Whats App's Third-Party Chatbot Restrictions: A Global Regulatory Battleground

In January 2026, Meta's Whats App implemented a sweeping policy that fundamentally altered the landscape of artificial intelligence integration within one of the world's most widely used messaging platforms. The company announced restrictions on third-party, general-purpose chatbots—services like Open AI's Chat GPT and Elon Musk's Grok—that were being offered to users through the Whats App Business API. This decision represented a significant shift in how the platform intended to manage artificial intelligence applications, prioritizing infrastructure stability and user experience over the open ecosystem that had previously characterized Whats App's developer platform.

What makes this policy particularly noteworthy is not merely the restriction itself, but rather the immediate resistance it faced from regulatory authorities across multiple jurisdictions. Within days of implementation, Whats App found itself forced to make strategic concessions to comply with competitive investigation requirements in Brazil and Italy, two major markets representing hundreds of millions of active users. These exemptions reveal the growing tension between a private company's infrastructure management decisions and increasingly assertive competition authorities that view such restrictions as potentially anticompetitive.

The situation has become a critical case study in how global technology companies navigate the complex intersection of technical limitations, business strategy, competitive concerns, and regulatory oversight. As artificial intelligence becomes increasingly integrated into consumer communication platforms, the Whats App chatbot restrictions serve as a bellwether for how regulators worldwide will approach platform gatekeeping decisions that could affect the AI ecosystem.

This comprehensive analysis examines the policy's technical rationale, regional variations, competitive implications, and what these developments mean for AI providers, developers, and users across different markets. The story of Whats App's chatbot ban reveals fundamental questions about platform responsibilities, competitive fairness, and the future of AI accessibility in digital communications.

The Original Whats App Chatbot Policy: Technical Rationale and Implementation

What Changed and Why

On January 15, 2026, Whats App formally launched its policy restricting third-party, general-purpose chatbots from operating on its platform via the Business API. The company's public rationale centered on technical infrastructure limitations. According to Meta's official position, the emergence of AI chatbots on the Business API had created unexpected strain on systems that were originally designed for different use cases—primarily business-to-consumer customer service communications, appointment scheduling, and order management.

The technical argument presented by Whats App's leadership emphasized that the platform's infrastructure had reached capacity constraints when faced with the volume and complexity of queries that general-purpose AI chatbots were generating. Unlike traditional business bots that operate within defined parameters—responding to specific customer service inquiries, handling returns, or processing reservations—general-purpose chatbots like Chat GPT accept open-ended queries on virtually any topic. This architectural difference means that the computational load, response time requirements, and server resource allocation differ dramatically between the two application categories.

Meta's infrastructure engineers likely identified issues with response latency, system stability, and resource allocation efficiency when processing the diverse query types that general-purpose AI models require. The company also suggested that the proliferation of these chatbots might compromise the quality of service for legitimate business users relying on Whats App for critical customer interactions. This technical rationale formed the cornerstone of Meta's defense against subsequent regulatory challenges.

The 90-Day Grace Period Framework

Rather than implementing an immediate shutdown, Whats App provided what it termed a "grace period" beginning January 15, 2026, and extending 90 days into the future. During this window, AI providers and developers were required to undertake specific actions: cease responding to user queries on the chat application and implement company-approved auto-reply language notifying users that their chatbots would no longer function on Whats App.

This phased approach represented a pragmatic recognition that abruptly disconnecting potentially millions of active chatbot interactions could create significant disruption. The 90-day timeline presumably allowed developers adequate time to transition users to alternative platforms, update their documentation, and communicate the changes through their own channels. For many small and mid-sized AI startups that had built user communities within Whats App, this grace period was essential for implementing alternative monetization and distribution strategies.

The auto-reply requirement served multiple purposes: it protected user experience by preventing customers from receiving error messages or no responses, maintained transparency by clearly communicating why services had changed, and created an audit trail demonstrating compliance that regulatory authorities could verify. However, this requirement itself became a point of contention in regulatory investigations, as authorities questioned whether the specific language Meta required for these notifications might unduly bias users toward Whats App's own AI offerings.

Scope: What Was and Wasn't Restricted

A critical distinction that often became lost in initial reporting was what the policy actually prohibited. The restrictions applied exclusively to third-party, general-purpose chatbots—services designed to answer questions on a wide range of topics through the Whats App Business API interface. The policy did not restrict business customer service bots, even those powered by artificial intelligence, as long as they operated within specialized parameters.

Companies could continue deploying AI-powered systems within Whats App that handled customer support inquiries, appointment scheduling, FAQ responses, order tracking, and other business-specific functions. A bank's AI-powered customer service chatbot answering questions about account balances, transfers, and product options would remain fully operational. A clothing retailer's conversational commerce bot helping customers find items and complete purchases would continue functioning. The restrictions targeted only the subset of applications built around open-ended, conversational AI models.

This distinction carried important implications for the broader ecosystem. While services like Chat GPT, Claude, Grok, and similar general-purpose models faced removal, thousands of enterprise AI applications embedded within Whats App for legitimate business purposes would remain unaffected. Nevertheless, this nuance was frequently overlooked in headlines and regulatory discussions, leading to broader claims about Whats App "banning chatbots" that oversimplified the actual scope of restrictions.

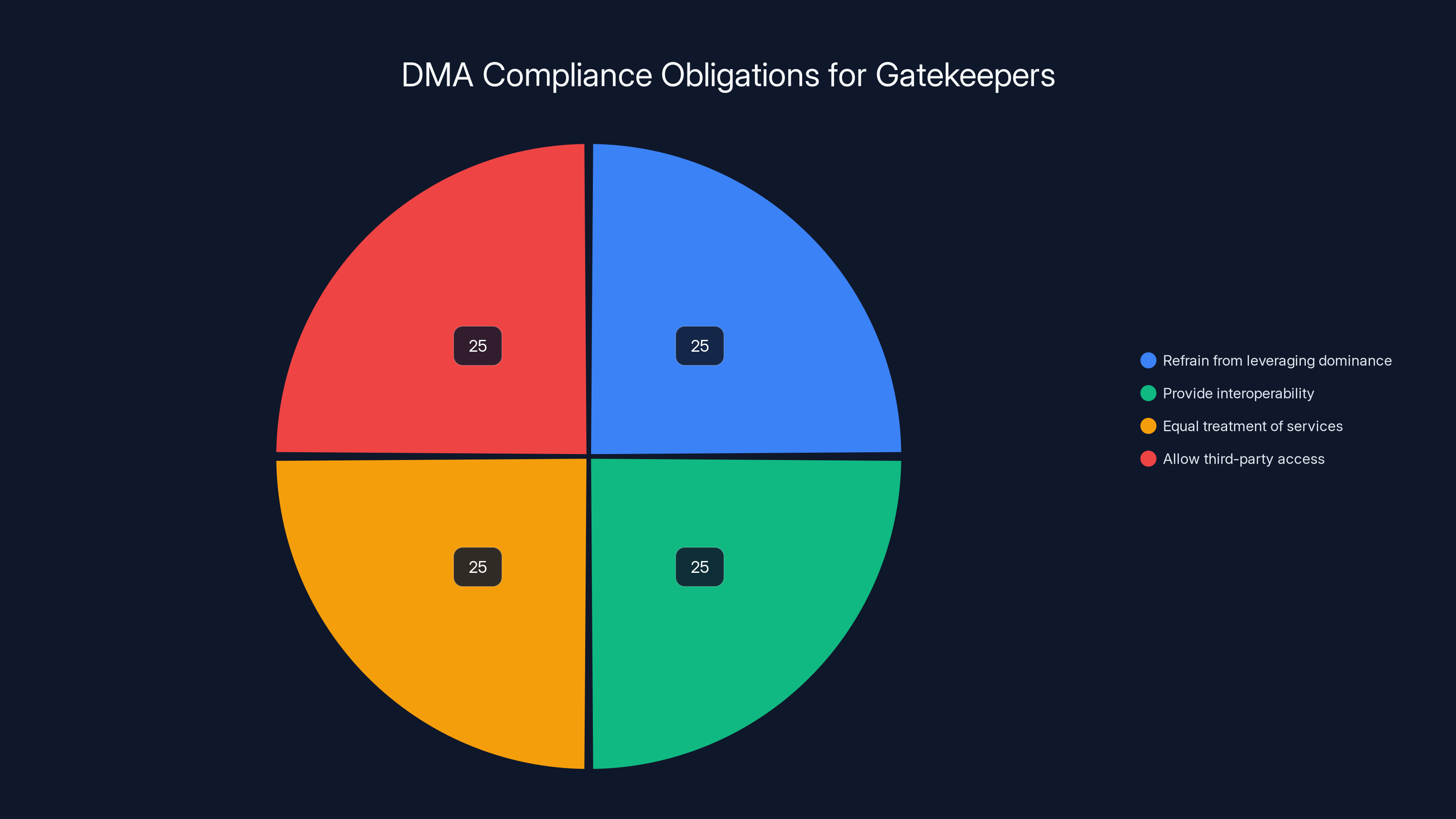

The Digital Markets Act imposes equal obligations on gatekeepers to ensure fair competition and prevent market dominance abuse. Each obligation carries significant weight in maintaining a balanced digital market.

Brazil's Competition Authority Intervention: CADE's Swift Response

The Regulatory Action That Changed Everything

Brazil's competition authority, formally known as the Administrative Council for Economic Defense (Conselho Administrativo de Defesa Econômica, or CADE), responded to Whats App's new policy with remarkable speed and decisiveness. Within days of the policy's implementation, CADE issued an order requiring Meta to suspend the restriction on third-party chatbots, pending investigation into whether the policy constituted anticompetitive conduct. This was not merely a warning letter or a request for information—it was a binding directive with immediate legal force.

CADE's intervention raised several critical concerns. The Brazilian authority suggested that Meta's rationale about infrastructure limitations and system strain appeared "fundamentally flawed," as Brazil's competition agency phrased it in official correspondence. More significantly, CADE opened a formal antitrust investigation to examine whether the policy was specifically designed to exclude competitors from the Whats App ecosystem and artificially advantage Meta's own AI offerings—a sophisticated AI system integrated into Whats App that competes directly with the restricted third-party services.

The investigation focused on competitive effects. If Meta had determined that its infrastructure couldn't support general-purpose chatbots, why could it simultaneously support its own Whats App-integrated AI? If the technical limitations were genuine and universal, they should apply equally to Meta's own offerings. If they applied selectively, this suggested the restrictions might be motivated more by competitive strategy than technical necessity. CADE's skepticism reflected a sophisticated understanding of how technology companies sometimes employ technical arguments to justify commercially beneficial restrictions.

Brazil's Market Significance

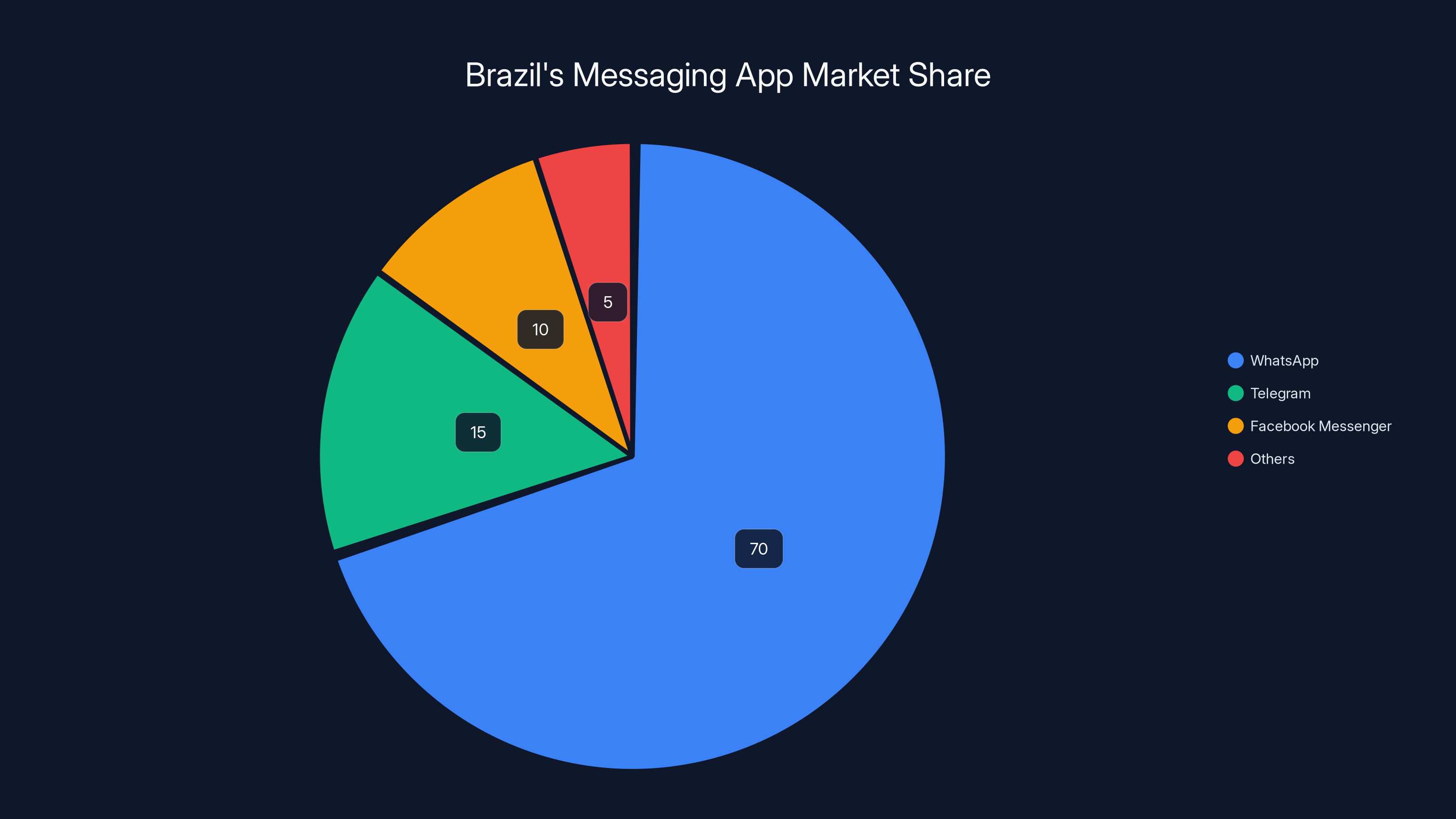

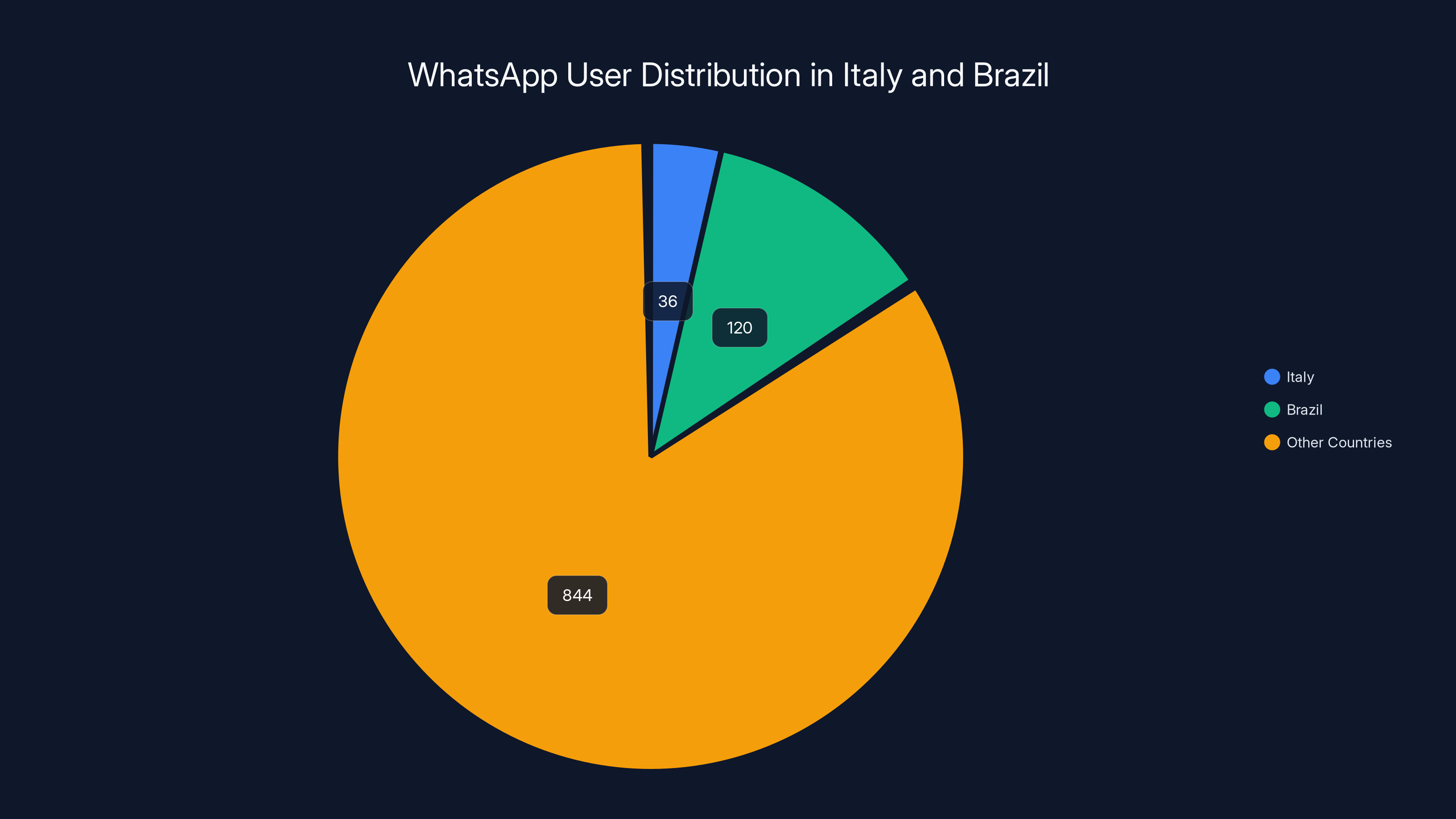

Why did CADE's action carry such weight in forcing Whats App's retreat? Brazil represents one of the world's most critical markets for both messaging applications and artificial intelligence adoption. With approximately 115 million active Whats App users, Brazil ranks among the top three countries globally in terms of Whats App usage. The platform's penetration into Brazilian society is extraordinarily deep—Whats App is not merely an app but an essential communication infrastructure, used for everything from intimate personal conversations to business negotiations, government services, and emergency communications.

Beyond usage statistics, Brazil has established itself as increasingly important to global AI development and adoption. The country hosts a thriving community of AI startups, developers, and research institutions. Brazilian companies and entrepreneurs had invested significantly in building chatbot applications that served the Portuguese-speaking market of over 250 million people globally. Removing access to Whats App's platform would have created significant commercial disruption for these businesses and potentially undermined Brazil's position in the emerging AI economy.

Moreover, CADE had demonstrated increasing sophistication in technology regulation and competitive analysis. The authority was not operating in isolation—it was observing similar actions and investigations occurring across Europe, India, and other jurisdictions. CADE's swift action signaled that it would not defer to Meta's technical assertions without rigorous scrutiny, setting a precedent for Brazilian regulatory independence in digital markets.

The Exemption Strategy

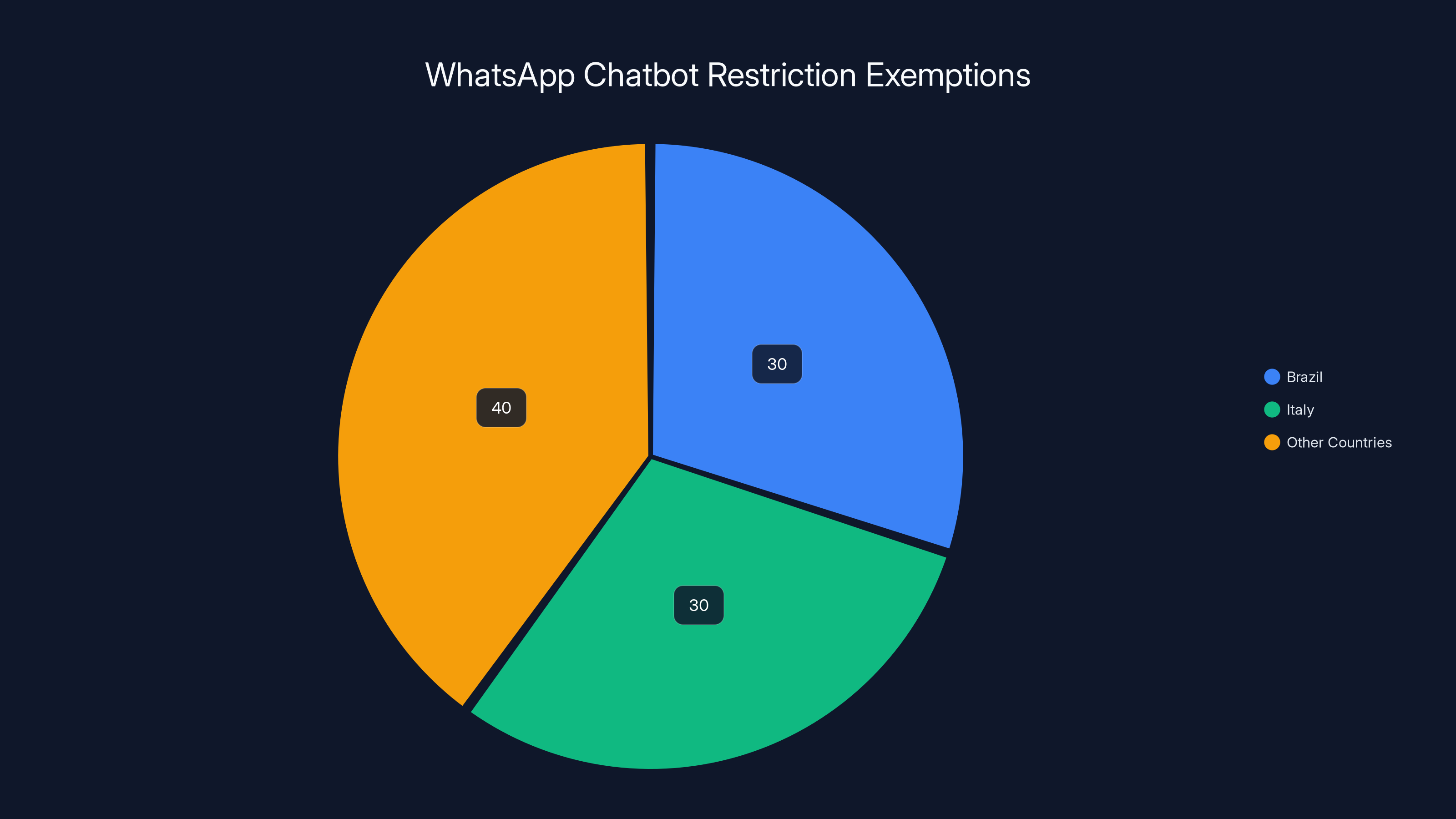

When CADE's pressure became impossible to ignore, Meta adopted a strategic accommodation rather than a full reversal. Instead of lifting the chatbot restrictions globally, the company created a geographic exemption specifically for Brazil. Users with Brazilian phone numbers (identified by the +55 country code) would not be subject to the chatbot restrictions. Developers and AI providers serving Brazilian users no longer faced the requirement to cease responding to user queries or implement the pre-approved auto-reply notification language.

This approach was ingenious from Meta's perspective for several reasons. First, it allowed the company to acknowledge CADE's concerns without completely abandoning its stated technical rationale. Meta could argue that it had been willing to accommodate Brazil's regulatory requirements while maintaining the policy elsewhere. Second, it created distinct rule sets based on user location, technically demonstrating that Whats App could operate under different policy parameters for different markets—potentially undermining the universality of the "infrastructure strain" argument. Third, it avoided the precedent of complete reversal, which might have emboldened other regulators or suggested that Meta's original position was untenable.

However, from a competitive standpoint, this exemption was profound. Brazil's AI provider ecosystem gained an advantage over other markets. Services that had planned to pivot away from Whats App distribution could now continue operating there. The exemption essentially created a geographic arbitrage opportunity where Brazilian startups could develop Whats App-first strategies while competitors in Europe or North America faced stricter restrictions.

Italy's Parallel Struggle: The European Precedent

Why Italy Preceded Brazil

Italy's competition authority had actually moved against Whats App's chatbot restrictions before Brazil, setting the stage for the subsequent Brazilian action. The Italian Competition Authority (Autorità Garante della Concorrenza e del Mercato, or AGCM) initiated scrutiny of Meta's policy in December 2025, prompting Meta to implement an exemption for Italian users before the January 15, 2026 policy launch date.

This sequence is significant because it revealed that Meta was prepared to make concessions to powerful regulatory authorities even before formal legal proceedings. The decision to exempt Italy suggested that Meta's legal team had assessed the competitive case against the policy as sufficiently robust that opposing Italian regulators would have been legally risky and commercially costly. Italy's AGCM has a track record of aggressive enforcement, substantial penalty authority, and visibility within the European Union system. Submitting to AGCM's informal pressure was preferable to facing either injunctive relief or substantial fines.

Italian Market Dynamics

Italy, with approximately 36 million Whats App users, is not as large a market as Brazil, but it carries disproportionate significance within the European regulatory framework. Italy sits at the intersection of multiple regulatory jurisdictions: it's subject to EU competition law through enforcement by the European Commission, it's part of the Digital Markets Act (DMA) framework that targets large tech platforms, and it maintains its own national competition authority with considerable influence.

Moreover, Italy's AGCM decisions frequently set precedents that influence other European authorities. European competition regulators engage in substantial coordination, particularly on digital platform issues. When Italy's AGCM expressed concerns about Whats App's chatbot restrictions, it sent signals to similar authorities across France, Germany, Spain, and other EU member states. This network effect made Italy a crucial jurisdiction for establishing precedent around AI platform governance.

The Italian tech entrepreneur and developer community also raised concerns about the restrictions' impact. Italy has seen growing interest in AI applications, particularly in sectors like e-commerce, language services (given the challenge of developing technology for Italian language), and small business automation. Restricting chatbot access in the Italian market would have handicapped these emerging sectors.

Coordinated EU Investigation

Parallel to Italy's specific action, the European Commission initiated a broader antitrust investigation into Meta's chatbot restrictions across the entire EU. This investigation operates under different legal frameworks than individual member state authorities, examining whether the restrictions violate EU Article 102 (abuse of dominance) or Article 101 (anticompetitive collusion) standards.

The EU investigation brings particular weight because the Commission can impose fines up to 10% of global annual revenue for serious violations. For Meta, which generates roughly $120 billion in annual revenue, this potential penalty scope is substantial. The Commission also has power to mandate behavioral remedies, impose interoperability requirements, or restructure operations in Europe, making its investigation potentially more consequential than individual member state actions.

WhatsApp dominates the Brazilian messaging app market with an estimated 70% share, highlighting the significance of CADE's intervention. (Estimated data)

Meta's Defense: The Infrastructure Strain Argument

The Technical Case for Restrictions

Meta's formal response to regulatory challenges emphasized a comprehensive technical argument about platform capacity and infrastructure design. Whats App's Business API was originally architected for specific, structured interactions: a customer asks a question about an order, and a business bot responds with deterministic information. The systems were optimized for this use case, with expectations about query patterns, response complexity, and server load.

General-purpose AI chatbots fundamentally change this dynamic. When a user can ask Chat GPT to write poetry, explain quantum physics, help with homework, or engage in open-ended conversation, the query patterns become unpredictable and the computational load varies dramatically. A simple FAQ bot can be stateless, responding with pre-written answers pulled from a database. A general-purpose AI chatbot must maintain conversation context, generate novel responses, and handle queries that might span complex reasoning processes.

From an infrastructure perspective, this creates several challenges. First, resource allocation becomes difficult when you cannot predict how much computational power a particular interaction will require. A simple weather query requires microseconds to process; a complex reasoning request might require several seconds. Second, latency becomes unpredictable, and users on a messaging platform expect rapid responses—delays of more than a few seconds feel unnatural. Third, concurrent users create scaling challenges—if millions of users are simultaneously interacting with general-purpose AI through Whats App, the cumulative server load could exceed capacity.

Meta's engineers likely observed that the proliferation of these chatbots was creating system strain: longer response times, more frequent timeouts, and a degraded experience for other Business API users. This wasn't hypothetical—it was a demonstrated technical problem requiring architectural solutions.

The App Store Argument: Distribution Alternatives

Meta advanced a secondary argument that has become increasingly central to platform regulation debates: AI companies have alternative distribution channels. Rather than relying on Whats App, AI providers can distribute their services through:

- Mobile app stores (Apple App Store, Google Play) where users can download dedicated applications

- Web applications and websites accessible through browsers, including Whats App Web

- Direct partnerships with other platforms, messaging services, and websites

- API integrations through emerging AI aggregation platforms

- SMS-based interfaces and other legacy communication channels

Meta's position essentially argued that Whats App should not be treated as the exclusive "route to market" for AI companies, even if it was a convenient one. From this perspective, restricting chatbots on Whats App doesn't prevent AI companies from reaching Brazilian, Italian, or any other users—it simply requires them to use alternative channels.

This argument carries some logical weight. Open AI's Chat GPT is accessible through the web, mobile apps, API integrations, and partnerships—Whats App was never its primary distribution mechanism. For most established AI companies, Whats App was a convenience feature, not a core business channel. The impact was more severe for smaller AI startups that had built their entire user acquisition strategy around Whats App's ubiquity in specific markets.

The Competitive Pressure Defense

Meta also suggested that the restrictions were not about crushing competitors but about managing infrastructure responsibly. The company maintained that if it had continued allowing unlimited general-purpose chatbots, system degradation would have affected all users—both business users relying on Whats App for customer service and users enjoying the primary messaging platform. From this perspective, the policy was a defensive action protecting the integrity of the platform rather than an offensive move against competitors.

However, this defense contained a critical vulnerability: Whats App's own AI system would continue operating on the platform, technically benefiting from reduced competition. If infrastructure truly required removing general-purpose chatbots, why could Meta's own bot continue functioning? Meta's response to this question essentially claimed that Whats App AI was engineered specifically for the constraints of the Business API, whereas third-party providers' models were more computationally expensive. This distinction might be technically accurate, but it's also unfalsifiable from the outside—it requires trusting Meta's engineering claims without independent verification.

Competitive Concerns: The DMA and Gatekeeping

Digital Markets Act Implications

Meta's chatbot restrictions arrived at a particularly sensitive moment in European regulation. The Digital Markets Act (DMA), which came into effect in 2024, established new rules for "gatekeepers"—large digital platforms with significant market power. Under the DMA, gatekeepers face enhanced obligations including requirements to:

- Refrain from leveraging their dominance in one market to gain unfair advantages in adjacent markets

- Provide interoperability when technically feasible

- Refrain from treating their own services more favorably than competing services

- Allow third-party developers reasonable access to their platforms

Whats App almost certainly qualifies as a DMA gatekeeper in Europe given its massive user base and centrality to digital communications. The chatbot restrictions potentially violated several DMA principles. If Meta was restricting third-party chatbots while promoting Whats App AI, it could constitute leveraging dominance and treating its own services more favorably than competitors—explicit DMA violations.

More broadly, the DMA framework suggests that platforms with gatekeeping status have diminished ability to make purely unilateral technical decisions. When a gatekeeper claims technical limitations require restricting competitors, regulators now have explicit authority to scrutinize whether those limitations could be resolved through alternative approaches, and whether restrictions are proportionate to legitimate business concerns.

Market Foreclosure Arguments

Regulatory authorities investigating the restrictions employed "market foreclosure" analysis—examining whether Meta's actions would prevent rival AI companies from reaching consumers. Market foreclosure doesn't require proving anti-consumer intent; it only requires showing that a competitor's distribution channels are materially restricted by a dominant platform's conduct.

Before the restrictions, users in Brazil and Italy could interact with Chat GPT, Grok, Claude, and other general-purpose AI through Whats App. These interactions might represent 5-15% of total user engagement with these services, depending on market-specific factors. Removing this distribution channel doesn't eliminate these services entirely, but it forecloses a valuable route to consumers. For users accustomed to having all communication within a single app (which is the case in countries where Whats App dominates communication), removing in-app access to AI chatbots materially limits their access.

This foreclosure concern becomes more acute when the gatekeeper (Meta) also operates a competing service (Whats App AI). Users who might have chosen a third-party chatbot before but can no longer access it through Whats App face a switching cost and convenience barrier. They might simply use Whats App AI instead, even if they would have preferred a different service when third-party options were accessible. This represents consumer harm through reduced choice and convenience.

The Interoperability Question

Some regulatory discussions around Whats App's restrictions raised interoperability as a potential remedy. Could Whats App be required to maintain open APIs allowing third-party chatbots while simultaneously implementing technical controls limiting resource consumption? This would be technically complex but potentially feasible.

For instance, Whats App could implement:

- Query rate limiting that caps how many requests any single third-party bot can process per user per minute

- Response time requirements mandating that bots respond within specified latency thresholds or be automatically disconnected

- Resource allocation controls that ensure business customer service bots receive priority server resources

- Query complexity classification that directs different request types to different infrastructure tiers

These technical approaches would allow third-party chatbots to operate while protecting platform integrity. Regulators have sometimes suggested that rather than banning categories of applications, platforms should implement proportionate restrictions that address the underlying concern without eliminating the entire category.

Meta's position appeared to be that these technical solutions were insufficient—that the architectural differences between general-purpose AI and traditional business bots were so fundamental that coexistence was infeasible without unacceptable performance degradation. But this claim remained largely opaque, as Meta didn't publicly document the specific technical constraints limiting this approach.

Antitrust Investigation Scope and Timelines

Brazil's CADE Investigation

Brazil's competition authority opened a formal antitrust investigation examining whether Meta's chatbot restrictions constituted abuse of dominance under Brazilian competition law. CADE's inquiry focused on several specific questions:

First, whether the restrictions were pretextual—whether the stated technical rationale about infrastructure strain was the genuine reason for the policy, or whether the real motivation was competitive foreclosure. This requires examining whether Meta's engineering teams actually identified specific system failures, whether those failures were quantified, and whether alternative technical solutions were genuinely exhausted before implementing restrictions.

Second, whether the restrictions discriminated between competing services—whether third-party general-purpose chatbots were treated differently than Whats App AI despite facing similar technical constraints. If Whats App AI could operate efficiently while third-party bots could not, CADE would want to understand why, and whether the differences were truly technical or based on different treatment.

Third, the competitive effects on the AI market in Brazil—how restricting Whats App access would affect competition among AI providers, whether it would create barriers for emerging Brazilian AI startups, and whether it would advantage Meta's AI offerings through reduced competition.

Fourth, the appropriateness of the remedy—whether a complete ban was proportionate to the underlying concern, or whether narrower restrictions (like rate limiting or resource prioritization) could address technical issues without eliminating entire categories of services.

CADE's investigation timeline likely extends several months, with formal proceedings, document requests, and expert testimony potentially spanning well into 2026. The exemption Meta granted for Brazil represented a concession, but not necessarily a final resolution of the investigation.

EU Commission Investigation

The European Commission's investigation operates on a broader scale, examining Whats App's restrictions across the entire EU under multiple legal frameworks. The Commission can investigate under:

- Article 102 TFEU (abuse of dominant position) examining whether Meta abused Whats App's dominance in messaging to restrict AI competition

- Article 101 TFEU (cartels and anticompetitive agreements) examining whether any coordination with other platforms occurred

- Digital Markets Act provisions examining whether gatekeepers engaged in prohibited conduct

The Commission's investigation brings higher stakes because it can result in substantial fines. Meta's 2021 GDPR fine of €405 million and its 2022 DMA-related fine of €60 million (for Whats App data sharing) demonstrate that the Commission is prepared to impose significant penalties on Meta for conduct it deems anticompetitive.

The investigation might require Meta to:

- Provide extensive technical documentation justifying the "infrastructure strain" claim

- Submit server logs, performance metrics, and capacity utilization data

- Undergo independent technical audits by Commission-appointed experts

- Demonstrate that Whats App AI operates under the same constraints as third-party bots

- Explain why technical solutions (rate limiting, prioritization) couldn't address concerns

Investigations of this scope typically last 12-18 months before reaching a preliminary assessment, with potential extensions for complex technical matters.

Italy has approximately 36 million WhatsApp users, which is smaller than Brazil's 120 million, yet Italy's regulatory influence is significant in Europe. Estimated data.

The Chatbot Ecosystem Impact: Winners and Losers

Impacts on AI Startups

The restrictions created a bifurcated impact on the AI startup ecosystem. Large, well-established AI companies like Open AI (Chat GPT), Anthropic (Claude), and companies with web application distribution were minimally affected. These companies had diversified distribution channels, established user bases, and the resources to manage policy changes across markets.

Smaller and medium-sized AI startups, particularly those focused on serving specific markets like Brazil, faced more significant challenges. Many had built user acquisition strategies around Whats App's ubiquity in their target markets. A Brazilian startup developing Portuguese-language conversational AI might have acquired 30-40% of its users through Whats App. Losing Whats App access meant rebuilding its distribution strategy from scratch: investing in app store optimization, paying for mobile advertising, or pursuing business partnerships to access alternative channels.

The timeline created additional problems. The 90-day grace period was announced just before implementation, giving startups minimal time to:

- Notify users that services would no longer work on Whats App

- Direct users to alternative platforms (web apps, mobile apps, SMS interfaces)

- Adjust business models that had assumed Whats App would remain a primary channel

- Potentially raise additional funding to sustain user acquisition through paid channels

Startups in Brazil and Italy, however, gained a reprieve. The exemptions allowed them to continue developing Whats App-first strategies in those markets, creating asymmetric opportunities for companies whose user bases were concentrated in exempt jurisdictions.

Impacts on Business Users

The restrictions had minimal direct impact on business users—enterprises running customer service bots, appointment scheduling systems, or FAQ responses on Whats App faced no changes. These specialized business bots fell outside the restrictions because they were not general-purpose conversational AI.

However, business users might indirectly benefit from infrastructure improvements. If genuine technical strain was constraining Whats App's Business API, removing general-purpose chatbots could free resources improving response latency and reliability for legitimate business applications. A small business relying on Whats App for customer service would potentially see faster response times, more consistent uptime, and better overall platform reliability.

Conversely, if the restrictions were anticompetitive rather than technical in nature, business users experienced no benefits—just reduced choice and convenience as they couldn't easily supplement Whats App's business tools with general-purpose AI assistance.

Impacts on End Users

From a user perspective, the restrictions represented a reduction in convenience and choice. Users who had been accessing Chat GPT through Whats App would need to open a separate app or browser tab to access the same service. This might seem like a trivial inconvenience, but in user experience design, requiring an additional app switch significantly reduces engagement. Many users would simply stop accessing these services rather than switching apps.

For users in Brazil and Italy, the exemptions meant continued in-app access to general-purpose AI, creating an interesting divergence in user experience across geographies. A person in Brazil could ask Whats App for creative writing assistance or homework help without leaving the app, while a person in Germany or France would need to open Chat GPT's standalone app. This geographic arbitrage in user experience would likely be temporary—either other jurisdictions would follow Brazil and Italy's lead, or Meta would eventually extend the restrictions globally.

Meta's Strategic Positioning of Whats App AI

Why Whats App AI Matters

Meta's own artificial intelligence system, available within Whats App, becomes the critical lens through which to examine the restrictions' competitive effects. Whats App AI is Meta's attempt to compete directly with Chat GPT, Claude, Grok, and other general-purpose AI services. By restricting competing services while maintaining Whats App AI, Meta could substantially increase the user base that defaults to its AI offering.

Whats App AI's competitive advantage stems from network effects and default position rather than necessarily superior capabilities. Users who open Whats App to check messages could easily access meta's AI without switching apps. Over time, as users become accustomed to Whats App AI's capabilities and limitations, they develop habits and patterns. Users might begin to prefer Whats App AI not because it's superior, but because it's convenient.

This is particularly powerful in markets like Brazil with extremely high Whats App penetration. For many users, Whats App is the primary interface for mobile communication. Making AI available within Whats App means Whats App AI gets used passively when other AI services require active effort to access. The difference in usage from this convenience factor alone could be substantial.

Whats App AI's Technical Implementation

Meta's claim that Whats App AI operates under different technical constraints than third-party bots raises important questions. If Whats App AI is truly more efficient or better optimized for the Business API infrastructure, what specific architectural differences enable this? Is it:

- Model size: Smaller, more efficient language models requiring less computational power?

- Response generation approach: Techniques that generate responses more quickly than large general-purpose models?

- Infrastructure location: Direct integration with Meta's servers rather than API calls to external providers?

- Caching and pre-computation: Responses to common queries pre-computed and cached?

- Rate limiting and prioritization: Whats App AI receiving priority resource allocation?

The distinction matters because it determines whether third-party providers could theoretically optimize their services to meet Whats App's technical requirements. If Whats App AI's efficiency advantage comes from architectural choices available to all providers, the restrictions unfairly target inefficient competitors. If it comes from deep integration impossible for external providers, the restrictions might be technically justified.

Publicly, Meta has not provided sufficient detail to verify these claims. Regulators investigating the restrictions have demanded more transparency on this question, but Meta's competitive concerns about revealing its AI capabilities have created an information asymmetry.

Implications for Platform Regulation and AI Governance

The Precedent for Other Platforms

Whats App's experience likely influences how other platforms approach AI integration and third-party access. Apple, Google, Microsoft, and other companies hosting third-party applications now have evidence that regulators will scrutinize restrictive policies on AI services, particularly when the platform operates competing services.

This might encourage platforms to:

- Provide more technical transparency about infrastructure limitations when imposing restrictions

- Implement proportionate alternatives (like rate limiting) rather than categorical bans

- Document decision-making processes showing that restrictions address genuine problems rather than competitive concerns

- Allow independent audits of claimed technical limitations

- Provide exemptions or grandfathering for existing services rather than immediate bans

The Whats App case becomes a reference point for regulators evaluating platform conduct. When another company claims technical reasons for restricting competitors, regulators will reference Whats App's experience and demand more rigorous proof.

The Role of Regional Exemptions

Whats App's creation of geographic exemptions for Brazil and Italy sets a problematic precedent. It suggests that regulatory pressure from certain jurisdictions can create carve-outs that apply only to specific countries. This produces several concerning effects:

First, regulatory arbitrage: Companies might concentrate lobbying and regulatory challenges in a few key markets, knowing that victories create exemptions. AI startups in countries without powerful competition authorities face permanent restrictions, while those in Brazil and Italy enjoy continued access.

Second, customer experience fragmentation: Users in different countries have fundamentally different experiences with the same product. Some get access to full chatbot ecosystems within Whats App; others don't. This creates maintenance and support burdens and complicates Meta's product strategy.

Third, enforcement challenges: Creating different rule sets for different markets is technically complex and creates opportunities for circumvention. Users could potentially spoof their location, or competition authorities could contest whether the exemptions fully comply with their directives.

Over time, this likely pressures Meta toward either fully restoring access globally (if regulatory consensus emerges that restrictions are improper) or expanding exemptions to additional markets as other authorities investigate.

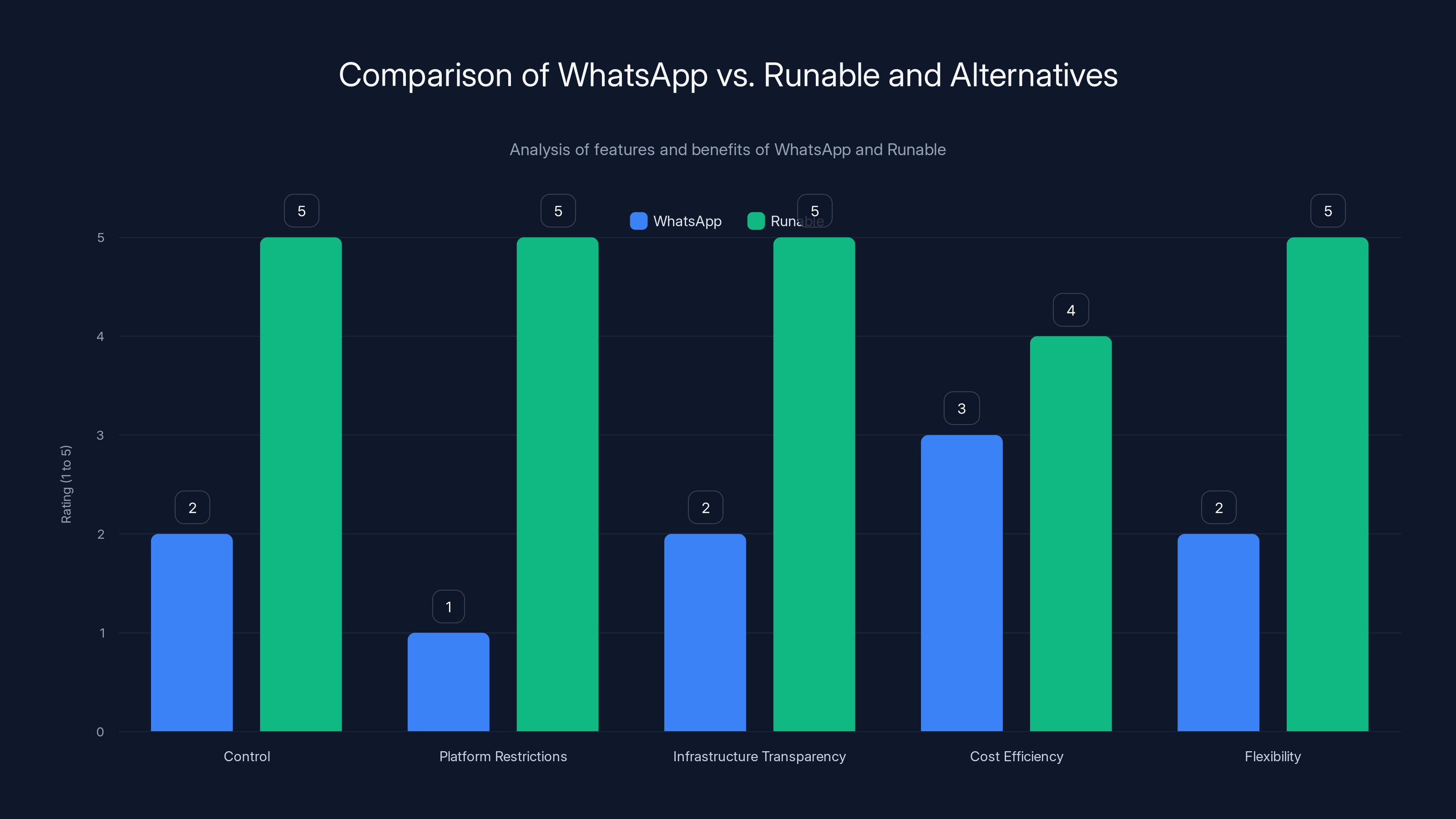

Runable outperforms WhatsApp in control, flexibility, and transparency, offering developers a more adaptable and cost-efficient platform. (Estimated data)

Global Regulatory Response and Coordination

EU Member States Beyond Italy

While Italy's AGCM took lead action within the EU, other member state authorities were monitoring the situation. Germany's Federal Cartel Office (Bundeskartellamt), which has been particularly aggressive in technology regulation, likely considered opening its own investigation. France's competition authority (Autorité de la concurrence) was similarly monitoring the issue. Countries with large AI communities and strong tech regulation—like Spain, Netherlands, and Belgium—were evaluating whether to pursue independent actions or support the EU Commission's investigation.

The possibility of a patchwork of national investigations created pressure on Meta. Multiple fines across different jurisdictions would be more expensive and operationally disruptive than a single EU-wide resolution. This dynamic often pushes companies toward early settlements with the EU Commission, trading restrictions and commitments for certainty and predictability.

Global South Considerations

Regulators in markets like India, Indonesia, and Nigeria—countries with enormous Whats App user bases but less developed regulatory infrastructure—were potentially disadvantaged by the exemptions granted only to Brazil and Italy. If Whats App could be required to exempt Brazil while maintaining restrictions elsewhere, other large markets might reasonably demand similar treatment.

India's Competition Commission briefly investigated Meta's Whats App policies on separate issues but hadn't yet directly challenged the chatbot restrictions at the time of writing. However, India's position as the world's largest Whats App market by user base gave its regulators potential leverage. If India moved to challenge the restrictions, Meta would face immediate pressure to provide exemptions there as well.

This dynamic highlights how regulatory responses to tech platform decisions increasingly occur at multiple levels simultaneously—national competition authorities, regional bodies like the EU Commission, and industry-specific regulators all operating with partially overlapping jurisdiction and enforcement power.

Toward International Standards

The Whats App case contributed to emerging international discussions about artificial intelligence regulation and platform governance. Organizations including the International Competition Network, UNCTAD, and various trade associations convened discussions about how competition authorities should approach AI integration into platforms.

These discussions grapple with difficult questions:

- Who bears responsibility for AI's resource requirements: Should platforms be required to accommodate any application regardless of resource consumption, or can they set technical limits?

- How to balance competition and infrastructure: How much weight should technical limitations receive when evaluating competitive conduct?

- What constitutes "proportionate" remedies: If a platform has legitimate concerns about resource strain, what restrictions are appropriate?

- How to ensure transparent gatekeeping: What disclosure requirements and audit rights should competitors and regulators have?

Whats App's restrictions and the subsequent regulatory response provided a real-world case study informing these international discussions.

Technical Solutions and Workarounds

SMS and USSD-Based Alternatives

While Whats App restrictions eliminated in-app access for many users, alternative delivery channels became available. SMS and USSD (Unstructured Supplementary Service Data) technologies, which operate over mobile networks rather than data connections, provided ways for AI providers to reach users.

Services like:

- SMS-based AI interfaces: Users text queries to a number and receive responses via SMS

- USSD menus: Navigating conversational menus using phone keypads

- Voice-based systems: Interactive voice response (IVR) systems accessed through phone calls

These technologies require lower bandwidth, work on basic phones without internet, and bypass Whats App entirely. However, they're less user-friendly than Whats App's interface and typically carry per-message costs. For users accustomed to seamless digital experiences, reverting to SMS feels archaic.

In markets like Brazil and India, where significant portions of the population still use feature phones without data connections, SMS-based AI could remain relevant. But for the smartphone-dominant user base Whats App primarily serves, these alternatives represented meaningful degradation of experience.

Web and App-Based Transitions

The primary workaround for most users was accessing AI services through dedicated web applications or mobile apps. For established services like Chat GPT, this transition was straightforward—users could:

- Access Chat GPT web interface through Whats App's built-in browser

- Download Chat GPT's mobile app and switch between apps

- Use Chat GPT's API through third-party apps that aggregate AI services

- Access Chat GPT through other platforms integrating its API

For smaller AI services lacking dedicated apps or marketing budgets, the transition was more difficult. Users who had discovered an AI service solely through Whats App might never find alternatives, or find the friction of switching apps too high to maintain engagement.

Whats App Web and Browser Access

An interesting dynamic emerged around Whats App Web and browser-based access. While the Whats App Business API restrictions applied to official bot interfaces, users could theoretically access external websites (including AI chatbot websites) through Whats App's embedded browser. Some smaller AI providers created browser-optimized interfaces that users could access through Whats App's web-link functionality.

This workaround partially preserved functionality—users could still access AI services by clicking links within Whats App conversations, though the experience was inferior to native bot integration. Whether this constituted genuine access or merely a technical loophole remained somewhat ambiguous.

Business Model Implications for AI Startups

Distribution Strategy Pivots

For AI startups that had built distribution strategies around Whats App, the policy required fundamental business model reconsideration. Startups had several options:

Option 1: Mobile App Distribution - Invest in i OS and Android app development, navigate app store approval processes, and compete in already crowded app stores. This required substantial engineering resources and time to market.

Option 2: Web Application Focus - Build web-based interfaces optimized for mobile browsers. Lower technical barriers than native apps, but web apps generally underperform compared to native experiences, particularly on mobile devices.

Option 3: API and Integration Strategy - Become AI providers supplying models and capabilities to other applications rather than building consumer-facing products. This required different sales and marketing approaches, targeting developers and companies rather than end users.

Option 4: Market-Specific Strategies - Focus exclusively on markets like Brazil and Italy where Whats App restrictions didn't apply, building Whats App-native products that couldn't expand to other geographies.

Option 5: Pivot to Business-to-Business - Shift from consumer AI to enterprise applications for customer service, knowledge management, and internal communications where different distribution channels applied.

Each option required different capital, technical capabilities, and time horizons. Startups with limited resources might have struggled to execute any transition successfully.

Monetization Changes

Whats App's Business API had enabled certain monetization approaches that became unavailable:

- Freemium models where users accessed basic features free within Whats App and paid for advanced capabilities

- Subscription services with monthly fees for premium chatbot access

- Pay-per-query systems where users paid for individual interactions

- Ad-supported models where ads were displayed within chatbot responses

Transitioning to alternative channels might require different monetization approaches. Mobile apps typically supported subscription and in-app purchase models better than Whats App had. But the shift involved friction—users were less likely to pay for standalone apps than for premium features within an already-familiar platform.

For some startups, the monetization transition proved insurmountable. Services that had been marginally profitable through Whats App's distribution might not survive the cost of acquiring users through paid channels.

Brazil and Italy are exempt from WhatsApp's chatbot restrictions, accounting for 60% of the exemptions, while other countries face restrictions. Estimated data.

Comparing Whats App's Approach to Other Platforms

Apple's App Store Restrictions

Apple's management of third-party applications through its App Store provides an interesting comparison. Apple has made numerous decisions restricting certain categories of apps, rejecting apps that compete with its own services, or requiring specific technical implementations. When questioned about these restrictions, Apple has provided various justifications: user privacy, platform stability, security concerns, and business model protection.

Regulators have increasingly challenged Apple's conduct, arguing that some restrictions are commercially motivated rather than technically necessary. The parallels with Whats App are clear: a dominant platform restricting competitors while promoting its own services. However, Apple has generally provided more detailed technical documentation for its restrictions, making it harder for critics to claim pretextual motivation. Whats App's opacity about its technical constraints might have damaged its credibility.

Google Play's Approach

Google's management of its Play Store follows different patterns. Google has maintained more open policies regarding third-party apps in some areas while implementing restrictions in others. Google's approach has been to provide detailed guidelines and give developers clear paths to compliance, rather than categorical bans. When Google restricts services, it typically provides proportionate alternatives (like rate limiting or sandboxing) rather than complete removal.

This approach has given Google somewhat better regulatory outcomes than Apple or Meta have experienced, though Google faces its own antitrust investigations in multiple jurisdictions.

Telegram's Approach

Telegram, Whats App's main competitor in some markets, had not implemented equivalent restrictions on third-party bots. This competitive difference might have influenced user choices. In markets where Whats App restricted bots but Telegram didn't, users seeking bot functionality might migrate to Telegram. However, Telegram's overall feature set and user base disadvantages might offset this competitive advantage.

Data Privacy and AI Governance Intersections

Privacy Concerns in Chatbot Interactions

Beyond competition and platform governance, Whats App's restrictions raise important privacy questions. When users interact with third-party AI chatbots through Whats App, their queries are transmitted through Meta's infrastructure. Meta could technically observe query content, build profiles of users' interests and concerns, and use this information to improve its own AI systems or inform advertising decisions.

The restrictions on third-party chatbots might reflect not just competition concerns but also a desire to prevent users from leveraging Whats App for interactions with non-Meta-affiliated AI systems. By pushing users to Whats App AI, Meta ensures that all conversational AI interactions on its platform remain within its data ecosystem. From a privacy perspective, users couldn't avoid sharing conversation data with Meta if all in-app AI access went through Meta's system.

Transparency and Consent Issues

Users might not understand that interacting with third-party bots through Whats App involved sharing data with both the bot provider and potentially Meta itself. Whats App's terms of service technically disclosed this, but in practice, most users don't read platform terms carefully. The removal of third-party options eliminated the choice users previously had regarding which organizations could access their conversational data.

Regulators investigating privacy aspects of the restrictions would need to evaluate whether the restrictions were necessary for data protection, or whether they were anticompetitive restrictions dressed in privacy language.

Future Outlook: Will Restrictions Expand or Contract?

Potential Scenarios

The Whats App chatbot restriction situation will likely evolve in several possible directions:

Scenario 1: Regulatory Pressure Forces Reversal - Brazil's and Italy's regulatory actions are the beginning of broader resistance. Other jurisdictions follow suit, CADE and EU investigations conclude that restrictions are anticompetitive, and Meta faces pressure to restore third-party access globally. This could occur within 12-18 months if regulatory momentum continues.

Scenario 2: Technical Workarounds Emerge - Meta implements technical solutions (rate limiting, prioritization, resource controls) that allow third-party bots to operate under constraints. The restrictions remain nominally in place, but are modified in ways that preserve some third-party access while addressing infrastructure concerns. This represents compromise between both sides.

Scenario 3: Global Exemption Expansion - Rather than fighting jurisdiction-by-jurisdiction, Meta gradually extends exemptions to additional countries as their regulators investigate. Eventually, exemptions become standard except in a few holdout jurisdictions. This effectively reverses the restriction without admitting it was problematic.

Scenario 4: Status Quo Persists - Despite regulatory investigations, Meta maintains restrictions in most jurisdictions while Brazil and Italy remain exempt. The investigations conclude without requiring changes. This outcome requires either regulatory authorities deciding the restrictions don't violate competition law, or settlements that satisfy authorities without requiring full reversal.

Scenario 5: Selective Restrictions Return - Meta eventually extends restrictions more broadly, potentially to Brazil and Italy, once regulatory attention diminishes. If a sufficient time period passes without major regulatory action, Meta might attempt to re-impose restrictions globally.

Broader Platform Governance Trends

Regardless of how Whats App's specific situation resolves, the case contributes to broader trends in platform governance:

- Increasing regulatory scrutiny of gatekeeper decisions: Platforms can no longer make unilateral restrictions without expecting regulatory investigation

- Demands for transparency and documentation: Companies must provide technical evidence for restrictions, not just assertions

- Proportionality requirements: Restrictions must be proportionate to underlying concerns, with less restrictive alternatives preferred

- Interoperability expectations: Regulators increasingly expect dominant platforms to maintain open access with reasonable technical controls

These trends will shape how platforms approach AI integration, third-party access, and competitive decisions going forward.

The antitrust investigation by Brazil's CADE into Meta's practices is projected to progress over several years, potentially concluding by 2026. Estimated data.

Comparative Analysis: Whats App's Approach vs. Runable and Alternative Solutions

The Ecosystem Alternative: Automation Platforms

While Whats App restricts third-party chatbots within its messaging ecosystem, alternative platforms offer different models for AI integration and automation. Platforms like Runable provide AI-powered automation capabilities without the gatekeeping constraints of messaging platforms.

Runable, an AI automation platform designed for developers and teams, offers several advantages over relying on restricted messaging platform access:

- Full control: Developers retain complete control over deployment, infrastructure, and resource allocation

- No platform restrictions: Runable doesn't ban or limit categories of applications; it supports diverse automation use cases

- Transparent infrastructure: Teams understand exactly how their applications use resources and scale

- Cost efficiency: At $9/month, Runable provides affordable access to AI automation capabilities without platform markup

- Flexibility: Users can build custom workflows, integrate external APIs, and create purpose-built solutions

For AI startups previously relying on Whats App distribution, platforms like Runable represent infrastructure where they own the relationship with users and maintain independence from gatekeeping decisions by third-party platforms.

Why Developers Consider Alternatives

Developers facing Whats App's restrictions quickly recognized that message platform dependencies create vulnerability. A platform can change policies overnight, restricting services that businesses have built around its access. This realization prompted evaluation of alternative approaches:

- Building proprietary applications on infrastructure developers control

- Creating web-first experiences independent of platform restrictions

- Developing API-first products serving multiple distribution channels simultaneously

- Using horizontal platforms like Runable that support broad use cases without categorical restrictions

Runable's positioning emphasizes this freedom: developers can build automated workflows, AI-powered documents, presentations, and reports without worrying that their application category might be suddenly restricted.

Comparison of Operational Models

Whats App Model: Centralized platform with gatekeeping authority, subject to Meta's unilateral policy decisions and regulatory constraints. Infrastructure managed entirely by Meta, with developers dependent on continued access and favorable policies. Highly convenient for users already active on the platform, but creates vulnerability for developers.

Runable Model: Developer-controlled platform where teams maintain infrastructure independence. Automation capabilities available regardless of competitive positioning. Teams select how to distribute and monetize their work. Removes gatekeeping risk while requiring more technical sophistication from developers.

Other Messaging Platforms (Telegram, Signal, etc.): Similar gatekeeping dynamics to Whats App but with different policy decisions and regulatory environments. Telegram permits bots more broadly but faces regulatory scrutiny in European markets.

For stakeholders valuing stability, independence, and freedom from gatekeeping restrictions, platforms like Runable offer compelling alternatives to the uncertainty created by Whats App's approach.

Regulatory Response Framework: A Model for Global AI Governance

The Precedent for Competition Analysis

The Whats App investigation established a framework that will likely influence how competition authorities approach AI and platform gatekeeping issues globally. The framework includes:

Technical burden of proof: When platforms claim technical limitations require restricting competitors, regulators increasingly demand rigorous evidence rather than accepting assertions. This includes performance data, capacity measurements, and expert validation.

Proportionality analysis: Restrictions must be proportionate to the underlying technical problem. If infrastructure strain exists, rate limiting or prioritization might address it. Categorical bans must be justified when less restrictive alternatives exist.

Self-dealing examination: Special scrutiny of restrictions that benefit the platform's own competing services. This reverses the burden of proof—platforms claiming their conduct benefits consumers while favoring their own services face skepticism.

Geographic variation evaluation: Creating different rules for different markets creates suspicion that restrictions are motivated by regulation-avoidance rather than technical necessity. If the platform can operate differently in Brazil, why not globally?

Future AI regulation will likely codify versions of this framework, creating standards that platforms must meet when making gatekeeper decisions.

The Digital Markets Act Effect

The EU's Digital Markets Act provided a legal foundation for the aggressive regulatory response to Whats App's restrictions. DMA provisions explicitly address gatekeeping, fairness to competitors, and proportionate conduct requirements. As DMA enforcement becomes established and more countries implement similar legislation, gatekeepers will face consistent pressure to justify restrictions under this framework.

This suggests that major platform decisions affecting AI or other services will increasingly trigger regulatory analysis under DMA principles, with implications for platform strategy.

Lessons for Technology Policy and Business Strategy

For Platform Companies

The Whats App case provides important lessons for how platforms should approach restrictive policies:

-

Document technical rationale thoroughly: Vague assertions about "infrastructure strain" will face skepticism. Platforms should document specific problems, attempted solutions, and why restrictions are necessary.

-

Implement proportionate restrictions: Categorical bans invite regulatory scrutiny. Rate limiting, prioritization, and other controls address technical concerns while preserving access.

-

Avoid selective restriction of competitors: Restricting third-party services while operating competing services creates obvious competitive concerns. If restrictions are technically necessary, apply them equally.

-

Provide transition time: Abrupt restrictions create disruption and opposition. Phased approaches with advance notice and grace periods are more likely to succeed.

-

Engage with regulators early: Rather than implementing restrictions and dealing with regulatory backlash, platforms should consult competition authorities during policy development.

For AI Startups and Developers

The restrictions highlight important strategic considerations:

-

Diversify distribution channels: Don't rely on a single platform for user acquisition. Build web apps, mobile apps, and API integrations simultaneously.

-

Maintain infrastructure independence: Platform dependencies create vulnerability. Consider building your own infrastructure or using neutral platforms that don't compete with you.

-

Monitor regulatory developments: Policy changes affecting your distribution channels can happen quickly. Stay informed about regulatory investigations and platform policies.

-

Develop direct relationships with users: Email lists, websites, and owned channels create independence from platform gatekeeping decisions.

-

Invest in international adaptation: Different jurisdictions have different regulatory environments. Strategies that work in one country may need adjustment elsewhere.

For Policymakers

The Whats App case reveals important dimensions of AI governance:

-

Differentiate between technical and commercial claims: Platforms often dress competitive motivations in technical language. Rigorous scrutiny is necessary.

-

Support infrastructure alternatives: Reducing platform dependence requires supporting alternative infrastructure and distribution channels. Investments in open-source AI, neutral platforms, and developer tools can reduce concentration.

-

Coordinate across jurisdictions: Platforms can play regulators against each other. International coordination helps ensure consistent standards.

-

Adapt existing frameworks: Digital Markets Act and competition law provide adequate frameworks for addressing platform gatekeeping. Specialized "AI regulation" may be unnecessary if existing tools are properly applied.

-

Protect access and interoperability: Ensuring users and developers have reasonable access to essential platforms, even when third-party services face restrictions, should be a core concern.

The Broader Context: AI Integration into Consumer Platforms

Why This Matters Beyond Whats App

The Whats App chatbot restrictions are not isolated—they're part of a broader pattern of how consumer platforms are integrating AI and making decisions about which AI services gain access. Telegram, Signal, Google Messages, Apple i Message, and other messaging platforms all face similar questions about how much third-party AI to permit.

How these questions are resolved will shape the AI ecosystem for years to come. If platforms can easily restrict competing AI services, this concentrates AI access through platform gatekeepers. If platforms must maintain open access, this democratizes AI availability but creates infrastructure challenges.

The outcome in Whats App—creating geographic exemptions while maintaining restrictions elsewhere—represents an intermediate position. It accommodates regulatory pressure in powerful jurisdictions while preserving gatekeeper authority globally. Whether this middle ground proves stable depends on whether other jurisdictions follow Brazil's and Italy's lead, and whether Meta faces political or economic pressure to reverse restrictions more broadly.

The Evolution of Platform Strategy

Meta's approach to Whats App restrictions likely influenced how other platforms approach AI integration. Apple, Google, Microsoft, and others will have observed Whats App's regulatory challenges and adjusted their strategies accordingly. Some platforms might have delayed announcing restrictions specifically because of Whats App's experience. Others might have decided to quietly restrict services before announcing policies, limiting regulatory reaction time.

The competitive dynamics have shifted: platforms can no longer assume that decisions about third-party access will go unquestioned. The regulatory environment has become more hostile to gatekeeping conduct, particularly in sophisticated markets with strong competition authorities.

FAQ

What is Whats App's chatbot restriction policy?

Meta's Whats App implemented a policy restricting third-party, general-purpose AI chatbots from operating through the Whats App Business API while continuing to permit Whats App AI—Meta's own chatbot service. The policy became effective January 15, 2026, with affected developers given a 90-day grace period to notify users and cease bot operations. The restrictions do not apply to business-specific bots handling customer service, appointment scheduling, or order management.

Why did Whats App restrict third-party chatbots?

Meta claimed that the proliferation of general-purpose AI chatbots on the Whats App Business API created unexpected strain on systems designed for traditional business communications. The company argued that the unpredictable resource requirements and latency expectations of general-purpose AI models exceeded platform capacity, degrading service for legitimate business users. However, regulatory authorities questioned whether this technical rationale was genuine or served as a commercial justification for restricting competitors.

Which countries exempted third-party chatbots from the restrictions?

Brazil and Italy received exemptions after their competition authorities challenged the restrictions. Brazil's CADE (Conselho Administrativo de Defesa Econômica) and Italy's AGCM (Autorità Garante della Concorrenza e del Mercato) both issued orders requiring Meta to suspend the chatbot restrictions pending investigation. Meta accommodated these jurisdictions by allowing developers to continue offering chatbots to users with Brazilian (+55) and Italian phone numbers while maintaining restrictions elsewhere.

What is CADE's investigation examining?

Brazil's competition authority is investigating whether the restrictions constitute anticompetitive abuse of dominance. CADE is examining whether the stated technical rationale is genuine or whether the true motivation is competitive foreclosure, whether restrictions discriminate against third-party services while favoring Whats App AI, how restrictions affect competition in the AI market, and whether less restrictive remedies could address technical concerns. The investigation represents Brazil's assertion that competitive concerns override infrastructure claims.

How did the European Union respond to Whats App's chatbot policy?

The EU Commission initiated a formal antitrust investigation examining whether the restrictions violate EU competition law or the Digital Markets Act. The investigation can result in substantial fines up to 10% of Meta's global annual revenue if violations are found. Italy's AGCM took action first, prompting the exemption before the policy took effect. The EU investigation operates under broader authority than individual member states and could require fundamental changes to Meta's approach or impose significant behavioral remedies.

What alternatives do AI providers have to Whats App distribution?

For teams seeking alternatives to platform-dependent distribution, platforms like Runable offer AI-powered automation capabilities with full developer control and no categorical restrictions. Additional alternatives include mobile apps through Apple App Store and Google Play, web applications accessible through browsers, direct website access, API integrations with third-party platforms, SMS-based interfaces, and business partnerships with other services. For established companies like Open AI, restricting Whats App access has minimal impact, but smaller AI startups building Whats App-first strategies face more significant challenges.

How does Whats App's approach compare to other platforms like Telegram or Apple Messages?

Telegram maintains more permissive policies toward third-party bots and hasn't implemented comparable restrictions. Apple's App Store enforces various restrictions on third-party apps but has provided more detailed technical documentation justifying those restrictions than Whats App provided. Meta's opacity about the specific technical constraints limiting chatbot compatibility likely damaged its credibility compared to platforms that provide more transparent justifications for their gatekeeping decisions.

What is the Digital Markets Act and how does it relate to Whats App's chatbot restrictions?

The EU's Digital Markets Act establishes enhanced obligations for "gatekeepers"—large digital platforms with significant market power. Under DMA provisions, gatekeepers must refrain from leveraging dominance in one market to gain advantages in others, provide interoperability when technically feasible, and avoid treating their own services more favorably than competing services. Whats App's restrictions potentially violate multiple DMA principles by restricting third-party chatbots while promoting Whats App AI, making the restrictions particularly vulnerable under this framework.

Could Whats App have implemented technical solutions rather than categorical restrictions?

Regulators investigating the restrictions have suggested technical alternatives like query rate limiting, response time requirements, resource allocation controls, and query complexity classification could allow third-party chatbots to operate while addressing infrastructure concerns. Meta's position is that these solutions are insufficient given architectural differences between general-purpose AI and traditional business bots, but the company hasn't provided sufficient technical documentation to verify this claim. The lack of transparency about why technical alternatives were inadequate strengthened the regulatory case that restrictions were commercially rather than technically motivated.

What happened to AI startups that relied on Whats App for user distribution?

Startups in Brazil and Italy were minimally affected by exemptions granted by competition authorities. Startups in other jurisdictions faced significant challenges: they either needed to rebuild distribution strategies through mobile apps, web applications, or other channels, pivot business models to focus on enterprise customers, shift to SMS or voice-based alternatives, or focus exclusively on exempt markets like Brazil. The 90-day grace period provided limited time for such pivots, and many smaller startups lacked resources to simultaneously develop new distribution channels. For established companies like Open AI with diversified distribution, the restrictions were inconvenient but not existential.

Are other platforms likely to face similar regulatory challenges for restrictive AI policies?

The Whats App case establishes precedent and regulatory expectations. Other platforms, particularly those designated as "gatekeepers" under DMA or similar frameworks, should expect scrutiny if they implement restrictions on AI services—especially restrictions that advantage their own competing services. The regulatory framework demonstrated in the Whats App investigations (demands for technical documentation, analysis of proportionality, examination of self-dealing, and geographic exemptions signaling discriminatory intent) will likely apply to similar policies by Apple, Google, Microsoft, Amazon, and other major platforms.

Conclusion: Toward a Regulated Ecosystem

The Whats App chatbot restriction saga represents a critical inflection point in how technology platforms interact with artificial intelligence, regulatory oversight, and competitive fairness. What began as an infrastructure management decision by a private company metastasized into a multi-jurisdictional regulatory battle with implications extending far beyond Whats App's business decisions.

The fundamental tension underlying the conflict is irreconcilable through pure technical argument. Meta's claim about infrastructure strain might be genuine—the architectural differences between general-purpose AI chatbots and traditional business bots are real, and capacity constraints on the Business API might truly exist. Simultaneously, Meta's interest in restricting the specific competitors to its own AI service is also real. Both statements can be true without resolving the underlying policy question.

Regulatory authorities across Brazil, Italy, and the European Union essentially concluded that claimed technical limitations do not justify categorical restrictions when the platform's own competing service continues operating. They required evidence, transparency, and proportionality that Meta was unwilling or unable to provide. The geographic exemptions Meta granted effectively acknowledged this regulatory power without conceding the underlying principle that the restrictions were commercially motivated.

What emerges from this conflict is a new regulatory baseline for platform conduct around AI services. Platforms cannot simply assert technical rationale for restricting competitors—they must document constraints, explain why less restrictive alternatives are inadequate, and apply restrictions equally to their own services. Regulators have demonstrated they will scrutinize gatekeeping decisions through the lens of market competition, not merely platform convenience.

For the AI ecosystem, this has significant implications. The concentration of AI access through dominant messaging platforms is now more difficult to achieve. Competitors of platform-operated AI services have regulatory champions willing to challenge gatekeeping. This creates space for alternative distribution channels, including platforms like Runable that operate without the gatekeeping constraints of consumer messaging platforms. Developers can now pursue diversified distribution strategies with confidence that regulatory authorities will challenge unilateral platform restrictions.

The uncertain outcome—where Brazil and Italy maintain exemptions while other jurisdictions preserve restrictions—represents an unstable equilibrium. Either regulatory consensus will eventually expand exemptions globally, suggesting the restrictions were unjustified, or additional jurisdictions will grant exemptions as their regulators investigate. The alternative is that Meta successfully maintains restrictions in most markets through political capital and strategic regulatory engagement, but this seems increasingly unlikely given established regulatory precedent.

Looking forward, the Whats App case will influence how every major platform approaches AI integration, third-party access, and competitive decisions. It establishes that infrastructure claims face rigorous scrutiny, that self-dealing raises immediate red flags, and that regulatory coordination across jurisdictions can constrain even the most powerful technology companies.

For stakeholders navigating these dynamics—whether as AI providers, platform companies, or users seeking optimal experiences—the lesson is clear: platform-dependent strategies carry regulatory and business risk. The future likely belongs to companies maintaining infrastructure independence, diversifying distribution channels, and refusing to depend on the gatekeeping decisions of dominant platforms. In this environment, platforms emphasizing open access and developer control (like Runable) are positioned to capture the value created by companies seeking alternatives to the restrictive dynamics demonstrated through Whats App's approach.

The regulation of AI within consumer platforms is no longer the domain of platform gatekeepers alone. It is now a matter of active regulatory oversight, competitive analysis, and public debate about what fairness means in digital ecosystems. Whats App's restrictions became a focal point for these discussions, and the resolution—however it finally unfolds—will shape the AI industry's structure for years to come.

Key Takeaways

- WhatsApp's January 2026 policy restricts third-party general-purpose chatbots (ChatGPT, Grok) while permitting WhatsApp AI and business-specific bots

- Brazil's CADE and Italy's AGCM quickly challenged restrictions, forcing Meta to grant geographic exemptions—a significant regulatory victory demonstrating platform accountability

- Meta's infrastructure strain argument faced skepticism; regulators questioned why self-dealing with WhatsApp AI occurred if technical constraints were universal

- EU Commission investigation under Digital Markets Act framework could impose fines up to 10% of Meta's $120B revenue, making this high-stakes for platform gatekeeping precedent

- AI startups in exempt markets (Brazil, Italy) gained competitive advantages while others faced forced pivots from WhatsApp distribution to apps, web, and alternative channels

- The case establishes regulatory baseline: platforms must document technical rationale, apply restrictions equally, and justify why proportionate alternatives are inadequate