Waymo in Miami: The Future of Autonomous Robotaxis [2025]

There's something surreal about summoning a car that shows up empty of a driver. No steering wheel adjustments from the front seat. No anxious glances at the road. Just a vehicle that knows where you're going, navigates traffic, and gets you there without a human touch.

That's happening right now in Miami.

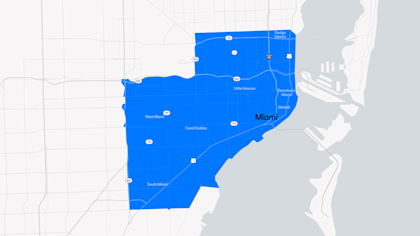

Waymo, the autonomous vehicle company spun out of Google, just launched its fully autonomous robotaxi service in Miami. After months of testing without passengers, the company is now accepting real riders across a 60-square-mile service area that includes trendy neighborhoods like the Design District and Wynwood. Nearly 10,000 Miami residents have already signed up for access, and Waymo plans to send out invitations on a rolling basis to new riders over the coming weeks and months.

This isn't just another city launch for Waymo. It's evidence that autonomous vehicles are transitioning from experimental curiosity to actual transportation infrastructure. And Miami, a sprawling, chaotic city with unpredictable weather and aggressive drivers, proves that self-driving cars can handle real-world complexity.

Let's break down what's happening in Miami, why it matters, and what comes next.

The Miami Launch: What You Need to Know

Waymo's Miami rollout started with months of unpiloted testing. The company ran empty vehicles through the streets, mapping routes, identifying hazards, and teaching the AI what Miami's unique driving environment looks like. Then, in November 2025, they began testing with passengers.

Now it's official.

The service area covers 60 square miles, which sounds smaller than it is. Miami's urban core is dense and compact. That 60-square-mile radius includes neighborhoods most residents actually visit: the Design District (where the nightlife and dining scene thrives), Wynwood (the arts and murals neighborhood), downtown Miami, and surrounding residential areas. It's not the entire Miami metropolitan area, but it's the heart of where people actually go.

Initially, Waymo robots can't reach Miami International Airport, but that's coming soon. The company has already announced plans to expand service to the airport, which would make Waymo the first fully autonomous transportation option connecting the airport to the city. That's huge for logistics and convenience.

The service uses Waymo's custom-built robotaxi, the Waymo One vehicle. It's purpose-built for autonomous operation—no steering wheel, no pedals, no human backup. The car seats five passengers comfortably and relies entirely on Waymo's AI system to navigate.

The 10,000 Early Adopters

Ten thousand Miami residents have signed up for Waymo already. That number tells you something important: people want this. They're not skeptical. They're not waiting for competitors. They see value in a service that's convenient, potentially safer, and maybe cheaper than traditional rideshare over time.

These early adopters aren't randomly distributed, either. They're concentrated in tech-forward neighborhoods and among demographics that skew younger and more urbane. The Design District residents probably have higher incomes. Wynwood is known for creative types and younger professionals. These are early adopter populations that have historically embraced new technology first.

Waymo will release access gradually. This has multiple benefits. It lets the company monitor system performance with small cohorts before scaling. It gives support teams time to handle issues individually. And it creates a waiting list phenomenon that builds demand. Everyone who signed up but hasn't received an invite yet is thinking about their first autonomous ride.

The 60-Square-Mile Service Area

Understanding the geography matters here. Miami isn't a grid city like San Francisco. It's irregular, with highways cutting through neighborhoods and unpredictable street patterns. The 60-square-mile zone isn't arbitrary. Waymo chose it because it represents a fully workable market: enough density to justify economic operation, enough variety of destinations to make the service useful, and enough complexity to stress-test the AI system.

The Design District and Wynwood are specifically important. Both are destination neighborhoods. Visitors travel specifically to go there. That means Waymo isn't just moving people between residential areas and work. It's handling tourist flows, entertainment destinations, and discretionary travel. That's harder than commuting because the patterns are less predictable.

As Waymo expands beyond this initial zone, it will have to navigate Miami's most notoriously challenging driving conditions. The Palmetto Expressway. I-95 during rush hour. Biscayne Boulevard during tourist season. Those come later, but they're coming.

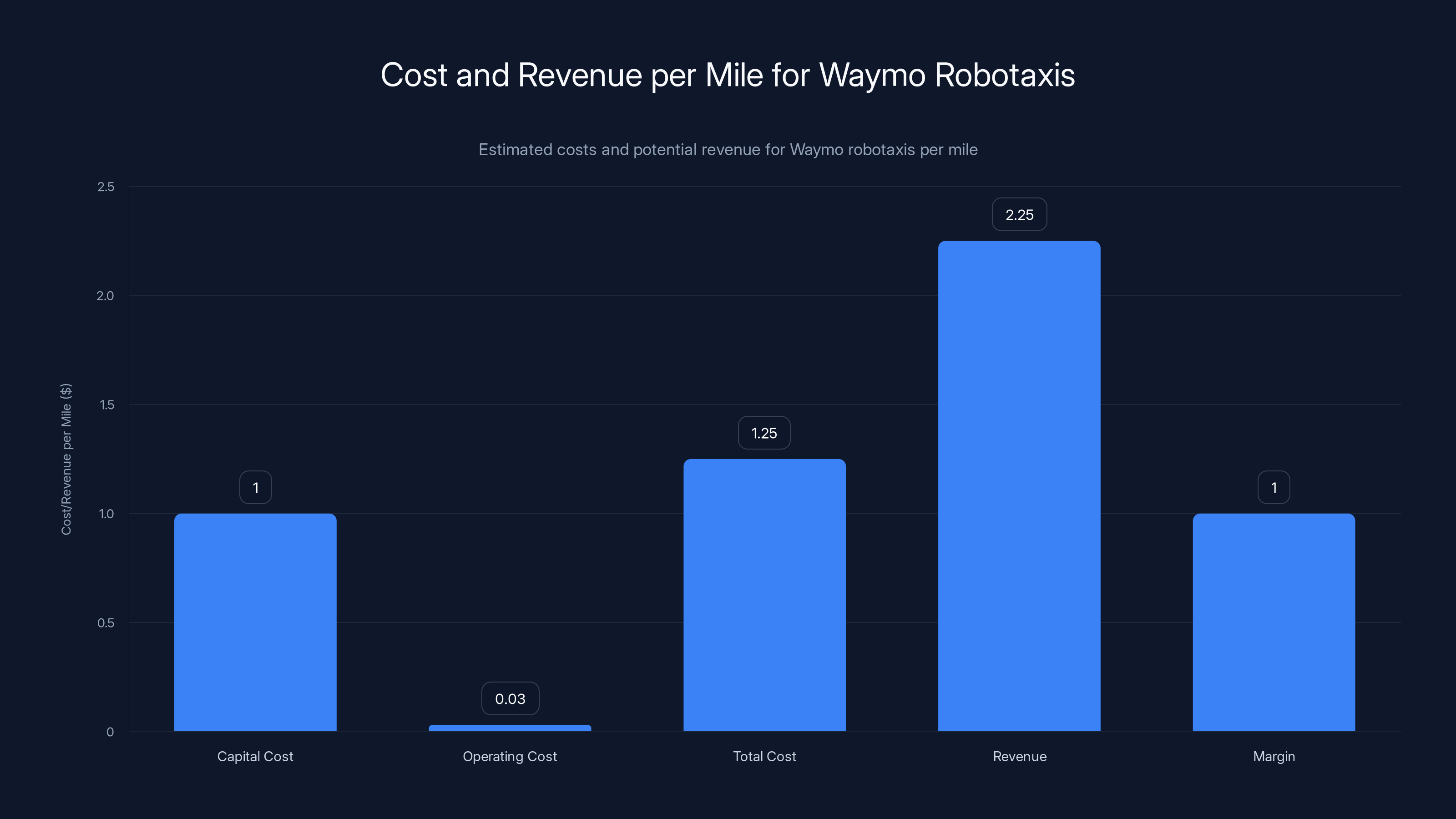

Waymo's robotaxis can potentially achieve a margin of

Why Miami Makes Sense for Autonomous Vehicles

Miami seems like an odd choice for robot taxi testing. The city has aggressive drivers. It has weather extremes—sudden thunderstorms, heat, salt air from the ocean. It has chaotic traffic patterns. It's not the controlled environment that autonomous vehicle engineers prefer.

That's exactly why it's brilliant.

Waymo started in San Francisco Bay Area with its Waymo One service, then expanded to Phoenix. Both are somewhat controlled markets. San Francisco has a population that's generally favorable to tech. Phoenix is sprawling and car-dependent, but the weather is predictable. Testing in Miami means Waymo's system has to handle:

Weather unpredictability: Miami gets sudden severe thunderstorms. Rain impacts camera and lidar performance. Waymo's system has to recognize that visibility is degraded and adjust accordingly. Flooding happens. Street conditions change rapidly.

Aggressive driving culture: Miami drivers aren't always following rulebook driving. They cut across lanes. They make unexpected turns. The AI system has to predict human behavior that isn't strictly rational.

Mixed infrastructure: Some streets are well-maintained. Others are potholed. Sidewalk conditions vary. Road markings aren't always clear. Waymo has to handle degraded infrastructure.

Density and complexity: Miami isn't a highway city like Phoenix. It's dense, with pedestrian traffic, cyclists, delivery vehicles, and constant activity. The AI manages thousands of simultaneous decisions every trip.

If Waymo's system works well in Miami, it can work almost anywhere. That's the value of choosing challenging environments early.

Safety Claims: The "Tenfold Reduction" Statistic

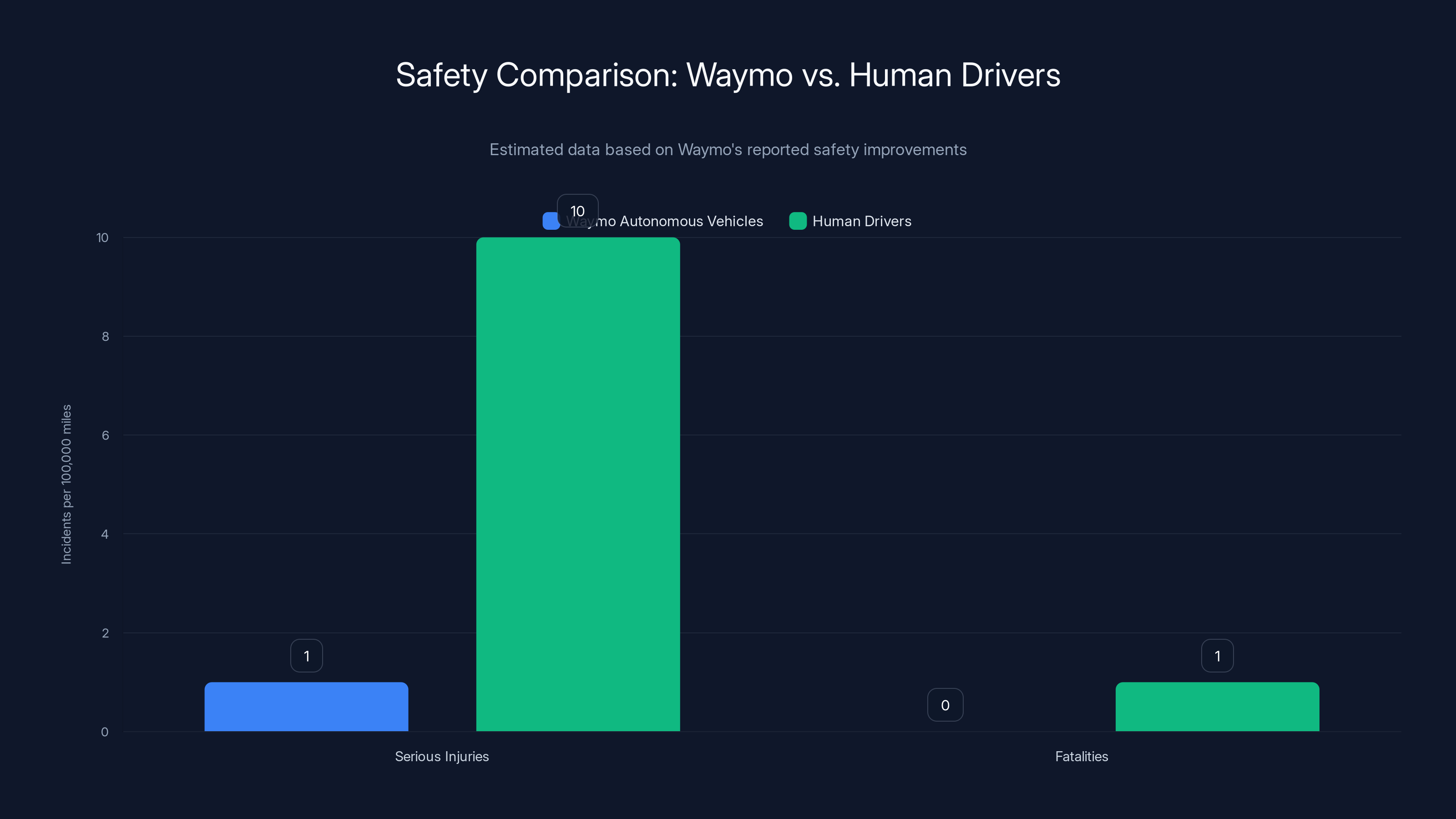

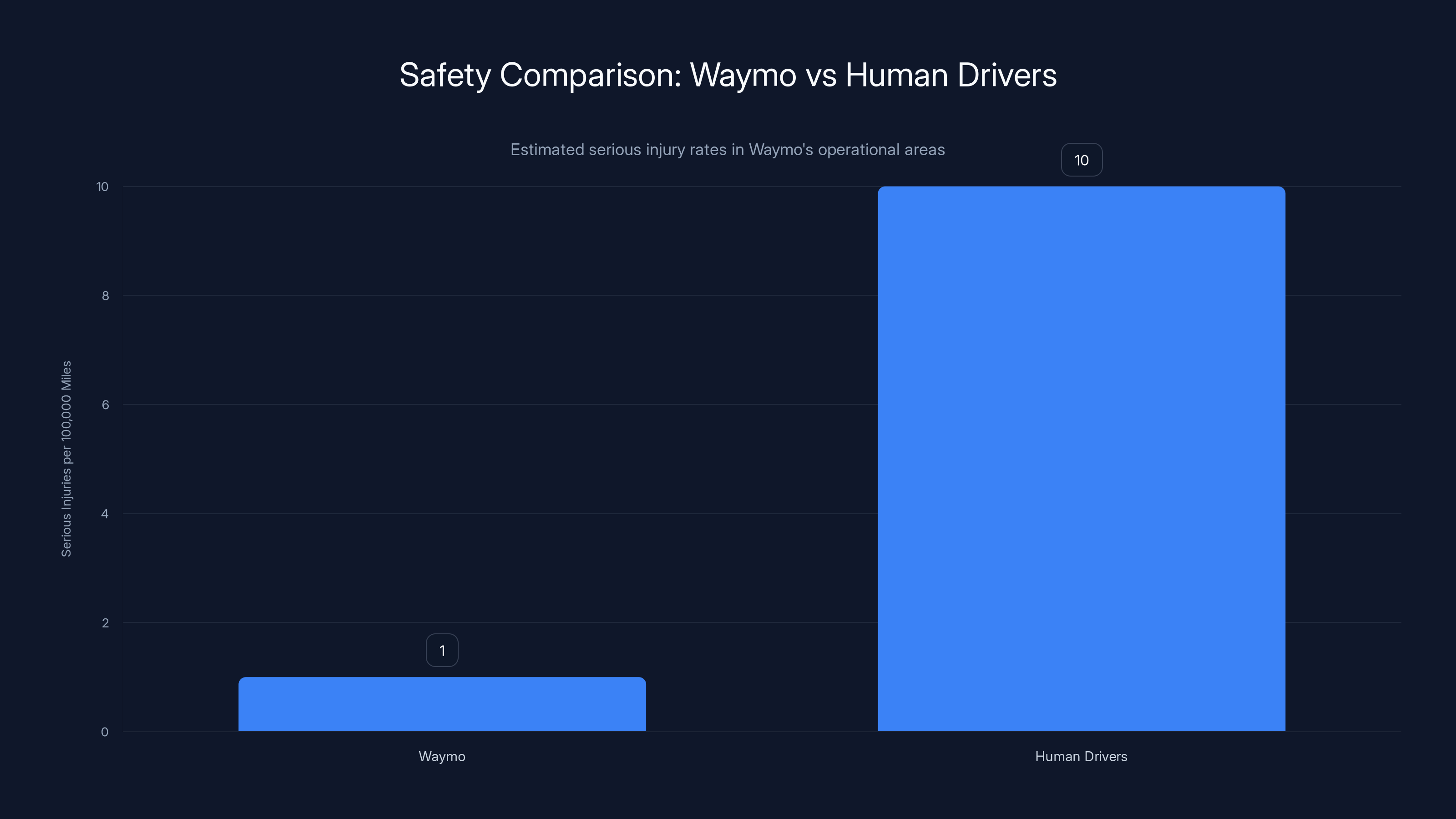

Waymo makes a bold safety claim: a tenfold reduction in serious injuries caused by crashes compared to human drivers in its current areas of operation.

Let's parse that carefully.

First, it's a relative comparison. Waymo is comparing its safety record to human driver safety records in the same cities. That's apples-to-apples geography and conditions.

Second, it's specific to "serious injuries caused by crashes." That's important language. It's not zero injuries. It's fewer serious injuries. There's an acknowledgment that accidents happen, even with Waymo, but they're less severe.

Third, it's measured across "current areas of operation," which means San Francisco, Phoenix, and now Miami. The data is aggregated. Individual city performance may vary.

A tenfold reduction is extraordinary if true. It means that for every injury a human driver causes in a Waymo service area, Waymo's system causes one-tenth of that. Over time, as Waymo's fleet grows and miles accumulate, this compounds.

But here's the catch: independent verification is limited. Waymo reports this data, but third-party testing hasn't fully validated it yet. Insurance companies, regulators, and safety organizations are still developing frameworks for measuring autonomous vehicle safety comprehensively.

What we do know from public data:

- Waymo hasn't had any reported fatalities in driverless operation in the U. S. (as of late 2025)

- Competitors like Cruise have had incidents that harmed passengers

- Tesla's Autopilot (which is not fully autonomous) has a mixed safety record

The tenfold reduction claim is plausible, but it deserves scrutiny. Insurance companies will eventually validate these claims because underwriting depends on accurate risk assessment. If Waymo's system is genuinely 10 times safer, insurance should eventually reflect that with lower rates for Waymo riders.

Measuring Safety: What Actually Counts?

Autonomous vehicle safety is measured differently than human driver safety. With human drivers, we count crashes, injuries, and fatalities per mile driven. We know the baseline: roughly 1.3 deaths per 100 million vehicle miles in the U. S.

For autonomous vehicles, measurement gets tricky because the operational domains are smaller and more controlled initially. Waymo isn't driving on every road in every weather condition. It's operating within defined zones. That means the comparison isn't perfectly apples-to-apples.

But there's a logical argument for why autonomous systems should be safer:

- They don't get distracted

- They don't drive drunk or impaired

- They don't experience fatigue

- They respond to hazards faster than humans (reaction time is milliseconds, not 1-2 seconds)

- They follow traffic laws consistently

- They plan routes in advance to avoid high-risk areas

The counterargument is that edge cases—unusual situations—can confuse AI systems. A human driver might navigate an unmapped detour by intuition. An autonomous system might freeze or make an unsafe choice.

Reality is probably in the middle: autonomous systems are safer for routine operations but may struggle with unprecedented situations. As they accumulate miles and encounter more edge cases, they learn and improve.

Waymo claims a tenfold reduction in serious injuries compared to human drivers, with no fatalities reported in fully driverless operations. (Estimated data)

Waymo's Expansion Timeline: A Masterclass in Measured Growth

Miami isn't Waymo's only target for 2025-2026. The company announced expansion plans that paint a picture of a national robotaxi network taking shape.

The timeline currently looks like this:

San Francisco Bay Area: Already operational (Waymo's home market). Extended coverage planned.

Phoenix: Already operational. Expanding beyond current zones.

Los Angeles: Expansion in progress, focusing on specific neighborhoods first.

Miami: Now operational as of early 2025.

Orlando: Launching later in 2025.

San Antonio, Houston, Dallas: Targeted for 2026.

That's six states across America. It's not random geography. Waymo is targeting cities where the infrastructure supports autonomous operation, regulations are favorable, and there's population density to justify service.

Or this expansion is strategic. Most autonomous vehicle companies would love to launch everywhere simultaneously. But Waymo learned from experience that measured rollout is smarter. It allows the company to:

- Adapt to local conditions (Miami has different weather and driving patterns than Phoenix)

- Train support staff properly (customer service scales better with gradual growth)

- Debug software based on real-world issues before expanding

- Build regulatory relationships city by city

- Manage fleet growth and vehicle manufacturing to match demand

This isn't rapid expansion. It's methodical scaling. Waymo could probably operate in 50 cities if it wanted to rush. Instead, it's choosing depth over breadth.

The Texas Gamble

Texas deserves special attention. San Antonio, Houston, and Dallas are massive metropolitan areas. Together they represent millions of residents and diverse driving conditions. Houston's traffic is notorious. Dallas's sprawl is extreme. San Antonio's infrastructure varies widely.

Success in Texas validates Waymo's technology at scale in truly challenging markets. Failure in Texas reveals limitations that matter for national expansion.

Waymo is betting on success. The company presumably wouldn't target three major Texas cities if it wasn't confident in its technology and operations. That's either bold or foolish—time will tell.

How Autonomous Vehicles Actually Work: The Technology Layer

Understanding what makes Waymo different from other autonomous systems requires understanding the technology stack.

Waymo's approach combines hardware and software in a specific way:

Hardware Suite:

- Multiple cameras (capturing color video)

- Lidar sensors (creating 3D maps using laser light)

- Radar (detecting motion and distance)

- Ultrasonic sensors (for close-range detection)

- IMU (inertial measurement unit) for acceleration and orientation

This redundancy is critical. If one sensor fails, the system still works. If cameras get dirty, lidar compensates. This is why Waymo's vehicles are so expensive—they're essentially mobile sensor suites.

Software Suite:

- Perception module: Interprets sensor data to identify objects (pedestrians, cars, bicycles, obstacles)

- Prediction module: Forecasts what other vehicles and pedestrians will do

- Motion planning: Calculates safe paths given current predictions

- Decision layer: Makes moment-to-moment choices about acceleration, braking, steering

What separates Waymo from competitors is the sophistication of each layer. The perception module has been trained on millions of miles of driving data. The prediction model understands human behavior patterns. The motion planner optimizes for passenger comfort and safety simultaneously.

This takes computational power. Waymo's vehicles have dedicated hardware for real-time processing. It's not running on a smartphone processor. It's running on automotive-grade compute platforms that can handle thousands of simultaneous calculations per second.

Machine Learning vs. Rules-Based Systems

There's a misconception that autonomous vehicles are purely machine learning based—just neural networks predicting the next move. Waymo's system is actually hybrid.

Machine learning handles perception: recognizing a pedestrian in an image, identifying a bicycle, understanding that a construction sign means the road is closed. These are pattern recognition problems where deep learning excels.

Rules-based systems handle decision-making: if a pedestrian is in the path and 0.5 seconds away, brake immediately. If the light is red, don't proceed. If a vehicle is merging, adjust speed to prevent collision. These are safety-critical decisions that shouldn't be left to probabilistic predictions.

The hybrid approach makes sense. Let neural networks do what they're good at (pattern recognition). Use explicit rules for safety-critical decisions. This reduces the risk of unexpected AI behavior in critical moments.

The Economics of Autonomous Robotaxis: Can They Be Profitable?

Waymo's service has to make money eventually. Right now, early markets are probably subsidized. The company is absorbing losses to build market share and learn about operations.

But let's think about the unit economics. What does it cost to operate a Waymo robotaxi per mile?

Capital costs: A Waymo One vehicle costs roughly

Operating costs: Electricity to charge the battery (~50 kWh per 200 miles in real-world conditions) costs roughly

Total cost:

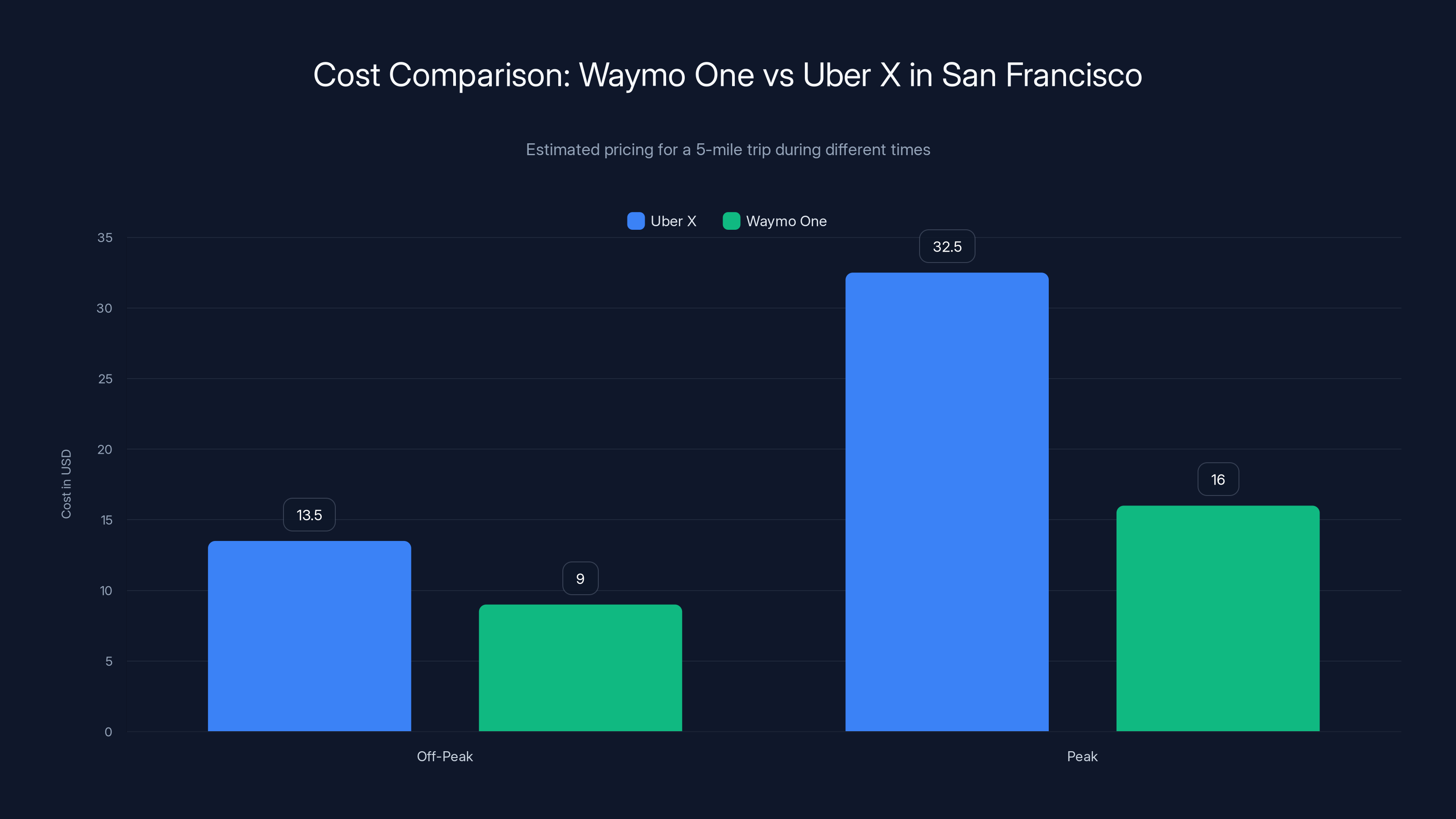

Now let's look at pricing. Waymo hasn't released official pricing for Miami yet, but in San Francisco, Waymo One rates are comparable to Uber X in many cases. Let's assume

That's potentially profitable at scale:

- Revenue: 2.50 per mile

- Cost: 1.50 per mile

- Margin: 1.00 per mile

A margin of 30-40% is healthy. The problem is that Waymo's currently operating below this because:

- Early fleets are small (high fixed costs relative to vehicle utilization)

- Support costs are high (customer service, maintenance, supervision)

- Fleet utilization isn't maximized (not enough demand yet to keep vehicles busy)

- Sensor and compute hardware is still expensive

As Waymo scales, all of these improve. Bigger fleets spread fixed costs. Support becomes more efficient. Demand grows. Hardware gets cheaper. In theory, Waymo could reach 40-50% margins at scale, competing effectively with human driver rideshare services.

The challenge is that they have to reach scale before profitability. That requires sustained investment and customer adoption. If people don't trust autonomous vehicles or regulators restrict operations, Waymo's economics break.

Time to Profitability

Industry analysts estimate that autonomous vehicle rideshare services could reach profitability in 5-10 years as fleets scale and costs decline. McKinsey estimates suggest that a fully mature autonomous rideshare fleet could operate at 30-40% lower cost than human driver services.

That would be transformative for transportation.

But there's a big "if": regulatory and consumer adoption has to support that growth. If people don't trust autonomous vehicles, adoption stalls. If regulations cap the number of autonomous vehicles operating in a city, growth is constrained.

Waymo One tends to be cheaper than Uber X during both off-peak and peak times in San Francisco, with less price volatility. Estimated data based on typical pricing.

Competition: Waymo Isn't Alone

Waymo dominates autonomous taxi conversations, but other competitors exist:

Cruise (by GM): Was operating robotaxis in San Francisco before pulling back after safety incidents. Recently resumed limited operations. Behind Waymo in scale but aggressive in development.

Zoox (by Amazon): Working on autonomous vehicle design and technology but hasn't launched public robotaxi service yet. Amazon's backing provides financial runway.

Tesla: Has full self-driving technology but hasn't launched a formal robotaxi service. CEO Elon Musk promised a "Tesla Robotaxi" event in 2024 that has been continuously delayed.

Traditional automakers: Ford, BMW, Audi, and others are investing in autonomous tech but haven't launched robotaxi services yet. Most are years behind Waymo.

Waymo's lead is substantial. It has millions of real-world miles, operational cities, regulatory approval, and profitability closer than competitors. But competition is intensifying. If another company achieves a breakthrough in cost or performance, market share could shift quickly.

The Miami Advantage: Geography and Demographics

Miami is specifically advantageous for Waymo because of how the city is structured:

Tourism economy: Miami has 20+ million annual visitors. These tourists are paying customers who specifically want reliable transportation. A tourist might be hesitant to try Waymo in their home city but willing to try it on vacation.

Tourism concentration: Tourists cluster in specific zones (South Beach, Design District, airport area). That matches Waymo's initial 60-square-mile service area perfectly.

Wealthy demographic: Miami-Dade County has high average household incomes in many areas. Wealthier residents are more likely to try new transportation services, especially if novelty appeals to them.

International market: Miami draws international visitors who might be more curious about new technology. Someone from Europe or Asia might be excited to try a robotaxi in Miami.

Existing rideshare penetration: Miami residents already use Uber and Lyft regularly. They're comfortable summoning cars via app. That's a behavioral foundation Waymo can build on.

These factors combine to create a market where Waymo's service could thrive. The company chose Miami for a reason.

Regulatory Landscape: How Cities Allow Autonomous Vehicles

Waymo didn't just decide to launch in Miami. The company had to navigate state and local regulations:

State level: Florida allows autonomous vehicles to operate under specific conditions. The state has granted permits for testing and limited commercial operation.

Local level: Miami-Dade County and the city of Miami had to approve Waymo's operation. This involved safety reviews, traffic impact studies, and insurance requirements.

Insurance: Waymo carries insurance that covers robotaxi operations. This is different from standard vehicle insurance—it has to address liability when there's no human driver.

Liability framework: This is the tricky part. If a Waymo vehicle hits a human-driven car, who's liable? Waymo? The other driver? The manufacturer of the other vehicle? Florida has addressed this but the framework is still evolving.

Regulation is one of the biggest factors determining autonomous vehicle rollout speed. Cities that are friendly to autonomous vehicles can have Waymo service. Cities that are restrictive can't.

Miami chose to be friendly. That's a competitive advantage. Other cities in Florida (Tampa, Jacksonville) might follow. If they don't, those cities lose out on the economic benefits of autonomous transportation and lose residents to cities that have it.

Waymo claims a tenfold reduction in serious injuries compared to human drivers in its operational areas. Estimated data based on Waymo's safety claims.

The Passenger Experience: What It's Actually Like

What happens when you summon a Waymo robotaxi in Miami?

-

App interaction: You open the Waymo app (or use a browser), enter your destination, and confirm the pickup location. The app shows the approaching vehicle in real-time, just like Uber.

-

Vehicle arrival: A Waymo One vehicle with no driver pulls up. The car is relatively small (seating for 5), clean, and clearly marked as autonomous.

-

Entry: You unlock the car with your app or enter a code provided by the app. The door unlocks automatically.

-

Seating: You sit in any of the five passenger seats. There's no driver seat in the front—the steering wheel area is open.

-

Departure: You confirm your destination in the car (or it's already set from the app). After a few seconds, the car drives autonomously. No waiting for a driver to "get ready."

-

The ride: This is the weird part. The car drives itself. If you're watching, you see the steering wheel move on its own. You see the car responding to traffic, stopping at lights, merging on highways. Some passengers find this fascinating. Others find it unsettling.

-

Arrival: The car pulls up to your destination. It parks itself. You exit. The car locks automatically.

-

Payment: This happened automatically through the app. No cash exchange, no tipping screen (though the app likely allows tipping).

The whole experience is optimized for simplicity. You're not interacting with a driver. You're not deciding whether to make small talk. You're in a small box that knows where you're going.

For some people, this is liberation. For others, it's anxiety-inducing. The first ride is the key moment—if passengers feel safe and experience zero issues, they become repeat users. If the first ride is rough (unexpected braking, weird navigation choice, feeling unsafe), they might not try again.

Safety Considerations: The Human Factor

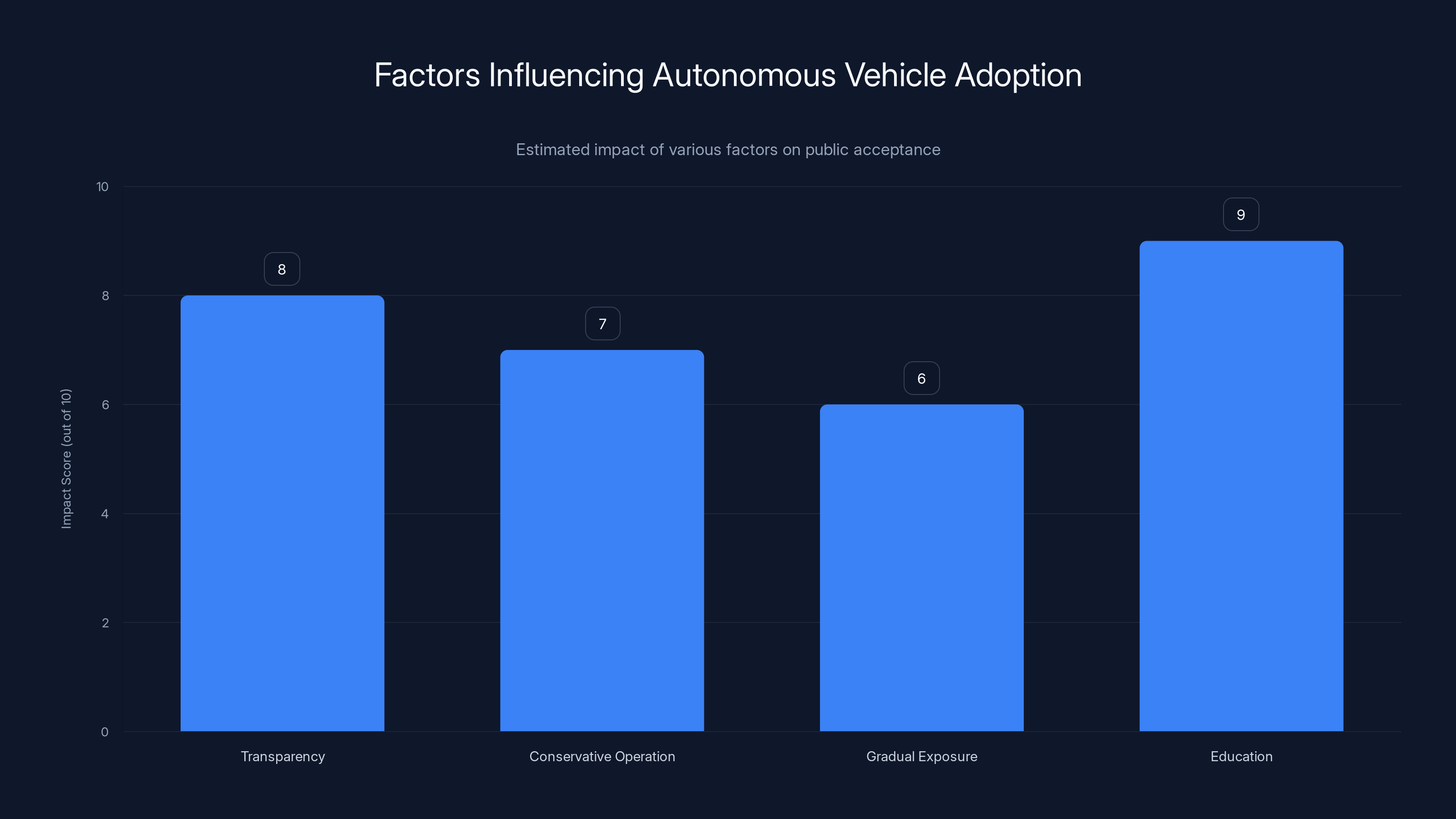

There's a psychological element to autonomous vehicle adoption that's often overlooked. Humans are irrational about risk. We're comfortable with the familiar, even if it's objectively dangerous.

Human drivers cause 1.3 deaths per 100 million vehicle miles in the U. S. Nobody panics about that. But if an autonomous vehicle causes one fatal accident, headlines scream about autonomous vehicle danger. The psychology of risk perception is asymmetric.

Waymo has to overcome this irrational fear. The company does this through:

Transparency: Waymo publishes safety data and operational reports. Waymo's safety page breaks down metrics clearly.

Conservative operation: Waymo's vehicles might drive slower than necessary in some situations. They prioritize safety over speed. This builds confidence.

Gradual exposure: Starting with early adopters (who are less risk-averse) normalizes the experience. As more people use Waymo safely, it becomes normal.

Education: Waymo could invest in campaigns explaining how autonomous vehicles are safer than human drivers. The data supports it, but the messaging needs to reach people effectively.

This is as much marketing and psychology as it is technology.

The Broader Implications: Urban Mobility Transformation

Waymo's Miami launch is significant beyond just robotaxis. It hints at a broader transformation in how cities manage transportation:

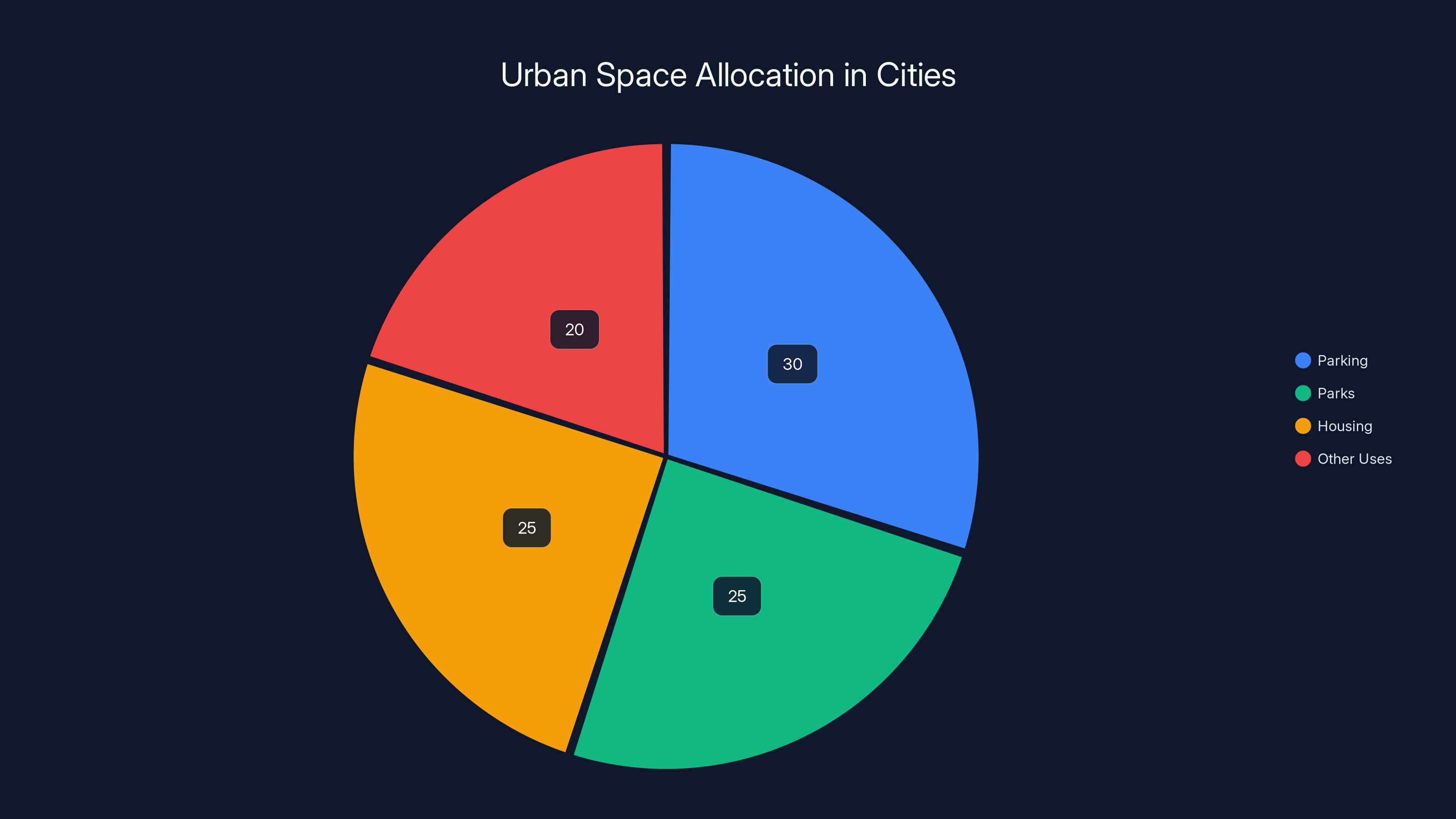

Reduced private vehicle ownership: If robotaxis are cheap, safe, and available, why own a car? You eliminate insurance, maintenance, parking hassles, and driving stress. For urban residents, robotaxis could mean getting rid of a $40,000 asset.

Freed-up urban space: Cars parked on streets occupy valuable real estate. In cities with 30% of street space dedicated to parking, autonomous rideshare could free up massive areas for parks, housing, or other uses.

Reduced traffic congestion: Autonomous vehicles can coordinate with each other, platooning to reduce drag and spacing. They can optimize routes in real-time. They don't get emotional or drive recklessly. Traffic flow improves.

Changed urban development: Cities don't need massive parking garages if cars aren't sitting idle. Development can move parking to cheaper land outside the city or underground. That frees up valuable urban real estate.

Redistribution of transportation economics: Today, you pay for vehicle ownership, insurance, maintenance, fuel, and parking. With robotaxis, that money goes to the service provider instead. The distribution of wealth in transportation changes.

These implications are 10-20 years out, but they're the trajectory autonomous vehicles are on.

Education and transparency are estimated to have the highest impact on increasing public acceptance of autonomous vehicles. Estimated data.

The Testing Phase: What Waymo Learned Before Launch

Before accepting paying passengers, Waymo tested its system in Miami for months with unpiloted vehicles. This "shadow testing" phase is crucial because it identifies local challenges:

Road conditions: Miami's streets have unique characteristics—potholes, deteriorating asphalt, irregular lane markings. Waymo's perception system had to adapt to these.

Weather patterns: Sudden thunderstorms, intense afternoon heat, humidity. These affect sensor performance. Rain on a camera lens degrades image quality. Waymo had to test how its redundant sensors compensate.

Traffic patterns: Miami drivers have specific behaviors. They make aggressive turns. They don't always signal. They block intersections. Waymo's prediction model had to learn these patterns.

Infrastructure gaps: Some intersections lack clear markings. Some roads are construction zones. Some routes have obstacles that aren't in the mapping database. Waymo had to deal with these real-world messiness.

Pedestrian behavior: Pedestrians in Miami neighborhoods have different crossing patterns than San Francisco or Phoenix. Waymo had to learn these local norms.

This testing phase is why autonomous vehicle rollout takes time. It's not just about having working technology. It's about validating that technology works specifically in the local environment.

Pricing Strategy: Will Waymo Be Cheaper Than Uber?

Waymo hasn't publicly released Miami pricing, but we can make educated guesses based on other markets.

In San Francisco, Waymo One pricing has been comparable to Uber X for many routes, sometimes cheaper, sometimes pricier depending on surge pricing and specific times. The comparison breaks down like this:

Uber X in San Francisco: ~

Waymo One in San Francisco: ~

Waymo's advantage is consistency. The company doesn't have aggressive surge pricing because the economics work better with volume than with price peaks. Also, no tipping screen (though tipping is possible), so the final cost is clear upfront.

For Miami specifically, pricing will likely be competitive with Uber and Lyft once the service stabilizes. In the introductory phase, Waymo might offer discounts to attract early riders and build habit.

Over time, Waymo's costs should decrease as fleet utilization improves and hardware gets cheaper. That allows for margin expansion or price reductions to maintain market share.

The Orlando Expansion: Testing Multi-City Operations

Orlando is coming next. This is interesting because Orlando is different from Miami:

Tourism vs. regular city: Miami is two-thirds tourism in some areas. Orlando is tourism-dominant. The entire city exists for tourists. If Waymo can master Orlando, it masters a fully tourist-dependent market.

Theme park connectivity: Orlando's theme parks (Disney World, Universal) are the primary destination. Can Waymo effectively handle the traffic chaos of a theme park? That's a different challenge than handling normal city traffic.

Sprawl: Orlando is sprawling in a way Miami isn't. Distances are longer. That might require extending service areas or operating different economics.

Weather: Central Florida has similar weather to Miami, but different rain patterns and storm timing.

Orlando becomes a test market for how Waymo handles a destination-heavy city versus a residential city. Success in Orlando validates the model for other tourism-heavy markets.

Estimated data shows that autonomous rideshare could reduce parking space usage from 30% to allow for more parks, housing, and other urban developments.

The Texas Question: Can Waymo Scale to the Megacities?

San Antonio, Houston, and Dallas represent the real test of Waymo's viability. These aren't boutique markets like San Francisco or Phoenix. They're massive metropolitan areas with millions of residents and complex infrastructure.

San Antonio (~1.5 million metro): Sprawling, car-dependent, strong tourism (Alamo, River Walk). Testing ground for a Texas city of moderate size.

Houston (~7 million metro): Massive sprawl, difficult traffic, diverse neighborhoods, petrochemical hub with unusual transportation patterns. Houston is a hard market.

Dallas (~8 million metro): Massive sprawl, fragmented city structure, complex highway system. Dallas is possibly the hardest U. S. market to operate autonomous vehicles in due to scale and sprawl.

If Waymo succeeds in Dallas, the company can claim viability in any major U. S. city. Failure in Dallas would be telling about the limits of current autonomous technology at scale.

Waymo is presumably confident enough to target these markets, but it's a big bet.

Future Infrastructure: The Waymo Network Vision

Waymo's long-term vision is a national network. Not just robotaxis in individual cities, but a connected network where you can summon a Waymo vehicle in most major U. S. cities.

This requires:

-

Regulatory approval in 50 states: Currently, regulations vary wildly. Some states are friendly. Others are restrictive. Waymo needs a path to operate nationwide.

-

Infrastructure standardization: Road markings, signage, traffic signals need to be consistent so Waymo's AI can operate anywhere. Some cities have poor infrastructure. That limits autonomous vehicle operation.

-

Fleet scale: Operating in 50 cities requires tens of thousands of vehicles. Manufacturing at that scale is a separate challenge.

-

Support infrastructure: Charging stations, maintenance facilities, support centers in each city.

This is a 10-15 year plan. Waymo is playing the long game.

Economic Impact: Job Changes in Transportation

There's an elephant in the room: what happens to professional drivers?

In the U. S., roughly 3.5 million people drive for a living (truck drivers, taxi drivers, Uber/Lyft drivers, delivery drivers). Autonomous vehicles will displace many of these jobs over 10-20 years.

That's a genuine economic hardship for affected workers. Policy makers need to address this through:

- Retraining programs: Getting former drivers into new fields

- Transition assistance: Income support during job transitions

- Job creation: New jobs in autonomous vehicle maintenance, fleet management, remote oversight

Waymo isn't responsible for solving this, but it's an important consideration for the broader autonomous vehicle transition.

There's also the argument that new transportation technology creates new jobs. The shift from horses to cars displaced stable workers, but created far more automotive jobs. The same might happen with autonomous vehicles, but the transition period is painful for those affected.

Miami's Competitive Advantage: First-Mover Status

By launching in Miami early, Waymo gives the city a transportation advantage. Residents can use Waymo before residents in other cities. This might attract tech workers to Miami. It might influence which companies locate their offices there.

Cities that adopt new transportation technology early gain economic advantages. Miami is positioning itself as a forward-thinking, tech-friendly city. That positioning has value.

Other Florida cities will notice. If Waymo in Miami creates economic benefits, other cities will want Waymo service too. That drives expansion.

What Could Go Wrong: Risks and Challenges

Waymo's Miami expansion is promising, but risks exist:

Safety incident: One serious crash or injury involving a Waymo vehicle could trigger backlash, regulatory crackdowns, and loss of consumer trust. The company operates under intense scrutiny.

Regulatory reversal: Florida could change regulations, limiting autonomous vehicle operation. This is unlikely but possible if political winds shift.

Competitor breakthrough: If another company achieves a significant technological advantage (cheaper, safer, more capable), Waymo's lead evaporates quickly.

Consumer adoption slower than expected: If fewer Miami residents use Waymo than projected, the business case weakens. Low utilization means poor unit economics.

Cybersecurity incident: Autonomous vehicles are computers on wheels. If hackers gain control, it's catastrophic. Waymo has to maintain perfect cybersecurity indefinitely.

Technological plateau: If current autonomous vehicle technology hits a ceiling and can't improve further, the service remains limited to controlled environments. Real-world complexity might exceed the AI's capabilities.

None of these are particularly likely, but they're not impossible either. Waymo's success isn't assured.

The Endgame: What Happens in 10 Years

If Waymo succeeds (and I'm betting it will), where does this end up in a decade?

Possibility 1: Autonomous rideshare dominates urban transportation. Private vehicle ownership in major cities plummets. Most trips are via robotaxis or autonomous transit. Traffic improves significantly. Parking garages convert to housing. Cities reshape around autonomous mobility infrastructure.

Possibility 2: Autonomous vehicles plateau at 20-30% market share. They become one option among many, alongside human-driven rideshare, public transit, private vehicles, and bicycles. No single mode dominates, but autonomous vehicles are a significant player.

Possibility 3: Autonomous vehicles never reach consumer scale. Regulatory restrictions, safety incidents, or technological limitations prevent widespread adoption. They remain a boutique service for wealthy early adopters in a few cities.

I think Possibility 1 is most likely. The economic case is too strong. The technology is advancing. Consumer adoption is happening. Regulators are being pragmatic. The trajectory points toward autonomous vehicles becoming normal within a decade.

But I've been wrong about technology predictions before, so don't take that as gospel.

FAQ

What exactly is Waymo?

Waymo is an autonomous vehicle company owned by Google's parent company Alphabet. It develops and operates self-driving robotaxi services in cities across the United States. The company operates fully autonomous vehicles with no human driver, passengers ride in the vehicle without intervention, and the service can be summoned via mobile app just like traditional ridesharing services such as Uber or Lyft.

How does Waymo's technology work?

Waymo's autonomous driving system combines multiple sensors (cameras, lidar, radar, ultrasonic) with advanced artificial intelligence software to perceive the environment, predict other drivers' behavior, plan safe routes, and make driving decisions in real-time. The system uses machine learning for perception (identifying objects like pedestrians and other cars) combined with deterministic rules for safety-critical decisions (when to brake or stop). The vehicles are equipped with onboard computers that process data from sensors continuously, 24/7.

Is it safe to ride in a Waymo autonomous vehicle?

Waymo reports achieving a tenfold reduction in serious injuries from crashes compared to human drivers in its areas of operation, though this claim hasn't yet been independently verified by third parties. The company has maintained an excellent safety record with no reported fatalities in fully driverless operation. The vehicles use redundant sensors so that if one fails, others compensate, and the system prioritizes safety over speed by operating more conservatively than human drivers in many situations.

Why did Waymo choose Miami as an expansion city?

Miami offers several advantages for autonomous vehicle testing: dense tourism creating constant demand for transportation, wealthy and tech-forward residents willing to try new services, challenging weather and driving conditions that stress-test the technology, and favorable state and local regulations. Successfully operating in Miami's complex environment validates Waymo's system can handle difficult real-world conditions before expanding to other challenging markets.

How much does a Waymo ride cost?

Pricing hasn't been officially released for Miami yet, but based on Waymo One pricing in San Francisco, rides are typically comparable to or slightly cheaper than Uber X, around

When will Waymo expand beyond Miami in Florida?

Waymo announced plans to expand to Orlando in 2025, followed by San Antonio, Houston, and Dallas in 2026. The company expands methodically, city by city, taking several months between launches to ensure local adaptation, staff training, and operational stability before entering new markets. The exact timing depends on regulatory approvals and internal operational readiness in each location.

What happens if there's a crash involving a Waymo vehicle?

Waymo carries commercial liability insurance covering autonomous vehicle operations. If a Waymo vehicle causes damage or injury, insurance handles claims just as it would for human-driven vehicle accidents. Regulatory frameworks are still evolving, but Waymo and the cities it operates in have established liability protocols. In practice, Waymo's excellent safety record means serious incidents are rare, but the insurance and legal frameworks exist to handle them if they occur.

Could Waymo replace taxis and rideshare companies?

Likely, yes, over time. If autonomous robotaxis become cheap, safe, and convenient, they'll displace traditional taxis and rideshare services within 10-20 years in major cities. However, some customers will always prefer human drivers for social reasons, and rural areas and less dense cities may require human drivers longer. But in urban markets like Miami, autonomous rideshare will probably become the dominant transportation mode eventually.

Is Waymo hiring in Miami?

Yes. Launching a new autonomous vehicle service requires support staff including customer service representatives, vehicle maintenance technicians, fleet operators, and safety specialists. Waymo typically hires dozens of local employees in each new city. If you're interested in working for Waymo in Miami, check their careers website for open positions.

What about competing autonomous vehicle services?

Cruise is operating limited robotaxi services in San Francisco, Tesla promised a robotaxi service that keeps getting delayed, and Zoox (owned by Amazon) is developing autonomous vehicles but hasn't launched public service yet. Waymo currently has the most operational cities, largest fleet, and most mature technology. Competition exists, but Waymo has a significant lead as of 2025.

Key Takeaways

- Waymo is now accepting paying passengers in Miami after months of unpiloted testing, with nearly 10,000 residents signed up for early access

- The company claims a tenfold reduction in serious injury-causing crashes versus human drivers, though independent verification is ongoing

- Miami's 60-square-mile service area covers destination neighborhoods like the Design District and Wynwood, with airport expansion planned

- Waymo's expansion timeline targets Orlando in 2025 and major Texas cities in 2026, validating the technology in increasingly challenging markets

- Operating costs of 1.50 per mile position autonomous rideshare to undercut traditional rideshare at scale while maintaining profitability

Related Articles

- Waymo Launches Miami Robotaxi Service: What You Need to Know [2026]

- New York's Robotaxi Revolution: What Hochul's Legislation Means [2025]

- Tesla FSD Federal Investigation: What NHTSA Demands Reveal [2025]

- Physical AI in Automobiles: The Future of Self-Driving Cars [2025]

- Luminar's Collapse: Inside Austin Russell's Bankruptcy Battle [2025]

- Physical AI: The $90M Ethernovia Bet Reshaping Robotics [2025]

![Waymo in Miami: The Future of Autonomous Robotaxis [2025]](https://tryrunable.com/blog/waymo-in-miami-the-future-of-autonomous-robotaxis-2025/image-1-1769099806294.jpg)