The Future of Work Just Got a Timeline: Tesla's Optimus Gen 3 is Coming

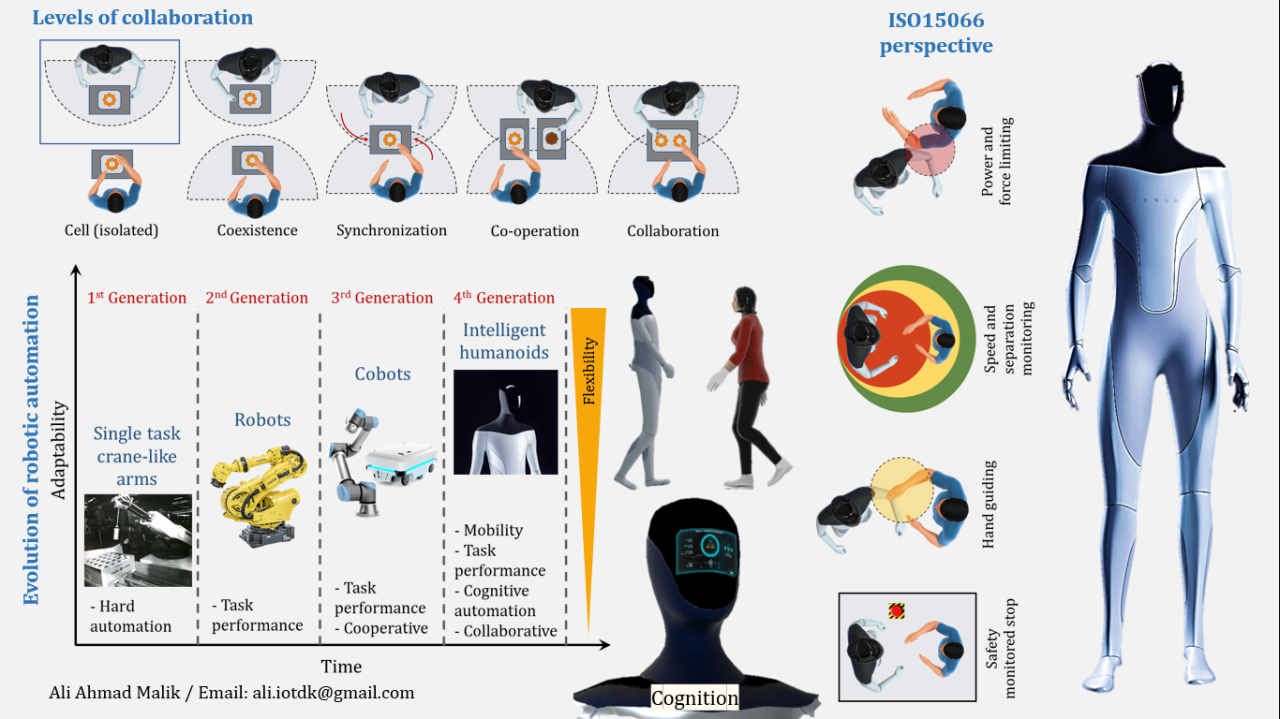

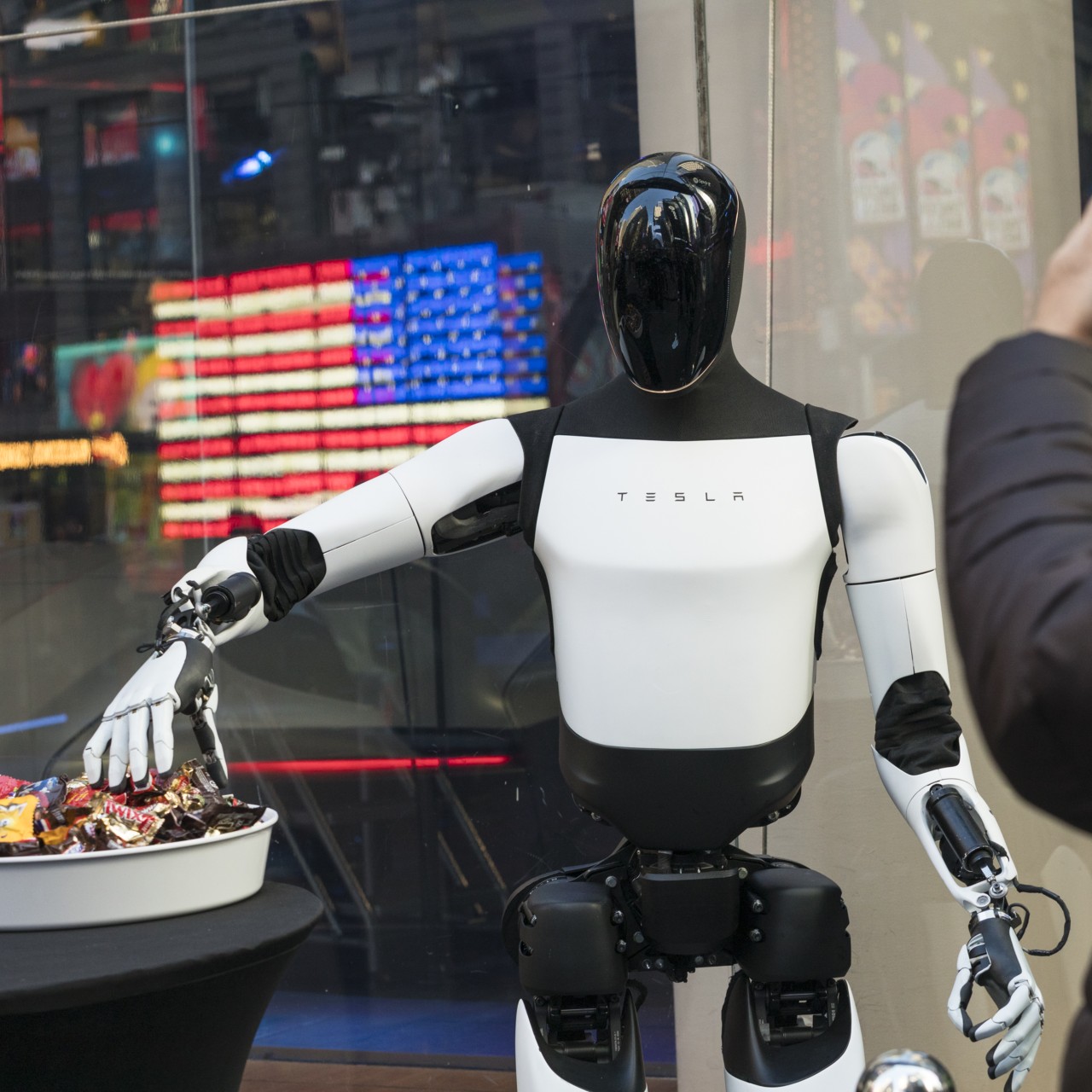

Last quarter, Tesla dropped something huge in its earnings report. Not the usual stuff about vehicle production numbers or margin improvements. No, this was bigger. The company officially committed to unveiling its third-generation Optimus humanoid robot in the first quarter of 2026, with actual production lines spinning up before the year ends.

Here's what makes this different from the dozens of other robot announcements floating around: Tesla isn't just talking about robots as some distant future fantasy. They're setting concrete timelines. They're building manufacturing infrastructure right now. They're betting their entire company's future valuation on this bet.

But let's be real. Tesla has talked about Optimus timelines before. They've made predictions that didn't materialize. Elon Musk claimed they'd produce 5,000 robots in 2025. Nobody actually believes that happened. So why should we take this new deadline seriously?

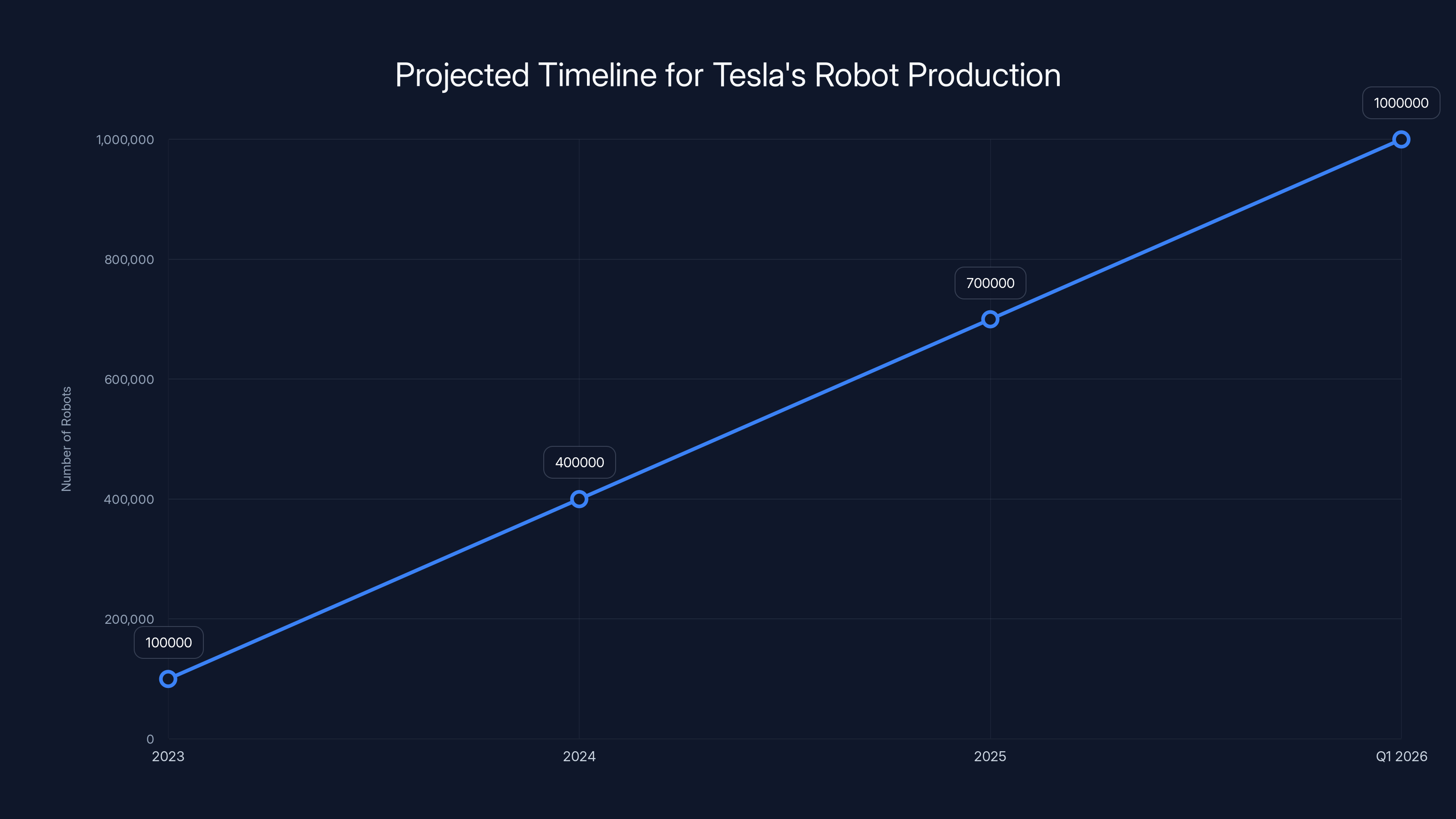

Because unlike previous announcements, this one comes with specific technical achievements and manufacturing commitments. The Gen 3 version represents "major upgrades from version 2.5, including our latest hand design." The company is actively preparing production capacity. And most importantly, Tesla's entire financial future depends on delivering this. Musk's compensation package literally requires building at least 1 million robots.

This article breaks down everything you need to know about the Optimus Gen 3 reveal coming in early 2026: what changed from Gen 2.5, why the hand design matters so much, what the production timeline actually means, and why this robot could fundamentally reshape labor economics across multiple industries.

TL; DR

- Gen 3 Optimus launches Q1 2026 with "major upgrades" including new hand design and improved dexterity

- Production ramp starts before end of 2026 with Tesla planning 1 million robots per year eventually

- Hand redesign is critical because previous versions couldn't handle complex real-world tasks effectively

- Musk's $1 trillion compensation requires 1 million robots, creating massive financial incentive for delivery

- Manufacturing timeline is aggressive but Tesla has factory expertise that competitors lack

- Market implications are enormous if Tesla actually delivers affordable, capable humanoid robots at scale

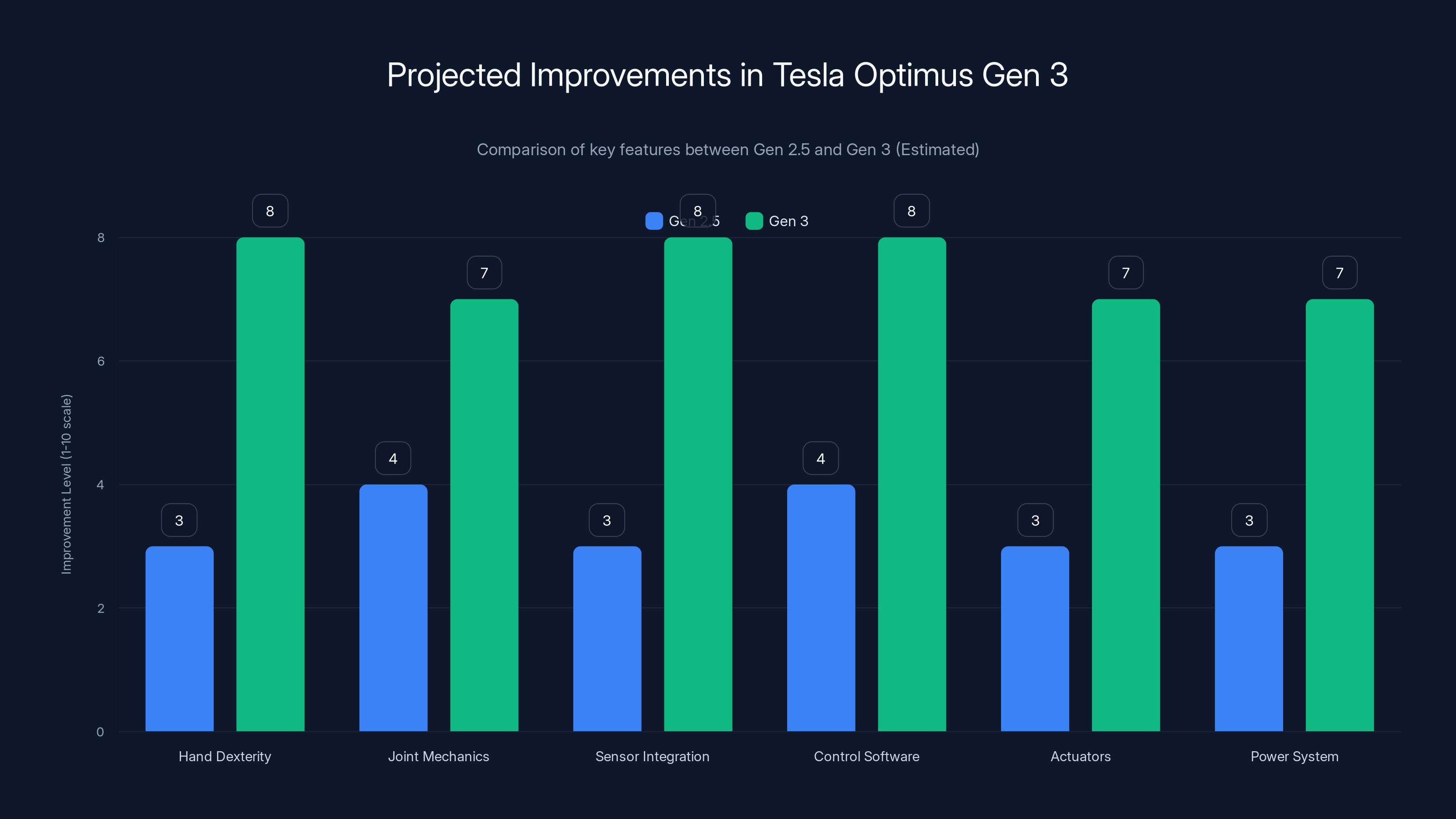

Tesla Optimus Gen 3 is projected to have significant improvements in hand dexterity, sensor integration, and control software, making it more suitable for complex tasks. Estimated data based on industry insights.

What Gen 3 Actually Means: Breaking Down the Upgrades

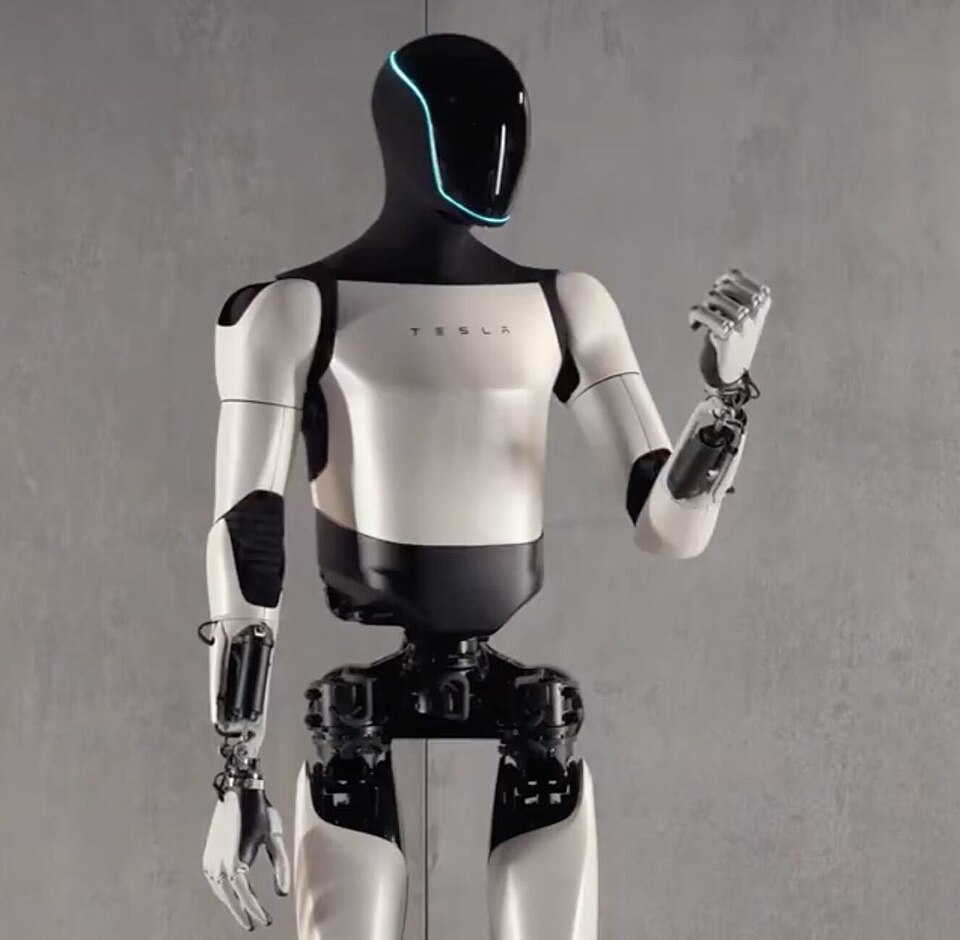

When Tesla says "major upgrades," they're not exaggerating. The jump from Gen 2.5 to Gen 3 represents a fundamental rethinking of what makes a humanoid robot functional in real environments.

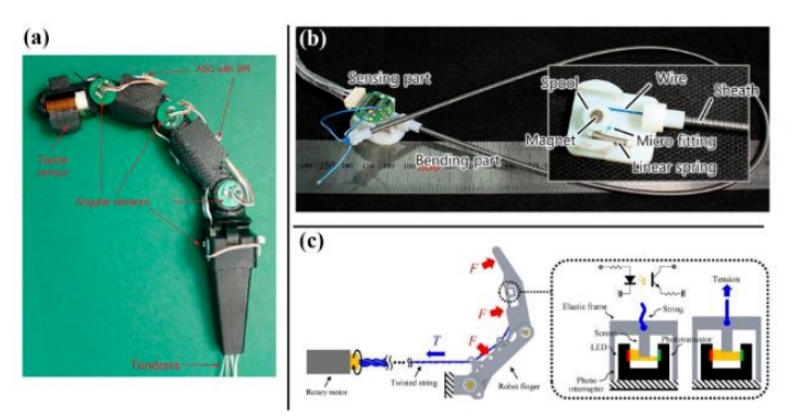

The biggest change is the hand design. This might sound like a minor mechanical improvement, but it's genuinely the make-or-break component for humanoid robotics. A robot with bad hands is just a rolling sculpture. You can't do anything useful with it. Previous versions of Optimus had hands that were, frankly, terrible. The dexterity was limited. The grip strength was inconsistent. Complex manipulation tasks? Forget about it.

Gen 3 completely redesigns this. Tesla's engineers focused on precision, range of motion, and adaptability. The new hand can handle objects of varying shapes and sizes. It can perform fine motor tasks that previously required expensive industrial arms. This is the difference between a robot that can hand you a wrench and one that can actually repair something.

Beyond the hands, we're looking at improvements across the entire kinetic chain. Better actuators mean faster movement and more reliable operation. Improved sensor arrays give the robot better spatial awareness. The AI underlying the motion control is smarter, learning from experience instead of just following rigid programming.

The power system has likely improved too, though Tesla hasn't released specifics. Current generation humanoids drain batteries like crazy. Long-term viability requires robots that can work an 8-hour shift on a single charge, perform repetitive tasks without degradation, and actually outlive their cost basis in maintenance.

There's also the question of what "meant for mass production" actually implies. This phrase suggests Tesla has already solved the fundamental engineering problems. They're not targeting a research prototype anymore. Gen 3 is supposed to be manufacturable at scale, which means it has to be reliable, repairable, and economical to produce.

The Timeline Advantage: Why 2026 Production Matters

Tesla announced production before the end of 2026. This isn't theoretical future-gazing. This is saying "we're building the factory, staffing it up, and making actual robots in nine months."

Compare this to competitors. Boston Dynamics has been developing humanoid robots for years but explicitly isn't focused on mass production. They're selling specialized units for specific tasks. Figure AI, which spun out from Open AI, is taking a different approach with more accessible robot designs. But none of them are committing to production timelines measured in single-digit year counts.

Why can Tesla move this fast? Because they already have the infrastructure. They don't need to build factories from scratch. They have supply chain relationships. They have manufacturing expertise. They can repurpose existing production lines and adapt them for robot assembly. A new company would need years just to set up sourcing and manufacturing partnerships.

The 1 million units per year target is ambitious but not impossible if Tesla actually gets them designed efficiently. For context, they produce over 1 million vehicles annually. The production logistics are similar. The supply chain requirements overlap significantly. Tesla understands battery management, electric actuators, and industrial-scale assembly better than almost anyone on the planet.

But let's inject some skepticism here. Tesla has a track record of missing deadlines. Production ramp usually takes longer than executives promise. Component sourcing always has surprises. Quality control hits unexpected snags. Any number of things could push the timeline out by 6-12 months.

That said, robotics production is actually simpler in some ways than vehicle production. Robots don't need to meet the same safety standards for occupants. The regulatory environment is lighter. Quality requirements are different. A humanoid robot that's 99% reliable is already useful. A car that's 99% reliable crashes and kills people.

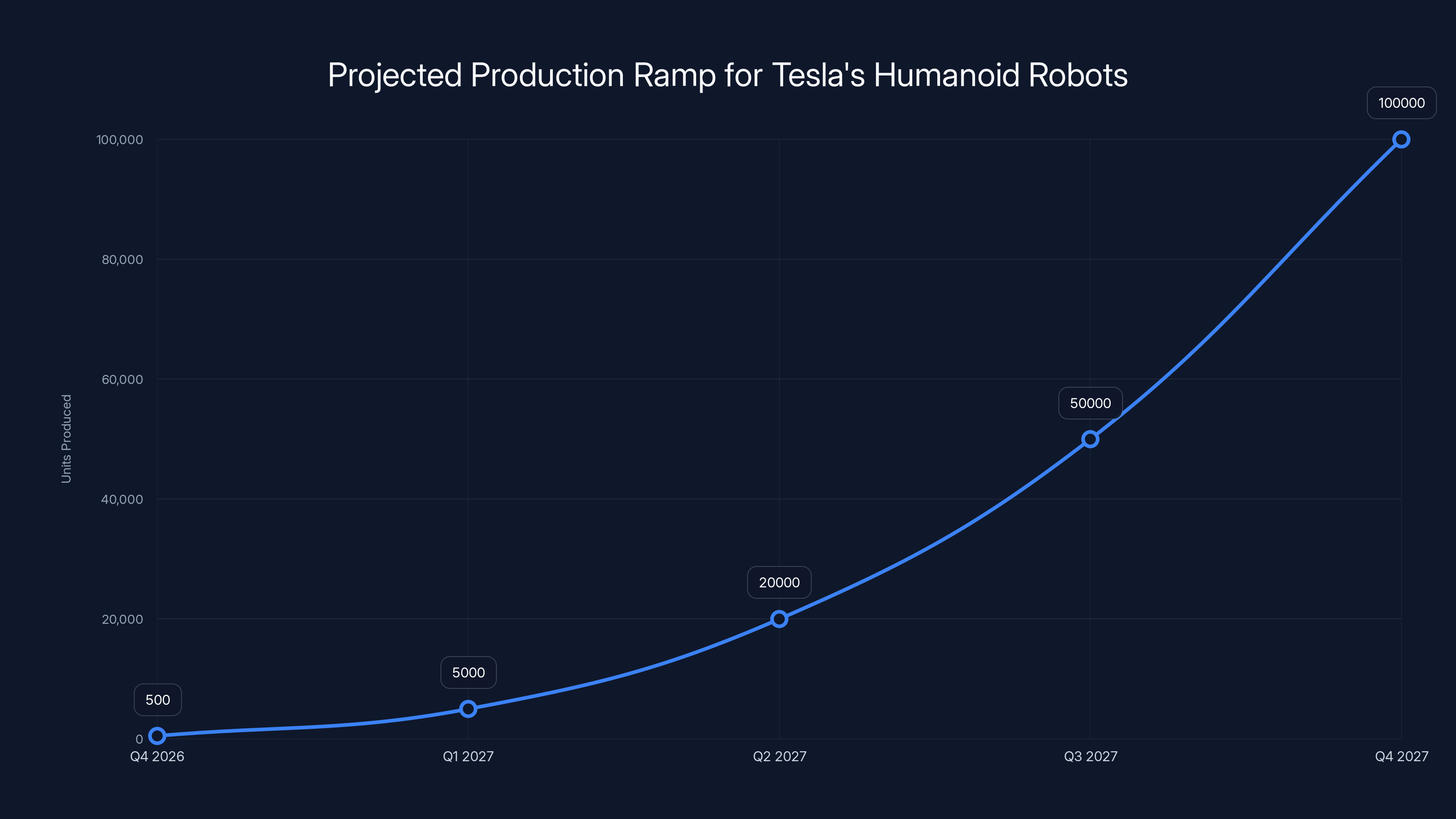

Tesla's humanoid robot production is expected to start with hundreds of units in late 2026, ramping up to significant volumes by the end of 2027. Estimated data based on typical production ramp timelines.

The Hand Revolution: Why This Specific Upgrade Changes Everything

Seriously, spend a moment thinking about hands. Right now, you're using yours to read this. Maybe you're scratching your neck. Maybe you're holding a coffee cup. Maybe you're typing on a keyboard. Your hands are performing thousands of micro-adjustments every second, all without conscious thought.

Robotic hands have been the bane of the robotics industry for decades. They're expensive. They break easily. They require constant calibration. They can't adapt to unexpected textures or shapes. Industrial robots work around this by using specialized grippers designed for specific tasks. One gripper for picking up boxes. Another for assembling circuit boards. Another for welding. You can't use a single gripper for everything.

Optimus Gen 3's new hand design supposedly solves this. We don't have the exact specs yet, but based on industry trends and what Tesla has hinted at, we're probably looking at improved joint design, better sensors in the fingers, and smarter control software.

The sensor part is crucial. If the robot can feel the resistance and texture of what it's holding, it can adapt grip strength in real time. Grab an egg too hard and it cracks. Grab it too gently and it drops. A human knows the difference immediately through proprioception. Robots need artificial equivalents, and that's genuinely hard to engineer.

Better hand design unlocks entire categories of work. Assembly line tasks that are currently done by humans become feasible for robots. Maintenance work becomes possible. Care work in homes becomes viable. This is the step from "robots that can do one specific thing" to "robots that can handle unexpected situations."

The implications are staggering. If Tesla delivers this, they've solved a problem that's stumped the robotics industry for 15+ years. That's not incremental progress. That's a fundamental breakthrough.

Manufacturing at Scale: The Production Reality Check

Here's where theory meets harsh reality. Building 100 prototype robots is one thing. Building 1 million units annually is completely different.

Scaling production requires solving dozens of problems simultaneously. Component suppliers need to ramp up. Quality control processes need to be validated. Assembly sequences need optimization. Logistics chains need to handle exponentially higher volumes. Workforce training needs to happen. Supply chain redundancy needs to be built in so a single supplier failure doesn't halt production.

Tesla has done this before with vehicles. But robots are different. Vehicles are mostly metal and glass, assembled in predictable ways. Humanoid robots require precision robotics, complex electronics, AI-enabled control systems, and battery packs all working together harmoniously.

The manufacturing timeline Tesla outlined is aggressive but potentially achievable. They said production lines start before the end of 2026. This doesn't mean full production. It means initial units come off the line. Maybe hundreds or low thousands in the last quarter of 2026. Then ramp accelerates in 2027.

For comparison, the Model S took about 3-4 years from unveiling to real volume production. But that included certification, regulatory approval, and more complex systems. A humanoid robot in an industrial setting doesn't need as much regulatory blessing. It's not carrying passengers at 70 mph.

One critical factor often overlooked: demand validation. Tesla might be able to make 1 million robots, but will anyone actually buy them at the price point Tesla needs to hit for profitability? If a single Optimus costs $100,000+, you're looking at a very narrow market. Industrial customers will buy them for high-value applications. But for the robot economy Musk envisions—where robots serve as general-purpose workers—prices need to be dramatically lower.

This is where Tesla's manufacturing expertise becomes decisive. They've proven they can manufacture complex, tech-heavy products at lower costs than competitors. If anyone can make humanoid robots economical at scale, it's them.

The Financial Imperative: Why Musk Can't Fail

Let's talk about the elephant in the room: Elon Musk's compensation package.

His contract with Tesla includes performance milestones tied to building 1 million robots. Not almost. Not approximately. One million actual robots. If he hits this target, his package could be worth around $1 trillion. If he misses it significantly, the value plummets.

This creates an almost comical level of alignment between Musk's personal wealth and actually delivering Optimus. He literally cannot afford to fail at this. Every dollar tied up in Optimus development is a dollar that increases the probability of hitting the target.

But here's the twist: this financial incentive cuts both ways. Yes, it motivates Musk to deliver. But it also means Tesla might cut corners to meet timelines. They might prioritize hitting 1 million units over ensuring those units are actually reliable. They might focus on industrial applications where imperfections are more tolerable rather than consumer applications where people are less forgiving.

Investors should be watching this closely. The robot timeline is directly tied to Tesla's stock valuation. If Optimus looks like it's slipping, expect Tesla's stock to react violently. Conversely, if early Gen 3 units impress, the stock could rocket.

The financial pressure also explains why Tesla is being specific about timelines now. They're signaling to investors that this is real, this is happening, and it's not some fantasy five-year plan. Specific announcements in earnings reports have legal weight. If Tesla commits to Q1 2026 and then misses significantly, shareholders could get angry. Boards could demand explanations. The SEC might ask questions.

So the fact that Tesla put this in an official earnings report suggests they have genuine confidence in hitting the target.

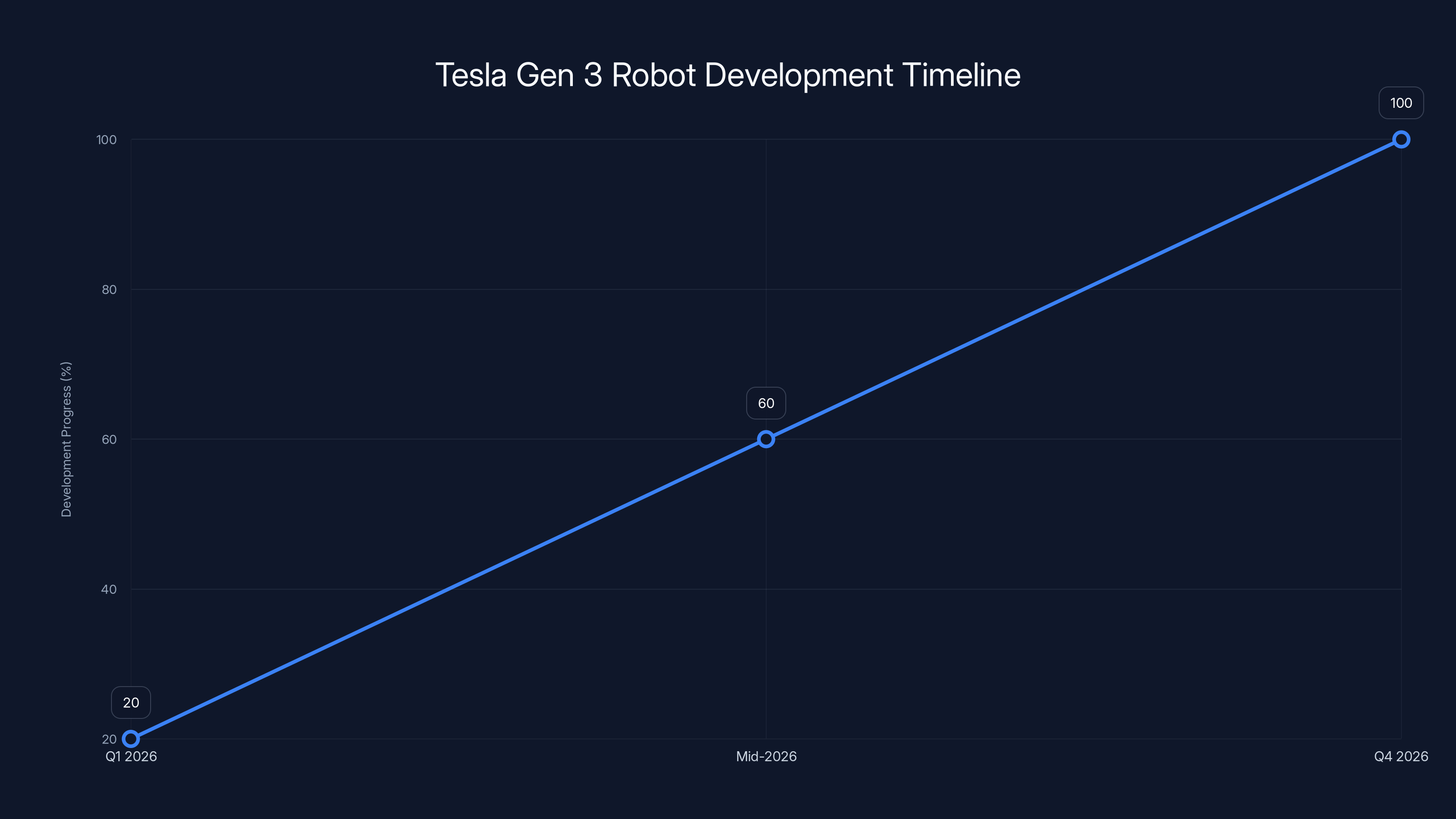

Estimated data shows Tesla's Gen 3 robot development progressing from reveal in Q1 2026 to production by Q4 2026, with significant ramp-up in mid-2026.

Competing Against Competitors: Who Else Is Building Humanoid Robots?

Tesla isn't alone in the humanoid robot space, but they have real advantages competitors can't easily match.

Boston Dynamics is the most famous name in robotics, but their approach is different. They build incredibly sophisticated robots that can do amazing things—parkour, complex manipulation, coordination. But they're not focused on mass production. Each robot is essentially custom. This limits their market to specialized applications and deep-pocketed buyers.

Figure AI took venture funding to build a more practical humanoid designed for task-specific industrial work. Their robots look more realistic and are built with manufacturing in mind. But they're a startup competing against Tesla's scale and capital resources. Even with strong product-market fit, building volume manufacturing is capital-intensive and time-consuming.

Several Chinese companies—Unitree Robotics, DEEP Robotics, others—are also pursuing humanoid robots. They're less well-known in Western markets but advancing rapidly. The competition is real.

But Tesla's advantages are substantial. Capital availability is essentially unlimited. Manufacturing expertise is unmatched in the robot space. Supply chain relationships give them cost advantages. The Tesla brand and Musk's credibility (however controversial) create demand. And they have a clear path to profitability through industrial applications before targeting consumer markets.

Most competitors are venture-backed, which means they need to show hockey-stick growth to satisfy investors. Tesla doesn't have that pressure. They can take longer to perfect the product before ramping production.

What Tasks Will Gen 3 Actually Handle?

Musk has made wild claims about Optimus. He's said they'll work as surgeons, home assistants, factory workers, and basically anything humans can do. Reality will be more limited, at least initially.

Phase 1 applications will almost certainly be factory work. Repetitive tasks, controlled environments, predictable scenarios. This is where humanoid robots can add value immediately. Factories have high wages, labor shortages, and boring, repetitive work. A robot that can do assembly, handling, packing, and quality checking pays for itself quickly.

The economics look compelling from Tesla's perspective. If an Optimus costs

Compare to hiring a worker at $20/hour plus benefits. The robot looks increasingly attractive as labor costs rise.

Home assistant roles are the long-term dream. Imagine a robot that can cook, clean, do laundry, provide companionship. This is the market that could be genuinely massive. But it requires robots to be far more capable, significantly cheaper, and dramatically safer than current technology allows.

Surgery is pure speculation at this point. Medical robotics exist, but they're not humanoid. They're specialized tools with extreme precision requirements. While theoretically possible, humanoid surgery robots are probably 10+ years away from viability.

Phase 1 is about proving the robot can work in controlled environments and pay for itself. That's the baseline. Anything beyond that is upside.

The Engineering Challenges That Make This Legitimately Hard

Building humanoid robots looks simple until you actually try it. Then you discover thousands of problems you never imagined.

Power management is brutal. Humanoid robots need batteries that power actuators, computing, sensors, and communications for hours while fitting in a human-sized package. This is why most current robots have terrible battery life. Tesla's battery expertise helps here, but it's still genuinely difficult.

Motion control is surprisingly complex. Human movement looks smooth and natural because our brains are running incredibly sophisticated control systems. Replicating this with mechanical and electrical systems requires massive computing power, perfect coordination between dozens of joints, and real-time adjustments based on sensory input.

Behavioral AI is challenging. The robot needs to understand what it's supposed to do, perceive the environment, make decisions, and execute actions. For simple tasks, you can hardcode behavior. For complex tasks, you need genuine AI. This is where large language models and vision systems become critical.

Reliability is non-negotiable. A human worker who breaks a finger and takes 6 weeks off to heal is frustrating for the employer. A robot that breaks and needs a $10,000 repair is uneconomical. Durability and repairability have to be engineered in from day one.

Safety around humans is a big deal. An industrial robot in a cage can move fast and strong. A humanoid working next to humans needs to be safe. This requires force limitation, good sensing, and failsafes. It's solvable but adds complexity.

The cost target is probably the hardest challenge. Manufacturing a humanoid robot at

Tesla's approach to this is probably clever manufacturing—using fewer unique parts, simpler designs, production techniques that work at scale. But we won't know if it actually works until Gen 3 ships and real production numbers are published.

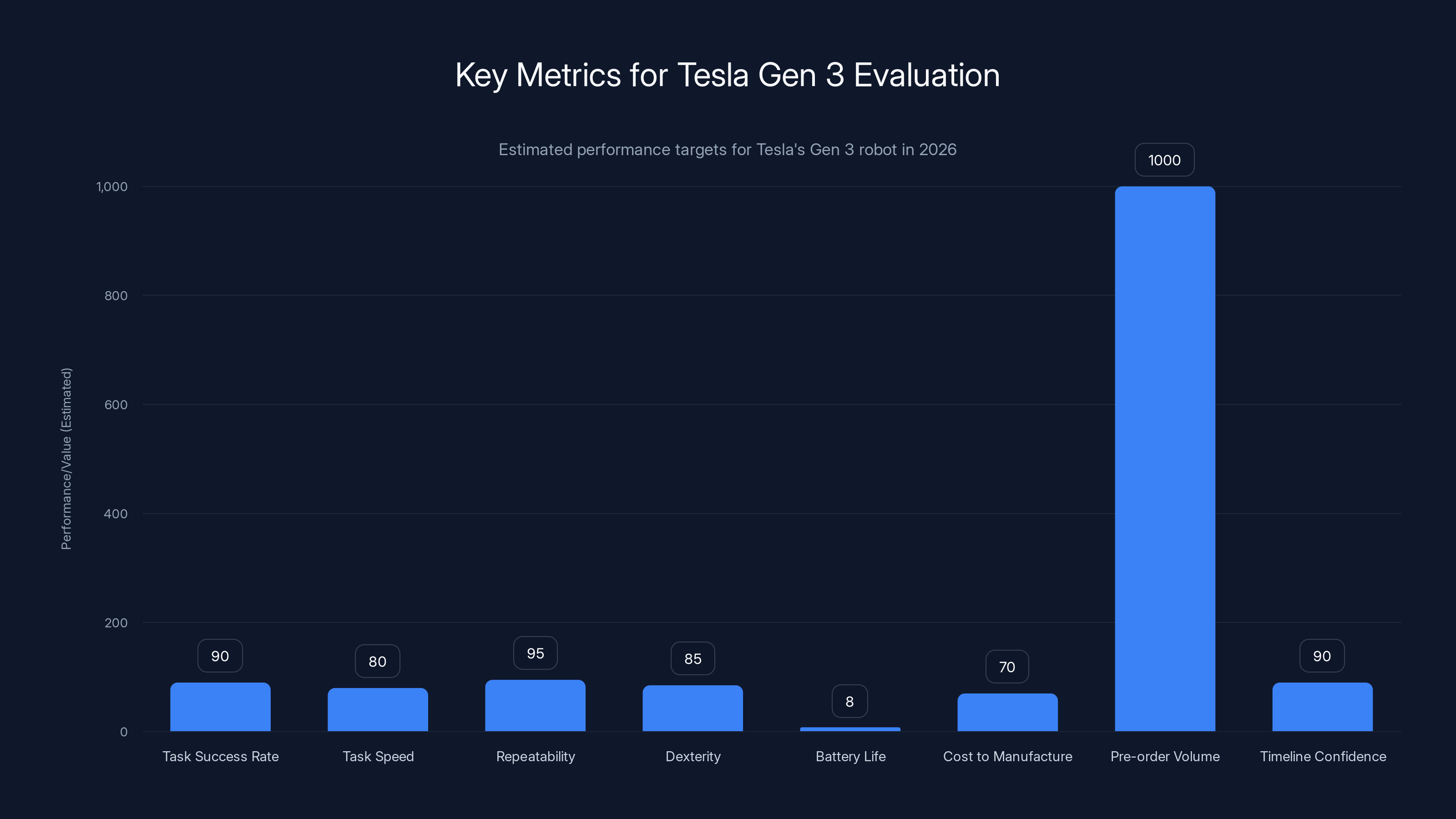

Estimated data suggests that Tesla's Gen 3 robot should aim for high task success and repeatability rates, competitive task speed, and substantial pre-order volumes for market success.

The Supply Chain Reality: Can Tesla Actually Source Components?

This is rarely discussed but utterly critical. Building 1 million robots requires sourcing massive quantities of specialized components.

Actuators are the constraint. These are the mechanical components that create movement. You need dozens per robot. High-quality actuators are expensive and in limited supply. Tesla needs to either develop their own at scale or secure exclusive deals with suppliers.

Electronics and computing power requirements are significant. Processors, memory, sensor chips—all needed in enormous quantities. Current chip shortages have proven how vulnerable supply chains are. Tesla needs redundancy and long-term agreements.

Batteries are obvious. Tesla makes batteries, which is a competitive advantage. But robot batteries are different from vehicle batteries. They need to be smaller, lighter, and have different discharge characteristics. Tesla probably can't use existing vehicle battery packs. They need to develop robot-specific battery technology and scale production.

Sensors are another pinch point. Vision systems, proximity sensors, pressure sensors, inertial measurement units—all needed in every robot. Suppliers of these components have limited capacity. Tesla might need to acquire sensor manufacturers or develop proprietary alternatives.

Aluminum, steel, various plastics, wiring, connectors—the bill of materials for a humanoid robot is massive. Tesla needs suppliers who can reliably deliver consistent quality at volume.

This is actually where Tesla's advantage is most pronounced. They've spent over a decade building supplier relationships, negotiating long-term contracts, and managing complex supply chains. Most competitors start from zero on this front.

The Timeline: What Actually Happens in Each Phase

Tesla's announcement laid out a specific sequence. Understanding each phase matters.

Q1 2026: Gen 3 Reveal

This is the public debut. Tesla will likely do a presentation similar to previous robot announcements. We'll get detailed specifications, demonstrations of capabilities, videos of the robot performing tasks, and comparisons to Gen 2.5.

Expectations will be sky-high. The robotics community and investors will scrutinize everything. Can it walk smoothly? Do the hands work well? Is it faster than competitors' robots? Can it handle unexpected scenarios?

Tesla will probably showcase the robot in various environments. Factory floor. Home setting. Interaction with humans. They'll emphasize improvements and breakthrough capabilities.

This reveal matters enormously. If Gen 3 looks impressive, investor enthusiasm will explode. If it looks incremental or reveals problems, sentiment shifts negative. Stock market reaction could be violent.

Mid-2026: Production Preparation

After the reveal, Tesla's focus shifts to manufacturing readiness. They begin setting up production lines, training workers, testing assembly processes, securing component supplies. This phase is invisible to the public but absolutely critical.

Quality control procedures need to be validated. Every component sourced needs to work reliably. Assembly sequences need to be optimized. Testing protocols need to be established. Documentation and training materials need to be created.

Early builds are made on test lines. These reveal manufacturing problems that the engineering team didn't catch. Design tweaks are made. Process improvements are implemented. Iterative refinement happens.

Q4 2026: Production Begins

First units roll off production lines. Volume is likely modest—maybe hundreds or a few thousand in the final quarter. These initial units are critical. Tesla likely sells them to partner companies or test customers. Real-world performance data is collected.

Known issues are documented. Improvements are prioritized for the next iteration. Worker feedback from manufacturing feeds back into engineering.

This phase is less about hitting volume targets and more about proving the production process works.

2027+: Scaling and Refinement

If all goes well, production ramps throughout 2027. Volume increases each quarter. The robot is refined based on real-world usage data. Costs decrease as manufacturing efficiency improves. New applications are explored as capability becomes proven.

By 2028-2029, if execution is flawless, Tesla could realistically be producing hundreds of thousands of robots annually. By 2030, potentially approaching the 1 million unit target.

But this assumes everything works perfectly, which never happens. More realistically, timelines slip 6-12 months. Costs stay higher than initially targeted. Reliability issues emerge requiring design changes. Competition advances faster than expected.

Even with delays, though, if Tesla delivers genuinely useful humanoid robots at reasonable cost within the 2026-2028 timeframe, they'll have changed the robotics industry fundamentally.

Economic Implications: The Labor Market Impact

If Tesla actually delivers what they're promising, the economic implications are massive. We're potentially looking at a fundamental disruption to labor markets.

Manufacturing gets disrupted first and most severely. Robots can work in factories 24/7. They don't need benefits. They don't unionize. They don't get tired. If humanoid robots become cost-competitive with human workers, manufacturing employment drops dramatically. This isn't hypothetical—it's what automation has done to every industry it's touched.

But the scale could be different here. Previous automation primarily displaced unskilled and semi-skilled labor. Humanoid robots could potentially automate all levels of work that don't require high judgment or creativity. This could affect middle-class employment more broadly than past automation waves.

The logistics industry faces massive change. Warehouses, delivery, sorting—all potentially automatable with capable robots. Amazon and other logistics companies are already investing heavily in robotics. Humanoid robots would accelerate this.

Home care is another potential application. Elder care is increasingly critical as populations age. Humanoid robots could assist with daily living tasks, monitoring, and companionship. This could be genuinely beneficial if implemented thoughtfully.

The economic opportunity for Tesla is enormous. If they capture even a fraction of the market, it's a multi-trillion-dollar business. This explains why Musk has bet his entire compensation package on it.

For workers and society, the implications require serious thought. Productivity increases could be transformative—fewer workers producing more value. But the transition creates genuine hardship for displaced workers. Policy responses will matter enormously. Retraining programs, social safety nets, education changes—all become critical if this transition actually happens.

Estimated data suggests Tesla aims to reach 1 million robots by Q1 2026, with significant production increases each year. This timeline is crucial for Tesla's stock valuation and Musk's compensation.

Why People Are Skeptical (And They Should Be)

Let's be honest about the skepticism. There are real reasons to doubt Tesla hits these timelines.

Elon Musk has a track record of missed deadlines. Full Self-Driving has been "coming soon" for over a decade. Mars timeline predictions have consistently slipped. The Cybertruck took far longer to reach production than promised. Hyperloop was going to revolutionize transportation—it's essentially abandoned.

This track record creates justified skepticism. When Musk makes promises, they should be discounted for reality.

Humanoid robotics is harder than Musk probably believes. The engineering challenges are immense. The complexity is hidden until you actually try to build at scale. Tesla's expertise in vehicles and batteries doesn't automatically transfer to robotics.

Competition is real. Tesla isn't the only smart people working on this problem. Boston Dynamics, Figure AI, Chinese manufacturers—they're all advancing rapidly. Tesla's advantage isn't permanent.

Market adoption might be slower than expected. Early customers might find that robots need more oversight than promised. Reliability might be worse. Capabilities might be narrower. Buyers might hold off waiting for improvements.

But here's the thing: skepticism doesn't mean it's impossible. It just means execution is hard and timelines slip. Even if Tesla misses by a year or two, they're still ahead of the industry. Even if robots cost

What Gen 3 Success Would Mean for Tesla Stock and Valuation

Much of Tesla's current valuation is baked into assumptions about Optimus success. The company's market cap already prices in enormous robot sales. If Optimus doesn't deliver, the stock gets crushed. If it does deliver, the upside is massive.

Investors are essentially making a binary bet on Musk's ability to deliver. Get 1 million robots made and sold profitably by 2030-2031? Stock could be worth dramatically more. Miss significantly? Stock gets rerated downward as the valuation premise breaks.

This creates pressure on Tesla to deliver or at least maintain belief that delivery is happening. Every quarterly update and announcement is analyzed obsessively for hints about progress or problems.

Historically, Tesla has been good at generating hype that sustains stock valuation even when timelines slip. But there are limits. If Optimus development stalls or reveals fundamental problems, investor patience eventually runs out.

The Gen 3 reveal in Q1 2026 will be a major inflection point for Tesla's stock. The market will carefully examine capabilities, timelines, and realistic assessments of when and at what cost these robots can be produced at scale. Early investor reactions could move the stock significantly.

Other companies will also be watching closely. Alphabet, Amazon, Meta—all have interest in humanoid robotics. If Tesla demonstrates Gen 3 is genuinely viable, expect other tech giants to either acquire robotics companies or start their own programs.

The Broader Robotics Industry Context

Tesla's Optimus is the highest-profile humanoid robot project, but it's not the only game in town.

Boston Dynamics' Atlas robot has been advancing steadily. Recent videos show impressive capabilities—running, jumping, coordinating with other robots. But Boston Dynamics hasn't committed to mass production timelines or public commercialization. They're focusing on perfecting the technology.

Figure AI has raised significant venture capital specifically to build a commercializable humanoid robot. Their approach is more pragmatic than Boston Dynamics—focused on industrial applications rather than pushing technical boundaries. They have a real path to customers and revenue.

Unitree Robotics and other Chinese manufacturers are advancing humanoid designs with manufacturing feasibility in mind. They're less well-known in Western markets but potentially more advanced in cost-effective production.

This ecosystem matters because Tesla doesn't operate in a vacuum. Competition will push them to innovate and produce. If competitors ship working robots before Tesla, the narrative changes. If Tesla ships first but competitors deliver better products, the advantage is temporary.

The robotics industry is at an inflection point similar to where electric vehicles were in 2010. The technology is proven. The economics are starting to work. Manufacturing at scale is becoming possible. The question is who executes best and fastest.

Tesla's advantages are real but not insurmountable. They have scale, capital, and manufacturing expertise. But competitors have focused approaches, venture backing, and the ability to move faster on specialized products.

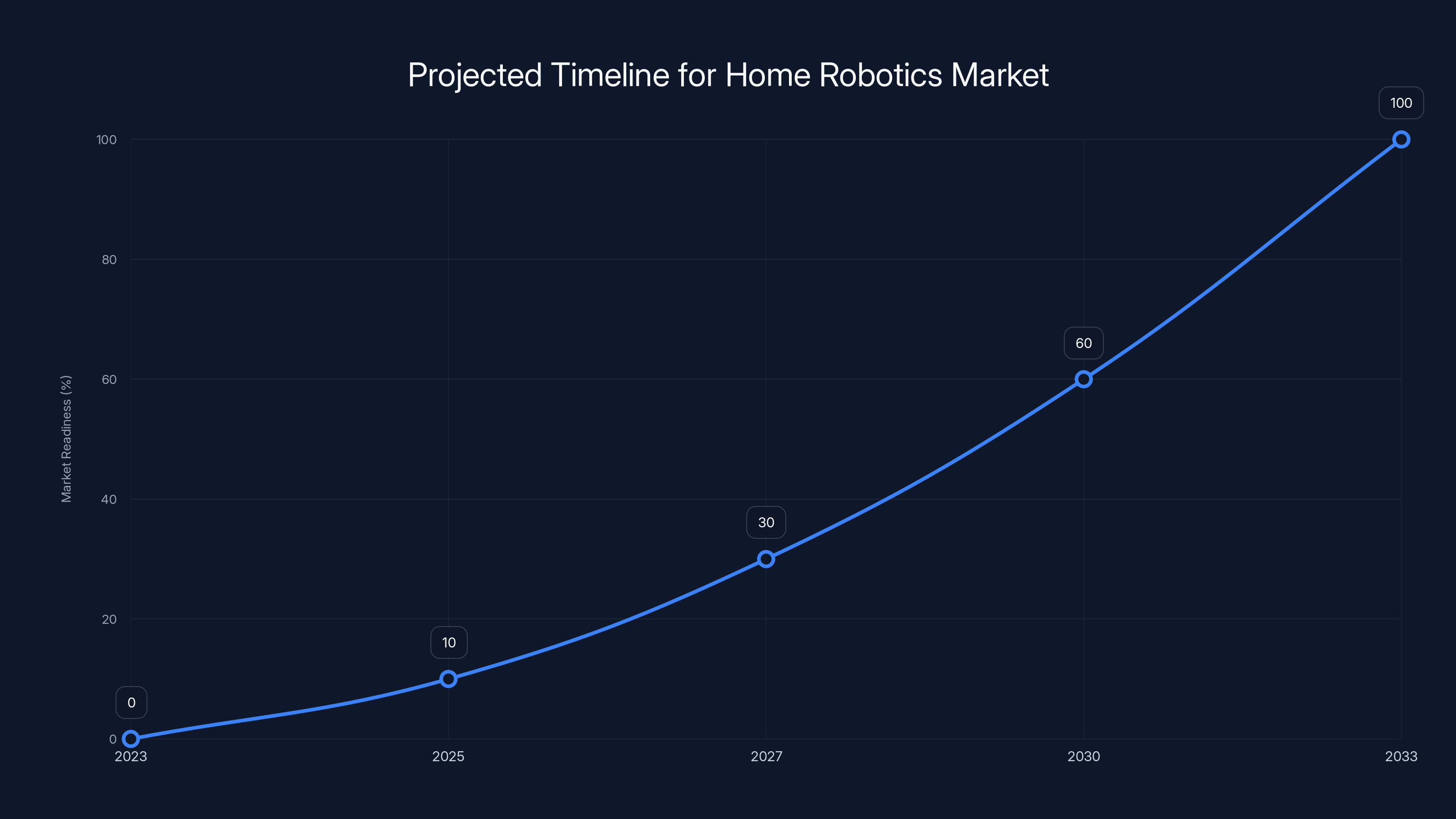

Estimated data suggests that consumer home robotics could become mainstream by 2033, with significant advancements in technology and cost reduction over the next decade.

Production Bottlenecks: The Hidden Constraints Nobody Discusses

When people talk about scaling to 1 million robots, they often gloss over the actual physical constraints that make this hard.

Factory floor space is limited. Building a line that produces 1 million humanoid robots annually requires massive facility investment. Tesla would need multiple factories. Buildout takes time and capital. Getting approvals, constructing facilities, installing equipment—easily 18+ months. So even if designs are done, manufacturing readiness is a multi-year project.

Workforce training is a genuine bottleneck. You need thousands of skilled workers to assemble robots. Assembly procedures need to be documented. Workers need to be trained. Quality control needs to happen at every step. Ramping workforce is slow. You can't suddenly hire 5,000 trained robot assemblers.

Testing and validation create constraints. Every robot needs to be tested before shipping. Does it move correctly? Do sensors work? Are there electrical issues? Testing takes time. Scaling testing infrastructure is expensive.

Component sourcing creates cascading delays. If a single critical supplier can't meet volume targets, the entire production line backs up. Tesla needs relationships with multiple suppliers for redundancy, but negotiating and validating new suppliers takes time.

Cash flow management is real. Building 1 million robots requires producing massive inventory. Component purchases happen months before revenue is received. Cash requirements could be billions of dollars annually. Tesla has capital, but deploying it efficiently matters.

These practical constraints are why even well-funded companies with clear strategies take years to ramp volume. Tesla will move faster than most companies could, but even they can't overcome physics and logistics overnight.

The Home Consumer Market: The Real Dream

For all the talk about factories, the real long-term market Tesla envisions is consumer homes.

Imagine having a robot that can help around the house. Clean, cook, do laundry, provide companionship. For aging populations or busy families, this has genuine value. The total addressable market is enormous—hundreds of millions of households worldwide.

But getting there requires robots to be dramatically cheaper (probably under $30,000) and dramatically more capable than current technology. They need to navigate cluttered homes, understand complex instructions, adapt to different living spaces, and do thousands of different tasks safely.

This is probably 5-10 years away at minimum, even if Tesla executes perfectly on Gen 3. The factory robot market needs to be proven first. Technology needs to be refined. Costs need to come down. Safety and reliability need to be demonstrated at scale.

But this is where the real wealth creation happens. A company that cracks the consumer home robotics market becomes one of the largest companies in human history. The TAM is just that enormous.

This is the real reason Tesla is pushing so hard on Optimus. It's not about making robots for factories. That's profitable but limited. It's about eventually having every home with a robot assistant. That's a multi-trillion-dollar market.

The timeline they're announcing is about getting to factory robots first, proving the concept, gaining manufacturing scale, and eventually building the cost and capability baseline to target homes. It's a deliberate sequence.

Key Metrics to Watch After Gen 3 Reveals

When Tesla shows Gen 3 in Q1 2026, here are the specific metrics investors and roboticists will be evaluating.

Task Success Rate: How many tasks does the robot attempt without human intervention or failure? Early target should be 90%+ success on demonstrated tasks.

Task Speed: How quickly does it complete common tasks compared to humans? For manufacturing value, it needs to be competitive with human workers.

Repeatability: When the same task is done 100 times, do results stay consistent? Variation indicates control problems.

Dexterity: Can it handle objects of varying sizes, weights, and fragility? Can it detect and adjust grip strength?

Battery Life: How long does it work on a charge? Eight hours minimum for industrial viability.

Cost to Manufacture: What's the actual bill of materials and estimated production cost? This determines whether the business model works.

Pre-order Volume: How many advance orders does Tesla get after the reveal? This shows market appetite.

Timeline Confidence: How specific is Tesla about when production actually begins and at what volumes?

These metrics will tell you far more than any marketing presentation. If Gen 3 nails these areas, it's genuinely revolutionary. If it's mediocre, we're looking at a longer timeline before real disruption.

Policy and Regulatory Considerations

As humanoid robots enter production, policy questions become critical.

Safety standards need to be established. What makes a robot safe for operation near humans? How much force can it exert before someone gets hurt? What sensors and failsafes are required? Regulators and manufacturers need to develop standards together.

Liability is complex. If a robot injures someone, who's responsible? The manufacturer? The operator? The owner? Insurance industry needs clarity to price policies. Legal frameworks need development.

Employment and labor policy require thought. As robots displace workers, what's the social response? Retraining programs? Universal basic income? Tax structures that fund transition? These are policy questions, not engineering problems, but they matter.

Data privacy and ethics matter for AI-enabled robots. How much of what the robot observes is recorded? Who owns that data? How is it protected? These questions become more important as robots enter homes.

Tariff and trade policy affect manufacturing. If key components are sourced internationally, tariffs impact costs and viability. Trade disputes could disrupt supply chains.

Regulators are generally moving thoughtfully on these issues rather than moving fast. This buys robotics companies time but also creates uncertainty about what requirements will eventually be imposed.

Tesla's announcement probably signals they've thought through regulatory strategy. Getting ahead of safety concerns prevents problems later.

The Next Two Years: What Actually Happens

Let's forecast realistically what probably happens between now and mid-2026.

Next 3-6 Months (Early 2025): Prototyping and testing intensify. Tesla engineers work through design revisions. Hand mechanics are refined. Software control is optimized. Internal testing pushes the design to find failure modes.

6-12 Months Out (Mid-2025): Manufacturing readiness kicks in. Tesla surveys potential factories, plans production line layouts, and secures component suppliers. Long-lead items are ordered. Workforce training materials begin development.

12-15 Months Out (Late 2025): Gen 3 is finalized for reveal. Manufacturing processes are documented. Quality control procedures are established. Pre-reveal media strategy is planned. Expectations are managed.

Q1 2026: The reveal happens. Market watches obsessively. Early reactions determine sentiment for months. Stock market reacts. Competitor responses shape the narrative.

Post-Reveal (Mid-2026): Manufacturing ramp accelerates. Supply chain problems emerge and are solved. Production line issues are debugged. First units are built and tested.

End of 2026: Early production units deliver to customer test sites. Real-world performance data comes in. Design revisions are made. The robot either validates or the narrative shifts.

This timeline has risks and uncertainties. But the sequence is predictable. Tesla is executing a well-defined playbook. They've done it before with vehicles.

The key variable isn't whether they can build robots. It's whether the robots actually work well enough to create real customer value at a price point that drives volume. That's the unknowable part until 2026-2027 when real units are in the field.

Final Assessment: The Odds and What This Means

Focusing on the core questions: Will Tesla reveal Gen 3 in Q1 2026? Probably yes. They've committed publicly, and missing would be catastrophic for credibility.

Will it be impressive? Probably somewhat. Tesla has strong engineering teams. The Gen 3 design has likely addressed Gen 2.5's main problems. The reveal should show genuine progress.

Will production actually start before end of 2026? Maybe. This is ambitious but Tesla has the resources. If they miss, it's probably by a quarter or two.

Will the robot be economically viable at scale? This is the hard part. If they pull it off, it's transformative. If not, Optimus becomes an expensive showcase project.

What's the probability of overall success (1 million robots by 2030)? Probably 30-40%. The engineering is hard. The manufacturing is harder. The market adoption is a wild card. But Tesla has the best shot of anyone on the planet.

This isn't certainty. It's a major company betting big on a transformative technology, with concrete timelines and everything to prove. The next two years will tell us whether this is hype or history.

For anyone interested in the future of work, automation, manufacturing, or just high-stakes corporate bets, Tesla's Optimus is the story to watch. Q1 2026 won't just reveal a robot. It'll signal whether the robotics revolution actually begins or remains perpetually five years away.

FAQ

What is Tesla Optimus Gen 3?

Optimus Gen 3 is Tesla's third-generation humanoid robot designed for mass production. Tesla announced in their earnings report that Gen 3 will be unveiled in Q1 2026 with significant upgrades from Gen 2.5, particularly improved hand dexterity and overall mechanical design. The robot is intended for industrial applications initially, with eventual expansion to home use and other domains.

When will Tesla Optimus Gen 3 be available?

Tesla committed to unveiling Gen 3 in the first quarter of 2026. Production line setup will begin immediately after, with first production units expected before the end of 2026. However, significant volume production ramping is likely to occur throughout 2027 and beyond. These are ambitious timelines and historical precedent suggests delays are possible.

What are the main improvements in Gen 3 compared to Gen 2.5?

The most significant upgrade is the new hand design, which addresses major dexterity limitations in previous versions. Gen 3 will feature improved joint mechanics, better sensor integration, and enhanced control software allowing more complex manipulation tasks. Beyond the hands, upgrades include better actuators for faster movement, improved sensor arrays for spatial awareness, enhanced AI-driven motion control, and power system improvements for longer operating duration.

How much will Optimus Gen 3 cost?

Tesla hasn't publicly disclosed specific pricing for Gen 3. Based on manufacturing economics and comparison to industrial automation equipment, industry estimates suggest a production cost likely in the

What can Optimus Gen 3 actually do?

Initial applications will focus on factory work: assembly, material handling, packaging, quality checking, and other repetitive industrial tasks. More complex capabilities like home assistance or detailed manipulation tasks will require additional refinement and testing. Early versions will likely need close human supervision and won't handle unexpected situations as well as marketing claims suggest.

Will Optimus Gen 3 replace human workers?

Likely, but gradually and unevenly. Robots will first displace workers in repetitive manufacturing tasks, then logistics and warehouse work. Long-term, broader job categories could be affected if robots become capable and affordable enough. However, historical automation shows that new jobs typically emerge even as old jobs disappear. The transition period creates genuine hardship for displaced workers, making policy responses important.

How many Optimus robots does Tesla plan to produce?

Tesla's target is eventually 1 million robots per year. This aggressive goal is baked into Elon Musk's compensation package. However, reaching this volume from current prototypes represents extraordinary scaling. More realistic near-term targets are probably hundreds of thousands annually by 2028-2029, with 1 million annual production potentially achieved by 2030-2031 at the earliest.

Is Optimus competition from other companies?

Yes. Boston Dynamics, Figure AI, Unitree Robotics, and others are developing humanoid robots. Boston Dynamics focuses on sophisticated capabilities rather than production. Figure AI is explicitly building for industrial manufacturing at scale. Chinese manufacturers are advancing rapidly. However, Tesla's manufacturing expertise, capital availability, and supply chain relationships give them significant competitive advantages. The winner will likely be whoever executes best on both technology and manufacturing.

Why is this important for Tesla's stock valuation?

Much of Tesla's current market value depends on successful robot production. Investors are pricing in the assumption that Optimus becomes a massive revenue driver. If robots deliver as promised, Tesla's market cap could grow significantly. If Optimus development stalls or reveals fundamental problems, the stock could be severely devalued. The Q1 2026 reveal will be a critical inflection point for Tesla's valuation narrative.

What could go wrong with Optimus development?

Multiple risks exist: manufacturing bottlenecks could delay production, component supply chain issues could constrain volume, robots might prove less capable than promised in real-world conditions, market adoption could be slower than expected, costs could exceed targets reducing profitability, or competitors could release superior products. Additionally, worker displacement could trigger regulatory restrictions, and Musk's track record includes numerous missed timelines.

How does this compare to other robotics company timelines?

Tesla is publicly committing to specific dates in a way most competitors aren't. Boston Dynamics focuses on capability rather than timelines. Figure AI is building for manufacturing but hasn't announced specific production timelines. Most robotics companies take 5-10 years from prototype to scaled production. Tesla's 2026 reveal and before-end-of-2026 production targets are aggressive compared to industry norms.

Would you like me to elaborate on any section or adjust the article's focus?

Key Takeaways

- Tesla will reveal Optimus Gen 3 in Q1 2026 with major improvements, particularly in hand design and dexterity for complex manipulation tasks

- Production lines launch before end of 2026, with target of 1 million robots annually by 2030, though actual timeline may slip 6-12 months

- The hand redesign addresses the critical bottleneck preventing humanoid robots from handling real-world factory tasks requiring precision and adaptability

- Musk's $1 trillion compensation package requires successful 1 million robot delivery, creating powerful financial alignment with announced timelines

- Manufacturing expertise and supply chain relationships give Tesla significant competitive advantages over venture-backed robotics startups

- Economic implications could be transformative for labor markets, particularly in manufacturing, logistics, and warehouse operations

- Early production will focus on industrial applications; consumer home robot market requires 5-10 additional years of development and cost reduction

- Success depends on solving engineering challenges (power, reliability, dexterity), manufacturing bottlenecks (component sourcing, workforce), and market adoption simultaneously

Related Articles

- Tesla Optimus: Elon Musk's Humanoid Robot Promise Explained [2025]

- Humanoid Robots in Factories: The Real Shift Away From Labs [2025]

- AI Pro Tools & Platforms: Complete Guide to Enterprise AI [2025]

- Amazon's 16,000 Layoffs: What It Means for Tech Workers [2025]

- How 2150's €210M Fund Is Reshaping Climate Tech for Urban Carbon Solutions [2025]

- AI Agents: Why Sales Team Quality Predicts Deployment Success [2025]

![Tesla Optimus Gen 3: Everything About the 2026 Humanoid Robot [2025]](https://tryrunable.com/blog/tesla-optimus-gen-3-everything-about-the-2026-humanoid-robot/image-1-1769636247465.jpg)