Valve's Steam Machine and Steam Frame Face Unexpected RAM Shortage Delays: What You Need to Know

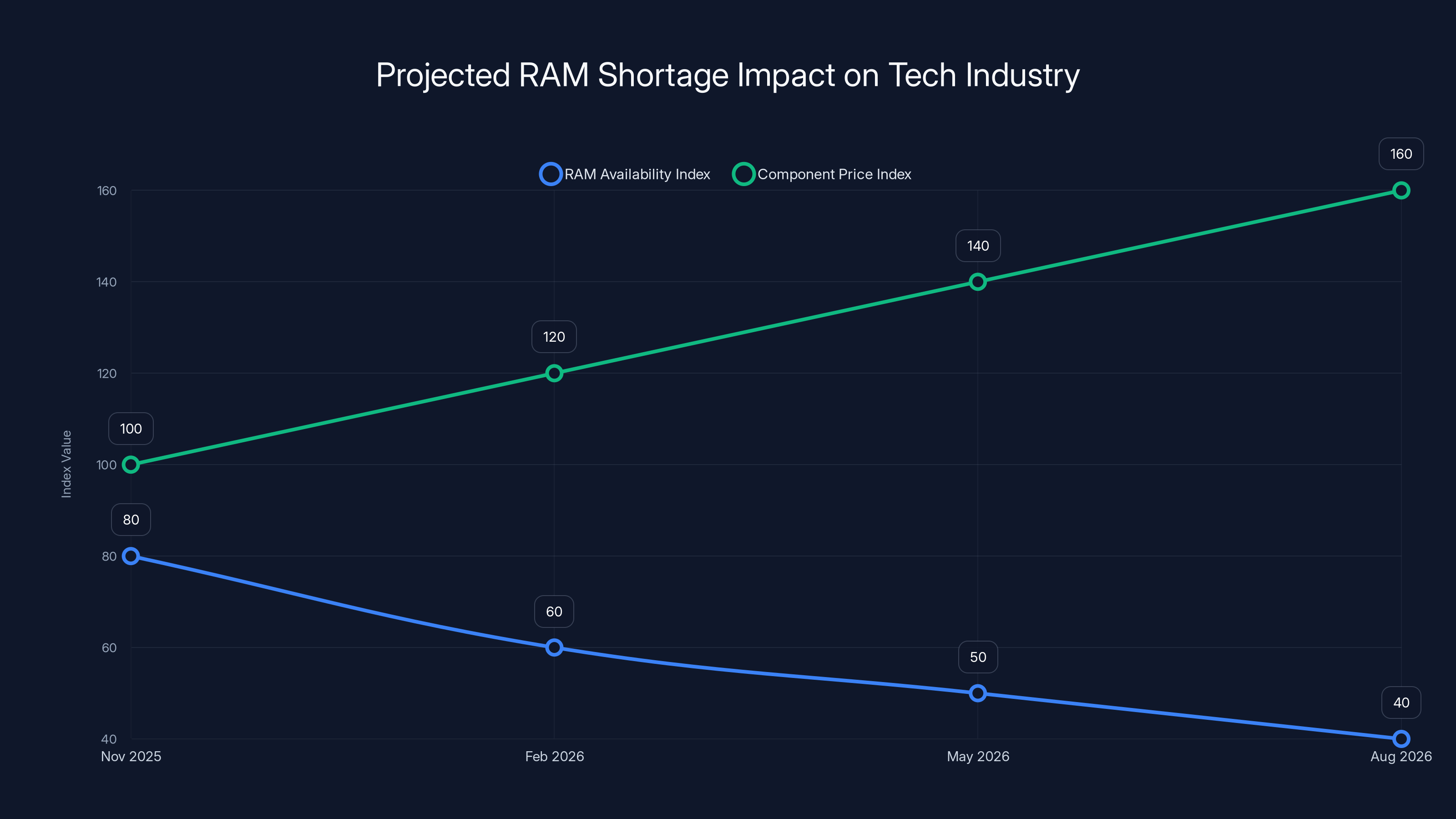

When Valve announced its highly anticipated Steam Machine desktop PC and Steam Frame VR headset back in November 2025, the tech community held its breath. Finally, the company was bringing its gaming hardware ambitions to life in a major way. But then February rolled around, and Valve dropped an unexpected bombshell: both devices would be delayed. The culprit? A memory crisis that's been spreading across the entire computing industry like wildfire.

The company took to its official blog to explain that while it still aims to launch both products in the first half of 2026, it can't yet commit to firm pricing or availability dates. This isn't just a minor hiccup—it's a reflection of something much larger happening in the tech world. RAM shortages have spiraled into a genuine supply chain emergency, one that's affecting everything from consumer laptops to enterprise servers. And for Valve, a company that prides itself on precision and control over its hardware ecosystem, this uncertainty is particularly frustrating.

The problem runs deeper than just memory scarcity. Storage components are equally tight, and these price fluctuations are trickling down into GPUs and other components that rely on semiconductor manufacturing. For a company like Valve, which manufactures at scale but doesn't have the purchasing power of giants like Microsoft or Apple, navigating these price swings has become nearly impossible. The company wants to price the Steam Machine competitively against other gaming PCs, but if component costs keep rising unpredictably, hitting a stable price point becomes a mathematical nightmare.

What makes this situation particularly interesting is how it mirrors challenges Valve faced during the Steam Deck's launch. The handheld device also experienced delays and supply constraints, but the company managed to maintain momentum through transparency and regular updates. This time, though, the uncertainty extends beyond just production capacity. It's about the fundamental economics of building and pricing hardware in 2026.

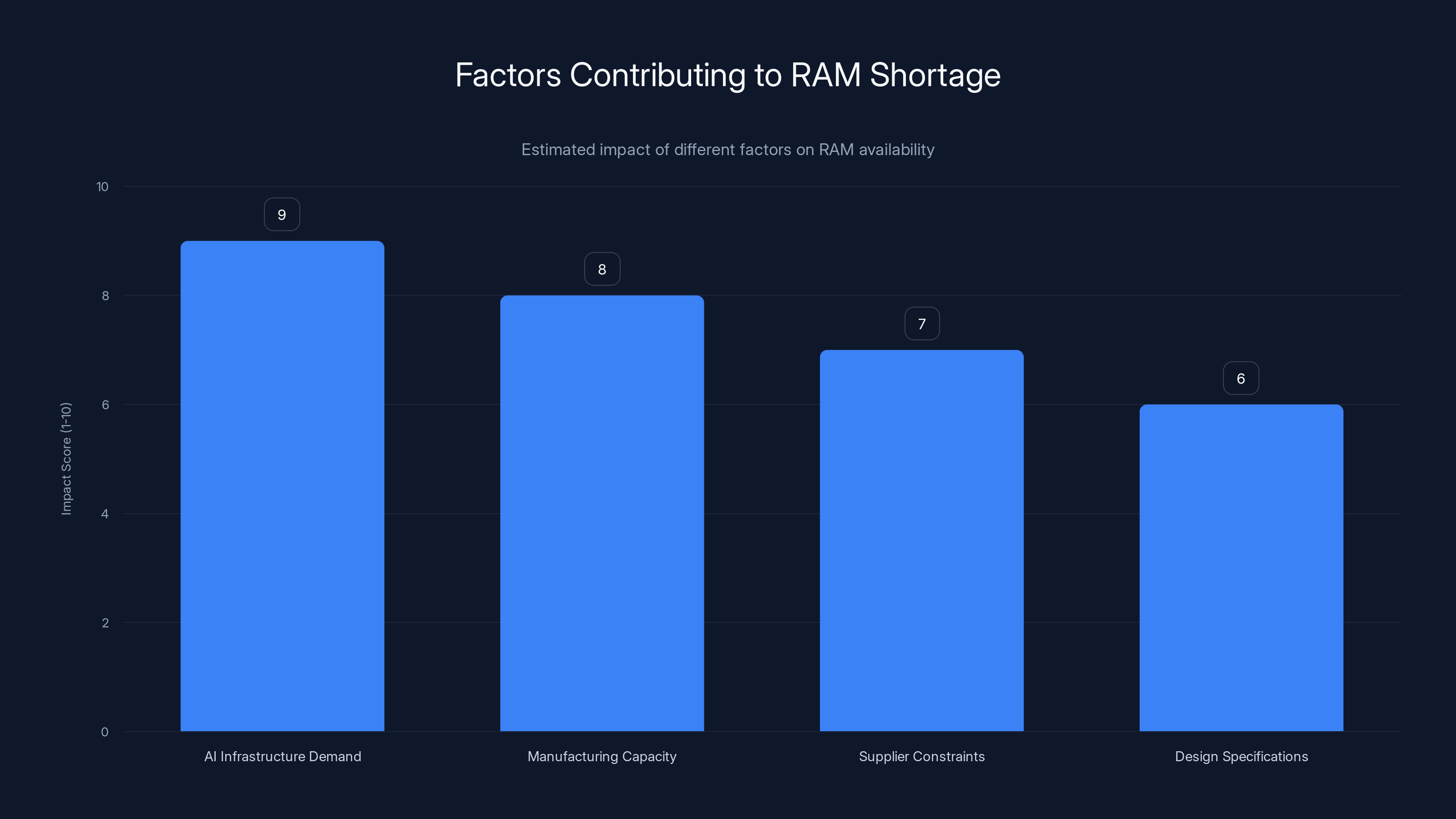

For enthusiasts and early adopters who've been waiting for the Steam Machine since its November announcement, this delay feels like a step backward. But it also highlights a critical reality: the AI boom of the past two years has fundamentally disrupted hardware supply chains globally. Data centers are hoovering up memory modules faster than manufacturers can produce them, and that competition is creating ripple effects throughout the entire computing ecosystem.

In this comprehensive guide, we'll explore what's behind these delays, what they mean for Valve's hardware strategy, and what consumers should expect when these devices finally do arrive.

TL; DR

- Supply Chain Crisis: RAM and storage shortages are causing Valve to delay both Steam Machine and Steam Frame launches indefinitely beyond "first half 2026"

- Pricing Uncertainty: AI-driven demand for memory chips has inflated component costs, making it difficult for Valve to commit to consumer pricing

- Competitive Pressure: Valve faces competing demand from data centers, cloud providers, and other PC manufacturers for limited memory inventory

- Historical Parallels: Similar supply constraints affected Steam Deck availability, though that device ultimately succeeded despite launch delays

- Industry-Wide Impact: GPU manufacturers, storage makers, and other hardware companies face similar challenges as AI infrastructure demands memory resources

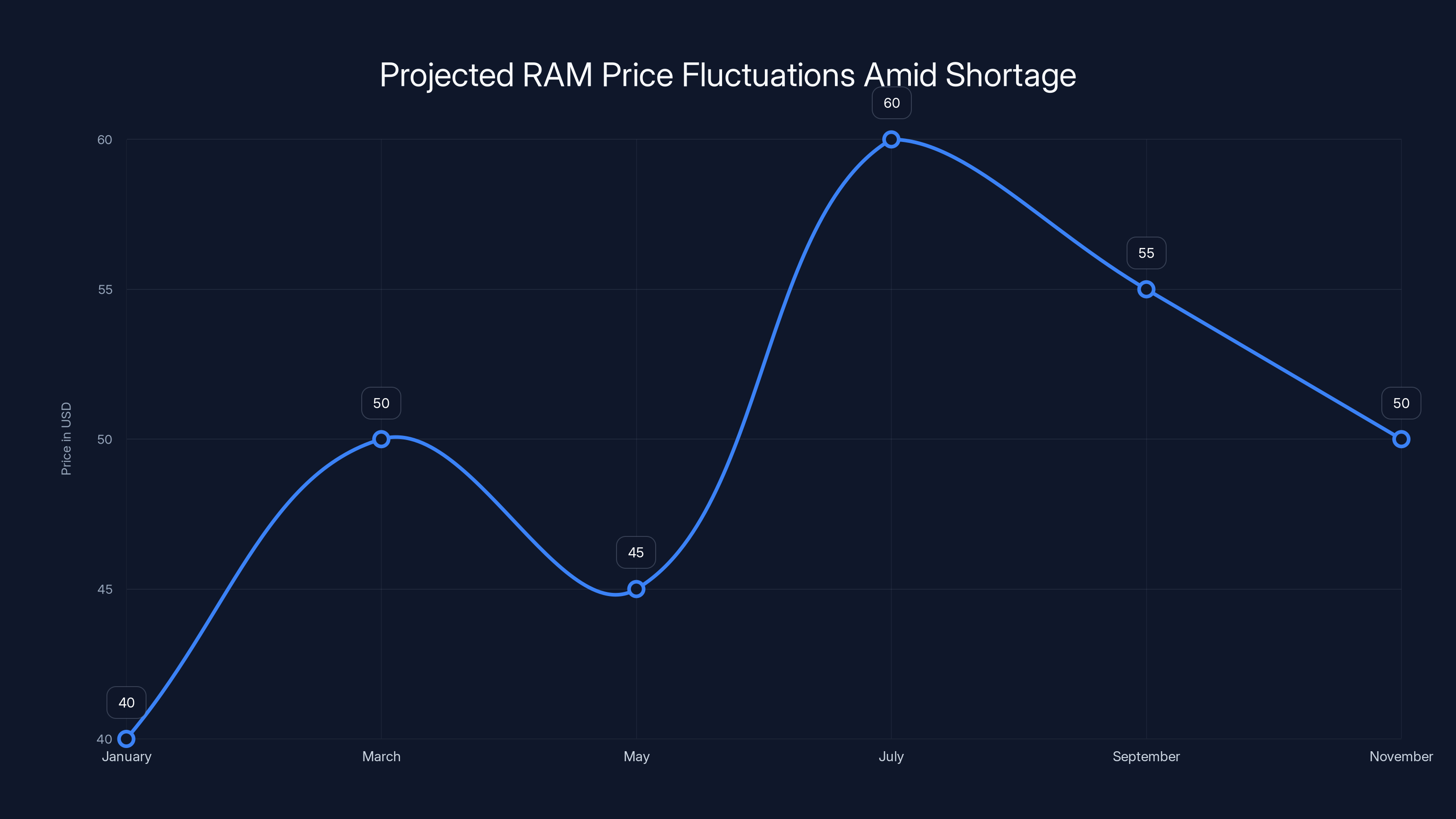

Estimated data shows fluctuating DDR5 RAM prices in 2023, driven by AI demand and supply constraints. Prices range from

Understanding the RAM Shortage Behind Valve's Delays

The RAM shortage didn't emerge overnight. It's the direct result of the artificial intelligence boom that accelerated dramatically following Chat GPT's explosive growth in late 2022. As companies worldwide rushed to build AI infrastructure, deploy large language models, and compete for cloud dominance, they all realized one critical thing: you can't run sophisticated AI systems without massive amounts of memory.

Data centers require staggering quantities of high-bandwidth memory. A single NVIDIA H100 GPU contains 80GB of memory. When you're building data centers with thousands of these GPUs, you're talking about millions of gigabytes of memory requirements. Amazon, Microsoft, Google, Meta, and countless other cloud providers all simultaneously entered a competitive bidding war for memory chips. This caused manufacturers to prioritize data center customers over consumer markets.

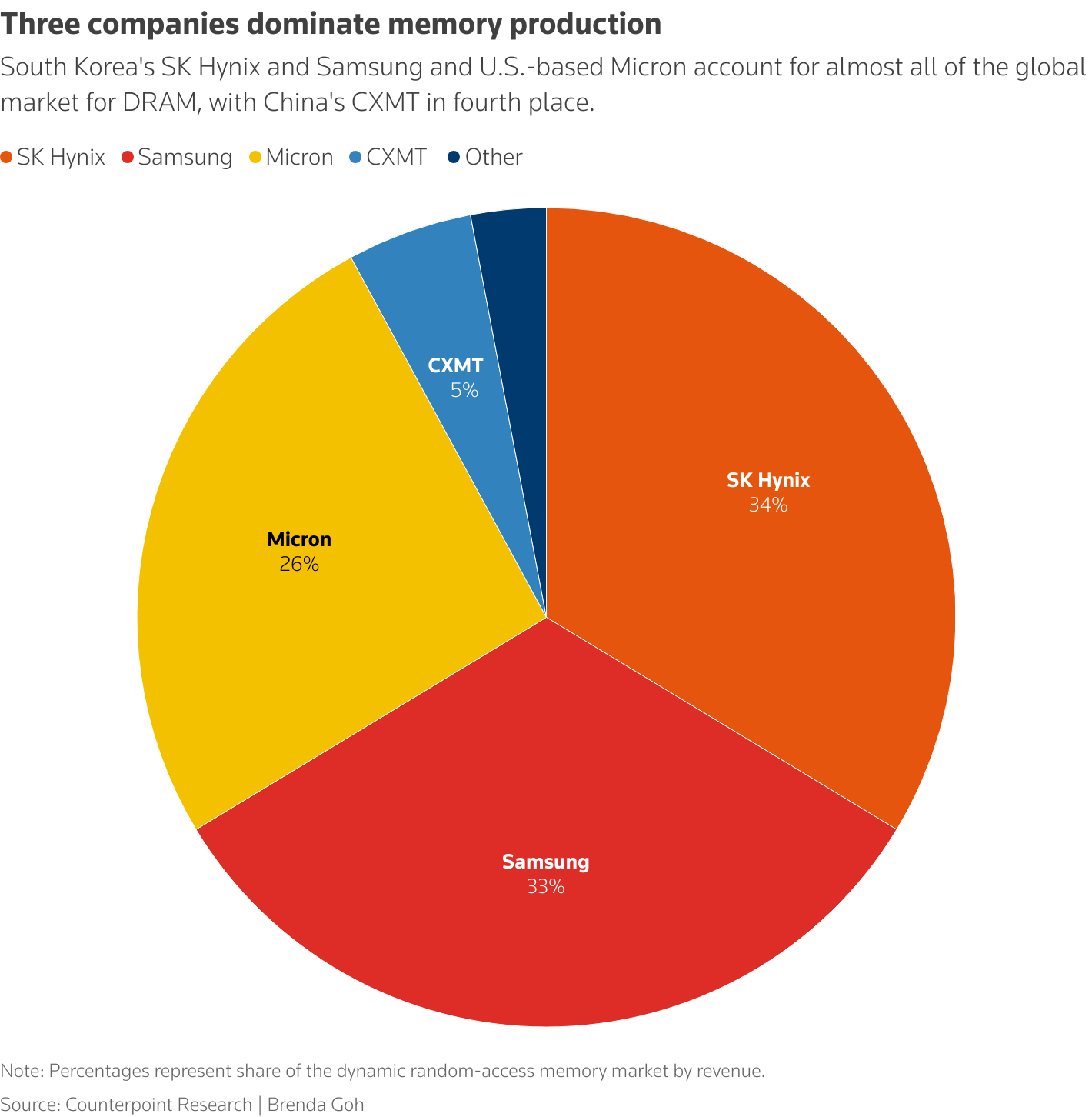

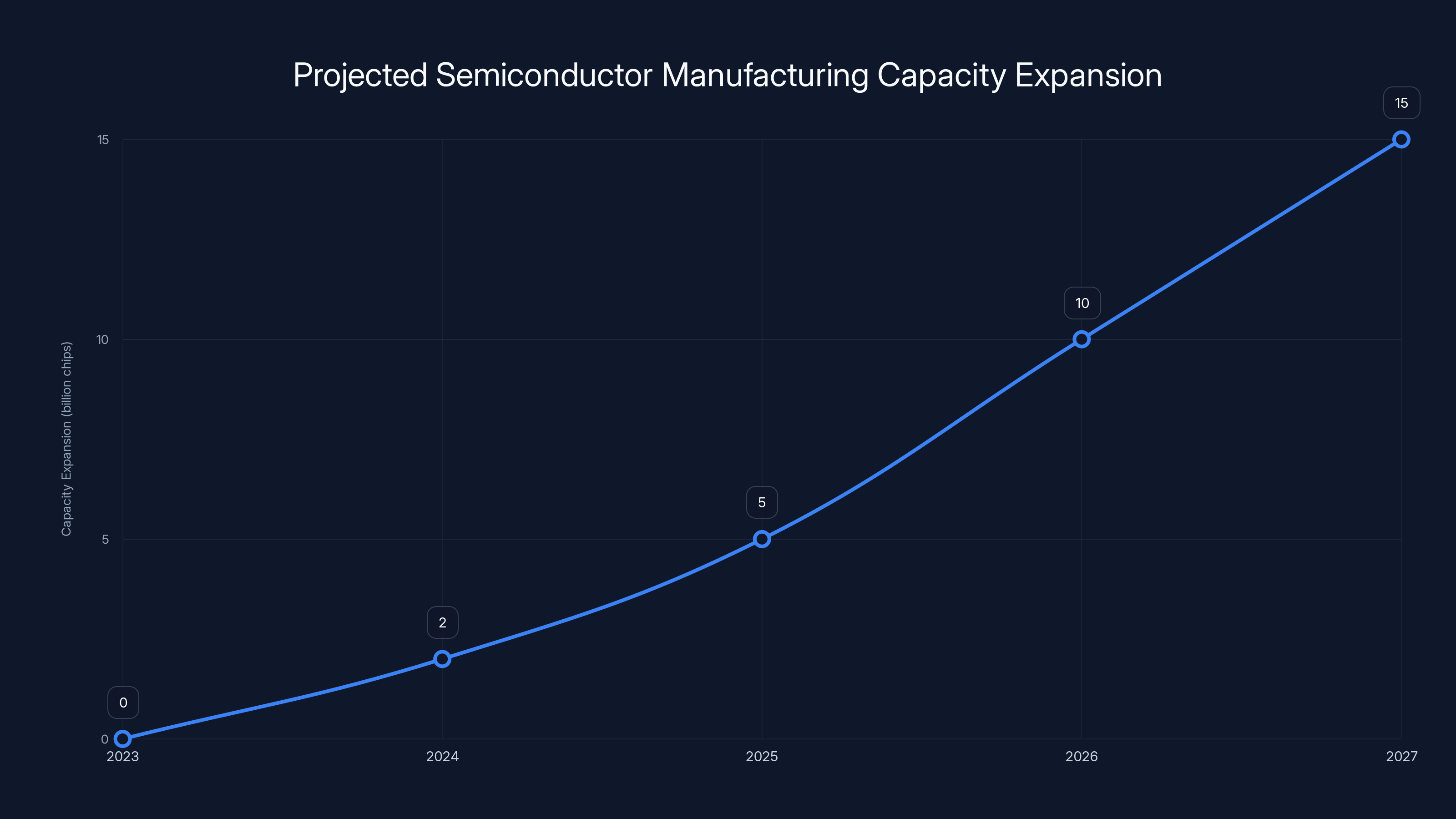

Memory manufacturers like Samsung, SK Hynix, and Micron have invested billions in expanding capacity, but silicon fabrication plants take years to build. You can't just flip a switch and produce billions more memory chips overnight. The lead time for building a new foundry is typically three to five years. This gap between demand surge and manufacturing capacity expansion is what created the shortage.

Valve's situation represents a microcosm of this broader problem. The company wants to launch the Steam Machine with predictable pricing, but component costs are fluctuating wildly. A month where DDR5 RAM costs

The shortage affects not just RAM but also storage components. NVMe SSDs, DRAM, and high-speed storage all rely on the same semiconductor ecosystem, and all are experiencing supply constraints. For a device like the Steam Machine that needs both high-capacity RAM for smooth gaming and fast storage for quick game loading, both components are critical to the user experience.

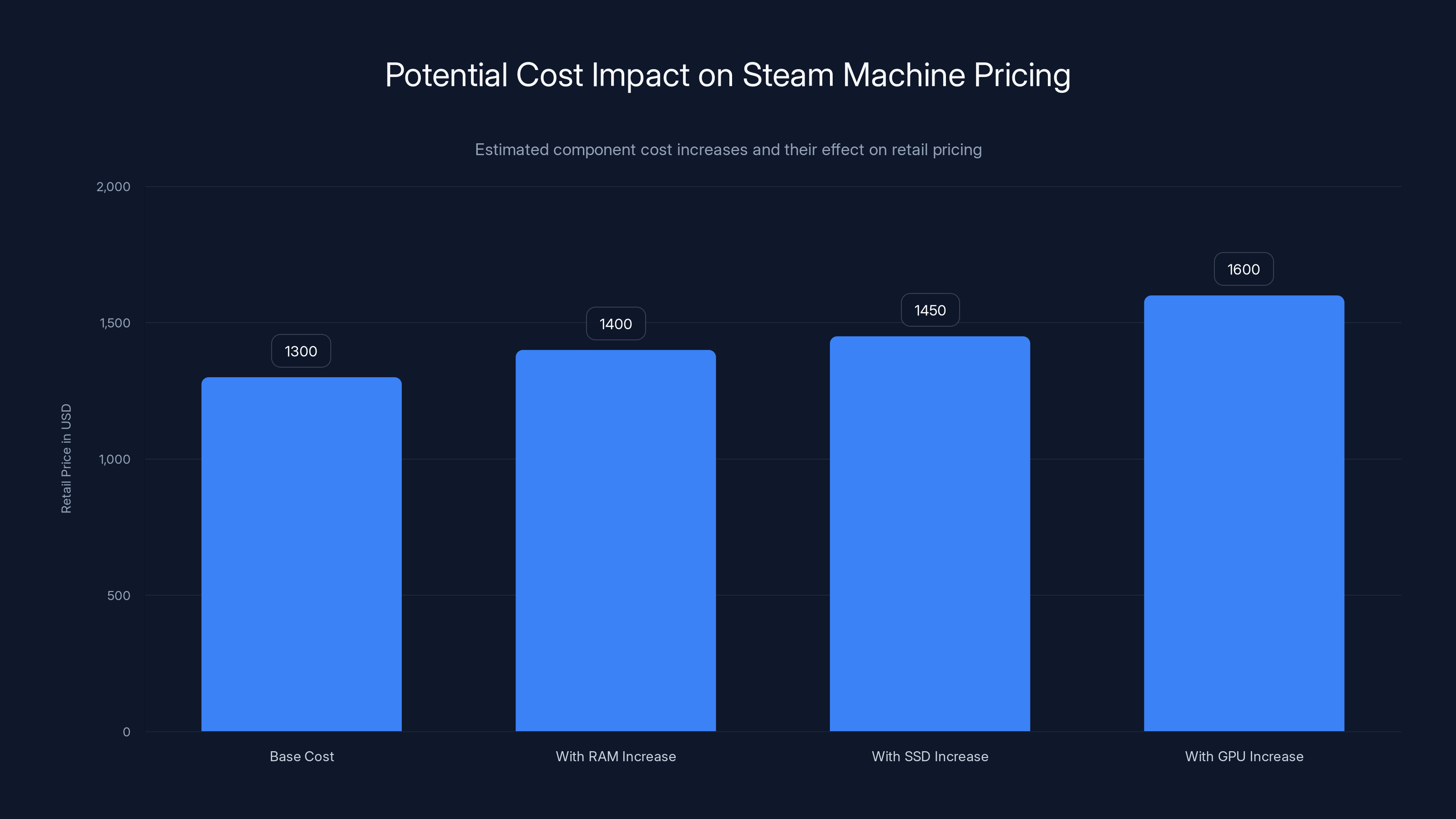

Estimated data shows potential retail price increases for the Steam Machine based on component cost surges. A significant rise in GPU prices could push the retail price to $1600, impacting consumer demand.

Why AI Infrastructure is Consuming Memory at Unprecedented Rates

Understanding the RAM shortage requires understanding why AI systems are so memory-hungry. Large language models operate fundamentally differently from traditional software. When you run a Word processor or a web browser, those applications use memory efficiently because they're designed to load only what's needed at any moment.

Large language models, particularly transformer-based architectures like those powering Chat GPT and other AI systems, work differently. They process information in parallel across massive matrices. Model weights, activation values, gradients during training, and intermediate computations all consume memory simultaneously. A 175-billion parameter model (like GPT-3) requires enormous amounts of memory just to hold the model weights, then additional memory for processing.

Companies running AI services at scale face multiplied memory demands. If you're running inference on GPT-4 and serving it to millions of concurrent users, you need enough memory capacity to handle that load. If you're fine-tuning models on custom data, you need even more memory for gradients and optimizer states. The math gets astronomical quickly.

The economic incentive to secure memory is enormous. A company that controls AI infrastructure capacity controls a valuable business. Cloud providers are spending billions on infrastructure not because they're altruistic but because AI services represent the next major computing paradigm. Everyone from Open AI to Anthropic to Meta to countless startups needs access to these resources, and they're willing to pay premium prices.

What this means is that data centers are effectively outbidding consumer manufacturers for memory. When a company can charge $10,000 per month for GPU access, it can afford to pay double or triple the normal price for memory components. Consumer applications like the Steam Machine simply can't compete at those price points. Manufacturers have to choose between selling to cloud providers who pay premium prices or consumer manufacturers who need to maintain competitive pricing.

Valve's Hardware Strategy in the Context of Component Shortages

Valve's approach to hardware has always been somewhat unconventional. Unlike traditional PC manufacturers, Valve doesn't aim to be a volume leader. The company makes hardware as a means to control its platform and improve the user experience for gamers. The Steam Deck exemplified this philosophy—a device designed specifically for gaming on Linux, with custom hardware optimizations and software integration.

The Steam Machine represents an evolution of that strategy. Rather than trying to dominate the gaming PC market, Valve wants to establish itself as a legitimate hardware manufacturer that can build experiences tailored to its ecosystem. The company has invested heavily in driver optimization, Steam OS improvements, and hardware-software integration that specifically benefit Steam users.

However, this approach faces real constraints when supply chains become uncertain. Valve can't simply adapt by using different components like a major OEM might. The company has already designed the Steam Machine around specific hardware configurations. Switching memory types, storage solutions, or GPU variants mid-production would require re-engineering and new certifications. The company has already announced performance targets and feature sets that depend on these components working in concert.

Moreover, Valve has a reputation to protect. The Steam Deck's launch faced criticism for slower-than-expected shipments and supply issues. A rocky launch for the Steam Machine could damage the company's credibility in hardware. This is why Valve is taking the conservative approach: delay announcement of pricing and availability rather than announce dates they might miss or prices they might not be able to sustain.

Valve's blog post specifically mentioned that the company wants to announce "concrete pricing and launch dates we can confidently announce." This language is telling. It reflects the company's desire to avoid another supply chain situation where customers pre-order, wait months, and then face delays. By holding off on firm announcements, Valve is protecting its reputation even if it frustrates eager customers.

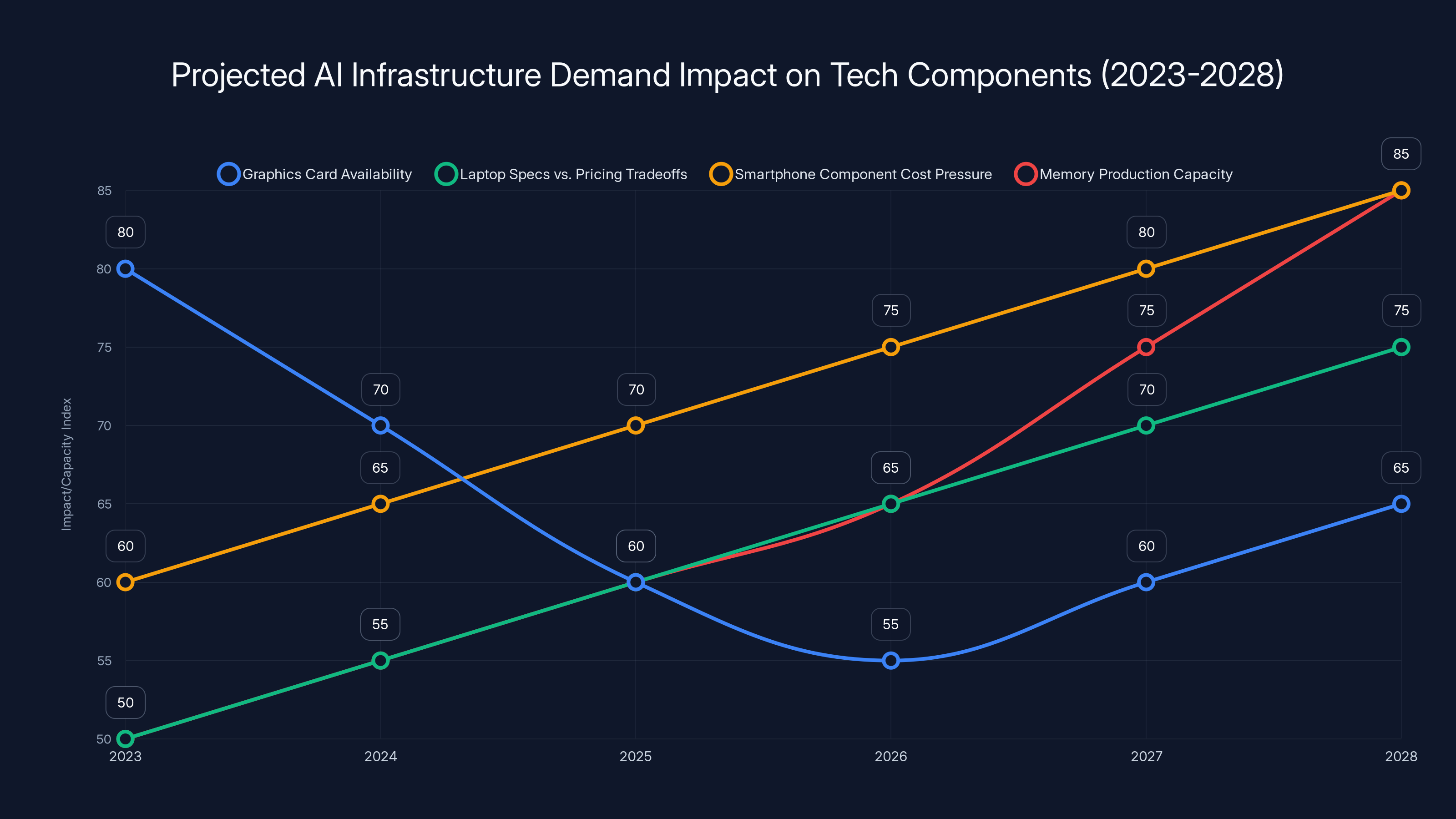

Estimated data shows AI infrastructure demand is expected to constrain tech component availability until 2028, despite increased production capacity. Consumer hardware will face ongoing challenges in balancing specs and pricing.

The New Reality: AI's Impact on Consumer Hardware Manufacturing

The Steam Machine delays signal something fundamental about the tech industry in 2026. We're entering a period where AI infrastructure competes directly with consumer hardware for manufacturing capacity and component availability. This isn't a temporary disruption—it's likely to be a structural feature of computing for the foreseeable future.

As AI capabilities improve and more companies integrate AI into their products and services, demand for memory will only increase. Cloud providers will continue to expand data centers. Edge computing will bring AI processing closer to users. Even consumer devices themselves are increasingly incorporating local AI processing, which requires more memory.

This creates a two-tier market for memory. High-capacity, high-bandwidth memory modules command premium prices and go to data centers first. Lower-end memory destined for consumer applications sits in shorter supply. Memory manufacturers face a choice: maximize profits by prioritizing enterprise customers, or maintain consumer market share by diversifying supply.

Historically, semiconductor manufacturers have followed the money. When one market segment offers significantly higher margins, that's where capacity goes. With enterprise AI infrastructure commanding such high prices, it's rational for manufacturers to prioritize that segment. Consumer manufacturers like Valve just have to adapt.

Valve's Messaging Strategy During Supply Chain Uncertainty

How Valve communicates about these delays matters enormously for the company's brand and customer relationships. The company took a relatively transparent approach, explaining specifically what components were causing problems rather than issuing vague "we'll announce later" statements.

This transparency is a double-edged sword. On one hand, it demonstrates honesty and helps customers understand that the delay is beyond Valve's control. On the other hand, it reinforces the reality that even well-capitalized companies struggle with supply chain management in 2026. This could make potential customers nervous about purchasing the device if they worry about future supply issues.

Valve's decision to commit to a "first half 2026" timeline without specific dates is strategically wise. The company isn't locking itself into a deadline it might miss, but it's also not abandoning the product. This middle ground acknowledges reality while maintaining some roadmap certainty.

The company also used the announcement to highlight other work being done on software optimization. The blog post mentioned improvements to memory management for the Steam Machine and driver optimizations for ray tracing performance. By highlighting ongoing technical work, Valve reinforced that the delay isn't because the product doesn't work—it's purely a supply chain issue.

This messaging approach contrasts with how some manufacturers handle supply constraints. Rather than being transparent, some companies issue vague delays and fail to explain root causes. Valve's approach, while still frustrating for customers, at least provides clarity about what's happening.

Estimated data shows a gradual increase in semiconductor manufacturing capacity over five years, reflecting the time and investment needed for new fabs.

Storage Shortages: The Secondary Supply Chain Crisis

While RAM gets most of the attention when discussing the memory shortage, storage components face equally serious constraints. The Steam Machine will likely come with an NVMe SSD for fast game loading and OS responsiveness. These drives also compete for manufacturing capacity with data centers that need massive amounts of storage for AI model training and inference.

Data centers require not just memory but also storage capacity to archive models, datasets, and inference outputs. A single large language model training run can generate terabytes of data that must be stored for validation, analysis, and potential rollback. Multiply this across the thousands of companies training models in 2026, and you get a clear picture of storage demand.

NVMe SSD manufacturers face similar constraints to memory manufacturers. Building new production facilities takes years and billions of dollars in investment. NAND flash manufacturing, which powers SSDs, is a specialized and capital-intensive process. Companies like Samsung, SK Hynix, and Western Digital have to allocate their capacity across multiple market segments.

For the Steam Machine, this means the company must decide between using smaller-capacity drives (which frustrate users who want local game libraries) or paying premium prices for larger drives (which increases the final price to consumers). There's no ideal solution when supply is constrained across the board.

Historical Precedent: How Steam Deck Navigated Similar Challenges

Valve has been through supply chain hell before. The Steam Deck's launch in 2022 faced significant constraints, with customers waiting months between reservation and fulfillment. Yet despite these challenges, the device ultimately succeeded and is widely considered one of the best-selling dedicated gaming handhelds ever made.

The Steam Deck's success despite supply constraints offers some optimism for the Steam Machine. Customers were willing to wait because the device offered something genuinely novel. The combination of PC gaming performance in a portable form factor, paired with Linux-based Steam OS, created demand that transcended typical supply-constrained product launch frustration.

However, there are important differences between the Steam Deck situation and what Valve faces with the Steam Machine. The Steam Deck benefited from being a new category—something consumers had never really experienced before. The Steam Machine, conversely, is competing directly against established gaming PC manufacturers. Customers can buy an ASUS gaming PC, an MSI pre-built system, or build their own custom PC while waiting for the Steam Machine.

The Steam Deck also had strong brand momentum from the handheld gaming community. Users had been asking for a portable gaming device for years. The Steam Machine doesn't have quite the same reservoir of pent-up demand. Gaming PC enthusiasts are already well-served by dozens of manufacturers.

Valve's handling of the Steam Deck supply issues taught the company lessons about managing expectations. The company learned that transparency about delays beats silence, and that maintaining production momentum matters more than hitting arbitrary ship dates. Those lessons are clearly informing how Valve is handling the Steam Machine situation.

AI infrastructure demand and limited manufacturing capacity are the primary drivers of the RAM shortage affecting the Steam Machine. (Estimated data)

GPU Supply Constraints: The Downstream Effect

Ram shortages don't exist in isolation. They create cascading effects throughout the component supply chain, affecting GPUs and other hardware. Many GPU designs are memory-limited, meaning their performance depends on how much high-speed memory they can access. When memory becomes scarce, GPU manufacturers must sometimes redesign products or reduce feature sets.

For gaming GPUs specifically, the memory situation is complex. High-end GPUs like the NVIDIA RTX series rely on specialized memory technologies like GDDR6X and GDDR6. These aren't the same memory types as system RAM—they're optimized for the parallel processing that GPUs require. However, they also share similar manufacturing capacity with system memory, and they're similarly constrained.

The Steam Machine's GPU selection will be critical to its performance and price point. Valve hasn't announced specific GPU partners or models, but the company will need to balance performance, power consumption, and cost. Whatever GPU the company selects, that choice will be constrained by what's actually available in sufficient quantities in 2026.

Some GPU manufacturers have started building reserve capacity to handle supply surges. However, these reserves exist for strategic customers—large cloud providers and enterprise buyers. Consumer manufacturers like Valve won't have access to those reserves unless they're willing to pay significant premium prices.

The GPU supply situation suggests that the Steam Machine might not feature the absolute latest generation of graphics chips. Instead, Valve might use slightly older but proven architectures that are more readily available in volume. This would be a pragmatic choice that ensures the device can actually ship in meaningful quantities.

The Steam Frame VR Headset: A Complex Supply Chain of Its Own

While the Steam Machine is a more traditional gaming PC with straightforward component requirements, the Steam Frame VR headset is far more complex. VR headsets combine displays, sensors, processors, memory, and storage in ways that create unique supply chain challenges.

VR display technology is particularly supply-constrained. High-resolution displays that can deliver smooth VR experiences without causing motion sickness are manufactured by only a handful of companies worldwide. These manufacturers serve the consumer VR market, the enterprise VR market, and other applications. Like memory manufacturers, they've had to contend with demand surges and capacity constraints.

The Steam Frame will need top-tier display hardware to compete with existing VR headsets from Meta, HTC, and other manufacturers. Users expect crisp visuals, wide fields of view, and smooth refresh rates. Any compromise on display quality would undermine the device's value proposition. Yet sourcing the necessary displays in volume while memory and other components are constrained makes manufacturing challenging.

Memory is particularly critical for VR headsets. Real-time rendering at the frame rates required for VR (90fps, 120fps, or even higher) demands fast memory for buffering, texture storage, and computational memory for graphics processing. The Steam Frame likely requires both high-speed GPU memory and substantial system RAM. Both types are constrained in the current environment.

Valve hasn't divulged much about the Steam Frame's specifications, but the company will face similar challenges as the gaming industry more broadly faces in 2026. Building a competitive VR headset requires specific components that are difficult to source in volume when data centers are also bidding for manufacturing capacity.

Estimated data shows a decline in RAM availability and a rise in component prices from late 2025 to mid-2026, highlighting the severity of the supply chain crisis.

Pricing Strategy Under Uncertainty: Valve's Calculation

Pricing the Steam Machine is an exercise in managing multiple competing uncertainties. Valve has indicated that pricing will be competitive with other gaming PCs with similar specifications. But what counts as "similar specifications" depends on component availability and what Valve can actually include in the device.

Let's work through the math. Suppose Valve wanted to build a gaming PC with a mid-range GPU, 16GB of DDR5 memory, a 1TB NVMe SSD, and a mid-range CPU. In 2026, with normal component pricing, this might cost around

But if memory prices surge 50%, suddenly the cost of RAM alone adds

Valve can't just absorb these cost increases as margin compression. The company makes money on hardware sales but more importantly on software sales through the Steam store. The Steam Machine's value proposition depends partly on attractive hardware pricing that drives adoption. If the device costs too much, it fails the market test regardless of software benefits.

This is why Valve is hesitant to announce pricing. The company doesn't know if component costs will stabilize in Q2 2026 or continue escalating. Announcing a price now only to revise it upward weeks before launch would damage customer trust. Waiting to announce pricing based on more certain component cost forecasts is the safer approach, even though it frustrates enthusiasts waiting to hear when and for how much they can buy.

Steam OS Optimization: Software Solutions to Hardware Constraints

While Valve can't control component availability, the company can optimize software to make the Steam Machine perform better with whatever hardware ends up in the final product. This is where Valve's leverage lies. The company has been working on Steam OS improvements that specifically address memory management and performance optimization.

Valve's blog post mentioned memory management improvements that should help gaming performance. This is critical because games were originally written for Windows on PCs with unlimited memory capacity. Linux-based Steam OS requires more careful memory management to achieve equivalent performance on similar hardware.

The company also mentioned work on improved upscaling technologies. Upscaling takes lower-resolution rendered images and intelligently increases resolution before displaying them. This reduces memory bandwidth requirements while maintaining visual quality. Technologies like DLSS from NVIDIA and FSR from AMD do this, but custom Steam OS implementation could provide additional performance gains on custom hardware.

Driver optimization for ray tracing is another key area. Ray tracing is computationally and memory-intensive, so optimizing ray tracing performance through better driver implementation can help games run faster on the Steam Machine. This kind of optimization is exactly where Valve's deep expertise gives the company advantages that generic gaming PCs don't have.

These software optimizations matter because they mean the Steam Machine won't need absolute cutting-edge hardware to deliver compelling gaming performance. A well-optimized system running on slightly older hardware can outperform a newer system running unoptimized software. This flexibility helps Valve navigate component availability issues.

The Steam Controller Announcement: Completing the Ecosystem

Valve's announcement also mentioned a new Steam Controller that would launch alongside the Steam Machine. While controller supply and price are presumably easier to manage than computing components, this addition to the ecosystem is strategically important.

The Steam Controller is the interface between player intent and the Steam Machine itself. A great controller can elevate the hardware experience; a poor controller can undermine it. Valve has learned this from previous controller iterations. The original Steam Controller, released in 2015, had decent hardware but suffered from software implementation issues that took years to resolve.

The new controller's availability will also depend partly on component supply, though to a lesser degree than the Steam Machine itself. Controllers have less complex electronics than gaming PCs, but they still contain processors, memory for configuration storage, wireless components, and sensors. Supply constraints could affect these as well, though less severely than they affect high-capacity memory and storage.

Valve's strategy of announcing all three products together—Steam Machine, Steam Frame, and new Steam Controller—creates a cohesive ecosystem narrative. Rather than selling individual devices, Valve is positioning these as an integrated platform for Steam gaming. This ecosystem approach differentiates Valve's products from generic gaming PC manufacturers.

Lessons for the Broader Consumer Hardware Industry

Valve's situation illustrates a larger pattern that hardware manufacturers must grapple with in 2026. The priority order in semiconductor manufacturing has shifted. Enterprise and AI infrastructure applications now command the highest prices and thus the highest priority in manufacturing allocation. Consumer applications have to wait in line.

This doesn't mean consumer hardware will disappear. It means pricing, availability, and product design will all be constrained by this new reality. Manufacturers will either need to accept higher prices, longer wait times, or less advanced components than they'd prefer to use.

Some manufacturers are responding by building strategic memory reserves. Others are exploring alternative materials and manufacturing processes that might be less affected by AI-driven demand. Still others are redesigning products to use less memory or accepting that consumer products won't feature cutting-edge components.

Valve's response—transparency about delays and continued software optimization—represents a mature approach to these challenges. Rather than pretending supply constraints don't exist or misleading customers with unrealistic timelines, Valve is being forthright about challenges while continuing to work on the product itself.

This approach builds long-term trust even if it frustrates customers in the short term. Gaming enthusiasts understand supply chain challenges. They appreciate honesty more than false promises. If Valve delivers a well-optimized, fairly-priced Steam Machine even with a few months delay, the delay itself becomes largely irrelevant to the customer experience.

Predicting H1 2026: Timeline Feasibility

Valve is committing to first half 2026 (H1 2026) for both Steam Machine and Steam Frame launches. Is this realistic given current supply chain conditions? The answer depends on how component pricing and availability evolve over the next few months.

Memory manufacturers have been increasing production steadily. NAND flash production is ramping up at multiple facilities. If these production increases continue at current trajectory, memory availability should improve somewhat by April-June 2026. This wouldn't solve supply constraints entirely, but it could provide enough relief for consumer manufacturers to scale production.

However, there's genuine uncertainty here. AI demand could continue escalating if new applications emerge that require even more memory. Data centers could expand capacity faster than currently planned, maintaining competitive pressure on memory availability. Conversely, AI adoption could slow if new models hit diminishing returns, freeing up more memory for consumer applications.

From Valve's perspective, committing to H1 2026 is a calculated bet that conditions will improve enough by then to make production feasible. The company is leaving itself flexibility by not specifying exact months or dates. May 31st is still H1 2026 as much as January 1st is.

This timeline also gives Valve breathing room for final optimization work. The company can continue refining Steam OS drivers, improving memory management, and optimizing ray tracing performance. By the time components are available for production, the software should be polished enough to ship.

Missing the H1 2026 target would be a setback but not a disaster. Gaming enthusiasts understand that hardware launches sometimes slip. What would damage Valve's credibility more would be announcing specific dates and then missing them repeatedly. By keeping the target vague but directional, Valve avoids that trap.

What This Means for Prospective Steam Machine Buyers

If you're considering buying a Steam Machine, these delays mean you should adjust your timeline expectations. Rather than expecting a launch announcement soon with availability shortly after, expect Valve to announce details (pricing, availability, exact specs) sometime in Q2 2026, with actual availability ramping through mid-2026.

This extended timeline gives you time to evaluate whether the Steam Machine actually aligns with your gaming preferences. Are you committed to Linux gaming and Steam OS, or would you be equally happy with a Windows gaming PC? Do you value Valve's software optimization enough to wait, or would you rather buy an equivalent PC from another manufacturer now?

The delays also suggest that when the Steam Machine does launch, inventory might be limited initially. If you're genuinely interested, paying attention to availability announcements and being ready to purchase early is wise. Components scarcity means production quantities will likely be constrained even once manufacturing begins.

Pricing is another consideration. While Valve has indicated competitive pricing with other gaming PCs, component scarcity could push prices higher than ideally competitive. Be prepared for the possibility that Steam Machine pricing might be slightly above what you'd expect for equivalent PC hardware from other manufacturers. The software optimization and Steam OS benefits need to justify any price premium.

The Bigger Picture: 2026 Tech Outlook

Valve's delay is one data point in a much larger story about technology in 2026. AI infrastructure boom is reshaping which components are scarce, which manufacturing facilities are prioritized, and how consumer hardware manufacturers operate.

We're seeing this impact across multiple industries. Graphics card availability for gaming is constrained. Laptop manufacturers are making tradeoffs between specs and pricing. Smartphone manufacturers are seeing component cost pressure. None of these issues would be as severe without the AI-driven demand for computing resources.

What's particularly interesting is how this plays out long-term. In 2027, 2028, and beyond, we'll likely see more production capacity come online specifically for memory and related components. But this expansion won't necessarily relieve consumer pressure if AI demand continues growing at current rates.

Valve's bet on H1 2026 assumes that by mid-2026, supply conditions will have stabilized enough to enable consumer product launches. This seems reasonable but isn't guaranteed. The company's willingness to delay rather than commit to aggressive timelines suggests Valve learned from past supply chain challenges with the Steam Deck.

The bigger lesson here is that hardware manufacturing in the era of AI involves navigating genuine constraints, not just marketing timelines. Companies that acknowledge these constraints and manage customer expectations appropriately build more sustainable businesses than those that make optimistic promises and miss them.

Making Sense of Component Shortage Dynamics

To truly understand the Ram shortage and its impact on products like the Steam Machine, it's helpful to understand semiconductor manufacturing economics. Chip makers don't just magically produce more chips when demand increases. Building a new fab (manufacturing facility) costs $10-20 billion and takes 3-5 years. Existing fabs have capacity limits that can't be exceeded without massive investment and lead time.

When demand surges, manufacturers must allocate scarce capacity across customer segments. They use price signals to manage allocation—higher prices incentivize some customers to use less and other customers to shift to alternatives. A company like NVIDIA might pay premium prices for high-speed memory to ensure its GPUs have the memory components they need. A company like Valve that wants competitive pricing has to accept longer wait times or settle for alternative components.

The AI boom created unprecedented demand precisely when manufacturers were dealing with after-effects of the COVID supply chain crisis and the crypto mining GPU shortage. Rather than getting time to catch up, manufacturers faced a new surge of demand. The response has been capacity expansion, but this takes time.

Valve's situation represents exactly this kind of allocation challenge. The company wants to build a specific product with specific components at a specific price. The market can't deliver all three constraints simultaneously, so Valve has to compromise on timeline to maintain the other requirements. This is economically rational even if it frustrates customers.

Future Outlook: Will This Affect Future Valve Hardware Iterations?

Beyond the Steam Machine and Steam Frame launches, these supply chain challenges will likely influence how Valve thinks about future hardware products. The company has signaled commitment to hardware as an important part of its platform strategy. But supply chain volatility makes hardware investment riskier.

Valve might respond by designing products that are more flexible about component choices. Rather than designing for specific chips, products could be architected to work efficiently with a range of component options. This flexibility would help Valve navigate future supply disruptions more easily.

Alternatively, Valve might increase strategic stockpiling of critical components. Some manufacturers have learned to maintain reserve inventory of essential parts to avoid being held hostage by supply constraints. This adds carrying costs but provides flexibility when supply becomes tight.

The company might also deepen partnerships with chip manufacturers. If Valve can secure supply agreements that guarantee certain quantities at agreed-upon prices, the company could plan more confidently. However, this requires Valve to commit to large purchase volumes in advance, which increases risk if demand doesn't materialize.

Long-term, the structure of the semiconductor industry will likely shift. More fabs will come online over the next few years. AI infrastructure demand will eventually stabilize or grow more predictably. Consumer and enterprise segments will find better balance in manufacturing priority. By 2028-2030, these dynamics might look quite different.

For now, though, Valve is adapting to 2026 reality as it exists. Delays that would have seemed unacceptable five years ago are now normal business practice. Companies that master supply chain navigation in the era of AI will gain competitive advantages in hardware markets.

FAQ

What exactly is causing the RAM shortage affecting the Steam Machine?

The RAM shortage stems from enormous demand for memory from data centers building out AI infrastructure. Companies like Microsoft, Google, Amazon, and Meta are building massive data centers filled with GPUs and specialized processors that require massive quantities of high-speed memory. This demand coincided with limited manufacturing capacity, creating a genuine supply constraint that's driving up prices and limiting availability.

Why can't Valve just use different RAM or find alternative suppliers?

Valve has likely already designed the Steam Machine around specific memory specifications that match the GPU and CPU choices. Switching to different memory types or speeds mid-production would require re-engineering, new testing, and potentially new certifications. Additionally, all memory suppliers face similar constraints—there's no alternative source with unlimited availability. Valve could source alternative products, but this could compromise performance or require design changes.

Will the Steam Frame VR headset also be affected by component shortages?

Absolutely. VR headsets contain high-speed memory, specialized display components, processors, and sensors—all of which are constrained in the current manufacturing environment. Display technology in particular is produced by only a handful of manufacturers, making sourcing difficult when multiple companies are building VR products simultaneously. Valve is facing similar challenges for both the Steam Machine and Steam Frame.

What was Valve's previous experience with supply chain challenges?

The Steam Deck faced significant supply constraints after its 2022 launch, with customers waiting months between reservation and fulfillment. However, the device ultimately succeeded and is considered one of the best-selling dedicated gaming handhelds ever made. This experience likely informed Valve's more cautious approach to announcing the Steam Machine and Frame. The company learned that managing expectations and being transparent about delays builds more trust than missing announced timelines.

How likely is the H1 2026 launch target for Steam Machine and Steam Frame?

It's realistic but not guaranteed. Memory production is ramping up, which should provide some relief by mid-2026. However, AI demand could continue escalating, or unforeseen supply chain disruptions could occur. Valve's vague timeline—first half, without specific months—gives the company flexibility to announce actual availability once conditions stabilize. This approach is pragmatic and acknowledges genuine uncertainty.

Will the Steam Machine be more expensive because of these component shortages?

Likely yes, though Valve will try to minimize price impact. Higher component costs will be partially absorbed by Valve but also reflected in pricing. The company indicated it wants pricing competitive with equivalent gaming PCs, but what counts as "equivalent" might mean Valve has to use slightly older components or reduce some specifications to maintain price competitiveness. Software optimization through Steam OS will help compensate for any hardware tradeoffs.

How do these delays compare to what other PC manufacturers are experiencing?

Most PC manufacturers are facing similar challenges. ASUS, MSI, Gigabyte, and other pre-built system manufacturers are all managing supply constraints and pricing uncertainty. The difference is that Valve is more transparent about challenges than many manufacturers, and the company has stronger relationships with its community that allow more candid communication about delays.

What should gamers do while waiting for the Steam Machine?

Consider whether a Steam Machine is truly what you want, or whether an alternative gaming PC would serve your needs now. The delays provide time to evaluate whether Linux gaming through Steam OS offers compelling advantages over Windows gaming, or whether you'd be equally satisfied with other options. You can also keep an eye on Steam Deck developments—improvements made to that device will likely benefit the Steam Machine as well.

Will this shortage affect Steam Deck availability or future Steam Deck updates?

The Steam Deck has been in production for several years and is past the critical launch phase, so shortages affect it less dramatically than new products. However, any Steam Deck updates or next-generation versions would face similar supply chain challenges. Valve's extensive optimization work on Steam OS and drivers benefits from the company's experience managing Steam Deck constraints and will help with future products.

Is this shortage temporary or a permanent feature of hardware manufacturing?

It's partially both. The acute shortage caused by recent AI boom will eventually ease as manufacturing capacity expands. However, the structural reality—that enterprise and AI infrastructure command premium prices and priority in manufacturing allocation—is likely permanent. Consumer hardware manufacturers will need to adapt to this new reality rather than expecting conditions to return to pre-AI dynamics.

Valve's announcement about Steam Machine and Steam Frame delays represents a candid acknowledgment of realities that shape technology development in 2026. The company is making pragmatic decisions: delay rather than commit to timelines that can't be sustained, optimize software to maximize performance within hardware constraints, and maintain transparency with the gaming community about challenges and progress.

For consumers waiting for these devices, the delays are frustrating but understandable. For the technology industry more broadly, Valve's situation illustrates how AI infrastructure is reshaping component availability, manufacturing priorities, and product launch timelines across computing categories. The companies that navigate these challenges successfully—through transparency, smart design choices, and software optimization—will build stronger products and maintain healthier customer relationships than those that make unrealistic promises and miss them.

The H1 2026 target remains achievable. Component production is ramping, and Valve is using this delay period for final optimization work. When the Steam Machine and Steam Frame eventually arrive, they'll likely represent well-engineered products that learned from past supply chain challenges. For now, patience is the virtue gaming enthusiasts will need in abundance.

Key Takeaways

- RAM shortage stems from AI infrastructure buildout: Data centers competing for memory allocation with consumer manufacturers, creating genuine supply constraints.

- Component costs remain unpredictable: Valve can't commit to pricing without knowing Q2 2026 component availability, making delays strategically sound.

- Software optimization compensates for hardware constraints: SteamOS improvements help maximize performance even with potential component compromises.

- H1 2026 target is realistic but not guaranteed: Manufacturing capacity is expanding, but sustained AI demand could maintain pressure on consumer segment allocations.

- Transparency builds customer trust despite delays: Valve's candid communication about supply chain challenges outperforms competitor approaches of vague delays and missed promises.

Related Articles

- Resolve AI's $125M Series A: The SRE Automation Race Heats Up [2025]

- ElevenLabs 11B Valuation [2025]

- Steam Machine Release Date 2025: Valve's AMD Gaming PC Launch Timeline

- Positron's $230M Series B: The AI Chip Challenger Nvidia Should Fear [2025]

- Space-Based AI Compute: Why Musk's 3-Year Timeline is Unrealistic [2025]

- Nvidia's $100B OpenAI Deal Collapse: What Went Wrong [2025]

![Valve's Steam Machine & Frame Delayed by RAM Shortage [2026]](https://tryrunable.com/blog/valve-s-steam-machine-frame-delayed-by-ram-shortage-2026/image-1-1770302248932.jpg)