AI Data Centers Are Straining Power Grids Like Never Before

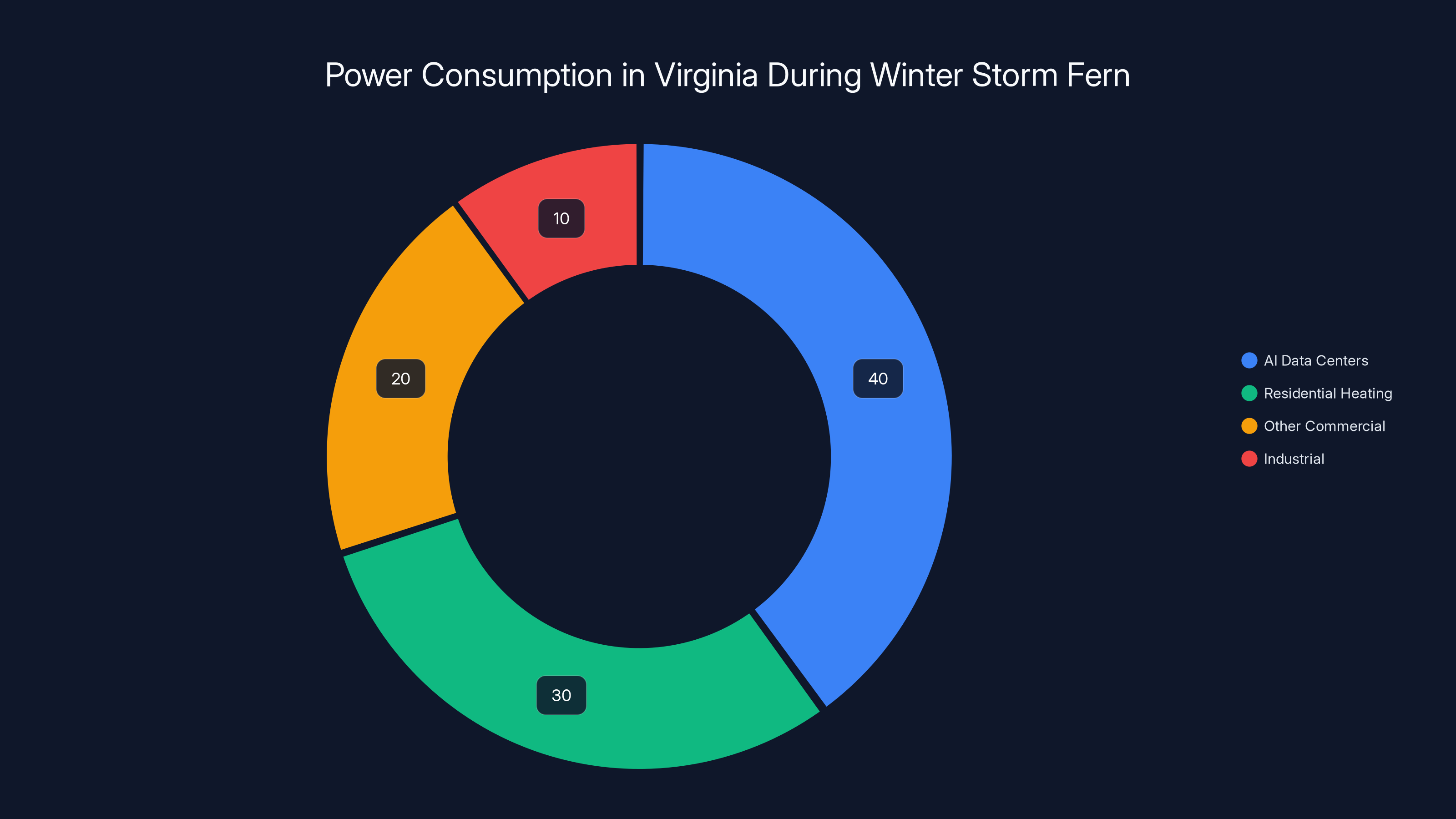

Last January, something happened that should've been a wake-up call for everyone paying attention to energy infrastructure. Winter Storm Fern swept across 34 states, leaving hundreds of thousands without power. But here's what really caught people's attention: wholesale electricity prices in Virginia didn't just spike. They went absolutely bananas.

On Sunday, January 26th, prices climbed above

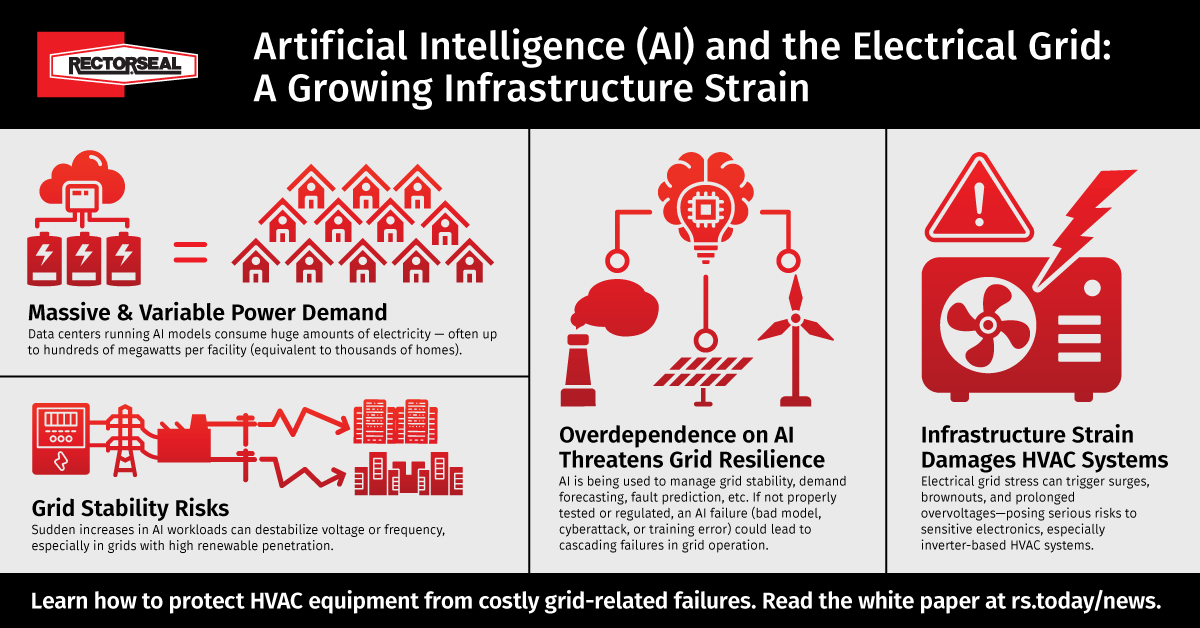

This wasn't just about cold weather and demand spikes. Something deeper was happening. The power grid, already stretched thin by decades of aging infrastructure, was now dealing with a brand new problem: the ravenous appetite of artificial intelligence.

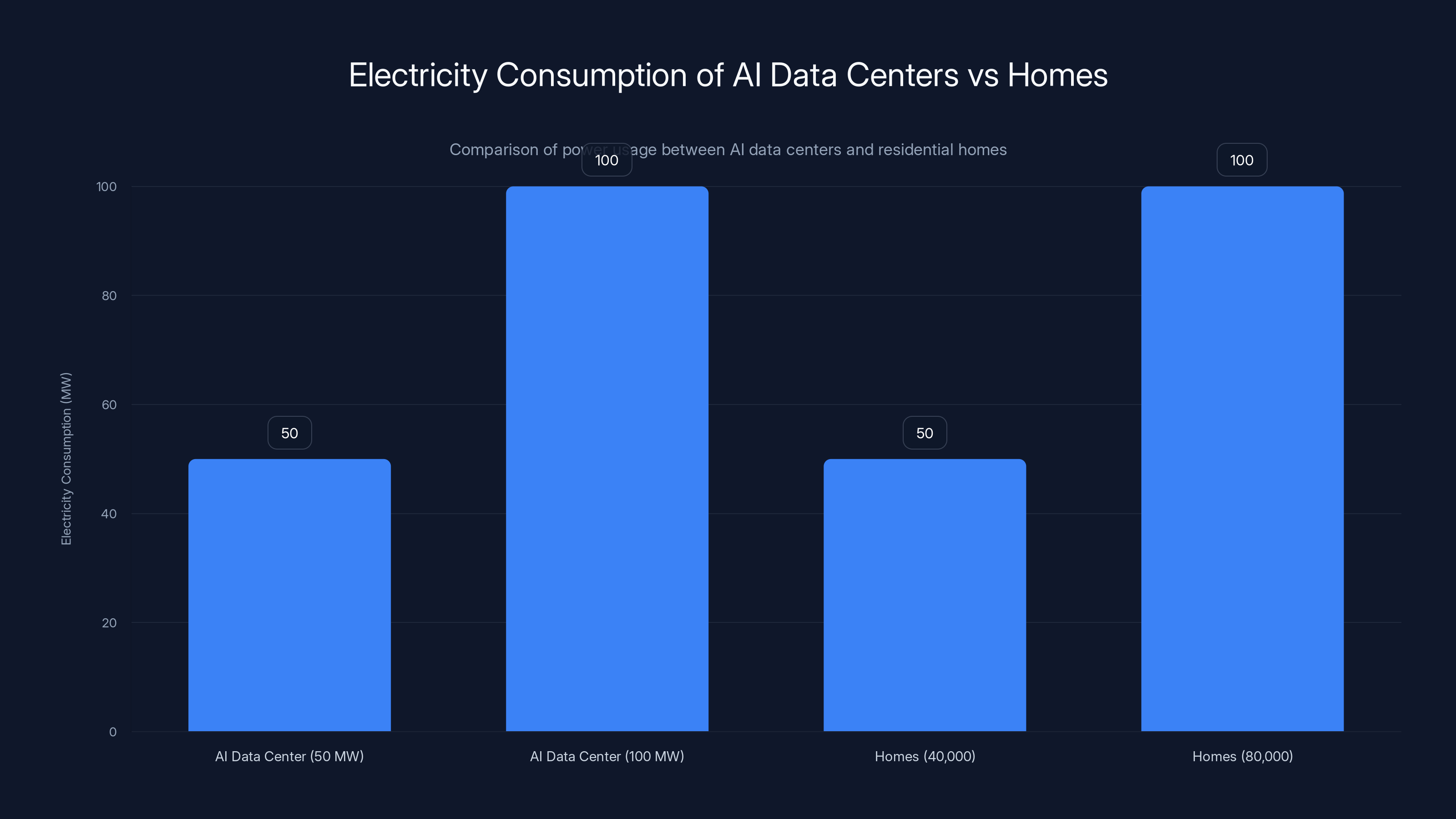

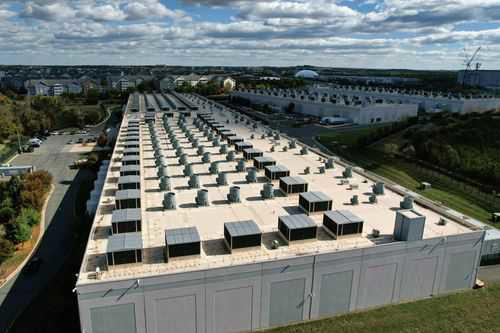

AI data centers consume electricity like nothing we've seen before. A single large data center can pull 50 to 100 megawatts continuously—roughly equivalent to powering 40,000 to 80,000 homes. And we're not building one or two. We're in the middle of an AI infrastructure boom that's adding data centers across the country at speeds utilities can barely comprehend.

The problem isn't just capacity. It's timing, location, and the cascading effects when everything goes sideways. During Winter Storm Fern, multiple things collided at once: extreme demand for heating, thousands of data centers needing uninterrupted power to stay operational, aging transmission lines struggling under the load, and limited ability for struggling utilities to call in backup power from neighbors.

Here's the thing: utilities design power grids for historical patterns. They account for winter peaks, summer peaks, industrial demand, and a safety margin. But they didn't account for something that doubles or triples electricity demand in specific regions in less than five years. And they certainly didn't account for needing to maintain that demand 24/7, even during emergencies.

Nikhil Kumar from Grid Lab, an energy consulting firm focused on grid resilience, explained it clearly: "It's certainly causing more pricing volatility." But he was also cautious about making direct claims, noting it's still too early to say exactly how much impact data centers had during the specific cold snap.

That caution is important. But the underlying pattern is unmistakable. Data centers plus weather extremes equals a power grid pushed to its breaking point.

The Electricity Demand Explosion Nobody Was Ready For

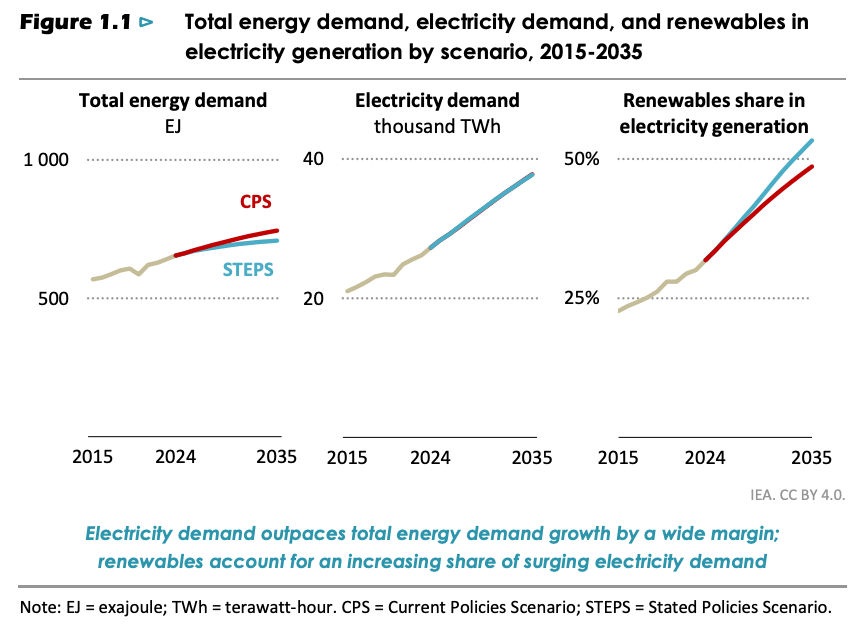

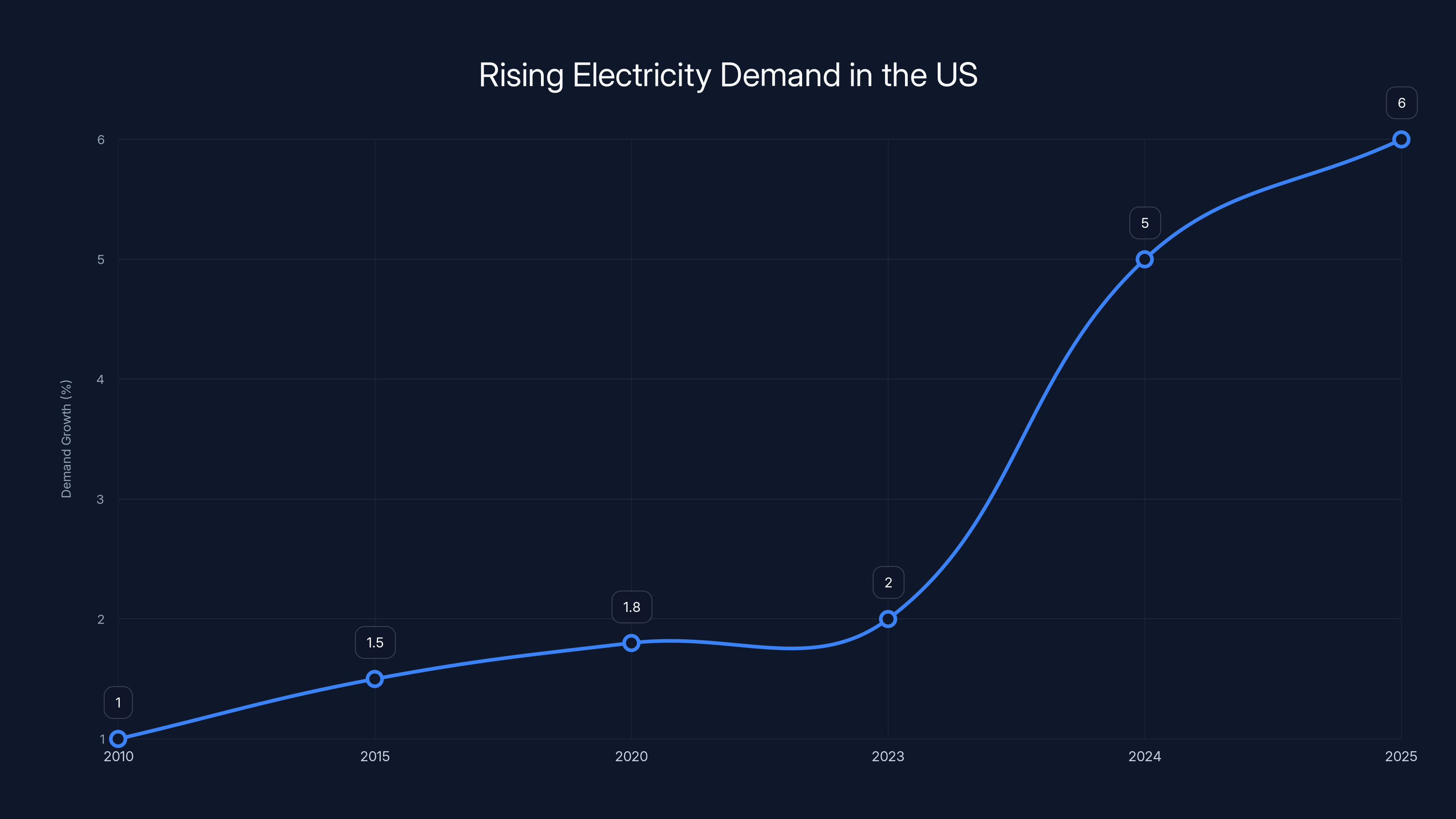

Electricity consumption has been remarkably steady for decades. Demand grows at a predictable 1-2% per year, utilities plan accordingly, and life goes on. Except it's not doing that anymore.

AI data centers changed everything. Electricity demand is now rising at rates we haven't seen in over a decade. The US added more data center capacity in 2024 than in the previous five years combined. And unlike a shopping mall or office building that sees predictable peak hours, data centers consume massive amounts of power 24 hours a day, 365 days a year.

But it's not just AI. Three other trends are hitting the grid simultaneously:

Domestic manufacturing expansion is driving demand. Companies are reshoring production, bringing factories back to the US instead of overseas, and these factories need reliable, cheap electricity.

Home and building electrification is accelerating. Heat pumps, electric water heaters, and induction stoves are replacing gas appliances faster than expected. That's good for emissions, terrible for grid capacity. A home switching from gas heating to an electric heat pump can increase electricity consumption by 50% or more.

Industrial growth across multiple sectors—not just tech—is adding load. Semiconductor fabrication, battery manufacturing, and advanced manufacturing all consume electricity like it's going out of style.

What this means: utilities are facing demand growth that's outpacing their ability to build new generation and transmission capacity. The North American Electric Reliability Corporation (NERC) has already warned that certain regions could face reliability concerns if demand continues accelerating.

George Gross, professor emeritus at the University of Illinois' Grainger College of Engineering, put it in terms everyone can understand: "We're working with our grandfather's Buick." He's talking about the fact that much of America's electrical grid was built 50-100 years ago. Replacing a Buick is an afternoon project. Replacing a century-old electrical grid? That's a multi-trillion-dollar endeavor.

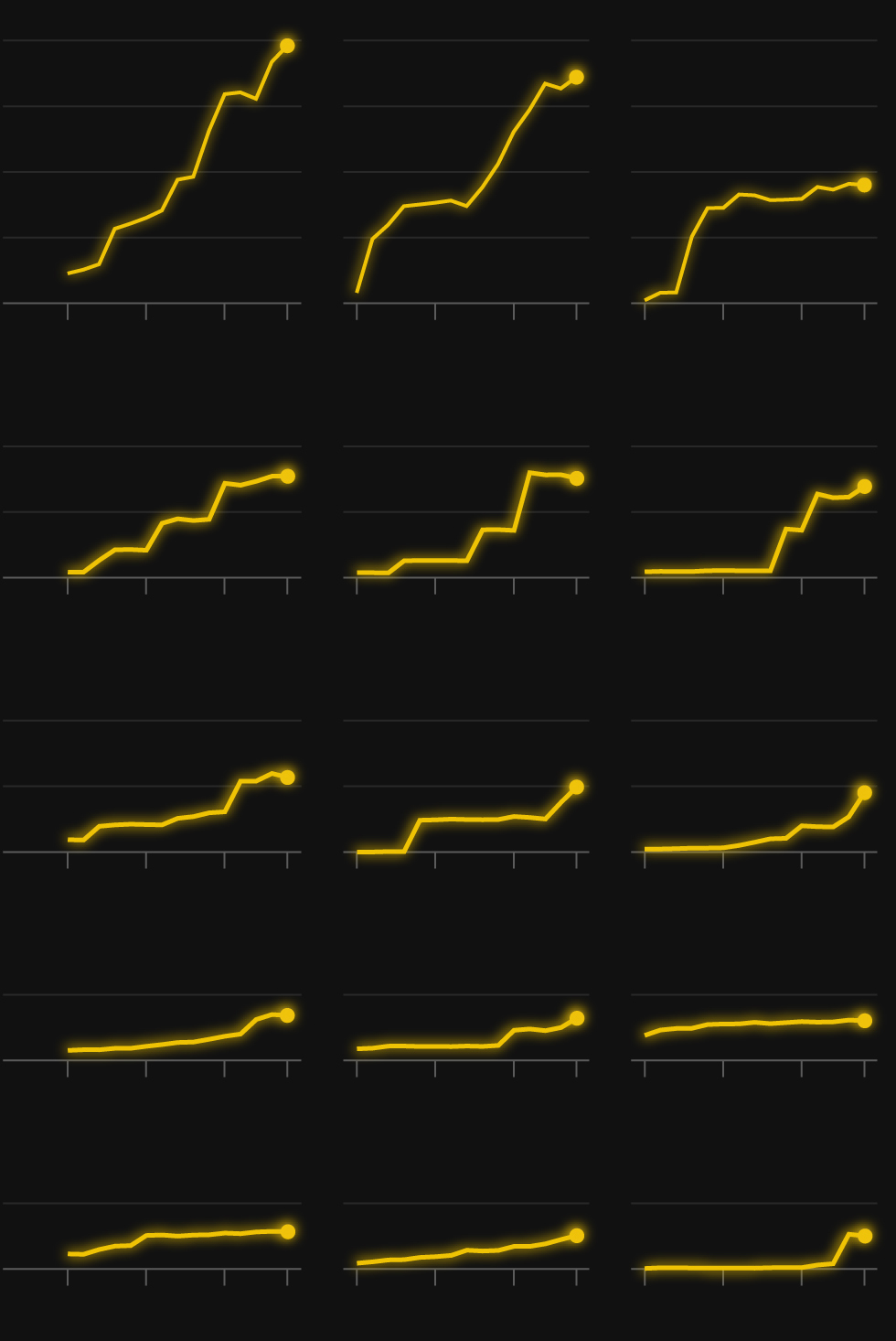

Electricity demand growth in the US is projected to spike significantly in 2024 and 2025, driven by AI data centers, domestic manufacturing, and electrification. Estimated data.

How Data Centers Specifically Strain Regional Power Systems

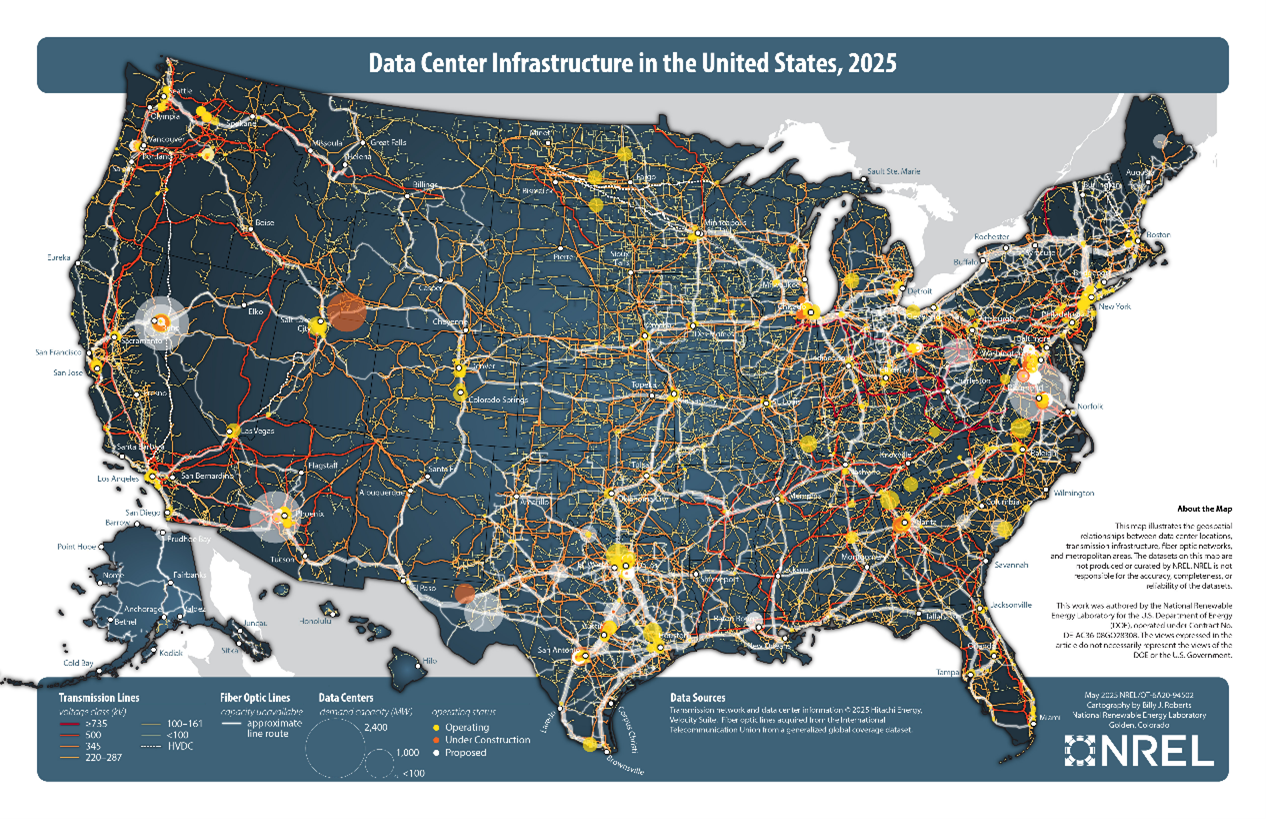

Data centers aren't evenly distributed. They cluster. Virginia, northern California, and parts of Texas have become data center magnets because they offer fiber optic infrastructure, existing power connections, and low energy costs (at least historically).

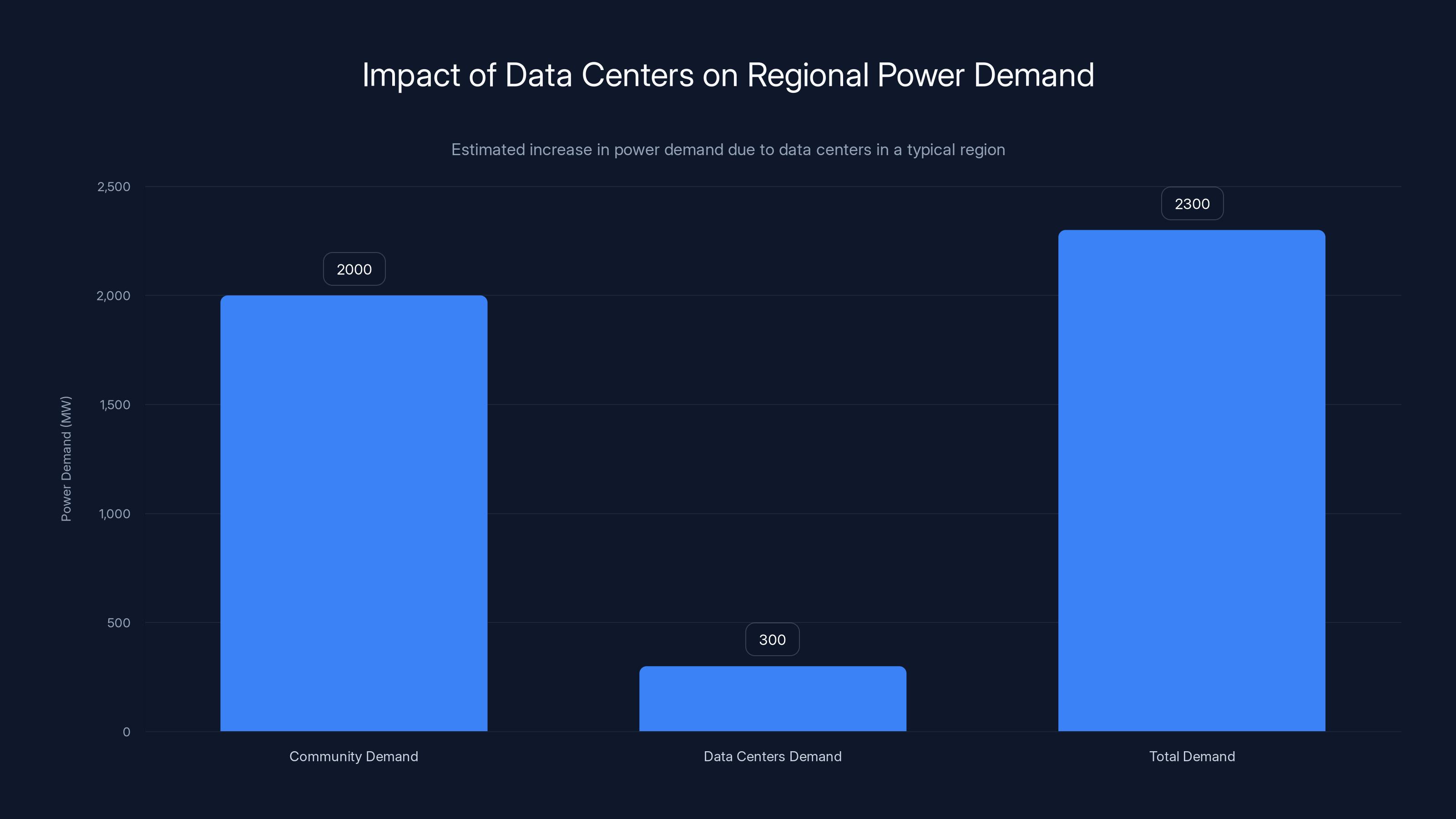

This clustering creates what engineers call "localized stress." Imagine a power grid that's designed to serve a community of 500,000 people with 2,000 megawatts of capacity. Now add three massive data centers totaling 300 megawatts of constant demand. That's a 15% increase in baseload demand concentrated in a specific geographic area.

The problem gets worse when you consider transmission constraints. Power has to physically flow from where it's generated to where it's used. If a data center is located in an area with limited transmission capacity, you get congestion. Congestion drives up prices. When Winter Storm Fern hit Virginia, that's exactly what happened.

The domino effect looks like this:

- Cold weather drives heating demand spike in the region

- Data centers still need their full 300+ MW, plus normal residential/commercial demand surges

- Transmission lines are congested because not enough power can flow into the area

- Local generation sources may be offline (coal plants, nuclear plants) due to cold weather impacts

- Prices spike dramatically because demand is high and local supply is constrained

- Some less critical industrial loads might be curtailed to keep the lights on

Virginia's Dominion Energy, the state's largest utility, provides a perfect case study. When the storm hit, Dominion had over 48,000 customers without power. More important from a grid stability perspective, the wholesale markets they operate in saw those price spikes that hit $1,800 per MWh.

For context, normal wholesale prices range from

This is where data centers create a unique problem. They can't just turn off during a crisis like a factory can. They're contractually obligated to maintain power for their customers (who might be running your email, your cloud storage, or critical business applications). So when a crisis hits, data centers stay operational, taking up a fixed amount of capacity that utilities can't redirect.

AI data centers consumed an estimated 40% of power during Winter Storm Fern, highlighting their significant impact on the grid. Estimated data.

Aging Infrastructure: Why Our Power Grid Can't Handle Modern Demand

Here's something that might shock you: much of the US electrical grid was built during the Eisenhower administration. The infrastructure we're using to power AI data centers in 2025 was designed in the 1950s for a fundamentally different America.

Back then, electricity demand was predictable and grew slowly. The grid was designed around large coal and nuclear plants that provided stable baseload power. Transmission lines were built to connect distant power plants to population centers. The system worked brilliantly for 60 years.

But 2025 isn't 1965. And the grid is creaking.

Transmission capacity is the bottleneck. Transmission lines—those high-voltage cables carrying power across regions—are literally running at or near capacity during peak demand periods. Adding new transmission lines is phenomenally expensive (

Transformer life expectancy is a real issue. Power transformers are expensive ($1-2 million each) and take months to replace. Many are now 50+ years old, running past their design life. During Winter Storm Fern, transformer failures were responsible for many of the outages that took days to restore.

Distribution infrastructure in data center regions is overloaded. When a new data center locates in an area, it needs local power connections. Those connections often have to be custom-built, requiring upgrades to distribution infrastructure that was never designed to support 100+ MW loads.

The math is brutal. Average transmission line age in the US is 38 years. Useful life expectancy is 40-50 years. We're entering the replacement cycle. Replacing all aging infrastructure while simultaneously expanding capacity to meet new demand? That could cost $1-2 trillion over the next 20 years, according to various grid modernization studies.

Utilities, already operating on thin profit margins (regulated industries intentionally have low margins), are squeezed. They need to spend massive capital on upgrades, but their ability to raise prices is limited by regulatory oversight. So they defer maintenance, replace equipment only when it fails, and hope extreme weather doesn't hit.

Then extreme weather hits.

Winter Storm Fern was a 1-in-30-year storm hitting a 38-year-old transmission system during unprecedented demand growth. The outcome was almost inevitable.

Renewable Energy Paradox: Why More Clean Power Makes Grid Management Harder

Here's an ironic twist: the move toward renewable energy is making grid management more complicated, not simpler.

Solar and wind are fantastic for reducing emissions. But they're also intermittent. The sun doesn't shine 24/7. Wind doesn't blow consistently. When a cold front moves through and demand for heating spikes, solar output often drops (clouds, shorter days) and wind behavior becomes unpredictable.

During Winter Storm Fern, this played out clearly. Solar output across the affected regions dropped to near zero. Wind resources, which should've been ramping up, were inconsistent. Natural gas plants became the backstop to keep lights on.

But here's where data centers complicate everything: they can't be powered intermittently. You can't run an AI training job on solar power that's only available when it's sunny. Data centers need 24/7 baseload power. So while residential customers can live with some blackouts, data centers can't.

This creates a fundamental tension. Utilities need to maintain enough reliable generation capacity (coal, nuclear, natural gas) to handle worst-case scenarios. But as renewable penetration increases, that reliable capacity is being retired. We're not building enough replacements.

The US Energy Information Administration data shows coal generation has dropped by half over the last 15 years. Nuclear plants keep getting decommissioned without replacement. Wind and solar have grown substantially, but not fast enough to fill the gap.

Natural gas has become the default replacement for coal. Gas plants are flexible (can ramp up and down quickly), can be built relatively quickly (2-4 years vs 10+ for nuclear), and provide the reliability data centers need.

But natural gas has its own vulnerabilities. When Winter Storm Uri hit Texas in 2021 and killed over 200 people, natural gas production froze up due to cold temperatures. Facilities weren't designed to operate in extreme cold. It's a vulnerability that's still being addressed, but slowly.

So we're stuck in a bind:

- Renewable energy is necessary for climate goals, but creates reliability challenges

- Natural gas fills the gap but has climate and weather vulnerability issues

- Nuclear is reliable but faces political opposition and long build times

- Data centers need 24/7 power but are helping drive demand growth

Virtuously, we could have solved this with better battery storage and grid management. And we're making progress. But we're not building storage fast enough to fully bridge the intermittency gap.

AI data centers can consume as much electricity as 40,000 to 80,000 homes, highlighting their significant impact on power grids. Estimated data based on typical consumption rates.

The Cascading Failure Problem: When Your Neighbor Can't Help

One of the most elegant features of the American electrical grid is how it's interconnected. When one region faces an emergency, it can draw power from neighboring utilities. This interconnection provides resilience and helps prevent blackouts.

Winter Storm Fern tested this system and found a critical vulnerability: when an emergency is large enough to affect many regions simultaneously, there's no backup help available.

George Gross pointed out the issue clearly: "So many of them are caught in exactly the same trouble that you can't get necessarily help from your neighbors."

When one region faces a crisis, utilities in other regions can typically sell excess power. But when a cold front affects 34 states simultaneously, everyone is facing demand peaks at the same time. Nobody has excess power to sell. Wholesale prices skyrocket because scarcity is real and immediate.

This is where data centers create additional risk. Normally, during an emergency, utilities can ask large industrial customers to reduce demand. Factories can shut down production for a few hours. But data centers can't. A data center going offline means millions of dollars in lost service, plus contractual penalties with customers, plus reputational damage.

So from a grid stability perspective, data centers look like non-dispatchable loads. They're treated like residential demand (which utilities can't ask to reduce) rather than industrial demand (which they can). This removes a tool utilities traditionally use to manage crises.

There's another cascading effect worth understanding. When wholesale prices spike to

Utilities, being regulated monopolies, typically get a fixed profit margin (usually 8-12% of their asset base). They don't benefit from high prices—those high prices get passed to consumers and cause political backlash. But they also don't bear the full cost of their underinvestment if something fails. That cost gets socialized across all customers.

The result: weak financial incentives to invest in resilience, strong incentives to defer spending, and a system that becomes increasingly fragile.

Natural Gas Supply Chains: Another Vulnerability in the System

When Winter Storm Fern hit, natural gas didn't become unavailable like it did during Winter Storm Uri. But prices spiked. Natural gas prices for January delivery climbed above

Here's why that matters: 60% of US electricity is generated by natural gas or coal plants. Coal plants provide baseload power but can't ramp up quickly. Natural gas plants are the flexible generation that ramps up when demand spikes.

So when natural gas gets expensive or scarce during cold snaps, electricity prices follow.

Winter Storm Uri in 2021 was worse. Frozen natural gas infrastructure made production difficult. Demand for heating soared because Texas homes are built for warmth efficiency (it's Texas, not Minnesota), so heating systems weren't prepared for sustained freezing temperatures. The combination created a perfect storm that left millions without power during deadly cold.

Utilities learned from that. ERCOT, the Texas grid operator, worked with natural gas producers to winterize equipment. It helped. But the underlying vulnerability remains: natural gas supply is weather-dependent.

Adding data center demand on top of this makes things more complicated. Data centers need power even during crises. So utilities can't let data center power consumption compete with heating demand during emergencies. This means either:

- Building enough generation capacity to handle both maximum data center load AND heating demand peaks (expensive)

- Accepting that during worst-case scenarios, data centers might lose power

- Finding ways to reduce data center demand during crises (customers won't accept this)

Most utilities are attempting option 1, which means massive capital investment in generation and transmission capacity that sits mostly idle outside of peak periods.

Data centers can increase regional power demand by 15%, straining local power systems. Estimated data based on typical community and data center demands.

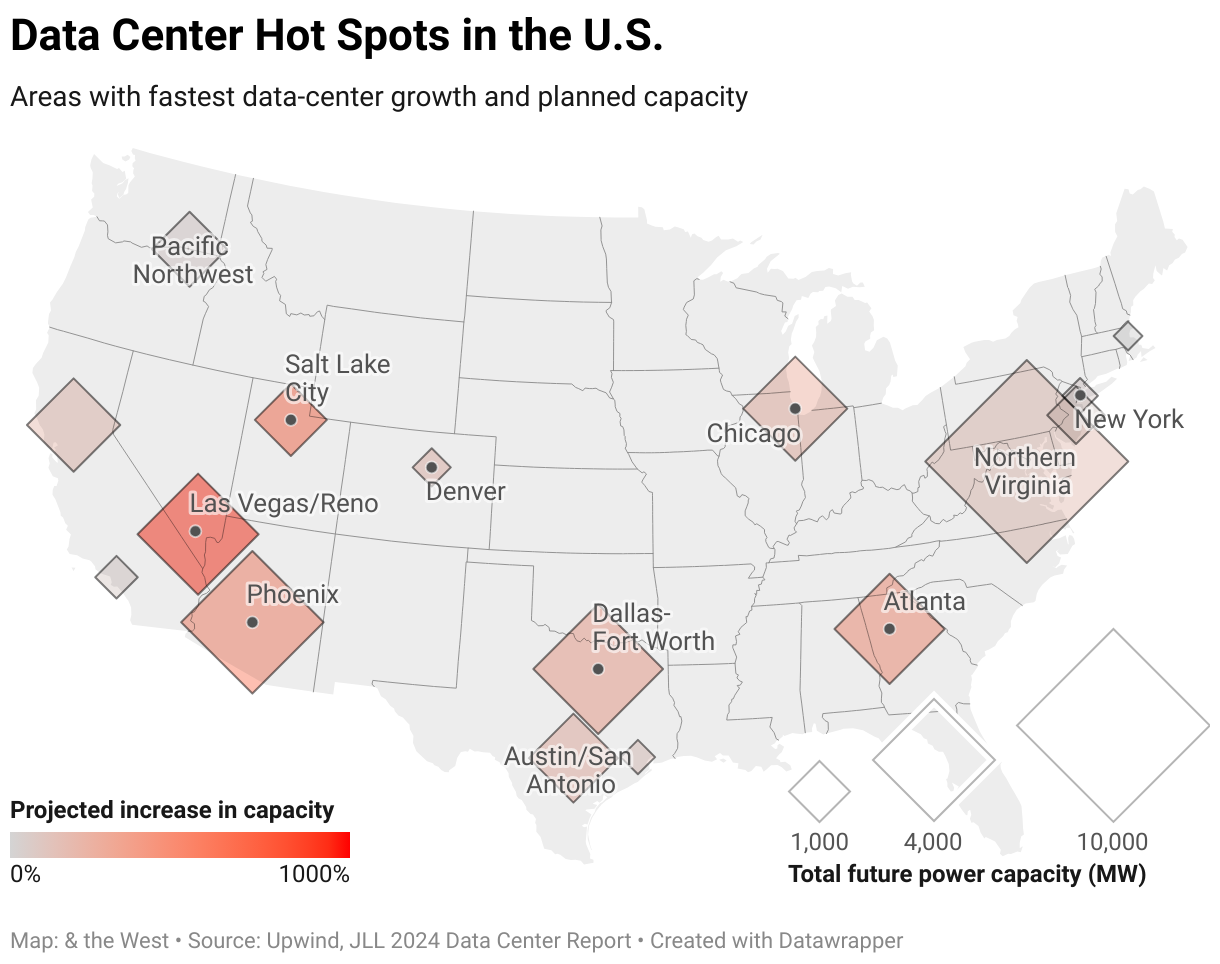

Geographic Concentration: Why Data Center Alley Is a Risk Hotspot

Data centers have clustered in specific regions for a reason. Virginia, northern California, and parts of Texas (especially Austin and Dallas) have become magnets because of:

- Existing fiber optic infrastructure enabling low-latency connections

- Established relationships with power utilities

- Favorable regulatory environments and tax incentives

- Proximity to major population centers and corporate headquarters

But this concentration creates systemic risk.

Virginia now hosts over 600 data center facilities consuming roughly 3% of the state's electricity supply. That doesn't sound like much until you realize Virginia's total electricity consumption is about 90,000 megawatts at peak. Three percent means data centers are using roughly 2,700 megawatts of constant power.

For context, Virginia's population is about 8.6 million people. Data centers are consuming as much power as roughly 2.1 million homes (assuming 1.3 kW average per household). And that's today's number. Projections show data center electricity consumption in Virginia could double within five years.

The problem is that Virginia's transmission and generation infrastructure wasn't built to handle this. When new data centers come online, utilities have to build new transmission lines, new substations, and sometimes new generation sources. This is extremely expensive and time-consuming.

During Winter Storm Fern, the concentration worked against Virginia. Because so many data centers were in the region needing power simultaneously, and because transmission was already constrained, prices soared. If those data centers had been geographically distributed across multiple grid regions with lower local demand, the impact would've been less severe.

There's an economic solution here: distributed data centers with geographic redundancy would be more resilient. But that's not how the market is working. Companies want to locate in "data center alley" because the infrastructure is already there, even if it's strained.

The Cooling Conundrum: Water and Energy in Extreme Weather

Data centers don't just consume massive amounts of electricity. They generate enormous amounts of heat that has to be dissipated. Most data centers use water cooling because it's far more efficient than air cooling. A large data center might use 10-30 million gallons of water per day for cooling.

During extreme weather events, water availability becomes a problem. Winter storms that cause flooding can overwhelm intake systems. Summer droughts can reduce water availability. And competitors for water (agriculture, municipalities) add pressure.

Virginia didn't face a water shortage during Winter Storm Fern because the storm brought snow and ice. But the storm's impacts on water infrastructure (frozen pipes, treatment plant issues) had secondary effects.

More troubling are summer scenarios. Data center demand for power peaks during winter (heating demand) and during summer afternoons (cooling demand). During summer, water availability is often lower due to drought or irrigation demands. This means data centers face a cruel choice: consume water they might not have, or reduce cooling and risk hardware damage from overheating.

Some data centers have started using alternative cooling methods:

- Immersion cooling (submerging servers in special liquids)

- Free air cooling (using outside air for cooling during cold months)

- Hybrid systems (water cooling + air cooling)

- Liquid cooling with recycled water

But these alternatives are more expensive and not yet at scale.

For utilities, this creates another pressure point. They need to ensure both electricity and water availability during extreme weather. These are often managed by different agencies (utilities handle electricity, water departments handle water), so coordination is imperfect.

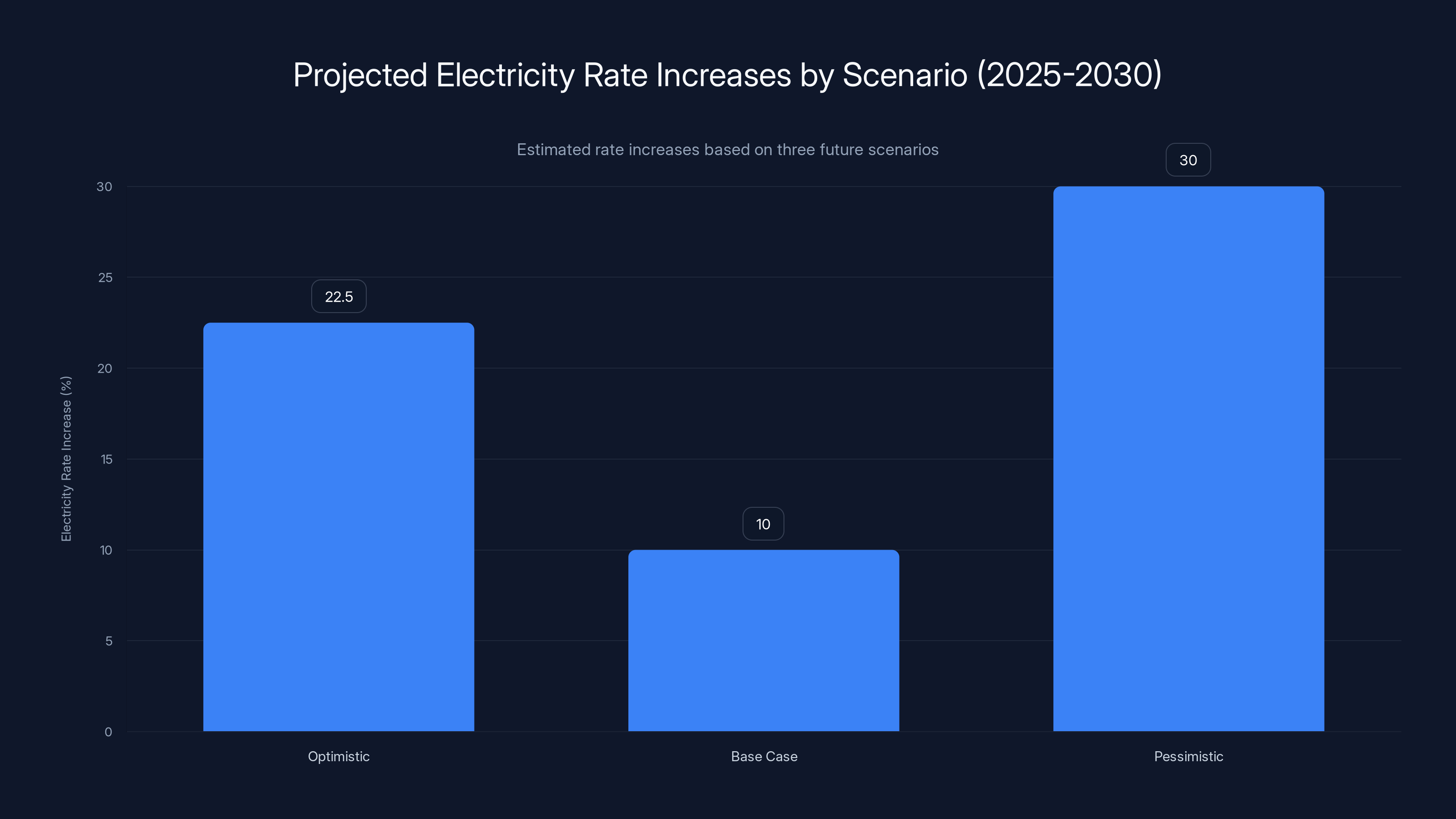

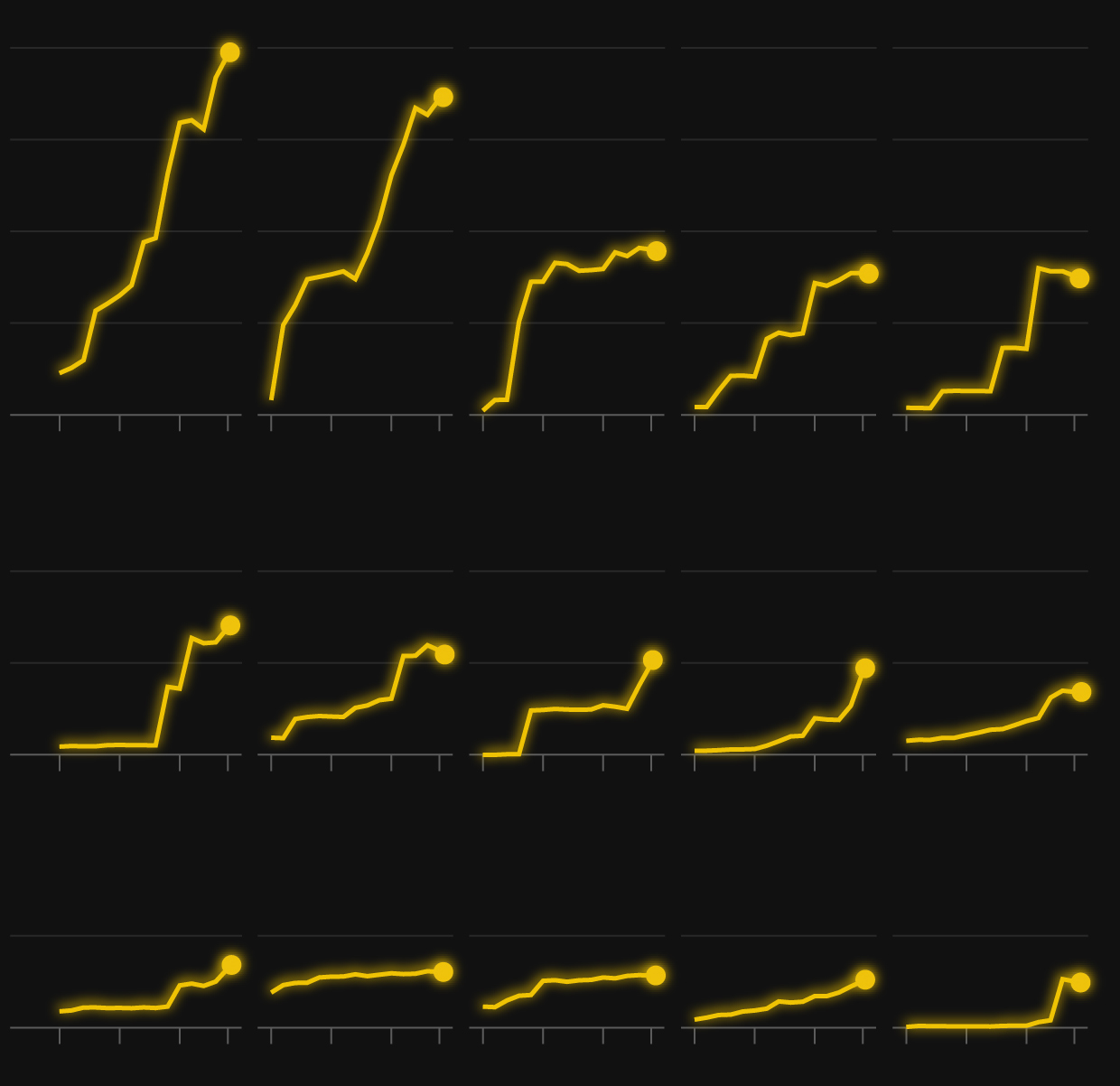

Estimated data shows that electricity rates could increase significantly under all scenarios, with the highest increase in the pessimistic scenario. Estimated data.

Grid Modernization: The $1-2 Trillion Question

Fixing these problems isn't simple. The US electrical grid needs massive modernization. We need:

- New transmission lines to move power from generation sources to load centers (especially to data center regions)

- Upgraded distribution infrastructure in areas seeing demand growth

- Smart grid technology to balance supply and demand more dynamically

- Battery storage to absorb excess generation and provide power during peak demand

- Generation capacity additions, especially flexible resources like natural gas and battery storage

The price tag is enormous. Various estimates put the cost of necessary grid upgrades over the next 20 years at

Who pays? Ultimately, customers through higher electricity bills. But the transition is contentious. Utilities want higher rates to fund upgrades. Consumers and businesses want lower rates. Regulators try to balance both.

The Federal government has tried to help through incentives. The Inflation Reduction Act provided

But it's not enough. Every year, utilities defer projects due to budget constraints. And every year, the grid gets closer to critical failure points.

There's also the innovation angle. New technologies could help:

- High-temperature superconductors could enable transmission lines with near-zero losses

- Advanced batteries (not just lithium-ion) could store power more efficiently

- Demand response systems could help balance loads dynamically

- Blockchain and AI could optimize grid management in real-time

Runable and similar platforms could help utilities optimize operations by automating report generation and workflow analysis across complex grid systems, enabling better decision-making.

But these technologies are mostly still in development or early deployment. We can't wait for breakthroughs. We need solutions now.

The Business of Blackouts: Who Bears the Cost?

When Winter Storm Fern caused outages and price spikes, different groups bore different costs:

Residents who lost power suffered directly. Beyond the inconvenience, extended outages (48+ hours) can be dangerous, especially for elderly people or those with medical conditions. The 2021 Winter Storm Uri killed over 200 people in Texas.

Businesses face compounded losses. A restaurant loses food inventory. A manufacturer stops production. A hospital might need to run on backup generators (expensive). Office buildings lose revenue.

Data centers have contractual obligations to customers, so they have to maintain operations even during grid emergencies. Their costs go up (fuel for backup generators, expedited repairs), but they're contractually locked into prices with customers.

Utilities face pressure from multiple directions. They're blamed for outages by the public and politicians. They face financial losses from wholesale price spikes when they've locked in lower costs for customers. They face regulatory scrutiny about reliability and requests to invest more in resilience.

The perverse outcome: nobody really bears the cost of unreliability. Residents get compensation for extended outages (in some states). Utilities spread costs across all customers. Businesses file insurance claims or absorb losses. Data centers have contract terms that protect them.

This diffused cost structure means there's insufficient economic incentive to invest in preventing outages. It's a market failure.

Some economic analysis suggests the true cost of electricity unreliability is 10-100 times higher than the cost of preventing it. But because costs are diffused and externalized, the investment doesn't happen.

During Winter Storm Fern, Virginia's Dominion Energy estimated customer impacts. They didn't immediately disclose details, but historical data from similar events suggests:

- Direct costs to customers: $200-500 million (from outages and price spikes)

- Indirect costs (spoiled food, lost productivity, health impacts): 1 billion

- Utility costs (emergency repairs, overtime labor): $100-200 million

Total economic cost of one winter storm for a single state? Likely $1-2 billion. And that's not even a worst-case scenario.

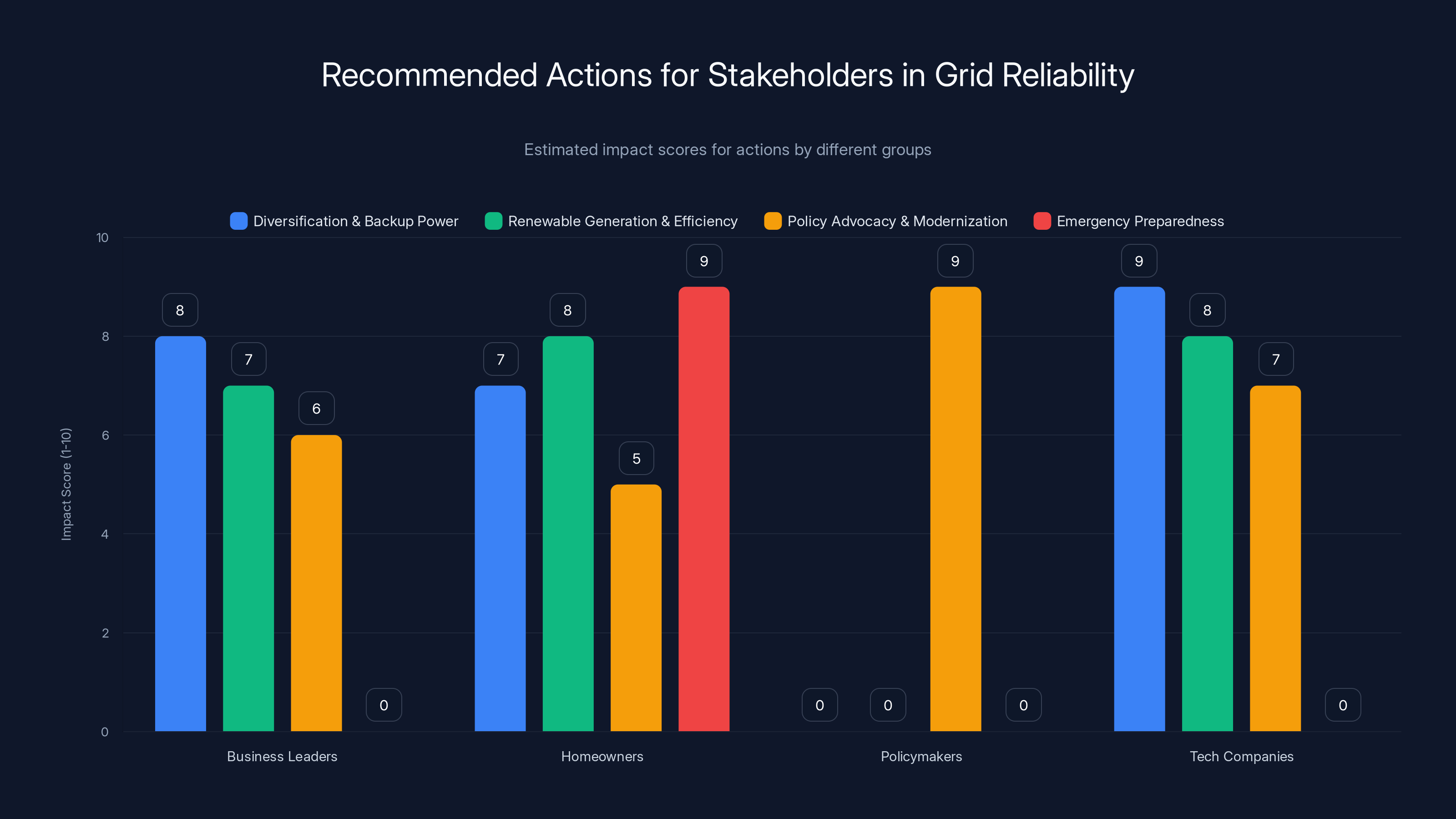

This chart estimates the impact of recommended actions for different stakeholder groups in enhancing grid reliability. Business leaders and tech companies have high potential impact through diversification and renewable investments. Estimated data.

Data Center Competition and Geographic Sprawl

The concentration of data centers in Virginia happened because of first-mover advantages and network effects. Early data center investment attracted more investment. Tech companies wanted to be near other tech companies. Infrastructure developers built more capacity, making it more attractive for new entrants.

But this is starting to shift. Virginia's power constraints are becoming impossible to ignore. Amazon Web Services, Google Cloud, and Microsoft Azure are now investing in data centers in other regions: the Midwest (cooler climate, abundant water and power), the Pacific Northwest (hydroelectric power), and other areas.

This geographic diversification is good for grid resilience. But it's happening slowly because existing infrastructure in Virginia is entrenched. Switching costs are high.

Winter Storm Fern will likely accelerate this shift. Companies will realize that putting all eggs in the Virginia basket is risky. Grid constraints during cold snaps mean potential outages, price spikes, and contractual violations.

But new regions have their own challenges:

- Midwest: Cold winters mean heating demand peaks (same problem as Virginia)

- Pacific Northwest: Dependent on hydroelectric power (vulnerable to droughts)

- Texas: Vulnerable to heat waves (summer cooling demand) and winter freezes

- California: Water-scarce and energy-constrained

There's no perfect location. Every region has vulnerabilities. The real solution is geographic diversity combined with local renewable generation and battery storage.

Learning from 2021: Did We Apply Any Lessons from Winter Storm Uri?

Winter Storm Uri hit Texas in February 2021. It was devastating. Over 200 people died. Millions lost power during deadly cold. The cause: natural gas infrastructure froze, power generation dropped, and demand for heating spiked simultaneously.

Utilities and grid operators said they'd learned lessons and upgraded infrastructure. By 2025, had they?

Partially. Texas added significant battery storage. ERCOT improved weather forecasting and coordination. Natural gas facilities were winterized. Demand response programs were expanded.

But Winter Storm Fern showed that lessons hadn't been fully applied nationally. Virginia didn't have the battery storage cushion that Texas had developed. Virginia's transmission infrastructure was still constrained. Virginia's utilities still faced pressure to defer maintenance spending.

The pattern is frustrating. Each major event prompts pledges to improve resilience. Investments are made. But funding is often insufficient, and the work of truly modernizing the grid is continuous and expensive.

It's like earthquake preparedness in California. After every significant quake, there's renewed focus on building codes and infrastructure hardening. Progress is made. But you can never make everything earthquake-proof, so the next big one still causes damage.

Except electricity isn't optional. It's essential infrastructure. Vulnerabilities have life-or-death consequences.

So did we learn from 2021? Some lessons stuck. Others faded as budgets tightened and collective memory dimmed. Winter Storm Fern in 2025 proved that the problem of grid fragility is still deeply embedded.

The AI Acceleration Problem: Building Infrastructure Slower Than Demand Growth

Here's the core challenge: AI demand is growing exponentially while infrastructure takes years to build.

A new data center takes 18-36 months from site selection to operational status. New transmission lines take 10-15 years from planning to completion. Natural gas plants take 5-7 years. Battery storage facilities take 2-4 years.

Meanwhile, AI adoption is accelerating. Major tech companies announced plans to build hundreds of new data centers globally. The compute infrastructure supporting AI is supposed to double or triple over the next 3-5 years.

This creates a dangerous gap. Demand is outpacing supply. Utilities are perpetually behind on infrastructure investment. When crisis events (like Winter Storm Fern) happen, the system is already stressed.

The math is brutal:

Assuming data center electricity demand doubles every 3-4 years (a reasonable estimate based on historical growth), and assuming new generation capacity takes 5-7 years to build, by the time new capacity is operational, demand will have grown beyond it.

This isn't sustainable. Something has to give:

- Investment accelerates - Utilities and governments fund massive grid upgrades (requires money and political will)

- Demand moderates - AI growth slows or efficiency improves, reducing power consumption per compute unit (seems unlikely)

- System breaks - Outages become more frequent, prices become more volatile, economic damage increases (happening now, getting worse)

None of these are attractive options. Option 1 requires money we're not currently spending. Option 2 contradicts market trends. Option 3 has already started.

There's a fourth option that nobody wants to talk about: rationing electricity to non-critical uses during peak demand periods. Basically, during winter cold snaps and summer heat waves, data centers would be asked to reduce power consumption. This would mean degraded service for cloud customers, which is unacceptable in today's market.

But if nothing changes, rationing might become necessary.

Federal Policy and Market Incentives: Are We Responding to the Crisis?

The Federal government has taken some action. The Inflation Reduction Act, signed in 2022, allocated $369 billion for clean energy and climate investments. Some of this is specifically for grid resilience and modernization.

The Bipartisan Infrastructure Law (2021) allocated $65 billion for electricity transmission and distribution infrastructure upgrades.

These are substantial investments. But put in context:

- US electricity industry revenue: ~$200 billion/year

- Needed grid modernization: $1-2 trillion over 20 years

- Federal investment: ~$100+ billion over 10 years

The federal contribution is significant but insufficient. The vast majority of funding has to come from utilities themselves, either through earnings or through rate increases to customers.

Market incentives are also problematic. Utilities are regulated monopolies with limited profit incentives to invest in resilience. They're incentivized to minimize costs and maintain stable rates. Investing heavily in grid upgrades increases costs and customer rates, which triggers regulatory and political backlash.

So utilities face a classic tragedy of the commons problem: the individually rational choice (defer investment) leads to collectively irrational outcomes (system fragility).

Some creative policy solutions are emerging:

Performance incentive mechanisms allow utilities to earn higher returns if they hit reliability targets. This provides incentive to invest in resilience.

Regulatory streamlining reduces the time needed to permit and build transmission lines. Some states have cut approval times from 10+ years to 3-5 years.

Public-private partnerships bring private capital to grid modernization in exchange for returns. This includes solar farms, battery storage facilities, and smart grid technology.

Renewable energy standards mandate utilities to source increasing percentages of power from clean sources, which requires new infrastructure.

But these policies are uneven. Some states are aggressive on grid modernization. Others are not. Federal policy helps but can't override state-level resistance.

Winter Storm Fern will likely prompt new policy discussions. When outages impact millions and prices spike dramatically, politicians face pressure to "do something." What that something looks like depends on political viewpoints and regional interests.

The Role of Energy Efficiency and Demand Response

One often-overlooked solution is energy efficiency. If we used electricity more efficiently, demand growth could be slowed without sacrificing service or functionality.

Data centers, in particular, have enormous efficiency opportunities. Modern hyperscale data centers (Google, AWS, Microsoft) have Power Usage Effectiveness (PUE) ratios around 1.1-1.2, meaning 90%+ of power goes to computing, with only 10% lost to cooling and infrastructure.

But older data centers, smaller regional facilities, and enterprise on-premises systems often have PUE ratios of 2.0 or higher, meaning they waste 50% or more of power on cooling and infrastructure.

If all data center infrastructure in the US were upgraded to hyperscale efficiency standards, it would reduce electricity demand by roughly 40-50%. That's equivalent to not building hundreds of new data centers.

Demand response is another lever. If data centers could intelligently reduce power consumption during grid stress events (with adequate compensation), utilities could manage crises without rolling blackouts.

Some companies are experimenting with this:

- Facebook (Meta) has built data centers that can shift compute to cooler regions dynamically

- Google has invested in smart load balancing across data center regions

- Microsoft has experimented with underwater data centers for cooling efficiency

But these are outliers. Most data centers operate relatively static loads. The infrastructure and incentives for dynamic demand response aren't widespread.

[IMAGE: Comparison chart showing Power Usage Effectiveness across different types of data centers (hyperscale, enterprise, regional)

Here's where tools like Runable enter the picture. By automating operational analysis and report generation, utilities and data center operators can identify inefficiencies faster. Better insights into where power is being consumed, which systems are underutilized, and where upgrades would have the highest impact.

It's not a complete solution, but visibility and automation are prerequisites for optimization.

Looking Forward: Five Years, Three Scenarios

Projecting five years forward, there are three plausible scenarios:

Scenario 1: Accelerated Investment and Adaptation (Optimistic)

Winter Storm Fern and other crises prompt serious policy changes and investment. Federal and state governments accelerate grid modernization funding. Utilities invest aggressively in new generation and transmission capacity. Tech companies diversify data center locations to reduce concentration risk. Battery storage capacity triples. Renewable energy penetration increases faster than projected.

By 2030, grid reliability improves despite continued demand growth. Price volatility decreases. Outages become rare. This scenario requires spending $200+ billion annually on grid upgrades and would likely trigger meaningful electricity rate increases (15-30% over five years).

Scenario 2: Muddling Through (Base Case)

Some improvements happen, but not at the pace needed to match demand growth. Policy changes are marginal. Investment increases modestly. Some utilities modernize aggressively while others defer spending. Data center growth slows slightly due to power constraints in hot regions. Price volatility continues but doesn't spike as dramatically as Winter Storm Fern. Outages increase 10-20% over the five-year period, but nothing catastrophic.

This scenario is where we're currently headed. It's the path of least political resistance, but it perpetuates system fragility.

Scenario 3: Crisis and Collapse (Pessimistic)

Winter storms, heat waves, and droughts continue. Grid failures become more frequent. A major outage affects 50+ million people for an extended period, causing hundreds of deaths and billions in economic damage. Tech companies face increasing power rationing and costs. Data center investments shift overseas or grind to a halt. Electricity becomes noticeably less reliable and more expensive for everyone. Demand growth slows due to scarcity and costs, not by choice.

This scenario seems unlikely but isn't impossible if political inaction continues for another 5-10 years.

Which scenario plays out depends on decisions made in the next 1-2 years. Winter Storm Fern was an inflection point. The response to it will set the trajectory.

Historically, Americans wait for crises before investing in resilience. We rebuilt New Orleans after Katrina, invested in dam safety after Oroville, and strengthened electric systems after widespread blackouts in 2003. But the cost of waiting is always higher than the cost of prevention.

For power grids in the age of AI, waiting might no longer be viable.

What You Can Actually Do About This

If you work in utilities, energy policy, or grid operations, you probably already understand the urgency. But what if you don't? What if you're a business leader, a homeowner, or someone concerned about grid reliability?

For Business Leaders:

- Diversify cloud infrastructure across multiple regions to reduce single-region risk

- Invest in backup power (generators, battery storage) for critical operations

- Engage with local utilities about grid resilience plans

- Support policy advocacy for grid modernization

- Consider on-site renewable generation (solar, wind) to reduce dependence on grid power

- Implement energy efficiency measures to reduce electricity consumption

For Homeowners:

- Install a battery backup system (Powerwall, etc.) if you live in a vulnerable region

- Consider a solar system with battery storage to maintain power during outages

- Ensure your home is properly insulated to reduce heating/cooling demand during extreme weather

- Maintain an emergency preparedness kit for extended outages

- Support local policy advocacy for grid modernization

For Policymakers:

- Streamline permitting for transmission line and generation projects

- Implement performance incentives for utilities to invest in resilience

- Fund grid modernization through public investment

- Require utilities to develop resilience plans and hold them accountable

- Support battery storage development and deployment

- Balance climate goals with grid reliability needs

For Tech Companies:

- Invest in geographic diversity for data center locations

- Commit to power efficiency improvements in data center operations

- Participate in demand response programs to help utilities during stress events

- Invest in on-site renewable generation and battery storage

- Support grid modernization initiatives in regions where you operate

None of these are silver bullets. But collectively, they move the system toward sustainability and resilience.

The Underlying Economics: Why This Matters Beyond Electricity

The power grid crisis isn't just about electricity. It's fundamentally about economic capacity and sustainability.

Electricity is the foundation of modern industrial civilization. Everything from manufacturing to healthcare to transportation increasingly depends on reliable, affordable power. When the grid becomes unreliable or power becomes expensive, economic activity contracts.

Historically, the US has had essentially unlimited electrical capacity. Power was cheap. You didn't think about it. That changed with deregulation in some markets and with renewable energy adoption, but the abundance mentality remained.

AI data centers shatter that assumption. They represent a new, massive demand on infrastructure that was never designed for this. And they're not going away. AI adoption will only accelerate.

So we're at an inflection point. We can either:

- Build the infrastructure needed to support the demand (expensive, requires investment)

- Slow demand growth artificially through rationing or pricing (economically inefficient)

- Accept system fragility and operate with frequent outages and price spikes (economically damaging)

Option 1 is the only viable long-term path. But it requires sustained investment, political will, and public acceptance of higher electricity costs in the short term.

Winter Storm Fern was a reminder that infrastructure investments have real returns. The cost of preventing outages (through grid modernization) is far lower than the cost of outages themselves.

This principle applies to many infrastructure domains: water systems, transportation, communications, public health. But nowhere is it more critical than electricity. Everything else depends on it.

The question isn't whether we'll invest in grid modernization. The question is whether we'll do it proactively or reactively. Proactive investment prevents crises. Reactive investment responds after crises have already caused damage.

Based on historical patterns, we're probably headed toward more reactive investment. Which means more Winter Storm Ferns. Which means more economic damage. Which means the eventual proactive investment will be even more expensive.

FAQ

What is the relationship between AI data centers and power grid strain?

AI data centers consume massive amounts of electricity continuously (50-100+ megawatts per facility), creating localized demand that wasn't anticipated by existing infrastructure. When multiple data centers concentrate in regions like Virginia, they consume such large percentages of available power that grid operators have less flexibility to respond to emergencies, making the system more fragile.

Why did electricity prices spike during Winter Storm Fern?

Wholesale electricity prices spiked because demand for heating surged while local supply was constrained by transmission limitations and some generation facilities being offline. With data centers maintaining their heavy consumption alongside residential heating demand, local power scarcity became severe. On Sunday January 26th, Virginia prices hit

How does the age of electrical infrastructure contribute to grid vulnerabilities?

Much of the US electrical grid was built 50-100 years ago and designed for steady-state demand growth of 1-2% annually. The infrastructure wasn't engineered for the rapid demand spikes from AI, electrification, and manufacturing reshoring. Aged transformers, transmission lines, and distribution systems fail more frequently and have less capacity margin, making the grid more susceptible to cascading failures during extreme weather.

What is "data center alley" and why does it matter?

Data center alley refers to regions like Virginia, Northern California, and Texas where data center investments have concentrated due to existing fiber optic infrastructure, established utility relationships, and low electricity costs. This geographic concentration creates systemic risk because a single regional extreme weather event impacts hundreds of data centers simultaneously, and neighboring utilities can't provide backup power because they're experiencing the same crisis.

Can renewable energy solutions help solve the grid strain problem?

Renewable energy is necessary for climate goals, but it creates new challenges. Solar and wind are intermittent, so grid operators still need reliable baseload power (natural gas, nuclear, or storage). During Winter Storm Fern, solar output dropped significantly while wind patterns were unpredictable. Data centers can't be powered intermittently, so utilities must maintain expensive, underutilized backup generation capacity to handle worst-case scenarios where renewables fail to generate during peak demand.

What would grid modernization cost and who would pay for it?

Estimates suggest US grid modernization requires

Are there technological solutions that could reduce grid strain?

Several technologies could help: high-temperature superconductors for transmission (near-zero losses), advanced battery storage (not just lithium-ion), immersion cooling for data centers (more efficient than water), smart grid systems using AI for real-time optimization, and demand response systems that allow data centers to reduce power consumption during emergencies in exchange for compensation. However, these are mostly in early deployment or development stages and won't scale fast enough without significant investment.

What lessons did utilities learn from Winter Storm Uri in 2021?

Texas made significant improvements after Winter Storm Uri: winterizing natural gas facilities, deploying battery storage, and improving demand response coordination. However, these lessons weren't universally adopted nationally. When Winter Storm Fern hit Virginia in 2025, the state hadn't invested as heavily in resilience, suggesting that each region has to experience a crisis to prompt investment. Learning from others' crises remains politically difficult.

How can businesses protect themselves from grid instability?

Businesses can take multiple approaches: diversify cloud infrastructure across multiple geographic regions to avoid single-region outages, invest in backup power systems (generators or batteries) for critical operations, improve energy efficiency to reduce electricity consumption, install on-site renewable generation (solar/wind), participate in utility demand response programs for potential financial incentives, and engage with local utilities on resilience planning. For data center operators, geographic diversification and on-site generation are particularly important.

What does the future of the power grid look like?

Three scenarios are plausible. Optimistic: accelerated investment leads to modernized infrastructure supporting robust growth. Base case: gradual improvement but perpetual lag between demand growth and capacity addition, with periodic crises. Pessimistic: continued underinvestment leads to increasingly frequent outages, price volatility, and eventual demand destruction when power becomes unreliable or unaffordable. The path depends on policy decisions and investment commitments made in 2025-2026.

Key Takeaways

- Winter Storm Fern caused electricity prices to spike 900% in Virginia (from 1,800/MWh) due to constrained supply and massive concurrent demand from heating and data centers

- AI data centers consume 50-100+ megawatts continuously per facility, equivalent to powering 40,000-80,000 homes, straining grids not designed for this scale of constant demand

- US electrical grid infrastructure is 50-100 years old, designed for 1-2% annual demand growth, not the current 5-10% growth driven by AI, electrification, and manufacturing reshoring

- Geographic concentration of data centers in 'data center alley' (Virginia, Northern California, Texas) creates systemic risk where single extreme weather events impact hundreds of facilities simultaneously

- Grid modernization requires $1-2 trillion over 20 years, but current federal and utility investment is insufficient, creating growing gap between infrastructure capacity and electricity demand

Related Articles

- EPA Closes Generator Loopholes: AI Data Center Expansion Hits Federal Wall [2025]

- Kioxia Memory Shortage 2026: Why SSD Prices Stay High [2025]

- Trump and Governors Push Tech Giants to Fund Power Plants for AI [2025]

- Meta's Nuclear Bet With Oklo: Why Tech Giants Are Fueling the Energy Revolution [2025]

- Why RAM Prices Are Skyrocketing: AI Demand Reshapes Memory Markets [2025]

- PC Prices Set to Soar in 2026: RAM Shortage & AI Demand Explained [2025]

![AI Data Centers and Power Grids: The Winter Storm Crisis [2025]](https://tryrunable.com/blog/ai-data-centers-and-power-grids-the-winter-storm-crisis-2025/image-1-1769553475457.jpg)