Turbo Tax Discount Codes: Complete Guide to Maximizing Your Tax Savings in 2026

Tax season rolls around every year, and every time, people groan at the thought of filing. Not because taxes are fun (they're not), but because the cost of professional help keeps climbing. Here's what's happening right now: Turbo Tax is running aggressive discounts through early 2026, and if you don't act soon, you'll be looking at full price when March hits. I'm talking about savings that run deep—10% off across the board, an extra 10% for federal filings, and in some cases, discounts that push past 54% off the regular price.

The challenge most people face isn't finding coupons. It's knowing which ones actually apply to their situation. Are you filing as a single person with W-2s? A freelancer with Schedule C? Someone with investments and capital gains? The discount landscape changes based on what you're filing, when you file it, and whether you want to do it yourself or hand it over to a professional.

I've been filing taxes for over twenty years, and I've watched the tax software industry evolve from desktop CD-ROMs to cloud-based platforms. Turbo Tax has remained consistent—sometimes frustratingly so—but they've gotten genuinely better at helping people navigate one of the most stressful financial tasks of the year. The software isn't flashy, but it works. And when you add these discounts into the mix, it becomes one of the smartest financial moves you can make before the filing deadline.

Let me break down exactly what's available, how to use these codes, and most importantly, which discount actually makes sense for your specific tax situation. Because spoiler alert: not all discounts are created equal, and some might actually cost you money if you're not paying attention.

TL; DR

- Save 10% immediately with standard Turbo Tax discount codes across all federal products

- File free as a new customer in the Turbo Tax app through February 28 for both federal and state returns

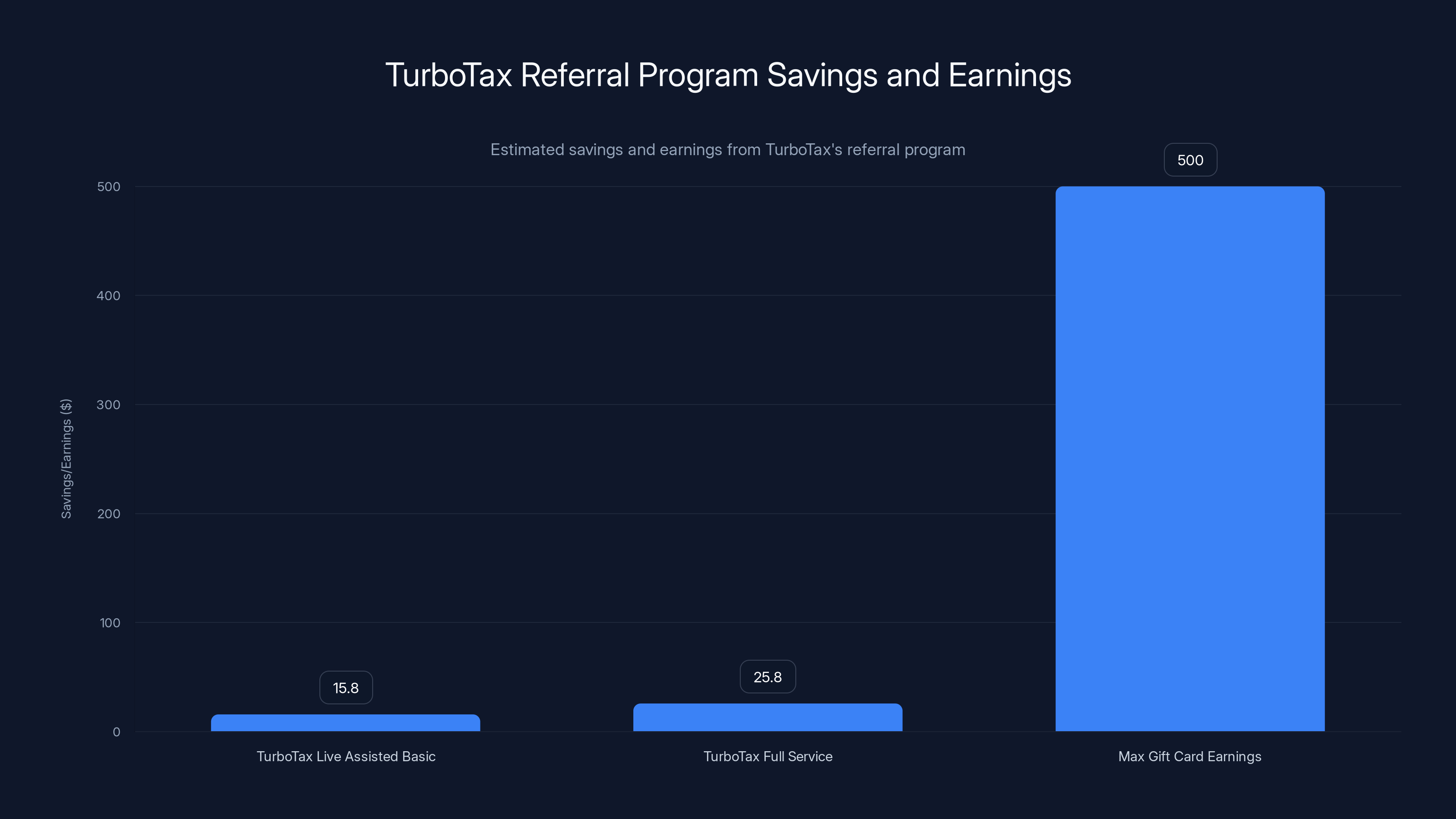

- Earn $500 in gift cards by referring friends who save 20% off Turbo Tax products

- **Turbo Tax Full Service starts at 143.99 after early-filing savings

- New customer special: flat $150 fee for Full Service with federal and state included (deadline February 28)

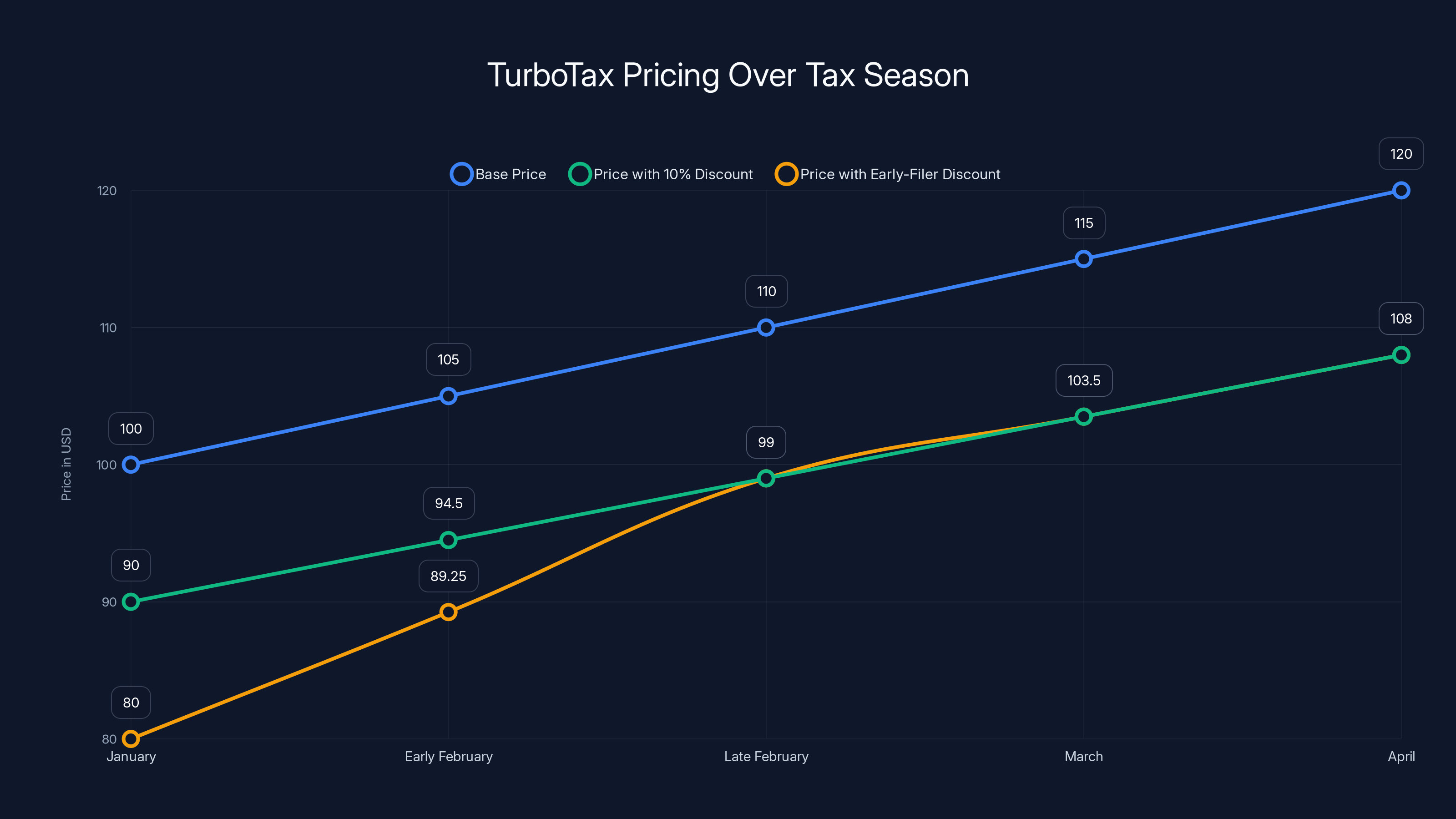

Estimated data shows that filing in January with both the 10% discount and early-filer discount offers the greatest savings, with prices gradually increasing towards April.

How Much Can You Actually Save With Turbo Tax Discount Codes?

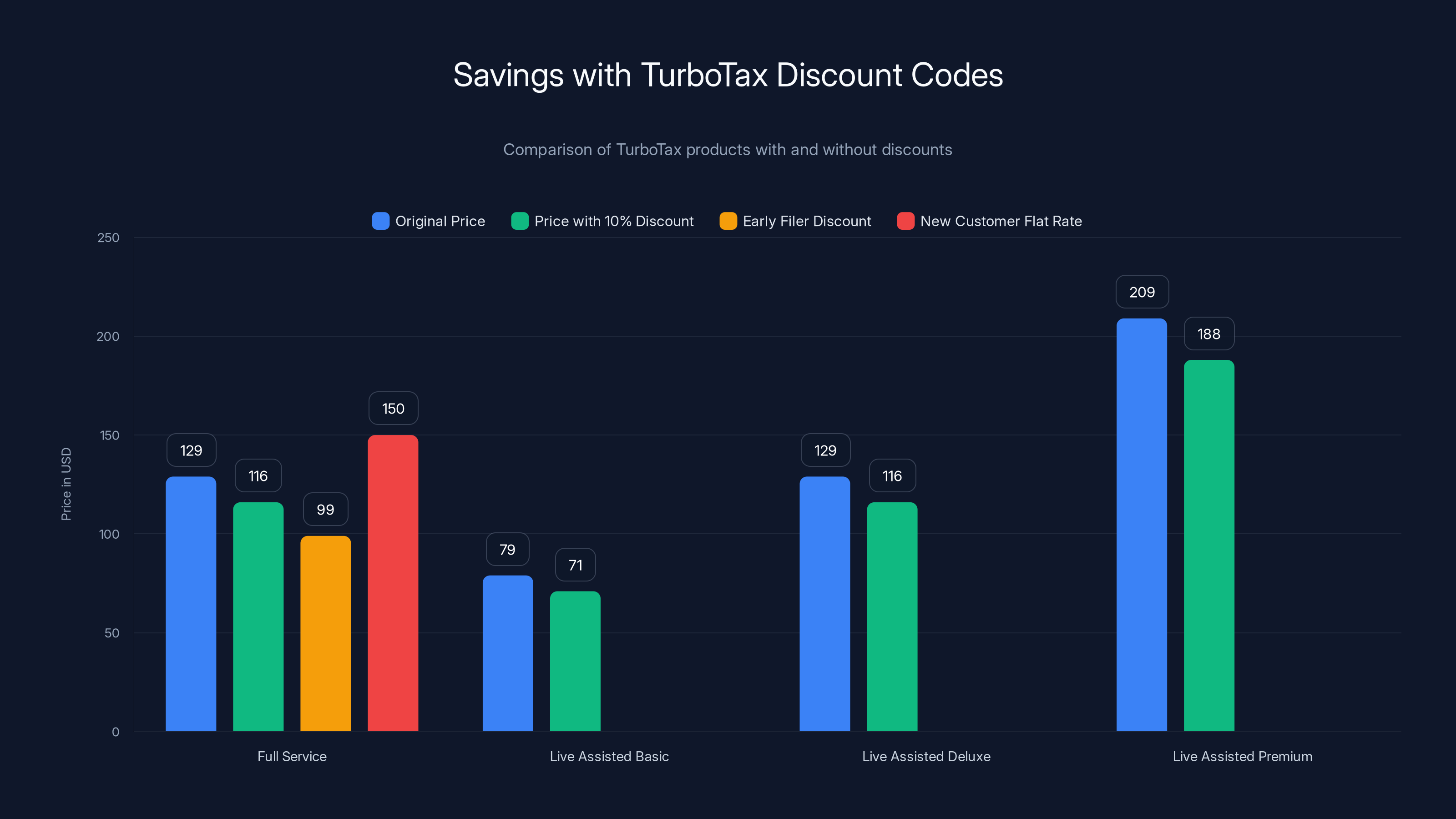

Let's talk numbers, because that's what really matters here. The discounts aren't theoretical—they're tangible, and they stack in ways that surprise most people.

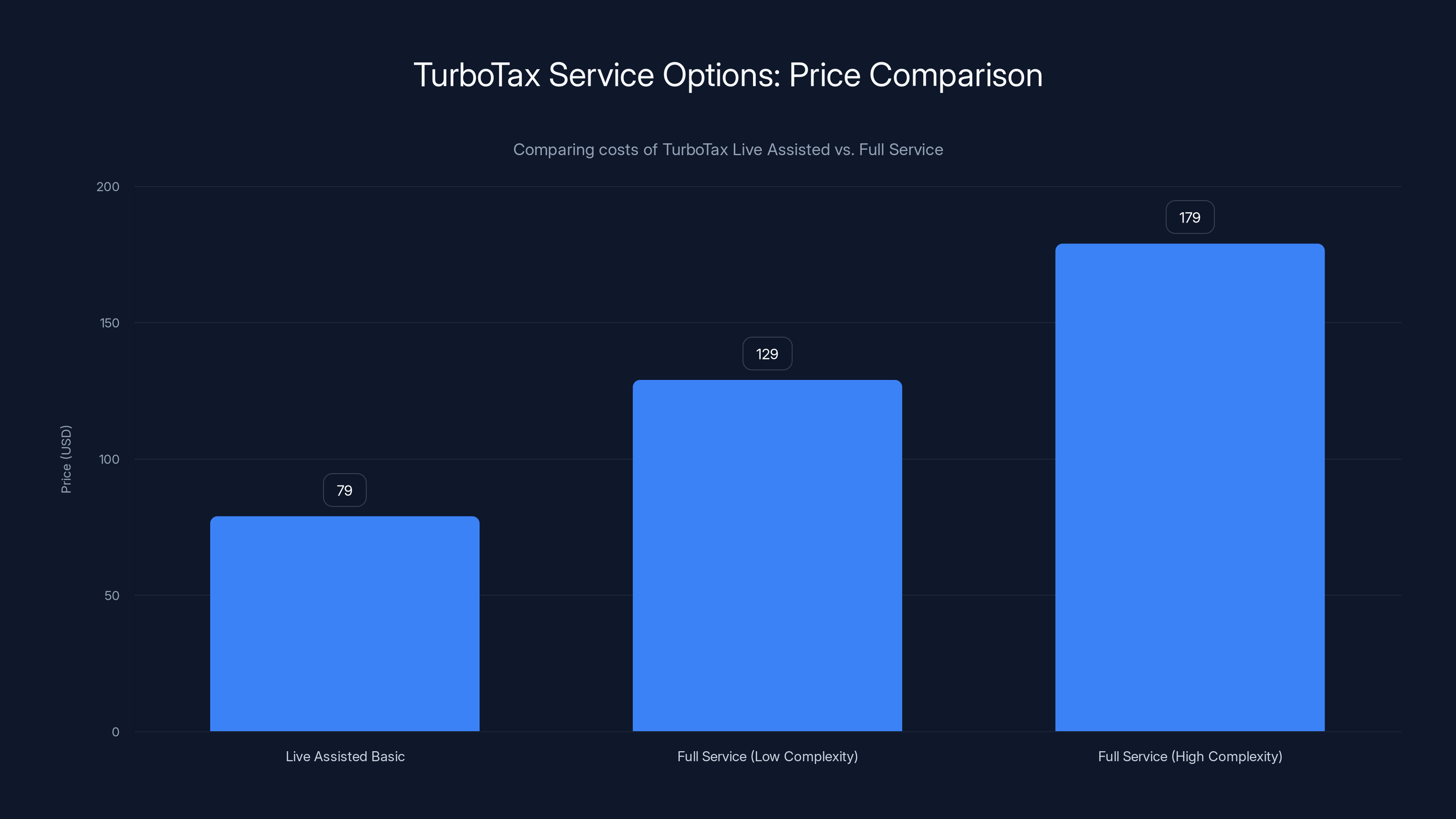

Start with the baseline: Turbo Tax Full Service, which is their premium product where a tax professional prepares your return, typically costs

For Turbo Tax Live Assisted, where you file yourself with a professional available to answer questions, the math shifts. Basic Live Assisted runs

The wildcard offer—and this is the one that catches people off guard—is the new customer flat-rate Full Service at

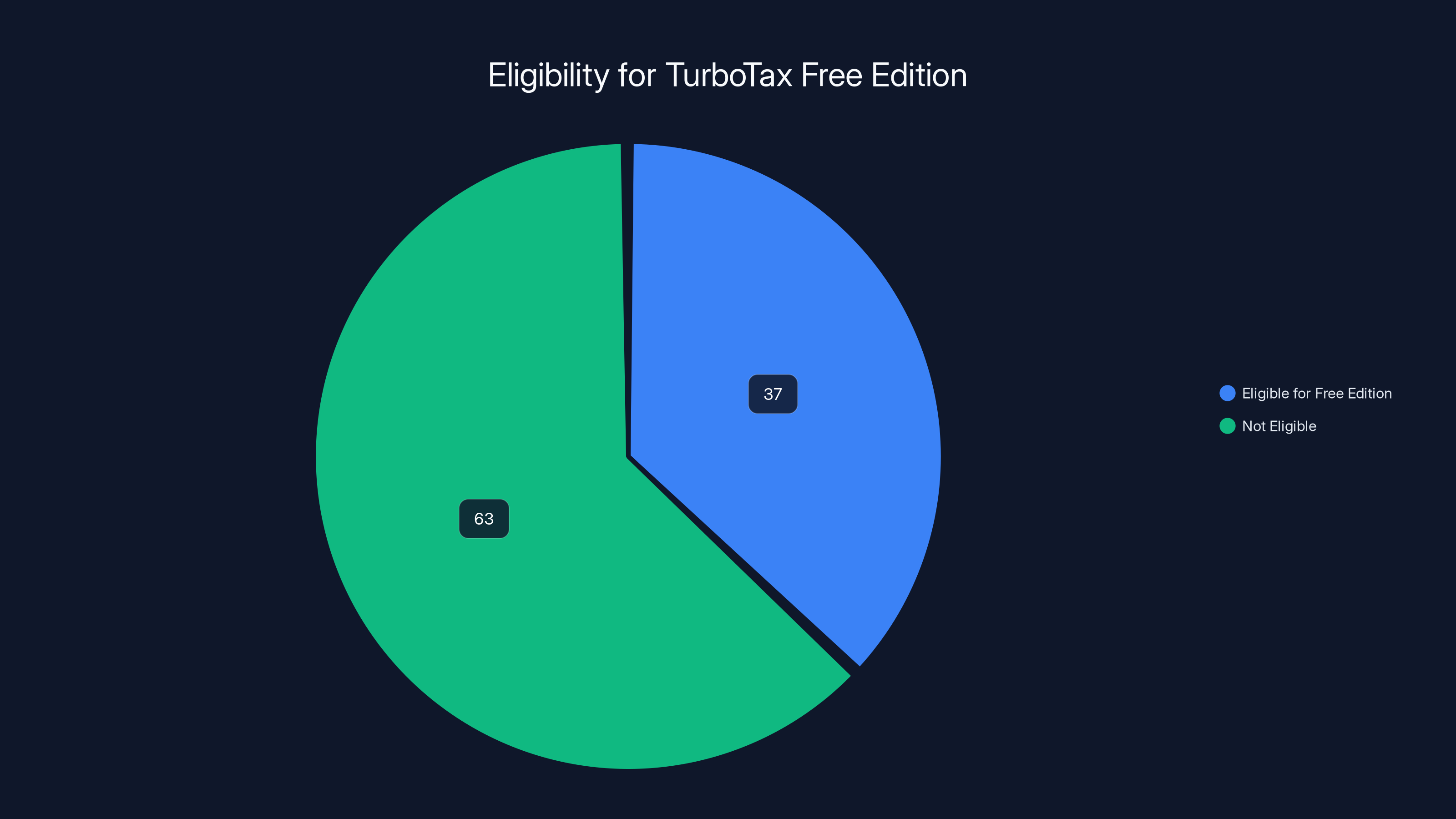

The free filing option deserves its own spotlight. If you're a new customer and you file through the Turbo Tax app (not the web version), you can file your federal and state taxes for zero dollars. No coupon code needed. Just install the app, start your return, and go. The restriction is simple: your taxes have to be straightforward enough for the free tier to handle them. That means W-2 income, basic interest and dividend income, and maybe a few standard deductions. If you've got business income, significant capital gains, or rental property, you'll likely need to upgrade. But for the estimated 37% of taxpayers who qualify, this is genuinely free filing.

Approximately 37% of taxpayers qualify for TurboTax Free Edition due to simple tax situations. Estimated data based on IRS guidelines.

The 10% Discount Code: How It Works and When to Apply It

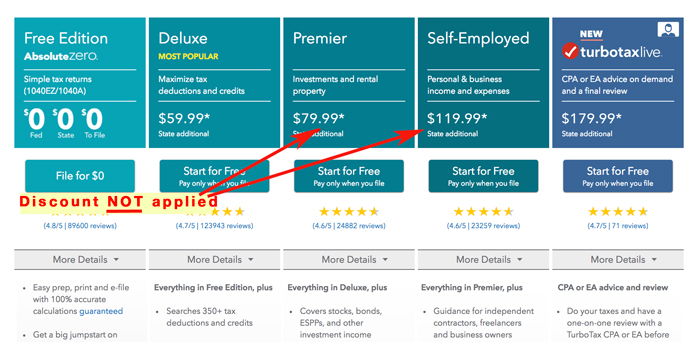

The foundation of every Turbo Tax savings strategy right now is their standard 10% discount code. This isn't a limited-time flash sale that expires in 72 hours. It's been available consistently through tax season, and it applies to the full range of federal Turbo Tax products.

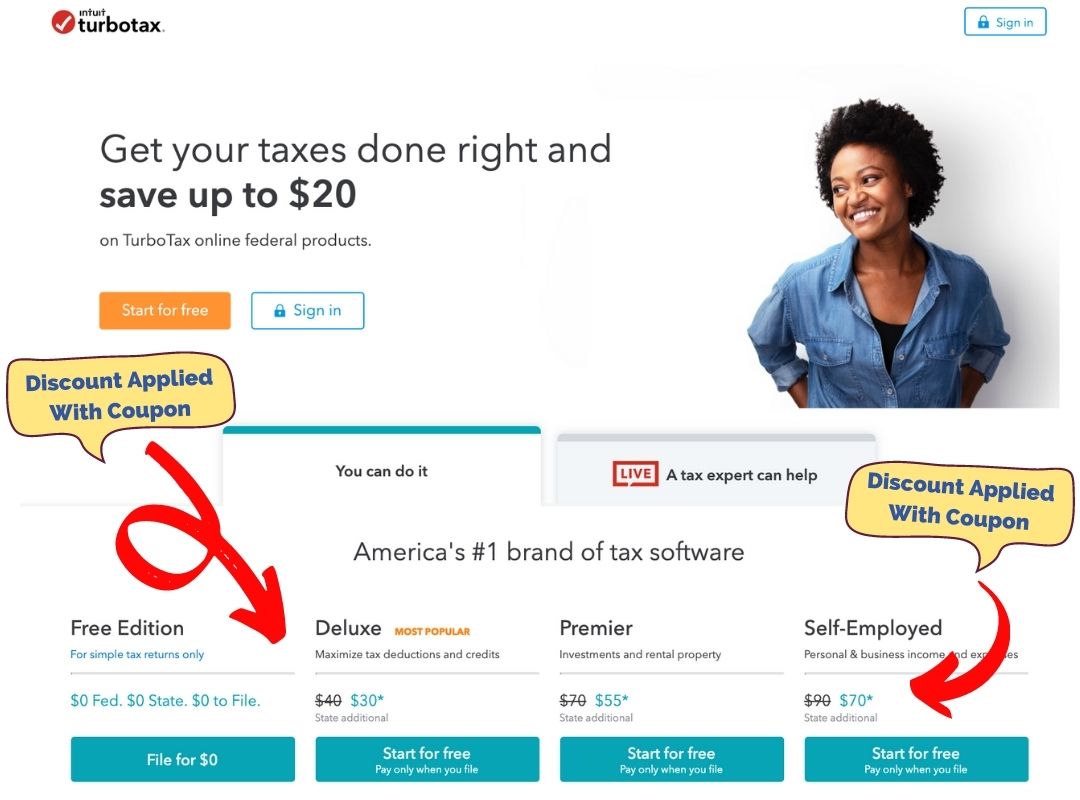

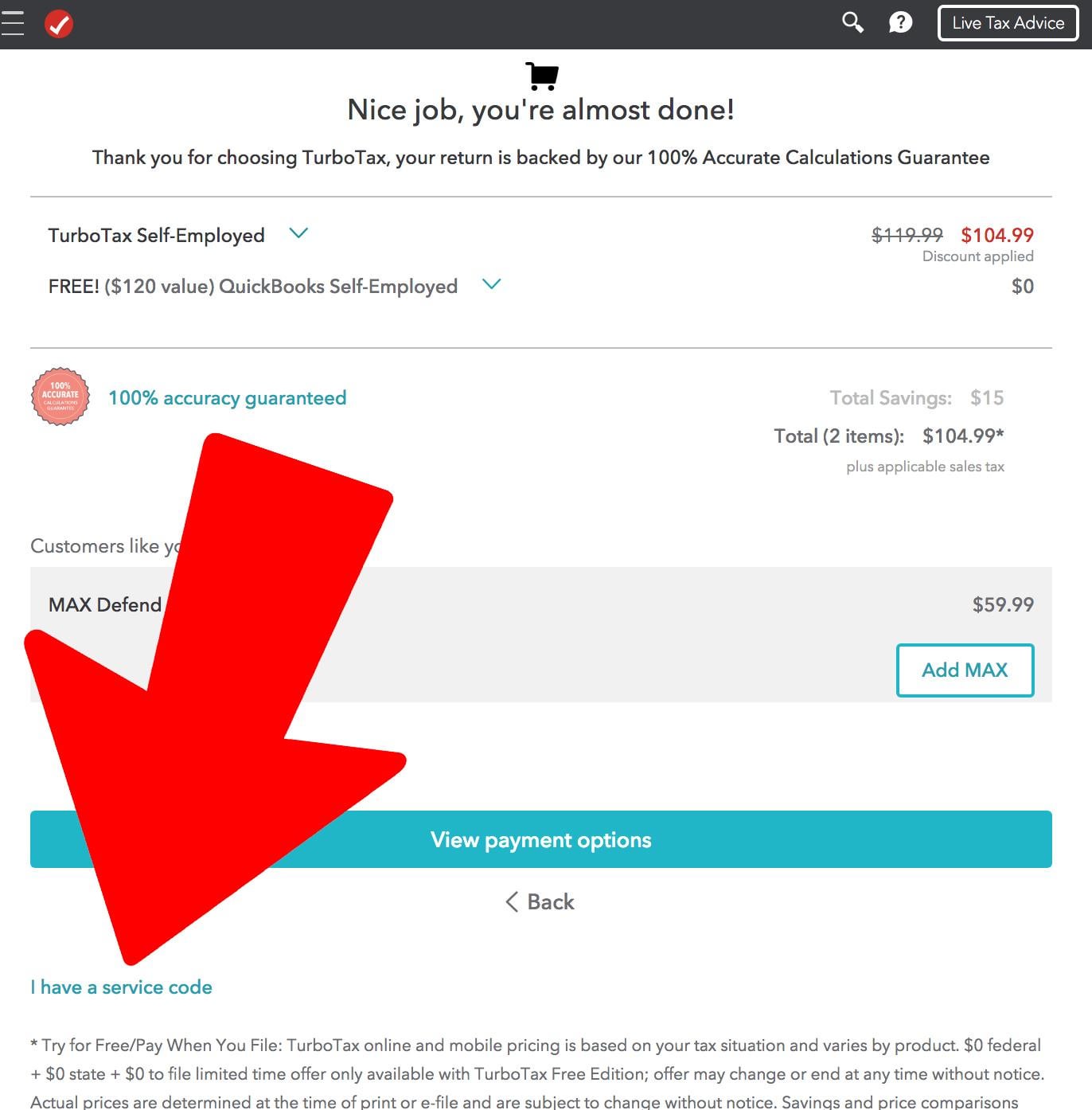

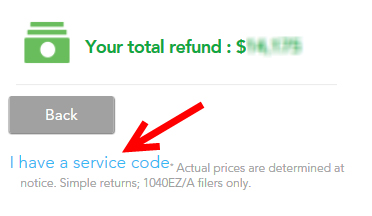

Here's how the application works: when you're in the Turbo Tax checkout process, after you've selected your product (Free Edition, Expert Assist, Live Assisted, or Full Service) and gone through the initial questions about your tax situation, you'll hit a page that asks if you have a coupon code. This is where you enter the discount code. The system calculates your savings right there, before you pay anything. No surprises at the end.

The critical nuance is this: the 10% discount applies to federal products only. State filing fees are separate and don't get the same percentage discount. If you're in New York and filing both federal and state, the federal portion gets 10% off, but New York state filing stays at its standard rate, typically around

Timing matters more than you'd think. File in January? The discount stacks with early-filer pricing, and you save more. File in early February? Same discount, still great. Wait until mid-March? The discount might still be there, but Turbo Tax is quietly rolling back their promotional pricing as we get closer to the April deadline. It's not that the coupons disappear—it's that the base prices start creeping up to compensate for the rush of last-minute filers.

One thing that confuses a lot of people: does the 10% discount stack with the early-filer discount? Yes, it does. They're two separate calculations. Turbo Tax calculates the early-filer discount first, then applies the percentage coupon on top of that discounted price. On a

New Customers Get Free Filing in the App (Through February 28)

If you've never filed with Turbo Tax before, there's a specific offer worth understanding: completely free filing through the Turbo Tax mobile app, and the deadline is February 28.

Let me be direct about what "free" means here. It means zero dollars for federal tax preparation and filing. Zero dollars for state filing. You won't see a charge on your credit card or bank account when you file. The trade-off is that your tax situation has to be simple enough for their automated system to handle it without escalating to a human being.

What qualifies as simple enough? Generally, if you have W-2 income from a job (or a few jobs), basic interest or dividend income under

Here's what makes this offer valuable compared to free alternatives: Turbo Tax's free filing is genuinely easy. Import your W-2 by photographing it with your phone. Answer straightforward questions about dependents and credits. Review the summary. File. The entire process takes 30 to 45 minutes for most people. Compare that to filling out a 1040 form by hand (takes hours and introduces error risk) or using a bare-bones free alternative that requires more technical knowledge.

The timing restriction is critical. You need to complete your filing by midnight on February 28. That doesn't mean you have to file it by then—you have to complete the entire return in the app by that date. So if you start on February 27, finish entry of all your information, and review everything, but don't hit "file" until March 1, you've broken the terms of the offer. Plan accordingly.

Expert Assist offers a middle-ground solution at

The $150 Flat Rate for Full Service (New Customers Only, February 28 Deadline)

This is the deal that catches the most attention, and for good reason. New customers can file through Turbo Tax Full Service—where a tax professional does your entire return—for a flat $150. Federal and state included. No surprises, no price increases based on complexity.

Full Service normally runs

What does the professional actually do? They prepare your entire federal return from the information you provide. They review it with you before filing. They handle the state filing as well. If the IRS has questions about your return, Turbo Tax includes support to help you respond. It's a genuinely comprehensive service.

The catch—and this is non-negotiable—is the February 28 deadline. Turbo Tax emphasizes this heavily because it creates urgency. File by February 28 and get the flat rate. File after that, and you're back to variable pricing. There's a business logic to this: they want to spread out the volume of returns across January and February rather than seeing everyone wait until March and April. For you, it means if you're even thinking about using Full Service, the time to lock in this rate is now.

Another thing to understand: this offer applies to new customers only. If you filed with Turbo Tax at any point in the past, even three years ago, you're not eligible. Intuit defines "new customer" strictly. If you're unsure, you can start an online chat with their customer service before paying anything, and they'll tell you whether you qualify.

The 20% Referral Discount Plus $500 in Gift Cards

Turbo Tax's referral program might seem like it's designed to get you to bother your friends about tax software (which, to be fair, it is). But the numbers are compelling enough that it's worth understanding how it works.

Here's the basic structure: you get a unique referral link. You share it with friends. Each friend who signs up using your link and completes their filing gets 20% off federal Turbo Tax products. You get a

The gift cards arrive via email within 45 days of your friend's purchase. They're not tax credits or anything fancy—they're literal gift cards, meaning you could use them on Turbo Tax for next year's filing, or potentially other Intuit products, though the terms vary.

Let's talk about the math for your friends. If your friend is a new customer considering Turbo Tax Live Assisted Basic (normally

Where this breaks down is if your friends were already going to file for free. If someone qualifies for Turbo Tax Free Edition, there's no discount to apply because it's already zero. The referral program works best when you're referring people who were planning to pay for a mid-tier or premium product anyway.

One more thing about referrals: they're not limited to new customers only. You can refer someone who's been using a different tax software for years, and they become a "new customer" to Turbo Tax, which means they qualify for the 20% discount through your link. This is actually where the program becomes most valuable—you're not just recruiting friends who were on the fence. You're converting people from Intuit's competitors.

TurboTax discount codes can significantly reduce costs, especially for early filers and new customers. Estimated data for early filer and new customer discounts.

Turbo Tax Free Edition: Who Actually Qualifies?

The marketing around "free tax filing" is so saturated that people assume it's either fake or riddled with hidden charges. Turbo Tax Free Edition is neither. It's genuinely free for people whose taxes are actually simple.

The IRS publishes data on this: approximately 37% of taxpayers have tax situations simple enough to qualify for free filing. That's a massive number of people. If you fall into that group, filing costs you nothing. Zero. Complete transparency there.

What does simple mean? Turbo Tax Free Edition handles your federal return if you:

- Filed Form 1040 (the basic individual return) only

- Claimed the standard deduction (not itemized)

- Had only wage income from W-2s

- Didn't have more than $1,500 in interest or dividend income

- Might have the Earned Income Tax Credit or Child Tax Credit, which are handled fine

- Didn't have business income, capital gains, rental income, or major schedule items

If your situation includes business income (Schedule C), capital gains (Schedule D), rental property (Schedule E), or major deductions requiring detailed schedules, you'll likely be bumped up to a paid tier. Turbo Tax's system tells you this immediately. You start the return, answer questions about your situation, and it'll say "your taxes are too complex for Free Edition, but Expert Assist is available at $X." No surprises.

Here's the realistic take: if you're a single person working a job, you probably qualify. If you're married filing jointly with one job between you, you probably qualify. If you have a kid and claim the child tax credit, you still probably qualify. Where people hit the wall is when they have self-employment income, significant investment income, rental properties, or stock transactions.

Live Assisted vs. Full Service: Breaking Down the Difference

One of the biggest sources of confusion with Turbo Tax is understanding the difference between their "assisted" and "full service" offerings. The names are similar, the prices are adjacent, and the value proposition of each is different enough that picking the wrong one could cost you.

Turbo Tax Live Assisted is you doing the work, with professional help on standby. You're in control. You answer the questions, you input your information, and you guide the process. The tax professional is there if you get stuck. Need clarification on whether a home office deduction qualifies? Ask them. Unsure if a gifted amount from family counts as income? They can tell you. You're filing your own return with a professional available for consultation.

Full Service flips the script. You provide information—upload documents, provide numbers, describe your situation—and the professional takes over. They prepare the return entirely. They ensure all the complex pieces fit together correctly. They review everything with you before filing. You're not doing the tax work; you're providing the raw material and then reviewing what they've done.

Pricing reflects this difference. Live Assisted Basic runs

Here's the decision framework: if you have confidence in your own ability to organize information and answer technical questions (or you're willing to look things up), Live Assisted works well. You save money and retain control. If your return has complex elements and you want a professional to quarterback the entire process, Full Service is worth the premium cost. It's not necessarily better—it's different.

One detail people miss: both services include professional support if the IRS questions your return. That's valuable insurance if something gets flagged. You're not alone dealing with the IRS.

TurboTax Live Assisted is priced at

Expert Assist: The Middle Ground Nobody Talks About

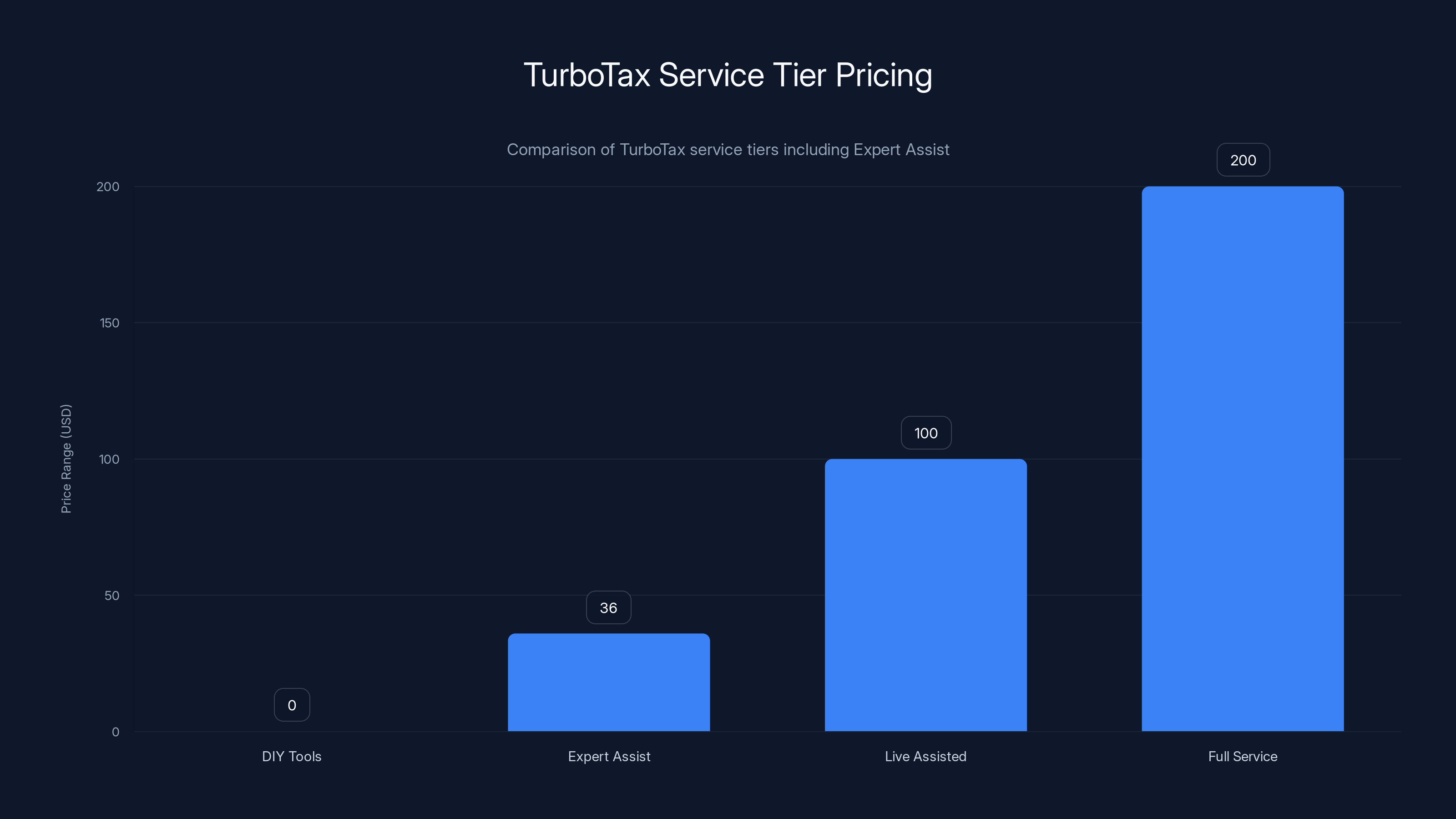

Turbo Tax has a tier called Expert Assist that sits between the DIY tools and the fully managed services. It's not heavily marketed, which is probably why so many people don't know it exists.

Expert Assist lets you prepare your return using Turbo Tax's guided process, and you can message a tax professional with questions. You can show them sections of your return and get feedback. You're mostly doing the work, but you have professional oversight built in. It costs less than Live Assisted (

The trade-off is support availability. You're not getting real-time chat with a professional. You're getting message-based responses, which might take a few hours. If you have simple questions and can plan ahead, this works perfectly. If you need immediate answers on complex issues, Live Assisted is better.

With the 10% discount code applied, Expert Assist ranges from about

How to Apply Turbo Tax Discount Codes Without Losing the Savings

The mechanics of applying a coupon code are straightforward, but the timing and sequence matter.

First, you select your product. You decide whether you want Free Edition, Expert Assist, Live Assisted, or Full Service. You start the process on Turbo Tax's website or app. Answer initial questions about your tax situation.

As you progress through the workflow, Turbo Tax estimates your price based on what you've entered. You'll see a summary that shows the product you've selected and the estimated cost. Before checkout, there's always a space where you can enter a coupon code. This is where the 10% discount code goes. The system validates the code and recalculates your price immediately.

Once you've applied the code and confirmed the new total, proceed to payment. Don't leave the page or change products, because if the system timeout expires or you navigate away, you might lose the discount. Once the payment is processed, the discount is locked in.

One critical thing: the discount applies to your prepared return, not to add-ons like state returns or the premium e-file service. If you're filing multiple states, you'll pay full price for each state. If you want to e-file (which you should—it's faster and more secure than paper), that's standard and included in most packages.

If you have a discount code that expires on a specific date and you're worried it might not work, test it before entering your full tax information. Apply the code to see if the system accepts it. If it doesn't work, you'll get a message saying the code is invalid or expired. Better to know before you've spent 45 minutes entering all your tax details.

With TurboTax's referral program, friends save

State Tax Filing: What the Discounts Don't Cover

Federal filing gets the discount love. State filing? Not as much. This is one of those areas where people get surprised if they're not paying attention.

The 10% discount applies to federal Turbo Tax products. State returns, filed separately, are typically charged at full price unless there's a specific state promotion running. A state return usually costs

Some states (like Missouri and Indiana) have programs where Turbo Tax participates in free state filing for people with low to moderate income. If you qualify for those programs, your state return filing is included at no cost. You need to check whether your state participates and whether your income level qualifies.

For everyone else, plan on paying for state filing separately. If you're in a high-tax state like New York or California, the state return can be as expensive as the federal return. Budget accordingly.

The Full Service flat-rate offer at $150? That includes both federal and state. That's valuable because you're not doubling the cost when you add state to the equation. Full Service is the exception where state is rolled into one price.

Common Mistakes People Make With Turbo Tax Discounts

I've watched enough people file taxes to know where the confusion points are. Let me save you from the most common mistakes.

Mistake 1: Waiting for better discounts. People assume that if 10% off is available now, maybe 15% will be available next week. Sometimes coupons do improve, but usually they just disappear. The discount landscape gets worse as the April deadline approaches, not better. File early and lock in the discount you have.

Mistake 2: Assuming free means restricted. Turbo Tax Free Edition isn't a limited version that encourages you to upgrade. It's a full, complete tax return. If your taxes qualify, you're not missing features. You're just not paying.

Mistake 3: Picking the wrong service tier because of price. Someone chooses Expert Assist (

Mistake 4: Missing the deadline on limited-time offers. The $150 flat rate for Full Service expires February 28. A lot of people read that, think "I'll get to it eventually," and then it expires. These deadlines aren't arbitrary—they're hard stops. If you think you might use it, lock it in before February 28.

Mistake 5: Not checking if you're a new customer. You might think you're new to Turbo Tax, but if you used it back in 2019 or 2020, you're not new. The system will tell you during signup if you're ineligible for new customer offers.

Mistake 6: Entering your code during checkout instead of before. Some systems let you add codes at the final step. Turbo Tax is picky about this. Apply it during the checkout flow, not after. If you pay first and then try to apply a code, you won't get the discount.

Alternative Options: When Turbo Tax Might Not Be Your Best Bet

Turbo Tax is the market leader, but it's not perfect for everyone. Sometimes other services offer better value, or a different approach fits your situation better.

If you have a simple return and want the absolute lowest cost, the IRS Free File program (not Turbo Tax's version) includes certified providers like H&R Block Free, Free Tax USA, and others. Some are genuinely free with no upsell. The catch is they're not as well-marketed as Turbo Tax, and the user experience isn't as polished.

If you have business income or more complex needs, some CPAs or tax professionals might charge less than Turbo Tax Full Service, especially if you're in a major city where competition is fierce. A quick call to a few local firms could reveal options.

If you've switched to Apple ecosystem heavily and love tight integration, other products have better Mac/i OS experiences than Turbo Tax, though Turbo Tax's app works fine.

But for most people filing W-2 income with maybe some investment income or a kid or two, Turbo Tax—especially with these discounts—is genuinely the best value. The software walks you through every step. The professional services are competent. The discount codes bring the price to reasonable levels. It's not the cheapest possible option, but it's among the best value.

Planning for Next Year: Why You Should File Your 2025 Taxes Now

Here's a thought that doesn't get discussed enough: filing your 2025 taxes in January gives you information that helps you plan for 2026.

When you file, you'll see your total tax liability, whether you owe or get a refund, and—if you have self-employment income or investment income—where your tax bottlenecks actually are. That information is gold for tax planning.

If you file in January, you have 12 months to adjust your situation for 2026. Increase 401k contributions? Make estimated tax payments if you're self-employed? Tax-loss harvest in your brokerage account? Fund a HSA? All of these decisions are better made with actual numbers from your filed return than guesses made in April.

Beyond the financial planning angle, there's just the peace-of-mind factor. File early, get your refund faster, and stop thinking about taxes for the rest of the year. File in March or April, and you're in a constant state of incomplete-ness until you finally submit.

Plus, the IRS processes returns faster when they arrive early in the season. Refunds come back quicker. If you're relying on that refund for cash flow, filing in January rather than April could mean having money in your account two or three weeks earlier.

FAQ

What is the best Turbo Tax discount code for 2026?

The best code depends on your situation, but the standard 10% off code works across all federal products and stacks with early-filer discounts. For new customers, the free filing option through the mobile app is unbeatable if your taxes qualify. For maximum savings overall, the $150 flat-rate Full Service for new customers (deadline February 28) represents the best value if you want professional preparation.

How do I enter a Turbo Tax coupon code?

During the checkout process on Turbo Tax's website or app, you'll see a field asking if you have a coupon code. Enter the code there and the system will validate it and recalculate your price immediately. Apply the code before you complete payment, as it's difficult to add it retroactively. Make sure you're applying the code for the correct product tier (federal only discounts won't apply to state returns).

Can I use multiple Turbo Tax coupon codes on one return?

Turbo Tax doesn't allow traditional code stacking—you can only apply one coupon code per return. However, codes do stack with time-based early-filer discounts, which means your total savings is the combination of both. The early-filer discount applies automatically based on when you file, and the coupon code applies on top of that discounted price.

Is Turbo Tax Free Edition actually free with no hidden costs?

Yes, Turbo Tax Free Edition is genuinely free for federal and state filing if you qualify. There are no hidden fees or surprise charges. The restriction is that your taxes have to be straightforward (W-2 income only, standard deduction, etc.). The system tells you immediately if you qualify. If Turbo Tax determines your taxes are too complex, you'll be offered an upgrade with full transparency on the cost.

How long does a Turbo Tax discount code take to work after I enter it?

Turbo Tax discount codes are validated instantly during checkout. You enter the code and the system either accepts it and recalculates your price, or it rejects it and tells you the code is invalid or expired. There's no delay. If the code doesn't work, you'll know before paying.

Do Turbo Tax discounts apply to state tax returns?

Federal product discounts don't automatically apply to state returns. State returns are usually charged separately at full price (

What's the difference between Turbo Tax Free Edition, Expert Assist, Live Assisted, and Full Service?

Free Edition is completely self-service for simple tax situations at zero cost. Expert Assist (

When does the Turbo Tax discount expire?

The standard 10% coupon codes are typically available through tax season, but the timing and specific codes change year to year. Early-filer discounts (the bigger savings) usually run from January through mid-February, with the $150 Full Service flat rate expiring February 28. The sooner you file, the deeper the discounts. Don't assume discounts will improve or last—they usually get worse as April approaches.

Final Thoughts: Making Your Tax Filing Actually Affordable

Taxes aren't optional, and tax software shouldn't be a luxury. The discounts and options available right now make it possible to file competently and affordably. If you have straightforward taxes, file for free. If you want professional guidance without paying full-service prices, Live Assisted at 10% off gives you that. If you want to hand everything to a professional, the flat-rate Full Service offer for new customers is genuinely fair pricing.

The hardest part isn't selecting a product or applying a discount. It's actually starting the process. Most of the people who procrastinate on taxes aren't avoiding it because Turbo Tax is bad. They're avoiding it because taxes are stressful and boring. But the moment you open Turbo Tax and answer the first few questions, momentum takes over. The software is genuinely easy to use. Before you know it, you've answered all the questions, reviewed your return, and filed.

File sooner rather than later. Use the discounts that apply to your situation. If there's any chance you qualify for the free filing or the $150 Full Service offer, lock it in before the February 28 deadline. And once you've filed, you can actually relax for the rest of the year.

Tax season is temporary. The peace of mind from filing early? That lasts until next January.

Key Takeaways

- TurboTax's 10% discount code applies to all federal products and stacks with early-filer discounts for deeper savings

- New customers can file federal and state taxes completely free through the mobile app (deadline February 28)

- The $150 flat-rate Full Service offer for new customers includes both federal and state filing (deadline February 28)

- TurboTax Free Edition is genuinely free with no hidden charges if your taxes are simple (approximately 37% of taxpayers qualify)

- Filing in January/February captures early-filer discounts that disappear as the April deadline approaches

Related Articles

- eBay Coupon Codes & Deals: Save Up to 60% [2025]

- Nomad Goods Promo Codes & Deals: Save 25% Off [2026]

- Monarch Money 50% Off Deal: Complete Guide to Annual Budgeting [2025]

- Best Budgeting Apps 2025: Complete Guide After Mint Shutdown

- Canon Promo Codes & Discounts: Save Up to 30% [2026]

- Best Mint Alternatives in 2025: Complete Guide to Top Budgeting Apps

![TurboTax Discount Codes & Coupons: Save Up to 54% [2026]](https://tryrunable.com/blog/turbotax-discount-codes-coupons-save-up-to-54-2026/image-1-1768289743303.jpg)