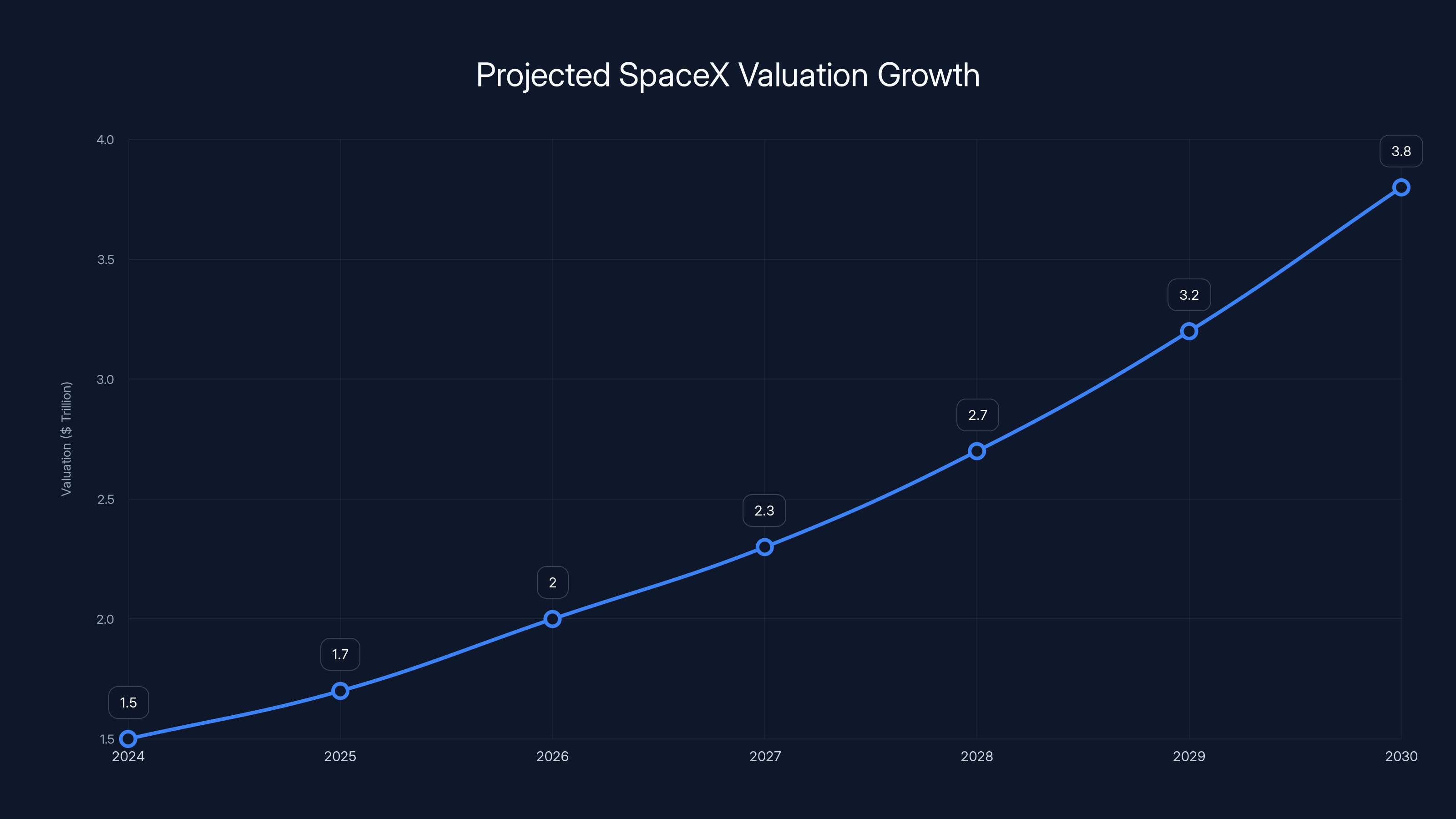

SpaceX's valuation is projected to grow significantly as Starship reduces launch costs and increases market share, potentially reaching $3.8 trillion by 2030. Estimated data.

The IPO Roadshow: What Musk and Team Will Say

When Space X launches the roadshow, here's what the pitch will look like:

Slide 1: The Problem We Solved

Before Space, launches cost

Slide 2: Our Market

The space economy is

Slide 3: Our Track Record

Space X has launched 300+ rockets. We've landed boosters 200+ times. We invented orbital refueling. We built the only American crew vehicle approved for NASA missions. We're not a startup with promises. We're a company executing on moonshots.

Slide 4: Our Revenue

Space X generates

Slide 5: Our Path to $20+ Billion Revenue

By 2030, Starship commercialization will unlock point-to-point flights, cargo missions, and space tourism. Conservative scenario:

Slide 6: Why Now?

We've de-risked the core technology. Starship is working. Demand from government, commercial, and international customers exceeds our launch capacity. We need capital to:

- Build 5-10 additional Starship vehicles

- Construct additional launch facilities

- Develop lunar/Mars infrastructure

- Fund Mars mission development

This capital will generate 3-5x returns within a decade.

Slide 7: The Risk Factors We'll Disclose

Space X will be obligated to disclose real risks:

- Regulatory approval for point-to-point flights is uncertain

- Mars missions are unproven technology

- Starlink competition from Amazon (Project Kuiper) and others

- Dependence on government contracts (largest customer)

- Musk's public statements occasionally create regulatory tension

- Launch accident risk (mitigated but nonzero)

Investors will price these in. The $1.5 trillion valuation isn't saying "no risk." It's saying "the upside justifies the risk."

Regulatory Approval: The Unsexy But Critical Factor

Here's what the financial headlines won't emphasize: Space X's IPO success depends entirely on federal regulators. To launch Starship at the scale Space X wants, the company needs:

FAA approval for expanded launch frequency from Starbase (Space X's Texas facility). Currently, Starship launches are conditional and require cumulative approval. For commercial operations, Space X needs broader approval for frequent launches with minimal delays. The FAA is moving in that direction, but it's not guaranteed.

FCC approval for Starlink ground terminals and increased spectrum allocation. Starlink's value depends on the ability to deploy worldwide. The FCC controls frequency allocations. More Starlink spectrum = higher valuation.

State Department approval for satellite exports and international launches. Space X wants to launch satellites for international customers. State Department rules control what can be exported. Each rule change opens or closes markets.

NORAD approval for point-to-point hypersonic flights. This is future revenue. Flying New York to Tokyo in 30 minutes requires military coordination (U. S. air space) and international agreements. That's regulatory complexity that could take years.

Investors understand this. The $1.5 trillion valuation bakes in an assumption that regulatory approvals continue at current pace or accelerate. If the FAA suddenly restricted Starship launches, valuation craters. If Starlink gets approved for global deployment faster than expected, valuation spikes.

Space X's IPO disclosure will need to address regulatory risk prominently. Expect a section in the S-1 filing devoted entirely to regulatory dependencies. Sophisticated investors will model regulatory scenarios (base case, optimistic, pessimistic) and decide accordingly.

SpaceX's projected IPO aims to raise

Comparison: How Space X's IPO Stacks Against Other Mega-IPOs

Let's put Space X in context with other blockbuster offerings:

| Company | IPO Year | Raise Amount | Valuation at IPO | Key Factor |

|---|---|---|---|---|

| Saudi Aramco | 2019 | $25.6B | $1.7T | Global oil demand |

| Alibaba | 2014 | $25B | $231B | E-commerce in China |

| 2012 | $16B | $104B | Social network scale | |

| 2004 | $1.7B | $23B | Search advertising | |

| Space X (projected) | 2026 | $50B | $1.5T | Starship reusability |

Space X's offering is bigger than Saudi Aramco's in absolute dollars. The valuation is higher in absolute terms. But here's what makes it different: Space X's revenue is a fraction of these companies.

- Saudi Aramco: ~$160B annual revenue → 10.6x P/S multiple

- Alibaba: ~$70B annual revenue → 3.3x P/S multiple

- Facebook/Meta: ~$40B annual revenue → 2.6x P/S multiple

- Google: ~$280B annual revenue → 5.3x P/S multiple

- Space X (projected): ~$3-4B annual revenue → 375-500x P/S multiple

Yes, that multiple is insane. But Space X investors aren't buying current revenue. They're buying the assumption that Starship works at scale and unlocks revenue growth to $15-20B within 7-10 years. At that scale, a 75-100x P/S multiple is reasonable for a high-growth industrial company.

The risk, obviously, is if Starship doesn't deliver commercially. Then the multiple compresses and Space X looks overvalued. But that's the bet investors are making.

The Secondary Market Aftermath: What Happens to Early Employees and Investors

Space X going public is life-changing for thousands of people.

Early employees with equity grants—people hired in 2005-2010 when Space X was worth $100 million or less—suddenly have options worth hundreds of millions. Some become billionaires. Others become very, very comfortable.

Early investors—venture firms that bet on Space X when it was 0-for-five on launches—see 10,000x+ returns on their initial bets. Founder funds, university endowments, sovereign wealth funds that invested at Series A or B valuations will see gains that define their track records.

Musk, already the world's richest person, becomes even wealthier. His Space X stake (roughly 50% of the company) at

But here's what's interesting from a market perspective: post-IPO, there will be massive secondary liquidity. Venture investors who've been waiting 15+ years to cash out can finally do so (with some restrictions—lockup periods prevent immediate selling). This creates supply of Space X shares that will eventually settle into long-term holders.

Likewise, employee stock options finally have a public market price. Tax planning becomes complicated—employees need to decide whether to exercise options, hold shares, or sell. Financial advisors will have a field day.

The IPO itself will probably be 80% institutional investors (mutual funds, pension funds, sovereign wealth funds) and 20% retail. A

By June 2026, SpaceX is projected to achieve significant milestones, including 16 Starship test flights and over 100 booster reusability attempts. Estimated data based on current cadence.

The Broader Impact: What This Means for the Space Industry

Space X going public will reshape the entire commercial space industry.

Right now, companies like Relativity Space, Axiom Space, and Blue Origin (owned by Jeff Bezos) operate as private companies. Space X's IPO and multi-hundred-billion-dollar valuation gives them a public market standard. Valuations of other space companies will adjust accordingly.

If Space X is worth $1.5 trillion based on Starship's potential, then companies developing:

- Point-to-point hypersonic vehicles (Hermeus, Axiom)

- Space stations (Axiom Space, Orbital Reef)

- Lunar landers (Axiom, Intuitive Machines)

- In-space manufacturing (Made in Space, Velo 3D)

...will see their valuations revalued upward. Capital will flow into the space ecosystem.

Venture funding for space startups will increase. Institutional investors will see spacetech as a legitimate investment class, not a moonshot bet. Public market exits become visible: go public, like Space X, or get acquired by a public Space X competitor.

This all happens because Space X proved that commercial space can be profitable, scalable, and world-changing. The IPO is validation.

The Musk Element: Why Eccentric Timing Doesn't Matter (But Makes Headlines)

Last thing: let's address the elephant that got us here. Musk's interest in timing the IPO with his birthday and planetary alignment is unconventional. By normal corporate standards, it's bizarre.

But it's not unprecedented. Musk has a history of making decisions most CEOs wouldn't. He bought Twitter based partly on a whim. He announced an IPO for Tesla with a single tweet. He's willing to make unconventional bets.

Is timing an IPO based on astrology rational? No. But is it harmful? Also no. The IPO will happen when regulatory and market conditions allow, birthday alignment or not. The broader timing (June vs. September vs. October) is strategically sound regardless of birthday coincidence.

What the birthday-planetary-alignment angle does do is create viral headlines. "Elon Musk times Space X IPO with planetary alignment" gets way more engagement than "Space X targets mid-year IPO to capture Q2 institutional investor momentum." One is a story. The other is finance boring.

So the eccentricity serves a purpose: free marketing. Everyone talks about it. Space X's IPO is top of mind. When the roadshow starts, journalists and investors are already primed to pay attention.

Is it unconventional? Yes. Is it smart from a PR perspective? Also yes. Would a traditional CEO do this? Never. Does it matter for the IPO? Not really.

What Investors Should Actually Watch Before the IPO

If you're seriously considering Space X stock when it goes public (and it'll likely sell out in minutes), here's what matters:

Starship test flight cadence: Count the launches. Successful catches. Successful orbital tests. Each one increases probability of commercialization.

Government contract wins: Track NASA and Space Force announcements. New contracts = revenue certainty.

Starlink subscriber growth: Starlink's financial performance drives Space X's overall economics. Watch for subscriber growth rates and ARPU (average revenue per user).

Regulatory approvals: Monitor FAA statements on Starship launch frequency approval and international spectrum allocations for Starlink.

Competitive announcements: Watch Blue Origin's New Glenn development, Relativity Space's 3D-printed rocket launches, and Amazon's Kuiper satellite Internet progress. These aren't direct competitors yet, but they will be.

International geopolitics: Tension with China affects U. S. space spending. Trade policy affects satellite launch licensing. These are macro factors that impact Space X's business.

Musk's attention level: This might sound flippant, but it matters. When Musk focuses on Space X, progress accelerates. When he's distracted by Tesla or other companies, progress slows. His Twitter activity is a useful proxy for focus level.

FAQ

What is Space X's IPO valuation based on?

Space X's

When is Space X's IPO expected to happen?

Reports indicate Space X is targeting June 2026 for its IPO, with June 28th being a particularly interesting target date (Musk's birthday). June is strategically sensible for IPO timing because it falls at the end of Q2 when institutional investors have capital available, before summer trading volume drops, and allows Space X time to demonstrate additional Starship test flight progress and secure additional government contracts. The exact date will depend on regulatory approval timelines and market conditions, but June 2026 is the reported target window.

How much money will Space X raise in the IPO?

Space X is targeting at least

Why would investors buy Space X stock at such a high valuation?

Investors would be betting on Starship's ability to dominate the space launch market, open entirely new markets (point-to-point Earth travel, lunar/Mars tourism), and achieve margins similar to technology companies rather than traditional aerospace companies. At current launch costs, many potential space-based business models are economically unviable. If Starship reduces costs by 90%+ as designed, previously impossible businesses suddenly become profitable. Investors are essentially buying the upside scenario where Starship commercialization succeeds fully and Space X captures 50-70% of the growing space economy.

What are the main risks to Space X's IPO valuation?

The primary risks are regulatory (FAA approval for expanded launch frequency or point-to-point flights might be delayed), technical (Starship might not achieve design performance targets or might have safety issues), and competitive (Blue Origin, Amazon, or international companies might develop competing reusable launch vehicles faster than expected). Additionally, Space X's dependence on government contracts creates political risk—a change in U. S. space policy could reduce government spending. There's also Musk-related execution risk; if his attention is divided among Tesla, X, and other ventures, Space X progress could slow.

How will Space X's IPO affect other space companies?

Space X's IPO will validate the commercial space industry and likely increase capital flowing to competing space startups and companies. Relative valuations of companies developing satellites, launch vehicles, space stations, and in-space manufacturing will adjust based on Space X's public valuation and growth metrics. The IPO will also increase public awareness of space-based business opportunities, potentially accelerating adoption of space-based solutions for Earth applications (satellite internet, imaging, communications, etc.). Companies like Axiom Space, Relativity Space, and others will benefit from increased institutional investor interest in the space sector.

What is Starlink and how does it affect Space X's valuation?

Starlink is Space X's satellite internet constellation—a network of thousands of small satellites in orbit providing broadband internet globally. Starlink is currently valued at around $180 billion as a separate entity, though it operates under Space X. Starlink is hugely relevant to Space X's IPO because it generates recurring subscription revenue (unlike launch services which are transaction-based). Starlink already has 500,000+ active subscribers and is expanding internationally. If Starlink spins out as a separate IPO post-Space X (similar to how Google created Alphabet), it could unlock significant value for Space X shareholders and explain the high parent company valuation.

Will Musk retain control of Space X after the IPO?

Musk will almost certainly retain majority voting control through a dual-class share structure (similar to how Tesla is structured). Space X will likely issue Class A (10 votes per share) and Class B (1 vote per share) shares, with Musk's existing shares being Class A. This keeps founder control intact while allowing public ownership through lower-voting Class B shares. This is controversial among corporate governance advocates but is common practice for founder-led tech companies going public. Investors in the IPO will be aware they're buying into a Musk-controlled company, not a professionally managed public corporation with independent board governance.

How does Space X's business model compare to traditional aerospace companies?

Traditional aerospace companies like Boeing and Lockheed Martin primarily earn revenue through government contracts and build custom spacecraft for each mission. Space X operates differently: it manufactures reusable rockets (Falcon 9, Starship) that fly multiple times, operates its own satellite internet service (Starlink), and pursues both government and commercial revenue simultaneously. Space X's gross margins on launches are higher than traditional aerospace (due to reusability and manufacturing efficiency), and Starlink provides recurring subscription revenue that traditional aerospace doesn't have. This hybrid model—manufacturer + service provider—is unique and explains part of the high valuation multiple.

Final Thoughts: Why This IPO Matters Beyond the Numbers

Space X's IPO isn't just another billion-dollar company going public. It's validation that space exploration can be profitable, scalable, and accessible to private capital. It's a statement that the future of humanity's relationship with space isn't determined by governments alone—it's built by entrepreneurs willing to bet billions on moonshots.

Will the

But whatever the final number, Space X going public changes the calculus for everyone in space-related business. It says: "Space is the next frontier for business and investment."

That's why June 2026 matters. Not because of planetary alignment (that's noise). But because Space X's IPO signals that commercial space has entered the mainstream. And that's genuinely transformative for the industry.

The Elon Musk birthday/planetary alignment angle is pure marketing genius. Everyone talks about it. Everyone remembers it. It makes Space X's IPO a cultural moment, not just a financial event. And in a sea of billions in IPO noise, that differentiation is worth something.

So yeah, watch the planets if you want. But watch Starship's test flights more closely. They're the real story.

Key Takeaways

- SpaceX targets June 2026 IPO at 50B+, making it the largest IPO in history—driven by Starship's proven reusability technology.

- June timing is strategically sound for market seasonality and regulatory momentum, though Musk's birthday/planetary alignment angle is mostly marketing genius.

- Starship's technical validation (booster catches, orbital refueling) has compressed SpaceX's valuation timeline, jumping from 1.5T in 60 days.

- SpaceX's revenue model—government contracts, commercial launches, Starlink subscription—differs fundamentally from traditional tech IPOs and justifies 375x P/S multiple.

- Investors are betting on Starship unlocking $500B+ addressable markets (point-to-point flights, Mars missions, space manufacturing) within 7-10 years.

Related Articles

- 2026 Rocket Failures: China, Rocket Lab Setbacks & Space Race Evolution

- Elon Musk's Davos Predictions: Why They Keep Missing [2025]

- SpaceX IPO 2025: Why Elon Musk Wants Data Centers in Space [2025]

- Elon Musk's $134B OpenAI Lawsuit: The Math Controversy Explained [2025]

- Tesla's Dojo Supercomputer Restart: What Musk's AI Vision Really Means [2025]

![SpaceX IPO in 2026: Inside Musk's Billion-Dollar Timing Strategy [2026]](https://tryrunable.com/blog/spacex-ipo-in-2026-inside-musk-s-billion-dollar-timing-strat/image-1-1769621931524.jpg)