Introduction: The Comeback Story Nobody Expected

When Getir raised its Series E funding round in 2021, valued at $12 billion, the Turkish startup looked unstoppable. The company had captured the ultra-fast grocery delivery wave before most competitors even understood it existed. But then everything changed. The pandemic ended. Consumer spending habits normalized. The venture capital funding that had flooded the space dried up. By 2024, Getir was shutting down operations across the United States, Europe, and the UK, laying off thousands of employees and retreating to its home market in Turkey and surrounding regions.

Now, in a twist that feels both inevitable and surprising, Uber has stepped in to acquire Getir's food delivery business for

This wasn't just any startup either. Getir had raised over $2.4 billion in total funding, making it one of the most well-capitalized startups in Turkey's history. The company had expanded aggressively during the pandemic, acquiring competitors and entering new markets with the kind of spending that venture capitalists dreamed about. But the economics of food and grocery delivery proved far more challenging than anyone predicted. Margins compressed. Customer acquisition costs climbed. The unit economics never quite worked out.

For Uber, the acquisition makes strategic sense. The ride-hailing giant has been aggressively expanding its delivery business globally, recognizing that food delivery generates revenue while also improving driver utilization. By acquiring Getir's food delivery assets, Uber gains an established platform with over $1 billion in annual gross bookings, strong market share in Turkey, and a base of experienced merchants and customers. The purchase also includes the option to acquire the remaining 85% of Getir's grocery delivery business over the coming years, as detailed in Business Wire.

What makes this deal particularly fascinating is what it reveals about the state of the delivery market in 2025. The era of reckless expansion and "growth at any cost" has ended. The age of consolidation has begun. Smaller players are getting absorbed. Markets are consolidating around two or three dominant platforms in each geography. And the companies that thrive are those that can achieve profitability while maintaining scale.

The Rise and Fall of Getir: A Case Study in Startup Hubris

Getir launched in 2015 in Istanbul with a simple premise: deliver groceries and everyday items to customers in under 10 minutes. This wasn't a new idea globally, but Getir executed it with particular skill in the Turkish market. The company built a network of small dark stores (micro-fulfillment centers) strategically placed throughout Turkish cities, allowing them to hit the sub-10-minute delivery promise that customers craved.

For the first few years, Getir dominated its home market. By 2020, the company had expanded to Germany, the United Kingdom, France, Spain, Portugal, Italy, the Netherlands, and Belgium. The company was raising capital at extraordinary valuations from top-tier venture firms like Sequoia Capital, Tiger Global, and others who believed that the ultra-fast delivery market was genuinely transformative.

Then the pandemic hit, and everything accelerated. Consumer spending on food and grocery delivery skyrocketed. Getir expanded its footprint aggressively, entering new markets and scaling operations rapidly. The Series E funding round in 2021 valued Getir at $12 billion, making it one of the most valuable startups in Europe and the Middle East. Investment flowed in from Mubadala, the Abu Dhabi sovereign wealth fund, which became the company's largest shareholder and most powerful voice in governance.

But the underlying economics were always questionable. Ultra-fast delivery requires expensive infrastructure. You need to operate dark stores in expensive real estate locations. You need to hire and retain couriers, a high-turnover position. You need to invest heavily in logistics software and routing optimization. And all of this needs to happen at scale to work economically. The unit economics require either very high order values or very high order frequency (or both).

What happened in 2022 and 2023 was devastating for every player in this category. Consumers stopped ordering food for delivery as frequently. They returned to restaurants. They went back to shopping for groceries themselves. The stay-at-home effect evaporated. Getir was suddenly operating at a massive loss. The company had built out infrastructure for a universe of demand that no longer existed.

By 2024, the situation had become untenable. Getir announced that it was shutting down operations in the United States, United Kingdom, Spain, Portugal, Italy, the Netherlands, Belgium, and Germany. Thousands of employees were laid off. The company retreated to Turkey and a few other markets where it still had competitive advantage and positive unit economics.

The retreat wasn't clean either. Mubadala, which by this point owned a substantial stake in Getir, proposed a radical restructuring plan to turn the company around. One of Getir's co-founders opposed the plan, arguing that it amounted to an illegal coup. The founder sued in Dutch courts (where the company incorporated) to block the restructuring, but ultimately lost. Mubadala gained control and began trying to salvage value from the company.

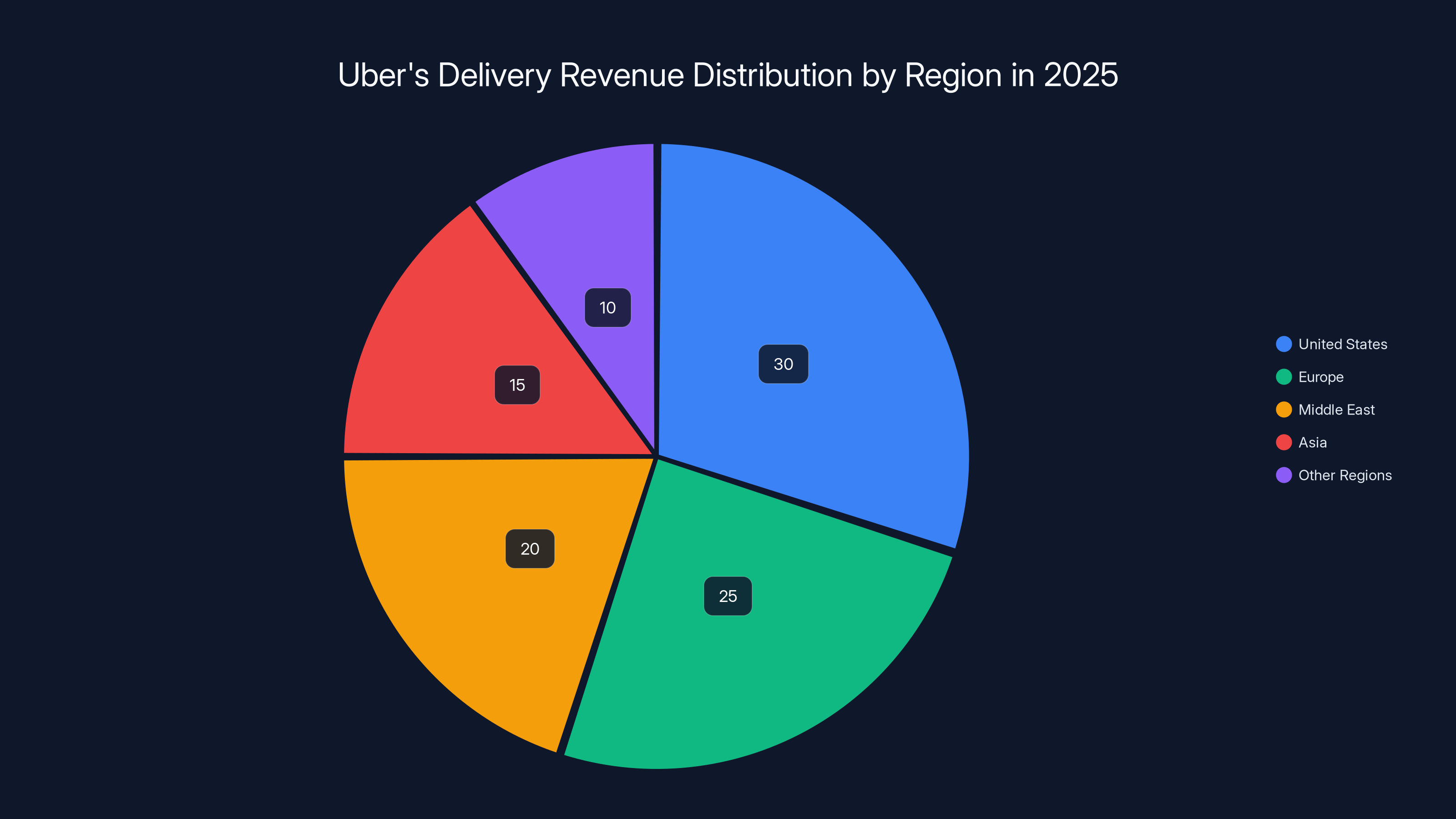

Estimated data shows the United States as the largest revenue contributor, followed by Europe and the Middle East, reflecting Uber's strategic focus on these high-growth regions.

Why Uber Decided to Acquire Getir Now

For Uber, the acquisition of Getir's food delivery business makes a lot of sense strategically, even if the timing might seem unusual. Uber has been trying to build a dominant delivery platform globally for the past five years. The company acquired Deliveroo in some markets, took minority stakes in others, and built its own Uber Eats platform from scratch in many regions.

In Turkey specifically, Uber had already invested heavily. The company acquired Trendyol Go, a food and grocery delivery service, for $700 million in May 2024. Trendyol was a solid platform, but Getir's food delivery business had scale and customer loyalty that Trendyol Go lacked.

According to the announcement, Getir's food delivery business generated over $1 billion in gross bookings in 2025, representing 50% growth compared to 2024. That's substantial volume. That's real revenue flowing through the platform. For Uber, acquiring that volume is significantly cheaper than building it organically.

Moreover, Getir comes with an established merchant network. Restaurants and food merchants are already integrated into the platform. They have supplier relationships, integration infrastructure, and business relationships that would take Uber years to replicate from scratch. By acquiring Getir, Uber also acquires all of those relationships and integrations.

The price paid (

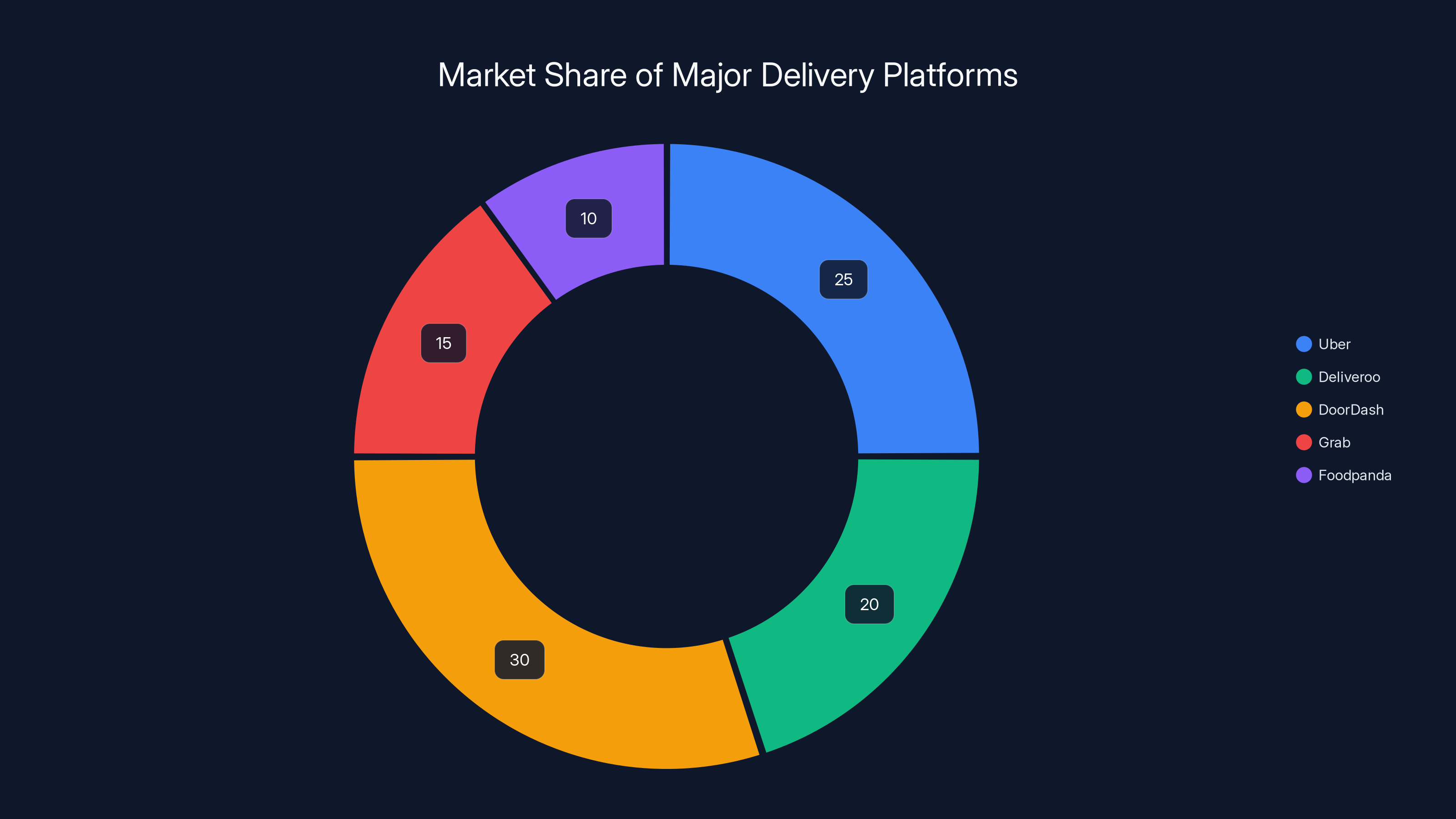

Estimated data shows Uber, Deliveroo, and DoorDash as dominant players in their respective regions, capturing significant market share.

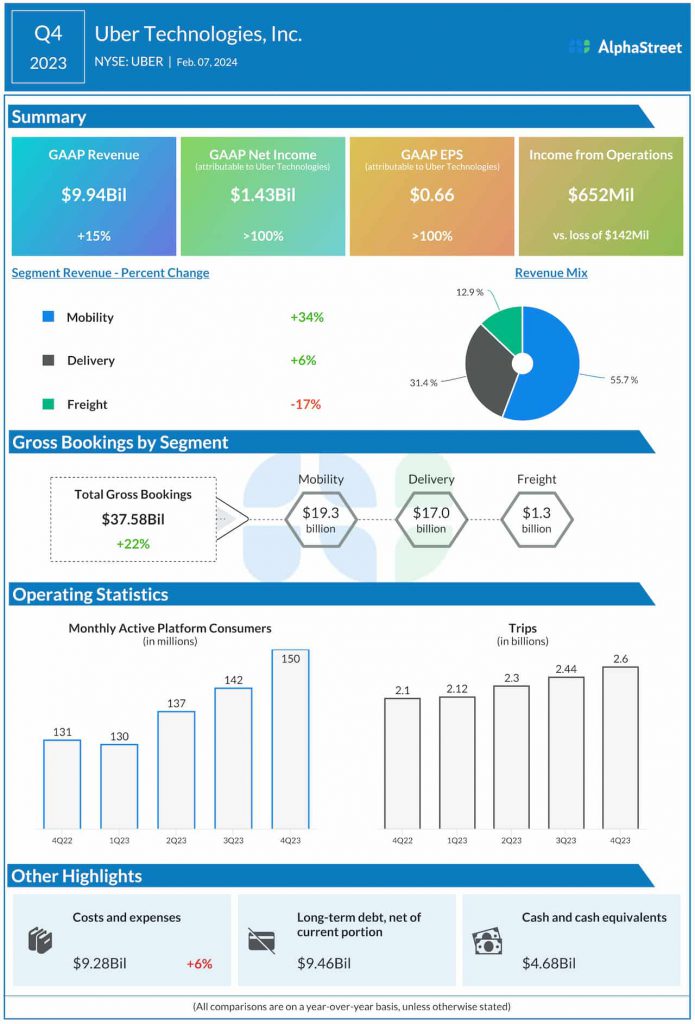

The State of Uber's Delivery Business in 2025

Uber's delivery business has become increasingly important to the company's financial performance. In the fourth quarter of 2024, Uber's delivery segment reported revenue of $4.89 billion, representing 30% growth compared to the same quarter the previous year. That growth rate is healthy, especially for a mature segment. The company has successfully positioned itself as a leader in food delivery across most major markets globally.

But Uber's delivery business faces persistent challenges. Competition remains fierce. Profit margins on delivery are notoriously thin. Regulatory pressures keep increasing. Several countries have implemented or are considering caps on delivery fees, which directly impacts profitability. The company needs to continuously invest in technology, logistics infrastructure, and marketing to maintain its competitive position.

Geographically, Uber identified Europe, the Middle East, and Asia as the fastest-growing regions for delivery in 2025. That's exactly where Getir operates now, after retreating from its overly ambitious global expansion. By acquiring Getir, Uber strengthens its position in these high-growth regions.

The combined entity of Trendyol Go and Getir food delivery would create a dominant platform in Turkey, Uber's second-largest market for delivery after the United States. This consolidation gives Uber better negotiating power with restaurants, better utilization of courier networks, and better economics overall.

Market Consolidation: The Delivery Industry's New Reality

The Getir acquisition is just one piece of a much larger story about consolidation in the delivery industry. Over the past two years, we've seen a dramatic reshaping of the competitive landscape. Companies that once seemed unassailable have either been acquired or forced to merge. Startups that promised to disrupt food delivery have been subsumed into larger platforms. The free-for-all era of multiple delivery services in each neighborhood has given way to a more concentrated market structure.

This consolidation makes economic sense. The delivery market was oversupplied with competition. In most major cities, there were five to ten different delivery apps available. Consumers didn't need that many options. Restaurants found it expensive and complicated to maintain relationships with dozens of different platforms. The result was that everyone was losing money.

As consolidation progresses, we're seeing a natural market structure emerge: two to three dominant platforms in each geography. In most developed markets, Uber is one of those platforms. Deliveroo is another in Europe. Door Dash dominates North America. In Asia, regional players like Grab and Foodpanda compete with global players.

This market structure is healthier than the previous oversaturated environment, but it raises important questions about consumer welfare, pricing, and innovation. With fewer competitors in each market, platforms have more pricing power. They can impose higher fees on both consumers and restaurants. The competitive pressure that once drove rapid innovation and service improvements diminishes.

Governments are paying attention to this consolidation. Regulators in the European Union, the United Kingdom, and several other jurisdictions are scrutinizing delivery platform mergers more carefully. Some are considering antitrust action against dominant platforms. The concern is that consolidation, while economically rational, may not serve consumers' long-term interests.

Getir's valuation peaked at

Getir's Pivot: From Global Ambition to Regional Focus

What's striking about Getir's journey is how quickly it went from startup to consolidation target. The company launched in 2015, spent about six years building a dominant position in Turkey and expanding globally, and then spent the next two years retreating from nearly everything it had built.

This isn't unusual in the startup world. We've seen this pattern before with companies like Didi Chuxing (ride-hailing), OYO Rooms (short-term rentals), and others. The pattern is: (1) Raise massive amounts of capital, (2) Expand aggressively into multiple markets, (3) Discover that expansion is more expensive and harder than anticipated, (4) Face investor pressure to achieve profitability, (5) Retreat to core markets and downsize operations.

For Getir, the retreat was particularly painful because the company had moved quickly to establish operations in sophisticated markets like the United States and Western Europe, where regulatory environments are complex and competitive dynamics are intense. Building a delivery platform in Berlin or New York requires navigating labor regulations, dealing with established competitors, and overcoming consumer inertia toward existing platforms.

But here's the thing: Getir's business in Turkey and surrounding regions didn't collapse. The company maintained positive unit economics in its core markets and continued to generate significant revenue. The problem was that the company had overextended itself internationally and couldn't sustain those losses while also investing in growth.

By accepting the Uber offer, Getir is essentially admitting that the company can't achieve global scale in the current competitive environment. But it's also finding a path forward. The company can still focus on its core markets in Turkey and the Middle East, now under the broader umbrella of Uber, with access to greater resources and a clearer path to profitability.

The Strategic Genius (or Risk) of the Deal Structure

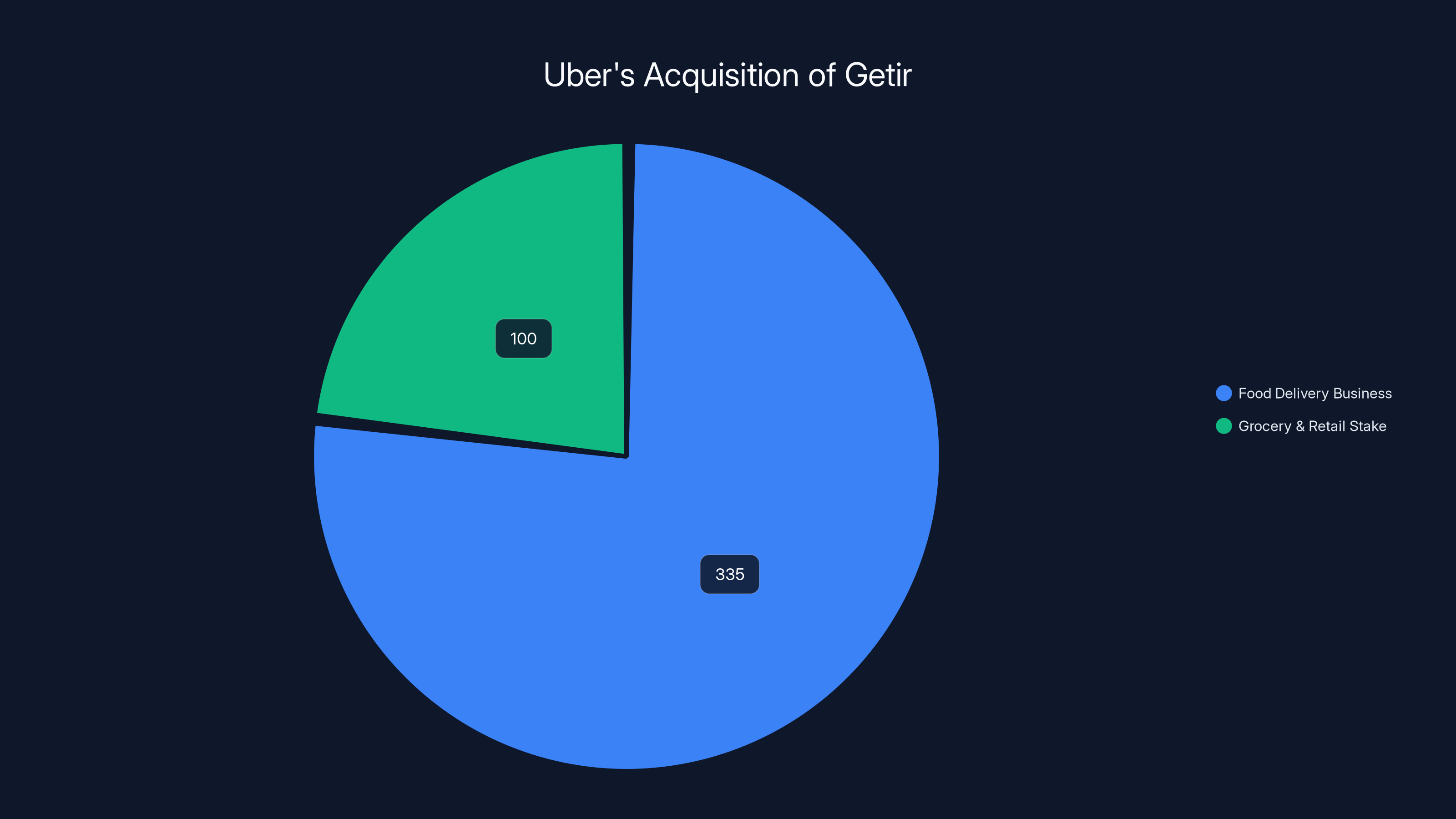

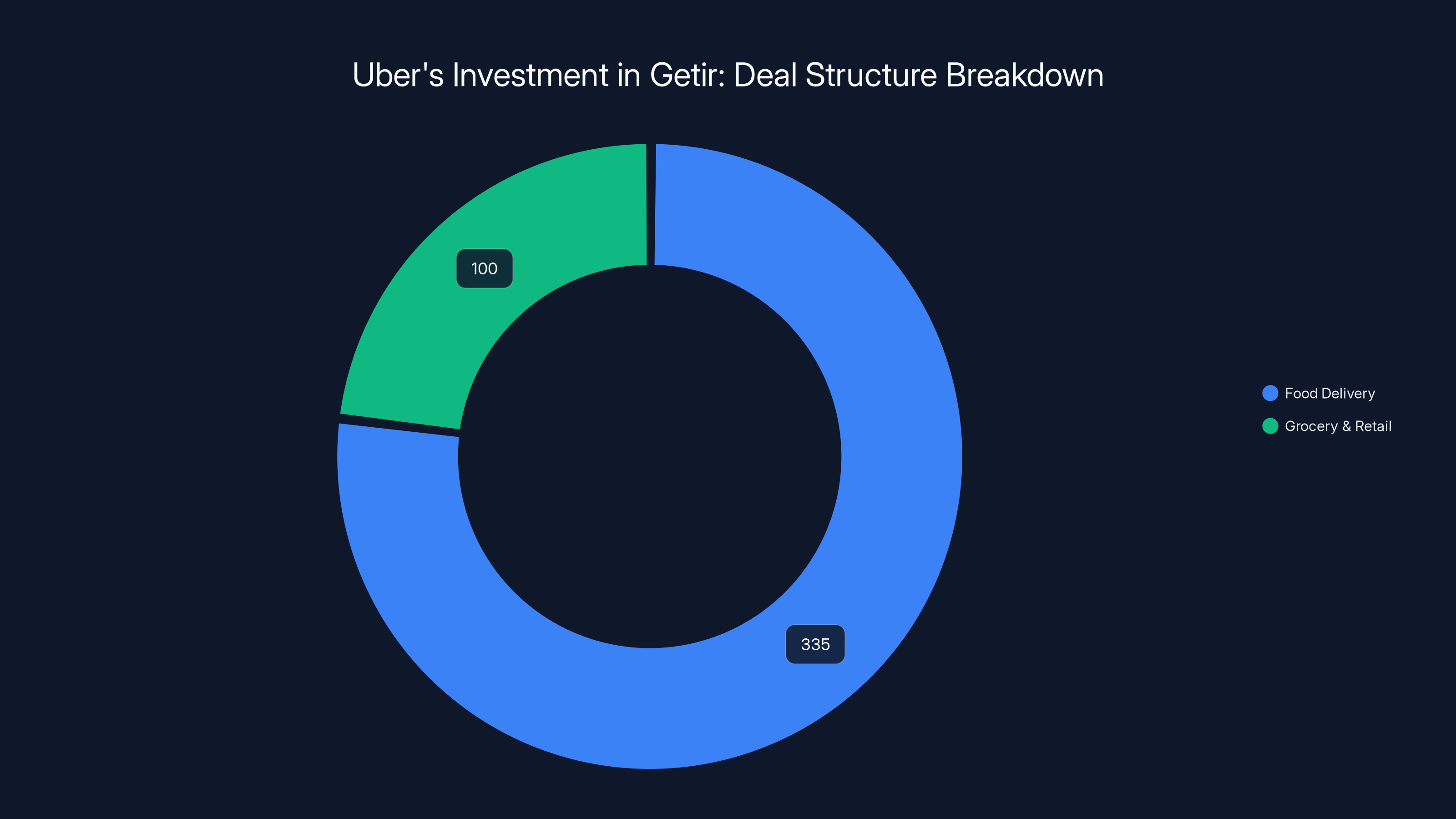

The way Uber structured the Getir deal is worth examining in detail. The company paid

This structure reveals Uber's confidence in the food delivery opportunity but caution about the grocery delivery business. Food delivery is Uber's core competency. The company understands how to operate food delivery platforms, manage restaurant relationships, and optimize delivery logistics for restaurants. Getir's food delivery business with $1 billion in annual GMV is valuable and worth integrating immediately.

But grocery and rapid delivery is a different beast. The unit economics are worse. Customer acquisition costs are higher relative to order values. The competitive dynamics are different. Uber is taking a cautious approach, acquiring a minority stake and keeping the option to expand ownership if the business performs well.

This is smart deal structuring. It allows Uber to gain exposure to Getir's grocery business without committing to a massive upfront payment. The company can observe how the business performs over the next few years and decide whether to increase its stake. If the grocery business thrives, Uber can acquire the rest. If it struggles, Uber's minority stake can be a good long-term investment without requiring significant operational commitment.

Uber invested

Mubadala's Exit: A Win or Damage Control?

Mubadala, the Abu Dhabi sovereign wealth fund, was Getir's largest shareholder and played an increasingly important role in the company's governance, particularly after proposing the controversial restructuring plan in 2024.

For Mubadala, selling the stake to Uber is primarily damage control. The fund invested in Getir expecting the company to achieve a massive exit at a significantly higher valuation. Instead, Mubadala is exiting most of its stake at a valuation representing a massive loss compared to what the company was worth at its peak.

But from Mubadala's perspective, this is the best realistic option available. The fund had already restructured Getir's operations, removed the co-founder, and taken control. The company was bleeding money internationally. There was no clear path to Mubadala achieving its return expectations as an independent operator.

Selling to Uber allows Mubadala to recover some capital and move on to other investments. The fund could have held out for a better price, but the risk of holding on is that the business continues to deteriorate and Mubadala ends up with even less.

What This Means for Employees and Users of Getir

For the thousands of Getir employees who survived the 2024 restructuring and layoffs, the Uber acquisition presents both opportunity and uncertainty. On the positive side, being part of Uber provides stability. Uber is a profitable, publicly traded company with resources to invest in product and infrastructure.

On the negative side, acquisitions typically involve significant organizational changes. There will be redundancies. Uber will consolidate back-office functions, potentially eliminating duplicative roles. Some Getir employees may not be comfortable working in Uber's culture and may choose to leave. The company Getir built will cease to exist as an independent entity.

For users of Getir, the acquisition means that the service will likely continue, but under Uber's brand and operating model. In the short term, nothing may change. But over time, we can expect that Trendyol Go and Getir's food delivery service will be integrated, consolidated, or rebranded under Uber Eats or another unified platform.

The consolidation means fewer delivery options for Turkish consumers, but it also potentially means better service, faster deliveries, and more reliable operations, as Uber can leverage its scale and operational expertise to improve the service.

Getir's food delivery business experienced a 50% growth in gross bookings from 2024 to 2025, reaching over $1 billion. This growth highlights the strategic value of the acquisition for Uber.

Implications for the Broader Tech Ecosystem

The Getir acquisition is one data point in a larger trend that's reshaping the technology ecosystem. Over the past two years, we've seen a marked slowdown in venture capital funding, increased focus on profitability and unit economics, and a wave of consolidation across multiple sectors.

Startups that were celebrated as "unicorns" and industry disruptors five years ago are now being acquired by larger competitors at valuations representing massive losses for investors. This doesn't mean that venture capital is dead or that startups aren't important anymore. But it does mean that the era of funding growth at any cost has ended. The era of consolidation and disciplined capital allocation has begun.

For Turkish entrepreneurs and the broader Turkish startup ecosystem, the Getir story carries important lessons. Building a global startup is harder than it looks. Unit economics matter. International expansion requires a level of operational maturity and capital efficiency that many startups underestimate. The companies that survive are those that find sustainable business models early and focus on profitability before expansion.

But the story isn't entirely negative for Turkish tech. Getir still exists. The company's core business in Turkey is healthy. The company will continue to operate and generate value for users and merchants. And for future Turkish startups, Getir's founders and employees have gained valuable experience that they can apply to future ventures.

The Future of Delivery: What's Next?

Looking ahead, the delivery industry will likely continue to consolidate. We can expect to see one or two dominant platforms in each major geography, competing on price, service quality, and coverage area. We can also expect to see increased regulatory scrutiny in Europe and other developed markets, potentially limiting how much power these platforms can exert over restaurants and consumers.

The economics of delivery will also continue to improve, but from a lower baseline. As competition consolidates and platforms achieve scale, they can reduce operational costs and improve margins. However, regulatory pressure on fees and increasing labor costs will cap how much improvement is possible. Delivery will likely remain a moderately profitable business for scale players like Uber, but not the extraordinarily profitable business that venture capitalists once imagined.

For Uber specifically, the Getir acquisition strengthens its position in a region where delivery growth is fastest. The company is positioning itself to be a dominant platform globally, with strong positions in North America (via Door Dash investments and partnerships), Europe (via Deliveroo and Uber Eats), and now Turkey and the Middle East (via Getir and Trendyol Go).

Uber invested

Profitability and Path to Sustainability

One of the most important aspects of the Getir acquisition is what it reveals about the path to profitability in the delivery industry. For years, the conventional wisdom was that delivery companies needed to achieve massive scale before thinking about profitability. Uber, Door Dash, Deliveroo, and others spent years burning billions of dollars to capture market share, with the assumption that profitability would come later.

The data is now clear: profitability does come later, but only if companies achieve sufficient scale and consolidation. In markets where two or three platforms dominate, margins improve significantly. In oversaturated markets where ten or more platforms compete, profitability remains elusive. This is why consolidation is happening: it's the only way for these companies to become genuinely profitable.

Getir's core markets in Turkey and surrounding regions are now consolidated around fewer players. By acquiring Getir, Uber is consolidating further and improving unit economics in these markets.

Regulatory Considerations and Antitrust Implications

As Uber consolidates its position in delivery markets globally, regulatory scrutiny is intensifying. In the European Union, regulators are examining whether Uber's dominance in delivery violates competition law. The UK Competition and Markets Authority is also investigating the delivery market. Similar investigations are ongoing in other jurisdictions.

The Getir acquisition may face regulatory review in some markets. Regulators will ask: Does this acquisition reduce competition and harm consumers? In Turkey, where Uber is combining Getir's food delivery with Trendyol Go, there may be concerns about dominance.

However, the acquisition will likely be approved in most jurisdictions for a simple reason: Getir is effectively exiting the markets in which it previously competed with Uber. The company has no presence in North America. It exited most of Europe. It's focusing on Turkey and a few adjacent markets. The acquisition doesn't create a dominant player where one didn't previously exist; it consolidates a region where multiple players were struggling.

Learning from Getir: Key Takeaways for Startups and Investors

Getir's rise and fall offers several important lessons for startups and venture investors in 2025 and beyond.

First, unit economics matter more than growth rate. Getir grew rapidly, but the underlying unit economics of ultra-fast delivery were always questionable. The company should have focused more on getting unit economics right before expanding internationally.

Second, international expansion is harder than it looks. Launching in Turkey and expanding to Germany and France are very different challenges. The capital required to build scale in mature markets is often 5-10 times higher than the capital required in emerging markets. Getir underestimated this and stretched its capital too thin.

Third, founder alignment and governance matter. When Mubadala and the founder disagreed about the restructuring plan, the conflict damaged the company's ability to execute quickly. A more aligned cap table and governance structure might have enabled faster decision-making.

Fourth, market conditions can change rapidly. The pandemic created artificial demand for delivery services. When the pandemic ended, demand normalized, and the entire competitive landscape shifted. Startups need to plan for scenarios in which favorable conditions don't persist.

Fifth, profitability beats growth. Looking back, Getir would have been better off focusing on profitability in Turkey and a few adjacent markets rather than pursuing global scale. A profitable company with

The Role of Capital in This Story

It's worth examining the role of venture capital in the Getir story. The company raised an extraordinary amount of capital, enabling it to scale rapidly. But that same capital also created pressure and expectations. Investors who poured billions into Getir expected the company to achieve returns of 10-100x their investment. That expectation pushed Getir to expand more aggressively than was economically sensible.

Had Getir raised less capital and been more disciplined about expansion, the company might be in a stronger position today. Instead, the company raised too much capital, expanded too fast, and is now being sold to Uber at a massive loss for investors.

This is the dark side of venture capital. The model works brilliantly for companies that achieve massive scale and exit at high valuations. But it can be destructive for companies that end up in the middle—big enough that they can't be bootstrapped or grown organically, but not big enough to achieve the returns that investors require.

Looking Ahead: 2025 and Beyond

As we look toward the rest of 2025 and beyond, the Getir acquisition is one marker of a larger shift in the technology industry. The era of abundant capital and growth-at-any-cost is over. The era of consolidation and focus on profitability has begun.

We'll likely see similar acquisitions and consolidation moves in other sectors. Companies that expanded too aggressively will either be acquired or will continue to shrink. The consolidators—companies like Uber, Amazon, and others—will become stronger.

For consumers, this consolidation may result in fewer choices and potentially higher prices in the long term. For entrepreneurs, it means that the path to success now requires more discipline and focus on unit economics. For venture investors, it means accepting lower returns and being more selective about which companies receive funding.

The Getir story isn't a failure story per se. The company still exists and operates successfully in its core markets. The founders and employees gained valuable experience. The technology and operations that were built are still valuable. But it's also not a success story in the way that the venture industry defines success—a 10x or 100x return on investment.

Instead, it's a cautionary tale about the dangers of overexpansion and the importance of building sustainable businesses from the beginning.

FAQ

What is Getir and why was it valuable?

Getir was a Turkish ultra-fast delivery startup founded in 2015 that promised to deliver groceries and everyday items to customers in under 10 minutes. The company became one of Europe's most valuable startups at a peak valuation of

Why did Getir struggle and retreat from most international markets?

After the pandemic ended and consumer behavior normalized, demand for ultra-fast delivery dropped significantly. The company's business model, which relied on expensive dark store networks and courier infrastructure, proved to have negative unit economics in most international markets. Combined with competitive pressure and regulatory challenges, Getir was forced to exit its US, UK, and most European operations in 2024 and focus on its profitable core market in Turkey.

How much did Uber pay for Getir and what did it get?

Uber paid

Why would Uber want to buy a struggling startup like Getir?

Uber's acquisition of Getir makes strategic sense because it acquires an established platform with

What does this acquisition mean for the delivery industry and consolidation?

The Getir acquisition is part of a larger consolidation trend in the delivery industry. After years of oversaturation with too many competing platforms, the market is consolidating around two to three dominant players in each geography. This consolidation improves unit economics for survivors like Uber but may reduce competition and consumer choice in the long term.

What lessons does Getir's story provide for startups and investors?

Getir's story demonstrates that rapid growth without profitable unit economics is unsustainable, that international expansion is more expensive than many startups anticipate, that founder alignment and governance matter, and that profitability in a sustainable business is often more valuable than growth in an unprofitable one. The company's experience shows the risks of the venture capital model when applied to capital-intensive businesses like logistics and delivery.

Is Getir completely disappearing after this acquisition?

No, Getir will continue to operate in Turkey and surrounding regions, but as part of Uber's portfolio. The company's food delivery service will likely be integrated with Trendyol Go (another Uber acquisition) and eventually rebranded or consolidated under a unified Uber platform, but the underlying service and operations will continue serving customers and merchants.

What happened to Mubadala's investment in Getir?

Mubadala, the Abu Dhabi sovereign wealth fund that became Getir's largest shareholder, is exiting most of its stake through the Uber sale. This represents a significant loss compared to the $12 billion peak valuation, but allows Mubadala to recover capital and avoid further deterioration of the investment if the business continued to struggle as an independent operator.

Key Takeaways

- Uber acquired Getir's 335 million, plus $100 million for a 15% stake in grocery/retail operations

- Getir's 374 million in 2024 assets after pandemic demand normalized and international expansion proved unprofitable

- The acquisition reflects larger industry consolidation trend: oversaturated multi-player markets consolidating to 2-3 dominant platforms per region

- Unit economics matter more than growth rate: Getir expanded internationally without achieving profitable unit economics in most markets

- Profitability beats growth: A bootstrapped 2B+ revenue company facing collapse

Related Articles

- AMD's Strong Financial Results Despite PC Market Decline [2025]

- Crunchyroll Price Hikes: Inside Sony's Anime Streaming Strategy [2025]

- How Ethos Reached Profitability While Insurtech Rivals Collapsed [2026]

- DoorDash Promo Codes & Coupons February 2025: 50% Off Guide

- Telly's Free TV Strategy: Why 35,000 Units Matter in 2025

- Micron Kills Crucial Brand: What It Means for RAM Consumers [2025]

![Uber Acquires Getir's Delivery Business: What It Means for the Market [2025]](https://tryrunable.com/blog/uber-acquires-getir-s-delivery-business-what-it-means-for-th/image-1-1770651681314.jpg)