Introduction: When India's Tech Market Goes Beyond Consumer Apps

India's startup ecosystem has earned its reputation building consumer applications. Apps that serve hundreds of millions, payment platforms that rival banking infrastructure, and e-commerce ventures that've grown to rival their American counterparts. But on January 20, 2025, something different happened.

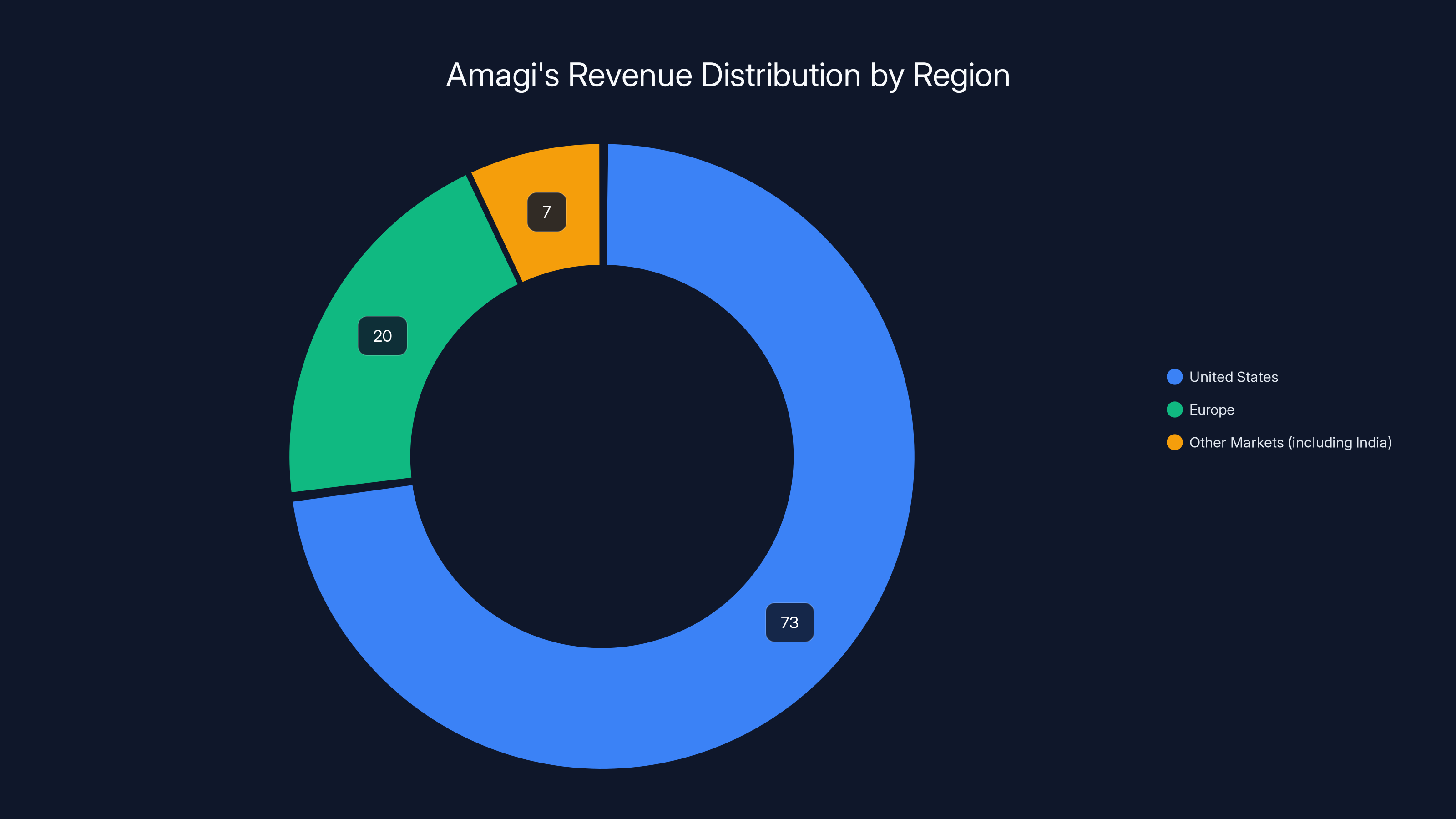

Amagi Media Labs, a Bengaluru-headquartered software company that most Indians have never heard of, went public on the National Stock Exchange. The listing wasn't about serving Indian consumers. Instead, this was an enterprise software play targeting broadcasters and streamers worldwide, with nearly three-quarters of its revenue coming from the United States.

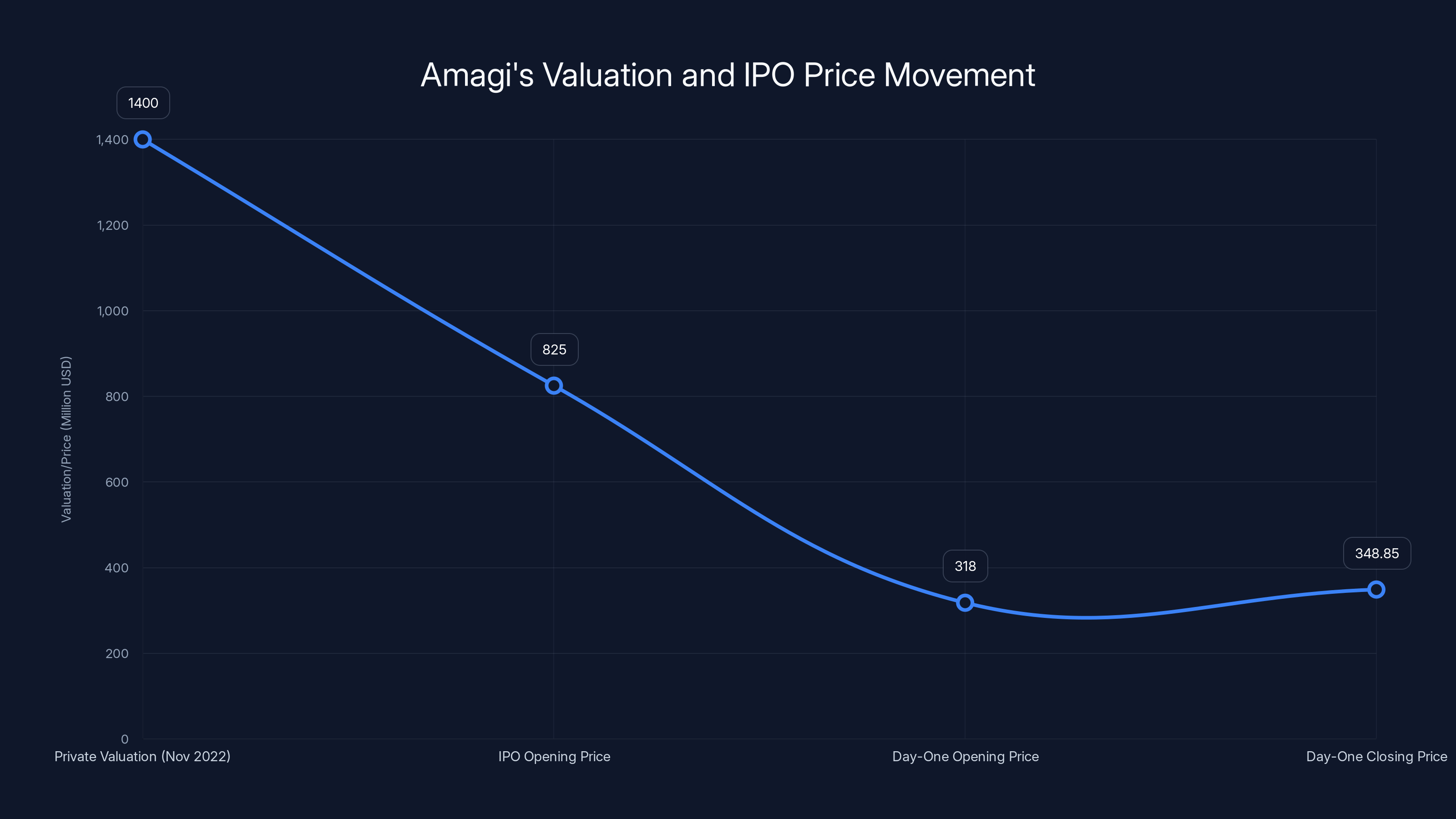

The shares opened at ₹318, a 12% discount to the ₹361 issue price. Not exactly a triumphant debut. By day's end, the stock recovered somewhat, closing around ₹348.85. Amagi raised ₹17.89 billion (roughly

This might seem unremarkable in isolation. Tech IPOs happen regularly. But for India's venture capital ecosystem, this represented something genuinely novel: a rare export-focused infrastructure company going public on a domestic exchange, offering early signals about how Indian capital markets view specialized B2B software businesses serving global markets.

The company itself started quietly in 2008, founded by Baskar Subramanian, Srividhya Srinivasan, and Arunachalam Srinivasan Karapattu. For years, it operated largely under the radar, building cloud-based infrastructure that keeps live television and streaming services running. Its customers read like a who's who of media: Lionsgate Studios, Fox, Sinclair Broadcast Group, Roku, Vizio, Rakuten TV, Direc TV, The Trade Desk, and Index Exchange.

But what does Amagi actually do? And why does its IPO matter beyond India's borders?

Understanding Amagi: The Infrastructure Nobody Notices Until It Fails

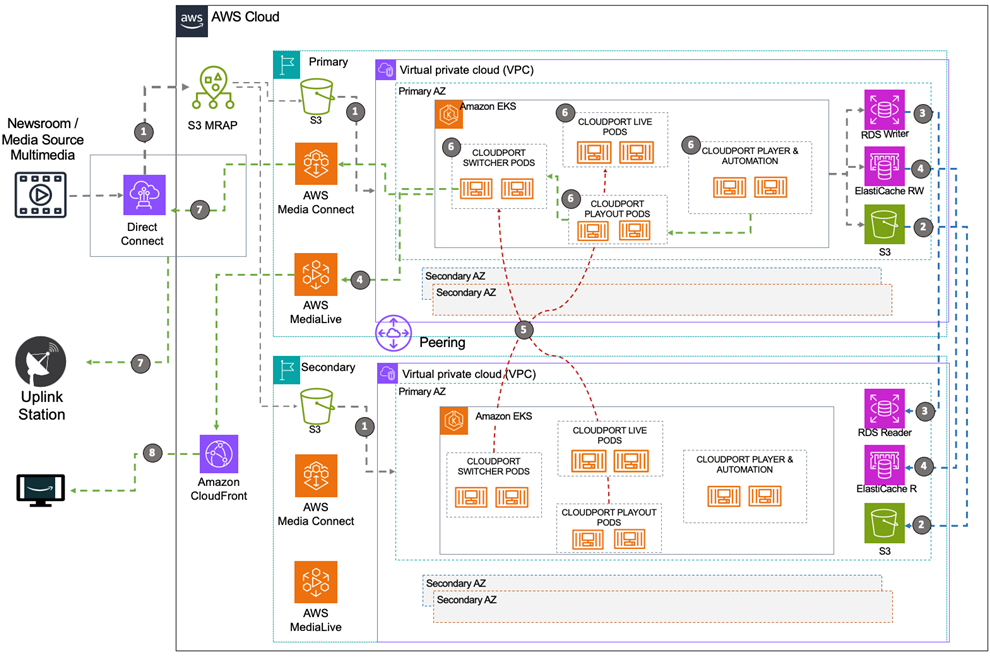

Amagi builds cloud software that does something deceptively complex: it helps media companies distribute video content and monetize it effectively. More technically, the company operates what's essentially the plumbing of modern broadcast and streaming infrastructure. When you watch a live sporting event on your streaming app, or when a broadcaster switches between local and national advertising feeds in real-time, Amagi's software is frequently orchestrating that transition.

The company operates in what's called the "media supply chain." Broadcasters, streaming services, and content distributors need ways to ingest, process, package, and distribute video content. Historically, this required massive on-premises servers, satellite uplinks, and armies of technicians monitoring systems 24/7. This approach, which Subramanian calls "big iron," dominated the industry for decades.

Amagi's core value proposition is elegantly simple: move all of this to the cloud. The company offers automated workflows that handle content ingestion, format conversion, compliance checking, and real-time distribution. Instead of maintaining expensive hardware, broadcasters pay subscription fees for Amagi's cloud platform.

But execution matters enormously in this space. When a major live event broadcasts, downtime isn't just an inconvenience. It's a direct financial hit. A sports broadcast goes dark for five minutes? That's lost advertising revenue, angry viewers, and potential penalties from contractual obligations. This reliability requirement creates a defensible moat. Media companies can't simply switch vendors whenever a competitor offers slightly lower pricing. They need proven reliability at scale.

Amagi claims to process over 1,000 channels globally and handles more than 200 million events annually. The platform supports everything from 24/7 linear television to live sports to video-on-demand. The company's infrastructure spans multiple cloud providers, including AWS and Google Cloud, ensuring redundancy and preventing vendor lock-in.

The company generates revenue through recurring subscription fees, typically based on the number of channels a customer manages or the volume of content processed. This creates a predictable revenue model with high gross margins, since incremental cloud processing costs decrease as the platform scales.

Amagi generates the majority of its revenue from the United States (73%), followed by Europe (20%), and other markets including India (7%).

The IPO Numbers: What They Tell Us About Market Conditions

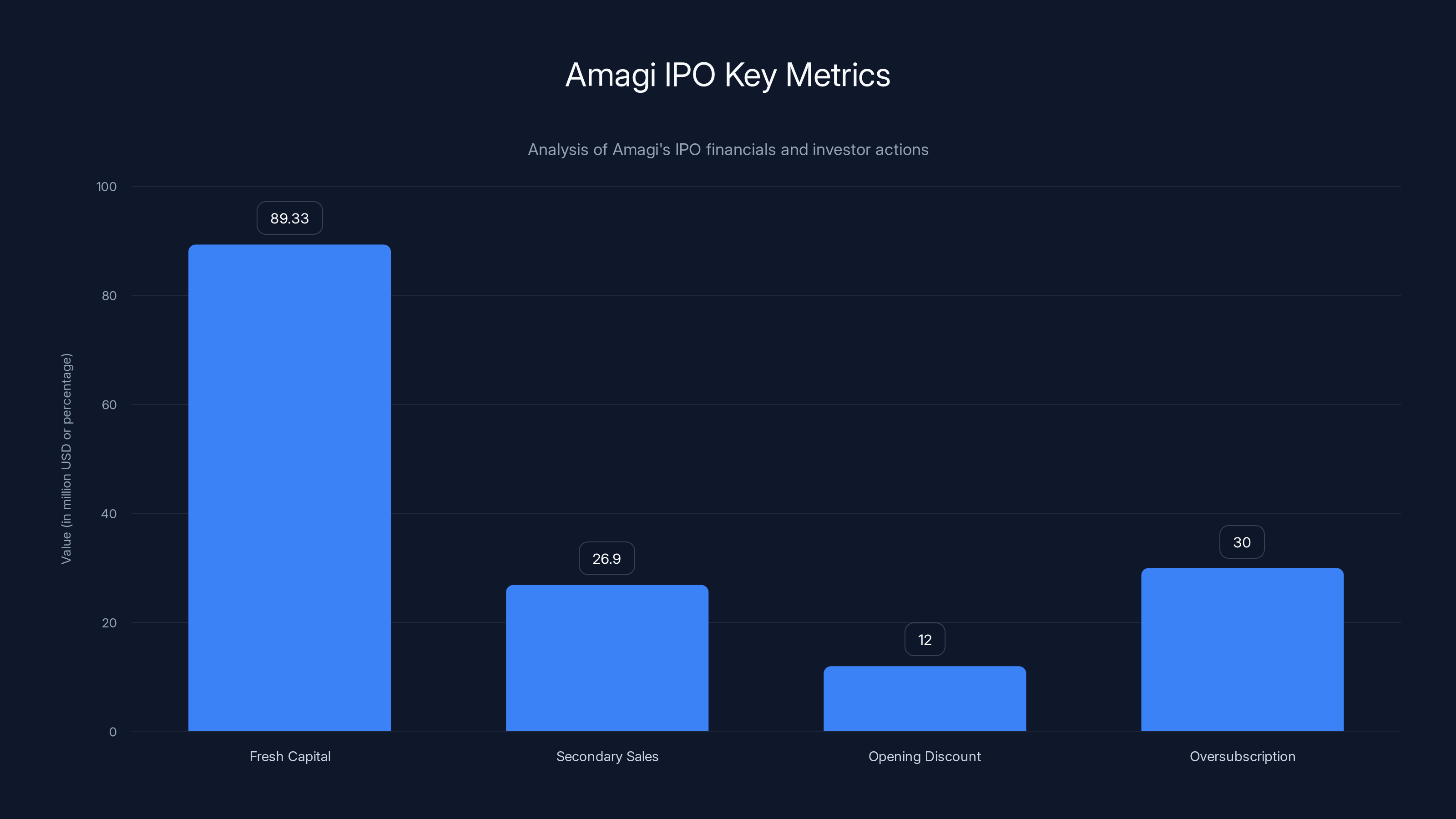

Amagi's IPO involved both fresh capital issuance and secondary sales by existing investors. The company raised ₹8.16 billion (approximately $89.33 million) in fresh share issuance, while existing backers, including Norwest Venture Partners, Accel, and Premji Invest, sold approximately 26.9 million shares. This structure is worth understanding because it reveals something about investor appetite.

When existing investors participate in secondary sales during IPOs, it often signals confidence in the business fundamentals paired with a desire to crystallize gains. The secondary sales aren't desperation; they're rational portfolio management. Accel, for instance, maintained close to a 10% stake in Amagi even after selling, locking in roughly a 3.3x gain on shares acquired at around ₹108 per share.

The 12% opening discount, however, tells a more nuanced story. Amagi had originally planned to raise more capital through a larger fresh issue and bigger secondary sales from existing shareholders. The company trimmed the fresh issue and reduced secondary share sales, suggesting underwhelming demand at the initially planned price levels.

This discount isn't unprecedented for India IPOs, but it matters. When shares open below issue price, it reflects investor hesitation. Markets were essentially saying: "We believe in this business, but not at that valuation." The oversubscription—more than 30 times the available shares—provided some cover, but oversubscription can be misleading. Often, it reflects retail investor enthusiasm rather than institutional conviction.

By comparison, many Indian tech IPOs in recent years, particularly fintech and consumer-focused businesses, have opened at premiums. Amagi's discount suggests investors needed convincing that cloud TV infrastructure, however sound the business logic, deserved growth stock valuations.

The valuation itself presents another data point. At

The Business Performance Backdrop

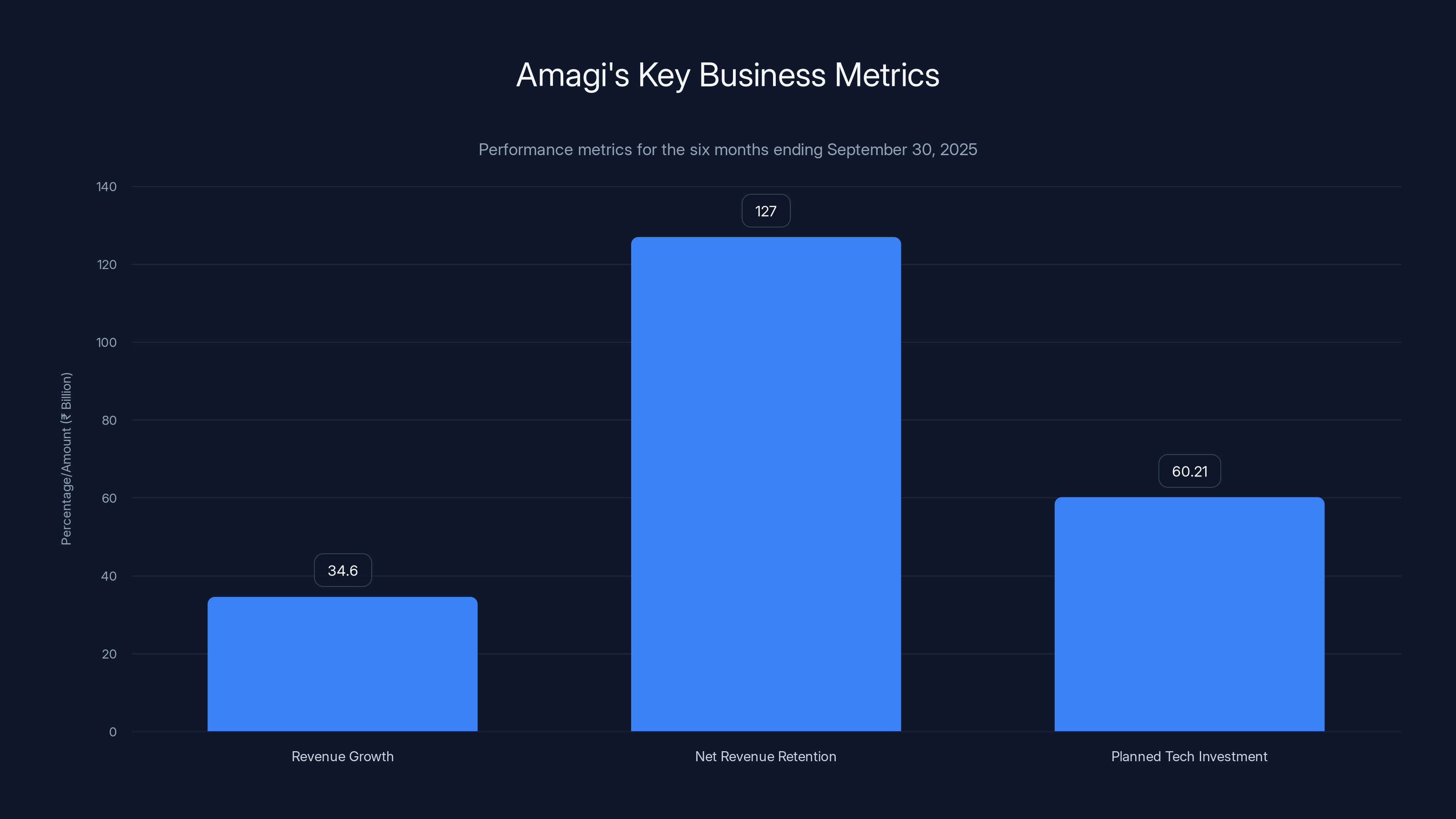

Underlying the valuation and investor sentiment is actual business performance. In the six months ended September 30, 2025, Amagi's revenue from operations grew 34.6% year-over-year to ₹7.05 billion, roughly $77.18 million. For a B2B infrastructure company, 34.6% growth year-over-year is solid but not spectacular. Saa S companies, particularly in infrastructure, often grow faster, especially at earlier stages.

More interesting is the net revenue retention metric. Amagi reported approximately 127% net revenue retention, meaning existing customers increased their spending by roughly 27% annually. This signals healthy expansion within the existing customer base. Companies aren't just renewing contracts; they're spending more, typically by deploying the platform to additional channels or expanding usage.

However, 127% net revenue retention, while strong, doesn't match the elite Saa S companies posting 130-150% expansion rates. It suggests Amagi customers are genuinely satisfied and expanding, but the growth is measured rather than explosive.

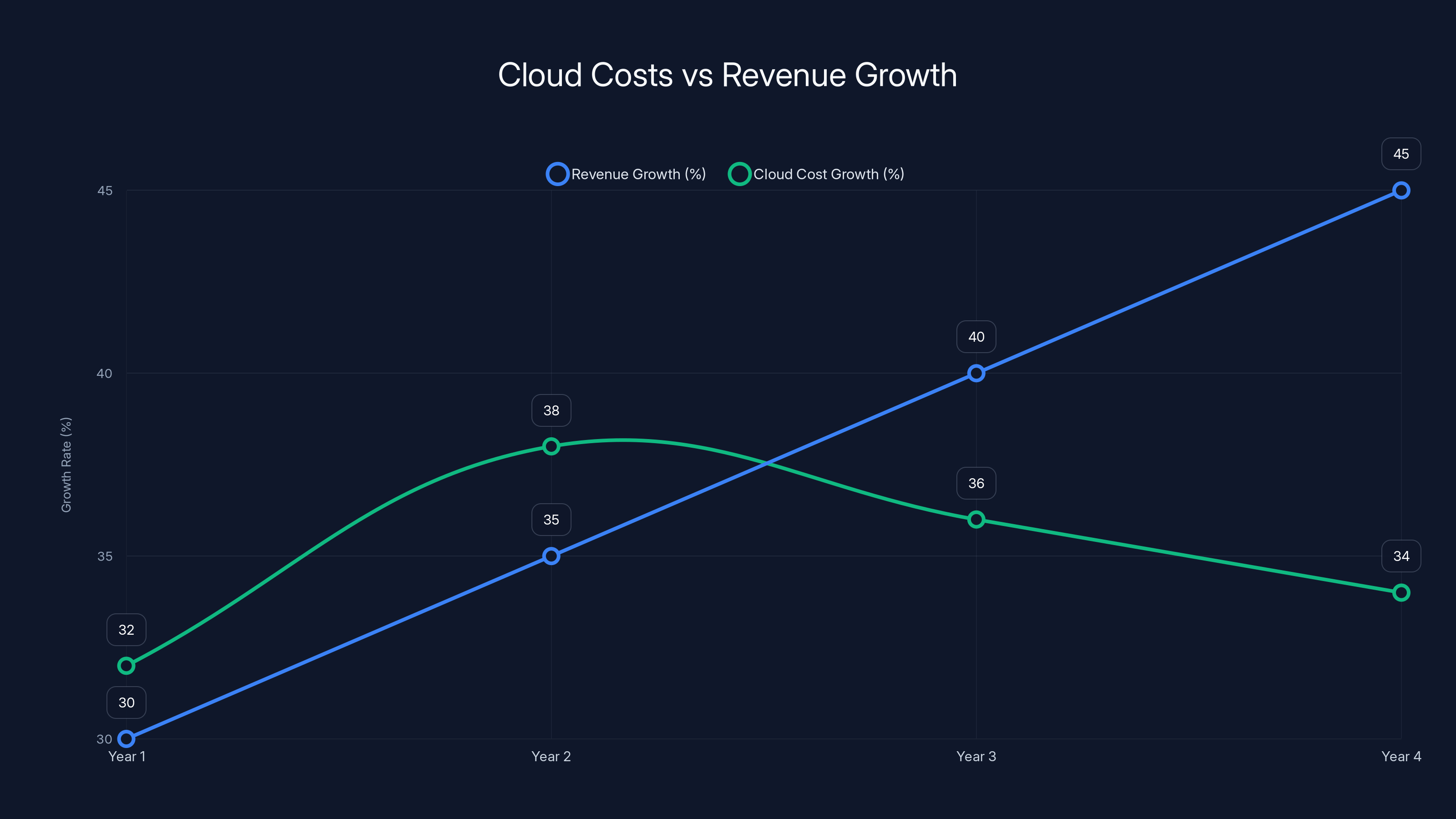

The operating margin picture remained challenging. Like many infrastructure companies, Amagi faces pressure from underlying cloud costs. As usage grows, so do the costs of AWS and Google Cloud resources. The company must balance aggressive customer acquisition and expansion with margin discipline. The prospectus indicated that Amagi planned to allocate ₹5.50 billion ($60.21 million) of IPO proceeds toward technology and cloud infrastructure, suggesting the company anticipates ongoing investment pressure.

Amagi's revenue grew by 34.6%, with a net revenue retention of 127%, indicating healthy customer expansion. Planned investment in technology and cloud infrastructure is ₹5.50 billion ($60.21 million).

The Market Opportunity: Early Innings in Cloud Migration

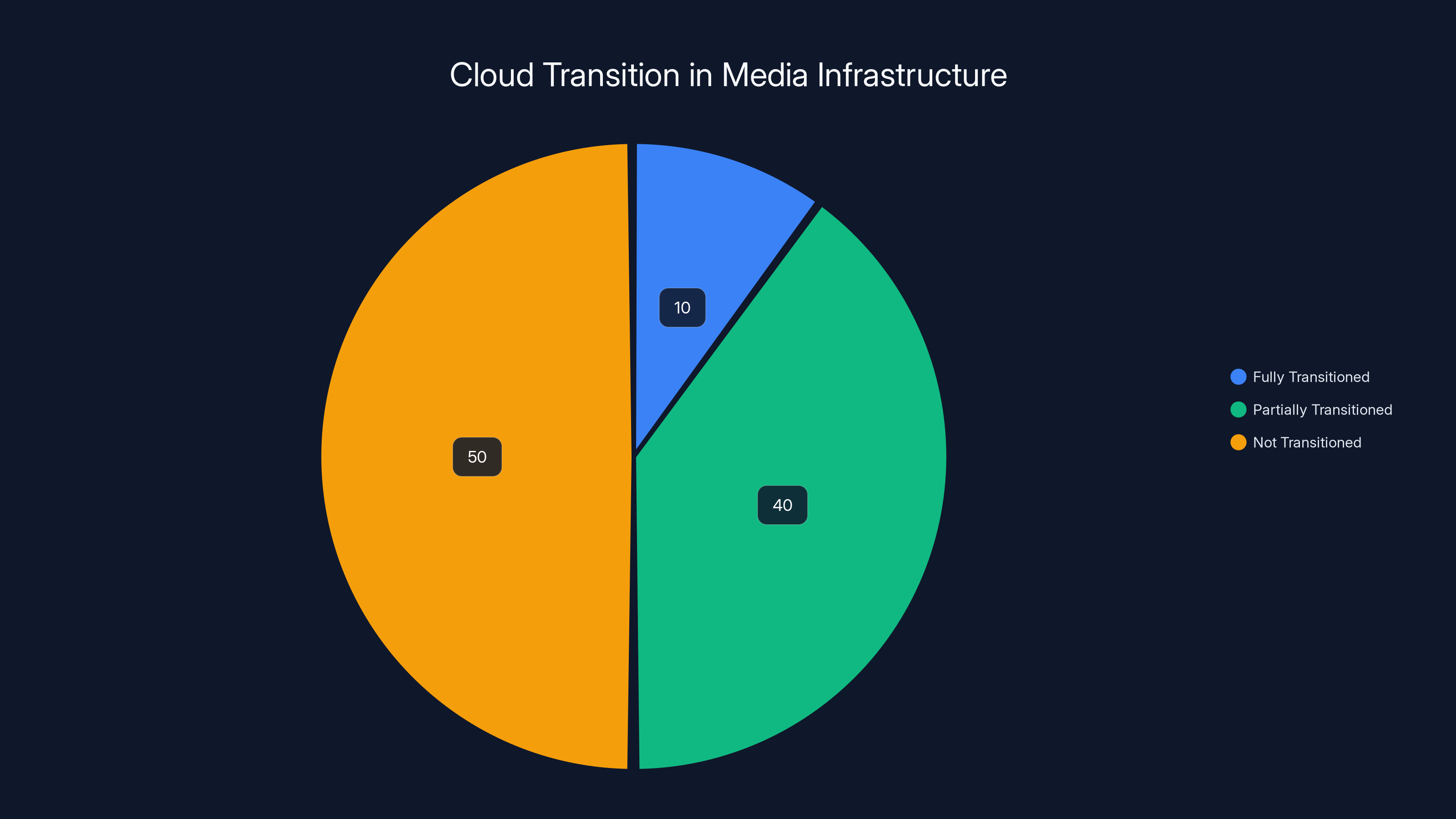

Amagi's pitch to investors rests on a single insight: the broadcast and streaming industry remains in the early innings of cloud migration. The company estimates that less than 10% of the industry has fully transitioned from on-premises hardware to cloud-based operations.

This assessment aligns with broader industry dynamics. Broadcasting infrastructure represents some of the oldest capital equipment in media. Many regional broadcasters, in particular, operate systems deployed 10-15 years ago. These systems work, they're paid off, and they're familiar to operators. Replacing them requires capital expenditure, staff retraining, and operational risk. It's the classic innovator's dilemma: the working system creates inertia.

However, underlying pressures are mounting. Live content production increasingly requires flexibility. Networks want to spin up new channels quickly, test regional variations, and serve different content to different audiences. On-premises infrastructure makes this cumbersome. Cloud-based systems allow rapid provisioning.

More significantly, streaming services have demonstrated the viability of cloud-based broadcast infrastructure. Netflix, Disney+, and Amazon Prime Video operate almost entirely on cloud platforms. As traditional broadcasters launch streaming services to compete, they're forced to confront the limitations of their legacy infrastructure. A broadcaster running linear TV on 20-year-old hardware suddenly needs to stream that same content globally in adaptive quality formats. The legacy systems aren't built for that.

Amagi's opportunity thesis depends on this transition accelerating. Every broadcaster upgrading infrastructure represents a potential customer. Every new streaming service represents another potential customer. The company's visibility into this pipeline was likely a key factor in its ability to raise capital, despite the IPO discount.

But there's an important constraint on this opportunity: market size. The global broadcast and streaming industry is substantial but not infinite. There are only so many television networks and streaming services worldwide. A company like Amagi can potentially capture significant market share, but it won't grow to $100 billion in revenue because the total addressable market doesn't support it.

Competition: The Legacy Vendors Strike Back

Amagi doesn't operate unopposed. It competes against legacy broadcast equipment manufacturers that are themselves modernizing. Companies like Sony, Grass Valley, and Harmonic have decades of relationships with broadcasters and massive installed bases of equipment in facilities worldwide.

These incumbents have significant advantages. They control customer relationships, understand workflow requirements intimately, and can bundle cloud offerings with existing service contracts. When a broadcaster considers modernization, the incumbent vendor often has the first conversation.

However, incumbents face their own challenges. Their legacy product organizations are often separate from cloud initiatives. The sales teams are organized to sell hardware licenses rather than recurring subscription services. The business model incentives create friction. If a vendor has historically made 40% of its revenue from hardware margins, shifting to cloud subscriptions feels like revenue collapse, even if the lifetime customer value is higher.

This creates an opening for Amagi. As a cloud-native vendor, subscription revenue is its only model. It can optimize for customer success metrics in ways incumbents find difficult. If Harmonic's hardware division is evaluated on quarterly license revenue, while Harmonic's cloud division is evaluated on subscription metrics, the organizational incentives misalign.

Amagi's competitive moat rests on this advantage: pure cloud focus, deep technical expertise in media workflows, proven reliability, and customer relationships built on subscription economics rather than one-time hardware sales.

But this moat isn't unassailable. Larger software companies could build or acquire similar capabilities. The technical barriers to entry, while real, aren't insurmountable for well-funded competitors.

The AI and Automation Play: Amagi's Next Frontier

Amagi's management has emphasized a new initiative that investors should monitor carefully: AI-driven automation for media operations. Subramanian told investors the company is "pitching new automation and AI-driven tools to help media companies cut labor-heavy operating costs."

This matters because it represents Amagi's attempt to expand beyond infrastructure into higher-margin software. Historically, Amagi has been a platform vendor: it runs the workflows, handles the distribution, manages the technology. But much of the value in media operations comes from human decision-making: scheduling, content placement, advertising optimization, and creative decisions.

AI automation tools could address the labor-intensive aspects of broadcast operations. Automated playout systems can handle routine scheduling without human intervention. Machine learning models can optimize ad placement within content. Automated quality assurance can detect encoding errors, compliance issues, or content problems without human review.

If Amagi successfully builds these capabilities, it could expand its addressable market and increase customer lock-in. Instead of providing infrastructure, Amagi would provide intelligence. Customers would develop dependencies on Amagi's recommendations and automations.

However, this represents a different competitive dynamic. Building AI systems requires data science talent, algorithm development expertise, and continuous model improvement. It's not the same skill set as infrastructure engineering. Companies that enter AI successfully typically do so by acquiring talent or companies that already have this expertise.

Amagi hasn't announced major AI acquisitions or hiring announcements. The company is likely still in early stages of this transition. Success isn't guaranteed. Many infrastructure companies have attempted similar pivots into higher-margin software and stumbled.

Amagi's valuation decreased from

Regulatory and Market Structure Considerations

Amagi's IPO took place within India's regulatory framework, but the company operates globally. This creates interesting structural questions. Why would Amagi go public on an Indian exchange if three-quarters of its revenue comes from the United States?

Several factors likely contributed to this decision. First, founders Subramanian, Srinivasan, and Karapattu have deep ties to India. Bengaluru is home. Going public at home provides alignment with community and offers a public exit that benefits Indian investors who participated in early rounds.

Second, Indian capital markets have become more receptive to B2B tech companies in recent years. Historically, Indian IPOs were dominated by consumer companies. But as the startup ecosystem has matured, larger tech infrastructure companies have accessed public markets. Amagi may have believed it could find sufficient investor interest in India.

Third, listing in India offers tax advantages and regulatory certainty for the founders and existing investors, many of whom have India tax residency. Converting private holdings to public shares on an Indian exchange is structurally simpler than a direct cross-listing in the US.

However, the discount at opening and the revised fundraising size suggest the Indian market has limits for specialized B2B infrastructure companies. Domestic investors may lack deep familiarity with media technology. The customer base is primarily international. The growth narrative might be more obvious to Silicon Valley venture capitalists than to Indian retail or institutional investors.

The Venture Capital Ecosystem Signal

Amagi's IPO matters to India's broader venture capital ecosystem, even if the immediate financial returns seem modest. The listing demonstrates that venture-backed B2B infrastructure companies can exit to public markets in India. Previously, successful tech exits typically meant acquisition by larger tech companies or listing on US exchanges.

This new pathway affects founder incentives. When Subramanian and his co-founders started Amagi in 2008, the idea of a domestic India IPO for a B2B enterprise software company was improbable. The IPO option creates a new long-term value creation path for founders building infrastructure businesses.

For venture capital firms investing in India, the IPO provides an exit mechanism without requiring US listings or acquisitions. This affects deployment of capital. More venture firms might fund infrastructure companies if they perceive India IPO as a viable outcome.

However, Amagi's underwhelming IPO debut tempers this signal. The 12% discount and reduced fundraising size suggest Indian capital markets aren't equally enthusiastic about all B2B tech companies. Investors discriminated based on fundamentals, growth rates, and market opportunities. Amagi qualified for a public listing, but not at premium valuations.

This is actually healthy market functioning. It signals that Indian exchanges won't accept all venture-backed tech companies at inflated valuations. Discernment matters. Amagi proved its business model, demonstrated revenue growth, and earned a public listing. But it also proved that premium valuations require premium growth or market conditions.

The Global Cloud Infrastructure Consolidation Trend

Amagi's IPO reflects a broader global trend: consolidation around specialized cloud infrastructure providers. The media industry is just one example, but the pattern holds across sectors.

Historically, each industry vertical built its own infrastructure. Healthcare systems built electronic health record platforms. Financial services built trading and settlement systems. Media companies built broadcast infrastructure. Each sector developed deep expertise, strong incumbents, and high switching costs.

But cloud computing has disaggregated this model. Now, infrastructure vendors can build once and serve multiple industries. A platform handling real-time video distribution could theoretically serve broadcasting, live streaming, conferencing, and surveillance simultaneously.

This creates opportunities for specialized vendors serving specific vertical niches. Instead of being a small player in a massive infrastructure market, a company can be a dominant player in a narrower vertical. Amagi chose to be the dominant cloud media distribution platform rather than compete broadly with AWS or Google.

This strategy works when (1) the vertical has enough customers to achieve scale, (2) the vertical-specific requirements are sufficiently complex that generic solutions underperform, and (3) the vendor can defend its market position against both incumbents and new entrants.

Amagi appears to satisfy these conditions. Media distribution has industry-specific requirements. Broadcast workflows differ from software deployment workflows. The company has built defensible moats through reliability, customer relationships, and specialized expertise.

If this thesis holds, we should expect similar IPOs from other vertically-focused cloud infrastructure companies in coming years. Companies serving specialized infrastructure needs in healthcare, finance, industrial manufacturing, and other sectors might follow similar paths to public markets.

Amagi's IPO raised $89.33 million in fresh capital with a 12% opening discount, indicating investor caution despite a 30x oversubscription. Estimated data.

Geographic Concentration Risk

Amagi's revenue geography presents a structural consideration. Nearly 73% comes from the United States, with about 20% from Europe. This concentration makes the company vulnerable to regional economic downturns or competitive dynamics specific to North America.

A recession in the US would likely pressure broadcaster budgets. Content companies might delay infrastructure investments, renew existing contracts without expansion, or renegotiate pricing downward. Amagi's growth would suffer materially.

Moreover, this geographic concentration reflects the reality of global media markets. The largest broadcasters, streaming services, and advertising technology companies are concentrated in the US. Amagi built its business around serving these companies. Expanding significantly into other geographies would require different sales strategies, localization efforts, and customer relationship building.

The company could potentially address this by expanding in India, Southeast Asia, Latin America, or other emerging markets. But these markets have different media infrastructure landscapes, lower monetization of video content, and lower willingness to pay for premium services. Amagi would need to adapt its pricing and feature set, which requires different product investments.

Management hasn't communicated strong ambitions to diversify geographic revenue. The focus remains North America and Europe. This leaves the company concentrated in markets with mature, competitive landscape dominated by large incumbents.

The Acquisition and M&A Landscape

Amagi's IPO doesn't eliminate acquisition possibility. Public companies acquire and are acquired regularly. However, going public makes acquisition more complex and expensive. Acquiring a public company requires paying a significant premium, dealing with a board of directors, and navigating regulatory approvals.

For Amagi, potential acquirers could include larger software companies looking to expand into media, major cloud providers wanting deeper vertical expertise, or consolidators in the media technology space.

A cloud provider like Amazon or Google might acquire Amagi to strengthen media services. A software company like Salesforce or Adobe might acquire for market presence. A media company like Disney or Paramount might acquire for internal operational capabilities.

But at current valuation (approximately $825 million), Amagi is expensive enough that acquisition becomes a strategic decision rather than opportunistic. An acquirer would need to justify a significant premium to the public market price.

Amagi's IPO has likely priced in most acquisition risk. The founders and early investors have now achieved a partial exit. They have liquidity and can make future decisions based on long-term strategy rather than near-term financial pressure.

Technology Stack and Infrastructure Considerations

Amagi operates on multi-cloud infrastructure, utilizing AWS and Google Cloud rather than building its own data centers. This architecture decision has profound implications for the business model.

Using public cloud providers means Amagi's costs scale with usage. As customers process more video content, Amagi's cloud bills increase proportionally. This creates a variable cost structure. During quarters with high customer activity, cloud costs spike. During quiet quarters, they decrease.

This differs from companies with fixed infrastructure costs. A company operating its own data centers has relatively fixed costs once capacity is built. Gross margins expand as revenue grows. But Amagi's margins are partially hostage to cloud provider pricing.

Cloud providers have historically increased prices for certain services and decreased them for others. A multi-year commitment to a particular encoding format or storage tier could be disrupted by provider pricing changes. Amagi must constantly monitor cloud economics and optimize workloads.

On the positive side, this architecture avoids massive capital expenditure. Amagi doesn't need to build and maintain its own data centers. It can scale capacity instantly without capital planning cycles. The operational agility is significant.

But the margin question remains. For Amagi to achieve healthy operating margins as a public company, it needs to optimize cloud costs faster than the company grows. If revenue grows 35% annually but cloud costs grow 38%, margins compress. Conversely, if the company can grow revenue faster than cloud costs, margins expand, and the public market typically rewards this.

Estimated data shows revenue growth outpacing cloud cost growth by Year 4, potentially improving Amagi's margins.

What the IPO Discount Actually Means

The 12% opening discount deserves deeper analysis because it contains real information about market sentiment. When public market investors reject a price that private investors accepted, it signals revaluation of future prospects.

Private investors valued Amagi at

This isn't quite a 41% decline in value, because the company has grown significantly. Revenue has expanded, customer base has scaled, and operational metrics have improved. The decline in valuation primarily reflects multiple compression: public investors are willing to pay less per dollar of revenue than private investors were in 2022.

Why? Several possibilities exist. First, the broader venture capital market has recalibrated. Private investment returns have disappointed in many cases, leading LPs to demand higher returns from venture funds, which creates pressure for more conservative valuations. Second, interest rates have risen significantly since 2022, increasing the discount rate applied to future cash flows. Third, market saturation concerns: perhaps public investors believe the media infrastructure market opportunity isn't as large as private investors assumed.

The opening discount specifically reflects day-one trading sentiment. Investors had the opportunity to buy at ₹361 during the IPO process. They declined sufficiently that the offering was reduced. Then, on day one, shares opened at ₹318. This suggests that even at the reduced price, the market was oversupplied.

By day's end, shares recovered to ₹348.85, suggesting some bargain hunting or shorts covering. But the lack of a strong pop indicates the IPO wasn't underleveraged. Underwriters typically underprice IPOs to ensure strong opening pops that generate positive momentum and media attention. Amagi's discount suggests the underwriters struggled to find buyers at the IPO price.

The Broader Indian Tech IPO Pipeline for 2025-2026

Amagi's listing occurred within a context of accelerating Indian tech IPOs. In 2025, India saw 42 tech IPOs, up from 36 in 2024. For 2026, early indicators suggest continued momentum, with dozens of late-stage venture-backed companies expected to test public markets.

This pipeline diversification matters. Historically, Indian IPOs clustered around consumer companies: e-commerce platforms, fintech apps, food delivery services. These companies could pitch rapid user growth, market-size expansion, and clear monetization paths.

Now, the pipeline includes infrastructure companies, B2B Saa S businesses, and specialized technology vendors alongside consumer platforms. Amagi exemplifies this diversification. It's not a consumer app; it's specialized B2B infrastructure.

For venture capital firms in India, this diversification improves exit options. Companies don't need rapid consumer adoption to achieve viable exits. Steady growth in B2B revenues suffices. This broadens the investment thesis space that VC firms can pursue.

For public market investors, the diversification creates complexity. Evaluating consumer companies is relatively straightforward: look at user growth, engagement, monetization rates, and competitive positioning. Evaluating infrastructure companies requires understanding technical architecture, cloud economics, customer concentration, and competitive moats.

Amagi's IPO likely benefited from this investor learning curve. Indian institutional investors are still developing expertise in evaluating specialized B2B tech businesses. Some were probably underconfident in assessing the business quality, leading to the discount. As the pipeline matures, investor sophistication will likely improve.

Future Growth Vectors and Investment Priorities

Amagi management indicated that IPO proceeds would fund three primary initiatives: technology and cloud infrastructure, potential acquisitions, and general corporate use. The ₹5.50 billion ($60.21 million) allocated to technology and cloud infrastructure represents the bulk of capital deployment.

This allocation suggests management sees continued need for infrastructure investment as the business scales. The company likely plans to build redundancy, improve performance, expand geographic coverage, or optimize cloud costs. Technical infrastructure investments typically have long payoff periods, making them appropriate for IPO capital rather than operational cashflow.

The acquisition line item is interesting. Amagi hasn't announced major acquisition targets, but the reserved capital suggests openness to inorganic growth. The company might acquire complementary technology, specialized expertise (particularly AI/ML capabilities), or customer relationships in adjacent markets.

Amagi's core strength is media distribution infrastructure. Complementary acquisitions could include advertising technology companies, content management platforms, or analytics vendors. These would expand the customer value proposition without requiring entirely new technical domains.

The general corporate use category represents dry powder. In startup culture, this category often funds unexpected opportunities, contingencies, or strategic flexibility. Given the IPO's lukewarm reception, retaining substantial cash provides optionality.

Estimated data shows that only 10% of the media infrastructure industry has fully transitioned to cloud operations, indicating significant growth potential.

Competitive Positioning and Industry Dynamics

Amagi's positioning within the broader media technology landscape reflects a fundamental shift in how broadcast infrastructure operates. Historically, broadcast technology meant hardware: encoders, transmitters, multiplexers, and similar physical equipment. Companies like Sony and Grass Valley dominated through manufacturing excellence and customer relationships.

Amagi arrived when the industry was ready for this transition to software. Cloud-native architectures offered economics advantages, operational agility, and capital efficiency that hardware couldn't match. But the transition happened gradually because incumbent customers had massive investments in existing infrastructure.

Now, enough migration has occurred that pure-cloud vendors like Amagi can achieve scale. The company serves customers who've committed to cloud operations and need sophisticated software to manage that transition. This market is real and substantial.

But the market is also consolidating. Larger software companies see opportunity and are investing. Microsoft, Google, and Amazon increasingly offer media-specific cloud services. Specialized vendors like Amagi face pressure from these general-purpose cloud providers that can cross-subsidize media services with profits from other businesses.

Amagi's defensibility depends on specialization. If the company builds media-specific workflows, customer relationships, and integrations that general cloud providers can't easily replicate, the moat remains defensible. If cloud providers' media offerings become sufficient for most customers' needs, Amagi's market shrinks.

The company's ability to expand into AI-driven automation could strengthen its moat by creating software-specific lock-in beyond infrastructure. If Amagi's AI systems become critical to customer operations, switching becomes harder. This represents a strategy to move from commodity infrastructure toward specialized intelligence.

Market Sentiment and Valuation Multiples

Amagi trades on different fundamentals than broader market indices. Media technology isn't a hot sector in 2025. Cryptocurrency, artificial intelligence, and biotech captured venture capital enthusiasm in recent years. Broadcast infrastructure ranks lower on the excitement spectrum.

This affects valuation multiples. High-growth AI companies might command 10-15x revenue multiples in public markets. Mature software companies might trade at 3-5x revenue. Amagi, showing 35% revenue growth but not explosive expansion, likely trades somewhere in the 5-8x revenue range depending on profitability expectations and growth trajectory.

At the IPO valuation of roughly

This multiple suggests public investors view Amagi as a steady-growth business rather than a moonshot. The company will likely grow steadily, maintain strong customer relationships, and gradually expand into new markets and products. But it won't explode to a $50 billion company within five years.

This valuation reality doesn't diminish Amagi's business quality. Profitable, steady-growth companies often deliver better risk-adjusted returns than volatile hypergrowth ventures. The valuation simply reflects realistic expectations about market opportunity and competitive dynamics.

Risk Factors and Execution Challenges

Despite strong fundamentals, Amagi faces several risks that could impact future performance. Technology obsolescence represents one category. If new media distribution paradigms emerge (perhaps AI-driven adaptive streaming that doesn't require traditional encoding), Amagi's infrastructure could become less relevant.

Customer concentration poses another risk. Major customers represent significant portions of revenue. Loss of a major customer would meaningfully impact revenue. While the company appears to have diversified customer base, revenue concentration risk remains.

Pricing pressure from competitors or cloud providers could compress margins. If competitors reduce prices to capture market share, Amagi would face pressure to match. Simultaneously, cloud providers could increase media service pricing, directly impacting Amagi's costs.

The AI automation bet represents execution risk. Building effective AI products requires different skills than infrastructure engineering. The company could invest in this area and fail to achieve traction. Or competitors could build superior AI solutions, outflanking Amagi's market position.

Geographic concentration in North America creates regional risk. Economic downturns, regulatory changes, or competitive dynamics specific to the US could pressure growth. International expansion would address this but requires significant investment and execution capability.

Technical risk also exists. Real-time video infrastructure is complex. A major outage affecting customer operations could damage Amagi's reputation and customer relationships. The company's architecture includes redundancy specifically to mitigate this risk, but residual risk remains.

Long-Term Strategic Implications

Amagi's successful IPO, despite modest opening performance, establishes that specialized B2B infrastructure companies can exit through domestic Indian public markets. This precedent may catalyze other founders to pursue similar paths.

For Amagi itself, public status changes the company's access to capital, employee incentives (through stock-based compensation options), and strategic flexibility. The company can now pursue larger acquisitions, expand internationally, and invest in new product areas without depending on venture capital funding rounds.

The modest valuation multiple suggests public investors won't easily accept aggressive expansion stories. Amagi will need to demonstrate disciplined growth with improving margins. This differs from venture-backed environments where growth often takes precedence over profitability.

Management's job becomes more challenging. The company must balance shareholder expectations (steady growth, improving margins, consistent results) against the imperative to expand into new markets and products. This tension characterizes most public software companies.

Amagi's path forward likely involves steady expansion in core media infrastructure business while methodically building AI-driven automation capabilities. International expansion in selected markets where media infrastructure modernization is occurring. Possible acquisitions of complementary technologies. And gradual margin improvement as cloud costs optimize and scale efficiencies emerge.

None of this is dramatic or exciting. But for shareholders seeking stable, profitable growth from a specialized technology vendor, Amagi may deliver reasonable returns over a multi-year timeframe.

Conclusion: The Market's Realistic Assessment

Amagi's India IPO presents a fascinating case study in how public markets value specialized infrastructure companies. The 12% opening discount and reduced fundraising suggests realistic investor assessment rather than irrational exuberance.

The company operates a strong, defensible business. Its customers are blue-chip media companies that depend critically on infrastructure reliability. The market opportunity is substantial, with less than 10% of the industry having fully transitioned to cloud operations. The management team has demonstrated execution capability over 16+ years of operations.

But the company also faces real constraints. The addressable market is narrower than consumer platforms. Competitive dynamics are complex, with both specialist vendors and general-purpose cloud providers competing. Margin expansion depends on executing cloud cost optimization effectively. International expansion beyond North America and Europe remains uncertain.

Public investors incorporated all of these factors into their valuation. They priced Amagi at multiples appropriate for a steady-growth, specialized B2B business rather than an explosive growth story. This valuation is neither particularly bullish nor bearish; it's realistic.

For venture capital firms in India, Amagi's listing validates a thesis that's increasingly obvious: specialized infrastructure companies can achieve viable exits without requiring massive consumer adoption or US listings. This should encourage more investment in B2B technology in India.

For potential customers, Amagi's public status enhances credibility. Public companies have disclosure requirements, regulatory oversight, and external accountability that reassure enterprise customers about operational stability and long-term viability.

For employees and stakeholders, the IPO provides liquidity, enables wealth creation, and establishes a public market valuation against which future performance can be measured.

Amagi's ultimate significance may not be in the numbers on day one. Instead, it lies in demonstrating that India's capital markets can accommodate specialized technology companies with global customer bases, strong unit economics, and steady growth profiles. As India's venture ecosystem continues maturing, more companies like Amagi will likely follow this path. The precedent matters more than the opening discount.

FAQ

What is Amagi Media Labs?

Amagi Media Labs is a Bengaluru-headquartered software company that provides cloud-based infrastructure for managing, distributing, and monetizing television and streaming content. Founded in 2008, the company serves broadcasters, streaming services, and media distributors worldwide, with customers including Lionsgate Studios, Fox, Sinclair Broadcast Group, Roku, and Vizio. The platform automates workflows that historically required expensive on-premises hardware and enables real-time content distribution across multiple channels and formats.

How does Amagi's technology work?

Amagi's cloud platform ingests video content, processes it through automated workflows including format conversion and compliance checking, and distributes it to multiple channels and platforms. The system operates on multi-cloud infrastructure (AWS and Google Cloud) to ensure reliability and redundancy. When a broadcaster or streamer uploads content, Amagi's software automatically handles packaging, quality assurance, and real-time distribution to viewers, eliminating the need for traditional broadcast hardware and satellite infrastructure.

What was Amagi's IPO valuation?

Amagi raised ₹17.89 billion (approximately

What percentage of Amagi's revenue comes from India versus international markets?

Amagi generates approximately 73% of its revenue from the United States, about 20% from Europe, and the remaining 7% from other markets including India. This geographic concentration reflects the company's focus on serving North American broadcasters and streaming services, which represent the largest media companies globally. The company's export-focused business model makes it unusual for an India IPO, as most domestic listings serve primarily Indian customers.

What is Amagi's net revenue retention rate and what does it mean?

Amagi reported approximately 127% net revenue retention for the six-month period ending September 30, 2025, meaning existing customers increased their spending by 27% on average. This metric indicates strong customer satisfaction, successful upselling, and expansion of platform usage within the existing customer base. NRR above 100% is generally considered healthy for Saa S companies, suggesting customers find increasing value in the platform over time.

What growth rate is Amagi achieving?

For the six months ended September 30, 2025, Amagi's revenue from operations grew 34.6% year-over-year to ₹7.05 billion (approximately $77.18 million). For a B2B enterprise software company, particularly one serving specialized infrastructure needs, 34.6% year-over-year growth is considered solid. This growth rate, combined with strong net revenue retention, suggests both successful customer acquisition and expansion within existing customers.

What is the total addressable market for Amagi?

The global broadcast infrastructure market is valued at approximately

What are Amagi's main competitive advantages?

Amagi's primary competitive advantages include proven reliability critical for live broadcasts, deep customer relationships with blue-chip media companies, specialized expertise in media workflows that generalist vendors struggle to match, cloud-native architecture enabling rapid scaling, and growing net revenue retention demonstrating strong product-market fit. The company's focus on infrastructure reliability creates defensibility, as broadcast downtime during live events directly impacts customer revenue, making switching vendors risky.

How does Amagi plan to use IPO proceeds?

Amagi allocated approximately ₹5.50 billion ($60.21 million) of IPO proceeds toward technology and cloud infrastructure improvements. The company also reserved capital for potential strategic acquisitions and general corporate use. These allocations suggest management plans to invest in maintaining infrastructure reliability, optimizing cloud costs, potentially acquiring complementary technologies, and retaining flexibility for unexpected opportunities.

What is Amagi's strategy regarding AI and automation?

Amagi is developing AI-driven automation tools to help media companies reduce labor-intensive operating costs. These tools aim to automate routine operational tasks like scheduling, ad placement optimization, and quality assurance, potentially expanding the company's market from infrastructure-only services into specialized intelligence and decision support. Success with AI products could increase customer lock-in and expand addressable market, but represents execution risk as it requires different skills than infrastructure engineering.

Summary

Amagi Media Labs' January 2025 IPO on India's National Stock Exchange represented a significant moment for the country's venture ecosystem: a rare export-focused B2B infrastructure company achieving public market exit without pursuing a US listing. While the 12% opening discount and reduced fundraising size initially suggested investor hesitation, the underlying business fundamentals remain solid.

The company operates in a massive, underpenetrated market where less than 10% of the broadcast industry has migrated to cloud infrastructure. With 34.6% revenue growth, 127% net revenue retention, and blue-chip customers including Fox, Lionsgate, and Roku, Amagi has built a defensible business positioned at an important inflection point in media infrastructure modernization.

Public valuations have compressed from private market multiples, reflecting realistic investor assessment of growth constraints and competitive dynamics. But this valuation discipline may ultimately serve shareholders better than speculative pricing. Amagi will likely deliver steady, profitable growth rather than explosive returns, which aligns with its mature market position and stable customer base.

For India's startup ecosystem, Amagi establishes a new exit pathway for specialized technology companies serving global markets. As more venture-backed B2B companies mature, this precedent encourages founder ambition and investor capital deployment in infrastructure sectors beyond consumer-focused applications.

The real story isn't in the opening day trading. It's in the systematic transition of broadcast infrastructure to cloud operations that Amagi has positioned itself to serve for the next decade. If the company executes disciplined growth, optimizes cloud economics, and successfully expands into AI-driven automation, shareholders can expect reasonable long-term returns. And for the broadcast industry, Amagi represents the kinds of specialized infrastructure vendors that will power the next generation of media delivery.

Key Takeaways

- Amagi's 12% IPO discount reflects realistic valuation of specialized infrastructure vendors, not market rejection—the company raised 825M

- With less than 10% of broadcast infrastructure migrated to cloud and $4.2B addressable market, Amagi operates in growth phase despite mature business model

- Geographic concentration (73% US revenue) and competitive pressure from both legacy vendors and cloud providers create meaningful execution challenges

- Net revenue retention of 127% and 34.6% YoY growth demonstrate strong product-market fit, but public market multiples compressed from private valuations

- Amagi's IPO establishes precedent for export-focused B2B infrastructure companies accessing Indian public markets, potentially catalyzing similar exits from India's VC ecosystem

Related Articles

- Ethos Insurance IPO 2026: Inside the First Tech IPO of the Year [2026]

- 55 US AI Startups That Raised $100M+ in 2025: Complete Analysis

- HBO Max's Spoiler Problem: Why Modern Streaming Trailers Ruin Everything [2025]

- IT Spending Hits $1.4 Trillion in 2026: Where Money Really Goes [2025]

- AI Bubble Myth: Understanding 3 Distinct Layers & Timelines

- TikTok's PineDrama App: The Micro-Drama Platform That's Learning From Quibi's Failures [2025]

![Amagi's India IPO: Cloud TV Software's Market Test [2025]](https://tryrunable.com/blog/amagi-s-india-ipo-cloud-tv-software-s-market-test-2025/image-1-1768977409207.jpg)