Steam Deck Stock Crisis: Why Memory and Storage Shortages Are Crippling Availability [2025]

If you've been thinking about picking up a Steam Deck lately, here's something you need to know: Valve just admitted the handheld isn't getting any easier to buy. The company posted a notice on the Steam Deck page warning that units "may be out of stock intermittently" in certain regions, and the culprit isn't what you'd expect. It's not a viral demand spike or a marketing blitz gone wrong. It's memory chips and storage drives.

Valve's stock problems stem from something way bigger than the gaming world. The artificial intelligence industry has gone absolutely berserk for semiconductor components over the past two years, hoovering up nearly everything manufacturers can produce. When AI companies are building massive data centers and training facilities, they're not picking up a few RAM sticks here and there. They're signing contracts for hundreds of millions of chips. That leaves companies like Valve competing for scraps.

This announcement matters because it signals something we haven't seen before: hardware manufacturers openly admitting they can't fulfill orders because of supply chain dysfunction outside their control. Valve isn't saying demand is too high. They're saying the raw materials simply don't exist in sufficient quantity. That's a fundamentally different problem, and it changes how we should think about Steam Deck availability going forward.

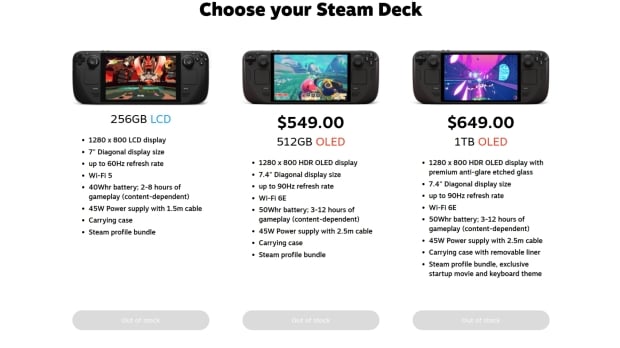

The situation also marks the end of an era for Steam Deck users. The LCD version, the more affordable option that launched in 2021, is being retired. Once existing stocks dry up, you'll have exactly one choice: the Steam Deck OLED. That's good news if you prefer the superior screen and longer battery life, but it's bad news for your wallet and bad news for choice.

What makes this story particularly interesting is what Valve revealed about its future plans. The company had to delay the Steam Machine and its Steam Frame VR headset, originally scheduled for early 2026, specifically because of component shortages. Valve is now reconsidering launch dates and pricing, which is corporate speak for "these things are going to cost more than we wanted." When a company with Valve's resources and experience is publicly wrestling with supply constraints, it tells you something serious is happening in the hardware industry.

This article explores what's really going on behind the Steam Deck shortage, why AI is eating all the memory in the world, what it means for gamers, and where handheld gaming might be headed when shortages finally ease up. We'll dig into the semiconductor supply chain, understand why this shortage is different from previous ones, and figure out what your options actually are if you want a Steam Deck right now.

TL; DR

- Memory and storage components are vanishing because AI companies are buying everything manufacturers produce, leaving Steam Deck production constrained

- Steam Deck LCD is officially discontinued with immediate effect; OLED models are now the only option available

- Intermittent stock is the new normal for at least the next 12-18 months until memory production capacity increases

- Valve's future hardware is delayed, including Steam Machine and Steam Frame VR, due to component unavailability

- Prices are likely headed up as manufacturers pass component cost increases to consumer hardware makers

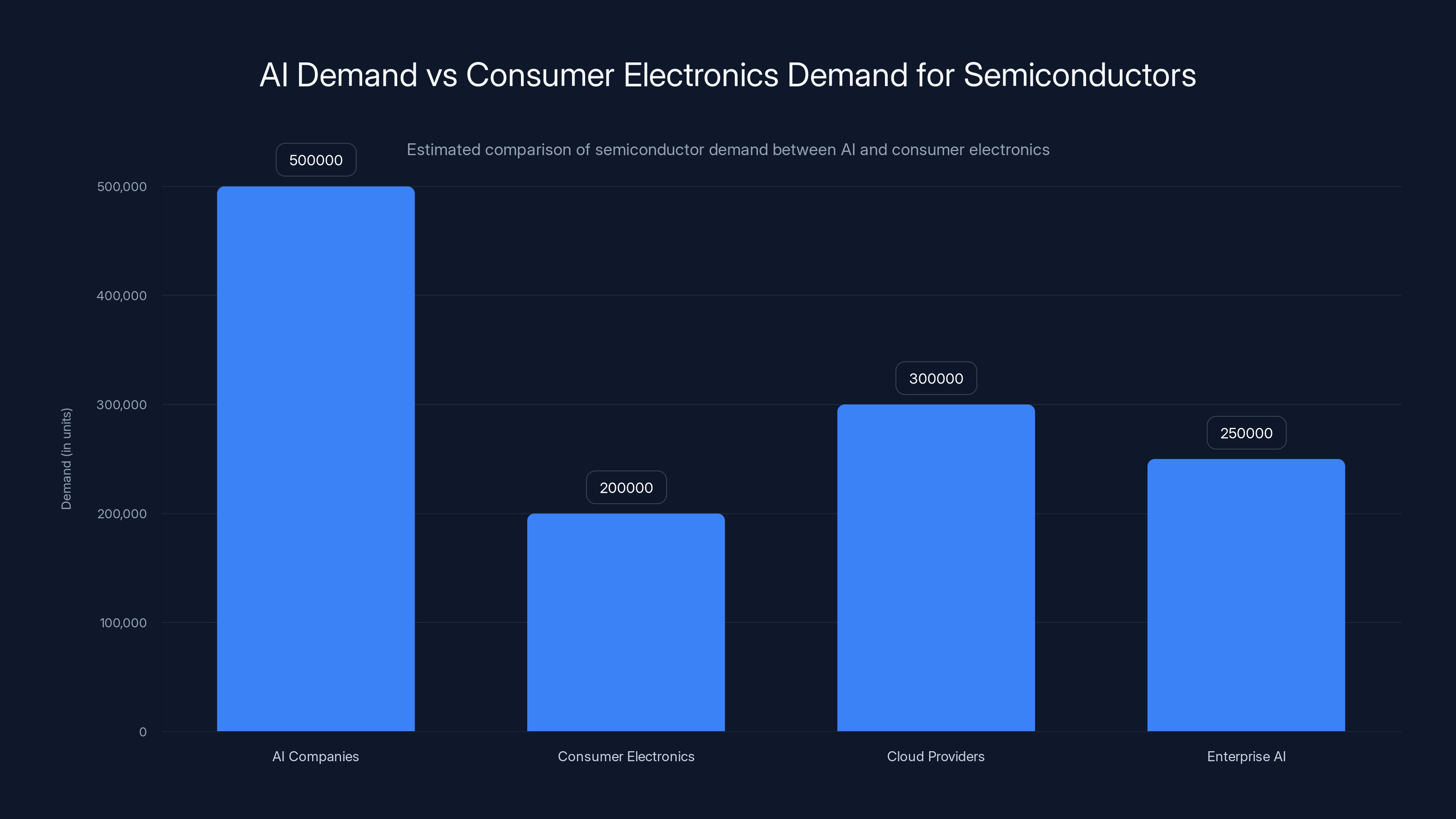

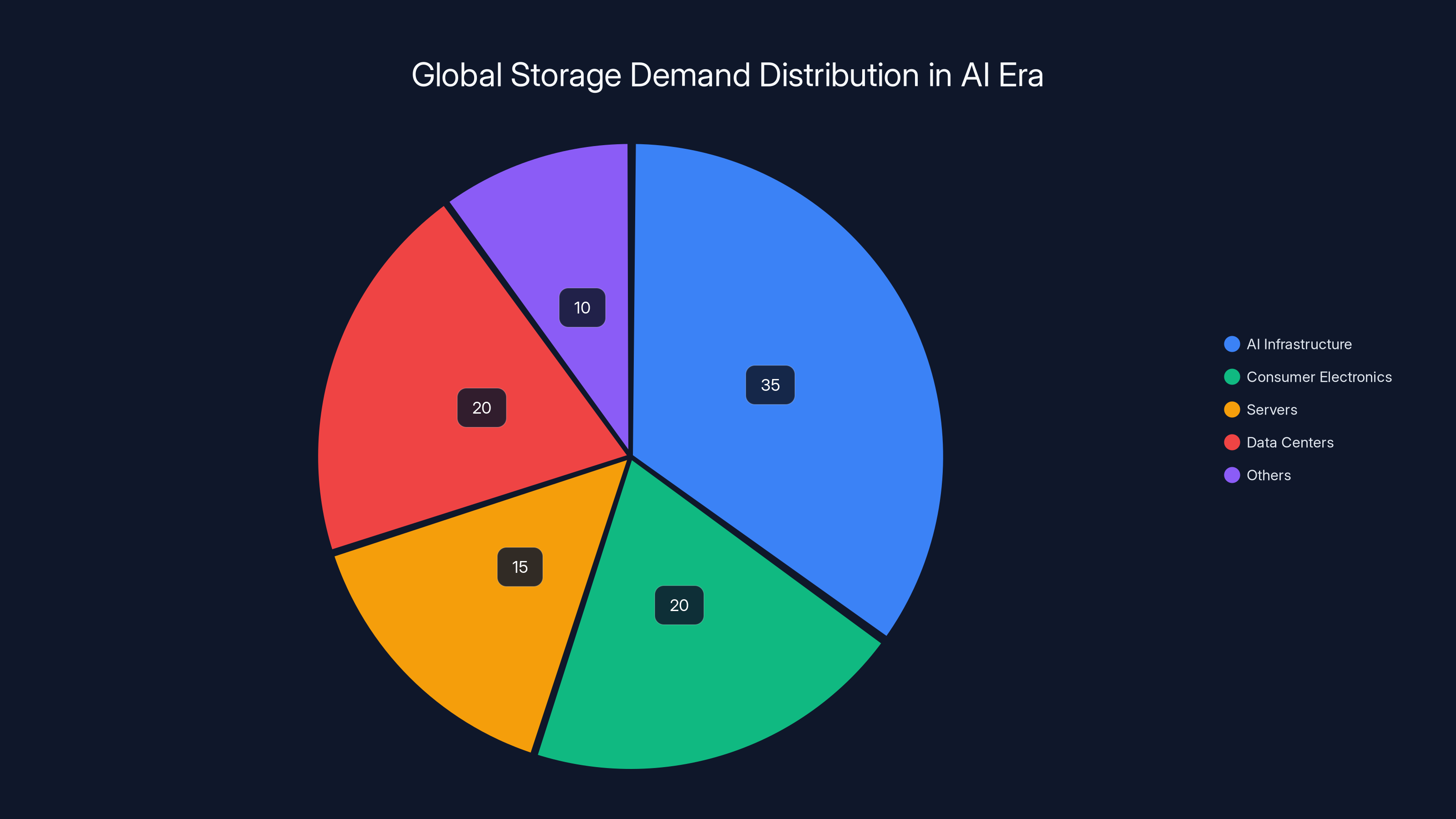

AI companies are estimated to demand significantly more semiconductors compared to traditional consumer electronics, highlighting the strain on supply. Estimated data.

The Perfect Storm: How AI Created a Semiconductor Shortage

Understanding why Steam Deck is out of stock requires understanding what's happened to the semiconductor industry. This isn't the supply chain crisis of 2020, where COVID factories shut down and everyone panicked. This is fundamentally different. This is one industry outbidding everyone else for finite resources.

Large language models require staggering amounts of RAM and storage to operate. When Open AI trains GPT-4 or when companies build AI inference clusters, they're not deploying thousands of chips. They're deploying hundreds of thousands. A single major data center buildout can consume more high-capacity RAM than would typically be allocated to consumer electronics manufacturing for an entire quarter.

The math is brutal. Consider that a single NVIDIA H100 GPU contains 80GB of memory, and top-tier data centers deploy thousands of these units. One data center might need hundreds of terabytes of storage. When you multiply this across the dozens of major AI companies building infrastructure, plus cloud providers spinning up new availability zones, plus enterprise companies racing to deploy AI systems, the demand absolutely dwarfs historical consumption.

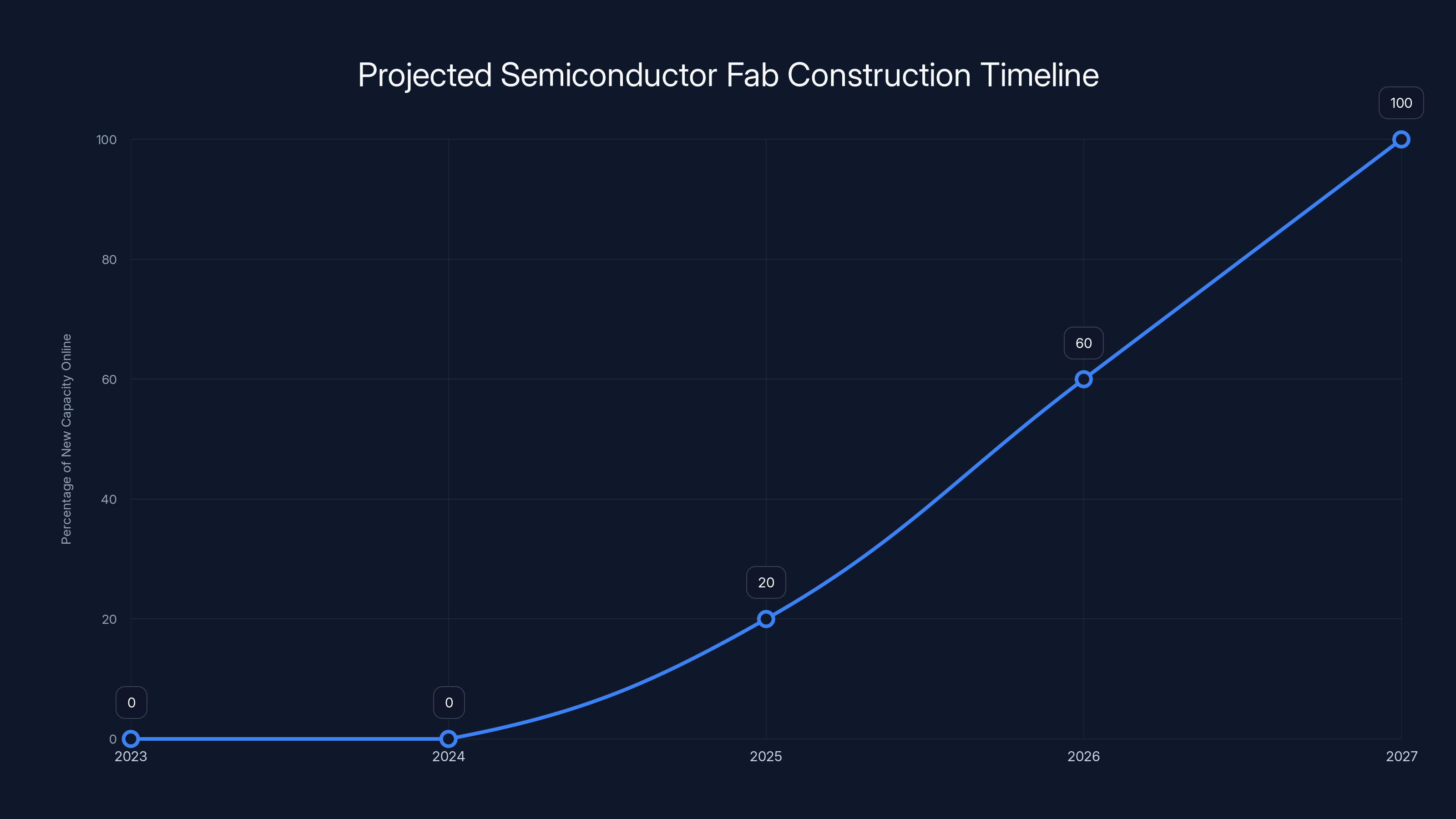

Memory manufacturers like SK Hynix, Samsung, and Micron have been ramping production, but there's a lag between placing orders and actually producing chips at scale. A semiconductor fab takes years to build and billions of dollars to construct. You can't just flip a switch and double memory production overnight. Fabs currently operate at high capacity utilization, but they're still not producing enough to meet demand from AI companies plus all the traditional consumer hardware manufacturers still trying to make products.

What makes this different from the 2020-2021 shortage is urgency and pricing power. AI companies will pay premium prices for components because the opportunity cost of not having them is enormous. If an AI infrastructure buildout is delayed by a quarter, the company loses millions in potential revenue from new AI services. That buying power translates into priority allocation from manufacturers, which pushes other customers into a queue.

Valve isn't alone in experiencing this. Samsung's global marketing leader warned at CES 2025 that memory price hikes are on the horizon. That warning came after Black Friday 2024 saw virtually zero RAM deals available anywhere in the market. When deals dry up on the second-biggest shopping day of the year, it signals genuine scarcity, not just normal market dynamics.

Estimated data shows that significant new semiconductor fab capacity will not be online until 2026 or later, highlighting the prolonged nature of supply chain constraints.

Why Steam Deck Specifically Is Vulnerable

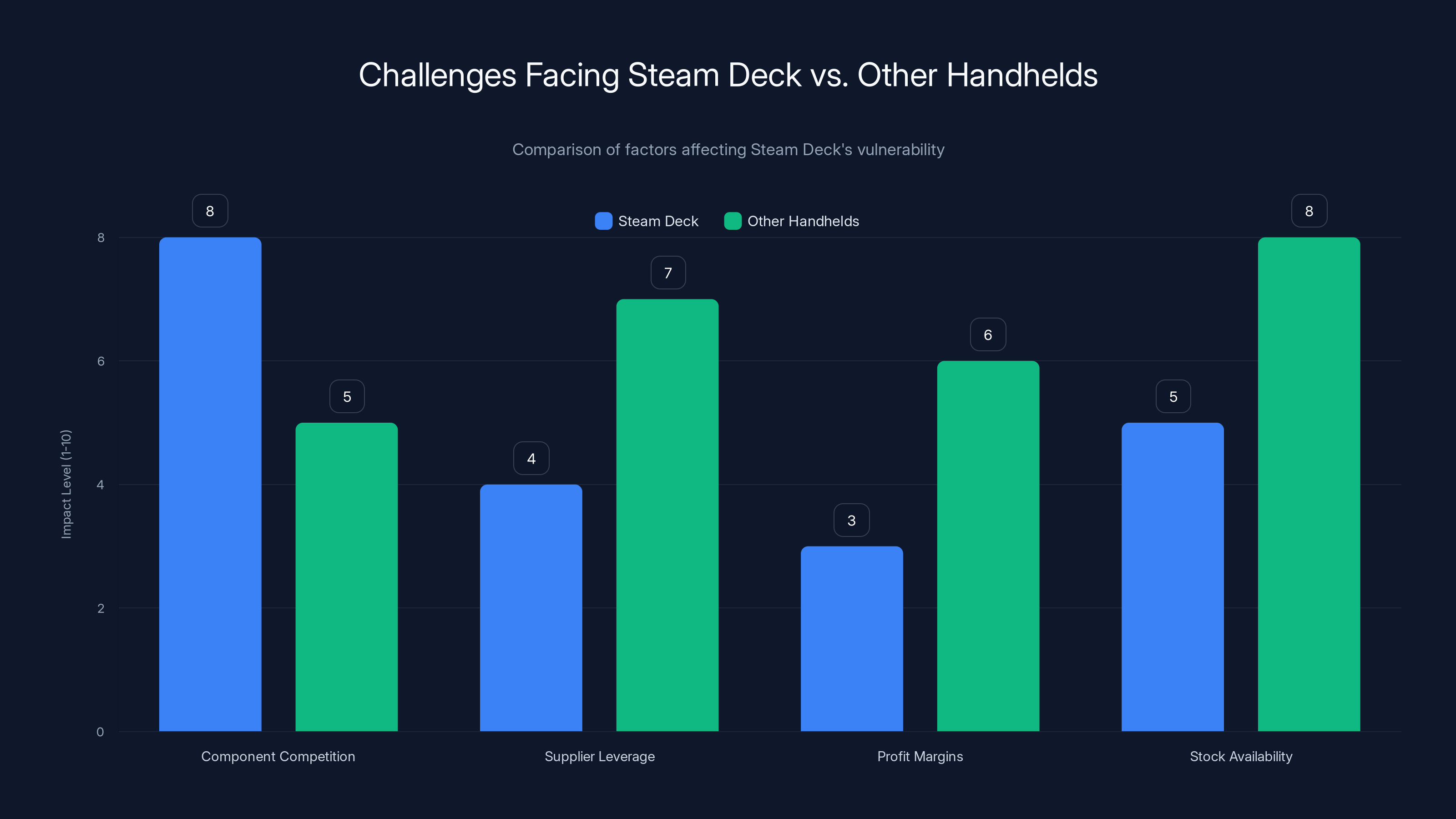

You might ask: why is Steam Deck getting hit so hard while other gaming handhelds seem to have less trouble? The answer relates to how Valve manufactures the Steam Deck and what components it uses.

The Steam Deck uses high-capacity storage and memory configurations that are the same components AI companies want. A 512GB Steam Deck OLED uses enterprise-grade storage that could theoretically be deployed elsewhere. This isn't like a phone, where manufacturers often use slightly custom form factors that don't directly compete with other markets. Steam Deck components are more generic, which means they're directly in competition with server manufacturers and cloud infrastructure builders.

Valve also operates at a different scale than major smartphone or console manufacturers. Nintendo, Sony, and Microsoft have long-term contracts and priority allocation agreements with component suppliers locked in years in advance. They commit to buying specific quantities at specific prices. Valve, while a massive company, doesn't have the same institutional leverage with manufacturers that a company like Samsung does when sourcing components for its own devices.

Additionally, Steam Deck has lower profit margins than flagship consoles. While Microsoft might accept lower margins on the Xbox Series S to build market share, Valve has positioned Steam Deck as relatively affordable compared to comparable alternatives. That means there's less margin available to pay premium prices for components when supplies get tight. A manufacturer might be willing to pay a 20% component surcharge for a

Valve also competes against Chinese handheld manufacturers that have different supply chain advantages. Companies like Ayaneo and GPD have different relationships with Chinese component suppliers and sometimes source components before they hit international markets. This isn't malicious or illicit, but it does mean that Western manufacturers like Valve can face tighter constraints.

The Death of Steam Deck LCD and What It Means

The deprecation of Steam Deck LCD is the clearest signal that this shortage is serious and likely to last. Valve didn't kill the LCD because it wanted to, but because it needs to consolidate manufacturing around a single SKU. Producing two different models requires twice the component sourcing complexity, twice the manufacturing coordination, and twice the inventory management.

When you're facing component shortages, the smart move is to ruthlessly eliminate complexity. Valve chose to keep OLED in production and discontinue LCD because OLED is the higher-end, higher-margin product. From a business perspective, it makes sense: you'd rather sell fewer units at better margins than fight for components to make budget versions.

For users, this is painful. Some gamers prefer LCD because it's more durable, less prone to burn-in concerns, and cheaper. Many casual players found LCD's lower price point perfectly adequate. Now those users have a choice: spend $549 on OLED or don't buy. There's no middle option anymore.

Valve's announcement that LCD will continue to be available "once stocks run out" is doing some rhetorical heavy lifting. It's a polite way of saying: when these units sell through, we're not making more. The company is clear on this point. LCD production has been phased out as of now, and that's final.

This consolidation also helps Valve with another constraint: manufacturing facility capacity. If you're producing two models on the same production line, you're switching tooling, different quality control specifications, different packaging. By going single-model, Valve can run longer production batches and reduce setup time between runs. That translates into more total units produced even if component supply stays flat.

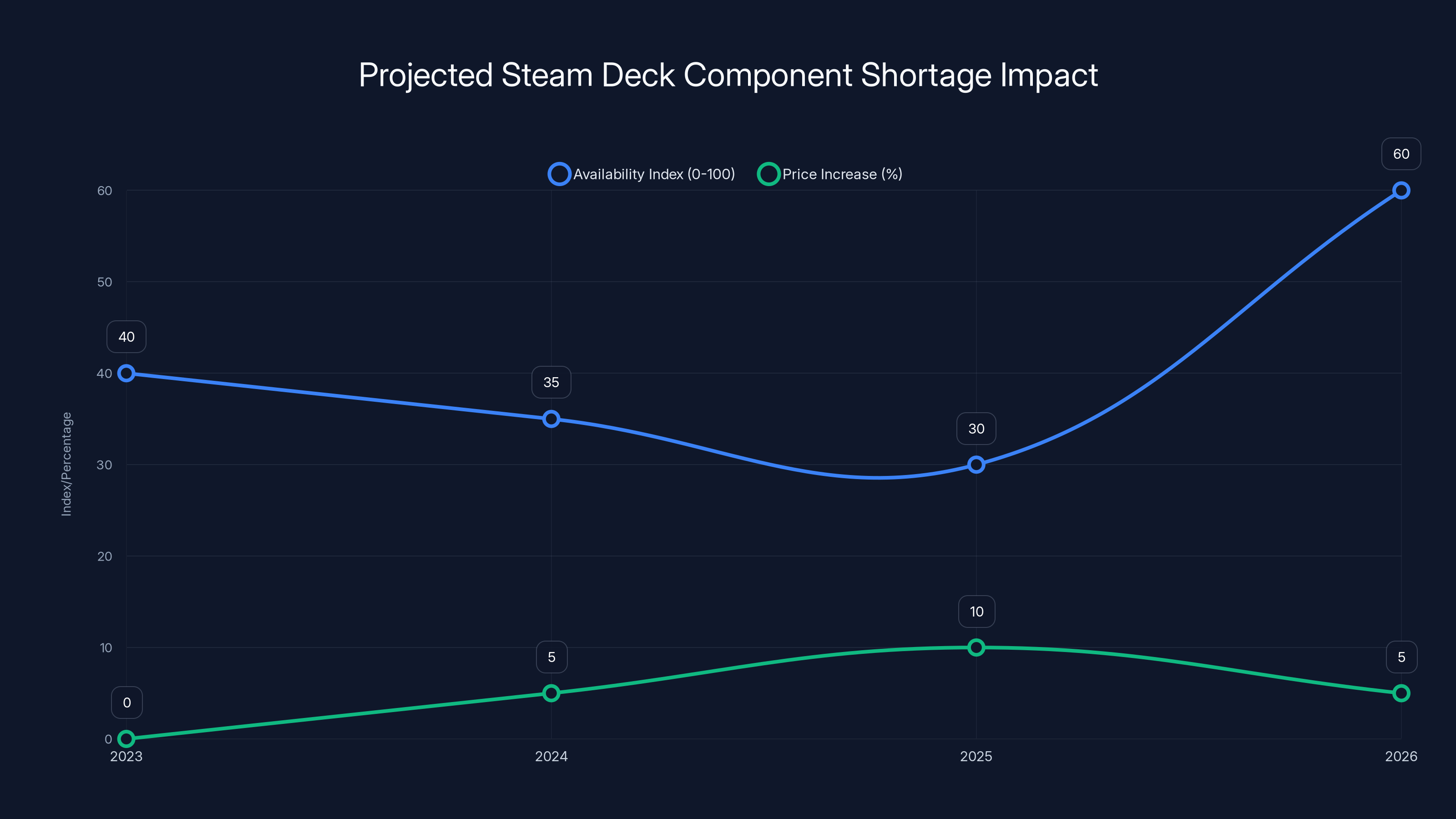

The Steam Deck is expected to face availability challenges through 2025, with potential price increases of up to 10% due to component shortages. Availability may improve by 2026 as new manufacturing capacity comes online. (Estimated data)

How AI Demand Created a Component Bottleneck

To really understand why Valve is struggling, you need to see the scale of AI infrastructure buildout happening right now. This isn't speculative or theoretical. Major companies have publicly disclosed their spending plans.

Microsoft announced plans to invest over $80 billion in AI infrastructure through 2025. That spending goes to data centers filled with GPUs, memory, and storage. Google is spending comparable amounts. Amazon Web Services is building new AI capacity rapidly. Meanwhile, every enterprise company is racing to build private AI infrastructure, and startups are raising capital specifically to build AI-as-a-service infrastructure.

The component requirements for all this infrastructure are staggering. A single state-of-the-art AI data center might require several petabytes of storage. Across hundreds of data centers being built globally, you're talking about exabytes of storage capacity needed. That's a billion times a gigabyte. That's the entire Steam Deck population worth of storage multiplied by tens of thousands.

Memory demand is similarly intense. The GPUs doing AI work require high-bandwidth memory. The systems storing training data and models need massive RAM pools. The economics favor using the densest, highest-capacity memory available, which puts AI companies in direct competition with consumer hardware for the same components.

A practical example: suppose a storage manufacturer has capacity to produce 1 billion terabytes of storage per year. Pre-AI boom, that capacity was allocated across thousands of manufacturers building consumer devices, servers, data centers, and storage systems. Each category got a slice. Now, AI infrastructure accounts for maybe 30-40% of total demand. That means consumer electronics like Steam Deck get proportionally less, even if the manufacturer hasn't reduced total production.

The pricing dynamics make this worse. Storage and memory are commodities, meaning prices are set by supply and demand. As AI demand spiked, prices increased. AI companies, facing massive capital expenditure pressure to build infrastructure before competitors do, are willing to pay elevated prices to secure supply. That signals to manufacturers that they should allocate scarce inventory to whoever pays most. Consumer electronics rarely win that auction.

Supply Chain Realities: Why This Won't Fix Quickly

Here's where it gets frustrating for gamers: this problem won't resolve in weeks or months. It's likely to persist through 2025 and potentially into 2026. Understanding why requires understanding semiconductor manufacturing timelines.

When a component manufacturer like Micron or SK Hynix decides to increase memory production, they don't just ask the fab to work harder. They might bring existing fabs online that were in reserve, but meaningful capacity expansion requires either building new facilities or retrofitting existing ones. A semiconductor fab costs between $10-20 billion to build and takes 3-5 years from groundbreaking to full production. Even retrofitting an existing fab takes 12-18 months minimum.

Memory manufacturers are investing heavily in new capacity, but you won't see that production hit the market until 2026 or later. In the meantime, existing capacity stays stretched. Demand keeps growing because every new AI model, every new startup, every new enterprise AI initiative requires more infrastructure.

There's also a demand elasticity problem. As prices increase, demand typically decreases somewhat. But not in the AI case. Companies building AI infrastructure are locked into timelines. Miss your deployment window and you lose market share to competitors. So even if prices spike 50%, demand only drops maybe 10%. The incentives don't balance out quickly.

Valve's situation specifically won't improve until either: (1) memory production capacity increases significantly, (2) AI companies complete their major buildout phases and demand moderates, or (3) alternative suppliers emerge. None of these happen quickly.

The company's willingness to delay Steam Machine and Steam Frame VR, their upcoming products, shows that Valve isn't betting on rapid resolution. These products were planned for early 2026, but Valve publicly admitted that component availability forced a rethink. That suggests the company is modeling scenarios where this constraint persists through 2025 and into 2026.

AI infrastructure now accounts for an estimated 35% of global storage demand, significantly impacting the availability for consumer electronics and other sectors. Estimated data.

Valve's Hardware Roadmap Gets Derailed

The Steam Deck shortage has ripple effects beyond the handheld itself. Valve's entire hardware strategy is getting recalibrated based on component availability. The company revealed that two major products are now delayed: Steam Machine and Steam Frame VR.

Steam Machine was supposed to be a refresh of Valve's earlier foray into living room PC gaming. The original Steam Machine, launched in 2015, was technically impressive but commercially failed. Nobody wanted a specialized box in their living room when they could use a regular PC or just buy a console. Valve had learned this lesson and was apparently planning something different for the new version. The exact specifications weren't public, but the company was planning to ship "early 2026."

Steam Frame VR was more mysterious. The company had never announced this product publicly, so learning about it was surprising to most people. It appears to be Valve's answer to Meta Quest and other VR headsets, though details are sparse. The fact that Valve felt comfortable publicly mentioning it suggests they were planning some kind of announcement or reveal during the delay window.

Both products are now indefinitely delayed, with Valve explicitly citing memory and storage shortages. The company said it needs to "rethink their launch date and pricing," which is a loaded phrase. When a manufacturer says they need to rethink pricing, it usually means they've concluded costs will be higher than planned and they need to figure out whether to eat the difference, pass it to customers, or scale back the product.

This is significant because it shows that hardware shortages are now central to Valve's product planning in a way they weren't before. For years, Valve's constraint was software and market fit. Could they build products people wanted? Could the software work well? Now the constraint is physical: can they source components?

It also suggests Valve is thinking seriously about long-term hardware strategy. You don't delay products and revise pricing forecasts lightly. This indicates the company is preparing for a scenario where component scarcity persists and costs remain elevated. Maybe Steam Machine and Steam Frame VR need to be positioned differently, or maybe they need fewer components, or maybe they need to target a different price point.

Alternative Handheld Options and What They're Doing

While Valve struggles with stock, other handheld gaming devices are facing similar pressures but have responded differently. Understanding how competitors are handling this gives us insight into what might come next.

Nintendo's strategy with Switch is to maintain pricing and accept intermittent stock. The company has massive purchasing power and long-term component contracts, so they're probably less affected than Valve. However, Nintendo is also phasing out the older model (original Switch) and consolidating around Switch OLED, which mirrors Valve's approach. When multiple companies in different niches start doing the same thing, it signals that simplifying product lines is the rational response to component scarcity.

GPD and Ayaneo, Chinese manufacturers, have had more success maintaining stock. Part of this is due to being located in a region with different supply chain advantages. These companies also move production between multiple contract manufacturers, which provides more flexibility. They've also been more aggressive about source-shifting, substituting components when preferred options aren't available. This is a trade-off: they can maintain availability but sometimes at the cost of quality consistency or feature changes.

Rig, the handheld that was kickstarted and got a lot of attention, has faced significant delays. Their situation is actually worse than Valve's because they lack Valve's existing supply chain relationships. Startups trying to launch new products in this environment face brutal constraints. If Valve, with all its resources and experience, is struggling, small manufacturers are facing existential challenges.

What's notable is that nobody is claiming the shortage is temporary or will resolve soon. Every hardware company is hedging their bets, consolidating product lines, and preparing for elevated costs. That's a clear signal about how they're perceiving the situation internally.

Steam Deck faces higher challenges in component competition and lower profit margins compared to other handhelds, making it more vulnerable to supply chain issues. (Estimated data)

The Cryptocurrency Boom Parallel: Lessons from GPU Shortages

This situation echoes what happened during the cryptocurrency boom around 2017-2018 and again in 2021. At that time, miners were buying every GPU they could find to hash cryptocurrencies. Gamers found themselves unable to buy graphics cards. Prices tripled. Availability vanished.

The dynamics were similar but not identical. Miners wanted specific GPU models that also happened to be popular for gaming. As miners bought supply, prices spiked, and gamers got priced out. Manufacturers saw higher prices, but margin pressure limited how much they could increase production. The shortage lasted about 18 months until either mining became less profitable or manufacturers increased production significantly.

The AI memory shortage is different in scale and duration. The cryptocurrency boom was localized to GPUs. This shortage spans memory, storage, and arguably processors. The AI boom is also more fundamental to the industry's future, so companies are making bigger investments to support it. The cryptocurrency boom was viewed as a speculative bubble by most mainstream businesses. AI is viewed as transformational.

This parallel is instructive because it shows how long these kinds of shortages typically last. Once resolved, prices and availability normalize relatively quickly. But the resolution phase is frustratingly slow. We're probably 12-18 months into what will eventually be a 24-36 month cycle from shortage start to normalization.

Valve would be wise to study how GPU manufacturers handled the crypto boom. Some increased capacity aggressively. Some rode out high prices. Some maintained lower prices and accepted reduced availability. Different strategies had different outcomes in terms of brand loyalty and market share.

What Gamers Should Do Right Now

If you've been thinking about buying a Steam Deck, the decision is now clearer: buy one if you can find stock, because availability will likely get worse before it gets better. Prices probably won't drop significantly until shortages ease. Waiting for better deals or easier availability is a losing strategy.

If you find a Steam Deck in stock, grab the OLED version. Yes, it's more expensive than LCD was, but LCD is disappearing anyway. OLED is objectively better hardware: better screen, longer battery life, quieter fans. The premium is justified, and you're not paying extra compared to the new baseline.

If you can't find stock, consider alternatives. Ayaneo and GPD make capable handhelds with more powerful processors. They cost more and have software quirks, but they exist and are obtainable. Nintendo Switch remains available and offers a completely different gaming library. These aren't perfect substitutes, but they're actual options if you want to play portable games right now.

For competitive gaming or productivity use, a standard laptop or even an iPad might be worth considering if you need something now. Steam Deck is great for specific use cases, but it's not the only device that can play PC games or run development tools.

The reality is that Steam Deck is a luxury item. It's incredibly cool and surprisingly capable, but nothing about it is essential. If you already have other gaming options, waiting six months might be prudent. If you really want one and it's available, buy it. Trying to game the market and time availability perfectly is probably futile.

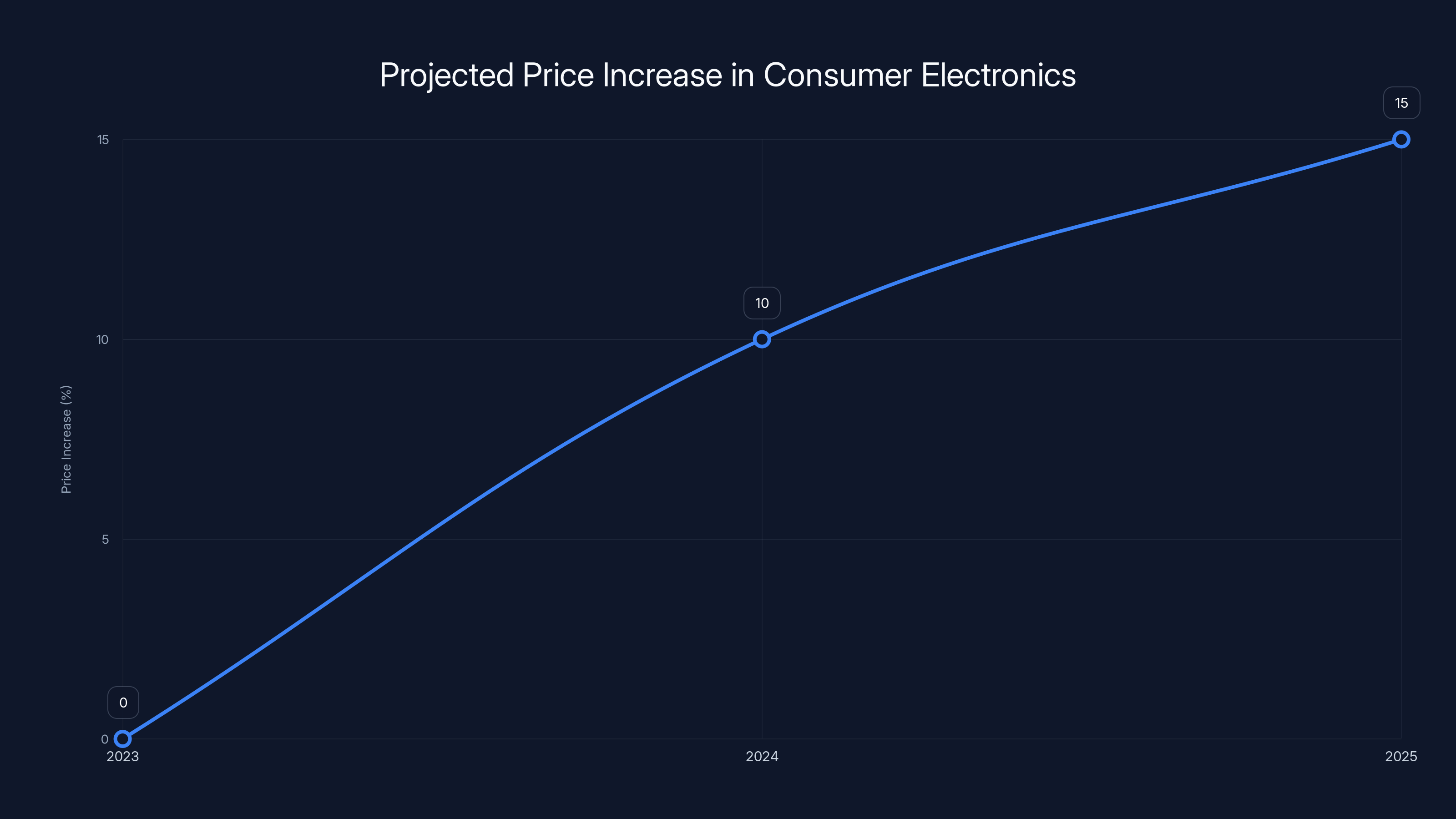

Consumer electronics prices are projected to rise by 5-15% over the next 24 months due to increased component costs and manufacturing constraints. Estimated data.

The Bigger Picture: Hardware Manufacturing in an AI World

Steam Deck's shortage is actually a symptom of a bigger shift. We're entering an era where hardware manufacturing is subordinated to AI infrastructure buildout. This won't be permanent, but it's going to reshape consumer hardware for the next 2-3 years.

Manufacturers will increasingly optimize for efficiency and cost reduction. Products like Steam Deck, which are nice-to-have consumer electronics, will get lower priority than AI infrastructure, which is core to company growth. This doesn't mean consumer electronics will disappear, but they'll face more constraints and higher component costs.

We'll probably see more consolidation in consumer hardware categories. Just like Valve killed LCD Steam Deck, other manufacturers will kill low-margin product variants. The handheld gaming market, the budget laptop market, and other competitive segments where margins are thin will get squeezed.

Prices for consumer electronics will likely rise 5-15% over the next 24 months as manufacturers pass through component cost increases. Smartphones, tablets, laptops, and gaming devices will all face pressure. It won't be catastrophic, but it'll be noticeable.

We might also see manufacturers invest in alternative component sourcing or vertical integration. Valve, for example, could theoretically acquire or partner with a memory or storage manufacturer to secure supply. That's expensive and complex, but if shortages persist, it becomes a viable strategy.

Eventually, as new manufacturing capacity comes online in 2026 and beyond, this constraint will ease. Prices will come down. Availability will normalize. But we're probably going to spend the next 12-24 months in a world where hardware scarcity is a genuine problem that shapes what gets made and what gets delayed.

Valve's Future in Handheld Gaming

Despite the current shortage, Steam Deck has been a massive success for Valve. The device has sold millions of units, established a genuine market for portable PC gaming, and changed how people think about gaming handhelds. Competition from Ayaneo and GPD, while growing, hasn't meaningfully detracted from Steam Deck's position.

Valve's refusal to abandon the platform despite supply chain chaos suggests the company is in this for the long haul. The Steam Deck isn't a one-off novelty product. It's becoming a core part of Valve's hardware strategy.

Looking forward, expect Valve to iterate on Steam Deck in ways that reflect lessons learned. Maybe the next generation uses more efficient components that require less manufacturing complexity. Maybe Valve builds in more margin so it can absorb component cost increases. Maybe the company invests in supply chain diversification so it's not at the mercy of a single manufacturer.

Valve might also push more aggressively into China and Asia-Pacific markets, where component sourcing might be easier. The company has some presence in these regions, but nothing like the dominance it could achieve. Asian markets might also have faster adoption of alternative component suppliers, reducing dependency on Western manufacturers.

The bigger strategic question is whether Steam Deck becomes a laptop competitor or remains primarily a gaming device. If Valve wants to use Steam Deck for productive work beyond gaming, the company would need to address docking, keyboard support, and software optimizations. That would open up a much larger market but also complicate the product significantly.

FAQ

Why is memory and storage shortage affecting Steam Deck specifically?

AI companies are aggressively buying high-capacity memory chips and storage components to build data center infrastructure. These are the exact same components Steam Deck uses. Because AI companies have higher profit margins and urgency in their buildouts, they outbid consumer electronics manufacturers for scarce supply. Valve doesn't have the same component purchasing leverage as massive smartphone manufacturers like Apple, making Steam Deck particularly vulnerable.

Will Steam Deck prices increase due to component shortages?

Valve hasn't announced price changes to Steam Deck OLED yet, but the company explicitly said it needs to "rethink pricing" for upcoming products like Steam Machine due to component costs. Consumer electronics prices typically rise 5-15% when component costs spike. If the current shortage persists through 2025, price increases become likely, though Valve might absorb some costs to avoid sticker shock.

When will Steam Deck stock normalize?

Component shortages are expected to persist through 2025 and possibly into 2026. New semiconductor manufacturing capacity is under construction but won't reach meaningful production until mid-2026 at the earliest. Until then, Steam Deck will likely experience intermittent stock and higher-than-normal prices when available.

Should I buy a Steam Deck now or wait for better availability?

If you want a Steam Deck and can find one in stock, buy it now. Waiting for availability to improve and prices to drop is probably a losing strategy. Component shortages suggest availability will remain constrained for at least 12 months. Prices are unlikely to drop significantly until shortages ease. Waiting likely just delays your purchase without meaningful benefit.

What happened to Steam Deck LCD and will it come back?

Valve discontinued Steam Deck LCD production and will not manufacture new units once current stock is exhausted. The company prioritized OLED production to simplify manufacturing during the shortage. LCD will eventually disappear from the market, and Steam Deck OLED is now the only available option from Valve.

Are there alternatives to Steam Deck I should consider?

Ayaneo and GPD make capable gaming handhelds with specifications comparable to or better than Steam Deck. They're more expensive and have different software ecosystems, but they're obtainable right now. Nintendo Switch offers a completely different gaming library and is widely available. If you need portable gaming immediately and can't find Steam Deck, these are legitimate alternatives, though they each have trade-offs in price, library, and ease of use.

Why did Valve delay Steam Machine and Steam Frame VR?

Valve explicitly attributed delays to memory and storage component shortages. The company said it needs to rethink launch dates and pricing for these upcoming products. This suggests Valve couldn't secure enough components to launch on schedule and needs to either wait for supply to improve or redesign the products with fewer component requirements.

How long have memory and storage shortages been happening?

Component shortages began accelerating in 2023-2024 as AI companies ramped up data center buildouts. The shortage has worsened through 2024 and is expected to persist through 2025. This is distinct from the 2020-2021 pandemic-related shortages, which were supply-side driven. The current shortage is demand-side driven by AI infrastructure investment.

Will other gaming handhelds or devices face similar shortages?

Yes. Nintendo is consolidating product lines similarly to Valve. Manufacturers of laptops, tablets, and other consumer electronics will face component pressure through 2025. Smartphones might see less dramatic impacts due to larger purchasing power, but even flagship phones could face pricing pressure or delayed launches for certain models or markets.

What can I do to prepare for ongoing handheld gaming hardware shortages?

If you want a Steam Deck, buy one when stock is available rather than trying to time the market. Set up availability alerts on the official Steam Deck page and be ready to purchase immediately when stock appears. Consider whether alternative devices like Ayaneo or GPD might meet your needs. If you're considering other electronics purchases, expect slightly higher prices through 2025 as manufacturers pass through component cost increases. Plan accordingly and make purchases when needed rather than waiting for deals that may not materialize.

The Road Ahead: What Comes After the Shortage

Eventually, this shortage will end. New manufacturing capacity will come online. AI infrastructure buildouts will moderate as companies complete their initial deployments. Supply and demand will rebalance. When that happens, what will the market look like?

First, we'll probably see price normalization more than dramatic drops. Memory prices won't plunge like they did after previous shortage cycles. Manufacturers will keep prices elevated because it's profitable, and consumers will accept higher prices because they've adjusted expectations.

Second, we'll see hardware optimizations. Devices designed during the shortage will be built with efficiency and cost reduction in mind. Steam Deck generation two, whenever it arrives, will probably have a different architecture or use different components than current models, shaped by lessons learned during supply constraint.

Third, the AI infrastructure boom will have established new permanent demand baselines. Even when data center buildouts slow, AI companies will continue buying memory and storage at elevated volumes compared to pre-AI levels. This shifts the industry's equilibrium, potentially meaning consumer electronics permanently gets a smaller proportion of available components.

For Steam Deck specifically, the shortage is a temporary problem. Valve will sell every unit it can produce for the next year, which is actually beneficial for the company financially. Once supply catches up with demand, Steam Deck will compete on merits again. The handheld has proven it's a compelling product with strong software support and growing library. Once the shortage ends and inventory normalizes, Steam Deck should be easier to buy and might even face price reductions if Valve wants to expand market share.

The real question is what Valve learns from this experience. If the company decides to invest in supply chain resilience or component sourcing, future products might be less vulnerable to shortage cycles. If Valve decides this is a one-time anomaly, it might not change strategy significantly. Either way, Steam Deck has demonstrated both the appeal of portable gaming and the fragility of hardware supply chains in an AI-obsessed world.

For gamers, the lesson is clear: hardware isn't guaranteed to be available just because it's popular. Buy what you want when you can find it. Waiting for perfect availability or ideal pricing might mean never buying at all. Steam Deck is worth it, but only if you actually get to own one.

Key Takeaways

- AI companies are outbidding consumer electronics manufacturers for scarce memory and storage components, causing Steam Deck shortages

- Steam Deck LCD is permanently discontinued; OLED is now the only available model from Valve

- Component shortages likely to persist through 2025 and into 2026 as semiconductor manufacturing capacity ramps slowly

- Valve delayed Steam Machine and Steam Frame VR specifically due to component unavailability, signaling supply crisis severity

- Prices for consumer electronics likely to rise 5-15% through 2025 as manufacturers pass through component cost increases

Related Articles

- Steam Deck Out of Stock 2026: What RAMaggedon Means [2025]

- Steam Deck OLED Out of Stock: The RAM Crisis Explained [2025]

- Valve's Steam Machine & Frame Delayed by RAM Shortage [2026]

- Steam's New PC Specs Review Feature: Complete Guide [2025]

- Steam Machine 2026: Complete Guide to Valve's Living Room Console [2025]

- Nintendo Switch 2 Review: Why You Should Buy Now Before Price Hikes [2025]

![Steam Deck Stock Crisis: Memory & Storage Shortage Impact [2025]](https://tryrunable.com/blog/steam-deck-stock-crisis-memory-storage-shortage-impact-2025/image-1-1771324588678.jpg)