Why Navan's IPO Flopped While AI Companies Soar: The B2B SaaS Reckoning [2025]

October 30th, 2025 should've been a celebration. Navan—the former Trip Actions that had rebranded, raised billions, and promised to revolutionize corporate travel—finally rang the bell at the New York Stock Exchange at

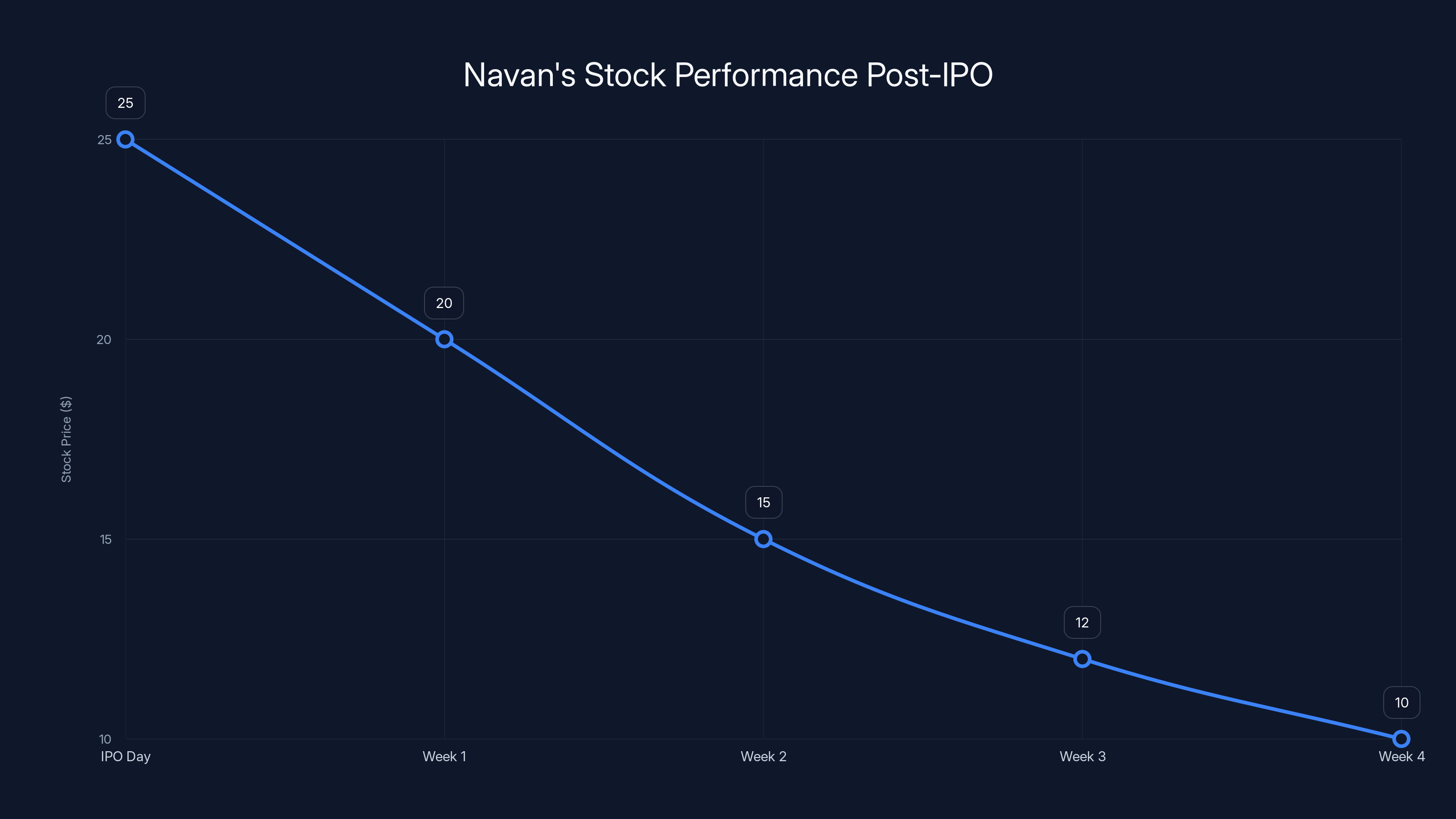

By end of day one, the stock had dropped 20%. Within weeks, it was down 50% from the IPO price, trading around

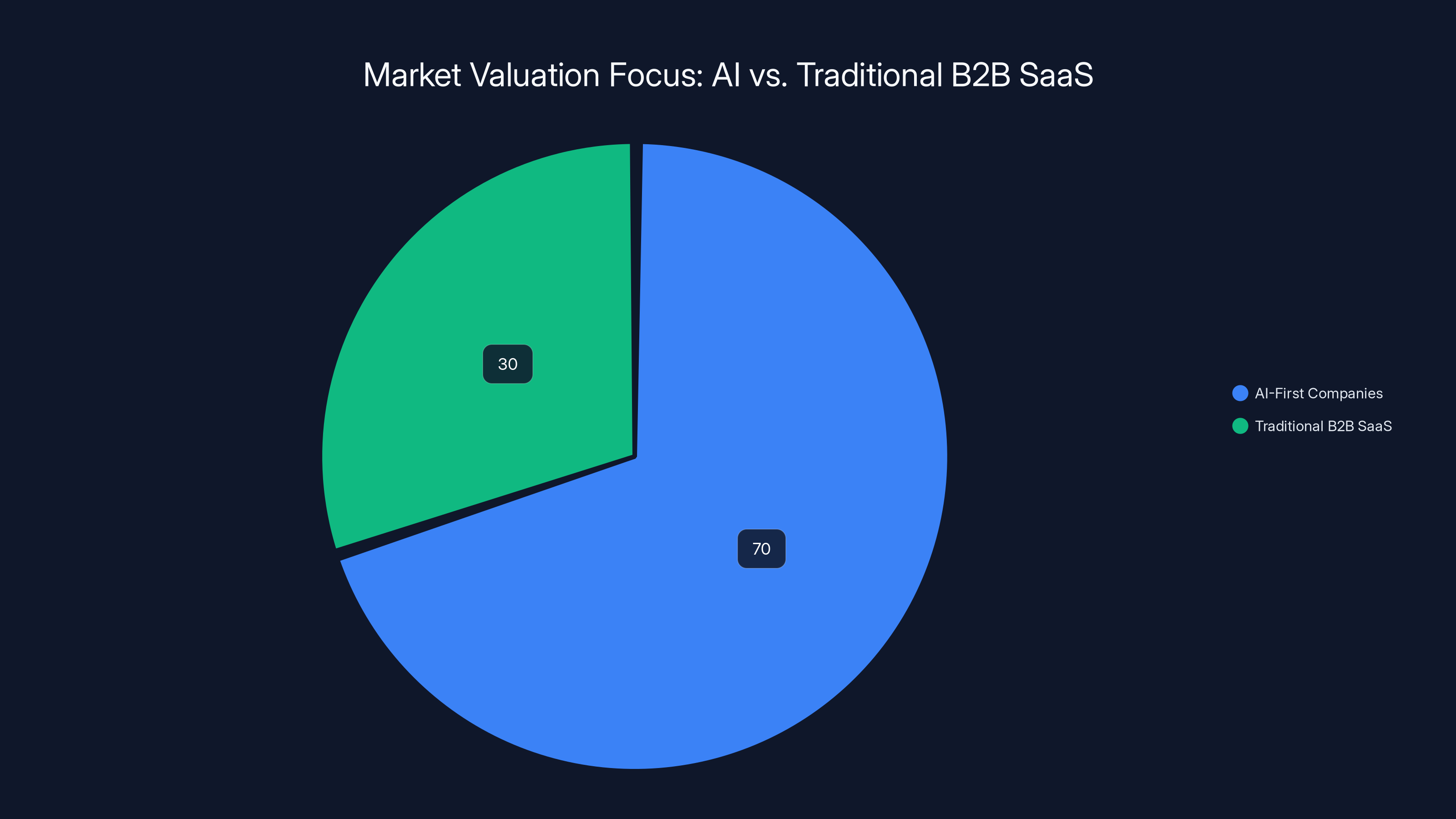

But here's what makes this story less about Navan failing and more about something much bigger happening in B2B software: the market has bifurcated into two clear tiers. If your company touches AI in a meaningful way, you can do almost anything and still be celebrated. If you don't? You'd better be profitable, efficient, and diversified, or the public markets will punish you—even if your fundamentals are actually solid, as noted by SaaStr.

Navan isn't a broken company. Its financials prove it. But it's caught in a vortex between two different versions of SaaS reality, and it's worth understanding why, because this dynamic will reshape which B2B companies go public, how they're valued, and what the next decade of software investment looks like.

TL; DR

- Navan crashed 32% after IPO despite $800M ARR, 29% growth, and 97% customer satisfaction because the market sees it as "good but not AI"

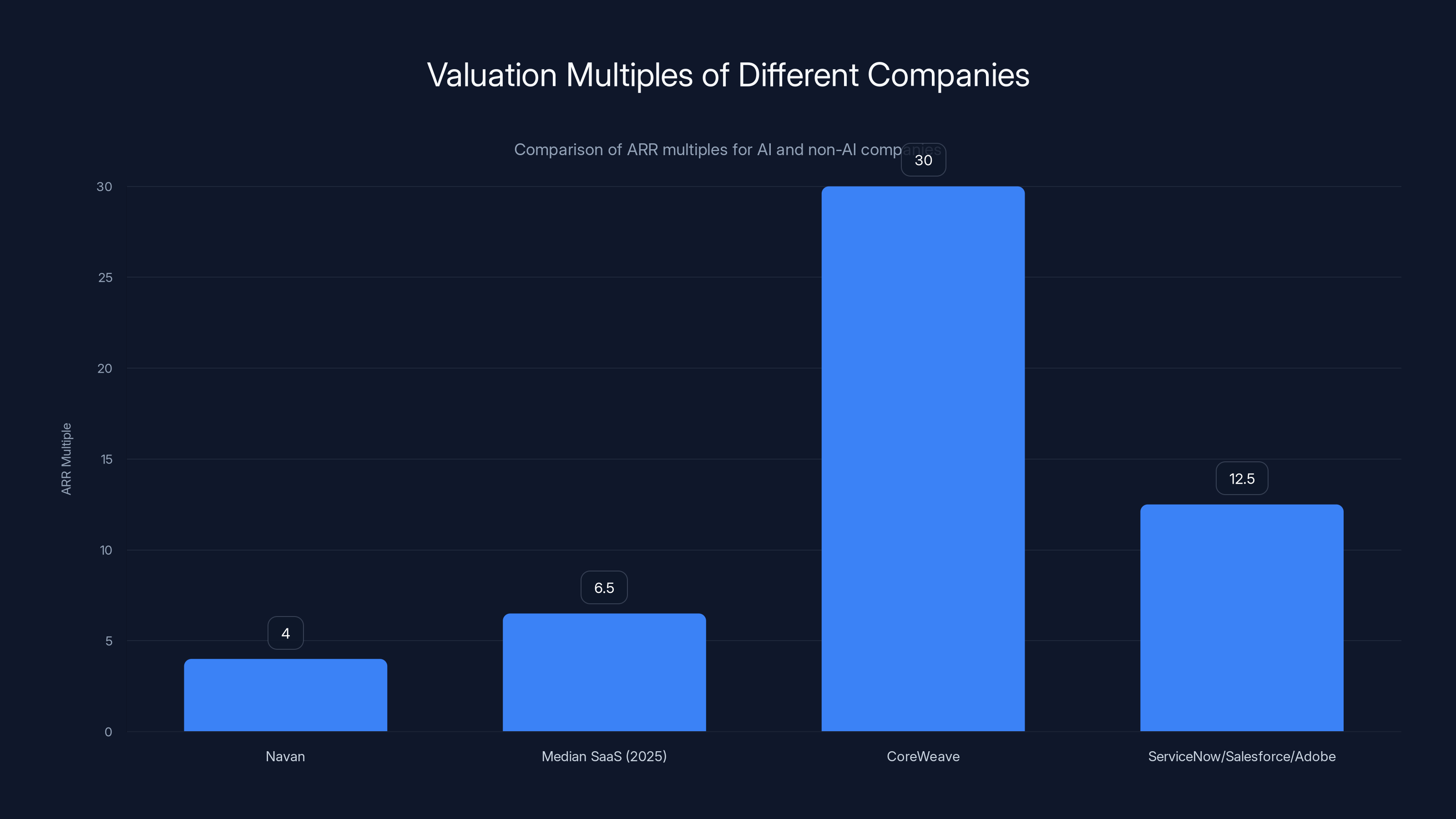

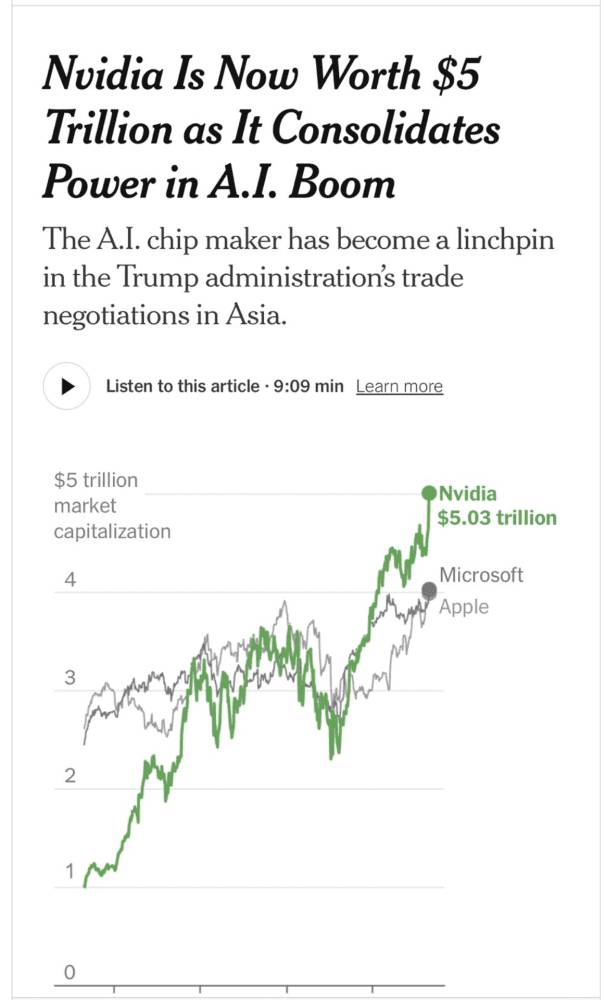

- AI-first companies command 20-40x ARR multiples while traditional B2B SaaS trades at 5-6x, creating a two-tiered market that ignores fundamentals for AI narrative

- **Even a16z buying 12-16 per share post-IPO couldn't stabilize the stock, revealing just how powerful market sentiment is

- Non-GAAP profitability no longer matters; the market now demands GAAP profitability AND growth, a new bar that wasn't required just two years ago

- Usage-based revenue models (92% of Navan's revenue) are harder to value and less predictable than pure SaaS subscriptions, causing investor anxiety

AI-focused B2B SaaS companies command significantly higher valuation multiples (20-40x ARR) compared to non-AI companies (5-7x ARR). Estimated data.

The Math That Explains Everything: Why Navan Got the "Good But Not AI" Discount

If you want to understand what happened to Navan—and what's happening to most non-AI B2B companies right now—the valuation math tells the story.

Navan trades at roughly 5-6x revenue on a

But then you look sideways.

CoreWeave, which IPO'd in December 2024 as an AI infrastructure play, trades at 20-40x ARR. Hugging Face (still private but recently valued at $13 billion) is trading on a multiple that assumes decades of AI dominance. Every AI-forward company—from Databricks to Mistral AI to Anthropic—has seen their valuations soar on speculation, momentum, and narrative.

Meanwhile, traditional SaaS darlings like ServiceNow, Salesforce, and Adobe trade at 10-15x revenue because they've been around forever and are considered "mature" plays. They've already had their moment.

Navan? It's stuck in limbo.

It's too established to be a hot private darling. It's too good-but-not-AI to command the multiples that venture-backed AI infrastructure companies get. And it's too reliant on a complex, fintech-adjacent business model (92% of revenue from travel booking transactions, not subscriptions) to be easily comparable to pure SaaS peers.

The brutal math: Navan grew at 29%, is on a path to sustained profitability, has iconic customers, and still got punished. That's the "good but not AI" discount in action.

What Actually Happened on IPO Day (And Why It Matters)

Navan's IPO process was already rocky. The company had filed confidentially in early 2023, expecting to go public that year. Then came the banking crisis of March 2023. Then repeated delays. The company pushed the timeline back again and again, likely waiting for better market conditions that never quite came. By the time they actually IPO'd in late 2025, the hype had largely dissipated.

The S-1 filing showed strong fundamentals, but the market had already moved on. Travel-tech wasn't a hot category. Corporate spend management wasn't exciting anymore. Even though the company had built an AI copilot (Ava) that handled 54% of customer interactions, investors treated it as an afterthought—a feature, not a fundamental transformation.

The IPO priced at

Instead, the stock opened and immediately sold off. By the close of day one, it was down 20%. Over the next few weeks, it crashed another 50% as selling pressure continued, driven by:

- CFO departure announcement - Sarah Friar, who had been the public face of the company's financial discipline, announced she was stepping down post-IPO, as reported by CFODive.

- GAAP profitability concerns - Q3 showed a -41% GAAP operating margin. Only non-GAAP profitability at 13% mattered, but the market demanded real profitability.

- Execution questions - Travel is complicated. Fintech is complicated. The combination is even more so. Investors wanted clarity and got opacity instead.

- No "AI narrative" - Unlike every hot IPO of 2024-2025, Navan couldn't confidently claim to be an AI company. It was a travel company with AI features. That positioning killed momentum.

The market didn't kill Navan because it's bad. It killed it because the narrative was wrong, the timing was off, and investor sentiment had shifted toward a new category: AI infrastructure and AI-first companies that promise to reshape business forever.

Estimated data shows that AI-first companies dominate market valuation focus, capturing 70% of investor interest compared to 30% for traditional B2B SaaS companies.

Why Even a16z Couldn't Save It: The Limits of Insider Credibility

Here's something that should have been a huge signal to the market: Andreessen Horowitz went on a buying spree after the IPO crashed.

Between December 17-29, 2025, various a16z funds and Ben Horowitz personally purchased over 1.7 million shares worth approximately

This is noteworthy because a16z doesn't often buy stocks on the open market. It's a venture capital firm, not a hedge fund. When it does buy shares post-IPO, it's typically a sign of either massive conviction or regret-induced averaging down.

In this case, it was almost certainly conviction. a16z had been invested in Navan since 2017. The team knew the business intimately. They saw the numbers. They knew Navan's path to sustained profitability. They knew the customer concentration was reasonable and the product was solid.

So they bought.

And the stock... barely moved. It stayed flat to down. Even the endorsement of one of the world's most respected tech investors couldn't move the needle. Why? Because sentiment had shifted. The market was no longer buying traditional B2B stories, no matter how solid. It was only buying one story: AI is going to reshape everything, invest in that.

That's what the Navan IPO really taught us. It's not that a16z lacked credibility. It's that credibility doesn't matter when you're fighting the current. The current is toward AI. Navan is adjacent to AI at best.

The Numbers Everyone Glosses Over (But Shouldn't)

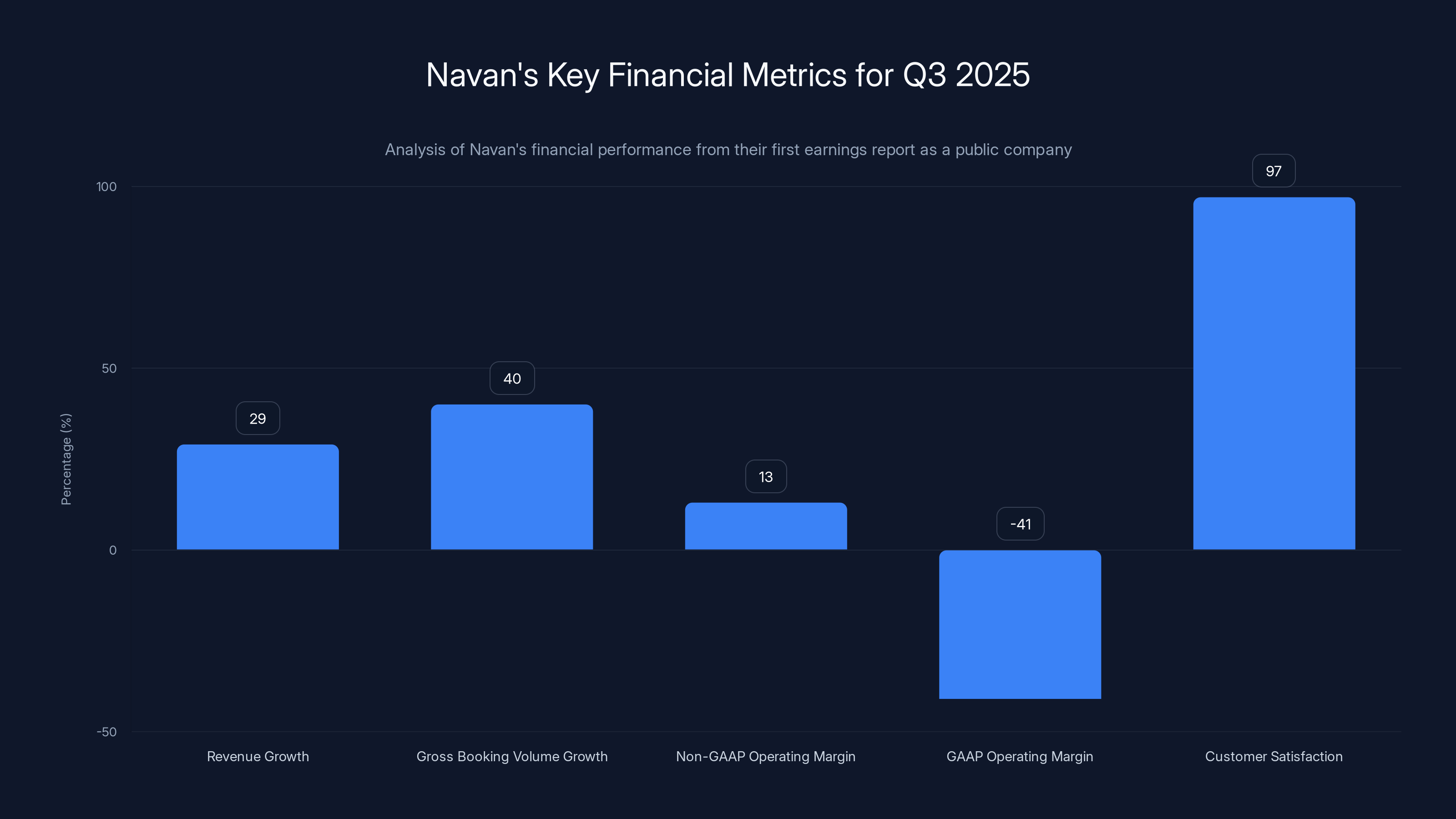

Let's look at Navan's actual results from their first earnings report as a public company, released in December 2025 for Q3:

Revenue Growth: Q3 brought in

Gross Booking Volume: $2.6 billion, up 40% year-over-year. This is the total value of all travel and fintech transactions running through the platform. It's growing faster than revenue, which is a good sign (operational leverage).

Profitability: Here's where it gets interesting. Non-GAAP operating income hit

That's actually really solid for a company at this scale and growth rate. Most 29%-growing SaaS companies at $800M ARR are burning cash or breaking even at best. Navan is already pulling positive cash.

But then you look at GAAP numbers: -41% operating margin in Q3, meaning they're still losing significant money on a real accounting basis. The difference is stock-based compensation, which is still a massive line item at this stage of maturity.

The market cared about the GAAP number. It ignored the non-GAAP progress.

Customer Satisfaction: 97% CSAT. That's exceptional. Most B2B companies would kill for that. It means they're not just retaining customers, they're delighting them.

Customer Concentration: ~10,000 customers, none representing more than 3% of revenue. That's healthy diversification. OpenAI, Adobe, and Unilever are on the customer list, which gives credibility, but they don't drive the business.

AI Progress: Ava, Navan's AI copilot, was handling 54% of customer interactions by Q3. That's meaningful automation. But it's not positioned as a core value driver—it's treated as a feature that improves the existing product, not as a fundamental reimagining of the business.

So let's be clear: Navan's fundamentals are actually quite good. Growing at 29%, approaching profitability, high customer satisfaction, diversified customer base, and a functioning AI product. By almost any historical standard, that's a solid B2B SaaS company.

But the stock still dropped 32% from IPO because fundamentals no longer determine valuation. Narrative does. And the narrative is: "You must have AI at your core, not just at the edges."

The Two-Tier B2B SaaS Market: AI vs. Everything Else

What Navan's IPO really exposed is that we no longer have one B2B SaaS market. We have two.

Tier 1: The AI Category

Companies that can credibly claim to be AI-first or AI-forward operate under a completely different valuation regime. Examples include:

-

CoreWeave: GPU cloud infrastructure for AI. IPO'd at

90+. Trading on 30-40x forward revenue despite Microsoft being 60%+ of customers and the company carrying $18B in debt. Why? Because the market believes AI infrastructure is the next trillion-dollar category. -

Databricks: Still private at $43 billion valuation, growing at >100% with no clear path to profitability. The market accepts it because it's positioning itself as essential to the AI data stack.

-

Anthropic: Valued at $60 billion+ privately, still burning billions annually, not yet profitable. But it's Claude, it's AI, and that's enough.

These companies operate with a playbook that would be considered reckless if they weren't in the AI space: massive burn, customer concentration risk, unproven unit economics. None of that matters because investors believe AI is winner-take-most and they want exposure.

Tier 2: Everything Else

Traditional B2B SaaS companies—CRM tools, HR platforms, project management, travel tech, whatever—now face an entirely different standard:

- Must achieve profitability (or at least have a clear path within 12-24 months)

- Must show reasonable customer diversification

- Must explain growth in traditional metrics (ARR, NRR, magic number)

- Must not have customer concentration risk

- Must be efficient on capital

- Stock-based compensation is now a negative, not a cost of doing business

- Debt is treated as a risk, not capital structure

It's the return of pre-2021 SaaS metrics, except the bar is even higher because these companies have to compete for narrative attention against AI-forward peers.

Navan is firmly in Tier 2, even though it has an AI product. Why? Because the AI product (Ava) is auxiliary, not core. The business would work without it. That makes it a travel/fintech company with AI features, not an AI company that happens to operate in travel.

The market treats those very differently.

AI-focused companies like CoreWeave trade at significantly higher ARR multiples (20-40x) compared to non-AI companies like Navan (4x), highlighting the valuation premium for AI narratives. Estimated data.

The Revenue Model Problem: Why 92% Usage-Based Revenue Is Harder to Value

One thing most analysts glossed over but is actually crucial: Navan's revenue model is weird for SaaS.

Of the ~$800M in ARR:

- 92% is usage-based, derived from actual travel bookings and fintech transactions (travel booked through the platform, card spend processed, transaction fees, etc.)

- Only 8% is true subscription revenue for platform access and services

For comparison, pure SaaS companies like Salesforce are almost 100% subscription. Slack is mostly subscription. ServiceNow is mostly subscription. That makes them easier to model, easier to predict, and easier to value.

Navan's usage-based model means revenue is tied to customer travel spend patterns. If a recession hits and companies cut travel budgets by 30%, Navan's revenue drops 30% (minus the subscription baseline). There's leverage in the downside.

Investors hate that. They want predictable, subscription-based revenue that grows independently of economic cycles. Navan's model creates a direct line between economic health and revenue, which is seen as higher risk.

The irony is that usage-based revenue can actually be better for customers—you only pay for what you use. But the capital markets have decided subscription is superior because it's more predictable. So Navan gets a valuation penalty for having a business model that should theoretically be lower-risk.

This is a real headwind for any company with usage-based economics, and it's worth understanding if you're evaluating similar companies or planning a software business.

Why CFO Departure Tanked the Stock More Than Growth Rates

A few days after the IPO opened, Sarah Friar announced she was stepping down as CFO. This shouldn't have been surprising—executive transitions are normal post-IPO—but the market treated it like a defection signal.

Why? Because Sarah Friar is credible. She had been the public face of Navan's financial discipline story. When she left, it created a narrative vacuum. Suddenly, the questions became: "Did the CFO lose faith? Is profitability harder than stated? Are there hidden problems?"

None of that was necessarily true, but in markets where narrative matters more than fundamentals, perception becomes reality.

This taught the market something: Navan's valuation was somewhat propped up by the credibility of its executive team, not just the business metrics. Remove a key player, and suddenly the floor drops out.

By contrast, AI companies can lose executives constantly and the stock barely flinches. Why? Because the narrative is bigger than any individual. The AI story is assumed to be inevitable, so personnel changes feel like rearranging deck chairs on a ship that's obviously sailing into the future.

The GAAP Profitability Inflection: When Non-GAAP Numbers Stopped Mattering

In 2022-2023, non-GAAP profitability was the new golden metric. Companies that were non-GAAP profitable but GAAP negative (due to heavy stock-based comp) were still rewarded because they demonstrated operational discipline.

Navan is exactly that profile: 13% non-GAAP margin, -41% GAAP margin. Two years ago, this would've been celebrated as a company that had figured out how to build a profitable business while still investing in growth.

Today? The market demands both. Navan's -41% GAAP margin is treated as a failure, even though the non-GAAP progress is real and improving.

Why the shift? A few reasons:

-

Stock-based comp has become a point of friction. There's increasing regulatory pressure and investor awareness that stock-based compensation is real dilution, not just an accounting fiction. Companies that can't get to GAAP profitability are seen as inefficient.

-

The private market made people aware of real valuations. In venture rounds, companies are often valued on multiple metrics and narratives. Going public forces a moment of clarity where the market prices in current reality, not future potential.

-

Capital is scarce. In 2021, there was so much money chasing SaaS growth that profitability seemed optional. By 2025, capital is more rational. The market wants returns, not just growth.

Navan has to solve this. Its path to 3% GAAP profitability (projected for 2025 FY) is real and achievable, but it's slower than the market wants to wait.

Navan's Q3 2025 report shows strong revenue and booking volume growth, with a notable 97% customer satisfaction rate. However, the GAAP operating margin remains negative at -41%, highlighting ongoing financial challenges.

The Private-to-Public Haircut: Why 4B

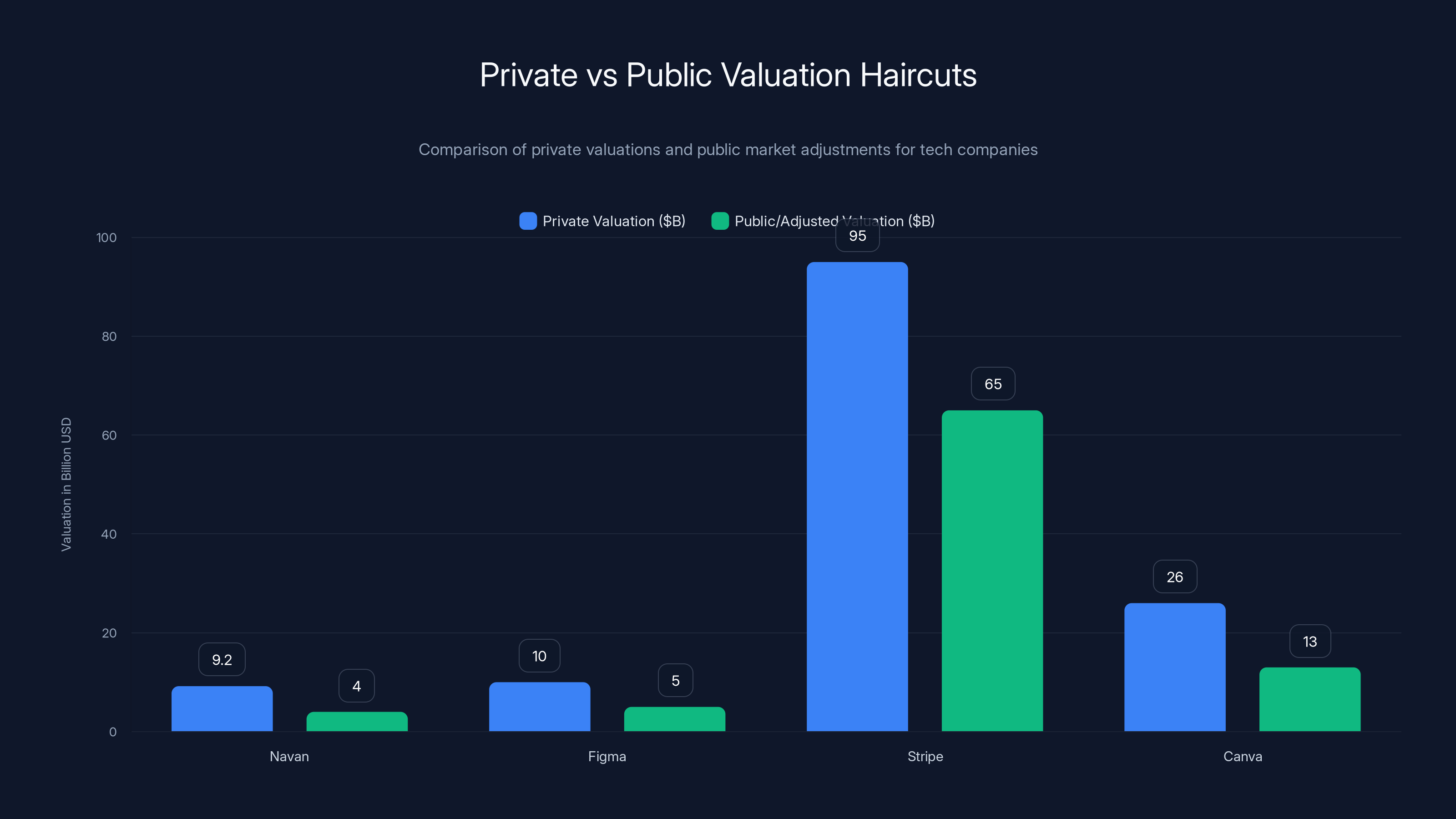

Navan's IPO represents the complete end of the era where private markups translated into public enthusiasm.

In October 2022, Navan raised a round at a

Total haircut: 65% from peak private valuation.

This pattern is repeating across the market:

- Figma was privately valued at $10B+ and is still private because an IPO would mean a 50%+ markdown

- Stripe was valued at 65B in secondary sales

- Canva was a $26B private darling and would IPO at half that valuation at best

The private market has become completely disconnected from the public market. Why?

Venture capital funds need to paint an optimistic picture to justify returns to LPs. When they mark a company at $9B, they're assuming multiple expansion, massive markets, AI upside, and growth trajectories that sound reasonable from a PowerPoint but look aggressive from a public market lens.

The public market reprices based on current reality, not potential. It asks: "At current revenue, current growth, current profitability, what multiple should this trade at compared to peers?" That almost always results in a markdown from private valuations.

Navan is a perfect case study in this: strong company, good metrics, but fundamentals don't support a $9B valuation when the public market can compare it to peers and see there's no reason for a 1.5x premium over the median SaaS company.

What Navan's AI Product Tells Us About AI Hype vs. Reality

Navan's AI copilot, Ava, is actually impressive. It handles 54% of customer interactions. It's trained on 12+ years of corporate travel data. It learns from user feedback. It actually solves problems.

But here's the thing: it didn't save the stock.

Why? Because AI features are no longer differentiators. Every B2B SaaS company now has (or claims to have) AI built in. The market has moved from "AI is magical" to "AI is table stakes." Unless your AI is genuinely reshaping the business model or creating a new category, it doesn't move the valuation.

Navan's Ava is solving an existing problem (customer service efficiency). It's not creating a new business model or a new way for customers to think about travel. So even though it's objectively good and working, it's priced in as a feature, not a strategic inflection.

Compare that to a company building AI for something no one has ever done before (e.g., Anthropic building better reasoning models), and the market goes berserk. The difference isn't the quality of the AI. It's what the AI allows you to do that was previously impossible.

This is an important distinction. Not all AI is created equal for valuation purposes. If your AI solves an existing problem better, you get a feature boost. If your AI creates a new capability, you get a narrative boost and a valuation reset.

Comparing Navan to Other B2B IPOs: Why the Cycle Flipped

It's worth comparing Navan to other B2B SaaS IPOs from the last few years to understand how much has changed.

**Canva (Private, 2023 valuation:

**Figma (Private, 2022 valuation:

**Datadog (Public 2019,

Slack (Public 2019, IPO'd at

**Palantir (Public 2020, IPO'd at

Navan fits into the Slack/Figma bucket: strong product, good growth, but hard-to-explain business model that doesn't fit neatly into public market comparables. The difference is that Slack IPO'd in 2019, when there was more tolerance for companies that didn't fit neatly. Navan IPO'd in 2025, when tolerance is zero and everything is compared to AI benchmarks.

The chart illustrates the significant valuation haircuts tech companies face when transitioning from private to public markets, with Navan experiencing a 65% reduction.

What This Means for Future B2B SaaS IPOs

Navan's IPO is going to have a chilling effect on the B2B SaaS IPO market. Here's why:

Founders and VCs will be more selective. If going public means a 65% haircut and your stock trades at a 50% discount to peers, why not just stay private and raise more funding? Figma, Stripe, and other unicorns are taking this approach. They're staying private longer, raising mega-rounds from private equity, and avoiding public market scrutiny and repricing.

Only companies with AI narrative will be rewarded. If you're building a traditional B2B tool, going public now means joining Navan in the penalty box. The only way to get a decent IPO is to position your company as AI-first or AI-forward, even if that's partially a story.

Profitability will become mandatory. The Navan earnings report made clear that the market no longer cares about non-GAAP metrics or growth-at-all-costs narratives. You need to be GAAP profitable or have a very clear path (12 months or less) to profitability.

Business model clarity matters more than growth. Pure SaaS subscription companies will always trade higher than usage-based or hybrid models. If you're building a company with usage-based revenue, understand that you're accepting a 20-30% valuation penalty on the public markets relative to a comparable subscription business.

Customer concentration is now a critical risk factor. Navan's diversification helped it, but even that wasn't enough. If you're an enterprise SaaS company with >20% of revenue from a single customer, investors are going to mark you down significantly.

The Brutal Truth: Good Isn't Good Enough Anymore

Here's what really stings about the Navan story: the company didn't fail. It succeeded.

- $800M ARR

- 29% growth

- Path to profitability

- 97% customer satisfaction

- 10,000+ customers

- Iconic brand names using the product

- An AI product that's actually working

- Andreessen Horowitz buying more shares at $12-16

By literally any metric that mattered 24 months ago, Navan is a triumph. It's executing. It's building a large, profitable business in a category that's harder than pure SaaS (travel + fintech + software).

But it's 2025, and the market only wants one story: AI is going to change everything, and we're investing in that. Everything else? Too slow, too traditional, too much like the old economy.

This bifurcation is real, and it's going to reshape B2B software for the next 5-10 years. Companies that aren't AI-first will face:

- Harder fundraising

- Lower valuations

- Pressure to achieve profitability quickly (no growth-at-all-costs)

- Public market skepticism

- Pressure to either (a) sell to a larger tech company, (b) stay private indefinitely, or (c) completely rebrand as AI

Navan chose to go public on its own terms. The market punished it for not being AI enough. That's the lesson every other B2B founder is learning right now.

What Navan Could Do Now: Repositioning vs. Acceptance

Navan has a few paths forward:

Path 1: Lean harder into Ava and reposition as AI.

The company could dump the "travel platform" brand positioning and become "AI-powered corporate spend management." Make Ava the headline, not the feature. But this would feel inauthentic to investors who already see through it.

Path 2: Aggressively cut costs and optimize for cash generation.

Grow slower (even if capable of growing faster), hit GAAP profitability targets in the next 12-18 months, and become a "boring but solid" cash generator. Eventually the stock stabilizes and maybe compounds at 10-15% annually. Not exciting, but not a disaster.

Path 3: Sell the company to a larger enterprise software platform.

Salesforce, SAP, or another enterprise platform could acquire Navan for $6-8B and integrate it. The founders and early investors would take their lumps but still exit reasonably.

Path 4: Acquire aggressively and consolidate.

Navan could use its software platform, customer list, and existing infrastructure to acquire smaller travel/spend management companies, roll them up, and become an undeniable category leader. This doesn't help the stock immediately but builds real value over time.

My guess? Navan will do a combination of 2 and 4. Cut costs quietly, optimize for profitability, and buy smaller competitors. The stock will eventually stabilize somewhere between $20-25 per share, and it'll be a reasonable return for late IPO investors but a disappointment for early VC holders.

Navan's stock price fell sharply after its IPO, dropping 20% on the first day and continuing to decline by 50% over the following weeks due to various market concerns.

The Bigger Picture: How the B2B Market Is Reshaping Itself

Navan's IPO is one data point in a much larger pattern: the B2B SaaS market is in the middle of a fundamental restructuring.

For the last 15 years (2010-2025), the narrative was: "Build fast, grow at all costs, worry about profitability later." That created companies like Uber, Airbnb, and countless SaaS darlings that raised at huge multiples and then IPO'd into euphoria.

But that model relied on two things:

- Cheap capital - When money costs nothing and investors have unlimited deploy capital, they'll fund anything.

- Narrative momentum - As long as the story is exciting (scale, disruption, new category), valuations can float higher.

Both of those assumptions have broken down. Capital is expensive. Interest rates are above 4%. Investors are rational again. And the narrative has shifted entirely toward AI.

In this new environment:

- Companies that don't have a clear path to profitability within 24 months will struggle to raise capital.

- Companies that have profitability but don't have AI will trade at commodity multiples.

- Companies that have both (profitability + real AI upside) will be extremely valuable.

- Companies that are "too traditional" and don't have AI will face a long grind to build value.

Navan is in that third bucket. It's profitable. It has AI. But the AI isn't redefining the business, it's just optimizing it. So it's trading at a discount.

The next wave of B2B SaaS companies being built (2025 onward) will either:

- Be AI-first from the start (and raise at AI multiples), or

- Focus on profitability and cash generation (and be valued as boring-but-solid), or

- Find themselves caught in the middle (like Navan) and struggle.

How to Value B2B SaaS in This New Era

If Navan taught us anything, it's that traditional SaaS valuation metrics are broken. Here's a framework for what the market actually cares about in 2025:

Tier 1: AI-First Companies

- Valuation multiple: 20-40x ARR

- Profitability requirement: None (burn is acceptable)

- Customer concentration tolerance: High (60%+ from single customer okay)

- Business model: Any (subscription, usage-based, hybrid all work)

- Growth floor: 50%+ YoY required

- Example: CoreWeave, Databricks, Anthropic

Tier 2: Profitable Traditional SaaS

- Valuation multiple: 5-10x ARR

- Profitability requirement: GAAP profitability or <12 months to profitability

- Customer concentration tolerance: Low (no customer >20% of revenue)

- Business model: Subscription strongly preferred, usage-based penalized 20-30%

- Growth floor: 15-25% YoY

- Example: Zuora, Twilio, MongoDB

Tier 3: Growth-Stage SaaS (Pre-Profitability)

- Valuation multiple: 3-6x ARR

- Profitability requirement: Roadmap to profitability within 24 months

- Customer concentration tolerance: Medium (no customer >30% of revenue)

- Business model: Subscription strongly preferred

- Growth floor: 20%+ YoY (otherwise you're underperforming)

- Example: Most Series C-E companies

Tier 4: Everything Else

- Valuation multiple: 2-3x revenue

- Profitability requirement: Achieved or within 6 months

- Customer concentration tolerance: Minimal (customers >15% are a red flag)

- Business model: Any

- Growth floor: 10-15%+ YoY (otherwise just stay private)

- Example: Navan (gets penalized for usage-based model despite solid fundamentals)

Navan occupies an awkward space: it has Tier 2 fundamentals (profitability, growth, customer list) but is forced into Tier 4 pricing because its business model is hard to model and it's not AI enough for Tier 1 narrative premium.

The Investment Lesson: Why You Shouldn't Buy Navan Stock Right Now

Here's the hard truth: even though a16z is buying Navan at $12-16 per share, and even though the fundamentals are solid, this is probably not a great public market investment.

Why? Because the market hasn't repriced it to fair value yet. Here's the math:

At

Fair value is probably $8-10B (6-7x ARR for a 29%-growing, nearly-profitable SaaS company). That implies another 40-60% downside before it recovers.

Alternatively, if the company executes perfectly over the next 2-3 years (hits 3-5% GAAP margins, grows at 25%+, builds a stronger narrative), the stock could revalue to $12-15B, implying 3-4x return.

But getting to that point requires perfect execution and 2-3 years of boring progress. Most public market investors don't have that patience.

So Navan becomes a classic "value trap"—a company with good fundamentals that trades below intrinsic value but keeps falling because the market has decided it's not interesting. a16z has the conviction and capital to average in and hold for 5 years. Retail investors don't.

What This Means for Corporate Travel and Spend Management Category

Navan's struggles aren't just about narrative. They also signal something about the corporate travel market itself.

Corporate travel is a big category ($1T+ globally), but it has some brutal characteristics:

- Cyclical exposure - When the economy slows, travel budgets get cut. This directly impacts Navan's usage-based revenue.

- Commodity risk - Airlines, hotels, and travel are competitive, low-margin businesses. Building a valuable software layer on top is possible, but the upside is limited.

- Integration challenges - Getting travel onto a single platform requires changing employee behavior (they're used to booking however they want) and corporate policy (approval workflows, preferred vendors).

- Fintech complexity - The business started as Trip Actions (travel) and evolved into something much broader (spend management, corporate cards, etc.). Adding fintech layers increases regulatory risk and complexity.

These aren't reasons the business fails. Navan is clearly executing at scale. But they are reasons why the market will always be skeptical. It's a harder, lower-ceiling category than pure SaaS. The best outcome is probably a $50-100B business at scale. Compare that to Microsoft (3T), Salesforce (300B+), Adobe (280B+), and you see why investors don't get as excited.

Key Takeaways: What Navan's IPO Reveals About B2B SaaS in 2025

Let's step back and look at what Navan's IPO really means for everyone building, funding, or investing in B2B software:

1. Valuation multiples have split into two tiers: AI vs. everything else. Companies with credible AI narratives command 20-40x ARR. Everyone else trades at 5-7x. This gap is unlikely to close in the next 2-3 years.

2. The private-to-public haircut is now the norm, not the exception. Expect your last private valuation to be marked down 30-50% when you go public. Factor that into planning.

3. Non-GAAP profitability is no longer sufficient. The market now demands GAAP profitability or a clear path to it within 12 months. Stock-based comp has become a negative, not a cost of growth.

4. Business model clarity matters more than growth rate. Subscription revenue is worth 20-30% more than equivalent usage-based revenue. Investors want predictability.

5. Even a16z's vote of confidence can't overcome market sentiment. When the broader narrative is "AI is the only thing that matters," one VC's conviction isn't enough to move a stock.

6. Going public is no longer the obvious exit. Figma, Stripe, Canva, and dozens of others are staying private longer because the IPO penalty is too high. Expect more companies to delay IPOs or pursue acquihires instead.

FAQ

What happened to Navan's stock on IPO day?

Navan IPO'd at

Why is Navan trading at a discount despite strong fundamentals?

The market has bifurcated into two categories: AI companies (trading at 20-40x ARR with high burn tolerated) and traditional B2B software (trading at 5-7x ARR with profitability mandatory). Navan, despite having an AI product (Ava, handling 54% of customer interactions), is positioned as a travel/fintech company with AI features, not an AI-first company. This narrative gap, combined with a complex usage-based revenue model (92% of revenue from transactions, not subscriptions), has resulted in a "good but not AI" discount that depresses the valuation regardless of execution quality.

How much did Navan's valuation drop from private to public markets?

Navan's valuation crashed 65% from its peak private valuation of

What does Navan's usage-based revenue model mean for its valuation?

Usage-based revenue (92% of Navan's revenue from travel bookings and fintech transactions, only 8% from subscriptions) creates valuation headwinds because it's harder to predict and more cyclical than pure SaaS subscription revenue. When customers cut travel budgets in a recession, Navan's revenue drops directly. Investors penalize usage-based models by 20-30% relative to equivalent subscription revenue because subscription provides revenue stability and predictability. This structural disadvantage persists regardless of the quality of the underlying business.

Why couldn't Andreessen Horowitz's $25 million share purchases stop the stock decline?

Between December 17-29, 2025, a16z funds and Ben Horowitz personally purchased over 1.7 million shares at

Is Navan's non-GAAP profitability enough for investors?

No. Navan reported a 13% non-GAAP operating margin in Q3 (profitable), but a -41% GAAP operating margin due to stock-based compensation. In 2022-2023, this would have been celebrated. In 2025, investors increasingly demand GAAP profitability because they view stock-based comp as real dilution, not just an accounting fiction. The market's shift toward demanding true profitability (both GAAP and non-GAAP) reflects a broader change in investor rationality and reduced tolerance for burn-based growth stories.

What does Navan teach us about the B2B SaaS IPO market in 2025?

Navan's IPO reveals that the B2B SaaS market has split into two tiers: (1) AI-first/AI-forward companies commanding 20-40x ARR multiples with burn acceptable, and (2) everything else trading at 5-7x ARR with profitability mandatory. Traditional B2B companies that aren't AI-first will face harder fundraising, lower IPO valuations (30-50% markdown from private rounds), and public market skepticism unless they achieve GAAP profitability quickly. This is driving companies like Figma, Stripe, and Canva to stay private longer rather than face unfavorable IPO repricing.

What are the paths forward for Navan?

Navan has four realistic options: (1) Aggressively lean into Ava and rebrand as an AI company (though investors may see through this), (2) optimize for cash generation and GAAP profitability and accept slower growth (stock eventually stabilizes but doesn't soar), (3) accept a strategic acquisition offer from a larger enterprise software platform like Salesforce or SAP, or (4) acquire smaller travel/spend management companies and consolidate the category (builds long-term value but doesn't help stock near-term). Most likely outcome is a combination of option 2 and 4: quiet cost optimization with selective M&A over 2-3 years.

The Final Word: The Bifurcated Future

Navan's IPO is a watershed moment for B2B SaaS. It marks the point where the market's willingness to reward traditional software companies—even ones with strong fundamentals—fundamentally changed.

The company did everything right. It built a large, profitable, diversifying business in a category that matters. It has iconic customers. It has an AI product that works. It's growing at 29% at scale. By any measure of traditional success, Navan is a massive achievement.

But it was born at the wrong time. It IPO'd into a market that had already decided AI is the only story worth telling, and everything else is yesterday's news. A company that would've been a

This is the harsh new reality of B2B software. The winners and losers are being sorted not by operational excellence, but by narrative fit. If your story aligns with "AI is reshaping everything," you can command any multiple and grow however you want. If it doesn't, you'd better be profitable and efficient, because the market won't reward you otherwise.

For founders, investors, and operators in B2B software, the message is clear: in 2025 and beyond, positioning is as important as product. A company that's technically weaker but positioned correctly as AI-first will raise more capital, go public at a higher multiple, and probably exit bigger than a technically superior company positioned as "traditional SaaS with AI features."

That's not fair. It's not efficient. But it's the market we're in now.

Navan didn't fail. It just arrived at the party after the narrative had already moved on.

Try Runable For Free: Automate Your B2B Workflows

Building a B2B SaaS company means handling countless repetitive workflows: generating reports, creating presentations from data, automating customer documentation, building proposals, and coordinating team handoffs. Runable is an AI-powered automation platform that handles all of that for you.

Instead of spending hours building slides for investor decks or writing quarterly reports, Runable's AI agents can generate presentations, documents, and reports automatically from your data. At just $9/month, it's built for teams that want to automate what's repetitive and focus on what matters.

Use Case: Automatically generate weekly customer reports and executive summaries from your SaaS metrics, saving your team 5+ hours every week.

Try Runable For FreeRelated Articles

- European Deep Tech Spinouts: How 76 University Companies Became Unicorns [2025]

- The 32 Top Enterprise Tech Startups from TechCrunch Disrupt [2025]

- The 7 Top Space and Defense Tech Startups from Disrupt Startup Battlefield [2025]

- How Mill Closed the Amazon and Whole Foods Deal [2025]

- [2025] Port Raises $100M to Challenge Spotify Backstage

FAQ

What is Why Navan's IPO Flopped While AI Companies Soar: The B2B SaaS Reckoning [2025]?

October 30th, 2025 should've been a celebration

What does tl; dr mean?

Navan—the former Trip Actions that had rebranded, raised billions, and promised to revolutionize corporate travel—finally rang the bell at the New York Stock Exchange at $25 per share

Why is Why Navan's IPO Flopped While AI Companies Soar: The B2B SaaS Reckoning [2025] important in 2025?

2 billion, backed by Andreessen Horowitz, Sequoia Capital, and virtually every major venture firm

How can I get started with Why Navan's IPO Flopped While AI Companies Soar: The B2B SaaS Reckoning [2025]?

It had $800 million in annual recurring revenue, 97% customer satisfaction, and enterprise clients like Unilever, Adobe, and OpenAI

What are the key benefits of Why Navan's IPO Flopped While AI Companies Soar: The B2B SaaS Reckoning [2025]?

By end of day one, the stock had dropped 20%

What challenges should I expect?

Within weeks, it was down 50% from IPO price, trading around $12

![Why Navan's IPO Flopped While AI Companies Soar: The B2B SaaS Reckoning [2025]](https://tryrunable.com/blog/why-navan-s-ipo-flopped-while-ai-companies-soar-the-b2b-saas/image-1-1767276414268.jpg)