AI-Led Growth: The Third Era of B2B SaaS [2025]

Your next customer might never speak to a human sales rep. And your biggest competitor might deploy its entire go-to-market machine without hiring a single new headcount.

This isn't science fiction. It's happening right now.

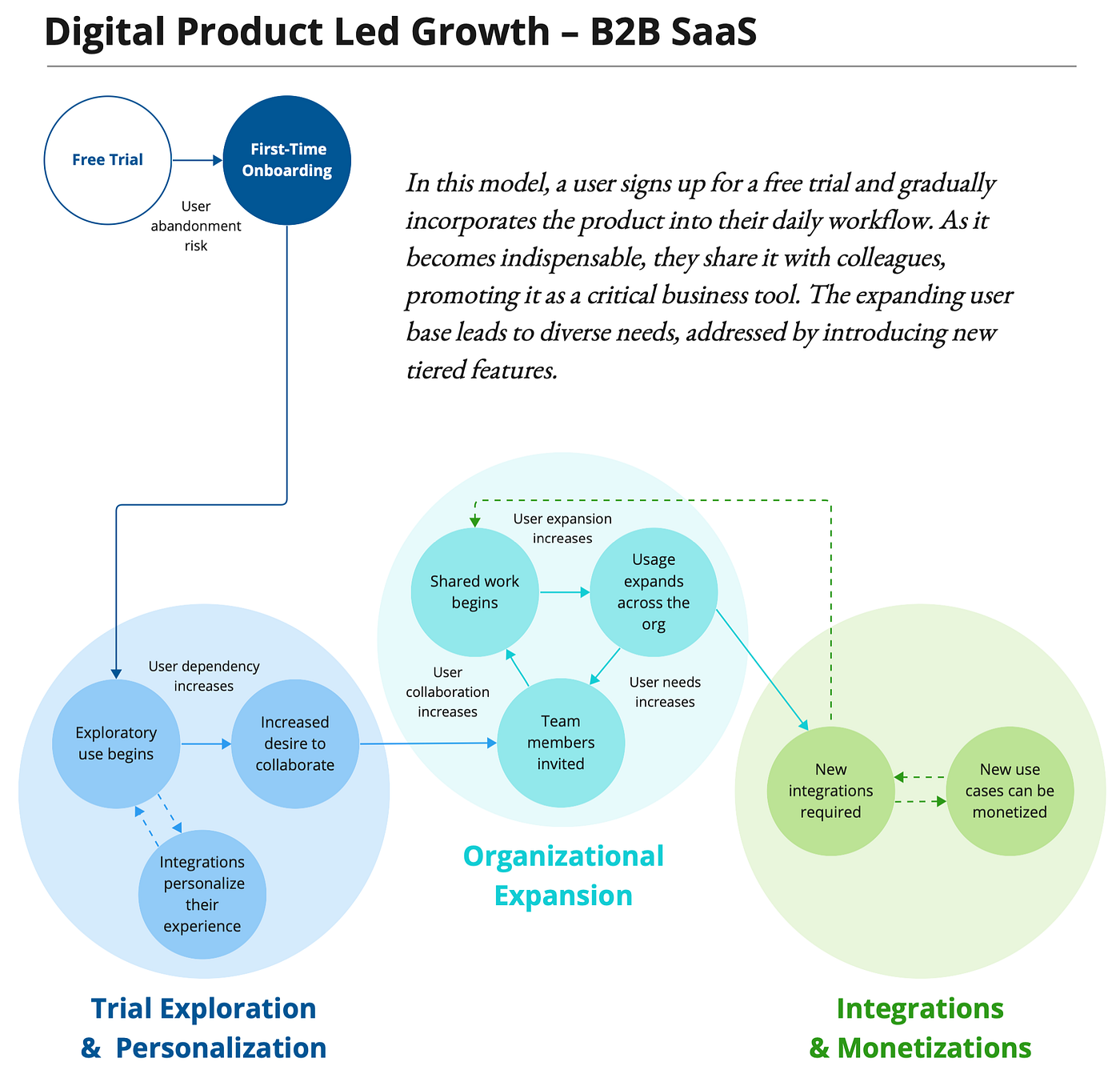

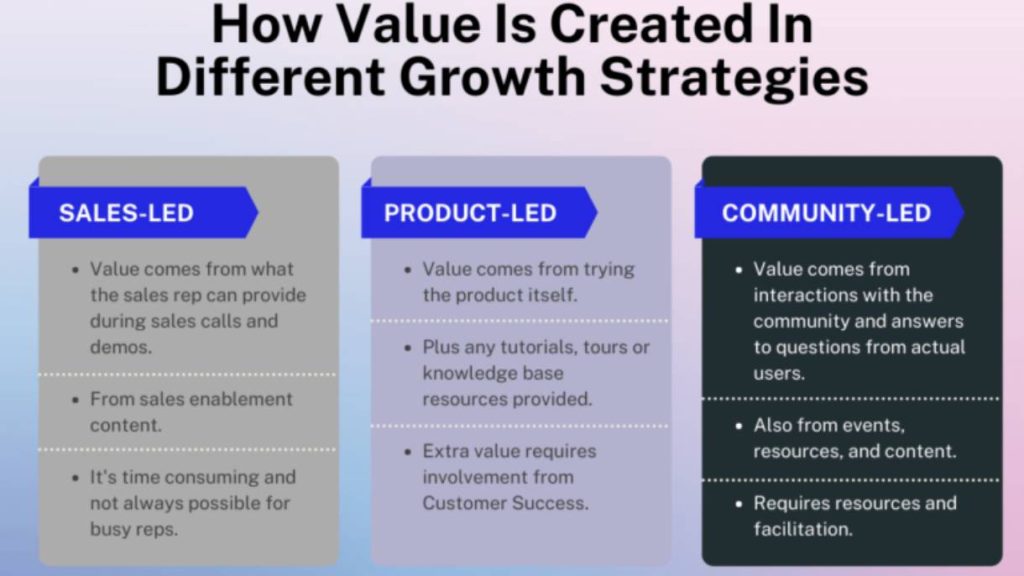

For the past 25 years, B2B SaaS has operated under two dominant playbooks: sales-led growth, where expensive teams of account executives hunt down enterprise deals, and product-led growth, where users drive adoption through freemium experiences and self-service onboarding. Every SaaS company you know fits somewhere on that spectrum. Both models work. Both have made billions of dollars. But both are becoming obsolete.

We're entering what industry experts now call AI-led growth, a fundamentally different approach to customer acquisition, engagement, and retention. And most B2B SaaS founders aren't ready for it.

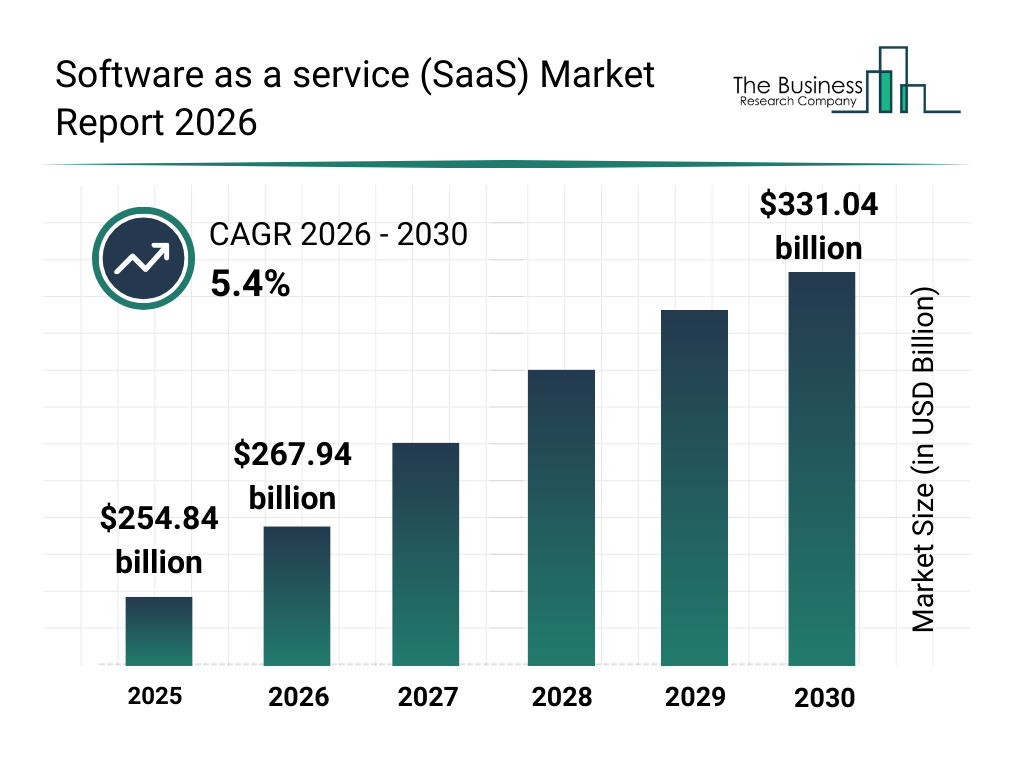

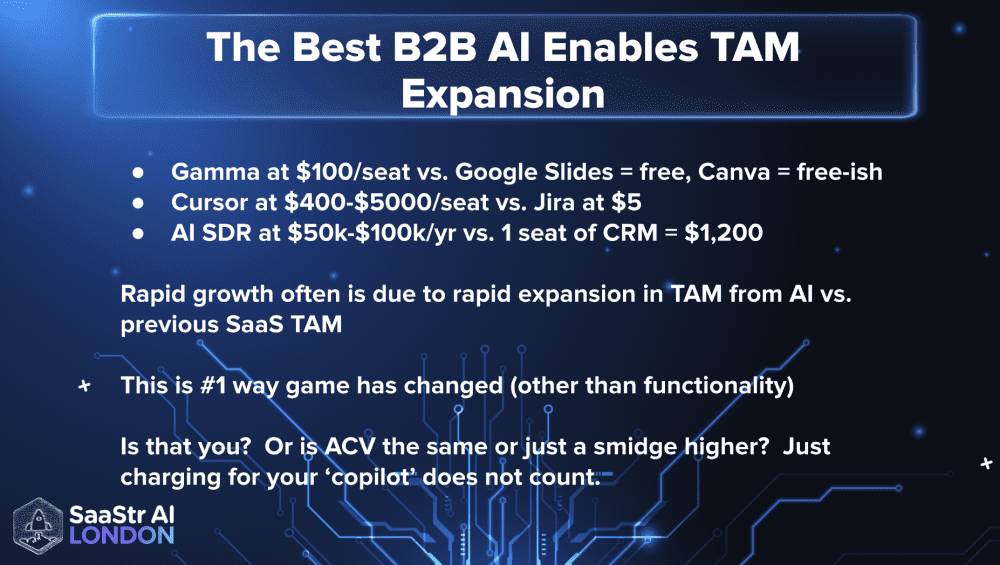

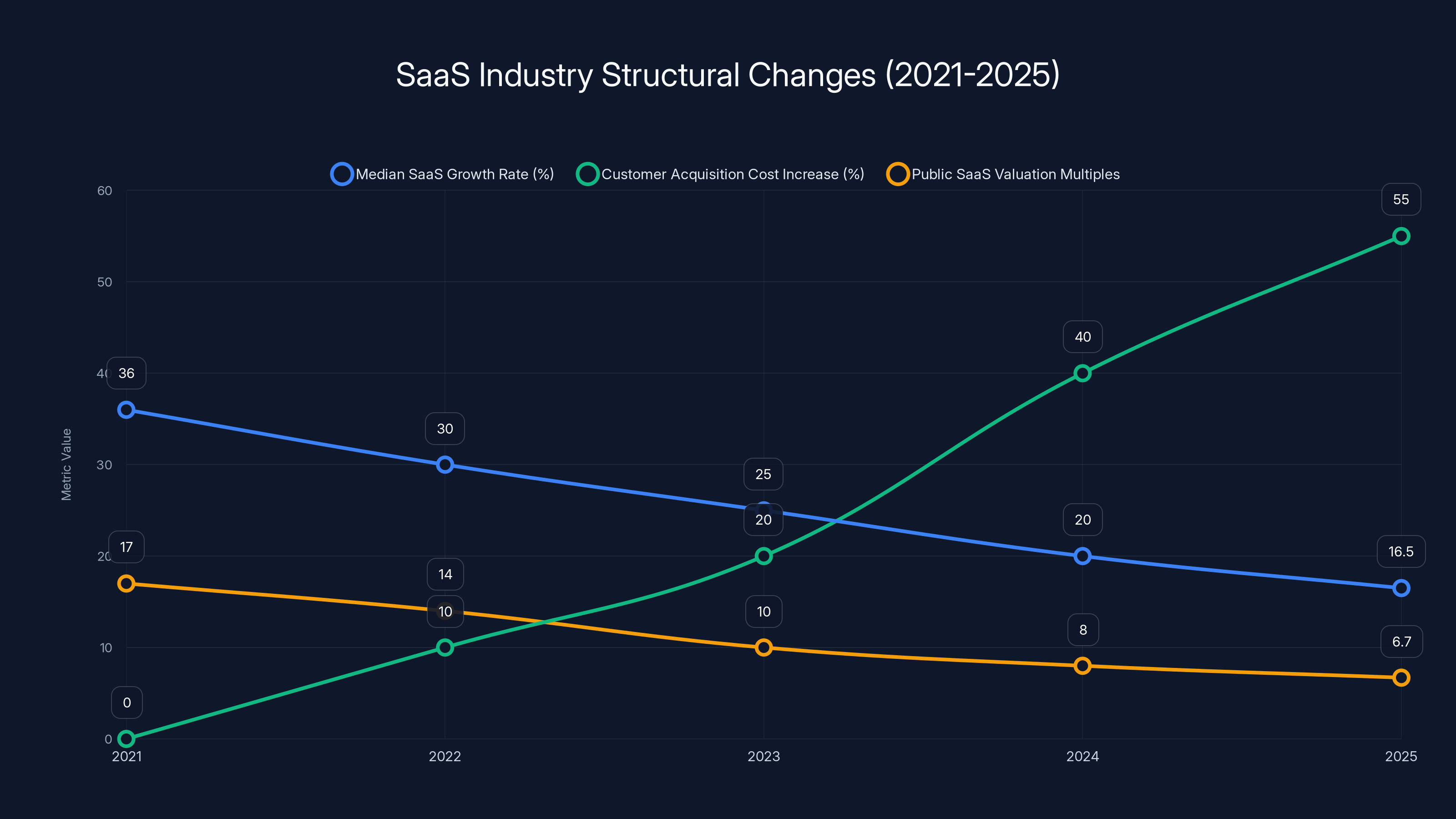

The stakes are brutal. Median SaaS growth has collapsed from 36% in 2021 to around 16.5% today. Customer acquisition costs have jumped 55% in just five years. Churn is now a $136 billion drag across the entire SaaS market. Public SaaS valuations have crashed from 17x revenue to 6.7x. Private companies face the same squeeze.

The old playbooks won't get you out of this hole. But AI-led growth might.

Here's what you need to know: AI agents are becoming your buyers, your sellers, and increasingly, your customer success team. They're doing research on your behalf before humans ever get involved. They're negotiating terms, building proposals, and identifying expansion opportunities. They're predicting churn weeks in advance and automatically correcting course. They're running entire customer success functions with minimal human oversight.

This shift represents a genuine inflection point in SaaS business models. It's not incremental. It's structural. And if you're still operating with the sales and marketing playbooks from 2019, you're playing a game that's already being automated out from under you.

Let's break down what's actually happening, why it matters, and what you need to do about it.

TL; DR

- AI agents are becoming your primary buyers: Chat GPT, Claude, and other models now consume product information before humans do, requiring a complete overhaul of marketing and positioning.

- Sales is evolving from rep-to-rep to agent-to-agent: AI seller agents interact with buyer AI agents in the middle funnel, compressing timelines and automating negotiation.

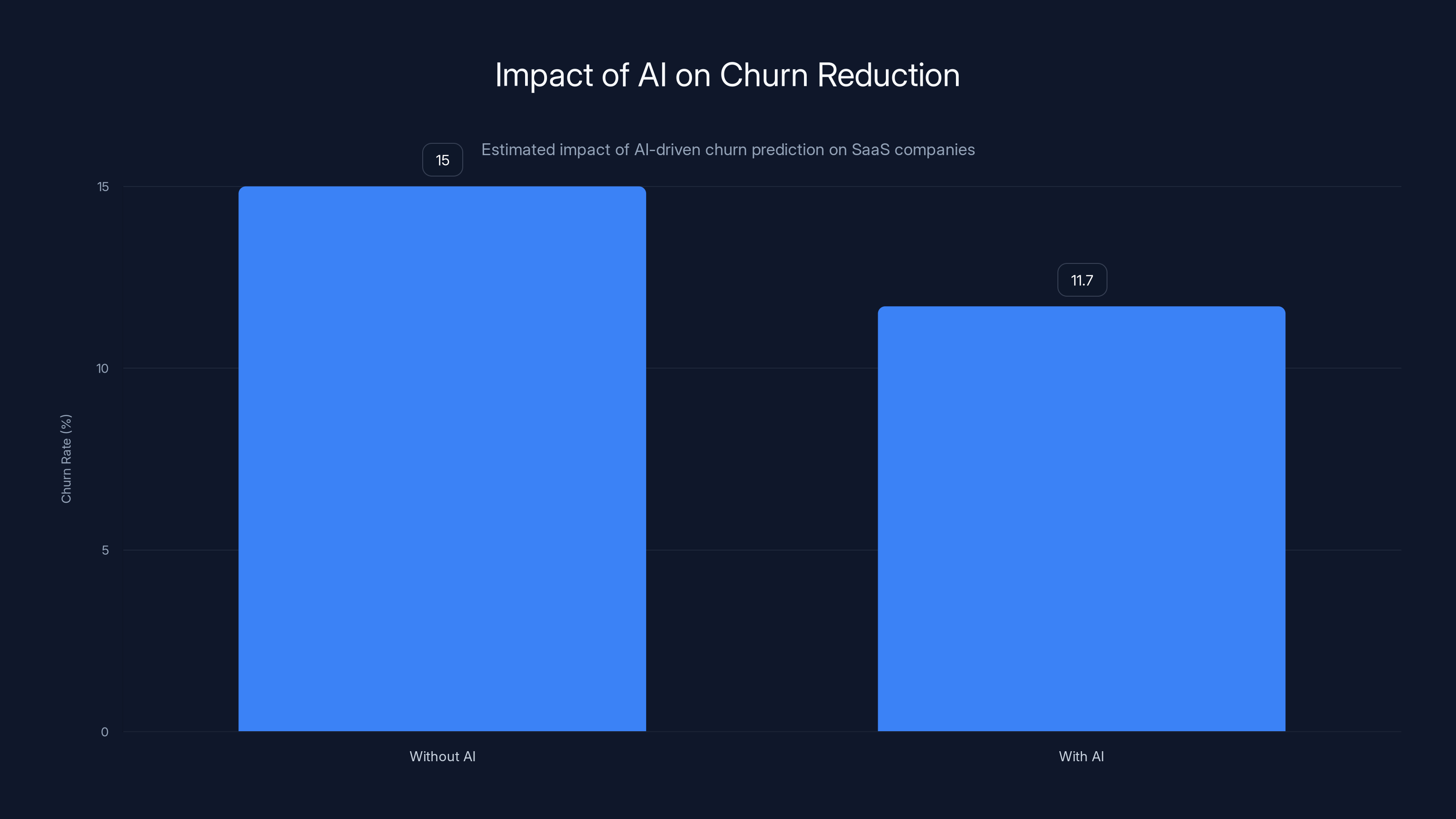

- Churn prediction now starts at Day Zero: Predictive models can reduce churn by 22% when deployed from the moment a customer signs, not 30 days before renewal.

- Customer success is becoming agentic: AI-powered QBRs, in-product personalization, and next-best-action engines replace manual CSM work while improving outcomes.

- The CISO becomes the Chief People Officer: Governing AI agent behavior replaces traditional people management as the biggest operational priority.

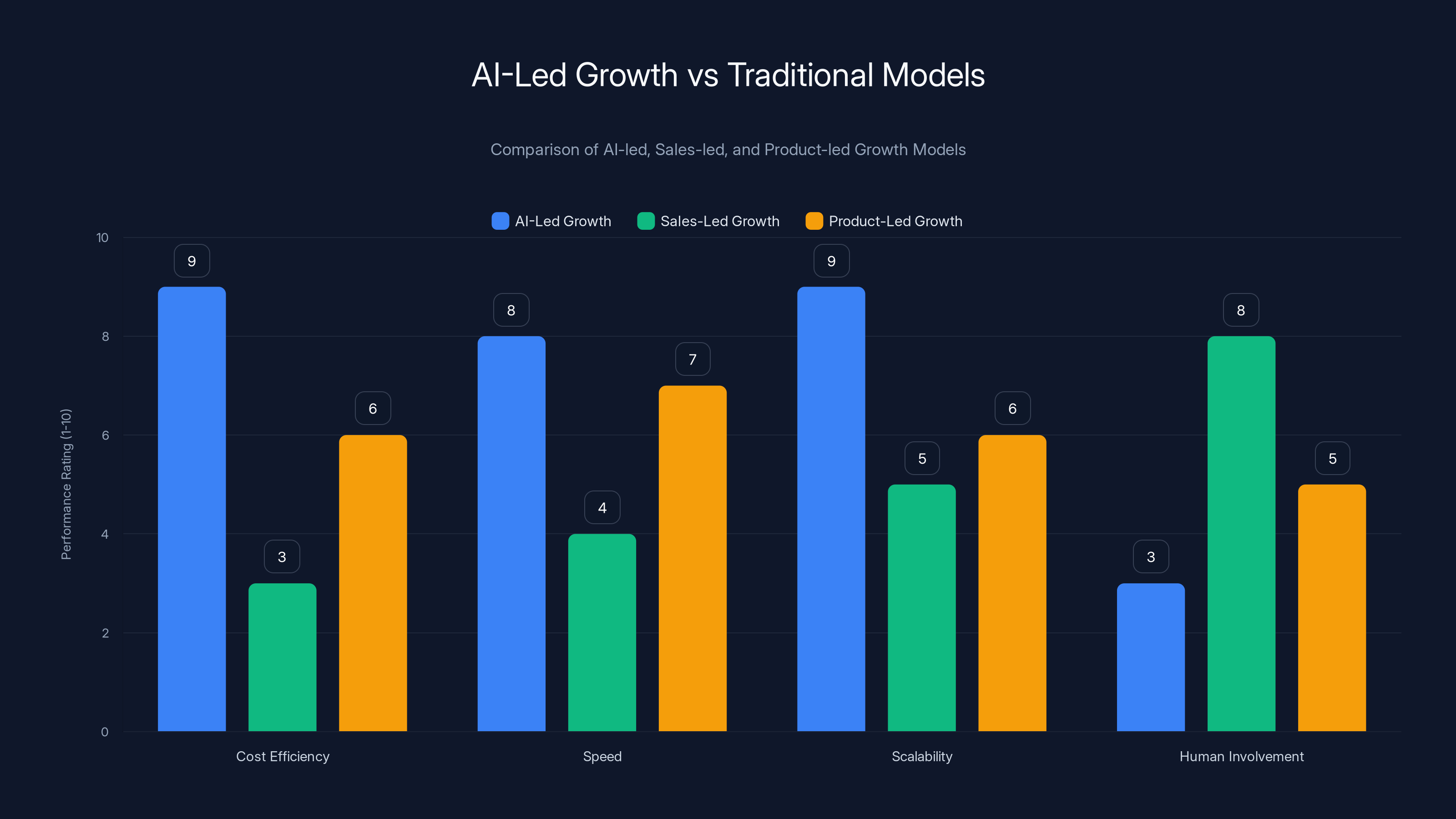

AI-led growth excels in cost efficiency, speed, and scalability, with minimal human involvement compared to sales-led and product-led growth models. Estimated data.

The Data Is Forcing a Reckoning

Let's start with why this matters. The SaaS growth model that dominated the 2010s is broken in 2025, and the numbers prove it.

Median SaaS growth has dropped 54% in four years. In 2021, the median growth rate for SaaS companies was 36%. Today, it's sitting at 16.5%. This isn't a cyclical dip. It's structural. You can't hire your way out of this problem.

Customer acquisition costs have climbed 55%. Not adjusted for inflation. Real, structural increases in what it costs to acquire a customer. A typical B2B SaaS company is now spending

Churn is destroying value at scale. The SaaS industry loses roughly $136 billion annually to customer churn. That's equivalent to 7-8 percentage points of ARR across the entire market evaporating. Even if you're not seeing this in your own metrics yet, your competitors are, and it's changing how they invest.

Public SaaS valuations have collapsed 60%. We went from ~17x revenue multiples at the peak (2021) to 6.7x today. Private company multiples have fallen from 20x+ to 6-7x. This means profitability and unit economics matter more than raw growth. If you're burning cash to acquire customers you can't keep, investors are watching more carefully.

Now, here's what most founders are doing about this: optimizing the old playbooks. Better targeting. Better messaging. Better follow-up sequences. Better CSM training. Incremental improvements to systems that are fundamentally broken.

That's like optimizing your horse-drawn carriage when the car industry is being invented.

AI-driven churn prediction can reduce churn rates by 22%, significantly impacting revenue retention. Estimated data based on typical SaaS company scenarios.

The First Two GTM Eras: A Brief History

To understand what's coming next, you need to understand what came before.

Era One: Sales-Led Growth (1995–2015)

This was the world of Salesforce's rise and the early SaaS boom. The playbook was straightforward: hire expensive salespeople, give them territories, let them hunt. Enterprise deals required relationship building, trust, and human persuasion.

The model made sense for the era. Internet penetration was lower. Buyers needed education. Contracts were expensive and complex. You needed a person who could explain the value, handle objections, and close the deal.

But it was also capital-intensive. A fully loaded enterprise sales team could cost $1 million+ per person per year. You needed 12–18 months to break even on a new hire. Scaling required hiring constantly, and hiring often meant hiring wrong.

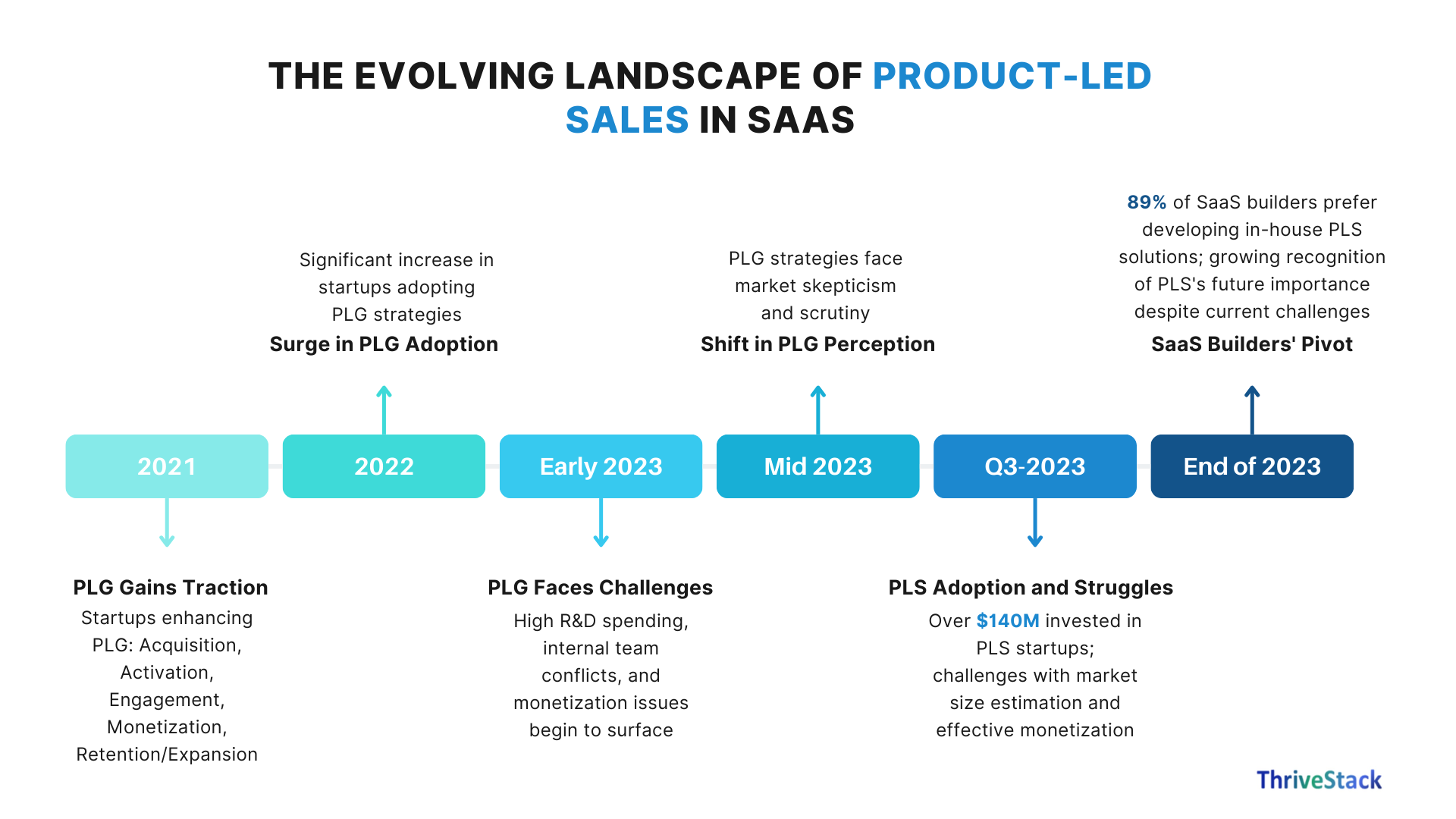

Era Two: Product-Led Growth (2015–2024)

Slack's rise changed everything. Instead of hiring 40 sales reps, Slack let users adopt the product organically. Freemium models. Free trials. Self-service onboarding. Land-and-expand, where you'd capture 100 users at a startup and then upsell the CFO.

The model was brilliant for unit economics. Your top-of-funnel CAC was almost zero. You could acquire users cheaply and serve them automatically. But you still needed humans to manage expansion. You still needed salespeople to close bigger deals. You still needed CSMs to keep customers alive.

Most successful modern SaaS companies—Notion, Figma, Canva—are hybrids. Some product-led motion at the top of funnel, some sales assistance in the middle.

But here's what both eras have in common: humans remained the central force in the go-to-market motion. Humans discovered products. Humans made buying decisions. Humans managed relationships.

That's no longer true.

Era Three: AI-Led Growth (2024–?)

AI-led growth is fundamentally different from its predecessors. It's not a sales tactic or a marketing channel. It's a complete restructuring of how buyers discover products, evaluate options, make purchasing decisions, and consume value.

Here's how it actually works in practice:

The Top of Funnel Is Now Agents, Not People

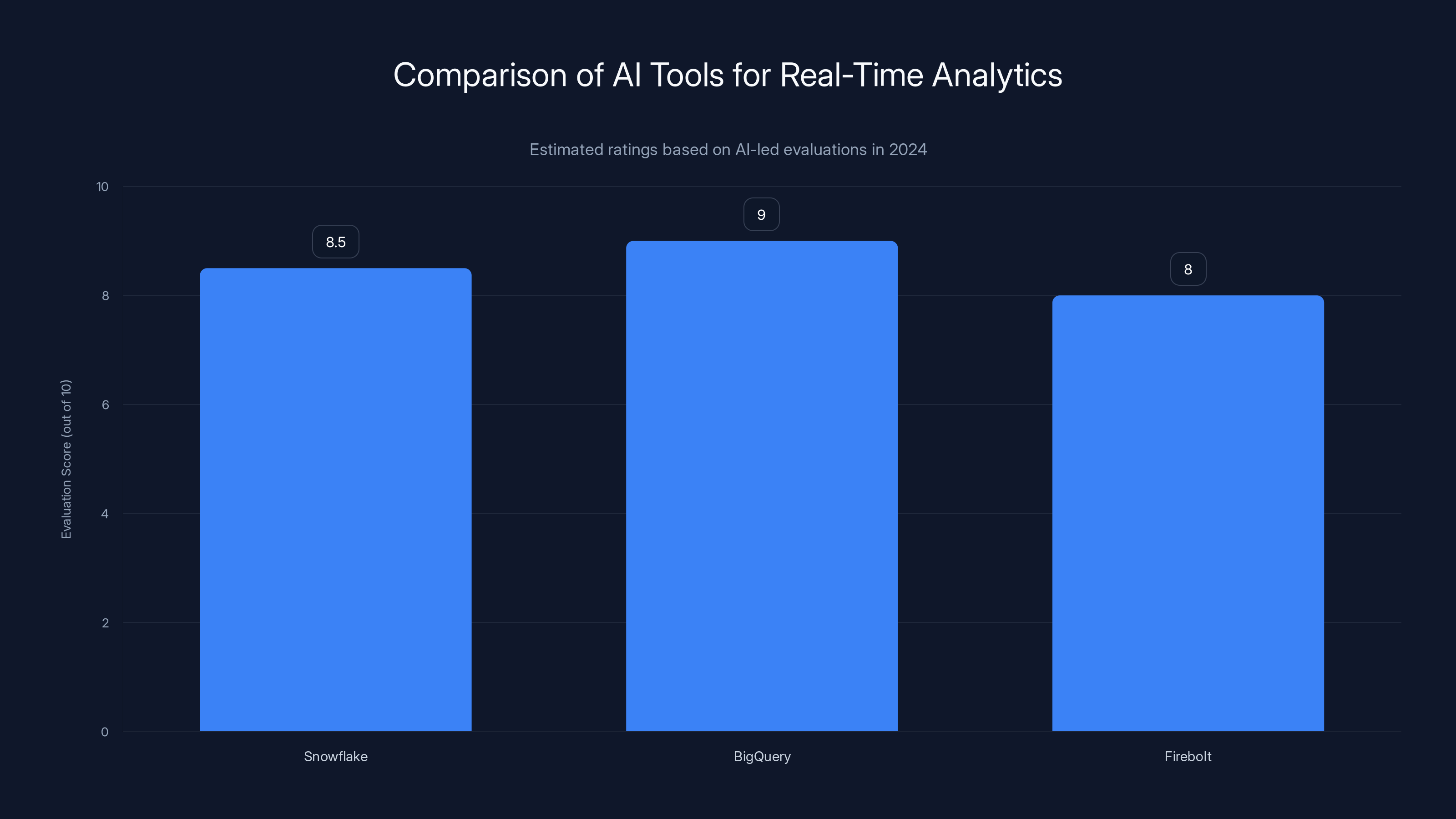

Imagine a VP of Engineering at a mid-market company evaluating data warehouse solutions. She doesn't start by visiting vendor websites. She opens Chat GPT or Claude and asks: "Compare Snowflake, Big Query, and Firebolt. Which one works best for real-time analytics on streaming data?"

An AI agent—not a human—is now your primary buyer. That agent reads your entire website, reviews your documentation, checks your pricing page, and compares you to competitors. It summarizes your strengths and weaknesses in 30 seconds.

If your website isn't optimized for AI consumption, you don't exist in that initial comparison. Your marketing materials need to be structured, scannable, and designed for LLM parsing. That's a completely different way of writing.

Consider the implications: you have zero opportunity to tell your story. No sales rep is explaining why your product is better. No CMO is crafting an emotional narrative. An algorithm is extracting facts and comparing them systematically.

This changes everything about positioning, messaging, and content strategy.

The Mid-Funnel Is Agent-to-Agent

Once a prospect clears the initial evaluation phase, the motion shifts. This is where things get weird.

Instead of your SDR emailing a prospect to set up a demo, your AI seller agent is interacting with the buyer's AI agent. They're sharing product information. They're negotiating pricing. They're discussing deployment timelines. They're building proposals.

Humans don't enter until very late in the process. By the time a human sales rep is involved, the major terms are already decided. The buyer is already 80% convinced. The rep's job shifts from selling to facilitating paperwork and relationship building.

This is already happening at scale. Some companies have deployed AI agents that can:

- Generate personalized product presentations automatically

- Answer technical questions with product documentation as context

- Negotiate volume discounts based on pre-set parameters

- Build and customize proposals in real-time

- Schedule follow-ups and manage the entire discovery process

Your 40-person SDR team? They might eventually shrink to 4 people managing exceptions and high-touch deals.

Everything Is Getting Operationalized

One of Firebolt's executives attempted something audacious: have an AI agent write and deliver an entire conference talk at SaaStr Annual. SaaStr declined (they needed a human), but the point was made. If you can operationalize a 45-minute keynote, you can operationalize everything.

Some companies are now running end-to-end events with zero human involvement:

- Invite generation (identifying accounts that match your ICP)

- Email outreach (personalized sequences at scale)

- Content creation (generating event-specific materials)

- Landing page design (building conversion-optimized pages automatically)

- Follow-up sequencing (automated nurturing based on engagement)

The human role shrinks to reviewing proposals and building final partnerships.

Estimated data shows BigQuery leading in AI evaluations for real-time analytics, followed by Snowflake and Firebolt. These scores reflect AI's systematic comparison of features and performance.

Rethinking Your Sales Organization

If AI agents are replacing your SDRs and half your sales process, what do your salespeople actually do?

This is where most founders get confused. They assume AI-led growth means "no sales team." It doesn't. It means a fundamentally different sales team.

The New Sales Role: Relationship Manager, Not Prospector

Traditional sales reps spend 60–70% of their time on prospecting, qualification, and initial discovery. They cold email. They cold call. They attend networking events. They try to get meetings.

AI agents are now doing all of that. Better, faster, and more consistently than humans.

Your sales team shifts to roles that AI can't do:

- Complex negotiations: When a deal involves custom terms, multi-year contracts, or nuanced pricing, a human brings value.

- Relationship building: For strategic partnerships and executive-level relationships, humans win.

- Problem-solving: When a prospect has concerns that don't fit standard answers, a human negotiator is valuable.

- Closing psychological barriers: Buying a major software system is still a decision that requires human trust.

The sales rep becomes a seller who closes deals that are 80% already sold, rather than a hunter who builds deals from scratch.

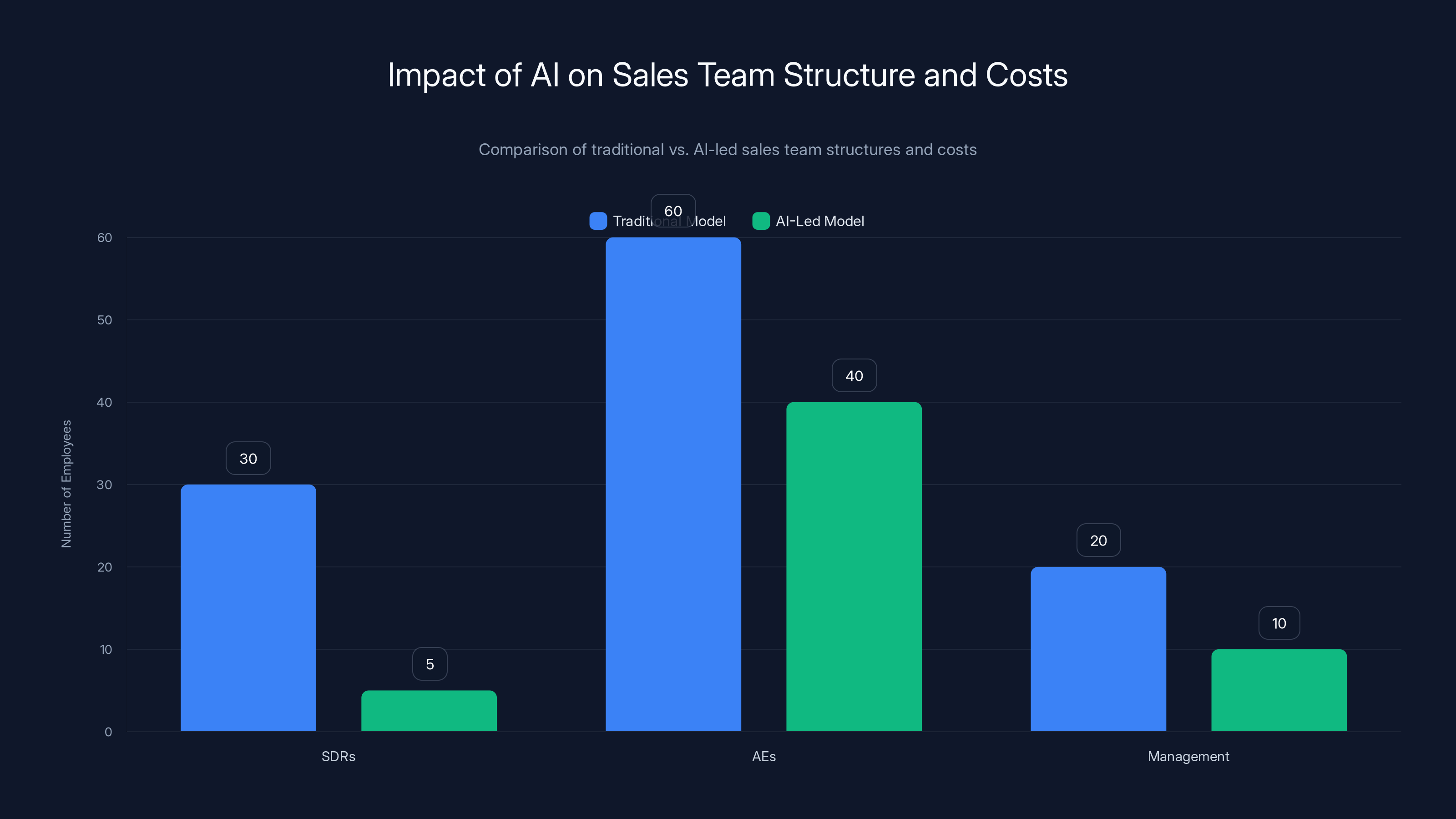

The Headcount Math Changes Completely

Let's do some math. A typical enterprise SaaS company might have:

- 30 SDRs (costing ~$1.5 million annually in salaries + benefits + tools)

- 60 AEs (costing ~$8 million annually)

- 20 Sales managers and leadership (costing ~$2.5 million annually)

Total: ~110 people, ~$12 million annual cost

With AI-led growth, the model might look like:

- 5 SDRs managing exceptions and complex accounts (~$250K annually)

- 40 AEs who focus purely on closing and relationship management (~$5.3 million annually)

- 10 Sales ops/management (they're now managing agent behavior and optimizing workflows) (~$1.2 million annually)

Total: ~55 people, ~$6.75 million annual cost

You've cut your sales team roughly in half while potentially increasing output, because the AEs spend more time selling and less time prospecting. Those AEs become more specialized, more expensive, and more valuable.

But here's the key insight: you're not reducing headcount to cut costs. You're reducing headcount because the work is being automated. That's a structural change.

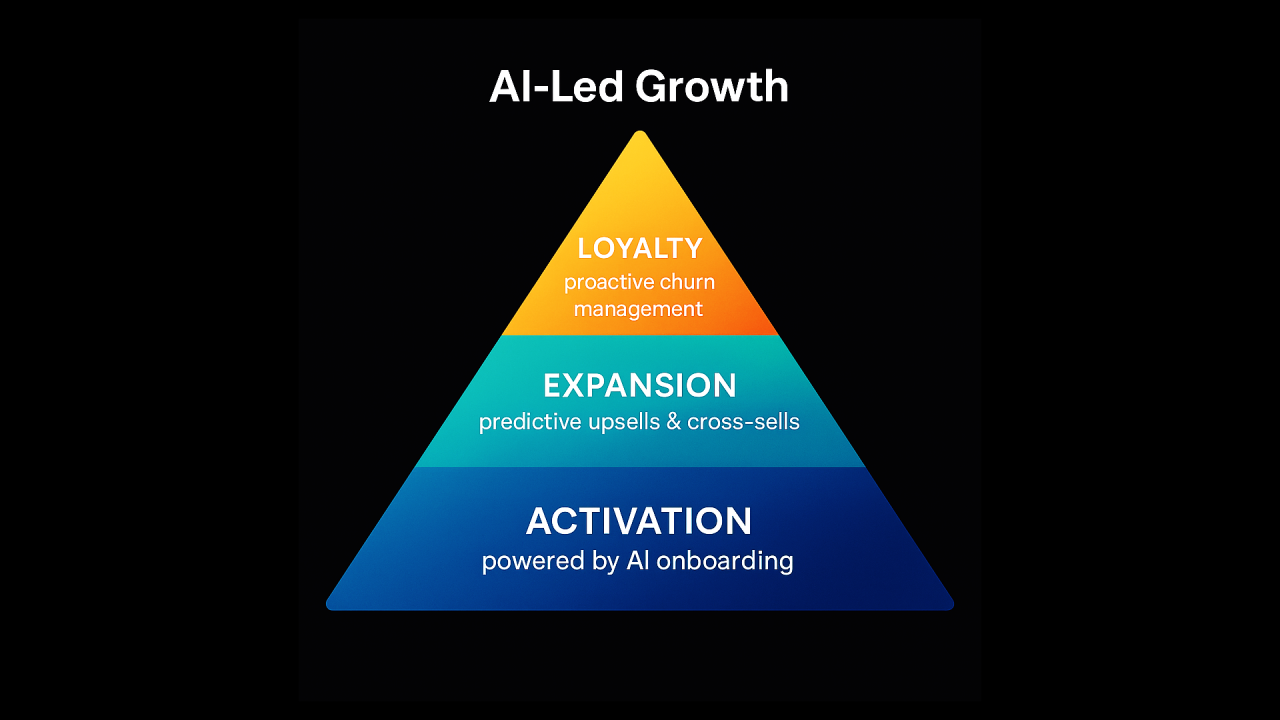

Why Churn Is Where AI Really Wins

Acquisition is impressive. But retention is where AI-led growth might have the biggest impact on your unit economics.

Here's the brutal truth: your CSM team is drowning. A customer success manager at a typical mid-market SaaS company manages 20–40 accounts. They:

- Prepare quarterly business reviews (8–12 hours per review)

- Monitor usage data and engagement (10+ hours per week)

- Proactively reach out to at-risk customers (5+ hours per week)

- Handle escalations and technical questions

- Manage expansion conversations

- Build business cases for renewal

That's a 50+ hour per week job. And they're drowning. Most customers don't get enough attention. Most at-risk customers get flagged too late.

Now, imagine what happens when you deploy AI to handle the repetitive work:

Predictive Churn Models Starting at Day Zero

Most SaaS companies start worrying about churn 30 days before renewal. By then, it's too late. A customer who isn't using your product probably won't renew, and no conversation in the final month will fix that.

AI flips this upside down. Churn prediction now starts the moment a customer signs.

For a three-year contract, your model is making predictions and recommendations from Day 1. It's identifying at-risk accounts before they become at-risk. It's recommending interventions months in advance.

How effective is this? Companies deploying predictive churn models from Day Zero are seeing 22% reductions in churn. That's a game-changing number. For a

How does this work in practice? The AI model monitors:

- Feature adoption rates (if a customer isn't using key features, they might be considering alternatives)

- Login frequency (declining activity is a strong churn signal)

- Support ticket patterns (certain types of tickets predict churn)

- Spending patterns (buying additional features often predicts stickiness)

- Competitive mentions in communications

- Executive team changes (new CTO often means technology re-evaluation)

When the model identifies a customer trending toward churn, it doesn't send a vague alert to a CSM. It recommends specific interventions:

- "Run a technical deep-dive on Feature X, which this customer hasn't used"

- "Schedule a renewal conversation 45 days earlier than planned"

- "Introduce them to Customer Y, who solved a similar problem using Feature Z"

- "Offer expanded usage of Feature A, which would unlock their key use case"

Generative QBRs With 80% Less Prep Time

Quarterly business reviews are critical but require enormous preparation. A typical QBR prep involves:

- Pulling usage data from your analytics platform

- Summarizing metrics, trends, and usage patterns

- Calculating ROI and business impact

- Identifying expansion opportunities

- Building a presentation

- Writing talking points

A CSM typically spends 8–12 hours on this. Across a team of 20 CSMs managing 500 customers, that's 2,000–3,000 hours per quarter just on QBR prep. That's roughly 10 full-time employees worth of time.

AI agents can now generate all of this automatically. Your CSM provides:

- The customer name

- Their primary use case

- Any special notes or concerns

The agent:

- Pulls usage data automatically

- Calculates ROI based on your pricing model

- Identifies expansion opportunities

- Generates a polished presentation

- Writes talking points optimized for that customer's context

The CSM then spends 90 minutes reviewing the AI-generated deck, adding personal touches, and having a strategic conversation instead of data assembly work.

Result: your QBR prep time drops from 12 hours to 2–3 hours. And often the AI-generated insights are better than human-prepared ones because they're based on comprehensive data analysis, not summary-level recollection.

In-Product Personalization Drives Expansion

Here's something that doesn't require a CSM at all: AI-driven product experiences that guide customers toward their next expansion opportunity.

Think about Netflix's recommendation engine. It shows you what to watch next based on your viewing history, genre preferences, and patterns similar users have followed. It's personalization at scale.

B2B products can now do the same thing. Your product can:

- Identify which features a customer is using heavily

- Recommend related features that would expand their use case

- Surface customers who have successfully adopted similar patterns

- Suggest the optimal sequence of feature adoption

- Trigger helpful tooltips and onboarding at the right moment

Instead of waiting for a CSM to reach out and suggest an expansion, the product itself guides the customer. Continuously. At scale.

One company reported that implementing AI-driven in-product expansion messaging increased expansion revenue by 34% with zero additional CSM headcount.

The AI-led sales model reduces the total headcount by 50%, from 110 to 55 employees, significantly lowering annual costs from

The Operational Shift: Meet Your New CISO CPO

If AI agents are now doing your selling, servicing, and customer management, who's managing them?

This is where the org chart gets weird.

Traditionally, your Chief People Officer oversees hiring, culture, compensation, and human resource management. But if your organization is becoming increasingly agentic, what does people management even mean?

The answer emerging from forward-thinking companies: your Chief Information Security Officer becomes the de facto Chief People Officer. Not in title, but in function.

Why? Because if AI agents are making important decisions about customer relationships, pricing, and product recommendations, somebody needs to govern their behavior. Somebody needs to set boundaries:

- What terms can agents negotiate?

- What customer data can they access?

- What recommendations can they make?

- How do they handle edge cases?

- What decisions require human escalation?

- How do we prevent biased or bad agent behavior?

This is an entirely different skill set than managing humans. It's less about inspiration and coaching, more about systems governance, prompt engineering, and risk management.

The companies getting this right are appointing leaders with strong technical backgrounds and risk management experience to oversee AI agent deployment. They're treating agent governance like security governance: critical, always-on, and requiring constant monitoring.

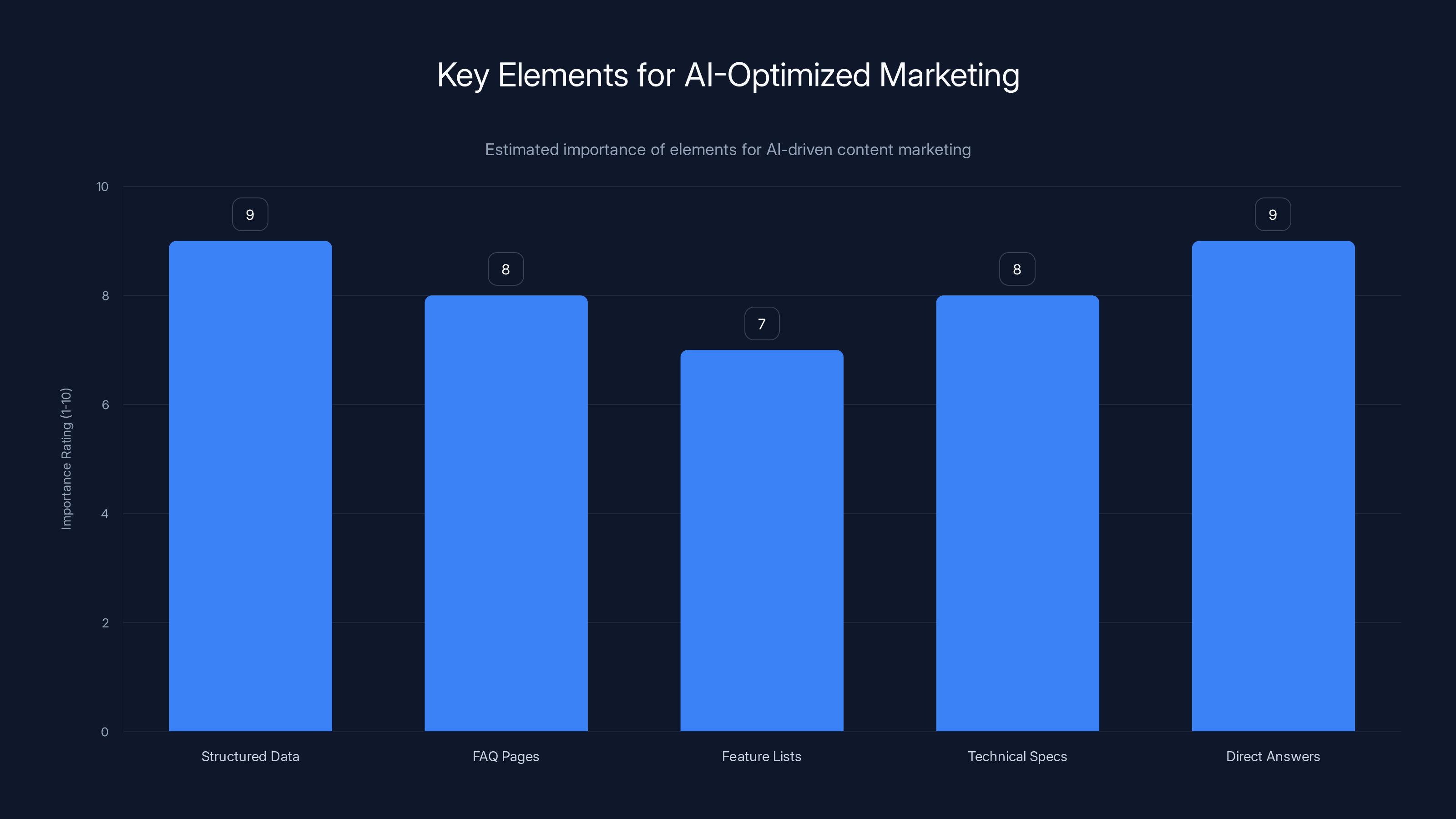

The Marketing Implications: Content for Machines

If AI agents are now your primary buyers, your marketing needs to change fundamentally.

Traditional B2B marketing is written for humans. It tells stories. It builds emotional connections. It uses metaphors and analogies. It's persuasive.

But when a Chat GPT instance is reading your website, none of that matters. The agent is extracting:

- Feature lists and capabilities

- Pricing information

- Integrations and data sources

- Performance benchmarks

- Security certifications

- Compliance standards

- Customer use cases

- Technical specifications

Your website needs to be structured, scannable, and machine-readable. Ideally:

Use Structured Data Markup

Implement schema.org markup for products, pricing, and specifications. This tells AI agents exactly what information they're reading and how it relates to other content.

Create FAQ Pages That Answer AI Questions

AI models learn by reading your FAQ sections. "How does your product handle X?" "What integrations do you support?" "What's your pricing for Y use case?" These are the exact questions agents ask.

Write Feature Lists That Are Scannable by Machines

Instead of hiding features in narrative prose, surface them in structured lists. Agents can extract "Feature A: Description. Feature B: Description" much more easily than parsing paragraph text.

Include Technical Specifications and Benchmarks

If you have performance data, API documentation, or technical specifications, surface them prominently. Agents need concrete data to make comparisons.

Optimize for the Question, Not the Click

Traditional marketing tries to get the click. Get the prospect to your demo. AI marketing tries to get the right answer. If an agent asks "Does this integrate with Snowflake?" and you answer clearly and directly, the agent will note you as a credible source.

Companies that haven't adapted to this yet are getting penalized. When an AI agent researches your category, you want to appear in its "research notes" as reliable and transparent, not as sales copy.

Structured data and direct answers are crucial for AI-optimized marketing, rated highest in importance. Estimated data.

Implementing AI-Led Growth: The Practical Framework

Knowing that AI-led growth is coming is one thing. Actually building it is another.

Here's a framework that companies are using to make this transition in 2025:

Phase 1: Audit Your Existing Motion (Weeks 1–2)

Before you implement anything, understand what you're starting with:

- Map your entire customer journey: from awareness to purchase to renewal

- Identify every human-dependent step

- Calculate the time each step takes and the cost (headcount, tools, etc.)

- Identify steps that are repetitive and rule-based (these are your targets for automation)

- Identify steps that require judgment or relationship-building (these stay human, for now)

Most companies find that 40–60% of their current GTM motion is composed of repetitive, rule-based tasks that are immediate candidates for automation.

Phase 2: Start With Churn (Weeks 3–8)

Don't start with acquisition. Start with retention. Here's why:

- It's easier to implement (you have clean customer data)

- The ROI is immediate and measurable (each percent of churn prevented = direct revenue impact)

- Your CSM team will be more receptive to AI helping with workload, not replacing them

- You'll build institutional confidence in AI agents before deploying them in high-pressure sales situations

Implementation:

- Deploy a predictive churn model that integrates with your product analytics

- Have the model surface at-risk customers in your CS tool daily

- Automate initial outreach attempts (AI-generated emails that offer help)

- Build a playbook: if customer X shows sign Y, recommend action Z

- Track: what % of at-risk customers do you retain? Compare to pre-AI baseline

Phase 3: Automate CS Operations (Weeks 9–16)

Once you've built confidence with churn prediction, expand into CS operations:

- Implement AI-generated QBR decks

- Deploy in-product next-best-action recommendations

- Build an AI chatbot that answers common CS questions (helps CSMs, reduces support load)

- Implement automated expansion monitoring (flag customers who are ready for upsells)

- Create automated renewal reminder sequences

Target: reduce your CSM preparation time by 70%, freeing them to focus on relationships instead of data assembly.

Phase 4: Rebuild Your Sales Org (Weeks 17–24)

Once CS is automated, tackle sales:

- Deploy an AI email outreach system (researches accounts, writes personalized emails, schedules sends)

- Build an AI lead qualification system (scores inbound leads, routes to appropriate rep)

- Implement AI proposal generation (agent builds custom proposals based on conversations)

- Automate discovery calls (AI agent conducts initial product discovery, summarizes findings)

- Deploy predictive deal scoring (model predicts deal probability, forecasts revenue)

Target: reduce the time from lead to qualified opportunity from 6 weeks to 2 weeks.

Phase 5: Rebuild Your Marketing (Weeks 25–36)

Finally, optimize your marketing for AI consumption:

- Restructure your website for machine readability

- Create comprehensive FAQ sections answering AI-likely questions

- Build structured feature lists and technical specifications

- Implement schema.org markup

- Track how AI agents research you and optimize based on findings

Target: improve your visibility to AI agents researching your category.

The Resistance You'll Face

Let's be honest: implementing AI-led growth creates real friction.

Your sales team will resist. They'll worry about job security. They'll argue that complex deals require human judgment (sometimes true, mostly not). They'll point to the one big deal that "needed relationship building." Manage this by being clear: AI takes the burden off them. They'll close more deals and spend more time with customers they've already qualified, which is better than cold prospecting.

Your board will worry about brand perception. "We're replacing humans with robots?" No. You're automating the parts of sales that are tedious busywork so your humans can focus on what they're actually good at. Frame it that way.

Your data won't be clean. You'll implement a predictive churn model and discover your customer data is a mess. Your product usage data has gaps. Your CSM notes are in 47 different formats. You'll need to clean data before you can automate anything. This takes time. Plan for it.

You'll have false positives and false negatives. Your churn model will flag a customer as at-risk who actually has zero intention to leave. Or it'll miss a customer who churns unexpectedly. AI is probabilistic, not deterministic. It gets it right 75–85% of the time, which is good enough to save time and money, but not perfect enough to remove all human oversight.

You'll need new skills. Managing AI agents requires different expertise than managing salespeople. You need people who understand prompt engineering, model behavior, and how to set agent guardrails. These skills are rare and expensive right now.

The SaaS industry has seen significant structural changes from 2021 to 2025, with median growth rates dropping by 54%, customer acquisition costs rising by 55%, and public SaaS valuations collapsing by 60%.

The Future: Three Years Out

If you were cynical, you might ask: does this eventually eliminate my need for a sales team entirely?

Not entirely. But your sales team will look radically different.

In three years, the most successful SaaS companies will probably have:

- 0 SDRs or maybe 2–3 managing only the most complex accounts

- 20–30% fewer AEs than they have today, but those AEs will be closing larger deals and managing strategic relationships

- A completely reorg'd CS team focused entirely on post-sale relationships and strategic expansion, with all routine work automated

- New roles that don't exist today: AI agent managers, prompt engineers, agent ethics leads

- Completely rebuilt marketing optimized for AI research and consumption

The companies that make this transition successfully will have unit economics that their competitors can't compete with. Lower CAC. Better retention. Higher ASP expansion. Those advantages are permanent.

The companies that don't adapt will find themselves with unsustainable go-to-market models. By 2027–2028, if you're still running a pure human-driven sales org, you'll be at a 30–40% cost disadvantage to competitors running AI-led growth.

That's not a prediction. That's a structural inevitability based on how productivity and efficiency compound.

FAQ

What exactly is AI-led growth?

AI-led growth is a go-to-market model where artificial intelligence agents handle tasks traditionally done by humans across acquisition, sales, and customer success. Instead of salespeople discovering prospects or customer success reps managing relationships, AI agents now handle discovery, qualification, negotiation, and expansion—with humans stepping in only for high-complexity or strategic situations. It represents a fundamental shift from human-centric to agent-centric go-to-market motion.

How is AI-led growth different from sales-led and product-led growth?

Sales-led growth relies on expensive sales teams to acquire customers through outbound prospecting and relationship-building. Product-led growth relies on self-service adoption and freemium models to drive users. AI-led growth automates the middle and back-office work that was previously human-dependent, making the process faster and cheaper. You're not choosing one over the other—you're automating the operational burden underneath both models so your humans can focus on strategic, relationship-driven work.

What specific tasks can AI agents handle in the sales process?

AI agents can now research accounts and identify prospects, write personalized outreach emails, conduct initial discovery conversations, qualify leads and score opportunity probability, generate custom proposals and pricing, negotiate terms within pre-set parameters, and manage follow-up sequences. Essentially, any task that follows a logical process and doesn't require deep relationship-building or complex human judgment is now a candidate for automation. This includes the entire SDR function for many companies.

How much can AI-led growth actually reduce churn?

Companies deploying predictive churn models from day one of the customer lifecycle see churn reductions of approximately 22% compared to traditional approaches that start churn prevention 30 days before renewal. This works because the model identifies at-risk behaviors months in advance rather than weeks, allowing time for intervention. For a

Does AI-led growth mean we don't need salespeople anymore?

No. AI-led growth doesn't eliminate the sales team—it fundamentally changes what salespeople do. Your SDR team shrinks dramatically because prospecting is automated. Your AE team shifts from hunters (cold prospecting) to closers (closing deals that are already 80% qualified by AI agents). You need fewer salespeople, but the ones you keep are more specialized and valuable because they focus purely on closing and relationship-building rather than grinding through research and qualification.

How should we restructure our sales organization for AI-led growth?

Reduce your SDR headcount by 80–90%, keeping 2–5 reps for complex exceptions. Keep your AE headcount at 60–70% of current levels, but shift their focus entirely to closing and relationship management. Add new roles for AI governance, prompt engineering, and agent monitoring. In customer success, reduce traditional CSM headcount by 30–40%, allocating those resources to strategic account management and expansion. The overall headcount reduction is 40–50% while often increasing output and revenue.

What's the fastest way to get started with AI-led growth?

Start with customer churn prediction, not acquisition. It's easier to implement because you have clean customer data, the ROI is immediately measurable in retained revenue, and it builds organizational confidence in AI before deploying agents in high-pressure sales situations. Deploy a predictive churn model that surfaces at-risk customers daily, automate initial intervention attempts, and track retention rates against your baseline. You'll see ROI within 60–90 days and can expand from there.

How does AI-led growth change marketing strategy?

Marketing shifts from persuasive storytelling (designed for humans) to structured information presentation (optimized for AI consumption). You need clearly organized feature lists, comprehensive FAQ sections answering common AI queries, technical specifications and benchmarks, structured data markup for machine readability, and transparent pricing information. The goal changes from getting clicks to appearing as a credible, transparent source when AI agents research your category. This benefits human buyers too—they often find the same improved information easier to navigate.

What data and infrastructure do we need for AI-led growth?

You need clean customer data (usage patterns, engagement metrics, business outcomes), integrated product analytics that tracks feature adoption, a CRM that can be programmatically accessed, clear definitions of churn signals and expansion opportunities, and APIs connecting your various systems. Most companies underestimate the data cleanup required—your data probably won't be clean enough for AI initially, and cleaning it becomes the first real bottleneck. Budget 4–6 weeks just for data infrastructure before deploying any AI agents.

How do we ensure AI agents make good decisions?

Set explicit guardrails on what agents can do, establish escalation thresholds (if uncertain, route to a human), require approval workflows for high-stakes decisions (like major discounts), continuously monitor agent behavior against expected outcomes, and maintain a human-in-the-loop review system for a sample of agent decisions. Treat AI governance like security governance—it requires constant monitoring, regular audits, and proactive updating of rules. Your CISO or a similar technical leader should oversee AI agent behavior oversight.

The Bottom Line

We're in a genuine transition period. The go-to-market playbooks that built billions in SaaS value over the past 25 years are becoming obsolete. Not broken—obsolete. There's a structural winner emerging, and it's powered by AI agents handling the repetitive, rule-based work that humans have been grinding through for decades.

This doesn't mean sales is dying. It means sales is evolving. Your sales team in 2027 will spend more time closing deals and building relationships than your team today, even if the total headcount is 40% smaller. Your customer success team will focus purely on strategy and expansion while AI handles the operational burden.

The companies that make this transition successfully will have permanent competitive advantages: 30–40% lower CAC, 40–50% faster sales cycles, and 15–25% lower churn. Those aren't temporary benefits. Those are structural advantages that compound.

The question isn't whether your company will move to AI-led growth. The question is when. And the companies that move first will have such a dominant position by 2027 that competitors will struggle to catch up.

Start small. Pick one piece. Get one win. Then expand. The time to begin is now.

Key Takeaways

- AI agents are now the primary buyers in B2B SaaS, requiring marketing to be optimized for machine consumption rather than human persuasion.

- Predictive churn models deployed from day zero reduce churn by approximately 22% compared to traditional 30-day-before-renewal approaches.

- Sales organizations need to be restructured to have 80-90% fewer SDRs and 30-40% fewer traditional CSMs while increasing output per remaining employee.

- The five-phase implementation framework (audit, churn, CS ops, sales, marketing) allows companies to systematically build AI-led growth over 36 weeks.

- Companies implementing full AI-led growth see structural competitive advantages: 30-40% lower CAC, 40-50% faster sales cycles, and 15-25% lower churn.

Related Articles

- How Airbnb's AI Now Handles 33% of Customer Support [2025]

- Why Customer Support Hiring Collapsed 65% in 2 Years [2025]

- Why B2B Software Survives the AI Era: Atlassian's Growth Blueprint [2025]

- AI Agents & Collective Intelligence: Transforming Enterprise Collaboration [2025]

- Robotaxis Meet Gig Economy: How Waymo Uses DoorDash to Close Doors [2025]

- How to Operationalize Agentic AI in Enterprise Systems [2025]

![AI-Led Growth: The Third Era of B2B SaaS [2025]](https://tryrunable.com/blog/ai-led-growth-the-third-era-of-b2b-saas-2025/image-1-1771076208810.jpg)