The Copilot Paradox: Billions Spent, Pennies Earned

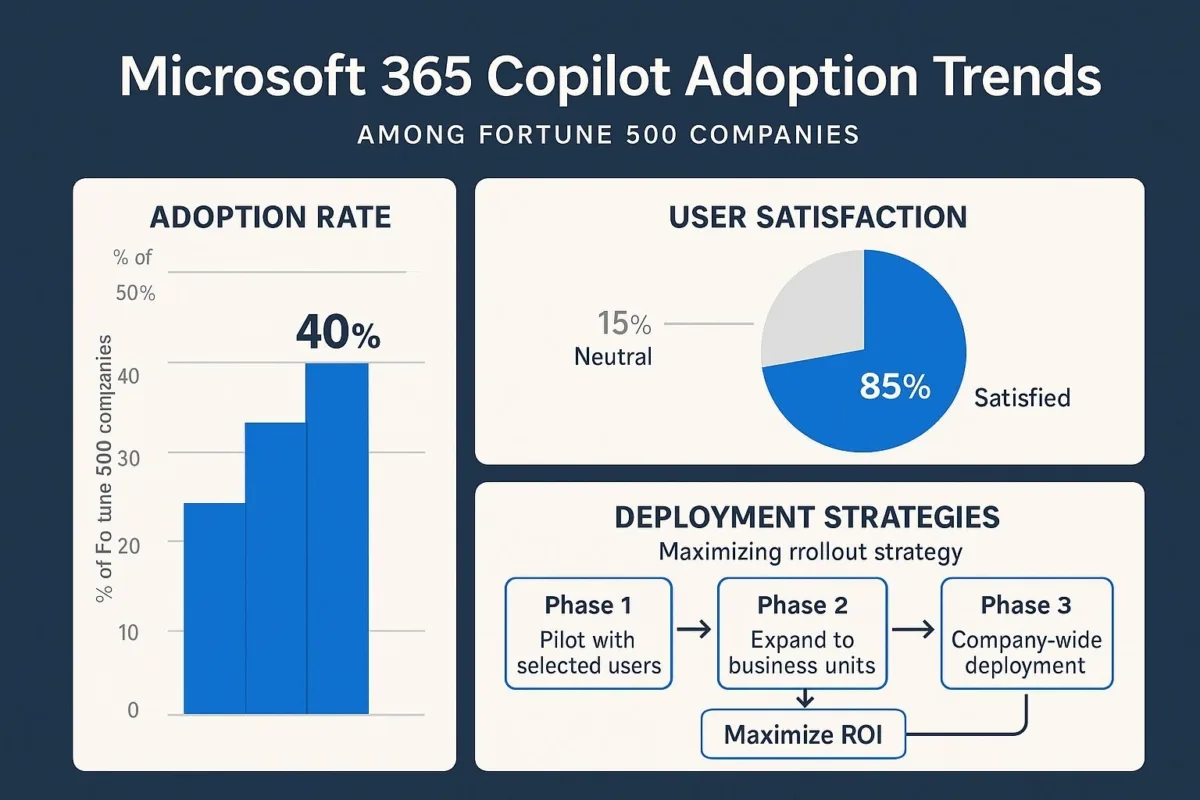

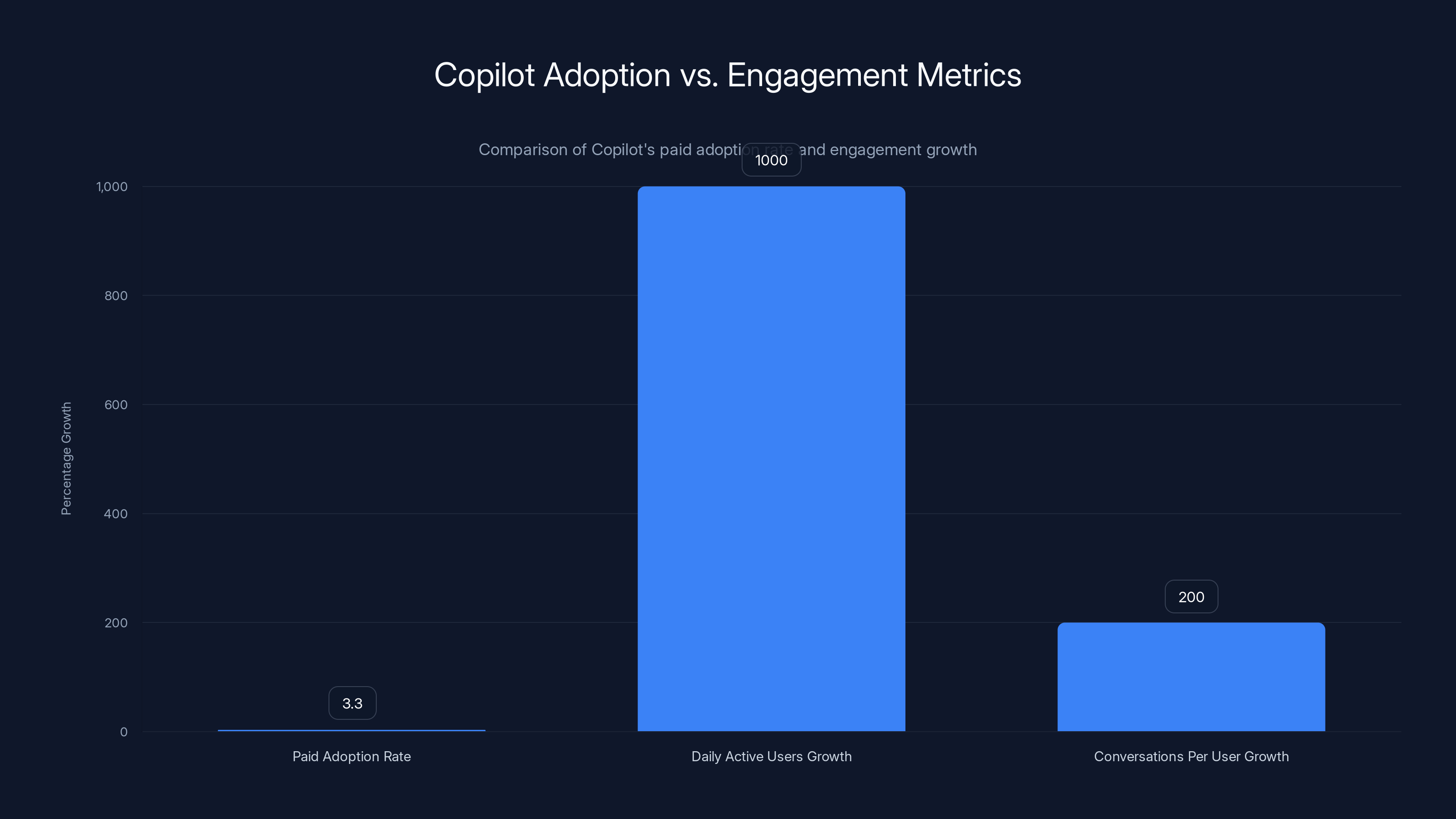

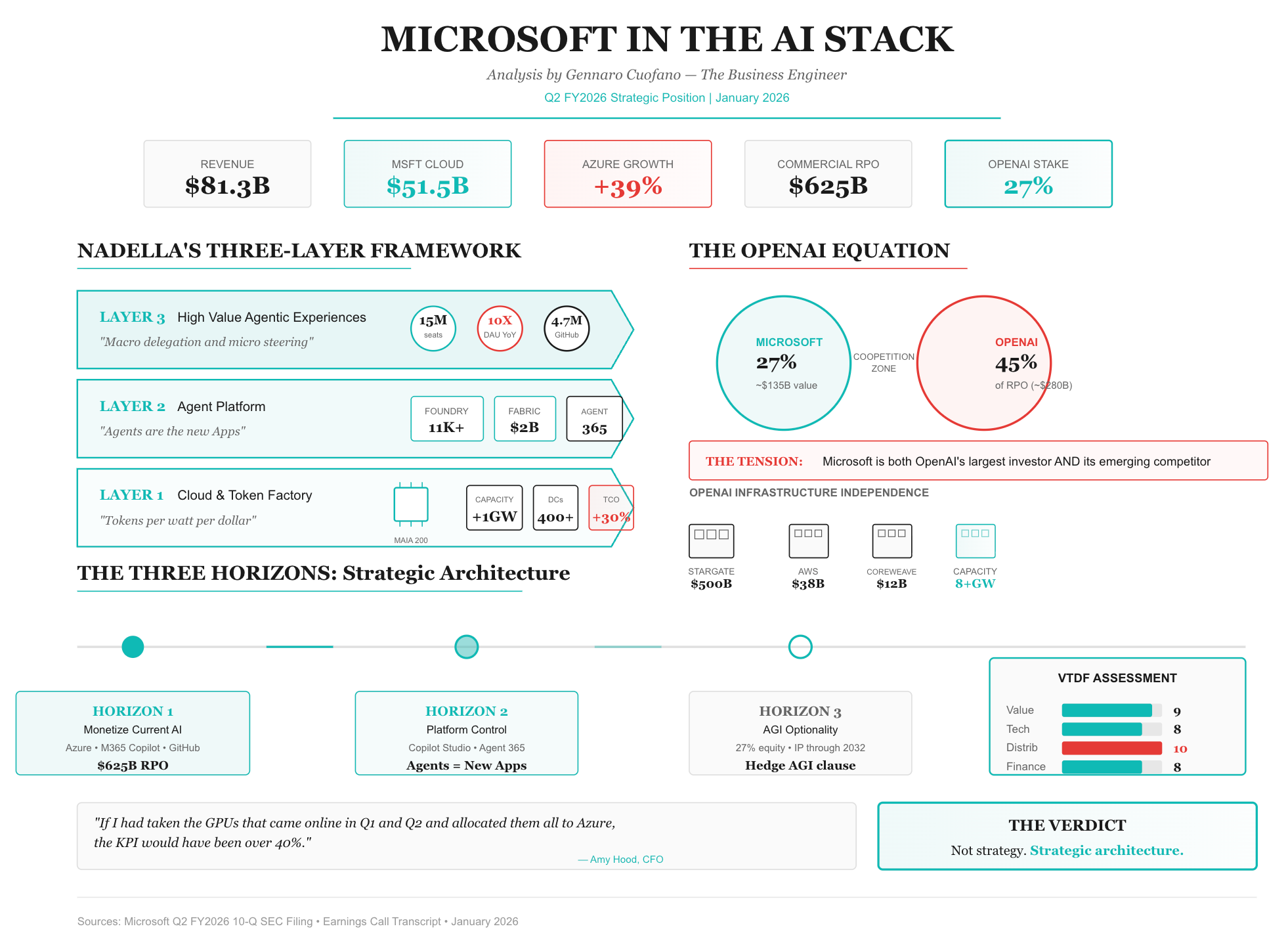

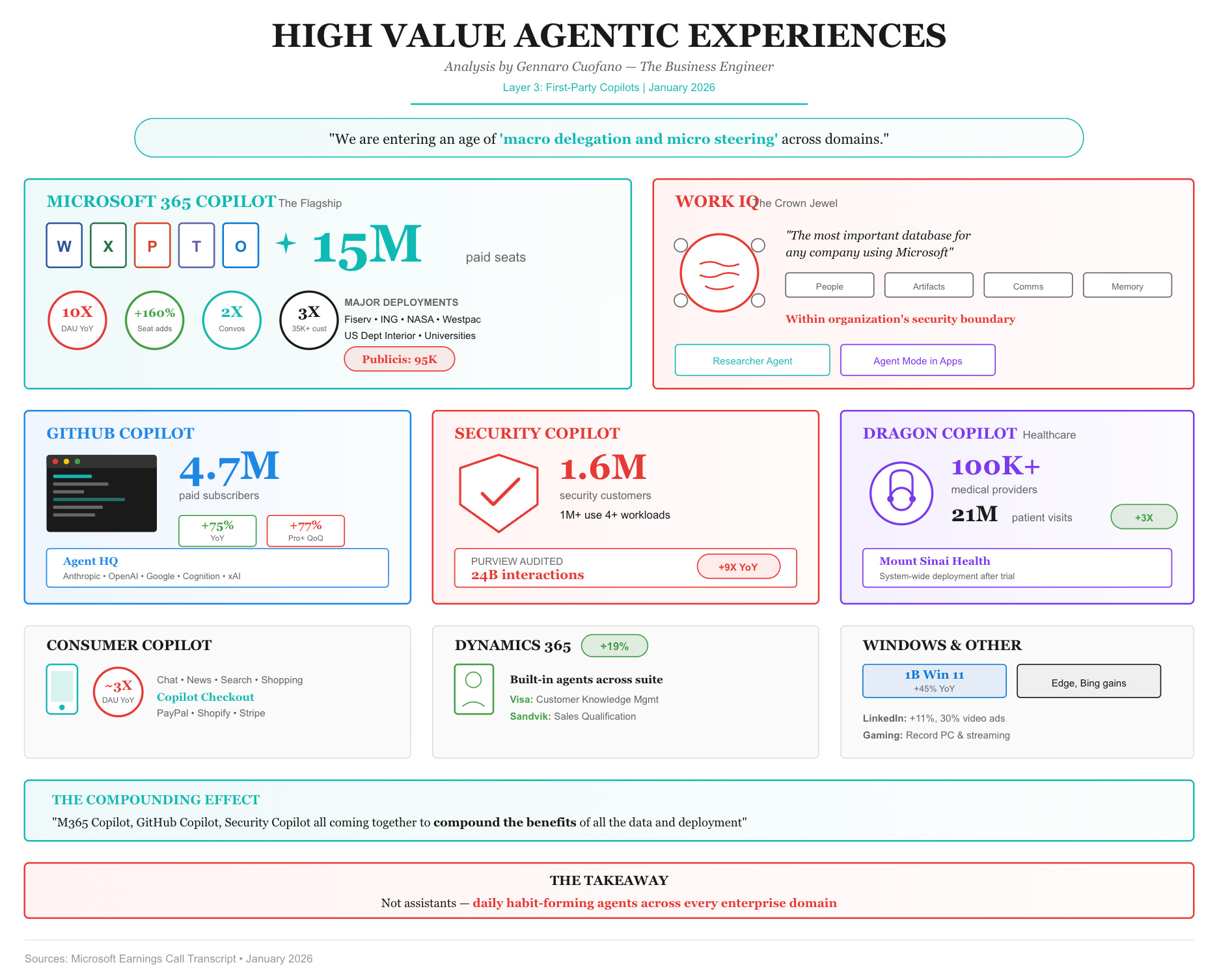

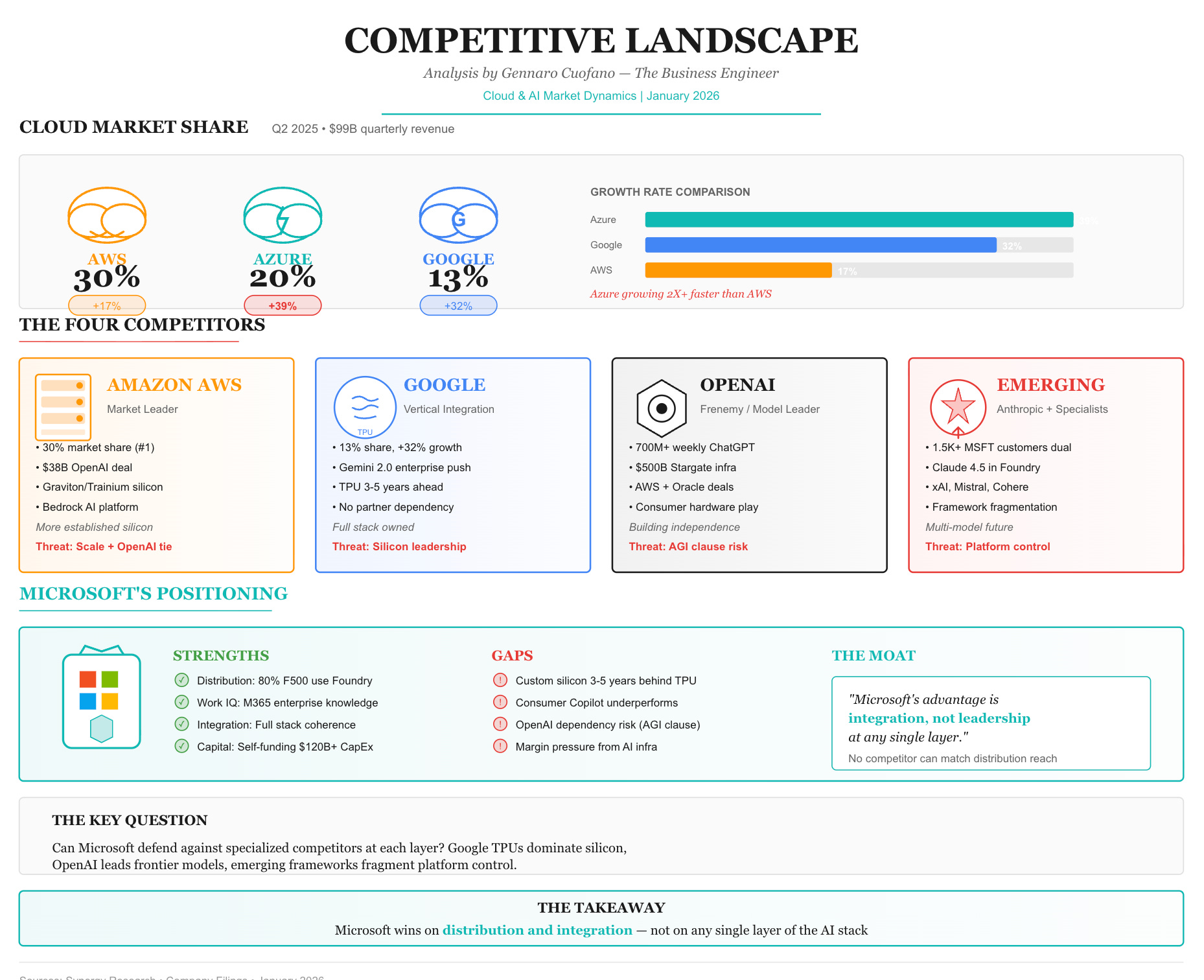

Microsoft CEO Satya Nadella stood before investors in early 2024 and made a bold claim. Copilot, his AI assistant platform, was becoming "a true daily habit" for millions of users worldwide. He cited impressive growth metrics: 15 million paid seats, a year-over-year increase of 160 percent, and daily active users up tenfold.

The numbers sounded incredible. Until you do the math.

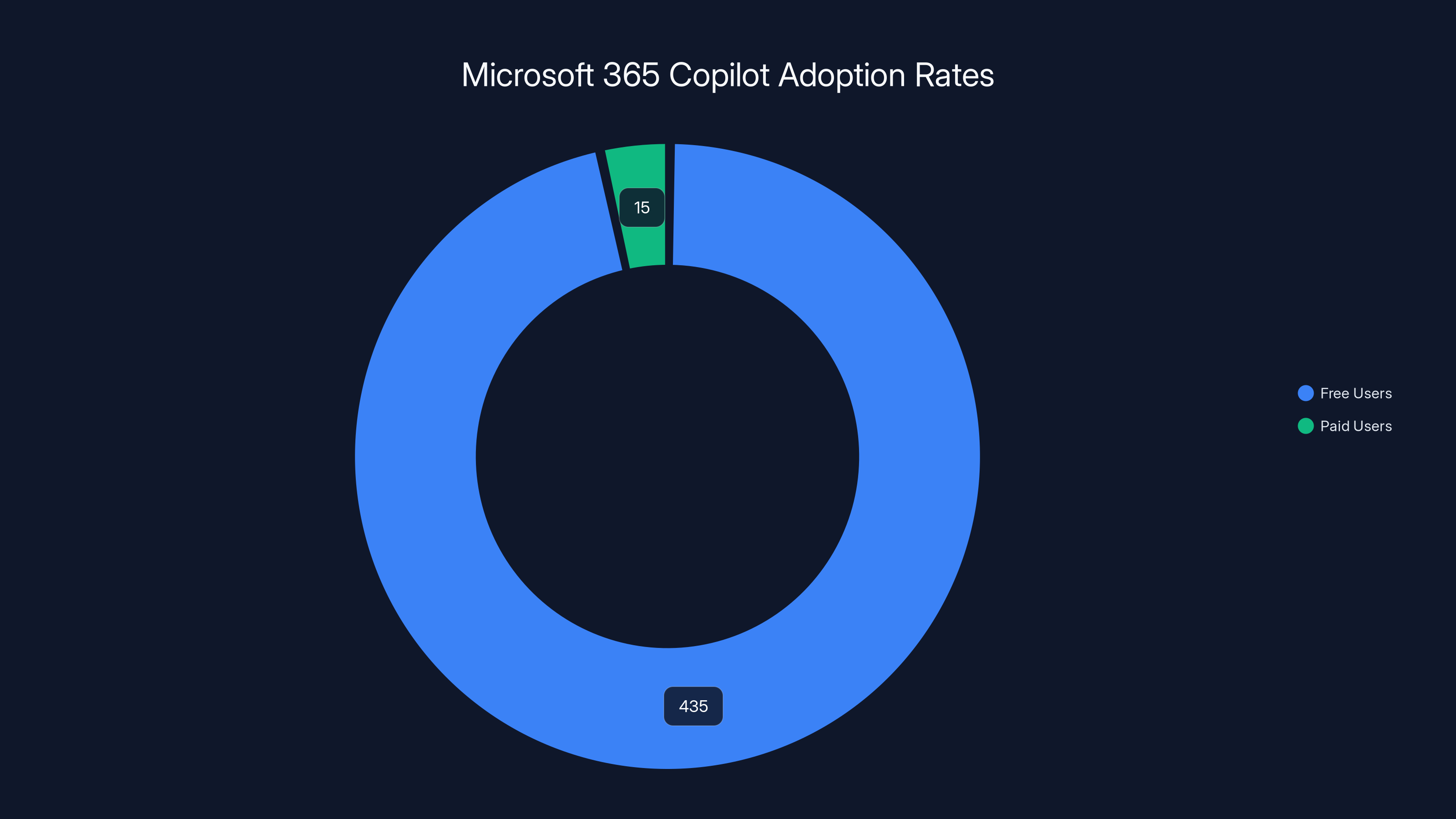

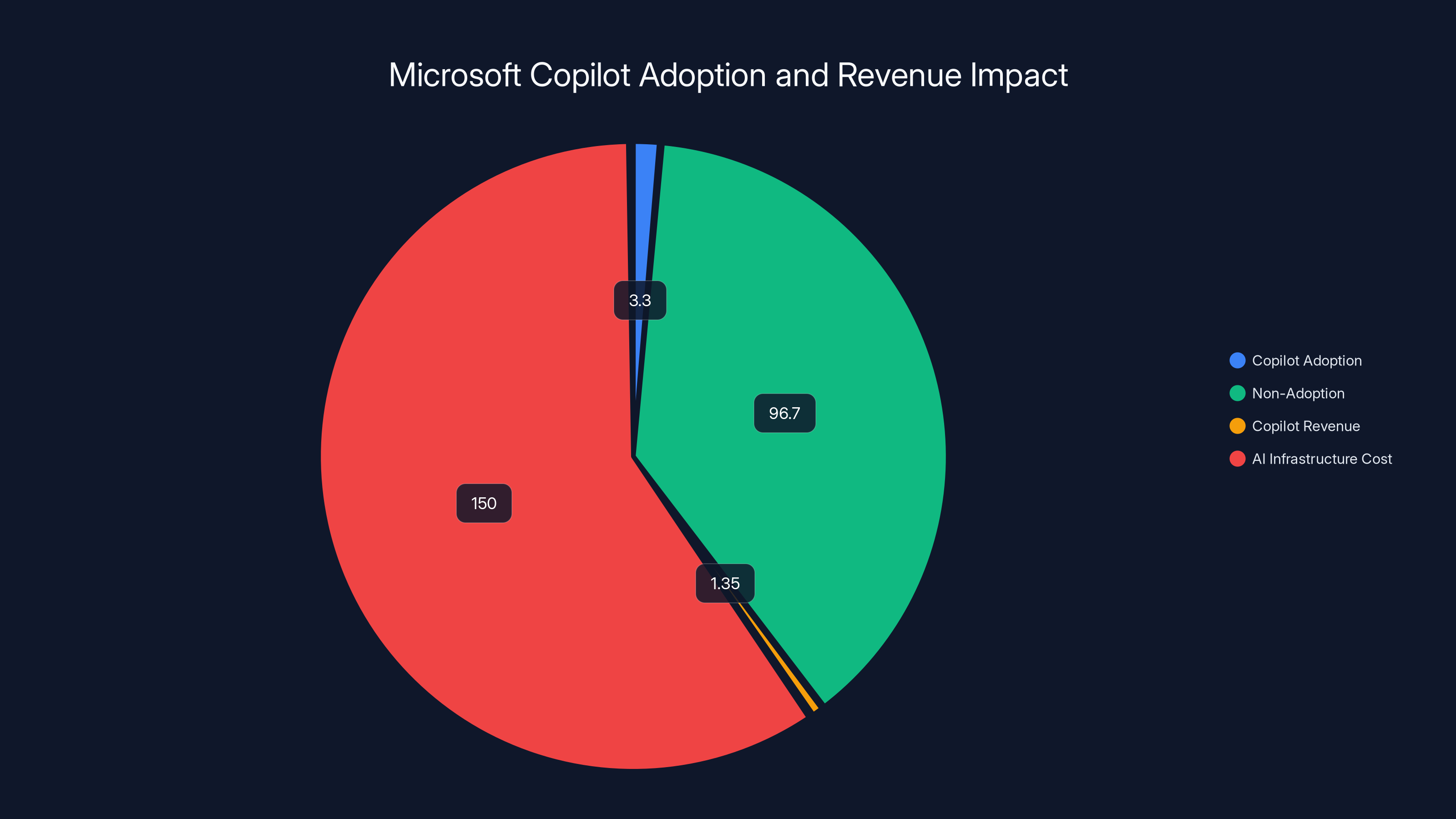

Microsoft 365 has roughly 450 million commercial users globally. The 15 million paid Copilot seats represent just 3.3 percent adoption. That means 97 percent of Microsoft's user base either isn't using Copilot or is using the free version.

This gap between hype and reality tells a story about AI adoption that tech companies don't want to tell. It's the story of massive capital expenditures, unproven business models, and the painful lag between technological capability and user willingness to pay.

For enterprise IT leaders evaluating AI tools, this matters enormously. Microsoft's struggles with Copilot monetization offer crucial lessons about what actually drives adoption, what companies are willing to spend on, and where the real value of AI actually exists in the enterprise.

Let's dig into what's really happening with Copilot, why adoption is stalling despite Microsoft's investments, and what this means for your organization's AI strategy moving forward.

TL; DR

- The Adoption Gap: Only 3.3% of Microsoft's 450 million commercial users pay for Copilot despite 160% year-over-year growth in paid seats

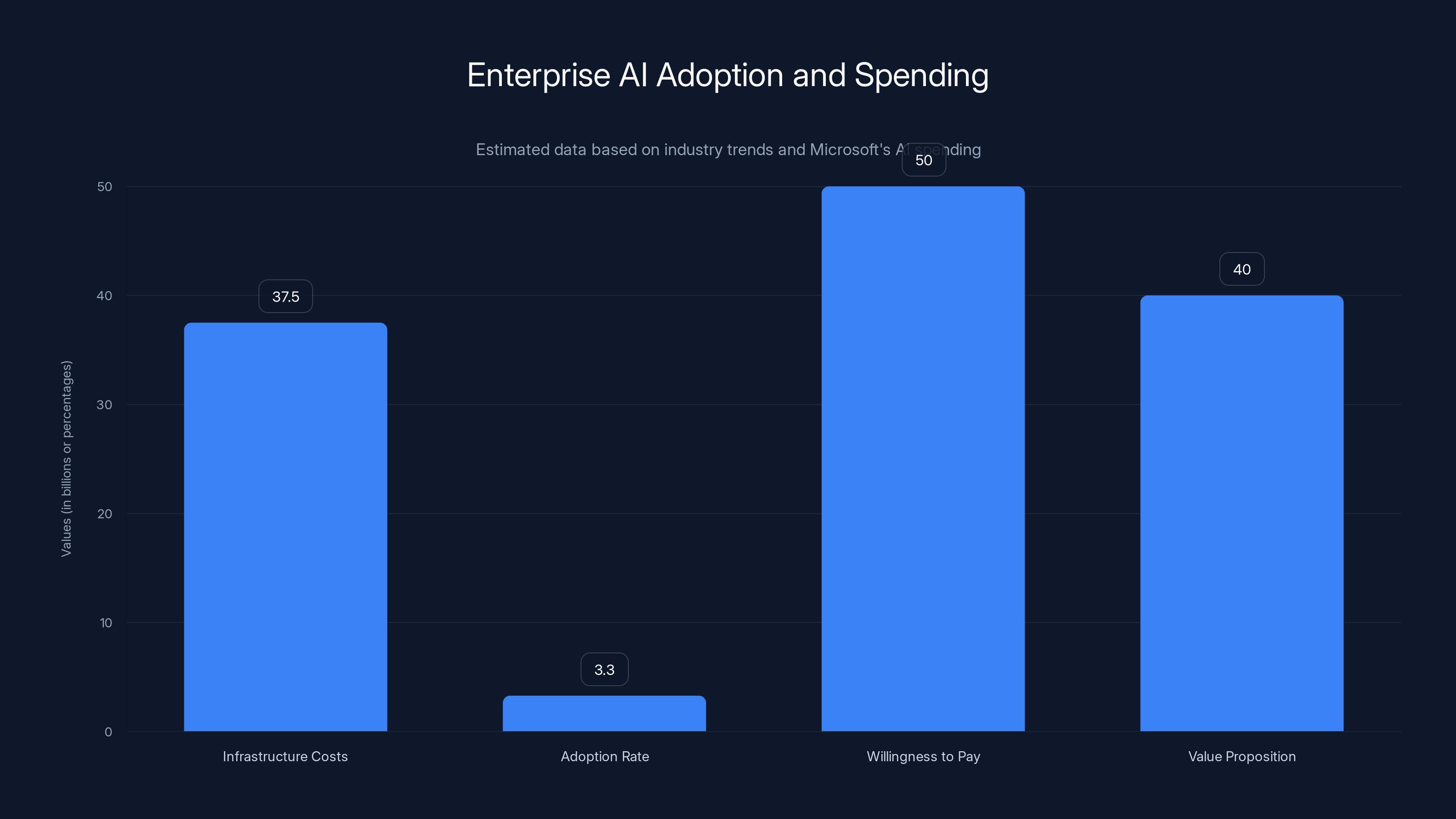

- Massive Investment: Microsoft spent $37.5 billion on AI infrastructure in FY26 Q2, with returns still uncertain

- Mixed Messaging: CEO claims "true daily habit" status while reports indicate internal reviews of Copilot's viability

- Enterprise Reality: Free tiers and limited perceived ROI are keeping 96.7% of users from converting to paid plans

- Bottom Line: Even tech giants struggle to monetize AI, suggesting enterprise demand for AI assistants remains far narrower than predicted

Only 3.3% of Microsoft 365 users pay for premium Copilot features, highlighting the challenge of converting free users to paid in an enterprise setting.

Understanding Microsoft's AI Spending and Investment Strategy

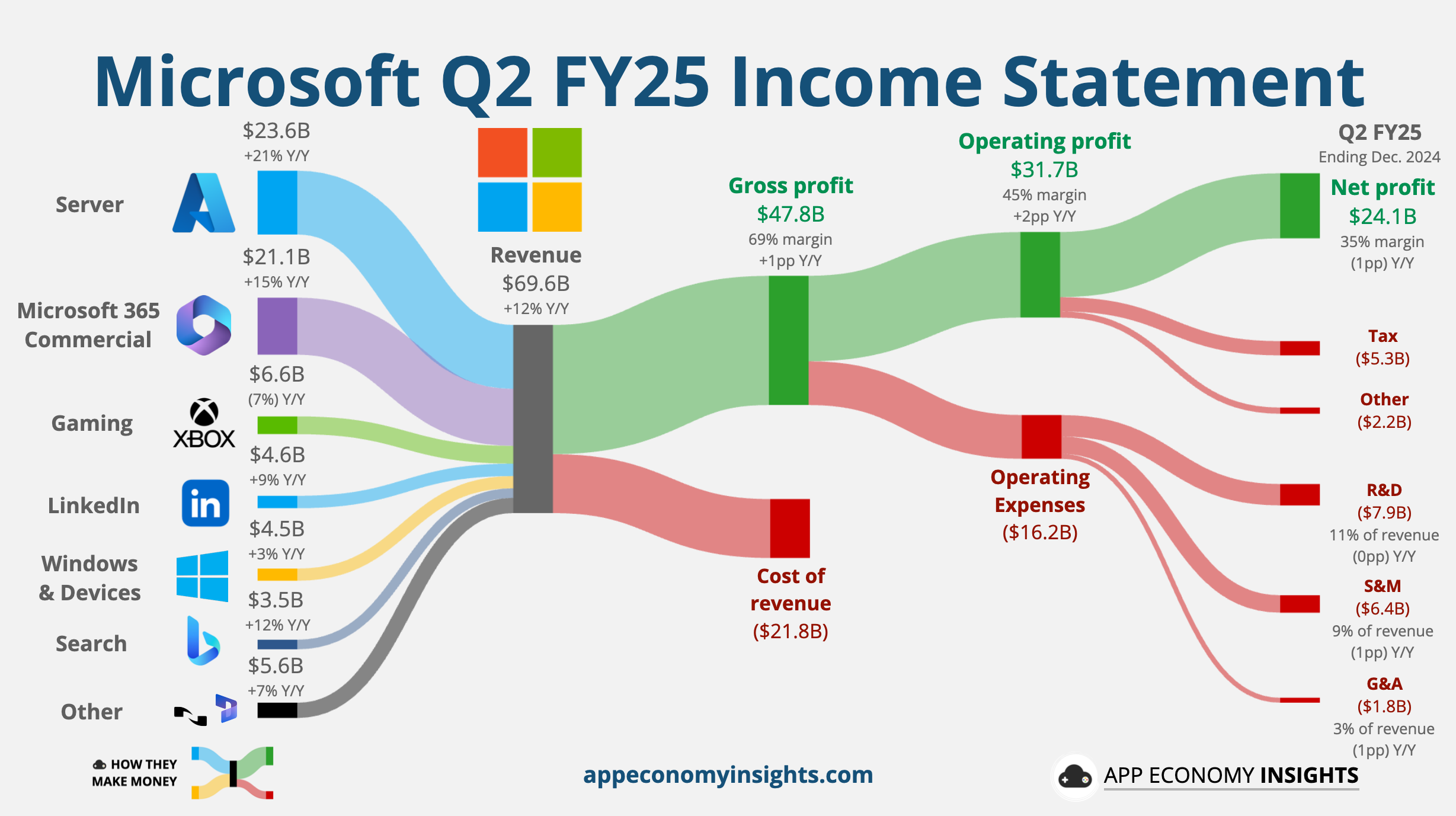

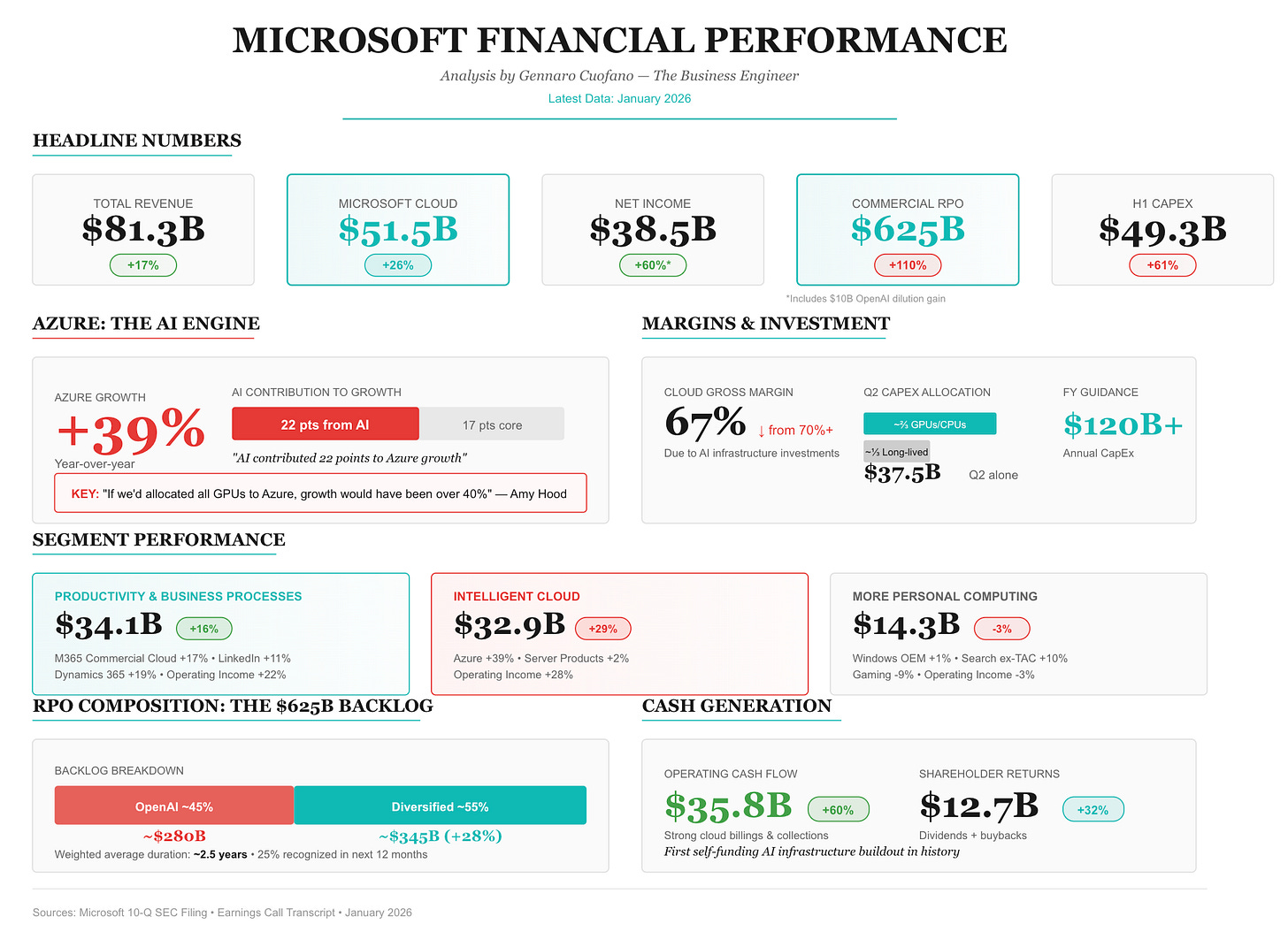

Microsoft's commitment to artificial intelligence spans far beyond Copilot. The company has structured massive capital allocations across multiple AI initiatives, with varying levels of commercial success.

In fiscal year 2026, second quarter, Microsoft reported total AI-related capital expenditures reaching $37.5 billion. This figure encompasses the infrastructure supporting Microsoft 365 Copilot, GitHub Copilot, Azure AI services, OpenAI partnership investments, and the foundational computing infrastructure required to train and deploy these systems.

Understanding where this money actually goes illuminates why conversion rates remain so low. A significant portion of this capital doesn't generate direct revenue. Instead, it funds free or subsidized AI features embedded into existing products like Windows 11, Microsoft Office applications, and Azure services.

CFO Amy Hood acknowledged this reality during investor calls, explaining that many analysts were making "a very direct correlation between capex spend and Azure revenue number." She pushed back on this assumption, noting that Microsoft first allocates AI capacity to its own products before offering excess capacity to external Azure customers.

This strategy represents a fundamental shift in how Microsoft thinks about technology deployment. Rather than asking "how quickly can we monetize this," the company is asking "how deeply can we integrate AI into our ecosystem." The Copilot for Microsoft 365 integration across Word, Excel, PowerPoint, Outlook, and Teams reflects this embedded approach.

Yet this strategy creates a structural problem for shareholders demanding near-term returns on AI investments. Free or low-cost features suppress the price elasticity across the entire Microsoft 365 ecosystem.

While Copilot's paid adoption rate is only 3.3%, engagement metrics like daily active users and conversations per user have seen significant growth, indicating increased usage but not necessarily conversion to paid tiers.

The 3.3% Conversion Rate: What the Numbers Actually Reveal

Thirty-three million sounds impressive as an adoption metric until you contextualize it against Microsoft's installed base. The company reports approximately 450 million commercial Microsoft 365 users have access to some form of Copilot functionality.

Of that 450 million, only 15 million pay for premium Copilot features. This creates a 3.3 percent paid adoption rate—an extraordinarily low figure for a product that's been in market for over a year and represents one of the most heavily marketed enterprise software launches in recent history.

To understand why this conversion gap exists, you need to understand what Microsoft is actually charging for and what users are getting for free.

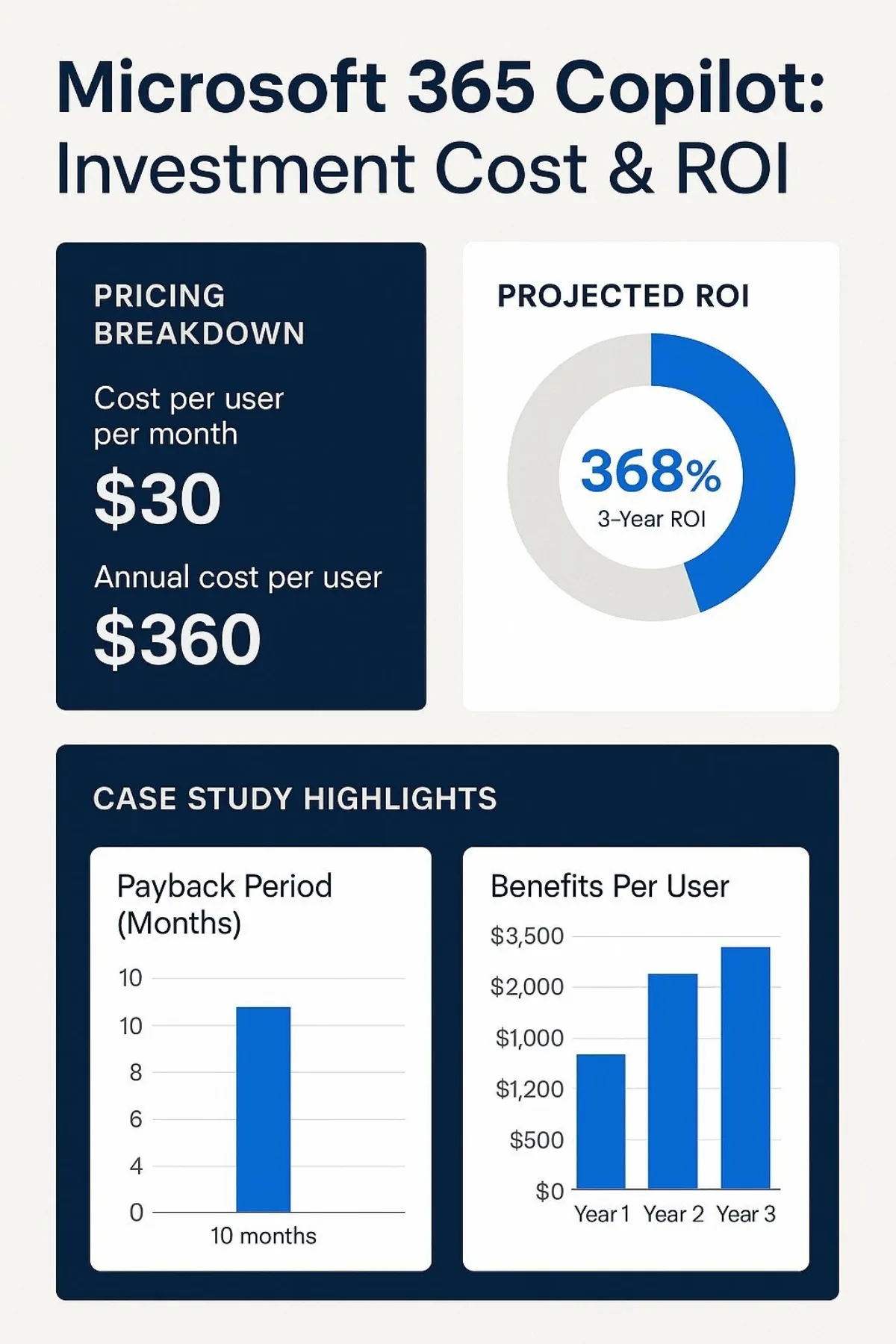

Microsoft 365 Copilot launched in late 2023 at

Simultaneously, Microsoft deployed free Copilot Chat across Windows 11, web browsers, and basic Microsoft applications. This creates a peculiar situation where users can access substantial AI capabilities for zero additional cost while paying for enhanced versions of those same capabilities elsewhere.

This freemium structure, common in consumer software, proves problematic in enterprise contexts. Organizations evaluate software purchases based on measurable productivity improvements, not feature breadth. If employees can accomplish 80 percent of their Copilot-related tasks with the free version, the business case for $30/user/month evaporates.

Analyst Mary Jo Foley noted that this massive free user base actually works against Microsoft's narrative of rapid Copilot adoption. Each free user is a potential paying customer who's decided the value proposition isn't worth the money. The sheer size of the free user base—450 million potential customers seeing the product's limitations daily—creates a constant stream of implicit rejections of the paid tier.

Satya Nadella's Claims vs. The Adoption Reality

Satya Nadella has been Microsoft's most visible champion of AI integration. His public statements about Copilot adoption paint a dramatically different picture than the 3.3 percent paid adoption rate suggests.

Nadella specifically claimed that Copilot is becoming "a true daily habit" for users globally. He pointed to growth in AI chats, search functionality, browser integration, shopping features, and OS-level integrations. His language implied ubiquitous adoption across Microsoft's ecosystem.

The "daily habit" framing matters because it suggests habitual, integral use. Habits create dependencies. Dependencies justify premium pricing. If Copilot had truly become a daily habit for most Microsoft 365 users, conversion to paid tiers should be substantially higher than 3.3 percent.

Nadella also cited impressive growth metrics: "daily active users are up tenfold year over year," and "conversations per user doubling." These metrics show increased engagement among users who do engage with Copilot.

However, engagement metrics and conversion metrics measure different things. A user who activates Copilot Chat daily but never subscribes to the paid tier is showing engagement without demonstrating the value perception necessary for conversion.

Hood's comments provided context for Nadella's framing. She emphasized the importance of looking at the "long game" rather than short-term adoption metrics. This language typically indicates a product that isn't meeting near-term commercial expectations but is expected to mature.

This patient-capital narrative works when companies have massive balance sheets, market dominance, and investor confidence. Microsoft possesses all three. However, it's worth noting that even for a company of Microsoft's scale and financial strength, justifying $37.5 billion in quarterly AI spending becomes difficult when only 3.3 percent of the target user base converts to paid status.

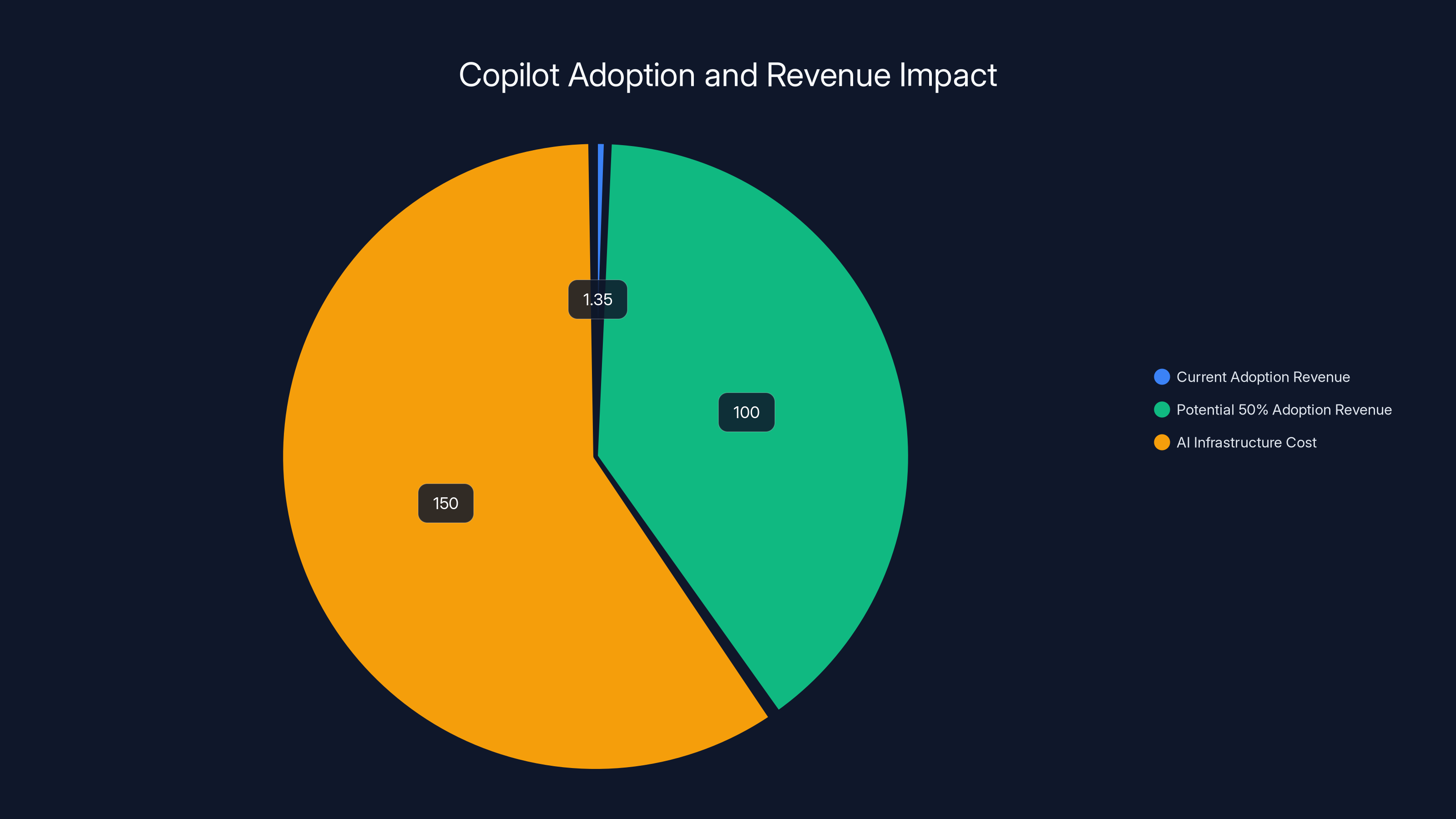

Microsoft's $37.5 billion quarterly AI spending highlights the infrastructure cost floor, while a 3.3% adoption rate indicates the ceiling of customer willingness to pay. Estimated data.

Why Enterprise Adoption of Copilot Is Stalling

Understanding the conversion gap requires understanding why organizations and individual users are declining to pay for Copilot despite having free access.

First, the value proposition remains unclear to many organizations. Copilot can search company documents, analyze meeting recordings, and automate routine workflows. These capabilities sound valuable in abstract terms. Quantifying actual productivity gains proves far harder.

Lloyd's Banking Group published one of the few detailed case studies on Copilot, estimating it saves staff 46 minutes per day on average. This number gets cited repeatedly, but it's worth examining the claim's foundation. Forty-six minutes of daily time savings per employee translates to roughly 10 percent of a workday across an organization. At scale, this would represent massive economic value.

Yet this estimate remains an outlier. Most organizations deploying Copilot report far more modest time savings, often measured in minutes per week rather than per day. The difference between 46 minutes daily and 5 minutes weekly represents the gap between transformative technology and marginal improvement.

Second, integration challenges persist. Copilot works best when documents, meetings, and communications flow through Microsoft tools. Many organizations maintain substantial infrastructure outside the Microsoft ecosystem, reducing Copilot's utility. A design team using Adobe Creative Suite, a development team using GitHub (yes, owned by Microsoft, but with tool-specific workflows), and an analytics team using Tableau or Looker all work in systems where Copilot has limited reach.

Third, and perhaps most important, organizations struggle to measure ROI on Copilot investments. The $30/user/month cost creates clear financial visibility. The productivity benefits remain abstract. When budgets tighten, spending on products with unclear ROI gets cut first.

Fourth, security and data governance concerns suppress adoption. Copilot requires access to company documents, email messages, and meeting transcripts to provide value. Many regulated industries and security-conscious organizations restrict this type of AI access, fearing data leakage or compliance violations.

The Growing Skepticism: Internal Reviews and Feature Rollbacks

Perhaps the most telling indicator of Copilot's struggles comes not from public adoption metrics but from internal Microsoft decisions. Reports indicate that Microsoft itself is reviewing Copilot's viability and considering removing or streamlining AI features in some applications.

Windows 11 is a notable example. The company integrated Copilot prominently into the OS, dedicating screen real estate and user interface elements to the AI assistant. Internal reviews apparently questioned whether this investment was justified by usage metrics, leading to discussions about reducing Copilot's prominence or removing it entirely from certain Windows 11 configurations.

If Microsoft's own product teams don't believe Copilot justifies premium positioning in their flagship OS, this sends a clear signal about internal confidence in the product's value. When a company built by software engineers removes features because usage doesn't justify the investment, external organizations should take note.

These internal reassessments suggest that even Microsoft's engineers, working with complete visibility into Copilot's performance and user behavior, aren't convinced the technology delivers sufficient value to justify its infrastructure costs and development resources.

This internal skepticism parallels broader industry doubts about generative AI's enterprise utility. Gartner, the research firm, adjusted its expectations for enterprise AI adoption downward in recent reports. Organizations are deploying AI more slowly than predicted, generating less revenue from AI initiatives than anticipated, and encountering more implementation challenges than vendor marketing suggested.

Microsoft's own internal reviews of Copilot fit this broader pattern. The gap between AI's theoretical capabilities and practical enterprise value remains larger than industry forecasters predicted.

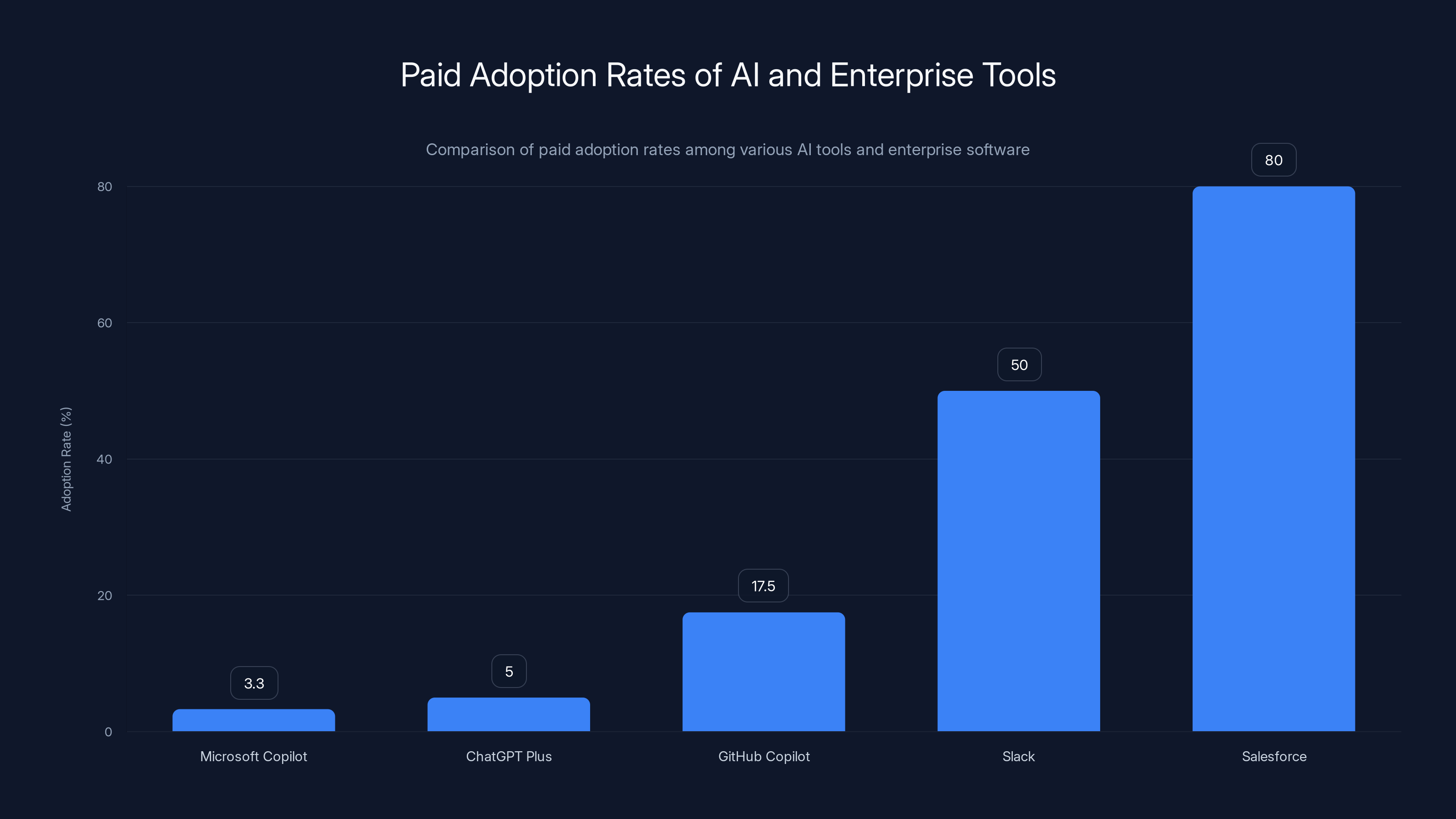

Estimated data shows Microsoft Copilot's 3.3% paid adoption rate is lower than GitHub Copilot's 17.5% and significantly lower than enterprise tools like Slack and Salesforce, which benefit from network effects and data lock-in.

Comparing Microsoft Copilot's Adoption to Competitive AI Tools

Context matters when evaluating Copilot's 3.3 percent paid adoption rate. How do competing AI tools perform? What adoption patterns do other enterprise software categories show?

ChatGPT, the consumer-focused AI assistant, reports approximately 200 million weekly active users globally. OpenAI has claimed roughly 10 million paid ChatGPT Plus subscribers. This creates a 5 percent paid adoption rate among engaged users, somewhat higher than Copilot's 3.3 percent but still indicating that free tiers suppress paid conversions dramatically.

Perplexity, the AI search engine, released publicly that only a small percentage of its user base converts to paid status, though the company hasn't disclosed exact figures. The pattern remains consistent: free access suppresses paid adoption.

For context, consider traditional enterprise software categories. Slack, the team communication platform, achieved paid adoption rates exceeding 50 percent among organizations with free workspace access. Salesforce, the CRM platform, maintains paid adoption above 80 percent among organizations using the free tier.

Why the dramatic difference? Slack and Salesforce create network effects and data lock-in. Once your team collaborates through Slack, switching costs become prohibitive. Once your sales pipeline lives in Salesforce, alternatives become painful. Copilot lacks these switching-cost dynamics. Organizations can continue using Microsoft 365 without Copilot, and individual employees can use free Copilot Chat without subscribing to the enterprise version.

Another relevant comparison: GitHub Copilot, which Microsoft owns. GitHub Copilot has achieved higher paid adoption rates (estimated at 15-20 percent among GitHub's developer user base) compared to Microsoft 365 Copilot's 3.3 percent. Why? Developers directly experience the time savings from AI code completion. The ROI on GitHub Copilot for a developer is more concrete and immediate than the ROI for office workers using Microsoft 365 Copilot.

This distinction suggests that Copilot's low adoption reflects not just a pricing issue but a fundamental challenge in demonstrating ROI for productivity AI in office environments.

The Economics of Microsoft's AI Strategy: When Does the ROI Appear?

Microsoft's leadership frames AI spending as a long-term investment in platform dominance, not as a bet on immediate Copilot subscription revenue. Understanding this distinction is crucial for evaluating whether the current 3.3 percent adoption rate represents a problem or a temporary step in a longer strategy.

The long-term theory works like this: AI capabilities become increasingly important in enterprise software. Organizations that integrate AI effectively will dominate their categories. Microsoft's massive AI infrastructure investments position the company to embed AI capabilities into every product it sells. Over time, as AI becomes integral to productivity, customers won't be able to imagine working without it. Pricing power increases. Revenue per user increases. Near-term adoption metrics matter less than long-term positioning.

This theory has historical precedent. Microsoft's massive investment in cloud infrastructure preceding Azure's dominance. Investment in gaming hardware preceding Xbox's profitability. These long-cycle bets eventually paid off, but not immediately.

However, the Copilot situation differs in important ways. Cloud computing and gaming represent entirely new product categories. Organizations had to evaluate whether to adopt cloud computing or stick with on-premises infrastructure. The choice was binary and consequential.

Copilot represents an enhancement to existing products. Organizations don't face a binary choice between using Microsoft 365 with Copilot or not using productivity software. They can continue using Microsoft 365 without Copilot indefinitely. The product is an optional add-on, not a fundamental platform shift.

This optional-add-on status limits long-term ROI potential. Even if Copilot becomes ubiquitous, its role remains supplementary. The

CFO Amy Hood's suggestion that investors focus on long-term strategy reads as acknowledgment that near-term returns on AI spending will disappoint expectations. This doesn't mean the investment is wrong, but it does mean patience is required.

The risk, of course, is that this patience doesn't pay off. If Copilot never achieves sufficient ROI to justify its cost, Microsoft has spent $37.5 billion quarterly on infrastructure that generates minimal revenue. Even for Microsoft's massive balance sheet, this becomes problematic at scale.

Current Copilot adoption generates

What Enterprise IT Leaders Should Learn From Copilot's Adoption Struggles

The Copilot adoption challenge offers concrete lessons for organizations evaluating AI tools and planning their own AI investments.

First, published adoption metrics often obscure more than they reveal. "15 million paid seats" sounds impressive until you contextualize it against 450 million potential users. When evaluating vendor claims about AI adoption or growth, always ask for the denominator. What percentage does this represent of the target user base? Growth means nothing without context.

Second, free tiers destroy price elasticity for premium offerings. If your organization plans to launch an AI product with both free and premium tiers, understand that free users will suppress paid adoption. Organizations should carefully model whether the paid tier will achieve sufficient adoption to justify development and infrastructure costs. If internal estimates show paid adoption below 10 percent, the business model may not work.

Third, measure productivity gains rigorously before rolling out expensive AI tools. Anecdotes and vendor case studies don't provide sufficient evidence. Conduct structured pilots with control groups. Track time saved, work quality improvements, and end-user satisfaction systematically. If pilots don't demonstrate clear ROI, enterprise-wide deployment is likely to disappoint.

Fourth, consider the switching-cost dynamics in your use case. AI value is highest in scenarios where switching to an alternative is expensive and where the AI provides capabilities that are genuinely unavailable elsewhere. AI value is lower in scenarios where competitors offer similar capabilities and switching costs remain low.

Fifth, understand that published leadership quotes about "daily habits" and "rapid growth" often reflect optimism rather than reality. Technology leaders have incentives to project confidence in their products. When leadership statements diverge significantly from objective metrics, the gap itself becomes informative.

The Broader AI Monetization Crisis in Enterprise Software

Copilot's struggles reflect a broader challenge in enterprise AI monetization that extends far beyond Microsoft. The entire industry is discovering that enterprise customers evaluate AI tools differently than consumer AI products.

Consumer AI products succeed when they provide entertainment, information access, or personal productivity improvements. The user benefits directly and immediately. ChatGPT's popularity reflects this dynamic: individuals see value for themselves and subscribe.

Enterprise AI products must justify their cost within corporate budgeting structures. Procurement teams, finance departments, and IT leadership evaluate cost-benefit analyses. An employee might love using Copilot, but if their manager can't demonstrate that Copilot spending generates quantifiable ROI, the subscription gets canceled during the next budget cycle.

This enterprise-evaluation reality creates a floor beneath which AI pricing can't fall and a ceiling above which adoption can't rise. The floor exists because infrastructure costs are real. AI systems require computational resources that cost money. The ceiling exists because organizations won't pay for tools unless the value-to-price ratio justifies the investment.

Microsoft's

Meanwhile, the 3.3 percent adoption rate reflects the ceiling. Enterprise customers have evaluated Copilot against the $30/month price and concluded that the value proposition isn't worth it for the majority of their users.

This mismatch between infrastructure costs and customer willingness to pay creates a squeeze. Microsoft must either reduce infrastructure costs (by developing more efficient AI models), increase customer willingness to pay (by demonstrating greater ROI), or accept lower margins on AI products than on traditional software.

No clear path to resolution currently exists. More efficient AI models will eventually arrive, but major improvements require years. ROI improvements require better product features and organizational learning about how to deploy AI effectively. Margin compression feels inevitable.

This monetization crisis isn't unique to Microsoft. Google faces similar challenges with Gemini adoption. Amazon has quietly reduced its public AI investment focus. Smaller vendors attempting to build pure-play AI software companies struggle to achieve sustainable unit economics.

The AI monetization crisis suggests that the industry's enthusiasm for AI in the 2022-2023 period was based on assumptions that haven't materialized. The market assumed enterprise customers would eagerly pay for AI capabilities once they became available. The market's assumption appears to have been wrong.

Copilot adoption is only 3.3% among Microsoft 365 users, generating

Why Productivity Improvements Don't Translate to Revenue

The Lloyd's Banking Group case study cited 46 minutes of daily time savings per employee from Copilot usage. This figure should theoretically translate directly to business value. An employee working 8 hours per day who saves 46 minutes is 9.6 percent more productive. At enterprise scale, this should generate enormous ROI.

Yet most organizations won't convert this productivity gain into Copilot revenue by paying $30/user/month. Why?

First, organizations don't capture all productivity gains as revenue. An employee who becomes 9.6 percent more productive doesn't automatically generate 9.6 percent more output. The productivity gain might become downtime. The employee leaves work at 4:45 PM instead of 5:30 PM. The productivity gain becomes personal benefit to the employee, not organizational benefit justifying software spending.

Second, productivity gains get distributed across multiple investments. If Copilot saves 46 minutes daily and requires 30 minutes of monthly management time, the net gain is 34 minutes daily. This improvement might combine with improvements from other tools, training, or process changes. Attributing the full benefit to Copilot becomes impossible.

Third, organizations measure productivity gains unreliably. The 46-minute figure from Lloyd's may reflect best-case scenarios, selection bias (participants aware they're being measured work more efficiently), or optimistic interpretations of time logs. Actual productivity improvements across a diverse organization are likely to be substantially lower.

Fourth, and perhaps most importantly, organizations have largely already captured easy productivity gains through automation, process improvements, and previous technology investments. The marginal productivity gain from each additional software tool decreases. Copilot isn't the first productivity tool an organization has invested in. It's the 50th or 100th. Each additional tool generates less incremental productivity gain than the previous tool.

This phenomenon, called the law of diminishing returns, applies directly to enterprise productivity technology. The first workflow automation tools generate enormous productivity gains. The 10th tool generates modest gains. The 50th tool generates barely measurable gains. Copilot competes as the 50th tool in most organizations' tech stacks, not the first.

Consequently, even if Copilot genuinely delivers the promised productivity improvements, the marginal value of those improvements within existing technology-heavy organizations remains too low to justify the cost.

The Windows 11 Integration Failure: Signs of Internal Doubts

Microsoft invested heavily in integrating Copilot into Windows 11, dedicating interface real estate, developing new features, and promoting Copilot across the OS. This integration represents one of the company's most visible AI bets outside of cloud infrastructure.

Yet internal reviews apparently questioned whether this investment was justified. Reports indicate Microsoft considered removing Copilot from Windows 11 or reducing its prominence significantly.

This internal reassessment reveals something important: Microsoft's own engineers, working with complete visibility into Copilot's Windows 11 usage metrics, apparently concluded that user adoption and engagement didn't justify the development investment and interface complexity Copilot added to the OS.

When the company that built the product quietly questions its viability in their own flagship product, external organizations should take note. If Copilot doesn't prove valuable enough for Microsoft to keep prominently featured in Windows 11, it's unlikely to prove valuable for organizations considering enterprise adoption.

The Windows 11 situation also reflects a broader UX problem with Copilot. The AI assistant adds complexity to applications without solving problems that most users actively recognize as problems. An average Word user has habitual workflows. Copilot is a new interface to learn and a new tool to evaluate. The learning curve must be worth it for adoption to succeed.

Evidence suggests that for many users, the learning curve isn't worth the promised benefits. Hence the low adoption rates.

This creates a strategic challenge for Microsoft. The company has painted itself into a corner with Copilot. The product is integrated across the entire Microsoft ecosystem. Removing it becomes embarrassing, a visible admission of failure. Yet leaving it in place while usage remains minimal also looks like failure.

Microsoft's apparent response—quietly reducing Copilot's prominence while publicly maintaining optimistic statements about adoption—represents a compromise between these undesirable positions. The company gets to keep Copilot in products without highlighting its low adoption rates.

Comparing Copilot to Specialized AI Tools: Where Adoption Actually Works

While Copilot struggles with enterprise adoption, specialized AI tools in narrow domains achieve significantly higher adoption rates. Understanding these successes provides insight into where AI monetization actually works.

Grammarly, the AI writing assistant, reports over 30 million monthly active users and a growing paid subscriber base. Why does Grammarly succeed where Copilot struggles? The problem Grammarly solves is discrete and measurable. Users immediately see improved writing. The value is tangible.

Copilot's value is diffuse. It might help with document analysis, email summarization, or workflow automation. These benefits are hypothetical until the user experiences them. The selling proposition is harder to understand and demonstrate.

Midjourney, the AI image generation tool, has achieved premium pricing ($20-120/month) with strong paid adoption among creators. Why? The alternative to Midjourney is hiring human designers or purchasing stock images. Midjourney replaces a clear existing service with a cheaper alternative. ROI is obvious.

Copilot's value proposition is less clear. The alternative to Copilot isn't hiring a human AI assistant. It's continuing to work as you already do. Copilot must improve on the existing approach by enough to justify additional cost. This bar is higher than replacing a clear existing service.

GitHub Copilot, which I mentioned earlier, achieves decent adoption among developers. Why? Developers immediately see Copilot's value when coding. The tool completes code faster than manual typing. ROI appears within the first session. Stickiness is high because discontinuing Copilot means slower coding.

Office workers using Copilot don't experience this immediate, obvious ROI. The benefits emerge gradually and diffusely across workflows.

The pattern suggests that AI adoption works best when the problem is narrow, the solution is obvious, and the ROI is immediate and measurable. Copilot's broad application across office productivity represents the opposite conditions.

This suggests Microsoft might achieve better Copilot adoption by developing specialized versions focused on specific use cases rather than the current general-purpose approach. A Copilot specifically for sales organizations, with sales-specific workflows and measurable outcomes, might achieve higher adoption than the generic version.

Infrastructure Costs and the Future of Enterprise AI Pricing

Understanding why Microsoft's AI spending remains so high requires understanding the infrastructure cost structure of modern AI systems.

Running large language models at scale requires extraordinary computational resources. Training models requires thousands of GPUs running simultaneously for months. Deploying models at the scale required to serve Microsoft's 450 million users requires thousands of servers globally processing queries in real-time.

Nvidia GPUs, the primary hardware for AI workloads, cost $10,000-50,000 per unit depending on the model. The software licenses, electricity, cooling infrastructure, and personnel to maintain this hardware add another 100-200 percent to the hardware cost.

A single GPU can train or serve models but has practical limitations. Serving 100 million Copilot queries requires distributing computational load across many GPUs. A conservative estimate suggests that Microsoft's Copilot infrastructure costs hundreds of millions of dollars annually.

These infrastructure costs create a floor beneath which Copilot pricing can't fall. If serving a user 10 Copilot queries monthly costs Microsoft

Microsoft's current $30/month pricing provides margin above these infrastructure costs, at least in theory. However, if adoption remains at 3.3 percent, with 96.7 percent of users accessing free Copilot Chat or limited free features, then Microsoft is paying the infrastructure costs for 450 million users while collecting revenue from 15 million.

This dynamic suggests that free Copilot access is effectively subsidizing Microsoft's AI ambitions. The company is investing in AI infrastructure and then giving access away for free to most users. This strategy makes sense only if the free users eventually convert to paid status or if free usage provides other benefits (data collection, lock-in, future monetization) that justify the infrastructure investment.

Alternatively, Microsoft could be accepting that free AI access to its user base is simply a loss-leader investment in long-term platform dominance, similar to how Xbox runs at low margins because it drives Game Pass adoption and entertainment ecosystem lock-in.

The key uncertainty is whether this strategy eventually produces acceptable returns. If Copilot adoption rates remain at 3.3 percent indefinitely while infrastructure costs grow with usage, the strategy becomes increasingly difficult to justify.

What's Next: Future Scenarios for Copilot and Enterprise AI

The current trajectory of Copilot adoption suggests several possible futures. Each scenario has different implications for organizations considering AI investments.

Scenario One: Copilot adoption increases gradually as AI becomes more integrated into enterprise workflows and organizational learning about AI deployment improves. Over the next 3-5 years, adoption climbs from 3.3 percent to 15-20 percent. This scenario vindicates Microsoft's long-term investment strategy. The company eventually achieves acceptable returns.

Scenario Two: Copilot adoption stalls at 3.3 percent or declines as organizations conclude that the ROI remains insufficient to justify widespread deployment. Free Copilot access continues to be used sporadically, but enterprises never commit budget to the premium offering. Microsoft's infrastructure investment becomes increasingly difficult to justify to shareholders.

Scenario Three: Microsoft introduces new pricing models, product configurations, or bundling strategies to increase adoption. Rather than charging

Scenario Four: Competitive pressure from alternative AI tools (including free tools like ChatGPT) undermines Copilot's positioning. Organizations conclude that free or cheaper alternatives provide comparable value, leading to adoption decline. Microsoft eventually makes Copilot free or deeply discounted to remain competitive.

Scenario Five: Copilot becomes integrated so deeply into Microsoft products and workflows that charging separately becomes redundant. The company incorporates Copilot access into higher-tier Microsoft 365 subscriptions as an included feature rather than an optional add-on, changing the monetization model entirely.

Each scenario influences whether organizations should invest in Copilot now or wait for clarity. Current 3.3 percent adoption rates suggest the market hasn't settled on Copilot's long-term role or pricing.

Strategic Implications for IT Leaders and Enterprise Purchasing Decisions

The Copilot adoption data offers strategic guidance for organizations making AI purchasing decisions right now.

First, the extremely low adoption rates suggest that the enterprise market for general-purpose AI office assistants remains premature. Organizations should approach category-wide adoption cautiously and pilot extensively before enterprise-wide deployment.

Second, the gap between marketing hype and actual adoption suggests that vendor enthusiasm for AI products should be discounted substantially. When vendors claim rapid adoption and critical user adoption, verify these claims with third-party data before committing budget.

Third, Microsoft's continued investment in Copilot despite low adoption suggests that the company isn't abandoning the product. Organizations shouldn't fear that Copilot will be discontinued. However, pricing and positioning may change. Organizations should avoid committing to Copilot-specific workflows that would create high switching costs if the product changes significantly.

Fourth, the focus on cloud-based AI infrastructure suggests that future competitive advantages will belong to organizations that master AI deployment and integration, not to the AI vendors themselves. The commoditization of AI models (increasing availability of open-source alternatives to proprietary models) means that vendor lock-in from superior models is decreasing. Lock-in will increasingly come from integration depth and organizational workflows built around AI systems.

Fifth, the current monetization struggles of enterprise AI suggest that opportunities exist for vendors who can solve the ROI measurement problem. Organizations will pay a premium for AI tools that transparently measure and demonstrate productivity gains. Vendors who focus on this measurement challenge rather than model sophistication may achieve higher adoption than those focused purely on AI capability.

The Data Behind Adoption: Quantifying the Gap

Let's put precise numbers on what the 3.3 percent adoption gap actually means economically.

Microsoft 365 commercial subscriptions average

If Copilot achieved 50 percent adoption (a level that would be considered disappointing for most enterprise software), it would generate approximately

At 3.3 percent adoption with Microsoft's ~450 million commercial users and assuming

Microsoft's quarterly AI spending of

This calculation clarifies why CFO Amy Hood emphasized looking at the long game. The company's AI infrastructure costs vastly exceed the revenue generated by the only commercialized AI product. The math works only if one of the following occurs: adoption increases dramatically, prices increase dramatically, or AI infrastructure generates revenue through multiple products and revenue streams rather than Copilot alone.

The most likely scenario involves Azure AI services generating revenue as enterprises build custom AI applications. The cloud computing infrastructure supporting those applications would be housed in Azure. This indirect revenue path may ultimately prove more valuable than direct Copilot subscription revenue.

However, this strategy depends on organizations adopting AI tools and services broadly, not just using Copilot. It requires competing effectively against other cloud providers' AI offerings. The path to profitability is longer and less certain than direct Copilot revenue would be.

FAQ

What exactly is Microsoft Copilot and how does it differ from Chat GPT?

Microsoft Copilot refers to AI assistants integrated into Microsoft products like Microsoft 365 (Word, Excel, PowerPoint, Outlook, Teams), Windows 11, and the web. ChatGPT is OpenAI's standalone AI chatbot. While both are built on large language models, Copilot is embedded into productivity tools to assist with document analysis, email summarization, and workflow automation, whereas ChatGPT functions as a general-purpose conversational AI that you access separately. Microsoft has licensed OpenAI's technology, so some versions of Copilot use the same underlying models as ChatGPT.

Why is Copilot adoption so low despite Microsoft's massive investment?

Copilot adoption remains at 3.3 percent of Microsoft 365 users for several interconnected reasons. First, free versions of Copilot suppress paid conversions because users can accomplish most tasks with the free tier. Second, the value proposition remains unclear for most organizations, particularly since productivity gains are difficult to measure and may fall within the noise of normal variation. Third, security and data governance concerns prevent regulated industries from deploying Copilot widely. Fourth, organizations already have multiple productivity tools in place, and Copilot represents a marginal improvement rather than a fundamental necessity. Fifth, switching costs remain low because organizations can continue using Microsoft 365 without Copilot indefinitely.

How much revenue does Copilot actually generate for Microsoft relative to infrastructure costs?

Based on available data, Copilot generates roughly

Should enterprises deploy Copilot for Microsoft 365 to their organizations?

Before deploying Copilot enterprise-wide, organizations should conduct rigorous pilots measuring actual productivity gains in their specific environments. The 46-minute daily productivity claim from Lloyd's Banking Group may not apply to your organization. Measure time saved, work quality improvements, and user satisfaction in a controlled pilot with 10-20 representative users before committing budget. Additionally, evaluate security implications thoroughly, particularly if your organization handles regulated data. Only deploy widely if pilot data demonstrates clear ROI exceeding the $30/user/month cost.

What does Microsoft's internal review of Copilot mean for the product's future?

Reports that Microsoft is reviewing and potentially reducing Copilot's prominence in Windows 11 suggest internal skepticism about the product's value from the company's own engineers. When the vendor building a product questions its viability in their flagship product, external organizations should interpret this as a signal that Copilot may not provide sufficient value even in Microsoft's own assessment. This doesn't mean Copilot will be discontinued, but it does suggest the company is reconsidering its positioning and may make strategic changes. Organizations should avoid building Copilot-dependent workflows until the product's future direction becomes clearer.

How does Copilot adoption compare to other AI tools and traditional enterprise software?

Copilot's 3.3 percent adoption rate is substantially lower than comparable tools. GitHub Copilot achieves 15-20 percent adoption among developers. ChatGPT achieves roughly 5 percent paid adoption among its engaged user base. Traditional enterprise software like Slack achieves 50+ percent paid adoption among organizations with free access. The low adoption rates suggest that general-purpose office productivity AI remains immature compared to specialized AI tools and traditional enterprise software. Specialized AI tools addressing specific problems achieve higher adoption rates than general-purpose AI assistants.

What does the future hold for enterprise AI pricing and monetization?

The struggle with Copilot monetization reflects a broader industry challenge. Enterprise customers evaluate AI products based on measurable ROI rather than feature breadth or theoretical capability. This creates a monetization gap: organizations won't pay premium prices for AI unless productivity gains are substantial and measurable, but measuring productivity gains proves difficult. Future success will belong to vendors who solve this measurement problem and offer transparent ROI documentation. Additionally, as AI becomes commoditized (open-source models improve), vendor differentiation will shift from model capability to integration depth and organizational workflow optimization. Pricing pressure will likely increase over time as competition intensifies.

Why do free tiers damage paid adoption for AI products?

Free tiers suppress paid adoption because users who can accomplish 75-80 percent of their desired tasks with the free version rationally decline to pay for the premium tier. The free tier essentially defines a reference point for value. Users evaluate the premium tier against this reference rather than against the alternative of using no AI at all. If the premium tier provides incremental benefits that don't clearly justify the additional cost, most users won't convert. This dynamic particularly affects enterprise software where purchase decisions require ROI justification. Unlike consumer products where users spend their own money and may value incremental convenience highly, enterprise buyers require clear productivity justification for additional spending.

How should organizations think about AI infrastructure costs when evaluating long-term viability of AI products?

When vendors claim that AI products are growing and becoming essential, organizations should consider whether the underlying infrastructure costs are being borne by current revenue or by investor capital funding. If infrastructure costs vastly exceed product revenue (as with Copilot), the product's long-term viability depends on either rapid adoption increases, price increases, or inclusion of the product in higher-tier offerings to increase adoption. Vendors may continue investing in unprofitable products if they believe long-term returns justify near-term losses. However, this patience isn't unlimited. If adoption doesn't increase meaningfully within 3-5 years, cost-conscious companies eventually reduce investment in such products.

Conclusion: The Reality of Enterprise AI Adoption

Microsoft's situation with Copilot represents a crucial inflection point in the enterprise AI story. The company spent tens of billions of dollars building AI infrastructure and integrating AI capabilities across its products. It then discovered that customers aren't willing to pay for these capabilities at expected rates.

This isn't a Microsoft-specific failure. It's an industry-wide phenomenon. Across the enterprise software and AI sectors, adoption of AI tools remains far below vendor predictions from 2022 and 2023. Organizations aren't rushing to deploy AI. Users aren't eagerly upgrading to AI-enhanced versions of their productivity software. The enthusiasm for generative AI hasn't translated into business model validation.

The reasons are clear in hindsight. Generative AI is genuinely powerful, but its power manifests in specialized domains with clear, measurable value creation. AI code completion for developers creates obvious value. AI image generation for creators creates obvious value. General-purpose AI assistance for office workers creates diffuse, difficult-to-measure value.

Companies budgeting for enterprise software care about the measurable kind of value. If you can't quantify the productivity gain, you can't justify the spending. Copilot struggles with this fundamental requirement.

For organizations sitting on the sidelines, wondering whether to invest in AI tools now, the Copilot data offers valuable guidance. The fact that only 3.3 percent of Microsoft 365 users pay for Copilot suggests the market for general-purpose office AI remains immature. Waiting for the market to mature, for use cases to clarify, and for vendors to develop tools with more obvious ROI may be the prudent strategy.

Microsoft isn't abandoning AI. The company has too much invested and too much confidence in AI's long-term importance to retreat. However, the path to profitability from enterprise AI remains uncertain and longer than industry enthusiasm suggested.

The Copilot adoption gap teaches organizations an important lesson: vendor enthusiasm for new technology doesn't correlate with customer willingness to pay. The gap between impressive capabilities and practical business value remains larger than expected. Organizations that invest in AI should focus relentlessly on measuring and demonstrating ROI in their specific contexts. And organizations considering whether to invest at all should take note that the company that invented modern productivity software itself is struggling to convince its own users that AI-enhanced productivity tools are worth paying for.

That reality should inform your AI strategy more than any vendor pitch.

Key Takeaways

- Only 3.3% of Microsoft's 450 million commercial users pay for Copilot despite CEO claims of 'true daily habit' status and 160% year-over-year growth

- Microsoft's 1.35 billion annually), revealing profitability challenges

- Free Copilot Chat access suppresses paid adoption by allowing users to accomplish 75-80% of desired tasks without payment

- Specialized AI tools (GitHub Copilot 15-20%, Grammarly 5%+ paid) achieve higher adoption than general-purpose office AI due to measurable, immediate ROI

- Internal Microsoft reviews questioning Copilot's prominence in Windows 11 suggest company engineers doubt the product's value despite public executive optimism

Related Articles

- How AI and Nvidia GB10 Hardware Could Eliminate Reporting Roles [2025]

- Z-Angle Memory: Intel & SoftBank's HBM Challenge Explained [2025]

- Workday CEO Leadership Shift: What Bhusri's Return Means [2025]

- Hauler Hero $16M Series A: AI Waste Management Software Revolution 2025

- Best Résumé Builders 2026: Complete Guide & Alternatives

- Best Walking Pads for Working From Home 2026: Complete Guide & Alternatives

![Microsoft's $37.5B AI Bet: Why Only 3.3% Actually Pay for Copilot [2025]](https://tryrunable.com/blog/microsoft-s-37-5b-ai-bet-why-only-3-3-actually-pay-for-copil/image-1-1770763011532.jpg)