Why Tech Crunch Disrupt 2026 Matters More Than Ever

Let's be honest: tech conferences have become noise factories. Thousands of people shuffling between booths, collecting business cards that never get called, sitting through panels where nothing new gets said. Tech Crunch Disrupt isn't that.

Disrupt is different because it's designed for people who actually move things in tech. We're talking founders wrestling with product-market fit, venture capitalists hunting for the next unicorn, engineers building infrastructure that powers the future, and operators who've scaled teams from five people to five hundred.

The conference happens October 13–15 at San Francisco's Moscone West, and it's become the place where real deals happen. Not the networking mixer kind of deals. The investment rounds, the partnership announcements, the "I met my co-founder here" kind of deals.

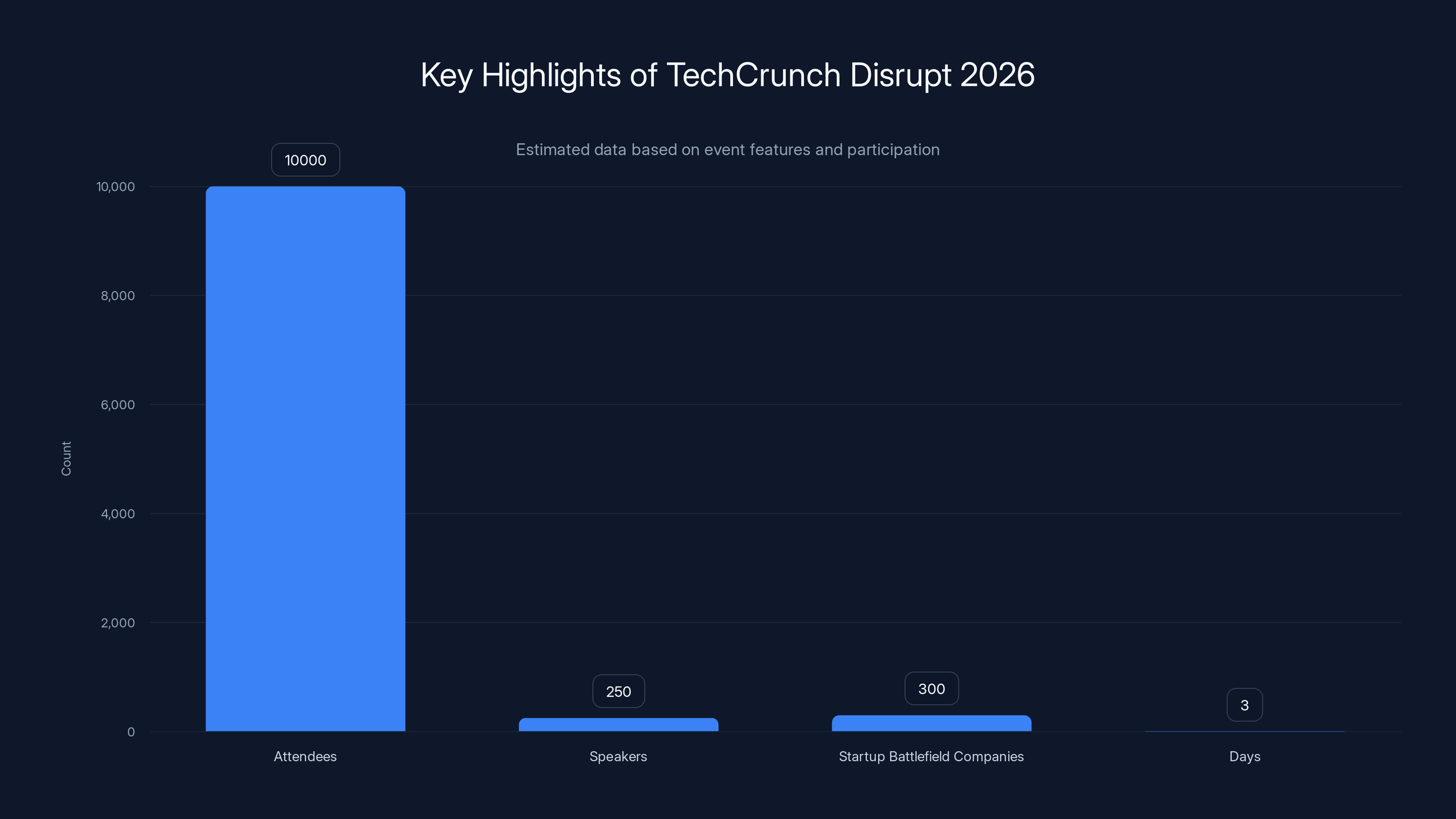

Here's what makes it work: 10,000 attendees, yes, but they're not random. They're curated. The 250+ speakers include people like Mary Barra from General Motors, the founders of Word Press, venture capitalists who've backed the biggest tech wins of the last decade, and emerging founders who are about to change everything.

Then there's Startup Battlefield 200, which is basically startup combat. Three hundred early-stage companies pitch in front of investors and a live audience. Some of these companies will be worth billions in five years. Some won't survive 2027. All of them are trying harder than they've ever tried in their lives on that stage.

The networking isn't forced. You're not stuck in a mixer where you don't know anyone. Disrupt structures it so founders meet investors looking specifically for their stage, industry, and stage of growth. VCs find founders they actually want to fund. Operators connect with peers solving the same scaling problems.

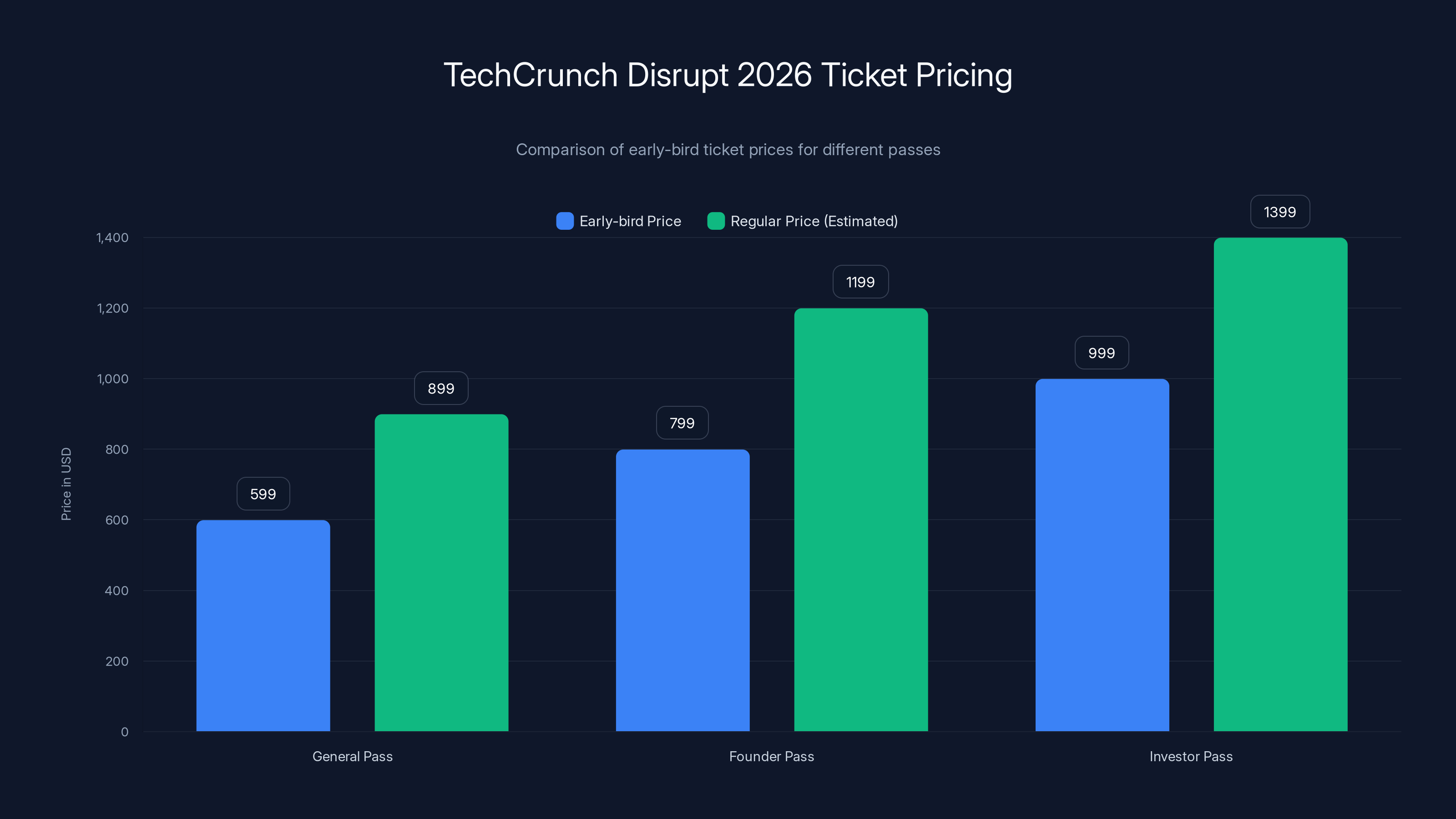

The early-bird pricing is ending January 30, 2026, or when the first 500 registrations hit their second-ticket discount. Whichever comes first. This isn't a marketing tactic—they actually cap it at 500 discounted +1 passes. Once they're gone, they're gone.

You can save up to $680 on your main pass alone. That's the difference between early-bird pricing and regular pricing. Add the 50% off +1 pass, and you're bringing a colleague or co-founder for basically half price. If you work at a startup, you know how much that matters for your budget.

Understanding the Ticket Pricing Structure

Tech Crunch doesn't publish all pricing tiers publicly until you start the registration process, but here's how Disrupt pricing typically works for founders, investors, and general attendees.

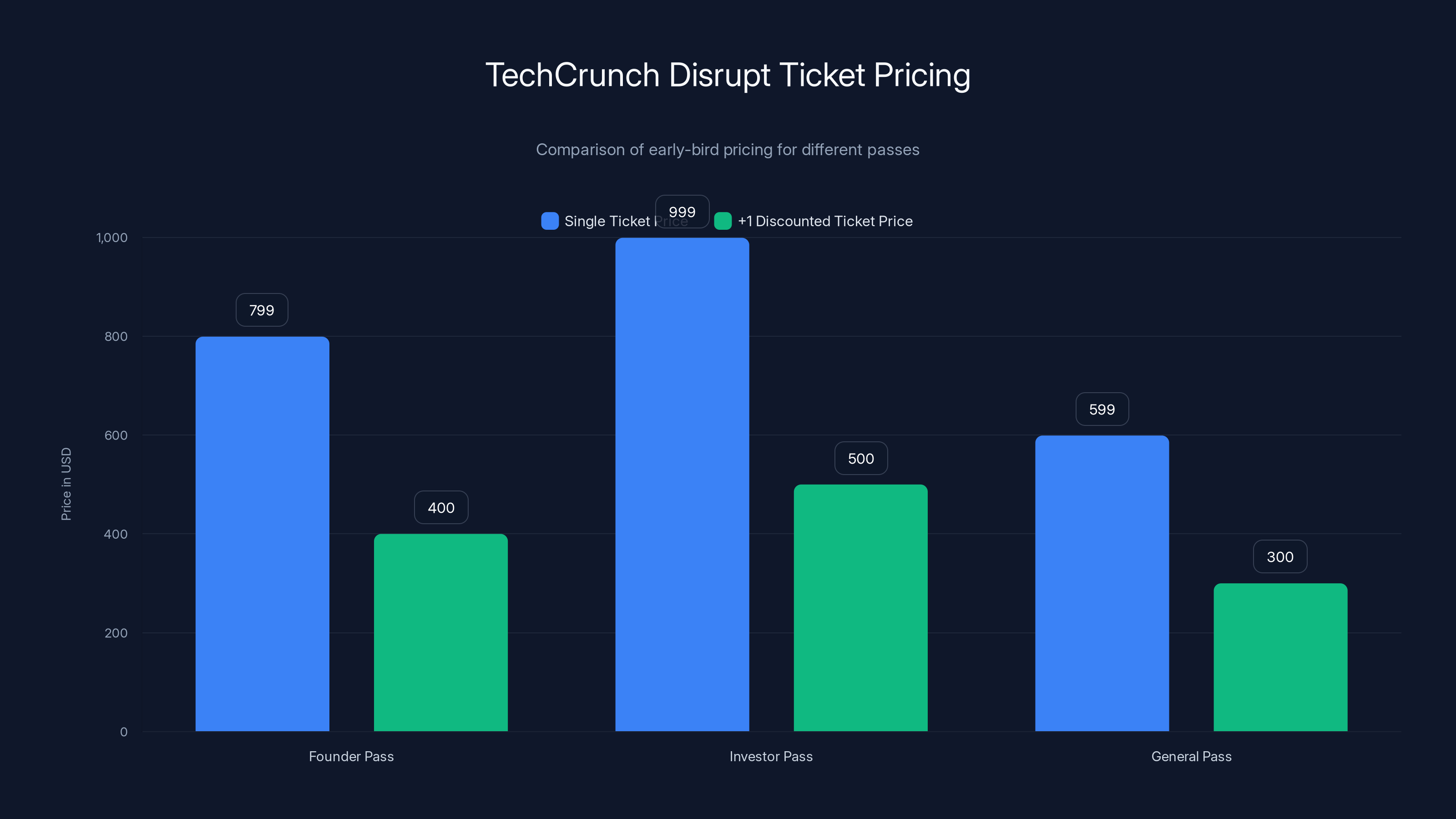

The Founder Pass is built for people building startups. You get access to all 250+ sessions, direct connections with investors and mentors, special founder-only networking events, and curated introductions. The pass is designed to compress what would normally take months of networking into three intensive days.

The early-bird Founder Pass typically runs

The Investor Pass targets VCs, angel investors, and corporate venture teams. This pass gives you first access to Startup Battlefield 200 companies, curated investor-only networking sessions, and the ability to schedule meetings with founders pitching companies. If you're an investor reviewing 500+ companies a year, having 300 pre-vetted startups in one place is worth the ticket price alone.

Investor Passes at early-bird pricing are typically

The General Pass is for anyone else interested in tech—engineers, operators, marketers, HR folks from tech companies, product managers. You get all the sessions, networking areas, and the experience of being surrounded by 10,000 people building the future. The early-bird General Pass is usually $599, with the +1 at 50% off.

Why does the +1 discount matter so much? Because if you're at a startup or early-stage company, you need multiple perspectives in that room. A founder needs their CTO or head of revenue there. An investor needs their analyst. Having that second set of eyes, that person to debrief with between sessions, that partner to follow up with investors you meet, multiplies the value of your attendance.

The

That's not fake savings. That's real money that either stays in your startup's budget or gets reallocated to something else.

Early-bird pricing offers significant savings, with prices increasing by 30-40% once the discount period ends. Estimated data for regular prices.

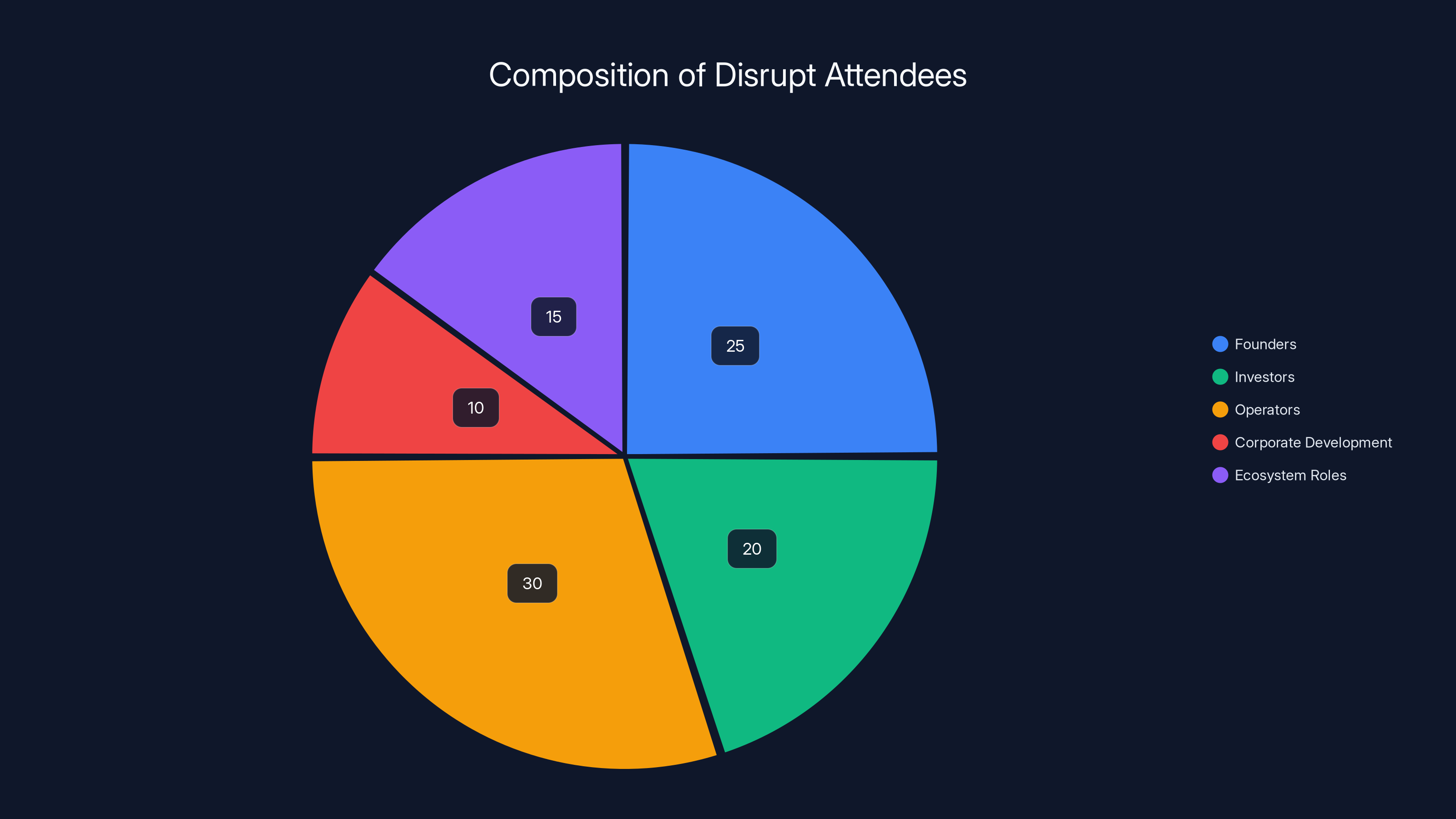

The 10,000-Person Network: Who Actually Attends

Disrupt attendees aren't random conference-goers. They're people with decision-making power and capital to deploy. The composition changes every year, but the pattern is consistent.

About 25% of attendees are founders—ranging from pre-seed founders building the first prototype to Series B and C founders raising their next rounds. You'll find CEOs of 5-person teams sitting next to founders with $50 million in revenue. The interesting thing is they all benefit from Disrupt differently. The early-stage founder is there to find mentors, investors, and co-founders. The later-stage founder is there to scout acquisition targets, find B2B customers, and stay connected to the broader ecosystem.

Another 20% are investors. These are partners at famous venture firms—a 16z, Sequoia, Bessemer Venture Partners, founders of angel syndication platforms. They come to Disrupt specifically to see Startup Battlefield 200 and meet hundreds of founders in three days. It's concentrated deal flow.

Then you have operators—about 30% of the room. These are CTOs, heads of product, scaling experts, engineering leaders, VP of sales people. They're not necessarily building their own companies, but they're building things that matter. They attend for the technical sessions, for hearing from Netflix's engineering team or Google Cloud's latest innovations, and for peer learning. "How does another CTO handle the scaling problems I'm dealing with?" is a real question that gets answered at Disrupt.

There's a smaller but important group—corporate development, M&A, business development teams from big tech companies. Microsoft, Google, Box, and others attend Disrupt to find acquisition targets, potential partners, and new technologies they should know about.

About 15% are what you might call "ecosystem roles"—recruiters for top tech companies, lawyers who specialize in startups, accountants who work with VC-backed companies, PR people. They're there because that's where their clients are.

The remaining 10% are journalists, analysts, researchers, and folks interested in tech but not directly working in it.

What's crucial is that these aren't separate groups that never interact. A founder might pitch to an investor who refers them to a potential CTO they met in the operator track. A corporate development person might meet a startup founder who becomes an acquisition target two years later. The network effects are real.

The diversity of attendees means the conference works for different purposes. You're not trying to sell enterprise software to a room full of Saa S companies. You're in a room where the person next to you might be building AI infrastructure, the person behind you might be evaluating that infrastructure for your company, and the person in front might be founding a company that uses it.

TechCrunch Disrupt 2026 features 10,000 curated attendees, 250+ influential speakers, and 300 startups in the Battlefield competition over 3 days. Estimated data.

The 250+ Sessions: What You'll Actually Learn

Disrupt's schedule is packed. There are 250+ sessions spread across three days, multiple tracks running simultaneously. You can't attend everything, but that's actually by design. The curation lets you build a custom experience.

The sessions fall into several categories, though they blur together. There are keynotes with major figures—these are the headline moments. There are deep-dive sessions where experts spend 45 minutes digging into specific topics. There are panels where four or five people debate different perspectives on a question. There are fireside chats with founders or investors where the interviewer asks the questions you actually want answered.

Past Disrupt sessions have covered everything from "How to Raise Your Series A" to "Building AI Products That Don't Hallucinate" to "Scaling Engineering Teams Without Losing Culture" to "The Future of Climate Tech" to "How to Recruit When Nobody Wants to Work at Your Startup." The topics shift every year based on what's actually important to the tech world at that moment.

In 2025, if Disrupt had happened, the heavy emphasis would be on AI—not AI in general, but applied AI. How companies are actually using large language models. What's working. What's not. The regulatory landscape. Safety and alignment. Specific tools and frameworks.

There would definitely be sessions on venture capital strategy, because founders always want to understand how investors actually think. There would be infrastructure sessions because every company eventually hits scaling problems. There would be founder wellness sessions because burnout is real and Disrupt acknowledges that.

The sessions work because they're taught by people who actually know what they're talking about. This isn't motivational speaking. It's tactical knowledge. A CTO from Netflix discussing how they handle massive scale isn't theoretical. A Slack executive talking about how to sell to enterprises isn't a sales pitch—it's lessons learned from selling Slack to every major company on Earth.

You also get access to the Content Library. After the conference, you can replay sessions you missed. That matters because nobody can attend everything. There are always conflicting sessions you want to see. Being able to watch them later means you don't miss the content.

The real learning at Disrupt isn't just in the sessions, though. It's in the hallway conversations. Someone mentions a problem they're solving, you realize you're solving something similar, you exchange contact info. That conversation—the one that wasn't scheduled—is often the most valuable part.

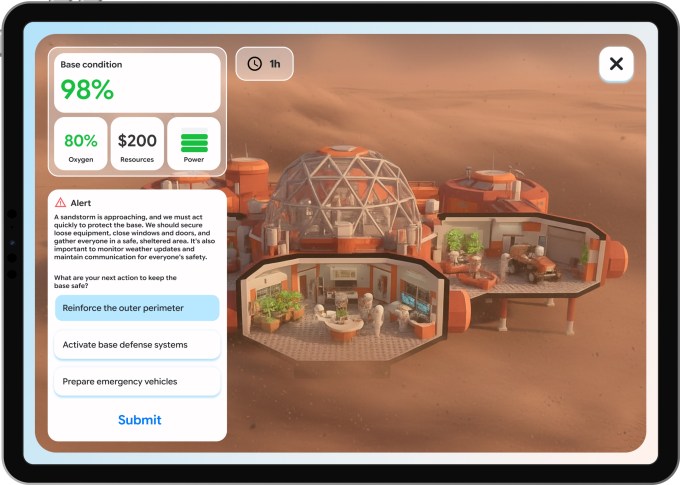

Startup Battlefield 200: Where Early-Stage Companies Get Seen

Startup Battlefield is the event within the event. Three hundred early-stage companies apply. About 200 get selected. Over three days, they pitch in front of thousands of people and a panel of judges who vote on the best companies.

For startups, Battlefield is a big deal. It's not the only place to raise money or get noticed—there are thousands of pitch events. But Battlefield is unique because 10,000 potential customers, investors, partners, and acquirers are watching. When you pitch at Disrupt Battlefield, you're not pitching to one or two people in a coffee shop. You're pitching to a live audience, journalists are writing about you, and the video will be online forever.

That's pressure and opportunity. Some founders thrive under it. Others freeze. But the companies that do well at Battlefield often see real follow-on effects. Investors reach out after seeing the pitch. Customers sign up. Talent applies to work there.

Past Battlefield winners have gone on to raise hundreds of millions in funding. Some have been acquired. Some have become significant companies in their own right. There's selection bias here—the companies that go to Battlefield are already pretty good, and the ones that pitch well are probably going to do well anyway. But Battlefield accelerates their trajectory.

For investors, Battlefield is deal sourcing on steroids. You get to see 200 companies that are serious enough to apply and pitch. Not every company that pitches will be investable by your fund. But finding even one company that fits your thesis and investment size, that you can actually close a deal with, justifies your attendance.

The competition aspect is real but not cutthroat. These founders are all trying to build something. The audience appreciates good pitching, clear thinking, and honest answers to tough questions. Some of the most interesting pitches are from founders building something that seemed impossible two years ago but is suddenly obvious.

If you're pitching at Battlefield, your time is limited. You have 60 seconds of talking, then judges ask questions. That's it. The entire first impression of your company happens in less than five minutes. Which means the preparation matters enormously. You need to communicate what you're building, why it matters, why now, and why your team is the one to do it. Everything else is noise.

Early-bird pricing for TechCrunch Disrupt shows significant savings with the +1 discount, particularly beneficial for teams needing multiple perspectives.

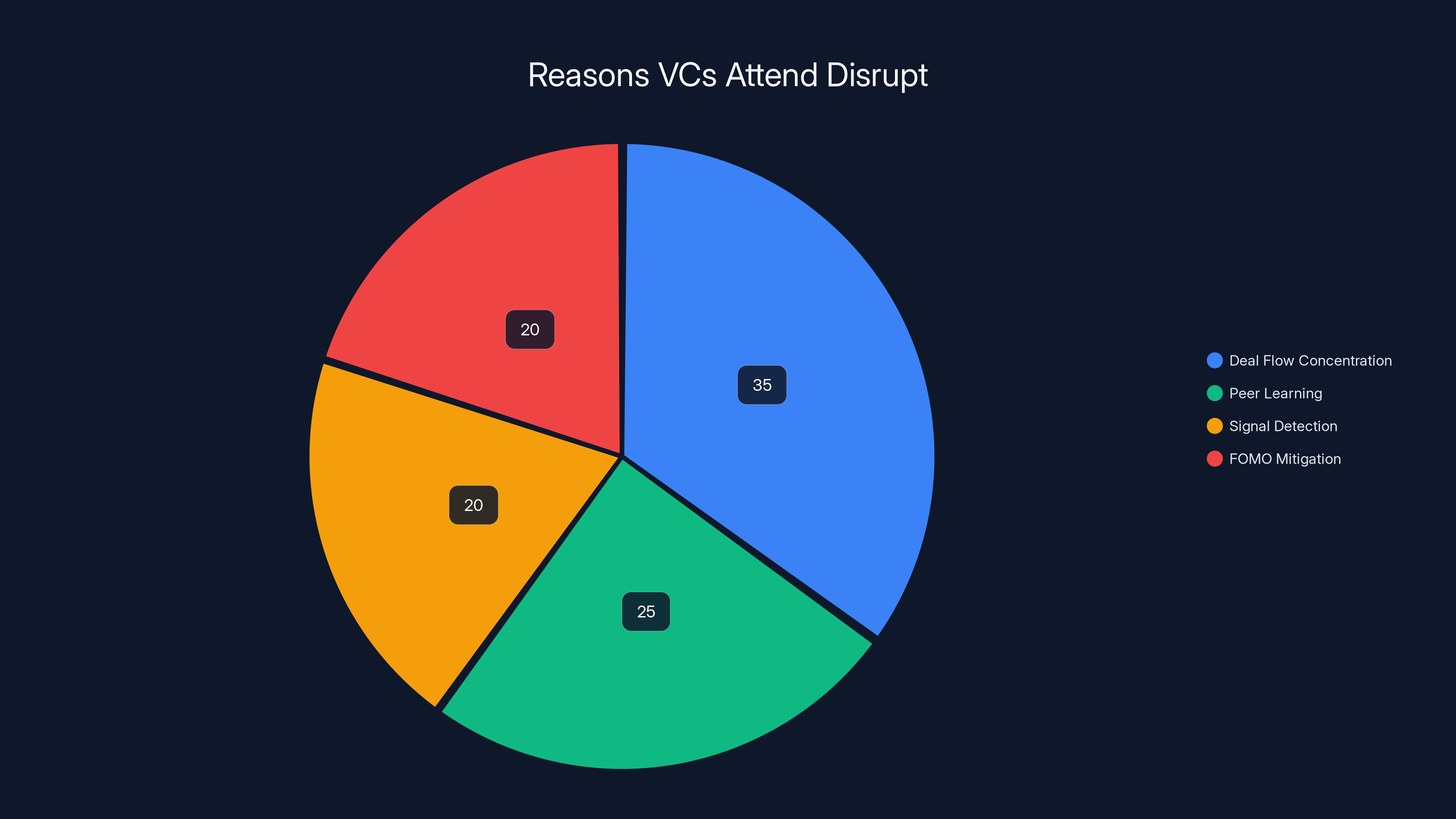

The Investor Perspective: Why VCs Show Up

Venture capitalists are busy. They're raising funds, managing their existing investments, sitting on boards, mentoring founders. Disrupt is a use of time. The question is whether that use of time makes sense.

The answer, for most VCs, is yes. But not for the reasons many people think.

VCs don't come to Disrupt expecting to write checks on the spot. That's not how venture capital works. Due diligence takes months. So that's not the value proposition.

What Disrupt offers investors is deal flow concentration. Normally, finding good companies takes months of networking, emails, Zoom calls, Linked In messaging. A VC might see 500 companies a year and fund five. At Disrupt, you can see 300 companies in three days. That's compression of the deal-sourcing funnel.

It also offers peer learning. VCs spend a lot of time with other VCs—in board meetings, at Limited Partner events, just networking. But Disrupt gives them a chance to learn from operators and founders at scale. A session on "How We Scaled to $100M Revenue" by someone who actually did it gives you patterns and anti-patterns.

There's also signal detection. What are founders excited about? What problems are they trying to solve? Which sectors are getting crowded? Which seem overlooked? Disrupt lets you see thousands of people thinking about similar problems, which gives you early signal on where the market is moving.

And then there's FOMO mitigation. If you don't go to Disrupt and a competitor VC finds the next great company there, that's an opportunity cost you're paying. By being in the room, you reduce that risk.

VCs also come to Disrupt to meet Limited Partners and fundraise for their own funds. If you're a partner at a venture fund, you might spend part of Disrupt talking to institutional investors who are considering committing to your fund. It's efficient networking for fund management.

For corporate venture teams at Microsoft, Google, Box, and others, Disrupt is even more valuable. They can identify acquisition targets, potential partners, new technologies worth learning about. A corporate development team can have conversations with dozens of founders working in their space in a single event.

The ROI on Disrupt attendance for a VC is hard to calculate because it's not linear. You might attend five years before a company you connected with at Disrupt actually becomes a significant investment. But the conversations matter. The signals matter. The relationships matter.

The Founder Advantage: Maximizing Your Three Days

If you're a founder, Disrupt is different. You're not there to passively consume content. You're there to actively create relationships, find investors, recruit talent, find co-founders, and understand your competitive landscape.

The strategy should start before you arrive. Know who you want to meet. Are there specific investors you want to have conversations with? Are there operators in your space who you could learn from? Are there potential acquirers? Disrupt's networking platform usually lets you search attendees ahead of time and request meetings.

The first day is for getting your bearings. You want to hit some sessions that matter to your business, but more importantly, you want to get into the flow of the conference. Who's around? Where are people hanging out? What's the vibe? Use the first day to calibrate.

Days two and three are execution. You have meetings scheduled. You pitch Battlefield if you're in it. You attend sessions that directly help your business. You have impromptu conversations in hallways and at networking events. You're looking for three types of people: (1) Potential investors or partners who can directly help your company, (2) Other founders or operators building similar things who can teach you patterns, (3) Potential customers or employees.

The +1 you bring should be strategic. If you're fundraising, bring your CTO or head of product. Someone who can have credible conversations about your technology and what you're building. If you're recruiting, bring someone passionate about your mission who can talk culture. If you're looking for customers, bring someone from your product or sales team.

The pitch is crucial if you're Battlefield. But even if you're not, you should have a 30-second, 2-minute, and 10-minute version of your pitch prepared. You'll meet hundreds of people, and many will ask what you're building. Being able to communicate clearly and compellingly at different time scales is a skill that matters.

Also, be honest. Disrupt is full of smart people. If you're pitching something you don't actually believe in, people will know. The founders who do well at Disrupt are ones who are genuinely excited about what they're building and can explain why they're excited without BS.

One last thing: take notes. You'll meet dozens of people. You'll learn dozens of things. A week after Disrupt, if you don't have notes, it all blurs together. Write down who you met, what you talked about, what the next step was. That follow-up is where the relationships actually deepen.

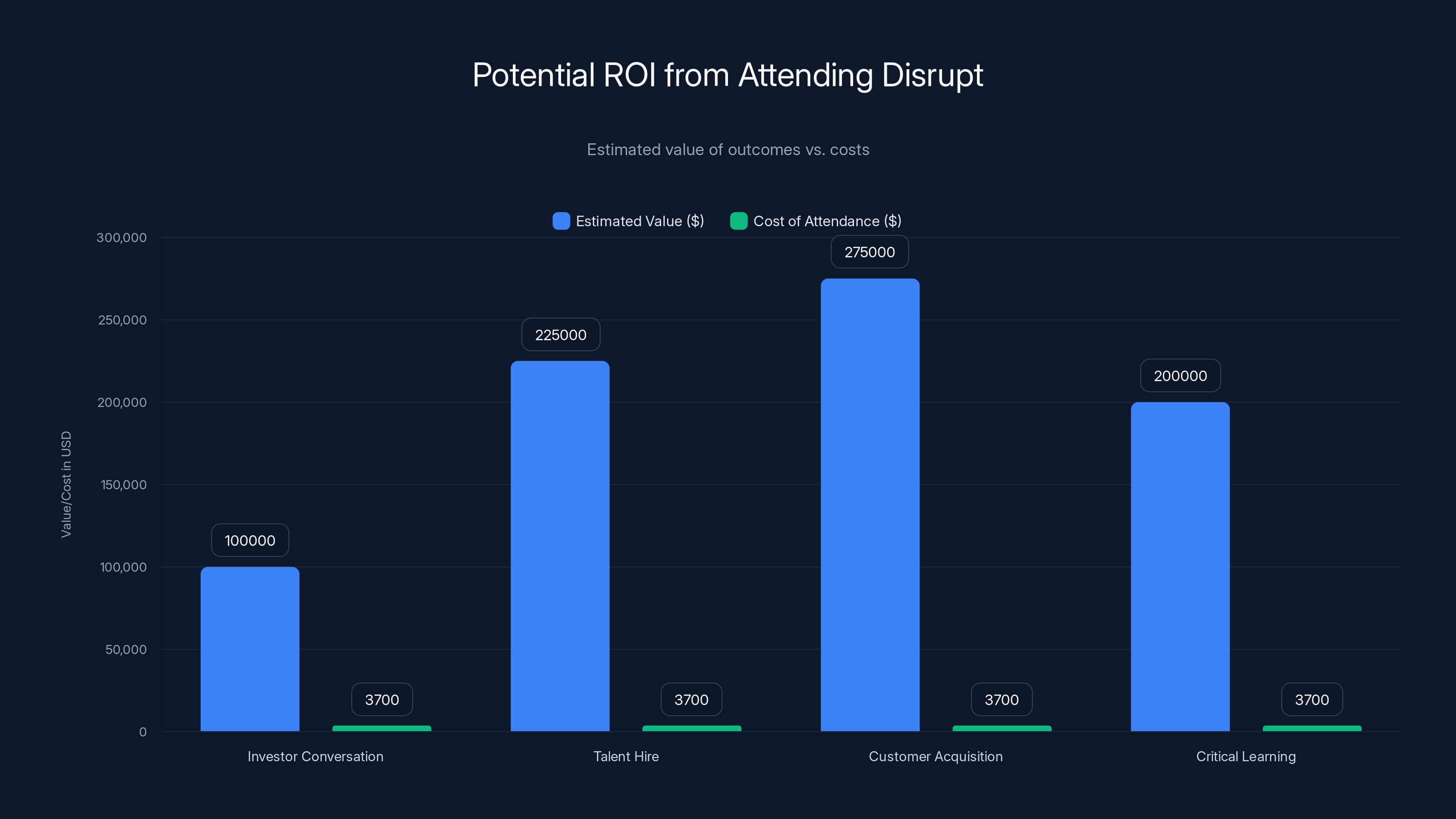

The potential ROI from attending Disrupt can significantly outweigh the costs, especially if key outcomes like investor conversations or talent hires are achieved. Estimated data.

The Operator Track: Learning from Scale

If you're not a founder and not an investor, the operator track at Disrupt is for you. This is where people building products, leading engineering teams, managing operations, and running go-to-market strategies share what they've learned.

The topics vary, but they're always practical. How do you scale your engineering organization without losing speed? How do you build a sales organization from scratch? How do you maintain engineering velocity while adding process and governance? These are real problems that operators hit.

What makes the operator track valuable is specificity. A CTO from Netflix isn't going to talk about generic engineering principles. They're going to talk about the specific problems they solved at Netflix's scale. That's useful because you can ask, "Does this apply to my company at our scale?" and get actual answers.

Operators also use Disrupt to find peers and mentors. One of the underrated parts of Disrupt is just talking to other people in your role. If you're a VP of Engineering, finding three other VPs of Engineering at Disrupt and spending time with them is worth the ticket price. You learn what they're struggling with. You get emotional validation that the problems you're facing are normal. You get ideas for how to solve them.

There's also talent recruitment. If you're scaling your team, Disrupt is a chance to meet potential hires. Engineers, designers, product managers, sales people. Not everyone at Disrupt is looking for a job, but many are. And the quality of people at Disrupt is high—they're the ones investing in their own professional development.

The networking is also less awkward for operators than for founders or investors. You're not trying to raise money or make an investment decision. You're just two people trying to build things better. That makes the conversation easier and often more genuine.

Why January 30 Deadline Matters (And It's Not Marketing)

Tech Crunch says the offer ends January 30, or when the first 500 registrations claim the 50% off +1 pass. Whichever comes first. Some people read this and think it's artificial scarcity—classic marketing tactic to force urgency.

There's some of that. Creating urgency does drive registrations. That's true.

But the 50% off +1 discount actually is limited to 500. There's a real business reason for that. Here's why:

Disrupt has a target capacity. The venue—Moscone West—holds about 10,000 people. That's the number they've built the conference around. The sessions, the networking space, the food, the infrastructure. If you add too many people, the experience degrades. You can't have enough networking space. The sessions get too crowded. Lines form for coffee.

So Disrupt caps attendance. That's not unusual for conferences. What Disrupt does differently is offer early-bird pricing to incentivize early registration. That way, they know the rough headcount early and can plan accordingly.

The 50% off +1 pass is a specific incentive. It's saying, "Register early and bring someone else at a discount." But they can't do that for everyone. If they offered 50% off +1 passes to everyone who registered, they'd blow past their capacity targets. So they cap it at 500.

Once those 500 are taken, the +1 goes back to regular pricing. That's not punishment—it's just the deal expiring. The main ticket is still cheaper if you registered early, but not as cheap.

So the January 30 deadline is real, but it's not fake. It's based on actual logistical constraints and pricing structures.

The question for you is: do you want to attend? Because if yes, registering now makes financial sense. If no, then the deadline doesn't matter. But if you're on the fence, the deadline might be the nudge that tips you over.

The primary motivation for VCs attending Disrupt is deal flow concentration, followed by peer learning, signal detection, and FOMO mitigation. (Estimated data)

Building Your Disrupt Agenda

Once you register, you get access to the full schedule. 250+ sessions across three days. The natural question is: how do I choose?

First, map out the sessions that matter to your specific situation. If you're a founder in AI, you want sessions on building AI products. If you're an investor focused on infrastructure, you want sessions on data infrastructure and Dev Ops. This should take maybe an hour. Block out your "must attend" sessions.

Second, leave 40% of your schedule open. Not unscheduled—that would waste time—but flexible. You might discover a session that sounds more interesting than what you planned. You might have an unexpected conversation with someone at lunch that leads somewhere important. You might realize partway through day one that you need to attend a different track. Having flexibility lets you pivot.

Third, build in break time. Disrupt is intense. You're meeting people, attending sessions, processing information. If you run back-to-back from 9 AM to 5 PM for three days, you'll burn out. Take a break in the afternoon. Get a coffee. Decompress for 20 minutes. You'll actually absorb more.

Fourth, use the evenings strategically. Disrupt has evening events—after-parties, networking dinners, special events. Some of these are valuable. Others are just crowded and loud. Go to the ones where the people you want to meet are likely to be. Skip the ones where it's just general networking.

Fifth, don't try to attend everything in your category. If there are five sessions on AI infrastructure and you can only attend two, that's okay. The ones you miss, you can usually watch recordings later. The networking time is the scarce resource, not the session content.

Also, plan your travel logistics. Moscone West is in San Francisco. Getting there is easy—airport is 20 minutes away. But parking is a nightmare. Stay somewhere walkable to the venue or use Uber/Lyft. Don't waste mental energy on transportation logistics during the conference.

The ROI Calculation: Is It Worth It?

Let's talk money. Early-bird Disrupt tickets range from

For a founder or early-stage employee at a startup, is that a good use of money?

Honestly, it depends. If you're pre-seed and bootstrapped, spending $2,000 on a conference is real money that could go to servers or hiring. That might not make sense.

If you're Series A or later, or if you're an employee at a funded startup and the company is paying, it usually makes sense. Here's the rough ROI calculation:

One quality investor conversation at Disrupt could lead to your Series A. That's worth

One quality talent hire you recruit at Disrupt is worth

One customer you land at Disrupt is worth whatever your customer lifetime value is. For B2B Saa S, that could be

One critical learning from a session or conversation that prevents you from making a mistake is worth whatever that mistake would have cost. If you avoid a $200K hiring mistake because you learned from someone at Disrupt, the trip paid for itself.

For investors, the ROI is similar. Finding one company at Disrupt that becomes a significant investment often returns the entire investment cost many times over.

For operators, the ROI is harder to calculate but real. A new hiring practice you learn about, a technical approach to a scaling problem, a connection with a peer you trust—these compound over your career. You might not see immediate ROI, but over five years, that peer network becomes incredibly valuable.

The early-bird pricing adds another layer. You're saving 30–40% by registering now instead of waiting. That's meaningful. If you're already planning to go, paying

The Disrupt conference is attended by a diverse group, with 30% being operators, 25% founders, 20% investors, 15% ecosystem roles, and 10% corporate development teams. Estimated data based on typical patterns.

Common Concerns and Honest Answers

Let's address some concerns people have about Disrupt:

"Won't it be too crowded?" Yes. 10,000 people in one venue is crowded. The hallways are packed during breaks. The main keynote is standing room only. Some sessions are so full people watch from the overflow room. But this is also why the networking works. You can't not meet people when you're shoulder-to-shoulder.

"Will I actually get value from sessions vs. just watching them later?" The sessions online will be the exact same content as in person. So if you just want the information, watching later is fine. The value of in-person is (1) live Q&A with speakers, (2) Running into someone in the hallway between sessions and having a conversation that changes your thinking, (3) The energy and momentum of being in a room with 10,000 smart people.

"What if I don't know anyone and it's awkward?" It's a conference designed for people to meet. There are explicit networking events, the sessions encourage conversation, and the people there generally want to meet other people. Talk to the person next to you. That's the whole point.

"What if the schedule conflicts with something important at my company?" October 13–15, 2026. If your company can't spare you for three days, that's a company culture problem you might want to solve. Most companies can handle three days without you if you plan it right. Hand off your critical stuff. Set up an on-call deputy. Check in once a day. You'll be fine.

"Is the 50% off +1 pass actually a good deal?" Yes. You're getting a full conference experience for someone at 50% off. That's a discount you don't normally see for conferences. And their experience is equal to your experience—they get access to all sessions, all networking, everything. It's not a "lite" version.

The January 30 Window: Why Act Now

Let's be specific about what's happening between now and January 30.

People are deciding. Some are thinking, "Yeah, I should probably go." Others are thinking, "This sounds interesting but I'm not sure." Others have already decided but haven't registered yet.

The people who register by January 30 get the best pricing. After January 30, anyone who registers pays more. It's that simple. There's no penalty for registering. There's a reward for registering early.

For the +1 discount specifically, only 500 slots. Based on typical registration patterns, those 500 might fill in the next few days or might last until January 29. You can't predict it. But the risk is: what if you wait until February 5 to register, you want to bring a +1, and the discounted slots are gone? Then you're paying full price for that second ticket.

So the January 30 deadline is a forcing function. It makes you decide: am I going or not? If yes, register. If not, no problem. But don't wait to decide.

Beyond the Ticket: Preparing for October

Once you register, the real work starts. You've got nine months between now (late January) and the conference (mid-October).

First, block the dates. October 13–15 on your calendar. Tell your team now. That gives them time to adjust and plan around your absence.

Second, if you have specific goals for Disrupt, write them down. What do you want to get out of three days? Three investor conversations? Find a new co-founder? Learn about a specific technology? Understand how competitors are solving a problem? Write it down. Vague goals lead to vague outcomes.

Third, as you get closer to October, start scoping the schedule. Disrupt usually releases the full speaker lineup and session schedule in July or August. Start building your must-attend list then.

Fourth, identify people you want to meet. Other founders in your space? Investors on your target list? Specific operators or thought leaders? Reach out 2–3 weeks before the conference. "I'm going to be at Disrupt in October. Would love to grab coffee." Most people will say yes.

Fifth, prepare your pitch. Not just for Battlefield if you're in it, but your general pitch. What are you building? Why? Why now? Why you? Practice it. Get it tight. You should be able to say it in your sleep.

Sixth, set up your Disrupt profile with a photo and bio that represents you well. People might check you out before meeting you. Make a good first impression.

Last, arrange logistics. Book your hotel in San Francisco soon. Flights fill up. Even though it's nine months away, getting those booked gives you peace of mind and usually lower prices.

The Broader Context: Why This Matters in 2026

Tech Crunch Disrupt has been happening since 2007. It's been through booms, busts, recessions, and paradigm shifts. The conference survives and thrives because it solves a fundamental problem: the gap between understanding what's happening in tech and actually meeting the people making it happen.

In 2026, that gap is more important than ever. Technology is moving fast. AI is reshaping every industry. Startup formation is accelerating and decelerating in waves. Capital markets are complex. Regulation is evolving. Staying current isn't optional if you're a serious person in tech.

Disrupt is one of the ways you do that. Three days. 10,000 people. 250+ sessions. Hundreds of startups. The future of tech, compressed into a conference.

The early-bird pricing is the entry point. The network you build is the real value. The learning is secondary to the relationships. That's what makes Disrupt work.

FAQ

What is Tech Crunch Disrupt and who should attend?

Tech Crunch Disrupt is an annual technology conference held in San Francisco that brings together 10,000 founders, investors, operators, and tech leaders for three days of sessions, networking, and startup pitches. Founders should attend to meet investors and other founders, venture capitalists attend for deal sourcing and peer learning, operators attend to learn scaling best practices, and anyone working in tech benefits from the speaker lineup and industry insights.

How much are Tech Crunch Disrupt 2026 tickets and what's included in the early-bird pricing?

Early-bird ticket prices range from

When does the early-bird discount and 50% off +1 offer expire?

The early-bird pricing ends on January 30, 2026, or when the first 500 registrations claim the 50% off +1 pass—whichever comes first. This is a real deadline with genuine capacity constraints, not just marketing. Once the date passes or the 500 discounted +1 slots are filled, regular pricing takes effect, which is 30–40% higher.

What is Startup Battlefield 200 and can I attend without pitching?

Startup Battlefield 200 is Disrupt's signature pitch competition where 300 early-stage startups present their companies over three days. The pitches are live in front of investors, industry peers, and journalists. You don't need to pitch to attend—all Disrupt passes include access to watch the pitches. However, if you're a startup founder interested in pitching, applications are separate from ticket registration and have their own deadline.

What's the difference between Founder Pass, Investor Pass, and General Pass?

The Founder Pass is designed for startup founders and includes access to founder-specific networking, mentorship opportunities, and curated investor meetings at early-bird pricing around

Is the 50% off +1 pass worth it and should I bring someone?

Yes, the 50% off +1 discount is a real deal that brings the second ticket to roughly

What's the actual ROI of attending Tech Crunch Disrupt?

The ROI depends on your role. For founders, one quality investor conversation or one hired talent recruit found at Disrupt often pays back the entire trip cost many times over. For investors, finding one company that becomes a significant investment return justifies attendance. For operators, the ROI comes from learning scaling practices, avoiding mistakes through peer conversations, and building a network that compounds over time. Save the $680 in ticket discounts and calculate whether one meaningful connection or learning is worth your time and travel costs.

When and where is Tech Crunch Disrupt 2026 held?

Tech Crunch Disrupt 2026 takes place October 13–15 at San Francisco's Moscone West. The venue is central in San Francisco, easily accessible from the airport (20 minutes), and located in an area with abundant hotels and restaurants. Plan to arrive October 12 to settle in, and stay through October 16 for full participation and follow-up conversations.

How many sessions and speakers are at Tech Crunch Disrupt?

Disrupt features 250+ sessions with 250+ speakers across three days. Sessions include keynotes, deep-dive sessions lasting 45 minutes, panel discussions with multiple experts, and fireside chats. Topics range from fundraising and product strategy to AI, infrastructure, recruiting, M&A, and emerging technologies. The schedule is released in July/August, so you can plan ahead rather than deciding day-of what to attend.

Should I book travel now or wait until the schedule is released?

Book your hotel and flights soon, even though the conference is nine months away. San Francisco hotels fill up for Disrupt, and airfare is often cheaper when booked in advance. Once you register and the schedule releases in mid-year, you can adjust details. But getting your accommodations locked down early eliminates logistics stress and usually saves money on flights and hotels.

What should I do to prepare for Tech Crunch Disrupt after registering?

After registering, block October 13–15 on your calendar and inform your team now. Write down your specific goals for the three days—what connections do you want, what do you want to learn, what opportunities are you looking for? As you get closer, identify specific people you want to meet and reach out 2–3 weeks before the conference. Prepare a tight 30-second and 2-minute version of your pitch. Set up a professional Disrupt profile. Finally, arrange logistics like hotels and flights as soon as the schedule is released to avoid last-minute stress.

Key Takeaways

- Early-bird TechCrunch Disrupt 2026 tickets save up to $680, and the first 500 registrations get 50% off a second ticket—both offers expire January 30.

- Disrupt attracts 10,000 attendees including founders, VCs, operators, and industry leaders across 250+ sessions and 300 Startup Battlefield companies.

- ROI is significant for founders (investor meetings, talent recruitment), investors (deal sourcing concentration), and operators (learning scaling practices and peer networks).

- The January 30 deadline is real due to venue capacity limits and pricing structure, not just marketing hype.

- Preparation matters: identify specific goals, map your session schedule in July, reach out to people you want to meet 2-3 weeks before, and prepare a tight pitch.

Related Articles

- Startup Battlefield 200 2026: Complete Guide for Founders [2025]

- Inferact's 800M Startup [2026]

- LiveKit Hits $1B Valuation: Voice AI Infrastructure Boom [2026]

- Startup Battlefield 2025: Glīd Founder Kevin Damoa's Winning Strategy [2025]

- Wellness Fund Boom: Inside Jenny Liu's $5M Venture Play [2025]

- General Fusion's $1B SPAC Merger: Fusion Power's Survival Strategy [2025]

![TechCrunch Disrupt 2026: Save $680 + 50% Off +1 Tickets [2026]](https://tryrunable.com/blog/techcrunch-disrupt-2026-save-680-50-off-1-tickets-2026/image-1-1769182843035.jpg)