The Day the Prince Fell Silent: What Happened to Ubisoft's Biggest Remake

It's not often that a major game studio puts the brakes on an entire remake of a beloved franchise. But that's exactly what happened when Ubisoft announced it was shelving the Prince of Persia: The Sands of Time remake, a project that had already been restarted once and pushed to 2026. The announcement came as part of a seismic shift in how Ubisoft operates, one that's forcing the entire industry to reconsider what "restructuring" actually means.

The story here isn't just about one canceled game. It's about a publisher desperately trying to stay relevant in a market that's become ruthlessly competitive. Ubisoft's leadership acknowledged this directly, saying they'd face "a never-before-seen level of competition" that demands they only greenlight projects with genuine blockbuster potential, as reported by Game Informer.

But here's what makes this moment significant: the cancellation ripples far beyond gaming forums and Reddit threads. It affects thousands of developers, impacts player expectations, and signals a major shift in how the industry thinks about remakes, nostalgia, and risk tolerance. Understanding what actually happened, why it happened, and what comes next matters if you care about where games are heading.

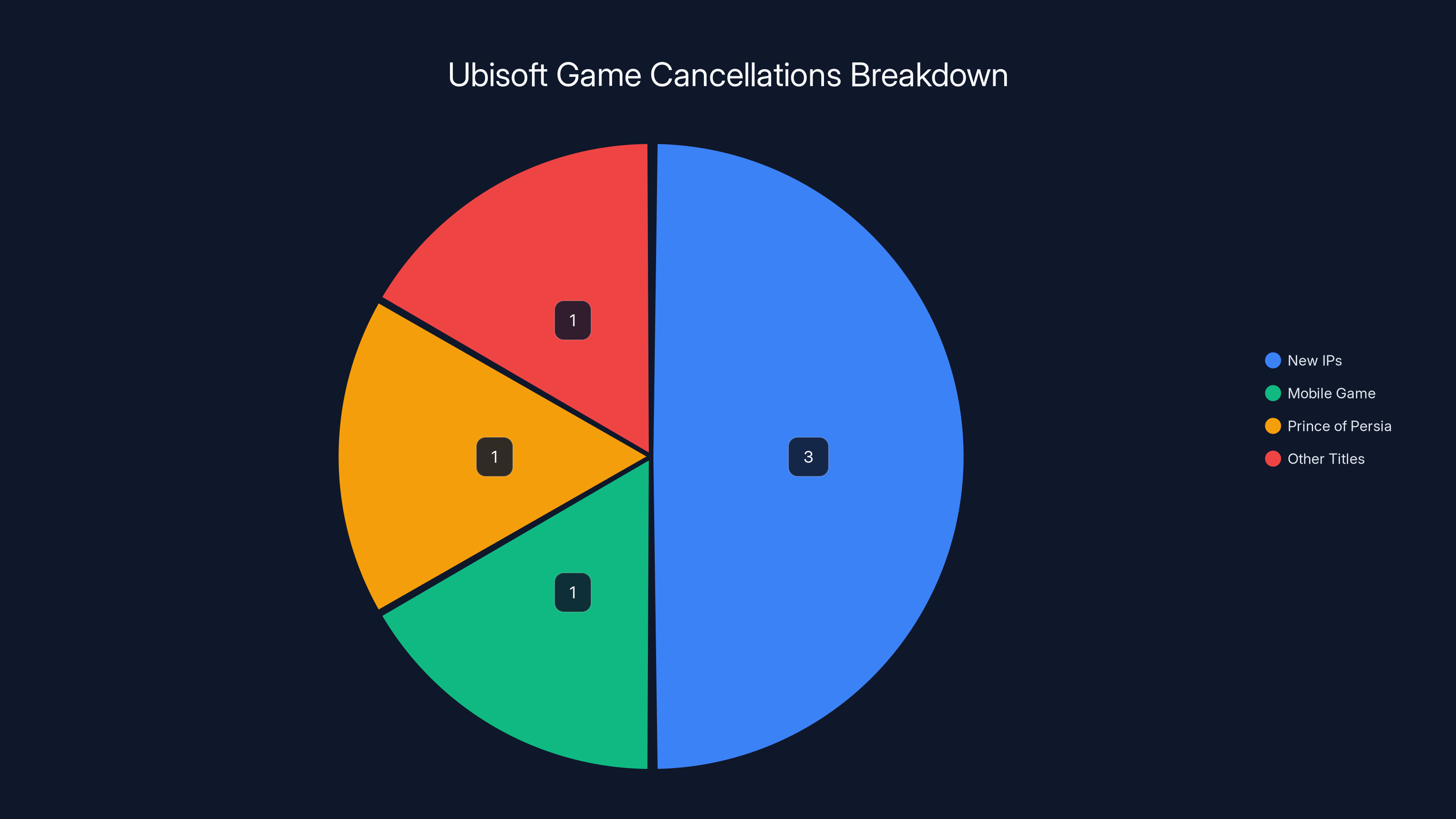

In December and January, Ubisoft conducted a sweeping review of its entire project pipeline. The results were brutal. Six games got the axe entirely. Seven more got delayed indefinitely. Three of those canceled titles were brand-new IPs, and one was a mobile game.

The most famous casualty was undoubtedly Prince of Persia: The Sands of Time. But it wasn't alone in getting canceled. The move signals something deeper about how big publishers now evaluate success, and it's forcing a conversation about whether remakes are actually worth the enormous investment required.

TL; DR

- Prince of Persia: The Sands of Time remake officially canceled after troubled development and a restart in 2022

- Six games canceled total as part of Ubisoft's major restructuring effort, three of which were new IPs

- Seven games delayed indefinitely, including a rumored Assassin's Creed Black Flag remake

- Ubisoft shuttered Stockholm and Halifax divisions, affecting multiple development teams

- New "Creative Houses" structure reorganizes the publisher into five focused divisions to compete more effectively

- Industry-wide impact: Signals shift away from risky remakes toward proven franchises with multiplayer and live-service potential

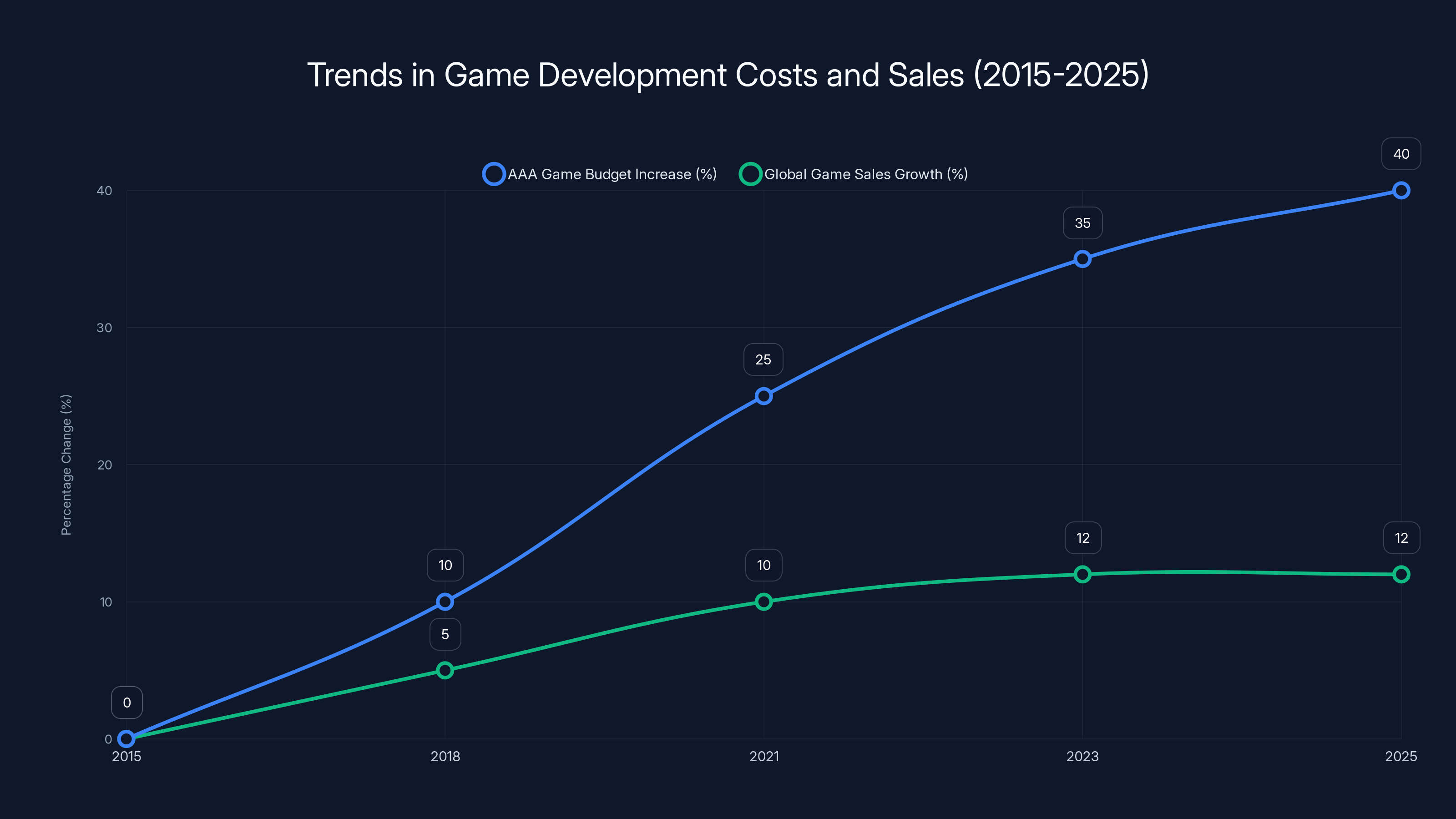

Since 2015, AAA game budgets have increased by 40%, while global game sales growth has remained relatively flat, highlighting a profitability challenge for publishers. Estimated data.

Why Prince of Persia Never Made It: The Troubled Development That Led to Cancellation

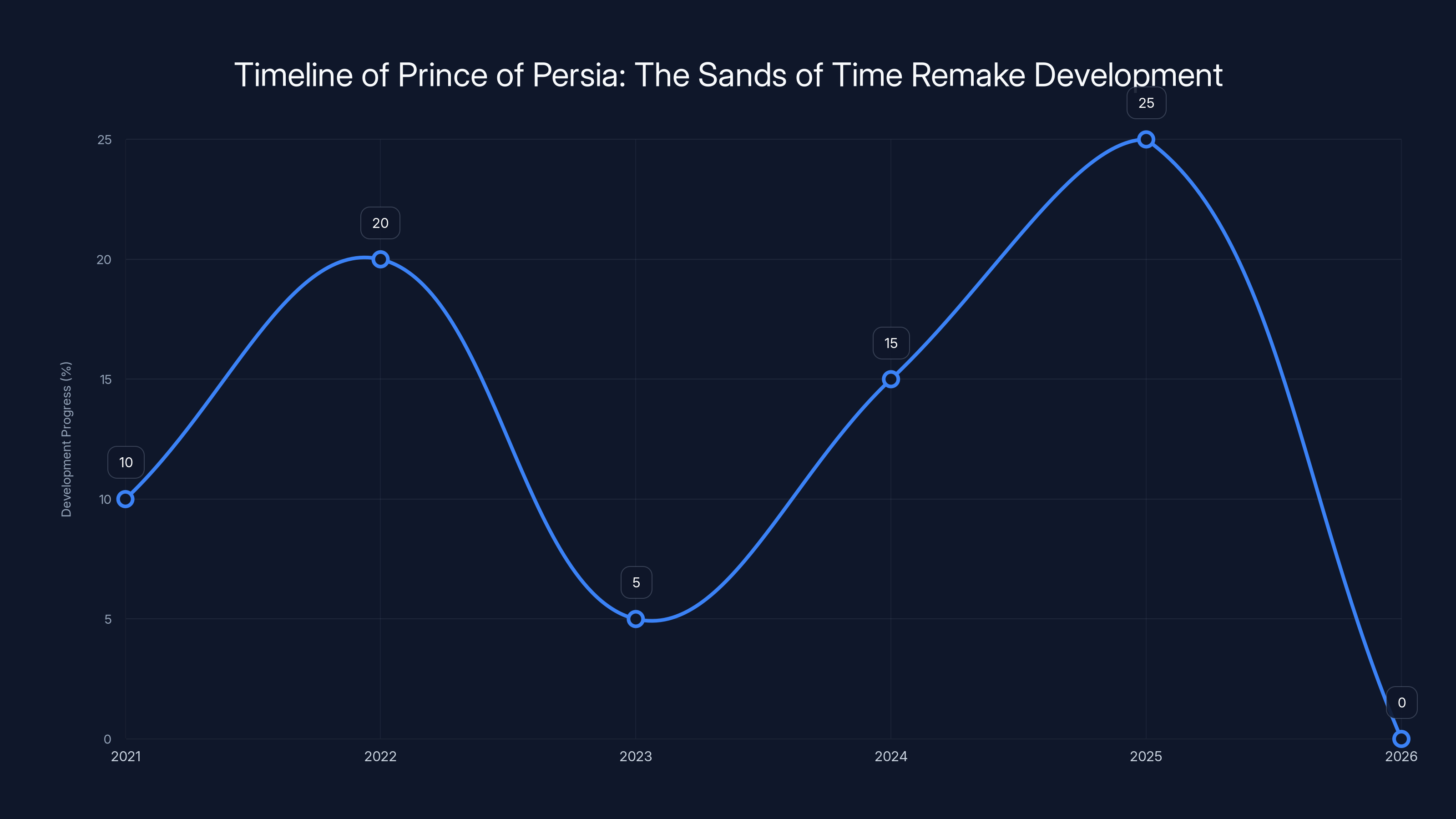

The Prince of Persia: The Sands of Time remake was cursed from the start. Ubisoft first announced the project back in 2021, positioning it as a faithful modernization of the 2003 classic that defined a generation of platformers. But "development" and "Prince of Persia" became synonymous with "problems."

In 2022, after significant progress, Ubisoft realized something fundamental wasn't working. The project was restarted from scratch. Not reworked. Not refined. Completely restarted. This is what happens when a creative vision doesn't align with technical execution, or when the team realizes the foundation they've built just isn't sustainable.

That restart pushed the release window to 2026. Three years felt like enough time to get it right the second time. It wasn't.

Why does a game get canceled after a restart? Several factors converge. First, development costs had almost certainly ballooned. A restart means burning months or years of work and starting over with a new vision, new technical architecture, and new staff. These costs compound quickly, especially on a AAA project. Second, market conditions changed. When Prince of Persia development began in 2021, the industry looked different. Live-service games were hotter. Player expectations had shifted. Remakes had mixed commercial performance.

Third, and this is crucial, Ubisoft's leadership made a strategic decision that some projects simply didn't fit their new competitive framework. Ubisoft CFO Frederick Duguet essentially said: if you're not coming in number one or number two in a given segment, don't bother. Prince of Persia, no matter how charming the original, couldn't compete with the heavy hitters in the action-adventure or platformer spaces.

Developers who worked on the project have stayed mostly quiet. But the message is clear: investing $50 million or more in a single-player, linear platformer in 2025 is a financial risk that even a publisher like Ubisoft can no longer absorb.

The development of Prince of Persia: The Sands of Time Remake faced significant setbacks, including a complete restart in 2022, leading to its eventual cancellation in 2026. Estimated data.

The Broader Massacre: Six Canceled Games and What They Tell Us

Prince of Persia wasn't traveling to cancellation alone. Five other games joined it on the chopping block, and the diversity of projects ax'd reveals something important about Ubisoft's new philosophy.

Of the six canceled titles, three were brand-new intellectual properties. This is the killer stat. New IPs are the lifeblood of creative industries. They're also extraordinarily risky. Developing a new game franchise requires proving that players actually want what you're making, and that proof only comes after launch, when it's too late to change course. Ubisoft made the calculated decision that it couldn't afford that risk anymore.

One canceled title was a mobile game. This is interesting because the mobile gaming market is generally considered more profitable and less risky than console or PC development. If Ubisoft is canceling mobile projects, it suggests they're focusing their resources even more narrowly on their proven console and live-service franchises.

The remaining titles details were sparse in official statements, but the message was unmistakable: unless your project fits into one of Ubisoft's five new "Creative Houses" (more on that in a moment), unless it has genuine blockbuster potential, and unless it can compete against the likes of Call of Duty, Fortnite, or the latest Nintendo offering, it's vulnerable.

This mentality represents a seismic shift from how publishers operated even five years ago. Back then, you could greenlight a moderately-budgeted action game and hope it found an audience. Today, that's considered reckless spending.

Seven Games Delayed: The Silent Casualties

Cancellation is dramatic. Delays are quieter, but potentially more damaging to developer morale and player expectations.

Seven Ubisoft projects received indefinite delays as part of this restructuring. Seven. That's not a minor adjustment. That's wholesale disruption.

For context, when a publisher says "indefinite delay," it's basically saying "this is no longer a priority, and we honestly don't know when we'll get back to it." Players read that as "it might eventually come out, but probably not." Developers read it as "you're working on this, but your resources are being reallocated, so expect more delays and staff reassignments."

One of the most significant rumors surrounding these delays involves the Assassin's Creed Black Flag remake. The rumor came from PEGI (Pan European Game Information) rating board listings that almost certainly pointed to a Black Flag remaster or remake. If that project did get delayed, it's particularly telling. Black Flag was arguably the most beloved entry in the Assassin's Creed franchise. A remake would have been a cash cow. The fact that it's been pushed back suggests even beloved legacy projects are getting second looks.

The delays also impact Ubisoft's financial forecasting. Public companies depend on revenue projections, and when you delay games that were supposed to launch within 12-18 months, those projections crater. This creates pressure to show something launching on time, which in turn creates pressure on the teams working on the non-delayed titles.

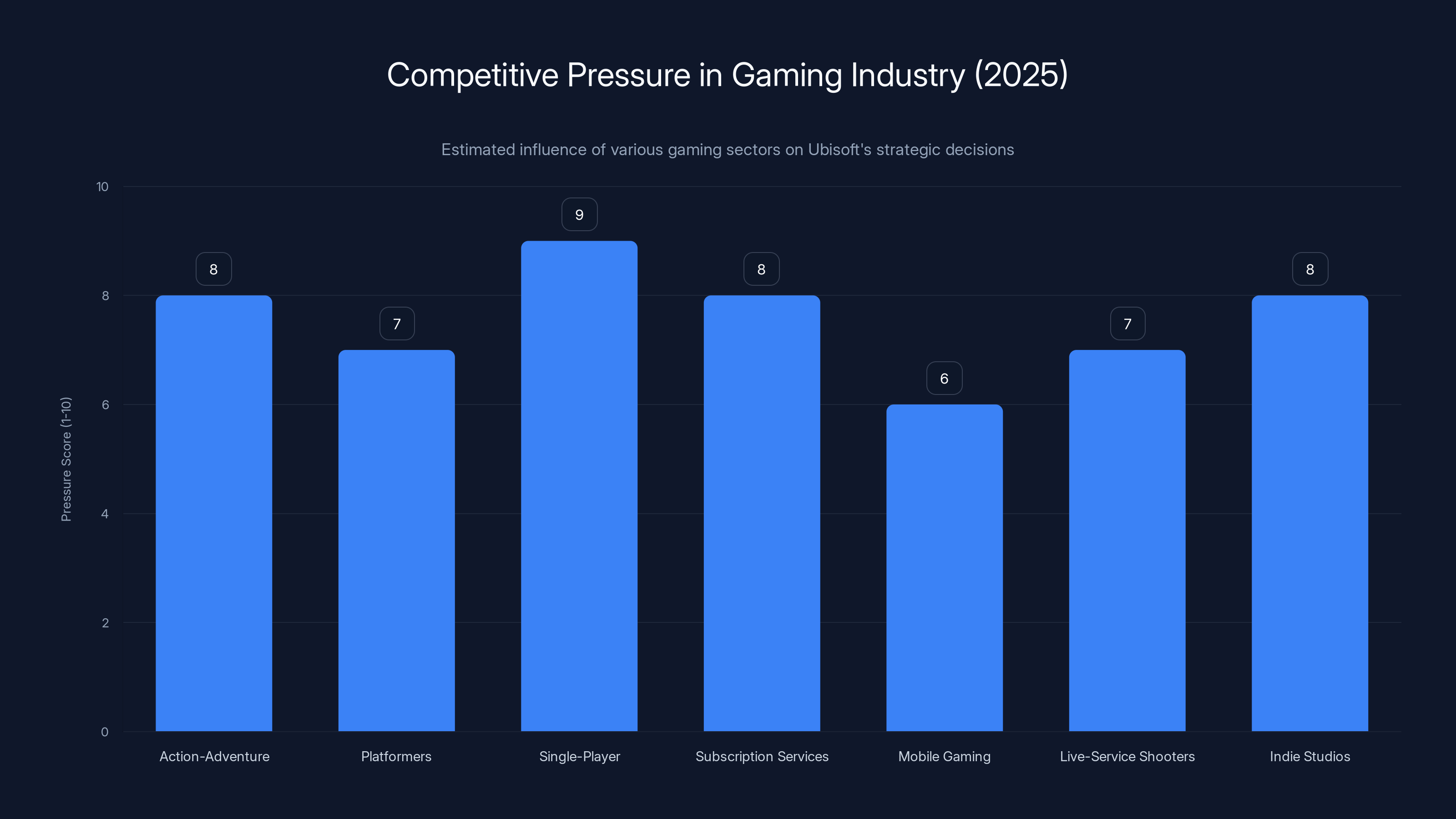

The competitive landscape in 2025 shows high pressure across various gaming sectors, influencing Ubisoft's strategic decisions. Estimated data.

The Stockholm and Halifax Shutdowns: Real People, Real Impact

Abstract restructuring only stays abstract until you realize it means closing offices and displacing workers.

Ubisoft shuttered two development divisions as part of this reorganization: its Stockholm studio and its Halifax studio. Stockholm had contributed significantly to Avatar: Frontiers of Pandora, a major AAA title that released in late 2023. Halifax was primarily a mobile-focused development shop.

Closing these studios had immediate human consequences. Developers in Stockholm and Halifax lost their jobs. Ubisoft claimed they'd try to place people internally, but that's not always possible, especially when a restructuring is explicitly designed to reduce headcount and consolidate resources.

From a business perspective, the closures make sense. Stockholm's production capacity was being reallocated to other Creative Houses. Halifax's mobile-game focus didn't fit the new strategic direction. But from a human perspective, it's a reminder that every corporate restructuring announcement includes layoffs, relocations, and career disruptions.

The Montreal-based creative leadership likely evaluated each studio and asked: "Can this studio's output justify its operational costs in the new marketplace?" For Stockholm and Halifax, the answer was no.

The Five Creative Houses: How Ubisoft Reorganized Itself

This restructuring wasn't random chaos. It had a clear architectural vision: divide Ubisoft's sprawling empire into five "Creative Houses," each with distinct strategic focuses.

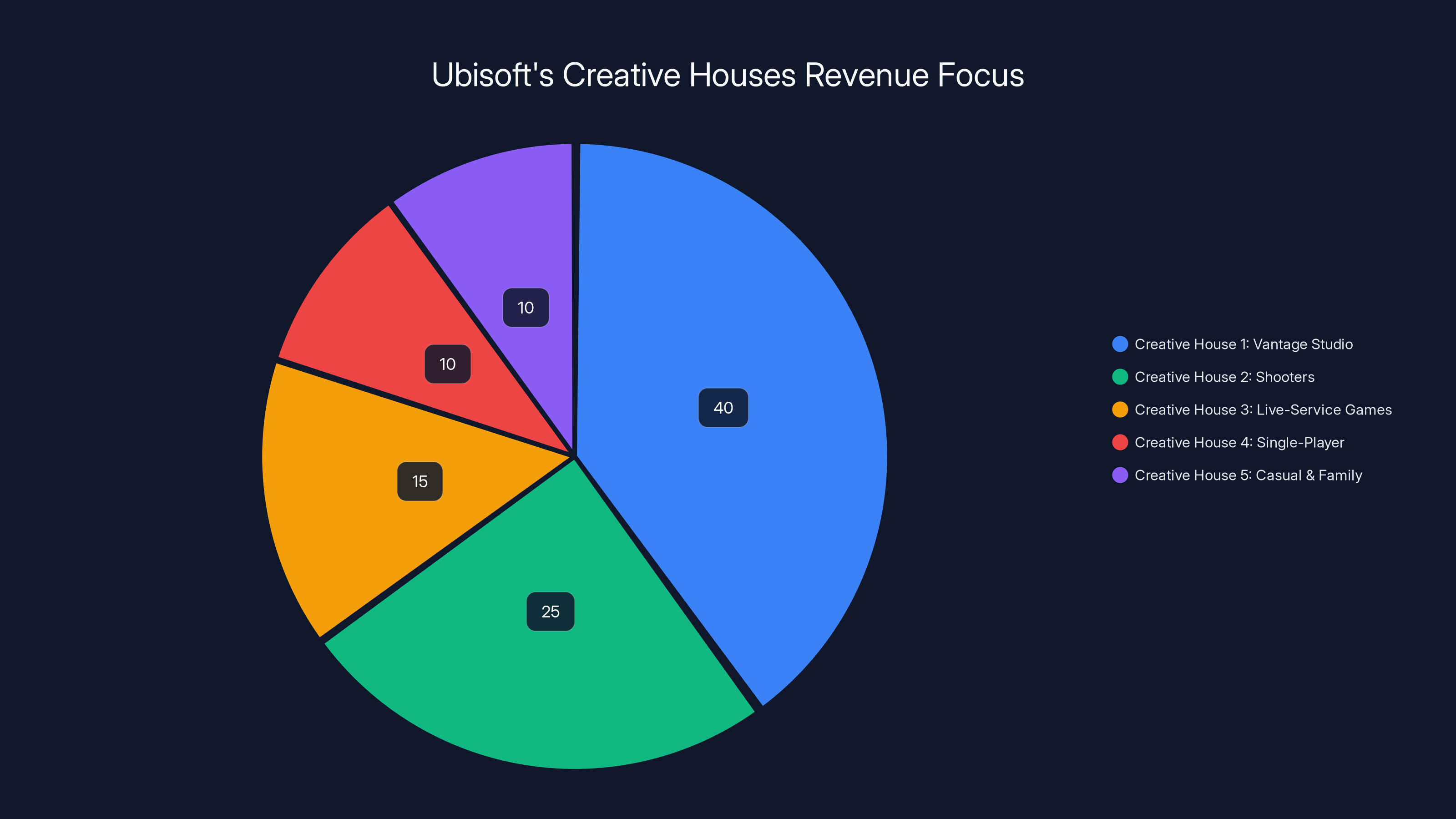

Creative House 1 (Vantage Studio) oversees Ubisoft's most profitable franchises: Assassin's Creed, Far Cry, and Rainbow Six. These are the crown jewels. They generate billions in revenue. They have proven player bases. They need minimal marketing because players already want them. This is where resources flow first.

Creative House 2 manages shooters, including Ghost Recon and The Division. This aligns with the industry's broader obsession with live-service shooters and multiplayer experiences. Shooters have consistent engagement metrics and can monetize aggressively through cosmetics and battle passes.

Creative House 3 handles live-service games like For Honor, The Crew, and Trackmania. These titles require constant updates, seasonal content, and community management. They're operationally intensive but can generate reliable ongoing revenue.

Creative House 4 is the single-player division, managing franchises like Rayman, Prince of Persia, and Beyond Good & Evil 2. This is the home for narrative-driven, story-focused experiences. It's also the riskiest division because single-player games have one shot to generate revenue at launch, then monetization drops off a cliff.

Creative House 5 focuses on casual and family-friendly games: Just Dance, card games, board game adaptations. These have smaller budgets and broader audience appeal across demographics.

The structure itself is telling. Creative House 4, where Prince of Persia lived, is positioned as the most creatively ambitious but commercially riskiest division. No surprise that Prince of Persia got canceled there. Single-player games need to be absolutely certain hits, and Prince of Persia, in its compromised state after a restart, clearly wasn't that.

Meanwhile, Creative Houses 1 and 2, managing multiplayer franchises and live-service games, get first dibs on resources and budgets.

Ubisoft canceled a total of six games, with half being new IPs. 'Prince of Persia: The Sands of Time' was the most notable cancellation.

The Competitive Pressure That Forced Ubisoft's Hand

Ubisoft didn't wake up one morning and decide to cancel games for fun. Something forced them into this corner, and that something was competition.

CFO Frederick Duguet's statement was remarkably candid: Ubisoft faced "a never-before-seen level of competition" that demands publishers only greenlight projects positioned to be number one or number two in their respective categories.

Consider what that actually means. In 2025, the competitive landscape for games looks like this:

For action-adventures, you're competing against Rockstar, Naughty Dog, and the established Assassin's Creed franchise itself. For platformers, you're up against Nintendo's first-party output and indie darlings that cost

Meanwhile, subscription services like Game Pass have fundamentally altered player expectations about pricing. A

Mobile gaming has cannibalized casual player attention. Live-service shooters have created permanent player communities that are hard to displace. Indie studios have proven they can punch above their weight in production value and creativity.

In this environment, a Prince of Persia remake, no matter how faithful or well-executed, simply doesn't guarantee success. It's a risk that exceeds what Ubisoft's shareholders would tolerate, especially when that capital could instead fund the next Assassin's Creed or Rainbow Six expansion.

What This Means for the Remake Industry

The cancellation of Prince of Persia sends a chilling message to the broader remake and remaster economy.

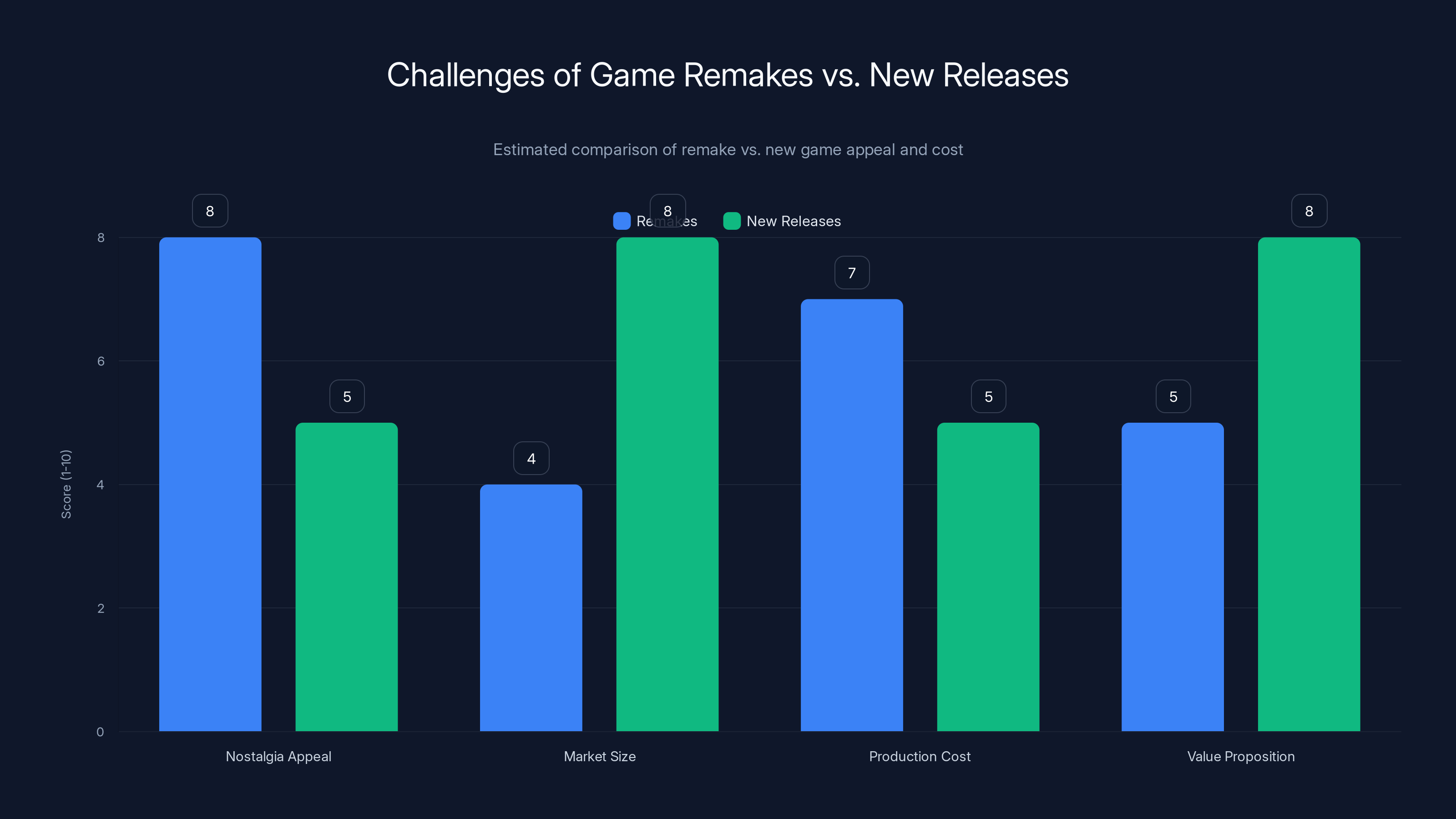

Remakes were supposed to be safe bets. Take a beloved classic, update the graphics, add modern gameplay conveniences, and watch existing fans and curious newcomers snap it up. Plenty of studios have found success with this formula. But the formula has limitations, and Ubisoft just demonstrated them.

A remake of a 22-year-old game, no matter how iconic, can't guarantee 10+ million copies sold. It can't compete for player attention against five new games launching the same month. It doesn't generate the same kind of influencer content or social media buzz as a brand-new franchise.

Worse, remakes often disappoint fans. The original Prince of Persia: The Sands of Time is perfect in players' memories. Any remake, no matter how good, will be compared to that perfect memory and found wanting in some way.

This has implications for every studio with remake ambitions. It suggests that remaking beloved older titles might no longer be a viable business strategy unless you're completely willing to diverge from the source material and create something new. And if you do that, you're no longer really making a remake—you're making a game inspired by legacy IP.

Estimated data shows that Vantage Studio (Creative House 1) likely commands the largest share of Ubisoft's revenue focus due to its high-profile franchises. Casual and family games, while broad in appeal, represent a smaller portion of the focus.

The Single-Player Game Problem: Why Creative House 4 Is Under Siege

There's a disturbing pattern in the games industry: single-player games keep getting canceled or deprioritized while multiplayer and live-service games get greenlit with increasing ease.

This isn't accidental. It's structural.

A single-player game launches, generates its revenue in month one or two, then revenue drops to nearly zero. Live-service games, conversely, can generate revenue indefinitely if the player base stays engaged. Cosmetic sales, battle passes, premium currency, seasons of content—these monetization strategies work endlessly on multiplayer games but fundamentally don't work on single-player games that end after 20 hours.

Publicly traded companies obsess over recurring revenue and lifetime customer value. Single-player games generate high revenue spikes followed by cliffs. Live-service games generate steady, predictable revenue streams that keep players engaged for years.

Creative House 4, managing Prince of Persia and Beyond Good & Evil 2, is essentially Ubisoft's "prestige" division. It's where narrative and artistic expression happen. But it's also where projects struggle to justify their budgets using the financial models that modern publishers demand.

The concerning implication: expect fewer narrative-driven, single-player experiences from major publishers going forward. These experiences will increasingly come from mid-size studios and indie developers who can operate on smaller budgets and don't have shareholder pressure to maximize quarterly revenue.

This isn't necessarily bad for gaming as an art form. Some of the most creative games in recent years have come from studios with budgets under $10 million. But it does mean fewer AAA single-player blockbusters, and that's a loss.

Assassin's Creed Black Flag Remake: The Rumor That Probably Isn't Staying Rumors

Amid the cancellations and delays, one project kept appearing in the conversation: Assassin's Creed Black Flag Remake.

The evidence was circumstantial but compelling. The PEGI ratings board, which classifies games for European distribution, listed what appeared to be a Black Flag remake. PEGI listings don't happen randomly—they typically appear when a game is far enough along in development that official submissions are being made.

Black Flag (2013) remains the most beloved entry in the Assassin's Creed franchise for many players. Pirate-themed gameplay, naval combat, exploration, and a charismatic protagonist combined to create something special. If Ubisoft announced a Black Flag remake, it would print money.

The delay of Black Flag (if the PEGI listing actually did point to that project) suggests even Ubisoft's most commercially viable remake isn't immune to the restructuring knife. A game that should be a financial home run got pushed back, which either means it's not ready (and Ubisoft is willing to take extra time to get it right) or it was deprioritized (which would be shocking for such an obviously marketable title).

If Black Flag did get delayed, it's because resources got reallocated to something considered higher priority. That something is almost certainly one of the main Assassin's Creed entries, which compete in a different category than Black Flag would.

Remakes often score high on nostalgia but fall short in market size and value proposition compared to new releases. Estimated data.

The Layoff Ripple Effect: Beyond the Official Announcements

When Ubisoft announced the restructuring, the official language focused on "realignment" and "strategic focus." The reality was more painful.

Studio closures mean layoffs. Delayed projects mean uncertain futures for teams. Game cancellations mean entire departments got dissolved or repurposed. Ubisoft Massive Entertainment, which developed Avatar: Frontiers of Pandora and the Rainbow Six franchise, reported layoffs as part of this process.

The human cost of corporate restructuring rarely gets mentioned in official statements. But it's real. Developers lose jobs, benefits, and career momentum. Families relocate. Communities in game development hubs get disrupted.

This also has quality implications. When you disrupt development teams mid-project, you often get reduced game quality, extended development timelines, or both. The teams that remain lose institutional knowledge when experienced developers leave. Junior developers lose mentorship. Morale tanks.

Ubisoft will likely see the consequences of this restructuring in game quality over the next 18-24 months. When teams get reorganized, when projects shift between Creative Houses, and when staff depart, the games in active development feel that friction.

Market Conditions: Why 2025 Is Different From 2023

Remember when live-service games seemed like guaranteed money makers? When every publisher was trying to build their "Fortnite killer?" That era has ended.

The live-service market has consolidated. Fortnite owns the youth demographic. Apex Legends, Call of Duty, Valorant, and a handful of others dominate their respective categories. New entrants face astronomical barriers to entry.

Console hardware is stagnant. We're three years into the PS5 and Xbox Series X generation, and there haven't been meaningful hardware upgrades. This means the graphical leaps that typically drove console adoption cycles aren't happening.

Game budgets keep increasing while player acquisition costs also keep increasing. It's getting harder to justify $100 million investments in projects that might only sell 5 million copies.

Inflation has impacted development costs. Salaries are higher. Software licenses are more expensive. Motion capture, voice acting, localization—all more costly than they were five years ago.

Player expectations are paradoxically both higher and lower. Players expect better graphics, smoother performance, and more content. But they're also more willing to play free-to-play games and less willing to pay $70 for a single-player experience.

In this environment, cautious consolidation around proven franchises makes business sense, even if it's creatively limiting.

What Remains: Ubisoft's Surviving Slate and What's Still in Development

Despite the carnage, Ubisoft still has an impressive portfolio in development. Understanding what survived tells you what the publisher still believes in.

Assassin's Creed remains a priority. The flagship franchise gets permanent resources, special treatment, and priority access to creative talent. That makes sense—it's Ubisoft's most consistently successful franchise.

Far Cry continues development. It's another proven franchise with a loyal audience, even if individual Far Cry games sometimes feel interchangeable to critics.

Rainbow Six Siege is a live-service juggernaut that will continue receiving support indefinitely. It's one of Ubisoft's most profitable titles, and abandoning it would be commercially suicidal.

Star Wars Outlaws is still in the pipeline, though it faced its own delays. This is a notable project because it's a AAA single-player game from a major licensor, which breaks the pattern of single-player deprioritization. But Star Wars carries such massive brand recognition that Ubisoft can probably justify the investment.

Beyond these anchors, uncertainty reigns. Projects that survived the restructuring might still face delays. New projects green-lit for 2025 have to fit into one of the five Creative Houses and justify commercial viability against proven competitors.

The Broader Industry Lesson: Consolidation and Risk Aversion

Ubisoft's restructuring isn't unique. It's part of a broader industry trend.

Sony's Play Station division has consolidated. Microsoft's Xbox division has consolidated. Take-Two has canceled projects. Embracer Group divested studios. Electronic Arts has shifted focus toward live-service games.

The pattern is consistent: major publishers are consolidating around proven franchises, canceling risky projects, and deprioritizing single-player experiences in favor of live-service games.

This isn't inevitable. It's the result of specific business decisions. Publicly traded companies face shareholder pressure to maximize quarterly revenue. That pressure incentivizes risk aversion. Risk aversion means not greenlight projects that can't promise blockbuster success.

The consequence is a narrowing of what kinds of games get made by major studios. This creates an opportunity for smaller studios, which can operate on smaller budgets and don't have shareholder pressure. Some of the most creative games of the past five years came from studios with budgets under $20 million.

But there's something lost when major publishers stop taking chances on innovative single-player experiences. AAA budgets allow for production values and scope that smaller studios can't match. When those budgets only fund sequels and proven franchises, players lose experiences they might have loved.

What Developers Should Learn From This Moment

If you're working in game development or considering it, Ubisoft's restructuring teaches some harsh lessons.

First: being a beloved franchise doesn't guarantee survival. Prince of Persia is iconic. It didn't matter.

Second: finishing a game is a prerequisite, not a guarantee. The Prince of Persia team got through a restart and continued development, and it still got canceled.

Third: institutional knowledge is fragile. When studios close and teams get reorganized, knowledge walks out the door with departing employees.

Fourth: predict publisher priorities by following money, not marketing. Ubisoft's five Creative Houses reveal that live-service and multiplayer games get resources first. Single-player games come last.

Fifth: career stability in game development is limited. Even employees at major studios should expect restructuring, layoffs, and uncertain futures. This is the industry as it currently exists.

Developers who want to build the games they're passionate about increasingly need to pursue indie development or smaller studios where decision-making is more aligned with creative vision rather than shareholder returns.

Looking Forward: What's Next for Ubisoft and the Industry

Ubisoft's restructuring isn't a one-time correction. It's a new operational model that will likely persist for years.

Expect continued consolidation around the five Creative Houses. Expect new projects to get evaluated ruthlessly against the "number one or number two" standard. Expect more delays as projects get reallocated between Creative Houses.

Expect live-service games to receive disproportionate resources. Live-service monetization works, and quarterly revenue matters to shareholders.

Expect fewer risky single-player games from major publishers. This doesn't mean single-player games disappear—it means they become rarer, more expensive, and more carefully selected.

Expect indie and mid-size studios to fill the gap. This is actually good for game diversity, even if it's bad for the vision of major publishers.

Expect other publishers to copy Ubisoft's restructuring template. Activision Blizzard, Electronic Arts, Take-Two—they're all watching how Ubisoft's reorganization plays out. If it works (and most signs suggest it will reduce unprofitable spending), expect wave after wave of similar restructuring.

The industry is entering a new era. It's characterized by cautious consolidation, live-service focus, and reduced appetite for risk. It's not necessarily an era that produces worse games, but it's an era that produces different games.

The Nostalgia Trap: Why Remakes Are Riskier Than They Appear

Remakes tap into a powerful emotion: nostalgia. But nostalgia is a terrible business foundation.

Nostalgia is personal and unreliable. Your favorite game from childhood isn't objectively better than modern alternatives—it just occupies a special place in your memory. When you remake that game, you're competing against both modern games and the player's idealized memory of the original. You almost always lose that comparison.

Remakes also cannibalize the original. Players can buy Prince of Persia: The Sands of Time on modern consoles or emulate it on PC for minimal cost. A remake costs $70 and requires new hardware. Unless the remake offers something fundamentally new, the value proposition is weak.

Furthermore, remake audiences are typically smaller than new game audiences. A new Assassin's Creed has to appeal to existing fans and attract new players. A Prince of Persia remake primarily appeals to players who already experienced and love the original—a finite, aging demographic.

Ubisoft likely ran the numbers and concluded that Prince of Persia's nostalgia value couldn't overcome the production costs required to make a AAA remake. It's a rational decision, even if it's disappointing to fans of the original.

This has implications for every studio considering remakes of classic games. The math has gotten harder. Remakes are no longer the safe bets they seemed to be five or ten years ago.

Beyond Games: How This Affects Players and Culture

This might seem like industry news that only matters to game enthusiasts. It actually matters more broadly.

When major publishers consolidate around proven franchises, they're choosing to serve existing audiences rather than create new experiences. This shapes gaming culture. New players are more likely to encounter Assassin's Creed (for the ninth time) than discover new franchises.

It also affects how games get funded and who gets heard. Games that align with publisher priorities—live-service games, sequels, proven franchises—get funded easily. Games that don't fit these categories struggle to get funding, even if they're creatively interesting.

This creates a self-reinforcing cycle. Publishers see live-service games generating revenue, so they fund more live-service games. New players are more likely to play live-service games because that's what's available. Publishers see this engagement and conclude live-service games are what players want. The cycle continues.

Breaking this cycle requires either publishers taking risks or players actively seeking out alternatives. Neither is happening at scale right now.

For players who care about game diversity, this moment is a wake-up call. The games you want to play—ambitious single-player stories, weird experimental projects, risky new IPs—aren't getting greenlit by major publishers anymore. You have to actively seek them out from smaller studios, or support crowdfunding campaigns, or wait for indie developers to deliver what major studios won't.

FAQ

Why did Ubisoft cancel Prince of Persia: The Sands of Time remake?

Ubisoft canceled Prince of Persia as part of a major restructuring driven by competitive pressure and financial constraints. The game had already been restarted once and was scheduled for 2026. Leadership determined that single-player remakes couldn't justify the enormous development costs in a market where live-service games generate more reliable revenue. CFO Frederick Duguet stated that Ubisoft would only greenlight projects positioned to be number one or number two in their respective categories—a standard the Prince of Persia remake didn't clearly meet.

How many games did Ubisoft cancel in total?

Ubisoft canceled six games total as part of this restructuring. Three of these canceled titles were brand-new intellectual properties that had never been released before, while one was a mobile game. Prince of Persia: The Sands of Time was the most high-profile cancellation. The remaining two canceled titles had less public visibility and detailed information about them remained limited.

What studios did Ubisoft close?

Ubisoft closed two development studios: Ubisoft Stockholm and Ubisoft Halifax. Stockholm had contributed significantly to Avatar: Frontiers of Pandora, a major AAA release from 2023. Halifax focused primarily on mobile game development. The closures resulted in layoffs and staff reallocation, though Ubisoft stated it would attempt to place displaced employees in other divisions where possible.

What is Ubisoft's new Creative Houses structure?

Ubisoft reorganized its development divisions into five "Creative Houses." Creative House 1 (Vantage Studio) manages flagship franchises like Assassin's Creed, Far Cry, and Rainbow Six. Creative House 2 handles shooters including Ghost Recon and The Division. Creative House 3 oversees live-service games like For Honor and The Crew. Creative House 4 manages single-player experiences like Prince of Persia and Beyond Good & Evil 2. Creative House 5 focuses on casual and family-friendly games like Just Dance. This structure concentrates resources around proven franchises while deprioritizing risky new projects.

Was Assassin's Creed Black Flag remake actually delayed?

Evidence suggests an Assassin's Creed Black Flag remake or remaster was in development, based on PEGI ratings board listings. The game likely received an indefinite delay as part of Ubisoft's restructuring, though official confirmation from Ubisoft remained limited. If the Black Flag project was indeed delayed, it indicates that even highly marketable remakes aren't exempt from restructuring pressures, though the delay might reflect reallocated resources rather than fundamental problems with the project.

Why are live-service games prioritized over single-player games?

Live-service games generate recurring revenue through cosmetics, battle passes, and seasonal content that can continue indefinitely. Single-player games generate their revenue primarily at launch, then drop off sharply. Modern publicly traded game publishers face shareholder pressure to maximize recurring revenue and lifetime customer value, which favors live-service monetization. This financial structure, combined with higher development costs overall, makes single-player games increasingly risky from a publisher's perspective, even when they're creatively ambitious.

What does this restructuring mean for game diversity?

Ubisoft's consolidation around proven franchises and live-service games suggests reduced diversity in AAA game publishing going forward. Fewer single-player games, fewer new intellectual properties, and less risk-taking from major studios means the games that do get greenlit by major publishers will be more similar and more focused on proven commercial formulas. This creates opportunity for mid-size and indie studios to fill the gap with creative single-player games and experimental projects, but at reduced production budgets and visibility compared to AAA releases.

Should I expect other publishers to undergo similar restructuring?

Yes. Ubisoft's restructuring follows a clear industry pattern, and other major publishers including Electronic Arts, Take-Two, and Sony Interactive Entertainment have already made similar moves consolidating around core franchises. If Ubisoft's restructuring successfully reduces unprofitable spending without hurting revenue, expect other publishers to implement comparable reorganizations within 12-24 months. This suggests that consolidation around proven franchises and live-service games will become the industry standard rather than an exception.

What happened to the developers working on canceled Ubisoft games?

Developers working on canceled projects faced reassignment, studio closures, or layoffs. Ubisoft stated it would attempt to relocate employees internally where possible, but studio closures like Stockholm and Halifax necessarily involved significant job losses. Those games that only faced delays rather than cancellation still disrupted development teams as projects got reallocated between Creative Houses or had resources reallocated to higher-priority titles, which typically reduced team morale and extended timelines.

How does this affect remakes and legacy IP going forward?

Ubisoft's cancellation of Prince of Persia suggests that publishers are becoming more skeptical of remaking classic games, even beloved franchises like Prince of Persia. Remakes compete against both modern games and players' idealized memories of the original, creating a difficult value proposition. The economics of remakes have also changed—higher development costs, higher player acquisition costs, and smaller target audiences make remaking legacy IP riskier than creating new franchises. This doesn't eliminate remakes, but it does make them rarer and more carefully selected by major publishers.

Conclusion: An Industry at an Inflection Point

When Ubisoft announced the cancellation of Prince of Persia: The Sands of Time and six other games, it wasn't announcing an anomaly. It was announcing an industry shift.

The market has sorted itself. Players have consolidated around a handful of massive franchises. Publishers have consolidated around live-service monetization. The space for risky single-player experiences, beloved remakes, and experimental new IPs has shrunk dramatically, at least in the AAA space.

This isn't inherently bad for gaming. Some of the most creative games of recent years came from smaller studios operating with smaller budgets and less pressure from shareholders. Indie developers are shipping innovative experiences that major publishers won't risk funding.

But there's something lost when major publishers stop taking chances. AAA resources create experiences that smaller studios simply can't match. When those resources concentrate exclusively on franchises like Assassin's Creed and Far Cry, we all lose something.

Ubisoft's restructuring is rational from a financial perspective. It's disciplined resource allocation. It's acknowledging market realities. It's also, fundamentally, a retreat from creative risk-taking.

For players, this means expecting fewer ambitious single-player games from major publishers. For developers, it means either aligning with what major publishers want to fund, or pursuing smaller studios or indie development. For the industry, it means watching whether other publishers follow Ubisoft's template, and whether consolidation eventually becomes so extreme that it creates space for new competitors to emerge.

Prince of Persia likely wasn't going to save gaming. But its cancellation signals what kind of games major publishers have decided are worth saving, and what kind they've decided are expendable. That's a decision that will reverberate through the industry for years.

The Prince has fallen. And the way the industry responded tells you everything about where games are heading next.

Key Takeaways

- Ubisoft canceled Prince of Persia: The Sands of Time remake after troubled development and a complete project restart, signaling reduced publisher appetite for ambitious single-player remakes

- Six games canceled total with three being brand-new IPs, reflecting strategic shift toward only greenlight projects positioned as category leaders

- Seven additional games delayed indefinitely, including possible Assassin's Creed Black Flag remake, indicating broader resource reallocation across the company

- New five Creative Houses structure consolidates resources around proven franchises (Assassin's Creed, Far Cry, Rainbow Six) while deprioritizing single-player and risky new IPs

- Live-service games now receive disproportionate resources due to recurring revenue monetization, while single-player games face existential pressure from shareholder demand for predictable revenue streams

Related Articles

- Ubisoft Cancels Prince of Persia Remake: Inside the Major Gaming Restructure [2025]

- Bungie's Marathon Extraction Shooter Launches March 5th: Complete Guide [2025]

- Krafton's Quest for the Next PUBG: Inside 26 Games in Development [2025]

- Amazon's New World: Aeternum Shutting Down 2027 [Complete Guide]

- Final Fantasy 7 Remake Intergrade Update 2025: Everything You Need to Know [2025]

- Battlefield 6 Season 2 Delay: What It Means for Players [2025]

![Ubisoft Cancels Prince of Persia Remake: What It Means for Gaming [2025]](https://tryrunable.com/blog/ubisoft-cancels-prince-of-persia-remake-what-it-means-for-ga/image-1-1769079969089.jpg)