Why B2B Software Survives the AI Era: Atlassian's Growth Blueprint [2025]

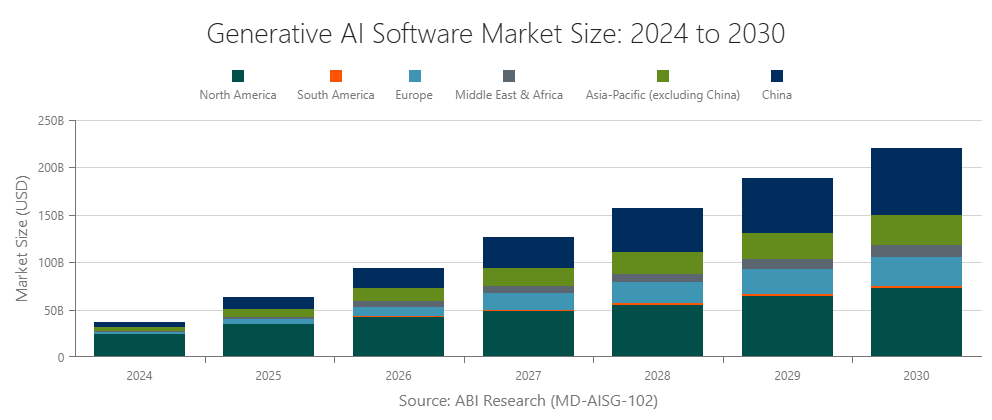

There's a lot of noise right now. Every other founder you meet is convinced their category is disappearing. The venture capitalists are doom-scrolling. The podcasts are filled with existential panic. "Software is dead." "Agents will replace everything." "AI companies are worth $150B in four years."

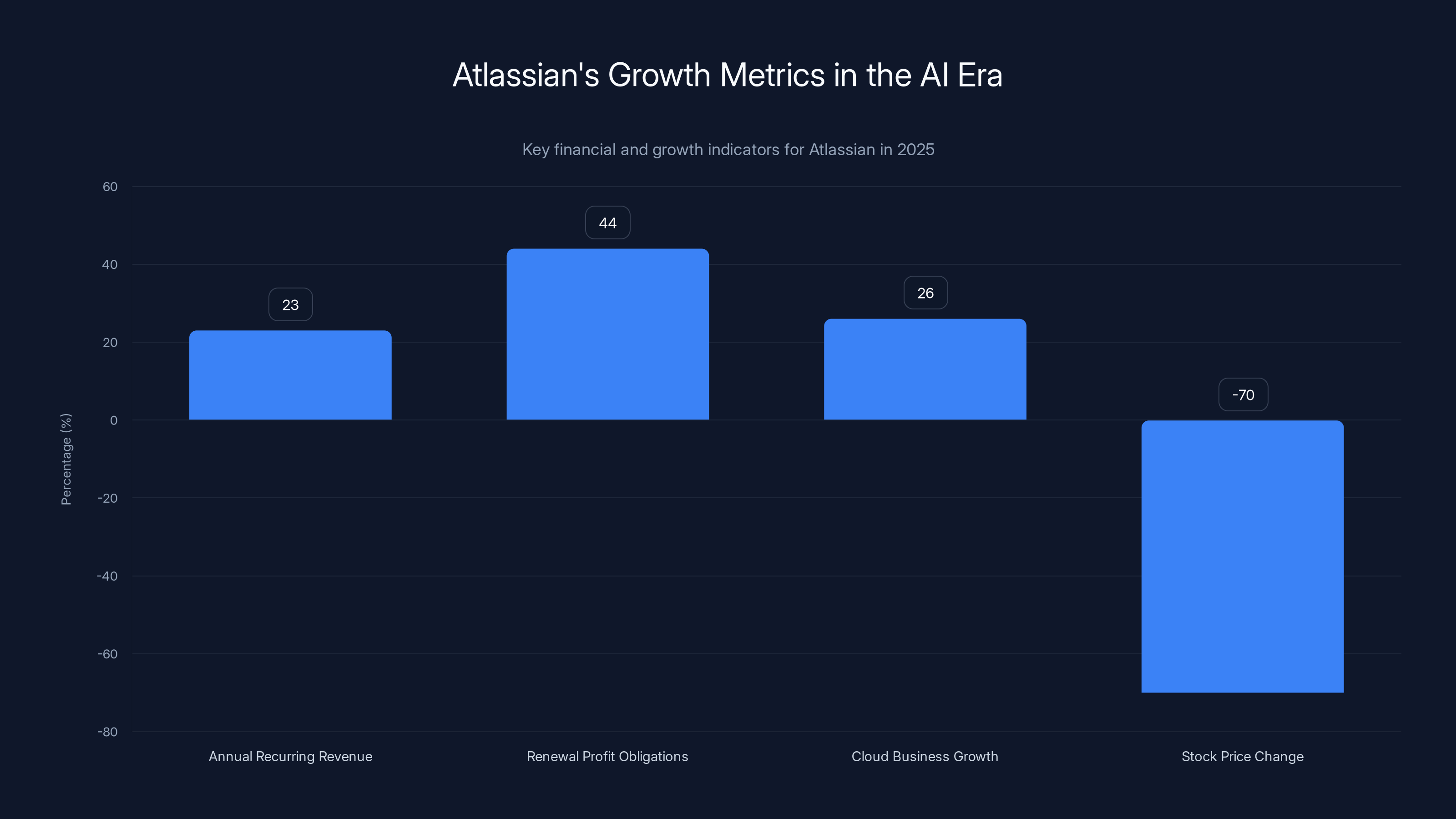

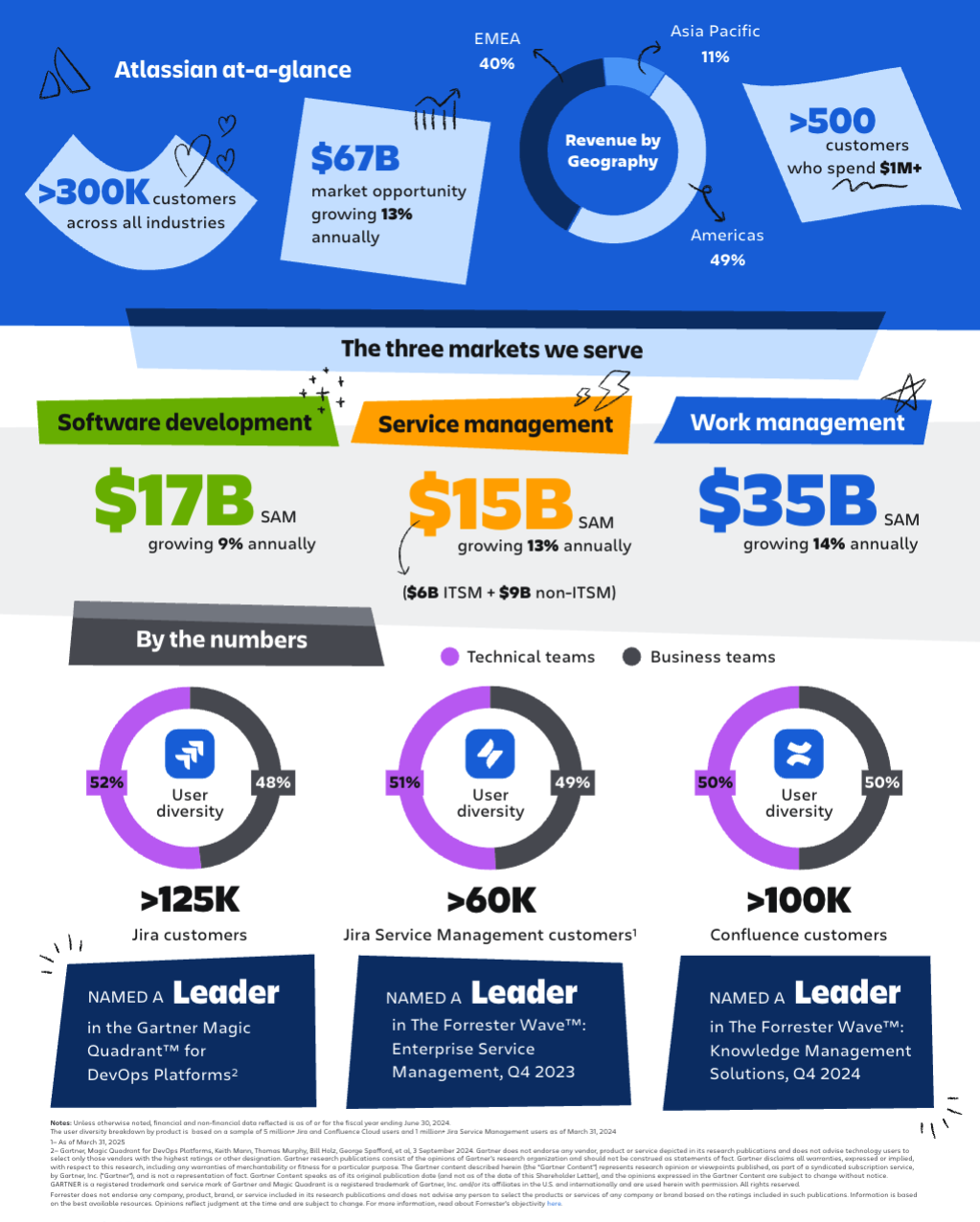

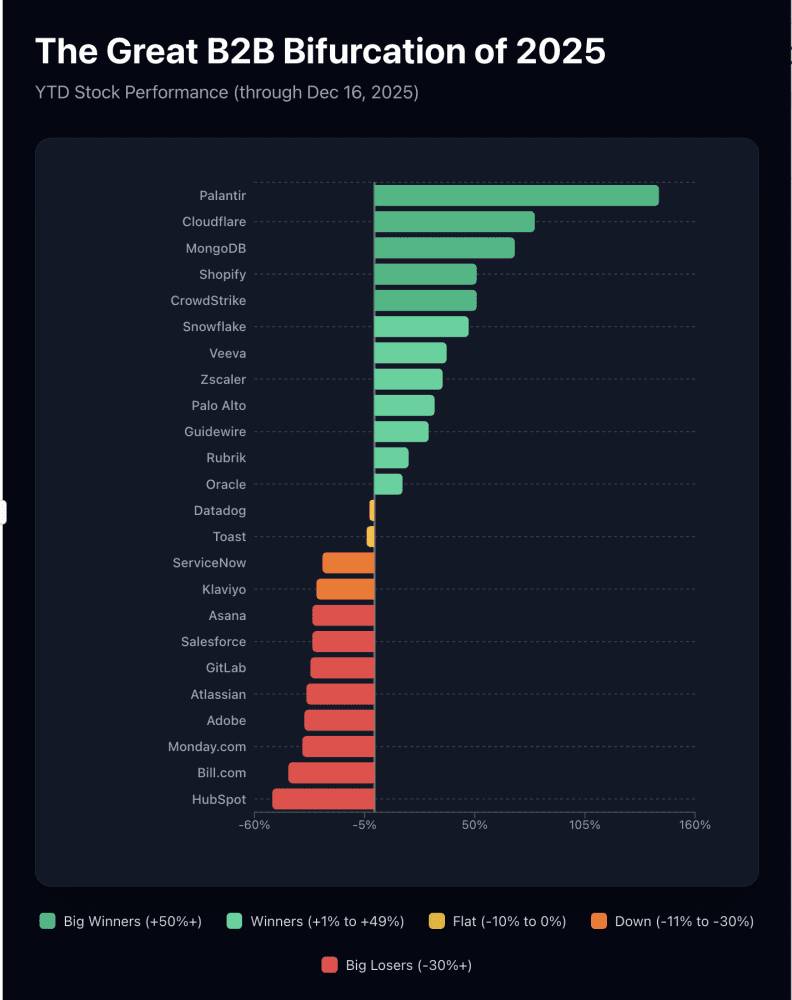

Meanwhile, Atlassian just reported 23% growth at $6.4B in annual recurring revenue, with renewal profit obligations accelerating at 44%. Their cloud business is growing 26%. They've deployed more AI features while improving gross margins over seven consecutive quarters. And yet the stock is down 70%.

Something doesn't add up.

Mike Cannon-Brooks, CEO of Atlassian, sat down recently for a candid conversation about what's actually happening in the B2B software market during the AI revolution. Not the hype version. Not the doom version. The real version, built on actual data from running a $6B+ business through the most disruptive tech shift in a decade.

What he said is worth listening to. Because if you're building a SaaS company right now, your entire strategy probably hinges on understanding the difference between the narrative everyone's telling themselves and the actual market dynamics Cannon-Brooks is seeing.

Here's the thing: B2B software isn't dead. But the rules for survival have changed dramatically. And most founders still haven't figured out what matters now.

The "Software Is Dead" Narrative Is Completely Missing the Point

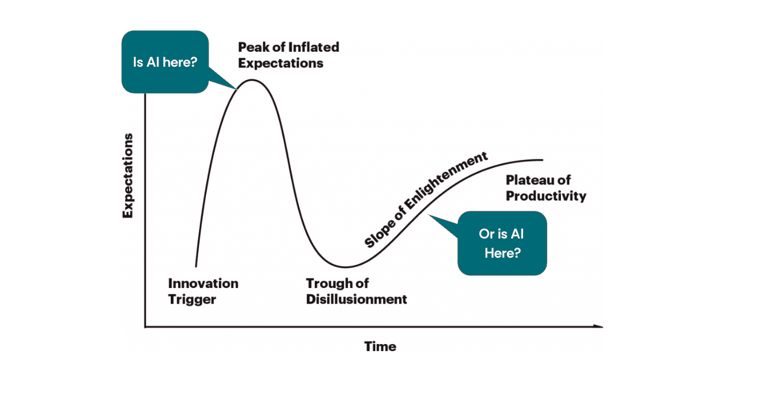

Let's start with the most persistent claim: that AI will render traditional software obsolete. That artificial intelligence and autonomous agents will replace the entire ecosystem of tools that companies have spent decades building.

Cannon-Brooks calls this out directly. The idea that businesses will stop buying pre-built software solutions is, in his words, "ludicrous." And the reasoning is almost painfully simple: companies have never built everything from scratch.

They didn't write everything in assembly language in the 1970s. They didn't build every system in COBOL in the 1980s. They didn't write all their infrastructure in C++ in the 1990s. They've always purchased pre-built solutions alongside custom development. That fundamental pattern hasn't changed. It's not changing now.

But here's what has changed: the pace of disruption has accelerated, and the ability to execute at scale matters more than ever.

Atlassian pulled up its competitive landscape analysis from different eras. Looking back at 2005, 2010, 2015—entire categories of competitors are simply gone. Merged. Acquired. Defunct. That's not new. That's the nature of technology markets. Every generation of technology shifts creates winners and losers.

What AI actually does is make that shift faster. It creates new categories before old ones fully mature. It raises the bar for what "good" looks like. Companies that can't reach that bar faster will get left behind.

But will B2B software go away? Will enterprises stop buying Atlassian, Salesforce, ServiceNow, or the next generation of tools? Absolutely not. They'll buy different things. They'll demand more value. They'll expect AI-native features. But the fundamental pattern—purchasing pre-built software—isn't going anywhere.

The real question isn't whether software survives. It's whether your software survives. And that depends entirely on execution.

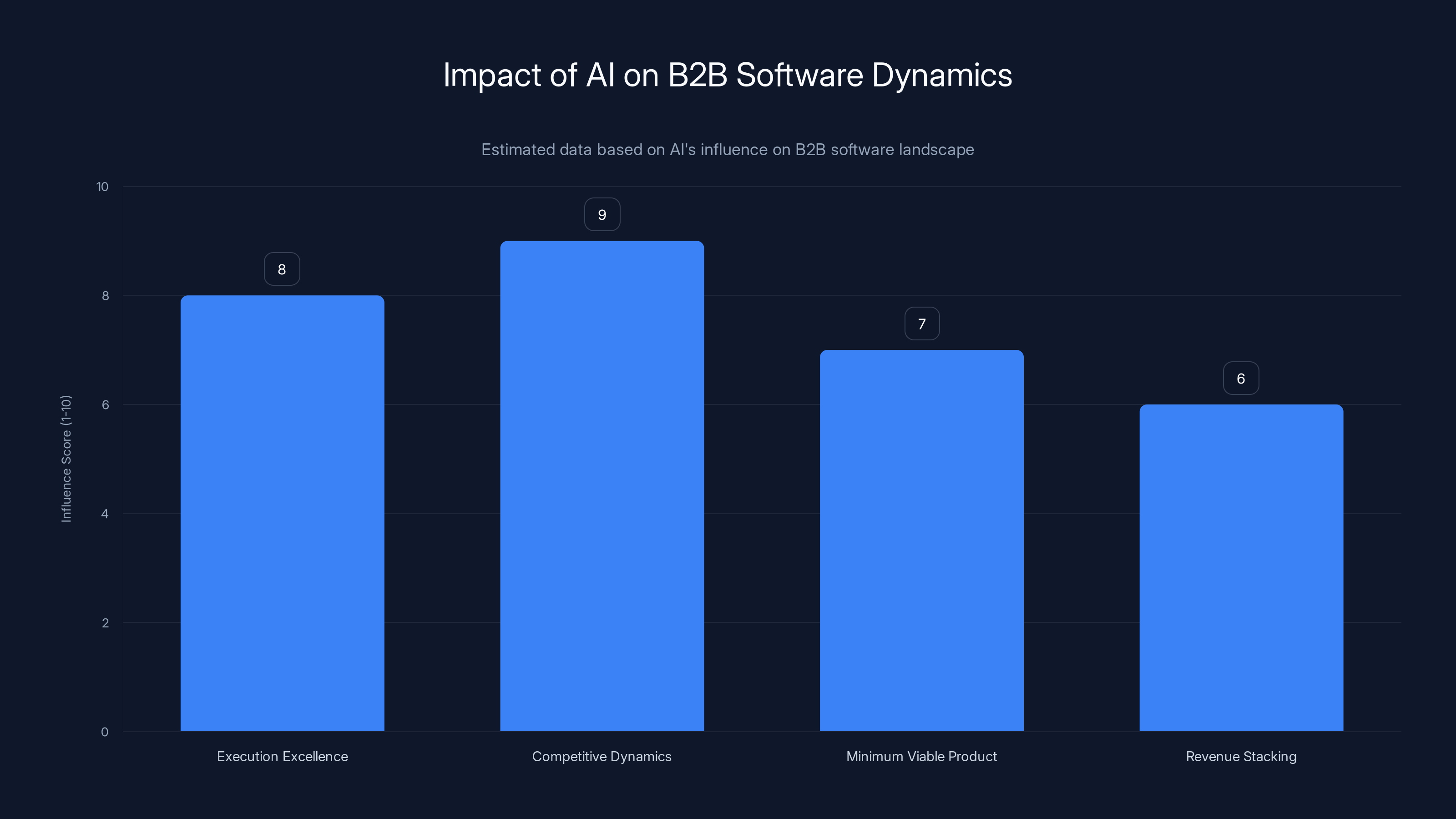

AI significantly influences B2B software through competitive dynamics and execution excellence, with revenue stacking also playing a notable role. Estimated data.

The Core Insight: You Have to Be Good. That's the Whole Strategy.

When the conversation shifted to how Atlassian competes with companies like Anthropic for enterprise budgets, Cannon-Brooks' answer was refreshingly blunt: "We have to be good."

Not "pivot to AI." Not "become an agent company." Not "integrate LLMs everywhere." Just: be good at what you do. Deliver more value to customers than the alternatives.

This sounds like a platitude. It's not. It's an execution standard.

Atlassian has 10,000 people in R&D. They're using Claude Code internally. Their inference costs per feature are declining while they're shipping more AI features. Some of their features now cost 1,000x less to run than when they initially launched them. Their gross margins have improved over seven consecutive quarters despite deploying more AI infrastructure, better customer support, and more generous freemium tiers.

That's what "being good" looks like in practice.

It's not about having the smartest AI strategy or the flashiest product marketing. It's about doing the fundamental work of building software that solves real problems, faster and more reliably than anyone else.

Here's the uncomfortable truth for most founders: if your competitive advantage is "we use GPT-4," you're already losing. Every company is using GPT-4. Every company is integrating Claude. Every company is experimenting with agents. That's table stakes now, not differentiation.

The differentiator is how efficiently you can integrate these capabilities without bloating your product, how well you understand your customer's workflow, how much value you can extract from AI without making your interface more complex, and whether your architecture can scale to support millions of users with these new capabilities.

Atlassian's playbook is instructive: they didn't reorganize around AI. They didn't create a separate "AI division." They embedded AI capability into their existing product development process, optimized for cost, and measured value against their core metrics.

That's boring. But it works.

Atlassian reported a 23% increase in annual recurring revenue and a 44% rise in renewal profit obligations, despite a 70% drop in stock price. Estimated data.

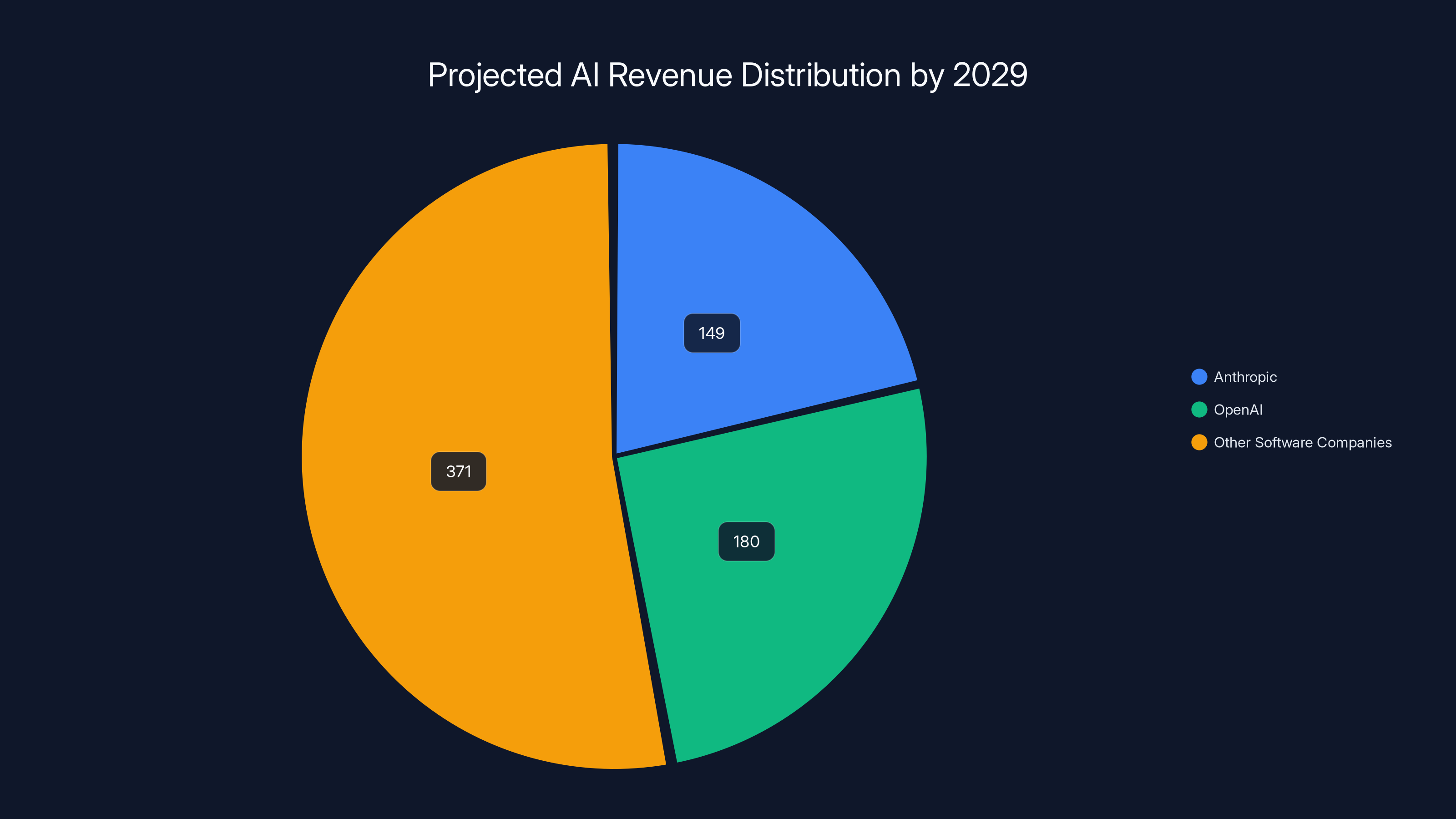

The Revenue Stacking Problem: Why $350B in AI Projections Isn't as Scary as It Sounds

Anthropic projects

Sounds apocalyptic, right? Two companies representing 50% of the entire software market?

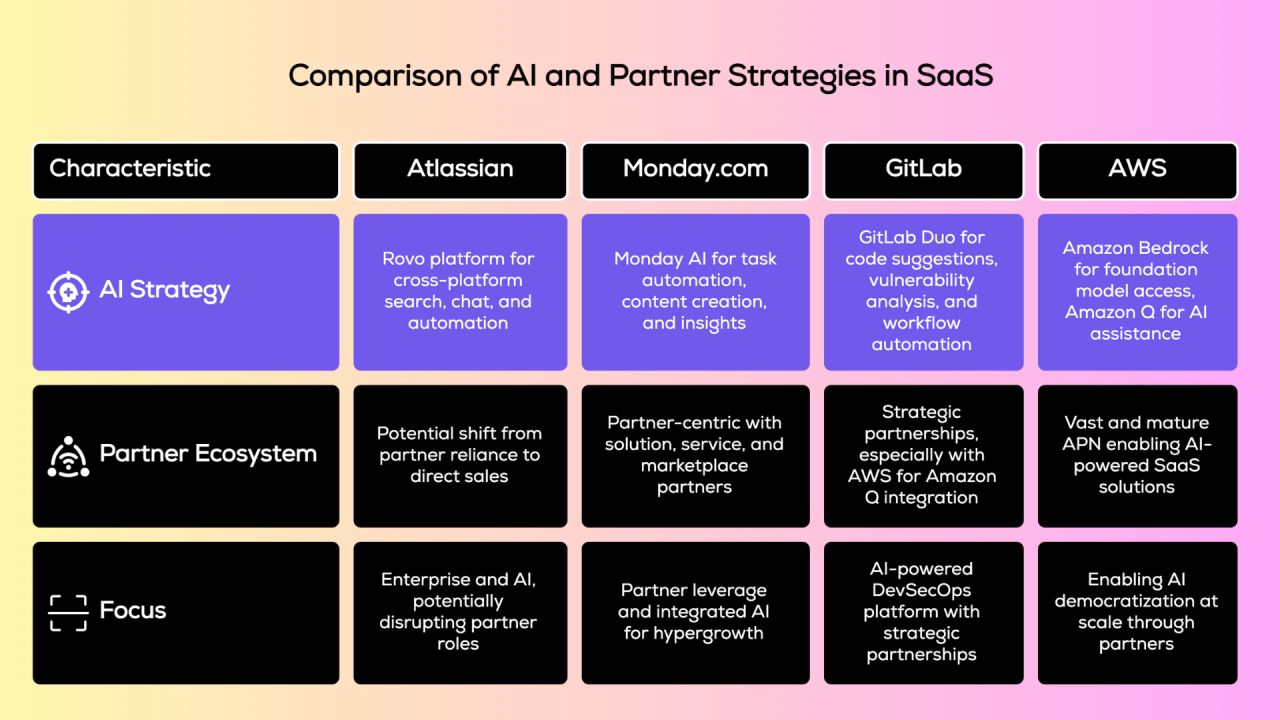

Cannon-Brooks brings up a critical nuance that almost nobody discusses: the revenue stacking problem.

When Atlassian spends

The individual line items don't stack cleanly. A large portion of what looks like $350B in new AI company revenue is actually the same revenue being counted multiple times across the stack.

So when you're panicking about where enterprises will find the budget to pay

That said, the underlying point is still massive. Anthropic and OpenAI reaching $150B+ ARR is essentially saying two new Microsofts appeared in four years. That's unprecedented. The market has to expand significantly for that to not cause displacement.

But the expansion is happening. New software categories are being created. New use cases are emerging. The total enterprise software spend is growing, not shrinking. Companies are hiring engineers faster than they're cutting other departments (more on that in a moment).

The revenue stacking actually makes the math more favorable for incumbents, not less. Because a lot of that AI revenue that looks scary at the headline level is actually flowing to existing companies through infrastructure, embedding, and integration.

The Jobs Market Reveals the Real Risk: Input-Constrained Versus Output-Constrained Functions

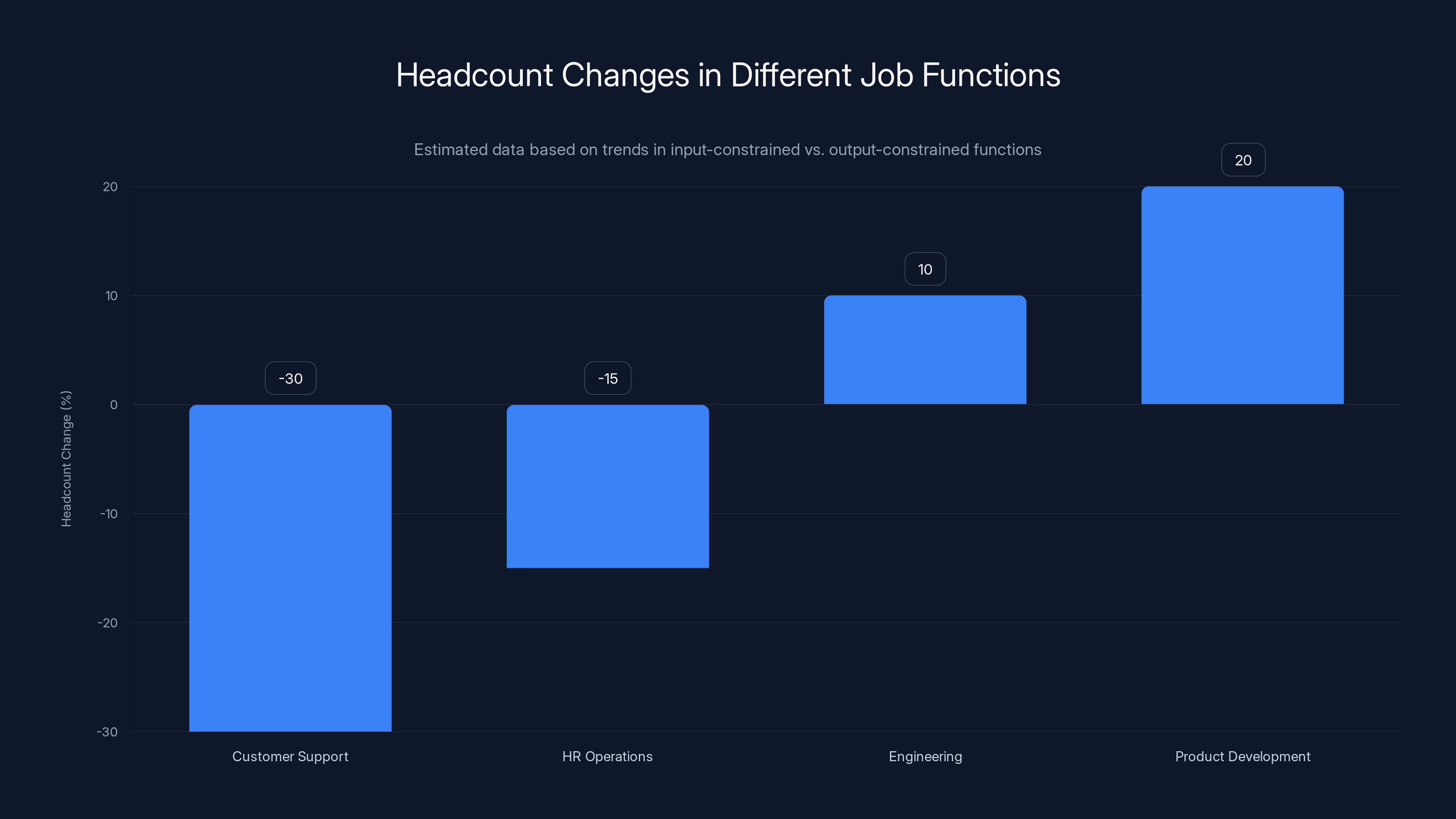

One of Cannon-Brooks' most useful frameworks for thinking about the AI era is distinguishing between functions that are input-constrained and functions that are output-constrained.

Input-constrained work is defined by how many customers, requests, or problems you have. Customer support is the canonical example: you have X customers generating Y support tickets per day. If you make your support team 50% more efficient with AI, you don't need as many people. You need fewer.

Output-constrained work is defined by how much work you need to accomplish. Engineering is output-constrained. Your roadmap has thousands of possible features. Your QA team could test infinitely more scenarios. Your infrastructure team could optimize ten thousand different systems. There's unlimited work to do. Making people more efficient doesn't reduce headcount. It just shifts them to harder problems.

Data from the hiring market confirms this framework. Customer support has been decimated—the category with the steepest headcount decline across Fortune 500 companies. Workday publicly acknowledged that even they are seeing headwinds on seats in categories like HR operations, because enterprises simply aren't hiring at the scale they used to.

Engineering? Engineering hasn't declined. In many cases, it's accelerating. Companies are shifting resources from operations and support into product development, infrastructure, and security.

Why? Because in the AI era, the rate of innovation matters more than ever. Your ability to ship features faster than competitors determines survival. That requires more engineers, not fewer.

Look at Replit—300 employees, 300 million in revenue, with eleven people in go-to-market. The rest? Engineers. That's not a company cutting R&D. That's a company structured entirely around technical velocity.

Cannon-Brooks' framework suggests that categories like legal, finance, HR operations, and customer support are at structural risk. Not because AI will make them disappear, but because the economic incentive to reduce headcount in those areas is now overwhelming. Enterprises can deploy AI to handle 70-80% of intake, triage, and routine work, then consolidate the rest.

But product, engineering, and technical infrastructure? Those are expanding.

For B2B software companies, this has a profound implication: if your product's primary customers are support, HR, finance, or operations teams, you need to think carefully about unit economics as those departments shrink. If your customers are engineering teams or product teams, you're swimming with the current.

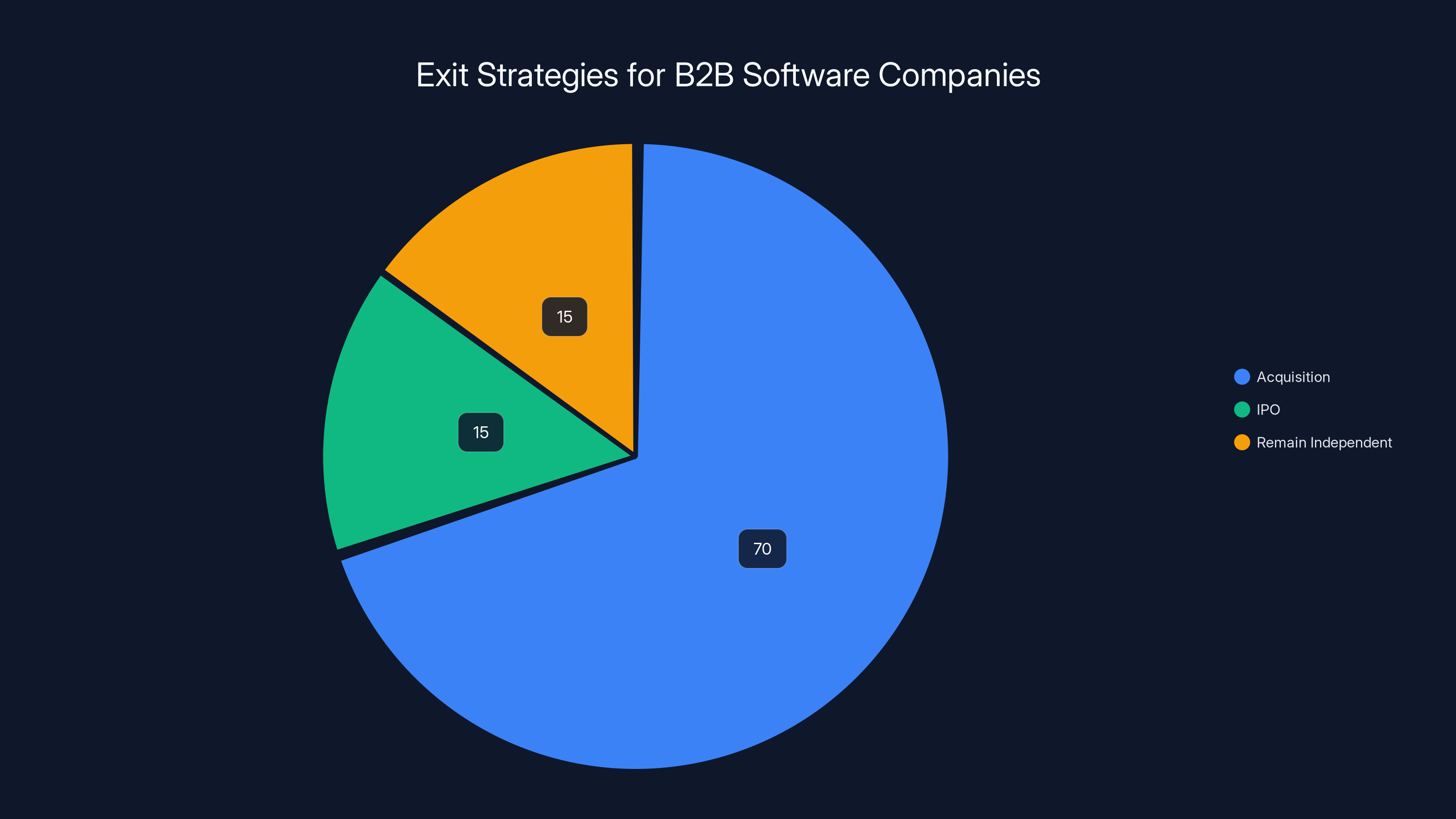

Estimated data suggests that 70% of B2B software companies are likely to exit through acquisition, while IPOs and remaining independent each account for 15%.

Margin Expansion While Deploying More AI: The Paradox Nobody Expected

Here's something that shouldn't be possible, but Atlassian's financials prove it is: deploying more AI features, more frequently, while expanding gross margins and improving unit economics.

The obvious assumption was that AI adoption would increase costs faster than revenue. Inference costs are real. Model API fees are increasing. Infrastructure to support AI at scale requires investment.

But Atlassian's experience shows a different pattern:

First, inference costs are collapsing. They've optimized their AI implementations to run more efficiently. Some features now cost 1,000x less per inference than when initially launched. As models become more available and specialized inference hardware (TPUs, GPUs) scales, cost curves are inverting faster than expected.

Second, AI enables revenue expansion without proportional cost increases. Each AI feature allows Atlassian to increase prices or expand their addressable market without building proportional infrastructure. A 10% increase in features doesn't require a 10% increase in infrastructure.

Third, AI improves retention and expansion revenue. Customers stick around longer and upgrade to higher tiers when they perceive more value from new AI capabilities. Churn decreases. Expansion revenue accelerates. Both improve margin.

Fourth, customer acquisition costs don't increase proportionally with feature complexity. Adding 50 new AI features doesn't require proportionally more sales and marketing spend. The word-of-mouth value scales faster than the acquisition cost.

This is the inverse of the "AI will be expensive" narrative. The companies that execute well on AI integration are actually getting better at margin expansion, not worse.

But—and this is critical—this only works if you're executing well. If you're building AI features that customers don't actually use, that add complexity without value, that increase support burden, then costs are rising faster than revenue. You get margin compression, not expansion.

The margin expansion pattern is a confidence indicator. Atlassian's improving margins say they're doing something right. Most other companies' stable or declining margins suggest they're not.

The Pricing Paradox: Why Enterprise Budgets Are Expanding, Not Contracting

One of the counterintuitive findings in Cannon-Brooks' analysis is that enterprise software budgets aren't contracting. They're shifting, consolidating, and becoming more selective—but not shrinking.

Why? Because AI-native software is solving problems that enterprises previously solved in expensive, inefficient ways.

Before intelligent code review tools, teams hired more senior engineers to review code. Before automated infrastructure monitoring, teams hired DevOps specialists. Before AI-driven analytics, teams hired data analysts.

New AI-native software replaces expensive human labor with tools. That changes where the budget goes, not the total size of the budget.

But it does mean that companies selling "AI features bolted onto legacy software" are in a weaker position than companies building AI-native from the ground up. Customers won't pay more for AI if it's just a better version of an existing capability. They'll accept it, expect it, and demand the price stay the same.

Companies building genuinely new workflows that weren't possible before—these can command premium pricing. Companies selling "Chat GPT integration" to 47 different use cases? These have weak pricing power.

Atlassian's approach is to build AI capability that expands their total addressable market, not just makes existing features cheaper. They're moving customers from self-serve into premium tiers by solving entirely new problems. That's why they can expand revenue and margins simultaneously.

Estimated data shows a decline in input-constrained roles like Customer Support, while output-constrained roles like Engineering see growth.

The Winners and Losers: The 90% Problem

Cannon-Brooks is direct about this: not all B2B software companies will survive the next five to ten years. In fact, the failure rate will likely be higher than the previous cycle.

Why? Because the bar for "good enough" has risen. When every company can integrate Claude or GPT-4, the companies that execute well pull ahead faster. Differentiation becomes harder to achieve and easier to lose.

The winners will likely be companies that:

Dominate a specific workflow or industry. Generalist software is under pressure. Vertical-specific solutions that understand the nuances of their industry, can integrate AI in ways that match domain-specific patterns, and can invest heavily in customer success are defensible.

Have strong unit economics and can invest in R&D. The R&D race is accelerating. To stay competitive, you need headcount, talent, and infrastructure. Companies with weak unit economics get stuck in a death spiral: not enough resources to innovate, so they lose customers to better competitors, so margins contract further.

Solve problems for output-constrained functions. As we discussed earlier, engineering, product, and infrastructure teams are still hiring. Software that helps these teams move faster has strong tailwinds. Software that helps input-constrained teams be more efficient has headwinds.

Can articulate value beyond "it uses AI." The AI feature checklist is table stakes. Winners will be companies with compelling narratives about why their AI implementation matters to their specific customer base, with metrics to prove it.

Have strong moat defensibility. Data advantages, network effects, switching costs, and brand trust matter more than ever. Companies without defensible moats will see commoditization accelerate.

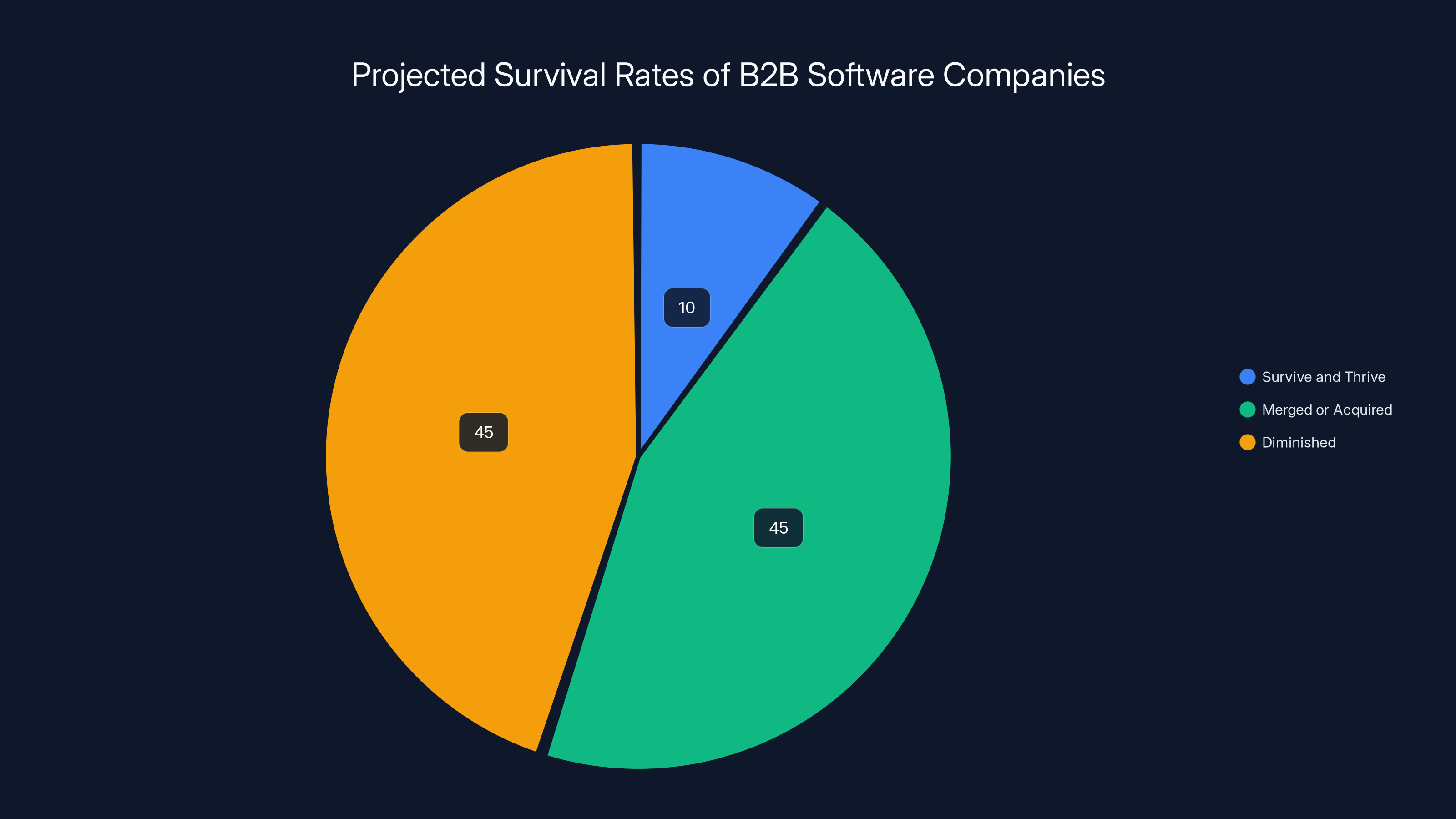

Cannon-Brooks' experience suggests that 80-90% of the companies that are "fine" today will be either merged, acquired, or significantly diminished in five years. The middle tier gets compressed. You're either a clear category leader in your space, or you're vulnerable.

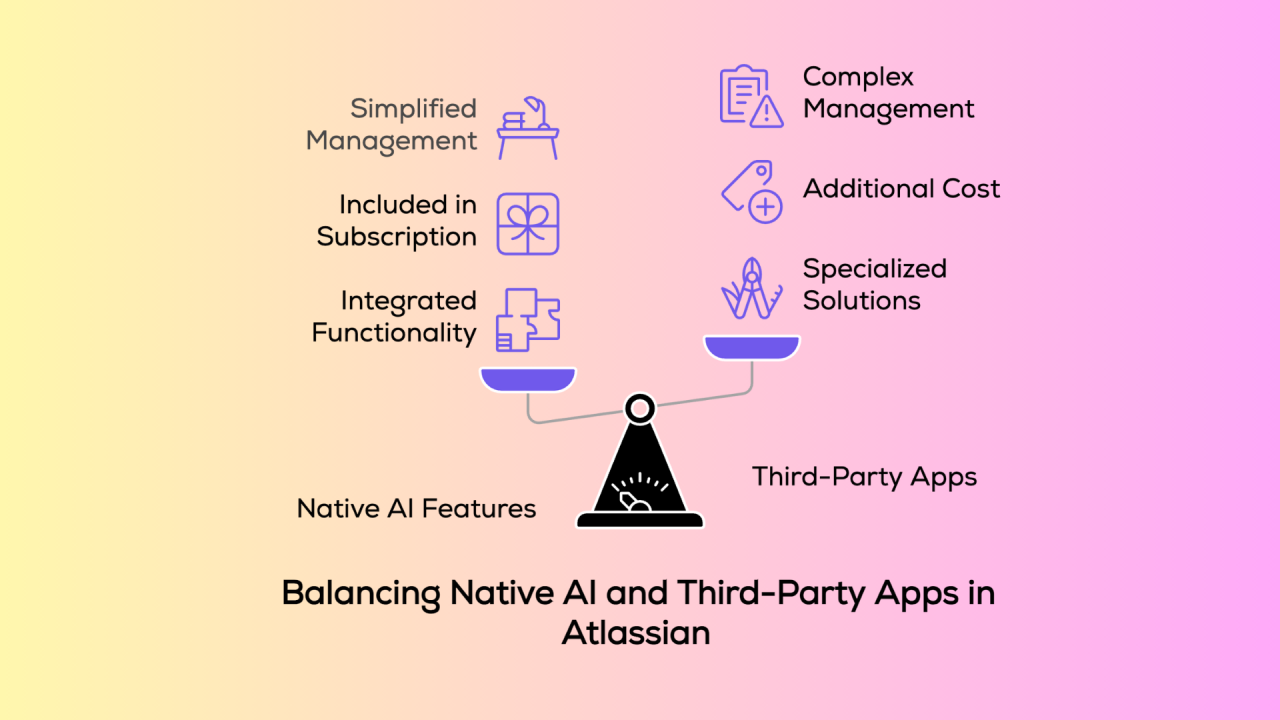

The AI Integration Playbook: How Atlassian Avoids the Feature Bloat Trap

Most B2B software companies are making the same mistake with AI: trying to add AI features to everything.

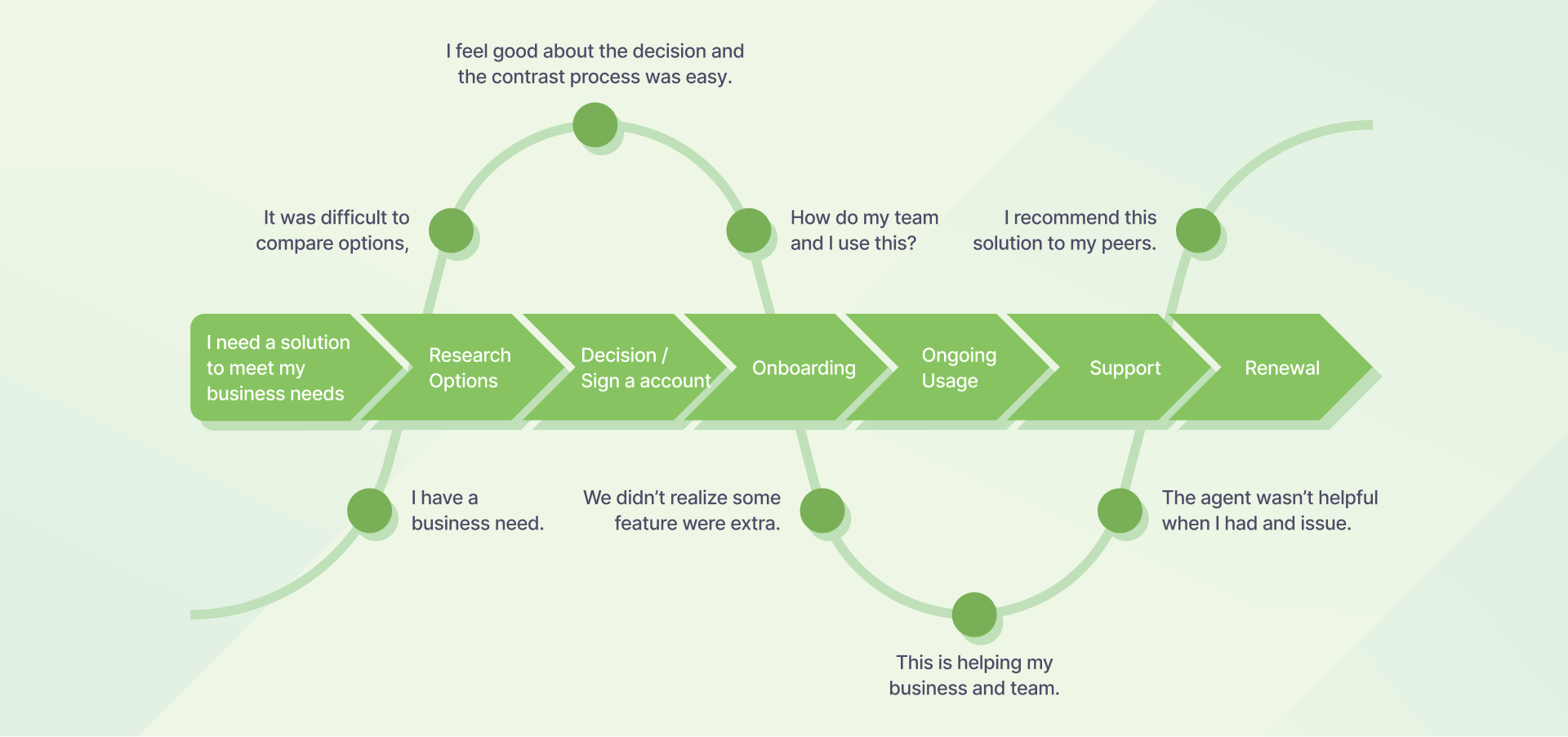

Atlassian's approach is more disciplined. They're asking a specific question before integrating AI into any workflow: "Does this meaningfully change the customer's outcome? Or does it just give them another way to do something they could already do?"

This sounds obvious. It's not. Most companies are adding AI features because competitors are, because investors expect it, or because the PR narrative demands it. Not because it solves a real problem.

Atlassian's framework:

Map the workflow. Understand every step of the customer's workflow. Where are the bottlenecks? Where is human judgment wasted on routine work? Where is the customer waiting for other humans?

Identify where AI actually helps. Some workflows benefit from faster processing. Some benefit from pattern recognition. Some benefit from summarization. Some don't benefit from AI at all. Be honest about this.

Test the value with real users. Don't assume the feature will be valuable. Have users test it. Measure: Do they use it? Do they get value? Does it reduce churn? Does it increase expansion?

Integrate or abandon. If the feature proves valuable, integrate it deeply into the core product experience. If it doesn't, kill it. Don't ship half-baked AI features hoping adoption will convince users of their value. It won't.

Measure against core metrics. Track: Does this feature improve NRR (net revenue retention)? Does it reduce churn? Does it enable upsells? If the answer to all three is no, it's a feature bloat addition, not a strategic AI integration.

Most companies fail at this framework. They ship AI features, declare victory, and move on. They don't actually measure whether it moved the needle.

Atlassian's discipline—testing, measuring, integrating deeply or killing quickly—is why they can improve margins while shipping more AI features. They're not padding the product with nice-to-have features. They're integrating AI where it creates compounding value.

Estimated data suggests that only about 10% of B2B software companies will thrive, while 90% will either be merged, acquired, or significantly diminished in the next 5-10 years.

The Talent Problem: Where the Real Constraint Actually Lives

Cannon-Brooks touches on something that gets less attention than it deserves: the talent constraint in the AI era.

There are only so many engineers in the world who deeply understand both (a) how to build production AI systems, and (b) how to integrate them into consumer-grade products at scale.

There are not enough of these engineers to go around. Every company that can afford to is bidding for their attention.

For Atlassian, having 10,000 people in R&D is an advantage—but it's also increasingly a disadvantage if the talent mix isn't right. You can't convert a 2008-era web engineer into a 2025-era LLM systems engineer overnight.

This means the companies with the strongest AI talent acquisition will pull ahead. But it also means something counterintuitive: some smaller companies might move faster because they can hire selectively and move fluidly. Some larger companies will move slower because they're constrained by legacy architecture and entrenched teams that haven't retooled.

Atlassian is aware of this. They're investing heavily in upskilling their existing teams, recruiting ML specialists, and structuring their teams around modern AI architecture patterns.

For other companies—especially mid-market SaaS companies—the talent constraint is becoming the binding constraint on innovation velocity. Not funding. Not market opportunity. Talent.

This has implications: invest in your ML hiring pipeline now, before the best talent is locked up at the mega-cap tech companies. Build a culture that attracts and retains strong technical talent. Create learning infrastructure to upskill existing teams. Because the gap between companies that crack the AI talent acquisition problem and those that don't is going to widen dramatically.

The Consolidation Thesis: M&A Will Be the Exit for 70% of Companies

One of the most realistic takeaways from Cannon-Brooks' experience is that consolidation will be the exit for most B2B software companies.

IPOs are getting harder. Venture returns are compressing. The public markets aren't rewarding modest growth anymore. Staying independent as a mid-market SaaS company generating

Instead, larger companies (Atlassian, Salesforce, Workday, Microsoft, Google, etc.) will acquire smaller companies to:

Fill capability gaps. If their AI implementation strategy requires ML expertise they don't have in-house, they'll acquire the company that has it.

Accelerate product development. Building features takes time. Acquiring teams that have already built them takes less time.

Prevent competitors from acquiring them. In a consolidation wave, strategic acquisitions happen preemptively. "We need to acquire this company before someone else does."

Acquire customer bases. Sometimes the acquisition is mostly about the revenue, ARR, and NRR the acquired company brings.

Cannon-Brooks' point is that staying independent and building a billion-dollar company is the exception, not the rule. For 70-80% of VC-backed B2B software companies, the realistic exit is acquisition by a larger player.

This doesn't mean failure. An acquisition by Salesforce at

Companies building defensible, vertical-specific solutions to problems that large companies can't economically build themselves are in the strongest acquisition position. Companies building horizontal "AI for spreadsheets" tools are in weaker positions (because Airtable, Notion, Google, and Microsoft are all building this).

Anthropic and OpenAI are projected to account for

The Macro Context: TAM Expansion and the Absence of Hyperscale Price Deflation

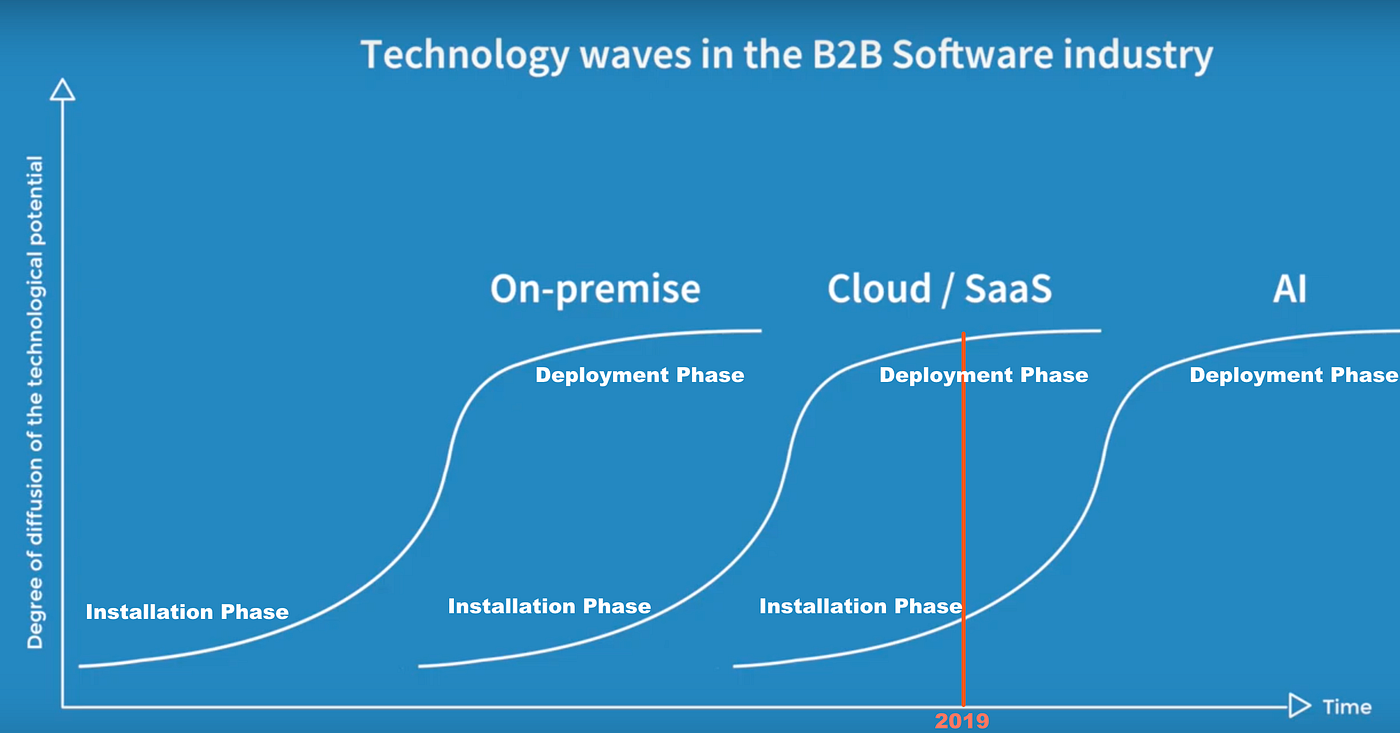

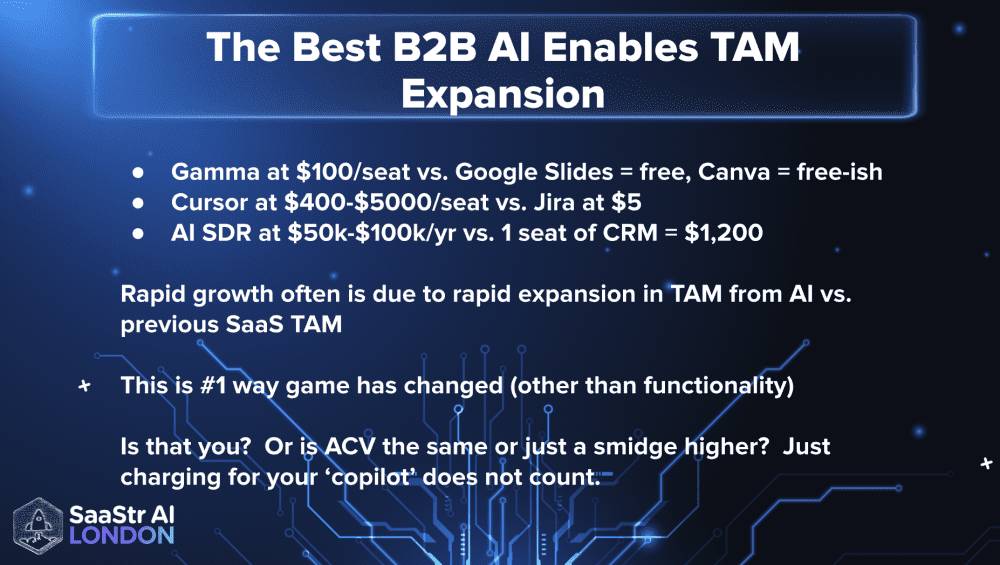

One thing that's different about this cycle compared to previous ones is that artificial intelligence is creating new total addressable markets, not just displacing existing ones.

In previous cycles, when a new platform or architecture emerged, it largely replaced the previous one. Cloud didn't expand the market much; it shifted spend from on-premise to cloud. Mobile didn't expand total IT spend dramatically; it shifted spend from desktop to mobile.

But AI is different. It's enabling entirely new workflows, new industries, new use cases that weren't economically viable before. Companies are hiring engineers to build with AI who wouldn't have been hired before.

This TAM expansion is critical because it means enterprises don't have to choose between Anthropic and Atlassian. They can spend more on both, because the total software budget is expanding.

However—and this is crucial—this TAM expansion is not infinite. There's a real scenario where two AI companies capturing $350B in four years compresses the budgets available to everyone else, even if the total TAM expands.

What prevents hyperscale price deflation (where everyone's contracts get renegotiated to lower prices) is switching costs, differentiation, and customer lock-in. Customers won't renegotiate Atlassian contracts downward because Atlassian's value isn't diminished by the existence of Anthropic. If anything, Atlassian becomes more valuable because it integrates Anthropic's capabilities into a mature workflow.

But if you're selling undifferentiated software, if your value proposition is thin, if customers aren't locked in—then yes, you face compression.

What Actually Matters Now (And What Doesn't)

So, given all of this, what should B2B founders and CEOs actually focus on?

Cannon-Brooks' list is short:

Execution speed matters more than strategy perfection. The companies that ship, iterate, learn, and course-correct faster will win. Not the companies that have the "perfect" AI strategy. Speed compresses planning cycles.

Unit economics matter more than growth rate. Investors were willing to ignore unit economics for a 3-year period. That's over. If your unit economics are broken, all the growth in the world doesn't help. Fix unit economics first.

Customer retention matters more than customer acquisition. CAC inflation is real. LTV expansion through retention and expansion revenue is the moat that matters.

Vertical specificity matters more than horizontal generality. Generalist tools are under pressure. Owning a specific workflow in a specific industry is more defensible.

Talent quality matters more than headcount. Hiring the strongest engineers and ML specialists will determine how well you can compete. Hiring to hit headcount targets will sink you.

Defensibility matters more than feature richness. Add AI features because they move your core metrics. Not because competitors added them. If you're just following, you're always behind.

What doesn't matter:

Claiming you're an "AI company." Everyone's an AI company now. The label is meaningless.

Having the longest AI feature list. Feature parity is achieved in weeks, not months. Differentiation comes from depth of integration, not breadth of features.

The specific model you're using. Whether you use Claude, GPT-4, or Mistral matters less than how well you integrate it. Most customers don't care which model you're running under the hood.

The fancy AI startup narrative. The AI startup that raised

The Honest Assessment: Yes, Most Companies Will Struggle

Let's be clear: this isn't a comfortable message. Cannon-Brooks isn't saying "everything is fine." He's saying "most companies won't make it, but the ones that execute well will be fine."

That's actually a more honest take than either the "SaaS is dead" panic or the "AI is a feature, not a threat" dismissal.

The reality is somewhere in between: SaaS as a category isn't going anywhere. But 80% of current SaaS companies will be significantly diminished, acquired, or defunct in ten years. The winners will be companies that:

Adapted their product strategy to AI-first thinking, not bolt-on thinking. Developed sustainable unit economics that compound over time. Built talent moats by attracting and retaining the best engineers. Created customer lock-in through switching costs and network effects. Moved faster than competitors to ship the features that actually matter.

That's hard. That's execution. That's not sexy. But it's what actually determines survival.

Atlassian's experience—growing 23% at $6.4B while improving margins and deploying more AI—is proving this is possible. Most companies just haven't figured out how to do it yet.

Looking Forward: The Next 24-36 Months Will Be Decisive

Cannon-Brooks' framework suggests that the next 2-3 years are decisive. By 2027-2028, the market will have largely settled into its shape. The companies that moved fast, executed well, and captured customer value will have compounding advantages. The companies that delayed or got the strategy wrong will have been passed.

This compression of the decision timeline is new. Previous cycles gave companies 5-7 years to figure things out. This cycle seems compressed to 2-3 years.

Why? Because AI adoption is faster. Competitive response times are shorter. Customer expectations are higher. The penalty for moving slowly is getting eliminated by faster competitors.

For founders and CEOs, this means: you don't have time to wait for the market to settle. You need to make your strategic bets now. You need to commit resources to upskilling your team. You need to start optimizing for the metrics that actually matter (retention, expansion, unit economics) instead of the metrics that got you venture funding (growth rate, ARR).

The window to get this right is open. But it's closing.

FAQ

What does Mike Cannon-Brooks mean by "you just have to be good"?

Cannon-Brooks is emphasizing that competing in the AI era requires fundamental product execution excellence rather than flashy features or strategic pivots. At Atlassian, "being good" translates to shipping AI capabilities that improve margins while maintaining growth, reducing inference costs 1,000x over time, and focusing on measurable customer value rather than feature checklists. The core message is that survival depends on execution discipline, not narrative positioning.

Why is B2B software not actually dying despite the rise of AI?

Business software isn't dying because enterprises have never built everything from scratch—they've always purchased pre-built solutions alongside custom development. What's changing is the rate of disruption and the bar for what qualifies as "good enough." AI accelerates competitive dynamics, eliminates weak players faster, and raises the minimum viable product quality threshold. But the fundamental pattern of buying software remains constant, just with higher stakes for execution.

What is the revenue stacking problem, and why does it matter?

When Anthropic and OpenAI project

How do you distinguish between input-constrained and output-constrained work in the age of AI?

Input-constrained work is defined by a fixed volume of requests (customer support, HR processing, legal review). Making these functions more efficient with AI reduces headcount needs. Output-constrained work is defined by unlimited potential work (engineering, product development, infrastructure optimization). Improving efficiency doesn't reduce headcount—it shifts people toward harder problems. This framework predicts which job categories will shrink (support, finance, operations) and which will expand (engineering, product, technical roles) in the AI era.

Why can Atlassian improve margins while deploying more AI features?

Atlassian's margin expansion happens because: (1) inference costs are collapsing as models mature and hardware optimizes, (2) AI features enable revenue expansion without proportional infrastructure costs, (3) new AI capabilities improve retention and reduce churn, and (4) customer acquisition costs don't increase proportionally with feature complexity. This only works with disciplined execution—measuring whether each AI feature actually moves core metrics like NRR and churn rather than adding feature bloat.

Which B2B software companies have the strongest survival odds?

Companies most likely to survive the AI era are those with: defensible positions in vertical-specific markets, strong unit economics that allow continuous R&D investment, customer bases in output-constrained departments (engineering, product), compelling value narratives backed by metrics, and sustainable competitive moats like data advantages or network effects. Companies with weak unit economics, horizontal positioning, or customers in input-constrained departments face higher failure risk. Cannon-Brooks suggests 80-90% of mid-tier companies will be consolidated or significantly diminished.

What's the right way to integrate AI into a B2B software product?

The disciplined approach involves: (1) mapping customer workflows to identify genuine bottlenecks, (2) testing whether AI actually solves the identified problem with real users, (3) integrating features deeply into core product experience rather than isolating them as separate modules, and (4) measuring impact against core metrics (NRR, churn, expansion revenue). Features that don't demonstrably move these metrics are feature bloat, regardless of their AI capabilities or competitive prevalence.

How does the talent constraint affect B2B software competitiveness in 2025?

There's insufficient supply of engineers experienced in production ML systems and consumer-grade product integration. Companies that crack AI talent acquisition will pull ahead dramatically. This advantages larger companies with resources to bid for talent, but also smaller, focused teams that can hire selectively. Mid-market SaaS companies face the greatest risk if they haven't developed AI talent acquisition strategies, built internal ML expertise, or created upskilling programs for existing teams.

Why is TAM expansion critical for avoiding enterprise budget compression?

In previous technology shifts, new platforms largely displaced older ones without expanding total IT spend. AI is different—it's enabling entirely new workflows and use cases that justify incremental enterprise spend. This TAM expansion means companies don't have to choose between buying Anthropic and Atlassian; they can increase spend in both categories. However, this expansion isn't infinite. Companies face compression risk if they lack differentiation or customer lock-in.

What should B2B founders stop focusing on and start focusing on instead?

Stop focusing on: growth rate over unit economics, feature lists over actual customer value, claiming "AI company" status, and strategic positioning narratives. Start focusing on: execution speed, sustainable unit economics, customer retention and expansion, vertical specificity, talent quality, and defensible competitive advantages. The companies that competed on narrative are getting crushed. The companies competing on metrics and execution are thriving.

How much time do B2B software companies have to adapt to the AI era?

Cannon-Brooks' analysis suggests the critical adaptation window is 24-36 months. Previous technology shifts allowed 5-7 years for companies to figure out strategy and execution. The AI shift is compressing that timeline because adoption velocity is higher, competitive response times are shorter, and customer expectations have risen. Companies that haven't started optimizing for retention, expansion, and unit economics already face time disadvantage. Strategic decisions made in 2025 will largely determine which companies survive through 2028.

Final Thoughts: The Age of AI Is Just Normal SaaS Acceleration

Here's the meta-insight from Cannon-Brooks' perspective: the AI era isn't actually new. It's just the normal pattern of technology disruption, compressed and accelerated.

Every generation of technology creates winners and losers. Cloud computing decimated 70% of the companies that were "fine" in the on-premise era. Mobile computing did the same to desktop-first companies. AI is doing the same to companies that can't execute well in an AI-native world.

The companies panicking about their survival are the ones that were never actually that good. They were just fine for 5-10 years, and now they're being exposed. The companies that were well-executed, customer-focused, and operationally disciplined are actually finding it easier to compete because weak competitors are falling away faster.

That's not a tragedy. That's efficiency. Markets work.

For founders and CEOs, the takeaway is clear: stop panicking about AI. Start optimizing for the metrics that actually matter. Build products customers love. Invest in your team. Maintain discipline on unit economics. Move fast. Iterate based on data, not narrative.

Do that, and you'll likely thrive. Don't do that, and you'll likely be acquired or obsolete within three years.

Atlassian's trajectory—growing at 23%, improving margins, deploying more AI—proves it's possible. The question isn't whether success is achievable in the AI era. It's whether you can execute well enough to achieve it.

Key Takeaways

- B2B software isn't dying—the failure rate is accelerating because execution standards have risen, not because the category is disappearing.

- Companies that execute well can improve margins while deploying more AI through disciplined integration, cost optimization, and focus on customer value.

- Revenue stacking creates double-counting in AI company valuations—the actual net new enterprise spend required is smaller than headline projections suggest.

- Engineering and product teams will expand in the AI era because they're output-constrained; support, HR, and finance will shrink because they're input-constrained.

- Survival requires moving faster than competitors over the next 24-36 months—this is the critical adaptation window before market structure solidifies.

Related Articles

- The ARR Myth: Why Founders Need to Stop Chasing Unrealistic Growth Numbers [2025]

- Living in AI Time: The Harsh Reality & Why We're Not Screwed [2025]

- xAI's Mass Exodus: What Musk's Spin Can't Hide [2025]

- How Deep AI Integration Transforms Customer Service ROI [2025]

- Why Waymo Pays DoorDash Drivers to Close Car Doors [2025]

- YouTube TV $80 Discount: How to Get It Before 2025 Ends

![Why B2B Software Survives the AI Era: Atlassian's Growth Blueprint [2025]](https://tryrunable.com/blog/why-b2b-software-survives-the-ai-era-atlassian-s-growth-blue/image-1-1771018594410.jpg)