Tech Crunch Disrupt 2026: The Complete Guide to the Tech Industry's Premier Event

Let me be direct: if you're building, investing, or scaling anything in tech, Tech Crunch Disrupt 2026 is probably on your radar. And if it's not yet, it should be.

Here's the context. Tech Crunch Disrupt has evolved into something genuinely unique in the tech conference space. It's not another vendor expo where you walk past 500 identical booths selling enterprise software you don't need. It's not a talking-head fest where someone lectures you for 45 minutes about "innovation." It's actually designed for founders, investors, and operators to get real work done.

October 13-15, 2026. San Francisco's Moscone West. Three days that have become synonymous with discovering the next generation of breakout startups, hearing from the executives shaping tech's future, and making connections that actually matter.

But here's what you're probably wondering: Is it worth it? What exactly happens there? Who should go? And honestly, is $680 or more a reasonable investment for three days of your time?

I'm going to walk you through all of it. We'll cover the event's structure, what makes it different from every other tech conference, the speaker lineup (and why these specific speakers matter), how to approach the networking, what to expect from Startup Battlefield, and whether the pricing makes sense for different types of attendees.

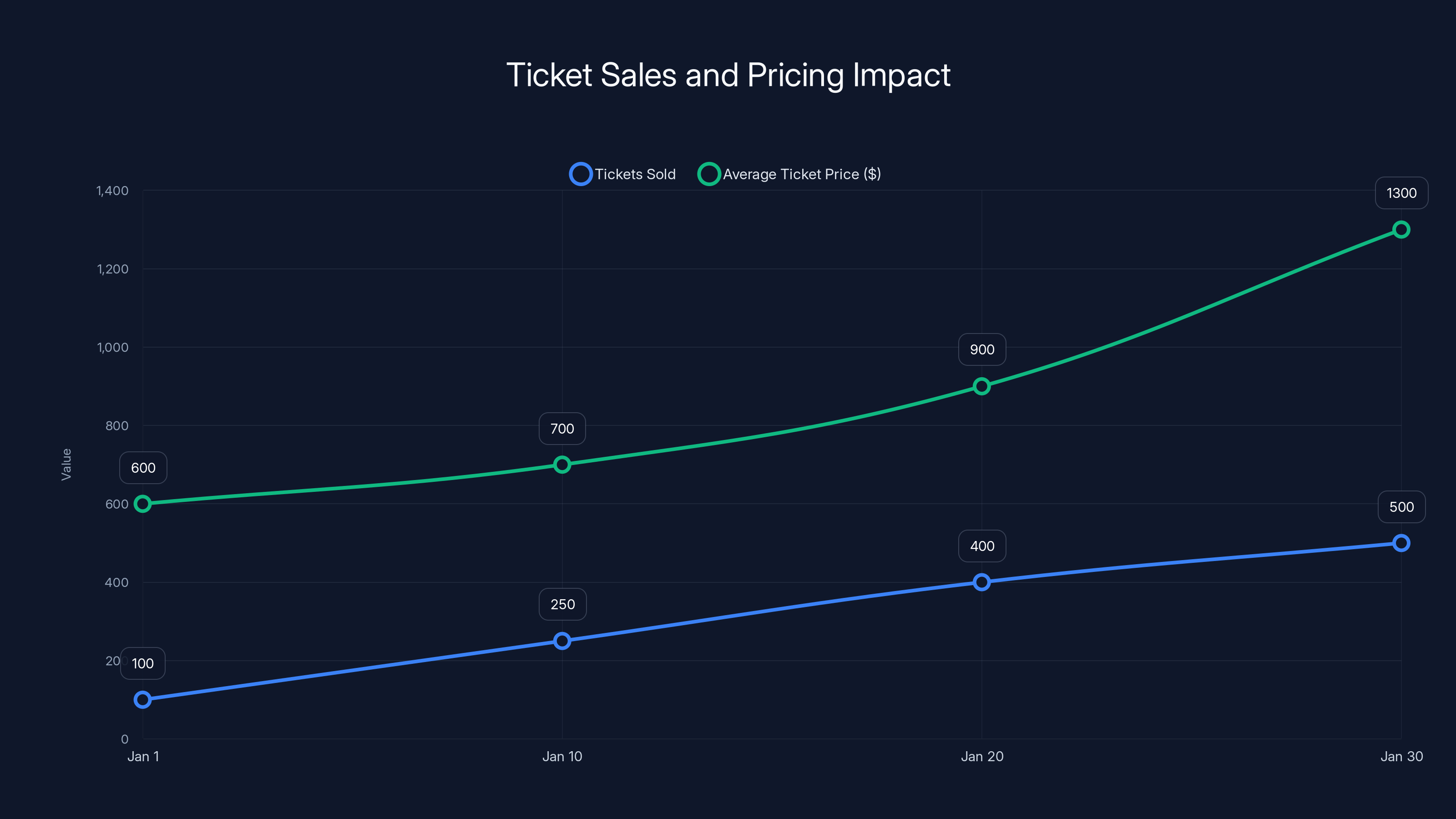

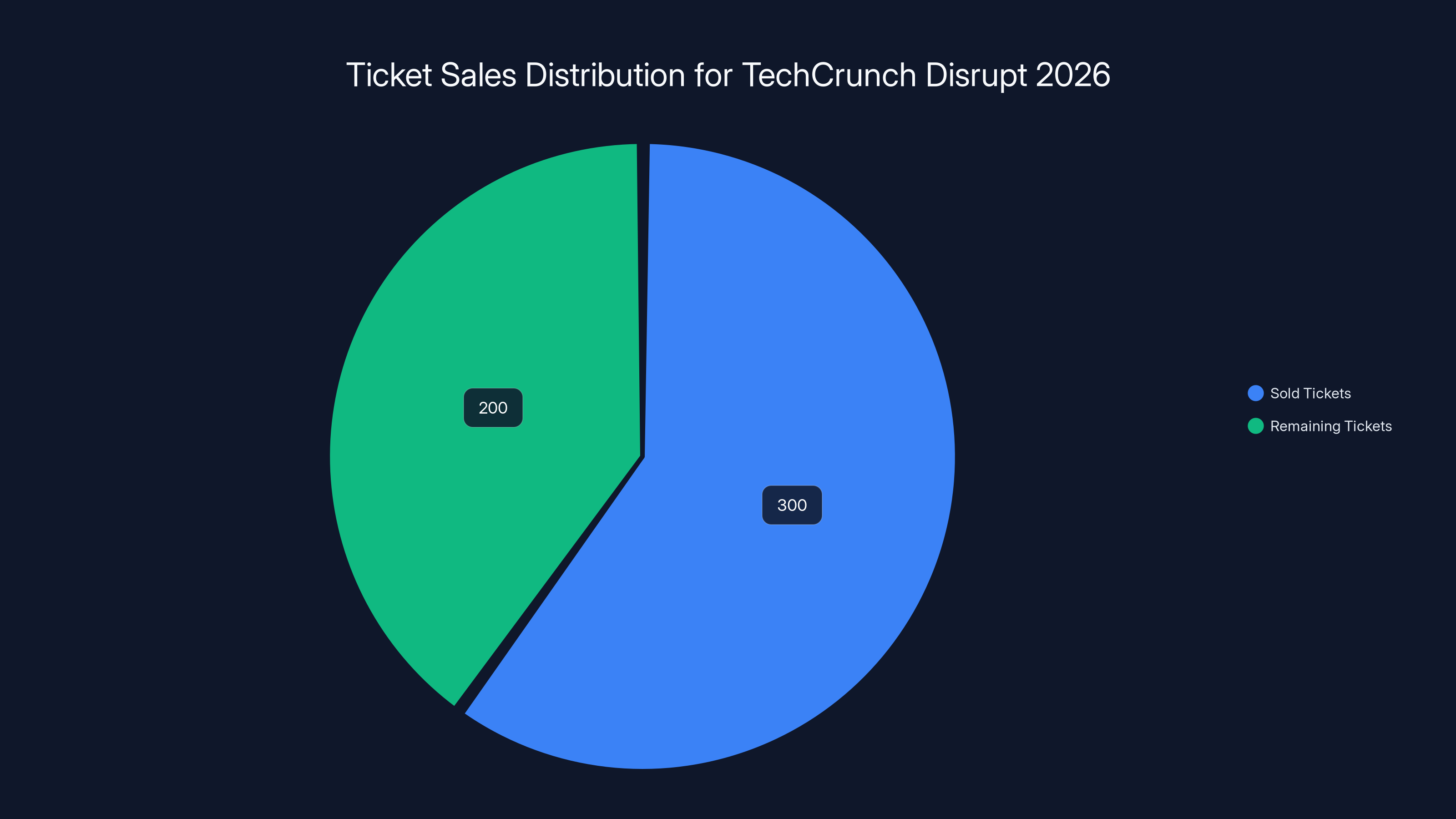

One quick note before we dive in: the current ticket pricing with the +1 discount (50% off a second ticket) only lasts until January 30, 2026, or until the first 500 registrations are claimed. More than half are gone already. This isn't a high-pressure sales pitch—it's just the reality. If you're genuinely considering going, waiting typically costs you $500-700 in ticket savings.

Let's break down what you actually get.

What Tech Crunch Disrupt Actually Is (And Why It's Not Like Other Conferences)

Tech Crunch Disrupt is often described as a "curated experience." That phrase gets thrown around a lot in tech marketing, so let me translate what it actually means.

Most tech conferences operate on a simple model: you pay for access, you get handed a schedule, and you navigate hundreds of simultaneous sessions picking whichever ones sound interesting. It's overwhelming. You end up in sessions where half the room is staring at their phones. You miss the good stuff because you didn't know about it. You spend more time navigating logistics than actually learning anything.

Disrupt operates differently. The conference team actively decides what content matters. They select 200+ sessions from submissions. They book specific speakers for strategic reasons, not just because they have a big following. The schedule is dense but intentional.

The goal is clear: maximize signal, minimize noise. In practical terms, this means you're less likely to waste time in a mediocre session, but you're also working with a more curated set of options rather than unlimited choice.

The event brings together roughly 10,000 attendees. That's big enough to have real density and variety, but small enough that you might actually run into someone you're trying to meet (this happens more than you'd think at Disrupt). Compare that to massive conferences with 50,000+ attendees where you're basically guaranteed to get lost.

The setup is three concurrent tracks across three days. You've got keynotes, panel discussions, fireside chats, and workshops. But the real differentiation comes from the ecosystem around the main sessions: the Startup Battlefield competition, expo floor interactions with 300+ startups, curated networking events, and what Tech Crunch calls "intentional connections."

What does that last part mean? Disrupt works with attendees in advance to help facilitate introductions between founders and investors, operators and potential hires, and strategists with aligned interests. It's not just "here's a conference, good luck." There's actual curation happening in the background.

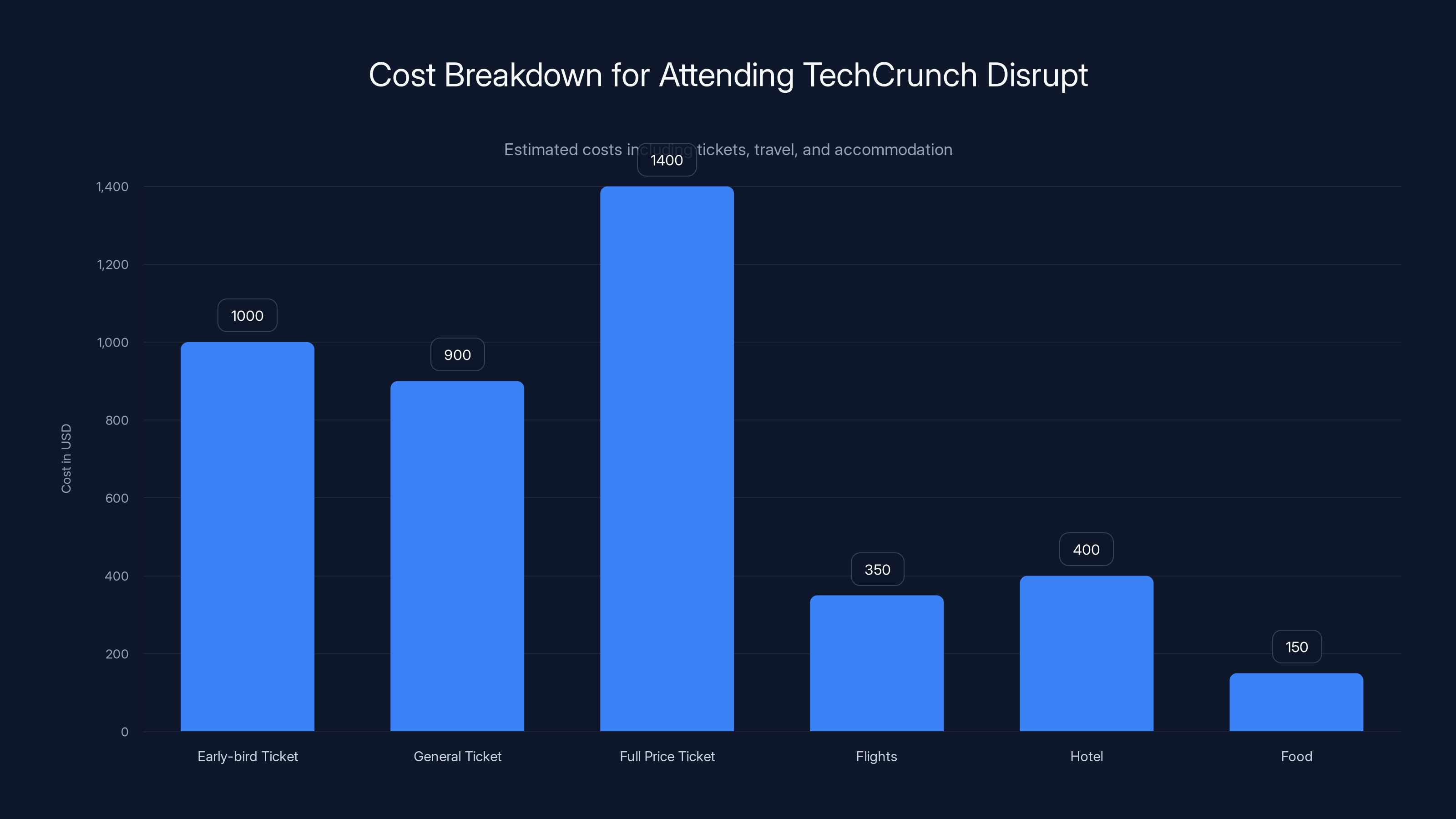

Attending TechCrunch Disrupt can cost between

The 250+ Speaker Lineup: Who's Actually Speaking and Why It Matters

Let's talk about the speakers, because this is where Disrupt differentiates itself in a meaningful way.

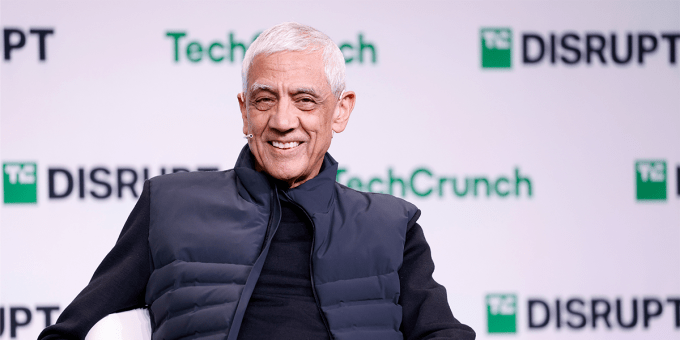

Past years have featured: Matt Mullenweg (CEO of Automattic, the company behind Word Press), Ashton Kutcher (early-stage investor through Sound Ventures), Mary Barra (CEO of General Motors), Peter Beck (Founder and CEO of Rocket Lab), Tekedra Mawakana (co-CEO of Waymo), Vinod Khosla (founder of Khosla Ventures), and Colin Kaepernick (founder of Lumi, his media company).

But here's the thing that matters more than the names: the speaker selection reflects where tech leadership actually is right now. You've got hardware founders (Rocket Lab), autonomous vehicle pioneers (Waymo), AI investment experts (Khosla Ventures), traditional industry disruption (General Motors), creator economy figures (Ashton Kutcher), and platform builders (Automattic).

That's diverse. And it's intentional.

Each speaker typically appears in specific session formats. Keynote speakers open the day and set thematic direction. Fireside chats go deeper with one-on-one conversations. Panel discussions bring multiple perspectives on a single topic. The format variety matters because different people absorb information differently.

In 2024, past speakers included representatives from Google Cloud, Netflix, Microsoft, Box, Sequoia Capital (a 16z), and Hugging Face. That's a mix of mega-cap tech companies, iconic streaming platforms, enterprise software, tier-1 venture capital, and AI research labs.

What you don't typically see at Disrupt: dozens of sessions by the same company's marketing team pitching their products. You do see their technical leaders discussing architecture decisions, market trends, or industry challenges. That distinction matters.

The speaker quality is consistently high because Tech Crunch has built trust with the ecosystem. Top executives will show up at Disrupt even if they won't speak at smaller events. That network effect is real.

The Startup Battlefield: Where Early-Stage Companies Get Real Exposure

Startup Battlefield is the competitive element of Disrupt, and it's genuinely high-stakes.

Here's how it works: The event hosts a pitch competition across three days. In 2026, it's called "Startup Battlefield 200." Roughly 200 early-stage startups apply. A panel of judges (usually consisting of famous founders, VCs, and operators) selects finalists. Those finalists pitch on the main stage in front of the entire Disrupt audience, with a winner crowned at the end.

Why does this matter if you're not a startup founder?

First, it's genuinely entertaining. Watching young founders pitch under pressure on a big stage creates real drama. Some pitches are incredible. Some are trainwrecks. Either way, you get to see raw entrepreneurship without the polishing that happens after a company becomes successful.

Second, if you're an investor, this is where you discover startups you haven't seen before. Hundreds of VCs use Disrupt as a sourcing event. The best startups at Battlefield often get follow-up meetings scheduled right during the conference.

Third, if you're an operator or strategist, Battlefield is a forced education in what's being built right now. You'll see 10+ startups across AI, fintech, hardware, biotech, climate, and every other category. Even if none of them are directly relevant to you, you get a pulse on what founders think the next wave of opportunity looks like.

The format is straightforward but tense: each founder gets 3 minutes to pitch, then a quick Q&A with the judges. The judges are chosen for credibility, so their questions (and sometimes skepticism) give you insight into how they actually evaluate startups. It's a masterclass in pitch feedback if you pay attention.

Historically, some of Disrupt's Battlefield winners have gone on to significant success. Others haven't. The competitive aspect is one element; the exposure to a room of 10,000 potential customers, investors, and partners is the real value.

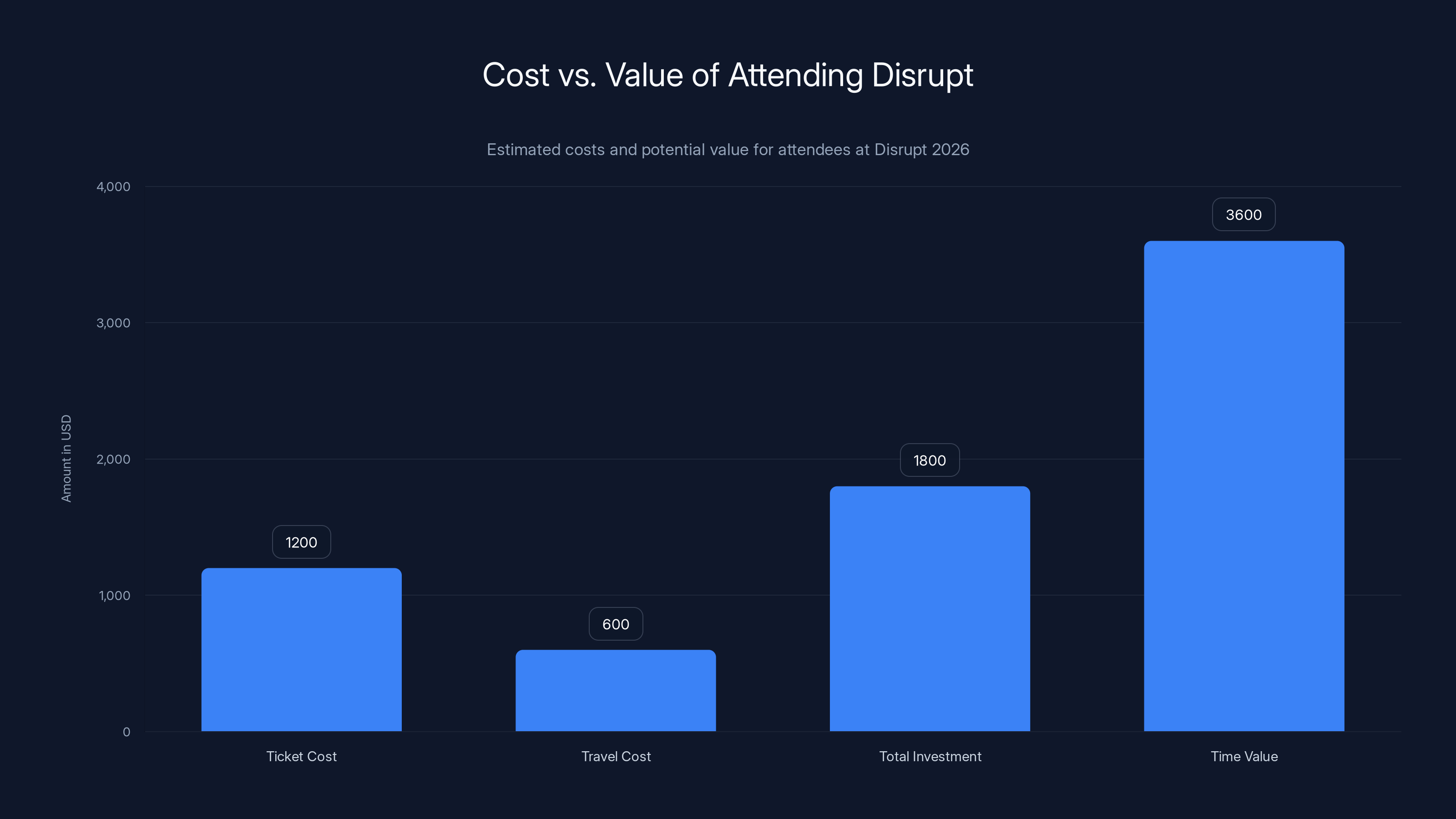

The total investment for attending Disrupt is approximately

The Expo Hall: 300+ Startups and Strategic Networking

If Battlefield is the spotlight, the expo hall is where the real network-building happens.

The expo floor features 300+ startups demoing their products and services. Unlike most trade show floors where booths are designed to funnel you into a sales conversation, Disrupt's expo emphasizes actual product interaction.

You can walk up to a booth, ask questions, and the team will usually show you the actual product or service. It's less polished than a traditional sales pitch, which actually makes it more honest.

The real strategy here: use the expo to identify companies and people worth deeper conversations. You're not going to make a major decision at a conference booth. But you might meet a founder or operator who becomes a strategic connection, find a tool that solves a real problem, or identify a potential hire.

The expo hall also serves as a casual meeting space. You can grab coffee, find a quieter corner, and have conversations with people you've met throughout the conference. Some of the most meaningful Disrupt conversations happen in the margins, not in scheduled sessions.

One practical note: the expo gets crowded on day one. Days two and three tend to be better for serious conversations because early attendees have already filtered through. Strategic timing matters.

Session Tracks: How the 200+ Sessions Are Actually Organized

Disrupt breaks its sessions into multiple concurrent tracks. In 2024, the major themes included AI and machine learning, enterprise infrastructure, climate and clean tech, fintech and cryptocurrency, hardware and robotics, and founder/investor topics.

But here's what's important to understand: the track titles are less important than the specific sessions. You navigate by finding speakers or topics you want to learn about, not by blindly following a track.

Session formats include:

Keynote addresses (30-40 minutes): A single speaker or small group setting the stage for a major theme. These happen at specific times and are high-energy.

Fireside chats (30-40 minutes): One person interviewing another in an conversational format. Usually more candid than formal presentations. These often surface unexpected insights because there's room for follow-up questions.

Panel discussions (45-60 minutes): Usually 4-5 people with different perspectives debating or exploring a topic. The tension between panelists is often more interesting than any individual statement.

Workshops and deep dives (60-90 minutes): Hands-on sessions where you're learning a specific skill or exploring a tactical topic. Smaller audience, more interactive.

Hot Seat sessions (30 minutes): A format where a founder or exec gets "hot seated" by an audience of investors and operators asking rapid-fire questions. Intense and genuine.

The variety matters because it keeps the experience from feeling like a lecture series. You're getting different content formats, which means different ways to absorb information.

Founder and Investor Passes: Specialized Benefits for Specific Attendee Types

Disrupt offers specialized pass types designed for specific roles. This is worth understanding because it affects which sessions you can attend and what perks you get.

Founder Pass: Designed specifically for founders and startup CEOs. Includes access to all sessions, plus specialized networking events with investors. You get founder-focused content like fundraising strategy, scaling advice, and investor relations. The point is to surround yourself with other founders and the capital providers who fund companies.

Benefit-wise, this includes curated matchmaking with investors based on your startup's stage and focus area. Disrupt literally facilitates introductions. You might have 2-3 scheduled investor meetings during the event, depending on interest.

Investor Pass: Designed for VCs, angel investors, and corporate development teams. Includes all sessions plus early access to Startup Battlefield startups, allowing you to research companies before they pitch on the main stage.

You also get access to founder networking events, so you're meeting early-stage founders in a more relaxed setting than a formal pitch session. The real value is sourcing: many deals get sourced through Disrupt relationships.

General Pass: If you're an operator, marketer, engineer, or someone else in the tech ecosystem, you get the general pass. This includes all sessions and expo access. It's the most flexible option because you're not locked into founder-specific or investor-specific programming.

The difference between pass types matters more for logistics and specific networking events than for core content. Most sessions are open to all pass types. But if you're raising money, the Founder Pass includes specific investor meetings that the General Pass doesn't guarantee.

Estimated data shows a rapid increase in ticket sales as the January 30 deadline approaches, along with a rise in average ticket prices due to the expiration of early-bird discounts.

Pricing Breakdown: Is the Investment Worth It?

Let's talk money, because this is where people get hesitant.

The current offer (as of January 2026) includes:

Regular pass: Typically around

+1 pass at 50% off: If you register in the first 500, you can add a companion at half price. If the second ticket would normally be

Let's do the math on ROI. If you're a founder, investor, or operator, your time is worth something. Let's assume

Pure time value: 18 hours ×

Ticket cost:

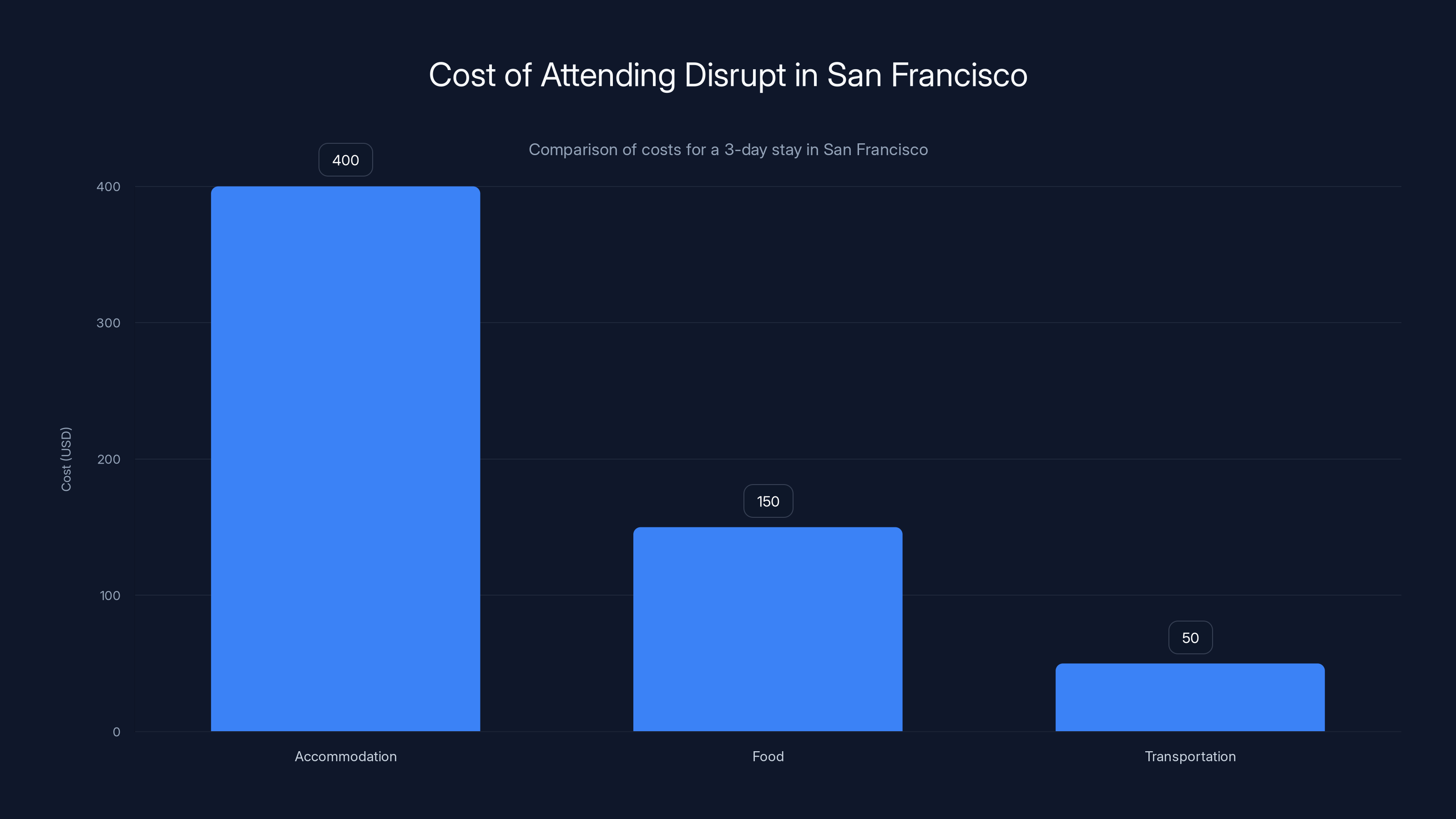

Travel costs: San Francisco flights and hotel, roughly $400-800 depending on where you're coming from.

Total investment: ~$1,600-2,000

Breakeven: If you generate even 10 hours of valuable conversation or connections from the event (less than 50% of your time), you've hit breakeven. If you land even one meaningful deal, partnership, or hire, you've exceeded ROI significantly.

For most tech professionals, the math works. But here's the honest part: only if you approach it strategically. If you attend passively, sit in sessions without engaging, and skip networking, you'll feel like you didn't get value. If you have a plan—specific people to meet, specific areas to learn about, specific problems to solve—Disrupt delivers real value.

For startups in early fundraising stages, Disrupt is often a net positive on the fundraising timeline itself. The meetings and investor exposure can compress a 6-month fundraising timeline into something faster.

For investors sourcing deals, it's a sourcing event equivalent to dozens of office hours. You see 200+ startups, filter for interest, and follow up afterward. The economics work if your capital deployment is large enough.

For employees and individual operators, it depends on your company's size and situation. If your company is growth-stage or beyond, your employer often covers the ticket. If you're solo or at an early-stage company, you're evaluating whether the ticket cost is worth the learning and networking.

The San Francisco Location: Why It Matters (And What to Expect)

Disrupt is held at Moscone West in San Francisco. This isn't random.

San Francisco remains the geographic epicenter of venture capital, with the highest concentration of VC firms and their associated capital. It's also where many of the most visible tech companies have major offices or headquarters. So being in San Francisco means you're physically proximate to the decision-makers and power centers in the industry.

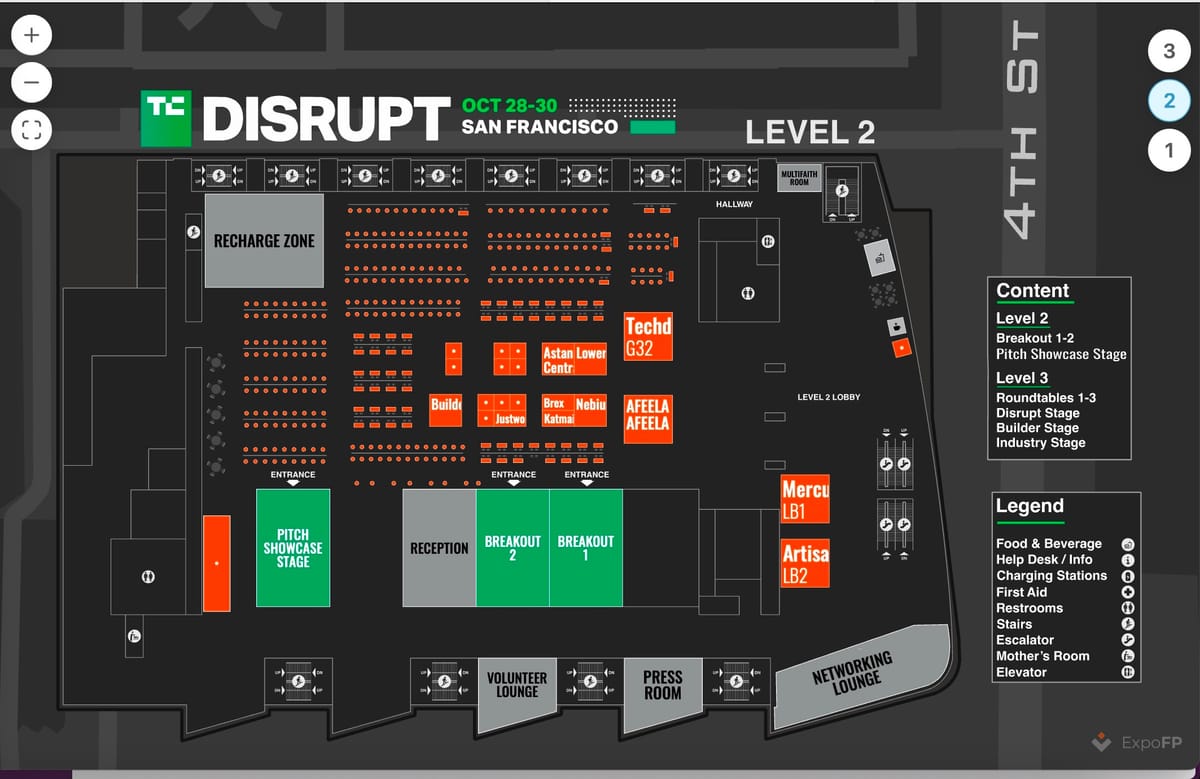

Moscone West is an iconic venue. It's hosted Tech Crunch Disrupt for years, so the logistics are refined. The main stage is large enough to feel important, but the conference layout is compact enough that you can navigate between sessions without losing 20 minutes between each one.

The practical side: San Francisco in October is excellent weather (usually 65-75 degrees, clear skies). You can move between the venue, nearby hotels, and restaurants without suffering through extreme weather.

The drawback: San Francisco is expensive. Hotels, food, and taxis all run 30-50% higher than most other US cities. Factoring in accommodation and meals, you're looking at $300-500 for three nights (depending on your hotel choice) plus food and transportation.

One strategy to reduce costs: if you're not a founder or investor (who might schedule back-to-back meetings), you might attend only two of the three days. Day one is typically the heaviest traffic with keynotes and panel setup. Day two and three include more specific sessions where you can be more selective. This cuts your accommodation costs in half and might still capture 80% of the value.

Networking Strategy: How to Actually Make Valuable Connections

Here's the thing about tech conferences: most people approach networking wrong.

They walk around hoping to run into someone useful. They collect business cards. They attend happy hours and have forgettable conversations. Then they go home and none of it converts into anything meaningful.

Disrupt enables better networking than most conferences, but only if you're strategic.

Before the event: Research attendees. Tech Crunch publishes confirmed speakers in advance. Look through them. Are there specific founders, investors, or operators you want to meet? Identify 5-10 people who would be genuinely useful to connect with. For each, understand why you want to meet them and what you could offer them in return (help, advice, an introduction, an interesting problem to think about).

Reach out before the event. Use the conference email or Linked In. "Hey, I'll be at Disrupt. Would love to grab coffee briefly." Most people will say yes to a 15-minute conversation if you're straightforward and specific about it.

During the event: Attend sessions where your target people are speaking. Ask a thoughtful question during the Q&A portion. This gives you context for approaching them afterward. "I had a follow-up question about X, do you have 10 minutes?" is a much better introduction than cold-approaching someone at a booth.

Use the founder or investor networking events if your pass includes them. These are smaller and more relaxed than the main conference floor. You're more likely to have genuine conversations.

In the expo: Meet booth runners. If a company is interesting, talk to the engineers or product people, not just the sales person. Engineers are usually happier to talk about product decisions. These conversations are often more interesting and genuine than sales pitches.

General principle: Quality over quantity. Three meaningful 15-minute conversations are better than 15 three-minute handshake conversations. You're looking for people you want to follow up with after the event.

Estimated data shows that more than half of the early bird tickets for TechCrunch Disrupt 2026 have already been sold, highlighting strong interest in the event.

What Founders Specifically Get Out of Disrupt

If you're a founder, Disrupt serves a few specific purposes depending on your stage.

Seed/Pre-seed founders: You're there to learn and build initial investor relationships. The sessions teach you what investors care about. Startup Battlefield shows you how pitch-ready companies tell their stories. The investor networking gives you warm intros to people you want to fund you. Many seed rounds start with Disrupt connections.

Series A/B founders: You're there to accelerate your fundraise if you're actively raising, or build strategic relationships for future rounds. You also attend to scout talent and potential customers or partners. The value is more strategic than educational.

Growth-stage founders: You're attending for executive learning (what are other fast-growing companies dealing with?), potential acquisition targets or partners (scanning the Battlefield and expo), and investor relationships for series C/D or future financing.

The Founder Pass specifically gives you structured investor meetings. Tech Crunch matches you with investors based on profile compatibility. These aren't cold pitches; they're scheduled conversations where you've already passed a basic interest threshold.

Realistically, 30-40% of founders who attend Disrupt while actively fundraising credit the conference with investor introductions that contributed to their round. That's a meaningful percentage, not "it might help" territory.

What Investors Specifically Get Out of Disrupt

If you're an investor, Disrupt is primarily a sourcing event.

You get early access to Startup Battlefield companies—you can review their applications and demos before they pitch publicly. This lets you identify interesting ones before the entire room knows about them.

The expo floor exposes you to 300+ companies simultaneously. This is efficient sourcing. In a typical week, you might meet 5-10 startups through inbound and outbound efforts. At Disrupt, you can evaluate 50-100+ startups in three days.

The founder networking events are crucial. Early-stage founders who aren't quite Battlefield-ready often show up to these events. You meet founders outside of the competitive pitch context, which often makes conversations more genuine.

You also learn from peer investors. The sessions include investor-focused programming on theses, market trends, and macroeconomic factors affecting returns. This keeps your perspective fresh.

Historically, tier-1 VCs have sourced multiple portfolio companies through Disrupt. It's not a guarantee, but the statistical likelihood of encountering interesting deal flow is genuinely high.

Sessions and Content Deep Dive: What's Actually Being Discussed

Disrupt 2026 sessions will likely focus on several major themes based on where the tech industry is heading in 2026.

AI and generative AI: This will be the biggest theme. Expect sessions on AI safety, AI for enterprise productivity, AI for specific verticals (healthcare, legal, etc.), and the macroeconomic implications of AI. The speakers will include AI researchers, executives implementing AI, and investors betting on AI.

Startup sustainability and unit economics: Founders are increasingly focused on profitability rather than growth at all costs. Sessions will cover CAC (customer acquisition cost), LTV (lifetime value), path to profitability, and unit economics fundamentals.

Climate and clean tech: This remains a major category. Sessions will cover electric vehicles, energy storage, sustainable materials, and climate-focused venture returns.

Infrastructure and developer tools: Companies building the foundation layer for other startups (databases, APIs, monitoring, etc.) are having major moments. Expect sessions on open-source strategy, infrastructure economics, and developer-first go-to-market.

Fintech and financial services: Whether it's embedded finance, neobanks, or fintech infrastructure, financial services companies will have dedicated programming.

Biotech and health tech: Personalized medicine, AI drug discovery, and healthcare tech continue to attract venture capital and Disrupt attendance.

What you actually care about will depend on your interests and role. The point: Disrupt's session selection reflects where venture capital and founder attention actually is. That's useful context even if you don't attend every session.

Estimated data suggests that 60% of the target demographic would benefit from attending, while 40% might find it less suitable. Estimated data.

The Expo Experience: Walking the Floor Strategically

The expo floor at Disrupt is different from most conference floors, but it still requires strategy.

Day one morning: This is peak chaos. Everyone is arriving, exploring, getting oriented. If you want one-on-one conversations, day one morning is the worst time. You'll spend a lot of time in lines and waiting. Day one afternoon is slightly better as the crowd normalizes.

Day two: This is often the sweet spot. Early attendees have filtered through. People are more relaxed than day one. You can usually have genuine conversations without it feeling like herding.

Day three: Great for deeper conversations with booth teams because the tourist effect has cleared. But some of the smaller startups might have already left. If there's a specific company you want to meet, day two or early day three is optimal.

Before approaching a booth: Know what the company does. A 30-second research pass on their website takes 2 minutes but makes your conversation 10x better. You ask smarter questions. The booth team recognizes you've done homework and engages more seriously.

During the conversation: Ask about their biggest challenge right now, not their pitch. "What's the hardest part of your product right now?" generates more interesting conversations than "So what do you do?" Most booth runners appreciate when someone asks something other than the scripted pitch.

Taking notes: Bring a notebook or use your phone to jot down specifics. "John, VP of Product at [company], they're solving X with approach Y." That specificity is crucial when you're following up weeks later.

Maximizing ROI: A Practical Pre-Event Checklist

If you're investing the money and time in Disrupt, here's how to actually get value from it:

Four weeks before:

- Block out the three days on your calendar. Treat it as unmissable work time.

- Research the confirmed speaker list. Identify 5-10 people you want to connect with.

- Review the startup applications or Battlefield list if available. Tag 20-30 interesting companies.

- Set your pass type (Founder, Investor, or General) based on your role.

- Update your Linked In and make sure your headline reflects what you do.

Two weeks before: 6. Reach out to 5-10 target speakers/attendees. "Hey, I'll be at Disrupt. Would love to grab 15 minutes to talk about X." 7. Book your flight and hotel. Prices get worse the closer you cut it. 8. Plan your session schedule. Identify 5-6 must-attend sessions and 10-15 backups. 9. Research the 300+ expo companies. Create a list of 10-15 you want to visit. 10. For investor attendees: review Startup Battlefield applications and identify interesting companies.

One week before: 11. Confirm any coffee meetings you've scheduled. 12. Print or download a simplified conference schedule. 13. Plan your outfit. Something professional but movable (comfortable shoes, weather-appropriate). 14. Write down your three main goals for the event. 15. Set expectations with your team at work about your availability during the event.

During the event: 16. Attend the sessions you prioritized, but don't be rigid. If an impromptu conversation is valuable, skip a session. 17. Keep the booth conversation list updated with contact info. 18. Exchange genuine contact info (not just business cards). Linked In connections are often better. 19. Take photos of interesting booth setups or whiteboard presentations if useful. 20. Attend any evening events or happy hours. Some valuable conversations happen outside of structured sessions.

Within one week after: 21. Go through your notes and book conversations. Compile a list of people to follow up with. 22. Send follow-up messages to 10-15 people you met. Specific reference to your conversation is key. 23. Schedule coffee calls or meetings with people where there was obvious mutual interest. 24. Evaluate what you learned from sessions and tag any relevant resources to share with your team. 25. Review the deals or connections that came from Disrupt after 30-60 days. Most take that long to develop.

Comparing Disrupt to Other Major Tech Conferences

Disrupt isn't the only major tech conference. Understanding how it compares helps you decide if it's worth your time.

CES (Consumer Electronics Show): Massive (100,000+ attendees), heavy on hardware and consumer tech, heavily corporate. Better for consumer hardware founders or people scouting consumer trends. Less focused on venture/startup ecosystem. CES is bigger but less curated.

SXSW (South by Southwest): Smaller than CES (10,000-15,000 attendees), mix of tech and creative industries, more accessible for indie developers and creators. Less venture capital density than Disrupt. Better if you're building consumer products or content. Lower intensity networking.

Web Summit: Similar size to Disrupt (15,000+ attendees), heavy on global perspective, includes non-tech verticals. More international attendees. Less focused on venture ecosystem, more generalist. Held in Lisbon, which means different attendee demographics.

Dreamforce (Salesforce): Enterprise software focused, massive (170,000+), heavily vendor-driven. Useful if you're evaluating enterprise software or building in that space. Not a VC/startup event.

All Things Open: Open-source focused, smaller (1,000-2,000), highly technical, free or low-cost. Better for developers and open-source maintainers. Less venture capital.

Y Combinator Startup School: Free and online, founder-focused education, less networking. Good foundational content if you're new to startup dynamics. Not an in-person event.

Compared to these, Disrupt occupies a specific niche: venture-backed startup ecosystem with high founder and investor density, US-centric, curated content, real product momentum (Startup Battlefield). If that's your world, nothing else matches it. If you're in a different category (consumer hardware, open-source, enterprise software), a different event might be better.

Estimated costs for attending Disrupt in San Francisco include

What Makes Disrupt Unique (And Why People Keep Coming Back)

Disrupt has been running since 2011, and it's evolved into something genuinely distinct in the conference landscape.

First: The founder-investor density. At most conferences, founders and serious investors are in the minority. At Disrupt, they're the core. This creates a gravitational pull. Serious capital providers show up because founders are there. Serious founders show up because capital is there.

Second: The Startup Battlefield competitive element. Most conferences have some form of startup stage or pitch competition. Disrupt's is higher-stakes and more visible than most. It attracts better founders (because the upside is real visibility) and therefore attracts more investor attention. It's a network effect.

Third: Tech Crunch's editorial trust. Tech Crunch has beat reporters and editors who've covered the tech industry for 15+ years. This credibility translates to the conference. Executives trust that Disrupt won't turn into a marketing circus. Journalists showing up means coverage. Coverage means attention.

Fourth: The curation. As mentioned earlier, Disrupt actively selects speakers, sessions, and startups. This requires editorial judgment, which Tech Crunch has developed over years of covering the industry. Not every company can participate. Not every session idea gets selected. This maintains quality.

Fifth: The repeating ecosystem. Many attendees go to Disrupt multiple years. This creates community and continuity. You see familiar faces, you follow up from previous years, you build deeper relationships. First-time attendees benefit from this ecosystem, even if they don't realize it.

These elements compound. Each year, Disrupt gets slightly better at curating speakers and startups because they've learned from previous years. The reputation attracts higher-quality founders. Higher-quality founders attract more investor attention. More investor attention attracts capital. Capital attracts more founders. It's a virtuous cycle.

Practical Tips for Getting the Most Out of Your Three Days

Beyond the strategic checklist, here are tactical tips from people who've attended multiple times:

On comfort: Wear comfortable shoes. You're walking the expo floor for 6+ hours across three days. A blister will ruin your conference experience. Bring a backpack or bag for swag, chargers, and notebooks. Don't use your laptop during sessions unless you're actively taking notes; it's distracting.

On time management: Sessions typically run 30-60 minutes. Build in 10-15 minutes between sessions for navigation, bathroom breaks, and mental breaks. Don't try to attend every session. Five good sessions you genuinely engage with are better than ten sessions where you're exhausted and checking your phone.

On networking effectiveness: Have your Linked In profile accessible and current before you arrive. Some people will connect with you directly; some will do it after the fact. Both work, but make sure your profile doesn't look abandoned. Wear something with a pocket or use a lanyard for your badge. It sounds silly, but it makes you more approachable. You're less likely to fumble around looking for your badge to give someone your name.

On energy management: Disrupt is exhausting. Three days of back-to-back sessions, conversations, and stimulation drains your battery faster than normal work. Plan for a serious nap or early evening rest on days 1 or 2. Don't schedule dinners with people for all three nights. You'll burn out.

On food and water: The conference provides coffee and snacks, but they sometimes run out. Bring your own water bottle and snacks. You don't want to spend time hunting for lunch during the sessions you care about.

On follow-up: This is crucial. The value of Disrupt is 20% the event and 80% the follow-up. Most people meet someone interesting and then never follow up. You follow up consistently, and suddenly you have a deal, partnership, or hire that came from that connection. Build this habit during the event by taking detailed notes and committing to following up within a week.

The Pricing Deadline and Ticket Scarcity: Why January 30 Matters

Let's address the deadline directly. The offer for 50% off a +1 pass expires January 30, 2026, or when the first 500 registrations are claimed (whichever comes first). More than half are already gone as of late January.

This isn't fake scarcity. Here's why:

First, Tech Crunch has limited comp tickets they can give away or discounts they can offer. The 50% off +1 promotion is genuinely limited by budget.

Second, the pricing is structured around early-bird incentives. They offer steep discounts early to lock in attendance and planning commitments. They don't because they're desperate to fill the conference; they do it because it helps their planning team (they need early registration numbers for logistics) and it rewards early commitments.

Third, full-price tickets are genuinely higher. If you miss the January 30 deadline, you're not just losing the +1 discount. You're paying full general ticket price, which is typically $1,200-1,600 depending on the tier. That's not a small difference.

So when Tech Crunch says "only 5 days left," they mean it. Not as marketing urgency, but as actual logistics. Miss it, and you'll pay more. Or you'll decide not to go, which is a real business outcome for Tech Crunch.

The practical decision: if you're genuinely considering Disrupt, the deadline creates a forcing function. You have to decide now whether it's worth $800-1,200 invested in your professional development. That's a reasonable decision to make, but the deadline is real.

Should You Actually Go? The Final Analysis

Let's be direct about who should go and who shouldn't.

You should go if:

- You're an early-stage founder (seed through Series B) actively fundraising or planning to fundraise in the next 6-12 months

- You're an investor at any stage looking to source deals or learn about emerging trends

- You're an operator at a growth-stage company looking to scout talent, partnerships, or strategic learnings

- You're a developer or engineer at a tech company interested in new tools, infrastructure, or frameworks

- You work in venture capital, corporate development, or business development and your industry is tech

- You're seriously considering starting a company and want to understand the current landscape

You should probably skip it if:

- You're early in your career and not yet in a decision-making role (save your conference budget for smaller, specialized events)

- You're building a non-tech business or your business is not venture-backed

- You can't commit to the follow-up. If you attend passively and don't follow up with connections, the ROI is weak

- Your cash flow is tight and you can't justify $2,000+ in total costs

- You're specifically interested in a domain not well-represented at Disrupt (like biotech, which has specialized conferences that might be better)

For most people in the target demographic, Disrupt delivers value. The question is whether it's the best use of your conference budget and time. If you attend with a plan, follow up with intention, and view it as a professional investment, the answer is usually yes.

What to Expect Logistically: The Practical Stuff

Since you're considering going, here's the logistical reality:

Venue: Moscone West in San Francisco is well-organized but crowded during peak times. Bathrooms are adequate but can have lines between sessions. The Wi-Fi is usually solid but can get spotty during sessions (everyone on their phones). Bring a phone charger.

Sessions: Arrive 5-10 minutes early if you want a good seat. The main stage sessions get full. Smaller sessions usually have plenty of space. There's no assigned seating; first come, first served.

Startup Battlefield: This happens on a main stage. The energy is high, audience applauds, judges ask tough questions. It's genuinely entertaining even if none of the startups are directly relevant to you.

Expo: Crowded but manageable. The companies are usually happy to talk. Bring business cards or have a way to share your contact info. QR codes are increasingly common.

Food: There are options near Moscone West (restaurants, cafes), but they get busy during lunch hours. Day two lunch is typically the worst time. Some hotels provide breakfast; some don't. Plan accordingly.

Networking: The official networking events are scheduled. Happy hours, founder meetups, and investor dinners are typically evening events. Some are ticketed, some are open. Review the agenda when you register.

Schedule: Sessions typically run 9am to 6pm with breaks. Keynotes are usually first session (9:15-10am). Everything wraps by 6pm, leaving evening for self-organized dinners or networking.

The Future of Disrupt: Where It's Heading

Disrupt continues to evolve. Recent years have seen:

Increased focus on profitability and unit economics: Rather than growth-at-all-costs sessions, there's more emphasis on sustainable business building.

Expanded international representation: More founders and investors from outside the US, though it remains primarily a San Francisco/Bay Area focused event.

More AI and foundation model content: This is the obvious trend, but Disrupt has quickly pivoted to AI as a central theme.

Smaller, more specialized tracks: Rather than one big conference, there's been experimentation with specialized tracks (women founders, climate tech, infrastructure, etc.).

Increased focus on actual outcomes: Tech Crunch has started tracking deals, hires, and partnerships that came from Disrupt. This keeps the conference honest and helps them improve programming year to year.

The broad trajectory suggests Disrupt is moving toward being even more selective and outcomes-focused rather than trying to be all things to all people.

Making Your Decision: The Action Steps

If you've read this far, you're seriously considering Disrupt. Here are your next steps:

Step 1 (Today): Decide if you want to go based on the analysis above. Does it fit your role, goals, and budget?

Step 2 (By January 27): If yes, register before the deadline. The early-bird pricing and +1 discount are real benefits. Don't wait until January 30.

Step 3 (Within 3 days): Book your flight and hotel. Prices increase as you get closer to the event.

Step 4 (Within 1 week): Start researching speakers and companies. Make your list of 5-10 people to connect with and 10-15 companies to visit.

Step 5 (2 weeks before): Reach out to target connections. "Hey, I'll be at Disrupt. Want to grab 15 minutes?"

Step 6 (1 week before): Finalize your session plan. Identify must-attend sessions.

Step 7 (October 13-15): Show up with energy and intention. Execute your plan.

Step 8 (Within 1 week after): Follow up with everyone you met. Send specific, personalized messages.

Do this, and Disrupt will deliver value. Skip the follow-up, and you're paying for an expensive conference that feels like a waste. The difference is mostly execution on your end, not the conference itself.

FAQ

What exactly is Tech Crunch Disrupt?

Tech Crunch Disrupt is an annual three-day conference held in San Francisco that brings together founders, investors, operators, and tech leaders. It features 200+ expert-led sessions with 250+ speakers, hosts the competitive Startup Battlefield competition where early-stage startups pitch on the main stage, and includes an expo floor with 300+ participating companies. The conference is designed to be curated and intentional rather than overwhelming, focusing on high-signal content and meaningful networking rather than traditional vendor expo formats.

Who should attend Tech Crunch Disrupt?

Disrupt is best suited for founders and startup CEOs (especially those actively fundraising), venture capital investors and VCs scouting deals, corporate development and business development professionals, operators and executives at growth-stage companies, developers and engineers interested in new tools and infrastructure, and anyone seriously planning to start a company. If you work in venture-backed tech ecosystems, have decision-making authority, and can commit to meaningful follow-up after the event, Disrupt will likely deliver solid ROI. Early-career employees or people in non-tech industries may find specialized conferences more aligned with their needs.

How much does it cost to attend Tech Crunch Disrupt?

Early-bird tickets typically cost

What is Startup Battlefield and why does it matter?

Startup Battlefield is the competitive element of Disrupt where roughly 200 early-stage startups apply, with finalists selected to pitch on the main stage in front of 10,000 attendees. Each founder gets 3 minutes to pitch plus Q&A with a panel of judges (typically famous founders, VCs, and operators). It's valuable because it's entertainment value combined with market signal: the startups selected are often the highest-quality early-stage companies. If you're an investor, it's a sourcing opportunity where you discover companies before the broader market knows about them. If you're a founder or operator, it's a masterclass in how different approaches to pitching, problem-solving, and storytelling resonate with experienced judges.

Is the January 30 deadline real or just marketing?

The deadline is real. Tech Crunch limits the number of discounted +1 passes to the first 500 registrations and sets a hard deadline of January 30, 2026. This is both a logistical reality (they need time to plan) and a pricing strategy. After January 30, you'll pay full price: roughly $800-1,200 more for your ticket and you'll lose the 50% off +1 pass. The scarcity is genuine—more than half of the 500 early-bird +1 passes were already claimed as of late January. If you want the discount, you need to register before the deadline.

How should I approach the expo floor to make the most of it?

Research the 300+ companies before arriving (takes 20 minutes for a quick scan). During the event, prioritize conversations over booth browsing: identify 10-15 companies you actually want to talk to rather than randomly walking around. Ask booth teams about their biggest challenges or product decisions rather than requesting the standard pitch. Take detailed notes with specific names and context ("John, VP Product at Company X, working on Y challenge"). Visit on day two or early day three rather than day one morning, which is peak chaos. After the event, follow up within a week with specific references to your conversation—this is where expo conversations convert to actual value.

What's the difference between the Founder Pass and Investor Pass?

The Founder Pass is designed specifically for startup founders and CEOs. It includes curated matchmaking with investors, scheduled meetings with capital providers interested in your stage/sector, access to founder-focused sessions (fundraising strategy, scaling, investor relations), and networking events specifically for early-stage entrepreneurs. The Investor Pass is designed for VCs, angels, and corporate development teams. It includes early access to Startup Battlefield companies (let you research before they pitch), founder networking events (more relaxed than the main event), and all general sessions. If you're raising money, the Founder Pass includes specific investor meetings; if you're looking for deal flow, the Investor Pass accelerates your sourcing process.

Should I attend all three days or just some days?

If you have flexibility, all three days is ideal because you get the complete conference arc: keynotes and major announcements on day one set the theme, day two goes deeper with more specialized sessions and expo time, day three includes the Startup Battlefield competition finale and closing sessions. However, if you're budget-constrained or geographically distant, attending days 2 and 3 captures maybe 75-80% of the value while cutting accommodation costs in half. Day one is heavily keynote/intro-focused; day three often has the most specialized content. If you can only do one day, day two is your best option. The real answer depends on your specific goals and constraints.

How important is following up after Disrupt?

Following up is where 80% of Disrupt's real value comes from. The conference itself is 20% of the value. Most people attend, meet interesting people, exchange business cards, and then never follow up. If you follow up intentionally—sending specific, personalized messages to 10-15 people within one week, scheduling actual meetings, and maintaining relationships—you'll see concrete outcomes (deals, partnerships, hires, investments). If you attend passively without follow-up, you'll feel like you paid for an expensive event that didn't deliver. The difference is mostly your execution, not the conference's quality. Budget dedicated time (3-4 hours minimum) for follow-up in the week after Disrupt.

Let me be honest with you: Tech Crunch Disrupt is worth your time and money if you're in the venture-backed tech world and you approach it strategically. It's not worth it if you're just going to passively attend sessions and collect business cards. The difference between a great conference experience and a disappointing one comes down to preparation, intention, and follow-up. If you can commit to that, register before January 30 and lock in the best pricing. If you can't commit to being strategic about it, wait and evaluate for next year.

Key Takeaways

- TechCrunch Disrupt 2026 (Oct 13-15, San Francisco) brings together 10,000 founders, investors, and operators for 200+ curated sessions with 250+ speakers.

- Early-bird pricing saves $400-680, with first 500 registrants getting 50% off companion passes—deadline is January 30, 2026.

- ROI typically breaks even within 10 hours of strategic networking, making it worthwhile for founders actively fundraising and serious investors sourcing deals.

- Success at Disrupt requires preparation (research attendees/companies), intention (specific goals), and follow-up (personalized outreach within 1 week).

- Startup Battlefield competition and 300+ company expo provide unique sourcing and learning opportunities unavailable at competing tech conferences.

![TechCrunch Disrupt 2026: Complete Guide to Tickets, Speakers & Networking [2025]](https://tryrunable.com/blog/techcrunch-disrupt-2026-complete-guide-to-tickets-speakers-n/image-1-1769442068496.png)