AI.com's Super Bowl Bet: Inside Kris Marszalek's AI Agent Platform

You've probably seen the ad. A glossy Super Bowl commercial, the kind that costs millions of dollars to air for just 30 seconds. Only this time, it wasn't promoting a beer brand or a car. It was promoting AI.com, a platform for creating custom AI agents. And it's backed by someone most people know from cryptocurrency, not artificial intelligence.

Kris Marszalek, CEO and co-founder of Crypto.com, just acquired one of the most coveted domain names in the world. AI.com. We're talking about a domain that was valued at $100 million at one point. He's building a company around it, and he's betting big enough to take it to the Super Bowl.

This move tells you something important about where the tech industry thinks we're headed. We're past the hype phase of AI assistants answering your questions. We're entering the era of AI agents actually doing things on your behalf. Not just talking. Acting.

The timing is interesting too. AI.com is launching while companies like OpenAI, Anthropic, and Google are all pushing their own agent capabilities. Claude can write code. Chat GPT is getting better at multi-step reasoning. Gemini is learning to navigate the web. And now here comes Marszalek with a $100 million domain name and a Super Bowl ad, saying his platform will let anyone build custom AI agents.

So what's actually happening here? Is this the next big shift in how we work? Or is it another expensive bet on hype, like his previous ventures? Let's break it down.

TL; DR

- AI.com acquisition: Kris Marszalek bought one of the most valuable domain names ever for his new AI agent platform

- Super Bowl marketing: The platform is launching with a major Super Bowl ad during peak hype for AI agents

- Agent-building focus: Users can create custom AI agents to handle tasks, from trading stocks to updating dating profiles

- Market timing: Launch coincides with major AI companies releasing their own agent capabilities

- History repeating: Marszalek's previous crypto ventures peaked with massive advertising right before major price crashes

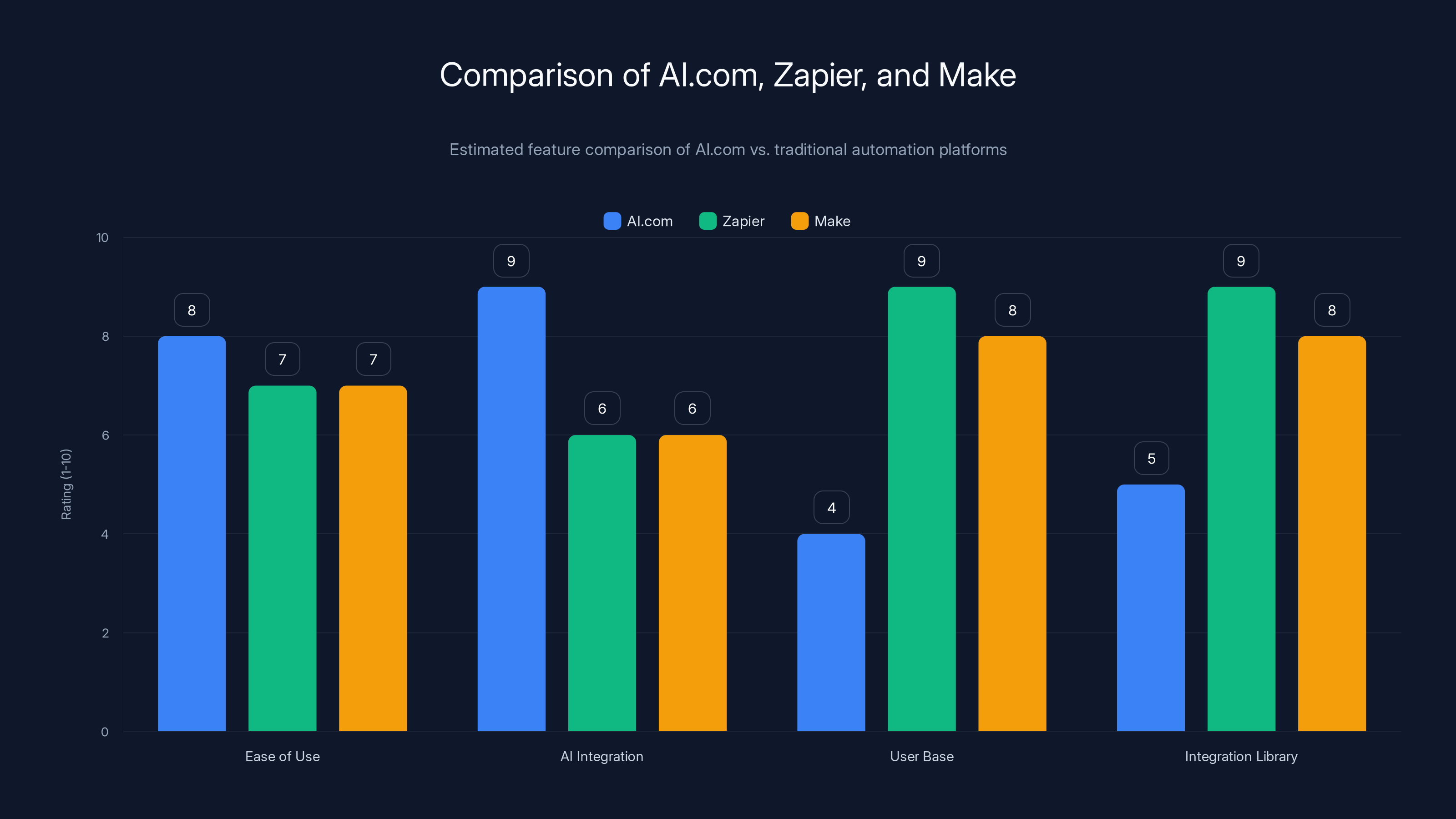

AI.com excels in AI integration and ease of use, while Zapier and Make have larger user bases and more extensive integration libraries. Estimated data.

The Domain Name That Changed Hands

Let's start with the obvious question: how much did he actually pay for AI.com?

Marszalek hasn't publicly confirmed the exact price. But the domain's valuation history is fascinating. At various points, AI.com was valued at

The point is, this wasn't a cheap acquisition. We're talking about nine figures for three letters and a dot.

But why would he pay that much for a domain name? Simple. Three-letter domains are rare. Two-letter domains are rarer still. And AI.com is probably the most valuable three-letter .com domain still available before Marszalek bought it. It's the digital equivalent of owning a billboard in Times Square that just happens to have your entire product category written on it.

When someone types "AI" into their browser, they might end up at AI.com. When people search for AI tools, AI.com could rank for the broadest, most valuable keywords. When the platform becomes a household name, the domain itself becomes the brand.

Compare that to a platform like Make (formerly Zapier competitor) that has to spend marketing dollars to build brand recognition. Or Compare to Open AI, which had to build the Chat GPT brand from nothing. With AI.com, Marszalek got a head start on brand recognition just from owning the most obvious domain.

It's a bet on the platform becoming synonymous with AI agents the way Google became synonymous with search. And that bet cost serious money.

The Super Bowl Ad: Going All-In on Hype

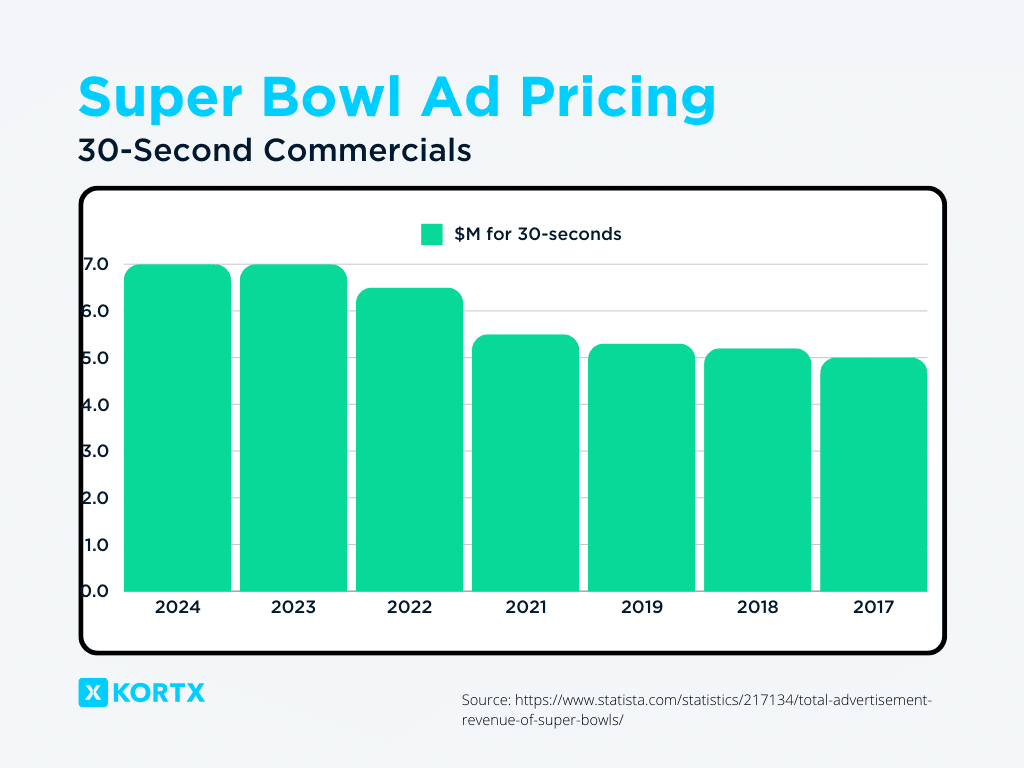

Super Bowl advertising costs roughly $7 million per 30-second slot in 2025. That's not a typo. Just for the air time. Production costs, talent, agency fees, and media buying add another couple million on top.

So Marszalek is looking at spending $10 million-plus just to tell people about AI.com during the Super Bowl.

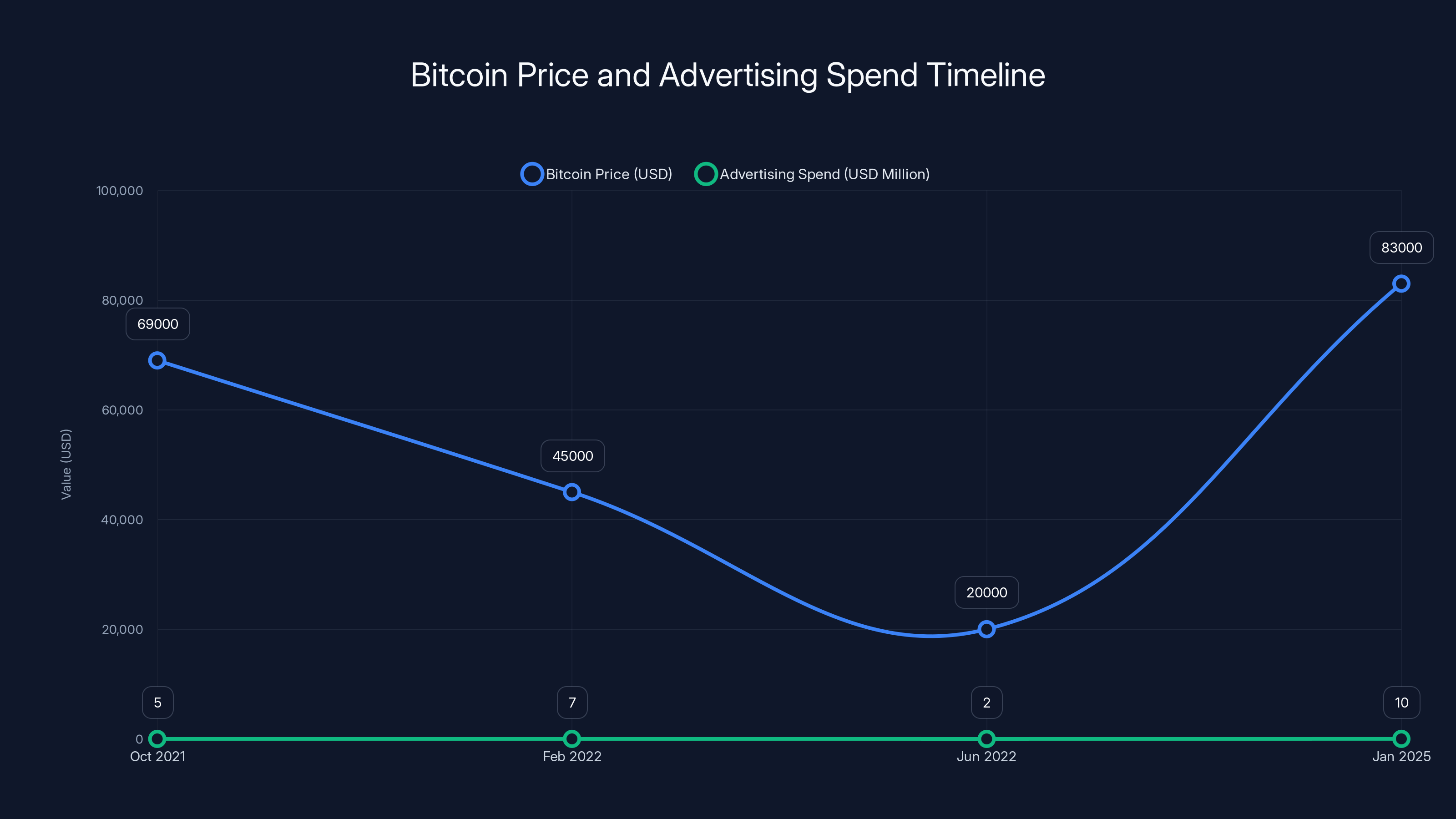

Here's the fascinating part: this isn't his first rodeo with expensive sports advertising. In 2021 and 2022, Crypto.com was everywhere. Matt Damon appeared in commercials saying "Fortune favors the brave" while promoting crypto trading. The company had a Super Bowl ad in 2022. They even renamed the LA arena from Staples to Crypto.com Arena.

Then something happened. Bitcoin crashed. The crypto winter arrived. In June 2022, Bitcoin hit its lowest point since 2020. Crypto.com had to do a massive layoff.

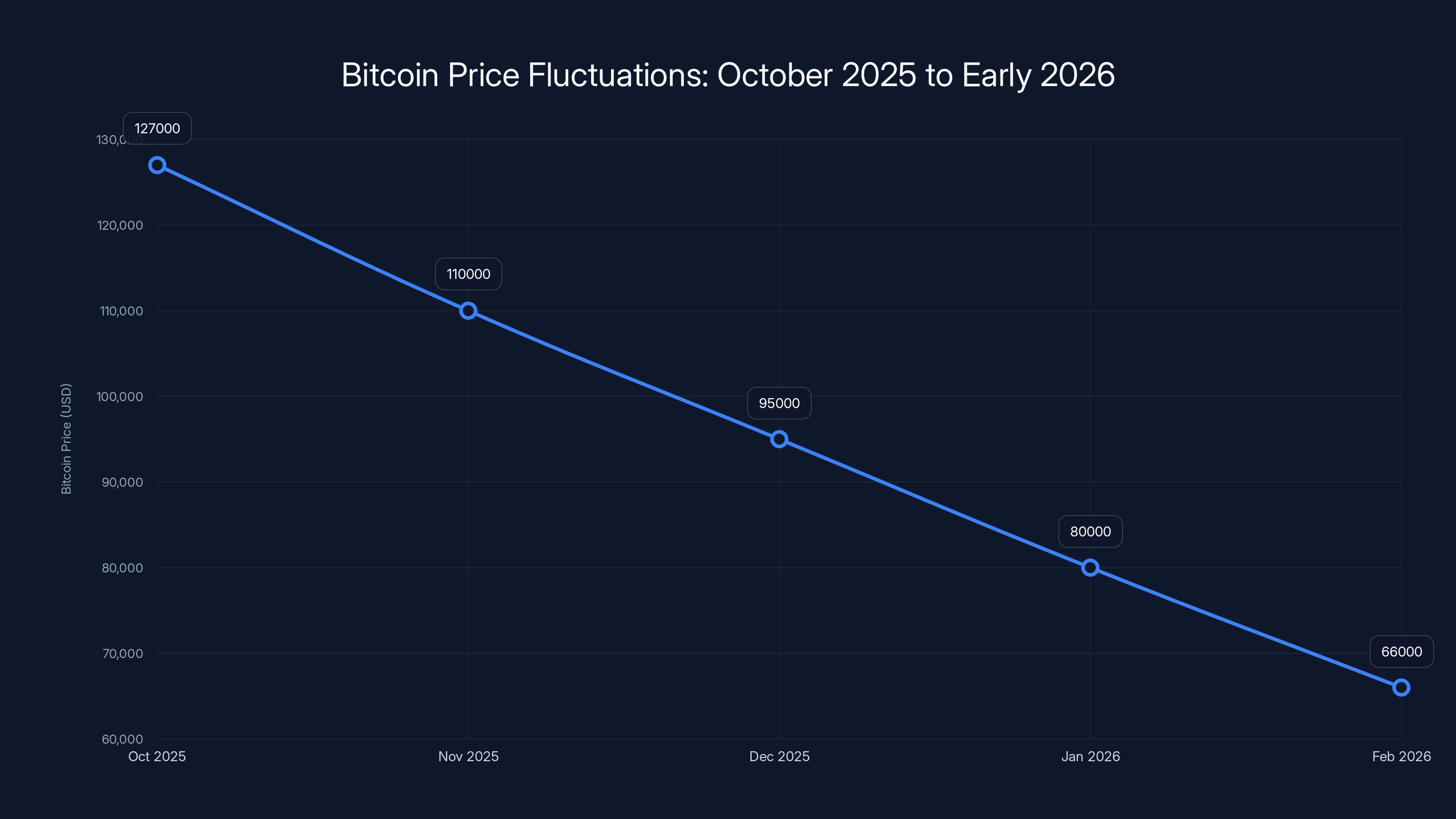

The timeline matters here. Big advertising push in late 2021 and 2022. Crypto prices peaked in October 2021 when Bitcoin hit

Now, in early 2025, Bitcoin is trading around

Is this genius timing or history repeating itself?

There's a pattern worth noticing. When new technology reaches peak hype, certain entrepreneurs pour money into high-visibility advertising. The Super Bowl ad is the ultimate status symbol in advertising. It says "we're a big company now" and "our product is important."

But the timing of massive advertising pushes often coincides with market peaks. Not always. Sometimes they precede major growth. But often enough that investors notice the pattern.

The timeline shows a correlation between high advertising spend and Bitcoin price peaks, with notable advertising pushes in 2021 and 2025 coinciding with high Bitcoin prices. Estimated data for 2025.

What AI.com Actually Does (And Doesn't)

So what is the product itself? What are users actually getting when they visit AI.com?

According to the company's announcements, AI.com offers a platform for creating custom AI agents. These agents "operate on the user's behalf—organizing work, sending messages, executing actions across apps, building projects, and more."

Let's unpack that. These are supposed to be autonomous or semi-autonomous AI systems that take actions on your behalf. Not just generating text. Actually doing things.

The examples given by the company: trading stocks, updating a dating profile, organizing work, sending messages. These are interesting choices because they highlight what the platform can do. They're also notable for what they reveal about the vision.

Stock trading is ambitious. It means the AI agent would need to integrate with brokerage accounts, understand financial data, and execute transactions. That's not just language understanding. That's decision-making with real financial consequences.

Updating a dating profile is simpler but equally revealing. It suggests the agents can interact with web interfaces and make updates. Can they do this securely? Can they handle authentication? Can they understand privacy implications?

Here's what we don't know yet: is AI.com building its own AI models, or is it licensing models from other companies like Open AI, Anthropic, or Google?

This is a crucial question. If you're licensing models, your costs scale with usage. You're paying per API call. That limits your margins and your ability to offer low-cost or free service. If you're building your own models, you have higher upfront costs but potentially better margins and more control over capabilities.

The company has mentioned both a free tier and a paid subscription plan, which suggests they need to manage costs somehow.

Another big question: where's the moat? If AI.com is just a wrapper around existing AI models with a nice UI, then competitors can do the same thing. Make, Zapier, and dozens of other automation platforms already let you connect apps and create workflows. What's the difference?

The answer likely lies in the agent-building experience. If AI.com makes it dramatically easier to create agents than competitors, they've got something. If they've got proprietary techniques for agent orchestration, that's valuable. But the company hasn't revealed those details yet.

The Competitive Landscape: Everyone's Building Agents

Here's what makes this timing particularly interesting. AI.com isn't entering a vacuum. It's entering a market where the biggest tech companies in the world are making agent capabilities central to their strategy.

OpenAI released its agents framework. You can now build agents using GPT-4. Multiple companies are already doing this in production.

Anthropic released Claude with expanded capabilities for code execution and web browsing. They've been publicly talking about agentic workflows. Claude Code and Claude Cowork are their agent-like offerings that suggest what's coming.

Google has Gemini, which is learning to navigate the web autonomously. Google also owns everything from Gmail to Google Workspace to YouTube, giving it leverage points that AI.com doesn't have.

Microsoft has invested heavily in both OpenAI and its own AI infrastructure. Copilot is being integrated into everything.

Meta has Claude integration coming. Meta also has its own AI work going on.

Into this landscape walks AI.com with a three-letter domain and a Super Bowl ad.

Now, there's an interesting argument in favor of AI.com's timing. All these big companies are releasing agent capabilities, which means the market is getting educated. Users are learning what agents can do. The technology is becoming mainstream. That creates demand for easier ways to build agents.

Think about the app store ecosystem. When smartphones became mainstream, everyone wanted to build apps. App builders and app development platforms became valuable. Square became valuable. Shopify became valuable. Companies that made it easier for non-engineers to build applications made a lot of money.

Similarly, as agents become more standard, demand will grow for platforms that make agent building accessible. That could be AI.com's opportunity.

But it's also possible that the big tech companies will bundle agent building into their existing products. Zapier users might just get better agent building within Zapier. Make users might get it within Make. Chat GPT users might get it within Chat GPT.

This is the classic competition problem for startups in AI. The big companies have distribution advantages, existing user bases, and the technical talent to build anything they want. A startup needs either a dramatically better product or a different market approach.

Marszalek's Track Record: Crypto Lessons

Who is Kris Marszalek? Beyond being the Crypto.com CEO, what should we know about his track record?

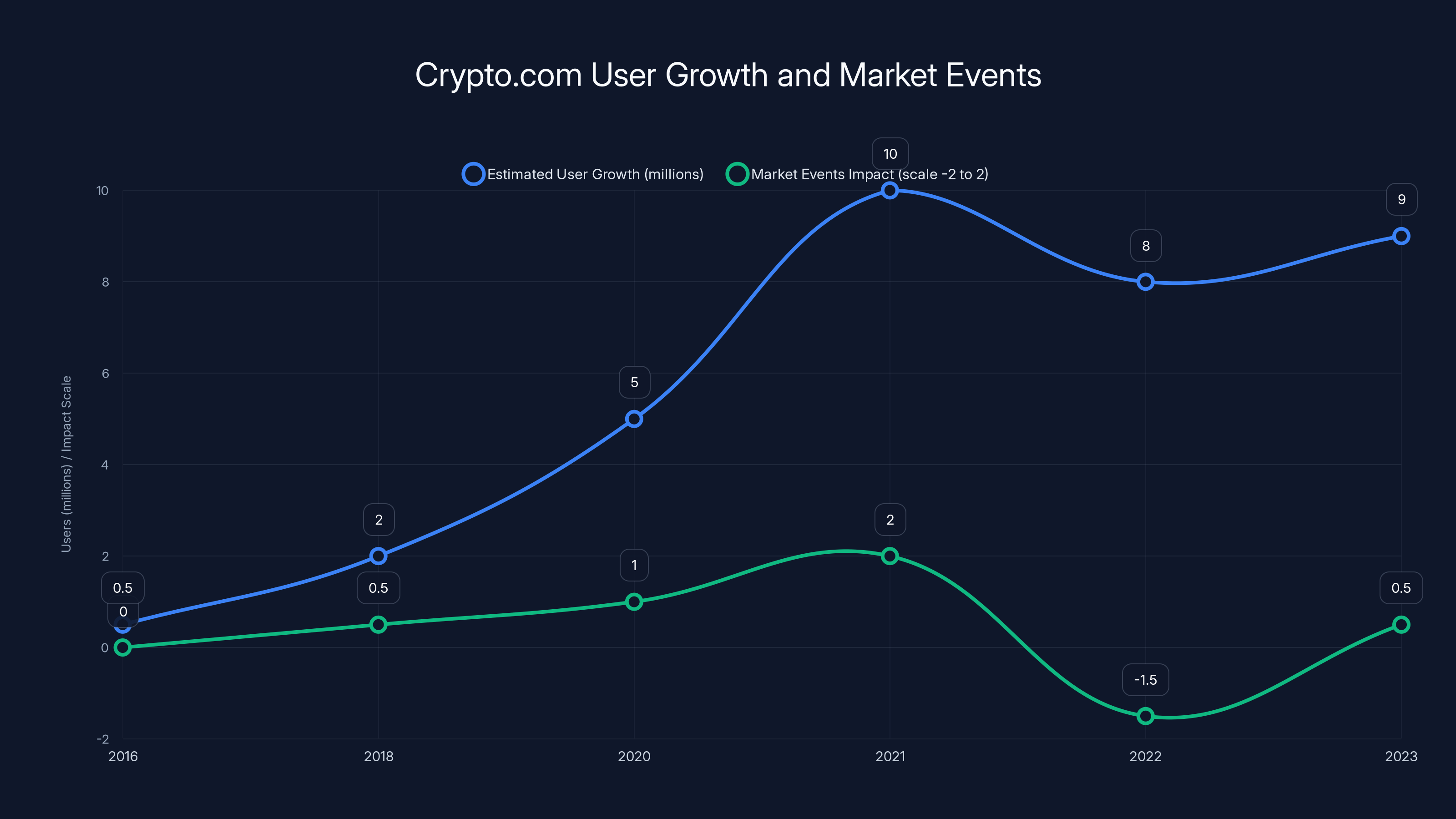

Marszalek co-founded Crypto.com in 2016. The company grew to become one of the larger cryptocurrency exchanges. At its peak, Crypto.com had millions of users and was competing with Coinbase and Binance.

What's notable about Marszalek is his willingness to make big bets. He's not cautious. He's not incremental. He commits significant capital to growth and expansion.

The Matt Damon commercial was a bet. The Super Bowl ad was a bet. The Crypto.com Arena naming was a bet. When the crypto market peaked in late 2021 and early 2022, Marszalek was positioned aggressively.

Then the market crashed. The crypto winter hit. The company had to lay off people. But Marszalek didn't disappear. He stayed with Crypto.com, guided it through the downturn, and recently has been expanding again.

What's the lesson here? Marszalek is an aggressive entrepreneur who believes in getting his company's name in front of people. He doesn't do quiet, efficient growth. He does visible, memorable, expensive campaigns.

That approach works great when markets are growing and sentiment is positive. It's questionable when markets are declining. People remember your ad when things go well. They resent your ad when things go poorly.

Now he's doing it again, this time with AI.com.

The question for investors and users is: will the AI agent market follow the trajectory of cryptocurrency (which had a boom, then a bust, but eventually recovered and grew)? Or will it be different?

Artificial intelligence is more fundamental than cryptocurrency. AI has applications in nearly every industry. It's not just speculation like crypto trading. It's actual productivity software.

But that doesn't guarantee success for any particular company. IBM had artificial intelligence aspirations. They built Watson. It won Jeopardy. And then... it wasn't the future of computing.

Marszalek's bet on AI.com is a bet that agent-building platforms will be valuable, that his platform will be the clear leader, and that a Super Bowl ad in early 2025 is the right time to make this play.

That's not a crazy bet. But it's also not a sure thing.

Bitcoin experienced a significant decline of 48% from its peak of

The Economics of AI Agents: Free vs. Paid

Here's a practical question that determines whether AI.com becomes a sustainable business: can you make money offering AI agents?

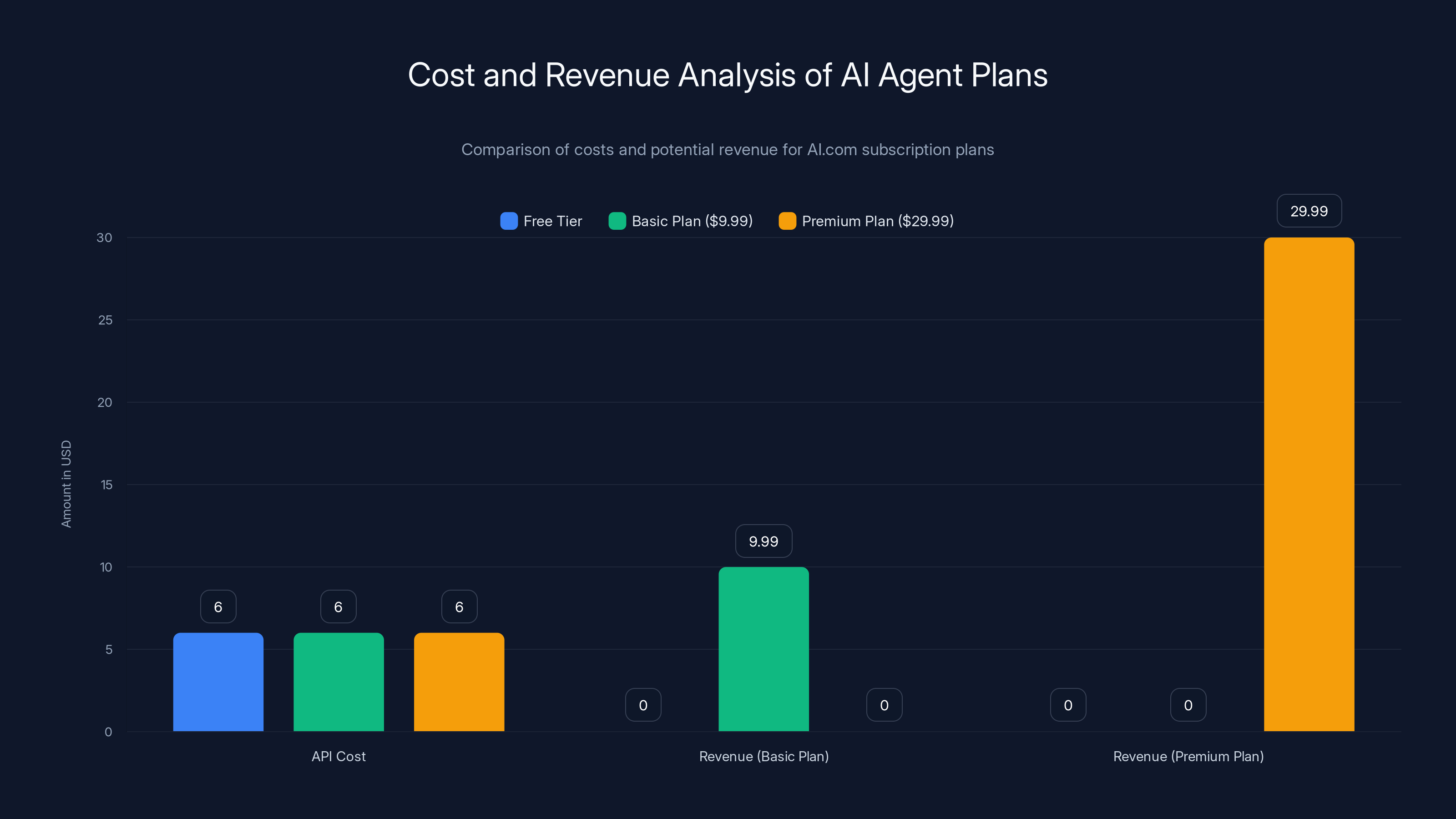

Let's think about the math. If AI.com is using OpenAI's API under the hood, they pay per token. GPT-4 costs roughly

Say an AI agent processes a moderately complex task. It might generate 100,000 tokens of activity per month for one user. At GPT-4 pricing, that's $6 in API costs per user per month.

Now, if you're charging

If you're charging

The free tier is the wild card. Free tiers work when they acquire users who eventually convert to paid. But if your free tier gets heavily used by people who never upgrade, you're burning money.

Another economic model: API access. If developers build their own applications on top of AI.com, you can charge for API access. This is what OpenAI, Anthropic, and other model providers do. It scales better because usage is tied to the developer's business success.

But this requires building a developer-friendly platform, documentation, support, and distribution. It's more work upfront but potentially more lucrative.

The wild card in all of this: if Marszalek has the financial resources to subsidize AI.com for years while building scale, he might be able to outcompete services that need to be profitable immediately.

Crypto.com did this. The company raised massive venture capital and used it to acquire users aggressively, even when unit economics weren't great. Once they had scale, they could improve profitability.

AI.com could follow the same playbook. Spend on Super Bowl ads and marketing, acquire users cheaply, and figure out profitability later.

But that only works if there's an eventual path to profitability, and if capital markets stay favorable.

AI Agents vs. Automation: What's the Difference?

You might be wondering: isn't this just automation? Zapier has been doing automation for years. Make (formerly Integromat) does automation. Why is AI.com different?

Good question. The difference comes down to intelligence and autonomy.

Traditional automation: if A happens, do B. If your Slack message contains "invoice," create a task in Asana. If your calendar shows you have five free hours, email your manager. These are rule-based workflows.

AI automation: the system understands context, can handle variations, and can make judgment calls.

For example, with traditional automation: "If I receive an email about an expense, create a task." With AI agents: "If I receive an email that might be about an expense, understand what the expense is, categorize it, determine if it needs my approval, and take the appropriate action."

The AI agent can understand that "bought coffee for the team" is an expense that might not need approval, while "booked a vendor contract for $50,000" definitely needs approval. A traditional automation rule can't distinguish between them without explicit programming for each scenario.

This is why AI agents are genuinely different. They reduce the need for explicit rule-building. Instead of telling the system "do A in case B," you can tell the agent "handle expense tracking," and it figures out the details.

Of course, there are limitations. Agents can make mistakes. They can misunderstand context. They might take actions you don't want. This is why AI.com emphasizes that agents are "permission-based." You're supposed to grant the agent permission to act in specific contexts.

But the vision is clear: less explicit programming, more natural language instruction, smarter automation.

Zapier and Make are starting to add AI features, which suggests they see the threat. If traditional automation gets disrupted by intelligent automation, they need to compete or die. Their billions in valuation are on the line.

For AI.com, this is the opportunity. Come in with a platform built for AI agents from day one, rather than bolting AI onto a platform designed for rule-based automation.

The Stock Trading Use Case: Higher Stakes

Let's zoom in on one specific use case AI.com mentioned: automated stock trading.

This is where things get legally and practically complex.

First, the practical side: executing trades requires integration with a brokerage. You need API access to accounts. You need to handle authentication securely. You need to ensure that your system understands the difference between a market order, a limit order, and a conditional order. You need to understand position sizing, risk management, and portfolio allocation.

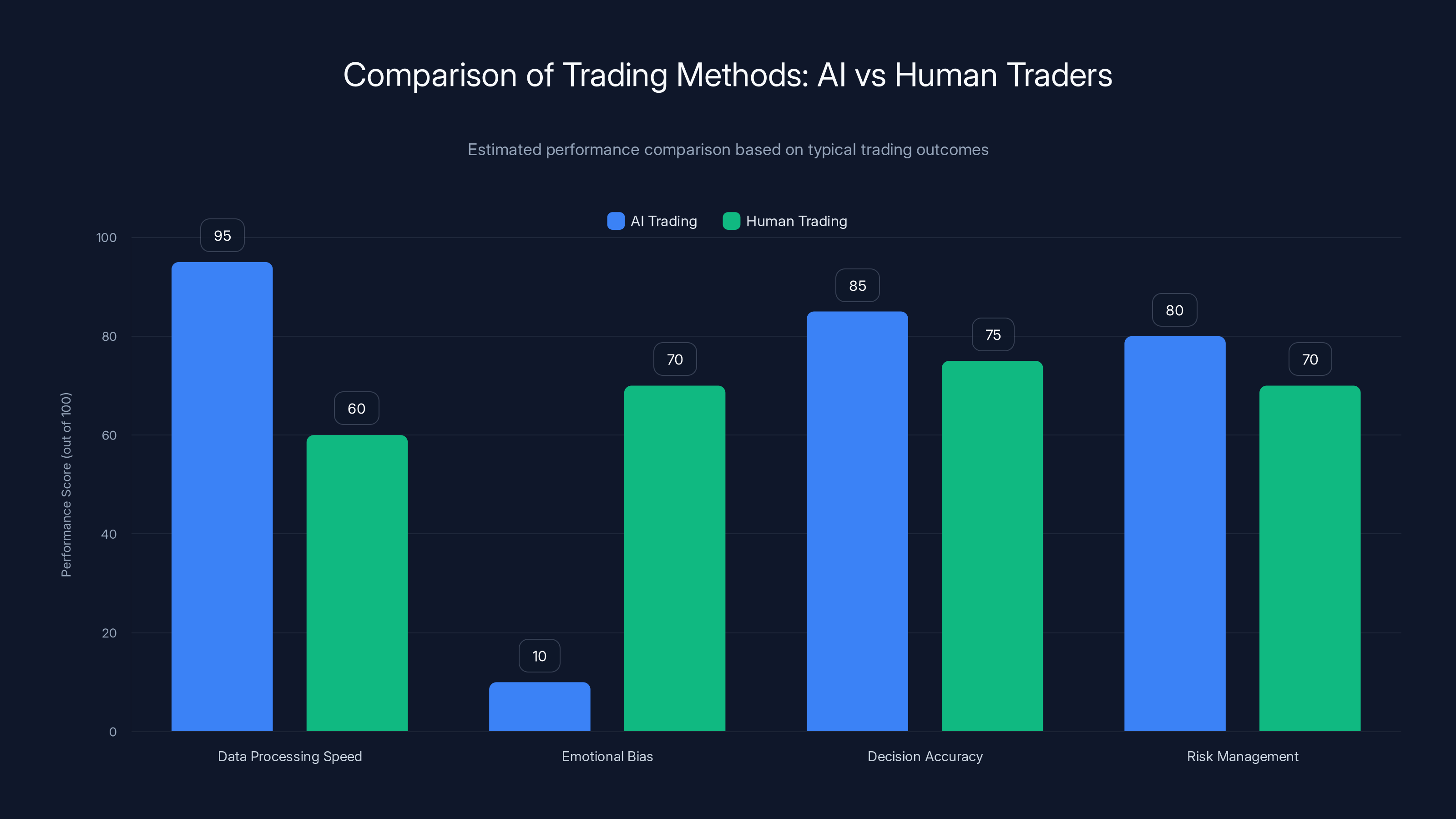

An AI agent that trades could potentially make better decisions than humans in some cases. It can process more data, react faster, and remove emotional decision-making. There's research suggesting that algorithmic trading outperforms human traders on average (though not always).

But here's the problem: if an AI agent makes a bad trade using your platform, who's responsible? If someone loses $100,000 because the AI agent misunderstood market conditions, do they sue AI.com?

There are regulatory issues here too. The SEC has rules about what constitutes investment advice. If your AI agent recommends a trade, is that advice? The SEC cares. They want to regulate investment advisors.

Then there's the fiduciary duty question. If you're handling someone's money, you have fiduciary obligations. These are serious legal requirements.

AI.com hasn't detailed how they're handling these issues. They might have built compliance features. They might have terms of service that disclaim liability. They might require users to be classified as sophisticated investors.

But the fact that they're mentioning stock trading as a use case tells you they're thinking big. This isn't just scheduling your calendar or organizing your email. This is where AI agents touch money, and that's where regulation, liability, and stakes all increase.

Crypto.com saw significant user growth from 2016 to 2021, peaking during the crypto boom. The market crash in 2022 led to a decline, but recovery efforts are visible in 2023. (Estimated data)

Crypto Winter and AI Hype Cycle: Timing Everything

Here's something interesting to think about: the timing of AI.com's launch coincides with interesting market conditions.

In October 2025, Bitcoin peaked at around

Wait, let's check that timeline. The article mentions Bitcoin hitting

That's a 48% decline in just a few months. That's a serious crash, though not as catastrophic as 2022.

Now, why does this matter? Because it suggests we're potentially in a crypto cycle again. Peaks followed by declines. And Marszalek is launching a massive advertising campaign during a crypto decline.

Some would say that's terrible timing. You don't want to be associated with a sector that's crashing. Others would say it's brilliant timing. When everyone's depressed about crypto, you pivot to AI and rebranding.

The thing is, Marszalek has lived through this before. In 2021-2022, he was advertising when crypto was booming. He didn't flee then or pull back advertising. He rode it out. Crypto.com survived the crash and is still operating.

Maybe he knows something about long-term cycles that most people don't. Or maybe he's just aggressive regardless of market conditions.

As for AI hype, we're definitely at an inflection point. AI has moved from niche interest to mainstream business focus. Every company is either building AI capabilities or figuring out how to integrate AI. That's real demand.

But hype cycles are real too. Peak hype doesn't last forever. Interest cycles. New technology gets shiny. Then cracks appear. Then either it becomes fundamental (like the internet) or it deflates (like certain blockchain promises).

AI is more likely to become fundamental, but that doesn't mean every AI company succeeds.

The Distribution Question: How Will People Find It?

Having a great product is one thing. Getting people to use it is another.

AI.com has a domain advantage, but domain traffic alone won't make the business. Some people will type "ai.com" into their browser. But will enough?

Super Bowl advertising solves part of this problem. It creates awareness and brand recognition. People see the ad and remember "oh, I can go to AI.com to build AI agents."

But Super Bowl ads reach a massive audience that doesn't necessarily overlap with your target market. If the target is serious AI developers and business users, is the Super Bowl the right place?

Alternatively, the target might be everyone. The vision might be that AI agents become as common as apps, and anyone should be able to build them. In that case, a mass-market Super Bowl ad makes sense. You're educating the market about what's possible.

Beyond the Super Bowl, AI.com will need ongoing marketing. Search engine optimization. Content marketing. Developer relations. Partnerships with other platforms.

Comparison to competitors: OpenAI has Chat GPT, which became the fastest-growing application ever. That created massive brand awareness and distribution. Anthropic doesn't have the same level of user distribution but has credibility in AI safety. Google has email and cloud products that it can integrate Agents into.

AI.com has a domain and a Super Bowl ad. That's not nothing, but it's not enough to guarantee success.

Brand building takes years. Marszalek has demonstrated willingness to spend for that. But execution matters too.

Security and Privacy: The Unresolved Questions

When you have an AI agent handling your personal work, your emails, your calendar, or your financial accounts, security and privacy become paramount.

AI.com emphasizes that agents are "permission-based and private." That sounds good, but what does it actually mean?

Permission-based presumably means: before the agent accesses your Gmail, you explicitly authorize it. Before it trades stocks, you authorize it. Before it updates your dating profile, you authorize it.

But authorization is tricky. Do you understand what you're authorizing? An agent that "handles your email" might sound innocuous. But it could potentially read sensitive information, expose it during processing, or make decisions based on patterns you don't want.

Private presumably means: data isn't shared with third parties. But is it encrypted? Is it stored securely? What happens if AI.com gets hacked? What are the liability terms?

These are complex questions that require detailed documentation and likely legal review. AI.com hasn't published comprehensive security or privacy documentation yet (as of the timing of this article).

Compare to traditional services. When you connect Gmail to Zapier, you're trusting Zapier with your Gmail access. Zapier has built a reputation for security and handles millions of users' data. They're a substantial company with security practices and audit logs.

AI.com is new. They need to build that trust. The Super Bowl ad doesn't establish security credentials. Only time, audits, and proven track record do.

For early users, this is a risk. For mass market adoption, this is a blocker. People won't give AI agents access to sensitive data until they're confident it's secure.

The basic plan leaves only

The Regulatory Minefield: Investment Advice and Data

Here's something that doesn't get enough attention: AI agents operating on behalf of users might trigger regulatory requirements that the company isn't prepared for.

Investment advice: If an AI agent recommends trading a stock, is that investment advice? The SEC believes it is. If so, you need to be registered as an investment advisor. You need compliance staff. You need to maintain audit trails. This is expensive and complex.

Data handling: If an agent has access to personal data, financial data, or health data, GDPR applies (if you have EU users). CCPA applies (if you have California users). These regulations require explicit consent, data minimization, and the right to deletion. Violating them carries massive fines.

Banking regulations: If an agent has access to bank accounts or can initiate transfers, you might need to be regulated as a financial services company. This is a major regulatory hurdle.

And there's the liability question. If an agent causes harm, what's your liability? If an agent trades poorly and loses money, are you liable? If an agent accidentally sends a sensitive message, are you liable? Without clear legal precedent, this is uncertain.

AI.com will need to navigate these regulatory questions. They may need banking licenses or advisor registrations. They may need compliance infrastructure that most AI startups don't have.

Marszalek's background in crypto might actually help here. Crypto.com has dealt with regulatory complexity. It's a domain where they have expertise and relationships.

But regulatory uncertainty is a risk factor for early users. If regulators decide AI agents need specific licensing, the entire business model could change.

Comparison to Existing Automation Platforms

Let's compare AI.com to the existing automation and AI platform ecosystem.

Zapier: The dominant automation platform with millions of users. Zapier is adding AI features. They have distribution, execution, and market leadership. AI.com is the insurgent here, trying to position agents as better than Zapier's automation.

Make (formerly Integromat): Similar to Zapier, Make is a powerful automation platform. Make's pricing is sometimes cheaper than Zapier for power users. Make is also adding AI. Again, AI.com is the newer, agent-focused alternative.

OpenAI: OpenAI can let you build agents using the API and GPT-4. But it requires technical knowledge. It's not a visual builder for non-technical users. AI.com might position itself as the accessible alternative.

Google's Workspace Automation: Google is building automation directly into Docs, Sheets, Gmail, etc. If you're a Google Workspace user, you'll get agents built into your daily tools. This is a serious competitive threat to standalone agent platforms.

Microsoft Copilot for Microsoft 365: Similar to Google, Microsoft is building AI and agents into Excel, Word, Outlook, Teams. If you're a Microsoft user, why use a separate platform?

The competitive position for AI.com is: easier than APIs, more focused on agents than Zapier/Make, independent from the big tech platforms.

That's a viable position. But it depends on agents becoming mainstream enough that people want a standalone platform for them, rather than using their existing tools.

The Vision: Where Are We Headed?

Setting aside Marszalek and AI.com specifically, what does the broader AI agent trend tell us about where technology is going?

We're moving from interaction-driven AI (you ask, it answers) to action-driven AI (you ask, it does).

Chatbots are reactive. You type a question, you get an answer. That's valuable but limited. You still have to decide what to do with the information.

Agents are proactive. You give them an objective, and they work toward it. They can iterate, try different approaches, and adjust based on results.

This is genuinely more useful for knowledge work. Instead of asking Chat GPT how to fix a bug, you give an agent your code and it fixes it. Instead of asking for a sales summary, you give an agent access to your CRM and it builds the summary, updates forecasts, and identifies at-risk deals.

The vision Marszalek is betting on is a world where everyone has AI agents handling routine work. The accountant's agent handles data entry and reconciliation. The salesperson's agent handles pipeline updates and follow-ups. The engineer's agent handles code reviews and testing.

If this vision is correct, then agent-building platforms become valuable infrastructure. Just like Salesforce became essential for sales teams, agent platforms could become essential for any knowledge worker.

That's a big vision. And it's possible. But it's also got serious hurdles: security, regulatory, technical reliability, and adoption.

AI trading systems typically outperform human traders in data processing speed and decision accuracy, but human traders may have better risk management due to experience. (Estimated data)

The Super Bowl Bet: Why Now?

Why does Marszalek think right now is the moment for a Super Bowl ad?

A few factors probably influenced the decision:

Market timing: AI agents are hot. Multiple major companies are releasing agent capabilities. The market is educating itself. Sentiment is positive. This is the moment when a new category becomes mainstream.

Domain acquisition: AI.com became available or Marszalek decided the time was right to acquire it. This is a limited-time opportunity. You can't just wait forever to use a domain.

Capital: Marszalek has access to capital from Crypto.com. He can afford a Super Bowl ad. Not every entrepreneur can. This is a capital-intensive strategy.

Brand momentum: Coming off crypto challenges, pivoting to AI is a clever positioning move. It lets Marszalek and Crypto.com say "we're not just crypto people, we're tech innovators." The Super Bowl ad amplifies that.

Personal conviction: Marszalek clearly believes in this. He's not making a cautious bet. This is a bet-the-farm move for a new product. That usually means the person behind it is convinced of the vision.

Whether the timing is actually optimal, time will tell. But the decision to go all-in right now makes sense from Marszalek's perspective.

Learning from Crypto Boom and Bust

We can't discuss Marszalek and big advertising bets without discussing what happened in crypto.

Crypto.com's advertising was everywhere in 2021-2022. The company was confident and visible. Then crypto crashed. Hard.

What did Marszalek do? He didn't disappear. He didn't abandon the company. Crypto.com went through a difficult period but emerged. The company is still operating, still has users, still has revenues.

The lesson: sometimes massive bets on brand and marketing don't pay off immediately. The markets crash. The hype deflates. But if you have a solid product and you can survive the downturn, you eventually recover.

If Marszalek learned this lesson from crypto, he might be applying it to AI.com. Invest heavily now. Build brand awareness. Get distribution. Then survive whatever market cycles come next.

But that requires the product to be solid. If AI.com is just a wrapper with no real differentiation, it won't survive. If it's a genuinely useful platform for building agents, it might.

What Success Looks Like for AI.com

If we're being specific about what would constitute success for Marszalek:

Three years: AI.com has 500,000 monthly active users. The platform has a reputation in startup and SMB communities for being the easiest way to build agents.

Five years: AI.com has 5 million monthly active users. It's becoming mainstream. Enterprises are using it. The platform has expanded to support complex use cases and integrations.

Seven years: AI.com is either public or acquired by a larger tech company. The platform is recognized as one of the major agent-building platforms alongside or competitive with what the big tech companies offer.

Those timelines and numbers are speculative. But they give you a sense of what a successful outcome looks like.

The Super Bowl ad is an investment in reaching that outcome. It's not something you do if you're trying to have a moderate, slow-growth startup. It's what you do if you're trying to capture a market fast.

The Broader Context: Why Agents Matter

Why is everyone suddenly so focused on AI agents?

Because generative AI hit a limitation: generating text is great, but real value comes from taking action.

Imagine you're a project manager. Chat GPT can help you write a status report. But your agent could actually compile the status report from your project management tool, your email, your calendar, and your task list. That's better.

Or imagine you're an accountant. Chat GPT can explain accounting principles. But an agent could process your receipts, categorize them, identify deductions, and prepare tax documents. That's genuinely valuable.

Or imagine you're an engineer. Chat GPT can explain code. But an agent could review your pull requests, suggest improvements, run tests, and potentially apply fixes. That's game-changing.

This is why every major AI company is focusing on agents. It's the evolution of the technology from interesting to truly valuable.

AI.com is betting that this evolution is real and that building a platform for it is a valuable business.

Potential Pitfalls and Challenges

Not everything will go smoothly for AI.com. What could go wrong?

Technology limitations: Building reliable agents is hard. They need to handle exceptions, understand context, and make good decisions. If AI.com's agents are unreliable or make obvious mistakes, users will lose confidence.

Competition from big tech: Google, Microsoft, and Meta could all decide to bundle agent building into their existing products. That's a tough competitive moat to overcome.

Economic headwinds: If the economy slows and companies cut spending on new tools, adoption slows. A startup without revenue might struggle.

Regulatory crackdowns: If regulators decide to regulate AI agents, compliance costs could become prohibitive.

Brand association: If AI.com becomes associated with failed predictions or overhype, adoption suffers. (This is the crypto lesson.)

Security breaches: One major security incident could destroy trust in the platform.

These are real risks. Not every company succeeds, even with massive capital and good timing.

The Bigger Picture: Tech Cycles and Hype

Marszalek's AI.com bet is part of a larger story about technology cycles and hype.

Every few years, a new technology becomes "the future." In the 1990s, it was the internet. In the 2010s, it was social media and mobile. In 2020s, it's AI.

When a technology reaches hype peak, two things happen: real innovation accelerates, and marketing becomes aggressive.

Small companies try to position themselves as leaders in the new category. Big companies try to ensure they're not disrupted.

Some of these bets pay off. Some don't.

Webvan failed as an e-commerce grocery delivery company. But Amazon Fresh eventually succeeded at the same thing (though differently). The timing and execution matter.

Crypto has had cycles. Boom, crash, recovery, boom again. Each cycle brings new companies and new ideas.

AI is likely to follow a similar pattern. Periods of rapid growth, periods of disillusionment, periods of stability. Throughout, the companies that build real value survive. The companies that don't, disappear.

Marszalek's bet is that agent-building platforms will survive and thrive through the AI hype cycle. The Super Bowl ad is his statement: "We're betting big on this."

That's either brilliant or foolish. Time will tell.

Lessons for Other Entrepreneurs

If you're building an AI startup, what can you learn from AI.com's approach?

Domain matters: A good domain can be worth serious capital. If you're trying to build a platform in a new category, owning the obvious domain is valuable.

Timing is important but not everything: You could launch at the perfect time and still fail if your product isn't good. But bad timing (launching in a market downturn) makes success harder.

Brand building takes capital: If you want to reach scale quickly, you need to invest in visibility. Super Bowl ads are extreme, but the principle applies. Content, marketing, sponsorships, and partnerships all cost money.

First-mover advantage is real but limited: Being early matters. But if bigger companies can build the same thing, being early isn't enough. You need differentiation.

Track record matters: Marszalek has experience building and scaling a company. That credibility helps with investors, customers, and employees. If you're starting from zero, you have a harder climb.

Conviction matters: You can't make a Super Bowl ad bet if you're not convinced. Entrepreneurs who succeed usually have strong conviction about their vision, even when others are skeptical.

Final Verdict: Is This a Good Bet?

Let's try to synthesize everything and offer a verdict.

Is Marszalek's AI.com bet likely to succeed?

Honestly: it's unclear. There are strong arguments both ways.

The bull case: AI agents are becoming real and valuable. The market will grow. Marszalek has capital, conviction, and experience. A dedicated platform for building agents could carve out a niche even if big tech companies are also competing. The domain is valuable. The brand momentum from Crypto.com's recovery could carry over.

The bear case: Big tech companies are building agents into their existing platforms. That's a huge competitive advantage. Marszalek's track record in crypto is mixed—great growth followed by a crash. The Super Bowl ad strategy is expensive and has poor timing track record. The product details are vague. Security and regulatory questions are unresolved.

If I had to bet: I think AI.com will succeed in finding an audience and building a meaningful business. Whether it becomes a major platform or remains a niche tool is less certain. The Super Bowl ad will create awareness, which helps. But execution on the product will determine the outcome.

Marszalek has proven he can build and scale a business. That's a point in his favor. But so many AI startups are launching right now with smart teams and good timing. Most will not become valuable platforms.

The bet I'd make: AI.com has a 40% chance of becoming a meaningful platform with significant users and revenue. A 20% chance of becoming a major platform. And a 40% chance of becoming a small platform serving a niche or getting acquired or fading away.

Those odds make it an interesting bet from Marszalek's perspective. And an interesting story for the rest of us to watch.

The Evolution of Work and AI

Underlying this entire story is a deeper question: how is AI going to change how we work?

The assumption in AI.com's vision is that AI will handle routine and repeatable work. That AI agents will augment human capabilities. That the future of knowledge work involves a partnership between humans and AI.

This assumption might be right. Or it might be incomplete.

Maybe AI will disrupt knowledge work in ways we don't expect. Maybe certain job categories will simply disappear. Maybe new job categories will emerge that we can't predict.

Maybe AI agents will be essential tools. Or maybe they'll be interesting but not transformative.

This uncertainty is why betting on AI platforms is risky. We're not just betting on a product. We're betting on a vision of the future.

Marszalek is betting on one vision. Others are betting on different visions. Time will reveal which visions match reality.

What to Watch

If you want to follow AI.com's progress, here's what to pay attention to:

User acquisition: How many people actually visit AI.com post-Super Bowl? Are they trying it? Are they signing up? This is the first real test.

Product feedback: What are early users saying? Is the agent-building experience genuinely better than alternatives? Or is it comparable?

Enterprise adoption: Does AI.com get traction with businesses, or just tinkerers and enthusiasts?

Revenue: Is the company developing a clear path to profitability? Or is it burning capital indefinitely?

Regulatory events: Do regulators decide to regulate AI agents? How does that affect AI.com's business?

Competitive moves: How do big tech companies respond? Do they build competing agent platforms? Do they try to acquire AI.com?

Marszalek's next move: Does he stick with AI.com if it struggles? Or does he pivot to the next opportunity?

These signals will tell us whether AI.com becomes a significant platform or becomes another expensive Super Bowl ad that people remember but nothing else.

Conclusion: The Bet is On

Kris Marszalek has made a big bet. He's acquired a valuable domain, built a company around it, and invested millions in a Super Bowl ad to launch it.

That takes conviction. It also takes capital and willingness to risk failure.

The outcome will depend on whether AI agents become as important as Marszalek believes. It will depend on whether AI.com's product is actually better than alternatives. It will depend on execution, timing, and market conditions.

History suggests that aggressive entrepreneurs who make big bets sometimes win big. Elon Musk has done it multiple times. Richard Branson has done it. Jack Ma did it.

But history also shows that sometimes the expensive Super Bowl ad precedes the crash.

What makes this story interesting is that we get to watch it unfold in real time. The Super Bowl ad has aired. The platform is launching. Users are trying it.

The next 12 to 24 months will tell us whether Marszalek's vision for AI agents is viable and whether AI.com can win in a crowded market.

For Marszalek, it's a high-stakes game. For the rest of us, it's a fascinating case study in tech entrepreneurship, market timing, and the future of AI.

The bet is on. Let's see what happens.

FAQ

What is AI.com?

AI.com is a platform for creating and managing custom AI agents. These agents can handle tasks autonomously across different applications and systems. The platform was founded by Kris Marszalek, CEO of Crypto.com, and launched with a Super Bowl advertisement. Users can build agents for various purposes, from organizing work to trading stocks, without requiring deep technical knowledge.

How much did Kris Marszalek pay for the AI.com domain?

Marszalek has not publicly disclosed the exact purchase price for the AI.com domain. However, the domain was previously valued at approximately $100 million. Given its status as one of the most valuable three-letter .com domains available, the acquisition likely represented a significant investment in the tens of millions of dollars, though exact figures remain proprietary.

How does AI.com compare to platforms like Zapier and Make?

AI.com is specifically designed around AI agents, whereas Zapier and Make are traditional automation platforms with AI features being added. Traditional automation relies on rule-based workflows (if A happens, do B), while AI.com emphasizes intelligent agents that can understand context, make judgments, and handle variations without explicit rules. AI.com positions itself as more intuitive for agent building, though established platforms have larger user bases and more extensive integration libraries.

What are the security concerns with using AI agents for sensitive tasks?

AI agents handling sensitive data raise several security considerations. These include data encryption, secure authentication, protection of personal and financial information, and transparency about how data is processed. Additionally, liability becomes unclear if an AI agent makes a mistake with financial or critical business data. Users should verify that any AI agent platform has comprehensive security documentation, regular security audits, and clear liability terms before granting access to sensitive systems.

How does the AI.com Super Bowl ad fit into the broader AI hype cycle?

The Super Bowl advertisement represents a significant marketing bet during a period of peak AI interest and adoption. Similar to Crypto.com's aggressive marketing in 2021-2022 (which preceded the crypto market crash), AI.com is investing heavily in brand visibility during peak AI sentiment. The strategy aims to capture market share during high public interest, though timing relative to market cycles can be unpredictable. Whether this timing proves optimal depends on how the AI market evolves over the next few years.

What is Kris Marszalek's track record with big marketing bets?

Marszalek has demonstrated a pattern of making aggressive, high-visibility marketing investments through Crypto.com. The company launched notable campaigns including Matt Damon commercials and a Super Bowl advertisement in 2022, plus paid to rename the LA arena to Crypto.com Arena. While these created significant brand awareness, they coincided with the crypto market peak in late 2021, followed by a 71% decline in Bitcoin prices by mid-2022. This history suggests Marszalek is willing to invest heavily in growth regardless of market conditions, with mixed results depending on market timing.

How do AI agents differ from traditional automation tools?

Traditional automation relies on explicit rules and conditional logic that users must program in advance. AI agents, by contrast, use artificial intelligence to understand context, handle variations intelligently, and make decisions with less explicit instruction. For example, a traditional rule might say "when an email mentions an invoice, create a task," while an AI agent could understand the context of different emails, distinguish important from routine expenses, and take appropriate actions without specific rules for each scenario.

What are the regulatory challenges for AI agent platforms?

AI agent platforms face several regulatory hurdles including investment advice restrictions (if agents recommend financial trades), fiduciary duty requirements (when handling others' money), data privacy regulations (GDPR, CCPA), and potentially banking regulations (if agents access bank accounts). These requirements could necessitate licensing, compliance infrastructure, and legal oversight that significantly increase operational complexity. AI.com's approach to these regulatory questions remains largely undisclosed and represents a significant uncertainty for the platform.

Is AI.com's business model sustainable at its pricing?

AI.com's sustainability depends on its cost structure and pricing strategy. If the platform licenses AI models from providers like OpenAI, per-token usage costs could consume significant margin if pricing is low. For a $9.99 monthly plan, after API costs are paid, only a few dollars remain for infrastructure and operations. The company likely depends on higher-tier paid plans, API-based revenue from developers, or building its own models to achieve sustainable margins. This economic model remains unconfirmed in public statements.

What would indicate success or failure for AI.com within the first year?

Key indicators of success would include substantial user acquisition post-Super Bowl, positive product feedback from early adopters, enterprise customer interest, clear path to revenue sustainability, and the absence of major security incidents. Signs of difficulty would include low user acquisition, negative reviews comparing it unfavorably to alternatives, difficulty demonstrating unique value beyond existing platforms, regulatory obstacles, or competitive pressure from major tech companies integrating agents into existing products.

This article was researched and written as an independent analysis of AI.com's market entry, Kris Marszalek's strategic approach, and the broader AI agents ecosystem. Information is based on public announcements, market context, and industry trends as of early 2026.

Key Takeaways

- Kris Marszalek acquired AI.com (valued at $100M+) and launched a Super Bowl ad, representing a massive bet on AI agents becoming essential automation tools

- AI agents differ from traditional automation by using intelligence to understand context and make decisions, rather than following explicit if-then rules

- Marszalek's track record shows aggressive marketing coinciding with market peaks (crypto boom in 2021-2022 followed by 71% crash), raising timing questions about AI.com's launch

- AI.com faces serious competition from OpenAI, Google, Microsoft, and Anthropic who are building agents into existing products, plus Zapier and Make adding agent capabilities

- Regulatory challenges around investment advice, fiduciary duty, data privacy, and banking create significant compliance hurdles that could impact AI.com's business model

Related Articles

- Can AI Agents Really Become Lawyers? What New Benchmarks Reveal [2025]

- AI Agent Social Networks: The Rise of Moltbook and OpenClaw [2025]

- Microsoft Copilot OneDrive Agents: Complete Guide [2025]

- From Chat to Control: How AI Agents Are Replacing Conversations [2025]

- Moltbook: The AI Agent Social Network Explained [2025]

- The LLM Context Problem: Why Real-Time AI Needs Fine-Grained Data [2025]