The Retail Revolution Nobody's Talking About

Walk through a shopping mall today. Notice anything odd about the signage? If you're paying attention, you'll spot something changing beneath the surface. What used to be static posters taped to walls are becoming networked displays. What were standalone screens scattered across the mall are becoming part of a unified system. And behind the scenes, data is flowing from every screen back to a central control hub.

This isn't science fiction. It's happening right now, and companies like LG are leading the charge with technologies that fundamentally reshape how retailers communicate with customers. The shift from isolated, analog signage to integrated digital ecosystems represents one of the biggest untapped opportunities in retail today. Shopping centers that ignore this trend will find themselves stuck with outdated infrastructure while competitors move to smarter, more responsive systems.

The transformation started quietly. For years, retailers deployed individual digital signage screens, each operating independently. But independent screens create chaos: inconsistent messaging, wasted content distribution resources, and zero visibility into what's actually working. No central dashboard. No real-time analytics. No ability to push updates across 50 locations simultaneously.

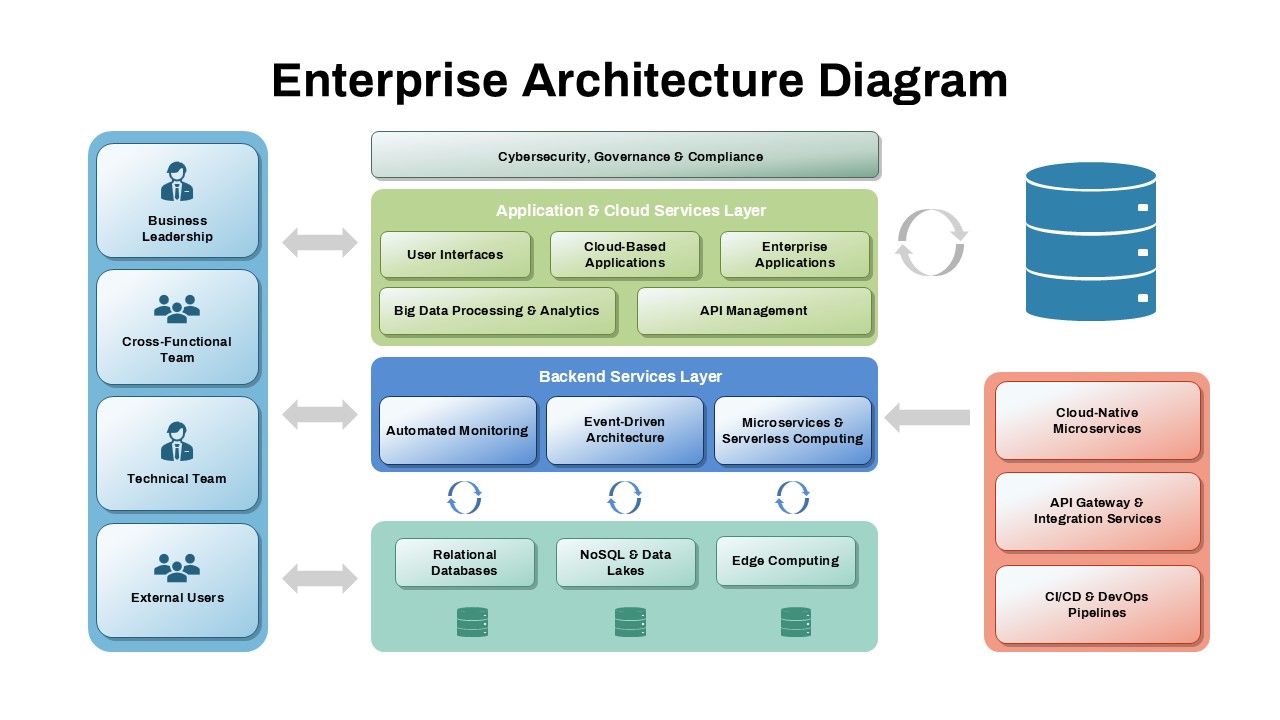

Now that's changing. Enterprise display management systems are creating the backbone for what the industry calls "connected retail." These aren't just prettier screens. They're complete ecosystems combining hardware, software, cloud infrastructure, and data analytics into one coherent platform. And the implications are massive.

TL; DR

- Enterprise display networks are replacing standalone screens, enabling centralized management across multiple locations

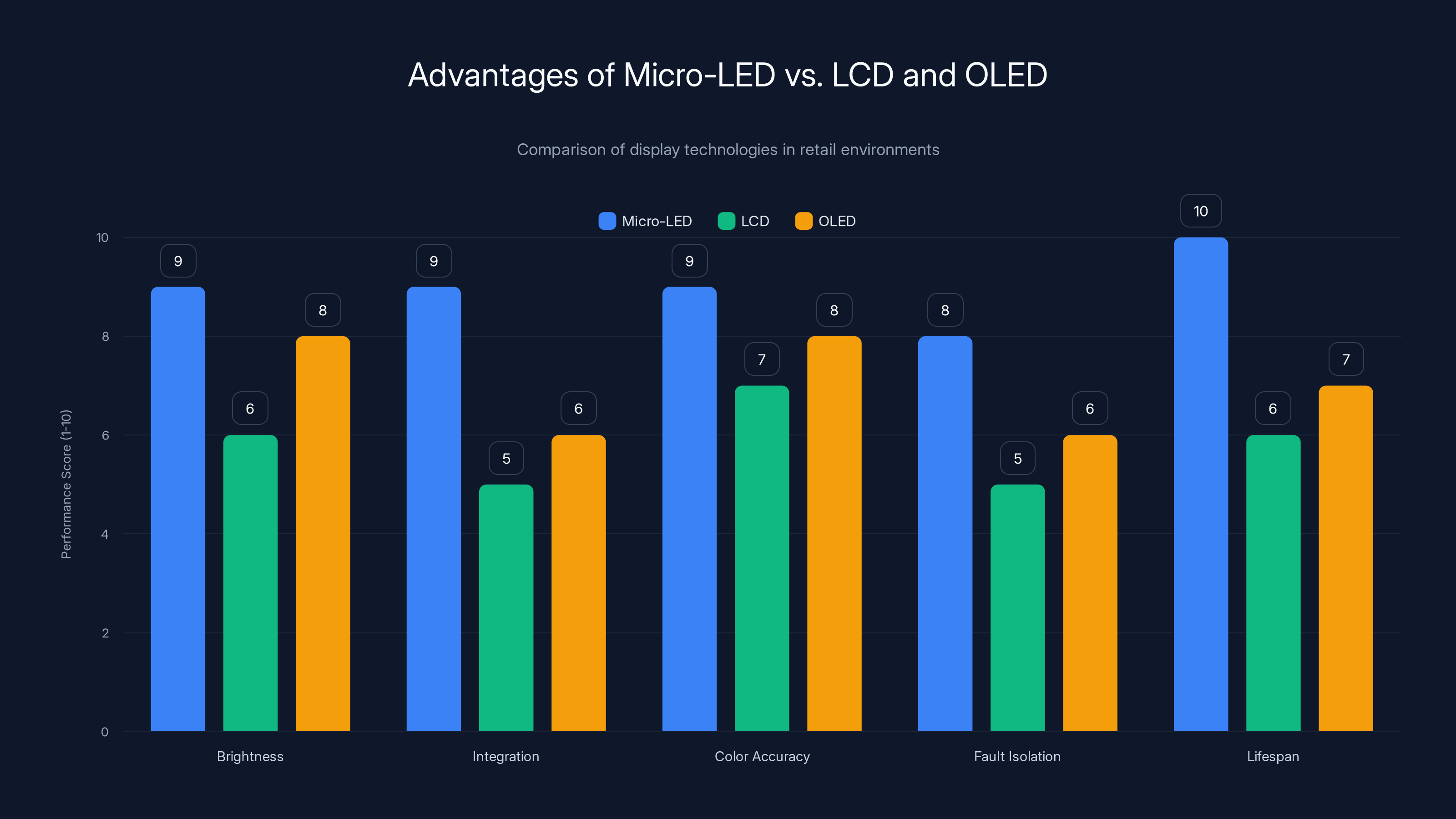

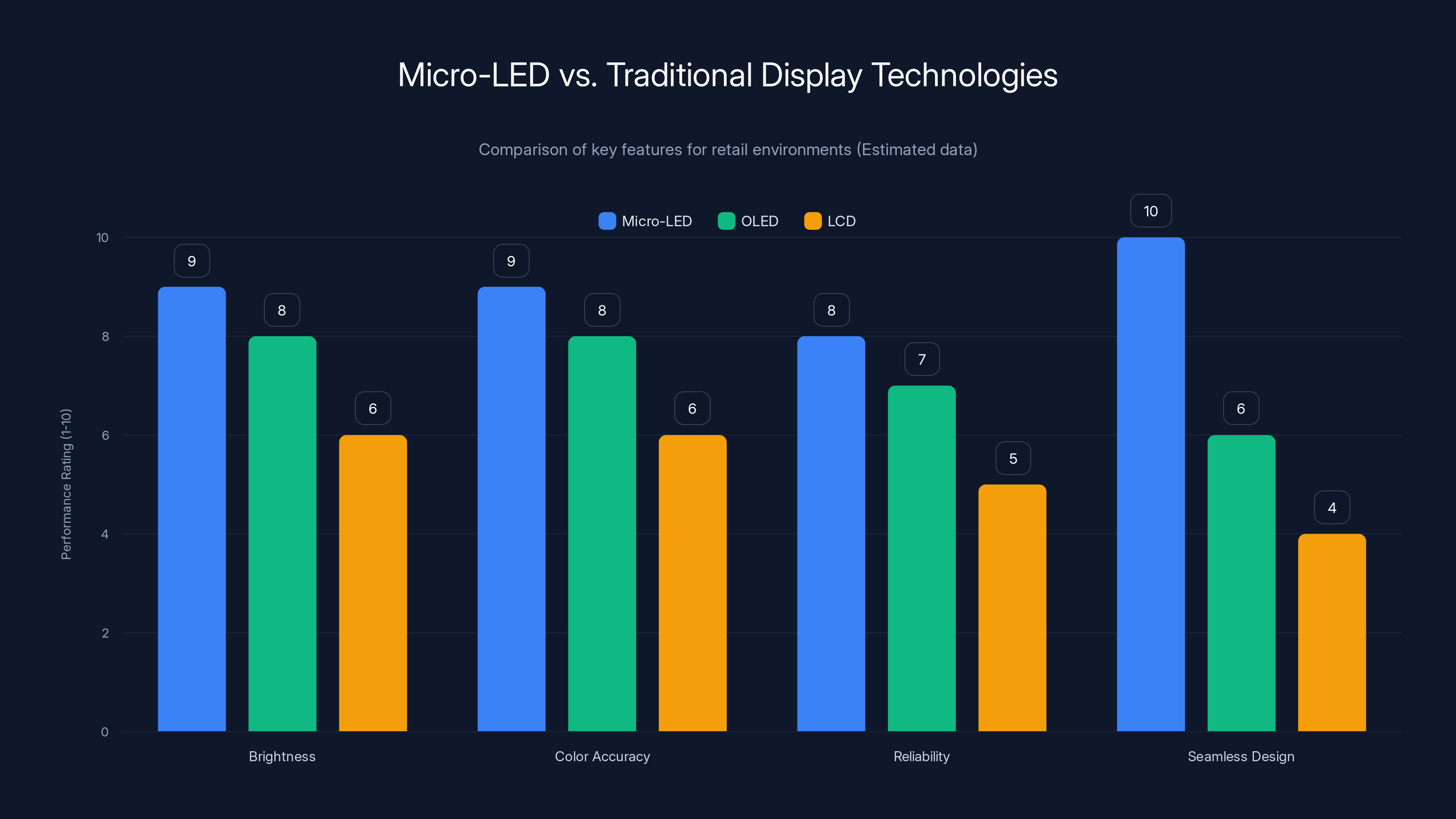

- Micro-LED technology offers superior brightness, color accuracy, and reliability compared to traditional LCD and OLED displays

- Real-time data analytics help retailers understand foot traffic, dwell times, and customer engagement with specific content

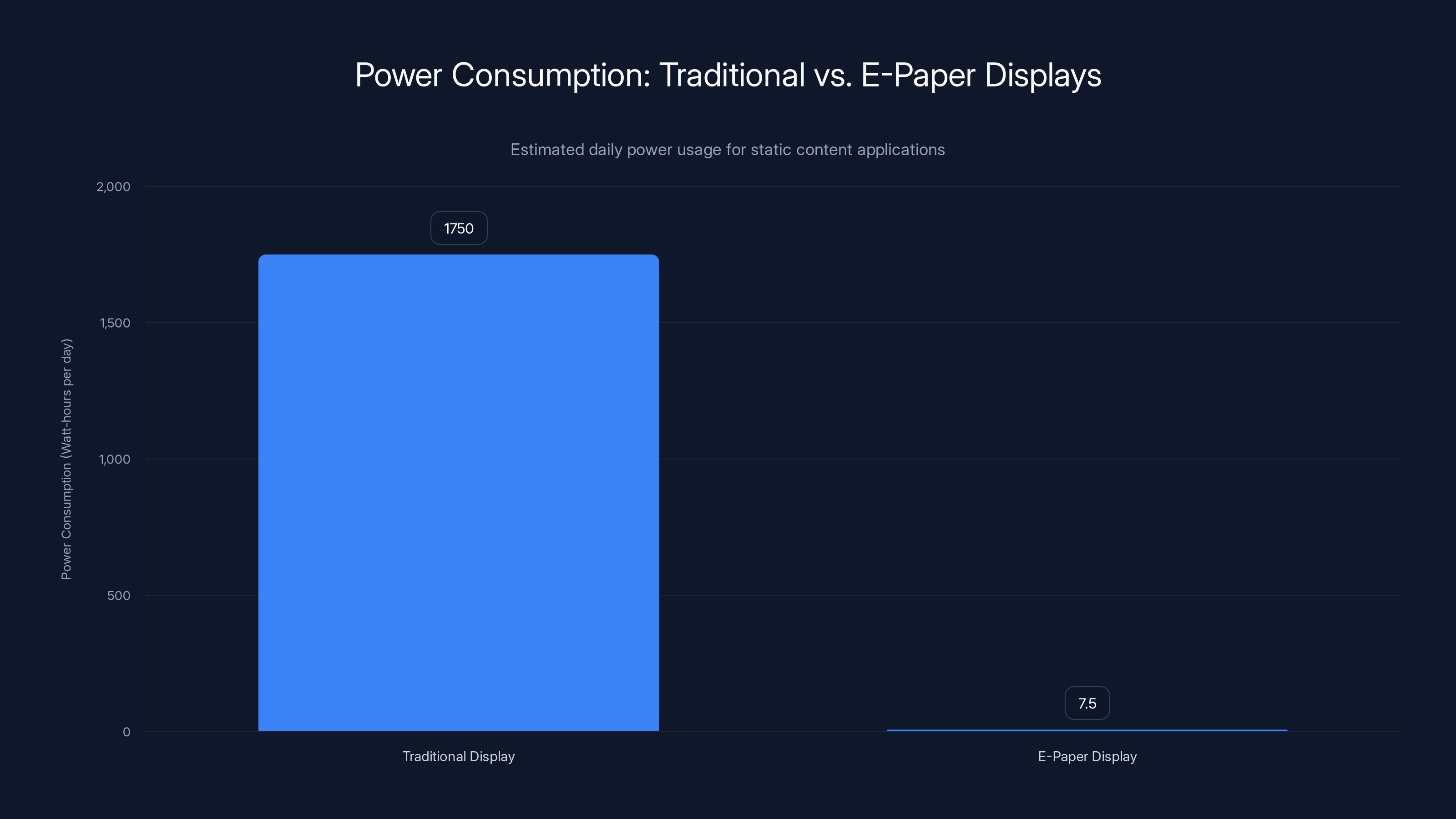

- E-Paper displays reduce power consumption by 90% and eliminate the need for constant electricity, perfect for shelf labels and information boards

- Centralized management platforms allow retailers to update content, monitor performance, and troubleshoot issues remotely across dozens of locations

Micro-LED displays outperform LCD and OLED in brightness, integration, color accuracy, fault isolation, and lifespan, making them ideal for large-scale commercial installations. Estimated data.

Understanding Enterprise Display Systems

Let's start with a fundamental question: what exactly is an enterprise display system, and why should anyone care?

Traditional retail signage works like this: a store manager prints posters, hangs them on walls, and they stay there until someone remembers to take them down. Digital signage improved on this model slightly. A screen could display different content throughout the day. But it still operated in isolation.

Enterprise display systems change this entirely. Imagine a network where every screen in a shopping mall connects to a single cloud platform. That platform allows a central team to manage all content simultaneously. Push a new promotion to 100 screens across 20 locations in seconds. Monitor energy consumption in real-time. Get alerts when a screen fails before customers even notice. Track which content drives the most engagement. This is enterprise-scale retail technology.

The key differentiator is centralization. Instead of technicians running from screen to screen with USB drives and manual updates, everything flows through software. LG's Business Cloud platform exemplifies this approach. It links signage hardware to remote monitoring, content control, and data collection all from a single interface.

The business case is compelling. Large shopping centers increasingly recognize that standalone screens don't scale efficiently. Coordinating content across 50 independent displays requires exponentially more effort than managing one networked system. Maintenance becomes predictable instead of reactive. Energy costs become measurable. And customer engagement becomes quantifiable.

This shift toward enterprise systems reflects a broader trend in retail: treating the physical space as a data-generating asset, not just a container for products. Every screen becomes a sensor. Every interaction becomes a data point. Every pixel displayed becomes part of a larger intelligence gathering operation.

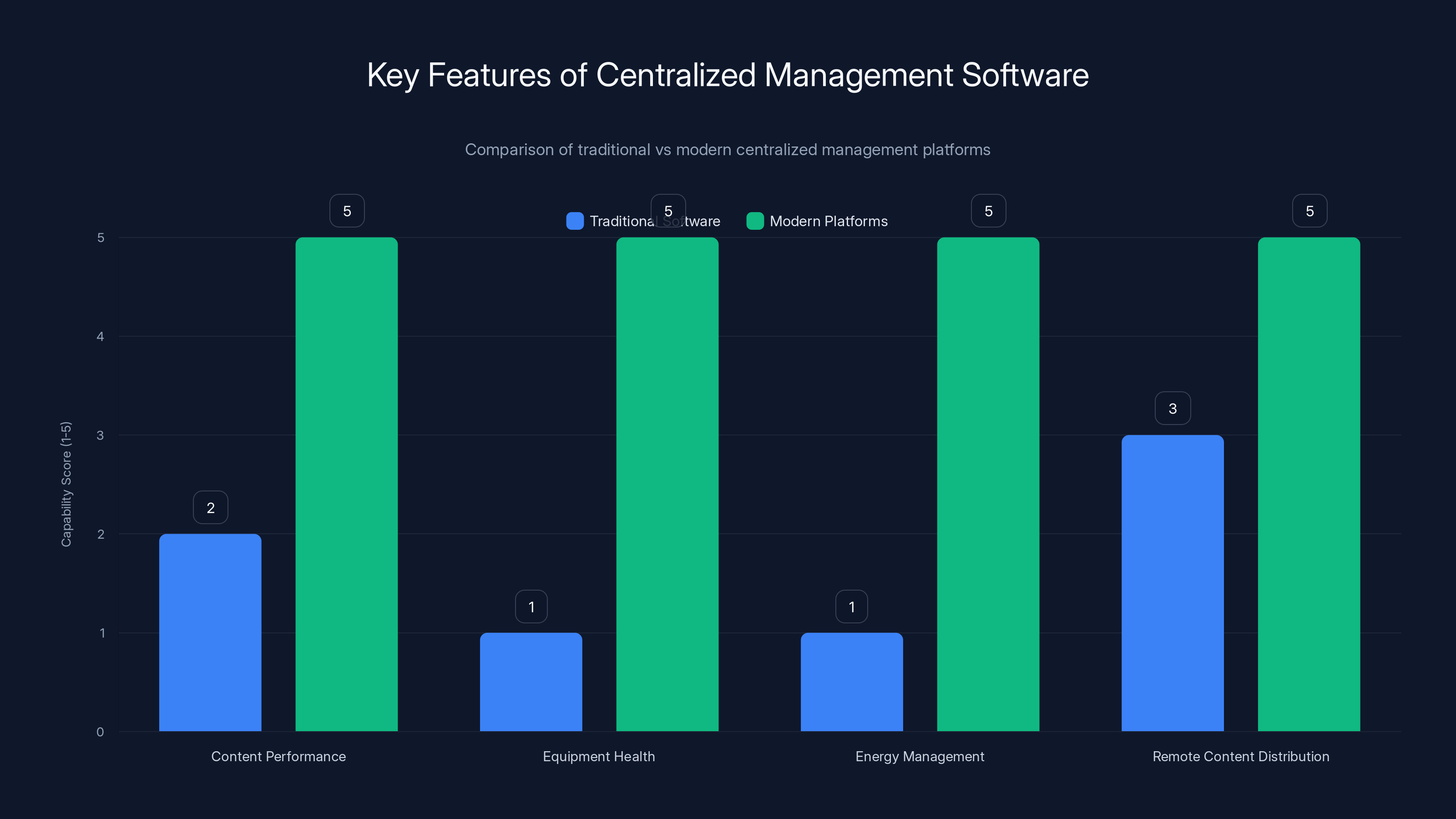

Modern centralized management platforms significantly outperform traditional software in key areas such as content performance, equipment health, energy management, and remote content distribution. Estimated data based on typical capabilities.

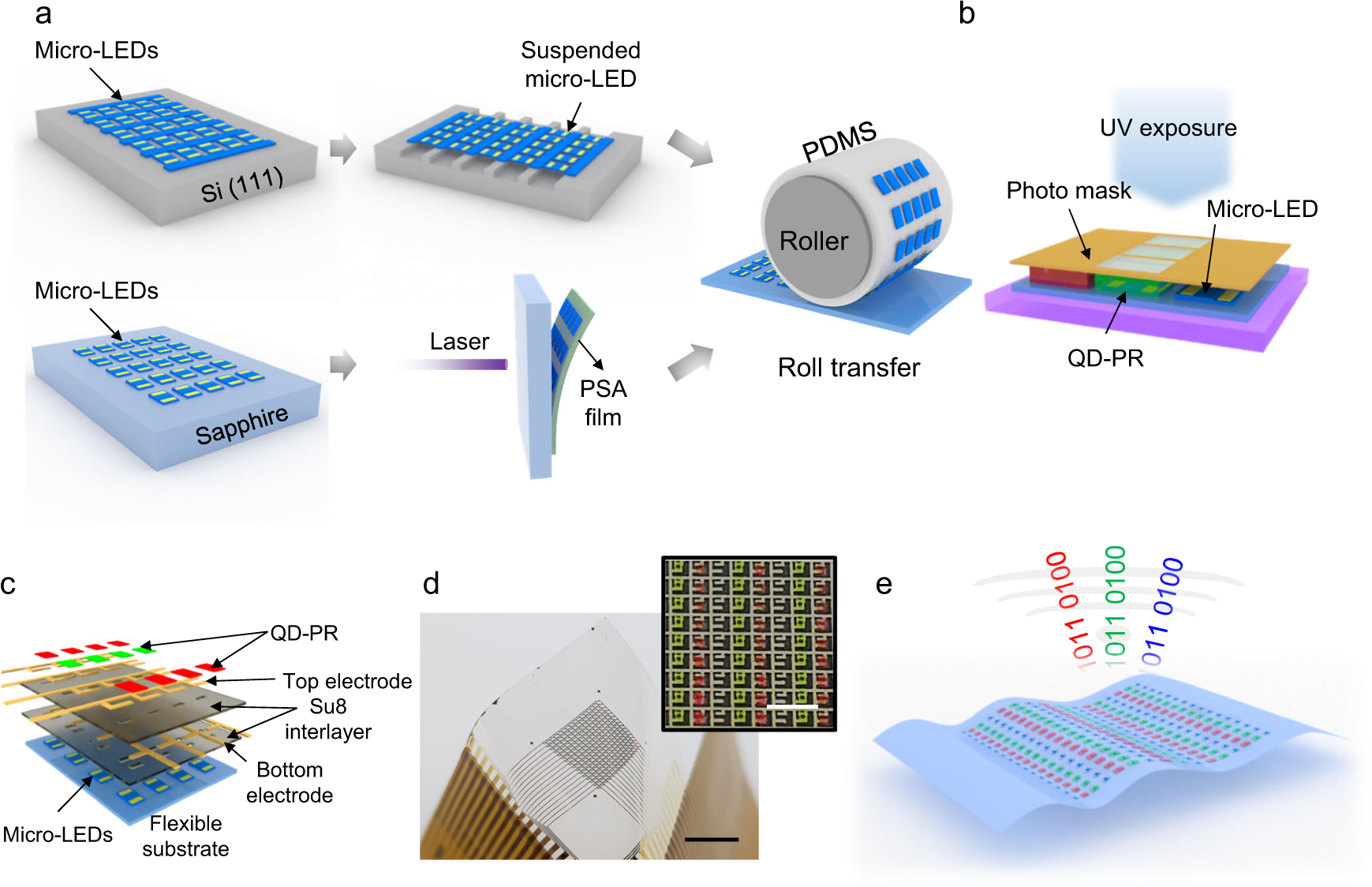

The Micro-LED Advantage: Why This Technology Matters

You've probably heard of OLED displays. Chances are you've seen one in a smartphone or premium TV. OLED technology produces incredible colors and perfect blacks because each pixel generates its own light.

Micro-LED takes this concept further and scales it dramatically. Instead of millions of tiny pixels, Micro-LED displays are composed of thousands of modular cabinets, each containing microscopic LEDs. LG's MAGNIT system uses these modular components to build displays at virtually any scale.

Here's why this matters for retail spaces. Traditional large displays suffer from a critical limitation: seams. When you assemble multiple LCD or LED panels into a large wall, you get visible gaps between sections. These gaps look terrible and break the visual experience. Micro-LED cabinets connect seamlessly, creating one unified display surface regardless of size.

But the advantages go deeper than aesthetics.

Brightness and visibility. Micro-LED displays generate substantially more light than LCD or standard LED. This means better visibility in bright retail environments without the washed-out look that plagues many LCD displays when sunlight hits them. A Micro-LED wall visible in direct sunlight looks as vivid as one in a dark room.

Color accuracy. Each Micro-LED pixel produces extremely pure colors. This matters enormously for fashion retailers, luxury goods vendors, and food displays where color representation directly impacts purchasing decisions. A product displayed inaccurately looks less appealing, period.

Reliability and fault isolation. With LG's Line to Dot control technology, if one section of a Micro-LED display fails, only that specific section goes dark. The rest of the display continues operating. Compare this to older LED technology where an entire panel might go out. From a customer perspective, you see a small dark patch. From a business perspective, you avoid a complete system failure.

Longevity. Micro-LED displays degrade much more slowly than LCD or standard LED panels. After five years of continuous operation, an OLED display might show noticeable color drift. A Micro-LED display looks almost identical to day one.

The catch? Cost. Micro-LED displays are expensive. A large Micro-LED wall easily costs 3-5 times what an equivalent LCD or standard LED display would cost. This pricing puts them out of reach for small retailers but perfectly positions them for large shopping malls, airports, and high-traffic commercial spaces where the ROI justifies the expense.

Consider the math. A shopping mall with 200 display screens. Using traditional LCD technology across 5-year lifecycle:

E-Paper Displays: The Power-Efficient Alternative

Not every retail space needs brilliant color and animation. Price labels on supermarket shelves. Wayfinding signs in malls. Information boards in corridors. Informational signage. These applications benefit from a completely different technology: electronic paper.

E-Paper displays work through electrophoresis, a process where electrically charged particles move within a sealed layer to create visible patterns. Think of it as digital ink that responds to electrical signals. The critical advantage: E-Paper displays only consume power when the image changes. A price label that displays the same price for three weeks uses almost no electricity.

LG's E-Paper display measures just 17.8mm at its thickest point and tapers to 8.6mm, enabling installation in spaces where traditional screens don't fit. This ultra-slim form factor opens possibilities. Imagine promotional signage integrated directly into shelf edges. Information panels suspended from mall ceilings. Wayfinding displays integrated into architectural elements.

The power efficiency is staggering. A traditional digital signage display running 16 hours daily uses roughly 1,500-2,000 watt-hours per day. An E-Paper display showing the same content uses 5-10 watt-hours per day. Over a year, you're looking at a 99% reduction in electricity consumption for static content applications.

For shopping malls with hundreds of information points, the cumulative savings become significant. A mall with 500 E-Paper price labels and informational displays could reduce signage-related electricity costs by thousands of dollars monthly while providing superior visibility compared to paper labels that fade and wear.

The tradeoff? E-Paper displays work poorly for content that changes rapidly or requires rich color. A video advertisement needs a traditional display. A dynamic pricing label that updates every minute needs a traditional display. But for content that changes infrequently and doesn't require vibrant colors, E-Paper is the superior choice technically and economically.

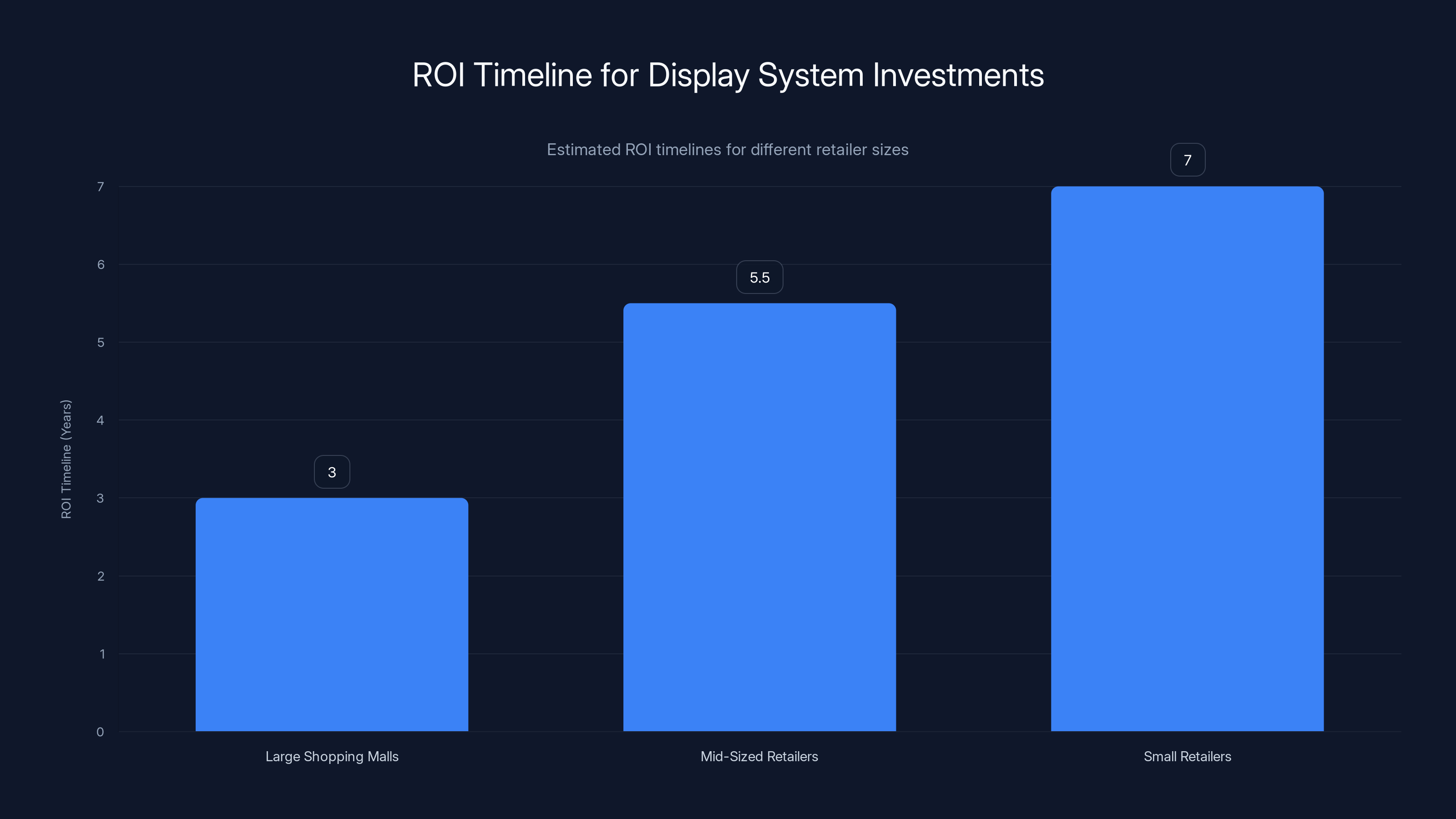

Large shopping malls see the quickest ROI in 3-5 years due to labor savings and centralized management. Mid-sized retailers have a moderate ROI timeline of 4-7 years, while small retailers may not see significant ROI within 7 years. Estimated data.

Centralized Management Software: The Intelligence Layer

Hardware is just the foundation. What transforms a collection of displays into an intelligent system is software. LG Business Cloud represents a fundamental shift in how retailers manage physical spaces.

Traditional digital signage software operates like a filing cabinet with network connectivity. You upload a file, assign it to displays, push it live. Done. Limited reporting. No analytics. No predictive capabilities.

Modern centralized management platforms operate like an intelligent operations center. Every display becomes a node in a network monitored continuously. The system tracks:

Content performance. Which advertisements drive engagement? When do customers stop and look? How long do they stand in front of specific content? These metrics come from embedded sensors or integrated tracking systems, creating a data stream that wasn't previously available to retailers.

Equipment health. When will a display fail? Modern platforms use machine learning to predict equipment failures before they happen. Instead of a screen going dark unexpectedly, the system alerts maintenance teams weeks in advance that a component is degrading. Preventive maintenance replaces reactive firefighting.

Energy management. How much electricity is each display consuming? Which locations have efficiency problems? The software identifies energy waste and suggests optimizations. A display running at 85% brightness might look the same to customers as one at 100% brightness. Cut to 85%, reduce power consumption by 15%, and save thousands annually across a large network.

Remote content distribution. A new promotion launches with 30 days notice. Instead of technicians visiting 50 locations, the central team uploads content once, schedules it to go live simultaneously, and monitors performance in real-time. When metrics show a particular promotional message underperforms at certain locations, the team swaps in alternative content for just those displays.

Retailers are discovering something remarkable: their displays are data-generating assets. By instrumenting displays with sensors and connecting them to analytical platforms, retailers transform physical retail space into something resembling digital space in terms of measurability.

Traditional retail's fundamental challenge was invisibility. You spent thousands on a billboard. Did it work? No idea. You changed the billboard three months later hoping for better results. Did those changes help? Still no idea. You made decisions based on intuition and old marketing rules.

Centralized display platforms eliminate this guesswork. Every impression is measured. Every engagement is tracked. Changes are tested and validated. This represents a fundamental reorientation of retail from tradition-based decision-making to data-driven decision-making.

Transparent and Mesh Displays: Creating Experiential Retail

Not all display innovation focuses on replacing traditional signage. Some innovations create entirely new retail experiences through novel form factors. Transparent OLED panels and T-Mesh (transparent mesh LED) technology exemplify this experiential direction.

Imagine walking into a mall entrance and seeing a 4.2 by 5.6 meter transparent LED display tower. It's not solid. You can see through it. Around it hangs T-Mesh, transparent mesh LEDs that convey visual content while maintaining sight lines through the display. Combined, these create an immersive entrance that communicates brand messaging while preserving the architectural space.

Transparent displays serve multiple purposes. They make a space feel more open and connected rather than walled off by static screens. They create focal points that draw the eye without feeling like aggressive advertising. They enable architects and designers to integrate displays into spaces while maintaining sightlines and preserving spatial qualities.

For luxury retailers, this matters enormously. Placing a massive black rectangle in the center of an elegant retail space damages the aesthetic. A transparent display conveys the same information while respecting the architectural intent.

Retailers at ISE 2026 showed these technologies integrated with smartphone interaction systems. Visitors point phones at displays, and dedicated apps launch supplementary content. Transparent displays show products; phone apps provide detailed product information, styling suggestions, and purchasing options. The physical and digital layers work together.

This integration points toward the future of retail: physical spaces augmented by digital information layers. A customer walks by a clothing display. A transparent overlay shows how that garment looks in different colors and sizes. Another layer shows styling suggestions. A third shows inventory across nearby stores. All from a single display system.

Micro-LED technology excels in brightness, color accuracy, reliability, and seamless design compared to OLED and LCD, making it ideal for retail environments. Estimated data.

The Data Collection Question: Privacy and Implementation

Centralized display systems collect data continuously. This generates obvious questions about privacy, consent, and how retailers intend to use this information.

The platforms track foot traffic patterns. They measure dwell times in front of specific content. They correlate displayed advertisements with purchase behaviors in nearby stores. They build heat maps of how customers move through spaces. They measure emotional responses to content through facial recognition or biometric sensors in some implementations.

This data is genuinely valuable to retailers. Understanding foot traffic patterns helps optimize store layouts. Knowing which advertisements drive engagement lets retailers allocate digital signage budgets more effectively. Correlating displayed content with sales reveals which promotions actually work versus which ones look good in pitch meetings.

But this data collection happens with varying levels of transparency. Some systems operate with clear signage explaining what data is being collected and how it's used. Others operate more quietly. From a consumer perspective, there's ambiguity about whether you're being tracked when you shop.

Retailers deploying these systems face important choices about transparency. Clearly disclosing data collection builds trust and establishes relationships with customers who appreciate the benefit of better-targeted promotions. Operating quietly and hoping customers don't notice risks backlash if practices become public.

From a regulatory perspective, the landscape is rapidly evolving. The EU's GDPR and emerging privacy legislation in various US states impose requirements around consent, data minimization, and explicit communication of tracking practices. Retailers deploying these systems need legal guidance on compliance requirements.

The technology itself is neutral. Data collection becomes concerning primarily when it's non-consensual or deceptive. A customer who knows they're being tracked and accepts it as the tradeoff for better shopping experiences has a different relationship with the data than someone who discovers tracking is happening by accident.

Integration with Physical Space: Architecture Meets Technology

The most sophisticated display installations don't treat technology as separate from architecture. Instead, they integrate display systems into the space itself, making technology feel like a natural extension of the retail environment rather than something bolted on.

LG's showcase at ISE included retail environments where displays were integrated with lighting systems, sound systems, and HVAC controls. Change the displayed content and the lighting shifts to match. A fashion display might trigger warmer, directional lighting. A food display might trigger brighter, cooler lighting. A promotional video might synchronize sound through the entire area.

This integration transforms retail from a flat, static environment into something dynamic and responsive. Customers experience spaces that evolve throughout the day. Morning environment feels different from evening environment. Different promotional themes trigger different sensory environments. The entire space becomes a medium for communication.

Architects working on new retail projects now need to understand display technology because it shapes space planning. Where can displays be integrated? How should electrical infrastructure be designed to support power-hungry display networks? How should climate control be engineered since display systems generate heat? How should acoustics account for integrated sound systems?

This integration trend creates opportunities for retailers who embrace it early. A shopping mall that thoughtfully integrates displays into architecture creates a more compelling experience than one that simply covers walls with screens. The difference is the difference between a space designed for technology and a space designed as a place that happens to include technology.

E-Paper displays consume approximately 99% less power than traditional displays for static content, making them an energy-efficient choice for applications like price labels and informational signage. Estimated data.

Real-World Implementation: From Concept to Operation

Understanding display technology and centralized management is one thing. Actually deploying these systems in operating retail spaces is another challenge entirely.

Successful implementations follow a pattern. First, audit current infrastructure. What displays exist? How are they currently managed? What content is displayed? How often does content change? What maintenance issues occur regularly? This baseline understanding informs system design.

Second, pilot in a single location. Deploy a centralized management system controlling displays in one store or mall section. Learn how the software operates. Train staff on management and troubleshooting. Identify integration challenges with existing systems. Discover unexpected issues before scaling.

Third, gradually expand. Once the pilot proves successful and staff becomes comfortable with the system, deploy to additional locations. Each deployment gets easier as teams develop expertise and understand the specific challenges of your retail environment.

Fourth, optimize content and analytics. Initial deployments often simply replicate old static content in the new digital system. Once the technical foundation is solid, shift focus to creating dynamic content that takes advantage of capabilities that weren't previously possible. Use analytics to understand what works. Iterate based on data.

Fifth, plan for evolution. Technology changes. Customer expectations evolve. Display hardware becomes outdated. The most successful retailers plan their systems assuming continuous evolution rather than a one-time deployment and done mentality.

Cost-Benefit Analysis: When Does the Investment Make Sense?

Not every retailer should deploy enterprise display systems immediately. The investment is significant, and the benefits vary by business model and location type.

For large shopping malls, the case is clearest. A major shopping center might have 150-300 displays across anchor stores, corridors, and common areas. Managing these with outdated technology requires multiple staff members and significant ongoing maintenance. A centralized system reduces labor, improves consistency, and enables analytics previously unavailable. ROI timeline typically ranges from 3-5 years.

For mid-sized retailers operating 10-20 locations, the case is moderate. The benefit of coordinated campaigns across locations is real. The reduction in management overhead is meaningful. But the investment is still substantial, and smaller organizations need to ensure they have the expertise to manage the system. ROI timeline typically ranges from 4-7 years.

For small retailers with single locations, the case is weak. A single digital display with simple software might make sense. But comprehensive enterprise systems are overkill. The complexity doesn't justify the cost when you're managing one or two screens.

Beyond store size, location type matters. High-traffic locations where displays generate engagement and drive traffic justify investment. Low-traffic locations might make more modest investments. A display in an airport terminal reaches thousands daily. A display in a quiet corridor reaches dozens. Expected ROI differs dramatically.

Simplified example: A shopping mall spends

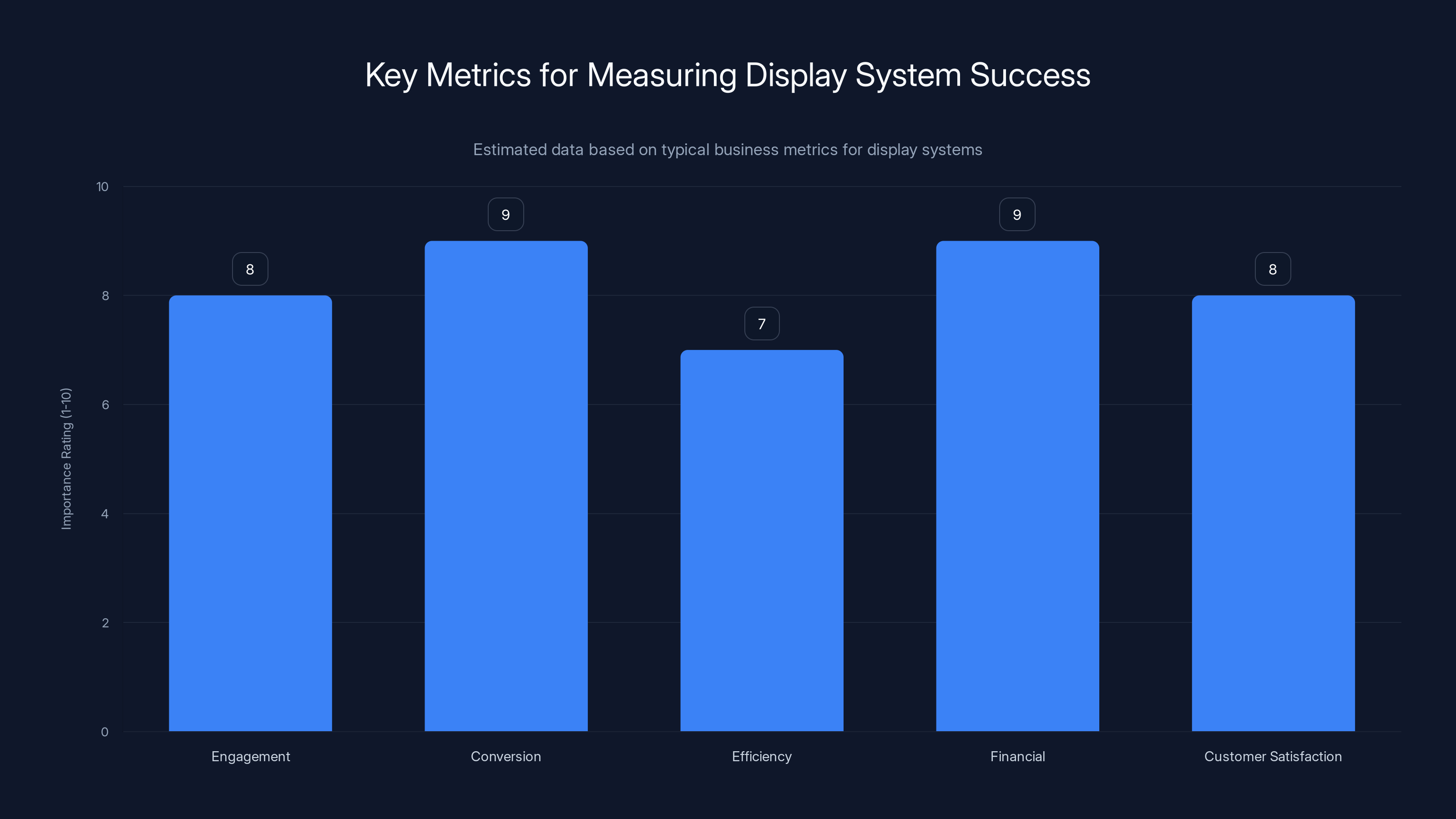

Estimated data shows conversion and financial metrics as most critical for assessing display system success, emphasizing business outcome alignment.

Integration with E-Commerce and Omnichannel Retail

Physical retail space used to exist separately from e-commerce channels. Online was one business. In-store was another. Increasingly, these merge.

Display systems now integrate with e-commerce platforms. A product displayed on a mall screen might show inventory at nearby stores. A customer scanning a product code at a physical display can see detailed product information, customer reviews, and pricing across all channels. A promotion running on display screens synchronizes with email, social media, and website marketing.

This integration matters because customer journeys cross channels. Someone might see a product promoted on a mall display, research it on their phone while standing there, visit the store to try it on, then purchase online later. The display system becomes part of the larger customer journey tracking and attribution model.

Retailers sophisticated about omnichannel integration use display analytics to understand channel attribution. A product heavily promoted on displays drives foot traffic to stores, but not all of that traffic converts to in-store purchase. Some converts to online purchase later. Measuring the relationship between display promotion and downstream e-commerce sales requires cross-channel tracking.

Centralized display systems enable this tracking by integrating with e-commerce platforms and CRM systems. When integrated properly, retailers can measure the complete impact of physical display campaigns, not just the immediate in-store effect.

Future Directions: What's Next for Retail Display Technology

The technology shown at ISE 2026 represents the current state of the art. But innovation continues. Several directions are emerging.

AI-powered content optimization. Instead of humans deciding what content displays at what times, machine learning systems analyze viewer engagement and automatically optimize content schedules. A system might discover that a particular advertisement performs better in the morning than evening and automatically shift the schedule. As engagement drops with repeated exposures, the system rotates to different content.

Augmented reality integration. Displays might evolve from static visual elements to components of larger AR experiences. Point your phone at a display, and the AR experience extends beyond what the display shows. Virtual products appear in the physical space. Mannequins appear to move. Architectural spaces transform.

Holographic displays. Current displays are flat. Emerging holographic technology creates 3D images visible from multiple angles without requiring glasses. Early implementations exist in high-end retail. As costs decline, this technology might become mainstream for premium retail spaces.

Biometric feedback integration. Some experimental systems measure viewer emotional responses through facial recognition and body language. Feedback loops then adjust displayed content to maximize positive responses. Regulatory and privacy questions remain significant, but the technology is emerging.

Sustainable display technology. Environmental concerns drive innovation in display efficiency and recyclability. Displays that consume less power and use sustainable materials become market differentiators.

The fundamental trajectory is clear: displays evolve from static communication channels into interactive, intelligent, responsive systems. They become less about broadcasting messages and more about dynamic conversation with customers. They become less about technology and more about experiences.

Implementation Strategy for Retailers

If you're a retailer considering moving toward centralized display systems, here's a practical implementation framework.

Phase 1: Assessment (Weeks 1-4). Audit existing display infrastructure. Document all current displays, their ages, maintenance costs, and management requirements. Interview staff about pain points. Identify locations with highest foot traffic and therefore highest ROI potential.

Phase 2: Requirements definition (Weeks 5-8). Based on your assessment, define system requirements. How many displays? What form factors? What content change frequency? What analytics capabilities matter most? What integration with existing systems is necessary?

Phase 3: Vendor evaluation (Weeks 9-12). Research vendors. Request proposals. Evaluate based on total cost of ownership, not just hardware cost. Assess software capabilities and user experience. Talk to current customers about their experiences.

Phase 4: Pilot deployment (Months 4-8). Deploy in single location. Start with a small number of displays. Learn the software. Train staff. Document processes. Identify and resolve integration issues.

Phase 5: Scaling (Months 9-18). Based on pilot results, expand to additional locations. Each deployment should proceed faster as your team builds expertise. Ramp up content creation capacity.

Phase 6: Optimization (Months 18+). Once systems are deployed, shift focus to optimization. Analyze engagement metrics. Refine content strategies. Implement more advanced capabilities like AI-powered scheduling. Plan for technology upgrades and maintenance.

The Bigger Picture: Retail's Digital Transformation

Retail display technology doesn't exist in isolation. It's one component of larger digital transformation reshaping how retail operates.

Everywhere you look, retail is becoming more technology-driven. Cashier-less stores use computer vision to track purchases. Inventory management systems use Io T sensors to monitor stock levels in real-time. Customer behavior is tracked through loyalty programs and smartphone location data. Predictive analytics forecast what products will sell.

Display systems fit into this ecosystem. They're another data stream. Another touchpoint. Another opportunity to understand customer behavior and optimize operations.

Retailers who embrace this transformation holistically create competitive advantage. Those who adopt individual technologies in isolation find benefits are limited. A great display system in a store with outdated everything else provides less value than you'd expect. Conversely, display systems integrated with modern inventory, payments, loyalty, and analytics create compounding benefits.

The retailers leading today's market are those who've fundamentally rethought retail from the ground up, incorporating technology throughout the entire experience. Display systems are part of this, but only one part.

Measuring Success: Metrics That Matter

After investing in new display systems, how do you know if the investment is working?

Simple vanity metrics like "number of displays deployed" or "total system uptime" don't tell you much. You need business metrics that connect display performance to actual outcomes.

Engagement metrics. How many customers interact with displays? How long do they spend in front of displays? Which content drives engagement? These metrics come from integrated sensors or tracking systems. Track these over time to understand which content and placements resonate.

Conversion metrics. Do customers who interact with displays make purchases? Track purchase behavior for customers exposed to specific displays or promotional content. Do the displays drive incremental sales, or just show products people would have bought anyway?

Efficiency metrics. How much labor does the system require? Track staff hours devoted to content management, troubleshooting, and maintenance. Compare to hours previously required. Calculate cost per screen per month including all labor and overhead.

Financial metrics. What's the total cost of ownership? Calculate all costs: hardware, software, installation, training, ongoing support. Compare to revenue generated through increased sales or cost savings through reduced overhead. Calculate ROI timeline and payback period.

Customer satisfaction metrics. Do customers prefer the new system? Survey visitors about their perception of the retail experience. Track Net Promoter Scores or similar satisfaction metrics before and after display system deployment.

The key is measuring actual business outcomes, not just technical implementation details. Beautiful displays that look impressive but don't drive sales or reduce costs don't deliver ROI. Your measurement framework should tie display performance to business results.

Challenges and Realistic Expectations

Display system implementations don't always go smoothly. Knowing common challenges helps you prepare.

Content creation bottleneck. Creating compelling content is harder than many expect. Generic product photos and bland promotional messages underperform. Engaging content requires professional design, copywriting, and often video production. Many retailers deploy systems then discover they lack capacity for content creation.

Integration complexity. Connecting display systems to existing POS, inventory, CRM, and e-commerce systems is more complicated than vendors often suggest. Legacy systems may not integrate easily. Data formats may not align. Custom integration work may be required.

Staff training. Using the software is one thing. Understanding strategy for effective content deployment is another. Staff need training not just on software operation but on best practices for retail display content. This training takes time and rarely gets the attention it deserves.

Maintenance and reliability. Display hardware fails occasionally. Software bugs appear. Cables get loose. Power supplies malfunction. The more complex your system, the more potential failure points. Budget for ongoing maintenance and support.

Display technology evolution. Display technology improves rapidly. The Micro-LED displays you deploy today will seem dated in five years. Plan for hardware refresh cycles and technology upgrades.

Realistic retailers expect the first year of operation to involve learning curves, refinements, and modest ROI. By year two, benefits become clearer as teams develop expertise and processes mature. By year three to five, strong ROI becomes evident as efficiency gains and engagement improvements compound.

FAQ

What is enterprise display management in retail?

Enterprise display management refers to centralized systems that allow retailers to control, monitor, and analyze networks of digital displays across multiple locations from a single cloud-based platform. Instead of managing displays independently at each store, a central team can push content updates, monitor equipment health, track engagement metrics, and optimize energy consumption across all displays simultaneously, dramatically improving operational efficiency and enabling data-driven decision-making.

How do centralized display systems improve retail operations?

Centralized systems eliminate time-consuming manual updates, reduce maintenance overhead through predictive failure detection, enable consistent brand messaging across locations, provide real-time engagement analytics, and allow retailers to measure which promotional content actually drives sales. They transform displays from static communication tools into intelligent, responsive systems that generate continuous data streams retailers can use to optimize marketing and operations.

What are the advantages of Micro-LED displays over traditional LCD and OLED?

Micro-LED displays offer superior brightness for high-ambient-light environments, seamless integration without visible gaps between modular sections, excellent color accuracy, fault isolation where individual sections can fail without affecting the rest of the display, and dramatically longer lifespan with minimal color degradation. They're specifically designed for large-scale commercial installations where reliability and visual quality over many years justify their higher initial cost compared to LCD or OLED technology.

When should a retailer invest in enterprise display systems?

Enterprise display systems make the strongest business case for large shopping malls (100+ displays), multi-location retailers (10+ stores), and high-traffic locations where display engagement is high. For single-location retailers or low-traffic environments, simpler solutions may provide better ROI. Decision should be based on total cost of ownership, expected labor savings, projected engagement improvements, and timeline to ROI, typically ranging from 3-7 years depending on scale and deployment.

How do retailers measure the success of display system implementations?

Success should be measured through business metrics rather than technical metrics: engagement rates (dwell time, interaction frequency), conversion metrics (purchase behavior for exposed customers), efficiency metrics (labor reduction compared to previous system), financial metrics (ROI timeline and payback period), and customer satisfaction metrics (Net Promoter Scores). Retailers should track actual sales impact of displayed promotions rather than assuming engagement automatically translates to revenue.

What role does data collection and analytics play in modern retail displays?

Data collection enables retailers to understand foot traffic patterns, measure engagement with specific content, correlate displayed advertising with purchase behavior, optimize display placement and scheduling based on performance metrics, and create omnichannel attribution models showing how physical displays drive downstream e-commerce sales. This transforms retail from tradition-based decision-making to data-driven decision-making where every marketing dollar can be measured and optimized.

How do E-Paper displays differ from traditional digital displays, and when should retailers use them?

E-Paper displays consume power only when the image changes, not continuously like traditional digital displays, reducing power consumption by up to 99% for static content. They work best for shelf labels, price displays, wayfinding signage, and informational boards that don't require rapid content changes or vibrant colors. Their ultra-slim form factor enables integration into tight spaces where traditional displays won't fit, making them ideal for space-constrained retail applications.

What should retailers budget for when implementing display systems?

Total cost of ownership includes hardware (displays, mounting, electrical infrastructure), software licensing, installation and integration, professional content creation, staff training, ongoing support and maintenance, and eventual technology refresh cycles. Hardware might be 40-50% of costs, with the remaining 50-60% for software, services, and ongoing operation. Retailers should expect 3-7 years to positive ROI depending on scale, with operational costs becoming clearer in years two and beyond.

How do display systems integrate with omnichannel retail strategies?

Modern display systems integrate with e-commerce platforms, inventory management, CRM systems, and email marketing to create seamless customer journeys across channels. A product displayed on a mall screen can show real-time inventory at nearby stores, link to online product pages, and track whether viewers subsequently make purchases online. This integration enables retailers to measure complete customer journey impact of physical displays rather than just immediate in-store sales.

What are the biggest implementation challenges retailers face with display systems?

Common challenges include content creation bottlenecks (creating compelling content is more demanding than expected), integration complexity (connecting to legacy systems takes longer than anticipated), insufficient staff training (teams need strategic guidance, not just software instruction), ongoing maintenance requirements (complex systems have more failure points), and technology evolution (hardware becomes dated faster than expected). Retailers should budget extra time and resources for these challenges rather than expecting smooth implementations.

The transformation of retail spaces through enterprise display systems represents one of the most significant but underappreciated shifts in how retailers communicate with customers. Unlike flashier technologies that grab headlines, display system evolution happens quietly in shopping malls, airports, and commercial spaces. But the cumulative impact is profound.

Retailers who embrace these systems early build competitive advantages that compound over time. Better content consistency. More efficient operations. Superior customer engagement. Deeper data about what actually works. These advantages become harder to catch up on as successful retailers accumulate expertise and data.

For retailers still operating with legacy signage infrastructure, the message is simple: the future of retail communication is digital, connected, and data-driven. The systems deployed today determine whether your retail spaces thrive or stagnate in the years ahead. The question isn't whether to adopt these technologies, but when and how to do it strategically.

Key Takeaways

- Enterprise display systems replace isolated screens with unified networks managed centrally, dramatically improving operational efficiency and content consistency across multiple retail locations

- Micro-LED technology offers superior brightness, color accuracy, seamless integration, and reliability compared to traditional LCD and OLED displays for large-scale commercial installations

- Centralized management platforms enable real-time content distribution, predictive maintenance, energy optimization, and engagement analytics previously unavailable with traditional signage

- E-Paper displays reduce power consumption by 99% for static content applications, making them ideal for shelf labels and informational signage where continuous power is impractical

- ROI typically ranges from 3-7 years depending on scale, with success measured through business metrics like engagement rates, conversion impact, and operational cost reduction rather than technical deployment metrics

Related Articles

- Why Allbirds Closing Stores Signals Tech Culture's Biggest Shift [2025]

- Why Amazon Shut Down Go and Fresh Stores [2025]

- GameStop Outage January 2026: Everything You Need to Know [2026]

- Samsung's Micro-LED TV With Interactive Bezel Screen [2025]

- Wing's Drone Delivery Expansion: 150 More Walmarts by 2027 [2025]

- Amazon's Buy for Me AI: The Controversy Shaking Retail [2025]

![How AI-Powered Digital Displays Are Reshaping Shopping Malls [2025]](https://tryrunable.com/blog/how-ai-powered-digital-displays-are-reshaping-shopping-malls/image-1-1770474939513.jpg)