Amazon Officially Dethroned Walmart as America's Largest Company [2025]

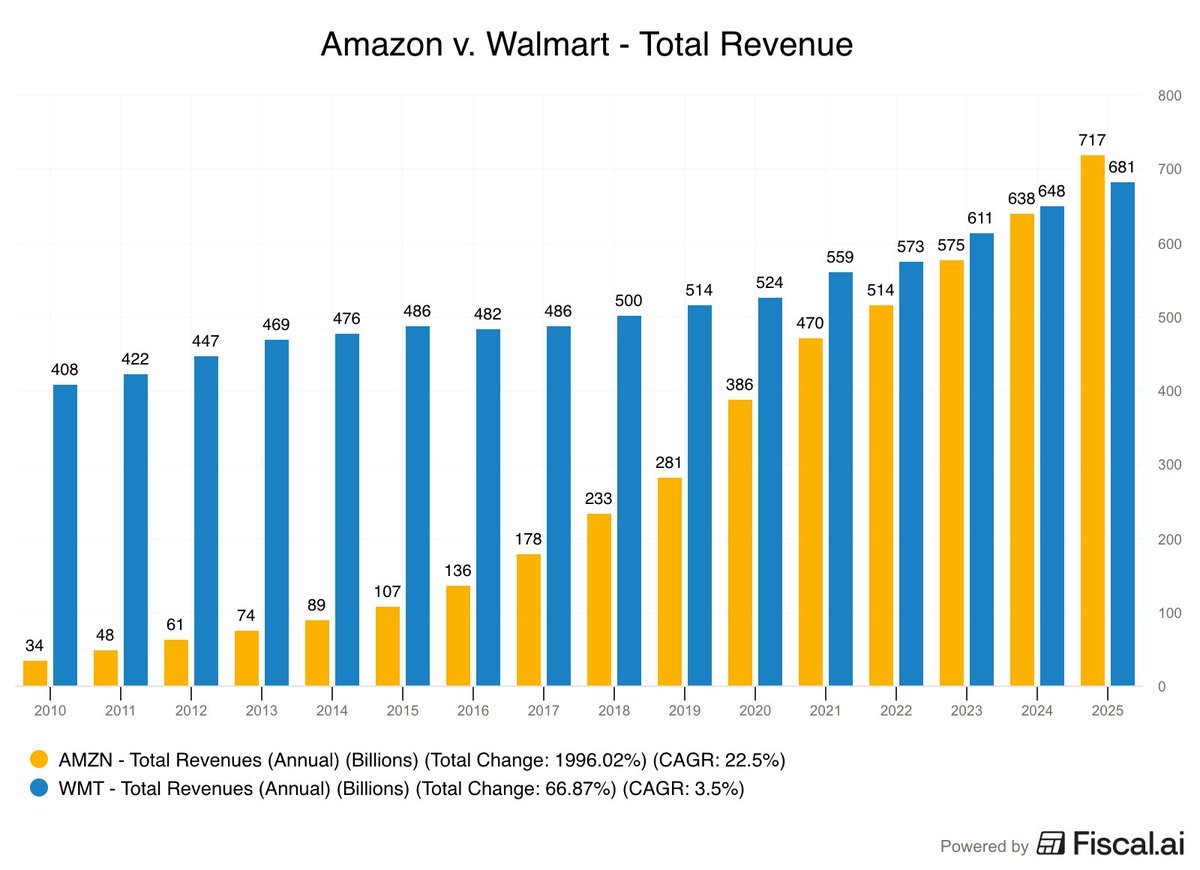

For the first time in 13 years, America's retail landscape shifted. Amazon crossed a threshold that seemed impossible just a decade ago. The company that started in a garage selling books online now generates more revenue than the enterprise that built modern retail itself.

On paper, the victory looks razor-thin. Four billion dollars separated the two giants in 2025. Amazon pulled in

The path here wasn't linear. For over a decade, Walmart held the crown. The retail behemoth that revolutionized supply chain efficiency seemed untouchable. Then Amazon did something counterintuitive. Instead of just winning at e-commerce, it built multiple revenue engines simultaneously. Cloud computing. Advertising. Marketplace services. Logistics infrastructure.

Walmart fought back, but with a different playbook. They leaned into store traffic, physical presence, and a loyalty base that shop at their locations out of habit and convenience. They invested in AI-powered shopping assistants. They partnered with third-party sellers. They tried to compete on the same terms as Amazon. But they're still a retailer at heart. Amazon became something else entirely.

This article breaks down what actually happened, why it matters beyond the headline, and where both companies go from here. Because this victory is just the beginning for Amazon. And Walmart's response will define retail for the next decade.

TL; DR

- Revenue Reversal: Amazon generated 4 billion more than Walmart's $713 billion, marking the first time Amazon held the #1 position as reported by Yahoo Finance.

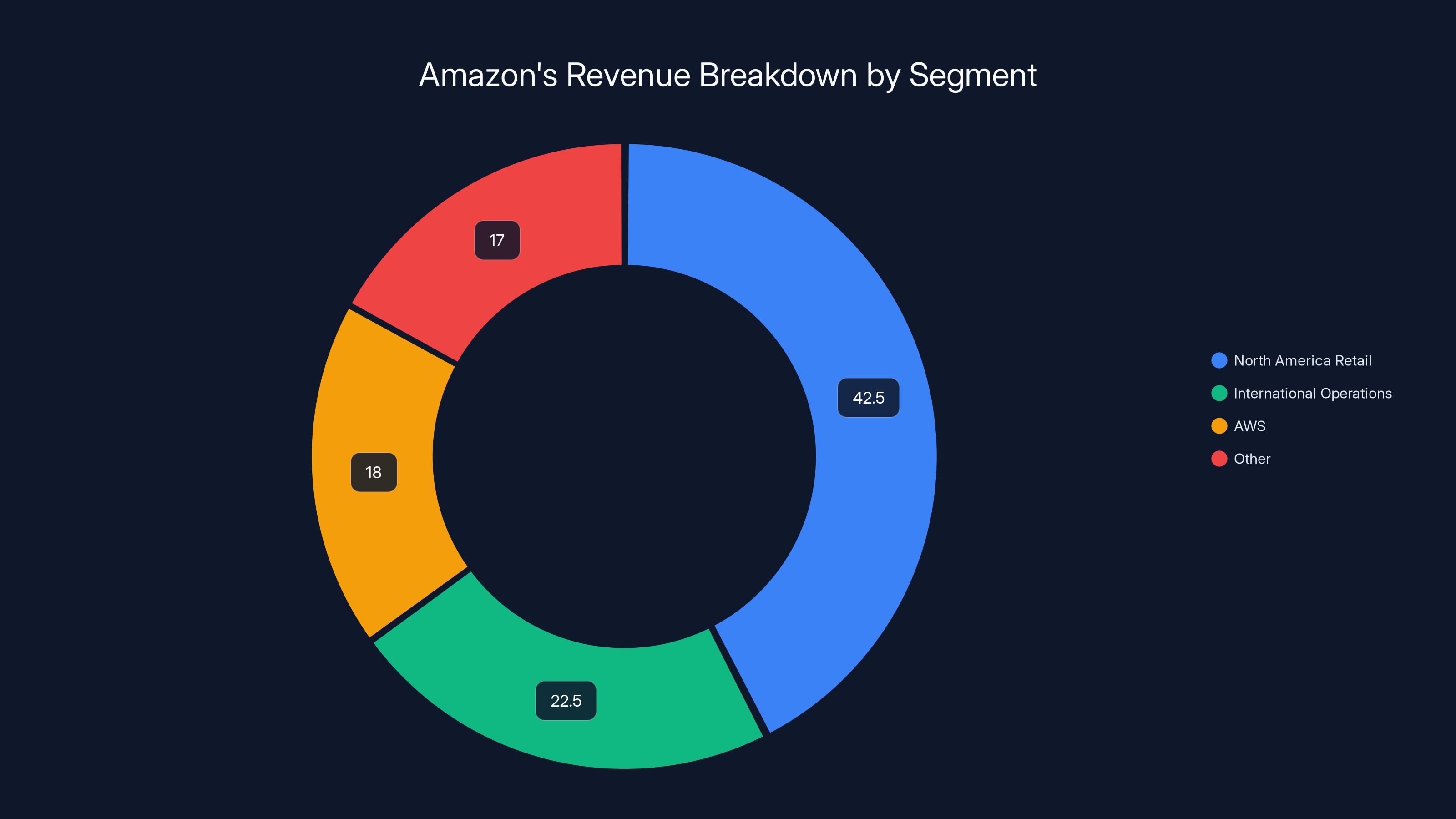

- Model Divergence: 90% of Walmart's revenue comes from traditional retail, while Amazon's revenue streams span e-commerce, AWS cloud services (18% of total), advertising, and seller services according to Modern Retail.

- Growth Gap: Amazon is targeting 11-15% year-over-year growth, while Walmart targets 3.5-4.5%, suggesting the gap will likely widen as noted by CNBC.

- AWS Impact: Cloud computing now represents nearly one-fifth of Amazon's revenue, fundamentally changing how investors should evaluate the company as highlighted by Digital Commerce 360.

- Retail Transformation: This marks a definitive shift from traditional retail dominance to platform-based business models as the future of American enterprise according to Fortune.

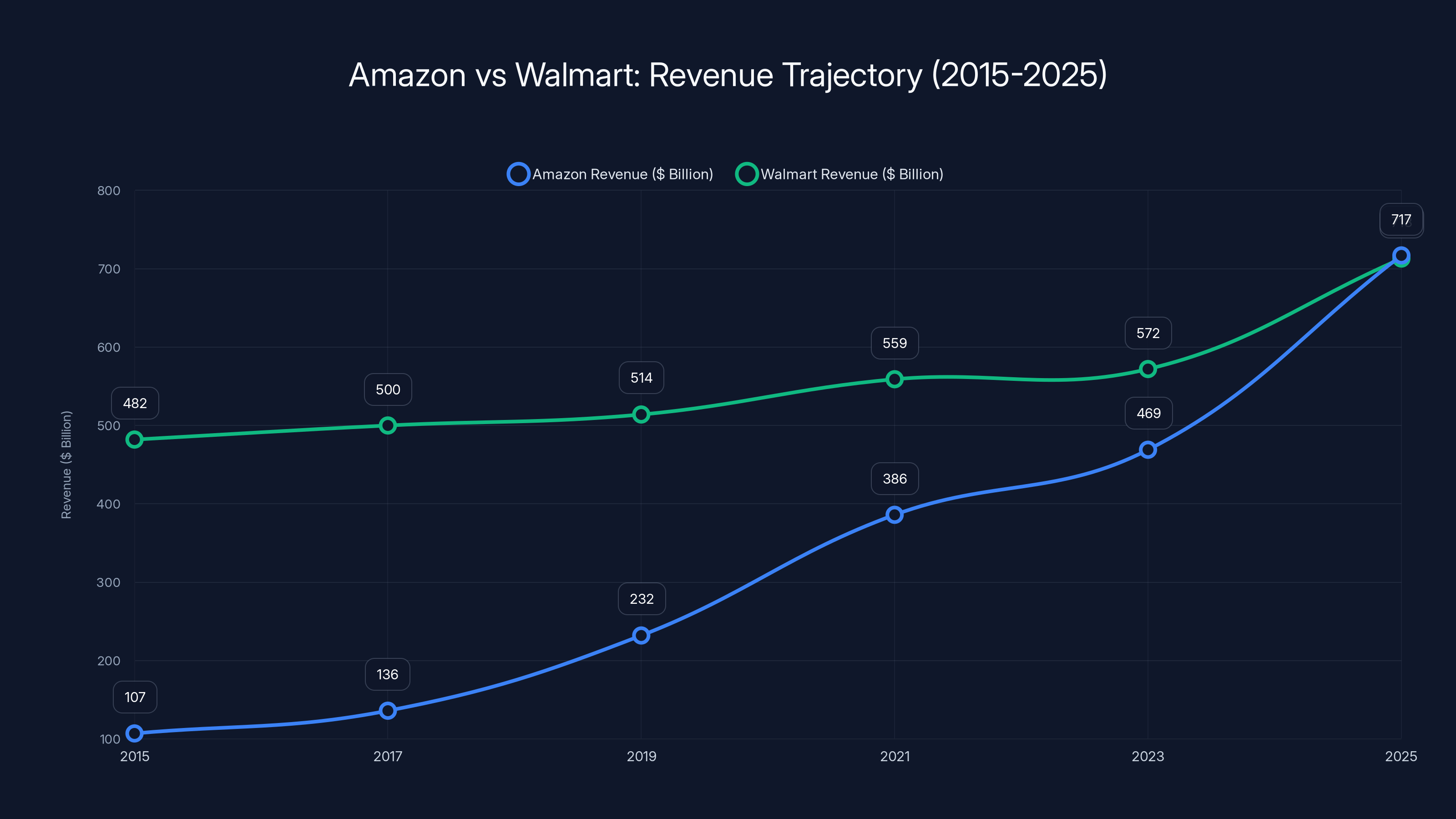

Amazon's revenue trajectory shows a significant rise from 2015 to 2025, surpassing Walmart in 2025. Estimated data highlights Amazon's diverse revenue streams contributing to its growth.

The Historic Moment: How Amazon Climbed to the Top

The Long Competition That Led Here

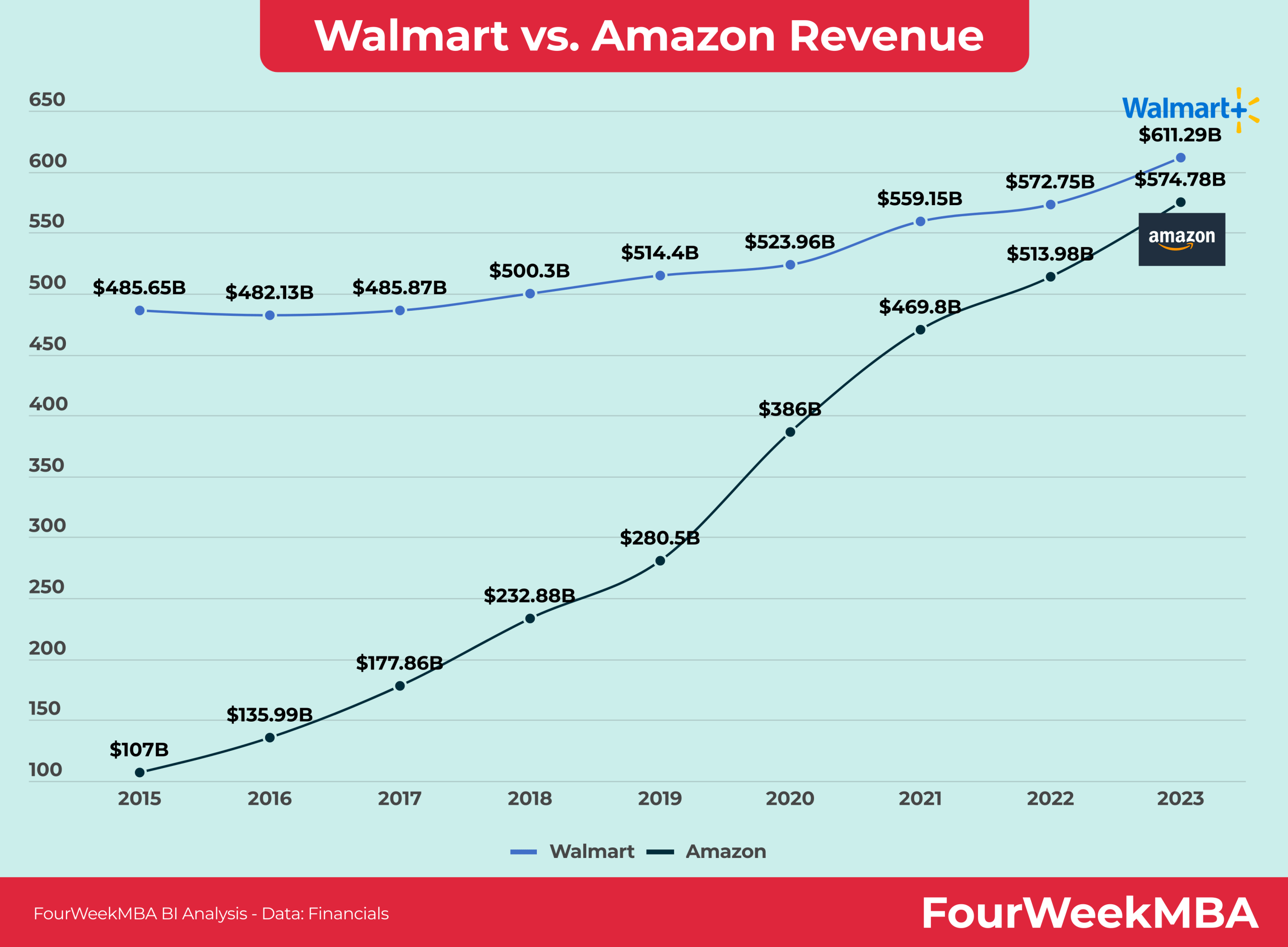

Walmart held the #1 position for 13 consecutive years. That's a long reign. The company practically invented the category of "biggest retailer in America." They built distribution networks that operated like clockwork. They squeezed suppliers with ruthless efficiency. They created low-price culture that shaped consumer expectations for an entire generation.

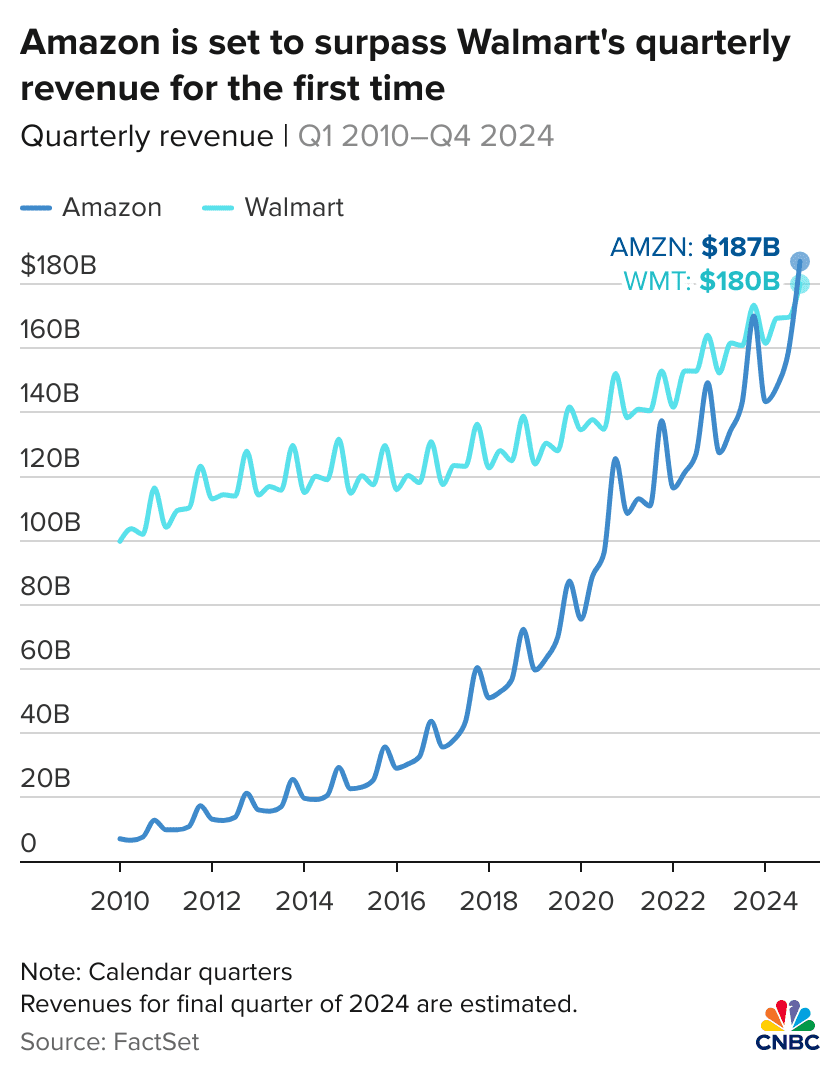

But starting around 2015, something shifted. Amazon's quarterly sales began creeping up. The trajectory was visible if you looked at the right data. By 2023, the gap narrowed dramatically. In 2024, Amazon briefly overtook Walmart in quarterly earnings during peak selling seasons, then fell back. The oscillation became more dramatic year over year.

2025 changed everything. It wasn't a surprise upset. It was the inevitable conclusion of a strategy that started 20 years ago, when Jeff Bezos decided that retail margins were too thin and that infrastructure was where real money lived.

Why the Gap Is Actually Wider Than It Looks

Here's what matters: that $4 billion difference is deceptive. It suggests parity. It suggests these are similar companies competing for the same customers. They're not.

Walmart's $713 billion comes almost entirely from selling merchandise. You buy something at Walmart. Walmart keeps a small percentage of the price. It's the traditional retail model. Effective. Profitable. Limited ceiling.

Amazon's $717 billion? That's organized into four distinct revenue streams, and they operate on completely different economics.

E-commerce and Physical Retail: This is the Walmart equivalent. Maybe $350-400 billion. It looks similar on the surface but operates differently. Amazon accepts lower margins on physical goods because other revenue streams subsidize growth.

Third-Party Seller Services and Marketplace Fees: When a vendor sells on Amazon's platform, Amazon takes a cut. For fulfillment. For storage. For using their logistics network. This generates roughly $150 billion annually and operates at much higher margins than retail as reported by Marketplace Pulse.

AWS Cloud Computing: This is the wedge. In 2025, AWS generated approximately $128 billion in revenue, accounting for nearly 18% of Amazon's total. Cloud infrastructure operates at 30-40% gross margins. This isn't retail economics. This is enterprise software economics according to Modern Retail.

Advertising: Amazon's ad business now rivals Google's in growth rate. Sellers pay to get placement. Brands pay for sponsored products. This is nearly a $50 billion revenue stream with margins approaching 50% as noted by Benzinga.

Walmart has none of this. They don't have an equivalent cloud division. Their advertising business is nascent. Their marketplace is secondary. They're a retailer selling products at retail margins to consumers.

So the revenue gap of $4 billion masks a profitability gap that's probably 10 times larger. Amazon makes more per dollar of revenue. Amazon can spend more on innovation. Amazon can afford to lose money on retail to gain share because other divisions bankroll the strategy.

The Quarterly Performance That Set This Up

The decisive moment came in Q4 2024, heading into the 2025 fiscal year. Amazon's reported revenue growth hit 11-15% ranges. Walmart managed 3-4%. That velocity difference compounds as highlighted by CNBC.

During the crucial shopping seasons, when retail typically dominates, Amazon's diversified model meant it could absorb slow retail periods with booming AWS quarters or ad sales. Walmart's retail sensitivity meant good quarters were dependent on consumer spending that didn't always materialize.

By mid-2025, the crossing was inevitable. Amazon didn't just pass Walmart. It became clear Amazon wouldn't look back.

Amazon's revenue is primarily driven by North America Retail (42.5%) and AWS (18%), with International Operations contributing 22.5%. Estimated data based on provided ranges.

The Revenue Breakdown: Where Each Dollar Comes From

Amazon's Four Pillars of Revenue

North America Retail Operations (40-45% of revenue)

Amazon's core business still looks like retail. Customers visit the website. They buy products. Amazon ships them. But the economics are different from Walmart's equivalent division.

First, Amazon accepts lower profit margins on physical goods. A 5% margin on

Second, the retail division is increasingly powered by marketplace sellers, not just Amazon's own inventory. This reduces holding costs and inventory risk. Amazon essentially rents shelf space to third-party sellers in exchange for a fee.

Third, retail drives logistics infrastructure investments that reduce costs across all divisions. If Amazon is already running a delivery truck through a neighborhood, the marginal cost of an AWS executive's dinner delivery is nearly zero.

International Operations (20-25% of revenue)

This segment grew 13% in 2025, faster than North America. International markets like Germany, Japan, India, and the UK are still in growth phase. They're not yet profitable. But they're establishing beachheads that will compound for decades.

Walmart's international operations are similarly sized, but they're struggling. Walmart International has been a drag on profitability for years. In some markets, Walmart retreated entirely. Amazon is still expanding, taking short-term losses for long-term position as reported by Digital Commerce 360.

AWS (18% of revenue, 40%+ of operating profit)

This is the secret weapon. AWS alone generates $128 billion in annual revenue. For context, that makes AWS bigger than Kraft Heinz or McDonald's. As a standalone company, AWS would be in the Fortune 50.

In 2025, AWS grew 20% year-over-year. That's growth velocity that dwarfs retail. Data centers, generative AI, enterprise adoption, cloud migration, storage services, database services—AWS is embedded in the infrastructure of modern enterprise as noted by Modern Retail.

Microsoft has Azure. Google has Google Cloud. But AWS arrived first, owns the most market share, and has achieved profitability that subsidizes Amazon's retail ambitions. Many analysts argue Amazon's stock should be valued as a software company with a retail division, not the reverse.

Advertising and Other Services (8-10% of revenue)

Amazon Advertising is the youngest major revenue stream but growing the fastest. When you search for "running shoes" on Amazon, the first results are sponsored. Brands bid for that placement. Amazon captures the spread.

Brand owners realize that advertising on Amazon reaches customers at the moment of purchase intent. On Google, you're advertising to someone thinking about buying. On Amazon, you're advertising to someone already shopping. Intent is closer to action. Conversion rates are higher. Ad prices reflect that efficiency.

In 2025, Amazon Advertising exceeded $50 billion in annual run rate. It's growing 30%+ year-over-year. Within five years, it could become Amazon's second-largest profit center after AWS as highlighted by Benzinga.

Walmart's Revenue Reality Check

Walmart's $713 billion in revenue breaks down more simply.

Walmart US Operations: Approximately

Walmart International: Approximately $150 billion. These are Walmart stores in Mexico, Canada, UK, Japan, and other markets. Many are struggling. Walmart has closed operations in several countries. International margins are lower than US operations as reported by Intellectia.

Sam's Club (Membership Warehouse): Approximately $100 billion. This is higher margin than traditional retail, maybe 4-5%, because members pay annual fees that increase profitability.

Walmart Marketplace and Services: Approximately $50-60 billion. This is Walmart's attempt to replicate Amazon's playbook. Marketplace vendors. Advertising. But it's still nascent compared to Amazon's equivalent.

The critical difference: roughly 90% of Walmart's revenue is still traditional retail. They haven't diversified effectively. They don't have an AWS equivalent. Their marketplace is smaller and less mature. Their advertising business is smaller. They're still fundamentally a retailer, not a technology platform that also sells stuff.

AWS: The Engine Behind the Throne

How Cloud Computing Changed Everything

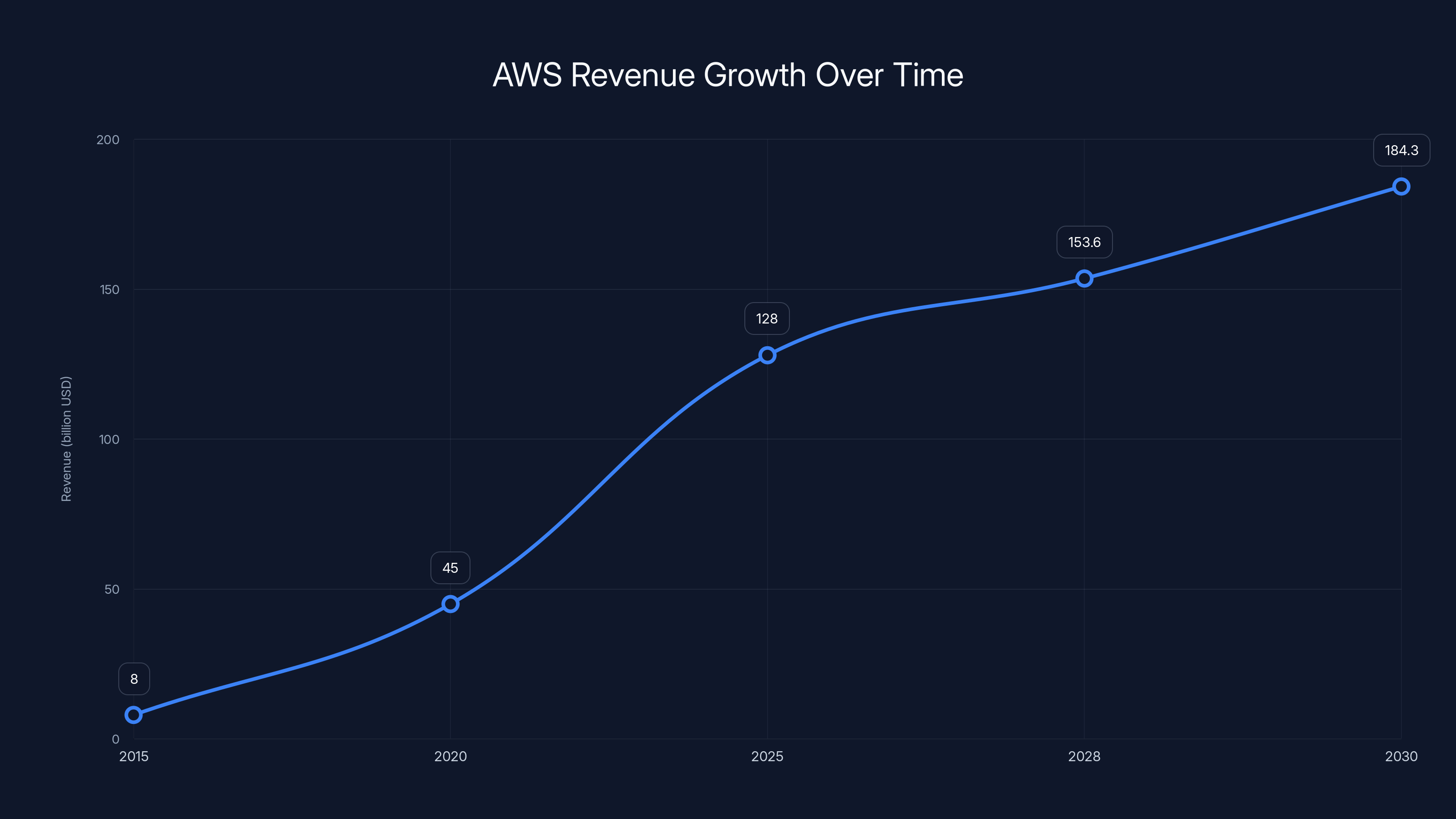

If AWS didn't exist, Amazon wouldn't be #1. This isn't controversial among investors. It's accepted fact.

Here's the math: Amazon's retail business, measured alone, probably operates at 1-2% net margins. That's typical for retail.

AWS changes the equation entirely. Cloud infrastructure is a different animal. It's software economics applied to hardware. High capital upfront. Low marginal costs at scale. Recurring revenue from customers who depend on your service for their operations.

When enterprises migrate to the cloud, they're making a multi-year commitment. A bank that moves its infrastructure to AWS isn't switching next quarter. The switching costs are too high. The architecture is too embedded. That stickiness yields predictable, recurring revenue.

AWS operates at 40%+ gross margins. That's not retail. That's not even close to retail. For every dollar of AWS revenue, Amazon keeps 40+ cents before operating expenses. Compare that to retail's 2-3 cents, and you understand why AWS has been transforming the entire company.

The Numbers That Tell the Story

In 2015, AWS was a $8 billion business. People didn't take it seriously. AWS was a side project. Amazon was a retailer, everyone said.

In 2020, AWS hit $45 billion. Now people paid attention.

In 2025, AWS hit $128 billion. It's 18% of Amazon's revenue but 40%+ of operating profit.

Growth has been accelerating as well. AWS grew 20% in 2025. Retail segments grew 8-10%. If AWS maintains 20% growth and retail maintains 8%, in three years AWS will represent 25% of revenue. In five years, close to 30%.

Most sophisticated investors now evaluate Amazon as a cloud company with retail attached, not the other way around. When you do that math, Amazon's valuation makes sense. When you don't, Amazon seems overvalued. That's the key tension.

The AI Accelerant

Generative AI changed AWS momentum in 2024-2025. Enterprises suddenly needed more compute power. Model training requires GPUs and custom silicon. Inference at scale requires distributed systems. AWS capitalized.

Amazon invested heavily in custom chips, building Trainium for model training and Inferentia for deployment. These are cheaper than NVIDIA GPUs and more efficient for Amazon's workloads. Customers benefit from lower costs. Amazon benefits from margin expansion.

Microsoft has Open AI integrated into Azure. Google has Gemini in Google Cloud. Amazon has custom silicon and a growing portfolio of AI services. Each cloud provider is using AI as both a cost driver (more compute consumption) and a competitive wedge (differentiated services).

For Walmart, none of this exists. They use cloud services. They don't provide them. That's a fundamental strategic difference.

AWS revenue has grown significantly from

The Growth Rate Gap: Why the Lead Will Widen

The Diverging Growth Trajectories

Amazon is targeting 11-15% year-over-year growth going forward. Walmart is targeting 3.5-4.5%. That's not a typo. It's a 3x difference in growth velocity.

This matters more than current revenue. If Company A grows at 3.5% and Company B at 12%, Company B will double its lead in 3 years. In 5 years, Company B will have 2.5x the revenue.

Here's why Amazon can grow faster:

AWS is in Growth Mode: Cloud adoption is still accelerating. Enterprises are still migrating. AWS market share is still expanding. A business at 20% growth is in an expansion phase. It has room to run.

Retail is Mature: Walmart's retail growth is constrained by market saturation. There are only so many US consumers. Walmart already captures the largest share of them. Growth is limited to population growth and market share shifts from competitors. Neither drives high-velocity growth.

International Expansion: Amazon has room to grow in markets where they're underpenetrated. Walmart International is struggling. Amazon International is growing at 13%. That difference compounds.

Advertising is New: Amazon's ad business is less than 10% of Walmart's age. New high-growth businesses are the easiest to scale.

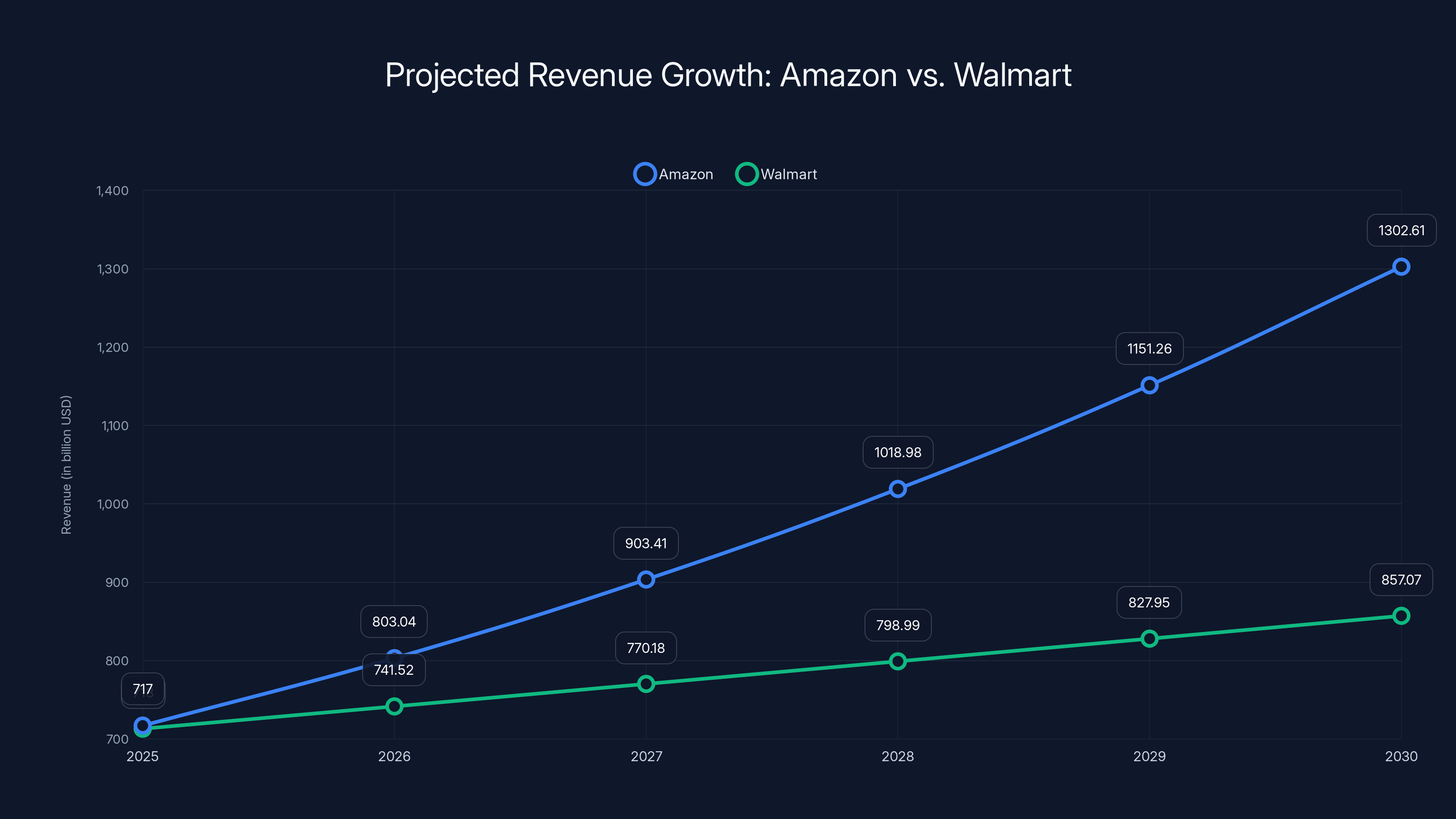

The Mathematics of Compound Growth

Let's project forward using simple compound growth math.

Starting positions (2025):

- Amazon: $717 billion at 12% growth

- Walmart: $713 billion at 4% growth

After 3 years:

- Amazon: 1.008 trillion

- Walmart: 803 billion

The gap grows from

After 5 years:

- Amazon: 1.265 trillion

- Walmart: 868 billion

Amazon is 46% larger. That's not a narrow lead. That's dominant.

These aren't aggressive assumptions. Amazon has hit 12%+ growth in recent years. Walmart's 4% is consistent with current guidance. Small differences in growth rates compound into massive differences in size.

This is why the 2025 crossing matters. It signals that Amazon has the faster business model, the more diversified revenue streams, and the ability to sustain higher growth. Walmart can't match it with traditional retail anymore.

The AI Shopping Assistant Advantage

Walmart's AI Initiative

Walmart invested in AI shopping assistants and agents. They found something remarkable: customers using Walmart's AI assistant spend approximately 35% more per order compared to traditional shopping as reported by Modern Retail.

That's a stunning finding. If a customer normally spends

Walmart is rolling out these AI assistants across their platform. They're integrating them into the mobile app. They're training customer service reps to use them. This is a legitimate competitive advantage. It addresses a key weakness: helping customers find what they need and discover products they didn't know they wanted.

Amazon's AI Strategy

Amazon built its own AI shopping agent, but it faced an interesting obstacle. Amazon itself wanted to block Chat GPT shopping agents. The company realized that third-party AI chatbots could redirect customer traffic away from Amazon's platform.

So Amazon did what dominant platforms do: they built their own equivalent. Amazon's AI assistant integrates with your purchase history, your preferences, your searches. It can answer product questions. It can make recommendations. It can facilitate transactions.

The advantage Amazon has: data depth. Amazon knows your entire purchase history across all categories. Walmart knows your purchases at Walmart, but not your grocery spending at other retailers, or your electronics purchases elsewhere. Amazon's personalization engine is more sophisticated because it has more data.

Second, Amazon's AI integrates with AWS's Bedrock platform. This means Amazon can continuously improve the model. Walmart depends on third-party AI providers to some extent. Amazon controls the stack.

The Bigger Implication

Both companies using AI shopping assistants signals a shift in retail competition. It's no longer about price or selection. It's about AI augmentation of human decision-making. The company that gets AI recommendations right wins customer preference. That drives more purchases. More data. Better models. Increasing advantage.

This is a form of competitive moat that's different from logistics networks or store density. It's algorithmic. Once you have better models, the advantage is durable.

Amazon's advantage here is probably bigger than advertised because Amazon has better underlying data and infrastructure. That compounds over time.

Amazon's projected revenue grows significantly faster than Walmart's due to higher growth rates, widening the revenue gap from

Revenue Diversification: The Strategic Difference

Why Multiple Revenue Streams Matter

When 90% of your revenue comes from a single source (as with Walmart and retail), your business is inherently constrained. Volatility in that source impacts everything. Slower consumer spending? Your entire company slows. Economic downturn? Revenue plummets. Competition intensifies? Margins compress.

When revenue comes from multiple sources with different growth rates and profit margins, you've built a more resilient business. Bad news in one segment is offset by good news in another. A down retail quarter is masked by a strong AWS quarter.

Amazon's diversification also allows strategic thinking that Walmart can't access. Amazon can afford to lose money on retail for years because AWS funds the strategy. Walmart can't do that because retail IS the strategy.

Over time, this creates a compounding advantage. Amazon can invest in new initiatives that Walmart can't justify. Amazon can expand into markets Walmart abandons. Amazon can take longer-term bets on emerging technologies.

The Specific Example: Logistics and Infrastructure

Amazon's diversification also means they can build infrastructure that serves multiple purposes. Their delivery network serves retail customers. The same infrastructure could serve healthcare logistics. The same data centers that power retail could power AWS cloud services.

Walmart builds logistics for one purpose: retail. It's efficient, but it doesn't compound.

This is the essence of Amazon's strategy: every investment serves multiple masters. It's why Amazon can afford to invest more per dollar of revenue than Walmart.

The Physical Retail Factor: Where Walmart Still Dominates

The Store Network Advantage

Walmart has approximately 10,500 stores worldwide. Amazon has zero traditional department stores. This gives Walmart real advantages that shouldn't be understated.

Physical stores are showrooms where customers can touch products before buying. They're convenience centers where you can get something immediately without waiting for delivery. They're community anchors that drive traffic. For certain demographics, store shopping is preferred.

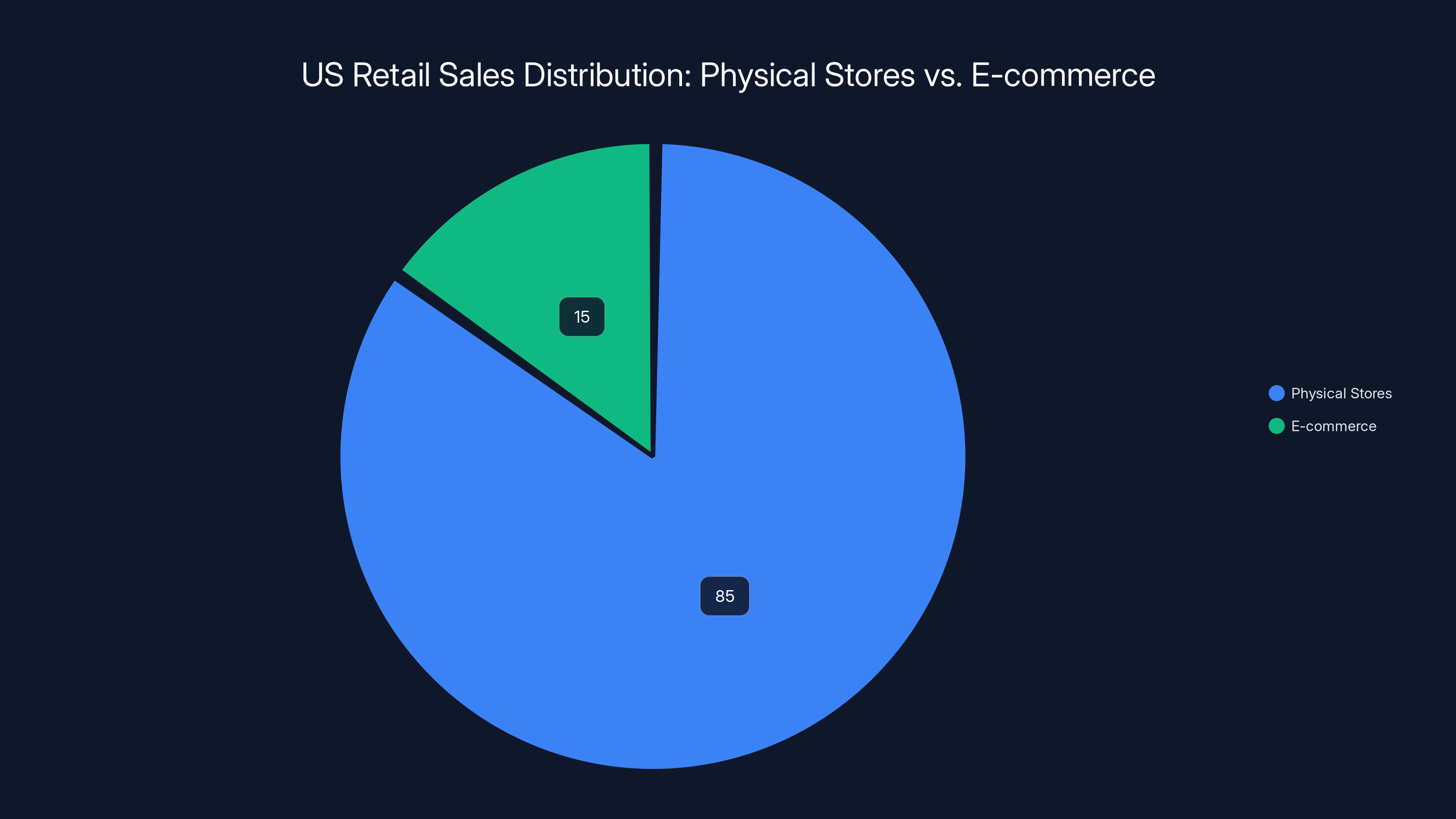

In 2024-2025, retail industry data showed that physical stores still account for roughly 85% of US retail sales, despite e-commerce growth. Walmart is capturing the majority of that traditional retail spending as noted by Business.com.

Amazon's advantage in e-commerce doesn't automatically translate to advantage in physical retail. Amazon owns Whole Foods, but it's a premium grocery chain, not a mass-market discount retailer like Walmart.

So while Amazon has overtaken Walmart in total revenue, Walmart still dominates in one critical channel: the customer walking into a physical location. For older demographics. For customers without reliable internet. For bargain hunters who want to comparison shop in person. Walmart wins.

The Omnichannel Reality

But omnichannel is the real battleground. Customers don't exclusively shop online or in stores anymore. They research online, buy in-store. They buy online, return in-store. They price-check in-store, then buy online. The channels are blending.

Walmart's advantage here is real. A customer can order online and pick up in store within hours. That's powerful. Amazon has similar service through Whole Foods, but coverage is limited.

However, Amazon's logistics are superior for home delivery, which is increasingly the preferred channel for most product categories. The omnichannel advantage isn't clearly won by either side. It's competitive.

Physical Retail Under Threat

The long-term question is whether physical retail matters less each year. Some indicators suggest yes. Younger demographics shop online preferentially. As demographics shift, store traffic will decline. Walmart will have paid billions for real estate that generates declining returns.

Walmart's response is to use stores as fulfillment centers. Inventory kept in stores can be shipped to nearby customers without separate warehousing costs. This is smart. But it's a defensive adaptation, not an offensive strategy.

In 2024-2025, physical stores accounted for approximately 85% of US retail sales, highlighting Walmart's dominance in this channel. Estimated data.

Marketplace and Seller Services: The Ecosystem Play

Amazon's Marketplace as a Model

Amazon's marketplace generates enormous revenue that Walmart's equivalent barely matches. Here's why:

When a third-party seller lists on Amazon, they pay referral fees (typically 15%), fulfillment fees if Amazon handles logistics, storage fees for inventory, and advertising fees if they want promoted placement. A seller doing

But here's the critical detail: Amazon assumes no inventory risk. The seller holds inventory. If something doesn't sell, the seller loses money, not Amazon. Amazon gets paid on every transaction that succeeds, and the seller absorbs the misses.

Scale this to millions of sellers, and you get a revenue stream that approaches $150 billion annually, with high margins because Amazon isn't carrying inventory as reported by Marketplace Pulse.

Walmart's marketplace is smaller. Sellers list on Walmart.com, but the ecosystem is less mature. Walmart has less developed fulfillment services to offer sellers. The network effects are weaker. Fewer sellers means fewer products means less traffic means fewer sellers want to participate. That's a declining spiral.

The Network Effect Advantage

Network effects are crucial here. The more sellers on Amazon, the more product selection. The more selection, the more reasons customers visit. The more customers, the more sellers want to list. Each addition creates value for the existing community.

Amazon crossed the threshold where they have enough sellers that network effects are self-reinforcing. Walmart hasn't crossed that threshold yet. So Amazon's marketplace grows faster than Walmart's, which further cements Amazon's lead.

This is a form of competitive advantage that's nearly impossible to overcome through traditional competition. You can't just pay your way into network effects. You have to build them over time. Walmart is trying, but Amazon had a 10+ year head start.

The Advertising Arms Race

Amazon's Ad Business Explosion

Five years ago, Amazon Advertising was approximately

Why is Amazon Advertising growing faster than Amazon overall? Because the infrastructure exists and the monetization is just beginning. Amazon has 300+ million customers visiting annually. It has a billion products catalogued. It has rich behavioral data on every customer.

Advertisers realize that Amazon ads reach customers at high purchase intent. Someone searching for "wireless headphones" on Amazon is seconds away from buying. An ad that appears in that moment has high probability of conversion. That's worth more money than an ad that appears in a general search engine context.

Amazon Advertising is also less cannibalizing of organic revenue than you'd think. An ad that appears in top position might take a sale from an organic result, but it also increases overall selection and visibility, which drives more traffic overall. The winner isn't clear, but the economics work out that Amazon can charge more for ads and still grow total commerce.

Walmart's Advertising Response

Walmart is building its own advertising business. But they have a problem: Walmart.com gets far less traffic than Amazon. Lower traffic means fewer ad impressions. Fewer impressions mean lower ad revenue.

Walmart's omnichannel advantage helps here slightly. Some customers shop in stores using the mobile app, and Walmart can insert ads into that experience. But it's still a fraction of Amazon's ad surface area.

Microsoft, which powers many Walmart systems, sees advertising as a growth opportunity. Expect Walmart's advertising business to accelerate over time. But the starting point is small compared to Amazon's momentum.

Amazon's overall profit margin is higher due to AWS's significant contribution, which operates at over 30% margins. Walmart's margins remain flat, highlighting Amazon's growing profitability advantage. Estimated data for illustration.

International Expansion: Where Amazon Hunts, Walmart Retreats

Amazon's Global Ambitions

Amazon's international segment grew 13% in 2025. It's not profitable yet, but Amazon is expanding aggressively into markets where e-commerce penetration is still low.

India is a key example. Amazon India is expanding rapidly. The company is investing heavily in warehousing, logistics, and customer acquisition. It's losing money currently. But the long-term bet is that as middle-class consumers in India grow and internet penetration deepens, Amazon will have the infrastructure to capture that market.

Europe is similar. Amazon has presence in the UK, Germany, France, and other markets. Growth is slower than India, but the markets are more developed and profitable faster.

Walmart International Under Pressure

Walmart's international operations are struggling. The company has exited several markets entirely. Walmart Brazil struggled. Walmart Japan was sold off. Walmart Canada is a secondary operation as reported by CNN.

Walmart's global ambitions faced cultural and logistical challenges that Amazon didn't encounter in the same way. Different retail cultures. Different consumer expectations. Different regulatory environments. Walmart's store-based model didn't transfer as smoothly across borders as Amazon's e-commerce model.

Going forward, Amazon will likely expand internationally while Walmart consolidates. That's a strategic divergence that plays into Amazon's favor.

The Profitability Question: Margin Expansion and Sustainability

Operating Profit Versus Revenue

Here's a critical detail often overlooked: Amazon's operating profit is much higher than revenue alone suggests because of margin differences across segments.

Walmart operates at roughly 2-3% net profit margin across the company.

Amazon operates at roughly 4-5% net profit margin, but that understates the true picture because of AWS profitability. If AWS (operating at 30%+ margins) represents 18% of revenue but 40%+ of profit, that means retail is dragging down the blended average.

Here's the implication: as AWS grows as a percentage of revenue, Amazon's overall profit margin expands. AWS grows faster than retail. Therefore, Amazon's profit margin is on an upward trajectory while Walmart's is flat to declining as noted by AdExchanger.

The Sustainability Question

Is Amazon's leadership sustainable? Or can Walmart catch up?

The answer depends on whether Walmart can build an equivalent AWS. Can they build cloud infrastructure that competes with Amazon's? Technically, possibly. Practically, unlikely.

AWS has a 10+ year head start. It's embedded in thousands of enterprises' operations. The switching costs are enormous. Competitors would need a significant price or feature advantage to make AWS customers migrate. By the time they build that, AWS has already advanced further.

Cloud computing is a winner-take-most market. AWS dominance is becoming more entrenched, not less. Walmart can't catch up in cloud. So they can't replicate Amazon's profitability model.

That suggests Amazon's lead is sustainable and likely to widen.

The Stock Market Implications

Why Investors Should Care About This Crossover

When Amazon overtook Walmart in revenue, stock markets moved. Amazon's valuation increased. Walmart's didn't decline sharply, but the psychology shifted.

Investors now view Amazon as the dominant player in retail AND cloud computing. Walmart is viewed as a traditional retailer managing decline in one channel while growing omnichannel. Different stories. Different multiples.

Traditional retailers trade at 10-15x earnings multiples. Technology companies trade at 20-30x. As investors increasingly view Amazon as a technology company that happens to sell retail, the valuation premium expands.

Walmart, even with decent earnings, is constrained by the perception that it's a mature retailer. That perception might be unfair, but it drives stock performance.

The Earnings Divergence

Earnings per share tell the real story. Amazon's EPS growth is projected to exceed Walmart's by 3-5x over the next 3-5 years. That's because revenue grows faster and profitability expands due to AWS leverage.

If an investor has a choice between a company with 3% revenue growth and 2% earnings growth (Walmart) versus 12% revenue growth and 8-10% earnings growth (Amazon), they'll choose Amazon. The compounding difference is massive over a 5-10 year horizon.

This is why many sophisticated investors believe Amazon's stock has more upside than Walmart's, despite both companies being massive and profitable as noted by Zacks.

What's Next: Walmart's Options and Amazon's Ambitions

Walmart's Potential Strategies

Build or Buy into Cloud: Walmart could partner with Microsoft Azure more deeply or attempt to build its own cloud offering. Microsoft ownership of enterprise relationships gives Walmart an edge, but building competitive cloud infrastructure is a 5-10 year commitment with uncertain returns.

Strengthen Marketplace: Walmart could invest heavily in expanding its marketplace and seller services. This is achievable, but the gap with Amazon is so large that catch-up is slow.

Optimize Omnichannel: Walmart's real strength is the seamless integration of stores and online. Doubling down on click-and-collect, same-day delivery from stores, and in-store tech could differentiate Walmart. This is where Walmart actually has competitive advantage.

Expand Advertising: Walmart's advertising business is smaller but growing. Expanding this could improve margins and compete with Amazon. Expect significant investment here.

The challenge: each of these strategies requires massive investment. Walmart can't do all of them simultaneously. They have to choose which battles to fight. In the meantime, Amazon is doing all of them plus more.

Amazon's Next Moves

Healthcare: Amazon is already making moves into healthcare through Amazon Pharmacy, AWS healthcare tools, and partnerships. Healthcare is one of the largest sectors and heavily underdigitized. Amazon is likely to expand aggressively here.

Financial Services: Amazon could expand into financial services more deeply. They already have lending to small businesses. Credit cards. Insurance products could follow. AWS financial services infrastructure could support this.

International Growth: Continuing expansion into India, Southeast Asia, and other emerging markets where e-commerce penetration is low. This is a decade-long bet, but the TAM (total addressable market) is enormous.

AI Advancement: Amazon will continue investing in AI infrastructure, customer applications, and AWS AI services. Every competitor is doing this, but Amazon's scale gives them resource advantage.

Amazon's strategy appears to be: become the infrastructure provider for as many industries and use cases as possible. Retail is the visible manifestation. Cloud is the profit engine. But the ambition is broader: to be the operating system of modern business.

The Broader Economic Implications

What This Means for Retail

Amazon's ascendancy signals the death of traditional retail as the organizing principle of commerce. Retail in the future looks like this: online storefront plus physical locations plus marketplace network plus advertising ecosystem plus AI assistance.

Companies that can build all these components will thrive. Companies that specialize in just retail will decline. That's not opinion. That's the direction of capital investment and customer preference.

Walmart is transitioning toward this model, but the transition is slow and incomplete. Amazon was born into it. That advantage is cumulative.

Employment and Logistics

Amazon employs approximately 1.5 million people globally. Walmart employs 2+ million. But the employment is structured differently. Amazon's jobs skew toward logistics, tech, and AWS. Walmart's skew toward store operations and customer service.

As automation advances, Amazon's employment model (warehouses full of robots, tech centers full of engineers) is more defensible than Walmart's (stores requiring staff to help customers). One is scaling. One is declining.

This has implications for wage levels, geographic employment, and skill requirements. Amazon's jobs in tech and logistics pay better than Walmart's retail jobs. But there are fewer total jobs. Economically, it's a shift toward higher-skill, higher-wage employment and lower total retail employment.

Consumer Impact

Consumers are mostly winners from this competition. Amazon forces Walmart to innovate on price, selection, and convenience. Walmart forces Amazon to compete on some dimensions. The result is better prices and service than either company alone would provide.

The risk: as one company becomes dominant, they have less incentive to compete on price. They can raise prices and cut service. Early signs suggest Amazon is experimenting with this (raised Prime fees, reduced benefits). Long term, this is a real concern if competition diminishes further.

The Competitive Response: Can Anyone Catch Up?

Microsoft's Partnership Opportunities

Microsoft is not a major direct competitor in retail, but they have leverage through Azure and enterprise relationships. Microsoft could partner with Walmart to offer cloud services, analytics, and AI to accelerate Walmart's digital transformation.

Expect Walmart-Microsoft partnerships to deepen. Microsoft has the technical capability. Walmart has the customer relationships. Together, they might slow Amazon's advance in B2B services.

Google's Play

Google is primarily a search and advertising company, with limited retail exposure. Google Shopping exists but is not a destination like Amazon. Google Cloud exists but trails AWS. Google's leverage is in advertising and data, where they're competitive with Amazon.

Expect competition to intensify in advertising specifically, which is one of Amazon's growth engines.

Chinese E-Commerce Giants

Alibaba and JD.com dominate in China, but they have limited presence in the US market. If either wanted to expand into North America, they'd face regulatory challenges and entrenched competition. Unlikely they'll disrupt Amazon's lead.

Niche Players

Specialist retailers like Target or Costco have loyal customer bases and differentiated value propositions. They'll survive and potentially grow, but they won't overtake Amazon or Walmart. The scale dynamics favor the largest players.

Scenario Analysis: Three Possible Futures

Scenario 1: Amazon's Continued Dominance (60% probability)

In this scenario, Amazon's growth trajectory continues. AWS expands. International markets develop. Advertising scales. AI improves unit economics. Walmart competes effectively in its strengths (stores, omnichannel) but doesn't successfully catch up in cloud, marketplace, or advertising scale.

By 2030, Amazon generates

Stock performance: Amazon significantly outperforms. Walmart matches market growth.

Scenario 2: Competitive Equilibrium (25% probability)

In this scenario, Walmart successfully invests in cloud, marketplace, and advertising capabilities. Microsoft partnership accelerates. Walmart's AI initiatives drive customer spending improvements. The gap narrows.

By 2030, both companies are roughly equal in scale, $1 trillion +/-, with Amazon stronger in cloud and Walmart stronger in physical retail and omnichannel.

Stock performance: Both companies meet expectations. No significant outperformance.

Scenario 3: Amazon Regulation and Fracture (15% probability)

In this scenario, antitrust concerns result in forced separation. AWS becomes independent. Amazon marketplace is regulated heavily. Amazon is broken into pieces.

This reduces Amazon's dominance but might actually help Walmart by removing scale advantages. However, broken companies often underperform whole companies. Stock performance would be depressed for years.

Probability: Lower, but increasing if political winds shift.

The Walmart vs. Amazon Investment Decision

For Growth Investors

Amazon offers higher growth, higher margins, and exposure to secular trends (cloud, AI, retail shift). Expected return over 5 years: 8-12% annually plus stock price appreciation.

Walmart offers steady dividends, lower volatility, and proven execution. Expected return over 5 years: 6-8% annually plus dividends.

If you can tolerate volatility and your time horizon is 5+ years, Amazon likely outperforms. If you want steady income and lower risk, Walmart is better.

For Employees and Partners

Amazon offers more rapid growth, higher tech salaries, but more intense competition. Walmart offers more stability and traditional career progression, but slower growth.

Choice depends on risk tolerance and career goals. High-growth tech skill: Amazon. Traditional retail management: Walmart.

FAQ

What does it mean that Amazon now has more revenue than Walmart?

It signals a fundamental shift in American retail from traditional discount retail toward digital marketplaces and platform economics. Amazon's revenue includes cloud computing (AWS), marketplace services, and advertising, which operate at higher margins and faster growth rates than Walmart's traditional retail. The crossing also reflects that e-commerce penetration in the US has grown from near-zero 25 years ago to over 25% of total retail, and Amazon captures the majority of that shift as noted by Modern Retail.

How sustainable is Amazon's lead over Walmart?

Very sustainable, based on current trajectories. Amazon's growth rate (11-15%) is 3x Walmart's (3.5-4.5%), which causes the gap to widen mathematically. Additionally, AWS cloud services represent 18% of revenue but 40%+ of profit, creating a profitability gap that Walmart can't easily close without building comparable cloud infrastructure. AWS has a 10+ year head start and is more entrenched in enterprise customers, making it nearly impossible for Walmart to catch up within a decade as highlighted by CNBC.

Why does AWS matter so much to Amazon's competitive position?

AWS operates at 40%+ gross margins compared to retail's 2-3% margins. A single dollar of AWS revenue contributes 40 cents to profit; a single dollar of retail revenue contributes 2-3 cents. This margin difference means Amazon can invest more in innovation, customer acquisition, and international expansion while remaining profitable. AWS growth also subsidizes Amazon's retail expansion into lower-margin categories that build market share.

Can Walmart catch up to Amazon in total revenue?

Unlikely within the next 5-10 years. For Walmart to catch up, they'd need to either: (1) accelerate their growth rate to match Amazon's, which requires building equivalent cloud infrastructure and marketplace scale, or (2) slow Amazon's growth rate, which would require superior competition across multiple fronts simultaneously. Neither seems probable. The more likely scenario is Amazon's lead widens.

What are Walmart's actual competitive advantages over Amazon?

Walmart dominates in physical retail, still commanding 85%+ of US retail sales through store locations. Walmart's omnichannel integration (online ordering with in-store pickup) is strong. Walmart's customer base is loyal and includes demographics that prefer store shopping. Walmart's supply chain efficiency is legendary. These are real advantages that keep Walmart profitable and relevant. However, these advantages don't extend to cloud computing, global marketplace scaling, or advertising, where Amazon leads decisively.

How does Amazon's AI strategy impact its competitive advantage?

Amazon's AI integration touches multiple value drivers: customer recommendation engines (retail), marketplace optimization (seller services), cloud infrastructure (AWS AI services), and advertising (ad targeting). Amazon's advantage is architectural control—they build the stack from data layer to customer application. Walmart depends on third-party providers for AI capabilities, giving Amazon faster innovation speed. As AI becomes more critical to retail and commerce, Amazon's integrated approach compounds its advantage.

What should investors focus on when comparing Amazon and Walmart stocks?

Look beyond headline revenue and examine: (1) revenue growth rate and sustainability, (2) profit margin trends, (3) capital intensity (how much investment is required per dollar of new revenue), (4) exposure to secular trends (cloud, AI, digital transformation), and (5) competitive moats. Amazon excels on growth and competitive moats. Walmart excels on current profitability and cash generation. Your choice depends on investment horizon and risk tolerance.

Is Amazon's dominance bad for consumers?

Short term, probably not. Competition between Amazon and Walmart has driven better prices, faster delivery, and improved service. Long term, if Amazon's dominance becomes so overwhelming that they eliminate meaningful competition, consumers might face higher prices and reduced choice. This is why antitrust concerns are growing. However, regulatory action is uncertain and often slow, so competitive pressure will likely persist for years.

What would it take for a new competitor to challenge Amazon?

Unlike retail (where entry barriers were low), the current competition requires billions in capital, decades of infrastructure investment, and excellence across multiple complex domains simultaneously. A startup could challenge Amazon in a single category (groceries, electronics, etc.) but not across categories plus cloud services. Walmart is the only competitor with sufficient scale to mount a challenge, and they're struggling. This suggests the competitive landscape will remain Amazon-dominant for the foreseeable future.

Conclusion: The New Retail Order

Amazon's crossing of Walmart in total revenue marks the beginning of a new era, not the end. The real story isn't that Amazon surpassed Walmart by $4 billion. It's that Amazon built a business model so superior that it overcame Walmart's 13-year head start and near-monopoly on American retail.

Walmart is a phenomenally run company. The logistics are efficient. The stores are profitable. The customer base is massive. By any historical measure, Walmart should have remained unbeatable. But Walmart was built for a previous era, when retail meant stores and supply chains. That era is ending.

Amazon was built for a new era where retail is a platform, where infrastructure is the product, where data is the competitive advantage, and where growth compounds through network effects and algorithmic improvement.

The gap between the two companies will likely widen. Amazon's growth rate is higher. Amazon's profit margins are expanding due to AWS leverage. Amazon's international presence is growing while Walmart's is shrinking. Amazon's exposure to cloud and AI gives it tailwinds that Walmart doesn't have.

Walmart's best path forward isn't to catch up to Amazon on Amazon's terms. It's to own the categories and channels where Walmart actually has advantage: physical retail, regional supply chains, omnichannel integration, and customer loyalty. Double down on strengths rather than chase weaknesses.

For investors, employees, and customers, the implication is clear: the future of retail is digital, global, and powered by technology that most traditional retailers don't possess. Companies that recognize this and adapt will thrive. Companies that fight it will decline.

Amazon understood this a decade ago. They bet the company on it. Now it's paying off in the most public way possible. And the story is just beginning.

Key Takeaways

- Amazon surpassed Walmart in 2025 with 713B, ending 13-year reign as reported by Yahoo Finance.

- AWS cloud services represent only 18% of Amazon's revenue but generate 40%+ of total profit, subsidizing retail expansion as noted by Modern Retail.

- Amazon targets 11-15% growth while Walmart targets 3.5-4.5%, creating 3x growth velocity advantage that compounds into exponential divergence as highlighted by CNBC.

- 90% of Walmart's revenue comes from traditional retail; Amazon's comes from diversified streams including high-margin cloud and advertising as noted by AdExchanger.

- Physical store network remains Walmart's strength, but shift toward digital channels and omnichannel limits traditional retail's future growth as reported by Business.com.

Related Articles

- Joseph C. Belden Innovation Award 2026: Complete Guide to Winning Scaling Perks [2026]

- The AI Productivity Paradox: Why 89% of Firms See No Real Benefit [2025]

- Why VR's Golden Age is Over (And What Comes Next) [2025]

- Uber Eats AI Cart Assistant: How AI Is Transforming Grocery Shopping [2025]

- Uber Acquires Getir's Delivery Business: What It Means for the Market [2025]

- How AI-Powered Digital Displays Are Reshaping Shopping Malls [2025]

![Amazon Officially Dethroned Walmart as America's Largest Company [2025]](https://tryrunable.com/blog/amazon-officially-dethroned-walmart-as-america-s-largest-com/image-1-1771596549915.jpg)