AMD Radeon GPU Price Increases: What You Need to Know Right Now [2025]

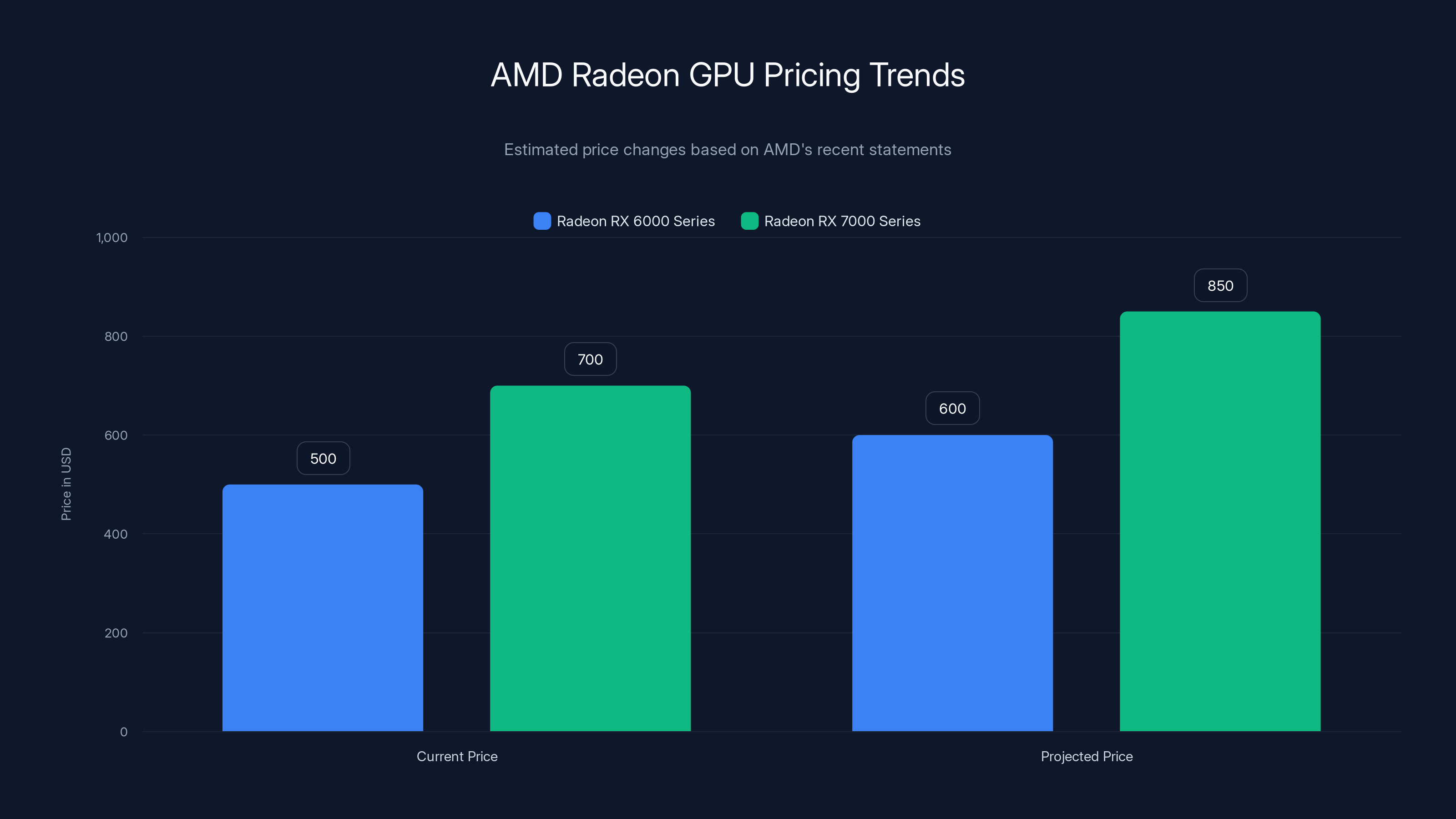

If you've been waiting for the perfect moment to upgrade your graphics card, AMD just delivered some unwelcome news. Executives at the company recently hinted that Radeon GPU prices are heading upward. The catch? It's not because there's a shortage. Instead, costs are climbing due to component pricing and other economic factors that are quietly squeezing the entire GPU market.

This isn't speculation—it's coming straight from AMD's leadership. During recent earnings discussions and industry events, AMD made it crystal clear: flatlined GPU pricing is off the table. For gamers, content creators, and AI enthusiasts, this means your next Radeon card purchase is probably going to cost more than current-generation models.

The interesting part is that AMD insists stock won't be an issue. Unlike the crypto mining boom and pandemic shortages that made finding a GPU impossible just a few years ago, supply chains are stable. You'll find cards on shelves. You'll just pay more for them.

Here's what's really happening beneath the surface, why it matters, and what you should know before your next GPU purchase decision.

TL; DR

- AMD confirms price increases for Radeon GPUs are coming in 2025, with no supply shortage justification

- Component costs are rising across memory, substrates, and other manufacturing inputs, not just NVIDIA pricing

- Supply chain is healthy, so shortages won't mask the price hikes like they did during 2021-2022 periods

- This affects all buyer segments from budget gamers to enterprise AI deployment customers

- Timing matters: Current-gen discounts may disappear, making 2025 an expensive year for GPU upgrades

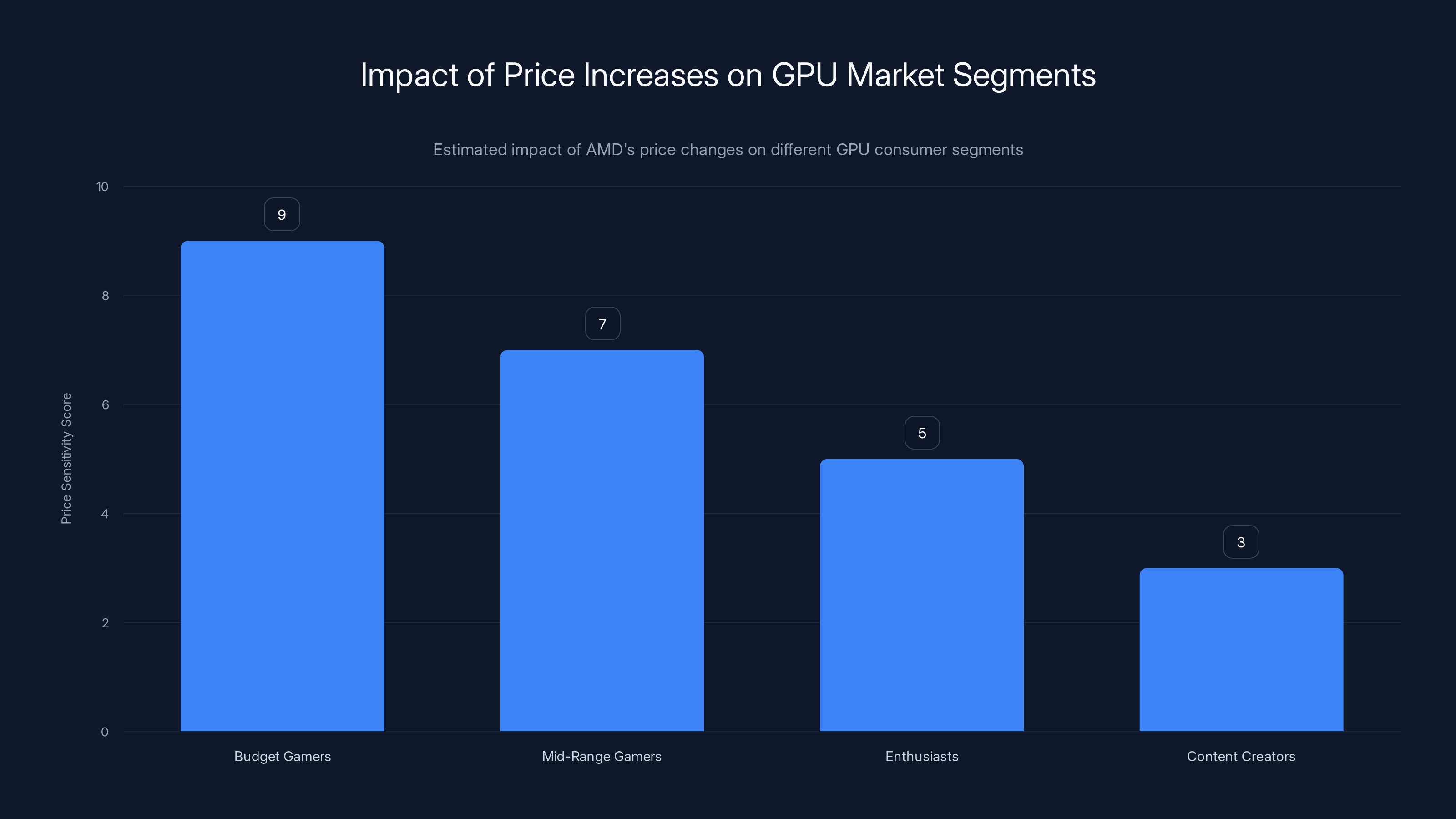

Budget gamers are the most price-sensitive, with a score of 9, while content creators are least affected by price increases, scoring 3. Estimated data based on market trends.

Why AMD Is Finally Being Honest About GPU Pricing

For years, GPU manufacturers have danced around pricing strategy. They talk about "market conditions," "component availability," and "customer value propositions." But AMD just pulled back the curtain. An AMD executive stated outright: "I'm not going to say prices across all these components will remain flat."

That's corporate speak for "prices are going up."

What makes this different from typical price-hiking PR nonsense is the honesty. AMD didn't blame supply chain chaos or unprecedented demand. They acknowledged that component costs themselves are escalating. This signals a fundamental shift in manufacturing economics, not a temporary market squeeze.

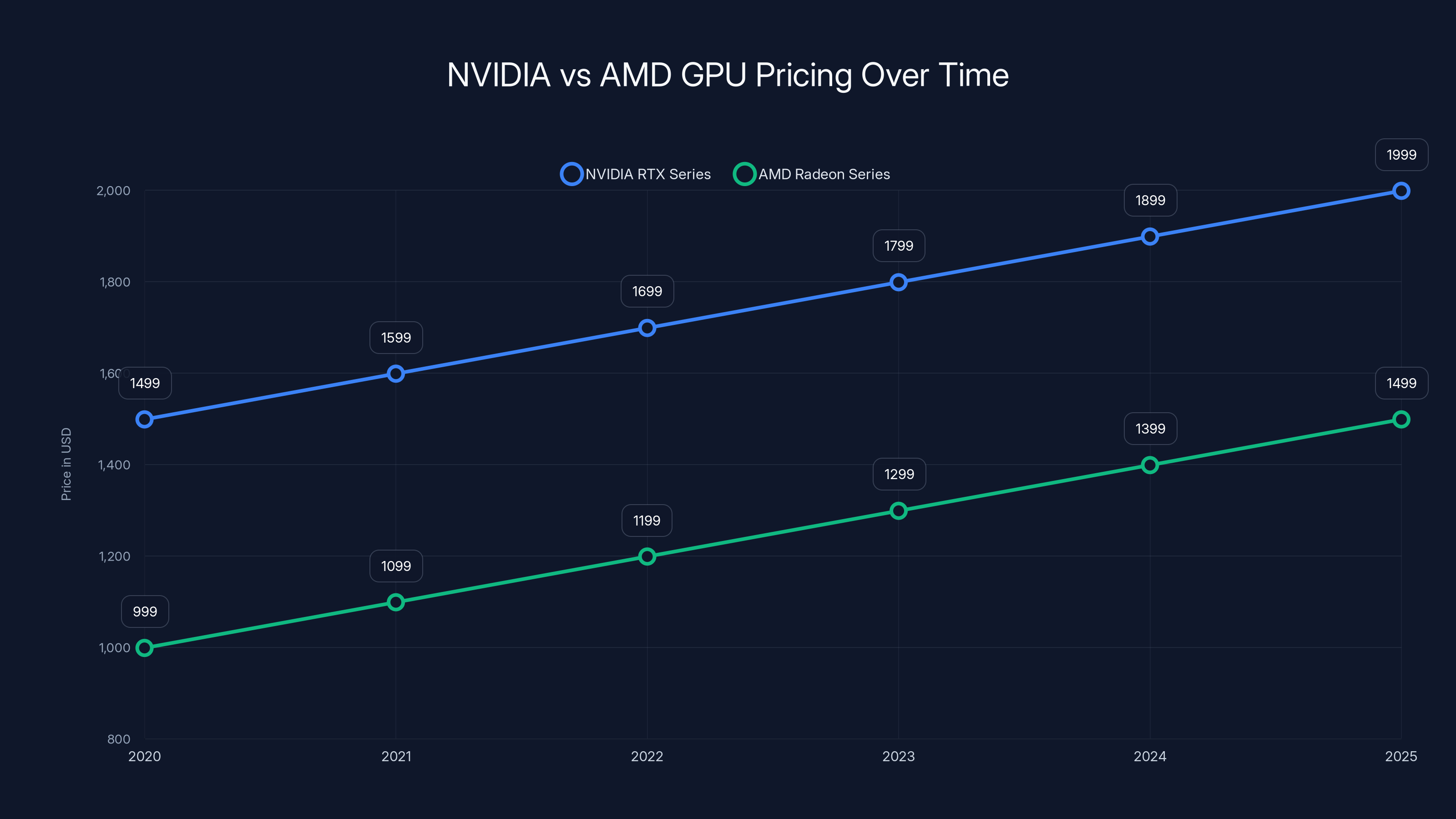

The statement also matters because it gives the market permission to normalize GPU pricing increases across the industry. When AMD—number two in discrete graphics—openly discusses rising costs, it validates similar moves by competitors. NVIDIA has already demonstrated willingness to push pricing higher. AMD following suit creates a one-two punch that hurts consumer choice and wallet health.

AMD historically positioned itself as the value option in GPU markets. Radeon cards offered 85% of GeForce performance for 70% of the price. That positioning is evaporating. If AMD raises prices while matching NVIDIA's pace of innovation, the traditional price-to-performance advantage disappears. Gamers and creators lose their budget-friendly alternative.

Understanding Component Cost Pressures in 2025

GPUs aren't made in a vacuum. A modern graphics card contains thousands of individual components, each with its own supply chain and cost structure. When AMD talks about component pricing pressure, they're pointing to several specific areas.

Memory costs are climbing. High Bandwidth Memory (HBM) and GDDR6X chips have become more expensive to manufacture. Yields are improving, but base costs haven't fallen. For high-end Radeon cards like the RDNA 4 lineup, HBM represents a significant portion of bill-of-materials cost. When memory suppliers raise prices by even 5-10%, it ripples through GPU costs substantially.

The semiconductor substrate situation is equally tight. The organic substrates that form the foundation of GPU packages require specific manufacturing processes. Only a handful of suppliers globally produce these at scale. Demand from AI accelerators, CPUs, and GPUs has concentrated pressure on capacity. Prices have risen accordingly.

Packaging materials, including the thermal interface materials and solder, have also experienced inflation. Copper and other rare earth elements used in electronics have become more expensive. Geopolitical tensions affecting supply routes have added tariff premiums to imported materials. These increases might seem small individually, but they compound across thousands of units.

AMD is also dealing with higher manufacturing costs at foundries. They don't own fabs—they rely on partners like TSMC for fabrication. As TSMC allocates more capacity to AI chips (where margins are higher), GPU production faces longer lead times and potentially higher per-unit costs. The economics of manufacturing haven't suddenly deteriorated, but they're definitely tightening.

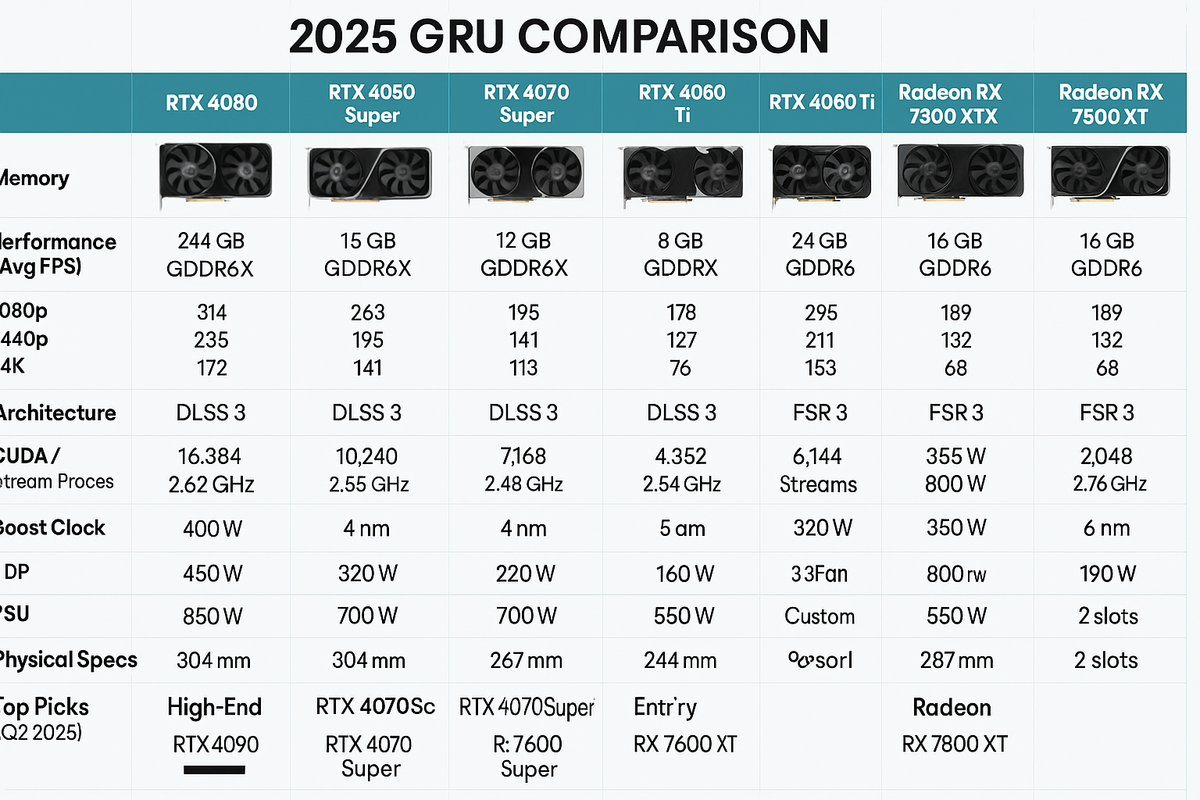

Estimated data shows that while new flagship GPUs offer top performance, previous generation and second-hand options provide better value for money with comparable performance.

The GPU Market's New Economics: Why Shortages Don't Drive Prices Anymore

During 2021-2022, GPU prices soared because supply was catastrophically constrained. Crypto miners were buying every card they could find. Gamers couldn't get anything. Retailers doubled prices because demand exceeded supply by 10-to-1 ratios. It was supply-and-demand economics at its most brutal.

That era is dead. Supply chains have normalized. Manufacturing capacity has expanded. Crypto is no longer consuming vast GPU volumes. Yet prices aren't dropping. Instead, they're stabilizing at elevated levels and now climbing from there.

This reveals something important about GPU pricing: it's not purely driven by shortage premiums. Manufacturers have learned that consumers will accept and rationalize higher GPU prices. The baseline expectations have shifted. A $700 RTX 4080 or Radeon equivalent used to feel outrageous. Now it's normal for flagship cards.

AMD's honesty about component costs is partly about conditioning the market for what's coming. If they stayed quiet and just hiked prices, retailers and customers would grumble. But when manufacturers pre-announce cost pressures, it feels justified. Inevitable, even. It's psychology combined with economics.

The lack of supply constraints actually makes price increases easier for manufacturers. When there's a shortage, you can blame external factors. When supply is healthy and prices rise anyway, it's pure margin expansion. This puts AMD and NVIDIA in an uncomfortable position—they need to justify it to customers and regulators, which is why AMD is providing the transparency about cost pressures.

Impact on Different GPU Market Segments

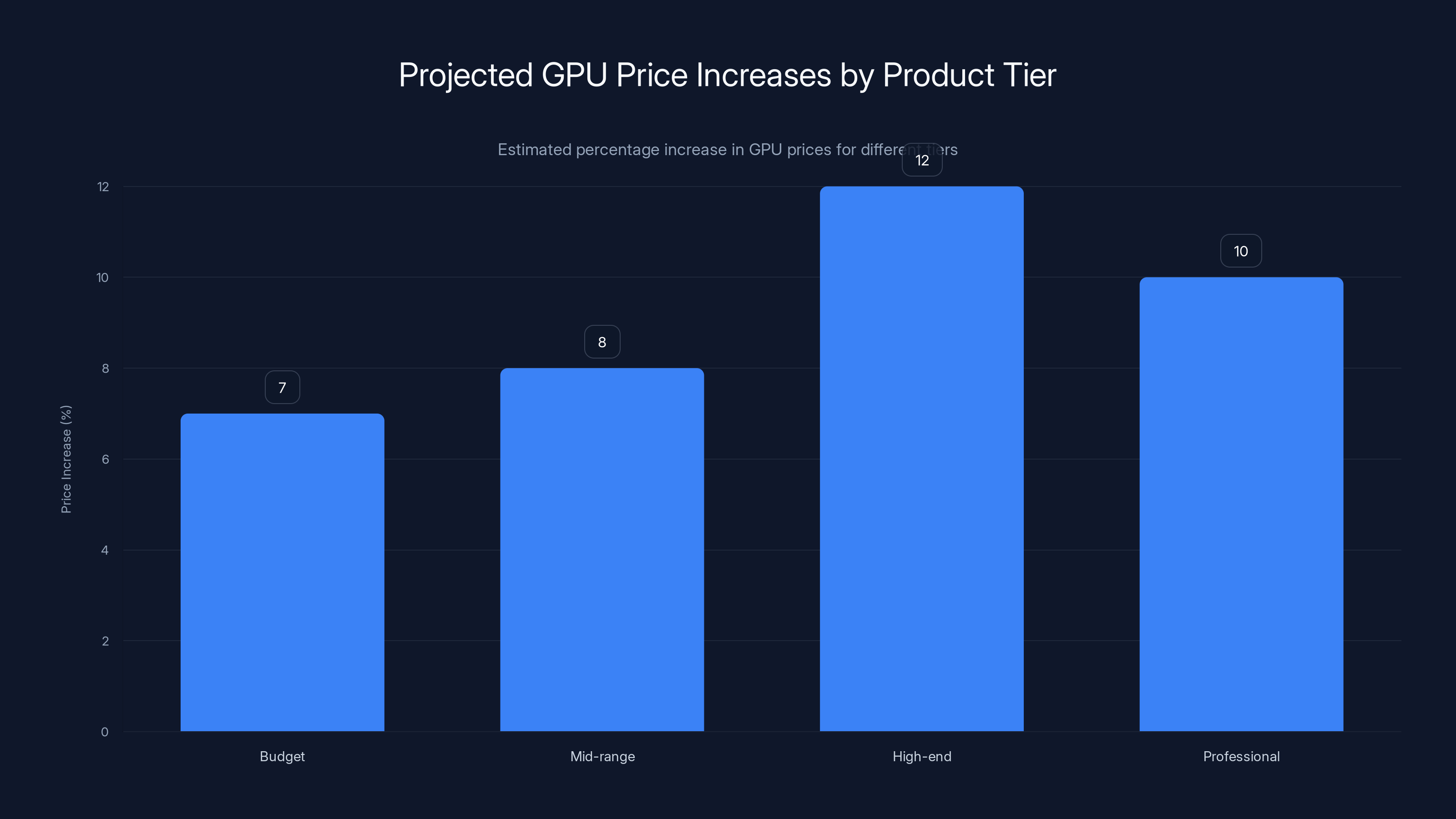

AMD's price increases don't hit everyone equally. Different customer segments experience the pain in different ways depending on their use cases and buying patterns.

Gaming and Consumer Graphics

Gamers are the largest GPU consumer segment globally. They're also the most price-sensitive. A $50 increase on a mid-range card represents a 10% jump for consumers who are already skeptical about GPU value.

The gaming market has already fragmented. Budget gamers are settling for previous-generation cards like RX 6700 XT variants. Mid-range consumers are waiting for bigger performance jumps to justify upgrades. Enthusiasts are the only segment willing to pay premium prices for maximum performance.

AMD's Radeon cards compete directly in all three segments, but they're stronger in mid-range and enthusiast categories. Budget gamers often gravitate toward NVIDIA's GeForce RTX 4060 because it's cheaper and widely available. When Radeon prices increase, AMD loses margin share in budget segments while mid-range and enthusiast buyers become more selective.

Content Creation and Professional Graphics

Content creators using GPUs for video editing, 3D rendering, and motion graphics represent a smaller but wealthier market segment. They value performance over price, but they still evaluate ROI carefully.

AMD has made significant inroads in this market with RDNA architecture and dedicated software optimizations. Price increases impact this segment less directly because creators justify purchases based on time savings and project throughput, not absolute cost. A

However, when professional tools across the board become more expensive, it squeezes creative industry margins. Studios might upgrade less frequently or shift workloads toward cheaper CPU-based rendering. AMD needs to maintain perceived value superiority to NVIDIA in this segment, which becomes harder when pricing parity exists.

AI and Data Center Markets

This is where price increases hit hardest but matter least. AI companies and research institutions need high-performance GPUs regardless of cost. They're evaluating NVIDIA H100s, H200s, AMD Instinct accelerators, and custom silicon solutions. For enterprise buyers, a 10% price increase is trivial compared to the value of inference speed or training throughput.

AMD is aggressively expanding Instinct GPU market share in AI applications. Price sensitivity is far lower in this segment compared to gaming. However, when you're competing with NVIDIA's higher-margin enterprise business, keeping your own margins competitive matters for investor confidence and long-term market positioning.

How This Compares to NVIDIA's Pricing Strategy

NVIDIA basically owns the GPU market at this point. They control discrete graphics for gaming, data center, AI, and professional applications. Their pricing power is almost unmatched because of software ecosystem advantages and perceived performance superiority.

NVIDIA has already pushed pricing up significantly. The RTX 4090 launched at

AMD announcing price increases now positions them as a market-follower. They're signaling that they'll match NVIDIA's pricing moves rather than undercut them. This is logical from a business perspective—why leave money on the table if customers are willing to pay?—but it's terrible for consumer choice.

When both dominant GPU manufacturers raise prices simultaneously, customers have no recourse. You either pay the new price, settle for older hardware, or skip GPU upgrades entirely. The latter is increasingly common among budget-conscious gamers who can't justify $700+ for a graphics card.

AMD's acknowledgment of rising component costs suggests a potential 20% increase in GPU prices. Estimated data based on industry trends.

The Supply Chain Story: Why Shortages Are Off the Table

AMD explicitly noted that stock shortages won't be an issue going forward. This is important context for understanding why prices can increase without artificial scarcity justification.

The semiconductor manufacturing ecosystem has dramatically expanded since 2020-2022. TSMC added capacity. Samsung invested heavily in cutting-edge fabs. Intel is ramping up Arizona and Ohio facilities. Geopolitical concern about Taiwan have actually motivated capacity building elsewhere, reducing concentration risk.

GPU-specific supply constraints have eased significantly. Memory suppliers have expanded HBM and GDDR production. Substrate manufacturers added lines. Package suppliers caught up with demand. The crisis mentality that dominated 2021-2022 has completely evaporated.

This stability is actually worse for consumers than you'd think. When supply is constrained, manufacturers can hide behind supply shortage arguments. "We'd love to lower prices, but we can't make enough units." It's a convenient excuse that sounds reasonable.

With stable supply, there's no such excuse. Price increases have to be justified purely on cost grounds or margin expansion. AMD is doing the former—transparently discussing component cost pressures. But the result is identical to margin expansion: consumers pay more for the same hardware.

Supply chain stability also means AMD can plan manufacturing volumes with confidence. They can target specific price points knowing they'll have adequate supply to meet demand at those prices. It's the opposite of the shortage era when every unit sold, regardless of price.

Timing: When Will Price Increases Actually Hit?

AMD's statements about rising prices aren't necessarily happening tomorrow. Companies rarely announce price increases with immediate effect. There's usually a lag—sometimes 6 months, sometimes longer—between announcement and retail price adjustment.

Current Radeon 7000 series cards (RX 7900 XTX, RX 7900 XT, RX 7800 XT) are already being phased out as next-generation Radeon cards approach launch. RDNA 4 architecture is coming, which typically commands premium positioning and pricing over previous-gen architectures.

The price increase strategy likely works like this: Next-generation Radeon cards launch at higher price points than equivalent previous-gen cards launched at. Previous-generation cards get clearanced or discontinued. Retailers have limited older inventory to discount, so they quickly transition to new products at new price points. Consumers face a fait accompli: upgrade at higher prices or don't upgrade.

This timeline also matters for market sentiment. AMD is pre-announcing to prevent customer backlash and to condition market expectations. If they stayed silent and prices suddenly jumped 15%, retailers and customers would be shocked and angry. By discussing it now, they're managing perception.

For consumers, the timing implication is clear: if you're thinking about a GPU upgrade, the window for current-generation pricing is narrowing. Once new Radeon cards launch and component cost increases fully propagate through supply chains, prices won't be dropping back down.

What This Means for Your GPU Buying Strategy

Reality check: GPU pricing is moving upward, and there's not much you can do to stop it. But you can make smarter purchasing decisions with this information.

Don't wait for prices to drop. GPU prices don't typically decline much after launch unless there's oversupply or a dramatically better product arrives. If you need a GPU now and prices are about to increase, buying immediately makes more sense than waiting for a sale that might be $20-30 off the newer, more expensive model.

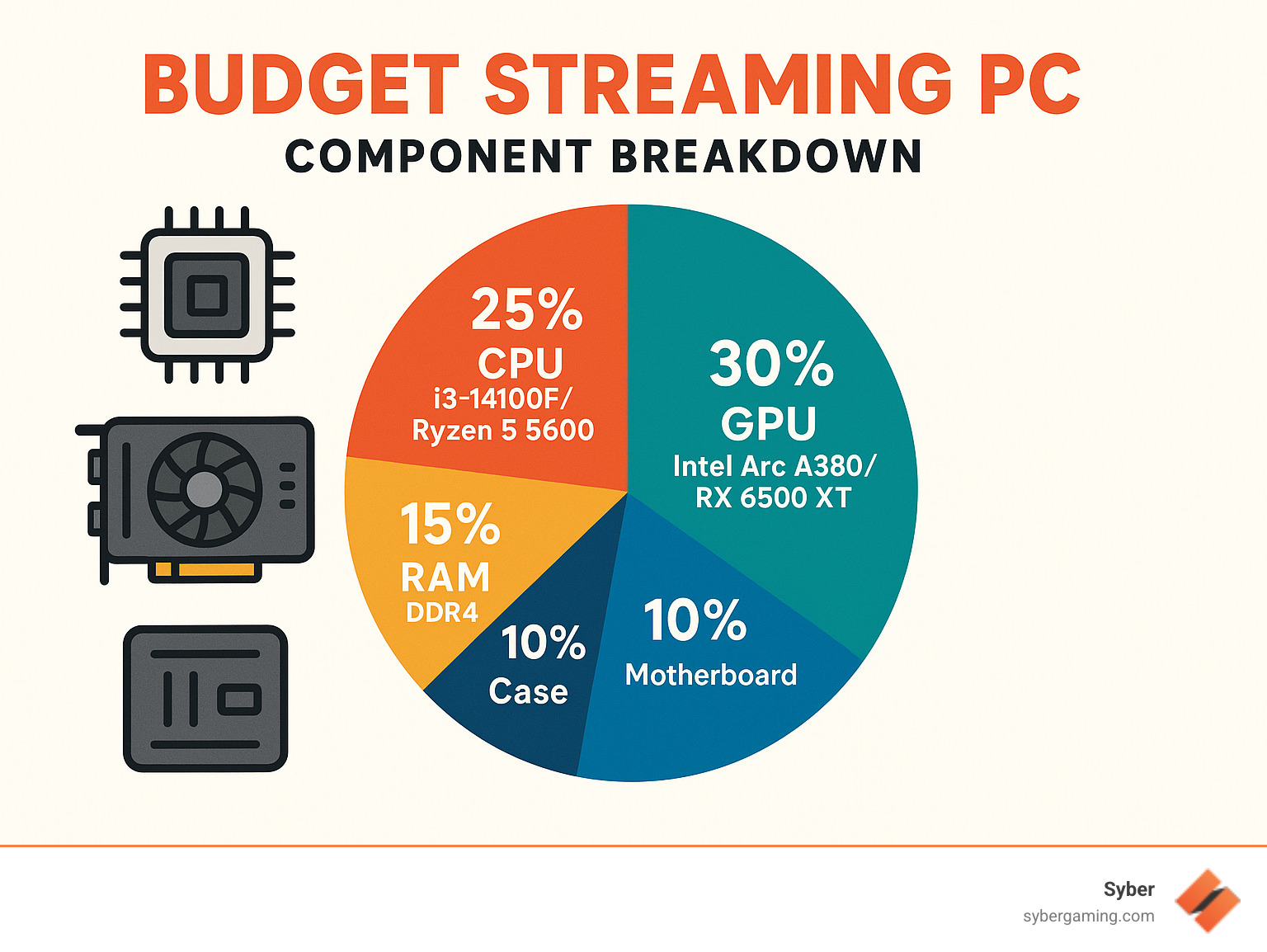

Evaluate total system cost, not just GPU cost. A

Consider second-hand or previous-generation options. As new cards launch and prices climb, previous-generation cards become better values in used markets. A one-year-old RX 7900 XT might perform 95% as well as a new card while costing 30% less. This strategy works best if you're not buying used from miners or heavily-utilized cards.

Evaluate your actual performance needs. Do you really need a

Estimated data suggests budget and mid-range GPUs may see 5-10% price increases, while high-end and professional models could rise by 10-15%.

The Broader Implications for GPU Market Competition

When AMD and NVIDIA move in lockstep on pricing, it suggests market consolidation rather than competition. True competition means one player undercuts the other to gain market share. Price coordination—even unintentional price coordination—indicates that both players are comfortable at higher price points.

This dynamic hurts emerging competitors like Intel. Intel Arc GPUs are still establishing themselves in the market. They need aggressive pricing to gain adoption. But if AMD and NVIDIA are both moving upmarket on pricing, Intel has less room to undercut them. Intel's strategy increasingly looks like "wait until next generation, hope our hardware is better, then compete on performance rather than price."

The consolidation also affects smaller markets like ARM-based mobile GPUs. As discrete GPU prices climb, mobile and integrated graphics become more attractive relative value propositions. For everyday computing, built-in GPUs handle most workloads adequately. Discrete GPUs increasingly occupy premium niches: gaming, professional work, and AI infrastructure.

Software compatibility and ecosystem advantages—traditionally NVIDIA's strength—become more important when hardware price differences compress. If AMD can match NVIDIA on performance while pricing similarly, software becomes the primary differentiator. NVIDIA's CUDA ecosystem, driver maturity, and gaming optimization remain superior, which justifies continued price parity or premium.

Energy Costs and Manufacturing Economics

Another factor AMD likely considered when discussing price increases is energy cost. GPU manufacturing, particularly at advanced nodes, consumes enormous amounts of electricity. Power costs have increased globally due to energy demand spikes and geopolitical factors affecting supply.

TSMC and other foundries pass energy costs to customers. Larger wafer productions consume more power. If baseline power costs have increased 20%, it directly impacts manufacturing cost per unit. That trickles through to retail pricing.

Thermal management and packaging also tie to energy considerations. GPUs that run hotter require better cooling solutions—better substrates, higher-quality thermal interface materials, more advanced heat spreaders. These additions increase costs but are necessary for reliability and longevity. AMD can't cheap out on thermals without sacrificing product reliability.

The irony is that AMD's performance improvements and architecture optimizations actually offset some of these cost increases by improving power efficiency and requiring less aggressive cooling. But that doesn't matter to customers who see higher end-user prices regardless of the underlying reasons.

Consumer Sentiment and Market Acceptance

Here's the uncomfortable truth: consumers will accept higher GPU prices because they have to. Gaming and creative work depends on GPUs. Enterprises deploying AI infrastructure need GPU horsepower regardless of cost. There's no realistic alternative that matches performance-per-watt at competitive prices.

Sentiment in gaming and tech communities oscillates between acceptance and frustration. Budget gamers are increasingly priced out of discrete GPU markets entirely. They're settling for integrated graphics improvements in new CPUs. Enthusiasts continue buying flagships because they're willing to allocate significant budgets to gaming.

There's a growing perception that GPU companies have trained consumers to accept premium pricing. $700 GPUs used to be outrageous. Now they're standard flagship prices. The market has shifted its psychological pricing anchors upward.

AMD's transparency about cost pressures is partly about managing this sentiment. Rather than appearing greedy, they're appearing responsive to market forces. It's a subtle but important distinction in consumer perception.

NVIDIA's pricing has consistently increased, with AMD following suit. By 2025, both companies are projected to have significantly higher prices compared to 2020. Estimated data.

Future Price Predictions and Market Outlook

If AMD and NVIDIA both increase prices in 2025, what does 2026 and beyond look like?

Short term (next 12 months), prices will stabilize at elevated levels. Initial enthusiasm around new product launches will fade. Retailers will clear inventory methodically. Prices might fluctuate 5-10% based on competition and demand, but won't drop significantly below initial launch prices.

Medium term (2-3 years), prices could move in either direction depending on several factors. If component costs plateau or decline, margins will expand rather than prices dropping. Manufacturers would rather maintain higher pricing than reduce prices and shrink margins. Conversely, if price increases stick and cost AMD market share to Intel or other competitors, they might discount more aggressively.

Long term (3+ years), new architectures and manufacturing processes might introduce efficiency improvements that allow lower pricing at equivalent performance. Moving to smaller process nodes reduces component costs. Architectural innovations reduce die sizes while maintaining performance. These advancements eventually translate to consumer benefit—but not immediately, and not without pressure from competition.

The wildcard is market disruption. If new competitors emerge with genuinely superior alternatives, or if AI acceleration moves toward custom silicon solutions, discrete GPU demand could soften. Then prices would have to come down. But this would require significant technological disruption and years of development.

Realistically, expect 2025 and 2026 to be expensive years for GPU upgrades, with gradual price moderation only arriving in 2027-2028 if component costs actually decline and competition intensifies.

What AMD's Message Says About Industry Confidence

AMD's transparency about price increases signals confidence in demand resilience. They're not worried that higher prices will destroy volume. They're betting that customers will pay because the alternative—not upgrading—is worse than the financial pain of higher prices.

This confidence comes from data. AMD sees sustained demand for gaming GPUs, creative pro work, and especially AI inference and training. They know enterprise customers will pay whatever necessary for performance. They understand that discrete GPU markets have bifurcated into premium segments where price sensitivity is low.

The confidence also suggests that AMD doesn't expect significant volume loss to competitors. If they did, they'd be more cautious about price increases. Instead, they're signaling that they can raise prices without market share degradation. That's either arrogance or justified by their internal projections. Time will tell.

From an investor perspective, AMD's price increase signals are positive—they indicate improving margins and business health. Shareholders hear "component costs are rising, so we're raising prices accordingly," and interpret it as "strong demand justifies pricing power." AMD's stock often responds positively to these announcements because Wall Street values margin expansion and pricing power.

The Intel Arc Wildcard Factor

Intel Arc represents the biggest potential disruption to AMD and NVIDIA's cozy pricing environment. Intel's entering the discrete GPU market as an outsider with massive manufacturing capacity and significant R&D resources. They're not immediately competitive in gaming performance, but they're gaining ground quarterly.

For Intel to gain meaningful market share, they need an aggressive pricing strategy. You can't convince gamers to buy your GPUs when they're 15% more expensive and 20% slower than NVIDIA. You need a compelling reason: either significantly better price-to-performance or exclusive features and ecosystem advantages.

AMD's price increases might be banking on Intel's continuing struggles. If Intel remains non-competitive, AMD can raise prices without fear. But if Intel's next-generation Arc Alchemist or later products deliver genuine performance improvements at lower prices, AMD and NVIDIA could face real pressure.

Historically, Intel's entrance into new markets has created pricing disruption. Their CPU competition with AMD drove prices down while performance increased. If Intel succeeds in GPUs at even a fraction of that level, consumer pricing will improve. But it requires years of development and market education.

Making Peace With Higher GPU Prices

Ultimately, consumers need to accept that GPU prices aren't dropping back to 2019 levels. The era of cheap, powerful graphics processing is ending. Several factors make this inevitable:

First, manufacturing physics. Advanced semiconductor processes are expensive. Moving to 3nm, 2nm, and beyond requires billions in foundry infrastructure. Those costs get distributed across billions of chips. As chip complexity increases, costs increase with it.

Second, demand continues outpacing supply in high-end segments. Enterprise AI demand is insatiable. Data centers are deploying GPUs at massive scale. This demand props up prices for all GPU tiers because manufacturers prioritize high-margin enterprise products.

Third, ecosystem advantages create pricing power. NVIDIA's CUDA dominance lets them maintain premium pricing. AMD's improving software story and performance parity provide justification for similar pricing. Once customers are locked into an ecosystem (through software investment, driver stability, or performance optimization), price sensitivity decreases.

The best strategy moving forward isn't fighting the price trend but accepting it and making smart purchasing decisions within that reality. Buy when your actual performance needs align with available offerings. Don't wait for prices that won't come. Choose products that offer genuine value for your specific use case rather than chasing abstract performance metrics.

Final Thoughts on AMD's Pricing Reality

AMD's candid admission about rising GPU prices is refreshing honesty in an industry that usually obscures cost structures with marketing language. They're telling customers: "Yes, prices are going up. Here's why." It's not apologetic, and it doesn't promise relief, but it's transparent.

That transparency changes nothing about the fact that your next GPU will cost more. But it does change perception. Customers who understand why prices are rising are less likely to feel cheated than customers blindsided by sudden price jumps.

For 2025 and beyond, budget your GPU purchases accordingly. The days of bargain-basement discrete graphics are over. The market has moved upmarket. Both AMD and NVIDIA are comfortable at higher price points, and nothing suggests they'll leave that comfortable position voluntarily.

The good news is that technology continues advancing. Next-generation GPUs will be faster and more efficient. Performance improvements might offset the psychological pain of higher prices. But that's a hope, not a guarantee. Plan your upgrades accordingly.

FAQ

Why is AMD raising GPU prices when there's no shortage?

AMD cited rising component costs as the primary driver of price increases. High Bandwidth Memory, substrates, packaging materials, and manufacturing processes have all experienced cost inflation. Additionally, higher energy costs at foundries and increased sophistication in thermal management add to manufacturing expenses. With supply chains stable and demand strong, particularly for AI applications, there's no shortage justification needed—cost increases alone justify retail price hikes.

Will NVIDIA follow AMD's price increases?

NVIDIA has already demonstrated pricing power by maintaining premium pricing on current-generation GPUs. While not formally announced in identical language, NVIDIA's actions suggest they're comfortable at elevated price points. Typically, when AMD moves on pricing, NVIDIA either matches or maintains their existing premium. Direct coordination isn't necessary because both companies observe market dynamics and respond accordingly.

Should I buy a GPU now before prices increase?

If you need GPU performance for gaming or professional work within the next 3-6 months, buying now makes sense compared to waiting for new products at higher price points. Current-generation Radeon and GeForce cards are being cleared at existing prices as newer products launch. Waiting typically means paying more for newer hardware, not less.

How much will GPU prices increase?

AMD didn't specify exact percentage increases. Price impacts will vary by product tier. Budget and mid-range cards might see 5-10% increases. High-end flagship products could experience 10-15% jumps. Professional and enterprise GPUs typically increase in step with component costs. The increases will likely roll out gradually as new products launch rather than all at once across entire product lines.

Will GPU prices eventually come down?

Significant price declines aren't likely in the short term (12 months). Medium-term outlook depends on whether component costs stabilize or decline. If manufacturing efficiency improves through process node transitions or architectural optimizations, cost reductions could eventually reach consumers. However, manufacturers historically keep that benefit as margin expansion rather than reducing prices. Genuine price declines would require competitive pressure—such as Intel Arc becoming genuinely competitive or new market entrants disrupting pricing.

Are previous-generation GPUs better value than new products?

Often yes. Previous-generation Radeon and GeForce cards perform 90-95% as well as new products while costing 20-30% less. For non-professional work, older GPUs remain viable. The tradeoff is warranty, driver support, and future game optimization favoring newer architectures. But from pure value perspective, last-year's flagship often beats this-year's mid-range by a significant margin.

How do AMD price increases compare to NVIDIA?

Both companies are moving upmarket on pricing. NVIDIA maintains a premium position due to software ecosystem advantages. AMD is achieving pricing parity on current generation products. New generation products will likely see both companies pricing at similar levels for equivalent performance tiers. The differentiation moves from price to performance and software features rather than cost-per-frame.

What about GPU prices in different regions?

Prices vary significantly by region due to tariffs, local market conditions, and supply chain differences. Asian markets typically see lower GPU prices than North America and Europe. Price increases may roll out at different timelines in different regions. If you have access to international purchasing, investigating regional pricing differences could yield savings.

What This Means for Your Next GPU Purchase

AMD's transparent acknowledgment of rising GPU prices removes any illusions about getting bargains on graphics hardware. The market has fundamentally shifted. Manufacturers have pricing power, component costs are climbing, and demand remains robust despite elevated prices.

For consumers, this reality demands pragmatism. Budget your GPU upgrades based on actual performance needs, not aspirations for future price drops. Current-generation pricing is likely the lowest you'll see until next-generation products mature and discounts accumulate. The days of waiting for GPU prices to fall are over—they're moving in the opposite direction.

AMD's honesty, while unwelcome, deserves credit. They're not disguising margin expansion as supply constraints. They're explaining legitimate cost pressures and letting the market adjust accordingly. That's more transparent than most tech companies manage.

The underlying reality remains unchanged: GPUs are essential computing components for gaming, creation, and AI. Consumers will pay these higher prices because the alternative is accepting obsolete hardware or integrated graphics. AMD, NVIDIA, and the entire industry knows this. It's why they're comfortable pushing prices higher.

Make your GPU purchasing decisions with eyes wide open. Know what you're paying for. Understand that next year's prices will be higher. Plan accordingly. Don't expect relief.

Key Takeaways

- AMD executives explicitly stated GPU prices are increasing due to rising component costs including HBM memory, substrates, and manufacturing processes

- Supply chain stability eliminates shortage-based price justification, making increases purely cost and margin-based

- Price increases will impact budget and mid-range segments most; enterprise AI markets show minimal price sensitivity

- Current-generation GPU pricing represents the lowest likely costs before 2027; waiting for price drops is not a viable strategy

- GPU market consolidation with two dominant players (NVIDIA and AMD) limits competitive pricing pressure and consumer choice

Related Articles

- Why RAM Prices Are Skyrocketing: AI Demand Reshapes Memory Markets [2025]

- Nvidia's Upfront Payment Policy for H200 Chips in China [2025]

- Intel Core Ultra Series 3: The 18A Process Game Changer [2025]

- Intel Core Ultra Series 3: The Panther Lake Comeback Explained [2026]

- Nvidia's Vera Rubin Chips Enter Full Production [2025]