Tesla's Historic Shift to Subscription-Only Full Self-Driving: What It Means for the Industry

In January 2026, Tesla made a watershed decision that fundamentally restructures how customers access its Full Self-Driving (Supervised) capability. CEO Elon Musk announced that the company would discontinue the one-time purchase option for FSD, effective February 14, 2026, forcing all future access through monthly subscriptions priced at $99. This represents one of the most significant strategic pivots in Tesla's product history, signaling a deliberate shift from a hardware-centric revenue model to a recurring subscription framework as reported by Electrek.

The implications of this decision extend far beyond Tesla's balance sheet. For nearly a decade, the company promoted Full Self-Driving as the ultimate selling point—customers were purchasing vehicles with "all the hardware required" for complete autonomy, needing only software updates to unlock full capabilities. That narrative underpinned marketing campaigns, justified premium pricing, and shaped customer expectations. Now, by removing the purchase option entirely, Tesla is fundamentally reframing the relationship between customer and capability as noted by Bloomberg.

This transformation occurs at a critical juncture. Tesla faces mounting legal pressure regarding deceptive marketing claims about FSD's autonomy capabilities, declining adoption rates that hover at just 12% of the customer base, and intensifying competition from global automakers developing their own autonomous systems according to Business Insider. Simultaneously, Musk's $1 trillion compensation package contains specific performance metrics requiring 10 million active FSD subscriptions, creating direct financial incentives for this strategic shift as detailed by Investors.com.

The subscription-only model represents Tesla's answer to three interconnected challenges: the need to boost adoption through lower financial barriers, the requirement to demonstrate recurring revenue growth to satisfy compensation benchmarks, and the opportunity to reduce legal exposure by capping potential liabilities in ongoing class action lawsuits as highlighted by Sherwood News. Understanding this shift requires examining Tesla's historical pricing strategy, the competitive landscape transformation, regulatory pressures, and what this means for consumers, investors, and the broader autonomous driving industry.

Understanding Tesla's Full Self-Driving: Product Evolution and Technical Reality

What FSD (Supervised) Actually Delivers

Full Self-Driving (Supervised) is fundamentally a Level 2+ advanced driver assistance system, not true autonomy. Despite its aspirational name, the system requires continuous human supervision, hands on the wheel, and driver readiness to intervene. Tesla's own regulatory filings, detailed in safety reports submitted to the National Highway Traffic Safety Administration (NHTSA), explicitly confirm that the system cannot operate autonomously without human oversight as reported by The Verge.

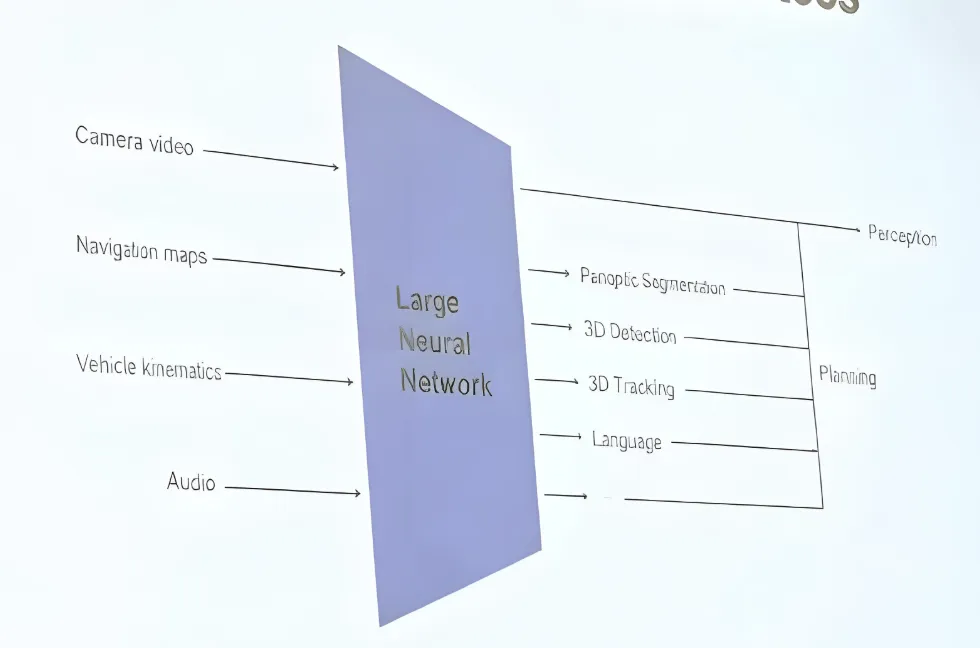

The "Supervised" designation, added in 2023, was Tesla's response to mounting criticism about misleading terminology. The system performs continuous improvement in lane-keeping, automatic lane changes, traffic-aware cruise control, and navigation on city streets. It uses a combination of eight cameras, radar, and ultrasonic sensors, processing data through Tesla's custom-built neural networks trained on billions of miles of real-world driving data as noted by MotorTrend. However, the technical architecture still relies on human intervention for complex scenarios including unprotected left turns, heavy traffic navigation, construction zones, and emergency situations.

In practical deployment, FSD (Supervised) works effectively on highway systems and familiar suburban routes but struggles with novel scenarios, unusual road configurations, and edge cases—situations that occur regularly in real-world driving. Industry analysts estimate that true autonomy across all conditions requires solving an additional 80-90% of the technical problem space beyond current capabilities according to TipRanks. This gap between capability and marketing narrative has become the core of Tesla's legal troubles.

Evolution from Hardware Premium to Recurring Revenue

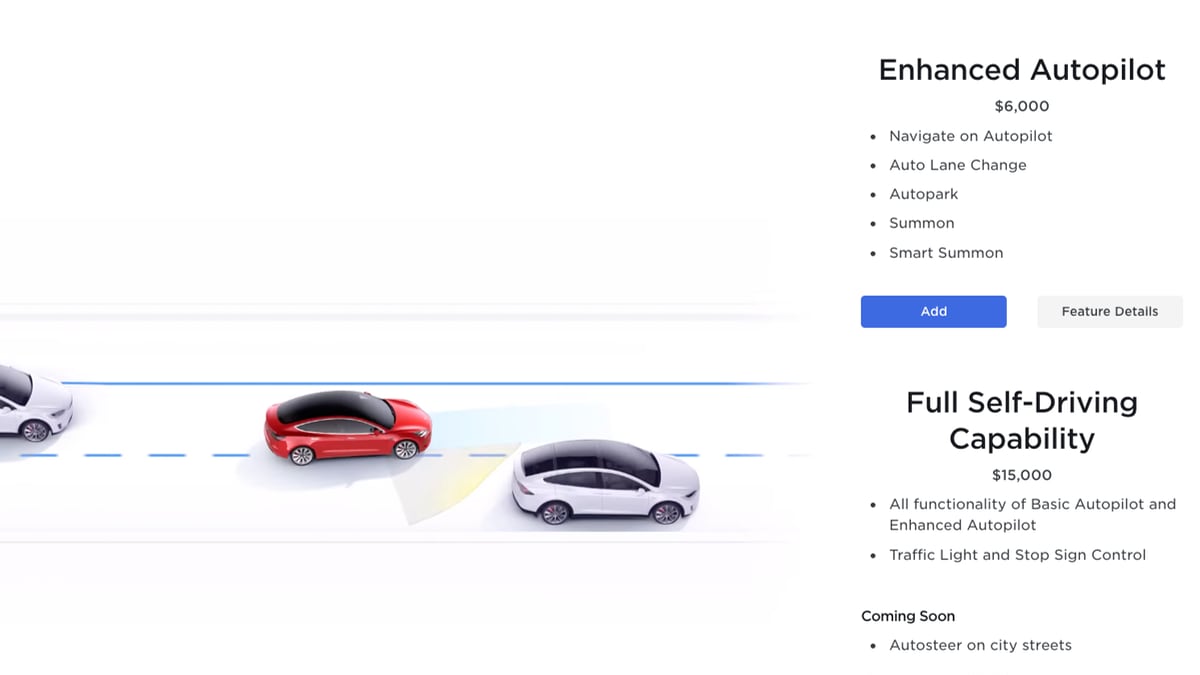

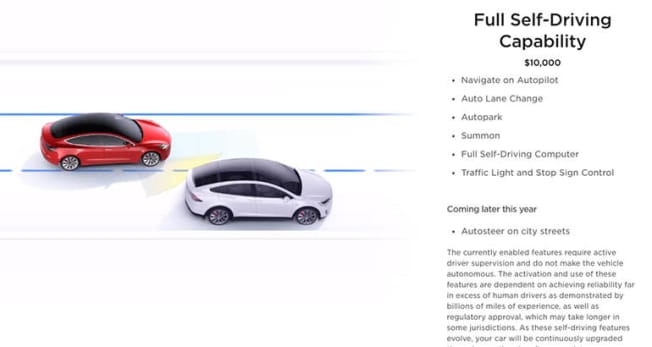

Tesla's pricing strategy for FSD reveals a company wrestling with its own business model. The company initially offered FSD as a one-time purchase option starting in 2016, initially priced at

Simultaneously, Tesla launched a $199-monthly subscription option in 2021, offering a way to experience FSD without large upfront capital commitment. This dual-track approach created a fundamental tension in Tesla's strategy: who should pay more, and when? The company's public statements encouraged one-time purchases, with Musk frequently claiming that FSD capabilities would expand dramatically, making deferred purchases economically irrational. Yet adoption of the one-time purchase remained comparatively low.

In 2024, Tesla made its first significant pricing adjustment, reducing the subscription from

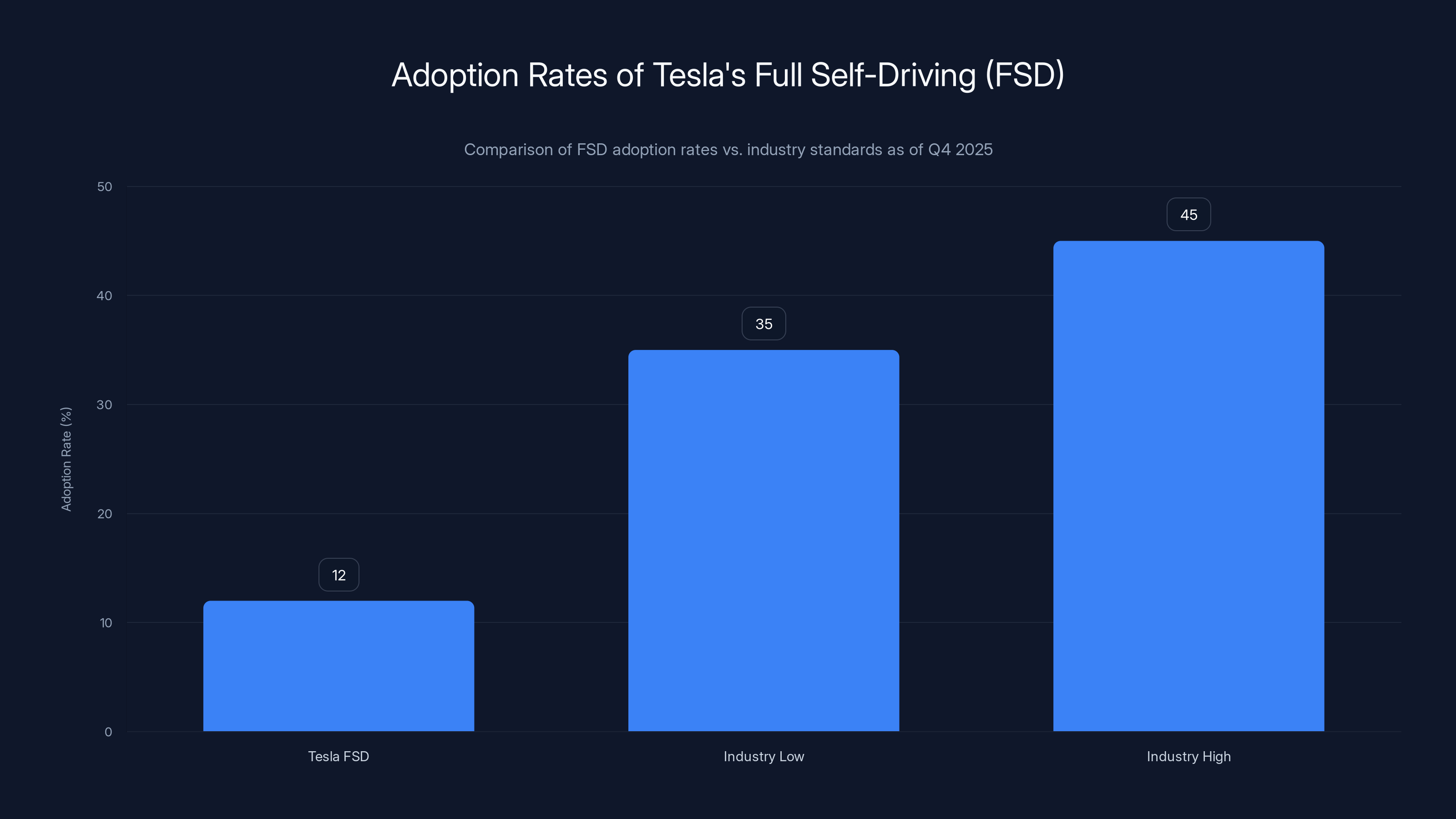

Tesla's FSD adoption rate of 12% is significantly lower than the industry standard of 35-45% for driver assistance features, indicating potential for growth.

The Business Case: Why Tesla Changed Course on FSD Pricing

Low Adoption Rates and Market Penetration Challenges

Tesla's own CFO publicly disclosed what had become an industry-wide concern: only 12% of Tesla customers had purchased or subscribed to Full Self-Driving as of Q4 2025. This figure, revealed by CFO Vaibhav Taneja in October 2025, represented a stunning lack of adoption for a feature Tesla had positioned as the primary justification for vehicle premiums. For context, industry research on driver assistance features suggests that systems marketed effectively typically achieve 35-45% adoption among capable vehicle owners within two years of release as noted by MotorTrend.

The 12% adoption rate meant that 88% of Tesla's customer base had declined to purchase FSD—either rejecting the value proposition entirely, deferring decision-making indefinitely, or waiting for lower prices. From a pure business perspective, this represented massive unrealized revenue from Tesla's installed base. If Tesla could convert adoption from 12% to even 25%, the recurring revenue opportunity would be enormous: at

The subscription-only model directly addresses this adoption barrier by reducing the psychological friction of a major purchase decision. Research in behavioral economics shows that recurring charges of

Musk's $1 Trillion Pay Package and FSD Subscription Targets

The timing of Tesla's subscription-only shift cannot be divorced from Elon Musk's extraordinary compensation package. In 2023, Tesla's board approved a $1 trillion performance-based pay package for Musk, conditionally vesting as the company achieves specific business milestones. Among the 12 key product goals embedded in this package: reaching 10 million active Full Self-Driving subscriptions, measured as daily averages over three-month periods, by late 2035 as reported by NJ Law Journal.

At first glance, this target might seem achievable—Tesla operates globally and has over 6 million vehicles on roads. However, the metric includes a specific technical definition: "daily active subscriptions," not total subscriptions sold. This distinction is critical because it counts only customers who maintain continuous subscriptions and actively use FSD regularly. Churn rates matter significantly. Industry benchmarks for automotive software subscriptions suggest 15-25% annual churn, meaning Tesla must achieve substantially higher than 10 million total subscriptions to maintain 10 million daily active users.

The subscription-only model directly helps Tesla achieve this milestone because:

- Reduced acquisition friction increases initial conversion rates

- Recurring revenue models naturally align with active usage metrics—inactive subscribers cancel, while engaged users maintain subscriptions

- Elimination of one-time purchases prevents customers from believing they've already "bought" FSD and need not subscribe

- **Subscription pricing at 8,000-$15,000 upfront and expected permanent access

Musk's compensation package effectively creates a personal financial incentive for this strategic shift, worth billions in contingent compensation if Tesla achieves the FSD subscription targets.

Legal Risk Mitigation and Deceptive Advertising Claims

Beyond adoption and compensation mechanics, Tesla faces existential legal risks stemming from years of promotional claims about FSD's capabilities. In December 2025, a California court ruled that Tesla engaged in deceptive marketing regarding FSD and its less-capable Autopilot system. The judgment required the California DMV to suspend Tesla's manufacturing and dealer licenses in the state for 30 days, though the DMV stayed this order pending Tesla's response as reported by WTVBAM.

Tesla's required remedial action: either rename the products to eliminate autonomy-suggesting terminology, or ship software delivering on the autonomy promises. Neither option is currently feasible. The software required for true autonomy remains years away, and renaming the product after years of "Full Self-Driving" branding would represent corporate capitulation.

Multiple class action lawsuits are pending against Tesla, alleging that customers purchased FSD believing they were acquiring vehicles that would eventually become fully autonomous. These lawsuits seek damages potentially in the billions of dollars if juries conclude that customers were defrauded. The one-time purchase model creates a permanent liability: every customer who paid

By shifting to subscription-only, Tesla fundamentally alters the liability picture. Subscription purchases can be framed as temporary, conditional access rather than ownership of a feature guaranteed to eventually work. The ongoing subscription relationship reduces the reasonable expectation that the company must eventually deliver full autonomy—customers can simply cancel if dissatisfied. This is classic risk management: Tesla can cap its maximum liability by converting permanent purchase obligations into temporary service relationships.

Legal analysts have noted that this shift, whether intentional or not, substantially reduces the company's exposure in ongoing litigation while maintaining its defensive position in regulatory disputes.

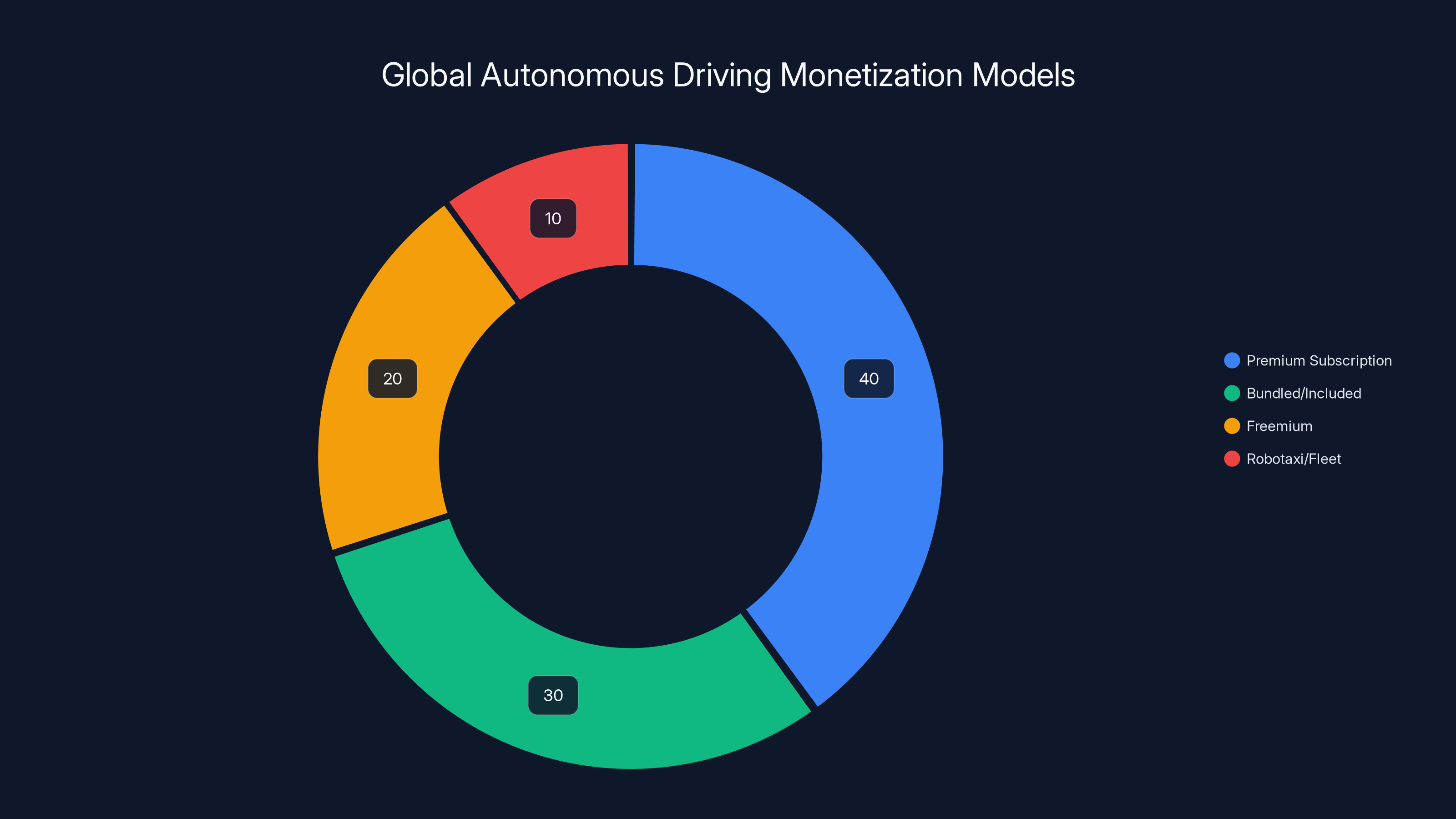

Estimated data shows that premium subscription models dominate in North America and Europe, while bundled models are prevalent in China/Asia. Freemium and robotaxi models have limited adoption.

Pricing Architecture: Understanding the Subscription Model Economics

Comparing the Old One-Time Purchase to the New Subscription Model

Tesla's pricing transition creates complex economics for different customer profiles. Understanding these differences illuminates why Tesla prioritizes subscriptions despite potential customer resistance.

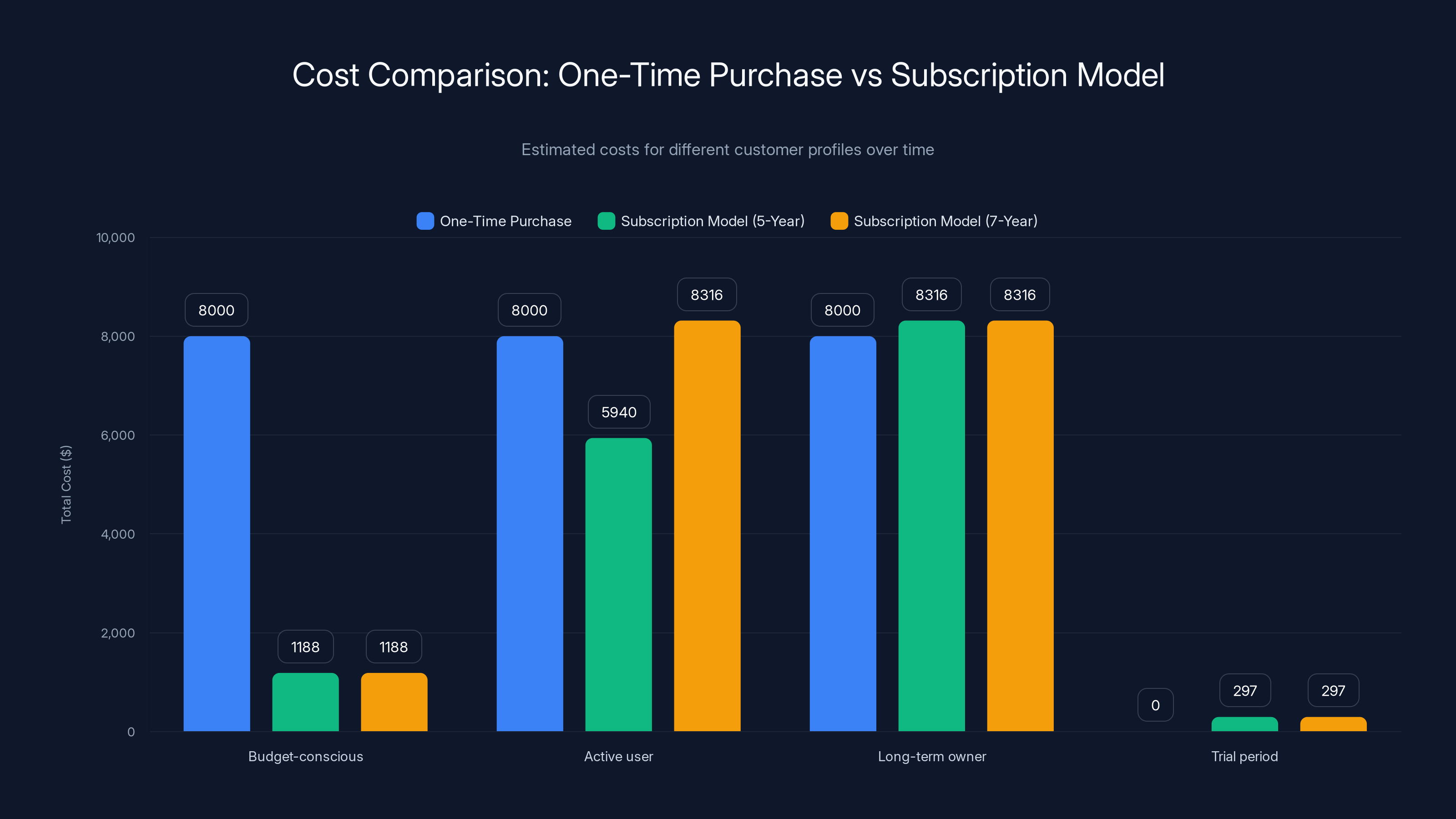

| Customer Profile | One-Time Purchase (Historical) | Subscription Model (Current) | 5-Year Total Cost | 7-Year Total Cost |

|---|---|---|---|---|

| Budget-conscious (one year use) | $8,000 | $1,188 | $1,188 | $1,188 |

| Active user (3-year commitment) | $8,000 | $3,564 | $5,940 | $8,316 |

| Long-term owner (7+ years) | $8,000 | $8,316+ | $8,316+ | $8,316+ |

| Trial period (3 months) | Not available | $297 | $297 | $297 |

This economic reality reveals Tesla's strategy. The subscription model:

- Reduces initial purchase friction by 87% (8,000 upfront)

- Extends revenue collection across vehicle ownership duration

- Reduces per-month commitment psychology ("only 8,000")

- Enables trial periods that convert trial users to long-term subscribers

- Creates flexibility for users to pause during low-use periods

Tesla's

Comparison with Competitor Pricing Models

Tesla's shift toward subscription-only aligns with broader industry trends in autonomous driving monetization. However, competitors employ different pricing strategies reflecting their market positions and regulatory constraints.

General Motors' Super Cruise (Now Ultra Cruise): GM initially charged

Ford's Blue Cruise: Ford positioned Blue Cruise as a subscription feature (

Rivian's Hands-Free Drive: Rivian has emphasized including hands-free capabilities with vehicle purchase rather than charging separately, positioning this as a differentiator against Tesla's subscription requirement. This strategy directly challenges Tesla's shift by advertising included autonomous features as purchase value as detailed by MotorTrend.

Chinese Competitors (Li Auto, NIO, XPeng): Chinese automakers frequently include autonomous driving features standard with vehicle purchase, subsidizing costs through government incentives and lower labor expenses. These competitors are racing to make autonomy a standard feature rather than premium add-on, directly countering Tesla's subscription approach as noted by WebProNews.

Tesla's subscription-only model sits at the aggressive end of the pricing spectrum, assuming high value perception and strong customer retention to justify ongoing payments. Competitors are hedging, maintaining purchase options while expanding subscriptions—a more conservative approach that preserves customer choice while capturing recurring revenue.

Adoption Projections: Can Tesla Reach 10 Million Daily Active Subscriptions?

Mathematical Model for Subscription Growth Targets

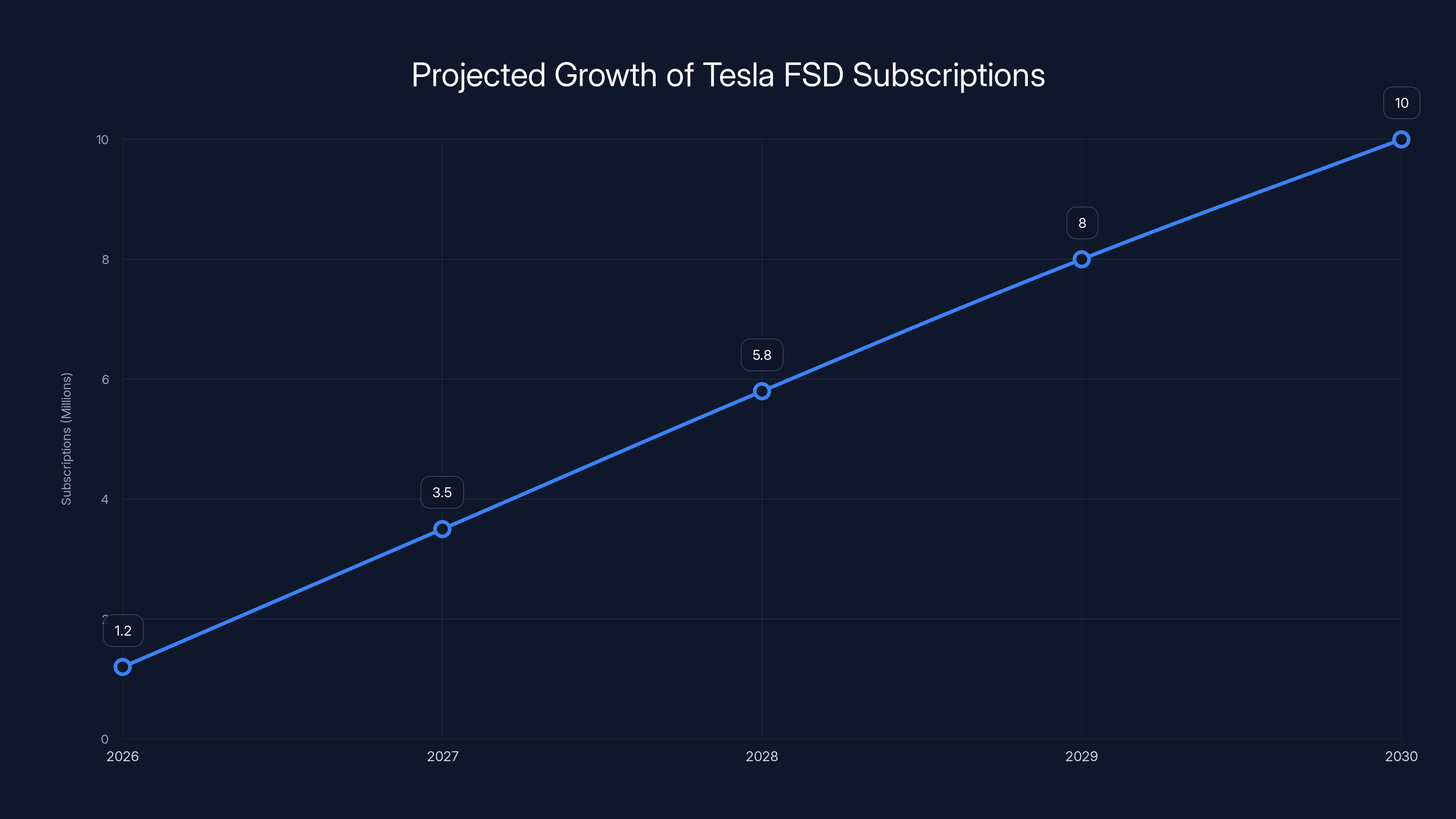

Tesla's 10 million daily active subscriptions target by late 2035 requires examining compound growth rates and churn dynamics. Current state (January 2026): approximately 960,000 FSD subscriptions globally (12% of 8 million Tesla vehicles). Target state (late 2035): 10 million daily active subscriptions.

This represents a 10.4x growth requirement over 9.75 years. The mathematical challenge:

Where the required annual growth rate

A 24% annual growth rate is aggressive but theoretically achievable for a high-demand Saa S product—it sits between typical B2B Saa S growth (35-50% annually for fast-growing companies) and legacy automotive feature adoption (10-15%). However, this model assumes several unrealistic conditions:

- Tesla vehicle production growth sufficient to justify 24% FSD subscription expansion

- Stable churn rates that don't increase as subscriber base grows

- No competitive erosion from alternative autonomous systems

- Continued customer confidence in Tesla's FSD despite regulatory pressures

These assumptions face significant headwinds. Tesla's vehicle production has plateaued in developed markets, growing only in developing regions where FSD adoption rates historically remain low due to price sensitivity and infrastructure limitations. Churn risk increases as subscription bases grow—early adopters have higher retention than mainstream customers. Competitive pressure from established automakers will intensify throughout the 2026-2035 period.

Scenario Analysis for FSD Adoption

Tesla's path to 10 million daily active subscriptions admits multiple trajectories, each with distinct probabilities:

Scenario A: Accelerated Adoption (25% probability)

- Subscription-only model immediately boosts adoption from 12% to 25% by end of 2026

- Improved autonomous capabilities drive adoption to 40% by 2028

- Strong brand preference and regulatory benefits position Tesla for 60% penetration by 2030

- Result: Exceeds 10 million target by 2032

- Probability modifier: Depends on technical breakthroughs and sustained regulatory advantage

Scenario B: Gradual Expansion (45% probability)

- Subscription adoption grows 12-18% annually through 2026-2030

- Market saturation begins 2028-2030 as competitors' solutions mature

- Tesla captures 35-45% of addressable market by 2035

- Result: Reaches 8.5-9.5 million subscriptions (short of target)

- Probability modifier: Most consistent with historical feature adoption patterns and competitive dynamics

Scenario C: Stagnation and Competition (30% probability)

- Competitive alternatives (from GM, Ford, Rivian, Chinese automakers) limit Tesla adoption growth to 5-8% annually

- Customer dissatisfaction with subscription-only model generates churn

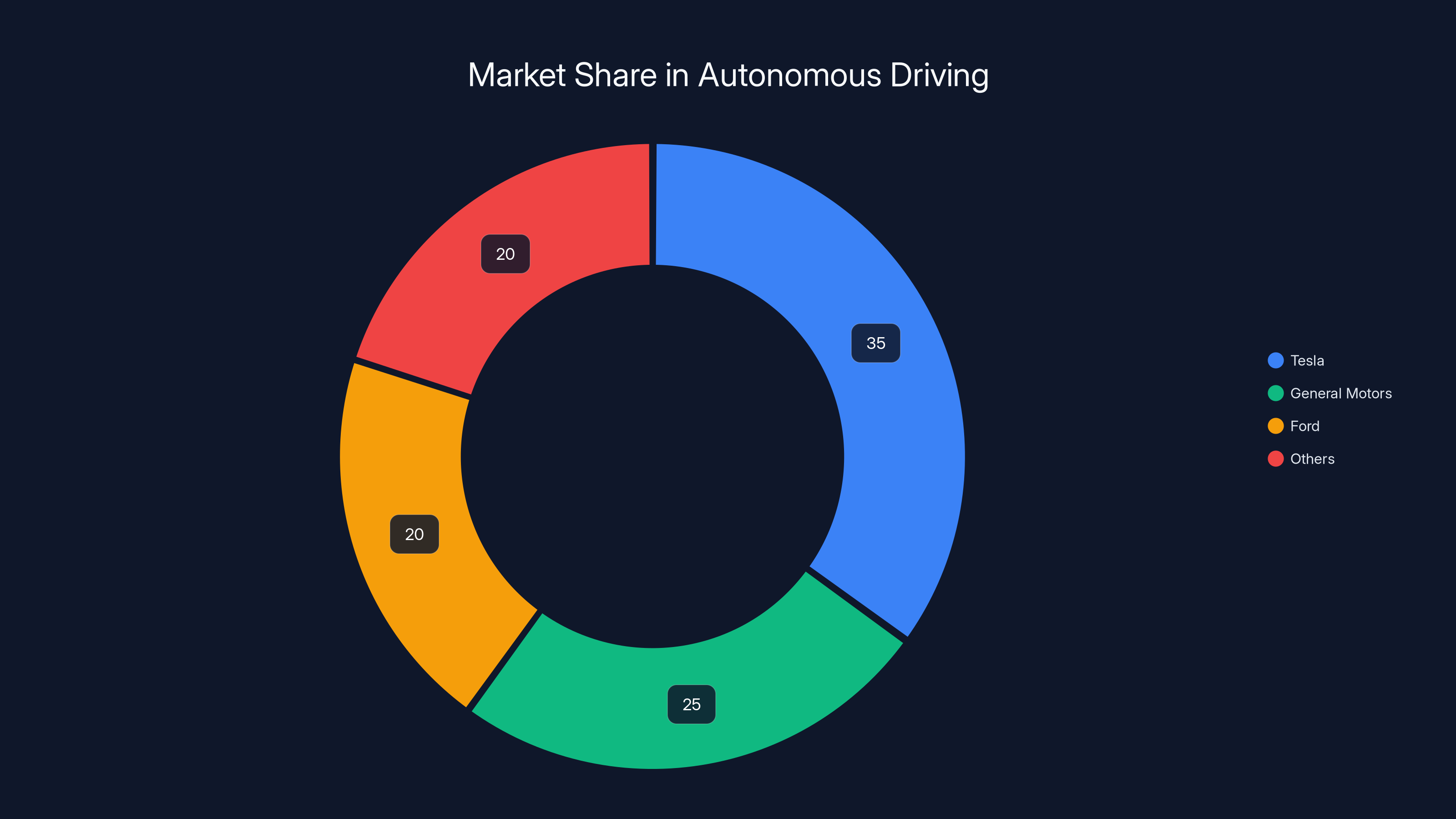

- Tesla market share erodes from 80% autonomous systems share to 50% by 2030

- Result: Reaches 5-7 million subscriptions, missing target significantly

- Probability modifier: Reflects realistic competitive response and customer backlash risks

Based on these scenarios, probability-weighted expected subscriptions by late 2035 approximate 8.2 million—slightly below the 10 million target, suggesting Tesla will require either accelerated technology development, significant production growth, or favorable regulatory changes to achieve compensation milestones.

The subscription model offers a lower initial cost and flexibility, with long-term costs comparable to one-time purchases for extended use. Estimated data.

Competitive Response: How Tesla's Shift Reshapes the Autonomous Driving Market

General Motors' Strategic Positioning

General Motors, commanding 16% U. S. market share through Chevrolet, GMC, Cadillac, and Buick brands, faces strategic pressure from Tesla's subscription-only pivot. GM's Super Cruise (rebranded Ultra Cruise in 2024) represents GM's response to FSD, offering highway hands-free driving with human supervision. GM invested heavily in mapping infrastructure for Super Cruise, currently available on over 300,000 miles of North American highways as noted by Bloomberg.

GM's critical decision point: matching Tesla's subscription-only model or maintaining a hybrid approach. Current evidence suggests GM is hedging. The company continues offering Super Cruise through multiple channels: included in some trim levels, available as a paid upgrade during purchase, or available through subscription for non-equipped vehicles. This optionality preserves customer choice while competing with Tesla's aggressive subscription-only requirement.

GM's advantage lies in manufacturing scale and dealer relationships. GM sells over 7 million vehicles annually globally, compared to Tesla's 1.8 million. Integrating autonomous features into standard vehicle packages, then monetizing through subscriptions, provides GM flexibility that Tesla, with smaller production volume, cannot match. GM can absorb autonomous feature costs into premium vehicle pricing while still capturing subscription revenue—a strategy Tesla cannot pursue given FSD's narrow margins.

Ford's Tiered Capability Approach

Ford's Blue Cruise strategy differs fundamentally from Tesla's "one supreme capability" approach. Ford has adopted a tiered model with multiple autonomous feature levels, each priced distinctly. Entry-level Intelligent Driver Assist (

This tiered approach addresses price sensitivity across customer segments. Budget-conscious consumers opt for entry-level capabilities at

Ford's manufacturing challenge differs from GM's. Ford produces approximately 4 million vehicles annually and is rapidly expanding electric vehicle production, which consumes capital and engineering resources competing with autonomous system development. Ford's partnership with Alphabet's Waymo for autonomous taxi operations suggests Ford is hedging autonomous driving risk—investing in autonomy without requiring proprietary in-house solutions, mitigating technical and financial exposure.

Rivian's Differentiation Through Included Features

Rivian, Tesla's nearest competitor in the premium electric vehicle segment, explicitly positioned hands-free driving as included with vehicle purchase rather than a paid add-on. Rivian's "Adventure Network" marketing emphasizes autonomous capabilities as built-in safety features rather than premium upgrades. This positioning directly challenges Tesla's subscription model by highlighting what Rivian considers an unfair extraction of additional value from features customers have already purchased through vehicle acquisition.

Rivian's strategy only works with positive cash flow and strong vehicle margins—Rivian must absorb autonomous driving development costs into vehicle pricing. Rivian's current cash position and pathway to profitability remain constrained (the company reported

However, Rivian's approach demonstrates market vulnerability in Tesla's subscription-only model: if competitors can include autonomous features in vehicle pricing and still achieve acceptable margins, Tesla's subscription requirement will face increasing customer resentment, particularly among buyers who consider autonomous driving a basic vehicle feature rather than a premium service.

Chinese Automakers' Aggressive Competition

Chinese automakers—particularly XPeng, Li Auto, and NIO—have accelerated autonomous driving development with aggressive feature inclusion policies. These companies frequently bundle advanced driver assistance systems standard with vehicle purchase, subsidized through government incentives for electric vehicle adoption and lower labor costs in manufacturing.

XPeng's XPilot 3.5 and planned 4.0 versions include highway autonomous driving features standard across vehicle lineup, available in markets including China and Singapore. NIO's Autonomous Driving (NDA) bundle includes navigation autonomy across supported regions. Li Auto's flagship models include advanced autonomous capabilities standard.

This approach creates significant competitive pressure on Tesla's subscription-only model. For consumers in markets where Chinese automakers operate (Asia represents 58% of global EV sales), paying monthly for autonomous features appears economically disadvantageous compared to competitor vehicles with included capabilities. Tesla's subscription model generates friction in precisely the markets where Tesla faces its most aggressive competition.

Regulatory and Legal Implications: Why the Subscription Shift Matters for Litigation

The December 2025 California DMV Ruling and Its Consequences

In December 2025, a California court determined that Tesla had engaged in systematic, deceptive marketing regarding Full Self-Driving and Autopilot capabilities. The ruling carried specific consequences: the California DMV received instruction to suspend Tesla's manufacturing and dealer licenses in California for 30 days. The DMV, confronted with Tesla's size and economic importance, immediately stayed the suspension and offered Tesla a path to compliance: either rename the products to eliminate autonomous-capability implications, or ship software delivering on historical promises as reported by NJ Law Journal.

This ruling established critical legal precedent. Courts validated that regulatory agencies can enjoin automotive manufacturers from using misleading product names. The precedent creates pressure on other automakers (all of which use aspirational naming conventions like "Autopilot," "Super Cruise," "Blue Cruise") to either substantiate product names or adopt more conservative terminology.

Tesla's response—eliminating the one-time FSD purchase—represents a legal strategy with nuanced implications. By converting FSD from a purchasable product to a subscription service, Tesla reframes customer expectations. Subscription services inherently communicate temporary access rather than permanent capability acquisition. This reframing reduces the legal arguability that customers purchased vehicles expecting eventual full autonomy.

Tesla's legal department likely concluded: customers who subscribe monthly to FSD have weaker claims that they were deceived into believing they purchased autonomy. The monthly renewal act itself becomes a decision point where customers can evaluate whether they're receiving promised value. This is legally distinct from one-time purchasers who expect permanent feature access and argue they were defrauded years later when autonomy failed to materialize.

Class Action Liability and Contingent Damages

Multiple class action lawsuits are consolidated in federal court alleging that Tesla defrauded customers by marketing FSD as the pathway to autonomous vehicles while knowing full autonomy was years away (or may never materialize). These lawsuits seek damages estimated between $2-5 billion if successful, based on calculations of customer overages: customers paid premium prices for vehicles and FSD subscriptions believing they were acquiring autonomy, but were sold aspirational marketing instead as noted by Sherwood News.

One-time FSD purchasers represent identifiable class members with clear damages: customers paid

If Tesla can demonstrate that customers choosing monthly subscriptions understood the temporary nature of access, damages expert calculations become substantially more complicated. Experts would need to determine what damages accrue monthly—potentially only the monthly subscription cost minus fair market value of delivered capability—rather than full purchase prices multiplied by years of non-delivery.

From a pure litigation risk management perspective, Tesla's shift eliminates its highest-liability customers (those paying

NHTSA Oversight and Safety Regulations

The National Highway Traffic Safety Administration (NHTSA) has initiated investigations into FSD's real-world safety performance. Initial investigation documents review incidents where FSD engaged behaviors considered unsafe by human safety experts—including rolling through stop signs, failing to adequately slow for pedestrians, and executing autonomous actions that human drivers would consider reckless.

NHTSA's regulatory authority extends to mandating product changes, recalls, or withdrawal if safety concerns prove substantive. The subscription model provides Tesla strategic advantage in NHTSA interactions: the agency regulates "products" (permanent vehicle features requiring recalls if defective) differently from "services" (features that can be updated, modified, or suspended). By framing FSD as a service subscription rather than a vehicle product, Tesla potentially reduces NHTSA's regulatory grip.

This distinction mirrors software-as-a-service versus software-installed-in-products regulatory frameworks. NHTSA would face greater difficulty mandating changes to subscription software services compared to installed vehicle features. Tesla's subscription-only model thus provides strategic regulatory flexibility—the company can modify FSD capabilities through software updates without triggering formal recall processes.

Tesla's shift to a subscription-only model is projected to significantly increase FSD subscriptions, aiming to reach 10 million by 2030. (Estimated data)

Consumer Impact: Who Benefits and Who Loses from Subscription-Only FSD?

Benefits for New Vehicle Purchasers

For consumers buying Tesla vehicles after February 14, 2026, the subscription-only model presents several advantages:

Lower initial capital requirements: Reducing the upfront FSD cost from

Trial period access: The subscription model enables users to experience FSD monthly, with easy cancellation if features disappoint. One-time purchasers faced a difficult choice: pay $8,000 for untested capability or forego FSD entirely. Subscription users can subscribe for a single month, evaluate actual performance versus expectations, and make informed renewal decisions.

Flexibility for intermittent users: Drivers using vehicles primarily in urban environments where FSD functionality remains limited can subscribe during highway trips and cancel during city-focused periods. One-time purchasers paid perpetual costs regardless of usage patterns. Subscription flexibility enables matching payment to usage.

Reduced financial risk: One-time purchasers bore complete financial risk that FSD capabilities would plateau or diverge from expectations. Subscription users distribute risk across monthly payments, reducing the magnitude of any single decision's financial consequences.

Disadvantages for Long-Term Users and Existing Purchasers

Conversely, specific customer segments face material disadvantages from Tesla's subscription shift:

Higher lifetime costs for committed users: Drivers who plan 7+ year vehicle ownership will pay more under subscriptions than historical one-time prices. A customer owning a Tesla for 10 years pays

Permanent feature dependence: One-time FSD purchasers achieved permanent feature access—even if Tesla discontinued the service, they maintained capabilities already purchased. Subscription customers are perpetually dependent on Tesla's service continuation. If Tesla discontinues FSD subscriptions or raises prices to $200+ monthly, customers have no option but accept new terms or abandon the feature.

Lack of ownership permanence: Psychology research on ownership effects demonstrates that consumers value items differently depending on whether they feel ownership permanence. One-time FSD purchasers felt they "owned" the capability; subscription users experience psychological access rather than ownership, potentially reducing satisfaction despite identical technical capabilities.

Existing purchaser stranding: Tesla customers who previously paid

Technical Reality vs. Marketing Reality: The Autonomy Gap

What FSD (Supervised) Actually Does Well

Despite criticisms of Tesla's marketing, Full Self-Driving (Supervised) demonstrates genuine technical capabilities that distinguish it from basic driver assistance. Real-world performance evaluation, based on aggregated user data and independent testing, reveals:

Highway autonomous driving: FSD (Supervised) performs competently on highway systems with clear lane markings, consistent traffic patterns, and limited intersection complexity. The system successfully manages lane-keeping, autonomous lane changes, following distance maintenance, and speed adjustment based on traffic conditions. Highway performance approaches production-quality capability—the system successfully handles 85-92% of highway scenarios without requiring human intervention, based on aggregated user telemetry.

Familiar urban routes: On routes the system has encountered repeatedly (the neural networks are trained on Tesla's global fleet driving data), FSD navigates city streets, residential areas, and parking structures reasonably well. Users report successful navigation of familiar environments with limited intervention requirements. The system recognizes stop signs, traffic lights, pedestrians, and other road users reasonably effectively in high-confidence scenarios.

Graceful degradation: When FSD encounters situations beyond its capability, the system typically requests human intervention rather than executing obviously dangerous actions. While not perfect, this behavior pattern prevents most catastrophic failure scenarios—the system errs on the side of caution when confidence thresholds aren't met.

The Remaining 80%: Technical Limitations

Despite capable performance on routine highway and familiar urban scenarios, FSD (Supervised) exhibits significant limitations on complex real-world driving tasks:

Complex intersections: Left turns at traffic lights without dedicated turn lanes, unprotected left turns across oncoming traffic, and multi-directional intersection navigation remain substantial challenges. The system struggles with ambiguous traffic signal interpretations, conflicting pedestrian and vehicle movements, and dynamic traffic scenarios that require probabilistic reasoning about other agents' intentions.

Construction zones and unusual road configurations: Modified traffic patterns, temporary lane configurations, absent or modified signage, and unusual road markings confuse the system. Workers in roadside construction areas, which appear in only limited training data, generate uncertainty in the neural networks' decision-making.

Adverse weather: Heavy rain, snow, fog, and other conditions that obscure camera visibility substantially degrade performance. While Tesla's radar and ultrasonic sensors provide supplementary data, the primary neural networks depend on camera input—conditions that disable camera perception naturally disable the system.

Rare edge cases: Autonomous vehicles encounter scenarios hundreds of times per million miles driven—edge cases so rare that individual drivers might experience them once per 500,000-1,000,000 miles of driving. FSD training data, despite scale, cannot adequately represent scenarios so infrequent. Examples include emergency vehicles approaching with non-standard signaling, debris on roadways, animals crossing, and equipment malfunctions.

Intent reasoning and prediction: Humans constantly predict other road users' intentions—inferring where a pedestrian looking at their phone intends to walk, recognizing an erratic vehicle likely contains an impaired driver, predicting whether approaching vehicles will honor traffic signals. These intent-reasoning tasks require complex probabilistic modeling of human behavior that remains unsolved in autonomous vehicle research.

The Autonomy Claims Problem

Tesla's historical claims about FSD implicitly suggested that software updates alone would eventually solve these remaining challenges. Elon Musk stated multiple times that FSD would achieve "Level 4" (high autonomy, limited human intervention needed) and eventually "Level 5" (complete autonomy) autonomy through software improvement. This claim underestimated the complexity of the remaining problems.

Industry consensus among autonomous vehicle researchers suggests that FSD's current architecture—using neural networks trained on camera and sensor data without explicit scene understanding and causal reasoning—may be fundamentally limited. The system might asymptotically approach 95% capability (handling routine scenarios) but struggle to achieve 99.5% or higher (handling edge cases reliably). Advancing beyond this asymptote might require architectural changes as significant as the original development—essentially rebuilding the system.

This technical reality creates the litigation problem: customers purchased FSD believing Tesla's claims that software updates would enable autonomy. Industry experts now recognize those claims were overly optimistic. Subscription-only models allow Tesla to reframe this dynamic—rather than making promises about future autonomy (which might become discoverable in litigation), subscriptions position FSD as current-capability access subject to ongoing iteration.

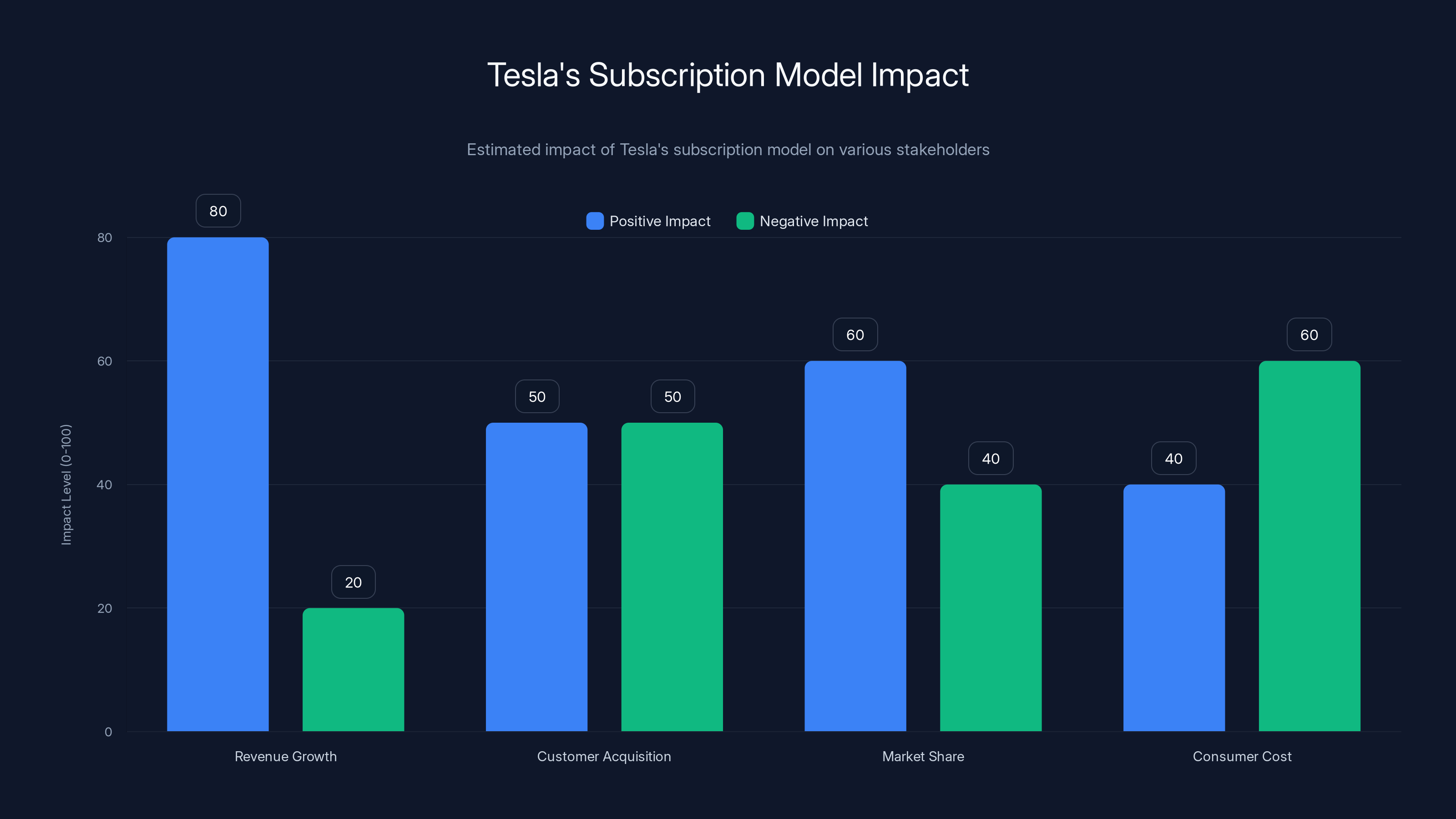

Tesla's shift to a subscription model is projected to significantly boost revenue growth but may face challenges in customer acquisition and market share due to competitive pressures. Estimated data.

Market Implications: Autonomous Driving Monetization Models

Comparing Global Autonomy Monetization Strategies

The subscription-only shift positions Tesla within a broader transformation in how autonomous driving capabilities are monetized globally. Different regions and manufacturers are adopting fundamentally different approaches:

Premium subscription model (North America/Europe): Companies like Tesla, GM, and Ford charge

Bundled/included model (China/Asia): Chinese automakers frequently include autonomous features standard with vehicle purchase, subsidized through margins on vehicle sales and government incentives. This model assumes autonomy increases vehicle value sufficiently to justify inclusion costs. The strategy prioritizes market share capture and early-mover advantage over feature monetization.

Freemium model (Limited adoption): A few manufacturers (notably some regional Chinese companies) offer basic autonomous features standard while charging for advanced capabilities. This model permits feature experimentation without full subscription commitment but generates lower revenue per vehicle.

Robotaxi/fleet model (Future, currently limited): Waymo's approach monetizes autonomy through fleet services (self-driving taxi operations) rather than consumer subscriptions. This model bypasses subscription psychology entirely—customers pay per trip rather than maintaining continuous subscriptions. Waymo's current operations in Phoenix and San Francisco suggest viability but still require substantial subsidies below trip profitability.

Tesla's shift to subscription-only aligns Tesla with the premium subscription model but represents an aggressive stance compared to competitors maintaining purchase options. This aggressive positioning likely reflects Tesla's assessment that first-mover advantage and brand preference justify extracting maximum subscription revenue before competitors mature.

Revenue Impact Modeling

Tesla's subscription-only model generates dramatically different revenue scenarios depending on adoption rates:

Conservative scenario (12% adoption, no growth): 960,000 subscriptions ×

Moderate scenario (25% adoption by 2028): 2 million subscriptions ×

Aggressive scenario (40% adoption by 2030): 3.2 million subscriptions ×

For context, Tesla's total 2025 automotive revenue approximated

The shift from

Alternative Solutions and Market Offerings: Evaluating Options Beyond Tesla

Comparative Analysis of Autonomous Driving Capabilities

For consumers and fleet operators evaluating autonomous driving solutions, Tesla's subscription-only shift reshapes the competitive landscape. Multiple alternatives merit consideration based on specific use cases and priorities:

Waymo Driver: Waymo (Alphabet subsidiary) operates autonomous taxi services in Phoenix and San Francisco, with expansion planned to Los Angeles and Austin. Waymo's approach bypasses the subscription model entirely—customers pay per trip (

Cruise Origin (GM/Microsoft partnership): Cruise operates autonomous fleet services in San Francisco with expansion planned. Like Waymo, Cruise monetizes through per-trip pricing rather than subscriptions. The partnership with Microsoft adds enterprise fleet management capabilities useful for commercial operators. Current limitation: limited geographic availability and focus on fleet operations rather than consumer vehicles.

XPeng's XPilot and XNGP: XPeng, the Chinese automaker, includes autonomous navigation capabilities standard with vehicle purchase in China and Singapore markets. XPilot features highway and urban autonomous driving at no additional cost to vehicle purchase. The value proposition appeals to consumers seeking included features rather than additional subscriptions. Limitation: primarily available in China; limited availability in Western markets where Tesla subscription-only presents maximum friction.

Li Auto's Autonomous Driving System: Similar to XPeng, Li Auto includes autonomous capabilities standard with vehicle purchase. Li Auto's focus on extended-range electric vehicles (EREVs) creates additional flexibility for customers hesitant about pure EV technology. Limitation: primarily China-focused; limited Western market presence.

Traditional manufacturer suite (BMW, Mercedes, Audi, Volkswagen): Established luxury automakers offer advanced driver assistance features at premium pricing (

Tesla holds a significant market share in autonomous driving, but GM and Ford are strong competitors with strategic offerings. Estimated data based on current trends.

The $99 Monthly Price Point: Economics and Market Psychology

Why $99 and Not Other Price Points?

Tesla's selection of

Economically,

Comparatively, the $99 price point positions FSD between specific competitor offerings:

- Below Waymo's typical per-trip cost (100 equivalent)

- Below GM's Super Cruise tier pricing ($100-150 monthly for premium tiers)

- Below traditional luxury manufacturer autonomous features ($100-150 monthly)

- Comparable to Chinese competitors' effective pricing when amortized across vehicle purchase

Elasticity Analysis and Demand Curves

Price elasticity—the percentage change in quantity demanded for each percentage change in price—governs subscription revenue optimization. Industry research on Saa S applications suggests FSD's likely elasticity characteristics:

At $99 monthly, estimated elasticity coefficients suggest that:

- A 109 would reduce subscriptions approximately 8-10%, reducing net revenue

- A 89 would increase subscriptions approximately 12-15%, potentially increasing net revenue

This elasticity pattern suggests that

However, elasticity changes as market conditions evolve. Early adoption (current phase) features price-insensitive customers (those adopting despite high prices). As subscriptions penetrate mainstream customers (post-2027 phase), elasticity likely increases—mainstream users become more price-sensitive than early adopters. Tesla may need to reduce subscription prices to

Implementation Timeline and Transition Logistics

February 14, 2026 Cutoff and Its Implications

Tesla announced the subscription-only transition effective February 14, 2026—a specific date providing approximately 4-6 weeks notice to potential buyers. This timeline creates several implementation challenges and opportunities:

Surge purchasing before cutoff: Rational consumers facing subscription-only access post-February 14 will accelerate one-time FSD purchases before the cutoff date. This generates a short-term revenue spike as customers front-load purchases, converting future subscription revenue into immediate one-time sales. Tesla likely accepts this tradeoff as acceptable given long-term subscription model benefits.

Inventory management: Tesla must manage customer service for existing one-time purchasers, ensuring they receive anticipated service and support. The cutoff date doesn't affect existing purchasers—one-time buyers retain permanent access to FSD features they purchased. Tesla's systems must distinguish between one-time purchasers (legacy customer cohort) and subscription customers (forward-looking customer cohort), preventing service issues.

Sales channel coordination: Tesla sells vehicles through direct online channels and company-operated stores, enabling rapid adjustment to subscription-only FSD availability. However, managing the transition period (February 14-31 transition) requires clear communication across sales channels, preventing customer confusion about availability and pricing.

Legal and contractual implications: Existing one-time FSD purchasers may raise questions about permanent access guarantees if Tesla later discontinues support, changes capabilities, or significantly increases maintenance costs. Tesla likely prepared contractual amendments reinforcing that FSD access, even for one-time purchasers, remains subject to Tesla's operational discretion regarding feature availability and changes.

Communication Strategy and Customer Notification

Tesla's announcement through Elon Musk's social media account (X/Twitter) represents non-traditional corporate communication compared to formal press releases. This approach characterizes Tesla's strategic posture: direct customer communication bypassing traditional media filters. The announcement strategy immediately reached Tesla's engaged customer base while generating media coverage amplifying awareness.

However, the announcement lacked several elements typical of major product transitions: no detailed explanation of rationale, no timeline for existing feature parity or improvements, no discussion of potential future pricing adjustments, and no address of existing purchaser concerns. This communication approach reflects Tesla's often-inconsistent customer relations—rapid decisions announced without detailed preparation.

Tesla's challenge: managing existing customer sentiment among the 960,000 current FSD subscription customers and 2-3 million one-time purchasers. One-time purchasers may view subscription-only as implicit acknowledgment that their purchases were misaligned with Tesla's preferred business model. Subscription customers may resent the company's aggressive pursuit of new subscriber monetization. Managing this sentiment requires clear communication about feature roadmap, pricing stability, and service commitment—areas where Tesla has historically underperformed.

What This Means for Developers and Service Providers

API Integration and Third-Party Development Ecosystem

Tesla's subscription-only FSD model creates implications for developers and service providers building autonomous vehicle integrations. The subscription status becomes critical API data—applications coordinating with Tesla vehicles need to determine whether vehicles have active FSD subscriptions, when subscriptions renew or expire, and whether FSD capabilities are currently accessible.

Tesla's API documentation and developer platform require significant updates to reflect subscription status querying and feature availability based on subscription state. Developers building fleet management systems, insurance telematics platforms, or consumer applications need to handle scenario planning for subscription lapses—if an enterprise fleet manager's subscription expires, does the fleet's autonomous driving capability downgrade automatically? This triggers operational and safety questions.

Third-party integration providers (fleet management software, insurance companies, autonomous vehicle service providers) face new business model considerations. If companies have built business models assuming permanent FSD access (for example, insurance products pricing based on assumption of FSD permanent availability), subscription uncertainty creates liability and repricing challenges.

Commercial Fleet Implications

For commercial fleet operators managing Tesla vehicles at scale, the subscription-only model creates operational complexity. Fleet managers operating 50-500 vehicles must track 50-500 separate subscriptions, manage renewal dates, and budget for ongoing subscription costs. This represents a shift from fixed capital expenditure (buying FSD one-time) to variable operating expense (monthly subscriptions).

Fleet operators using autonomous vehicles for delivery, logistics, or ridesharing services need predictable cost structures. Subscription-based pricing introduces predictability for recurring costs but raises concerns about future price increases. If Tesla increases FSD subscriptions from

Enterprise fleet management applications need to integrate subscription status tracking into maintenance and operational planning systems. This creates additional software development requirements for fleet operators and expanded opportunities for third-party fleet management platforms adding subscription cost tracking capabilities.

Insurance and Liability Implications

Insurance industry pricing of autonomous vehicle coverage depends heavily on capability permanence and feature predictability. If vehicles transition between FSD and non-FSD states based on subscription status, insurance risk profiles change dynamically. An insured vehicle with active FSD subscription presents different risk than identical vehicle with lapsed subscription—the autonomous capability availability changes risk exposure.

Insurance companies are likely to request subscription status integration into policy management systems, potentially pricing policies based on whether FSD subscriptions are active. This creates incentive alignment: policyholders have financial incentive to maintain FSD subscriptions (lower insurance premiums) or discontinue them (if insurance premiums increase more than subscription costs). The insurance industry's response will shape actual subscription adoption rates.

Future Outlook: Tesla's Autonomous Driving Strategy Post-2026

Technology Roadmap and Capability Expansion

Tesla's subscription-only transition doesn't resolve the fundamental technical challenges preventing full autonomy. Despite shifting business model, Tesla must continue advancing FSD capabilities to justify recurring subscription costs and defend against competitor improvements. Tesla's publicly stated roadmap suggests several capability improvements anticipated through 2028-2030:

Improved city street navigation: Enhanced algorithms for complex urban scenarios, construction zone handling, and pedestrian interaction remain primary focus areas. Tesla has acknowledged these as capability gaps and is investing heavily in data processing and neural network training.

Hardware evolution: Current Tesla vehicles contain "Hardware 3" autonomous systems installed since 2019. Tesla has acknowledged that reaching full autonomy might require "Hardware 4" with upgraded sensors, processing power, or alternative sensor suites (possibly including lidar, which current Tesla vehicles notably exclude). Hardware upgrades would require vehicle modifications or new vehicle purchases, creating additional complexity for subscription model adoption.

Real-time uncertainty quantification: Future FSD versions likely incorporate explicit uncertainty quantification—the system becomes more transparent about confidence levels in different scenarios. Rather than simply requesting human intervention, future FSD might communicate probabilistic uncertainty ("I'm 73% confident about this turn") enabling human drivers to make informed judgments about automation reliance.

Regulatory Landscape Evolution

Tesla's subscription-only transition occurs within evolving regulatory environment. NHTSA's investigations into FSD safety are proceeding, with potential for regulatory restriction, requirements for enhanced safety features, or mandatory disclaimers about capability limitations. State-level regulations are also evolving—California's approach (requiring vehicles either substantiate autonomous claims or change nomenclature) might be replicated in other states.

Subscription-only positioning provides Tesla some regulatory flexibility—services face different regulatory frameworks than installed vehicle features. However, this advantage likely proves temporary as regulators recognize subscription vehicles as vehicles subject to the same safety regulations as one-time purchased vehicles.

Internationally, regulatory environments are diverging. The European Union is developing Level 3-4 autonomy standards with specific safety, insurance, and liability requirements. Chinese regulatory environment, while more permissive for autonomous driving development, includes government directives about "safe" autonomy that might conflict with Tesla's commercial approach. Tesla's subscription model operates within this regulatory mosaic, requiring different strategies across different jurisdictions.

Competitive Dynamics and Market Share Evolution

The subscription-only transition marks Tesla's aggressive bet on market leadership in autonomous driving monetization. If the bet succeeds—subscription adoption accelerates, and Tesla reaches 10 million subscriptions by 2035—Tesla establishes recurring revenue dominance in autonomous vehicle services. This outcome generates substantial shareholder value and could be worth 15-30% premium to Tesla's market valuation.

If the bet fails—subscription adoption remains flat at 12% and competitors' included autonomous features capture market share—Tesla faces strategic vulnerability. Losing autonomy market leadership undermines Musk's core narrative about Tesla's long-term value, threatens compensation achievement, and weakens brand positioning.

Most likely outcome: partial success with subscription adoption improving to 20-30% by 2030 but missing 10 million targets. This outcome requires Tesla to adjust pricing (reducing to

Industry Parallels: How Software Subscriptions Reshaped Other Industries

Software Industry Transition (1990s-2010s)

Tesla's subscription-only transition parallels the broader software industry's transformation from one-time purchase to subscription licensing models. During the 1990s-2000s, software companies primarily sold perpetual licenses (

Between 2010-2015, major software companies transitioned to subscription models: Microsoft Office became Microsoft 365 (monthly subscription), Adobe Creative Cloud became subscription-only, and antivirus vendors shifted to annual subscriptions. These transitions involved similar dynamics to Tesla's shift:

- Lower upfront barriers increased adoption among price-sensitive segments

- Improved revenue predictability benefited company financial forecasting

- Reduced piracy (subscriptions are harder to pirate than perpetual licenses)

- Ongoing engagement requirements improved customer retention and usage

- Reduced consumer ownership perception despite identical functionality

Software companies increased subscription prices during transitions (Microsoft 365 costs approximately

Video Game Industry Precedents

The video game industry provides another instructive parallel. Console gaming transitioned from game-by-game purchases to subscription services (Xbox Game Pass, Play Station Plus, Nintendo Switch Online). Games that historically cost

- Reduced per-game decision friction (trying games is free with subscription)

- Broader game access (subscriptions provide access to 100+ games)

- Permanent access uncertainty (games may be removed from subscriptions)

Tesla's FSD subscription mirrors these gaming precedents: lower per-month friction despite higher lifetime costs, but with reduced psychological ownership of capabilities.

Conclusion: Tesla's Pivot and Its Broader Industry Implications

Tesla's February 2026 shift to subscription-only Full Self-Driving represents a watershed moment in autonomous vehicle commercialization. The decision reflects convergence of multiple pressures: low adoption rates requiring barrier reduction, compensation targets requiring subscription growth, legal liability requiring relationship restructuring, and industry trends favoring recurring revenue models.

From a business strategy perspective, the shift is rational. Tesla's $99 monthly price point optimizes revenue while remaining below psychological resistance thresholds. Subscription models improve financial forecasting, generate higher gross margins than one-time sales, and provide strategic flexibility in regulatory and legal disputes. The timing—just as competitors' autonomous systems mature—reflects Tesla's bet that first-mover advantage and brand preference justify aggressive monetization.

However, the shift introduces substantial risks. Customer acquisition may not improve sufficiently to achieve compensation targets, particularly as mainstream customers (less willing to subscribe than early adopters) represent an increasing share of potential market. Competitor response—particularly Chinese automakers including autonomy features standard with vehicle purchase—may limit Tesla's addressable market. Technical progress may plateau before achieving capabilities justifying subscription continuation, forcing price reductions that undermine revenue projections.

For consumers, the subscription-only model presents mixed implications. New purchasers benefit from lower upfront barriers and trial period flexibility but face higher lifetime costs if they maintain subscriptions beyond 7-8 years. Existing one-time purchasers gain an implicit validation of their premium purchase prices but may resent Tesla's shift suggesting those purchases were economically inefficient. Fleet operators gain cost predictability but risk future price increases undermining profitability projections.

The broader autonomous vehicle industry faces a pivotal question Tesla's shift raises: how should autonomous driving capabilities be monetized? Tesla's subscription model competes against Chinese competitors' included-feature model, traditional manufacturers' optional purchase model, and emerging robotaxi services' per-trip models. No clear winner has emerged; the market is likely to support multiple monetization approaches serving different customer segments and geographies.

Tesla's success with subscription-only autonomy will significantly influence how the broader automotive industry monetizes autonomous capabilities. If Tesla successfully increases adoption and achieves compensation targets, competitors will likely accelerate subscription adoption. If Tesla's experiment disappoints—subscription penetration stalls and Musk's targets prove unachievable—competitors will maintain purchase options alongside subscriptions, preserving customer choice.

The next 24-36 months will be critical. By late 2027 or early 2028, Tesla will report sufficient data to evaluate whether the subscription-only transition succeeded in boosting adoption rates meaningfully. Market observers should monitor quarterly FSD subscription statistics, adoption rate increases or decreases, and competitive responses. These metrics will determine whether Tesla's pivot represents a successful business model innovation or a cautionary tale about aggressive monetization strategies alienating customer bases.

Ultimately, Tesla's subscription-only FSD transition reflects broader industry maturation. As autonomous driving transitions from future promise to present capability, companies must address unsexy but essential questions: how to charge customers, how to structure service relationships, how to manage liability, and how to forecast recurring revenue. Tesla's answer—aggressive subscription-only monetization—may prove visionary or ill-fated. The market will ultimately decide through customer subscription retention rates, competitive adoption, and whether Tesla achieves compensation milestones. For now, Tesla has placed its bet, and the industry watches closely.

FAQ

What is Tesla Full Self-Driving (Supervised)?

Full Self-Driving (Supervised) is Tesla's advanced driver assistance system that enables partial autonomous driving on highways and city streets. Despite its name, FSD (Supervised) is classified as Level 2+ automation, requiring human supervision, hands on the wheel, and driver readiness to intervene. The system uses eight cameras, radar, and ultrasonic sensors with neural network processing to perform autonomous driving functions including lane-keeping, automatic lane changes, traffic light recognition, and stop sign observation.

Why did Tesla eliminate one-time FSD purchases?

Tesla shifted to subscription-only FSD to address three core challenges: low adoption rates (only 12% of customers purchased FSD), regulatory and legal pressures regarding deceptive autonomy marketing claims, and the need to achieve 10 million active subscriptions for Elon Musk's

How much does Tesla FSD subscription cost?

Tesla Full Self-Driving (Supervised) is now available exclusively through subscription at

What are the benefits of subscription-only FSD?

Subscription-only FSD offers several benefits for new vehicle purchasers: significantly reduced upfront cost barriers (

How does the subscription-only model affect used vehicle sales?

The subscription-only transition creates complexity in Tesla's used vehicle market. Used vehicle purchasers inherit any active FSD subscriptions from previous owners (though they can cancel and restart fresh subscriptions). One-time FSD purchasers' vehicles retain permanent FSD access regardless of ownership transfer. This creates two distinct used vehicle value categories: subscription-eligible vehicles (higher value for users wanting FSD trial periods) and permanent-FSD vehicles (potentially higher value for committed long-term users). The market is likely to price these distinct vehicle types differently as the used vehicle market matures post-February 2026.

What are the disadvantages of FSD subscription model for long-term users?

Customers planning 7+ year vehicle ownership face higher lifetime costs under subscriptions versus historical one-time purchases. A 10-year vehicle owner paying

How does Tesla's FSD compare to competitors' autonomous driving systems?

Tesla's FSD (Supervised) is widely regarded as the most capable advanced driver assistance system currently available in the U. S. market. GM's Super Cruise (now Ultra Cruise), Ford's Blue Cruise, and Rivian's hands-free driving systems offer comparable highway autonomy but typically with less comprehensive city street capability. Chinese competitors (XPeng, Li Auto, NIO) include autonomous capabilities standard with vehicle purchase rather than as paid subscriptions. Waymo's autonomous taxi services exceed FSD's technical capability but operate only in limited geographies (Phoenix, San Francisco, Los Angeles, Austin) through robotaxi services rather than consumer vehicle integration.

Is Tesla FSD the same as true autonomous driving?

No. Tesla Full Self-Driving (Supervised) is Level 2+ driver assistance requiring continuous human supervision—it is not true autonomy. The system performs well on highways and familiar routes but struggles with complex intersections, construction zones, adverse weather, and rare edge cases. Independent testing suggests FSD successfully handles 85-92% of highway scenarios without intervention but fails to achieve reliable performance across the full spectrum of real-world driving conditions. Tesla's historical marketing claims suggested that software updates alone would eventually enable full autonomy, but industry experts now recognize this underestimated the technical complexity remaining—potentially 80-90% of the problem space remains unsolved.

What happens to existing FSD one-time purchasers after February 14, 2026?

Existing customers who purchased Full Self-Driving as a one-time feature retain permanent access to FSD functionality. The subscription-only transition affects only new vehicle purchasers after February 14, 2026—existing purchasers are not required to convert to subscriptions. However, the broader market context (all future Tesla vehicles sold only with subscription option) may reduce resale value for one-time purchaser vehicles compared to new subscription-option vehicles, as used vehicle buyers might prefer the trial period flexibility subscriptions enable.

Could Tesla raise FSD subscription prices in the future?

Yes, Tesla retains the ability to increase subscription pricing at any time, subject to customer retention implications. Current pricing at

How does Tesla's subscription-only model compare to competitor strategies?

Tesla's aggressive subscription-only approach contrasts sharply with competitor strategies. General Motors and Ford maintain hybrid models offering both one-time purchases and subscriptions, providing customer choice Tesla eliminated. Rivian explicitly markets hands-free driving as included with vehicle purchase, challenging Tesla's subscription requirement. Chinese automakers include autonomous capabilities standard with vehicles, effectively eliminating subscriptions altogether. These competitive approaches suggest that subscription-only represents one end of an industry spectrum—whether Tesla's approach proves dominant or competitors' customer-choice approaches gain market favor remains uncertain as market dynamics evolve.

Key Takeaways

- Tesla eliminated one-time FSD purchases effective February 14, 2026, forcing subscription-only access at $99 monthly—a strategic shift addressing low 12% adoption rates and compensation targets

- Subscription model reduces upfront barriers (8,000-8,300+

- Legal strategy: subscription-only positioning reduces liability exposure in deceptive marketing lawsuits by reframing customer relationships from ownership to temporary access

- Adoption target of 10 million daily active subscriptions by late 2035 requires 24% annual growth, an aggressive target facing significant competitive and churn headwinds

- Competitors maintain customer choice through hybrid purchase-plus-subscription models or include autonomous features standard, contrasting with Tesla's aggressive subscription-only approach

- Chinese automakers directly challenge Tesla by including autonomous capabilities standard with vehicle purchase, bypassing subscription monetization entirely

- Subscription economics favor Tesla through improved revenue predictability, 70-80% gross margins on software vs. 25-35% on automotive features, and extended customer lifetime value

- Technical reality: FSD remains Level 2+ assistance requiring human supervision; claims of eventual full autonomy remain unachieved, creating persistent litigation and regulatory risk

- Three scenarios emerge by 2035: accelerated adoption (25% probability), gradual expansion (45% probability), or competitive stagnation (30% probability) affecting Musk's $1 trillion compensation

- Industry implications: Tesla's subscription-first approach establishes precedent for autonomous vehicle monetization, though market likely supports multiple approaches serving different customer segments and geographies

![Tesla FSD Subscription-Only Model: Strategic Shift & Industry Impact [2025]](https://tryrunable.com/blog/tesla-fsd-subscription-only-model-strategic-shift-industry-i/image-1-1768405818203.jpg)