Tesla's Fully Driverless Robotaxis in Austin: What You Need to Know

Elon Musk just posted on X that Tesla is offering passengers actual robotaxi rides in Austin with zero humans in the front seat. No safety monitor. No one ready to grab the wheel. Just you, your destination, and a self-driving car.

This isn't a press release or a concept video. It's happening right now in Texas, as detailed by local reports.

Here's why this matters way more than another autonomous vehicle announcement. For years, every robotaxi company—from Waymo to Cruise to Zoox—has kept a human safety driver in the passenger seat as a security blanket. That person was supposed to intervene if things went sideways. But Tesla just skipped that step entirely and went straight to fully driverless operation in an actual city with real passengers, as noted by The New York Times.

The implications are massive. Not just for Tesla's timeline toward autonomous vehicles, but for how regulators think about self-driving cars, how the industry responds, and what it actually means when a car is ready to operate without human supervision, as discussed in regulatory discussions.

Let's dig into what Tesla is actually doing in Austin, how it compares to what competitors are attempting, why the technology might be ready for this (or might not be), and what happens next in the race to deploy truly driverless vehicles.

TL; DR

- Tesla is operating fully driverless robotaxis in Austin without a safety monitor in the vehicle, marking a significant escalation in autonomous vehicle deployment, as reported by CNN.

- The rollout is gradual: Tesla is mixing unsupervised vehicles with monitored ones and increasing the ratio over time rather than going all-in immediately, as explained by local sources.

- Safety and regulatory questions remain unanswered: It's unclear what happens if a collision occurs, whether rides are free or paid, and whether other cities will allow this approach, as highlighted by The Motley Fool.

- Competitors like Waymo and Zoox have deployed driverless vehicles but typically started with paid testing in limited areas with different operational parameters, as noted by Electrek.

- The technology foundation matters: Tesla's years of Autopilot and FSD data collection have trained neural networks on billions of miles of driving patterns, giving it a significant data advantage, as discussed by InsideEVs.

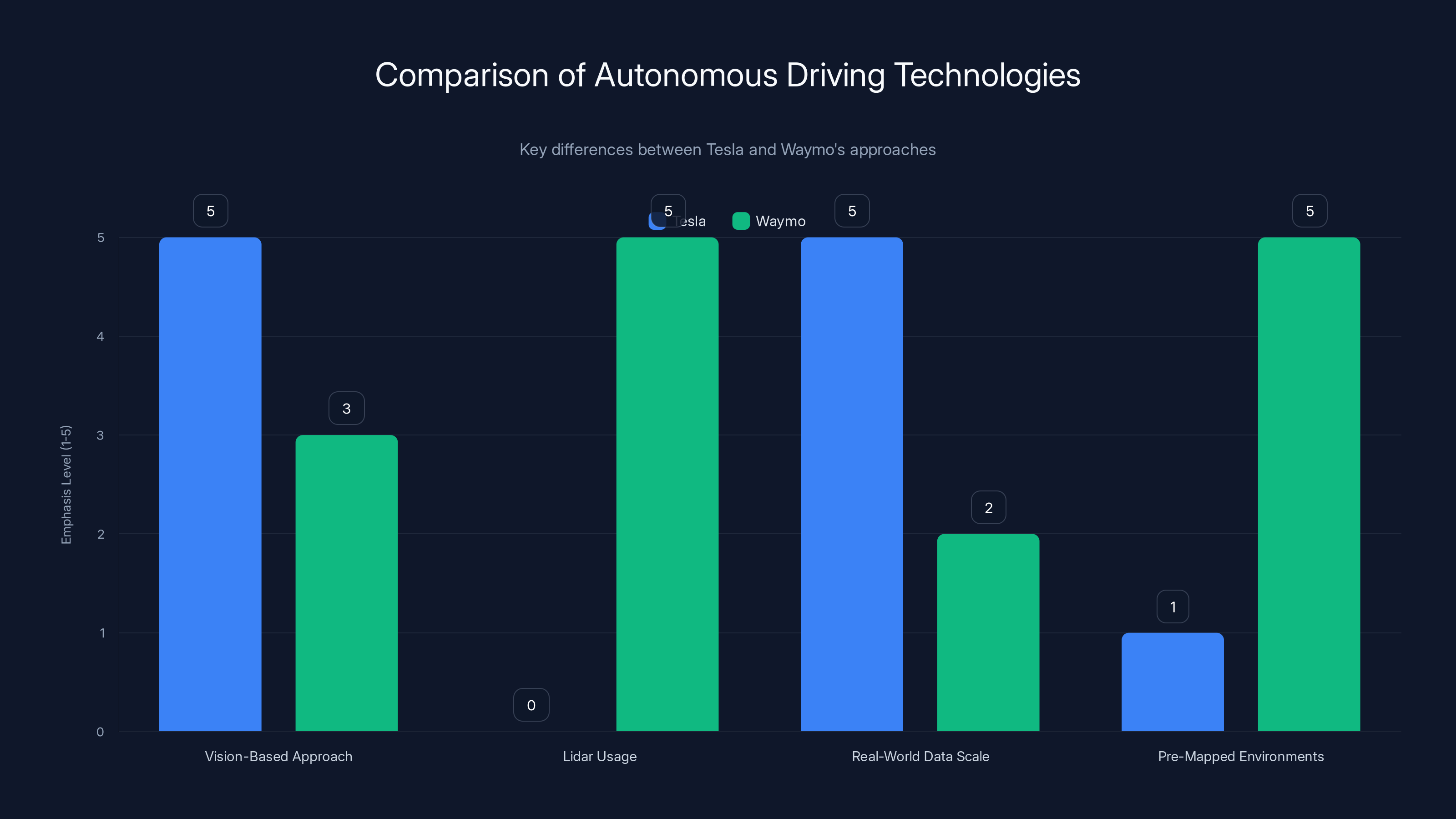

Tesla relies heavily on a vision-based approach and real-world data, while Waymo emphasizes lidar and pre-mapped environments. Estimated data based on known strategies.

The Announcement: Tesla Goes Full Driverless

On a Thursday in January 2025, Musk posted a three-sentence update that essentially said Tesla had started running robotaxis in Austin with no safety monitor. He then pivoted to recruiting, asking engineers interested in solving "real-world AI" to join the Tesla AI team, framing autonomous vehicles as a stepping stone to AGI (artificial general intelligence), as reported by local news.

It's a characteristically Musk move: announce something radical, flex the accomplishment, then use it as a recruitment hook.

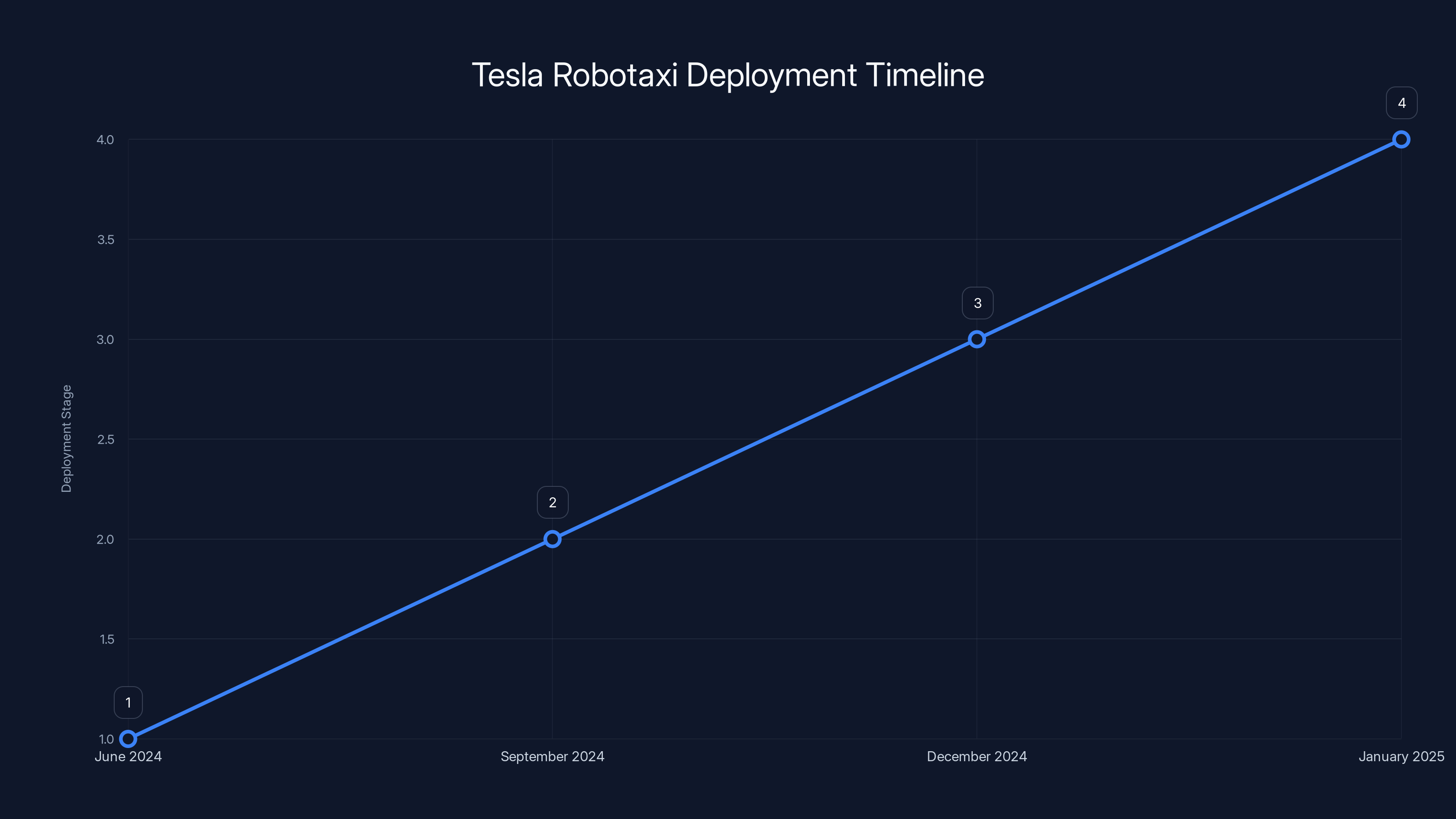

But the timing matters. Tesla had been testing robotaxis in Austin since June 2024 with a safety operator in the front seat. That initial deployment was limited to influencers and handpicked customers in a controlled rollout. By December 2024, Tesla began testing without a safety driver in the car. Now, less than a month later, they're offering those rides to passengers, as noted by The New York Times.

The speed of progression is telling. From limited deployment with safety monitors to no safety monitors in under eight months. That's aggressive even by Silicon Valley standards, as highlighted by CNN.

According to Ashok Elluswamy, Tesla's AI lead, the company isn't replacing its entire fleet at once. Instead, they're "starting with a few unsupervised vehicles mixed in with the broader robotaxi fleet with safety monitors, and the ratio will increase over time." That's strategic language for "we're dipping our toe in, then slowly turning up the heat," as detailed by local sources.

The mixed-fleet approach makes sense operationally. It lets Tesla collect data on how often fully driverless vehicles encounter situations they can't handle alone, how passengers respond, and what edge cases emerge in real Austin traffic, as analyzed by FreightWaves.

Tesla's robotaxi deployment in Austin progressed from initial testing with safety monitors to fully driverless operation in just eight months. (Estimated data)

The Technology Behind Tesla's Autonomous System

Underlying Tesla's robotaxi ambition is a neural network approach to autonomous driving that's fundamentally different from the lidar-heavy systems competitors use.

Where Waymo and other traditional autonomous vehicle companies built systems around lidar (light detection and ranging) sensors that create precise 3D maps of surroundings, Tesla bet on vision-based autonomy. The company stripped down the sensor suite to cameras and radar, then trained massive neural networks to understand the driving scene from visual data alone, as explained by NVIDIA News.

It's the difference between giving a car a mathematical blueprint of the world versus teaching it to see like a human.

Tesla's approach has advantages and risks. The advantage: cameras are cheap, easy to scale, and generate the kind of visual data that neural networks actually learn from well. A Tesla owner driving with Autopilot or FSD generates usable training data every single time. Multiply that by millions of vehicles, and you get a dataset that's essentially the recorded driving experience of an entire country, as highlighted by InsideEVs.

The risk: vision systems are vulnerable to edge cases cameras can't handle. Rain. Fog. Glare. Obscured lane markings. Unusual traffic patterns. Systems trained primarily on visual input can fail in ways that lidar-based systems might not, as discussed by FreightWaves.

Tesla has tried to solve this by building redundancy into the neural network architecture itself. Multiple parallel networks make predictions, and if they disagree on what they're seeing, the system defaults to caution. But there's no independent verification that this architecture is actually safer than alternatives, as noted by local reports.

The neural networks powering Tesla's system were trained on a specific kind of data: highway driving with Autopilot and Full Self-Driving engaged. That means the network learned from situations where a human was watching and could intervene. Now Tesla is asking the network to operate in city streets without that safety net, as reported by regulatory discussions.

City driving is fundamentally harder than highway driving. There are more actors (pedestrians, cyclists, parked cars), more ambiguous situations, more unpredictable behavior. Traffic laws change block to block. Parking spaces appear and disappear. People don't follow the rules.

For the neural networks to handle all this without a human in the loop, they need to generalize from their training data to novel situations. That's possible. Deep learning systems can generalize surprisingly well. But whether Tesla's system can do it reliably enough that a passenger doesn't die is the actual question nobody can answer yet, as highlighted by FreightWaves.

How Tesla's Deployment Compares to Waymo and Competitors

Waymo isn't standing still while Tesla makes headlines. The company announced robotaxi service in Miami recently and has been steadily expanding its driverless operations in Phoenix and San Francisco, as reported by Auto Connected Car. But there's a crucial difference in how Waymo and Tesla are approaching the same problem.

Waymo's strategy is conservative in deployment but aggressive in scope. The company thoroughly tests each geographic area before allowing driverless operation. It started in Phoenix's planned neighborhoods and suburb-like streets before expanding to dense San Francisco. It uses geofencing extensively—basically, the robotaxi service has strict boundaries about where it can and can't operate. Within those boundaries, Waymo has probably tested literally every block thousands of times, as detailed by Electrek.

Tesla's strategy is the opposite. It's aggressive in deployment but narrow in scope. Start with a few driverless vehicles mixed into a broader fleet, rely on the neural network to handle novel situations, and expand gradually based on what happens, as noted by local sources.

Zoox, which Amazon acquired, took yet another approach: build a purpose-built autonomous vehicle from the ground up (no steering wheel, optimized for ride-sharing), then deploy it in limited geographic areas. Zoox started with paid robotaxi rides in Las Vegas and other locations, but also under tight operational constraints, as reported by Auto Connected Car.

Cruise, which was Waymo's main competitor before a series of incidents and regulatory restrictions, attempted dense urban robotaxi deployment in San Francisco before encountering a pedestrian and eventually pulling back significantly, as discussed by FreightWaves.

Each company's approach reflects different assumptions about what autonomous systems need to be ready:

- Waymo assumes: Detailed environmental knowledge, extensive pre-testing, and geofencing are necessary for safety

- Tesla assumes: Trained neural networks can generalize to novel situations if they're good enough

- Zoox assumes: Purpose-built hardware and limited deployment areas reduce complexity

- Cruise assumed: Scaling quickly in dense cities would work (and proved wrong)

Tesla's willingness to operate without safety monitors is either visionary or reckless depending on whether the system actually works. The company seems confident enough to bet passengers' safety on it. But confidence isn't proof, as highlighted by regulatory discussions.

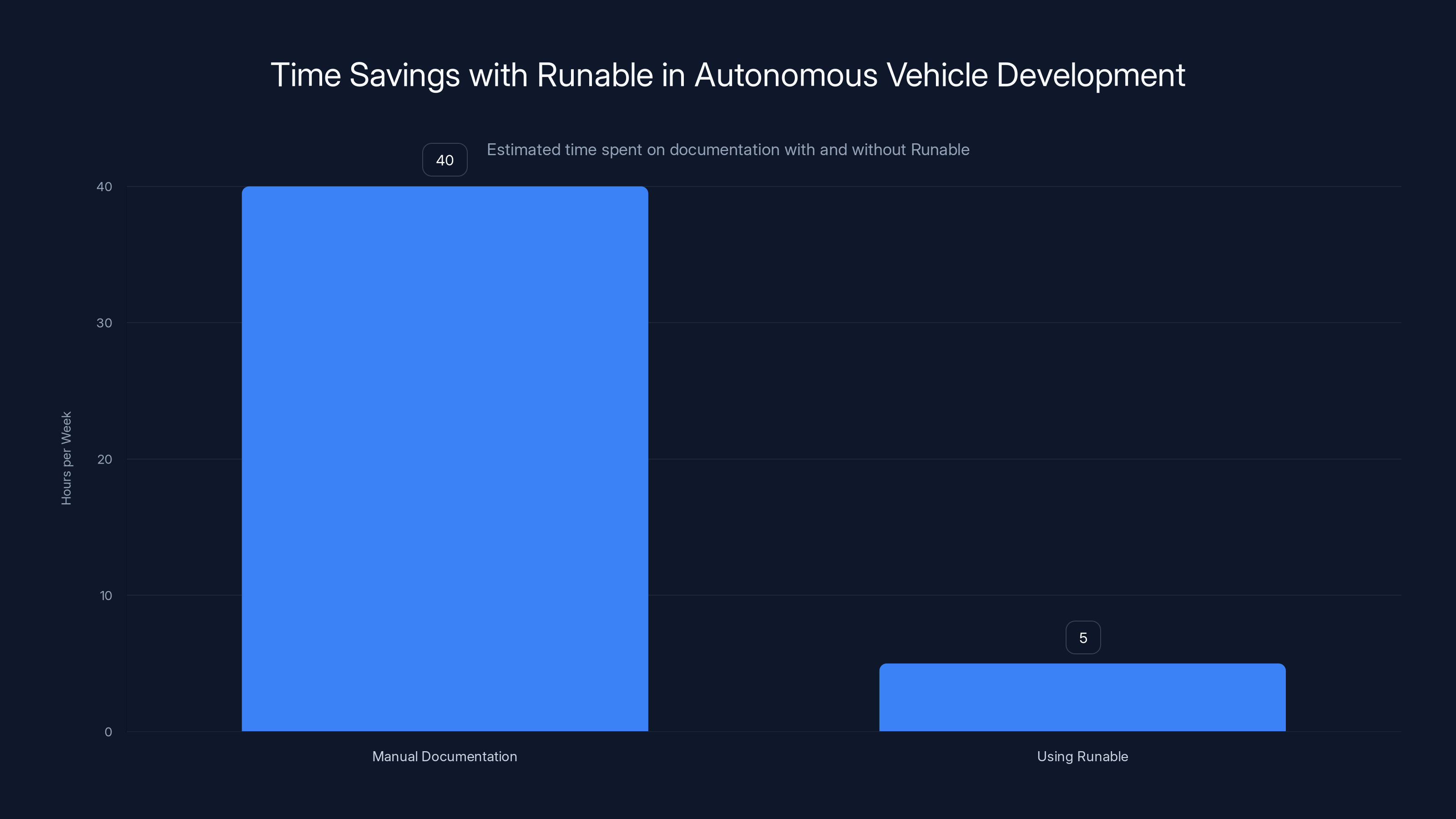

Using Runable can reduce documentation time from 40 hours to 5 hours per week, allowing engineers to focus on core development tasks. (Estimated data)

The Safety Question Nobody Is Asking Out Loud

Here's what Tesla hasn't clearly articulated: what happens when (not if—when) something goes wrong?

A fully driverless vehicle in Austin gets into a collision. Someone gets hurt. Who is liable? Is it Tesla? The passenger? A third party whose car got hit? The city of Austin?

Under normal circumstances, the driver is responsible. But there is no driver. So liability falls back to the manufacturer (Tesla) or the service operator. Tesla is both, as discussed by regulatory discussions.

Insurance is another unanswered question. Traditional auto insurance assumes a human driver. It assigns fault, calculates risk, and prices premiums based on driver behavior and vehicle type. How do you insure a car with no driver? Some insurance companies are starting to address this (Lemonade recently launched an insurance product for Tesla FSD customers), but the liability framework for fully driverless robotaxis is still being written, as noted by The Motley Fool.

Regulators in Texas seem comfortable with Tesla's approach, at least for now. The state hasn't prohibited fully driverless robotaxis, and Austin has been unusually permissive about autonomous vehicle testing. But that permissiveness could evaporate quickly if there's a serious incident, as highlighted by local sources.

Arizona (where Waymo operates extensively) has specific regulations about autonomous vehicles. California (where the robotaxi race is fiercest) requires detailed safety testing and reports. Texas has been more hands-off, which is probably why Tesla chose Austin for this deployment, as discussed by The New York Times.

The safety record of any autonomous vehicle system is ultimately measured in incidents per mile. Waymo has driven hundreds of millions of miles with very few serious accidents. But even one bad accident in a fully driverless Tesla Robotaxi would dominate news cycles and potentially trigger regulatory backlash, as noted by regulatory discussions.

Tesla is betting that its neural networks are good enough. The company doesn't seem to be betting cautiously, as highlighted by The Motley Fool.

The Data Advantage: Tesla's Secret Weapon

Why does Tesla think it can skip the safety monitor stage that every other company has used?

Data. Specifically, Tesla's access to real-world driving data at a scale competitors can't match, as discussed by InsideEVs.

Every Tesla vehicle with Autopilot or Full Self-Driving enabled sends data back to Tesla's servers. Not just sensor data—the actual decisions the car made, the human correction (if any), the outcome. Over years, across millions of vehicles, in every driving condition and scenario the real world offers, as noted by local sources.

That data is gold for training neural networks. It's the difference between learning to drive from a textbook versus learning from actually being on the road.

Let's put some numbers to this. If Tesla has 3 million vehicles on the road, and each drives an average of 40 miles per day, that's 120 million miles of driving per day. Over a year, that's roughly 44 billion miles of real-world driving experience encoded into training data, as highlighted by The Motley Fool.

Compare that to Waymo or competitors who collect data from their own fleets (vastly smaller) plus, in some cases, partnerships with ride-sharing services. Even aggregated, it's nowhere near Tesla's scale, as noted by Electrek.

The catch: most of that data comes from semi-autonomous driving situations where a human is paying attention and can correct the AI if needed. Deploying fully autonomous on that foundation is a leap. But it's a leap Tesla seems willing to take, as discussed by regulatory discussions.

Tesla's ratio is dramatically higher than competitors, which gives the company asymmetric information about edge cases and failure modes, as highlighted by InsideEVs.

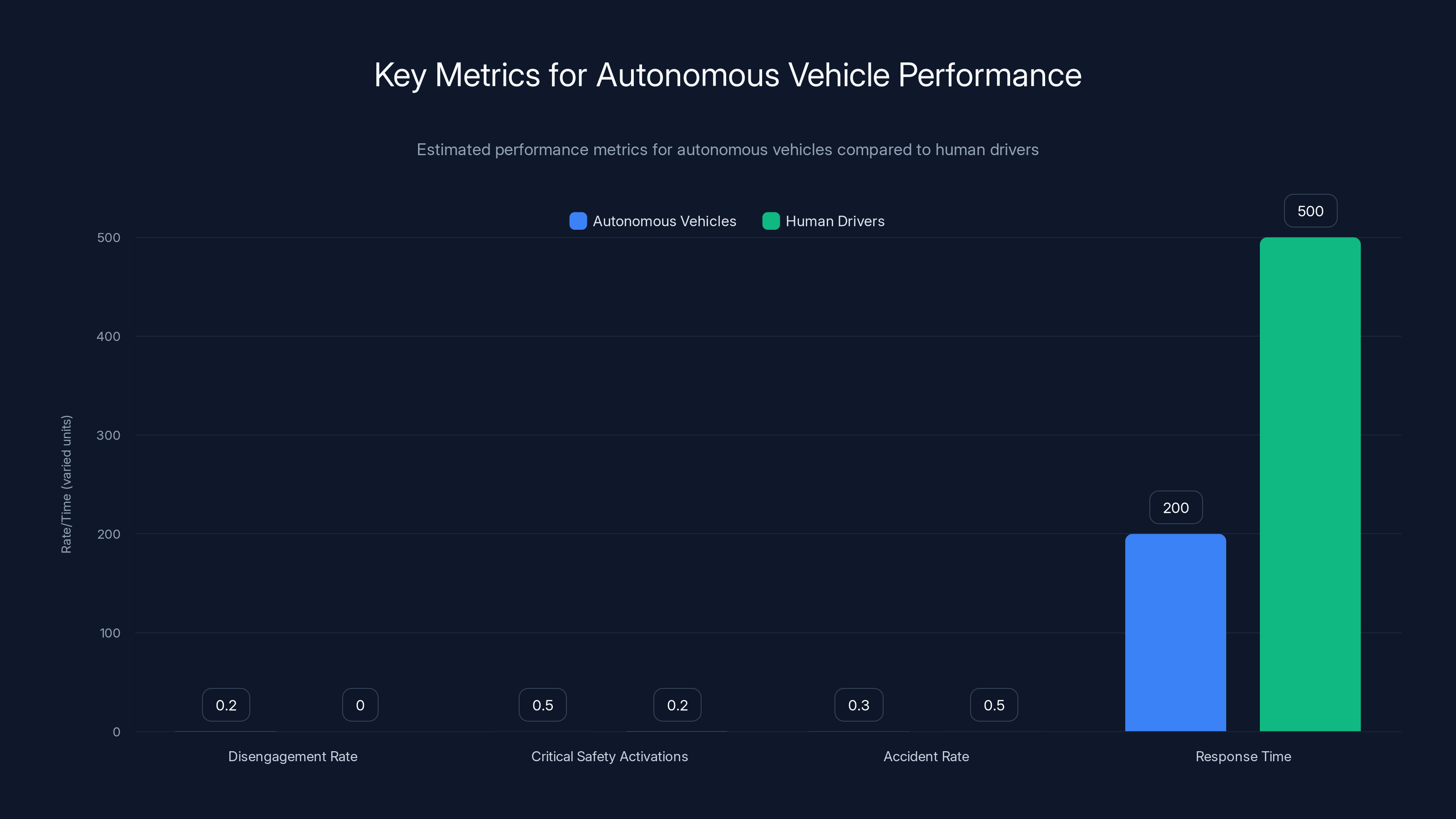

Estimated data shows autonomous vehicles have a lower accident rate and faster response time compared to human drivers, but higher disengagement and safety activation rates. Estimated data.

What Passengers Actually Experience

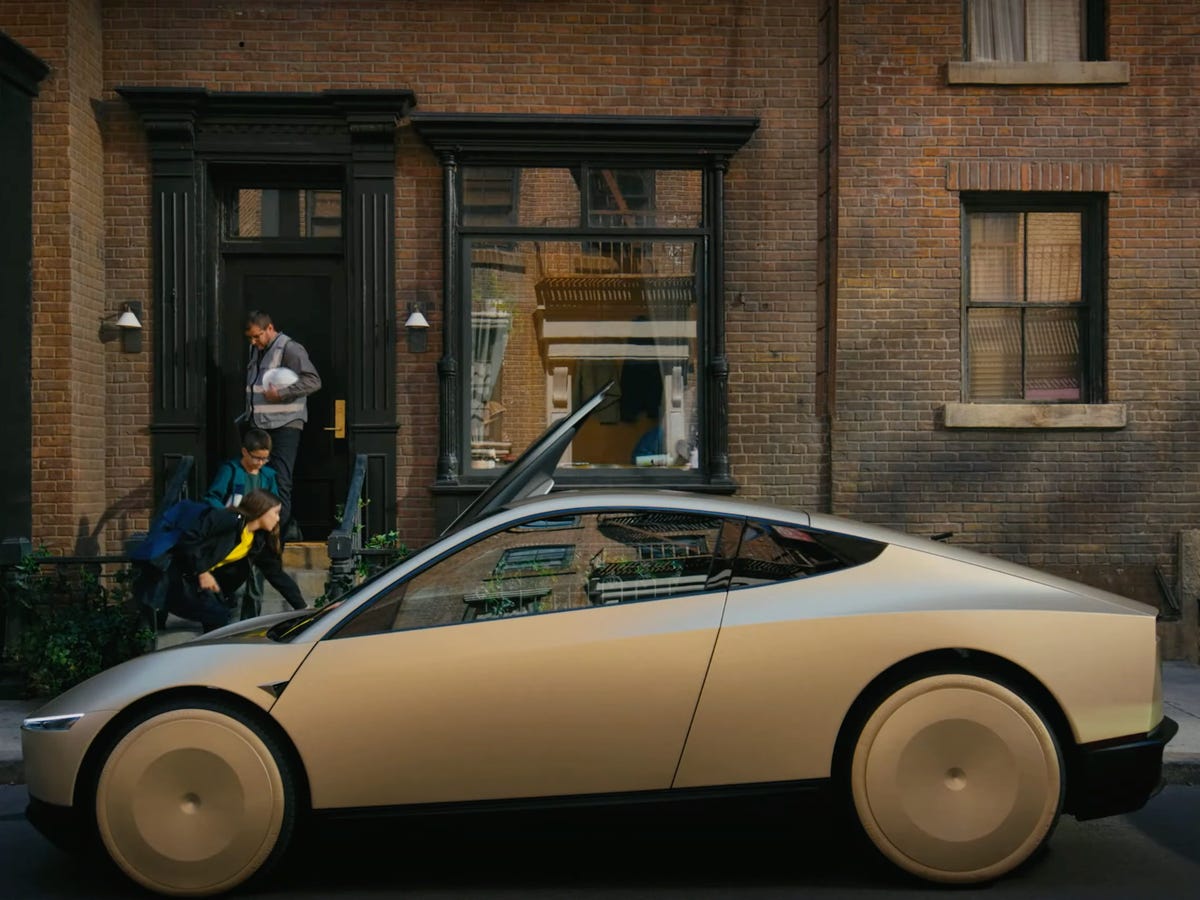

So what's it like to ride in a Tesla Robotaxi without a safety driver?

Early reports from Austin users describe a surprisingly normal experience. You request a ride in the Tesla app. A Tesla vehicle (likely a Model 3 or Model Y) arrives. You get in. The car takes you to your destination, as detailed by The New York Times.

The uncanny part: there's literally no one else in the car. No driver monitoring you. No safety operator ready to intervene. Just you and an AI deciding what to do at every traffic light, every pedestrian, every unexpected obstacle, as noted by local sources.

You're not even watching the road because you don't need to—there's no steering wheel in the front seat to grab. The car is fully responsible.

Understandably, that triggers some psychological responses. Trust is weird when it's computational. You're trusting code, not a human. Most people have way more faith in a competent human driver than in neural networks, even if the statistics might eventually prove neural networks are safer, as discussed by regulatory discussions.

Tesla hasn't released pricing information, though early reports suggest rides are either free or nearly free during this testing phase. That's standard for robotaxi deployments. You attract users, gather feedback, refine the system, and worry about profitability later, as highlighted by The Motley Fool.

The ride experience itself is reportedly smooth most of the time. The car drives at appropriate speeds, makes turns smoothly, stops at red lights. It handles basic city driving, as noted by local sources.

But there's always that moment of uncertainty: what if the car encounters something it wasn't trained on? What happens then?

The Regulatory Framework (Or Lack Thereof)

Autonomous vehicles are regulated at multiple levels: federal, state, and sometimes local. Right now, the framework is messy.

At the federal level, the National Highway Traffic Safety Administration (NHTSA) has provided some guidance but hasn't created comprehensive regulations for fully autonomous vehicles. Instead, NHTSA says states can establish their own rules, as discussed by regulatory discussions.

States have taken wildly different approaches. California requires autonomous vehicles to have detailed safety testing and regular safety reports filed with the state. The California Public Utilities Commission oversees robotaxi services specifically. A company can't just start offering driverless rides; it needs approval first, as noted by The New York Times.

Arizona took a more hands-off approach early on, which is why Waymo expanded there aggressively. But even Arizona has rules: autonomous vehicles need to be properly registered and insured, as highlighted by Electrek.

Texas, where Tesla is operating, has been the most permissive. The state has minimal specific regulations on fully autonomous vehicles. As long as the vehicle is registered and insured, and doesn't violate general traffic laws, it can operate. That lack of oversight is probably why Tesla chose Austin, as discussed by regulatory discussions.

But that permissiveness could change fast. If there's a serious accident, if a driverless car kills someone, the political pressure to regulate will be immense, as noted by The Motley Fool.

One complicating factor: federal law currently requires that vehicles have "a human driver capable of exercising control" under some interpretations. But that's a gray area, and it's unclear how it applies to robotaxis where there is no human at all, as highlighted by regulatory discussions.

International regulations vary wildly. Some countries (Japan, for example) are quite open to autonomous vehicles. Others require extensive testing and approval. The European Union is developing its own framework, as noted by Auto Connected Car.

For Tesla, the regulatory environment is a feature, not a bug. Operating in permissive jurisdictions like Texas lets the company test quickly and iterate without bureaucratic delays. By the time other states tighten regulations, Tesla will have years of data showing the system works, as discussed by regulatory discussions.

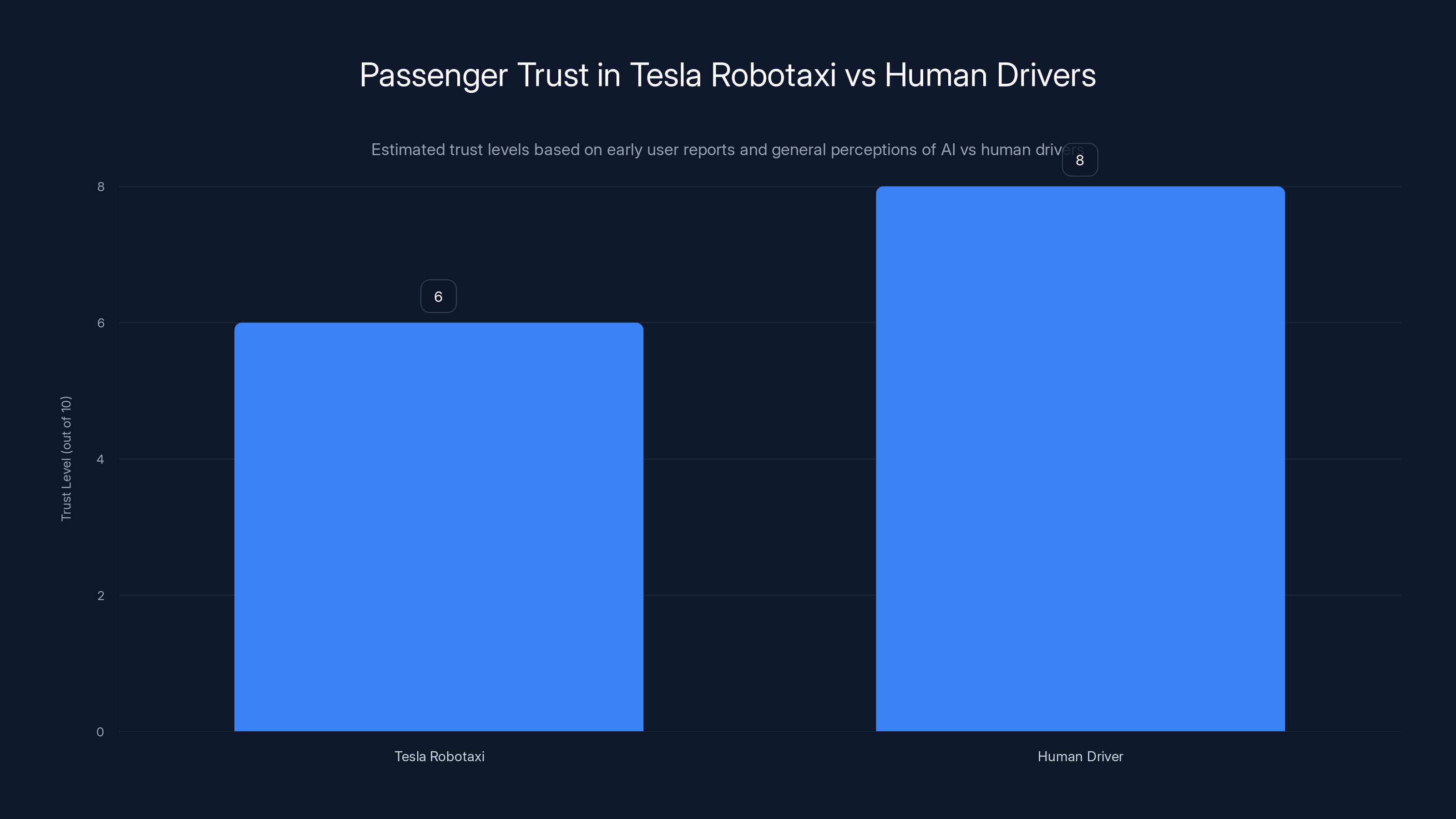

Early reports suggest passengers have a moderate level of trust in Tesla Robotaxis, but still trust human drivers more. Estimated data based on user feedback.

Financial Implications: The Path to Profitability

Elon Musk and Tesla have positioned robotaxis as the primary future revenue driver for the company. The pitch is straightforward: if cars can drive themselves, you don't need a driver. Robotaxi fleets could be far more efficient and profitable than human-driven services, as discussed by The Motley Fool.

But the math is hard.

Waymo, despite years of operation and a major investment from Alphabet, isn't profitable. Zoox is still in early deployment. Cruise pulled back from expansion after safety incidents. Operating robotaxi services at scale requires managing massive fleets, handling customer support, dealing with regulatory compliance, managing insurance and liability, and maintaining the software, as noted by FreightWaves.

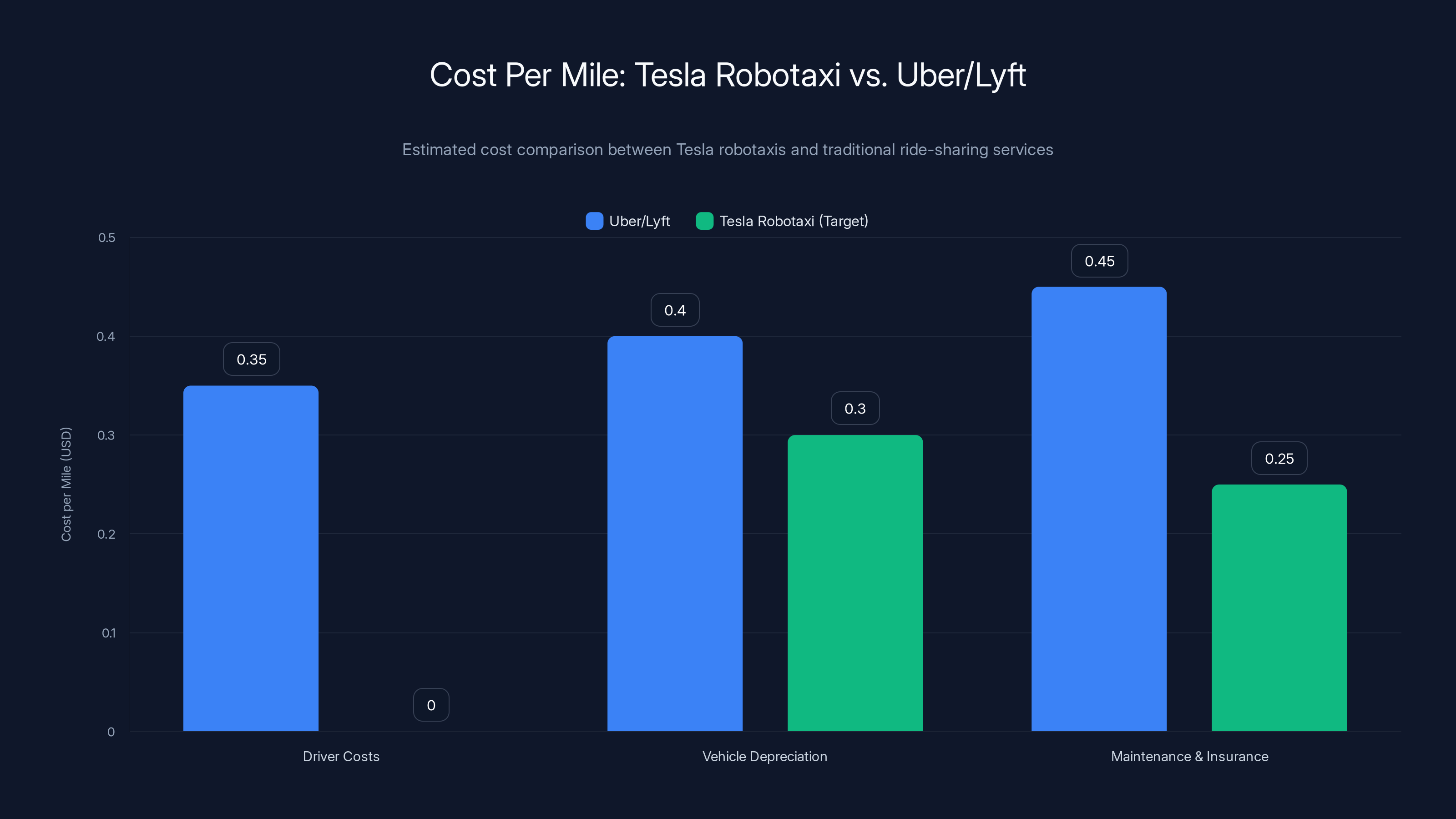

Uber and Lyft operate at single-digit margins in ride-sharing even with human drivers already employed. Removing the driver eliminates one cost category, but robotaxi operations introduce others: vehicle maintenance, depreciation, software updates and refinement, regulatory compliance, as highlighted by The Motley Fool.

Tesla's advantage is vertical integration. Tesla manufactures the vehicles, controls the software, runs the service. There's no middleman. Every dollar of revenue goes straight to Tesla (minus operating costs), as discussed by local sources.

The company could potentially offer cheaper rides than Uber or Lyft because it doesn't pay drivers. But cheaper rides alone don't guarantee profitability, as noted by The Motley Fool.

Here's what matters financially: if Tesla can operate robotaxis at a cost per mile lower than Uber/Lyft's driver costs plus vehicle depreciation, the company wins. Uber's driver costs are roughly

If Tesla's robotaxi system can deliver transportation for less than

That's Tesla's target. Whether the company hits it depends on how reliable the autonomous system needs to be and how much human intervention it actually requires in practice, as noted by regulatory discussions.

The Competitive Response

Waymo is watching Tesla's Austin deployment closely. The company has its own aggressive expansion plans. Waymo's robotaxi service is now open to the public in Miami, San Francisco, and Phoenix. The company has been operating in those markets with safety-monitored and driverless rides, building an operational model that works, as reported by Auto Connected Car.

Waymo's response to Tesla is likely not going to be accelerating its own driverless deployment. Instead, Waymo's strength is operational maturity. The company has developed processes for handling edge cases, customer support, incident response, and regulatory interaction that Tesla is still building, as noted by Electrek.

Zoox, under Amazon, is moving slower but with significant resources behind it. The company's purpose-built autonomous vehicle gives it a different approach to the same problem, as highlighted by Auto Connected Car.

Then there are the Chinese competitors. Companies like Baidu and Di Di are developing autonomous vehicle technology in their own markets, where regulatory oversight is different and deployment might actually happen faster than in the US, as discussed by Auto Connected Car.

The autonomous vehicle race isn't about who deploys first; it's about who builds a system that works reliably enough and can scale profitably. Tesla's move in Austin is notable, but it's not a decisive blow to competitors. It's a bet, not a victory, as noted by regulatory discussions.

Tesla aims to operate robotaxis at a lower cost per mile than Uber/Lyft by eliminating driver costs and optimizing vehicle-related expenses. Estimated data.

Safety Incidents: What Could Go Wrong

Let's be direct about the risks.

A fully autonomous vehicle operating without any human supervision increases the potential impact of software failures. If the neural network misclassifies a situation (thinks a pedestrian is a pole, thinks a stop sign means go), the consequences are immediate and potentially fatal, as discussed by FreightWaves.

Autonomous vehicle incidents do happen. In Arizona, a Waymo vehicle rear-ended a vehicle once. In California, Cruise vehicles got into scrapes with fire trucks and other obstacles. None of these were catastrophic, but they demonstrate that even mature autonomous systems make mistakes, as noted by Electrek.

Tesla's system is newer to fully autonomous operation. The company has less data on how its neural networks actually perform without a safety monitor catching and correcting errors, as highlighted by local sources.

A bad incident could trigger:

- Public backlash against autonomous vehicles generally

- Regulatory crackdowns that slow all deployments

- Liability lawsuits that could be existential for a robotaxi service

- Insurance companies refusing to insure fully autonomous vehicles

That's why competitors are moving more cautiously. They're not slower because they can't move faster; they're moving carefully because the downside risk is enormous, as discussed by FreightWaves.

Tesla, as a company, tends toward risk-taking. Elon Musk has staked the company's future on autonomous driving being viable. That confidence could be justified. Or it could be overconfidence, as noted by The Motley Fool.

The Path Forward: What's Next for Autonomous Vehicles

If Tesla's Austin deployment succeeds (and "succeeds" means passengers don't die, incidents stay minimal, and the system gradually gets better), the company will likely expand to other cities. Las Vegas, Los Angeles, or New York would be natural targets, as discussed by regulatory discussions.

Each new city requires new training data, new edge cases to encounter, new regulatory negotiations. But the foundation is there, as noted by The New York Times.

For the industry broadly, Tesla's move signals that fully autonomous operation without safety monitors is technically possible, at least in some conditions. Other companies will have to decide whether to match Tesla's aggressiveness or stick with their current more cautious approach, as highlighted by The Motley Fool.

A plausible future: in five years, major cities have robotaxi services from multiple companies. Tesla, Waymo, and maybe one or two others are operating driverless fleets. Regulation has matured. Insurance products exist for autonomous ride-sharing. The technology is still improving but is broadly considered safe enough for public use, as discussed by regulatory discussions.

A darker future: a serious autonomous vehicle incident kills multiple people. Public trust evaporates. Regulations become so strict that robotaxis become economically unviable. The entire sector slows down for years, as noted by FreightWaves.

Neither outcome is certain. What's certain is that Tesla just accelerated the timeline by deploying fully driverless rides without extensive precautions. That's either a breakthrough or a warning. We'll find out which one, as highlighted by The Motley Fool.

How Runable Relates to Autonomous Vehicle Development

While Tesla is building autonomous vehicles, companies in the autonomous vehicle space are using AI-powered tools to accelerate their development cycles. Runable represents the kind of AI automation that helps teams like those at autonomous vehicle companies generate documentation, create technical reports, and automate workflow processes that would otherwise consume engineering resources.

Autonomous vehicle development requires constant documentation of test results, safety reports, edge cases, and performance metrics. Teams could spend weeks creating those reports manually, or they could use Runable's AI-powered document and report generation to produce them in hours. That frees engineering talent to focus on core problems—like training neural networks and improving autonomous capabilities—rather than administrative work.

For companies building autonomous systems, every hour saved on documentation and report generation is an hour gained toward making the technology safer and more reliable.

Use Case: Autonomous vehicle teams generating weekly safety reports and performance summaries for regulatory compliance in minutes instead of hours.

Try Runable For Free

Key Metrics: Understanding Autonomous Vehicle Performance

How do you actually measure whether an autonomous vehicle system is ready for public use?

The industry uses several key metrics:

Disengagement Rate: How often a human safety driver (or in Tesla's case, a remote monitor or system failsafe) has to take control. A lower rate means the system is more autonomous. Tesla doesn't publish this metric publicly, which is notable, as discussed by local sources.

Critical Safety System Activations: How often the vehicle triggers emergency braking or other safety systems. Some activations are appropriate (avoiding a collision). Some are false positives (braking for a shadow). The ratio matters, as noted by FreightWaves.

Accident Rate Per Million Miles: The gold standard. How many accidents occur relative to miles driven? Human drivers in the US average about 0.5 to 1 accident per million miles driven. For autonomous vehicles to be considered safe, they'd typically need to match or exceed human performance, as highlighted by Electrek.

Edge Case Handling: How well does the system handle unusual situations? This is qualitative but crucial. A system that handles normal driving well but fails on unusual roads or weather is incomplete, as noted by regulatory discussions.

Response Time: How quickly does the system detect a problem and respond? For safety-critical situations, milliseconds matter, as discussed by FreightWaves.

Tesla publishes some safety data but not comprehensively. The company claims Full Self-Driving and Autopilot are safer than human drivers, but that claim is disputed by independent researchers, as noted by regulatory discussions.

Tesla's Austin deployment is essentially a real-world test of these metrics. How many accidents occur? How often does the system need to request human intervention (presumably remotely)? How do passengers rate the experience? How does performance degrade in bad weather or unusual traffic?

The answers will determine whether this deployment becomes a blueprint for other cities or a cautionary tale, as highlighted by The Motley Fool.

Insurance and Liability: The Legal Maze

One thing Tesla still hasn't fully addressed: insurance and liability frameworks for fully autonomous vehicles.

Traditional auto insurance assumes a driver. The policy covers the driver's mistakes, negligence, or violations. If there's an accident, the insurance investigates, assigns fault to the driver (or the other driver), and pays claims accordingly, as discussed by regulatory discussions.

With a fully autonomous vehicle, there's no driver to assign fault to. So who's responsible?

Legally, it could be:

- Tesla, as the manufacturer and service operator

- The passenger, as the "user" of the vehicle (though this seems unlikely)

- A third party, if they caused the accident

- A combination of the above, depending on the specific circumstances

Insurance companies are starting to grapple with this. Some are developing policies specifically for autonomous vehicles. The coverage levels and exclusions vary widely, as noted by The Motley Fool.

A critical unresolved question: if a Tesla Robotaxi is in an accident, is it covered under Tesla's liability insurance or the passenger's personal auto insurance? If it's Tesla's, the company's insurance premiums will be massive if the accident rate is high. If it's the passenger's, then passengers need special policies to use the service, as discussed by regulatory discussions.

Lemonade, an insurance startup, recently announced it's offering insurance products for Tesla Full Self-Driving customers. That's a step toward solving the problem, but it's coverage for semi-autonomous driving, not fully autonomous robotaxi operation, which presents different liability scenarios, as noted by The Motley Fool.

Regulators in Texas haven't required specific insurance frameworks for fully driverless vehicles yet. As deployment expands, that will likely change. California and other states may mandate specific insurance products or minimum coverage amounts for autonomous robotaxi operators, as highlighted by regulatory discussions.

This is a real business and legal risk for Tesla. If insurance becomes expensive or unavailable, the economics of robotaxi operation collapse, as discussed by The Motley Fool.

International Implications: How Other Countries Might React

Austin isn't the center of the autonomous vehicle world—that distinction probably belongs to cities in China or perhaps Singapore, where regulatory environments are sometimes more flexible and deployment happens quickly, as noted by Auto Connected Car.

Baidu, the Chinese search and AI giant, has deployed autonomous vehicles in multiple cities across China. Di Di, the dominant ride-sharing company in China, is also developing autonomous technology. The scale of potential deployment in China dwarfs the US robotaxi market, as highlighted by Auto Connected Car.

In Europe, the regulatory framework is more protective. The European Union has been developing rules around autonomous vehicles that emphasize safety and liability. Some European countries (particularly Germany and the UK) are more open to autonomous testing, while others are cautious, as discussed by regulatory discussions.

Tesla's Austin deployment might accelerate international interest. If the technology works without safety monitors, companies and regulators in other countries will take it seriously as proof the technology is viable, as noted by The Motley Fool.

Conversely, if there's a serious incident, international regulators will likely become more restrictive, setting back deployment timelines globally, as highlighted by FreightWaves.

The race isn't just between companies—it's also between regulatory philosophies. Do you regulate aggressively upfront (slowing deployment but reducing risk) or permissively upfront (allowing faster deployment but accepting more risk)? Tesla's approach suggests the company believes regulatory permissiveness is worth the risk. Waymo's approach suggests caution pays off in long-term trust and reliability. Time will reveal who's right, as discussed by regulatory discussions.

The Real Challenge: Generalization

Here's the fundamental problem Tesla is trying to solve: a neural network trained on millions of miles of driving data is great at handling situations similar to its training data. But what about situations that are different?

A classic autonomous driving problem: a traffic light is covered in snow. The neural network can't see the light clearly. What does it do?

If a human is in the car and notices the problem, the human takes over. If there's no human, the car has to make a decision: slow down and proceed cautiously, or stop and request remote assistance?

Tesla's system presumably has protocols for this, but the company hasn't detailed them. That's a gap in public information about how the system actually works, as noted by local sources.

Generalization from training data to novel situations is the deepest challenge in machine learning. It's why neural networks sometimes fail spectacularly in ways humans wouldn't. A deep learning model trained on road sign recognition might misidentify a sign with graffiti on it. A driving model trained on clear weather might struggle in rain, as discussed by FreightWaves.

Tesla's approach to this is to train massive networks on diverse data and hope the network learns robust representations. That might work. Or it might produce a system that's good at 95% of situations and dangerous in the other 5%, as highlighted by regulatory discussions.

The only way to actually know is to deploy the system, monitor what goes wrong, and refine it based on real-world performance. That's exactly what Tesla is doing in Austin, as noted by The Motley Fool.

Investment and Funding: The Money Behind Autonomous Vehicles

The robotaxi race is expensive. Waymo has raised billions (though exact figures are hard to pin down since Alphabet funds it). Zoox has Amazons resources behind it. Cruise was well-funded by General Motors before pulling back, as discussed by FreightWaves.

Tesla doesn't need to raise capital for robotaxi development because the company is already profitable and has cash on hand. That's an advantage. No investor pressure to hit specific milestones on an arbitrary timeline. Just develop the technology and deploy when ready, as noted by local sources.

But that advantage is also a constraint. Autonomous vehicle development requires world-class talent. That talent can command high salaries and equity. Tesla has attracted some of the best people in AI and robotics, but so have companies like Waymo and others, as highlighted by Electrek.

If Tesla's robotaxi deployment succeeds, the company could fund massive expansion of the fleet from profits. If it stumbles, the cost of failure falls entirely on Tesla shareholders, as discussed by The Motley Fool.

For investors, the robotaxi play is a long-term bet. Near-term profitability is unlikely. But if autonomous transportation works at scale, the market opportunity is enormous—potentially larger than the entire current auto industry, as noted by regulatory discussions.

FAQ

What exactly is Tesla's robotaxi service?

Tesla's robotaxi service in Austin is a ride-sharing platform where passengers request rides through the Tesla app and are picked up by fully autonomous vehicles with no driver or safety operator in the car. The service uses Tesla's Full Self-Driving system powered by neural networks trained on billions of miles of real-world driving data. As of early 2025, the service is operating with a mix of autonomous and safety-monitored vehicles, with the ratio of unsupervised vehicles increasing over time, as detailed by local sources.

How does Tesla's autonomous driving technology differ from Waymo's?

Tesla's approach is vision-based, relying primarily on cameras and neural networks to understand driving scenes, while Waymo uses lidar (light detection and ranging) sensors combined with high-definition pre-mapped environments. Tesla's advantage is scale: billions of miles of training data from Tesla vehicles worldwide. Waymo's advantage is detailed environmental knowledge and more extensive testing. Tesla generalizes from real-world data; Waymo pre-maps and carefully tests each deployment area, as discussed by Electrek.

Is Tesla's fully driverless robotaxi safe?

There's no independent, comprehensive safety verification yet. Tesla claims its autonomous systems are safer than human drivers, but independent researchers have disputed this claim. The Austin deployment will generate real-world data on safety, but early data is limited. Any autonomous system can fail in unexpected ways, especially in edge cases the neural network hasn't been trained on. Whether Tesla's specific system is safe enough for public use without safety monitors remains an open question that will be answered by real-world performance, as noted by regulatory discussions.

What happens if a Tesla Robotaxi gets in an accident?

Liability in autonomous vehicle accidents is legally unresolved. Potentially, Tesla could be liable as the manufacturer and service operator, though the specific circumstances matter. Insurance frameworks for fully driverless vehicles are still being developed. Passengers may need special insurance coverage. The regulatory and legal landscape will become clearer only as incidents occur and are adjudicated, as discussed by The Motley Fool.

How much does a Tesla Robotaxi ride cost?

Tesla hasn't clearly disclosed pricing. Early reports suggest rides are either free or heavily subsidized during the testing phase. The company is likely focused on gathering data and user feedback before implementing commercial pricing. Once paid rides begin, pricing will likely be comparable to or cheaper than Uber/Lyft since there's no driver salary to pay, as noted by local sources.

Can you use Tesla Robotaxi outside of Austin?

Not yet. As of early 2025, the service is limited to Austin, Texas. Tesla will likely expand to other cities if the Austin deployment succeeds, but timeline and city selection haven't been announced. Other cities may have different regulatory requirements that slow or accelerate expansion, as discussed by regulatory discussions.

How does remote monitoring work for Tesla Robotaxis?

Details are sparse, but Tesla has indicated some monitoring capability for vehicles encountering situations they can't handle alone. This presumably involves remote human operators who can view the vehicle's camera feeds and potentially suggest actions or take over control. However, Tesla hasn't disclosed how often this happens or how effective it is, as noted by local sources.

What's the difference between Full Self-Driving (FSD) and Robotaxi?

Full Self-Driving (FSD) is available to Tesla vehicle owners for a subscription fee ($199/month as of 2025) and operates semi-autonomously—the car can handle most driving but a human must be ready to take over. Robotaxi is the fully autonomous service where there is no human in the vehicle. Robotaxi uses neural networks trained partially on FSD data but requires independent safety verification before deployment without human supervision, as discussed by The Motley Fool.

How many Tesla Robotaxis are currently operating in Austin?

Tesla hasn't disclosed exact numbers. Early reports suggest hundreds of vehicles are in the service, with gradual increase as the deployment scales. The company is starting with a small percentage of unsupervised vehicles mixed into a broader monitored fleet and will increase the autonomous ratio over time, as noted by local sources.

What would cause Tesla to pause or shut down the robotaxi service?

A serious accident resulting in injuries or deaths would trigger immediate regulatory scrutiny and likely a temporary shutdown pending investigation. Sustained criticism or regulatory pressure could halt expansion even if the service continues locally. Multiple near-misses or safety incidents could also prompt Tesla to revert to safety-monitored operations. Public backlash against autonomous vehicles generally could affect the service's viability, as discussed by The Motley Fool.

Conclusion: The Inflection Point

Tesla launching fully driverless robotaxis in Austin represents an inflection point in autonomous vehicle development. For years, the industry consensus was that safety monitors were necessary—a human ready to take control if the autonomous system failed. Tesla just proved that's not actually necessary for the company to operate, as discussed by regulatory discussions.

That doesn't mean it's safe. It means Tesla is confident enough in its technology (or willing to accept enough risk) to put actual passengers in vehicles with zero human supervision, as noted by The Motley Fool.

The question now is whether that confidence is justified or overconfidence. The answer will come from real-world experience. How safe is the system in practice? How often does it encounter situations it can't handle? How do passengers and regulators respond? Do insurance frameworks hold up? Does the economics actually work at scale, as highlighted by regulatory discussions?

For the autonomous vehicle industry, this is a fork in the road. Other companies have to decide whether to match Tesla's aggressiveness or stick with their current cautious approaches. Regulators have to decide whether Tesla's permissive regulatory environment is a template or a warning, as discussed by FreightWaves.

For passengers in Austin, the robotaxi service represents access to a genuinely novel technology that would have seemed impossible five years ago. For passengers elsewhere, it's a preview of what's coming, for better or worse, as noted by The New York Times.

The robotaxi race isn't over. It's just entering a critical phase where technology meets reality, where theory gets tested against the actual chaos of city driving with real consequences, as highlighted by The Motley Fool.

Tesla's move is bold. Whether it's brilliant or reckless won't be clear for months or years. But there's no ambiguity about one thing: the robotaxi era has officially begun, and it's running faster than anyone expected, as discussed by regulatory discussions.

Use Case: Autonomous vehicle teams need rapid report generation and documentation for safety testing, regulatory compliance, and incident analysis—Runable's AI automation can generate these in a fraction of the time manual processes require.

Try Runable For Free

Key Takeaways

- Tesla is operating fully autonomous robotaxis in Austin without safety monitors, a significant escalation beyond competitors' cautious approaches, as noted by The New York Times.

- The company's neural network approach differs fundamentally from Waymo's lidar-based system, relying on visual data and scale rather than pre-mapping, as discussed by Electrek.

- Safety verification remains independent; real-world accident data will determine whether the system is truly ready for public operation, as highlighted by regulatory discussions.

- Liability, insurance, and regulatory frameworks for fully driverless vehicles are still being developed, creating legal uncertainties, as noted by The Motley Fool.

- The economics of robotaxi services depend on reducing cost-per-mile below human-driven alternatives while maintaining safety standards, as discussed by regulatory discussions.

![Tesla's Fully Driverless Robotaxis in Austin: What You Need to Know [2025]](https://tryrunable.com/blog/tesla-s-fully-driverless-robotaxis-in-austin-what-you-need-t/image-1-1769109095312.jpg)