Introduction: Threads Steps Into the Ad-Supported Era

For months, many Threads users were blissfully unaware of something brewing behind the scenes. While Meta quietly tested advertisements on a small portion of its 400+ million monthly active user base, the vast majority continued scrolling through their feeds without a single sponsored post in sight. That era just ended.

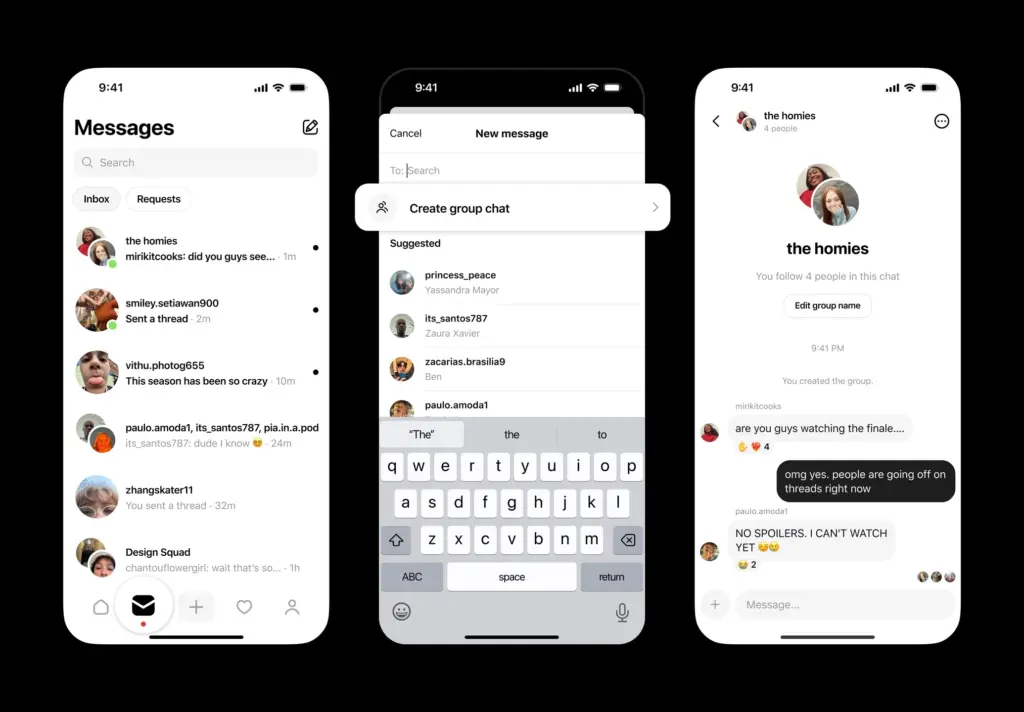

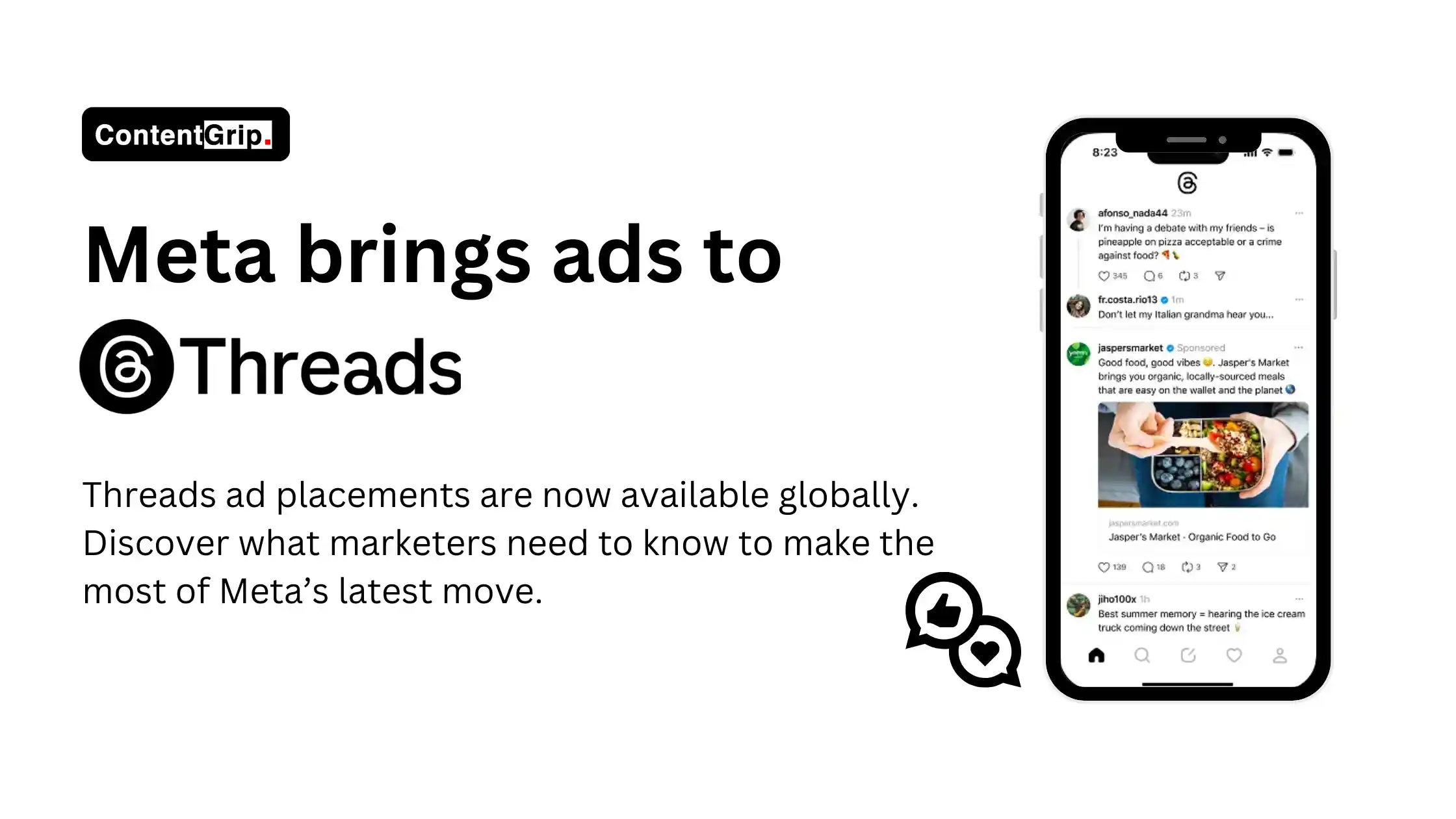

In January 2025, Meta announced a watershed moment for Threads: ads are coming to every user globally, with a gradual rollout set to unfold over the coming months. This isn't a surprise announcement if you've been paying attention to Meta's financial strategy, but it's undeniably significant. Threads launched just 18 months prior without a single advertisement, positioning itself as the antithesis to X's controversial content moderation policies and cluttered feed experience. Now, as the platform matures and Meta faces pressure to monetize its billion-dollar bet, the company is ready to insert ads into the experience.

But here's what most coverage misses: this isn't just about making money from Threads. It's about building the infrastructure for a new generation of social platforms that operate on Meta's advertising technology stack. It's about proving that advertisers will spend money to reach audiences on emerging platforms. And it's about establishing Threads as a legitimate rival to X, one that offers what X can't—seamless integration with Facebook and Instagram audiences and all the advertiser tools that come with them.

In this guide, we'll break down exactly what's happening with Threads ads, when you'll see them, how they work, what it means for creators, and whether this marks the beginning of the end for Threads as an ad-free sanctuary or simply the next logical step in platform maturation.

TL; DR

- Threads ads roll out gradually to all 400+ million users worldwide starting in late January 2025, with complete rollout expected to take months

- Ad delivery starts "low" and will scale over time, meaning you won't see constant ad bombardment right away

- Advertisers get full Meta integration: cross-platform campaign management, Advantage+ automation, and image, video, and carousel ad formats

- Brand safety features included: Meta expanded third-party verification tools to Threads to compete with X's deepfake problem

- Creators benefit indirectly through monetization pathways, though direct creator payouts remain limited compared to Instagram and YouTube

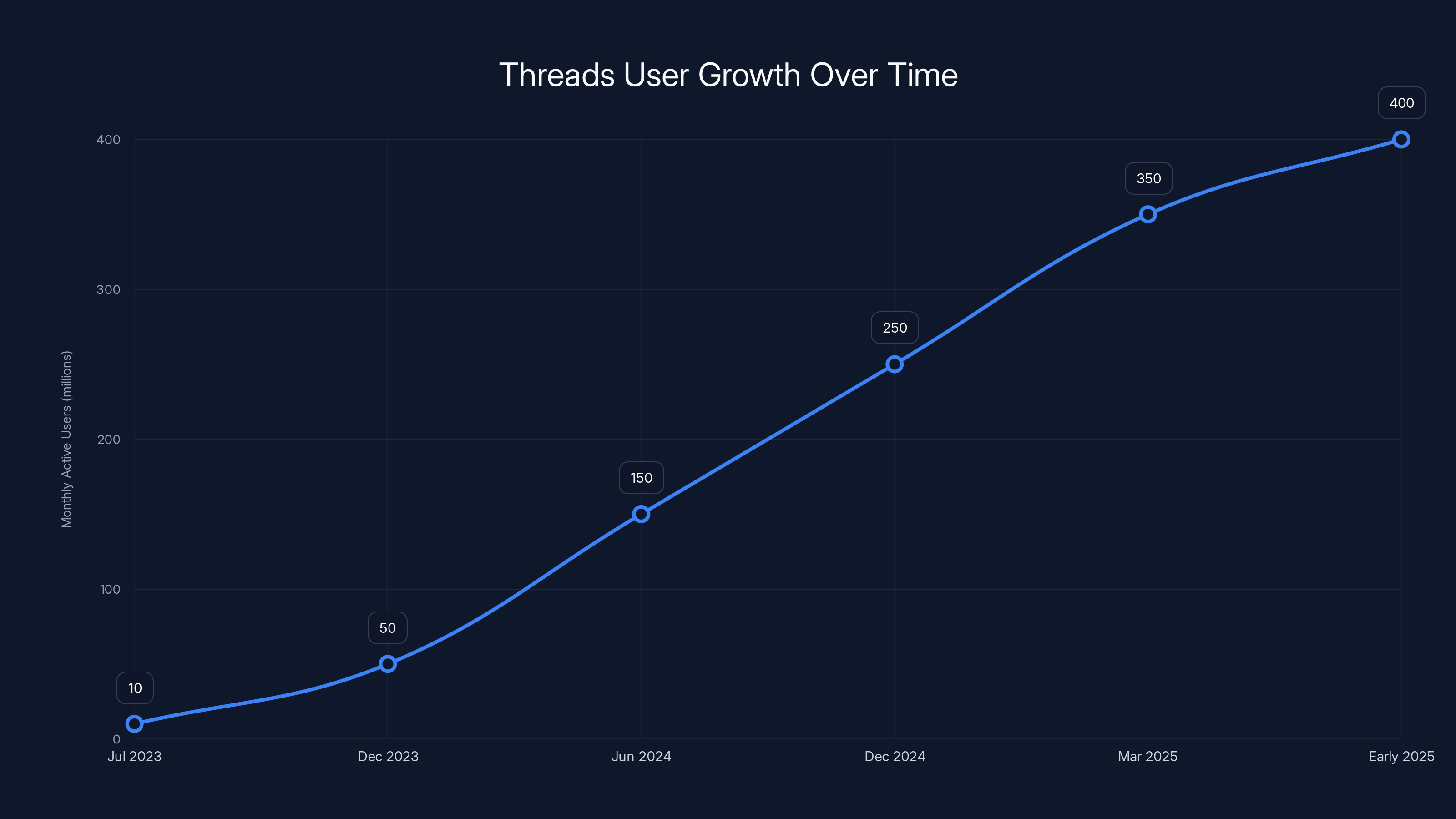

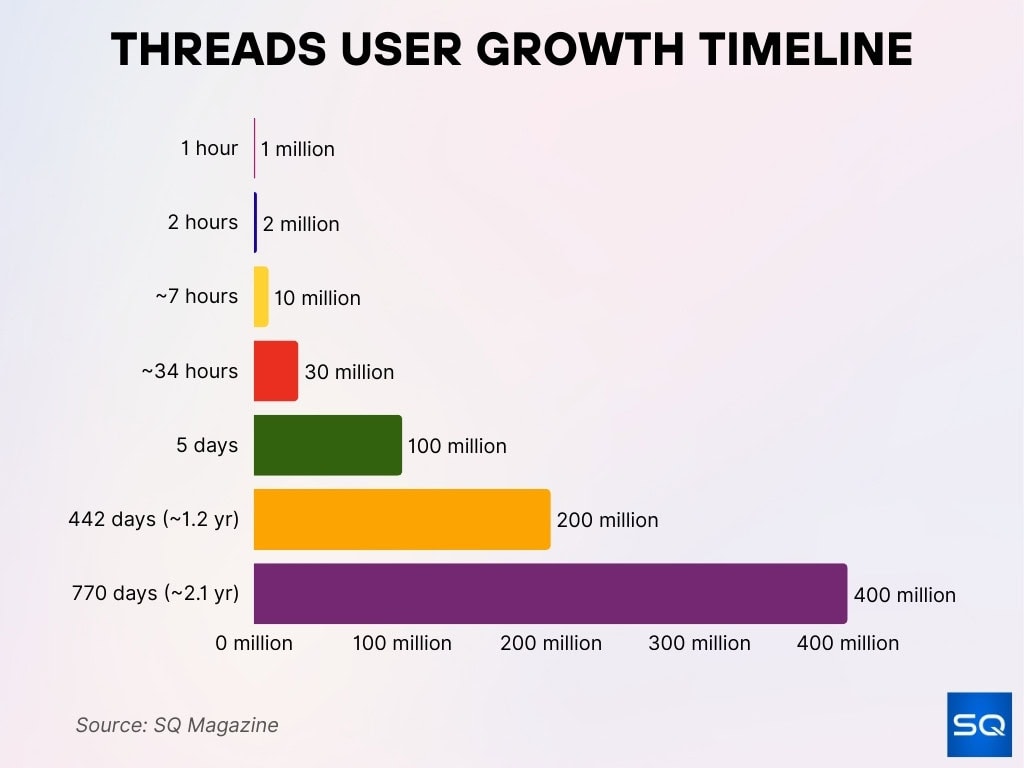

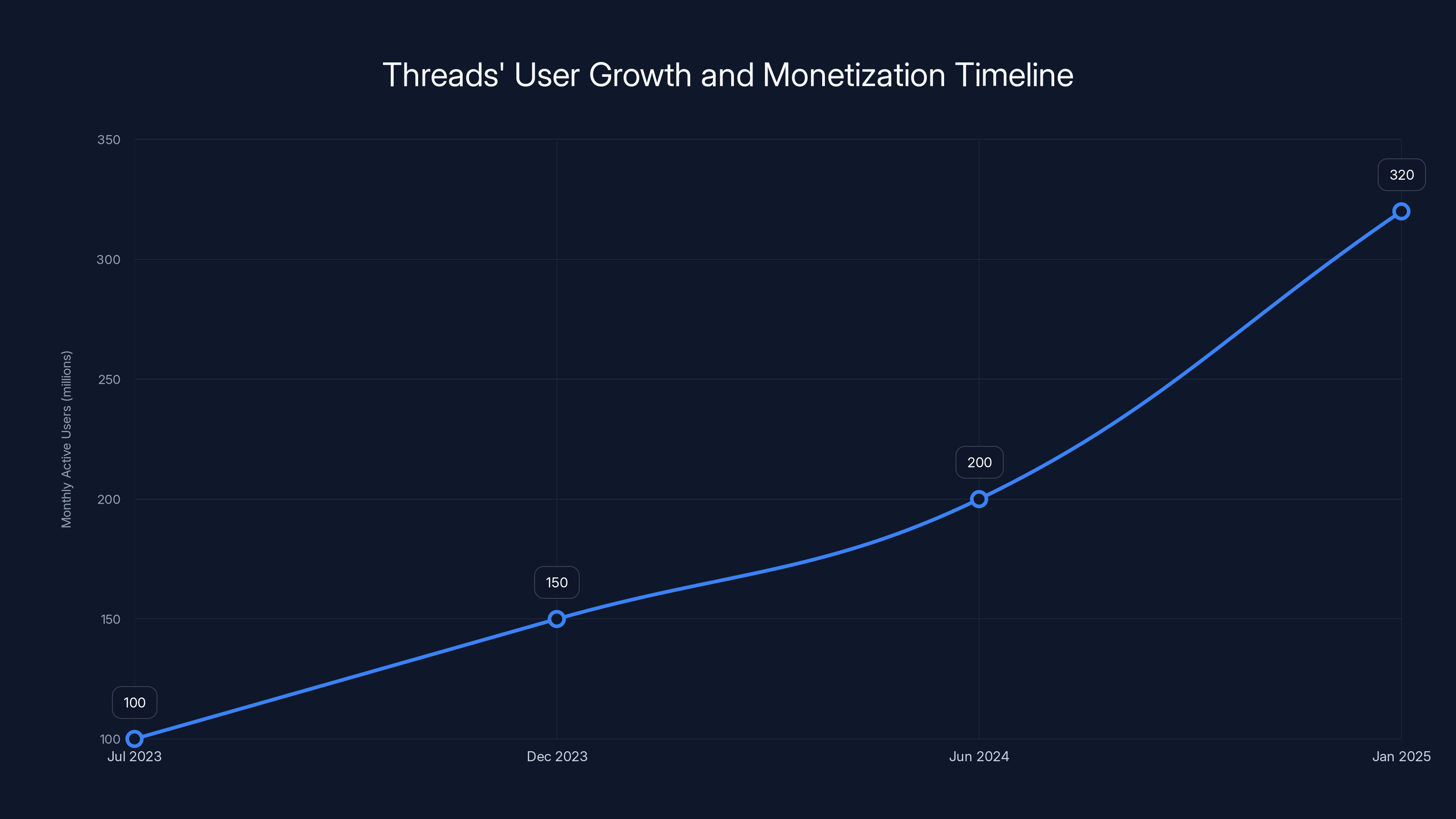

Threads rapidly grew to over 400 million monthly active users by early 2025, highlighting its successful positioning as a Twitter alternative. (Estimated data)

The Timeline: How Threads Went From Ad-Free to Ad-Supported

Threads' journey toward monetization tells a story about how rapidly Meta can pivot platform strategy when business realities demand it. When the platform launched in July 2023, it was explicitly positioned as the "no ads, no algorithms" alternative to X. This wasn't accidental branding. It was a direct response to user frustration with X's algorithmic feeds, content moderation, and pervasive advertising.

The first 12 months saw explosive growth. Threads hit 100 million users in just five days, making it the fastest-adopted app in history at the time. By mid-2024, the platform had grown to 200 million monthly active users. The momentum seemed unstoppable. Meta's leadership, particularly CEO Mark Zuckerberg, publicly stated that Threads could reach 1 billion users within a few years. These statements weren't idle speculation—they were forecasts driving internal resource allocation and investment decisions.

Then came the reality check. While growth continued throughout 2024, the rate of expansion began to plateau. By January 2025, Threads had 320 million monthly active users. The math became clear to Meta's finance team: if the platform wasn't generating revenue, the cost of maintaining it—infrastructure, moderation, development—couldn't be justified indefinitely, no matter how many users it had.

Meanwhile, X under Elon Musk's ownership was becoming increasingly untenable for many brands and creators. The platform's moderation challenges, algorithmic unpredictability, and advertiser exodus created an opening. But opportunity without monetization is just a hobby. Meta needed to prove that Threads could print money like Instagram and Facebook.

The company began testing ads quietly in the U.S. and Japan starting in early 2024. These tests were limited in scope and visibility—most users on those platforms didn't even notice they were happening. The goal was to gather data on advertiser demand, user tolerance, and performance metrics without triggering the backlash that comes with a splashy announcement.

Approximately one year into testing, Meta opened Threads advertising to global advertisers in April 2024, even though the ads weren't showing up in most users' feeds yet. This was the signal to Madison Avenue that Threads was a real advertising channel worth investing in.

Now, with the global rollout announced for early 2025, Meta is crossing the final threshold: making ads visible to every user worldwide.

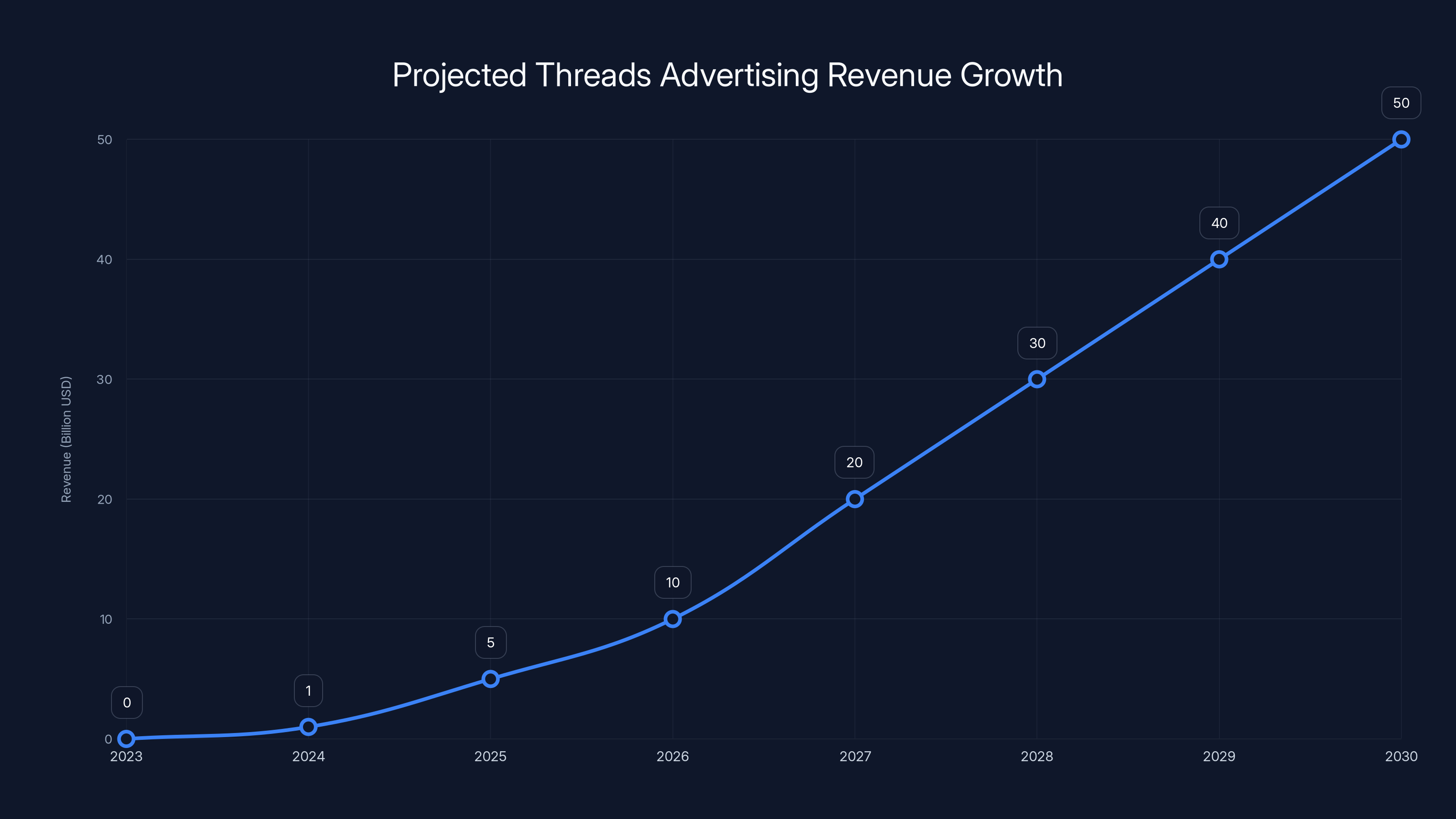

Estimated data shows Threads' advertising revenue could grow from

How Threads Ads Actually Work: The Mechanics

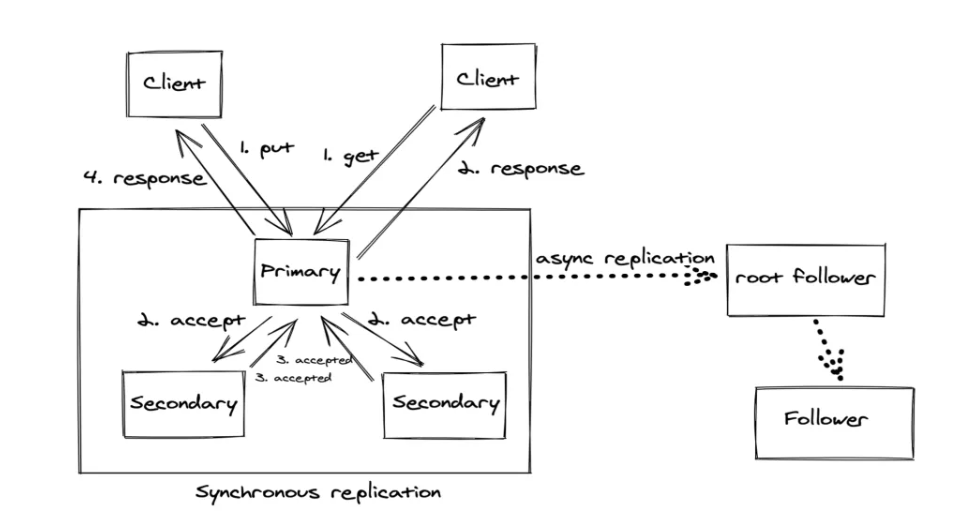

Understanding how Threads ads work requires understanding Meta's broader advertising infrastructure. This isn't a new system built from scratch—it's an adaptation of the proven machinery that powers Facebook and Instagram.

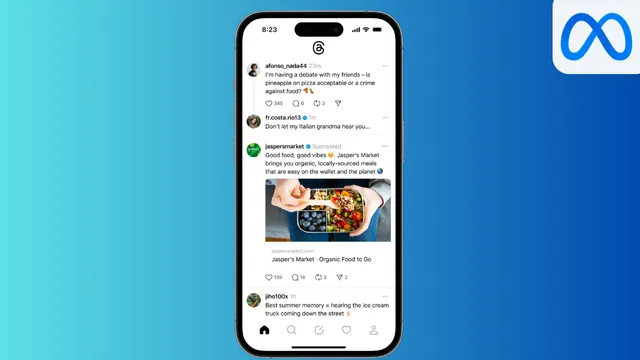

When an advertiser wants to run a campaign on Threads, they log into Meta Business Suite, the same interface they use to manage Facebook and Instagram campaigns. They don't need to learn new tools or set up separate accounts. This integration is intentional and strategic. It lowers the barrier to entry for advertisers and makes Threads feel like a natural extension of existing media buying strategies.

Advertisers can use Advantage+, Meta's automated AI-driven campaign system, which optimizes targeting, creative delivery, and bid strategy without human intervention. This is powerful for small businesses that lack sophisticated in-house marketing teams. They can upload a product image, write some ad copy, and let Meta's algorithms do the heavy lifting of finding interested users.

Alternatively, advertisers can run manual campaigns with granular control over targeting, budgets, and bidding strategies. This appeals to larger brands with established media buying processes and dedicated teams.

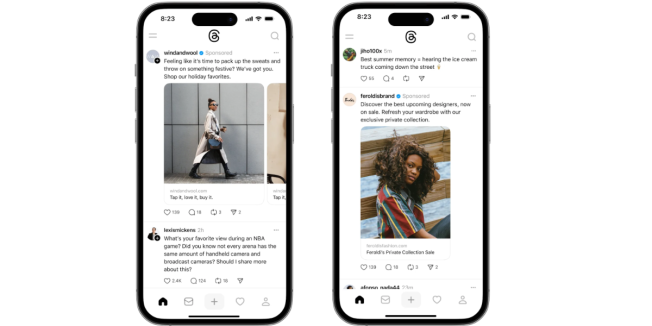

In terms of ad formats, Threads supports image ads, video ads, the newer 4:5 aspect ratio format optimized for mobile feeds, and carousel ads that let users swipe through multiple images or videos. There's no radical innovation here—these are formats perfected on Instagram over the past decade.

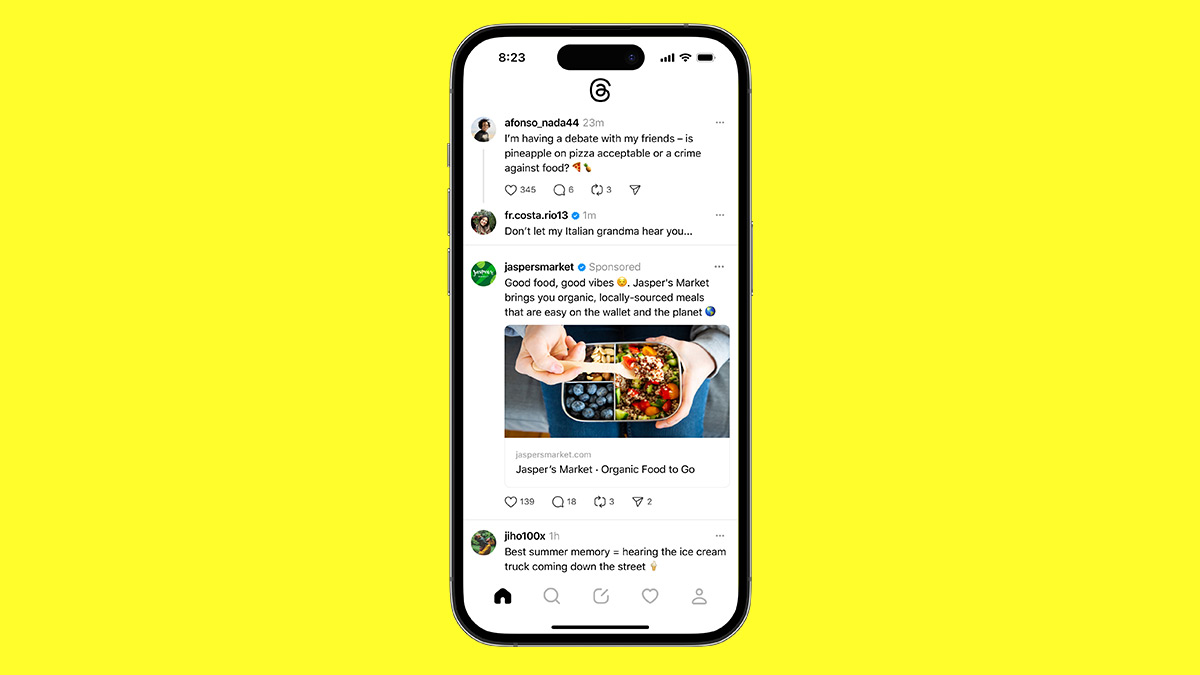

The critical question becomes: where in the Threads feed will ads appear? Meta hasn't specified the exact ratio, but the company said ad delivery will remain "low" initially as the feature scales. This is corporate speak for "we're not going to overwhelm users immediately." The implication is that ad density will increase over time, eventually reaching something closer to Instagram's current model, where every fourth or fifth post is sponsored content.

One thing that sets Threads ads apart from X is brand safety. Meta expanded third-party verification tools to Threads' feed, allowing independent verification of brand suitability. This addresses a real problem on X: the proliferation of deepfakes and low-quality content has made advertisers hesitant to run campaigns there. By offering verification, Meta is positioning Threads as the safe, premium alternative.

What This Means for Regular Users: The Ad Experience

For most Threads users, the immediate experience won't change dramatically. Meta has been explicit about starting with low ad density. This isn't generosity—it's a tested playbook. Instagram started with low ad density when it first introduced advertising in 2013, then gradually increased it over years as users became acclimated.

The psychological tolerance for ads on social platforms is fascinating from a user experience perspective. Instagram users now see ads routinely, yet the platform hasn't experienced a massive exodus. Why? Because the ads are usually relevant, well-targeted, and interrupted periodically by content from friends. Users accept ads as the implicit trade-off for a free service. They're implicitly saying: "I'm okay with ads if I get a platform where my friends are active."

Threads users will likely follow the same pattern. The platform's value proposition—being an X alternative with better moderation—doesn't evaporate because of ads. It's still a better moderated experience than X. The comparison that matters isn't "Threads with ads versus Threads without ads"—it's "Threads with ads versus X with ads and moderation chaos." On that basis, Threads wins.

That said, there will be friction points. Users who explicitly switched to Threads because of its ad-free positioning will feel betrayed. This is natural and predictable. Some will leave for other platforms like Bluesky, which is positioning itself as the true ad-free alternative. Others will stay because the alternative (X) is worse.

The interesting question is whether ad targeting on Threads will feel invasive. This depends on Meta's data infrastructure. Threads users don't generate as much explicit behavior data as Instagram or Facebook users do—they're not tagging products, saving items to wishlists, or engaging in ecommerce. This means targeting will initially rely on demographic data, interests inferred from follows, and cross-platform behavior on Meta's other properties.

This is simultaneously a limitation and an advantage. Limited targeting data means less relevant ads, but also less creepy surveillance feelings. Some users will appreciate this. Others will find ads irrelevant and annoying.

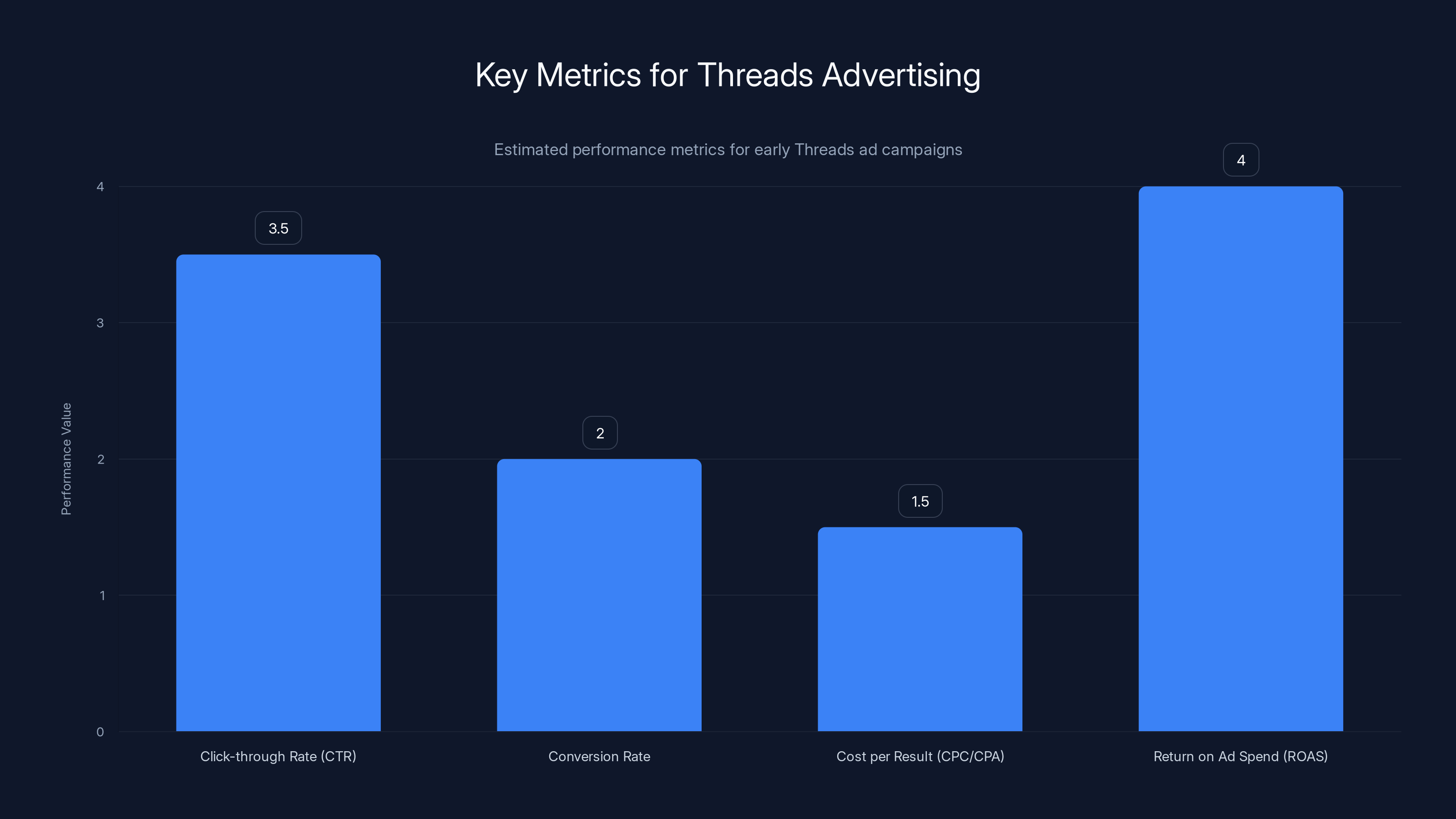

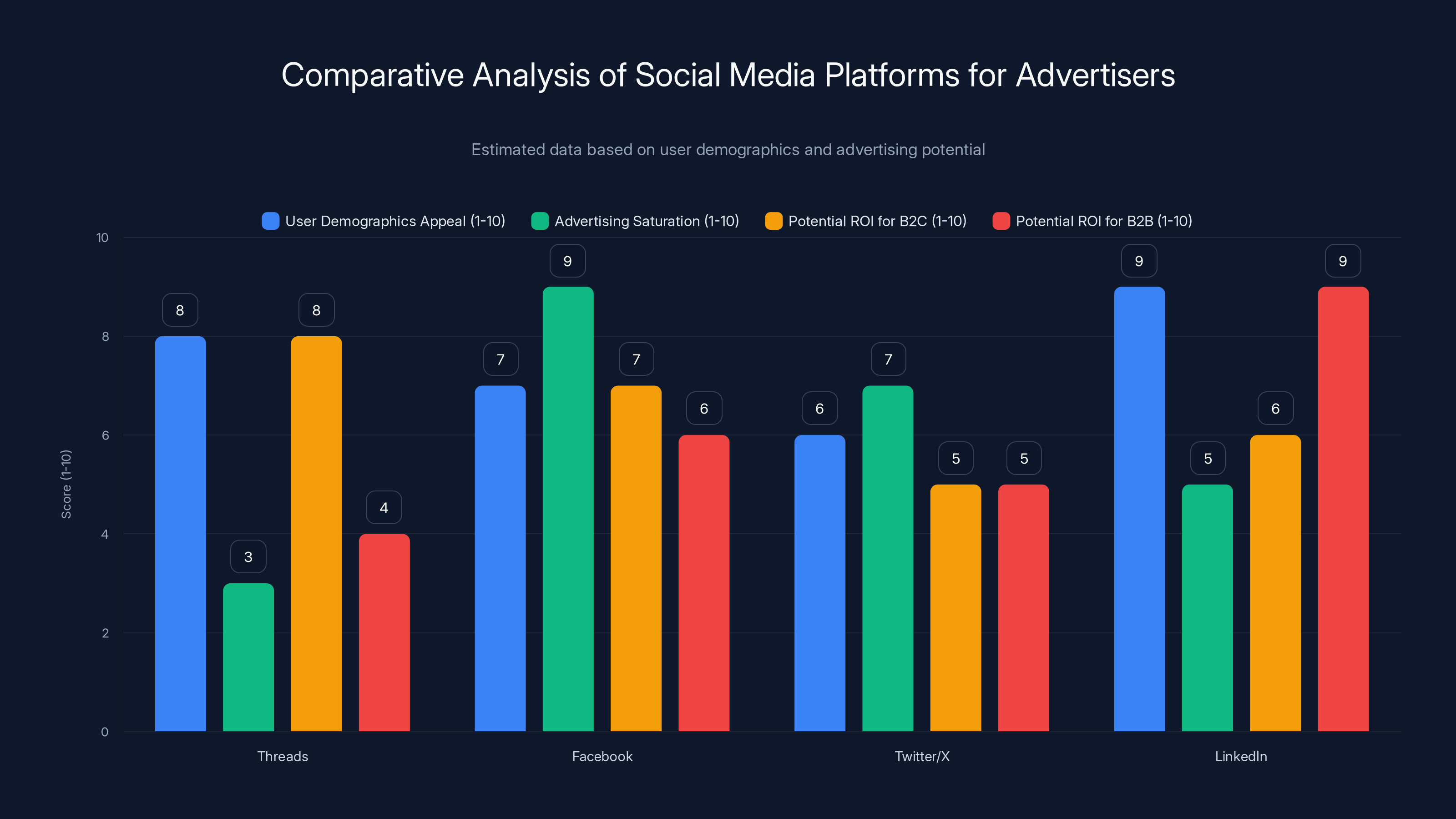

Estimated data suggests Threads advertising may offer higher engagement and returns compared to mature platforms due to lower saturation and competition.

The Creator Economy Angle: Monetization Pathways

While Threads ads primarily benefit Meta and advertisers, creators are asking the obvious question: what's in it for us?

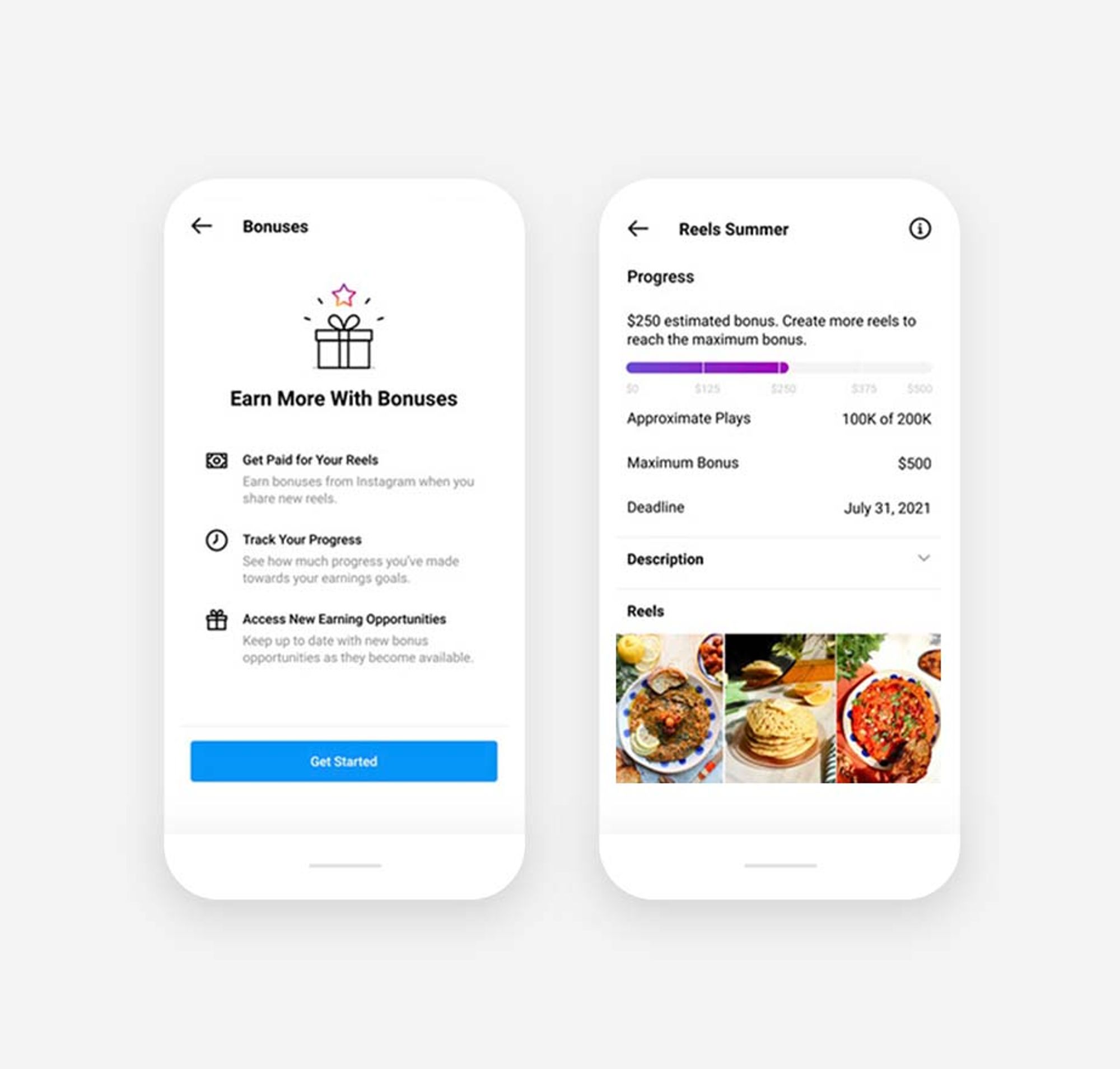

The answer is complicated and somewhat disappointing if you're coming from YouTube or Instagram backgrounds. Threads doesn't currently have direct creator monetization in the form of revenue sharing from ads. You don't get paid a percentage of the ad revenue generated next to your content, unlike YouTube's Partner Program or Instagram's Reels bonus program.

However, monetization exists indirectly through visibility. Creators who build engaged audiences on Threads can drive traffic to other monetized platforms. A creator might build a massive Threads following, then direct that audience to a Substack newsletter with paid subscriptions, a YouTube channel with pre-roll ads, or a personal website with sponsorship integrations.

Meta has occasionally offered Threads Monetization through its Creator Fund, paying select creators for high-performing posts. But these programs are limited, competitive, and notoriously underpaying compared to YouTube alternatives. Most creators on Threads are using the platform as a distribution mechanism and engagement tool, not as a direct income source.

This is actually a strategic decision by Meta. Direct creator payouts reduce platform profitability and make the business model more expensive to scale. By relying on advertiser revenue without creator revenue sharing, Meta keeps more money in the company's pocket. The trade-off is that some creators will remain frustrated and may allocate their energy to platforms like YouTube that offer better monetization.

Over time, this may change. If Threads becomes a significant traffic driver for creators, pressure will build for more direct monetization options. But for now, creators should think of Threads as a marketing channel, not a revenue stream.

Advertiser Strategy: Why Brands Should Care About Threads

For advertisers, Threads represents a new frontier, but not an unproven one. The platform already has 400+ million monthly active users, which is larger than most countries' populations. It has demonstrated user stickiness—people are returning daily—and it has solved the moderation problem that plagues X.

The decision for brands should be less about whether to advertise on Threads and more about how much to allocate. Early indicators suggest that audiences on Threads skew slightly younger, more tech-savvy, and more educated than Facebook's average audience, but less niche than Twitter/X's traditional user base. This makes Threads appealing for consumer brands targeting millennials and Gen Z.

For B2B advertisers, the picture is murkier. Threads hasn't yet become a hub for professional discussion the way LinkedIn dominates B2B marketing. It's primarily a social network for personal expression and cultural commentary. A B2B software company would likely see better ROI on LinkedIn or industry-specific channels. But a consumer brand selling apparel, food, entertainment, or lifestyle products? Threads is worth testing.

The platform's integration with Meta's Advantage+ system means advertisers can test Threads audiences with minimal effort. They can allocate budget to Threads campaigns and let algorithms optimize for conversions. This democratizes access to the platform—you don't need a specialized team to advertise on Threads anymore.

One strategic advantage that hasn't been fully appreciated: Threads ads reach users in a less advertising-saturated context than Instagram or Facebook. The average Instagram user sees dozens of ads daily. A Threads user, at least in the early months of the rollout, will see far fewer. This means attention is higher and CPMs (cost per thousand impressions) may be lower, creating an arbitrage opportunity for early adopters.

Smart brands will test Threads budgets in early 2025 while CPMs are still reasonable, gather performance data, and then scale up once they understand what works. This is the same strategy that worked when Instagram ads first launched, when TikTok ads became available to brands, and when Reels ads rolled out.

Threads experienced rapid user growth, reaching 320 million users by January 2025. Monetization efforts began in early 2024 as user growth plateaued. (Estimated data)

The Competition Question: How Does This Position Threads Against X?

This is the most important context that gets lost in most coverage: the Threads ad rollout is fundamentally a competitive move against X.

X, under Elon Musk's ownership since late 2022, has been a disaster for brand advertising. Content moderation has been chaotic, advertiser-friendly policies were dismantled, and user behavior became increasingly volatile. Advertisers fled. Some estimates suggest X lost 60% of its advertising revenue in the first year post-acquisition.

Meanwhile, Threads was positioned as the sane alternative. It had moderation policies that actually enforced civility. It had algorithm controls. It had brand safety features. But here's the problem: if Threads had no ads and X had ads, advertisers would gravitate toward X despite its moderation problems. Advertising is driven by reaching eyeballs, not by moral arguments about platform health.

So Meta faced a choice: either build Threads as a non-monetized platform (economically unsustainable long-term) or introduce ads to compete for advertiser spending. The company chose the latter.

The genius in Meta's approach is that Threads ads will initially be cleaner, less intrusive, and better targeted than X ads, while reaching nearly as many users. Advertisers who abandoned X due to brand safety concerns now have an alternative that offers both reach and safety. This creates a virtuous cycle where advertiser spending on Threads increases, Meta invests more in the platform, user experience improves, and X's decline accelerates.

X is aware of this dynamic. Elon Musk has made a series of increasingly desperate moves to attract advertisers back, including offering premium features and creator revenue sharing. But the damage is done. Brands have shifted their focus elsewhere.

Threads isn't just another social network—it's a direct threat to X's business model. The ad rollout is Meta's way of saying: "We're not just copying X's features. We're building a better version of X that advertisers actually want to use."

Brand Safety and Content Moderation: A Competitive Advantage

One of the most underrated aspects of the Threads ad rollout is the brand safety infrastructure Meta included. The company extended third-party verification tools used on Facebook and Instagram to Threads' advertising ecosystem. These tools allow independent verification firms to assess whether brand safety standards are being met.

What does this mean in practice? An advertiser can run a campaign and get independent assurance that their ads aren't appearing next to misinformation, deepfakes, or explicit content. This sounds obvious until you compare it to X, where deepfake videos and manipulated images have become endemic. Brands advertising on X have no such guarantees.

This is Meta playing chess while X plays checkers. The company is building trust in the advertising ecosystem not through promises, but through third-party verification. This costs Meta money (verification services aren't free), but it creates a tangible competitive advantage.

Over time, as deepfake problems worsen on other platforms, the importance of verified brand safety will only increase. Advertisers will be willing to pay premiums to guarantee their ads don't appear next to misinformation. Meta can command those premiums on Threads because the verification infrastructure is already there.

This is also significant for users. While nobody loves ads, users generally prefer ads that appear next to relevant, trustworthy content over ads that might appear next to hoaxes or manipulated imagery. The brand safety infrastructure actually improves the overall user experience, not just the advertiser experience.

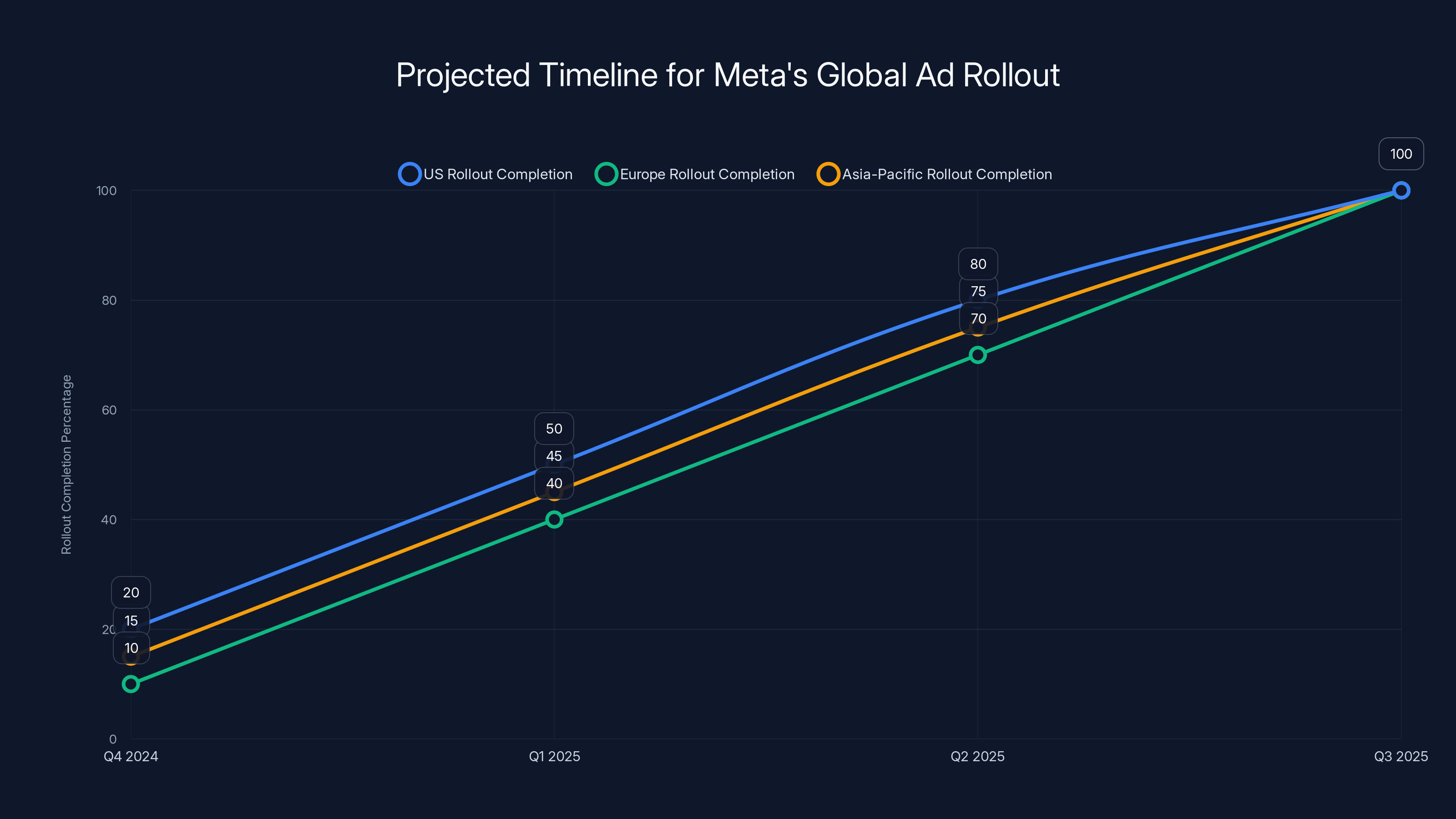

Estimated data shows a gradual increase in ad rollout completion, with full implementation expected by Q3 2025 across major markets.

Monetization Metrics: The Economics of Threads Advertising

Let's talk about the money. For this to make sense financially, Meta needs to hit certain benchmarks.

Assume Threads eventually reaches 1 billion monthly active users (as Meta's leadership has publicly projected). If average CPM (cost per thousand impressions) is

These are rough estimates—actual CPMs vary dramatically by country, time of year, and audience targeting quality—but they illustrate the scale. Meta's total advertising revenue across all properties is roughly

But here's the complication: early CPMs are almost always lower than mature CPMs. Facebook's CPMs started around

Meta is betting that Threads becomes a long-term cash cow. The platform is a loss leader right now, but if it can grow to 500 million+ active users (which seems likely) at mature CPMs (which will take years), it could rival Instagram's contribution to Meta's bottom line.

This is why the gradual ad rollout matters. Meta wants to scale ads slow enough to maintain user growth and engagement, but fast enough to eventually generate meaningful revenue. It's a delicate balance, and the company has done this dance before with Facebook and Instagram.

Cross-Platform Integration: The Meta Advantage

One of Threads' biggest structural advantages is that it exists within Meta's ecosystem. This isn't accidental—it's the entire point.

When you run a campaign on Threads, you're not running it on an isolated platform. You're tapping into Meta's entire audience graph. Meta knows which users are on Facebook, which are on Instagram, which are on WhatsApp, and now, which are on Threads. This allows for sophisticated audience targeting and retargeting across platforms.

For example, a brand could target cold audiences on Threads, then retarget those users on Instagram with a more specific message. Or they could use lookalike audiences built from high-value Facebook customers to find similar users on Threads. These cross-platform capabilities don't exist on X, TikTok, or any other social network.

This is perhaps Meta's most significant competitive advantage—not the size of any individual platform, but the interconnection between platforms. Advertisers pay a premium for this capability because it allows them to orchestrate sophisticated, multi-touch campaigns.

The cross-platform integration also benefits Threads itself. Users who engage with branded content on Threads can be retargeted with relevant ads on other Meta properties. This increases advertiser ROI and makes Threads more valuable. It's a virtuous cycle that benefits everyone except users who prefer less tracking.

From a platform dominance perspective, this is Meta's genius. By integrating Threads into the broader ecosystem rather than operating it as a standalone product, Meta has created lock-in not just for users, but for advertisers and developers.

Threads shows high appeal for younger demographics and lower ad saturation, making it a promising platform for B2C brands. Estimated data highlights its potential for early adoption.

The Bluesky Factor: How Threads Sits in the Broader Competitive Landscape

Threads isn't the only X alternative anymore. Bluesky, built by Jack Dorsey, has emerged as a competitor, positioning itself as the true ad-free social network. This complicates the narrative around Threads ads.

Bluesky's pitch is simple: we're building the social network that X should have been, completely free from ads and corporate control. Users who want a pure, unsullied social experience can migrate to Bluesky. Those who want functionality alongside community can stay on Threads.

This isn't necessarily bad for Threads. The platforms appeal to slightly different users. Threads has better features, integration with the broader Meta ecosystem, and 400+ million users. Bluesky has ideological purity and a more explicit commitment to open protocols. The same user can have accounts on both platforms.

However, Bluesky's growth is worth monitoring. If Bluesky reaches 100+ million users while positioning itself as ad-free, it could siphon off Threads users who specifically moved because of the no-ads promise. Meta would then be left with a smaller user base on Threads but one that's more tolerant of ads.

This is the key dynamic in social networks: if you lose users to competitors, your advertising reach shrinks, which makes your platform less attractive to advertisers, which accelerates user loss. It's a downward spiral. Meta is betting that Threads' advantages (better moderation, more features, larger audience) outweigh the ads disadvantage versus Bluesky.

Early evidence suggests this bet is working. Threads continues to grow while Bluesky growth has plateaued around 20-30 million users. But the competition is real and worth watching.

Creator Experience: How the Ad Rollout Affects Content Strategy

Creators on Threads are adapting to the ad environment even before ads are fully visible. The strategy is clear: understand what content performs well, build engaged audiences, then monetize those audiences off-platform.

The most successful Threads creators are typically those who already have built audiences elsewhere. They use Threads as a content distribution channel, directing followers to YouTube, newsletters, podcasts, or other monetized platforms. This isn't ideal from a Threads perspective—Meta wants creators who invest energy primarily in Threads—but it's the economic reality.

For creators building audiences from scratch on Threads, the dynamic is different. Without direct platform monetization (beyond limited Threads Creator Fund opportunities), building on Threads requires patience and faith that the audience you build will eventually be valuable off-platform.

The introduction of ads actually changes creator incentives. Creators now benefit indirectly from ads through increased discoverability. Posts that appear in ad-supported feeds get more visibility, which can drive follower growth. This creates positive feedback: better content gets seen more, creators invest more effort, content quality improves, audience grows.

Over time, if Meta introduces creator revenue sharing (which remains possible), the creator economy on Threads could flourish. For now, it's a channel to build audiences that you monetize elsewhere.

Privacy, Data Collection, and User Concerns

The introduction of ads also raises legitimate privacy concerns. Targeted advertising requires data, and the question of how much data Meta collects on Threads is relevant.

Initially, Threads had less data collection than Instagram or Facebook because users weren't doing things like tagging products, checking in at locations, or engaging with ecommerce. But as advertising has become integral to the platform's strategy, Meta has been quietly expanding data collection.

Threads now tracks which posts you engage with, how long you view each post, what accounts you follow, and crucially, your activity on other Meta platforms. This cross-platform data is what makes Meta advertising so powerful. Combined with demographic data from Facebook and Instagram, targeting on Threads can be quite granular.

Users who are uncomfortable with this level of tracking should understand that this is now an inherent part of using Threads. The platform cannot simultaneously have targeted ads and minimal data collection. Pick your priority.

Meta, for its part, is compliant with data protection regulations (mostly) and is transparent in its privacy policy about what data it collects. The question is whether users read and understand these policies. Most don't.

This is a real tension in platform design: better, more relevant ads require more data. More data raises privacy concerns. Platforms can't have it both ways. Threads is choosing the data collection route, as Meta has done with all its platforms.

Global Rollout Considerations: Why It Takes Months

Meta's statement that the ad rollout will "take months" isn't arbitrary. There are legitimate reasons why global platform launches are staggered.

First, infrastructure and scaling. Meta's ad serving systems are robust, but they're not infinitely scalable. Rolling out ads to 400 million users simultaneously could strain systems. A gradual rollout allows Meta to monitor performance, fix bugs, and scale infrastructure incrementally.

Second, regional regulatory considerations. Different countries have different rules about advertising, data privacy, and platform liability. Europe's regulations are stricter than the US, which is stricter than most Asian countries. Meta needs to adjust ad policies and data handling for each region. This takes time and coordination across legal and product teams.

Third, market testing. By rolling out ads gradually, Meta can test different CPM pricing, ad formats, and density levels in different regions. The company learns what works in each market and optimizes accordingly. A simultaneous global launch would prevent this learning.

Fourth, user habituation. Users need time to adjust to ads. A gradual rollout allows user sentiment to stabilize rather than triggering a backlash. This has been Meta's playbook with both Facebook and Instagram, and it works.

Expect the timeline to be approximately 6-12 months for complete global rollout, with most major markets (US, Europe, Asia-Pacific) seeing full ad implementation by Q3 2025.

Advertiser Onboarding: What Brands Need to Know

If you're a brand marketer trying to figure out whether to advertise on Threads, here's what you need to know about the onboarding process.

Threads ads will be managed through Meta Business Suite, the same interface you likely already use for Facebook and Instagram campaigns. The learning curve is minimal if you're already running campaigns on Meta properties. You'll find Threads listed as a placement option alongside Instagram Feed, Instagram Stories, and Facebook Feed.

Advertisers can start with small test budgets—even $100-500 can generate meaningful data about audience response. Meta's Advantage+ system will optimize this spend to find the most engaged users.

Key metrics to track: Click-through rate (CTR), conversion rate, cost per result (CPC or CPA), and return on ad spend (ROAS). Threads is too young to have industry benchmarks, so your early data becomes your benchmark. This is actually an advantage—without competitive pressure, performance metrics are often better than mature platforms.

Brand safety should be a concern. While Meta includes third-party verification, you should still monitor where your ads appear. Check the placements and audience composition regularly. Threads audiences skew younger and more casual than Facebook audiences, so ad messaging should reflect this.

One unique opportunity: Threads is less saturated than Instagram, so creative fatigue is lower. Your ads will feel fresher to users. Take advantage of this by testing different creative approaches and learning what resonates before the platform becomes saturated.

Future Evolution: What's Coming After the Ad Rollout

The ad rollout isn't the end of Threads' evolution—it's the beginning of a new chapter.

Meta is likely exploring several next-generation monetization features:

First, creator monetization programs. As Threads matures, Meta will almost certainly introduce revenue sharing for high-performing creators. This could take the form of engagement-based payments (similar to YouTube's Partner Program) or direct advertiser partnerships (similar to Instagram's Branded Content tools).

Second, ecommerce integration. Meta might add shopping features directly to Threads, allowing users to purchase products without leaving the app. This would unlock additional revenue streams and make ads more directly tied to conversions.

Third, premium tiers. Meta could introduce a paid tier (similar to Twitter Blue) that offers ad-free browsing or additional features. This would provide revenue without alienating users who want ad-free experiences.

Fourth, subscription models for businesses. Threads could eventually support business accounts with advanced analytics, content scheduling, and customer management tools, mirroring features available on LinkedIn and Instagram for Business.

None of these are announced, but they follow Meta's historical pattern of feature rollout. The company typically launches a core product, introduces advertising, then adds premium monetization layers.

The trajectory for Threads is clear: it will become a full-featured social platform with multiple monetization vectors, professional tools for businesses, and integrated ecommerce. The ad rollout is just the first step.

The Long Game: Why This Matters Beyond Just Ads

The Threads ad rollout matters for reasons that go far beyond immediate revenue generation.

On the surface, it's about monetizing a 400+ million user platform that's currently not generating meaningful advertising revenue. But at a deeper level, it's about something more significant: establishing that social platforms can transition from ad-free to ad-supported without collapsing.

This is a playbook that Meta will use repeatedly. Every new social platform Meta builds will eventually need advertising to be sustainable. If Threads successfully introduces ads while maintaining growth, it proves the model works. Future Meta platforms can launch ad-free, gain users, then introduce ads once critical mass is reached.

It's also about competitive positioning. Threads isn't just a platform—it's Meta's response to losing mindshare to X, Bluesky, and other platforms. By turning Threads into an advertising powerhouse, Meta ensures that brands and advertisers view Threads as a necessary part of their media buying mix, the same way they do with Instagram and Facebook.

The ad rollout also signals to Meta's board and shareholders that the company has a plan to monetize its latest bets. Meta has been criticized for investing heavily in unproven products (Reality Labs, for example). Demonstrating that Threads can generate meaningful revenue protects Meta's ability to fund future experimental projects.

Finally, this matters for the future of social media broadly. For years, observers have claimed that ad-free, algorithm-free social networks would replace the current system. Threads is Meta's answer to this claim: even a clean, well-moderated platform eventually needs ads to survive. This suggests that advertising may be an inescapable feature of social media, not a bug that can be fixed with better design.

Whether you view this as realistic necessity or a failure of imagination probably depends on your perspective. But it's the reality Threads users and creators face.

FAQ

What is Threads and why did Meta create it?

Threads is Meta's social media platform launched in July 2023 as a direct competitor to X (formerly Twitter). Meta built Threads to capitalize on user frustration with X's content moderation issues, algorithmic unpredictability, and advertiser exodus following Elon Musk's acquisition. The platform positioned itself as a clean, well-moderated alternative for social conversation and community building. It rapidly grew to over 400 million monthly active users by early 2025.

How do the ads on Threads work exactly?

Threads ads are managed through Meta Business Suite, the same platform used for Facebook and Instagram advertising. Advertisers can use Meta's Advantage+ automated system or run manual campaigns with granular targeting controls. Supported ad formats include image ads, video ads, carousel ads, and the 4:5 aspect ratio format optimized for mobile feeds. Ads are integrated directly into users' feeds, and delivery starts at low density before scaling up as the rollout completes. Meta included third-party brand safety verification tools to ensure ads don't appear alongside misinformation or inappropriate content.

When will Threads ads be visible to all users?

Meta announced the global ad rollout began in late January 2025 and will unfold gradually over the coming months, with complete rollout potentially taking until mid-2025 or later. The company intentionally staggered the rollout to allow infrastructure scaling, regional regulatory compliance, and user habituation. Most major markets (US, Europe, Asia-Pacific) will likely have widespread ad visibility by Q3 2025, though early-adopter regions may see ads sooner.

Will I see a lot of ads on Threads right away?

No. Meta stated that ad delivery will remain "low" initially as the feature scales to all global users. This follows the company's historical pattern with Facebook and Instagram, where ad density increased gradually over years rather than suddenly. Early Threads users may see one sponsored post for every 10-15 regular posts, with this ratio increasing as the platform matures. The gradual approach helps maintain user engagement and gives time for advertiser quality to improve.

How does Threads advertising compare to Instagram and Facebook ads?

Threads ads use Meta's existing advertising infrastructure, so they're mechanically similar to Instagram and Facebook ads. However, Threads currently has lower advertiser saturation, meaning CPMs (cost per thousand impressions) are likely 30-50% lower than Instagram CPMs. This makes Threads an arbitrage opportunity for advertisers in early 2025. The audience on Threads skews slightly younger and more tech-savvy than Facebook but is less niche than X's traditional user base. Threads also includes brand safety verification features specifically designed to address deepfake and misinformation concerns on other platforms.

Will creators get paid from Threads ads the way they do on YouTube?

Not initially. Threads does not currently offer direct creator revenue sharing from ads, unlike YouTube's Partner Program or Instagram's Reels bonus program. Some creators may qualify for Threads' Creator Fund, which offers limited payments for high-performing posts, but these programs are competitive and notoriously underpaying. Creators are currently using Threads as a distribution channel to build audiences that they monetize through Substack, YouTube, sponsorships, or other platforms. Meta may introduce creator monetization in the future, but nothing is announced yet.

Why is Meta introducing ads to Threads now?

Meta needs to monetize Threads to justify the ongoing infrastructure and development costs. While the platform grew explosively in its first 18 months, reaching 400+ million users, growth has plateaued. Without advertising revenue, Meta loses money operating Threads indefinitely. The company is also responding to competitive pressure from X, which despite its challenges, still generates advertising revenue. By introducing ads to Threads, Meta can compete for advertiser spending while maintaining growth. The timing also makes strategic sense: Threads has gained enough users to be attractive to advertisers, but hasn't yet seen the user backlash that comes with unexpected ad introduction.

How does Meta use my data to target ads on Threads?

Threads ads use cross-platform data from Meta's ecosystem. Meta knows your activity on Facebook, Instagram, and WhatsApp and combines this with Threads-specific data (which posts you engage with, which accounts you follow, how long you view content). This cross-platform data enables sophisticated targeting: advertisers can target cold audiences on Threads and retarget them on Instagram, or use lookalike audiences built from high-value Facebook customers. All of this is disclosed in Meta's privacy policy, though most users don't read it. If you're uncomfortable with this level of data collection, you should know that it's now an inherent part of using Threads.

What happens to Bluesky now that Threads is getting ads?

Bluesky's competitive positioning becomes clearer: it's the true ad-free alternative to X and Threads. Bluesky, built by Jack Dorsey, has positioned itself as an ad-free social network built on open protocols. As Threads introduces ads, some users will migrate to Bluesky seeking that ad-free experience. However, Bluesky currently has only 20-30 million users compared to Threads' 400+ million, so the switch likely involves only a small percentage of users. Threads' advantages in features, moderation, and integration with Meta's ecosystem will likely keep most users despite the ads. Both platforms can coexist, appealing to different user preferences.

Should my brand advertise on Threads right now?

It depends on your target audience and marketing goals. If you're targeting millennials and Gen Z consumers with lifestyle, apparel, food, or entertainment products, Threads is worth testing with small budgets ($100-500) to gather performance data. CPMs are currently lower than Instagram due to lower advertiser competition, so early adoption can be cost-effective. However, if you're a B2B company targeting professionals, Threads isn't a priority yet—focus on LinkedIn instead. Test small, measure results, and scale what works. Threads is in an early monetization phase with significant upside for advertisers willing to learn the platform early.

The Bigger Picture: Threads' Role in Meta's Future

The Threads ad rollout is more than a tactical decision to generate revenue. It's a strategic statement about Meta's evolution and priorities.

Meta is essentially saying: "We built a platform that users actually want to use without ads, and now we're proving we can monetize it successfully." This is important because it establishes a playbook for future platforms. Every new social platform Meta builds—whether VR-based, AI-powered, or something entirely new—can now launch ad-free and introduce advertising once critical mass is reached.

This playbook also extends to Meta's ambitions beyond traditional social media. As Meta invests in AI, spatial computing, and metaverse technologies, the ability to monetize these platforms through advertising becomes crucial to ROI. Threads is the proving ground.

For users, the implications are mixed. You're getting a cleaner, better-moderated social experience than X offers, but you're also trading away the ad-free promise that attracted many Threads users in the first place. Whether that trade-off is worth it depends on your priorities.

For creators, the calculus is more favorable. While Threads doesn't yet offer direct monetization, the platform's growth and advertising ecosystem create opportunities for building audiences that can be monetized off-platform. Early adopters who build engaged communities now will be positioned well if Meta introduces creator revenue sharing later.

For advertisers, Threads represents a genuine opportunity. The platform is less saturated than Instagram, CPMs are lower, and brand safety tools are robust. Smart brands will test Threads advertising in early 2025 while conditions are favorable, building audience insights that will compound over time.

The fundamental truth about social platforms remains unchanged: nothing is truly free. Platforms that don't charge users money must charge advertisers. Meta's genius has always been making this exchange feel natural and valuable to users rather than extractive. Whether Threads can maintain this balance as ad density increases remains to be seen. But if the company's track record with Instagram and Facebook is any guide, users will eventually accept ads as a normal part of the experience.

The Threads ad rollout isn't the end of the story—it's the beginning of a new chapter where Threads becomes a serious competitor to Instagram for both users and advertising dollars. The real test comes in the next 12-24 months as ad density increases and user sentiment evolves.

For now, early adopters—both advertisers and creators—should pay attention. The opportunities are real, the competition is lighter than on mature platforms, and the trajectory is clearly upward. Threads is no longer an experiment. It's Meta's next major revenue driver.

Key Takeaways

- Threads ads are rolling out globally starting January 2025, with gradual delivery remaining "low" to maintain user experience and engagement

- Advertisers can manage Threads campaigns through Meta Business Suite alongside Facebook and Instagram, with initial CPMs 30-50% lower than Instagram

- Threads' 400+ million users and superior brand safety tools position it as a viable competitor to X for advertising spend

- Creators currently lack direct ad revenue sharing on Threads but benefit indirectly through audience growth and cross-platform monetization opportunities

- Early-adopter advertisers can arbitrage low CPMs and lighter competition on Threads before the platform matures and CPMs rise to Instagram levels

Related Articles

- Why We're Nostalgic for 2016: The Internet Before AI Slop [2025]

- Instagram's AI Problem Isn't AI at All—It's the Algorithm [2025]

- Netflix Ads Revenue Hits $1.5B in 2025: What This Means [2025]

- YouTube's SRV3 Captions Disabled: What Creators Need to Know [2025]

- Complete Guide to Content Repurposing: 25 Proven Strategies [2025]

- Disney's Thread Deletion Scandal: How Brands Mishandle Political Content [2025]

![Threads Ads Global Rollout: What It Means for Users and Creators [2025]](https://tryrunable.com/blog/threads-ads-global-rollout-what-it-means-for-users-and-creat/image-1-1769015399155.jpg)