Steam Deck OLED Out of Stock: The RAM Crisis Explained [2025]

In early February 2025, something peculiar happened in the gaming hardware market. Valve's Steam Deck OLED, one of the most sought-after portable gaming devices on the planet, simply vanished from store shelves across the United States. One day it was available for purchase. The next, gone. Completely sold out, with no restock date in sight.

At first glance, you might think this is good news. A product so popular it sells out must be incredible, right? That's the narrative most companies would love to spin. But here's the thing: this isn't a story about runaway success. It's a story about supply chain chaos, memory chip shortages, and an industry struggling under the weight of AI's explosive growth.

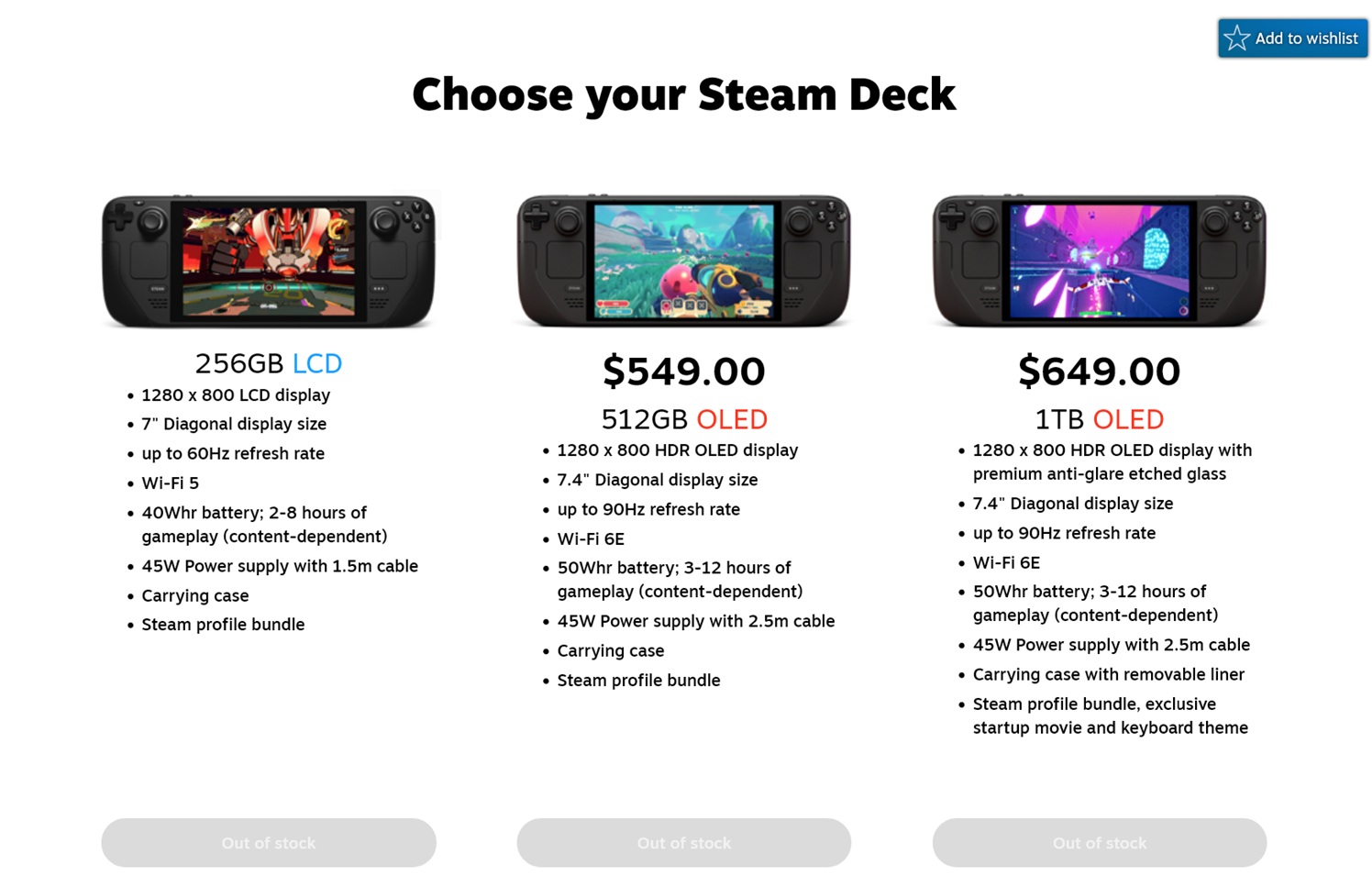

Valve didn't announce the outage. There was no press release explaining what happened. Instead, consumers simply tried to buy one and hit a brick wall. The Steam Deck OLED page on Valve's official store shifted to "currently unavailable in your region." Similar shortages appeared in Japan and several Asian markets. Meanwhile, the older LCD model that Valve had already discontinued faced the same fate—running out entirely as existing stock depleted.

What makes this genuinely interesting isn't just that a product sold out. It's why it sold out, and what that tells us about the state of the tech industry right now. The culprit? A massive RAM shortage that's been quietly reshaping everything from graphics cards to data center equipment. And Valve's situation is just the most visible symptom of a much larger problem.

When you dig into what's happening behind the scenes, you discover something manufacturers aren't shouting about from the rooftops: they're caught between competing demands, rising costs, and supply chains that can barely keep up. The Steam Deck OLED outage is a window into a crisis that's affecting far more than just gaming handhelds.

The RAM Crisis: What's Actually Happening

Memory chips aren't glamorous. They don't get headlines. Most people can't even name the RAM manufacturer inside their phone or laptop. But right now, the global shortage of DRAM (dynamic random access memory) and NAND flash storage is one of the most consequential supply chain problems facing the hardware industry.

Let's be clear about the scale: demand for RAM has exploded in ways that even pessimistic forecasters didn't anticipate. The culprit is artificial intelligence. Data centers worldwide are racing to build out infrastructure to run large language models, training neural networks, and supporting AI applications. This requires staggering amounts of memory. A single modern GPU can demand 80GB, 192GB, or even more of high-bandwidth memory. When you multiply that across millions of GPUs being installed in data centers, you're talking about unprecedented memory consumption.

Companies like OpenAI, Google, Microsoft, and Meta are all pouring hundreds of billions into AI infrastructure. They're not buying one GPU. They're buying tens of thousands. And every single one needs memory chips. This created a situation where the world's RAM manufacturers can barely keep up with the insatiable appetite of AI data centers. The problem cascaded down the supply chain to consumer devices.

The Scale of the Shortage

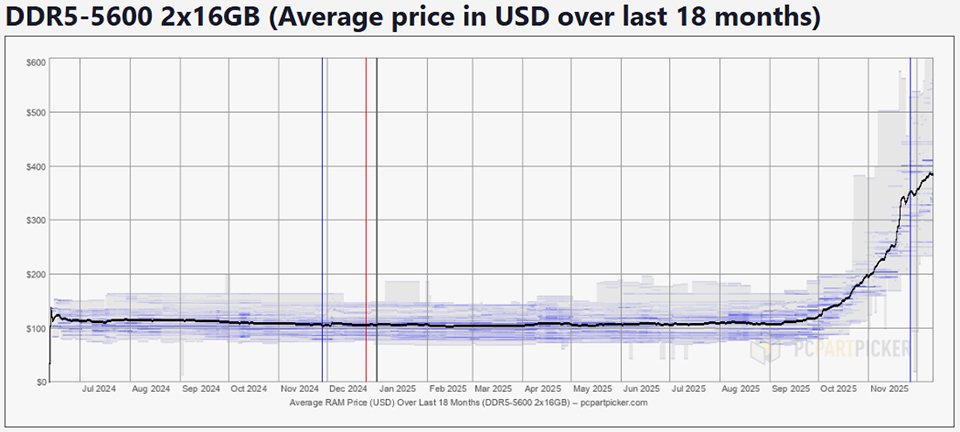

The numbers are staggering. Memory chip manufacturers ramped up production, but even their maximum capacity couldn't match the demand. Prices for certain types of memory spiked dramatically. High-bandwidth memory used in AI applications saw price increases of 30-40% in some cases. Meanwhile, consumer-grade RAM faced allocation issues, with manufacturers forced to choose between supplying data centers or consumer device manufacturers.

Valve's engineers needed 16GB of LPDDR5 memory for the Steam Deck OLED. That's not a massive amount by data center standards, but when you're making hundreds of thousands of units, you need to secure consistent supplies. With memory suppliers deprioritizing consumer devices in favor of lucrative AI contracts, Valve found itself competing for scraps.

The irony is delicious and painful. The Steam Deck OLED was winning. Player reviews were fantastic. Demand exceeded supply. Valve was finally hitting a rhythm with production and distribution. Then suddenly, the availability of a critical component became the bottleneck that killed momentum entirely.

Why Data Centers Win This Competition

When it comes to allocating scarce memory chips, data centers have significant advantages. First, they're buying in truly massive volumes. A single order from a major cloud provider might be worth more in annual revenue than Valve's total Steam Deck business. When you're TSMC or Samsung deciding how to allocate limited wafer capacity, the choice becomes obvious.

Second, data center customers have longer-term contracts. They commit to buying millions of chips over multiple years, providing visibility and stability for manufacturers. Consumer device manufacturers like Valve can't guarantee that kind of volume lock-in. Demand could drop next quarter. It's a riskier bet from the memory maker's perspective.

Third, margins are better for data center memory. High-bandwidth memory and specialized chips command premium prices. Consumer DRAM has become commoditized, with thinner margins. A memory manufacturer's accountants prefer the high-margin AI business over the lower-margin consumer market.

This created a perfect storm: AI demand soared, memory suppliers reallocated production toward data centers, consumer device makers got squeezed, and products that were readily available six months earlier suddenly became unobtainable.

Estimated data shows the Steam Machine's price could rise from

Impact on Valve's Steam Ecosystem

For Valve, the timing of this shortage couldn't have been worse. The Steam Deck OLED represented the company's statement that it was serious about portable gaming. The original LCD model had been a moderate success, proving there was a market. The OLED upgrade showed the company was committed to iterating and improving the product line.

The outage came at a critical moment. Valve had just discontinued the LCD model entirely in the US market to make room for OLED in the supply chain. This decision made sense at the time: OLED offered better margins, better optics, and better consumer satisfaction. But it also meant that if OLED supplies dried up, Valve had no fallback. There was no older, cheaper model to sell instead.

In other regions like Europe and parts of Asia, the LCD model lingered for a bit longer, but with discontinuation looming, it was clearly on borrowed time. Once supplies ran out globally, Valve would have nothing to offer customers until OLED stock returned.

The Messaging Problem

What made the situation worse was Valve's silence. The company never officially explained why the Steam Deck OLED disappeared. Customers weren't told "We're experiencing memory shortages. New stock should arrive in April." Instead, there was just an unavailable listing and questions left unanswered.

This created a vacuum of information that filled with speculation. Some thought Valve was discontinuing the product. Others wondered if a new model was coming. A few worried the entire Steam Deck line was being abandoned. None of this helps customer confidence or brand loyalty. When a company goes radio silent during a supply crisis, people assume the worst.

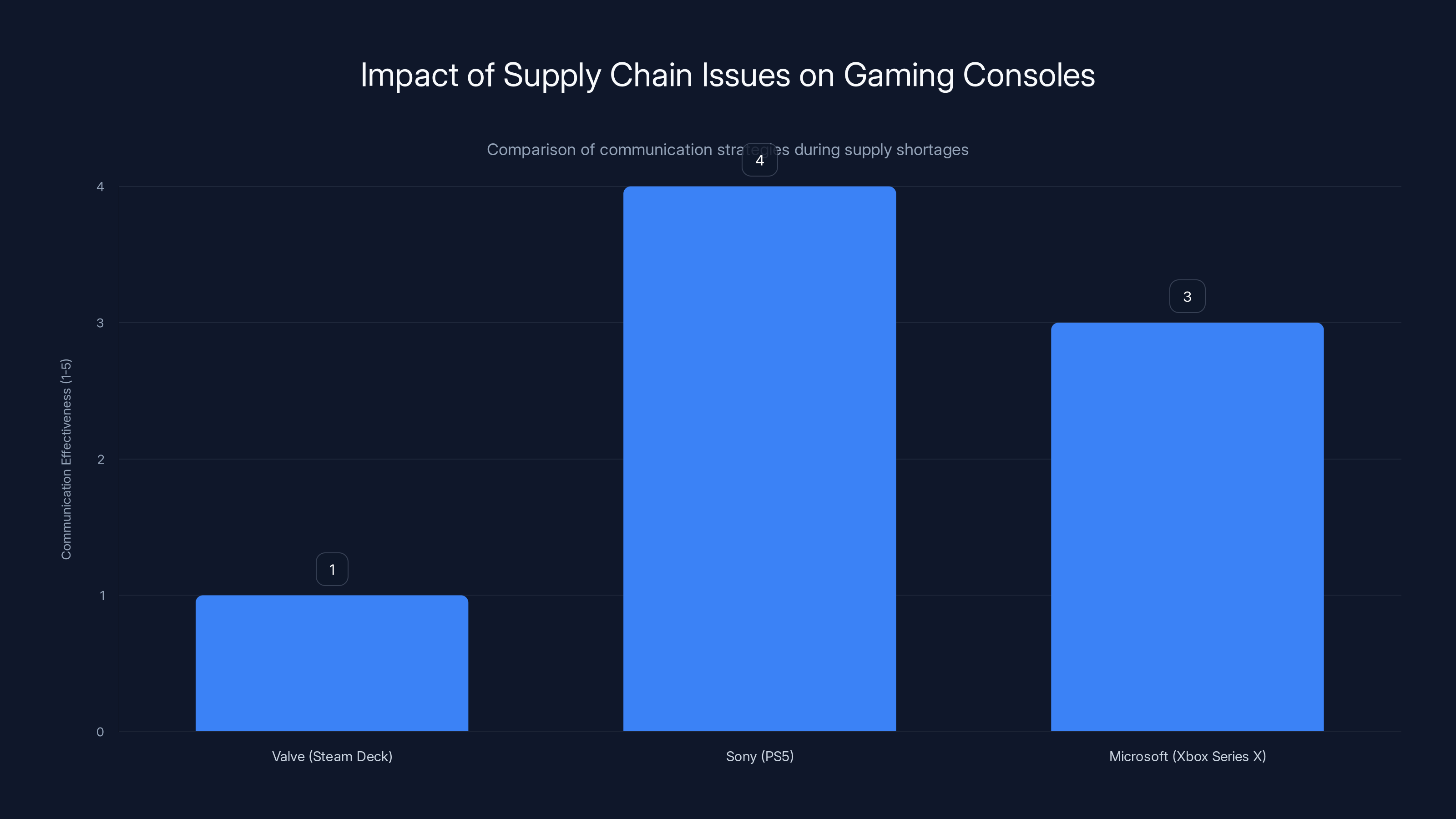

Compare this to how Sony and Microsoft handled their own supply chain challenges with the PS5 and Xbox Series X. They didn't always get it right, but they at least communicated. Valve's approach of saying nothing arguably made the situation feel more dire than it actually was.

Gaming's Busiest Season

The timing was particularly brutal because February-April is when gaming hardware typically sees increased demand. Winter holidays are over, spring break approaches, and gamers are looking for new entertainment. This is when Valve should have been running manufacturing at maximum capacity, not dealing with supply constraints.

Instead, just as demand peaks, Valve had nothing to sell. Customers who wanted to buy a portable gaming device either had to order one for future delivery (if they could get on a waitlist) or turn to alternatives. Some probably bought a Nintendo Switch, Play Station Portal, or other competitive device instead. That's a lost sale that Valve will never get back.

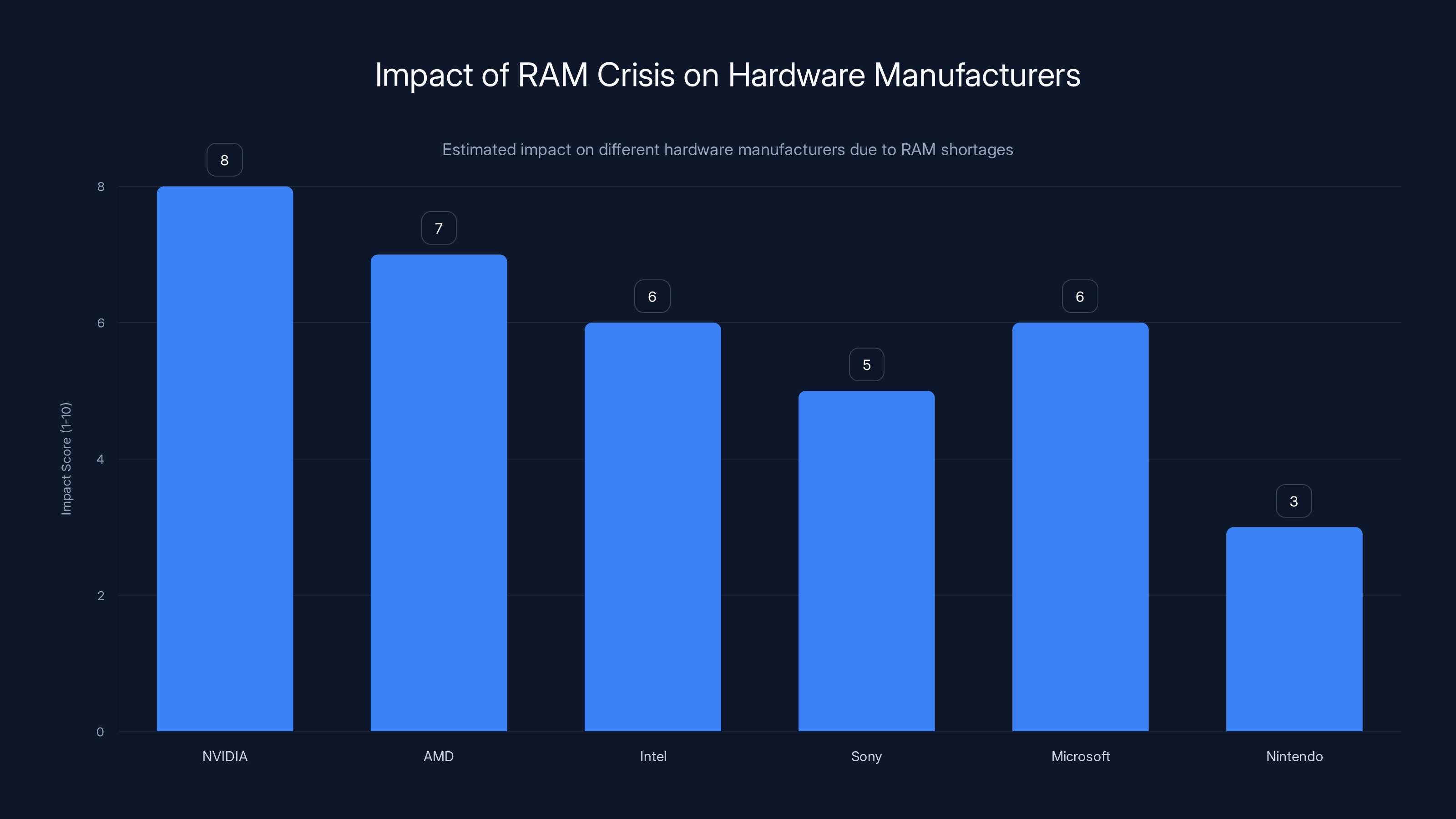

Estimated data showing the varying impact of the RAM crisis on different hardware manufacturers. NVIDIA and AMD are highly affected due to their reliance on DRAM and VRAM.

The Broader Hardware Market Crisis

The Steam Deck situation is visible, but it's just one symptom of a much wider problem affecting the entire consumer electronics industry. Multiple manufacturers are experiencing shortages, and the RAM crisis is only part of the story.

Graphics Card Makers Under Pressure

GPU manufacturers like NVIDIA, AMD, and Intel are experiencing similar memory constraints. Graphics cards require massive amounts of both DRAM and VRAM (video memory). The explosion in demand for consumer GPUs (driven partly by AI interest, but also by gaming) combined with data center hoarding has created allocation issues.

Zotac, one of the major GPU manufacturers, publicly warned that graphics card makers could be wiped out by the RAM crisis if the situation continued unchecked. That's not hyperbole. These companies operate on relatively tight margins. If memory costs spike 30-40%, it's hard to absorb that hit without raising prices. Raising prices kills demand. If you can't sell at profitable prices, you have to stop making product.

The gaming GPU market is already competitive and margin-challenged. Add a memory shortage on top, and suddenly some manufacturers are in genuine financial danger. Consolidation could follow. Smaller players might exit the market entirely.

Console and Device Manufacturers Scrambling

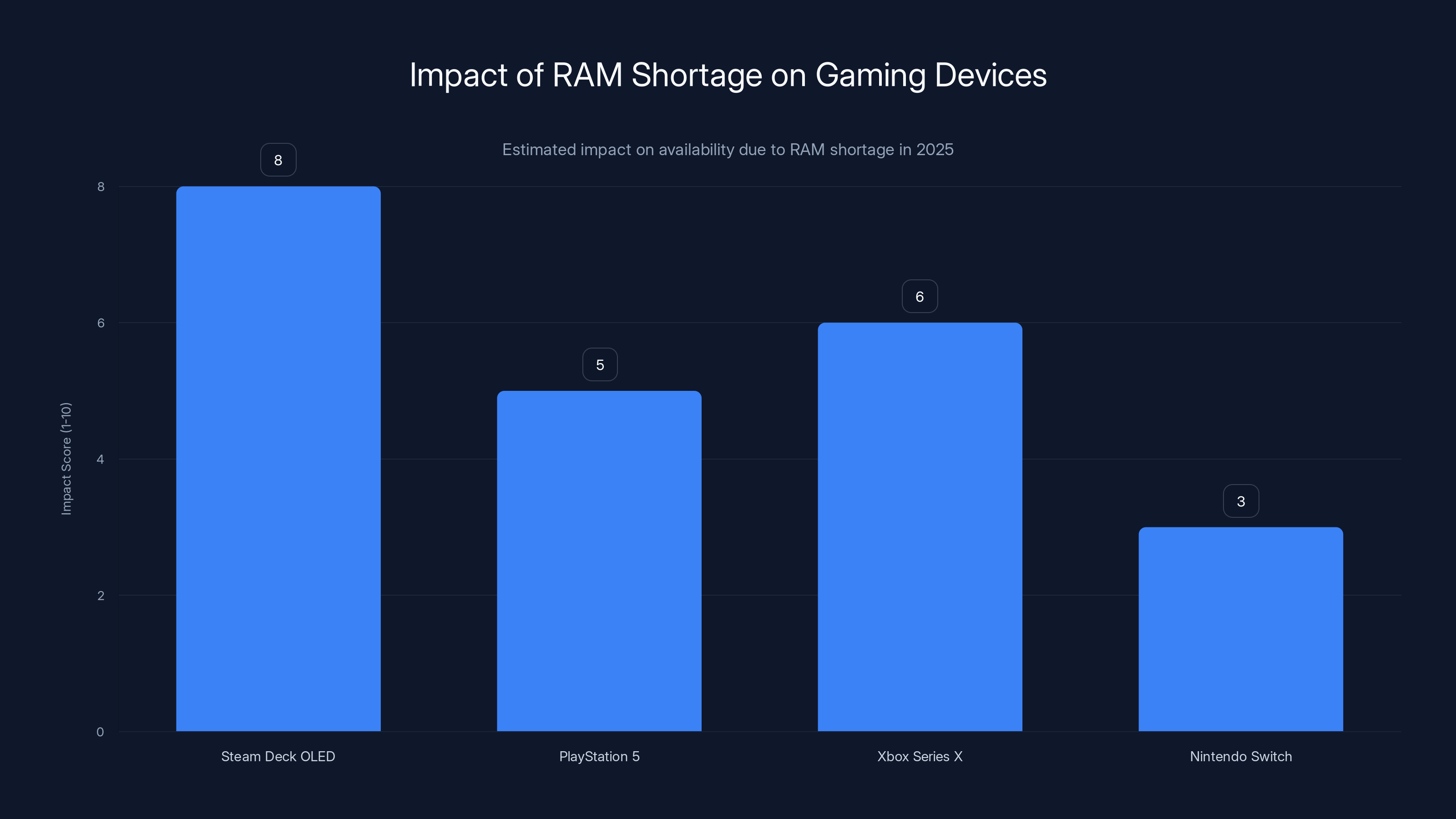

Sony and Microsoft both faced questions about their own production and pricing during the RAM crisis period. Sony announced it had "secured stock" of PS5 units and wouldn't be raising prices due to RAM shortages ("not yet, anyway" was the unspoken addition). Microsoft, meanwhile, faced the opposite problem: it was having trouble keeping Xbox Series X and S units in stock as manufacturers competed for memory.

Nintendo, which uses older, simpler memory in its devices, experienced fewer issues. The Switch OLED and Switch Lite continued to be available. This is because Nintendo's products use mature memory technology that's mass-produced globally, not cutting-edge components that are in short supply. It's an advantage of not chasing the absolute latest specs.

But traditional game console makers like Sony and Microsoft are locked into using current-generation memory because of performance requirements. They can't simply use older chips. This puts them in direct competition with data centers for the same memory sources.

Phone Makers and PC Manufacturers

Smartphone manufacturers, which make up the largest segment of memory chip consumers (behind data centers), are experiencing similar issues. Apple, Samsung, and other phone makers need billions of memory chips per year. When memory becomes scarce, they use their enormous buying power to secure allocation. Smaller manufacturers get squeezed.

PC makers face the same challenge. Whether it's DRAM for systems or memory for SSDs, the supply chain is stressed. Some manufacturers have had to negotiate price increases with customers or delay product launches.

The Cost of Memory: Why Prices Are Rising

Memory chip manufacturing is one of the most capital-intensive industries on the planet. A single modern semiconductor fabrication facility costs $10-20 billion to build. These fabs are already running at maximum capacity. Expanding production takes years, not months.

When demand outpaces supply, prices rise. It's simple supply and demand economics. And memory manufacturers, while busy, can't instantly create new wafer capacity. They have to plan for that years in advance. So we're stuck with a situation where demand will exceed supply for quite a while.

Margin Expansion for Memory Makers

While this is bad news for hardware manufacturers like Valve, Sony, and Microsoft, it's excellent news for memory chip makers like Samsung, SK Hynix, Micron, and KIOXIA. These companies are enjoying higher prices and better margins than they have in years. Their stock prices reflect this opportunity.

In some cases, memory makers are even reducing production of consumer-grade memory (where margins are thinner) to focus on premium products (where margins are fatter). This exacerbates the shortage for consumer devices like the Steam Deck.

It's a classic prisoners' dilemma: individual companies making rational decisions that lead to collectively irrational outcomes. Memory makers maximize profit by serving data centers. Hardware makers like Valve lose out. Consumers suffer from higher prices and reduced availability.

The Steam Deck OLED faces the highest impact from the RAM shortage, while Nintendo Switch is least affected due to older memory technology. Estimated data.

Valve's Steam Machine and the Future

While the Steam Deck OLED shortage grabbed headlines, Valve has been working on something even bigger: the Steam Machine, a "console-style" PC designed to compete with Play Station and Xbox. This device was scheduled for early 2026 release, but Valve quietly announced a delay, citing memory and storage shortages as the reason.

That announcement was revealing. Valve explicitly called out the RAM crisis as the cause. It wasn't a vague supply chain issue. It wasn't logistical problems. It was memory. The company acknowledged what everyone in the industry knows: you simply can't get enough memory chips right now.

The Steam Machine delay raises uncomfortable questions about pricing. Valve said it would "revisit" the price, which is industry speak for "it's probably going to be more expensive than we planned." If memory costs have risen 30-40%, and Valve wants to maintain manufacturing margins, prices will have to rise proportionally. A device Valve planned to price at

That's a problem because the whole appeal of the Steam Machine is that it offers console-level gaming at a PC-friendly price. If pricing rises significantly, some of that advantage evaporates.

Competition From Play Station and Xbox

Sony and Microsoft have deeper pockets than Valve and long-standing relationships with memory suppliers. They're in better positions to weather memory shortages. They can negotiate better allocation deals. They can absorb price increases more easily. Valve, being a smaller player, doesn't have those advantages.

This could reshape the competitive landscape. The Steam Machine was supposed to be Valve's play to compete in the living room, offering PC gaming on a TV. If it arrives late and costs more than planned, it might not gain the traction Valve hoped for. Play Station and Xbox will have been on the market longer and will have had time to drop prices and build momentum.

The VR Headset Dimension

Valve is also working on the Steam Frame VR headset, which was supposed to launch around the same time as the Steam Machine. VR hardware is even more memory-intensive than handhelds. A high-end VR headset needs significant amounts of VRAM and fast storage. Guess what's in short supply?

If the Steam Machine is delayed due to memory issues, the VR headset probably is too. Valve hasn't announced this officially, but it's reasonable to assume similar supply chain problems affect the entire product roadmap.

This puts Valve in a difficult position. The company has spent years investing in Steam OS, in Steam Deck, in the broader ecosystem. These products were supposed to represent Valve's push beyond just being a software platform into being a full hardware manufacturer. But supply chain chaos could derail those ambitions, at least temporarily.

Historical Context: RAM Crises and Supply Shocks

This isn't the first time the tech industry has faced a RAM shortage. It's happened before, and the pattern is always the same: demand spikes, supply can't keep up, prices rise, manufacturers invest in new capacity, supply eventually exceeds demand, prices collapse, and the cycle repeats.

The difference this time is the scale and the driver. Previous shortages were often regional or temporary. This shortage is global and tied to AI infrastructure investment, which shows no signs of slowing down. The memory crisis could persist for years, not months.

The 2017-2018 Memory Shortage

The last major DRAM shortage happened in 2017-2018, when demand from data centers, smartphones, and gaming GPUs all spiked simultaneously. Memory prices more than doubled. Laptop makers had to raise prices. Phone manufacturers' margins got squeezed. It was painful for hardware makers but profitable for memory manufacturers.

That shortage eventually eased as memory makers expanded production and demand moderated. But it took years to fully resolve. We're likely in for another multi-year cycle this time, possibly even longer.

Lessons Not Learned

You might think that after the 2017-2018 shortage, hardware makers would diversify their memory suppliers and build strategic reserves. Some did, but many didn't. Building inventory ties up capital. If you get it wrong, you're stuck with expensive inventory sitting on shelves. It's cheaper to hope supply stays stable.

This time, hardware makers are getting punished for that optimism. They gambled on supply stability and lost. Now they're scrambling to secure memory, negotiate better contracts, and communicate with customers about delays and potential price increases.

The demand for RAM has surged dramatically due to AI infrastructure needs, with a projected increase of over 300% from 2019 to 2023. Estimated data.

Impact on Gaming Industry and Players

The Steam Deck shortage has ripple effects throughout the gaming industry. Let's look at what it means for different stakeholders.

For Hardcore Handheld Gamers

Steam Deck fans are frustrated. They wanted to buy the best portable gaming device available, and they can't. Some waited in queues for months after the original launch, only to find they can't get an OLED unit now that it's available. Others who planned to upgrade from LCD to OLED are stuck.

Some will switch to competitors. Nintendo Switch OLED, Play Station Portal, and other alternatives are more readily available. These sales are lost, possibly permanently. Even when Steam Deck stock returns, the customer might have already bought something else.

Others will simply wait it out, maintaining loyalty to Valve's ecosystem. But patience has limits. If the shortage stretches into spring and summer, more customers will give up.

For Game Developers

Game developers care about the Steam Deck for one reason: it expands their addressable market. More players with handheld devices means more potential customers for their games. A Steam Deck shortage means fewer handheld players, which means less incentive for developers to optimize for the platform.

Some indie developers made the Steam Deck their primary platform, given its open nature and the enthusiasm from the community. Those developers are probably sweating right now. If the install base stops growing, their games might not reach the sales targets they planned for.

Larger studios probably care less, but for smaller developers, handheld gaming is an important market segment.

For Valve's Software Business

Valve makes money from Steam, the digital distribution platform. Every game sold on Steam gives Valve a cut. The company's revenue doesn't directly depend on Steam Deck sales. But the Deck helps build the Steam ecosystem and lock players into Valve's platform.

When Steam Deck sales slow down due to shortages, Valve's long-term ecosystem building suffers. Players who might have become Steam customers (because they liked the Deck) might instead stick with Play Station or Xbox. This affects Valve's software revenue in the future.

What Happens Next?

Memory production will eventually catch up to demand. This could take months or years, but it will happen. Memory chip manufacturers are investing in new capacity, fabs are ramping up, and supply will increase. But timing is uncertain.

Short-term: Continued Constraints

For the next 6-12 months, expect memory shortages to persist. Hardware makers will continue to compete for allocation. Prices will remain elevated. New product launches will face delays. Gaming devices, PCs, and other consumer electronics will continue to experience supply constraints.

Valve's Steam Deck OLED will probably remain unavailable through spring 2025. By summer, maybe there's some stock. But don't expect the device to be widely available until fall at the earliest. The Steam Machine won't arrive in early 2026 as originally planned, probably late 2026 at the earliest.

Medium-term: Gradual Recovery

As we move into 2026-2027, memory production will ramp up. New fabs will come online. Supply will increase. But demand from AI data centers will also remain strong, so the situation will be balanced rather than oversupplied.

Hardware prices might stabilize but remain elevated compared to pre-crisis levels. The Deck won't return to the same price point Valve originally planned. The same is true for other devices.

Long-term: Structural Change

The AI boom has permanently increased demand for memory chips. Data centers will continue to consume massive amounts of RAM and storage. This means memory will remain more expensive than it was in the 2010s. Hardware margins will be permanently tighter.

Manufacturers will adjust their strategies accordingly. Some will switch to more memory-efficient designs. Others will pass higher costs to consumers through higher prices. The era of cheap memory-heavy devices is probably over.

Valve's lack of communication during the Steam Deck OLED shortage resulted in lower customer confidence compared to Sony and Microsoft, who managed their messaging more effectively. Estimated data.

Industry Solutions and Workarounds

Hardware makers aren't just sitting around waiting for memory to become available. They're taking action to mitigate the shortage.

Design Optimization

Some manufacturers are redesigning products to use less memory. This is more common for established product lines where you can iterate gradually. For new launches like the Steam Machine, there's less flexibility. The core design is already set.

But companies like Apple have shown that you can squeeze significant performance out of lower memory amounts through careful optimization. The chip design, the software, and the hardware architecture all matter. Smart engineering can reduce memory requirements without sacrificing too much performance.

Strategic Partnerships

Manufacturers are negotiating long-term contracts with memory suppliers. Valve, Sony, Microsoft, and others are trying to lock in memory allocation with multi-year deals. This reduces uncertainty and helps memory makers plan production.

These contracts often come at a premium price. You pay more to guarantee supply. But for essential components, it's a worthwhile tradeoff.

Vertical Integration

Some hardware makers are investigating whether they can partially manufacture their own memory or work more closely with suppliers. This is complicated and expensive, but it reduces dependence on the open market.

Apple has a history of vertical integration in chip manufacturing. It designs its own processors and works closely with TSMC for production. Other companies are exploring similar strategies, though on a smaller scale.

Looking Ahead: The Bigger Picture

The Steam Deck OLED shortage is a symptom of larger forces reshaping the tech industry. AI's explosive growth is consuming resources at unprecedented rates. Cloud computing demands are pushing beyond what traditional supply chains can handle. Semiconductor manufacturing, despite being incredibly advanced, is struggling to keep pace.

This has implications far beyond gaming handhelds. Data centers are competing for the same resources that consumer device makers need. Whoever has the most leverage—which usually means whoever has the most money—wins. That advantage typically goes to hyperscalers like Google, Microsoft, and Amazon.

This could reshape the competitive landscape. Smaller hardware makers might struggle to get components. Startups trying to build new devices might find the supply chain barriers too high. Established players with deep relationships with component suppliers will have advantages.

For Valve specifically, the shortage is a wake-up call. The company had been assuming it could scale hardware production incrementally. The shortage shows that supply chains can fail suddenly and unpredictably. Future hardware launches will need to account for these risks.

Conclusion and What You Should Know

Valve's Steam Deck OLED disappeared from US shelves in February 2025, and the reason is clear: a global RAM shortage driven by explosive AI infrastructure investment. Memory chip manufacturers are prioritizing data centers over consumer devices, creating allocation problems for gaming hardware makers, PC manufacturers, and phone makers.

This isn't a short-term hiccup. It's likely to be a multi-year situation. Memory production will eventually catch up, but not before many products experience delays, price increases, and availability issues. The Steam Deck OLED will return to shelves, but probably not until later in 2025. The Steam Machine will likely arrive late and at a higher price than Valve originally planned.

For consumers, the shortage is frustrating but not catastrophic. You can still buy other gaming devices. Your PC or phone will still work fine. Games will still launch. It's an inconvenience rather than a crisis.

But for hardware makers, the situation is genuinely challenging. They're competing for scarce resources against well-capitalized data center operators. Margins are getting squeezed. Product roadmaps are getting disrupted. It's a reminder that even in the tech industry, physical constraints matter. You can't innovate your way around memory that doesn't exist.

The bigger lesson is that the AI boom is having unexpected consequences across multiple industries. It's not just affecting cloud computing and AI services. It's affecting gaming handhelds, graphics cards, game consoles, and probably dozens of other products you use every day. Understanding these supply chain dynamics helps explain why some products become expensive or unavailable seemingly out of nowhere.

Valve will get through this. The company is well-capitalized and has loyal customers. The Steam Deck will return. The Steam Machine will eventually launch. But the shortage is a reminder that hardware manufacturing is fundamentally constrained by physical reality. When demand spikes, supply can't always keep up, and everyone downstream pays the price.

FAQ

What caused the Steam Deck OLED shortage in February 2025?

The shortage was caused by a global RAM crisis. Memory chip manufacturers, facing explosive demand from AI data centers, reallocated production away from consumer device makers like Valve. Since the Steam Deck OLED requires significant amounts of LPDDR5 memory, Valve couldn't secure enough chips to meet production targets, leading to the outage.

Why do data centers get priority for memory chips over consumer devices?

Data centers get memory priority because they purchase in massive volumes, have longer-term contracts that provide revenue stability, and can pay premium prices. A single order from a major cloud provider like Google or Microsoft might be worth more than Valve's entire annual memory budget. From a manufacturer's perspective, data center customers are more valuable than consumer device makers.

When will the Steam Deck OLED be back in stock?

There's no official timeline, but based on industry trends and memory production forecasts, stock will likely return gradually throughout 2025. Limited availability might appear in mid-to-late spring, with broader availability by fall. However, this is an estimate. Actual timelines depend on how quickly memory production ramps up and how demand trends develop.

How does the RAM shortage affect other gaming devices like Play Station 5 and Xbox Series X?

Sony and Microsoft face similar constraints but have advantages over smaller manufacturers. They have larger order volumes, long-standing relationships with memory suppliers, and deeper financial resources. Sony announced it had "secured stock" of PS5 units, while Microsoft experienced intermittent availability issues. Nintendo, using older memory technology, faced fewer problems.

Will the Steam Deck OLED be more expensive when it returns?

Possibly. Valve hasn't officially announced pricing changes, but the memory crisis has driven up costs for manufacturers. The company may need to raise prices to maintain profit margins. Valve also said it would "revisit" pricing for the upcoming Steam Machine, which is industry-speak for likely price increases.

Is the Steam Deck OLED being discontinued?

There's no official announcement of discontinuation, and the outage appears to be temporary supply constraints rather than a permanent end to production. However, Valve's silence about the shortage has fueled speculation. The company will eventually clarify its plans, but for now, it's reasonable to assume the Deck is just temporarily unavailable, not permanently discontinued.

How long will the RAM shortage last?

Experts predict the shortage will persist for at least 12-24 months, possibly longer. Memory production will gradually catch up to demand, but AI data centers will continue consuming massive amounts of chips, keeping overall supply tight. This could be a multi-year situation rather than a temporary shortage.

What impact does this have on gaming?

For players, the impact is moderate: some devices are harder to buy and might cost more, but gaming itself continues without disruption. For developers, reduced Steam Deck availability means a smaller addressable market, potentially affecting investment in handheld-optimized games. For Valve, the situation delays hardware expansion plans and threatens ecosystem growth.

Are there alternatives to the Steam Deck while it's unavailable?

Yes. Nintendo Switch OLED continues to be available and offers excellent game library. Play Station Portal streams games from your PS5. Various Android-based handhelds exist. ASUS ROG Ally and other Windows-based devices are available. Each has different strengths and weaknesses, but multiple options exist for portable gaming.

What does this shortage mean for the future of hardware manufacturing?

It suggests that supply chain constraints will become more common as demand continues to exceed production capacity. Hardware makers will need to plan for longer lead times, potentially higher costs, and uncertain availability. The AI boom will continue driving competition for scarce resources like memory chips, putting pressure on consumer device manufacturers.

Key Takeaways

- Steam Deck OLED stock collapsed in February 2025 due to a critical global DRAM shortage driven by AI data center demand

- Memory chip manufacturers prioritize data centers over consumer devices because of higher volumes, longer contracts, and better margins

- The shortage is expected to persist 12-24+ months, affecting pricing and availability across gaming, PC, and consumer electronics

- Valve's Steam Machine launch will be delayed and likely priced higher due to rising memory costs and supply constraints

- Competitors like Nintendo Switch OLED are less affected because they use older, mass-produced memory technology with stable supply

- This shortage represents a structural shift where AI infrastructure will permanently consume more memory resources than previously expected

Related Articles

- Steam Deck Out of Stock 2026: What RAMaggedon Means [2025]

- John Carmack's Fiber Optic Memory: Could Cables Replace RAM? [2025]

- xAI's Interplanetary Vision: Musk's Bold AI Strategy Revealed [2025]

- Anthropic's Data Center Power Pledge: AI's Energy Crisis [2025]

- Who Owns Your Company's AI Layer? Enterprise Architecture Strategy [2025]

- StreamFast SSD Technology: The Future of Storage Without FTL [2025]

![Steam Deck OLED Out of Stock: The RAM Crisis Explained [2025]](https://tryrunable.com/blog/steam-deck-oled-out-of-stock-the-ram-crisis-explained-2025/image-1-1770899793965.jpg)