The Quiet Revolution Happening in Your Neighbor's Living Room

There's a revolution happening in America's streaming landscape, and it's not one that Netflix or Disney are celebrating. Walk into a farmers market, a church festival, or scroll through a Facebook group dedicated to "cutting the cord," and you'll find something that would've seemed impossible a decade ago: openly available illegal streaming devices selling faster than legitimate alternatives.

These aren't sketchy, underground operations hidden on the dark web. They're being sold by real people in real places. A retired cop selling v See Box units at an upstate New York church festival. A pastor in Utah marketing them as a way to "defund the swamp." A special education teacher in Illinois. A wedding DJ in New Jersey. Real people, with real names (though some prefer pseudonyms), operating in plain sight because the market demand is so overwhelming that enforcement can't keep pace.

The devices themselves look innocent enough. Generic black boxes with nondescript branding. Super Box. v See Box. Streamium. They sit on your entertainment center like any other streaming device. But plug them in, connect to your internet, and you've got access to thousands of cable channels, live sports, premium movie channels, and streaming services without paying a cent. No subscription to Dish Network. No $150+ monthly cable bill. No juggling between Netflix, Hulu, Disney+, Max, Paramount+, and Apple TV+ accounts.

This isn't new technology piracy. This is the modern equivalent of bootlegging. People who are fed up with what they see as an untenable system have become distributors of an alternative, and they're finding eager customers everywhere. The cost of legitimate entertainment has become so fragmented, so expensive, and so complicated that illegal hardware is becoming mainstream.

Here's what's really happening beneath the surface.

Why This Moment, Why Now

Ten years ago, cable companies ruled with an iron fist. Your options were limited: pay for cable with a contractor, or watch antenna TV and whatever free content you could find online. Internet streaming was the promise of liberation. Pay

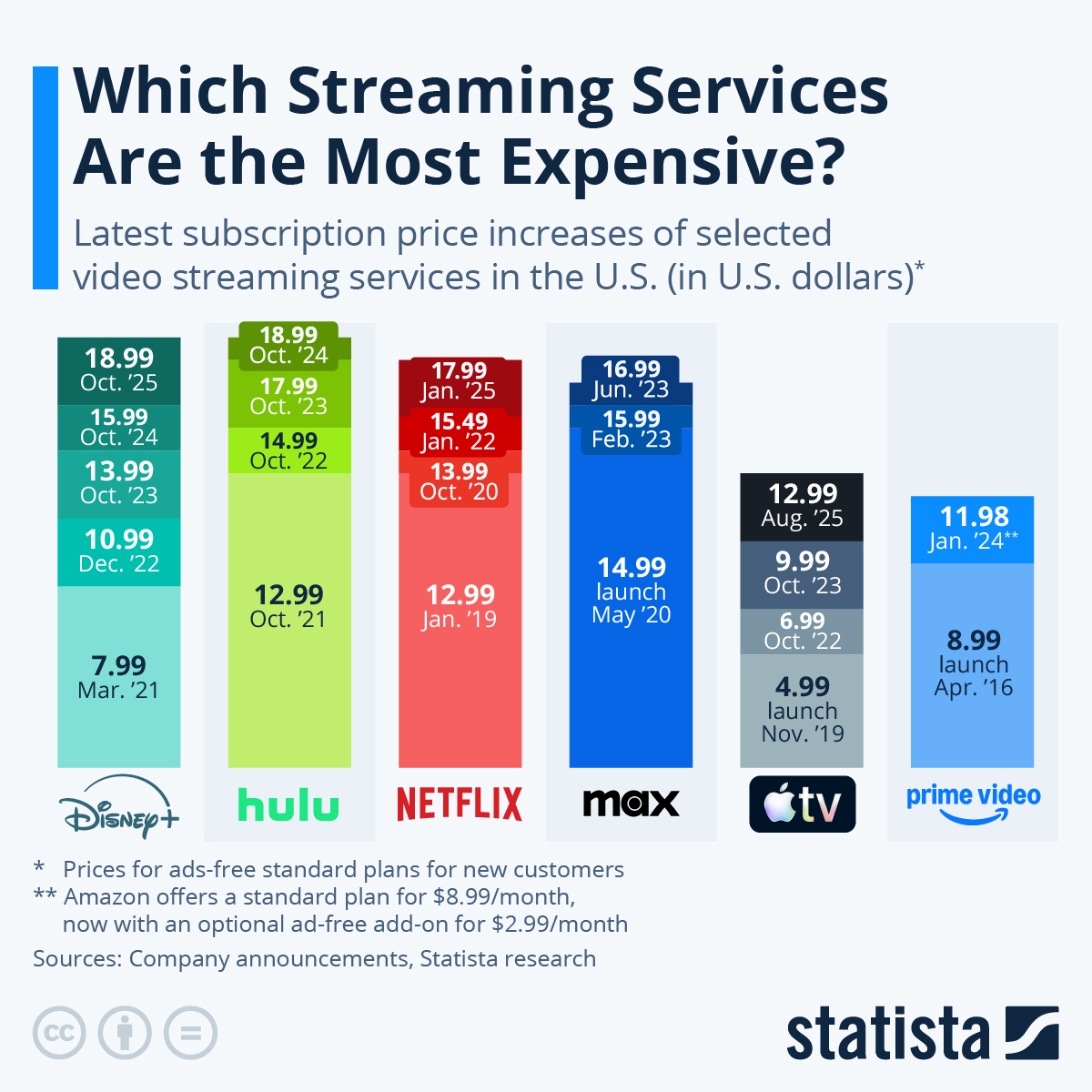

Today, that same promise has shattered into a thousand subscriptions. Want to watch football? That's ESPN+, NFL+, and potentially another regional sports network. Want movies? Netflix, Max, Paramount+, Apple TV+, Amazon Prime Video. Want comedians? You need Netflix, but also Max, and probably Peacock for specific networks. The math no longer works.

Consider the economics. A family that subscribed to basic cable 15 years ago paid roughly

- Broadband: 100

- Netflix Standard: $15.49

- Disney Bundle (Disney+, Hulu, ESPN+): $14.99

- Max: 20 (ad-free)

- Paramount+: 12.99

- Apple TV+: $9.99

- Amazon Prime Video: 11.58/month)

- ESPN+ (if not bundled): $11.99

- Peacock: 11.99

- YouTube TV (for live channels): $72.99

That's roughly

Streaming fragmentation didn't happen by accident. Studios realized that Netflix's model of having all content in one place was economically terrible for them. Disney launched Disney+. Paramount launched Paramount+. Every major media company wanted to own its own distribution. This maximized revenue extraction but destroyed user experience.

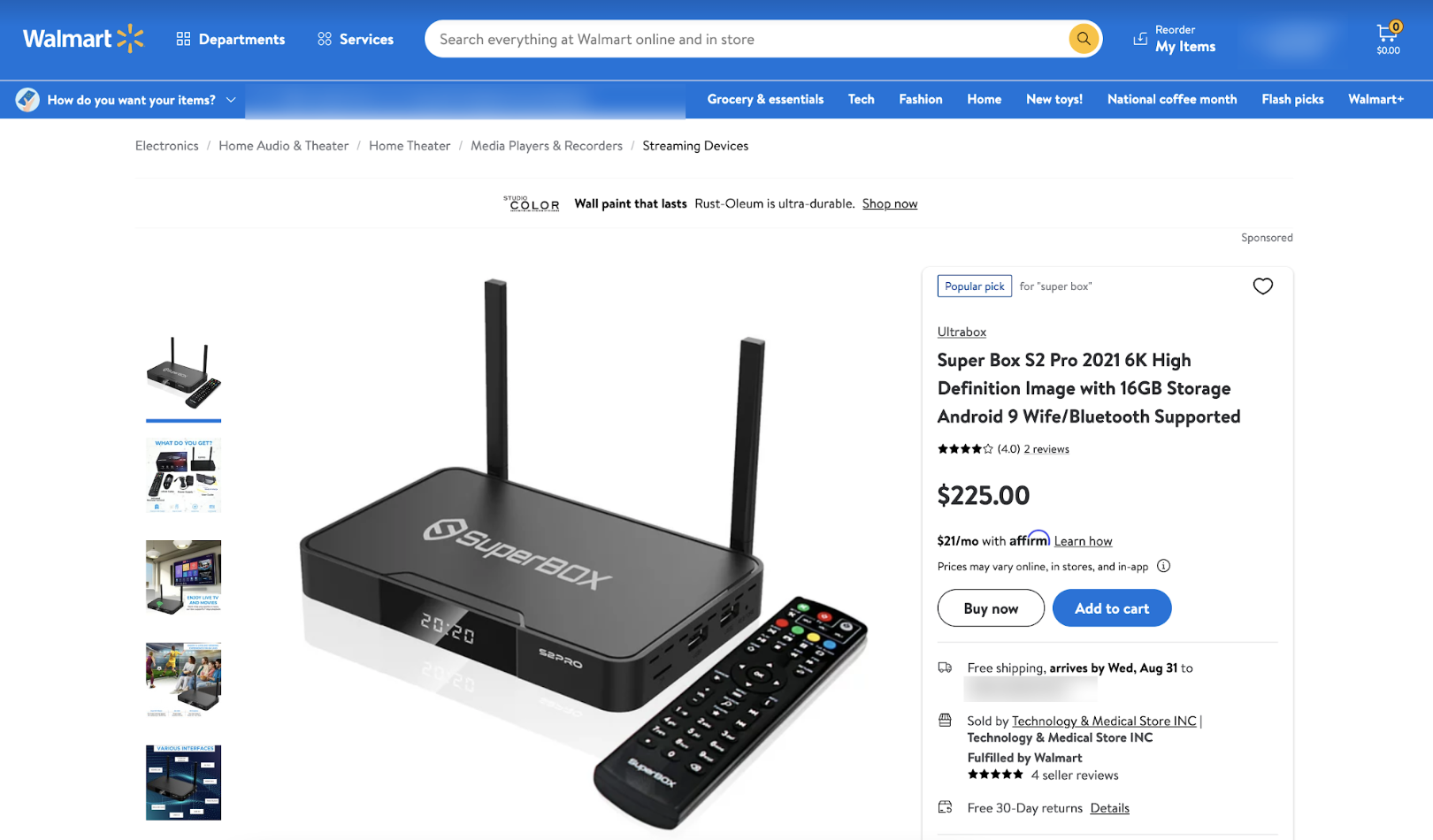

Into this gap stepped the hardware pirates. A Super Box costs

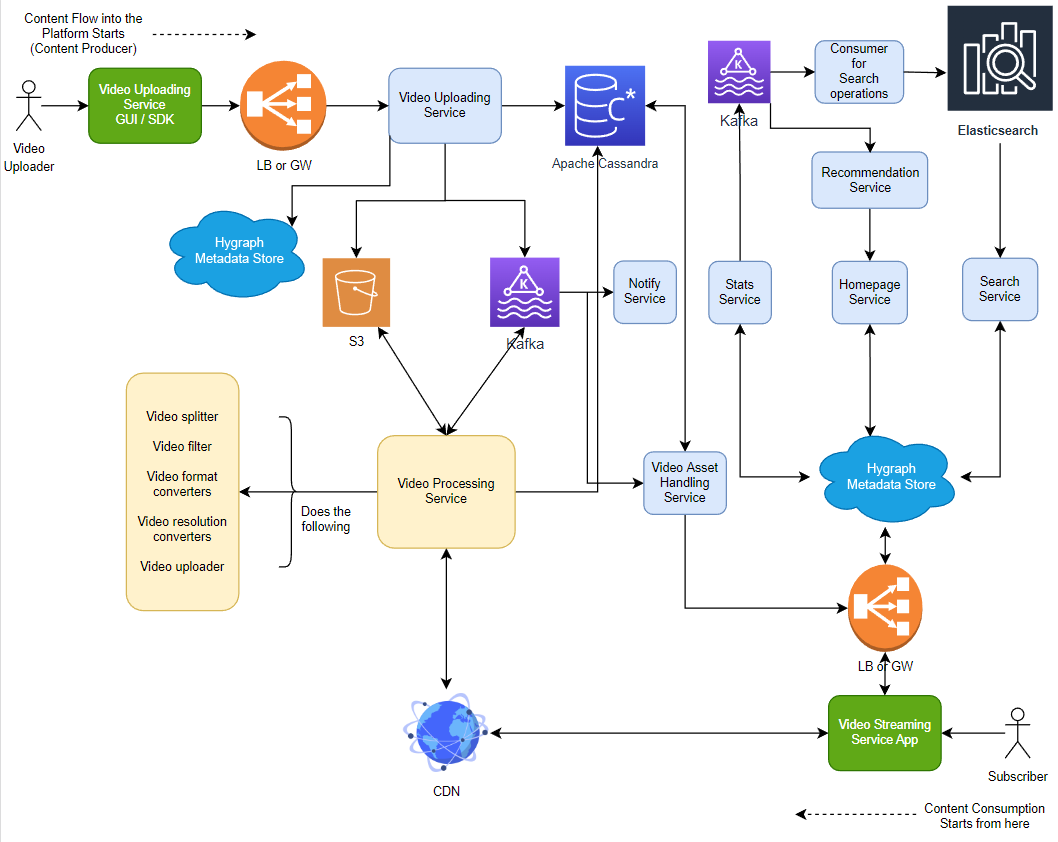

Understanding the Hardware: What Is a Streaming Box, Really?

When people talk about rogue streaming boxes, they're referring to small, networked devices that run modified versions of Android or Linux operating systems. The hardware itself isn't inherently illegal. It's what the manufacturers and distributors preload onto the software that makes them problematic.

A legitimate streaming device like a Roku, Amazon Fire TV, or Apple TV connects to legitimate apps: Netflix, Disney+, Hulu, etc. You log in with your credentials and stream content you're paying for. The device is just the conduit.

A Super Box or v See Box works differently. When you turn it on, it displays menus organized by content type: Movies, TV Shows, Sports, UFC, WWE, Premium Channels. Click on "HBO," and you get HBO content. Click on "Showtime," and you get Showtime. But you didn't subscribe to any of those services. The device has built-in access to content streams that are either stolen from legitimate services or captured from broadcast sources.

How do they actually pull this off? The mechanics matter here. Most of these devices use a combination of approaches:

Stream Aggregation: Some unauthorized services have built their own APIs that scrape content from multiple sources, then re-stream it. Users connect to these streams, which act as intermediaries.

Stolen Credentials: Some services operate by pooling username and password combinations that have been stolen, purchased, or shared. They automatically rotate through these credentials so any single account doesn't get flagged and shut down.

Broadcast Capture: Live sports and news channels can sometimes be captured directly from broadcast feeds, then redistributed.

VPN Tunneling: By routing traffic through international servers, some services mask the origin of the stream.

The actual technical implementation varies, and it's often deliberately opaque. The sellers and users generally don't know exactly how the content gets to their device. They just know it works.

What makes this different from earlier forms of piracy is the consumer experience. You're not downloading files. You're not searching through sketchy streaming sites. You're not dealing with buffering and low quality. It just works, and it works reliably, which is something many legitimate streaming services can't claim.

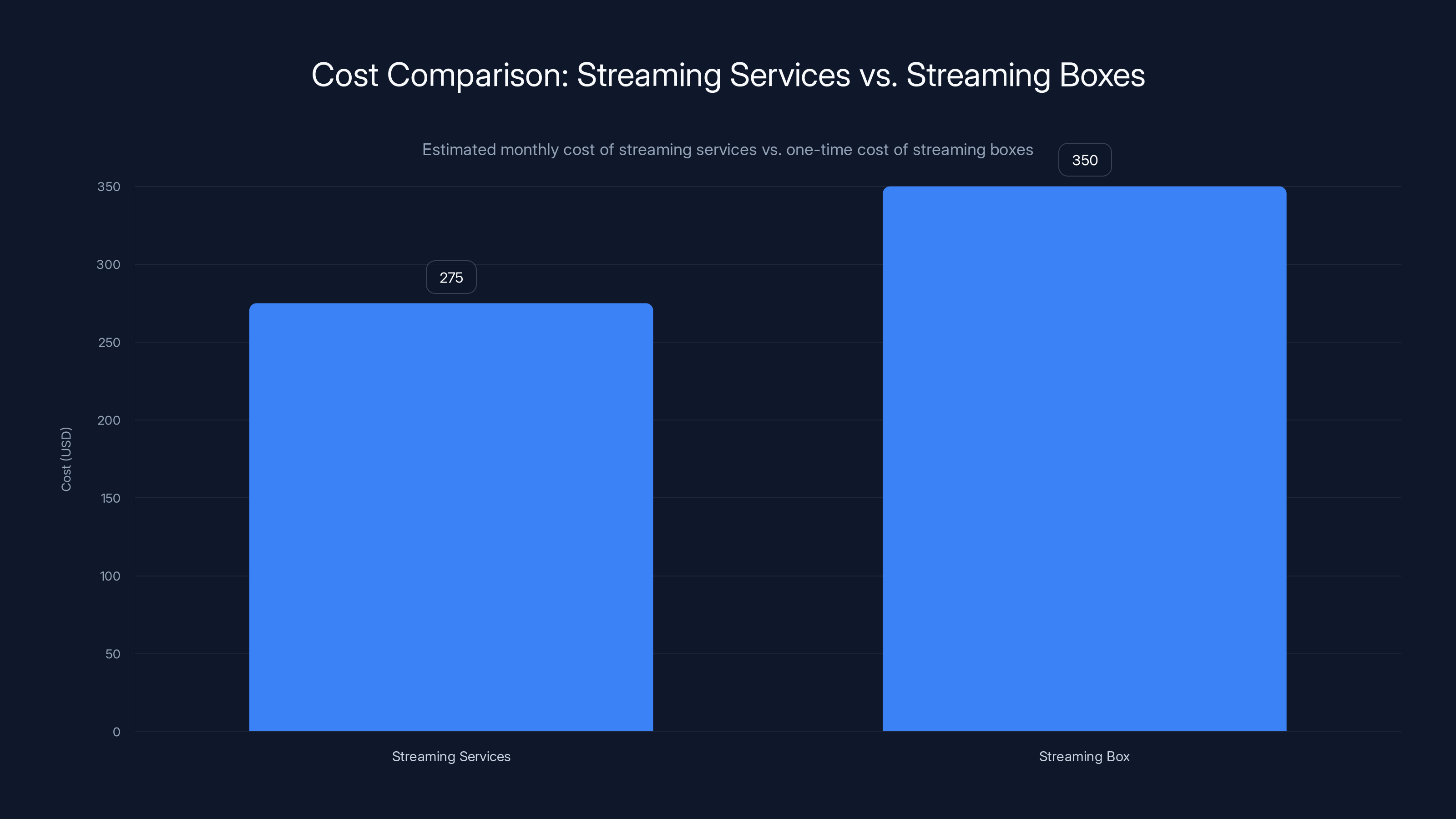

Estimated data shows that the total monthly cost of multiple streaming services can exceed

The Economics of Piracy: Why Consumers Are Switching

When someone buys a Super Box for $350, they're not making an impulse decision. They're making a calculated economic choice based on their household streaming spend.

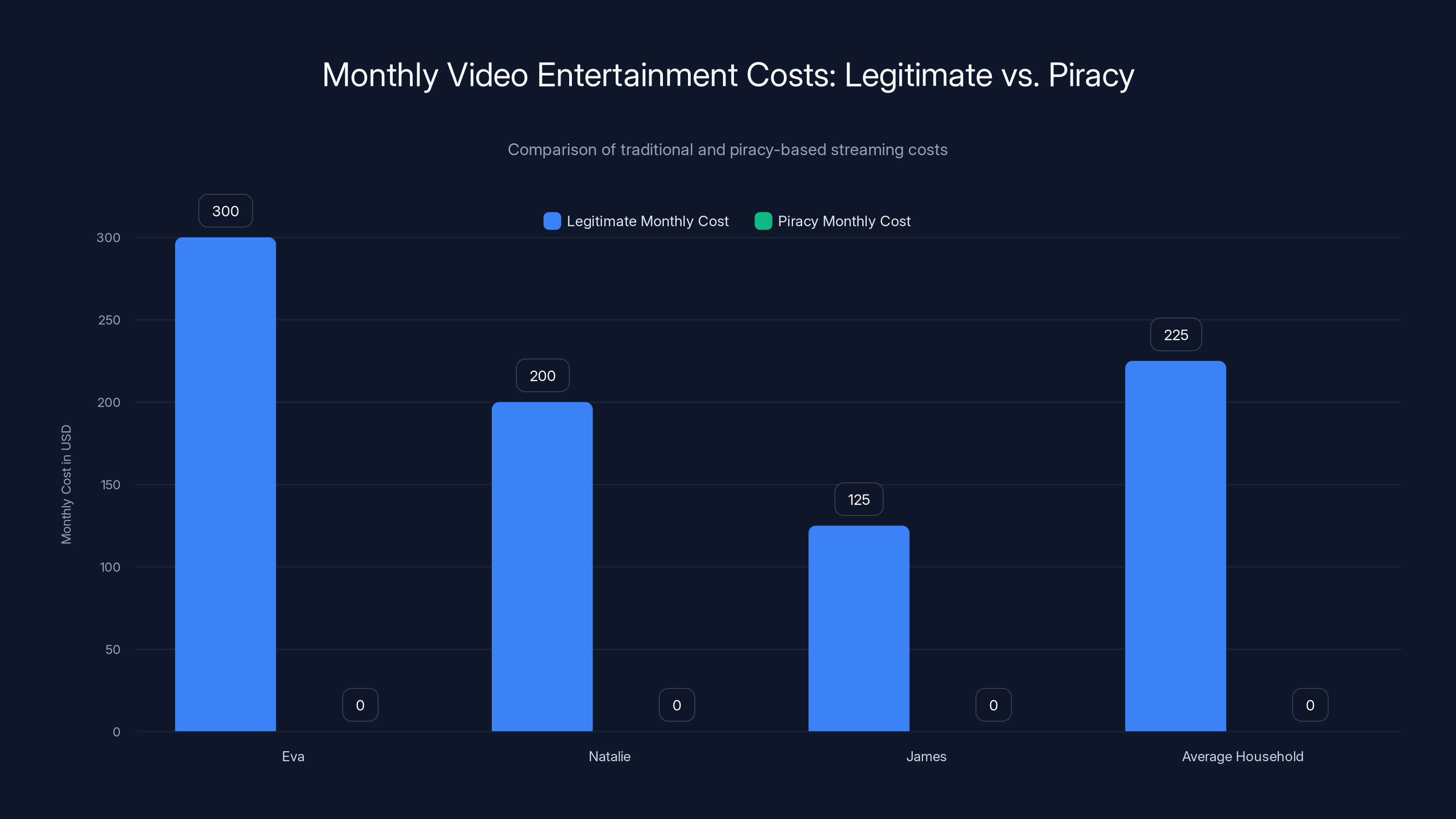

Let's talk about real numbers from real people. Eva, a social worker and grandmother from California, was paying nearly

Natalie, a software consultant, was paying

James, a gas station repairman from Alabama, was spending roughly

These aren't edge cases. These are mainstream consumers doing basic math and choosing the better economic option. The average American household spends between

Here's the brutal economics that the streaming and cable industries won't acknowledge:

Legitimate Cost Scenario (2025):

- Broadband: $75/month

- Netflix (Standard): $15.49/month

- Disney Bundle: $14.99/month

- Max: $16/month (with ads)

- Paramount+: $7.99/month (with ads)

- Apple TV+: $9.99/month

- ESPN+: (usually bundled with Disney)

- YouTube TV or similar: $72.99/month

Total:

And this assumes you're choosing the cheapest tier (with ads) for everything. For ad-free viewing, add another

Piracy Cost Scenario:

- Broadband: $75/month

- Super Box/v See Box: 29/month over 12 months)

Total:

The difference is over

When the legal option costs 2x as much as the illegal option, and the illegal option often provides better user experience, you've created a market. And markets respond to incentives.

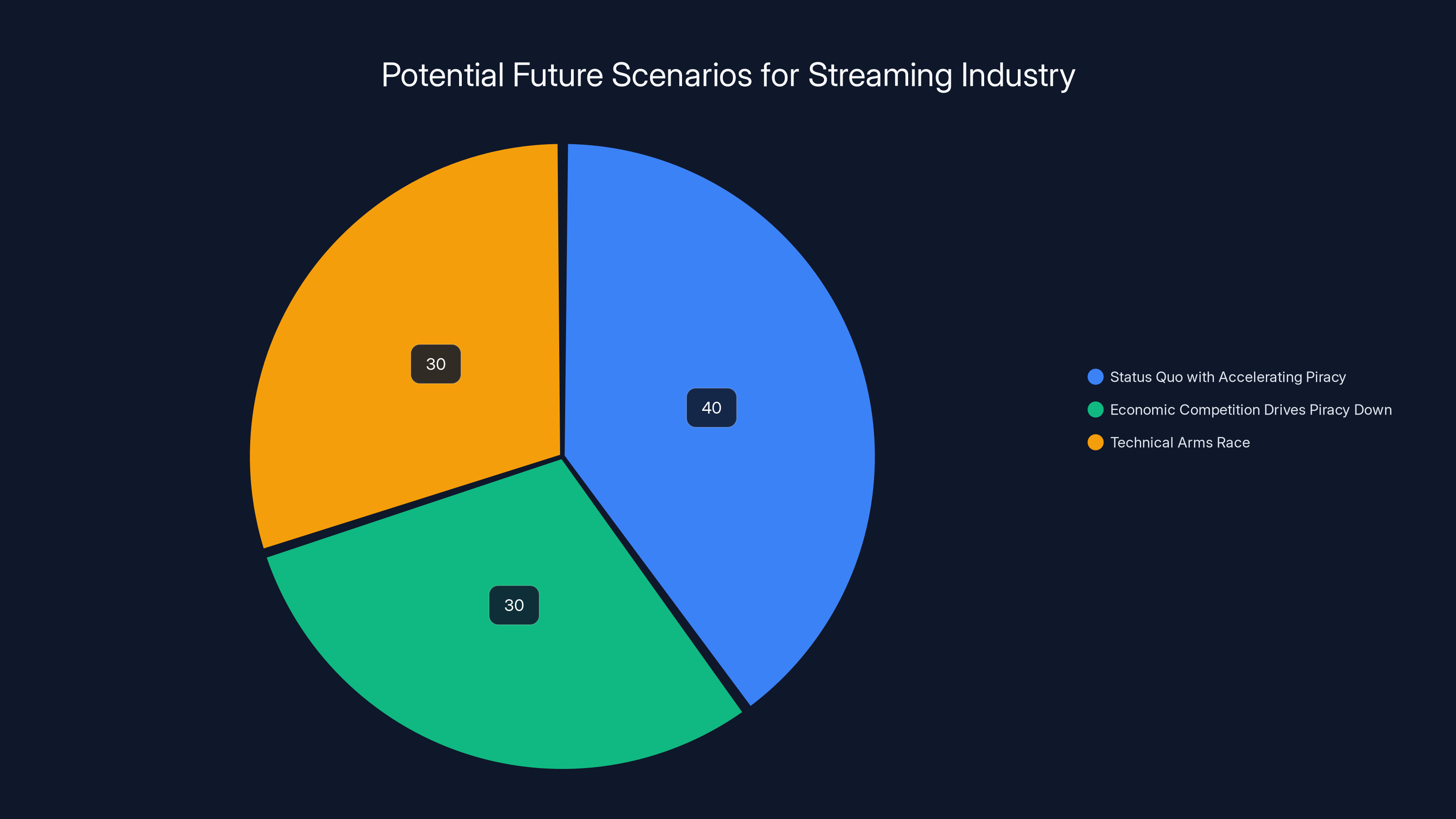

Estimated data suggests that the 'Status Quo with Accelerating Piracy' scenario is slightly more likely, with a 40% chance, compared to the other two scenarios, each at 30%.

The Distribution Network: How Boxes Get Into Homes

What's remarkable about streaming box piracy is how openly it operates. This isn't a dark web operation. It's local, distributed, and normalized in ways that would've been impossible for previous forms of piracy.

The supply chain works like this: Manufacturers (primarily based in China) produce the boxes and ship them to distributors in the US. Those distributors then sell to regional resellers, who sell to local retailers, who sell directly to consumers. But because there's little centralized oversight, the entire system is decentralized and resilient.

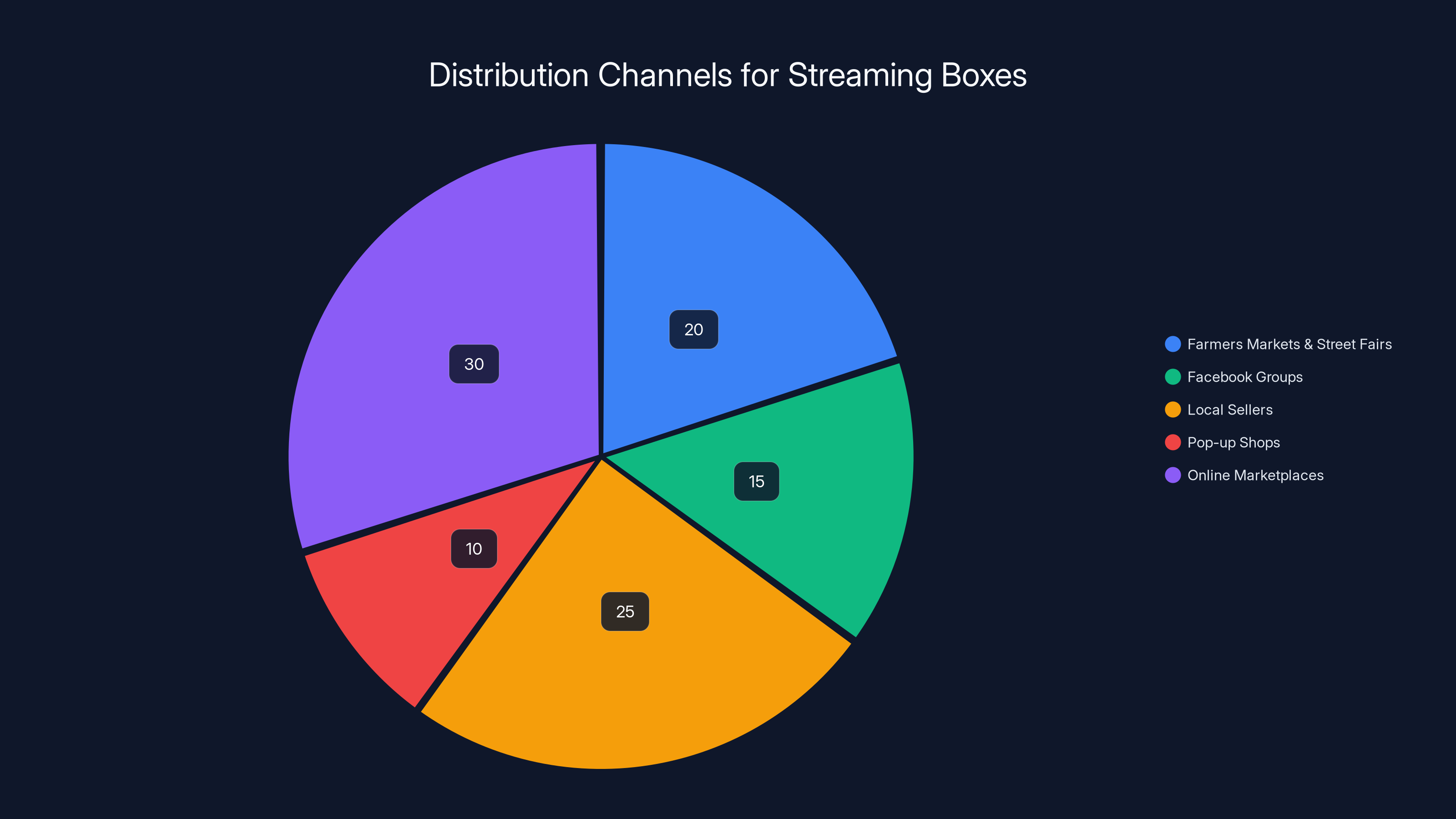

Where do you buy one? The distribution channels are surprisingly diverse:

Farmers Markets and Street Fairs: Direct retail to consumers. Jason, selling at a Texas farmers market between pickles and pies, is typical. He demonstrates the device, shows customers what they get, and closes the sale.

Facebook Groups: There are hundreds of dedicated Facebook groups where owners congregate. "Super Box Users," "v See Box Community," etc. These groups serve as customer support forums, troubleshooting resources, and secondary markets where used boxes are bought and sold.

Local Sellers: Real estate agents, MMA fighters, wedding DJs, church volunteers. Anyone can become a reseller with minimal barrier to entry. Buy a few boxes wholesale for

Pop-up Shops: In areas with high demand, resellers set up temporary retail locations. These appear and disappear, making enforcement difficult. By the time authorities investigate one location, the seller has moved to a different church, community center, or marketplace.

Online Marketplaces: While mainstream platforms like Amazon technically prohibit the sale of devices designed for piracy, enforcement is spotty. You'll find listings from overseas sellers claiming to sell generic "streaming boxes" with "customization options."

Word of Mouth: This is probably the most effective distribution method. Once someone in a community has a box, they tell their friends. Their friends tell their friends. In some neighborhoods, it feels like everyone has one.

The genius of this distribution model is its resilience. Cable companies and studios can sue individual sellers, and they do regularly. But there's no central authority to shut down. When one seller gets a cease-and-desist letter, three new sellers appear. The supply is effectively infinite because the profit incentive is so strong.

Who's Actually Buying These Boxes?

The demographic profile of streaming box buyers defies the typical piracy stereotype. This isn't primarily young tech-savvy millennials. This is mainstream America.

A significant portion of buyers are older consumers, ages 55+. They grew up with cable TV and feel entitled to watching the same channels they've watched for decades. When cable prices became unreasonable, they didn't learn to navigate multiple streaming subscriptions. They bought a box that approximates the cable experience they knew.

Rural and small-town America is heavily represented. In places where broadband is expensive and cable monopolies still exist, a

Households with children are significant buyers. Parents dealing with the reality that kids now want Netflix, Hulu, Disney+, YouTube, and TikTok understand the cost explosion intimately. A device that consolidates everything eliminates the monthly sticker shock.

Sports fans are overrepresented. If you want to watch your team play, you often need multiple services. A football fan might need ESPN+, NFL+, the team's regional sports network, cable for local broadcasts, and occasionally pay-per-view events. That's easily $100+ per month during season. A piracy box that includes all of this for one upfront cost is economically irresistible.

Immigrant communities are significant buyers and sellers. The boxes frequently include content from Indian, Chinese, Arabic, Spanish, and other language channels. For recent immigrants, this provides culturally relevant entertainment that's otherwise difficult to access or expensive when spread across multiple services.

What unites these diverse groups isn't a defiant attitude toward intellectual property. It's frustration with what they perceive as an unjust pricing system. They're not stealing because they're criminals. They're buying piracy boxes because they believe the legitimate alternative is unaffordable and exploitative.

During interviews and Facebook group discussions, you rarely hear moral justifications. You hear economic ones. "I'm not paying $200 a month for cable." "Streaming subscriptions have gotten out of control." "It's ridiculous that I need 10 different apps to watch sports."

This is important because it suggests that enforcement or legal action alone won't solve the piracy problem. You'd need to address the underlying economic incentive structure.

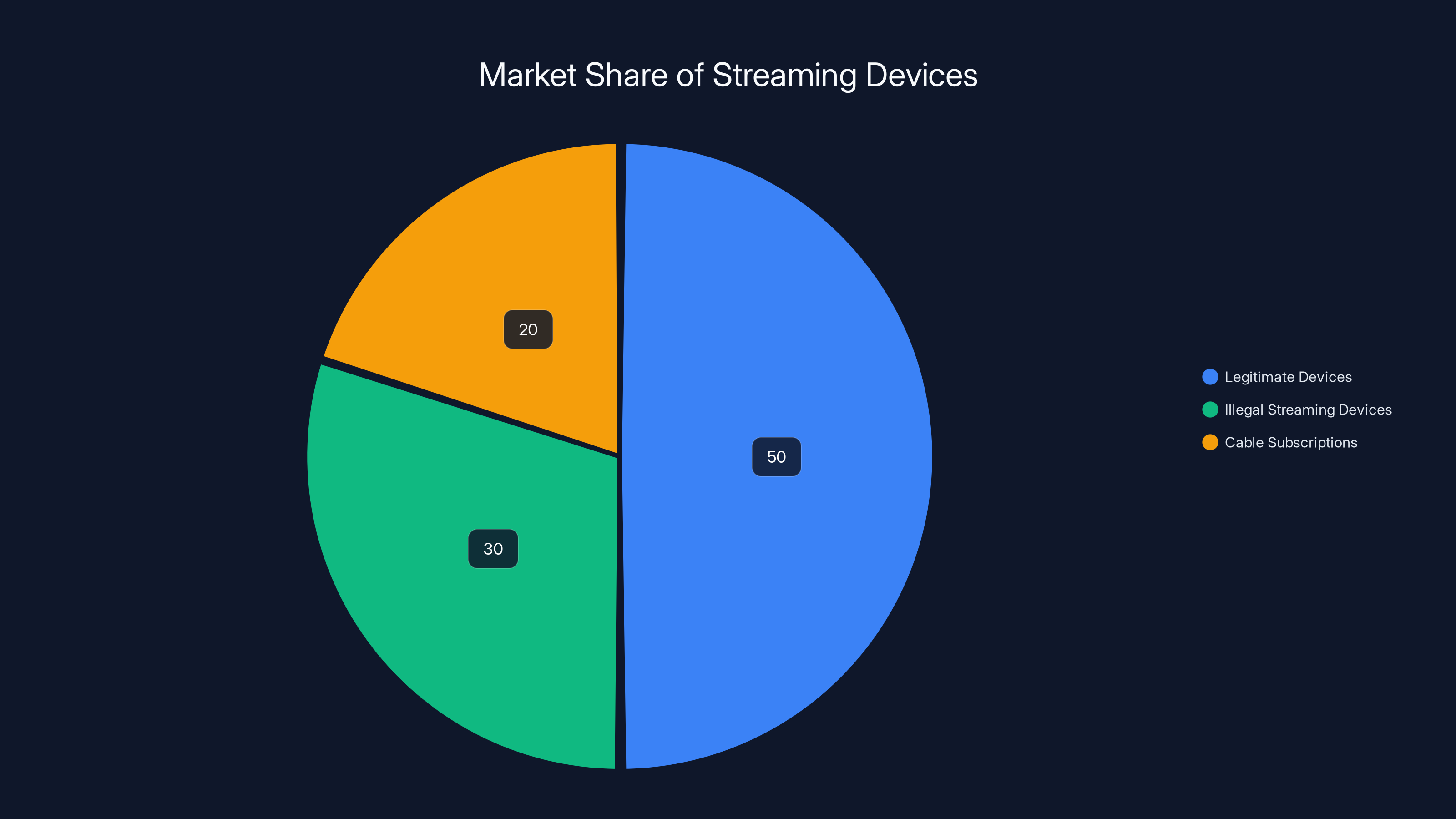

Illegal streaming devices are estimated to hold a significant 30% market share, reflecting the growing demand for cost-effective entertainment solutions. Estimated data.

The Business Model of Selling Piracy

For sellers like Jason, v See Box reselling is genuinely profitable. He buys boxes for roughly

If he sells 10 boxes per month (not unreasonable for someone with a regular farmers market stall and an active Facebook presence), that's

The wholesale suppliers selling to people like Jason are themselves profitable, though less visible. These are often companies based overseas that handle manufacturing partnerships with Chinese factories. They maintain inventory, handle shipping logistics, manage distributor relationships, and handle the regulatory risk. They're the actual business operators in this economy.

Where does the profit come from? Mostly from the price arbitrage between manufacturing cost and retail price. A Super Box costs roughly

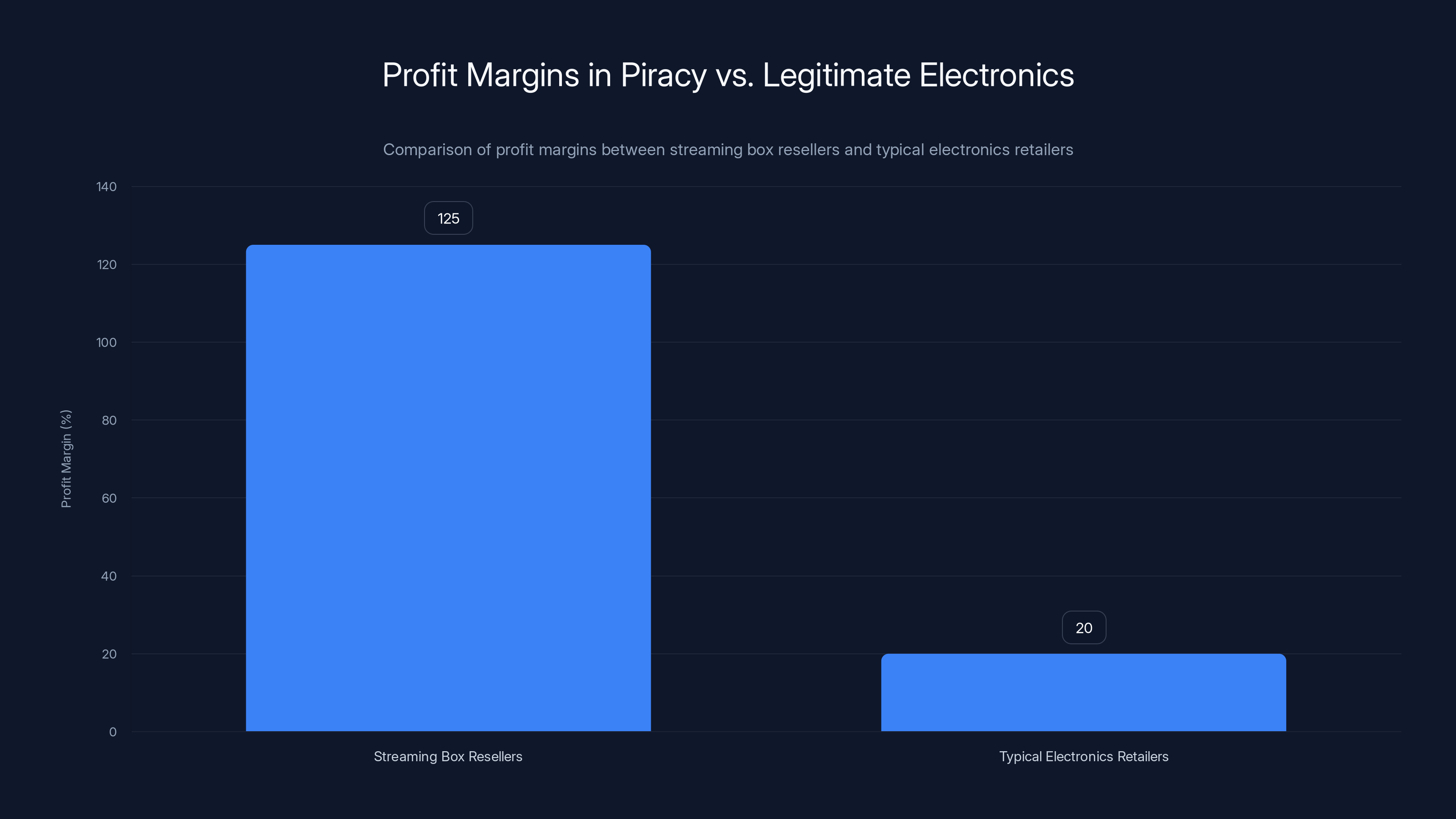

What's interesting is that this is significantly more profitable than legitimate electronics retail. A typical electronics retailer operates on 15-25% margins. Streaming box resellers operate on 100-150% margins. The economics are compelling.

But here's the tricky part: the sellers and manufacturers aren't actually benefiting from the pirated content. They're just distributing the hardware. The content comes from somewhere else (various piracy services, stolen credentials, etc.). The box makers aren't paying for Netflix content or HBO content. They're just providing the pipe.

This creates an interesting legal gray area. Selling a device that can access pirated content isn't technically illegal in many jurisdictions, especially if the device itself can also be used for legitimate purposes. Liability depends on whether the manufacturer knowingly enabled piracy, whether they marketed it for piracy, and whether they provided ongoing piracy services.

Manufacturers typically defend themselves by claiming the device is a generic Android computer that users can load with any apps they want. If some users choose to load it with piracy apps, that's on them, not the manufacturer. This argument has been moderately successful in keeping manufacturers out of legal jeopardy.

But the sellers, distributors, and resellers are more exposed. If they're actively marketing the device for piracy (and they usually are—that's their entire value proposition), they're more clearly liable for contributory infringement or similar claims.

Which is why we see constant lawsuits. Studios and cable companies file cases against resellers regularly. And just as regularly, new resellers appear to take their place.

The Legal Landscape: Why Enforcement Is Difficult

The rights holders—studios, cable networks, sports leagues—understand the problem and have been fighting it for years. The lawsuits are constant. But they face a fundamental enforcement challenge: the market is too large, too distributed, and too resilient.

When you sue one manufacturer, another emerges. When you take down one reseller network, three new ones pop up. The core issue is that the incentive structure is so compelling that enforcement can't match supply creation.

Consider the mechanics: There are probably tens of thousands of people selling streaming boxes in the US at any given time. The studios have budgets to pursue maybe dozens of legal cases per year. That's a rounding error in a market this large.

Furthermore, many sellers are small enough that they're not worth pursuing. Is it economically rational to spend

The manufacturers are often overseas and beyond easy reach of US jurisdiction. Governments could theoretically pressure China to enforce IP laws, but China's enforcement of IP against its own manufacturers is notoriously weak.

Legislatively, the challenge is tricky. Creating new laws against the devices themselves is complicated by the fact that they're generic computers that have legitimate uses. You could theoretically use a Super Box to run open-source software, watch YouTube, or access any legal streaming service. The device itself isn't inherently for piracy.

You could target the sellers more aggressively, but that requires enforcement at the local level. A county sheriff in Alabama isn't prioritizing streaming box enforcement when they have actual crime to deal with.

The digital services platforms that provide the actual pirated streams are sometimes subject to DMCA takedowns and similar actions, but they operate from jurisdictions with weak IP enforcement, often cycling through domain names and server locations constantly.

So the legal system isn't broken so much as it's structurally ill-equipped to handle a distributed, low-value-per-transaction problem at scale. It's like trying to use federal courts to combat street-level drug dealing. Technically possible, practically ineffective.

Streaming box resellers enjoy significantly higher profit margins (100-150%) compared to typical electronics retailers (15-25%). This highlights the lucrative nature of the piracy hardware business.

The Content Sources: Where Does the Stream Actually Come From?

This is the murkier part of the piracy ecosystem. How do the boxes actually get access to HBO content, NFL games, and UFC fights without paying for them?

The answer: multiple sources, often changing constantly.

Account Sharing: Some services rely on shared Netflix, HBO, or Disney+ credentials. Whether obtained through theft, purchase, or family sharing, accounts are pooled into databases. The piracy service rotates through these credentials to keep any single account from being flagged. If Netflix notices unusual access patterns, the account gets shut down, but there are plenty of others to rotate to.

Stream Scraping: Some services re-stream content from legitimate sources. If you can access a YouTube live stream, you can capture and restream it. Similarly, some cable channels broadcast over-the-air or via IP protocols that can be intercepted and restreamed.

Direct Server Connections: Some piracy services have reverse-engineered the APIs that cable and streaming companies use internally. They can directly query these APIs for content and serve it without going through the normal authentication path.

Broadcast Capture: Live sports and news broadcast over satellite or cable can be captured and restreamed to piracy boxes.

VPN-Based Access: By routing connections through VPNs in countries with weak IP enforcement, some services can access regional content libraries cheaply, then distribute to US users.

The specific technical implementation varies wildly. Some boxes might use method A for movies, method B for live TV, and method C for sports. The implementation is often deliberately obscured so that buyers and sellers don't fully understand how it works.

What's clear is that it works reliably enough that users report significantly better uptime and stream quality than they sometimes get from legitimate services. A pirated ESPN stream might be more reliable than ESPN+ on a busy Sunday.

The cat-and-mouse game between piracy services and the companies trying to shut them down is constant. A service gets shut down, gets its domain seized, has its streaming infrastructure knocked offline. And then it reappears a week later on a different domain, with a different company, slightly modified architecture, using different credential sourcing methods.

It's an arms race with no clear endpoint.

The Streaming Industry's Response: Why It's Not Working

The studios and streaming companies aren't stupid. They understand the piracy problem. They've spent millions on enforcement and technical countermeasures. But their responses have been inadequate to the challenge.

Litigation: As discussed, lawsuits against resellers are constant but ineffective at scale. The legal system can't move fast enough to match the market.

Technical Measures: Both Netflix and other services have cracked down on password sharing, implemented stronger geolocking, and improved account security. But the adversaries adapt. If you're building systems to detect credential sharing, sophisticated piracy services will find ways around it.

Consolidation and Bundling: In recent years, studios have begun bundling services (Disney Bundle, Max providing HBO + Warner Bros content). This reduces fragmentation and makes pricing more competitive. But it hasn't eliminated the economics that drive piracy.

Price Reductions and Ad Tiers: Netflix, Hulu, Disney+, and others have introduced cheaper ad-supported tiers. But even these are significantly more expensive than piracy for comprehensive coverage.

Content Improvements: Some streaming services have invested heavily in exclusive, original content to differentiate themselves and justify subscription costs. This has created even more fragmentation as each service has unique content available nowhere else.

PR and Education: Rights holders have launched various public education campaigns about piracy risks (malware, legal liability, etc.). These have been notably ineffective. Streaming box users aren't significantly concerned about these risks, and the risks are often overstated.

What's conspicuously absent from their response is a serious business model innovation. They haven't fundamentally rethought the economics of video distribution in an era where streaming costs are heavily commoditized.

The piracy problem isn't primarily a legal problem or a technical problem. It's an economic problem. When the legal option is twice as expensive as the illegal option and arguably provides worse user experience (worse fragmentation, more authentication hassles, more ads), price-sensitive consumers will choose piracy.

Consumers like Eva, Natalie, and James save significantly by switching to piracy devices, reducing their monthly video entertainment costs to zero.

The Risks That Actually Matter

Streaming box sellers always downplay risks, and rights holders always exaggerate them. The truth is somewhere in the middle.

Legal Liability: Is it legal to buy and use a piracy box? Technically, using pirated content is illegal in the US and most countries. But enforcement against individual consumers is extremely rare. The studios focus on sellers and services, not users. That said, there's always some legal risk. If you're in a lawsuit or being audited for some other reason, having a piracy box could become a liability.

Malware: One legitimate concern is that piracy boxes and their associated apps could contain malware. The supply chain for these devices is not regulated. A compromised box or a malicious app could theoretically steal your credit card information, install ransomware, or use your device for cryptocurrency mining. That risk is real, though probably less common than rights holders claim.

Service Reliability: While many users report good reliability, piracy streams are always subject to disruption. If the underlying service gets shut down, your box stops working. Unlike Netflix or Disney+, there's no company you can contact for support. You're stuck.

Terms of Service: Using a streaming box violates the terms of service of every legitimate streaming service whose content you're accessing. If the service detects that you're using pirated credentials, it might shut down that account, affecting anyone else using it.

Subscriptions Tied to Account: Some piracy services charge subscription fees in addition to the hardware cost, claiming content updates or enhanced features. These subscriptions often stop working as the underlying piracy services get shut down.

These risks are real, but for many consumers, they're acceptable trade-offs for the cost savings. It's similar to any technology risk calculation: Is the benefit worth the potential downside? For many people dealing with $250+ monthly video bills, the answer is yes.

What Happens to the Industry From Here?

Extrapolating forward requires understanding that this isn't a temporary phenomenon. Streaming box piracy is growing, not shrinking. Why? Because the economics favor it, and the underlying cause—subscription fragmentation and high prices—isn't going away.

Three possible futures seem plausible:

Scenario 1: Status Quo with Accelerating Piracy

The studios and services continue their ineffective enforcement while piracy continues growing. Eventually, piracy might represent 20-30% of video consumption in the US, similar to rates in some other developed countries. The streaming industry adapts by accepting some piracy as an inevitable cost of doing business, like legitimate industries have done.

Revenue impacts would be significant but manageable because rights holders would adjust their financial models. A movie studio might assume that 80% of US consumers pay legitimately for new theatrical releases, while 20% access them through piracy. They price content accordingly.

Scenario 2: Economic Competition Drives Piracy Down

The streaming industry consolidates further, reduces pricing, and improves user experience enough that the piracy option becomes less attractive. Imagine if Disney, Warner Bros, Paramount, Sony, and others moved toward a single unified platform with reasonable pricing (

The technology barriers would be significant (studios are reluctant to give up control and data), but economic pressure might eventually drive it.

Scenario 3: Technical Arms Race

Streaming services implement increasingly sophisticated account verification, device fingerprinting, and anti-piracy measures. Piracy services adapt with more advanced workarounds. The technological sophistication of both sides increases dramatically, but neither side definitively wins. It becomes a highly technical arms race that raises costs for everyone.

This seems most likely in the near term, though none of these scenarios is guaranteed. What seems certain is that piracy won't significantly decrease until the economic incentive structure changes.

Estimated data suggests online marketplaces and local sellers are the most prevalent channels for distributing streaming boxes, making up 55% of sales combined.

The Bigger Picture: What Piracy Reveals About Market Demand

Streaming box piracy is revealing something important about consumer preferences that the streaming industry doesn't want to acknowledge.

People want everything in one place. They want to pay one reasonable price. They want reliable service. They want to understand what they're paying for. The fragmented, ever-increasing subscription model isn't meeting these needs.

Streaming promised to be better than cable. In some ways it is—better interface, more on-demand content, the ability to watch anywhere. But in many ways, it's worse. Cable gave you hundreds of channels for one monthly price. Streaming fragmented everything so that every major content owner could extract maximum revenue.

Consumers adapted by going back to piracy, which ironically provides a better aggregated experience than legitimate alternatives. It's the market literally voting with their wallets.

The companies could interpret this as a signal: maybe the current model is failing. Maybe consolidating streaming options and pricing competitively would generate more legitimate revenue than the current system of maximum price extraction combined with ineffective piracy enforcement.

But institutional incentives make that unlikely. Each studio wants its own platform. Each is betting that its exclusive content will justify a separate subscription. They're individually rational but collectively creating the conditions for piracy.

FAQ

What exactly is a streaming box like Super Box or v See Box?

A streaming box is a small, networked device running a modified Android or Linux operating system that comes preloaded with applications providing access to television channels, movies, and live events. Unlike legitimate devices like Roku or Fire TV, these unauthorized boxes provide access to content without requiring paid subscriptions or authentication through legitimate services. Users simply plug the device into their television and internet connection, and content becomes available immediately.

How do streaming boxes access cable and premium content without paying for it?

Streaming boxes use several methods to access content without authorization, including pooling stolen or shared account credentials from legitimate services, re-streaming content from broadcast sources or the internet, reverse-engineering service APIs to bypass authentication, or routing traffic through VPNs in regions with weak intellectual property enforcement. The specific methods vary and are often deliberately obscured. The devices essentially act as intermediaries that aggregate pirated streams and present them in a user-friendly interface.

Why are streaming boxes becoming more popular?

Streaming box adoption has accelerated due to several converging factors: the fragmentation of streaming services means consumers need subscriptions to Netflix, Disney+, Max, Paramount+, Apple TV+, ESPN+, and others to watch comparable content to what cable once offered. The total monthly cost of legitimate subscriptions often exceeds

Is buying a streaming box legal in the United States?

Using pirated content is technically illegal in the US under copyright law, but enforcement against individual consumers is extremely rare. The studios and streaming services primarily pursue legal action against manufacturers, distributors, and resellers, not end users. However, there is always legal risk when using unauthorized services. Situations involving audits, lawsuits, or regulatory investigations could expose your use of piracy devices as a liability. The terms of service for all legitimate streaming platforms prohibit access through piracy devices.

What are the legitimate downsides or risks of using a streaming box?

Real risks include potential malware or security vulnerabilities since these devices operate in unregulated supply chains; service disruptions when underlying piracy services get shut down; potential detection and banning of accounts if the piracy service uses stolen credentials that get flagged; lack of customer support if something goes wrong; and some subscription-based piracy services that fail when their underlying infrastructure is taken offline. Users also lose the reliability and consistent service quality that legitimate platforms provide, as well as high-definition streaming availability which varies across piracy services.

How do streaming companies respond to piracy box distribution?

Streaming companies and studios employ multiple strategies including litigation against manufacturers and resellers, technical measures like password-sharing detection and improved account security, service bundling to reduce fragmentation, introduction of cheaper ad-supported subscription tiers, and education campaigns about piracy risks. However, enforcement at scale has proven ineffective because the market is too large and distributed to control through legal action alone. New resellers and modified devices continuously emerge faster than authorities can take action. The underlying economic incentive—piracy's significantly lower price compared to legitimate services—drives continued growth despite these countermeasures.

Could legitimate streaming solve the piracy problem?

Many analysts suggest that more competitive pricing and reduced fragmentation would naturally decrease piracy demand. If studios consolidated streaming options into fewer platforms with reasonable unified pricing (potentially

What percentage of US viewers use piracy devices?

Exact figures are difficult to determine because piracy is inherently hidden and untracked, but industry estimates suggest piracy accounts for 5-15% of US video consumption currently and is growing. Some specific markets and demographics have significantly higher piracy rates. The growth trajectory suggests that without business model changes, piracy could eventually represent 20-30% of video consumption, similar to rates in some international markets with fragmented and expensive streaming ecosystems.

The Future Depends on Economics, Not Enforcement

The rise of streaming box piracy isn't actually about technology or criminality. It's about economics. When a legal option costs twice as much as an illegal option and arguably provides worse user experience, significant segments of the population will choose the illegal option.

This applies not just to streaming but to every digital good. Piracy persists not because rights holders haven't tried hard enough to stop it, but because the economic incentive structure drives it.

The streaming industry built a system that prioritized maximum revenue extraction over user experience. Multiple studios insisted on separate platforms. Prices kept rising. Users got frustrated. Piracy filled the gap.

None of this is inevitable. A different business model—fewer platforms, lower unified pricing, better service reliability—could address the piracy problem more effectively than litigation or enforcement ever will. But that requires companies to accept lower per-unit revenue in exchange for higher volume and reduced piracy.

Will they make that choice? Probably not in the near term. Corporate incentives favor maximizing today's revenue over protecting tomorrow's market share. Each studio wants its own distribution platform. Each wants to keep pricing high.

So piracy will likely continue growing. Jason will keep selling Super Boxes at farmers markets. Eva will keep saving $3,600 per year on her cable bill. The FBI will keep suing resellers. New sellers will keep appearing. And the streaming companies will keep insisting that enforcement is the answer, even though the evidence clearly shows it's not.

The piracy problem is really a pricing problem. Until the streaming industry addresses that, devices like Super Box and v See Box will continue spreading, one local seller at a time.

Key Takeaways

- Streaming box piracy (SuperBox, vSeeBox) is growing rapidly as legitimate subscription costs exceed 300 monthly for comprehensive access

- The decentralized distribution network makes legal enforcement ineffective, as new resellers emerge faster than authorities can pursue existing ones

- Consumer adoption is driven by economics, not criminality. Piracy boxes pay for themselves in 1-2 months of saved subscriptions

- Demographic buyers span all groups: older consumers, rural areas, sports fans, immigrant communities, and families frustrated with subscription fragmentation

- The streaming industry's current business model—fragmented platforms with escalating prices—structurally drives piracy adoption and cannot be solved through enforcement alone

Related Articles

- YouTube TV Genre Packages: How Flexible Subscriptions Are Solving Cable's Biggest Problem [2025]

- Crunchyroll Price Increase 2025: Complete Breakdown & What It Means [2025]

- How to Watch the 2026 Grammys for FREE [Complete Streaming Guide]

- How to Watch The Apprentice Season 20 Free Online [2025]

- Verizon Boston TV Blackout: Why the Rare Refund Matters [2025]

- Neil Young's Greenland Music Donation & Amazon Boycott [2025]

![Streaming Box Piracy: The Rise of SuperBox and vSeeBox [2025]](https://tryrunable.com/blog/streaming-box-piracy-the-rise-of-superbox-and-vseebox-2025/image-1-1770212161205.jpg)