Introduction: Why India's Voice AI Market Is About to Explode

When Maitreya Wagh and Prateek Sachan first pitched Bolna to Y Combinator, the response was brutal. Rejected five times. The feedback stung even more than the rejections themselves: Indian enterprises won't pay for voice AI. The market doesn't exist. You'll fail.

But here's what happened next. The founders kept building. They kept shipping. And by the time they applied for the fall 2025 batch, they had something Y Combinator couldn't ignore: $25,000 in monthly recurring revenue. Real customers. Real money. Real proof.

Today, Bolna announced a $6.3 million seed round led by General Catalyst, with backing from Y Combinator, Blume Ventures, Orange Collective, Pioneer Fund, Transpose Capital, and Eight Capital. The round also includes individual investors with serious credibility in the space.

But this isn't just another startup funding story. This is a watershed moment for voice AI in India.

Here's why this matters. India has over 1.4 billion people. English fluency sits around 10 percent. Meanwhile, voice is how Indians communicate. Not text. Not email. Voice. It's cultural, it's practical, and it's why WhatsApp's voice calling feature exploded in the region while competitors stumbled.

Now imagine that voice communication layer powered by AI. Customer support agents that speak Hindi, Marathi, Tamil, Telugu, and Kannada without losing quality. Sales agents that understand local nuances, verify callers through Truecaller, handle background noise from bustling Indian streets, and manage code-switching when customers slip between languages mid-sentence.

That's what Bolna is building. And the market is finally ready to pay.

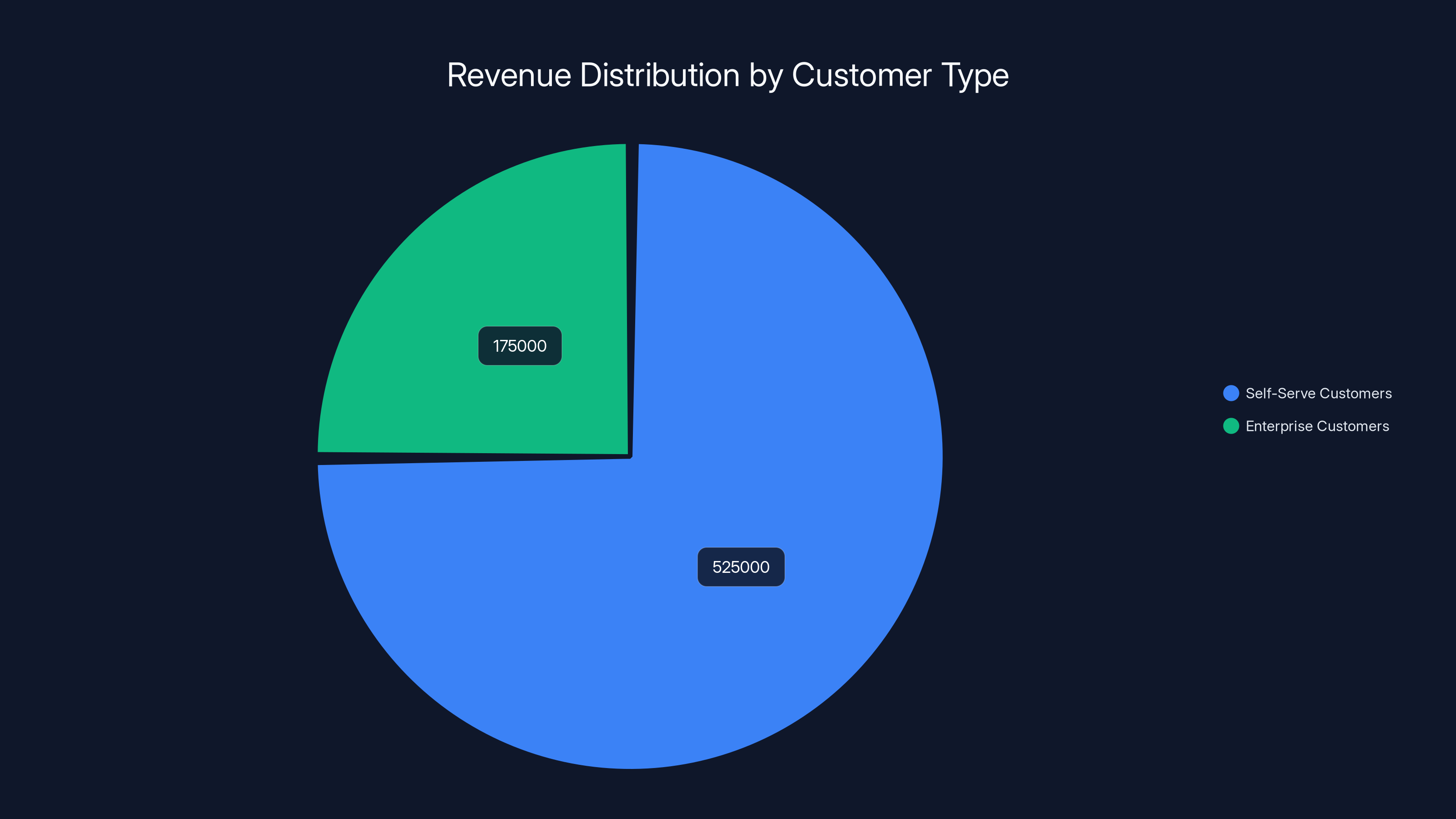

The company is now handling over 200,000 calls per day. Annual recurring revenue sits at the edge of $700,000. Growth is accelerating. Self-serve customers account for 75 percent of revenue. Enterprise deals are in pilot stages. The trajectory tells a clear story: voice orchestration is about to become table stakes for Indian businesses.

But Bolna isn't alone in this space. Competitors like Vapi, Live Kit, and Voice Run are building similar orchestration layers globally. The difference is focus. The difference is understanding India's idiosyncrasies so deeply that the product feels native, not imported.

In this guide, we'll break down what Bolna is actually doing, why the timing is perfect, how they're different from competitors, and what this funding round tells us about the future of voice AI in emerging markets.

TL; DR

- **Bolna raised 25K+ monthly revenue

- 75% of revenue comes from self-serve customers, proving Indian enterprises will pay for voice AI solutions despite early skepticism

- Processing 200K+ calls daily and approaching $700K ARR, with enterprise customers including Spinny and Snabbit showing market-wide demand

- Voice orchestration solves India-specific problems: noise cancellation, Truecaller verification, mixed-language handling, and region-specific features like speaking English numbers

- The market is finally ready: India's 1.4 billion people, low English fluency, and voice-first communication culture create massive TAM for localized voice AI solutions

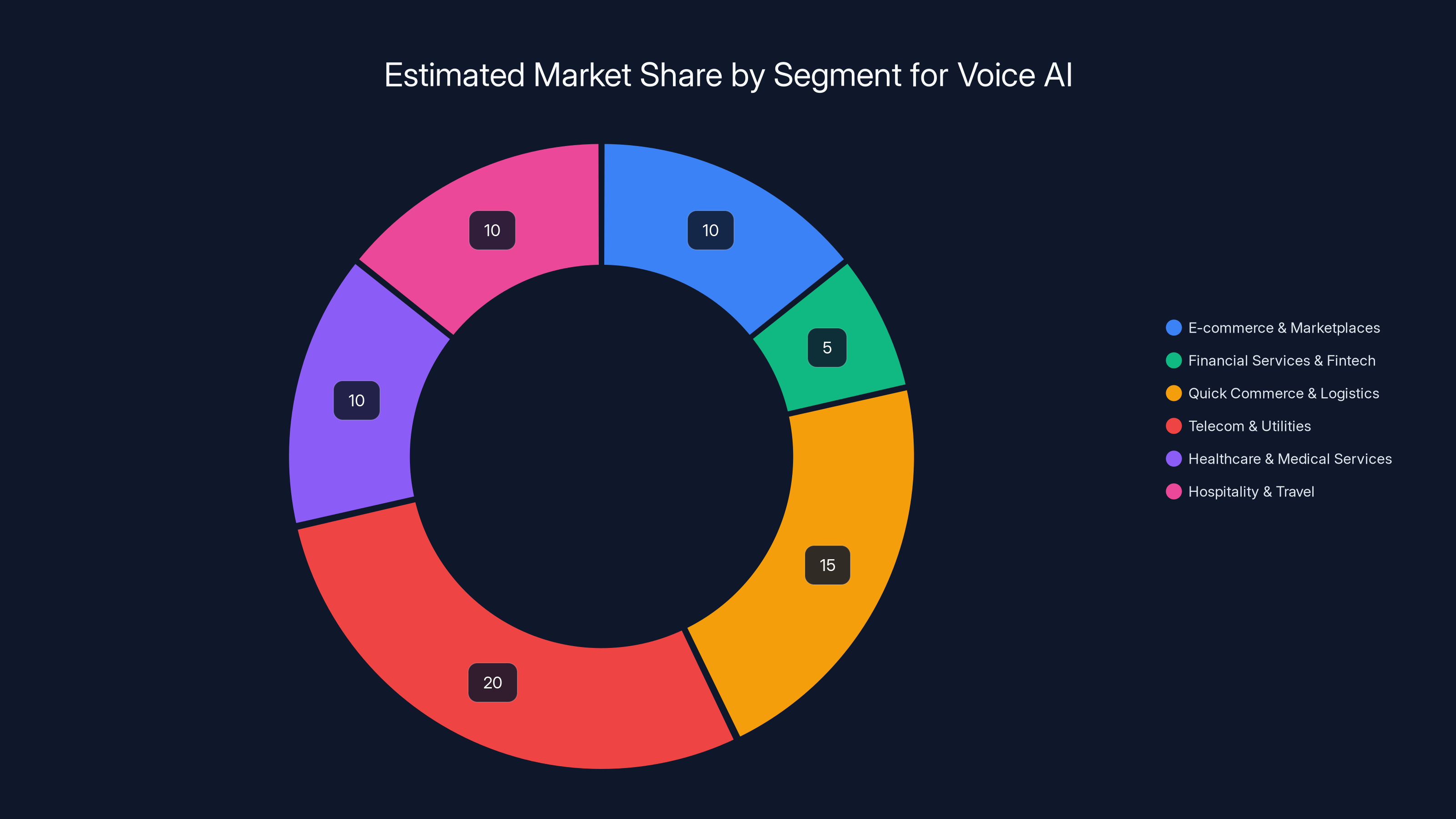

Estimated data shows Bolna's potential market share across sectors, with Telecom & Utilities having the largest opportunity at 20%. Estimated data.

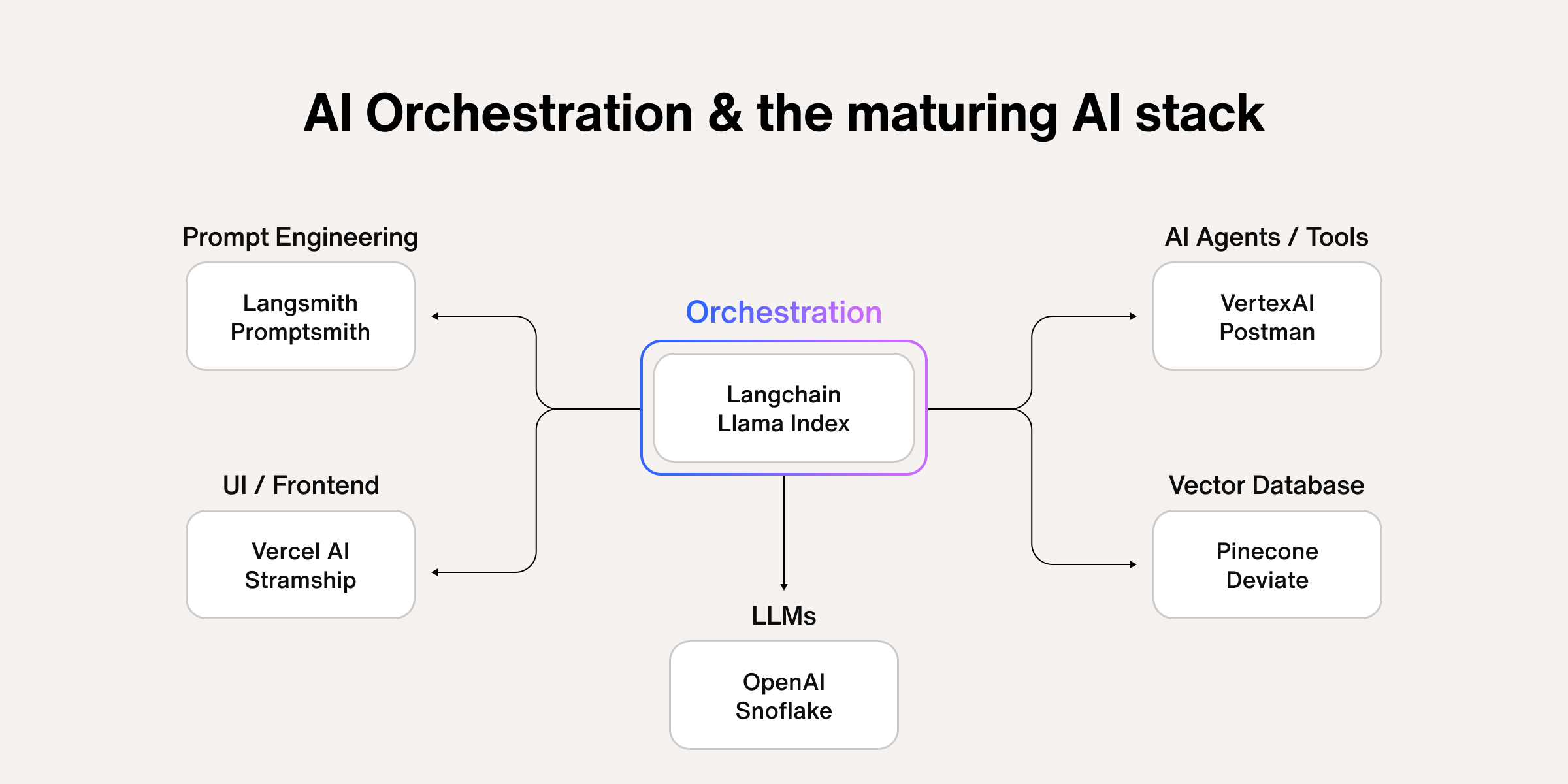

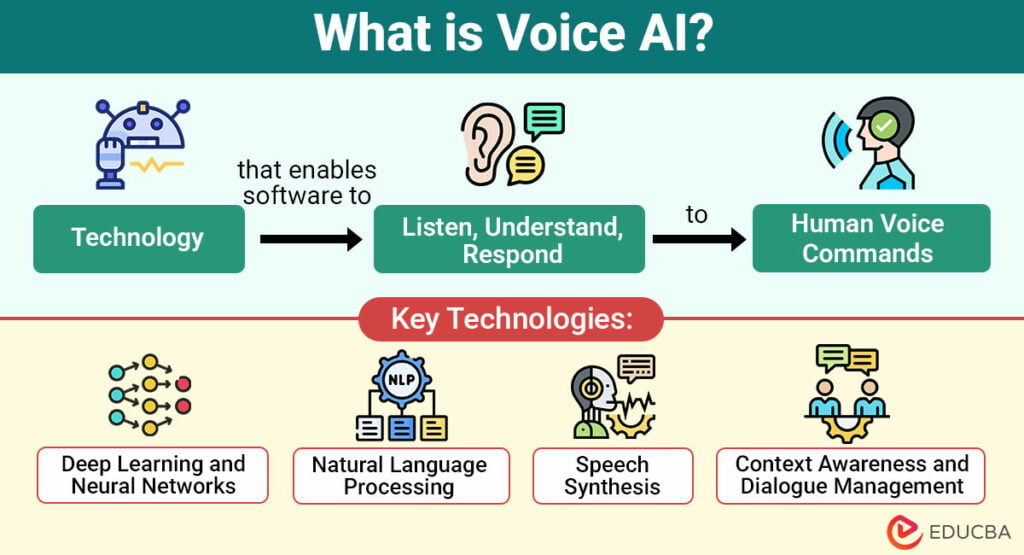

Understanding Voice Orchestration: The Missing Layer Between Voice Models and Applications

Before diving into Bolna's specifics, we need to understand what voice orchestration actually is. If you're not familiar with the term, you're not alone. It's relatively new, and the concept sits at an interesting intersection of voice AI infrastructure and application development.

Think of voice orchestration as the middleman layer. On one side, you have voice models. Companies like OpenAI, Google, and emerging Indian players have built excellent voice models. On the other side, you have businesses that need to deploy voice agents. Customer support teams. Sales departments. Recruitment functions. Training divisions.

The problem is the gap between these two sides.

Raw voice models are powerful but abstract. They don't understand the context of your business. They don't know your customer base's language preferences. They don't know that your business operates primarily in Mumbai with regional centers in Bangalore, Chennai, and Delhi. They don't know that your customers might code-switch between Hindi and English in a single sentence.

This is where orchestration comes in. It's a platform layer that sits between the voice model and your application. The orchestration layer handles all the messy, business-specific stuff: connecting different voice models, managing fallback logic when one model fails, applying business rules, integrating with your backend systems, handling language detection, managing context, and learning from interactions.

For a customer support application using orchestration, the flow might look like this:

- Call comes in from a customer in India

- Orchestration layer detects the incoming region and preferred language

- It routes the call to the appropriate voice model for that language and locale

- The voice model generates a response

- Orchestration layer applies your business rules (tone, specific phrases, escalation triggers)

- Response is delivered to the customer

- Conversation is logged and analyzed

- Insights are fed back into the system for improvement

Without orchestration, each business would need to build this stack themselves. With orchestration, you get a platform that handles the infrastructure while you focus on your business logic.

The genius of orchestration is flexibility. If a new voice model launches that's 20 percent better for Hindi conversations, you don't need to rebuild your entire voice agent. You flip a switch in orchestration and start using the new model. If you want to use Model A for Hindi and Model B for English to get the best quality in each language, orchestration lets you do that transparently.

This is why orchestration matters for India specifically. India isn't a single market with uniform language and cultural preferences. It's a federation of markets. Each region has different languages, different communication styles, different business practices. An orchestration layer built by people who understand this complexity is invaluable.

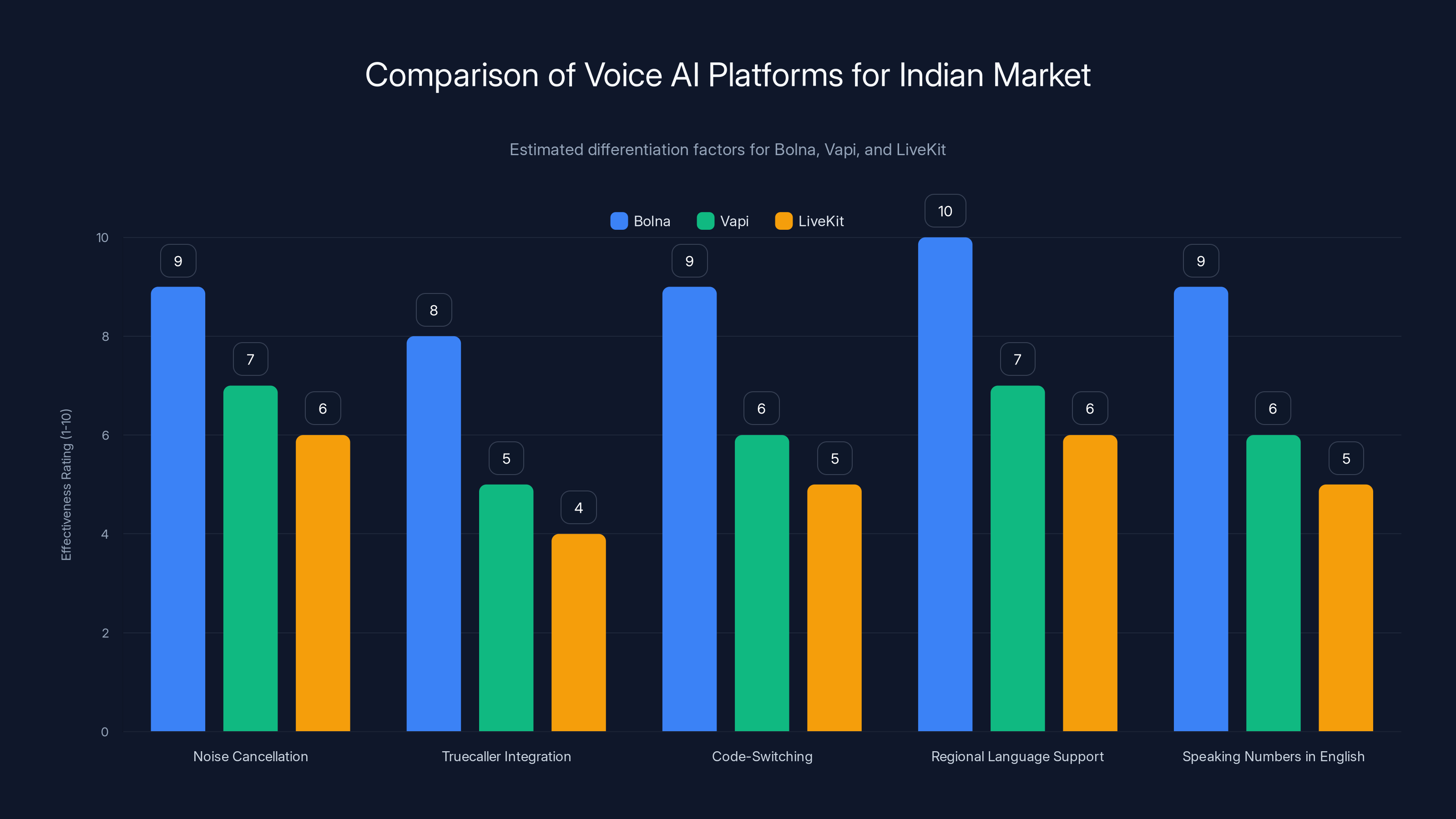

Bolna excels in features tailored for Indian enterprises, such as noise cancellation and regional language support, compared to competitors Vapi and LiveKit. Estimated data.

Why Y Combinator Was Wrong (And Why Bolna Proved It)

The rejection story is worth examining in detail because it reveals something fundamental about market timing and founder conviction.

When Bolna first applied to Y Combinator, the feedback was consistent: this won't work. Indian enterprises don't pay for software. Voice AI is too niche. The market doesn't exist.

This wasn't unique to Y Combinator. It's a common pattern in venture capital. Investors see a large market (India has 1.4 billion people), but they struggle to believe that market will adopt a specific solution at scale. The mental model is: "We understand enterprise software in the US. We don't understand enterprise software in India. Therefore, it probably doesn't exist."

But the founders kept building. They kept selling. And by the time they reapplied, they had proof: $25,000 in monthly recurring revenue.

Let's sit with that number for a moment. Twenty-five thousand dollars monthly. That's $300,000 annually from a handful of customers. With less than a year of real sales operations, without enterprise sales teams, without massive marketing budgets, just through understanding what Indian businesses actually need.

Y Combinator's investment committee saw that number and reconsidered. The market does exist. Enterprises will pay. These founders know something we don't.

Now, three to four months after joining the Y Combinator fall 2025 batch, the company is announcing a $6.3 million seed round. The velocity is remarkable. Most seed-stage companies take 6-12 months to raise after joining YC. Bolna did it in a quarter.

Why? Because the market is moving fast. Because enterprises see voice as critical infrastructure. Because they're already paying competitors for inferior solutions that aren't India-focused.

The lesson here is important: founder conviction plus real revenue plus emerging market timing equals venture attention. Bolna checked all three boxes.

The $6.3M Seed Round: Who's Betting on Bolna and Why

Let's break down the investors and what their participation signals about the market.

General Catalyst Leading the Round

General Catalyst isn't known for making impulsive bets. The firm has a thesis-driven approach. When they lead a seed round, it's because they've done diligence and believe in the founder, the market, and the timing.

Akarsh Shrivastava from General Catalyst's investment team explained the appeal clearly. The firm found three key things compelling about Bolna:

First: Flexibility at the infrastructure layer. General Catalyst understands that infrastructure that doesn't lock customers into a specific vendor wins long-term. Bolna lets enterprises choose any voice model. Switch models. Use different models for different regions. This flexibility is increasingly valuable as the voice AI landscape becomes more fragmented, with specialized models emerging for specific languages and use cases.

Second: Stack ownership. Enterprises increasingly want to own parts of their technology stack. They don't want to be fully dependent on a single provider. Bolna positions itself as the orchestration layer that gives enterprises control and flexibility, not as a black box that forces a specific approach.

Third: Long-term defensibility. An orchestration layer that understands local market needs better than global competitors is defensible. You can't easily replicate understanding of Indian enterprises, language nuances, regulatory requirements, and business practices. This gives Bolna a moat that's difficult to copy.

Y Combinator's Follow-On Investment

Y Combinator participating in the seed round is significant but also expected. When batch companies raise seed rounds, Y Combinator typically participates on a pro-rata basis. However, the fact that the company was accepted into YC at all is the real signal.

YC's founder-market fit bar is high. The committee saw something in Bolna that reminded them of companies like Stripe (which also had to overcome skepticism about international markets), Airbnb (which had to prove demand existed in non-obvious markets), and Twilio (which had to convince enterprises that communications infrastructure could be abstracted).

Strategic Angel Investors

The angel list is worth examining: Aarthi Ramamurthy, Arpan Sheth, Sriwatsan Krishnan, Ravi Iyer, and Taro Fukuyama.

These aren't random wealthy people. They're operators and investors who understand technology, India, and voice/AI specifically. Their presence signals that people with deep domain expertise believe in this team and market.

Taro Fukuyama, for example, has invested in companies at the intersection of voice and AI. Sriwatsan Krishnan understands India's technology landscape intimately. Their participation tells a story: this isn't a speculative bet, this is a high-conviction play from people who know the space.

Other Institutional Investors

Blume Ventures is India's first venture fund and understands the local market deeply. Orange Collective, Pioneer Fund, Transpose Capital, and Eight Capital all bring specific value: regional expertise, founder networks, technical depth, or operational support.

This diversified investor base is actually more impressive than a single mega-firm leading. It suggests conviction across multiple investment thesis and geographies.

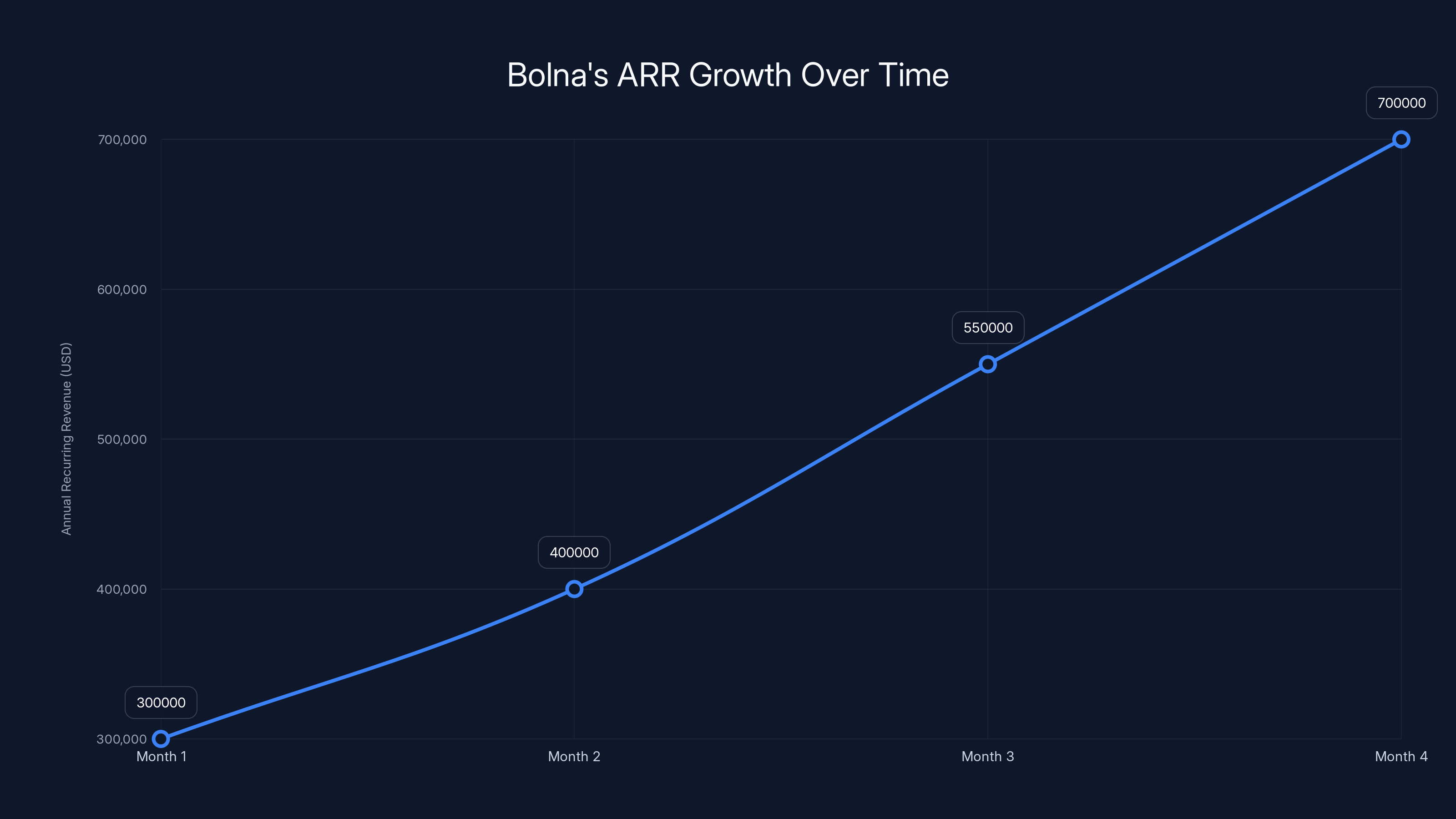

Bolna's ARR grew from

From 700K ARR: The Revenue Growth That Changed Everything

Let's talk numbers because numbers don't lie.

When Bolna applied to Y Combinator for the fall 2025 batch, they had $25,000 in monthly recurring revenue. That's the starting point for this story.

Fast forward a few months. The company has processed over 200,000 calls per day. Monthly call volume is now a multiple of what it was. Annual recurring revenue is approaching $700,000.

Sit with that trajectory for a moment. From

Here's what makes this especially impressive: 75 percent of that revenue is coming from self-serve customers. Not enterprise accounts with dedicated sales teams. Not managed services contracts. Self-serve.

This means Bolna built a product so intuitive, so valuable, and so native to Indian enterprise needs that businesses could discover it, onboard themselves, and start paying without human sales intervention.

The remaining 25 percent comes from enterprise deals. The company has signed two large enterprises as paying customers and has four more in the pilot stage. These enterprise customers are different animals. They need custom integrations, dedicated support, forward-deployed engineers embedded in their organizations.

Bolna has nine forward-deployed engineers and is adding two to three people to that team every month. This is the infrastructure of a company that's going from self-serve success to enterprise scalability.

The Economics of Voice Agents

Why are Indian enterprises willing to pay for voice agents? Let's think about the unit economics.

A human customer support agent in India costs between 12,000 and 20,000 Indian rupees monthly (roughly

A voice agent through Bolna, handling a portion of support volume, might cost

For small to midsize businesses, the math is simple: a voice agent can handle 30-40 percent of support volume (mostly routine queries, account lookups, scheduling), reducing your human headcount needs from five agents to three. That's

For larger enterprises, voice agents can handle 15-20 percent of volume but at massive scale. A company handling 100,000 support calls monthly can remove 15,000 to 20,000 calls from human queues. At

The ROI math works in India especially because human labor is abundant but voice AI alternatives are rare. Global voice solutions don't understand Hindi code-switching. They don't know to ask for Truecaller verification. They don't handle the background noise of Indian streets.

Bolna solves these problems. The ROI is immediate and measurable.

The Customer Base: Who's Actually Using Bolna

Let's look at who's adopting this platform. The customer base is revealing because it shows what types of businesses find voice agents most valuable.

Spinny: Automating Sales for Used Car E-Commerce

Spinny is a platform for buying and selling used cars. Car transactions are high-value, long-sales-cycle deals. The typical flow is: customer sees a car, calls to ask questions, schedules a test drive, negotiates price, completes purchase.

Traditionally, all of this happens through human sales agents. Spinny probably handles hundreds of inbound calls daily from interested buyers.

With Bolna, Spinny can deploy voice agents that handle initial qualifying calls. The agent asks: what budget range, what brand preference, what features matter? Based on the answers, the agent recommends specific vehicles and schedules test drives.

Human sales agents focus on hot leads that are already qualified and ready to buy. The voice agent handles the 70 percent of calls that don't convert immediately. The result: better conversion rates, shorter sales cycles, and reduced cost per acquisition.

Snabbit: Automating Help for House Help Services

Snabbit is an on-demand platform for household help. Think Uber but for house cleaning, laundry, repairs, and similar services.

Their call volume is massive and predictable. Customers call to:

- Request a cleaner for next Saturday

- Ask about pricing

- Report a problem with completed service

- Reschedule an appointment

These are routine, repeatable interactions. Perfect for voice agents.

Snabbit can deploy Bolna-powered agents that handle 80 percent of these calls. The business becomes more scalable because support costs don't grow linearly with customer growth.

Beverage Companies and Dating Apps

The customer list also includes beverage companies and dating apps. These are interesting because voice agents serve different functions:

For beverage companies: customer complaints about products, distribution inquiries, promotional offer details, retailer support lines.

For dating apps: customer support questions, subscription management, billing issues, content policy questions.

In each case, voice agents handle routine interactions at scale while humans focus on complex issues that need judgment, empathy, or creative problem-solving.

The Self-Serve Success Story

The fact that 75 percent of revenue comes from self-serve customers is crucial. It means small to midsize businesses discovered Bolna, figured out how to use it, and started paying without needing a human to walk them through the process.

This suggests the product is genuinely intuitive. The setup process is smooth. The onboarding experience works. The documentation is clear. The ability to define voice agents through natural language description, not complex configuration, is paying dividends.

This self-serve revenue is also more defensible. These customers have low switching costs if they're happy, and high switching costs if they're not. They've integrated Bolna into their operations. Switching would require rebuilding.

Deep localization and self-serve revenue are crucial for success in emerging markets, as shown by Bolna's experience. Estimated data based on narrative.

India-Specific Features: Why Generic Voice Solutions Won't Win Here

This is where Bolna's competitive moat becomes clear. The company has built features that make sense only if you deeply understand India.

Noise Cancellation for Indian Environments

Global voice solutions are built for office environments. Quiet backgrounds. Clear speech. Minimal interference.

India presents different challenges. Calls come from bustling streets with traffic. From markets with constant ambient noise. From homes where multiple people are talking simultaneously. From buses and trains.

Bolna's noise cancellation is tuned for these environments. It understands that Indian communication happens in noisy contexts and adjusts expectations and algorithms accordingly.

This seemingly simple feature is actually complex. It requires training data from Indian environments, understanding what matters in Indian speech, and calibrating the algorithm for Indian dialects and speech patterns.

Truecaller Verification Integration

Truecaller is India's phone directory. Over 400 million Indian users use Truecaller to identify incoming calls, check if a number is spam, and save contact information.

Bolna can integrate with Truecaller's API to verify caller identity before routing calls. This is valuable for:

- Customer support: confirming the person calling is actually a customer

- Telemarketing compliance: respecting Do Not Call registries

- Fraud prevention: blocking known spam numbers

- UX improvement: greeting customers by name

This integration matters in India because Truecaller is ubiquitous. Using Bolna without Truecaller would feel incomplete to Indian enterprises.

Mixed Language Handling

Code-switching isn't a bug, it's a feature of how Indians communicate. A single sentence might start in Hindi, switch to English for a technical term, then back to Hindi.

"Mera Wi Fi theek nahi hai, signal weak hai, kya kar sakta hoon?"

Translated loosely: "My Wi Fi isn't working, signal is weak, what can I do?"

Notice the mixing of Hindi nouns and English terms. This is normal Indian communication, especially around technical topics.

Global voice solutions treat code-switching as an error. They try to force the speaker into a single language. Bolna treats code-switching as expected behavior. The system understands the intent regardless of which language the speaker is using.

Speaking Numbers in English Regardless of Language

Here's a quirk of Indian communication: when discussing specific numbers (like phone numbers, account numbers, prices), Indians often switch to English numbers even when speaking in regional languages.

So an agent might say (in Hindi): "Aapka account number kya hai?"

And the customer responds with: "Nine-zero-two-four-five-three-two-one"

Mixing languages for numbers is so standard that Bolna has built specific handling for it. The system understands that numbers might come in English even during a primarily regional language conversation.

Keypad Input for Longer Information

Speaking account numbers, phone numbers, and other sensitive information to a voice system feels unnatural. Many Indian users prefer to input numbers using their phone keypad.

Bolna supports this seamlessly. The voice agent asks for account number. The customer presses digits on the phone keypad. The system processes the input and continues the conversation.

This small feature dramatically improves user comfort and reduces errors from misheard digits.

The Competitive Landscape: Vapi, Live Kit, Voice Run, and the Global Players

Bolna isn't building in a vacuum. Competitors exist. The question is: how does Bolna differentiate?

Vapi: The General-Purpose Voice Orchestration Platform

Vapi is building voice orchestration for a global market. The platform handles voice agents, voice applications, and voice infrastructure. It's well-funded, well-engineered, and growing quickly.

Vapi's strength is generality. It works everywhere. Its weakness is that it doesn't optimize for specific markets.

For Indian enterprises, Vapi feels foreign. The documentation assumes English-first thinking. The features are designed for English conversation. The support is time-zone shifted. The pricing assumes a global buyer.

Bolna optimizes for Indian enterprises specifically. Documentation in English but designed for Indian use cases. Features for Hindi, Tamil, Telugu, Marathi, Kannada. Support during Indian business hours. Pricing in Indian rupees with payment methods Indians prefer (UPI, bank transfers).

Live Kit: The Real-Time Communication Layer

Live Kit is building the infrastructure for real-time communication. Video, audio, data. The platform is powerful and flexible.

Live Kit's challenge is that it's lower-level infrastructure. Building voice agents on Live Kit requires significant engineering. Live Kit is for companies that want to build custom voice solutions, not for companies that want off-the-shelf voice agents.

Bolna is higher-level. Setup a voice agent by describing what you want. Define customer journeys. Connect to your backend systems. Done. No deep engineering required.

Voice Run: The Specialized Competitor

Voice Run is building voice orchestration specifically for specific use cases (like sales and support). The platform is specialized and focused.

Voice Run's limitation is geographic and linguistic. It's built for English-speaking markets primarily. Extending to other languages and regions requires significant effort.

Bolna starts from India-first thinking. This is its home market. Every feature, every decision, every integration reflects this understanding.

The Indian Players (Or Lack Thereof)

Interestingly, there aren't established Indian voice orchestration platforms at scale. Most Indian AI companies focus on B2B services, consulting, or custom development.

This is Bolna's opportunity. The first mover in a nascent market segment, with deep local understanding, is hard to displace.

75% of Bolna's $700K ARR comes from self-serve customers, highlighting the product's intuitive design and market fit. Estimated data.

The Product: How Users Actually Build Voice Agents on Bolna

Let's walk through what the product experience is like because this is where Bolna's advantage becomes tangible.

The Core Insight: Voice Agents Through Natural Language

Bolna's key insight is that building voice agents shouldn't require technical expertise. Business teams should be able to describe the agent they want, and the system builds it.

Traditional voice infrastructure makes you think in terms of: models, APIs, routing logic, state management, error handling.

Bolna makes you think in terms of: what do I want the agent to do, what questions should it ask, what responses should it give, where should it route different scenarios.

This shift is fundamental. It means any person with domain knowledge can build and iterate on voice agents without waiting for engineers.

The Workflow

-

Define the agent: Describe what the agent should do in plain English. "I want an agent that answers customer support questions about billing and shipping. If the customer is angry, escalate to a human."

-

Connect your backend: Integrate with your systems. Look up customer account information. Fetch order history. Check inventory. Process refunds.

-

Test and iterate: Test the agent with your own voice. Listen to responses. Adjust logic. Refine prompts. Test again.

-

Deploy: Route incoming calls to the agent. Monitor performance. Collect analytics. Iterate based on real interactions.

-

Optimize: Analyze which conversations worked, which failed, where customers got frustrated. Use insights to improve prompts, routing logic, and escalation rules.

This workflow is remarkably lean. A non-technical founder can do steps 1-3. Steps 4-5 involve engineering but are mostly operational, not developmental.

Real-Time Analytics and Iteration

Bolna provides analytics on every call. Which prompts were effective. Where customers got confused. Which voice model performed better for specific languages. How long typical conversations take.

This data-driven approach to voice agent improvement is powerful. You're not guessing what works. You're measuring what actually happens in production.

The Business Model: Usage-Based Pricing With Self-Serve and Enterprise Tiers

Bolna's pricing strategy reflects its market. Dual-track monetization for self-serve and enterprise.

Self-Serve Pricing: Usage-Based

The self-serve model is usage-based. You pay for calls processed. The exact pricing isn't publicly detailed in the funding announcement, but the pattern is clear: usage-based pricing aligns buyer and seller incentives.

For Bolna, it means revenue scales directly with value delivered. More calls means more customer value, which means Bolna gets paid more.

For customers, it means predictable costs. Handling 1,000 calls per day costs something. Handling 10,000 calls per day costs proportionally more. No surprise bills.

This is why piloting at

Enterprise Pricing: Value-Based

Enterprise deals are different. Bolna charges based on value. A large enterprise handling 1 million calls monthly pays differently than a startup handling 10,000 calls monthly, even though the underlying infrastructure cost might be similar.

Enterprise pricing also includes services: forward-deployed engineers, custom integrations, dedicated support, strategic consulting.

Bolna is hiring fast for this function (9 engineers with 2-3 additions monthly). This suggests enterprise deals are expanding and the company is building infrastructure to serve them.

The Key Metric: ARR Growth

Approaching

Assuming the $700,000 is real and current, the growth rate is roughly 230 percent annualized (if this happened over 3-4 months).

For context, venture-scale SaaS companies typically target 3-4x YoY growth. Bolna is exceeding this significantly, which explains the fast seed round timing.

Bolna places a high focus on both self-serve and enterprise models, with a slightly higher emphasis on enterprise due to hiring forward-deployed engineers. Estimated data.

Call Volume and Languages: The 200K Calls Per Day Milestone

Two hundred thousand calls per day is a remarkable milestone. Let's unpack what this means.

Call Volume Trajectory

Bolna started with a handful of customers on pilot programs. Now it's processing over 200,000 calls daily. That's 6 million calls per month. 72 million calls annually.

For context, this is production-scale volume. This is managing real, live customer conversations for real businesses. This isn't a test or beta. This is the core of the product working at meaningful scale.

What's especially notable is that this volume is distributed across multiple languages, multiple voice models, and multiple customer use cases. The platform is handling complexity at scale.

Language Distribution: 60-70% English/Hindi, Rising Regional

Approximately 60 to 70 percent of call volume is in English or Hindi. The remaining 30 to 40 percent is split across regional languages: Tamil, Telugu, Marathi, Kannada, and others.

What's important is the trend. Regional language volume is steadily rising. This makes sense as Indian enterprises expand beyond metropolitan areas into tier-two and tier-three cities where English fluency drops significantly.

It also suggests Bolna's product is becoming more valuable the broader it gets. As the platform improves Hindi support (reducing errors, improving naturalness), more customers shift conversations from English to Hindi. As Tamil support improves, Tamil-speaking regions adopt faster.

This creates a virtuous cycle. More volume in a language means more data for improving that language model. Better language models mean better customer experience. Better experience means faster adoption.

Technical Implications of Scale

Handling 200,000 calls per day at reasonable latency requires serious infrastructure:

- Distributed voice model inference (probably across multiple regions)

- Real-time speech-to-text processing

- Language detection and routing

- Context management and conversation state

- Integration with customer backends (APIs, databases, third-party services)

- Monitoring, alerting, and observability

- Disaster recovery and failover

This level of scale suggests Bolna's engineering is well-constructed. You can't accidentally build something that handles 200,000 calls daily. It requires thoughtful architecture, rigorous testing, and strong operations.

The Funding Round's Signaling Effects: What This Means for the Market

A $6.3 million seed round for a voice AI company signals several things about market dynamics and investor sentiment.

Signal 1: Voice AI in India Is Fundable

Just one year ago, Y Combinator rejected Bolna five times because investors were skeptical that Indian enterprises would pay for voice AI. Now, multiple tier-one investors are betting $6.3 million that they will.

This signals a shift in how investors think about India's technology market. It's not just about outsourcing. It's not just about IT services. It's about companies building and selling software solutions for Indian enterprises and Indian use cases.

Signal 2: Founder Conviction Plus Early Revenue Is Compelling

Bolna's path to funding—rejection, then proof of traction, then acceptance, then rapid seed round—shows that founder conviction plus early revenue wins funding decisions.

Bolna's founders didn't pivot when rejected. They kept building. They proved their thesis was right by generating revenue. This conviction plus proof is irresistible to investors.

Signal 3: Infrastructure Investments in Emerging Markets Are Back

The investor list includes infrastructure-focused firms (General Catalyst has deep infrastructure expertise), not just India specialists. This suggests investors see voice orchestration as core infrastructure, not a niche application.

This matters because infrastructure investments have different risk/reward profiles than application investments. If Bolna is being treated as infrastructure, the exit expectations (and therefore company growth expectations) are higher.

Signal 4: Specialized Platforms Beat Generic Platforms

Bolna is winning against more generic voice AI platforms (Vapi, Live Kit) by specializing on India. This signals that investors believe specialized platforms optimized for specific markets beat generalized platforms for most markets.

This is important because it suggests a future where many voice orchestration platforms exist, each optimized for different regions and use cases, rather than a single winner-take-all global platform.

Operational Challenges: Forward-Deployed Engineers and Enterprise Sales

The seed round is just the beginning. Real challenges lie ahead.

The Self-Serve vs. Enterprise Balance

Bolna is operating a dual-track business: high-margin self-serve plus high-ACV enterprise. This is actually harder than focusing on one.

Self-serve requires:

- Intuitive product

- Excellent documentation

- Responsive customer support

- Product-led growth

Enterprise requires:

- Solutions engineering

- Custom integrations

- Dedicated account management

- Forward-deployed engineers

Optimizing for both means treating each as distinct rather than trying to sell one as a scaled version of the other. Bolna's hiring of forward-deployed engineers (9 now, adding 2-3 monthly) shows they're taking enterprise seriously.

But there's a risk: enterprise services can become a distraction from product development. If the team spends too much time on custom integrations, product progress slows. If product slows, self-serve growth suffers.

Bolna will need to be disciplined about which enterprise requests become features versus custom implementations.

Scaling Engineering for Growth

With 200,000 calls per day and ambitions to scale 10x, the engineering team needs to grow significantly. Building infrastructure that handles that much volume, supports that many languages, and operates at that reliability level requires serious engineering.

There's a risk of over-hiring (which wastes capital and creates culture problems) or under-hiring (which creates bottlenecks and reliability issues). Bolna has $6.3 million in funding, which should provide runway to hire and scale thoughtfully.

Language Model Evolution

Voice models are improving rapidly. New models emerge frequently. A model that's state-of-the-art today might be obsolete in 12 months.

Bolna's architectural advantage is supporting model switching easily. But the company still needs to constantly evaluate new models, test them, and help customers understand when to upgrade.

This requires dedicated ML engineering resources and a process for continual evaluation and rollout.

The Market Opportunity: TAM and Long-Term Potential

Let's estimate the addressable market.

Bottom-Up: From Customer Segments

Consider addressable segments:

E-commerce and Marketplaces: Thousands of Indian e-commerce companies and marketplaces. Average inbound call volume: 1,000 to 10,000 daily. Voice agents could handle 20-30% of volume. If Bolna captures 10% of this segment, that's significant revenue.

Financial Services and Fintech: Banks, insurance companies, and fintech startups. Inbound call volume is massive (100,000+ calls daily for major banks). Even capturing 5% of this market is huge.

Quick Commerce and Logistics: Companies like Blinkit, Dunzo, and countless logistics companies handle thousands of customer inquiries daily. Voice agents could handle most routine queries.

Telecom and Utilities: Massive call volumes. Automation opportunity is enormous.

Healthcare and Medical Services: Appointment scheduling, prescription refills, patient support. Growing segment.

Hospitality and Travel: Hotels, travel booking platforms, tour operators. Seasonal demand spikes make voice agents especially valuable.

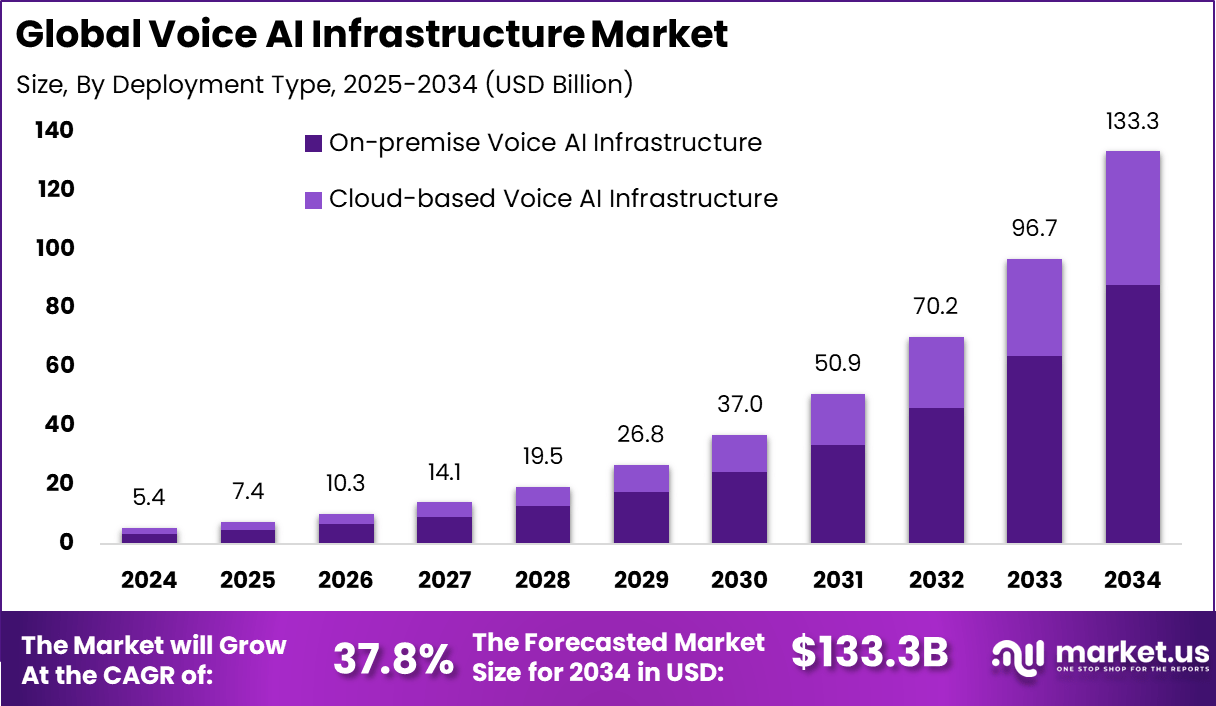

Top-Down: From Industry Reports

Various reports suggest India's enterprise software market is growing 20-30% annually. Voice AI specifically is growing faster (40-50%) as businesses recognize value.

If voice AI represents 5% of the total enterprise software spend in India (a conservative estimate), that's billions of dollars in addressable market.

Conservative TAM Estimate

Thinking conservatively:

- 50,000 Indian enterprises that could benefit from voice agents

- Average spend of 1,000 and large enterprises at $50,000+)

- Total addressable market: $250 million

This is enormous for a startup at $700K ARR. Bolna is capturing less than 1% of even this conservative TAM.

Market Catalysts for Growth

Several trends could accelerate market adoption:

-

Regulatory tailwinds: Indian regulations around telecom quality and customer support requirements could drive adoption of voice agents as compliant solutions.

-

Infrastructure improvements: As 5G and fiber coverage expands, voice call quality improves, making voice agents more reliable.

-

Model improvements: As voice models improve, accuracy increases and cost decreases, improving the ROI calculation.

-

Global parent company adoption: As multinationals operating in India adopt voice agents, Indian homegrown companies follow.

-

Developer tooling improvement: As it gets easier to build and deploy voice agents, more companies try and more stick.

Future of Voice Orchestration: Where the Market Is Heading

Bolna is executing well in the current market, but what's next?

Consolidation Around Orchestration Layers

The market will likely consolidate around orchestration platforms rather than voice model providers. This is because:

- Voice models are becoming commodities (OpenAI, Google, and specialized providers compete intensely)

- Orchestration is where the value lies (connecting, routing, optimizing, managing)

- Enterprises want flexibility, not lock-in

Bolna is positioned well for this consolidation. The company is building the layer that allows enterprises to be agnostic about voice models, language, and specific implementations.

Expansion Beyond Voice

Eventually, Bolna might expand beyond voice. Orchestration logic applies to text, video, and multimodal interactions too. A single platform managing customer interactions across voice, chat, video, and other modalities makes sense.

But this is a multi-year expansion. First, dominate voice. Then, add other channels.

Integration Into Broader Communication Platforms

Communication platforms (Twilio, Vonage, etc.) will want to integrate voice agent orchestration. Bolna could become part of the communication platform stack.

Alternatively, Bolna remains independent, selling to enterprises directly while also integrating with larger platforms.

Vertical-Specific Solutions

Eventually, companies might build voice orchestration platforms for specific verticals (e-commerce, fintech, telecom). These would be pre-configured, tuned, and optimized for specific use cases.

Bolna's horizontal platform is flexible and universal. Vertical solutions would be faster to deploy but less flexible.

The market probably has room for both: Bolna as the horizontal platform, and vertical-specific solutions built on top of orchestration.

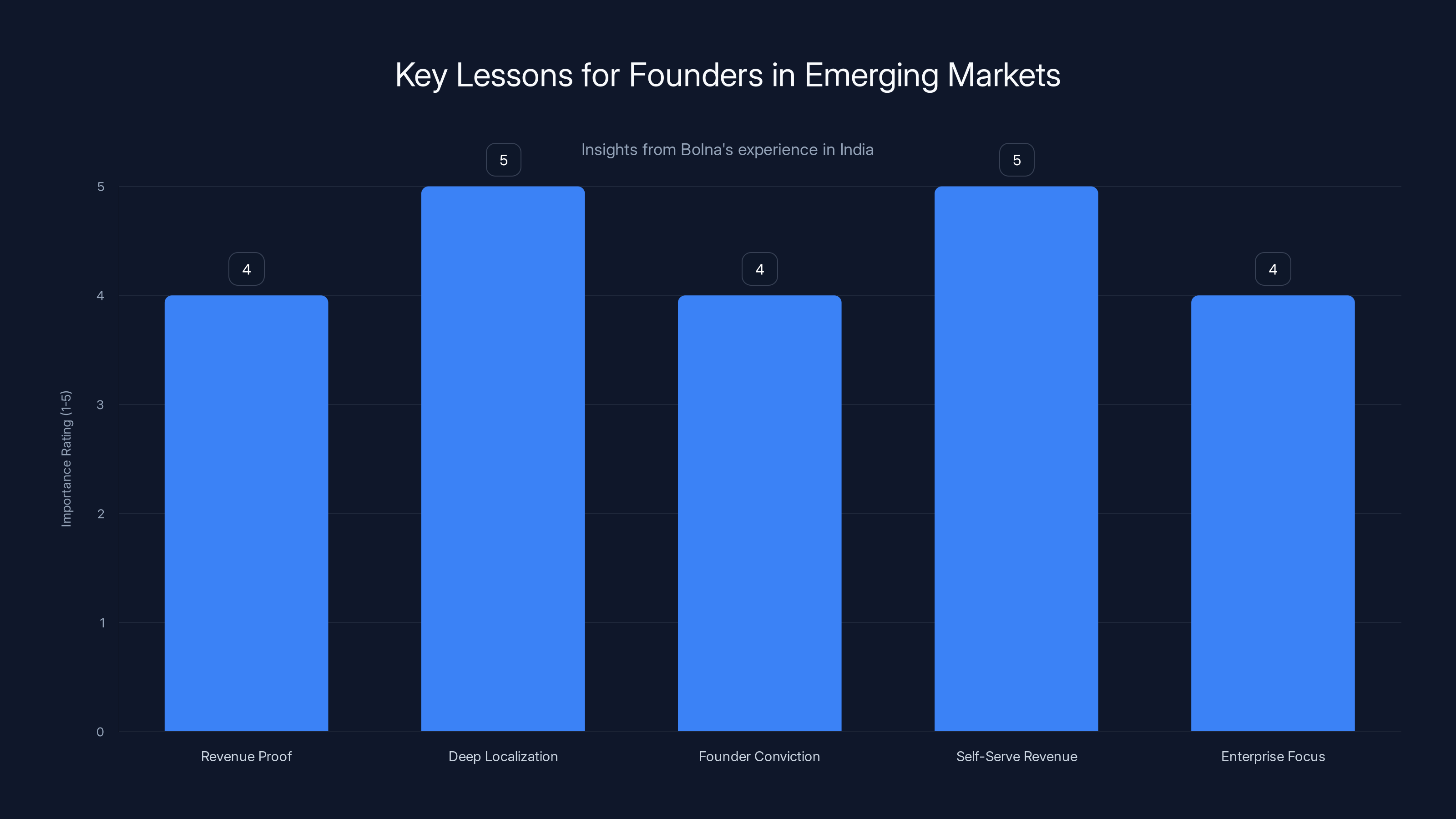

Lessons for Founders Building in Emerging Markets

Bolna's story offers lessons for founders building technology for India and other emerging markets.

Lesson 1: Revenue Proof Beats Market Size Arguments

Bolna couldn't convince investors with arguments about India's market size. But $25K monthly revenue in a market that's supposed to not pay? That was convincing.

If you're building for an emerging market and facing investor skepticism, focus on proving revenue early. That's more valuable than TAM estimates or market reports.

Lesson 2: Deep Localization Creates Defensible Advantages

Bolna's features for Indian enterprises (noise cancellation, Truecaller integration, code-switching, regional languages) aren't rocket science individually. Together, they create a product that local enterprises prefer.

Generic global solutions can never match this level of localization. Building defensible advantage means building for the specific market you serve, not building globally then adapting.

Lesson 3: Founder Conviction Matters When Rejected

Rejected five times by Y Combinator. Rejected by investors who said the market doesn't exist. Yet the founders kept building.

This conviction, combined with evidence that proves the skeptics wrong, creates an incredibly compelling story. Investors respond to founders who believe in their idea and validate that belief with traction.

Lesson 4: Self-Serve Revenue Is a Signal

75% of Bolna's revenue coming from self-serve customers means:

- The product is genuinely useful

- The onboarding works

- The pricing is acceptable

- Customers can implement without external support

Self-serve revenue is more profitable and more defensible than sales-heavy revenue. Building a product that customers want to use without heavy selling is harder but more valuable.

Lesson 5: Enterprise Doesn't Mean Abandoning Product

Bolna is pursuing enterprise deals (high ACV, dedicated support) while maintaining self-serve (efficient scaling). Many companies abandon self-serve when pursuing enterprise.

Bolna is treating them as complementary. Self-serve customers pay less but are numerous and predictable. Enterprise customers pay more but require service. Together, they create a stable, growing business.

Potential Risks and Challenges Ahead

Bolna faces real challenges that could limit growth or require pivots.

Risk 1: Model Commoditization

If voice models become so good and so cheap that anyone can build voice agents, Bolna's value proposition weakens. The company would need to differentiate on something else (integrations, analytics, specific use cases).

Mitigation: Keep investing in product experience, not just infrastructure. Make it so easy to build and optimize voice agents that even if models commoditize, Bolna still wins.

Risk 2: Global Competitors Getting Serious About India

Vapi and other global orchestration platforms could hire India expertise, build localized features, and compete directly. They have more capital, more name recognition, and more resources.

Mitigation: Use the first-mover advantage now to build such a strong product and community that switching is painful even if competitors improve. Build network effects (communities, templates, integrations) that increase lock-in.

Risk 3: Enterprise Sales Consuming Too Much Capital

Enterprise deals are high-margin in theory but require significant upfront investment (engineering, services, sales). If these deals don't materialize at the expected rate, Bolna burns capital without corresponding revenue growth.

Mitigation: Carefully measure CAC (customer acquisition cost) and LTV (lifetime value) for enterprise deals. Be willing to walk away from deals that don't meet financial hurdles, even if they're prestigious customers.

Risk 4: Voice AI Becoming Hypercompetitive

As the market proves out, every major technology company (Google, Amazon, Microsoft) will build voice orchestration platforms. These companies have distribution, capital, and resources Bolna can't match.

Mitigation: Build a business that's so embedded in Indian enterprises' operations that even big competitors have a hard time displacing. Focus on customer happiness, not just feature parity.

Conclusion: Voice AI Is India's Next Frontier

Bolna's $6.3 million seed round marks a turning point. Voice AI is no longer a niche experiment for India. It's becoming core infrastructure.

The journey from five Y Combinator rejections to a

But this is just the beginning. Bolna is operating in a market that's barely begun to recognize voice AI's potential. The company is handling under 1% of the addressable market. Growth runway is enormous.

What makes Bolna interesting beyond the funding news is what it signals about technology adoption in India. For years, India was perceived as a market for IT services and outsourcing. Enterprises in India would buy software built in Silicon Valley.

Bolna flips this. It's an Indian startup building sophisticated AI infrastructure for Indian enterprises because it understands Indian problems better than anyone else. This is the future of technology in emerging markets: not adoption of foreign solutions, but building local solutions for local needs.

Voice is particularly suited for this because voice is cultural. Communication norms, languages, dialects, and interaction styles are deeply local. A global voice orchestration platform can never match an India-focused platform's understanding of how Indians communicate.

The next chapter for Bolna is scaling this understanding to hundreds of thousands of enterprises. The company needs to maintain product quality while expanding self-serve, scale enterprise sales without compromising margins, and keep up with rapid voice AI model improvements.

If Bolna executes on these challenges, it could become the defining voice infrastructure company for India and potentially for other emerging markets that face similar language, cultural, and communication challenges.

The $6.3 million seed round gives them the runway to prove it. Now comes the hard part.

FAQ

What is voice orchestration and why does it matter for India?

Voice orchestration is a platform layer that sits between voice AI models and applications. It handles routing between different models, managing conversation context, applying business rules, integrating with backend systems, and optimizing based on performance. It matters for India because Indian enterprises communicate primarily through voice, operate in diverse language environments, and need solutions tailored to local nuances that global platforms don't address.

How does Bolna's platform differentiate from competitors like Vapi or Live Kit?

Bolna specializes in India-specific requirements that global platforms don't prioritize. The company's differentiators include noise cancellation tuned for Indian environments, Truecaller verification integration, mixed-language (code-switching) handling, regional language support, and features like speaking numbers in English mid-conversation. The product is designed from the ground up for how Indian enterprises communicate, not as a global platform adapted for India.

What does the 75% self-serve revenue figure actually mean for Bolna's business model?

Seventy-five percent self-serve revenue means most customers discover the platform, onboard themselves, and start paying without needing a human sales interaction. This indicates exceptional product-market fit and low customer acquisition costs. Self-serve revenue is more profitable and predictable than enterprise sales revenue, making it a stronger foundation for growth. The remaining 25% from enterprise deals provides higher average customer value and revenue diversification.

How does the company actually make money from voice calls if processing costs are so high?

Bolna doesn't get paid per call processed. The company charges usage-based fees (likely per call or per minute), similar to Twilio or other communication platforms. The key is that enterprises achieve ROI despite the fees because voice agents reduce the need for human support staff. A company handling 100,000 support calls monthly can reduce human headcount from five agents to three agents (a

Why didn't Indian investors fund voice AI companies earlier if the market is so obvious?

Investors, especially in India, were skeptical that Indian enterprises would pay for software solutions because enterprise software adoption has historically been lower in India than in developed markets. Additionally, voice AI is a relatively new technology, and early investors were uncertain whether the technology was mature enough for production use. Bolna proved both points wrong by generating revenue before raising capital, validating the business model before seeking large investment rounds.

What percentage of customer support calls can actually be handled by voice agents like Bolna's?

Most analyses suggest voice agents can handle 20-40% of routine support calls (password resets, account lookups, billing questions, simple troubleshooting). Complex issues requiring judgment, escalations, or specialized knowledge still need human agents. The benefit is that human agents can focus on high-value interactions while voice agents handle high-volume routine work, improving overall support efficiency and reducing costs per call handled.

How does Bolna handle the rapid evolution of voice AI models?

Bolna's orchestration layer architecture specifically enables flexibility regarding model selection. When a new voice model emerges that performs better for a specific language or use case, Bolna can integrate it and customers can switch with minimal effort. This is harder for vertically integrated voice platforms that depend on a single model provider. Bolna's architecture makes the company less vulnerable to specific model commoditization or deprecation.

Is there risk that big tech companies like Google or Microsoft will build competing platforms?

Yes. Large technology companies could build voice orchestration platforms for India. However, Bolna has several structural advantages: first-mover timing means enterprise relationships are established, deep Indian market understanding that takes time to replicate, and the ability to move faster than large bureaucratic organizations. The most likely scenario is that Bolna gets acquired by a larger company rather than crushed by competition from them.

How much funding will Bolna likely need to reach scale?

Assuming the company wants to reach

What are the biggest operational challenges Bolna faces in the next 18 months?

The biggest challenges are: maintaining self-serve growth while building enterprise sales infrastructure, scaling engineering fast enough to support 10x call volume growth without sacrificing reliability, staying current with voice model improvements and new models entering the market, maintaining quality as the team grows rapidly, and managing the balance between product development and services delivery for enterprise customers. Any of these could become a bottleneck if not managed carefully.

Key Takeaways

- Bolna's journey from five Y Combinator rejections to a $6.3M seed round from General Catalyst demonstrates how early revenue proof trumps market size arguments in venture funding decisions

- With 75% of revenue from self-serve customers and approaching $700K ARR, the company has achieved remarkable product-market fit without heavy sales infrastructure

- Processing over 200,000 calls daily across multiple languages proves the core technology works at production scale while serving a real, paying customer base

- Deep localization for Indian markets (noise cancellation, Truecaller integration, code-switching, regional languages) creates defensible advantages against global competitors

- The $6.3M seed round signals investor belief that voice AI in emerging markets is a fundable, scalable business category worthy of significant capital

Related Articles

- VoiceRun's $5.5M Funding: Building the Voice Agent Factory [2025]

- How BYD Beat Tesla: The EV Revolution [2025]

- Niko Bonatsos Launches New VC Firm After 15 Years at General Catalyst [2025]

- How Arya.ag Stays Profitable While Commodity Prices Fall [2025]

- Best Free CRM Software 2026: Complete Guide & Alternatives

![Voice Orchestration in India: How Bolna's $6.3M Seed Round Is Reshaping AI Voice Tech [2025]](https://tryrunable.com/blog/voice-orchestration-in-india-how-bolna-s-6-3m-seed-round-is-/image-1-1768963059555.jpg)