Introduction: When a Gaming Giant Stumbles

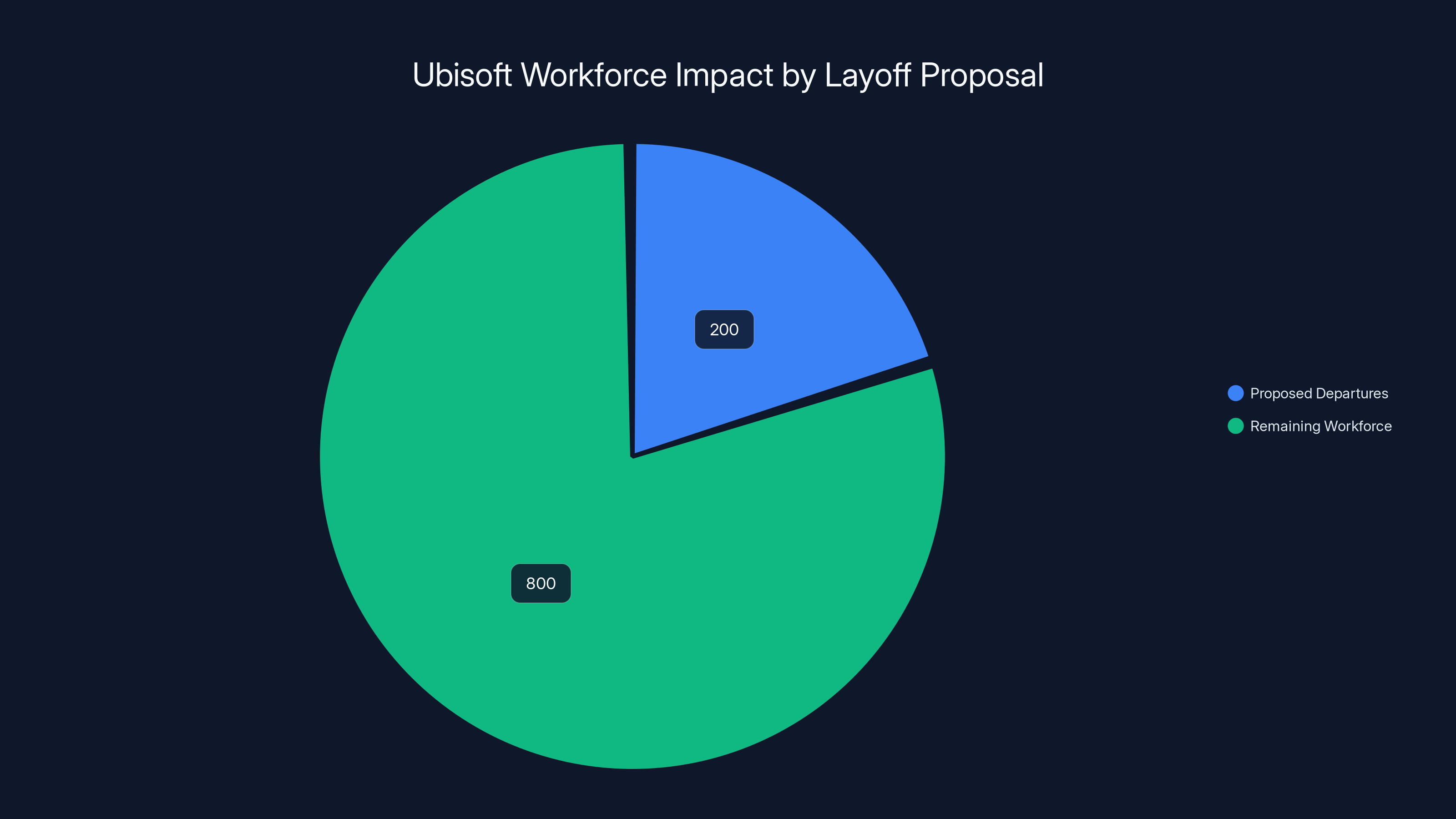

You've probably heard the news by now. Ubisoft, the company that brought us Assassin's Creed, Far Cry, and Rainbow Six, is in serious trouble. Not the kind of trouble that a successful game release can fix anymore. The company is proposing layoffs of up to 200 employees from its Paris headquarters alone, which represents nearly 20 percent of the staff at that location, as detailed in Wccftech's report.

But here's the thing: this isn't happening in a vacuum. The Paris layoffs are just the latest domino to fall in what's become a cascade of painful corporate decisions. Last week, Ubisoft shuttered its Stockholm studio entirely. Before that, it closed its Halifax studio just 16 days after employees had unionized, as noted by Game Developer. The company also announced the cancellation of six games—including the highly anticipated Prince of Persia: Sands of Time remake that fans had been waiting years to play. Seven additional games got delayed indefinitely, according to Gaming Bible.

What makes this situation genuinely noteworthy isn't just the scale of the layoffs or the studio closures. It's what they reveal about the state of the gaming industry itself. We're looking at a company that was valued at

So what actually happened? How did Ubisoft get here? And what does this tell us about the future of game development, employee treatment, and the economic model that's supposed to sustain the industry? Let's dig into the details, because the story gets a lot more complicated—and revealing—than just the headlines suggest.

TL; DR

- The Immediate Crisis: Ubisoft is proposing layoffs of up to 200 employees from its Paris headquarters through France's Rupture Conventionnelle Collective (RCC) voluntary agreement process, affecting roughly 20% of that location's workforce, as detailed by Wccftech.

- The Domino Effect: This follows the closure of Stockholm and Halifax studios, plus the cancellation of six major games and delays on seven others, as reported by Game Developer.

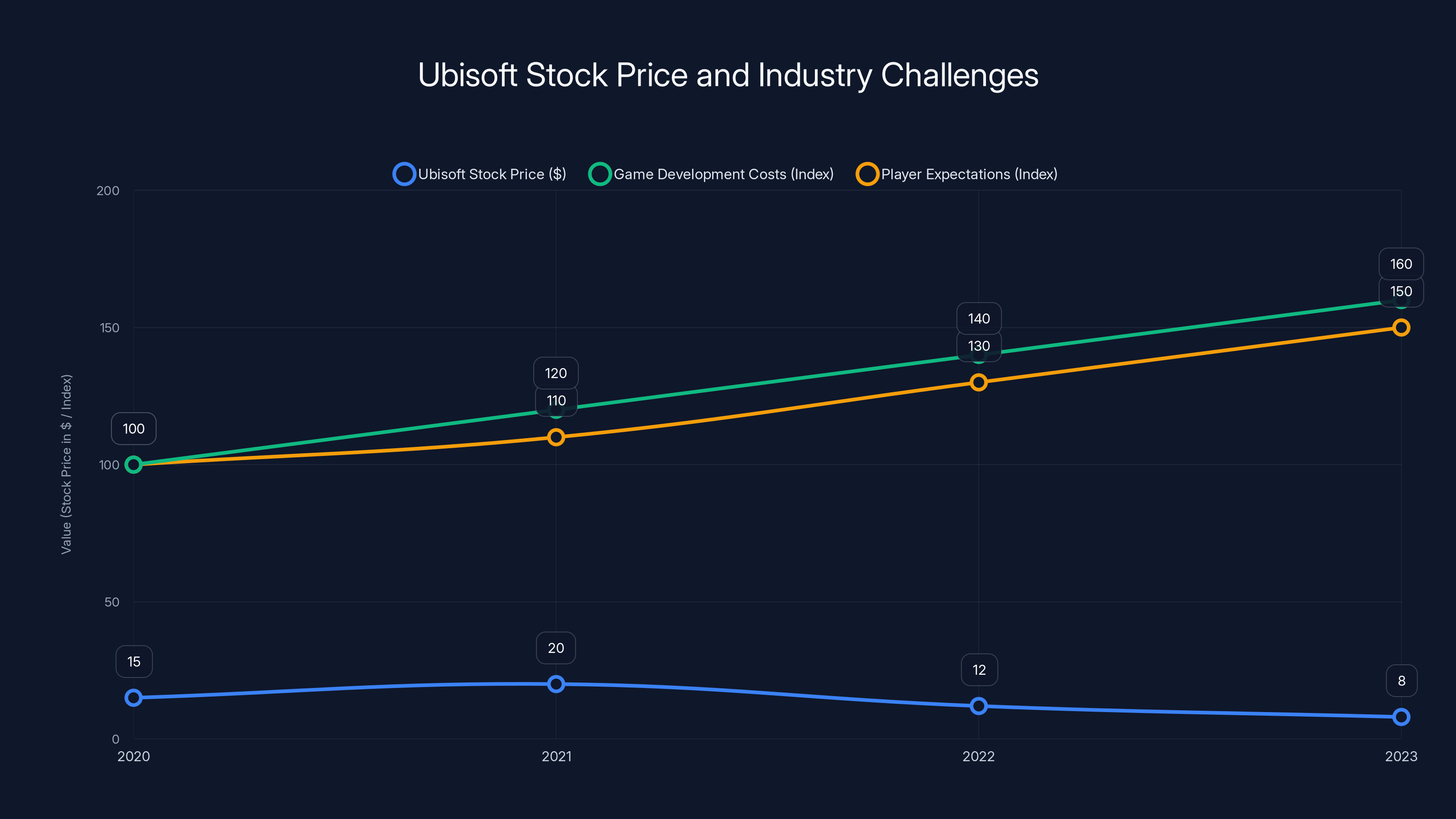

- The Financial Reality: Ubisoft's stock has collapsed from 1 per share, signaling deep structural problems, as noted by CNBC.

- The Workforce Impact: A mandatory return-to-office mandate for five days per week compounds the uncertainty and may be designed to pressure voluntary departures, as discussed in PC Gamer.

- The Bigger Picture: These layoffs represent a critical moment for how the gaming industry treats its workers and manages its long-term sustainability, as analyzed by GamesIndustry.biz.

Ubisoft's stock price has plummeted from

The Scale of Ubisoft's Current Crisis

Let's start with some hard numbers, because they tell an important story about just how deep Ubisoft's problems run. The proposed layoff of 200 people from the Paris location represents approximately 20 percent of the workforce there. That's not a minor adjustment or a small department restructure. That's a significant portion of a major studio's operational capacity being removed in one stroke, as reported by Wccftech.

The Paris headquarters isn't just any studio, either. It's been central to Ubisoft's operations for decades. This is where major franchises have been developed and managed. This is where strategic decisions get made. Cutting this deep into that particular location signals that the company is willing to sacrifice scale and capability to preserve cash in the short term, as noted by GamesIndustry.biz.

What makes the Paris situation particularly notable is the method being used to execute it. Rather than simple terminations, Ubisoft is using France's Rupture Conventionnelle Collective (RCC) process. This is a legal framework that allows workers and employers to form a collective, voluntary mutual termination agreement. Essentially, employees can agree to leave with severance, and the company saves on some of the legal entanglements that come with forced layoffs in France, where labor protections are considerably stronger than in North America, as explained by Harvard Business Review.

But here's the catch: it's only voluntary if the employees actually choose to participate. A company spokesperson confirmed that "at this stage, this remains a proposal and no decision will be final until a collective agreement is reached." Translation: if they can't get 200 people to voluntarily leave, the company hasn't ruled out other options—potentially including forced terminations, which would be messier and more expensive, as reported by Deadline.

There's also a suspicious detail in the timing here: Ubisoft recently introduced a mandate requiring employees to return to the office five days per week. For a company that's basically announcing layoffs, this seems almost deliberately harsh. It's hard not to notice that a policy forcing everyone back to the office—combined with the announcement of massive job cuts—creates the perfect environment for people to start looking for other jobs. Is it possible that the RTO mandate is actually designed to encourage voluntary departures? It's cynical, sure, but it's also the kind of thing that makes sense if you're trying to orchestrate what looks like a "voluntary" restructuring while actually controlling the outcome, as discussed in PC Gamer.

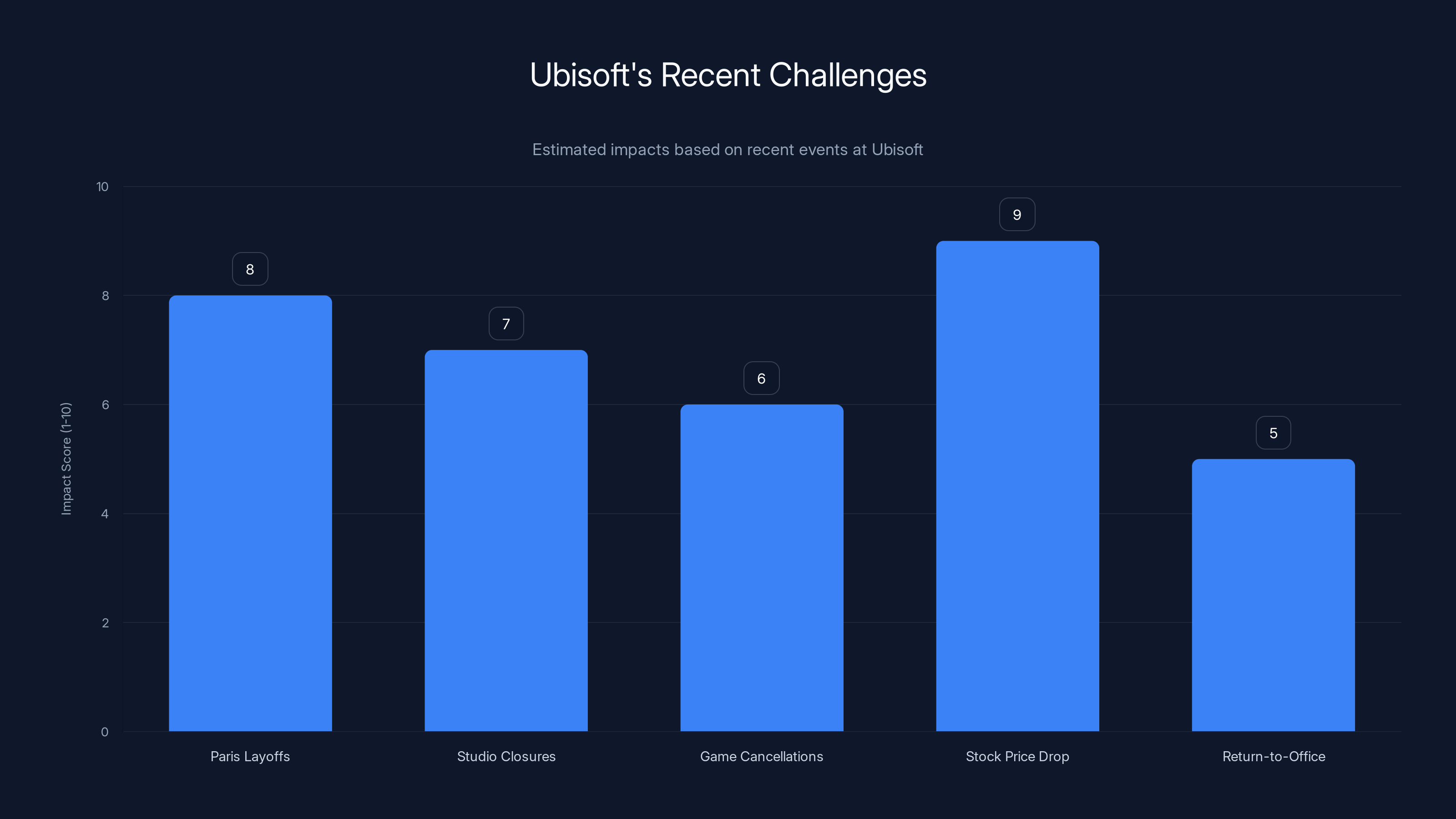

Ubisoft's stock price peaked in 2021 but has since declined, reflecting broader industry challenges such as rising development costs and increasing player expectations. Estimated data.

Studio Closures: The Week That Changed Everything

The Paris layoff announcement doesn't exist in isolation. It's part of a brutal sequence of events that began last week and continues to develop. To understand the full scope of what Ubisoft is going through, you need to understand what happened in the days leading up to the Paris announcement.

Ubisoft shuttered its Stockholm studio entirely. This wasn't a small office or a non-critical operation. This was a whole studio being erased from Ubisoft's portfolio. The company didn't provide extensive details about what happens to the projects that were in development there or what games might be affected by the loss of that studio's capabilities, as reported by Engadget.

But the Stockholm closure wasn't the first one. Just days earlier, Ubisoft had closed its Halifax studio. Here's where it gets particularly damning: the Halifax closure happened just 16 days after employees at that location had voted to unionize. Sixteen days. That's barely enough time to announce the union vote results, let alone have a single union meeting. The proximity between unionization and closure was so blatant that it became impossible to avoid questions about whether Ubisoft was union-busting, as noted by Game Developer.

These closures are significant because they destroy institutional capacity. Studios aren't just interchangeable collections of desks and computers. They're accumulations of expertise, project knowledge, team chemistry, and production capabilities that take years to develop. When you close a studio, you're not just eliminating jobs—you're destroying organizational assets that would be nearly impossible to rebuild, as discussed by GamesIndustry.biz.

The question that hangs over these closures is whether they're primarily about "restructuring" (a business term that sounds almost neutral) or whether they're about something else entirely. When you close a unionizing studio 16 days after union votes pass, the narrative shifts pretty dramatically.

The Game Cancellations: Creative Dreams Abandoned

If the studio closures were about eliminating capacity, the game cancellations reveal something darker about Ubisoft's decision-making: the company is essentially admitting that it's not confident in its creative future. Ubisoft announced the cancellation of six games. That's not a typo. Not three. Not two. Six games, completely cancelled, as reported by Gaming Bible.

The most notable cancellation was the Prince of Persia: Sands of Time remake. This wasn't some experimental indie-adjacent project. This was a major franchise reimagining that Ubisoft had been developing for years, that fans had been anticipating for years, and that represented significant investment in terms of development resources, marketing preparation, and corporate expectation, as noted by Deadline.

Prince of Persia is a storied franchise. The original Sands of Time from 2003 is legitimately considered one of the greatest action-adventure games ever made. The parkour mechanics, the time-manipulation puzzle solving, the art design—it all held up remarkably well even by modern standards. A remake had the potential to introduce that game to new audiences while letting longtime fans revisit a beloved property.

The fact that this remake got cancelled suggests that somewhere in Ubisoft's analysis of the current market, the company determined that even a major franchise reimagining wasn't worth completing. That's a profound statement about how pessimistic the company has become about its ability to ship successful products, as analyzed by GamesIndustry.biz.

Ubisoft didn't disclose details about the other five cancelled games. That information vacuum is itself interesting—it suggests either that those games weren't as far along in development, or that Ubisoft is trying to minimize additional negative PR by not drawing attention to each individual cancellation.

Beyond the six cancellations, seven additional games were pushed back into indefinite delays. That's a lot of release dates disappearing. For context, one or two delays per year is typical in game development—unexpected technical problems happen, creative ambitions exceed initial timelines, or external factors disrupt production. Seven games all being delayed simultaneously suggests something more systemic is wrong, as reported by Gaming Bible.

Interestingly, the game that didn't get cancelled was Beyond Good and Evil 2. This is notable because Beyond Good and Evil is not exactly a franchise that's been burning up the charts in recent years. The original game came out in 2003, and Beyond Good and Evil 2 has been in development for so long that it's become industry lore—the game that might never actually come out. Yet somehow it survives while major franchises get the axe. Whether that's because the project is genuinely closer to completion, or because it's become so invested with expectation that cancelling it would cause additional PR damage, is unclear, as noted by Engadget.

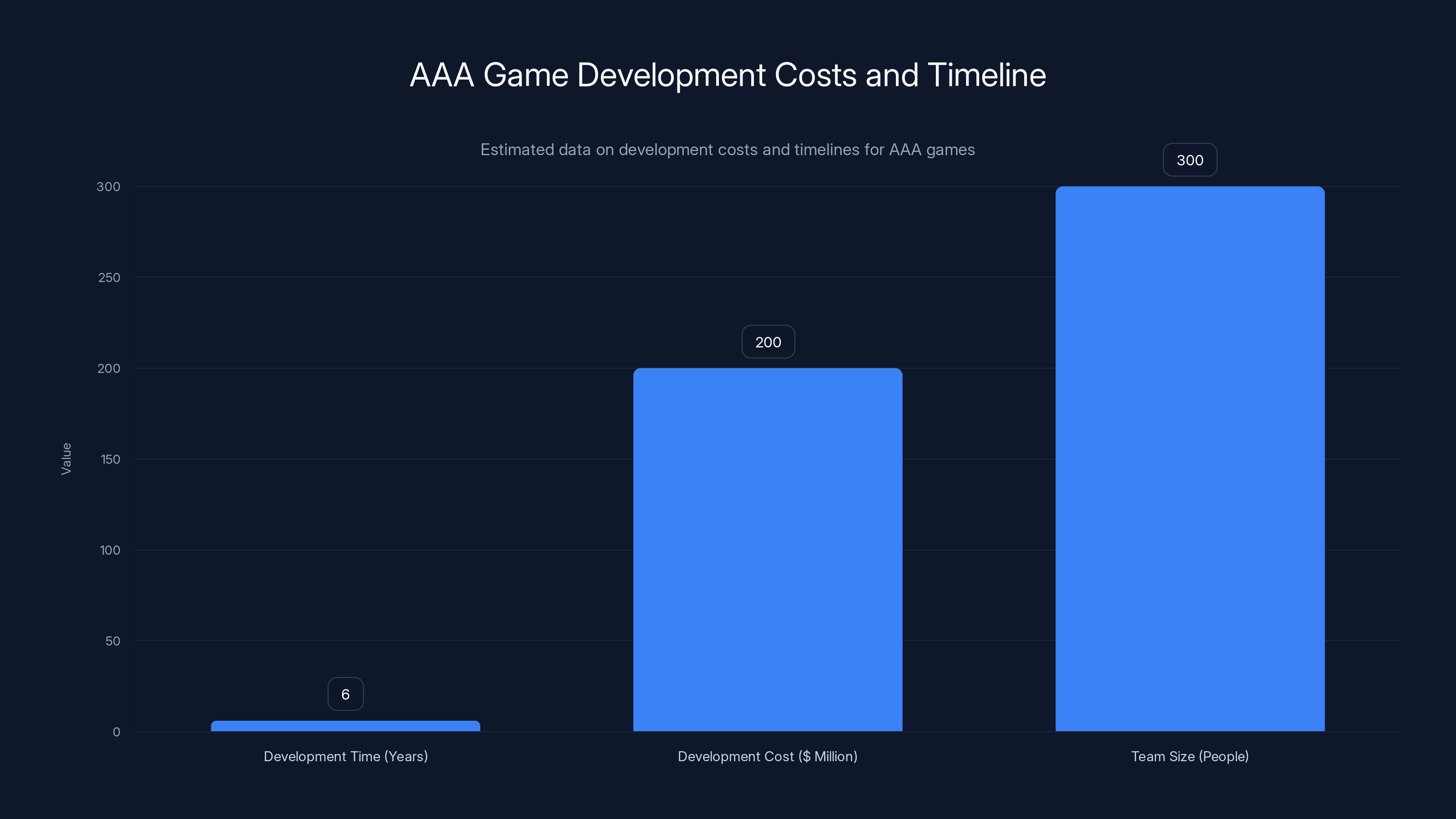

Estimated data shows that AAA games take around 6 years to develop, cost $200 million, and involve 300 people. These factors contribute to unsustainable economics in the gaming industry.

Understanding the RCC Process: How French Labor Law Shapes Corporate Restructuring

For readers unfamiliar with French employment law, the Rupture Conventionnelle Collective (RCC) process might seem like an obscure procedural detail. It's not. Understanding how this process works actually explains a lot about why Ubisoft chose this approach and what it might mean for the affected employees.

France has some of the strongest labor protections in the Western world. Firing someone for ordinary "at-will" reasons—the standard in the United States—is generally illegal in France. If a company wants to lay off employees, the company typically needs to prove legitimate business reasons, follow extensive procedural requirements, offer severance packages that meet legal minimums, and potentially negotiate with employee representatives or unions, as explained by Harvard Business Review.

Here's where the RCC comes in. The RCC process allows companies and employees to create a collective agreement where employees voluntarily agree to terminate their employment. When employees voluntarily agree to leave, the severance packages can be negotiated, and the company avoids some of the legal friction that comes with forced terminations.

From the company's perspective, this is attractive because it's cheaper and faster than forcing layoffs through the formal French labor system, which can involve months of negotiation with workers' councils, union representatives, and potential litigation, as noted by Deadline.

From the employees' perspective—at least in theory—this offers transparency and the opportunity to negotiate severance terms rather than having those terms imposed unilaterally.

The catch, of course, is that the RCC only works if enough employees actually agree to it. Ubisoft is proposing 200 departures. If the company can't find 200 people willing to voluntarily leave, the whole framework breaks down, and Ubisoft would need to pursue alternative approaches—potentially including forced terminations, as reported by Wccftech.

A company spokesperson acknowledged this uncertainty: "at this stage, this remains a proposal and no decision will be final until a collective agreement is reached." In corporate speak, that means they don't have it locked down yet, as noted by Deadline.

So what makes an employee agree to "voluntary" termination? Typically, a severance package that's more generous than the legal minimum. Ubisoft hasn't publicly detailed what they're offering, but French labor law typically requires companies to negotiate severance amounts that account for years of service, age, and difficulty finding new employment, as explained by Harvard Business Review.

There's also the practical reality that if you're unhappy at your current job and layoffs are coming anyway, accepting a voluntary departure with severance might be preferable to either staying at a company that's clearly in trouble, or waiting to see if you'll be among the people chosen for forced termination.

The Stock Collapse: Numbers That Tell the Real Story

To understand how serious Ubisoft's crisis actually is, you need to look at the stock price. Numbers don't lie, even when company communications do.

In 2021, Ubisoft stock was trading at around $20 per share. That was a high point, sure, but it represented a company that investors believed had solid long-term prospects. The company had successful franchises, strong IP, and a market position as one of the "big three" AAA game publishers alongside Activision Blizzard and Electronic Arts, as noted by BBC News.

Today, Ubisoft stock is trading at approximately $1 per share.

Let that sink in for a moment. That's not a correction. That's not a market adjustment. That's a 95 percent destruction of shareholder value over roughly four years, as reported by CNBC.

To put that in perspective: if you'd invested

Several factors have contributed to this collapse. Ubisoft has had a string of poorly received or commercially underperforming game releases. The company's flagship franchises haven't been generating the same level of excitement or sales that they did five or ten years ago. The gaming market has shifted—live-service games with continuous engagement mechanics have become more important, and Ubisoft hasn't always executed well in that space, as noted by BBC News.

But the stock collapse also reflects something else: investor skepticism about Ubisoft's management and strategic direction. When a company's leadership is making questionable decisions—like shutting down a unionizing studio 16 days after unionization votes pass—it signals to investors that management might be more focused on short-term cost-cutting than long-term value creation, as discussed by WNHub.

Ubisoft's layoff proposal affects up to 200 employees, representing approximately 20% of the Paris headquarters' workforce. Estimated data.

The Return-to-Office Mandate: More Than Just Office Policy

In the middle of all these layoffs and studio closures, Ubisoft introduced a mandate requiring all employees to return to the office five days per week. On the surface, this might seem like a standard office policy—the kind of thing companies have been pushing since remote work became normalized.

But the timing is suspicious. The RTO mandate was introduced while the company was simultaneously announcing massive layoffs, game cancellations, and studio closures. In that context, it reads differently, as reported by PC Gamer.

A five-day RTO mandate in a company where layoffs are happening and the stock price is in free fall isn't just about office culture or collaboration. It's about creating an environment where people start looking for other jobs. People with remote work privileges can more easily stay at a company they're becoming uncertain about. People forced into daily commutes, surrounded by the stress of potential layoffs, are much more motivated to find alternative employment, as noted by Engadget.

Is that what Ubisoft is deliberately orchestrating? It's hard to say for certain. But from a mechanical standpoint, an RTO mandate combined with layoff announcements creates perfect conditions for the kind of "voluntary" departures that the RCC process requires.

There's another angle to consider: the RTO mandate might also be designed to manage who actually leaves. A company that wants to keep certain skilled employees while shedding others might use office policies as a subtle screening mechanism. People with families, caregiving responsibilities, or those who've built lives around remote work will be more motivated to leave. People who are more geographically flexible or who prefer office environments might stay, as discussed by PC Gamer.

This isn't necessarily conscious on the part of individual managers or executives. But it's a natural consequence of implementing restrictive policies alongside layoff announcements.

Why Game Cancellations Hurt More Than Just Revenue

The cancellation of six games—plus delays on seven others—represents more than just lost revenue. It signals something fundamental about how Ubisoft's creative process is failing.

In game development, cancellations happen. It's an industry where projects get redirected, resources get reallocated, and sometimes the math just doesn't work out. No game industry professional is shocked when a game gets cancelled. What's notable is the scale and the apparent systemic nature of these cancellations, as reported by Gaming Bible.

When a company cancels one game, it's usually because that specific project had problems: technical debt, scope creep, market analysis suggesting it wouldn't sell well, or key personnel leaving. When a company cancels six games simultaneously, it suggests a different kind of problem. It suggests that the company's development pipeline itself is broken. That across multiple studios, working on different franchises, with different teams, something is fundamentally not working, as noted by Engadget.

Possibilities include:

-

Development costs are out of control: Games cost hundreds of millions to develop these days. If Ubisoft's development processes have become inefficient, the company might be making strategic decisions to kill projects rather than continue bleeding resources into them.

-

Quality standards have become unrealistic: If leadership is demanding development timelines or features that teams can't actually deliver, projects might be getting cancelled when they fall too far behind.

-

The market has shifted away from what Ubisoft develops: This is perhaps the most troubling possibility. It suggests that Ubisoft's development teams are spending years creating games that the market doesn't actually want.

-

Organizational dysfunction: When leadership is closing studios over unionization, is it possible that the broader organizational culture has become toxic enough that projects can't move forward effectively?

The reality is probably some combination of all of these. But the cascading cancellations suggest that Ubisoft's internal processes for making games—the thing the company actually exists to do—have become fundamentally broken, as analyzed by GamesIndustry.biz.

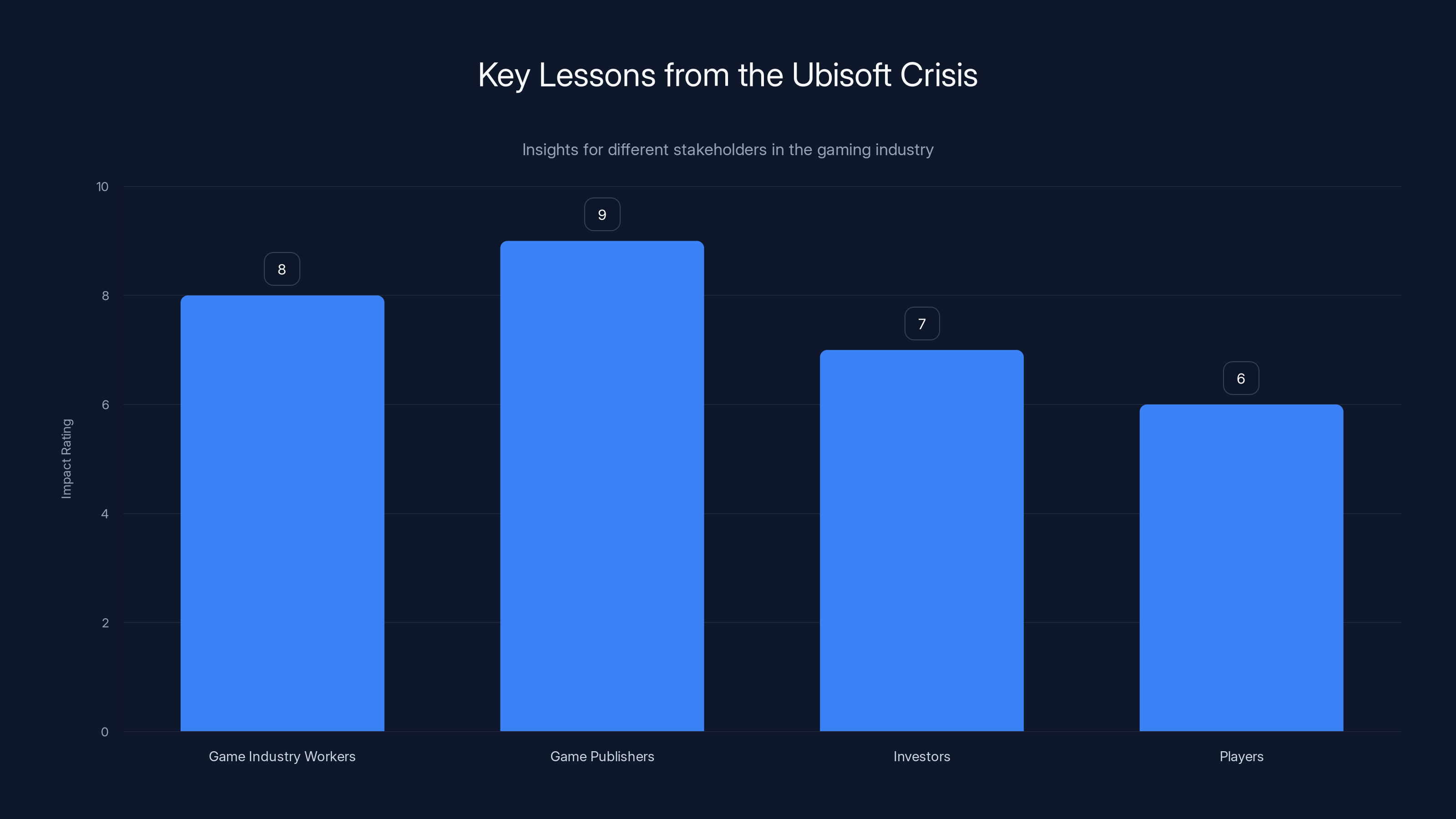

The Ubisoft crisis highlights significant lessons for various stakeholders, with game publishers needing to rethink AAA development models and workers considering unionization. (Estimated data)

The Gaming Industry's Bigger Problem: Unsustainable Economics

Ubisoft's crisis isn't unique. It's not even unusual anymore. Over the past two years, the gaming industry has experienced wave after wave of layoffs. Studios like BioWare, Riot Games, Rocksteady Studios, Bungie, and dozens of others have all conducted significant layoffs. Some of those layoffs were percentage-of-workforce reductions that rival or exceed what Ubisoft is doing now, as reported by BBC News.

What's happening at Ubisoft is a symptom of a deeper economic problem in game development. The economics of AAA game development have become nearly impossible to sustain.

Here's the basic problem: games take longer to develop and cost more money to make than ever before. A major AAA title now typically takes 5-7 years to develop, costs $100-300 million to create, and requires hundreds of people working simultaneously. That's an enormous capital commitment, as noted by BBC News.

In previous eras, a single successful game release could fund multiple years of operation. Publishers could take larger creative risks because even moderate commercial success would validate the investment.

But the market has changed. Player expectations have increased. Production timelines have extended. Development costs have inflated due to higher salaries, more advanced tools, and the need to support massive live-service ecosystems after launch.

Meanwhile, game sales—while still substantial—have become less predictable. The blockbuster market is dominated by a smaller number of franchises. Mobile gaming and free-to-play models have fragmented player attention. The days when a publisher could reliably count on 5-10 million copies of a new release are gone for most franchises, as discussed by WNHub.

When you combine these factors, you get the current situation: game publishers are under enormous pressure to reduce costs while simultaneously being unable to significantly reduce the scope of their productions (because players expect increasingly sophisticated games). The result is that cutting people becomes the primary cost-reduction lever, as noted by BBC News.

Ubisoft is caught in this bind. The company needs to continue producing AAA games to remain relevant and to justify its position as a major publisher. But the economics of AAA game development have become increasingly brutal. Layoffs aren't a sign that Ubisoft has made bad decisions (though that's probably partly true). Layoffs are what the industry structure itself now demands, as analyzed by WNHub.

Worker Impact: The Real Human Story Behind the Headlines

It's easy to get caught up in stock prices, business strategy, and corporate messaging. But behind all of these decisions are actual people who are now facing job loss, career disruption, and financial uncertainty.

For developers in Paris, Stockholm, Halifax, and other affected locations, the sequence of events over the past week has been devastating. People who came to work last week expecting to have a job are now potentially jobless within weeks, as reported by Game Developer.

The Paris layoff is being framed as "voluntary," but that framing masks the reality: people are being offered the choice between leaving with severance or staying at a company that's clearly in trouble and where their employment situation is now uncertain. That's not a genuine choice in any meaningful sense, as noted by Wccftech.

For developers at the closed studios, it's worse. They don't even have the option of staying. Their studios have been shuttered entirely. They're being displaced with, presumably, some severance, but the dislocation is real and immediate, as reported by Game Developer.

There's also the psychological toll of working at a company where you've just watched 16 days pass between a unionization vote and studio closure. If you're a developer at another Ubisoft location, that sequence of events sends a message: if you organize for better working conditions, your studio might be next, as discussed by Engadget.

The broader context matters too. The game industry has been notorious for "crunch culture"—the practice of demanding extremely long working hours during critical development periods. Workers have fought for better conditions, better pay, and more sustainable work practices. But if fighting for those improvements results in your studio being shut down, the incentive structure is clear: accept difficult conditions or risk being eliminated, as noted by Game Developer.

That's a grim situation for an industry that already struggles with burnout and retention.

Ubisoft faces significant challenges, with stock price collapse and layoffs having the highest impact. Estimated data.

The Unionization Question: A Glimpse of What's to Come?

The proximity between Halifax's unionization vote and the studio's closure raises an important question: is Ubisoft union-busting, or is the timing just coincidental?

From a purely logistical standpoint, closing a studio 16 days after a unionization vote is shockingly fast. Union campaigns typically take months or years to organize. The vote happens after extensive groundwork. The company then has time to adjust to the union's presence before implementing any major changes, as explained by Game Developer.

Closing the entire studio just 16 days after unionization votes pass is almost comically quick. It's hard to imagine that Ubisoft suddenly decided to close the Halifax location two weeks after the unionization vote if the closure wasn't at least partly a response to the unionization, as noted by Engadget.

Does that constitute illegal union-busting? That's a legal question that would depend on jurisdiction and specific circumstances. But from a practical standpoint, closing a studio that just unionized sends a message to workers at other Ubisoft locations: unionization might result in your studio being shut down, as discussed by Game Developer.

This has implications for the broader conversation about worker organizing in the game industry. The industry has seen growing unionization efforts over the past few years, especially in Quebec where Ubisoft has significant operations. If workers come to believe that unionization results in immediate studio closure, it will suppress those efforts regardless of what any labor board might rule, as noted by Engadget.

Strategic Questions: What's Next for Ubisoft?

Assuming the RCC process succeeds and Ubisoft manages to get 200 people to leave through voluntary agreements, what happens next? The company still has massive structural problems that layoffs won't solve.

The game cancellations represent years of failed development. That's not solved by cutting headcount. If anything, cutting 200 people from the development workforce might slow down the development of the remaining games even further, as noted by GamesIndustry.biz.

The stock price collapse reflects investor skepticism about Ubisoft's strategic direction. That skepticism won't disappear when a layoff is announced. If anything, large layoffs typically trigger more investor concern because they signal that management doesn't have a positive growth strategy—they're just cutting, as discussed by WNHub.

The loss of institutional knowledge and creative capability that comes with closing studios won't be quickly recovered. Stockholm and Halifax presumably had expertise and expertise unique to those locations. That's gone now, as reported by Engadget.

So what's actually supposed to happen? Does Ubisoft have a strategy that involves rebuilding? Or is the current sequence of closures, cancellations, and layoffs actually a slow-motion exit—a company systematically reducing its scope until it becomes small enough to be acquired by a larger player?

It's hard to say. But the pattern suggests that Ubisoft's leadership doesn't have a clear vision for how to rebuild the company. The moves they're making are all defensive—cutting costs, eliminating uncertain bets, reducing headcount. Those are the moves you make when you're trying to stabilize a situation, not when you're trying to grow, as analyzed by WNHub.

Comparing Ubisoft's Crisis to Other Publisher Challenges

To understand how unusual—or how typical—Ubisoft's situation is, it's worth comparing it to what's happening elsewhere in the industry.

Activision Blizzard faced a devastating sexual harassment scandal that destroyed its reputation and resulted in regulatory investigations. The company went through significant layoffs (over 8% of workforce in 2022) partly due to the scandal fallout and partly due to general industry cost-cutting, as reported by BBC News.

Electronic Arts has maintained more financial stability but has also been retreating from certain types of games and focusing more heavily on live-service and sports titles, as noted by WNHub.

Take-Two Interactive (Rockstar Games parent) laid off 5% of its workforce in 2023, as reported by BBC News.

Bungie, owned by Sony, laid off about 8% of its workforce despite being owned by one of the world's most profitable companies, as noted by WNHub.

So Ubisoft isn't alone. But the scale and speed of Ubisoft's retrenchment appears more severe than most peers. It's not just laying off a percentage of workers—it's closing entire studios and cancelling whole games, as reported by Engadget.

This suggests that Ubisoft's problems are more fundamental than the industry-wide challenges affecting other publishers. Yes, the AAA development economics are broken for everyone. But Ubisoft appears to be broken in particular, as analyzed by WNHub.

The Future of AAA Game Development

Whatever happens with Ubisoft specifically, the broader pattern suggests something important about the future of AAA game development.

The current model is unsustainable. When every major publisher is conducting massive layoffs, when studios are closing entirely, when games are being cancelled at this scale—that's not market correction. That's industry dysfunction, as noted by BBC News.

What might come next? Several possibilities:

Consolidation: We might see fewer, larger publishers controlling the market. Smaller publishers might be acquired by larger ones, or might fail entirely. The result would be less diversity in game development and less willingness to take creative risks.

Shift toward live-service: If traditional single-player and story-driven games are becoming economically non-viable, publishers might shift even more heavily toward live-service games with continuous monetization. This would change the creative landscape significantly, as analyzed by WNHub.

Independent and smaller studio growth: If AAA development becomes even more expensive and difficult, we might see more talented developers leaving for independent studios or mid-sized publishers where the economics are less brutal.

Technology shifts: AI, cloud gaming, or other emerging technologies might eventually change development economics, but we're not there yet.

Consolidation of resources: Publishers might start pooling resources on fewer, higher-stakes projects rather than spreading capital across many bets.

None of these outcomes are particularly appealing from a creative or worker perspective. But they're all plausible responses to the current economic pressures, as noted by BBC News.

Investor Perspective: Why This Matters to Shareholders

If you hold Ubisoft stock or are considering investing in the company, the current crisis raises serious questions.

Massive layoffs might provide short-term relief on cash burn, but they don't solve the underlying problems. The company still needs to create games that people want to buy. Cutting the workforce deep enough to avoid that problem would require reducing Ubisoft's development capability to a point where it's not a viable AAA publisher anymore, as noted by WNHub.

The strategic questions are critical: what is Ubisoft actually trying to become? A smaller publisher focusing on fewer franchises? A live-service specialist? A company waiting to be acquired? Without clarity on strategic direction, it's hard to have confidence that current management is making sound decisions, as analyzed by BBC News.

The stock price collapse itself might actually represent an opportunity for contrarian investors. If Ubisoft manages to emerge from this crisis with a viable core set of franchises and a sustainable cost structure, the stock could recover significantly from $1 per share. But that's a big "if."

More likely, at least in the near term, Ubisoft's stock remains pressured as the company continues to deal with the consequences of these decisions, as reported by CNBC.

Lessons for the Game Industry and Beyond

The Ubisoft crisis is instructive for several reasons:

For game industry workers: It's a reminder that company size and recognizable brand names offer no protection. Even working at a major publisher is precarious if the company's business model is failing. Unionization might help protect against sudden closures, but it comes with its own risks, as noted by Game Developer.

For game publishers: The economics of AAA development need to be rethought. The current model—where games take 5-7 years to develop, cost $100-300 million, and then succeed or fail based on a single launch window—is increasingly untenable. Publishers need to find alternative models, or they'll continue cycling through these crises, as analyzed by WNHub.

For investors: The gaming industry remains attractive because of the revenue potential, but individual companies can deteriorate quickly. Concentration of investment in a small number of megacap publishers might be safer than betting on turnaround stories at distressed companies, as noted by CNBC.

For players: The decisions being made right now about game cancellations, studio closures, and workforce reductions will affect the types of games that get made in the years ahead. A more consolidated, cost-focused industry will produce different kinds of games than a more diverse, risk-taking industry, as discussed by BBC News.

What We Don't Know Yet

For all the information that's been disclosed, there are still significant unknowns:

-

Will the RCC process succeed? Will Ubisoft actually find 200 willing participants, or will the proposed layoffs fall short and trigger more forced terminations?

-

What other games are affected? The company cancelled six games but didn't name them all. What franchises or genres are affected? Do the remaining game delays suggest more cancellations might be coming?

-

What's the strategic vision? Ubisoft hasn't articulated a clear path forward. Is the company trying to stabilize and rebuild? Or is management essentially managing a slow decline?

-

Will other studios close? The announcement of Paris layoffs, combined with the closures of Stockholm and Halifax, suggests that more facility closures might be coming. Which locations are next?

-

How will this affect live-service transitions? Ubisoft has been investing heavily in live-service games. Will studio closures and layoffs impact the quality or viability of ongoing games that rely on continuous development?

These are the questions that will actually determine whether Ubisoft has a viable future or whether this is the beginning of a larger dissolution.

The Broader Conversation About Tech and Media Company Layoffs

It's worth noting that Ubisoft isn't alone in experiencing massive workforce reductions. Over the past couple of years, we've seen layoffs across tech, media, and entertainment:

-

Meta: Laid off about 21% of its workforce (around 11,000 people) in November 2022, citing overexpansion and inefficiency, as reported by BBC News.

-

Twitter: Laid off roughly 50% of its workforce after Elon Musk's acquisition, then more layoffs followed, as noted by WNHub.

-

Amazon: Announced layoffs of over 10,000 employees in January 2023, followed by additional reductions, as reported by BBC News.

-

Microsoft: Laid off roughly 10,000 employees (about 3% of workforce) in January 2023, as noted by WNHub.

The pattern across all these companies is similar: rapid expansion during certain growth phases, followed by realization that the expansion was unsustainable, followed by massive cuts. The difference with Ubisoft is that the company is also closing facilities entirely and cancelling products, suggesting a more fundamental retrenchment than just optimizing headcount, as analyzed by WNHub.

FAQ

What is the Rupture Conventionnelle Collective (RCC) process?

The RCC is a French employment law framework that allows companies and workers to form collective, voluntary mutual termination agreements. Rather than forcing layoffs through traditional French labor procedures—which offer extensive protections to workers—companies can use the RCC process to negotiate agreed-upon departures with severance packages. The process is voluntary on both sides: the company proposes it, but employees must choose to participate, as explained by Harvard Business Review.

How many people are affected by Ubisoft's layoff proposal?

Ubisoft is proposing the departure of up to 200 employees from its Paris headquarters, which represents approximately 20 percent of that location's workforce. However, this is separate from the studio closures at Stockholm and Halifax, which represent additional job losses not included in this specific number, as reported by Wccftech.

Why did Ubisoft close the Halifax studio so quickly after unionization?

The Halifax studio closure occurred just 16 days after employees voted to unionize. While Ubisoft hasn't publicly stated that the closure was directly related to unionization, the timing is unusual enough that observers have noted the proximity. Under Canadian and U.S. labor law, closing a facility immediately after unionization can potentially constitute illegal union busting, but whether that applies in this specific case would depend on regulatory investigation and legal judgment, as noted by Game Developer.

What games has Ubisoft cancelled?

Ubisoft announced the cancellation of six games, with the Prince of Persia: Sands of Time remake being the most publicly notable cancellation. The company did not disclose the names of the other five cancelled games. Separately, seven additional games were pushed into indefinite delays rather than cancelled outright, as reported by Gaming Bible.

What does the Paris return-to-office mandate have to do with the layoffs?

Ubisoft recently introduced a requirement for employees to return to the office five days per week while simultaneously announcing the massive Paris layoffs. Some observers have suggested the timing is suspicious—that the RTO mandate creates pressure for people to seek employment elsewhere and makes participating in the RCC voluntary departure process more appealing. Whether this is deliberately orchestrated or coincidental is unclear, as discussed by PC Gamer.

How bad is Ubisoft's financial situation?

Ubisoft's stock price has collapsed from approximately

Could the RCC process fail?

Yes. The RCC process is voluntary, meaning Ubisoft needs 200 employees to agree to leave. If the company can't recruit 200 willing participants, the RCC process would break down, and Ubisoft would need to pursue alternative approaches—potentially including forced terminations or revised reduction proposals. The company has not stated what it would do if the RCC fails to achieve the targeted number, as reported by Wccftech.

Is game industry unionization becoming more common?

Yes. Over the past three to four years, game developers have increasingly organized unionization efforts at major studios including Activision Blizzard, Rockstar Games, and many others. However, the game industry has historically been anti-union, and worker organizing faces significant challenges. Ubisoft's response to Halifax's unionization vote—immediate studio closure—could have a chilling effect on future unionization efforts if workers believe unionization leads to termination, as noted by Game Developer.

What does this mean for players?

For players, the immediate impact is that games get cancelled and delayed, reducing the available catalog of new releases. More broadly, if the game industry continues consolidating and focusing on cost-cutting rather than creative risk-taking, the types of games being made might shift away from experimental or niche titles and toward franchises with proven commercial appeal, as discussed by BBC News.

Could Ubisoft be acquired by another company?

While Ubisoft hasn't announced any acquisition discussions, the massive stock price decline and strategic challenges could theoretically make the company an acquisition target for a larger media company or private equity firm. Such an acquisition could provide capital to stabilize the company, but it might also result in significant changes to the company's operations, employee count, and product strategy, as analyzed by WNHub.

Conclusion: A Industry at an Inflection Point

The Ubisoft crisis isn't just a story about one company hitting rough times. It's a symptom of a broader rupture in how the game industry operates and how it's sustainable from both a business and human perspective.

When Ubisoft was riding high at $20 per share in 2021, it seemed like the company had solved the puzzle of AAA game development. But that confidence turned out to be an illusion. The model was always unsustainable. Game development costs kept rising. Development timelines kept extending. Player expectations kept increasing. Meanwhile, the market for new games fractured into smaller niches, and the blockbuster business became harder to predict, as noted by BBC News.

The layoffs, studio closures, and game cancellations we're seeing now are what happens when reality catches up with unsustainable models. Ubisoft is experiencing this more intensely than some other publishers, but it's not experiencing anything unique—it's just experiencing it faster and more visibly, as analyzed by WNHub.

The questions that matter now are: What does Ubisoft do next? Does the company have a path to rebuilding, or is this a managed decline? Will the RCC process succeed and result in 200 voluntary departures, or will it fail and force messier alternatives? Will more studios close, or has the retrenchment reached an endpoint?

But beyond the Ubisoft-specific questions are the bigger industry questions: Can the AAA development model be fixed? Or do we need a fundamental reimagining of how games get funded, developed, and released?

For game industry workers, the Ubisoft situation is a harsh lesson in precarity. Even at major publishers with recognizable brands, employment is contingent on factors far beyond individual performance. Attempting to organize for better working conditions can result in your studio being shuttered within weeks. The economics of your industry can change the nature of your job fundamentally, with little warning, as discussed by Game Developer.

For investors, Ubisoft remains an interesting turnaround story—but it's a turnaround story where the path forward remains unclear. The immediate focus will be on whether the RCC process succeeds and whether the cost-cutting actually stabilizes the company. But even if it does, the fundamental question remains: what is Ubisoft actually going to do to return to growth, as noted by CNBC?

For players, the takeaway is more immediate: games you were anticipating are being cancelled, and the company's output will likely be reduced in the near term as the crisis unfolds. The long-term impact depends on whether the industry learns lessons from this crisis or whether we continue cycling through waves of unsustainable expansion followed by painful contraction, as analyzed by WNHub.

The Ubisoft crisis isn't a finale—it's an act break in a longer story about how the game industry is transforming. What happens next will shape game development for years to come.

Key Takeaways

- Ubisoft is proposing layoffs of up to 200 employees (20% of Paris workforce) through France's voluntary RCC process, reflecting a company in crisis, as reported by Wccftech.

- The crisis extends beyond layoffs: the company closed Stockholm and Halifax studios while cancelling six games and delaying seven others, as noted by Game Developer.

- Ubisoft's stock has collapsed 95% from 1/share, indicating fundamental investor skepticism about the company's viability, as reported by CNBC.

- The closure of Halifax just 16 days after unionization votes suggests retaliation, raising serious labor law questions and chilling effects on worker organizing, as discussed by Game Developer.

- Broader context: AAA game development economics have become unsustainable, forcing publishers across the industry to cut costs aggressively, as analyzed by WNHub.

Related Articles

- Ubisoft Cancels 6 Games Including Prince of Persia Remake [2025]

- Beyond Good and Evil 2 Survived Ubisoft's Purge: What It Means [2025]

- Ubisoft Cancels Prince of Persia Remake: Inside the Major Gaming Restructure [2025]

- Krafton's Quest for the Next PUBG: Inside 26 Games in Development [2025]

- Beast of Reincarnation: Why Game Freak Prioritizes Gameplay Over Graphics [2025]

- The New York Times Crossplay: Building the First Two-Player Game [2025]

![Ubisoft's Crisis: Layoffs, Studio Closures, and the Gaming Industry Reckoning [2025]](https://tryrunable.com/blog/ubisoft-s-crisis-layoffs-studio-closures-and-the-gaming-indu/image-1-1769456400489.png)