IT Spending Hits $1.4 Trillion in 2026: Where Money Really Goes

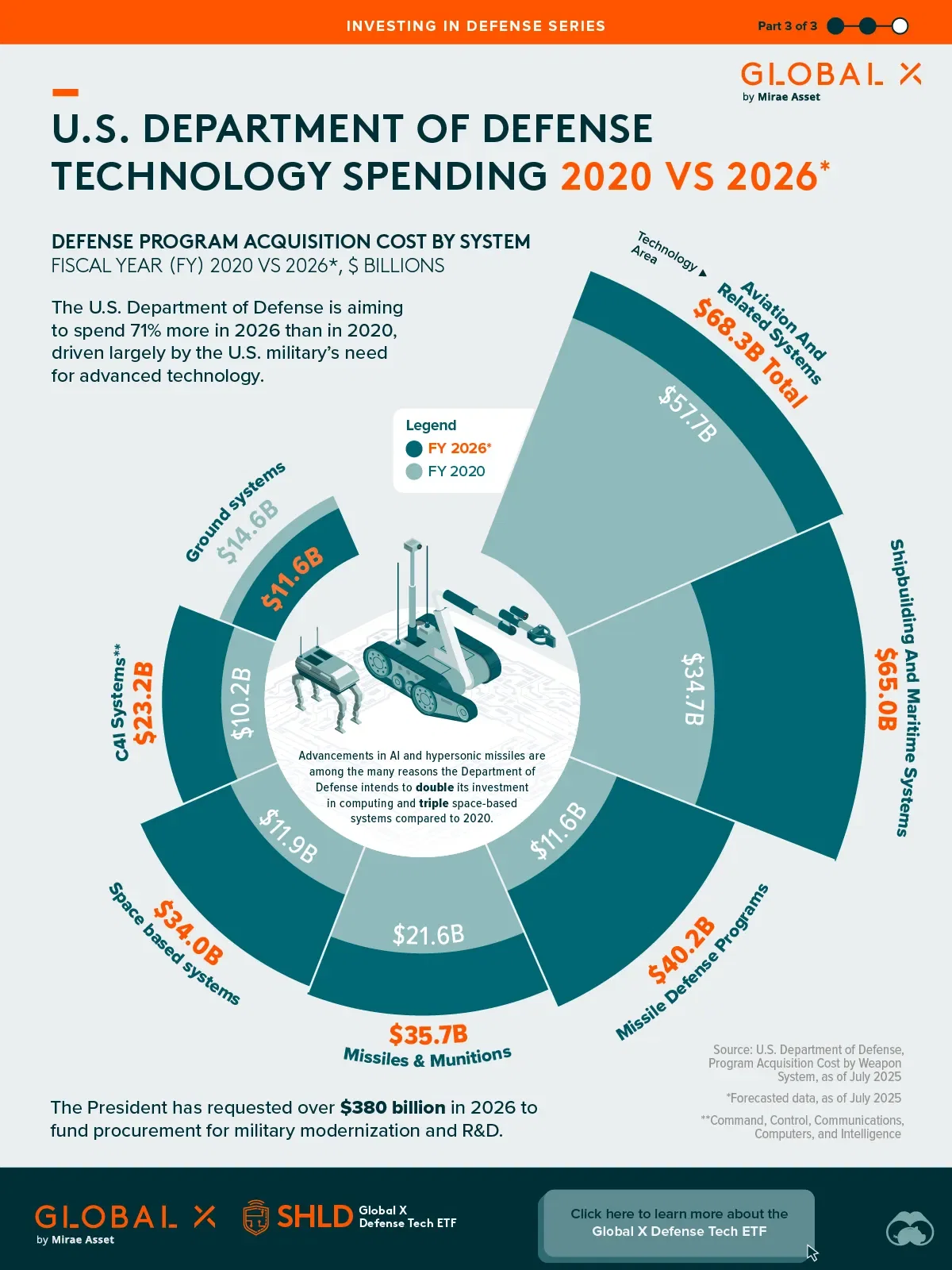

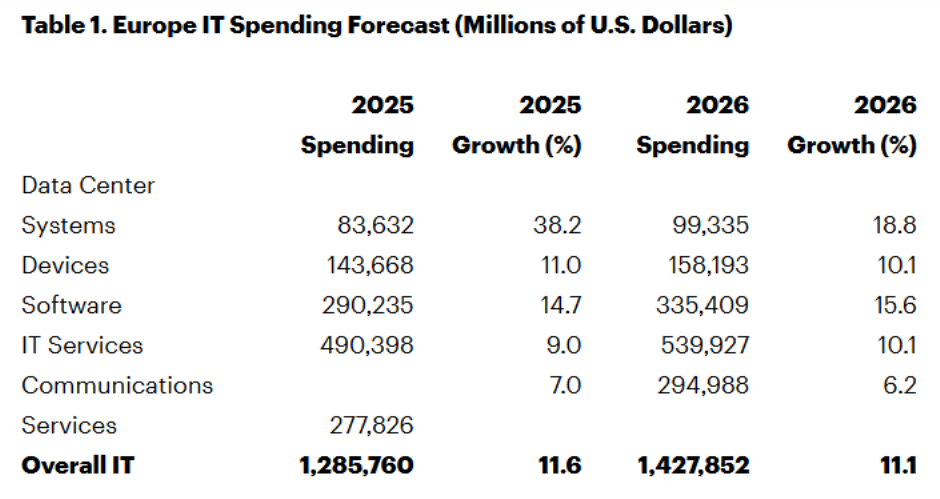

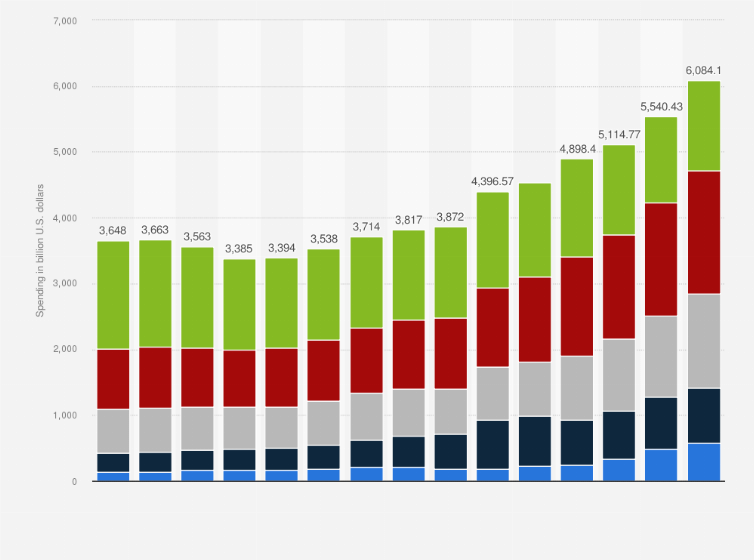

There's a $1.43 trillion question hanging over the tech industry right now. That's how much organizations worldwide are projected to spend on information technology in 2026, and honestly, the breakdown reveals something way more interesting than just a big number.

It's not actually about growth for growth's sake. It's about survival, regulation, and the weird economics of keeping up with technology that's changing faster than anyone predicted.

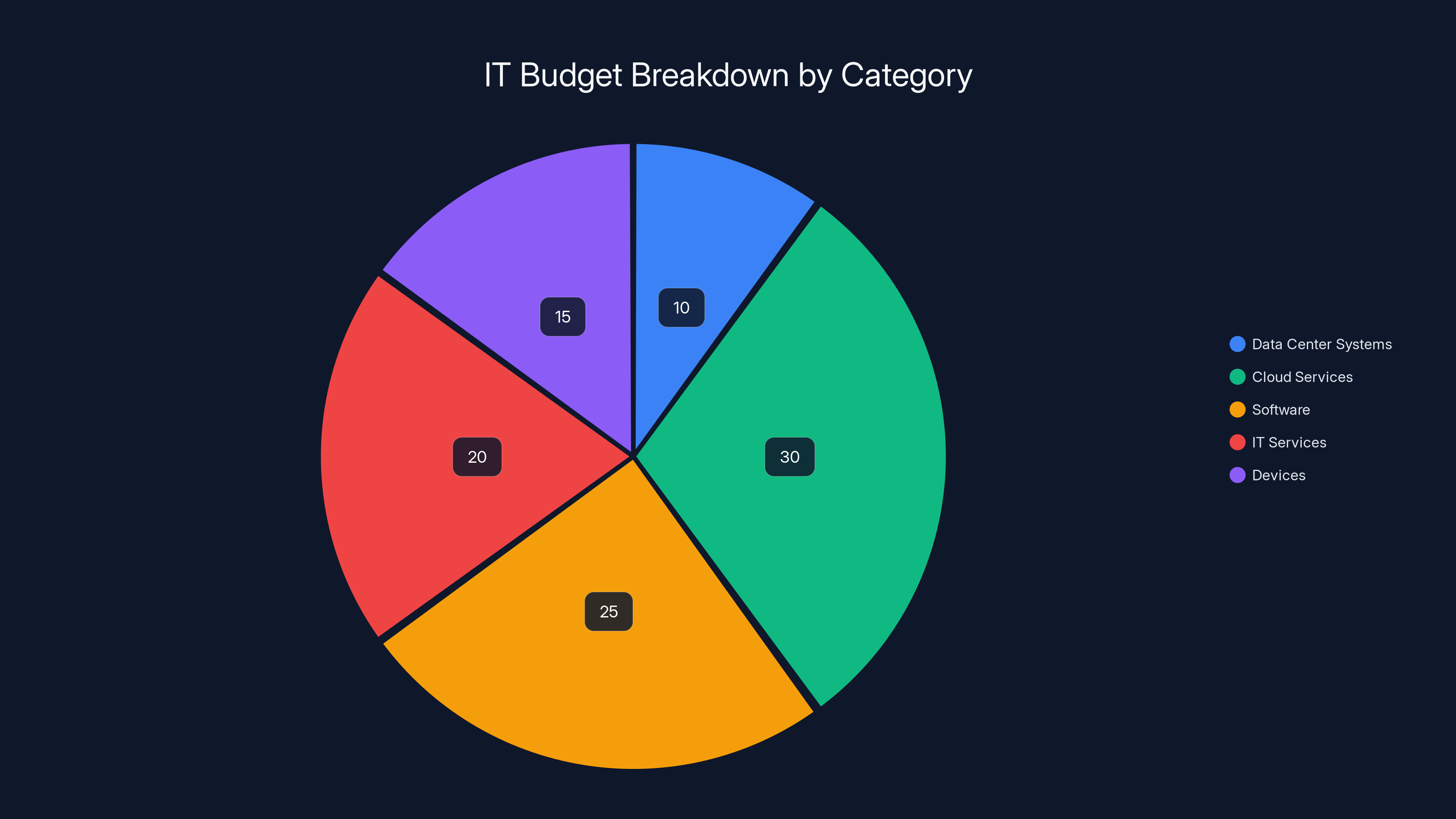

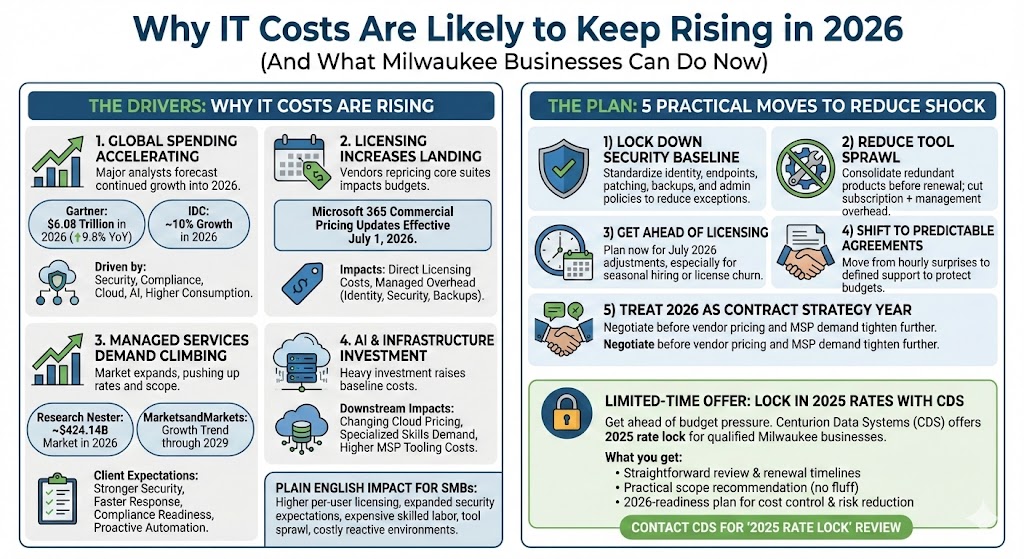

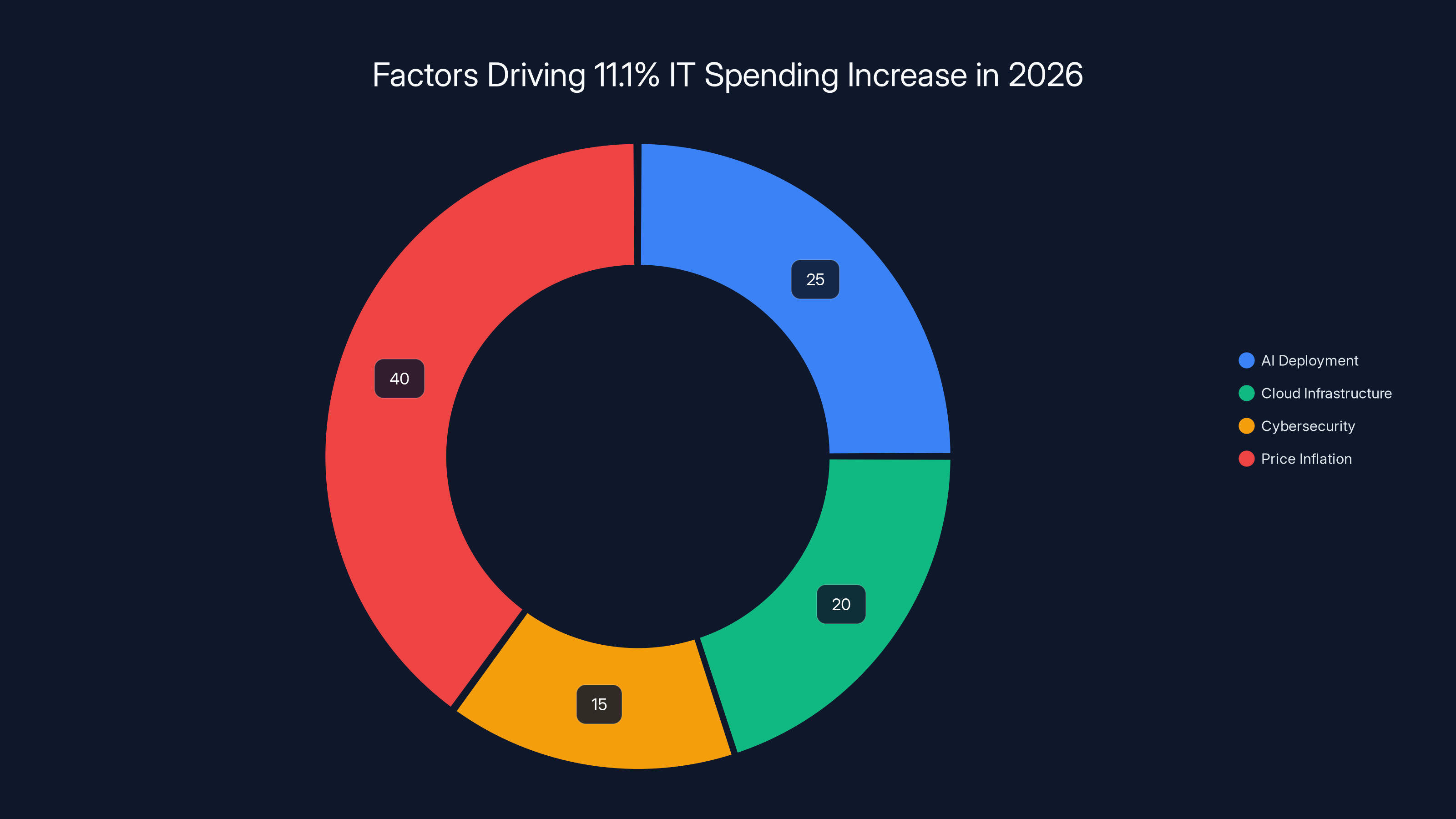

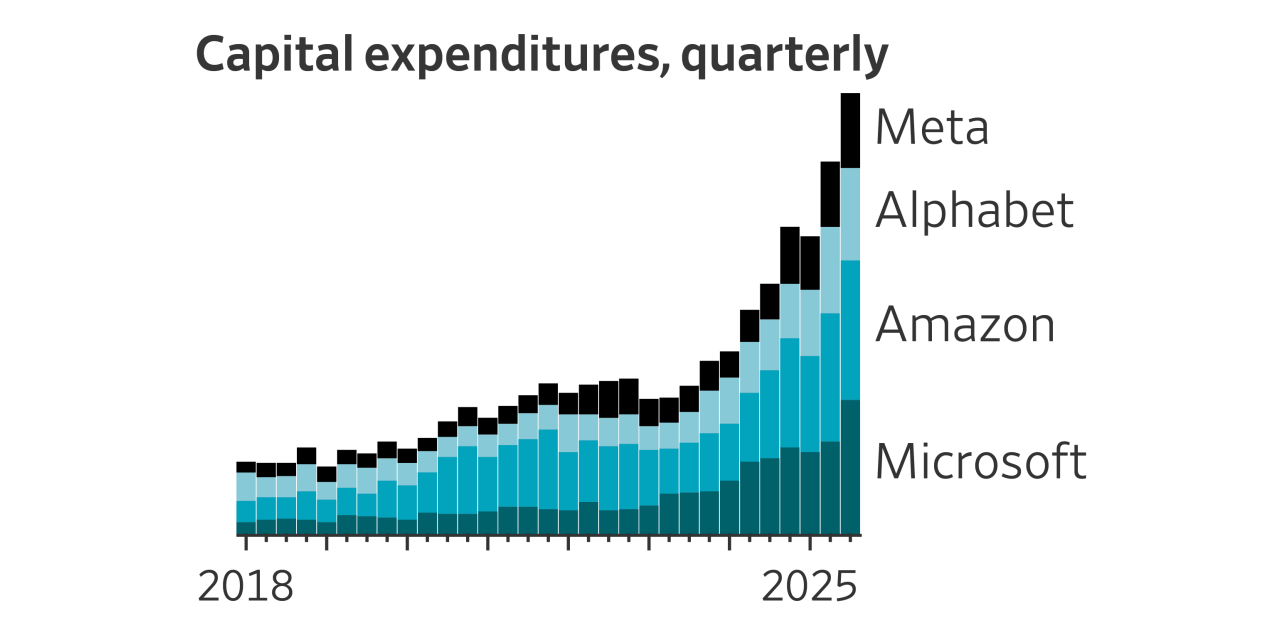

Look, when you see that IT spending is climbing 11.1% year-over-year, your first instinct might be: companies are doing great, right? But dig deeper and you find something messier. Price inflation is artificially boosting these numbers. Geopolitical tensions are forcing regional spending patterns that wouldn't exist in a truly global market. And AI is becoming so expensive that it's reshaping how every other budget dollar gets allocated.

This article breaks down exactly where that $1.43 trillion is going, why companies feel forced to spend it, and what it means for the future of enterprise technology. Because understanding IT spending isn't just accounting trivia—it reveals how businesses actually operate when money gets tight and stakes get high.

TL; DR

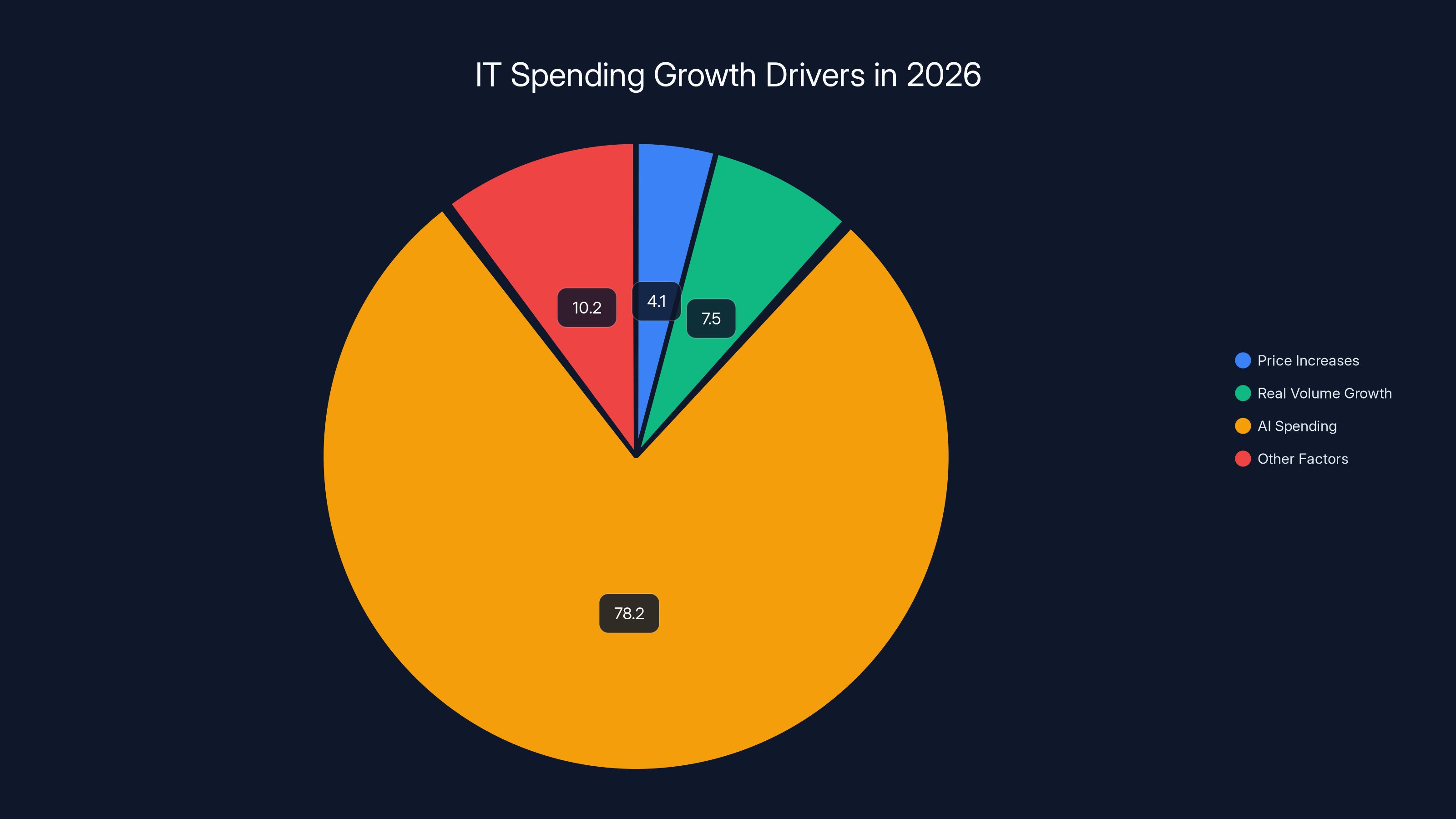

- AI deployment and generative AI models are driving a 78.2% increase in AI spending across Europe, making it the fastest-growing segment

- Data center systems are growing fastest at 18.8% year-over-year, though they remain the smallest overall expense category

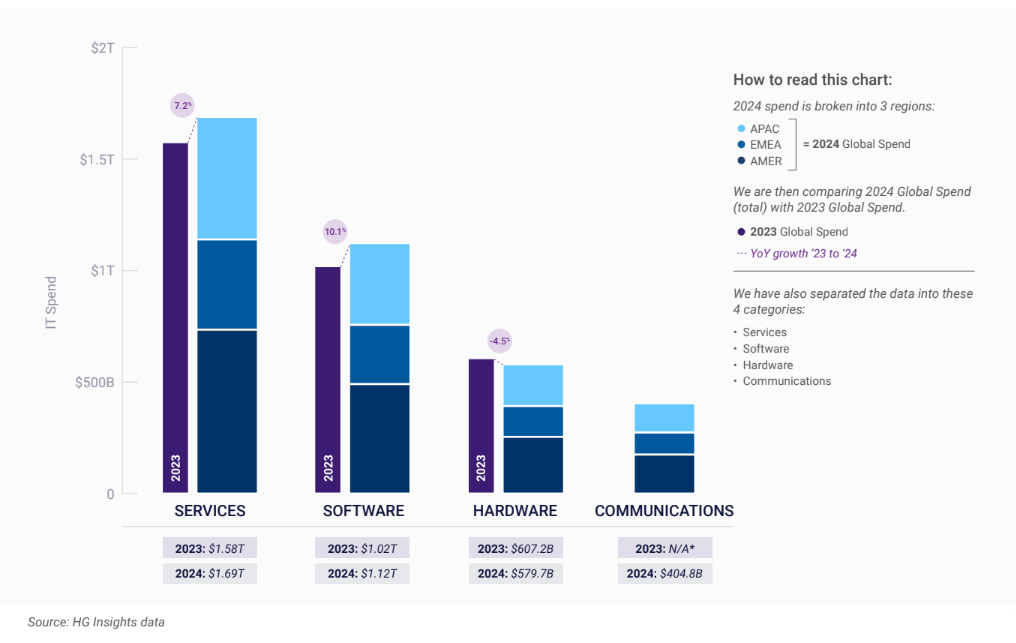

- IT services dominate spending volume, followed by software, but cloud and cybersecurity remain non-negotiable investments despite tight budgets

- Geopolitical pressure and regional compliance requirements are forcing 35% of countries to lock into region-specific AI platforms by 2026, up from just 5% today

- Price inflation is masking real growth, meaning actual volume increases are likely lower than the 11.1% headline figure suggests

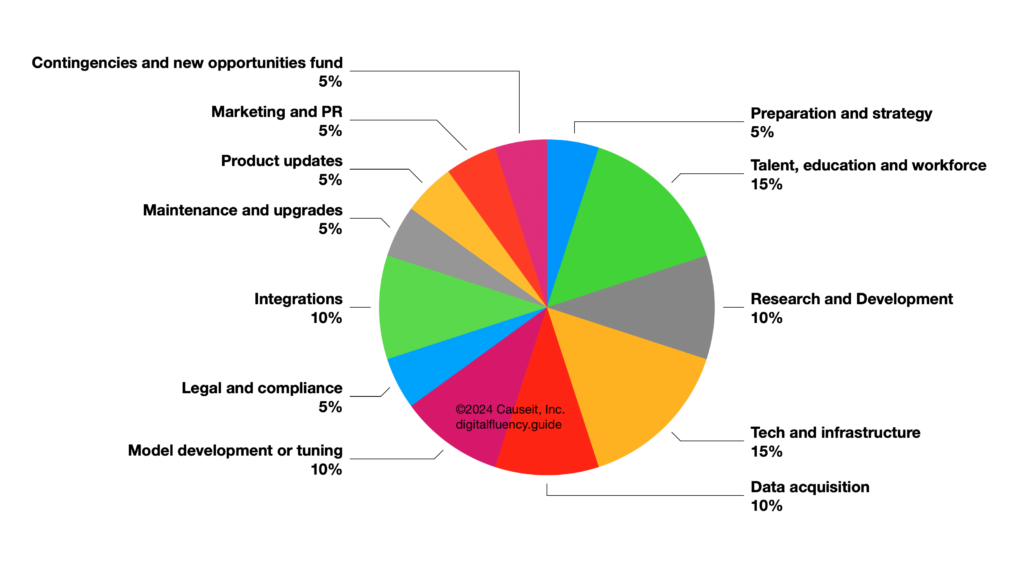

Data Center Systems, despite their rapid growth, remain the smallest budget category at an estimated 10% of total IT spending. Estimated data.

The $1.43 Trillion Reality Check: What's Actually Driving Growth

When analysts at Gartner project that IT spending will reach $1.43 trillion in 2026, they're not just watching historical trends and extrapolating forward. They're watching something messier: companies making uncomfortable choices about what stays funded when budgets tighten.

The 11.1% growth rate sounds impressive until you pull it apart. Some of that growth isn't about companies buying more technology. It's about paying more for the same technology. Cloud providers raised prices. Security vendors bundled new services into existing contracts. Data center operators passed through electricity cost increases. When you strip away pricing increases, real volume growth is probably closer to 7% or 8%.

But here's what makes 2026 different from previous years: AI isn't one line item on the budget anymore. It's the organizing principle reshaping every other spending category.

Generative AI model spending represents one of the biggest categories in Europe, with that 78.2% rise expected. That's not sustainable forever, but right now, companies believe they have to participate or risk getting left behind. The problem is they're not always sure what they're paying for. A lot of that AI spending is exploratory, experimental, and produces uncertain ROI.

CEOs seem determined to keep spending on AI despite mixed success with implementations. The business logic is clear enough: if AI becomes as fundamental as electricity to competitive advantage, you can't afford to bet against it. But the execution has been messy. Many organizations have launched AI initiatives that haven't delivered measurable results. Some have abandoned expensive AI projects after months of development. Others are paying for AI capabilities they're not actually using yet.

Yet spending continues. Companies would rather overspend on AI today and look foolish than underspend and get disrupted tomorrow.

Why AI Is Reshaping the Entire Budget

AI isn't just a new category in the IT budget. It's a parasite that feeds on existing budget categories. When organizations decide to deploy generative AI models, they need data infrastructure to support those models. They need security tooling because AI introduces new attack surfaces. They need cloud capacity because you can't run large language models efficiently on premises. They need more cybersecurity investment because data breaches now expose training data.

This cascading effect means that every percentage point of budget growth going to AI is a percentage point not going to system upgrades, network infrastructure, or developer productivity tools.

The worst part? Organizations don't always know they're making that trade-off. Budget reallocation happens gradually. Someone requests an additional GPU cluster for AI experiments. Someone else asks for security team expansion to monitor AI systems. Six months later, you've redirected $20 million from planned initiatives nobody talks about anymore.

What's happening in Europe is particularly instructive here. The regulatory pressure to develop AI systems locally, without dependence on foreign platforms, is creating spending patterns that wouldn't make economic sense in a pure free market. Companies are building redundancy, maintaining regional data centers, and paying premium prices for local services. It's expensive, but it's becoming mandatory.

This shift toward regional autonomy is expected to drive a 24% growth in public cloud spending in 2026, as companies set up separate cloud infrastructure in different regions. That's another hidden cost embedded in the "AI transition" that most organizations aren't explicitly accounting for.

Price inflation accounts for 40% of the projected 11.1% increase in IT spending by 2026, with AI deployment contributing 25%, cloud infrastructure 20%, and cybersecurity 15%. Estimated data.

The Five Categories Breaking Down the Budget

IT spending doesn't happen in a black box. Gartner breaks it into five distinct categories, and each tells a different story about where organizations are actually placing their bets.

Data Center Systems: The Explosive Growth That Stays Small

Data center systems are growing the fastest of any category. That 18.8% year-over-year increase is remarkable. But here's the deceptive part: it's still the smallest overall expense in terms of dollar value.

Why? Because data center systems are expensive to buy but cheap compared to ongoing labor costs. You might drop

Still, that 18.8% growth reveals something important: the data center hardware market is heating up again. For years, companies were consolidating to cloud. Now they're buying expensive on-premises equipment for AI workloads that are too expensive to run in public cloud.

GPU servers have become the new commodity hardware. Enterprises that adopted a cloud-first strategy five years ago are now having second thoughts because running large language models in the cloud costs a fortune. The economics of compute have shifted. A $500,000 GPU server sounds expensive until you realize running the same workload in AWS for a year costs more than the hardware itself.

This creates interesting dynamics. Companies are split-brained about infrastructure strategy. They want cloud's flexibility and pay-as-you-go model. But they need on-premises hardware to make the economics of AI work. So they're building hybrid infrastructure, which is more expensive and more complex than pure cloud or pure on-premises would be.

The data center systems category will probably keep growing as AI workloads mature. But organizations will eventually figure out how to optimize costs, and that growth rate will moderate.

IT Services: The Largest Slice, But For Why?

IT services represent the single largest portion of IT spending. This category includes everything from consulting services to managed IT support to custom development work.

The size of this category tells you something important: organizations don't just buy technology and make it work. They pay people to integrate it, customize it, maintain it, and keep it running.

There's a reason IT services haven't been disrupted by cloud migration or automation. Every technology transformation requires human expertise. When you migrate workloads to cloud, you need consultants who know both your legacy systems and cloud architecture. When you implement cybersecurity tools, you need people who can configure them properly. When you adopt AI, you need people who can integrate it into existing workflows without breaking things.

The IT services category is actually a proxy for transformation complexity. When this category is growing fast, it usually means organizations are undertaking major infrastructure changes. Growth in this category will probably accelerate as companies realize they need more help integrating AI into existing systems.

Here's a pattern worth noticing: IT services is where organizations hide technical debt. They budget for services thinking they're solving temporary problems, but those temporary problems become permanent. A company hires consultants to migrate databases to cloud. Two years later, they're still paying for managed services to keep those databases running because the internal team never became self-sufficient.

It's not malicious. It's just how technology organizations evolve. As systems get more complex, the ratio of specialists to generalists increases. And specialists command premium billing rates.

Software: Expansion Within Constraints

Software represents the second-largest spending category, and it's where the real AI transformation is happening in 2026.

Software spending is growing, but organizations are making deliberate choices about which tools stay funded. Companies are consolidating vendor relationships. They're moving away from specialized point solutions toward platforms that promise to do more with less. They're evaluating software licensing costs more carefully because cloud spending already stretched budgets.

What's interesting is how AI is changing software purchasing decisions. Organizations used to buy software based on features and price. Now they're evaluating software based on whether it integrates with their AI strategy. Does it export data in formats compatible with machine learning pipelines? Does it have an API that can be connected to AI workflows? Can it be partially automated using AI?

This is creating a new category of software vendors who are winning deals: platforms that claim to make other software more productive through AI. But many of these platforms are still immature. They work well for specific use cases but fail when you try to apply them broadly. Yet organizations keep buying them because the potential upside seems worth the risk.

The software category is also where pricing pressure is most visible. Companies are pushing back on vendor increases. Some are migrating from expensive legacy software to open-source alternatives. Others are renegotiating contracts aggressively.

But not all categories see price pressure. AI-specific software is still expensive, and budgets aren't pushing back hard because nobody knows what the "right" price for AI capabilities actually is yet.

Communication Services: The Stable Utility

Communication services include network infrastructure, telephony, and connectivity. This category is growing, but steadily, not explosively.

Why? Because communication infrastructure is largely mature. Organizations have figured out what they need: reliable connectivity at reasonable prices. There isn't a lot of innovation creating new spending in this category. Nobody's budget meeting includes a debate about whether to increase spending on network connectivity.

Where growth is happening: edge computing and specialized network infrastructure for AI. If you're running inference on distributed edge devices, you need network infrastructure to support low-latency communication. Some organizations are building out 5G infrastructure specifically to support AI-powered edge computing.

But for most organizations, communication services spending is predictable. You budget for bandwidth growth, perhaps some SD-WAN upgrades, maybe some 5G pilots. It's not exciting, but it's not surprising either.

The one category that might see pressure: international connectivity for regional compliance. If your company needs to keep data local in different regions for regulatory reasons, that multiplies your network infrastructure costs.

Devices: The Slowest-Growing Category

Devices include laptops, phones, tablets, and other endpoint hardware. This category is growing the slowest of the five.

Why? Because devices are commoditized. You can buy a corporate laptop today that will handle enterprise workloads as well as laptops from five years ago. There's no compelling reason to upgrade constantly. Organizations are extending device lifecycles from three years to four or five years.

The device refresh cycle is becoming less predictable. Instead of upgrading hardware every few years, companies are hanging onto devices until they break or become incompatible with new software requirements.

Where device spending is increasing: specialized AI hardware. Companies are buying faster laptops or workstations with better graphics processing for employees working on AI projects. But this is a small percentage of total device spending.

Device spending is also affected by remote work maturity. Five years ago, companies were buying laptops to support remote workers transitioning to home offices. Now that's settled. Device spending normalizes as the transition completes.

Geopolitical Forces Reshaping IT Budgets

Here's something that doesn't make it into most IT strategy conversations: your technology spending is increasingly determined by where you're located and which governments regulate your business.

Europe is facing regulatory pressure, competition between countries, geopolitical tensions, and national security concerns. The goal: make sure Europe can develop and manage AI systems without depending on American platforms or providers.

This isn't abstract policy discussion. It's creating real spending mandates. Organizations operating in Europe are being pushed toward European cloud providers, European AI platforms, and European data storage infrastructure. The economics don't always make sense. But the regulatory pressure does.

The numbers illustrate how significant this is. Gartner expects 35% of countries to be locked into region-specific AI platforms by 2026, up from just 5% today. That's a sevenfold increase in regional lockdown in just a few years.

What does regional lockdown mean in practice? If your organization operates in multiple regions, you can't use a single, globally optimized AI platform anymore. You need separate instances in different regions. That's infrastructure duplication. That's higher costs. That's complexity.

Some of this makes sense from a security perspective. Data sovereignty is a legitimate concern. Keeping customer data local in customer countries protects privacy. Some of this is about building competitive advantages for regional tech companies. Either way, companies are spending more money as a result.

This trend is particularly pronounced in Europe, but it's global. China has been doing this for years. India is starting to push for regional AI platforms. Even Japan is expressing interest in ensuring AI capabilities remain locally controlled.

The spending implications are enormous. Organizations need to maintain infrastructure in every region where they operate. They need to invest in regional technical expertise. They need to handle data replication, synchronization, and eventual migration if policies change. All of this costs money.

For organizations planning IT budgets, this is a critical wildcard. You can't just plan for global infrastructure anymore. You need to plan for regional complexity and accept higher costs as a result.

AI spending, particularly in Europe, is expected to be the largest driver of IT spending growth in 2026, contributing significantly more than price increases and real volume growth. Estimated data.

Price Inflation: The Hidden Multiplier Nobody Talks About

Here's something Gartner analysts mentioned that deserves much more attention than it typically gets: price increases are artificially inflating IT spending growth figures.

What this means in plain English: when analysts say IT spending is growing 11.1%, part of that growth isn't organizations buying more technology. Part of it is organizations paying more for the same technology.

This distinction matters for several reasons. If you're projecting IT budgets for your organization, knowing what portion of growth is price inflation versus real volume growth changes your planning. If you're evaluating vendors, understanding price inflation helps you negotiate better.

Where are price increases happening most aggressively? Everywhere, but especially in categories where vendors have market power.

Cloud Infrastructure Pricing

Major cloud providers have been raising prices. Some increases are from higher compute costs, especially for GPU-heavy workloads. Some are from bundling new security services into existing products and charging for the bundle. Some are just vendor strategy: cloud is now essential, so providers have pricing power.

Organizations are starting to push back. They're multi-clouding specifically to reduce vendor lock-in and negotiate better. They're moving workloads to cheaper cloud providers for non-critical applications. They're using reserved instances more aggressively to lock in lower prices.

But they can't escape cloud costs entirely. Cloud is now infrastructure, like electricity. You negotiate hard, but you ultimately accept the prices because the alternative is building your own data centers, which costs more.

Software Licensing Increases

Enterprise software vendors have been hiking prices aggressively. Some justify increases by adding AI features. Others are just raising prices because customers haven't pushed back hard enough.

Many organizations have become more vendor-aggressive in response. They're consolidating licenses, negotiating multi-year deals for discounts, and evaluating open-source alternatives more seriously.

But for mission-critical software, organizations accept price increases because switching costs are too high.

Data Center Costs

Electricity prices have increased substantially in many regions. Data center operators are passing these costs through to customers. Additionally, AI workloads consume more power than traditional computing, which compounds the price pressure.

Security and Compliance Services

As regulations multiply, compliance costs increase. Organizations need more security professionals, more specialized tools, and more consulting support. This is partly technology advancement but largely regulatory complexity.

AI Spending Acceleration: The 78.2% Growth Story

Generative AI spending in Europe is projected to rise 78.2% in 2026. That's not a typo. That's a 78.2% increase in a single year for a single region.

To put that in context, total IT spending is growing 11.1%. AI spending is growing more than seven times faster than overall IT spending. That's astonishing acceleration in a new category.

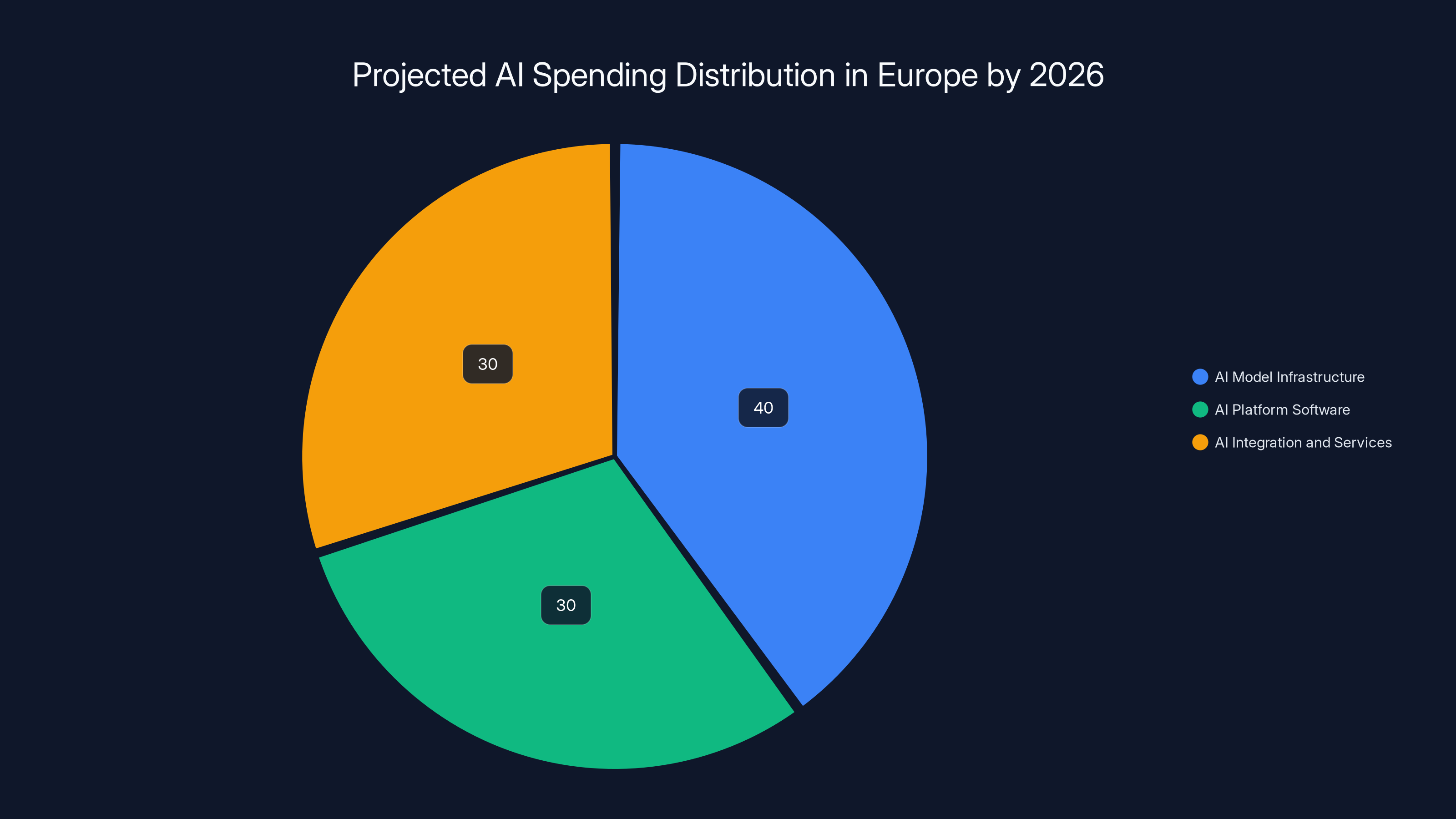

Where is this AI spending going? Several buckets:

AI Model Infrastructure

Companies are building infrastructure specifically to run large language models. This includes GPU servers, networking to connect those servers efficiently, and storage to handle the massive datasets that feed AI training.

This isn't theoretical. It's concrete hardware spending. Companies are buying H100 chips from Nvidia at premium prices. They're building specialized data centers to house these chips. They're installing power delivery systems robust enough to support power-hungry GPU clusters.

This spending will continue through 2026 and beyond. The cost of training and deploying large language models is still increasing faster than efficiency improvements are reducing those costs.

AI Platform Software

Beyond hardware, organizations are paying for AI platforms and services. This includes cloud-based AI services, specialized AI development platforms, and managed AI services.

Azure Open AI Services, Amazon Sage Maker, and Google Cloud Vertex AI are all ramping. Organizations are paying for API access to large language models. They're paying for fine-tuning services. They're paying for consulting to help them integrate AI into existing systems.

This category will see continued growth, though pricing pressure might develop as competition increases and organizations become more sophisticated about optimizing AI costs.

AI Integration and Services

This is where the real money is: paying people to make AI work in actual business contexts.

It's one thing to have access to Chat GPT or other large language models. It's another thing to actually use them in ways that deliver business value. That requires prompt engineering, workflow integration, security configuration, and ongoing optimization.

Most organizations aren't good at this yet. They need consultants who understand both their business and AI capabilities. They need to build internal expertise. They need to experiment extensively before knowing which AI applications are worth scaling.

All of this requires service spending, which is expensive and labor-intensive. This is where organizations will spend heavily through 2026 and beyond.

AI Cybersecurity

AI introduces new security challenges. Models can be attacked. Training data can be stolen. AI systems can be fooled into producing harmful outputs. Organizations need new security tools, training, and expertise to manage these risks.

Cybersecurity spending is already growing as a category. When you add AI-specific security concerns, that growth accelerates.

Estimated data shows that a significant portion (6.5%) of the 11.1% IT spending growth is due to price inflation, leaving only 4.6% as real volume growth.

Cloud and Cybersecurity: The Non-Negotiable Budgets

Despite tight budgets and limited headcount growth, companies are continuing to invest aggressively in cloud and cybersecurity. This is strategic: even when IT budgets are constrained, these categories continue to receive funding.

Why? Because the business consequences of getting them wrong are severe.

Cloud: Necessary But Expensive

Cloud adoption has become non-negotiable for most organizations. You can't build modern applications without cloud infrastructure. You can't enable remote work without cloud services. You can't compete with organizations that have cloud agility if you're locked into on-premises infrastructure.

But cloud has become expensive, especially as workloads mature and cloud consumption scales. Organizations are spending more on cloud every year, not because they're expanding capacity recklessly but because that's the nature of distributed applications: they consume more resources than we predict.

The response hasn't been to cut cloud spending. It's been to optimize cloud usage, negotiate better rates, and implement cloud cost management tools. But cloud spending continues to grow even as organizations become more cost-conscious.

Gartner expects public cloud spending to grow 24% in 2026, driven largely by regional infrastructure requirements. This is a significant growth category that shows no signs of slowing.

Cybersecurity: Fear-Driven Spending

Cybersecurity spending is driven by fear. Fear of breaches. Fear of ransomware. Fear of new threats. Fear of regulations.

This fear is justified. Breach costs are increasing. Regulatory penalties are increasing. Ransomware attacks are becoming more sophisticated. Organizations feel forced to spend on cybersecurity even when other budgets get cut.

What's changing in the cybersecurity budget? Shift toward more sophisticated tools and services. Organizations are moving beyond simple firewalls and antivirus toward behavioral analysis, threat hunting, incident response capabilities, and managed security services.

AI is becoming a tool within cybersecurity. Organizations are using AI to detect anomalies, predict attacks, and respond to threats faster. But they're also worried about AI systems themselves becoming attack targets.

This creates a vicious cycle: new threats drive security spending, which then drives spending on tools to secure the security infrastructure. Cybersecurity becomes increasingly complex and expensive.

Budget Constraints Meeting Expensive Priorities

Here's the tension that defines IT spending in 2026: budgets are constrained, but priorities are expensive.

Companies aren't hiring at rates that match IT needs. Many organizations have actually reduced IT headcount over the past few years. Yet the technology they need to run is more complex. AI is new. Cloud is everywhere. Cybersecurity is critical. Data volumes are exploding.

So what happens? Organizations try to do more with less. They implement automation to reduce manual work. They outsource tasks to service providers. They buy tools that promise to increase productivity.

This creates artificial demand for productivity tools, automation platforms, and consulting services. Some of this is genuine value creation. Some of it is buying solutions to problems created by understaffing.

Consulting spending specifically tends to spike when organizations are under-resourced but have important projects. This is visible in the IT services growth projections.

Estimated data shows AI spending in Europe by 2026 will be distributed across infrastructure (40%), platform software (30%), and integration services (30%). This reflects the comprehensive investment in both hardware and software to support AI growth.

The Growth-Not-Efficiency Paradox

Here's something counterintuitive: AI spending is increasingly driven by growth goals, not efficiency goals.

Traditional IT spending has been about efficiency. Virtualization was supposed to let you do more with less hardware. Cloud was supposed to reduce data center costs. Automation was supposed to reduce manual work.

AI is different. Organizations are investing in AI not to become more efficient but to access new capabilities and create new products.

This changes the spending dynamic. Efficiency-focused projects get scrutinized heavily. You need to show ROI: we spend

Growth-focused projects get more lenient evaluation. We spend

AI projects are mostly growth-focused. That's why spending continues despite mixed results. Organizations believe AI could unlock significant competitive advantages. They're willing to spend now even if early projects don't pay off, because they're optimizing for long-term positioning, not short-term returns.

This growth mindset is also why AI spending is growing faster than overall IT spending. Organizations are willing to reallocate budget from efficiency projects to growth projects.

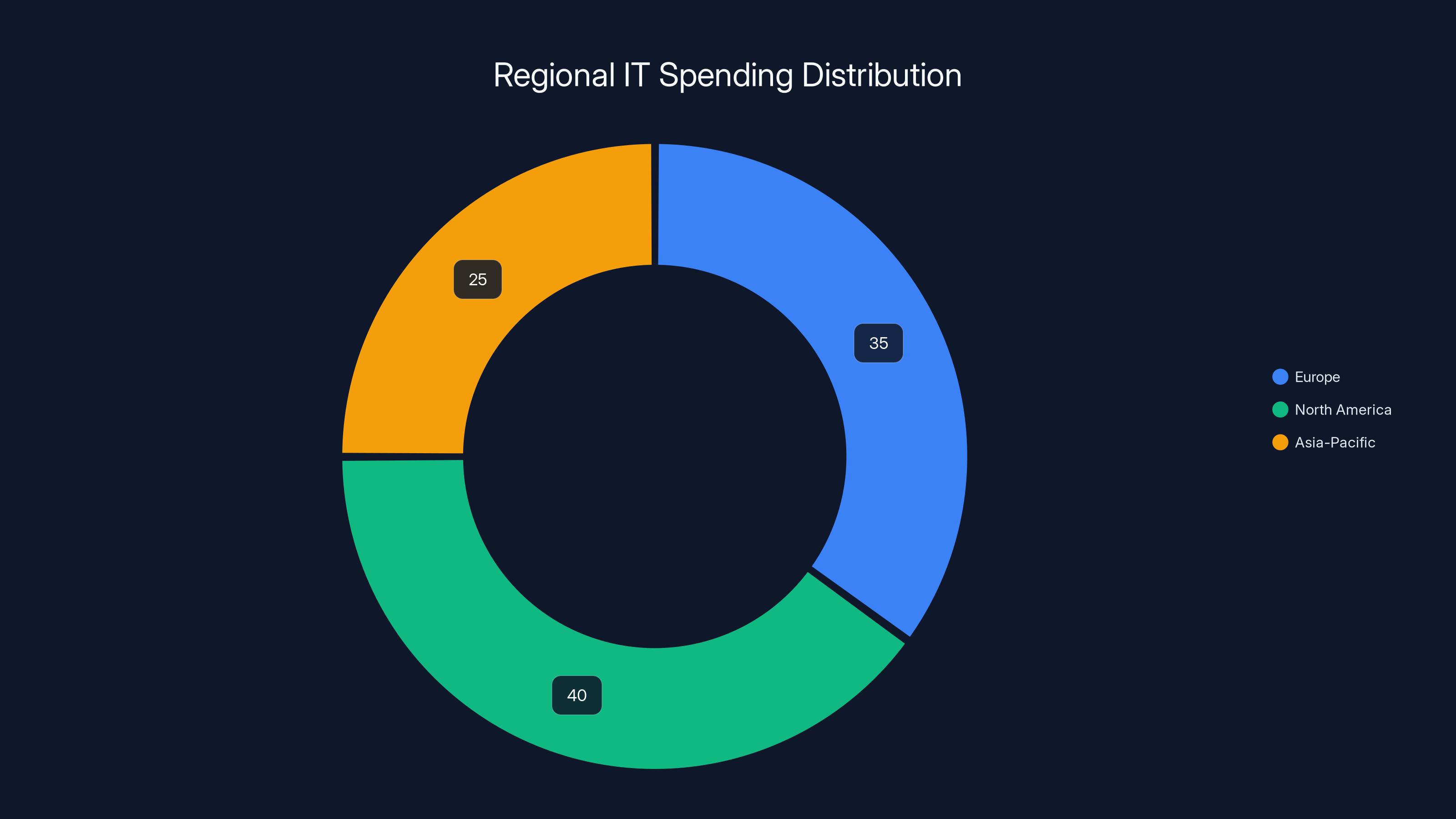

Regional Variations in IT Spending

The $1.43 trillion figure is global, but spending patterns vary significantly by region.

Europe: Regulatory-Driven Spending

Europe is spending more on IT infrastructure specifically to satisfy regulatory requirements and achieve technological sovereignty. Regional data centers, local AI platforms, and European cloud infrastructure are all premium costs.

European organizations are also spending more on compliance infrastructure. GDPR compliance alone created new spending categories that didn't exist before. If upcoming regulations require organizations to keep AI systems locally developed, that drives more infrastructure investment.

The 24% growth in public cloud spending in Europe is significantly influenced by regional requirements, not just general cloud adoption.

North America: Market-Driven Spending

US and Canadian organizations are spending based more on competitive dynamics than regulatory requirements. They're investing in AI and cloud because competitors are, and they don't want to fall behind.

Regulatory pressure exists but is less dominant than in Europe. This means more organizations can optimize for cost and efficiency, though fear-driven spending (especially cybersecurity) remains high.

Asia-Pacific: Mixed Dynamics

Regions like Singapore, Australia, and others are experiencing growth from cloud adoption, AI deployment, and increasing cybersecurity requirements. Regional compliance requirements similar to Europe are emerging.

Estimated data shows North America leading in IT spending at 40%, followed by Europe at 35%, and Asia-Pacific at 25%. This reflects regional priorities like regulatory compliance in Europe and competitive dynamics in North America.

Predicting IT Spending Trends Beyond 2026

If you're planning beyond 2026, some trends seem likely to continue:

AI commoditization will reduce price premium spending: As AI platforms mature and competition increases, organizations will negotiate better prices. The 78.2% AI spending growth probably won't be sustainable beyond 2026. Growth will moderate to something closer to general IT growth rates, maybe 15-20% annually.

Regional infrastructure duplication will normalize costs: Initially, building regional infrastructure is expensive. As organizations complete regional buildouts, the spending growth will slow. Maintenance costs will eventually replace buildout costs.

Cybersecurity spending continues upward: Threats keep evolving. Regulations keep expanding. Cybersecurity spending will probably remain one of the fastest-growing categories.

IT services spending grows as organizations mature: Early AI deployments relied on internal expertise. As AI scales, organizations will increasingly buy specialized services rather than building expertise internally. IT services spending will probably exceed software spending eventually.

Consolidation reduces overall software spending: Consolidating vendors and eliminating redundant tools could slow software spending growth even as individual tool prices increase.

How Organizations Should Respond to Rising IT Costs

If you're planning IT budgets for 2026 and beyond, several strategies can help manage rising costs while maintaining competitive capabilities:

Ruthless Vendor Consolidation

Have an inventory of all the software, cloud services, and support contracts your organization is paying for. You'll probably find overlap, redundancy, and abandoned tools still in contracts. Consolidating vendors reduces cost and complexity.

Prioritize High-ROI AI Initiatives

Not all AI spending is equal. Some AI initiatives deliver clear ROI. Others are experimental. Prioritize the former. Be disciplined about terminating the latter when they don't deliver results.

Invest in Cloud Cost Optimization

Cloud costs are typically 20-30% higher than they need to be due to poor resource allocation, inefficient queries, and non-optimized configurations. Hiring a cloud cost specialist might seem like an expense until you realize they save five times their salary annually.

Build Internal Expertise Over Time

Consulting is expensive. Building internal expertise is an investment that pays off over time. Start with consultants to jumpstart capability, then transition toward building internal expertise.

Negotiate Aggressively

Vendors have pricing power, but only if you let them. Get competitive bids. Use multi-year commitments to negotiate discounts. Threaten to migrate to competitors. Most vendors will negotiate if they think they'll lose your business.

Plan for Regional Complexity

If you operate in multiple regions, plan for infrastructure duplication costs. Build this into budgets explicitly rather than discovering it unexpectedly.

The Real Story Behind the Numbers

That $1.43 trillion in IT spending isn't just a big number. It's a story about how organizations are responding to technological change, regulatory pressure, competitive dynamics, and economic constraints.

Some of that spending is smart investment in capabilities that drive competitive advantage. Some of it is necessary infrastructure maintenance. Some of it is exploratory spending on technology that might not work out. Some of it is price inflation that has nothing to do with real value creation.

The challenge for technology leaders is separating the smart spending from the wasteful spending. That requires understanding where each dollar is going and why. It requires evaluating vendors critically. It requires saying no to initiatives that don't deliver value.

The organizations that will succeed in this environment are the ones that spend deliberately and strategically. They'll consolidate vendors. They'll evaluate AI initiatives critically. They'll invest in both capability and efficiency. They'll negotiate ruthlessly.

The organizations that will struggle are the ones that spend reactively. They'll implement every new technology that gets hyped. They'll maintain relationships with vendors who overcharge. They'll fund initiatives that don't deliver results. They'll end up spending more and getting less in return.

FAQ

What is driving the 11.1% increase in IT spending in 2026?

The increase is driven primarily by three factors: AI deployment and generative AI models becoming essential infrastructure, cloud infrastructure expansion (especially for regional compliance), and cybersecurity investments. However, a significant portion of the growth is price inflation rather than increased volumes. Organizations are paying more for similar amounts of technology due to vendor price increases, especially in cloud services and software licensing.

Why is AI spending growing seven times faster than overall IT spending?

AI is viewed as a growth opportunity rather than an efficiency play. Organizations are willing to spend aggressively on AI even with uncertain ROI because they believe it could unlock significant competitive advantages and enable new products. This growth mindset is different from traditional IT spending, which focuses on efficiency and clear ROI. Additionally, AI infrastructure requires new categories of expensive hardware (GPUs) and specialized consulting services.

How much of the IT spending growth is from price inflation versus actual volume increases?

Gartner analysts specifically note that price increases are artificially inflating the headline growth figures, suggesting that real volume growth is lower than the 11.1% projection. Cloud providers have raised prices substantially. Software vendors have bundled new services and increased licensing costs. Data center operators have passed through electricity cost increases. The actual volume growth is likely closer to 7-8% when pricing effects are removed.

What does the shift to regional AI platforms mean for IT budgets?

Gartner expects 35% of countries to be locked into region-specific AI platforms by 2026, up from 5% today. This means organizations operating in multiple regions must maintain separate infrastructure instances in different regions, creating duplication costs. Public cloud spending is expected to grow 24% in 2026 due partly to this regional infrastructure requirement. Organizations need to budget for higher infrastructure complexity and costs rather than leveraging a single global platform.

Which IT spending categories are growing fastest?

Data center systems are growing fastest at 18.8% year-over-year, driven by organizations buying GPU hardware for AI workloads. Generative AI spending is growing fastest in Europe at 78.2% annually. However, IT services represents the largest overall spending category because transformation and integration require specialized human expertise. Cloud spending is growing 24% due to regional expansion and AI infrastructure needs.

Why are organizations continuing to invest in cybersecurity despite tight budgets?

Cybersecurity is fear-driven spending. Organizations feel forced to invest in cybersecurity because the consequences of getting it wrong are severe. Breach costs are increasing. Regulatory penalties are expanding. Ransomware attacks are becoming more sophisticated. Additionally, AI introduces new security challenges, creating new spending categories. Cybersecurity is treated as non-negotiable even when other budgets face constraints.

How should organizations manage rising IT costs?

Effective strategies include ruthless vendor consolidation to eliminate redundancy, prioritizing high-ROI AI initiatives and terminating experiments that don't deliver results, investing in cloud cost optimization (which typically reveals 20-30% cost reduction opportunities), building internal expertise over time to reduce consulting costs, negotiating aggressively with vendors using competitive alternatives, and explicitly planning for regional infrastructure complexity in budgets rather than discovering these costs later.

What is the difference between growth-focused and efficiency-focused IT spending?

Efficiency-focused spending is evaluated based on clear ROI: spending

Looking Ahead: What 2026 Really Means

That $1.43 trillion in IT spending represents an inflection point. Organizations are doubling down on technology as competitive strategy, not just operational necessity. AI, cloud, and cybersecurity aren't nice-to-haves anymore. They're essential.

But the spending is inefficient in many ways. Price inflation is padding the numbers. Some AI spending produces limited returns. Regional complexity is driving costs higher than they need to be.

The organizations that win in this environment will be the ones that spend strategically and critically evaluate every investment. They'll optimize ruthlessly. They'll negotiate aggressively. They'll build capabilities over time rather than buying everything as a service.

The $1.43 trillion isn't a prediction of business success. It's a challenge to spending more wisely.

Key Takeaways

- Global IT spending reaches $1.43 trillion in 2026, growing 11.1% year-over-year, with significant portions driven by AI, cloud, and cybersecurity investments

- Generative AI spending in Europe accelerates at 78.2% annually, seven times faster than overall IT spending, reshaping budget allocation across organizations

- Price inflation artificially inflates growth figures, suggesting real volume growth closer to 7-8% rather than the headline 11.1%

- Regional compliance requirements force 35% of countries to lock into region-specific AI platforms by 2026, up from 5% today, driving infrastructure duplication costs

- IT Services dominates spending at $380B while Data Center Systems shows fastest growth at 18.8%, driven by AI workload GPU hardware demands

- Organizations must adopt ruthless cost management strategies including vendor consolidation, cloud optimization, and prioritization of high-ROI AI initiatives

Related Articles

- AI Bubble Myth: Understanding 3 Distinct Layers & Timelines

- Rackspace Email Hosting Price Hike: What It Means for Businesses [2026]

- OpenAI Ads in ChatGPT: Why Free AI Just Got Monetized [2025]

- Why Apple Chose Google Gemini for Next-Gen Siri [2025]

- US 25% Tariff on Nvidia H200 AI Chips to China [2025]

- Wikipedia AI Licensing Deals: How Big Tech Is Paying for Knowledge [2025]

![IT Spending Hits $1.4 Trillion in 2026: Where Money Really Goes [2025]](https://tryrunable.com/blog/it-spending-hits-1-4-trillion-in-2026-where-money-really-goe/image-1-1768822603866.jpg)