How Spotify Became the Unexpected Gateway to Your Concert Tickets

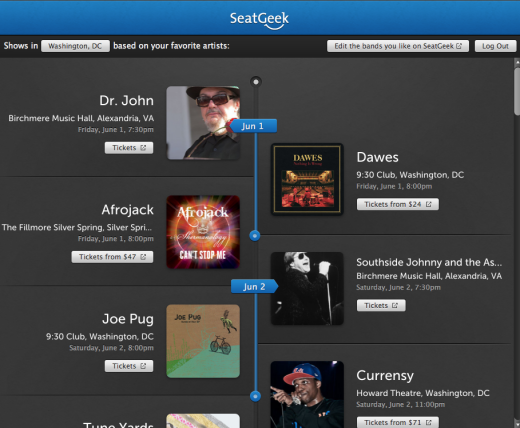

Imagine this: you're listening to your favorite band on Spotify, and you suddenly get a notification that they're playing at a venue near you. You tap once, and boom—you're buying tickets without leaving the app. No hunting through browser tabs, no sketchy third-party sites, no confusion about which ticketing service actually has the real inventory.

That's exactly what Spotify just made possible with its new partnership with SeatGeek.

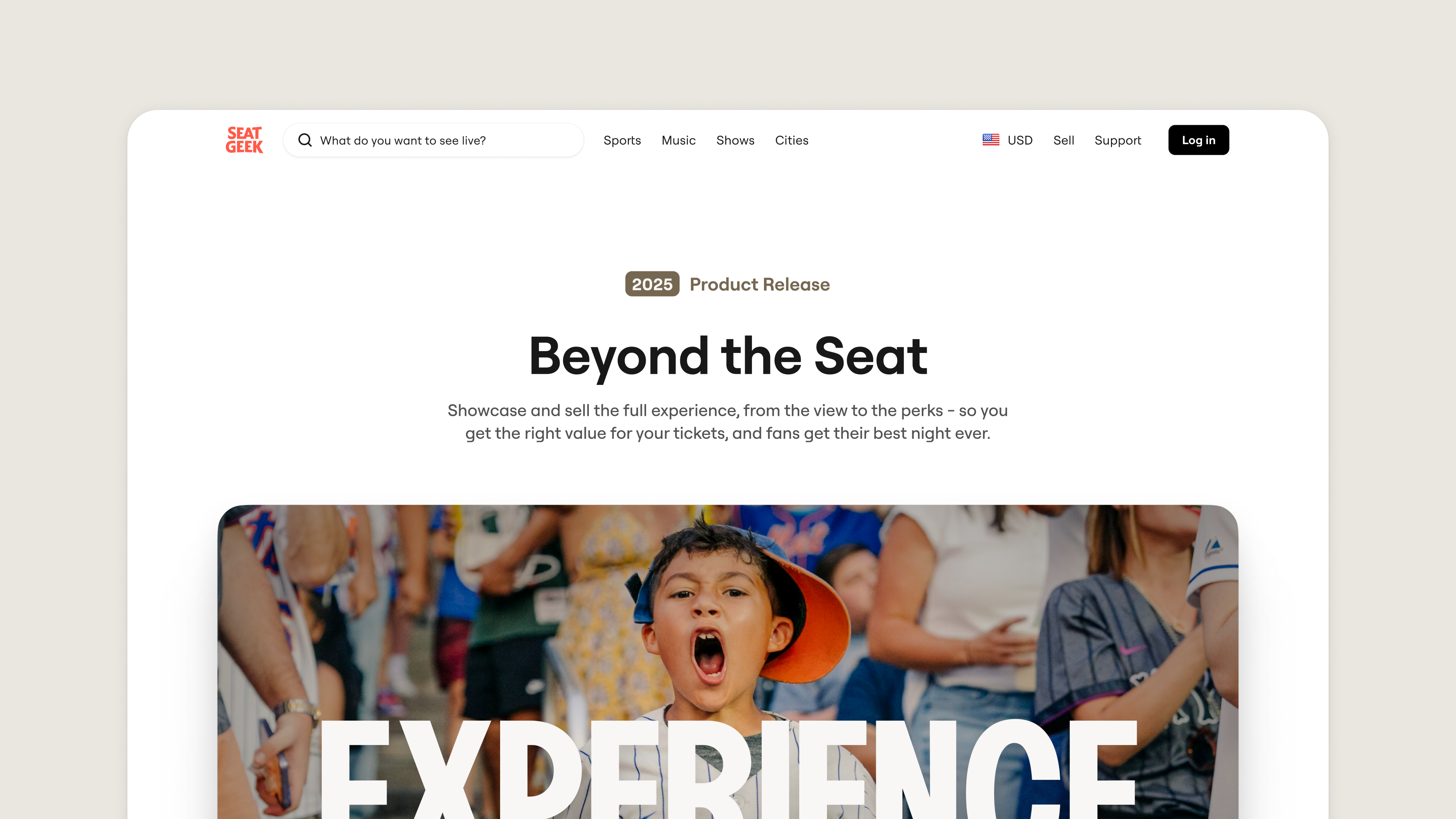

On the surface, this sounds like a small feature. A streaming app adding a ticketing link. But it's actually a much bigger story about how music streaming platforms are trying to capture every moment of the fan experience, from the first listen to the moment you're sitting in your seat. It's also a story about competition, because Spotify isn't just randomly choosing SeatGeek—it's making a strategic bet about the future of ticketing in the streaming era.

Let's unpack what's actually happening here, why it matters, and what it means for the next time you want to catch a live show.

The Live Event Problem That Streaming Services Are Trying to Solve

Streaming music got really good at one thing: making recorded music frictionless. You tap play, and the song is there. You don't think about it. The experience is so smooth that you almost forget you're using technology at all.

But here's where it breaks down. The moment an artist announces a tour, that frictionless experience ends. You get an email from your favorite band, or you see a notification on Twitter, or your friend texts you the link. You then have to go somewhere else—a separate website, a different app, maybe even a phone call if you're old school—to buy tickets.

For Spotify, with over 750 million monthly users, this is a leakage problem. The user's journey breaks. They drop off the platform. They engage with a competitor's ecosystem. And Spotify loses the chance to be part of that transaction.

More importantly, Spotify loses valuable data about what its users want to see live. It misses the chance to deepen engagement. It misses the moment when a user might be willing to spend money—because concert tickets are where people's discretionary spending actually happens in the music world.

So Spotify's strategy has been clear for a few years now: integrate ticketing into the streaming experience. Don't make fans leave. Keep them inside the ecosystem. Make it so easy to buy tickets that they do it without thinking.

The new SeatGeek integration is Spotify's latest move in that direction. But it's not their first, and understanding why they chose SeatGeek—and how the integration actually works—tells you a lot about where streaming and ticketing are headed.

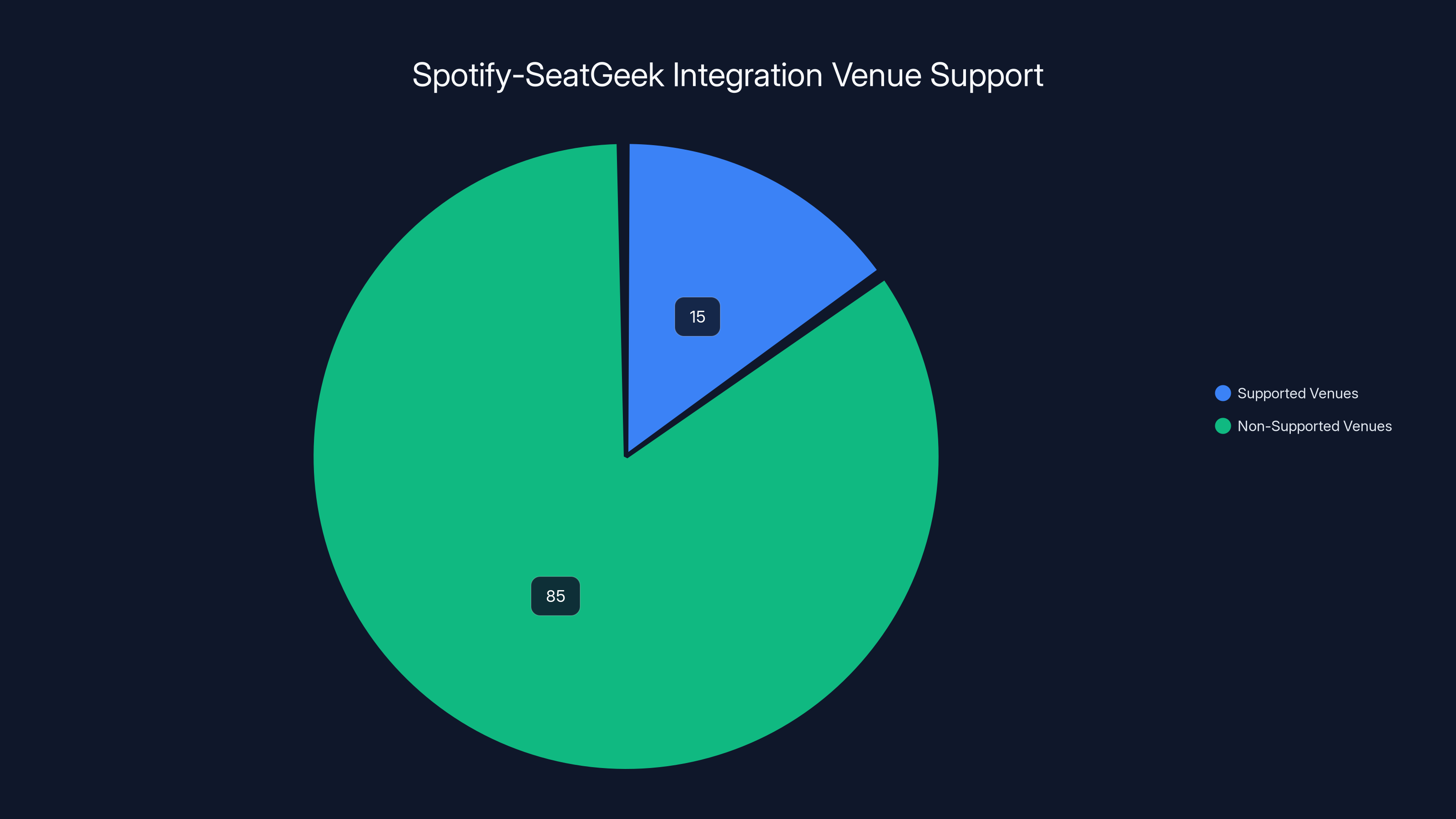

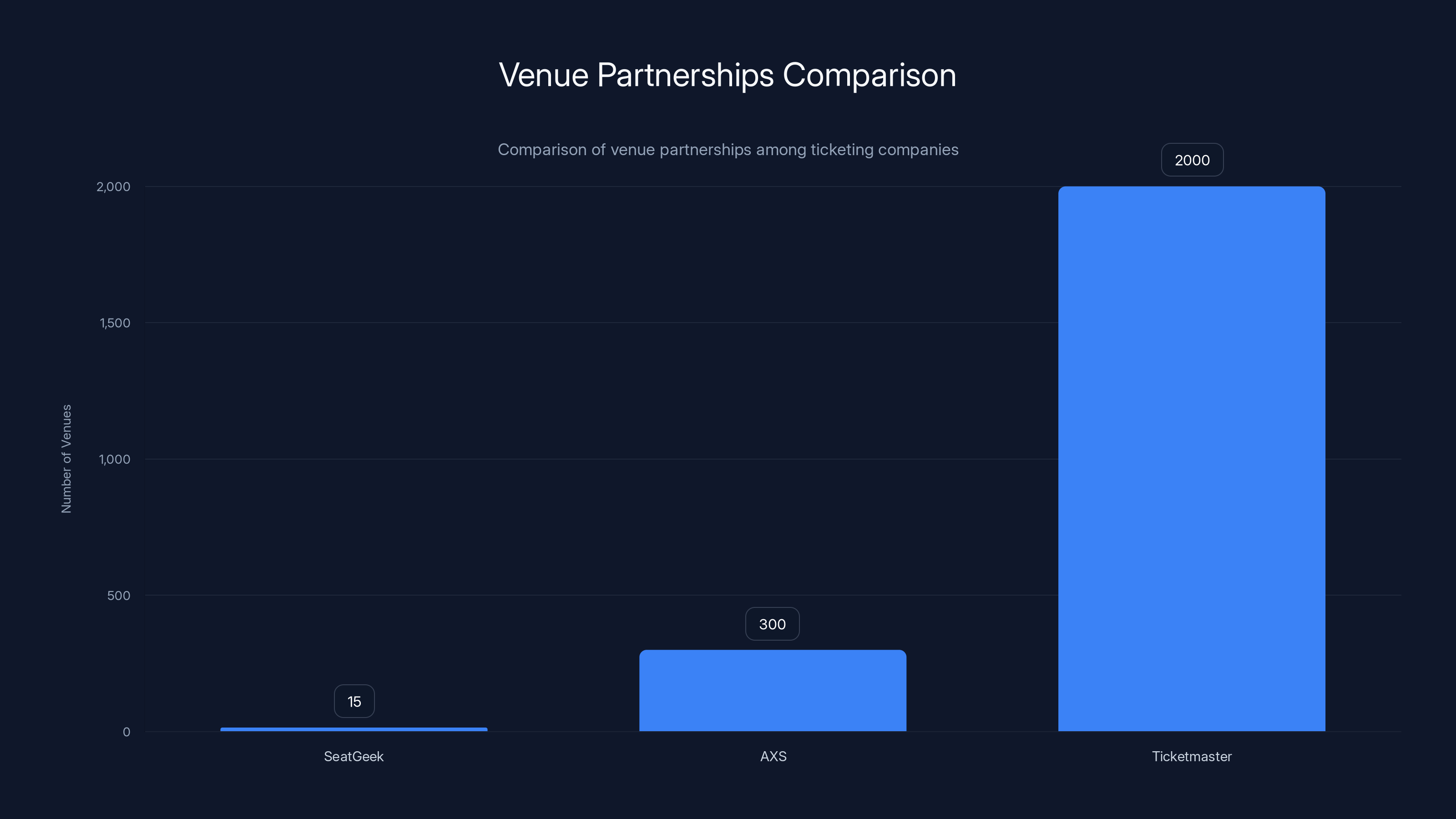

Currently, only 15 venues support the Spotify-SeatGeek integration, with plans for gradual expansion. Estimated data.

Understanding the SeatGeek Partnership: Limited Launch, Big Ambitions

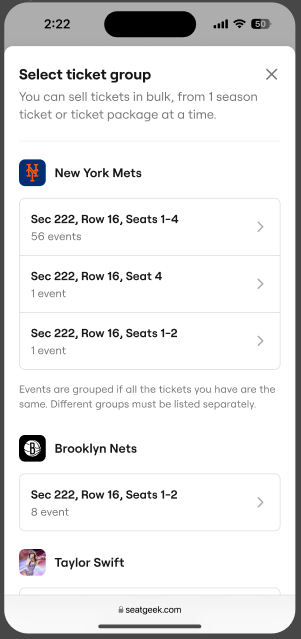

Let's be clear about what's actually available right now. The Spotify SeatGeek integration isn't ubiquitous. You can't buy tickets for every artist at every venue. Instead, it's currently available at 15 participating venues in the United States, and only where SeatGeek is the primary ticketing company.

That's a significant limitation. For comparison, Ticketmaster has partnerships with thousands of venues. AXS operates hundreds. SeatGeek's 15 venues are mostly major professional sports arenas—places like AT&T Stadium in Arlington, Texas, or similar large-capacity venues that sell enough tickets to make the partnership worthwhile.

So why start here? A few reasons make sense.

First, professional sports venues are high-traffic environments. They host events constantly—not just concerts, but sports games, festivals, conventions. That means there's always something to sell tickets for. From Spotify's perspective, there's always a reason for users to see that integration, which means it gets better at reminding people of the feature.

Second, sports arenas typically have simpler ticketing than concert venues. There's less inventory chaos, fewer resales happening in real-time, and more straightforward seating charts. This makes it easier for Spotify to surface that information cleanly and predictably. No surprises, no customer support nightmares.

Third, and probably most important, professional sports venues are operated by companies with technical sophistication and resources. They can handle API integrations. They understand how to work with partners. They're not going to panic if something breaks. These are institutions that invest in technology.

So Spotify's starting with the safest possible bet: partnership with venues that have the infrastructure to support a new sales channel and the incentive to drive volume through it.

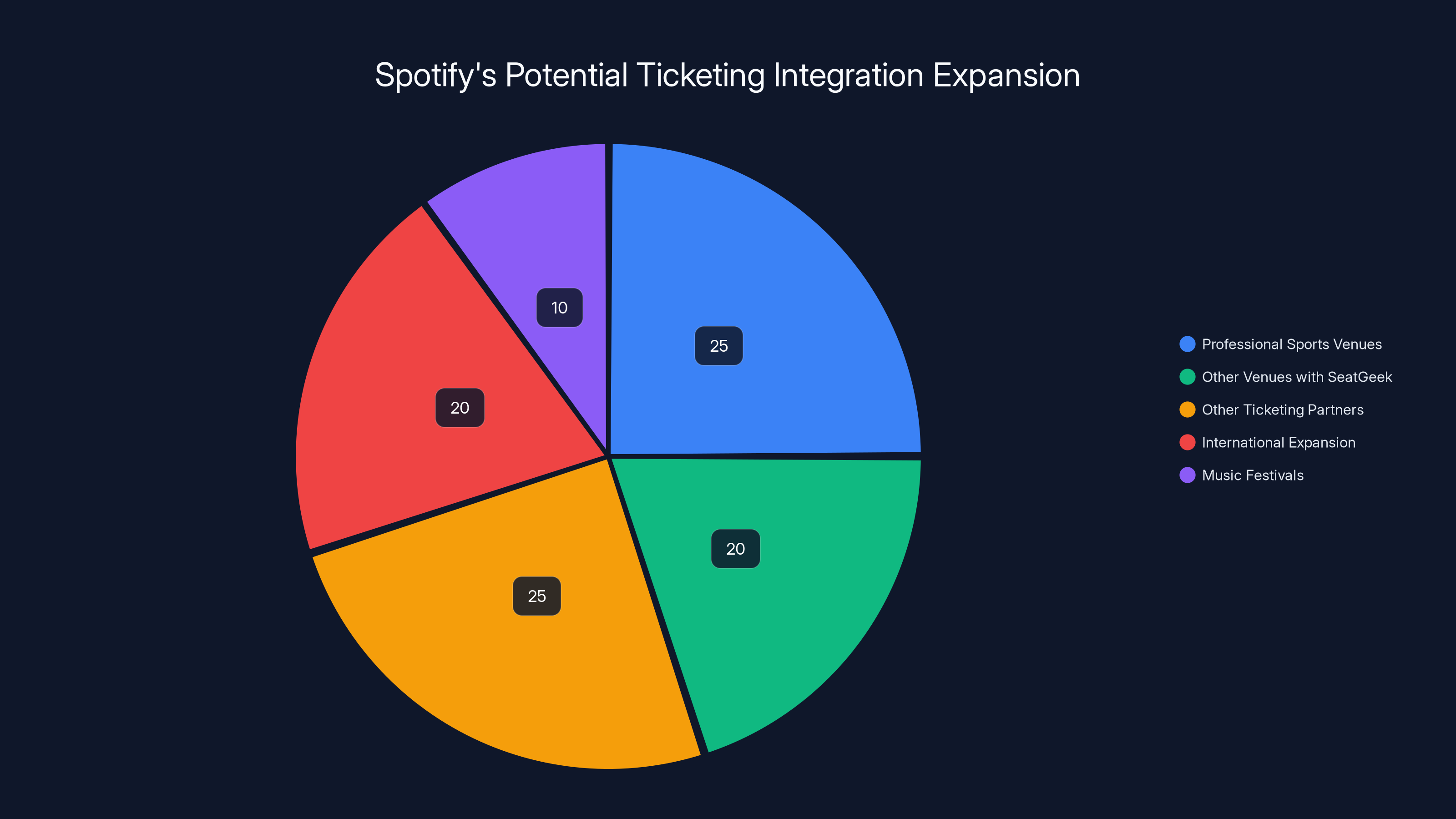

Estimated data suggests Spotify may focus equally on expanding to other ticketing partners and professional sports venues, with significant attention to international markets and SeatGeek venues.

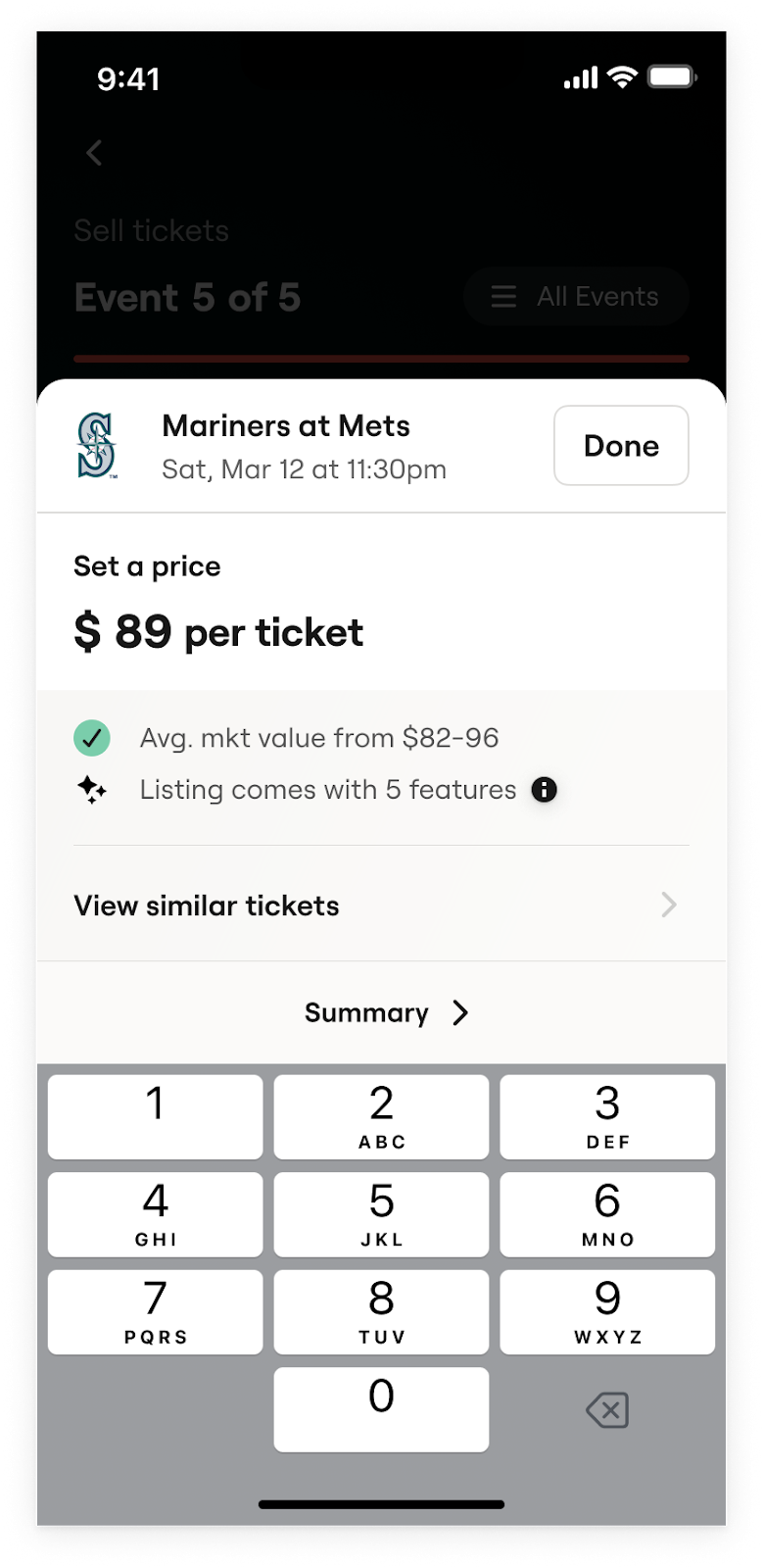

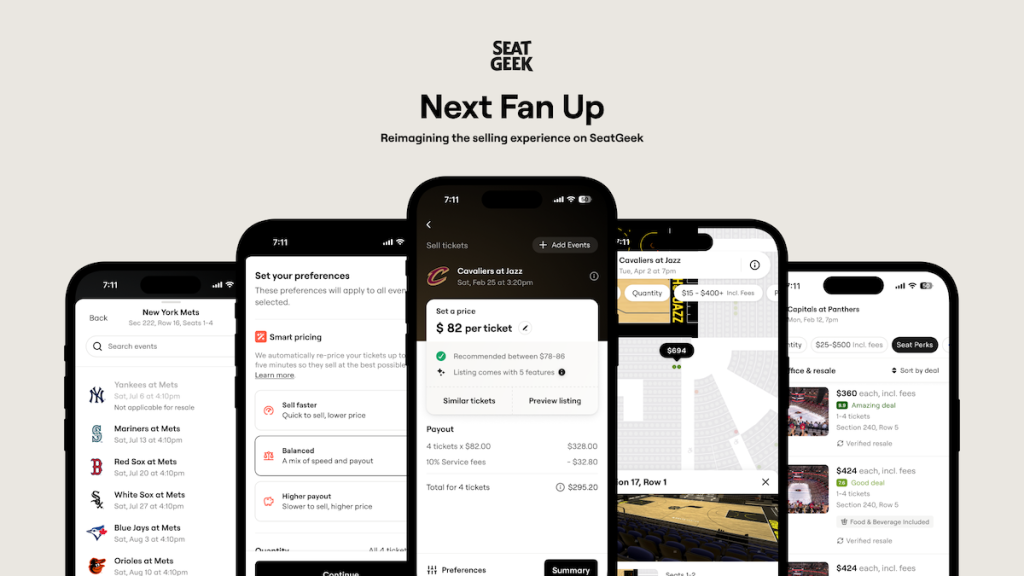

How the Integration Actually Works: The User Experience

Here's what happens when you encounter this feature in the Spotify app.

You're listening to an artist you follow. That artist has an upcoming event at a participating SeatGeek venue. Spotify detects this and shows you a notification or a promotional tile. It might appear on the artist's page, or it might show up in your home feed, depending on how Spotify decides to surface it.

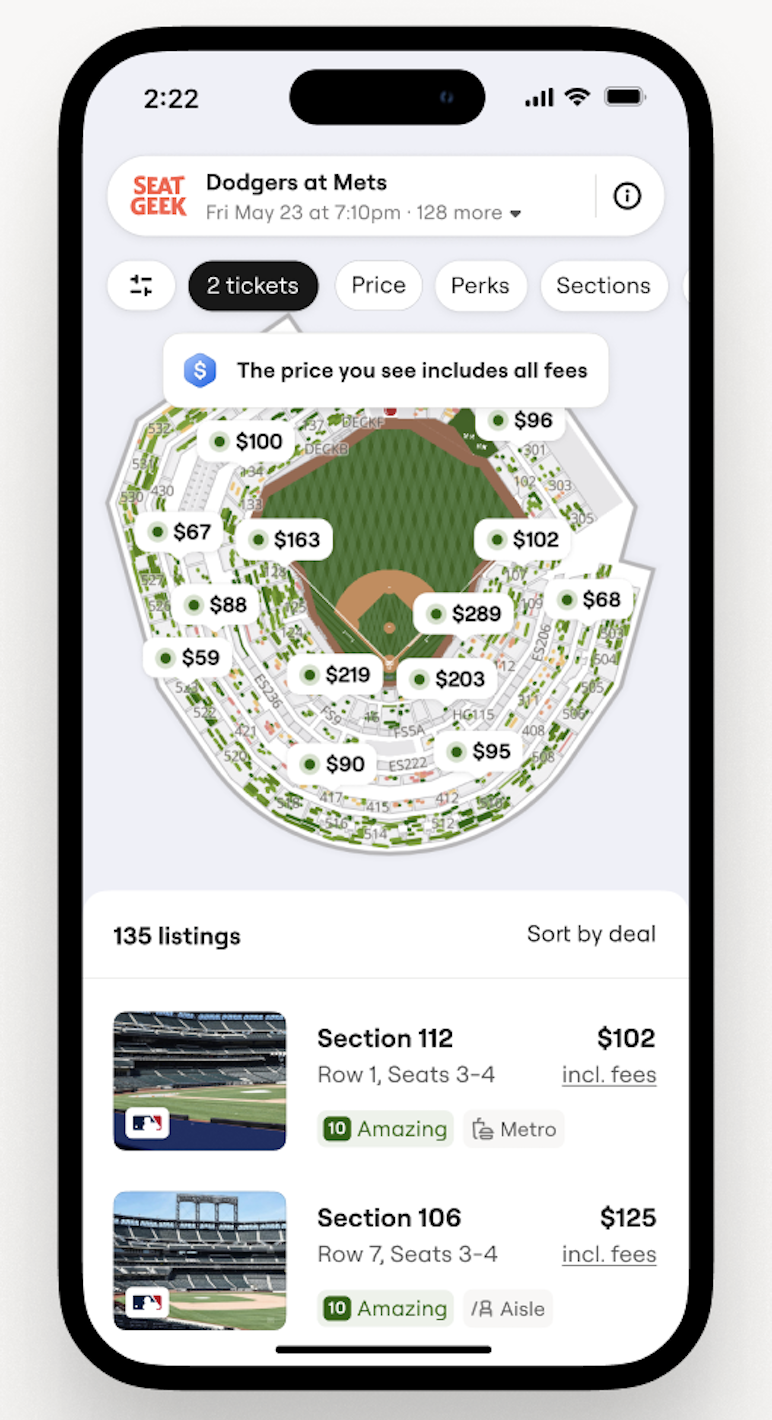

You tap the tile. You're taken to a dedicated SeatGeek interface inside the Spotify app—not kicked out to the browser or the SeatGeek app, but embedded within Spotify's own interface. You can see available tickets, prices, seat locations, and reviews from other buyers. You can filter by price, by location in the venue, by how far you want to sit from the stage.

If you want to buy, you can complete the transaction right there. Spotify handles the payment, the delivery method (digital tickets, physical mail, will-call), and the confirmation. You don't have to register separately on SeatGeek's website. The whole thing is frictionless.

This is important because friction is where ticketing conversions typically die. Every extra step, every new password, every moment of confusion costs you sales. By embedding the whole flow inside Spotify's app, they're removing that friction.

The data flow works like this: when a user follows an artist on Spotify, the system knows about it. When that artist has an upcoming tour with participating venues, Spotify connects those two pieces of information. It then reaches out to SeatGeek's API to check if tickets are available, what the price is, and what inventory exists. SeatGeek sends that data back, and Spotify displays it.

If you buy, Spotify and SeatGeek exchange information about the transaction—just what's needed for fulfillment and tracking. You get your ticket confirmation. SeatGeek gets the sale. Spotify gets the engagement data and user retention.

The History of Spotify's Ticketing Experiments: What Worked, What Didn't

This isn't Spotify's first attempt at ticketing. The company has been experimenting with concert sales integration for years, and understanding that history helps explain why they're taking this particular approach now.

Back in 2017, Spotify launched a partnership with Ticketmaster that allowed users to buy tickets directly from artist pages. The integration was available in select markets and worked through an embedded widget on the artist's Spotify page. It seemed promising, but it never became the seamless, pervasive feature that Spotify clearly wanted it to be.

Why? Partly because Ticketmaster's systems are complex. They operate thousands of venues with different rules, different inventory systems, and different business relationships. Integration with all of that is messy. Ticketmaster's primary interest is protecting their venue relationships and their existing user experience—not necessarily optimizing for Spotify.

Spotify also tried building its own ticketing infrastructure in 2017, briefly exploring whether they could become a ticket seller themselves, kind of like how they became a music publisher when they started a podcast division. That didn't work out. Ticketing is fundamentally different from streaming. It's localized. It's inventory-based. It's not a subscription model. Spotify realized they're better off as a distribution channel than as a primary seller.

So they pivoted. Instead of owning the ticketing relationship, they decided to own the distribution. They'd integrate with multiple ticketing partners—not just Ticketmaster, but AXS, Eventbrite, SeatGeek, and others—and let the partnerships grow naturally based on each venue's existing relationships.

Currently, Spotify lists 46 ticketing partners across their platform. That's a lot more than just SeatGeek. But the SeatGeek integration is getting special attention because of how it's structured—it's embedded, it's deep, and it's optimized for conversion.

The other partnerships often feel more like links. You click, and you go somewhere else. The SeatGeek partnership is different. You click, and you stay inside Spotify. That difference matters enormously for user experience and, ultimately, for conversion rates.

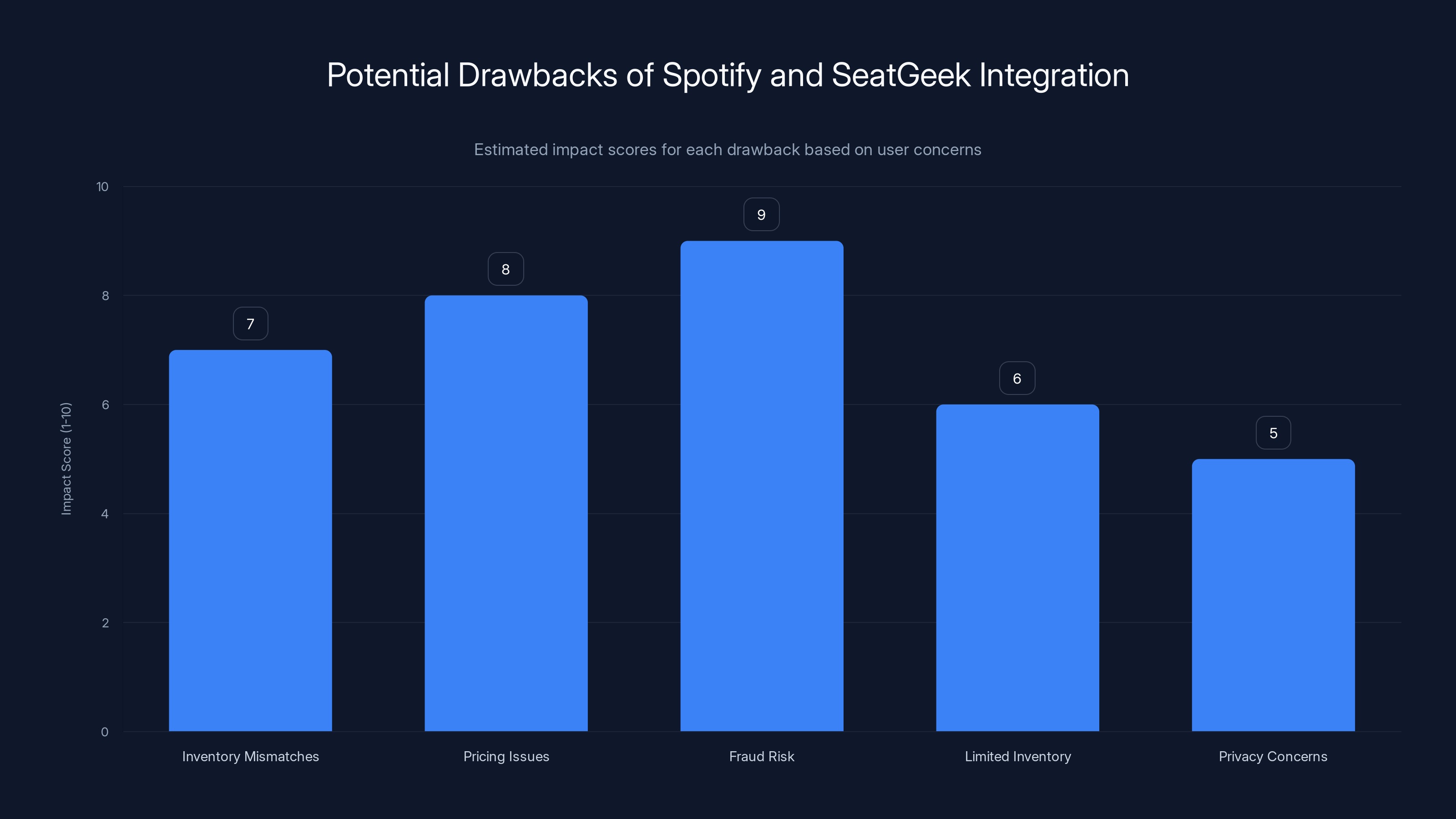

Fraud risk and pricing issues are estimated to have the highest impact on user experience, potentially undermining trust in the Spotify-SeatGeek integration. Estimated data.

Why SeatGeek Specifically? The Secondary Market Angle

You might notice something interesting about SeatGeek versus some of Spotify's other ticketing partners: SeatGeek is primarily a secondary market player. It's not like Ticketmaster, which sells most of its tickets at face value from the primary market. SeatGeek specializes in resale tickets.

Why partner with a secondary market platform instead of pushing harder on the primary market relationships?

It's actually a smart move, and it reveals something about how modern ticketing works. Primary market tickets—the ones sold directly by venues and promoters—often sell out within minutes. For a huge portion of users who see that integration on Spotify, if they click on it, the tickets are already gone. That's a bad user experience. You get them excited about buying tickets, you show them the option, and then the option isn't there.

Secondary market tickets, though, are always available. Fans who bought tickets and then can't go to the show sell them. Resellers buy them up. SeatGeek aggregates all that inventory and makes it available. So when a Spotify user clicks on a SeatGeek link two weeks before a concert, there's a much higher chance that tickets will actually be available.

From a user experience perspective, that's better. From SeatGeek's perspective, it's a huge distribution opportunity. Secondary market platforms live or die on volume. Getting access to Spotify's 750 million users is like winning the lottery.

For Spotify, it's a win too. They get to show users a working ticket-buying option more often. They get higher conversion rates. And they get to drive demand to a platform that will almost certainly have inventory to fulfill it.

There's one more angle to this: secondary market platforms have less regulatory friction. Primary market ticketing is heavily regulated in some jurisdictions. You have to work with local authorities, comply with venue agreements, navigate complicated licensing. Secondary market resale is more straightforward. You're just matching buyers and sellers. That makes the integration simpler to build, test, and launch.

The Bigger Picture: Streaming Platforms as Lifestyle Hubs

The SeatGeek integration is part of a much larger trend. Streaming platforms—Spotify, YouTube Music, Apple Music, Amazon Music—are all trying to become lifestyle hubs, not just music players.

They're adding podcasting. They're adding merchandise. They're adding concert ticketing. They're adding artist news and updates. Some are even adding social features, like the group messaging that Spotify added recently, or shared listening experiences.

The logic is clear: if you can capture every interaction a user has with music and artists, you can build a moat that's nearly impossible to cross. You become the central hub of someone's music experience. You're not just the place they listen to songs. You're the place they discover artists, follow artists, buy merch from artists, go to see artists live.

That's valuable. It's valuable for retention because you're embedded deeper in the user's life. It's valuable for data because you understand every stage of the fan journey. And it's valuable for revenue because you can take a cut—directly or indirectly—of every transaction that happens.

Spotify's been pursuing this strategy more aggressively than some competitors. Their acquisition of Podz, their investment in podcast exclusives, their expansion into audiobooks, their new social features—all of this is about becoming more than a music streaming service.

Ticketing is a natural extension of that. It's where fans spend real money. It's where they make big decisions about where to be and who to see. Getting into that conversation is incredibly valuable for Spotify.

SeatGeek currently partners with 15 venues, significantly fewer than AXS and Ticketmaster, which have partnerships with hundreds and thousands of venues respectively. Estimated data.

Comparing Spotify's Ticketing Strategy to Competitors

How does Spotify's approach compare to what Apple Music, YouTube Music, and Amazon Music are doing?

Apple Music hasn't made as much of a public push into ticketing. They have some integrations with Ticketmaster, but they haven't announced anything as distinctive as the Spotify-SeatGeek partnership. Apple's strategy seems to be bundling ticketing discounts with Apple One subscriptions rather than building native integration.

YouTube Music has been more aggressive. They've integrated with Ticketmaster and other platforms, and they've been showing ticketing information on artist pages. They're also doing something interesting: they're using YouTube's video library to make artist pages more engaging. Want to learn about a band before you buy tickets? You can watch their music videos right there.

Amazon Music has been relatively quiet on ticketing, though they do partner with Ticketmaster. Amazon's bigger play seems to be on live music content—they acquired Wondery for podcasts and have invested in concert film productions.

Spotify's advantage right now is speed and focus. They're moving faster than competitors, and they're not trying to do everything at once. The SeatGeek partnership is deep and integrated, even if it's limited to 15 venues. That's different from competitors who are offering ticketing as one of many features.

The risk for Spotify is that they're betting on one horse (SeatGeek) while competitors might be building broader partnerships. If SeatGeek stumbles, or if venue partnerships expand more slowly than expected, Spotify could look like they invested in the wrong place.

But the upside is huge. If this works—if conversion rates on the embedded SeatGeek integration are even 50% higher than on third-party links—then Spotify will be earning a bigger share of ticketing revenue than any competitor.

The Artist Perspective: What Do Performers Think About This?

Here's a question that often gets overlooked: do artists actually want this? Are they benefiting from Spotify's ticketing integration?

The answer is complicated. Most artists benefit from anything that makes it easier for fans to buy tickets. Higher visibility, simpler checkout, less friction—all of that translates to higher sales. And Spotify's reach is enormous. An artist getting promoted to Spotify's 750 million users because someone's following them is a massive distribution advantage.

But there are some artists who are skeptical about platforms controlling access to fans. They worry about algorithmic promotion replacing direct connection. They worry about platforms taking cuts. They worry about being bundled into generic "recommendations" that dilute their uniqueness.

For independent artists and smaller touring acts, the integration might feel like an opportunity they're not part of. If SeatGeek is only integrated with 15 venues, and an artist primarily tours smaller clubs, they won't see any benefit. The feature will feel like it's for major-label touring acts only.

There's also a strategic question for artists: who controls the fan relationship? If Spotify is the primary channel through which fans discover your tour and buy tickets, is Spotify now your main ticketing partner? What does that mean for your relationship with your booking agent, your merchandise company, and your other business partners?

Most major artists have sophisticated teams managing this. They understand that multi-channel distribution is better than betting on one platform. But for emerging artists, being left out of a Spotify integration could feel like missing an opportunity.

Currently, the Spotify-SeatGeek partnership is limited to 15 major sports arenas in the US. Estimated data.

The Data Play: Why Concert Data Matters More Than You Think

Here's something that doesn't get as much attention as it should: the data.

When someone buys a concert ticket through the Spotify-SeatGeek integration, Spotify learns something important: this user is willing to travel to a specific venue, at a specific date, to see a specific artist. That's valuable information.

Spotify can use that data in lots of ways. They can recommend other artists who are touring to the same venues on similar dates. They can recommend artists who have similar fan bases. They can predict which artists you'll want to see in the future based on your listening habits and your historical ticket purchases.

For the platform, that's a competitive advantage. Apple Music doesn't have that data the same way. YouTube doesn't have it the same way. Only Spotify sees your listening history and your concert attendance patterns in one unified place.

Over time, that data becomes incredibly valuable. It can train recommendation algorithms. It can help predict touring success. It can help Spotify advise artists on which cities to add to their tours, or which venues are undersaturated in terms of concerts.

It also helps Spotify understand economics in a way that pure music streaming data can't. Musicians make most of their money from touring, not from streaming. If Spotify can understand touring economics—which artists tour most, which tours sell out, which are profitable—they can make smarter decisions about which artists to promote on the platform.

That's a long-term strategic advantage that most people don't think about when they hear "Spotify adds SeatGeek integration." But it's real.

Expansion Plans: What's Next for the Integration

The current rollout is clearly a test. Fifteen venues is a proof-of-concept. The real question is: where does it go from here?

Spotify's strategy seems to be: prove it works with professional sports venues, then expand to other venues where SeatGeek is the primary ticketing partner. SeatGeek doesn't have primary ticketing at thousands of venues the way Ticketmaster does, but they do have partnerships with a growing number of venues.

There's also a question about whether this integration will expand to other ticketing partners. Right now it's SeatGeek. But Spotify has 46 ticketing partners. Will they integrate all of them this way? Or will SeatGeek remain special?

My guess is that Spotify will eventually integrate multiple partners the same way, because relying on a single partner is risky. But they'll probably do it carefully, testing what works and what doesn't with each new partner.

Geographically, you should expect the integration to expand beyond the current US venues first, then internationally. Spotify's user base is global, but their ticketing partnerships vary by country. In some countries, they might partner with different companies entirely.

There's also a question about music festivals and other non-venue events. Ticketing for festivals is different from ticketing for a single venue show. But there's clearly an opportunity for Spotify there too.

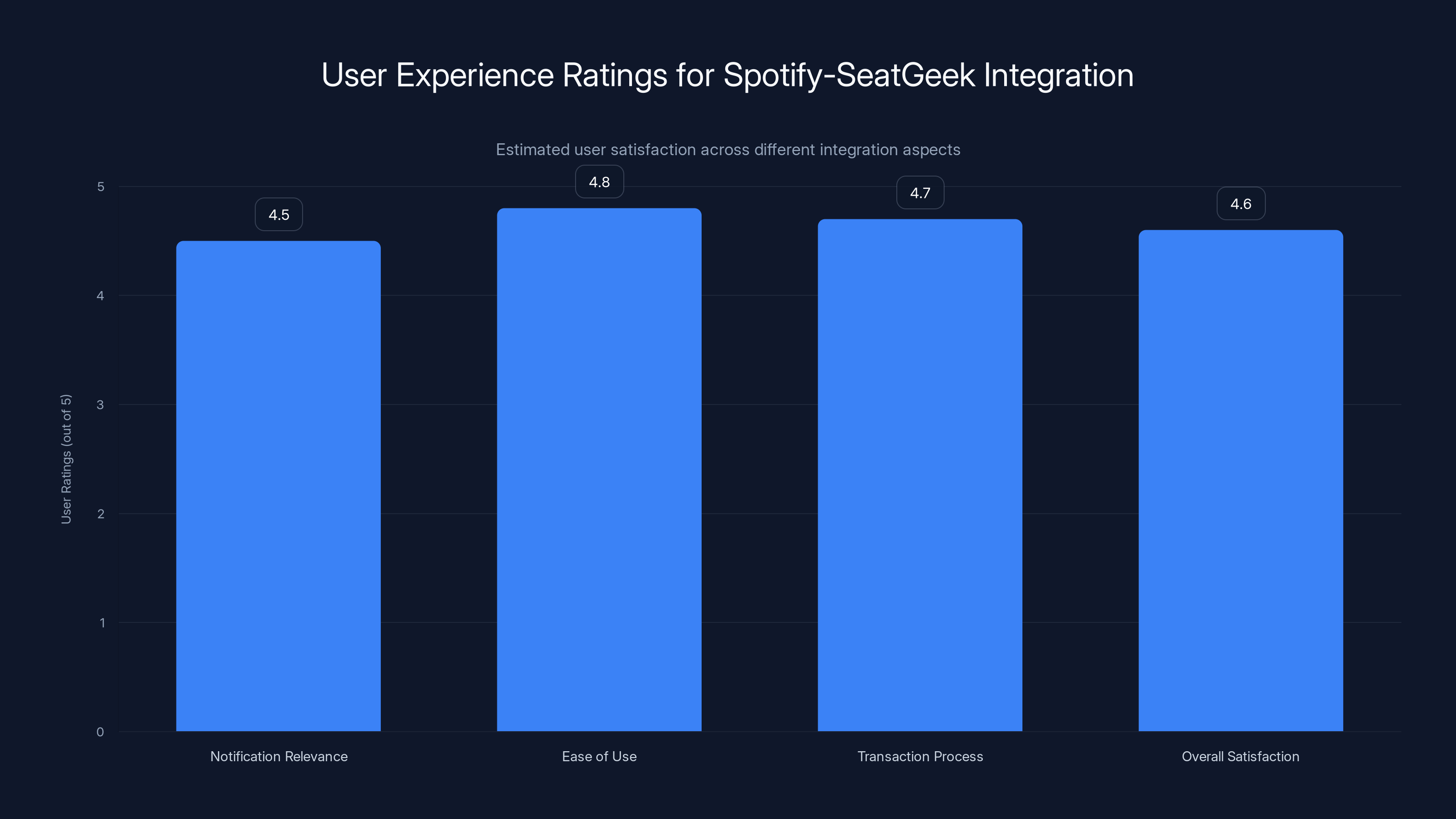

Estimated data shows high user satisfaction across all aspects of the Spotify-SeatGeek integration, particularly in ease of use and transaction process.

The Competitive Moat: How Spotify Stays Ahead

One reason Spotify can move faster on initiatives like this is that they have a fundamental competitive advantage: user attention. Spotify users spend an average of 45 minutes per day on the app. That's a lot of time, and a lot of opportunity to show new features.

When Apple Music or YouTube Music launch similar features, they're fighting against habit. Users are already used to using Spotify. Switching to buy tickets on a competitor's app is friction. Staying in Spotify is not.

That's why the embedded SeatGeek integration is so strategically important. It's not just about convenience. It's about habit formation. If using Spotify becomes the natural way to discover and buy concert tickets, that becomes a reason to stay on Spotify instead of switching to a competitor.

Over time, that compounds. Users develop workflows around Spotify. They learn where to find things. They trust the recommendations. Switching becomes harder and harder.

That's the flywheel that all streaming platforms are trying to build. Spotify's been executing on it better than most, which is one reason they're still the market leader despite competition from much larger companies like Apple and Amazon.

Potential Drawbacks and Friction Points

Not everything about this integration will be smooth. There are some potential problems worth thinking about.

First, inventory mismatches. SeatGeek shows available tickets, but if the API is delayed or if inventory sells out between when Spotify shows it and when you try to buy, you'll get disappointed. That's a trust issue that could undermine the feature.

Second, pricing. Secondary market tickets can vary wildly. You might see a ticket listed at $150 on SeatGeek and wonder if that's a good price. Without an easy way to compare across other platforms, you might feel like you're overpaying. The transparency will matter a lot here.

Third, fraud. Ticketing has a fraud problem, and it's worse in the secondary market. What happens if someone buys a fraudulent ticket through Spotify's interface? Who's responsible? Spotify? SeatGeek? The venue? That needs to be clear.

Fourth, limited inventory. If the integration only works at 15 venues, most users who click on it won't find anything available. That could create the impression that the feature is broken or useless, when really it's just limited.

Fifth, privacy concerns. Collecting data about what concerts people attend is collecting data about their location, their interests, and their financial behavior. Some users might be uncomfortable with that, even if they're technically consenting to it through the platform's terms of service.

The Regulatory Question: Is Ticketing Getting Safer or Riskier?

Ticketing has a regulatory problem. There are laws about ticket sales, resale, and pricing in various jurisdictions. Some states have ticket broker licensing requirements. Some countries have consumer protection rules. Adding a new distribution channel creates new regulatory questions.

When you buy tickets through SeatGeek on Spotify, which company is responsible for consumer protection? Who's the seller of record? If something goes wrong, who do you complain to? These questions matter because they determine who's liable if something goes wrong.

So far, Spotify and SeatGeek haven't faced major regulatory issues with the integration, possibly because it's so limited in scope. But as it expands, regulatory scrutiny will likely increase.

The good news is that SeatGeek is an established company with legal and compliance infrastructure. They've navigated ticketing regulations for years. They're not some rogue platform trying to dodge rules. That makes Spotify safer partnering with them than with a less-regulated alternative.

But regulators might also see Spotify's integration as Spotify entering the ticketing business in a new way. That could trigger new regulatory questions. It's worth monitoring.

Looking Forward: The Future of Streaming and Live Events

In five years, will buying concert tickets through Spotify seem totally normal? Or will this remain a niche feature?

I think it'll be normal. Here's why: the incentives are too strong. For users, frictionless ticket buying is better than the alternative. For platforms, capturing ticketing data is too valuable to ignore. For ticketing companies, access to streaming platform users is too big an opportunity to pass up.

The question isn't whether streaming platforms will integrate ticketing. It's what that integration will look like. Will it be embedded like the SeatGeek integration? Will it span multiple partners? Will it include merchandise, parking, food, and other venue services bundled together?

I'd bet that within three years, all major streaming platforms will have similar ticketing integrations. They'll probably all integrate multiple partners. There might even be competition to become the default ticketing integration, kind of like how there's competition to become the default payment processor.

We might also see streaming platforms get more directly involved in venue operations. If Spotify has data about which venues are undersaturated and which are oversaturated, why wouldn't they share that with artists and booking agents? Why wouldn't they offer guidance on where to tour based on fan demand?

The endgame might be that streaming platforms become full-service entertainment hubs. You discover music on Spotify. You follow artists. You get recommendations for shows. You buy tickets. You pre-order merchandise. You share the experience with friends. You get exclusive content from the artists you support.

It sounds like science fiction, but it's already happening in pieces. The Spotify-SeatGeek integration is just one more brick in that wall.

TL; DR

-

Spotify-SeatGeek partnership is live: The integration allows fans to buy concert tickets from within the Spotify app at select venues where SeatGeek is the primary ticketing partner, currently just 15 US venues, primarily major sports arenas

-

This is limited but strategic: Starting with professional sports venues allows Spotify to test the integration safely, gather data, and prove the concept before expanding to more venues

-

SeatGeek focus makes sense: Secondary market platforms like SeatGeek have more consistent inventory than primary market sellers, reducing the friction of unavailable tickets and providing better user experience

-

Data collection is the real prize: Spotify gains valuable information about concert attendance patterns, fan preferences, and touring economics that competitors like Apple Music and YouTube Music can't easily replicate

-

Expansion is inevitable: Expect broader venue coverage, additional ticketing partners, and international expansion over the next 2-3 years as Spotify solidifies ticketing as a core platform feature

-

Bottom line: This is how streaming platforms build moats. By becoming the central hub for discovering artists and attending their shows, Spotify makes switching to competitors more difficult and creates reasons for users to stay engaged

FAQ

What is the Spotify-SeatGeek integration?

It's a partnership between Spotify and the ticketing platform SeatGeek that lets users buy concert tickets directly within the Spotify app. When you follow an artist on Spotify and they have upcoming shows at participating venues, you'll see a notification or promotional tile allowing you to view available tickets and purchase them without leaving the app.

How does the Spotify-SeatGeek integration work?

When a Spotify user follows an artist, Spotify's system checks if that artist has upcoming events at participating SeatGeek venues. If they do, Spotify displays a ticket promotion on the artist's page or in the user's feed. Clicking it opens an embedded SeatGeek interface showing available tickets, prices, and seat locations. You can complete the purchase within Spotify using your payment method, and you'll receive digital or physical tickets depending on the venue's delivery method.

Which venues currently support this integration?

Currently, the integration is available at 15 US venues where SeatGeek is the primary ticketing partner, mostly professional sports arenas like AT&T Stadium in Arlington, Texas. Spotify plans to expand to additional venues gradually, but most concert venues are not yet included. You should check Spotify directly to see if your favorite venue is available.

Why did Spotify choose SeatGeek instead of Ticketmaster?

Spotify offers 46 ticketing partners including Ticketmaster, but partnered deeply with SeatGeek because SeatGeek specializes in secondary market (resale) tickets where inventory is more consistent. Primary market tickets often sell out within minutes, which would create a poor user experience. SeatGeek's secondary market inventory is always available, meaning users are more likely to find and purchase tickets when they click the integration.

What data does Spotify collect from this integration?

When you buy a concert ticket through Spotify, the platform learns which artist you want to see, which venue, and at what price. This data helps Spotify improve recommendations, predict touring success, understand fan preferences, and even advise artists on tour planning. Over time, this concert attendance data becomes a significant competitive advantage against other streaming platforms.

Will this integration expand to more venues?

Yes, expansion is expected. Spotify has indicated plans to roll out the integration to additional venues where SeatGeek is a primary ticketing partner, and likely to integrate other ticketing companies as well. International expansion will follow the US rollout, though it will depend on SeatGeek's partnerships in each country.

What are the risks of buying tickets through Spotify?

Potential issues include inventory mismatches (tickets showing as available when they're actually sold out), secondary market pricing that might be higher than primary market options, and limited availability since only 15 venues are currently supported. There's also the question of who's responsible if you receive fraudulent tickets, though SeatGeek's established compliance infrastructure makes this unlikely.

How does this compare to Apple Music and YouTube Music's ticketing features?

Apple Music offers ticketing partnerships but hasn't built as integrated an experience. YouTube Music has partnered with Ticketmaster and shows ticketing information on artist pages, but doesn't embed the purchase experience the way Spotify does with SeatGeek. Amazon Music has been relatively quiet on ticketing integration. Spotify's embedded integration is currently the most seamless.

Is my concert attendance data private?

When you purchase through the integration, Spotify collects data about which concerts you attend. This is shared with SeatGeek for fulfillment purposes and used internally by Spotify for recommendations and platform analytics. You can review Spotify's privacy policy for details, but generally, this data collection is part of using the platform and can improve your experience through better recommendations.

What happens if tickets sell out after I see them on Spotify?

Since the integration relies on real-time API data from SeatGeek, inventory changes frequently. If you see a ticket and wait too long to purchase, it might sell out. Secondary market inventory turns over more slowly than primary market inventory, but popular shows still sell out quickly. It's best to purchase immediately if you see something you want.

Conclusion: The Beginning of a Longer Story

The Spotify-SeatGeek integration seems like a small feature announcement. A streaming app added a ticketing link. Why would that matter?

But it matters because it's part of a much larger transformation in how music gets consumed and monetized. Streaming freed music from physical constraints—you don't need to own a CD anymore. But it also fragmented how fans engage with artists. You listen here, you buy merchandise there, you buy tickets somewhere else, you follow on social media somewhere else entirely.

Streamers like Spotify are now trying to reassemble that fragmented experience. They want to be the place where fans discover music, follow artists, buy tickets, purchase merchandise, and experience exclusive content. That's not a music streaming service anymore. That's a lifestyle platform. That's something much more valuable and much stickier for the user base.

The SeatGeek partnership is the latest step in that journey. It's limited right now, just 15 venues. But it's a test case, a proof of concept. And if it works—if users actually buy more tickets through Spotify than they would have through a website, if conversion rates are high, if the data is valuable—then you can expect rapid expansion.

Within a few years, buying concert tickets through Spotify might feel as natural as streaming a song. It might feel weird to go somewhere else. And that's exactly what Spotify wants. Because a platform that captures your full music and live event experience is much harder to leave than a platform that just plays songs.

That's the real story here. Not a ticketing integration. But a strategic move in the battle to own the entire music and entertainment experience. And Spotify, having stumbled on some fronts in recent years, is clearly determined to get this part right.

Key Takeaways

- Spotify partnered with SeatGeek to enable direct concert ticket purchases within the app at 15 participating US venues, primarily major sports arenas

- Secondary market ticketing inventory is more reliable than primary market tickets, making SeatGeek a strategic choice over primary ticketing platforms like Ticketmaster

- The integration captures valuable data about concert attendance patterns that helps Spotify improve recommendations and compete with Apple Music and YouTube Music

- This is part of a broader strategy to transform Spotify from a music streaming service into a complete lifestyle platform controlling the entire fan experience

- Expect rapid expansion to more venues and ticketing partners as Spotify proves the concept works and generates higher conversion rates than traditional external links

Related Articles

- Deezer's Bold Stand Against AI Slop: Why Spotify Users Are Finally Switching [2025]

- Spotify's About the Song Feature: What You Need to Know [2025]

- Spotify Hits 750M Users: Growth Drivers Behind the Numbers [2025]

- Spotify Offline Lyrics, Translations & Previews: Complete Guide [2025]

- Neil Young's Greenland Music Donation & Amazon Boycott [2025]

- Hi-Res Music Streaming Is Beating Spotify: Why Qobuz Keeps Winning [2025]

![Spotify & SeatGeek Integration: How Artists Sell Tickets [2025]](https://tryrunable.com/blog/spotify-seatgeek-integration-how-artists-sell-tickets-2025/image-1-1771432565272.jpg)