The Battle Over AI Training Data Just Got a Marketplace

Remember when everyone was just borrowing content for AI without asking? Yeah, those days are ending. Not because tech companies suddenly developed a conscience, but because they're realizing there's actual money to be made in doing this the right way.

Amazon just made a move that could reshape how AI companies acquire training data. The company is building a marketplace where media publishers can directly license their content to AI firms. This isn't theoretical. Amazon met with publishing executives, showed them slides about the platform, and circulated details at an AWS publisher conference. It's happening, as confirmed by Pymnts.

This is bigger than just Amazon being nice. What we're seeing is the inevitable collision between an industry desperate for quality training data and publishers who've watched their traffic disappear as AI summaries replace their articles. Someone finally decided: why fight in court when you can just build a marketplace?

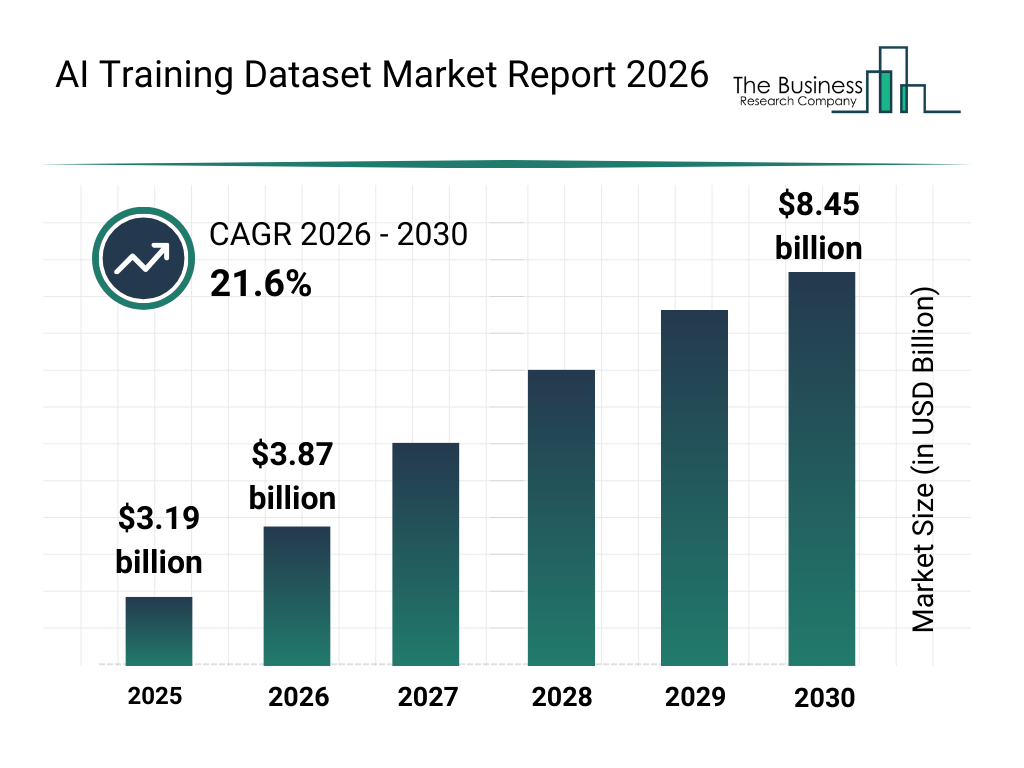

The stakes are enormous. The AI industry has been training models on everything from news articles to books to research papers, mostly without paying for it. Publishers have been losing sleep over it. Regulators have been watching. Lawsuits have been flying. And now we're seeing the market solution: structured, transparent licensing, as discussed in The Information.

But this raises real questions. Will this actually help publishers make meaningful money? Will it change how AI companies train their models? And what happens to the open web if everyone starts hiding their best content behind licensing agreements?

Let's break down what's actually happening here, why it matters, and what comes next.

TL; DR

- Amazon is launching a content marketplace connecting publishers directly to AI companies for licensing deals

- Publishers are desperate for revenue as AI summaries drain traffic from their websites, as noted by PPC Land

- This follows Microsoft's model but with Amazon's scale and reach

- The licensing approach is becoming industry standard to avoid copyright lawsuits, as highlighted by Tech Policy Press

- Key question: will this actually pay publishers enough to offset traffic losses from AI?

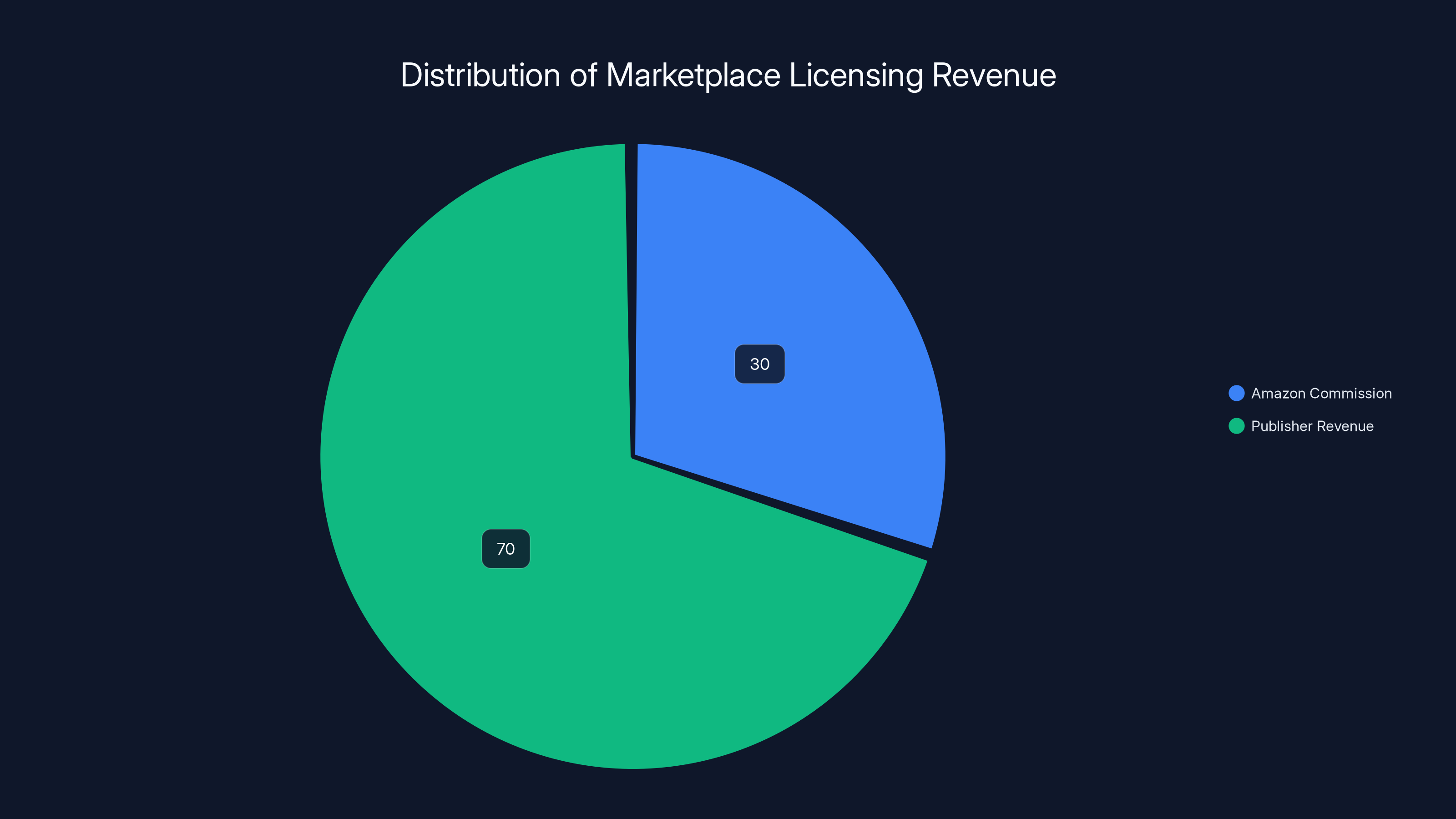

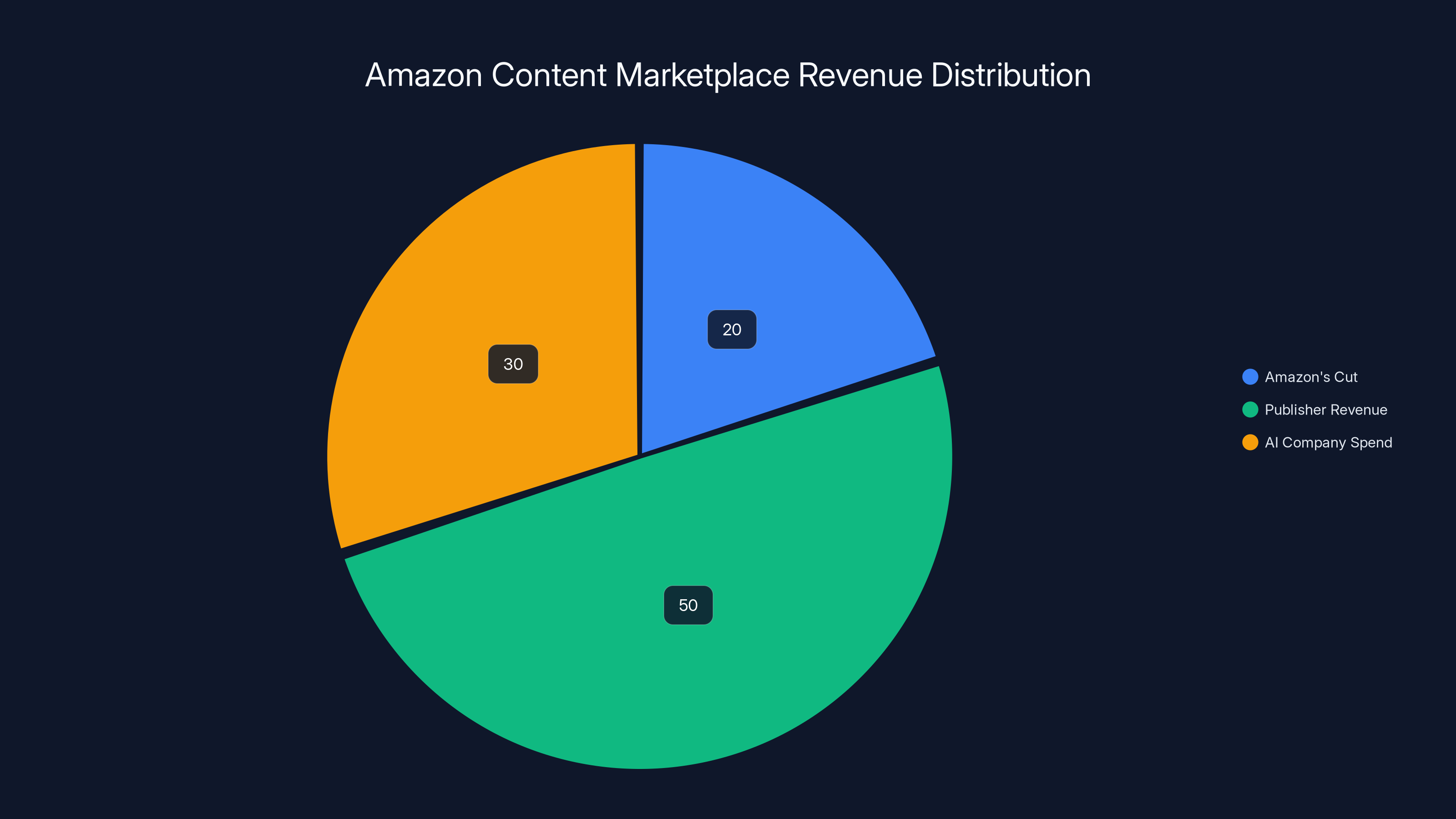

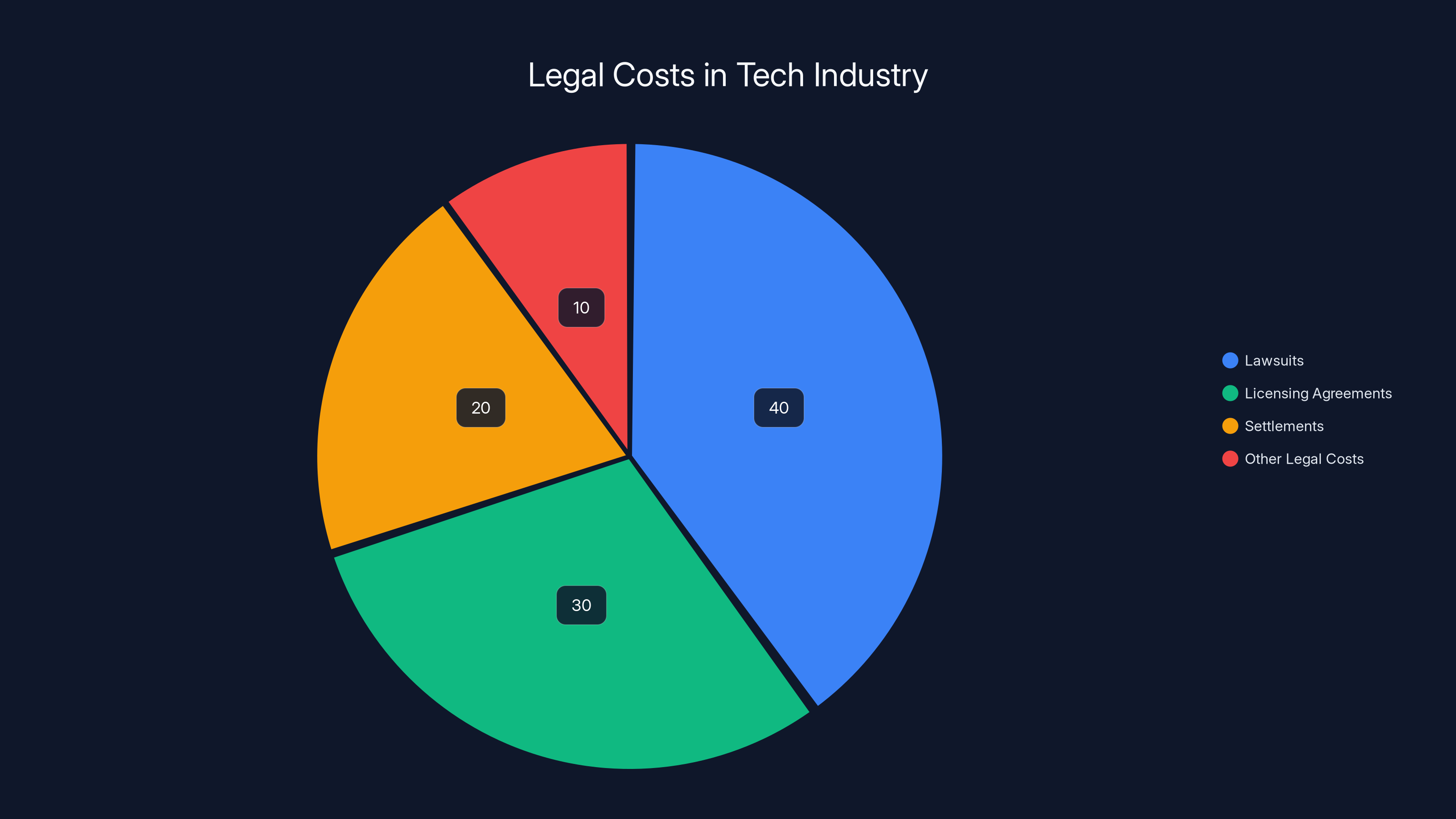

In a typical marketplace transaction, 30% of the revenue is taken as commission by Amazon, while 70% is distributed among the publishers. Estimated data based on standard marketplace commission rates.

Why Tech Companies Suddenly Care About Legal Content

Let's be real: the tech industry didn't rush to pay for content out of principle. They're doing this because getting sued constantly is expensive, regulatory pressure is mounting, and they need sustainable sources of high-quality training data.

The copyright lawsuits have been relentless. The New York Times sued OpenAI and Microsoft for training on millions of articles without permission, as reported by The New York Times. Major authors filed class actions against multiple AI companies. Musicians are suing for voice cloning. Getty Images sued for image scraping. The legal bills alone are probably in the hundreds of millions across the industry.

Moreover, there's a fundamental problem with unlicensed training data: it's toxic. If you train a model on copyrighted material, you're creating ongoing legal liability. You can't deploy it in certain markets. You can't guarantee it won't regurgitate copyrighted text. You're basically building on a time bomb.

From a business perspective, licensing is actually cheaper than litigation. If you're training a multi-billion parameter model, paying fair rates for quality content is genuinely more cost-effective than fighting lawsuits for five years, getting injunctions, and rebuilding your models.

But there's another reason tech companies are suddenly interested in legitimate licensing: quality. The internet is... messy. Not all content is good. Not all content is useful for training. When you're building models that need to reason, write, and create, you need premium training material. A New York Times article is worth more than a random blog post. Academic research is worth more than tweets.

So licensing becomes not just a legal strategy, but a quality strategy. You're saying: instead of scraping everything, let me buy the best stuff directly from the source.

This is where Amazon's marketplace enters the picture. Amazon understands marketplace dynamics better than almost anyone. They've built their entire business on being the intermediary, taking a cut, and creating systems where both sides benefit. A content marketplace for AI is a natural extension.

Understanding Amazon's Content Marketplace Strategy

Amazon isn't entering this space randomly. They've been watching the publisher problem for two years, watching Microsoft make moves, and watching AI companies scramble for defensible training data sources.

The marketplace model is straightforward: publishers list their content, set prices or licensing terms, and AI companies browse and purchase access. Amazon takes a cut. Everyone theoretically wins. Publishers get paid without having to negotiate individually with dozens of tech companies. AI companies get curated, legal access to content. Amazon gets a new revenue stream and more control over AI infrastructure.

What makes Amazon's version different from other licensing attempts is scale. Amazon has relationships with major cloud customers. AWS is where many AI companies already run their infrastructure. Selling content through the same platform where companies are already spending millions on compute? That's distribution. That's friction reduction.

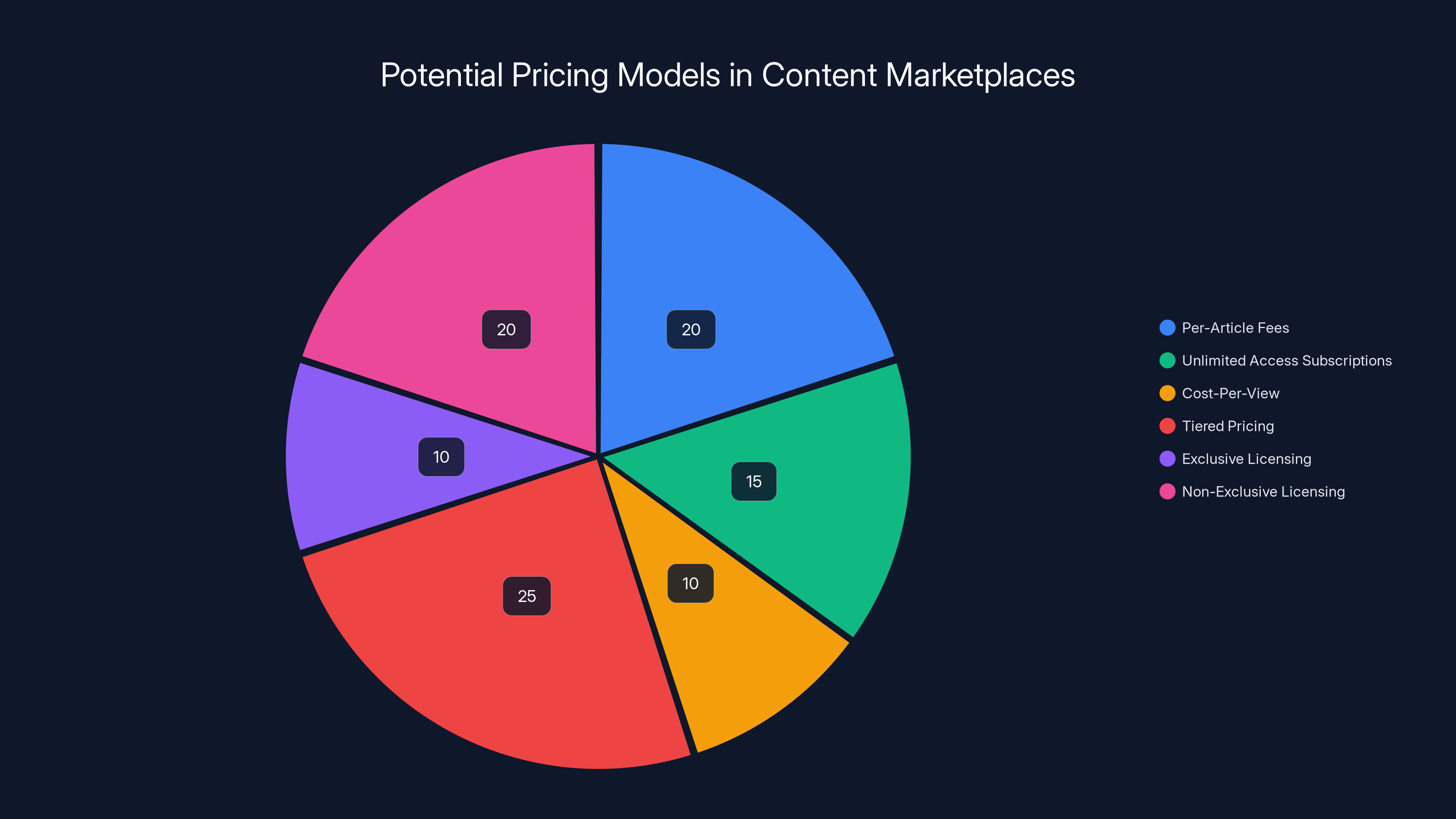

The platform likely works something like this: a publisher uploads their content catalog with metadata (publication date, category, quality tier). They set licensing terms: might be cost-per-view, might be cost-per-article, might be unlimited access for a flat fee. AI companies search the catalog, preview content, and purchase access. Amazon handles billing, contract management, and payment distribution.

But here's the thing that's interesting: Amazon is reportedly talking to publishing executives specifically. They're not just building a platform and hoping people show up. They're pre-selling the concept. This suggests they've already had commitments or strong signals that publishers are interested.

Why would publishers be interested? Because their current situation is dire. Media sites have watched traffic crater as AI summaries replace articles as the first place people go for information. A publisher said their traffic dropped 40% after Google started surfacing AI overviews in search results, as noted by PPC Land. They're bleeding audience and don't have a good way to monetize what's left.

Licensing content to AI companies is literally the only revenue lever some of these publishers have left. At least with a marketplace, they have transparency. They know what's being paid, they can see who's buying, and they can adjust their strategy.

Estimated distribution of pricing models shows tiered pricing and per-article fees as the most common, reflecting diverse needs of publishers and AI companies.

The Microsoft Precedent: What Amazon Learned

Amazon isn't the first to try this. Microsoft already launched their Publisher Content Marketplace, and understanding their approach reveals what's likely coming with Amazon's version.

Microsoft's marketplace positions itself as providing publishers with "a new revenue stream" while giving AI systems "scaled access to premium content." The company emphasizes transparency and what they call an "economic framework" for licensing. Translation: we're building the infrastructure so both sides know what they're getting.

Microsoft's marketplace has some interesting design choices. First, it's integrated with their Copilot products. When Copilot needs to cite a source, it can directly pull from the marketplace. That's valuable for publishers because it means their content isn't just being used for training; it's being surfaced directly in products. Your article might get cited in someone's Copilot conversation.

Second, Microsoft handles the contracting layer. Publishers don't have to negotiate individual deals with every AI company. Microsoft negotiates with AI builders (their customers) and acts as the intermediary. This reduces friction but also means Microsoft has significant control over pricing dynamics.

Third, the marketplace is relatively new and usage data isn't widely public. We don't have clear information on how much money publishers are actually making. This is important because it affects how seriously other publishers will take similar offers.

Amazon's version will likely learn from Microsoft's approach but with some critical differences. Amazon has deeper relationships with both cloud customers (AI companies building models) and existing media partnerships (through Prime Video, Alexa, and other services). They might also use their fulfillment and logistics networks as metaphorically relevant to content distribution.

The bigger strategic difference is that Amazon is fundamentally a platform company in a way Microsoft is mostly software. Amazon's entire business model is about connecting buyers and sellers, taking a cut, and optimizing the marketplace mechanics. They'll likely be more aggressive about the cut they take, but also more effective at getting both sides to participate.

Why Publishers Are Actually Interested (Despite the Skepticism)

You might be wondering: why would publishers agree to this? Why not just refuse to license content and hope the lawsuits work out?

Because they're desperate. And desperation makes you accept terms you'd normally reject.

Publishers have watched their business model collapse over the last decade. Advertising has moved to Google and Facebook. Subscription growth is slowing. Now AI is taking their most valuable asset (their writing) and using it to answer questions without directing traffic back to their sites.

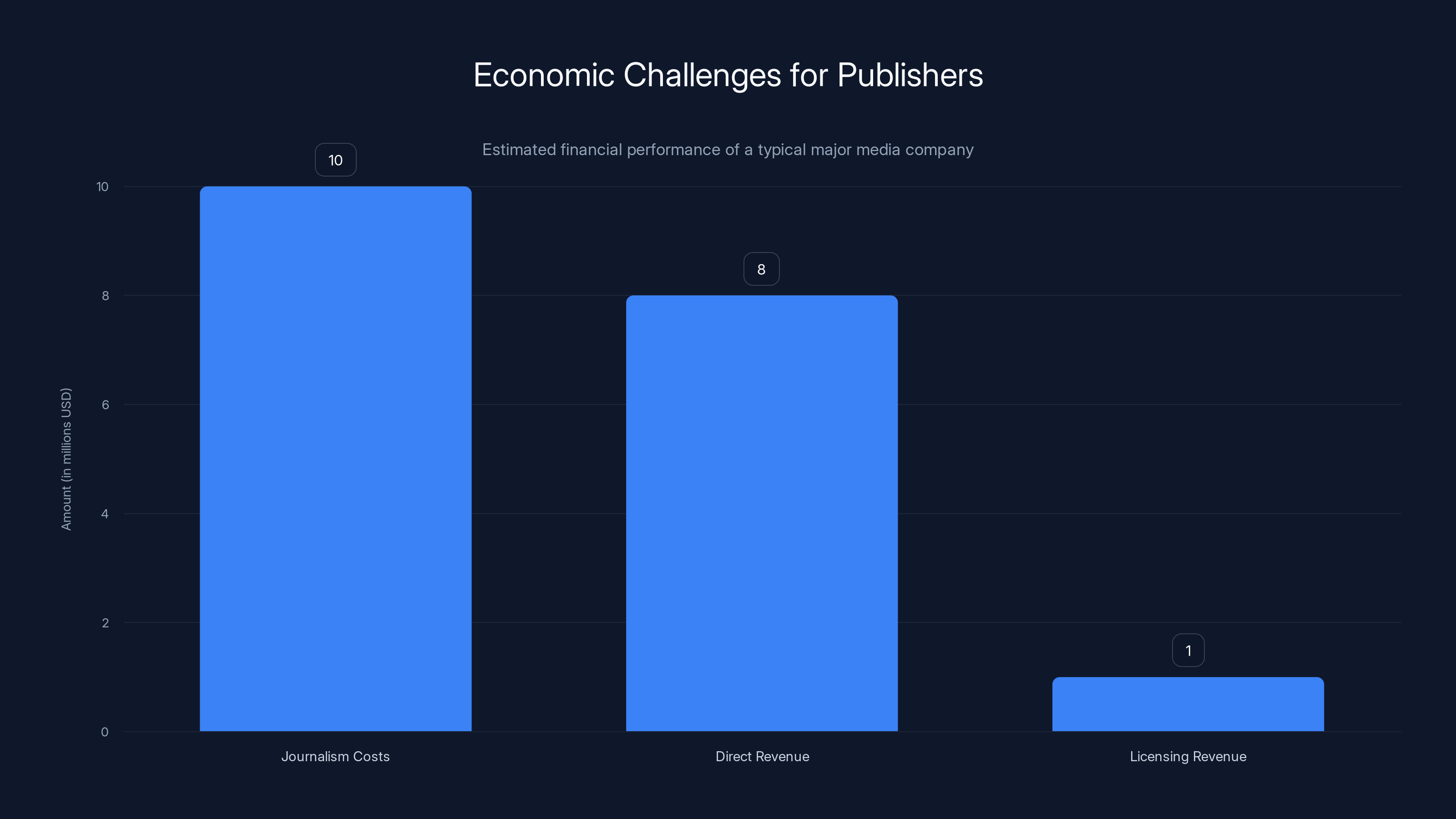

The economics are brutal. A major media company might spend

Licensing provides three potential benefits for publishers:

First, it's revenue. Even small amounts matter when you're operating on thin margins. If an AI company pays

Second, it establishes value. By licensing content, publishers prove that their work has economic value. This helps in negotiations with tech companies (maybe next time they ask for more). It also helps politically, because it's harder for regulators or the public to dismiss publishers when there's an actual marketplace proving their content is worth money.

Third, it creates a potential enforcement mechanism. If content is licensed through a marketplace, violations are easier to identify and prosecute. An AI company can't pretend they didn't know about copyright restrictions if they agreed to licensing terms.

There's also a strategic element. Publishers are increasingly seeing their role as content creators first, discovery engines second. They're making peace with the fact that traffic from Google or other discovery mechanisms might not be their core business. Instead, they're thinking about direct audiences, subscriptions, and licensing.

So when Amazon offers a marketplace, publishers see it as: "Finally, someone's building infrastructure for our new reality."

The Copyright Lawsuit Problem That Marketplaces Solve

The current legal landscape is messy, but it's pushing everyone toward licensing.

The New York Times' lawsuit against OpenAI and Microsoft is the most prominent case, but it's not unique. Authors are suing. Musicians are suing. Artists are suing. Getty Images is suing. The pattern is clear: if you trained without permission, you're facing litigation, as reported by Reuters.

What's interesting about these lawsuits is that they don't necessarily have clear outcomes. Copyright law in the digital age is genuinely unsettled. Courts are working through questions like: is training data use "fair use"? Does transforming content through a neural network count as transformation? What if the AI can be prompted to reproduce copyrighted material?

But you don't need court victories to incentivize licensing. You just need legal risk. And legal risk is expensive. Litigation costs drain resources. Injunctions can destroy business plans. Regulatory attention creates pressure from investors and partners.

A marketplace solves this by providing a clear chain of custody. If Amazon's marketplace has a licensing agreement between a publisher and an AI company, there's documentation. There's proof of permission. There's a clear audit trail. Even if questions emerge about whether the licensing terms were sufficient, you're in a much stronger legal position than if you just scraped content.

Moreover, licensing agreements can include restrictions that mitigate liability. An AI company might be allowed to use content for training but not for fine-tuning consumer products without additional payment. They might be required to include attribution. They might be prohibited from reproducing content verbatim.

These terms create a legal framework that protects both parties. Publishers know what they're allowing. AI companies know what they're getting. If disputes arise, there's documentation.

Estimated data: Amazon takes a 20% cut, publishers receive 50% of the revenue, and AI companies account for 30% of the spend in the marketplace.

How the Marketplace Economics Actually Work

Here's where it gets concrete. Let's think about the actual financial mechanics.

Assuming Amazon's marketplace charges a 30% commission (their standard rate for many marketplaces), the economics break down something like this:

An AI company wants to license 100,000 articles from 500 different publishers to train a model. Without a marketplace, they'd need to negotiate 500 separate contracts. With a marketplace, they browse, find what they want, and purchase through one interface.

Amazon structures pricing as cost-per-article-view or cost-per-article-license. Let's say the rate is

How do publishers get their cut? Based on how much of their content was licensed. If your 10,000 articles represent 5% of the content licensed, you get 5% of the pool: $17,500.

This creates interesting incentives. Publishers are incentivized to:

- Create more content so they capture more of the pool

- Create higher-quality content so AI companies are more likely to license it

- Diversify topics so they appeal to different AI companies with different needs

- Maintain consistent publishing so the content library is valuable

For most publishers, $17,500 wouldn't move the needle. But that's assuming modest licensing volumes. If Amazon actually manages to get major AI companies to use the marketplace, volumes could be substantial.

Consider a different scenario: An AI company licenses 5 million articles for

That's meaningful revenue for a mid-size publisher. Not transformative, but material.

The wildcard is whether Amazon actually manages to get AI companies to use this marketplace at scale. If major players like OpenAI, Google, and Anthropic participate, volumes could be much higher. If they build their own licensing infrastructure, Amazon's marketplace becomes less relevant.

This is a genuine competitive question. Amazon has advantages (existing relationships, infrastructure), but so do other tech companies (direct negotiating power, existing partnerships).

The Copyright Problem That Marketplaces Don't Fully Solve

Here's the uncomfortable truth: licensing marketplaces help but don't completely solve the copyright problem.

One issue is the copyright cliff. Thousands of older publications folded. Their copyright ownership is unclear. Some content is orphaned (the copyright holder can't be found). Some publishers that existed in 2015 don't exist now. Who owns the rights to their archives? Does Amazon's marketplace handle this?

Second, licensing doesn't retroactively fix what already happened. OpenAI trained GPT-4 on massive amounts of unlicensed content. That data is already in the model. Licensing going forward doesn't address the training that already occurred.

Third, not all content creators have equal bargaining power. A major newspaper can negotiate independently or through the marketplace. A freelancer who wrote articles for that newspaper but didn't retain copyright? They're out of luck. They don't own their work, and the marketplace likely only deals with the publication, not individual creators.

This creates a perverse incentive: AI companies prefer dealing with large publishers because it's simpler than tracking individual creator rights. Small creators get excluded from the value chain.

There's also a question about exclusive vs. non-exclusive licensing. If a publisher licenses content exclusively to one AI company, they can't license it to others. But they have more negotiating power. If it's non-exclusive, they can license to everyone, but the value drops because the content isn't unique.

Publishers will need to be strategic about these decisions. Some might try exclusive deals with one major partner for premium content, while licensing other content non-exclusively through marketplaces.

The Impact on Media Traffic and Business Models

Let's talk about the elephant in the room: does licensing solve the traffic problem publishers face?

Not really. In fact, it might make it worse.

A publisher makes money from traffic in three ways: advertising, subscriptions, and licensing. If licensing becomes significant, there's less incentive to drive traffic. Why pay to drive someone to your website if you can make money from an AI company licensing your content and serving it directly to users?

This is a fundamental shift in how media works. For 20 years, the internet economy has been about traffic. More traffic equals more eyeballs equals more advertising revenue. Publications competed on driving traffic.

But if your content gets served by AI summaries instead of driving traffic, the game changes. You're not competing on traffic anymore. You're competing on licensing value. That's a completely different market.

Some publishers might actually prefer this. It's less volatile. Licensing revenue might be more predictable than advertising. It's also less dependent on algorithms (Google changing the algorithm could tank your traffic tomorrow, but a licensing contract is a licensing contract).

But it also means accepting that your site traffic might decline. You're licensing your content to AI companies partly because you've already lost the traffic battle.

The counterargument is that some content will still drive direct traffic. Analysis, investigations, and original reporting might still get direct visits. Opinion pieces might still get shared. Licensing premium content to AI companies while still driving traffic for other content could be a mixed strategy.

But there's a coordination problem. If every publisher licenses everything to AI companies, AI companies serve all content, and traffic disappears, the entire media business model collapses. Everyone's worse off, including AI companies (because they've killed the golden goose that produces content).

Smart publishers will likely use licensing selectively: license commodity content, keep exclusive content for direct traffic, and try to make money from both.

Publishers face a

Regional Regulations and International Licensing

Here's a complication: copyright law isn't global, and neither is regulation.

Europe has the Digital Markets Act and Digital Services Act, which impose different requirements on tech companies. The EU is more protective of creator rights and more skeptical of AI training on copyrighted material without compensation.

This means Amazon's marketplace might need different terms in different regions. European licensing agreements might require explicit opt-in from creators. US agreements might not. Asian markets might have even different standards.

Publishers with international operations will need to navigate these differently. A marketplace that works perfectly in the US might not be compliant in the EU.

There's also the question of which law governs licensing agreements. If a publisher is in Ireland and the AI company is in California and Amazon is in Washington, whose laws apply? This matters because it affects enforceability and what's considered fair compensation.

Amazon will likely need legal structures to handle this complexity. They might create regional marketplaces with localized terms. They might require certain compliance certifications. They might structure agreements to default to the most protective legal framework.

For publishers, this means you need international tax and legal expertise to participate in these marketplaces effectively. That's another friction point.

The Broader AI Training Data Economy

Licensing marketplaces are part of a bigger shift in how AI companies source training data.

For the first time in the internet era, training data is becoming expensive and competitive. Historically, tech companies could just scrape everything. Now they're competing to acquire legal, high-quality data.

This has created several strategies:

Direct licensing deals: Companies like OpenAI negotiate directly with major publishers. This gives both sides more control but requires significant negotiating resources.

Marketplace licensing: Amazon and Microsoft's approach. Broader participation, less negotiation overhead, but less customization.

Synthetic data: Some AI companies are creating artificial training data to reduce dependence on scraped content. This works to some extent but doesn't fully replace human-created content.

User-generated data: Some AI companies are leveraging user interactions and feedback as training data. This is valuable but doesn't replace curated content.

Data collaboratives: Groups of organizations pooling data for shared access. This is emerging but still rare.

Amazon's marketplace is competing in this ecosystem. The question is what role it plays. Is it a primary source of training data for major AI companies, or a supplementary source?

The honest answer is: we don't know yet. It depends on execution. If Amazon manages to get major players to participate, it could be significant. If they build it and nobody comes, it's a failed experiment.

There's also a network effect question. The more publishers participate, the more attractive it is to AI companies. The more AI companies participate, the more attractive it is to publishers. Breaking into this network is hard. You need critical mass on both sides before the marketplace becomes valuable.

AI Model Quality and Premium Content

Let's discuss something tech companies don't always admit publicly: not all training data is equal.

A model trained on internet comments is fundamentally different from a model trained on academic papers and journalism. Quality data produces better models.

As the AI market matures, companies are learning this. GPT-4 is better than GPT-3.5 partly because OpenAI used higher quality training data. Anthropic's Claude emphasizes that they used curated data. Google's Gemini uses different training data than their earlier models, with a focus on quality.

This creates a market for premium content. A New York Times article is worth more as training data than a random blog post. Academic research is worth more than tweets. Books are worth more than short-form content.

Amazon's marketplace could capitalize on this by positioning itself as the place to find premium content. Instead of just aggregating all publisher content equally, they could have tiers:

- Premium tier: Top-tier publications, verified accuracy, rich metadata. Higher prices.

- Standard tier: Mid-market publishers, good content quality, basic metadata. Medium prices.

- Community tier: Small publishers, user-generated content, minimal curation. Lower prices.

This tiering could incentivize quality. Publishers have incentive to maintain high standards to stay in premium tiers.

AI companies would also have clarity about what they're getting. If you want to train a reasoning model, license from premium tier. If you're building a chatbot, standard tier might be fine.

This is actually more sophisticated than how licensing typically works. Usually it's just: "you can use this content." With tiering and quality metadata, you could be much more strategic.

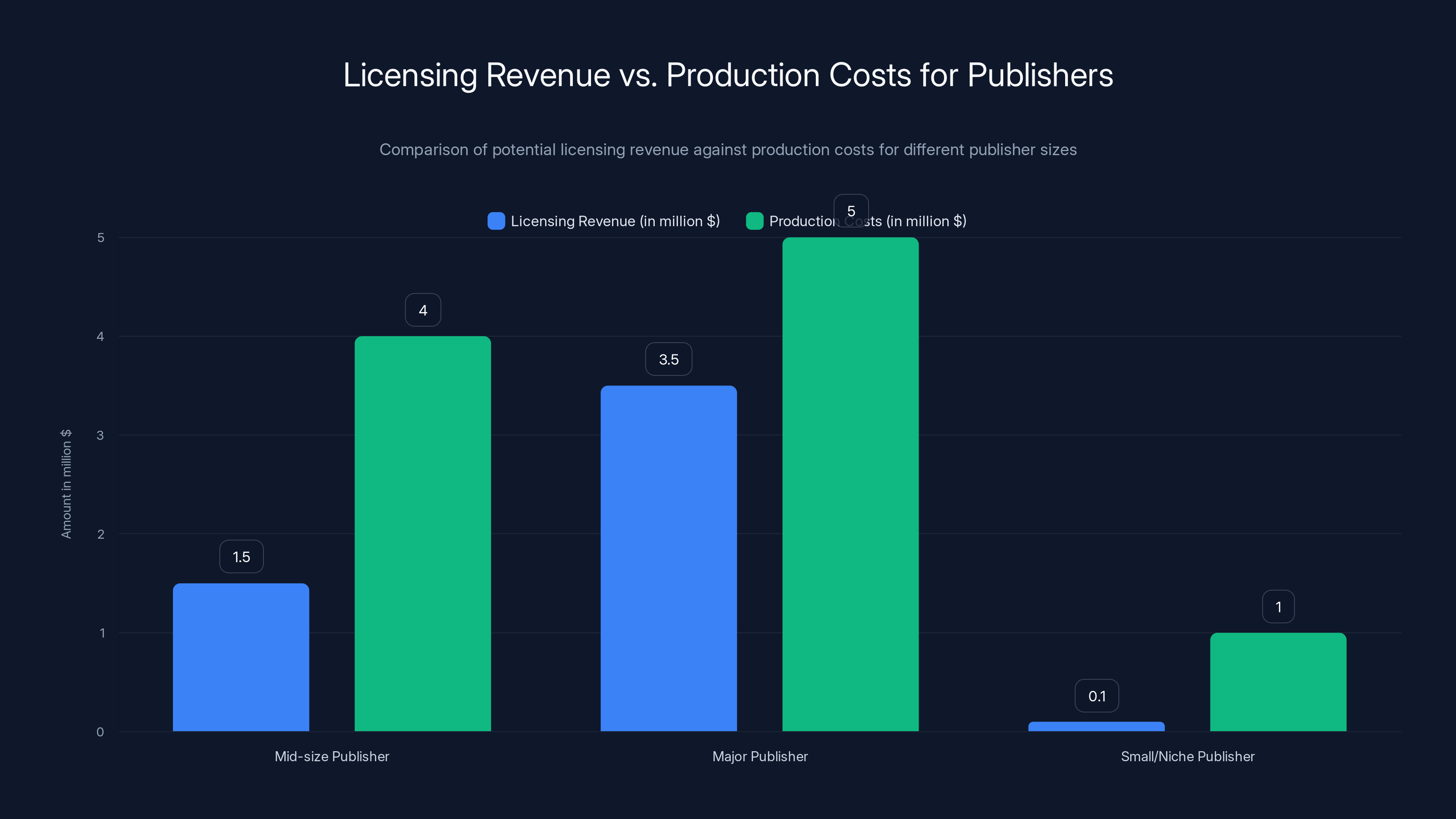

Licensing revenue covers 20-40% of production costs for mid-size publishers, 50-70% for major publishers, and is minimal for small/niche publishers. Estimated data.

The Creator Equity Problem

Here's something that gets less attention than it should: who actually owns the content?

In most publishing operations, the company owns the copyright, not the individual writers. A freelancer writes an article for a publication. The publication owns the copyright. When the publication licenses that article, the freelancer doesn't get a cut.

This is particularly unfair for freelancers because they're taking on all the career risk (building a portfolio, no job security, no benefits) but not capturing the licensing upside.

Some publishers might try to be fairer. They could allocate a percentage of licensing revenue to the individual writers who created the content. This would require tracking which writers created which pieces and managing micropayment distributions.

But most publishers won't do this unless forced. It's administratively complex and reduces their cut. They'll argue that they're already paying writers fairly through article fees, and licensing revenue is an additional business model benefit.

This creates an incentive for writers to consider starting their own platforms or contracting arrangements where they retain copyright. If your work has licensing value, you want to capture that value, not cede it to your employer.

This is already happening with platforms like Substack, where individual writers own their content. It's also accelerating creator exit from traditional publishers.

Amazon's marketplace might need to address this. If individual creators can participate directly, licensing becomes more attractive for writers. If only large publishers can participate, it's another reason for writers to leave traditional media.

Will Publishers Actually Make Money From This?

Let's be honest about the financial reality.

Most publishers won't make transformative money from licensing marketplaces. Here's the math:

A mid-size publisher with 10,000 pieces of content might be worth

So licensing covers maybe 20-40% of their production costs. It's helpful, but it's not a business model on its own.

Major publishers (New York Times, Wall Street Journal, Washington Post) might do better because they have more valuable content. They might capture 50-70% of production costs from licensing.

Small or niche publishers might capture very little. A specialized tech publication might have only 5,000 articles, most of which are less valuable because they're too specific. They might make $100,000 per year from licensing. That's real money but probably not enough to meaningfully shift the business model.

The real value of licensing comes when combined with other revenue: subscriptions, advertising, events, and licensing together might make a sustainable business.

Publishers who are realistic about this and use licensing as part of a diversified strategy will do better than those who think licensing will save them.

The Competitive Dynamics: Amazon vs. Microsoft vs. Others

Microsoft's Publisher Content Marketplace exists. Amazon is building something similar. But others might enter too.

Google is the obvious candidate. They have massive relationships with publishers through Google News and AdSense. They could easily build a licensing marketplace. The question is whether they will. Google might prefer to negotiate directly with major publishers rather than building a general marketplace.

Meta might also enter this space, particularly as they build more AI products and potentially generate LLMs internally.

News Corp (Rupert Murdoch's company, owner of Wall Street Journal, Fox News, etc.) has massive content assets and might build their own licensing infrastructure or marketplace.

OpenAI and Anthropic might build their own licensing marketplaces, focusing on premium content for their own use and potentially for other companies.

This is turning into a genuine competitive market. Publishers might have options: license through Amazon, Microsoft, Google, or directly to specific AI companies.

Having options is good for publishers because it creates competition for content. But it's also confusing because they need to manage multiple licensing relationships.

The long-term winner is probably whoever can:

- Get critical mass of both publishers and AI companies

- Reduce transaction costs for both sides

- Handle complex contract terms and payment distribution

- Maintain transparency and fairness

- Navigate international regulations

- Provide quality metadata and content discovery

Amazon has advantages in scale and infrastructure. Microsoft has advantages in AI company relationships. Google has advantages in publisher relationships. It's genuinely unclear who wins.

Estimated data shows that lawsuits account for the largest portion of legal costs in the tech industry, highlighting the financial impact of copyright issues.

What This Means for the Future of Content and AI

If licensing marketplaces become standard, several things change:

Content becomes valued transparently: Right now, content value is mostly implicit. A New York Times article has value because the Times has brand authority. With licensing, value becomes explicit because there's a price.

AI companies become customers of publishers: Instead of an adversarial relationship, publishers become vendors to AI companies. This shifts power dynamics.

Content strategy evolves: Publishers might optimize differently. Instead of just optimizing for traffic, they optimize for licensing value. This might mean different editorial decisions.

Micropayments become possible: If licensing infrastructure exists, it enables micropayments for content consumption. This might change how news websites monetize.

Data becomes a business line: For large publishers, data and licensing might become a major revenue source, not a minor one. This changes how you organize the business.

Open web content decreases: If licensing is lucrative, publishers might put more content behind paywalls or licensing restrictions. This could fragment the open web.

The long-term vision might be: a fragmented internet where different content is controlled by different entities, and AI companies pay for access to the pieces they need. Instead of a free open web that anyone can access, you have a licensed web where access is conditional.

This is actually how academic publishing works. Universities pay for access to journals. Researchers can't just read everything freely. It's expensive and creates access inequalities.

News publishing might end up similar. Premium publications get licensed and accessed by AI companies and paying subscribers. Lower-tier content is available freely or cheaply. And small publishers struggle to capture licensing value and compete.

Practical Steps Creators Should Take Now

If you're a publisher or creator concerned about licensing, here's what you should be doing:

First, audit your content: Identify which pieces are valuable, which are derivative, which are unique. This helps you understand what you can command premium pricing for.

Second, understand your rights: Check who owns copyright to your content. If you work for a publisher, does the publisher own everything? Can you negotiate copyright retention? If you're independent, can you register copyright officially?

Third, research licensing options: Don't wait for Amazon's marketplace to launch. Explore Microsoft's marketplace. Talk to AI companies directly. Understand what the market is willing to pay.

Fourth, consider your strategy: Some creators might prefer to hold their content tightly and license exclusively to one partner. Others might license broadly through marketplaces. Others might refuse to license and rely on paywall subscriptions. These are strategic choices.

Fifth, group together: Individual creators have little leverage. Creators might consider forming consortiums or collectives that can negotiate together. A group of niche publishers has more power than individuals negotiating alone.

Sixth, optimize metadata: The more information you provide about your content (publication date, accuracy verification, topic taxonomy, quality tier), the more valuable it becomes for licensing. Invest in metadata.

Seventh, focus on quality: Premium content commands premium prices. Focus on creating work that's worth paying for, not just content that fills a calendar.

The Regulatory Angle: Government and Licensing

Governments are watching this closely.

The US Congress has held hearings about AI training on copyrighted content. The European Union is considering regulations that would require explicit licensing or consent for AI training. Other countries are developing policies.

One possible regulatory framework: AI companies must demonstrate that training data was licensed or otherwise legally obtained. This would essentially require licensing marketplaces to exist (or direct licensing agreements).

Another possibility: Fair compensation requirements. Regulators could mandate that if an AI company profits from content trained on creator material, the creator gets a share of profits. This would incentivize licensing and ensure creators capture value.

Yet another approach: Transparency requirements. AI companies must disclose what training data they used. This makes licensing violations easier to detect and prosecute.

Each regulatory approach changes the incentives. If licensing is mandated, marketplaces become essential. If fair compensation is required, licensing becomes more expensive, which might reduce AI company usage. If transparency is required, licensing agreements become valuable evidence of compliance.

Amazon's marketplace might be positioning itself for whatever regulatory environment emerges. By building the infrastructure now, they're ahead of potential regulations that might require it.

Publishers should be aware that regulation is coming. They should engage with regulators and advocate for policies that protect creator interests. They should also prepare for licensing to become mandatory or highly incentivized.

Comparing Content Licensing to Other Data Acquisition Models

Licensing isn't the only way AI companies acquire training data. Let's compare models:

Scraping: Companies crawl the internet and download content without permission. Cheap, lots of data, but legally risky and ethically questionable. This is becoming less viable as companies face lawsuits.

Licensing: Companies pay publishers for permission to use content. More expensive, less data, but legally defensible. This is the direction the market is moving.

Synthetic data: Companies generate artificial data instead of using real human content. Increasingly viable for some use cases, but doesn't fully replace human data for models requiring real-world examples.

User data: Companies use data from user interactions, feedback, and conversations to improve models. This is valuable but raises privacy concerns. Regulatory restrictions limit how much user data can be used without explicit consent.

Academic/open data: Companies use publicly available academic datasets and open-source data. This is legal and free, but limited in scope. Researchers publish particular types of data, not the full spectrum of content.

Internal data: Companies generate their own proprietary data through users, products, and operations. Valuable for companies with large platforms, less useful for companies without direct users.

Most successful AI companies will use a mix of these approaches. Licensing becomes one tool among many, particularly for high-quality, specialized content.

The Real Question: Does This Change Anything?

Here's the uncomfortable truth: licensing marketplaces might not fundamentally change the dynamics between AI companies and creators.

Why? Because AI companies still have most of the power.

An AI company doesn't desperately need any single publisher. They need aggregate, large-scale training data. Publishers, on the other hand, need AI companies to pay them for their content because their traditional business models are broken.

This power imbalance means licensing rates are likely to be lower than creators want. A publisher negotiating individually is in a weak position. Even grouped together, publishers lack the leverage that a company with billions in funding has.

Moreover, network effects favor AI companies. The more training data you have, the better your model. The better your model, the more users you attract. The more users, the more data you collect from their interactions. This creates a compounding advantage that's hard for publishers to contest.

Licensing does help by creating legal clarity and establishing that content has value. But it doesn't necessarily solve the fundamental business model crisis for publishers. They're selling something they used to give away (access to their content), at prices set by entities with more power.

The real hope for publishers is that licensing becomes just one revenue stream among many. If a publisher can combine licensing revenue, subscriptions, advertising, events, and other revenue streams, they might build a sustainable business. But expecting licensing alone to save media is probably unrealistic.

FAQ

What is a content marketplace for AI training?

A content marketplace is a platform where media publishers list their content and AI companies can license it for training artificial intelligence models. Publishers set terms and pricing, AI companies browse and purchase access, and the marketplace operator (like Amazon) handles transactions, contracts, and payment distribution. This creates a transparent, legal way for AI companies to acquire training data instead of scraping content without permission.

Why is Amazon launching a content marketplace?

Amazon is launching a marketplace to create a new revenue stream for AWS customers (AI companies), establish itself as an intermediary in AI infrastructure, capture transaction fees, and position itself in a competitive market where publishers are seeking licensing options. The marketplace also helps Amazon's cloud customers address legal concerns about training data while giving publishers a direct channel to sell content access, which plays into both sides' interests.

How does licensing benefit publishers?

Licensing provides direct revenue for content that was previously distributed freely, creates transparent pricing that establishes content value, offers protection against copyright infringement (since usage is contractually documented), enables publishers to participate in the AI economy, and provides alternatives to declining advertising and subscription revenue. However, licensing typically doesn't generate enough revenue to fully replace traditional business models.

What pricing models will the marketplace use?

Marketplaces likely use models such as per-article licensing fees, unlimited access subscriptions, cost-per-view pricing, tiered pricing based on content quality, exclusive licensing (higher prices for unique access), or non-exclusive licensing (lower prices but available to multiple buyers). The specific pricing depends on how Amazon and publishers negotiate, but transparent pricing is a key advantage of marketplace models.

Will publishers actually make significant money from licensing?

Most publishers will make modest money from licensing, typically covering 20-40% of content production costs for mid-size publications. Major publishers with premium content might do better, capturing up to 70% of costs. However, licensing is more valuable as part of a diversified revenue model (combining subscriptions, advertising, events, and licensing) than as a standalone business. Small publishers or niche creators will likely make minimal revenue unless they have highly specialized, premium content.

How does Amazon's marketplace compare to Microsoft's?

Both Microsoft and Amazon offer publisher content marketplaces with similar functions: connecting publishers with AI companies, handling contracts and payments, and providing transparency. Key differences: Amazon has broader cloud customer relationships and more marketplace experience, Microsoft has stronger relationships with AI companies developing Copilot products, and Amazon likely offers different pricing structures or features. Microsoft's marketplace is already operational with early data about publisher participation.

What happens to copyright and licensing agreements?

Marketplaces standardize copyright and licensing agreements, making it easier for publishers to grant AI companies specific rights (training, deployment, restrictions on output). Publishers retain copyright ownership but grant limited usage rights for specific purposes. Agreements can include restrictions like attribution requirements, prohibition on content reproduction, or limits on how AI models are deployed. This creates more legal clarity than scraping models but still requires careful contract negotiation.

How do these marketplaces affect AI model quality?

Licensed premium content from major publishers can improve AI model quality because professional journalism, academic research, and verified content are higher quality than random internet data. However, the relationship is nuanced: models need volume of diverse training data, not just premium sources. Marketplaces enable AI companies to be more strategic about data selection, potentially improving models while also reducing legal risk compared to scraping approaches.

What are the regulatory implications of content licensing?

Regulators (particularly in the EU) are considering requiring AI companies to demonstrate that training data was properly licensed or legally obtained. This would essentially mandate licensing marketplaces or direct licensing agreements. Other regulatory approaches might require fair compensation for creator content or transparency in training data sourcing. These regulations would increase licensing adoption and potentially improve terms for creators.

Will licensing replace traffic-based publishing models?

Licensing won't completely replace traffic-based models but will supplement them, particularly for commodity content. Publishers will likely develop mixed strategies: licensing less-trafficked content while optimizing premium content for direct audience engagement and subscriptions. The long-term result might be a fragmented media landscape where content is simultaneously distributed through AI platforms via licensing and directly to audiences through traditional channels, requiring publishers to manage multiple customer relationships.

Conclusion: The Marketplace Moment

Amazon's content marketplace represents something important: the moment when the AI industry moved from taking without asking to actually paying.

It's not perfect. Publishers won't make transformative money. The power dynamics still favor AI companies. Individual creators might still get squeezed out. The impact on traffic-based publishing might be negative.

But it's better than the alternative. A world where AI companies scrape everything, publishers get nothing, and everyone ends up in court.

The marketplace model isn't the only possible future, but it's increasingly likely. Microsoft's already launched. Amazon's launching. Others will follow. Within five years, licensing content to AI companies might be as normal as licensing content to other publishers.

For publishers, this means adapting. You need to understand what content you own, what it's worth, and how to sell it. For creators, it means advocating for fair terms and potentially reconsidering your relationship with traditional publishers if they're not sharing licensing revenue.

For AI companies, it means higher training costs but more defensible models and better legal positioning.

For society, it's an interesting experiment: can we build platforms that fairly compensate creators while enabling AI development? Or will the power imbalances mean that even with licensing, creators capture little value?

The marketplace won't answer all these questions. But it's a structural change that forces everyone to be more explicit about who owns content, what it's worth, and who benefits from AI.

That transparency alone is valuable. Now let's see if Amazon and others actually build systems that work for everyone.

Key Takeaways

- Amazon is building a marketplace where publishers can license content directly to AI companies, creating transparent pricing and legal protection

- Publishers are desperate for new revenue sources as traditional business models collapse, making licensing attractive despite modest financial returns

- Licensing helps solve the copyright problem by creating documented chains of custody and reducing legal liability compared to content scraping

- Most publishers will capture only 20-40% of production costs from licensing, requiring it to be part of a diversified revenue strategy

- The long-term impact on publishing is uncertain: licensing might create sustainable new revenue or could accelerate the decline of traffic-based models

Related Articles

- Philips Fidelio FT1: Complete Review, Features & Best Alternatives [2025]

- Trump's 'Buy American' EV Charging Rule: A De Facto NEVI Moratorium [2025]

- AI-Generated Music at Olympics: When AI Plagiarism Meets Elite Sport [2025]

- Spring Cleaning Motivation: Budget Accessories Starting at $2 [2025]

- OpenAI's Responses API: Agent Skills and Terminal Shell [2025]

- Microsoft's $37.5B AI Bet: Why Only 3.3% Actually Pay for Copilot [2025]

![Amazon's AI Content Marketplace: How Publishers Get Paid [2025]](https://tryrunable.com/blog/amazon-s-ai-content-marketplace-how-publishers-get-paid-2025/image-1-1770766596520.jpg)