The Processor Wars Have Fundamentally Changed

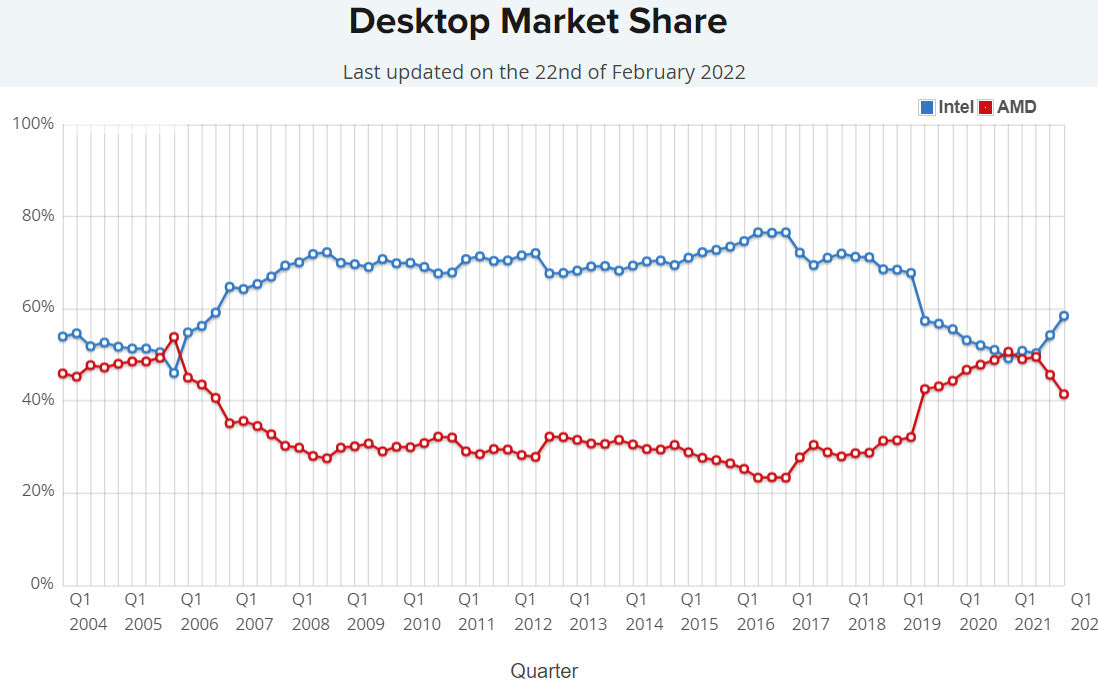

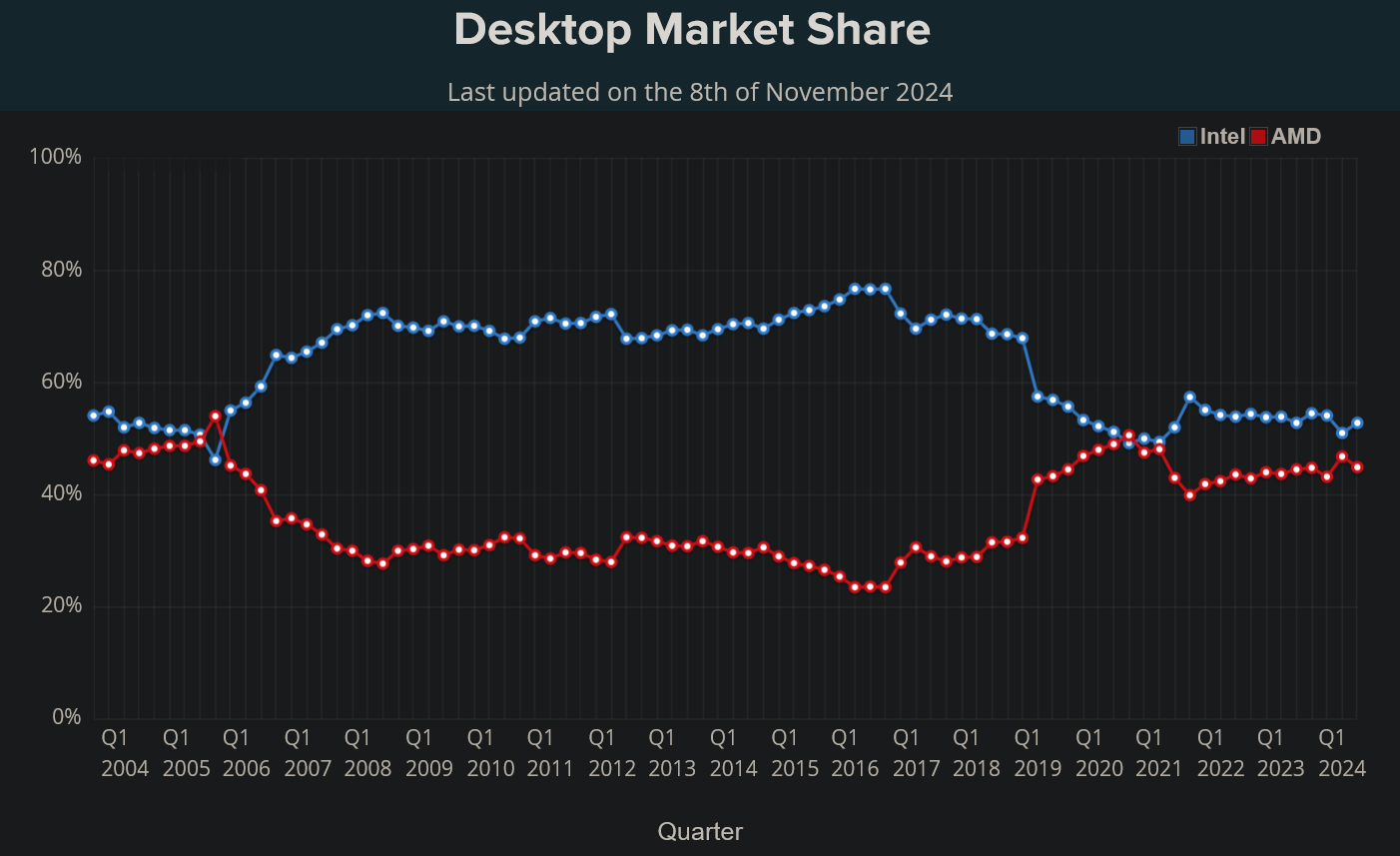

Intel built an empire on a simple formula: be faster, cheaper, and everywhere. For decades, that worked. But something shifted around 2017, and by 2025, the playing field looks almost unrecognizable. AMD went from a struggling underdog to a legitimate threat—and in some markets, the outright winner.

This isn't hype. This is market data telling a story of seismic change in computing infrastructure.

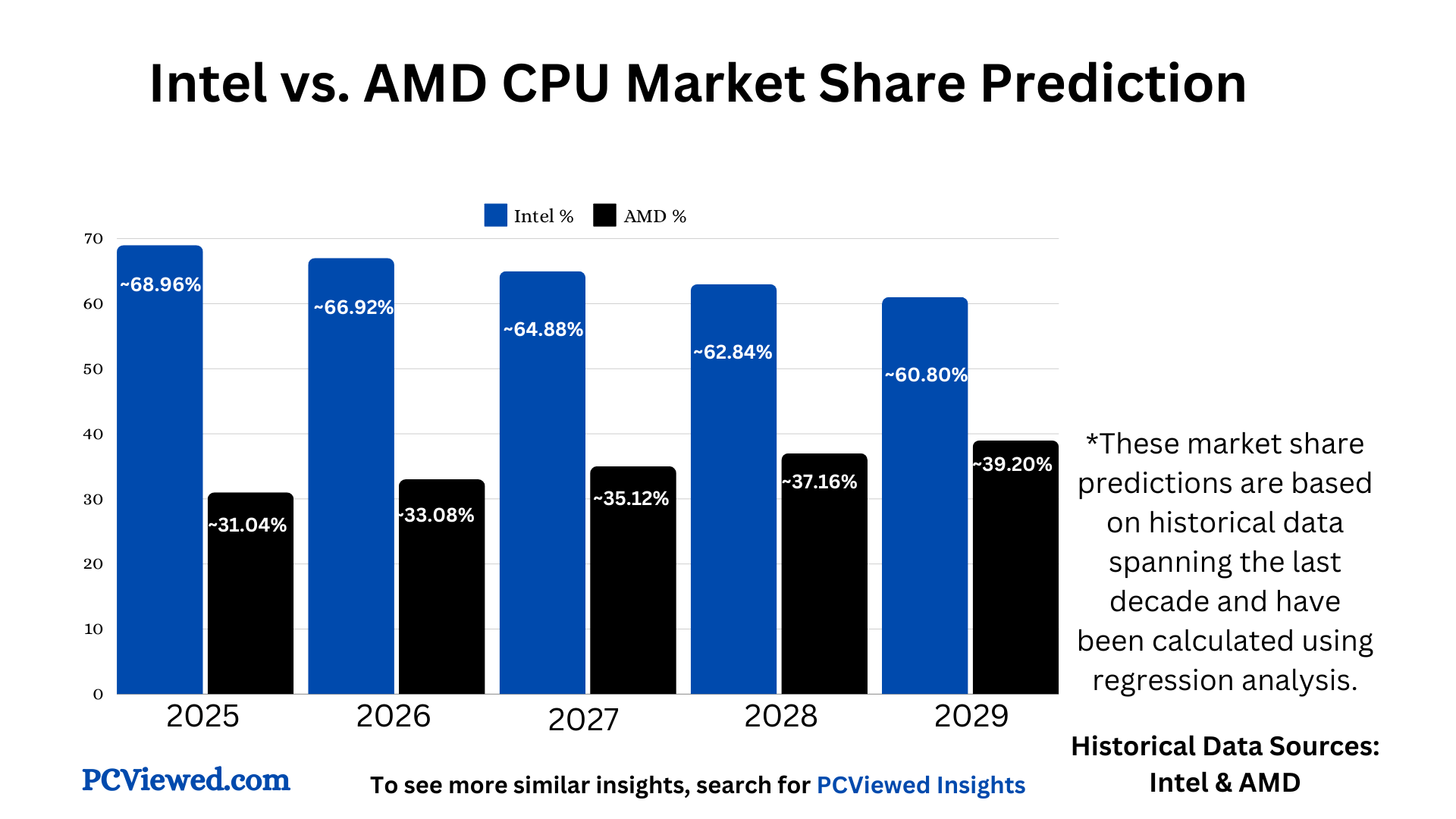

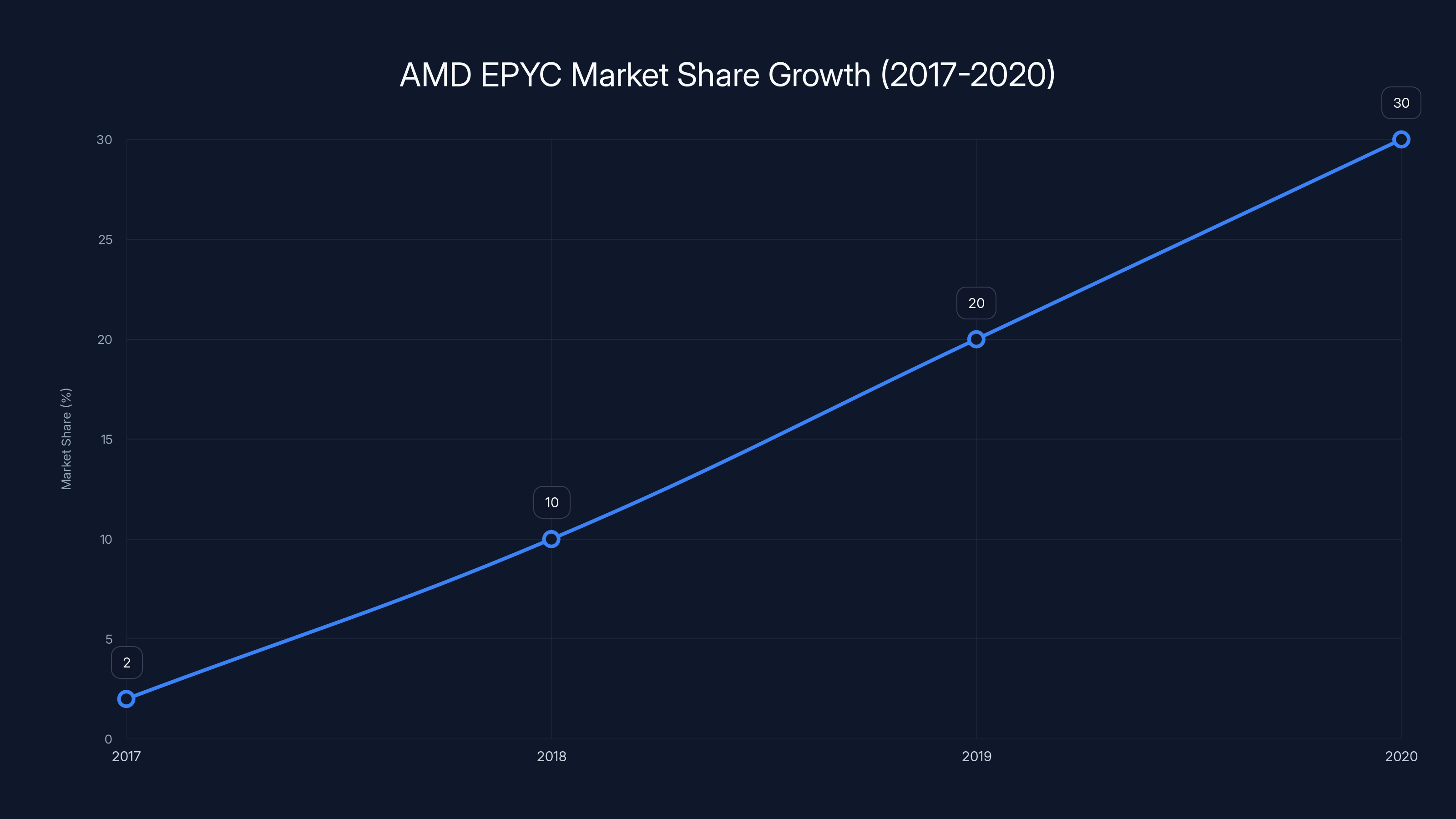

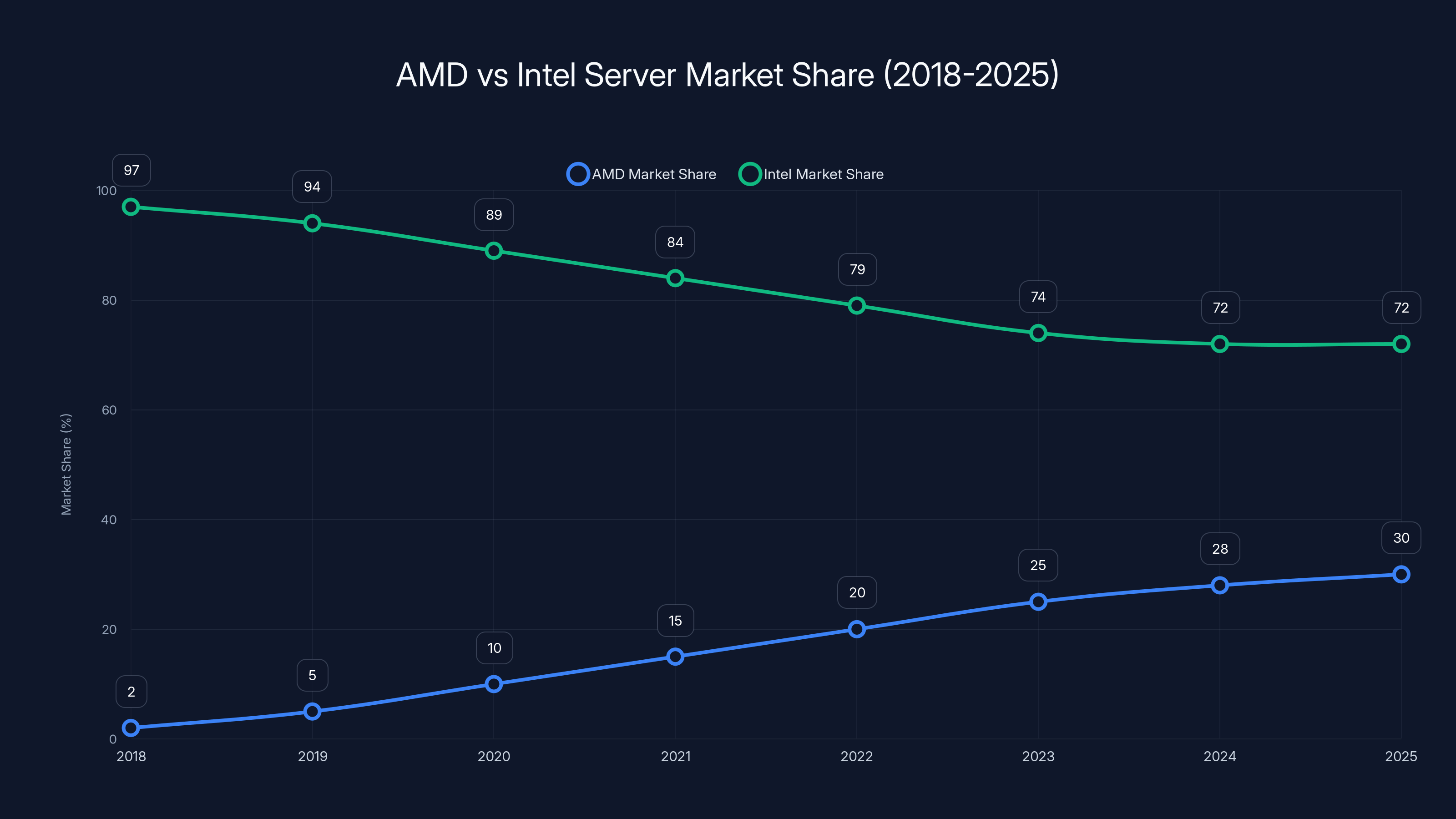

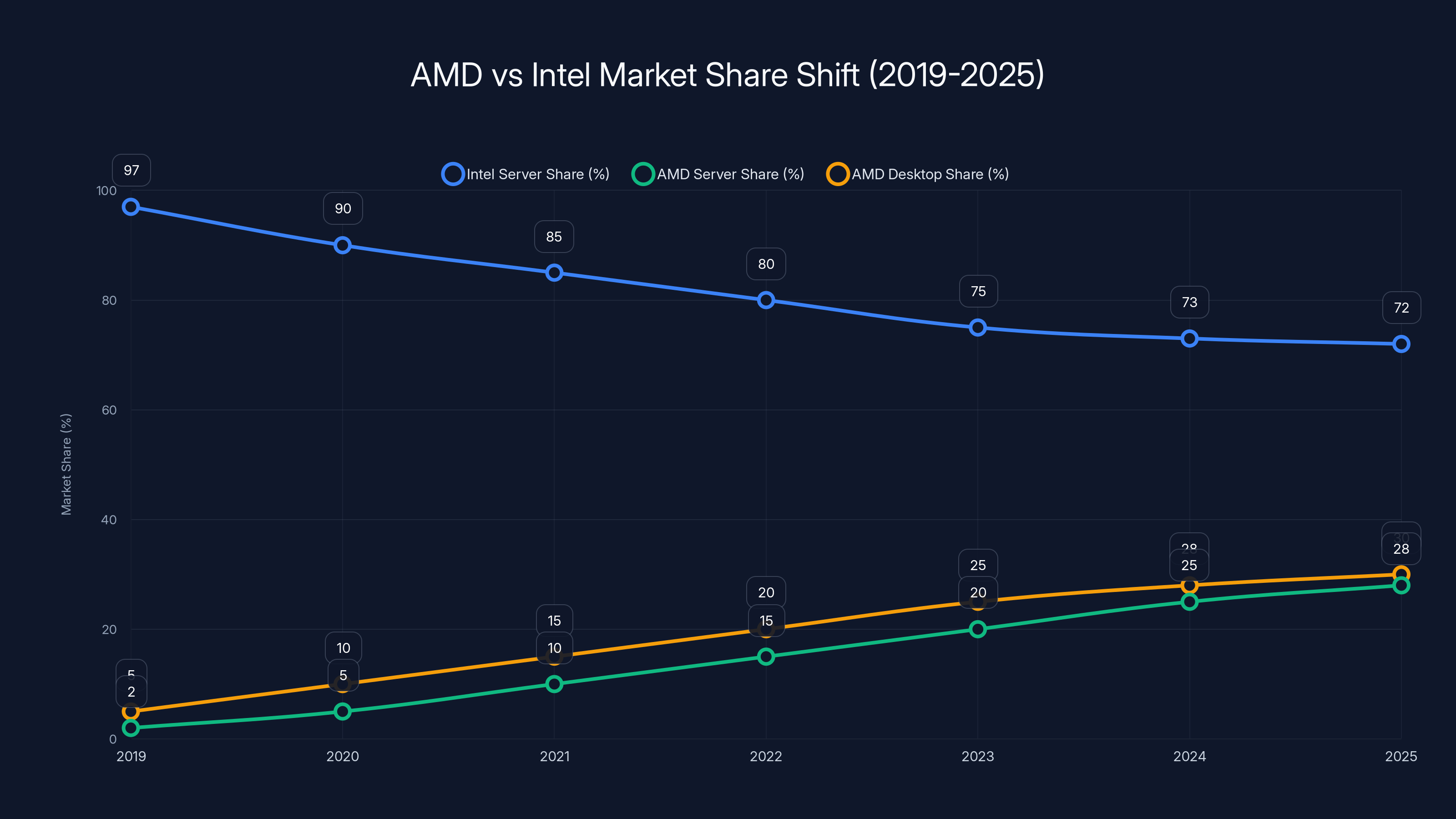

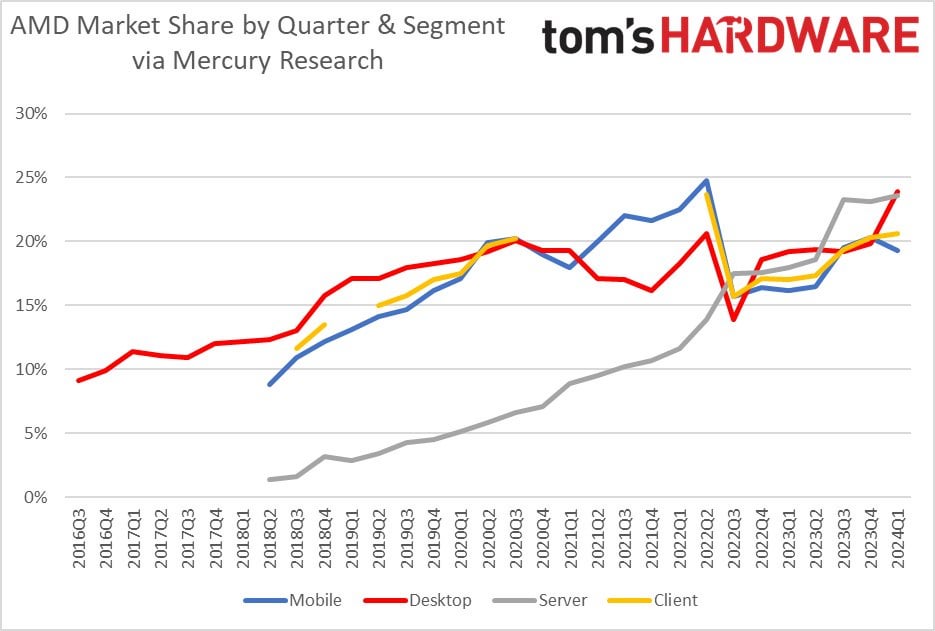

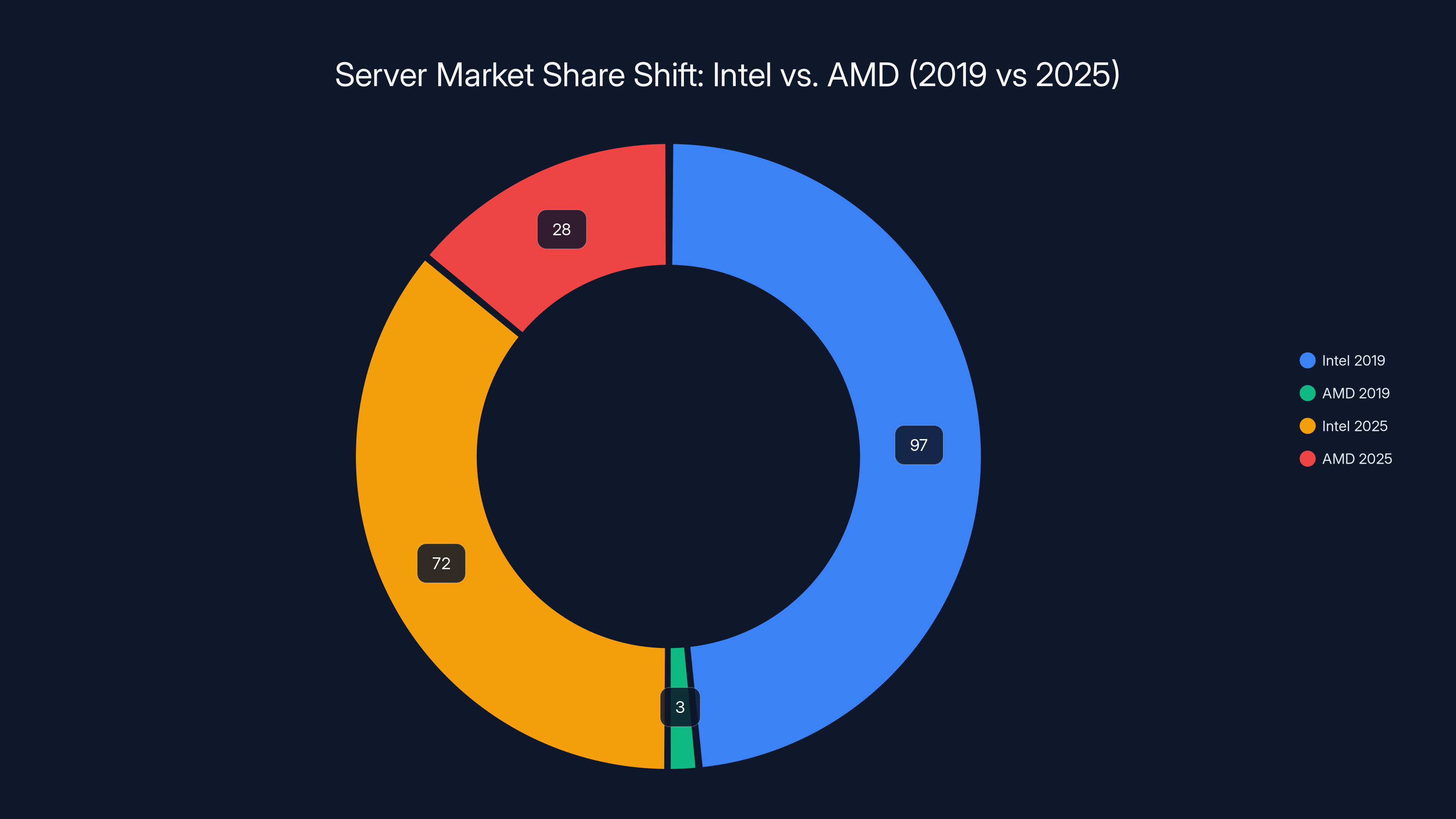

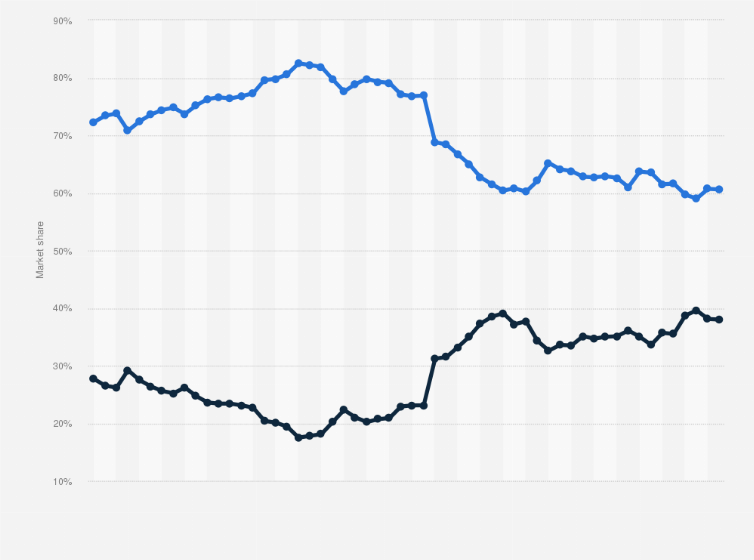

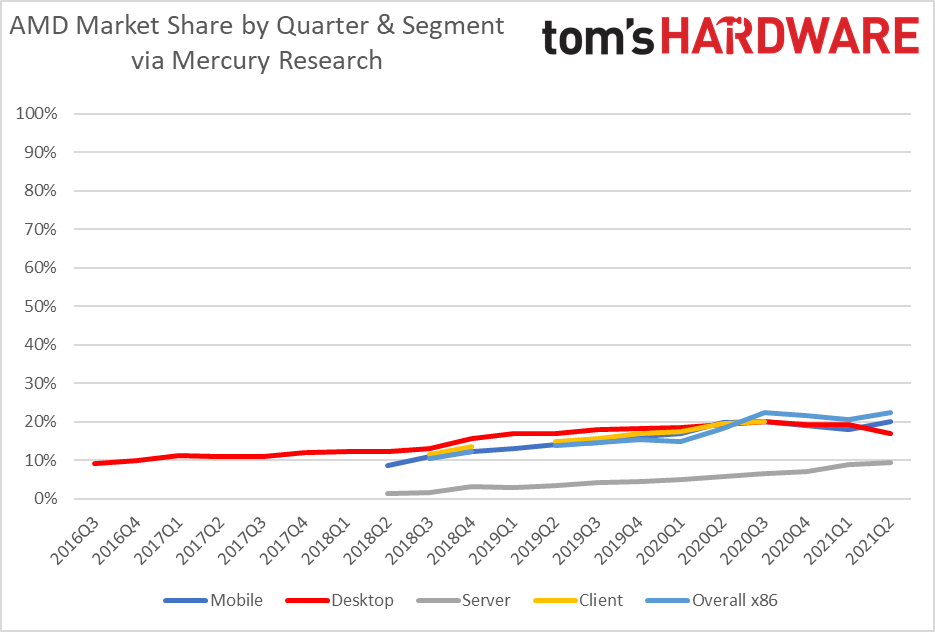

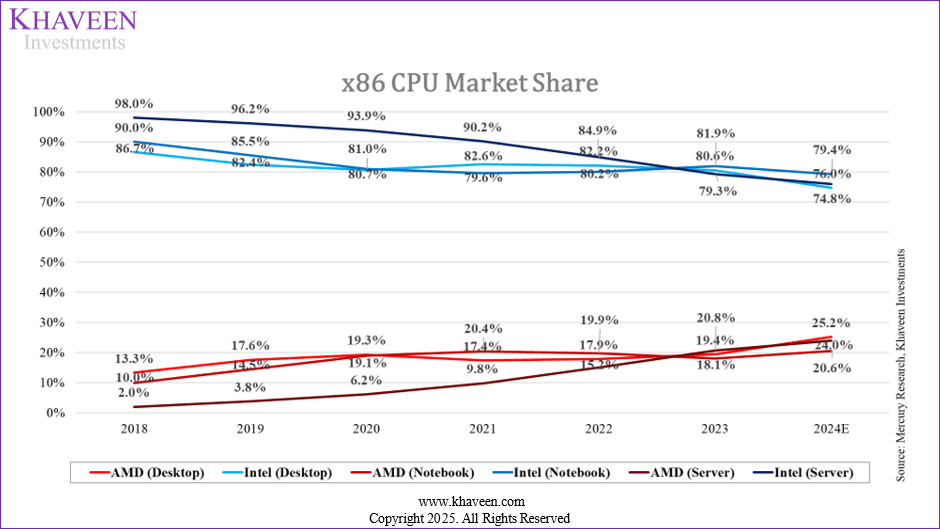

Intel's server market share collapsed from 97% in 2019 to 72% by 2025. AMD's EPYC processors grew from controlling less than 2% of new server deployments to nearly 30%. In desktops, AMD climbed from 3% market share to over 30%, while Intel's grip loosened from near-total dominance to roughly 60%. And here's the kicker: AMD's EPYC revenue exploded from under

That's not just market fluctuation. That's a restructuring of how enterprises, cloud providers, and builders choose processors.

So what happened? How did Intel, the company that defined the modern CPU, stumble so badly? And what does AMD's rise mean for anyone building servers, data centers, or high-performance machines?

Let's dig into the numbers, the technology, and the real reasons behind this historic shift.

TL; DR

- AMD's EPYC grabbed 30% of the server market in 2025, up from under 2% in 2018, while Intel's share fell from 97% to 72%

- Desktop shipments for AMD surged from 3 million to 35 million units quarterly between 2017 and 2025, capturing over 30% market share

- Revenue growth was staggering: AMD's EPYC revenue jumped from under 3.5 billion in eight years

- Intel's manufacturing missteps and thermal issues with 12th-gen and later processors pushed customers toward AMD

- Cloud providers and enterprises switched based on performance-per-watt efficiency, core count advantages, and competitive pricing

- The margin compressed dramatically: Intel still leads in budget CPUs, but AMD controls premium segments and server infrastructure

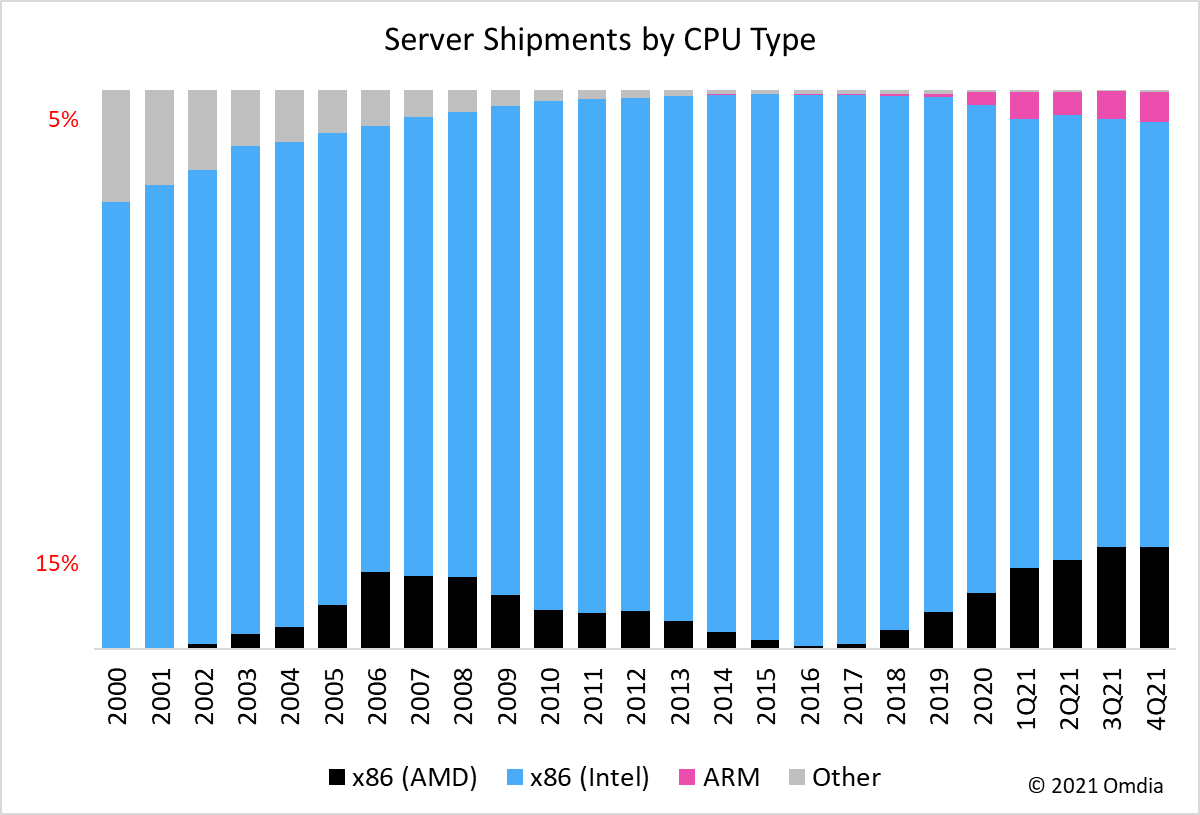

AMD's EPYC processors rapidly grew from 2% to 30% market share between 2017 and 2020 due to efficiency and cost advantages, especially in cloud deployments (Estimated data).

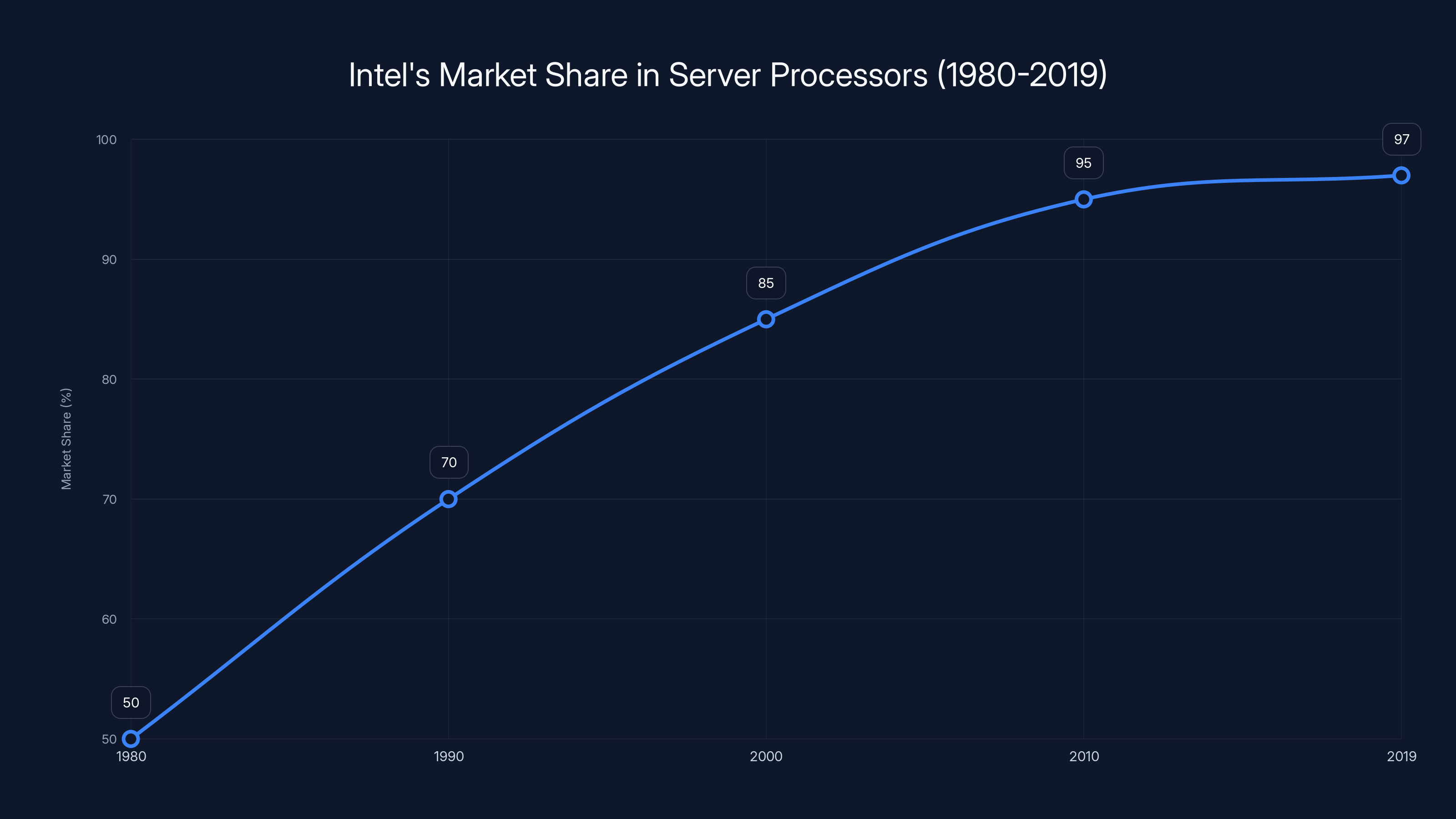

Why Intel Dominated for So Long

Intel's dominance wasn't accidental. From the 1980s through the 2010s, Intel executed almost flawlessly across multiple dimensions.

First, there was Moore's Law compliance. For years, Intel reliably shipped faster processors every 18-24 months. Their manufacturing process technology—the ability to cram more transistors onto a chip—stayed ahead of competitors. This meant Intel processors consumed less power while delivering more performance. That's a winning combination.

Second, Intel built a moat around software. The x86 instruction set, which Intel pioneered, became the de facto standard for servers, desktops, and workstations. Every major operating system, database, and enterprise application was optimized for x86. AMD used the same instruction set architecture, but Intel's first-mover advantage was enormous. Running workloads on Intel meant maximum compatibility and zero software concerns.

Third, Intel controlled supply chains ruthlessly. They had relationships with every major OEM, data center operator, and system integrator. When you wanted a server CPU in 2010, you went to Intel. Your vendor likely had a preferential relationship with Intel's sales team. Switching costs were high—not just in CPU cost, but in validation, testing, and qualification.

Intel's business model was simple: maintain leadership through superior execution. For 30+ years, it worked.

But there's a problem with this strategy. It only works if you keep executing. The moment you stumble, competitors catch up fast. And Intel stumbled hard.

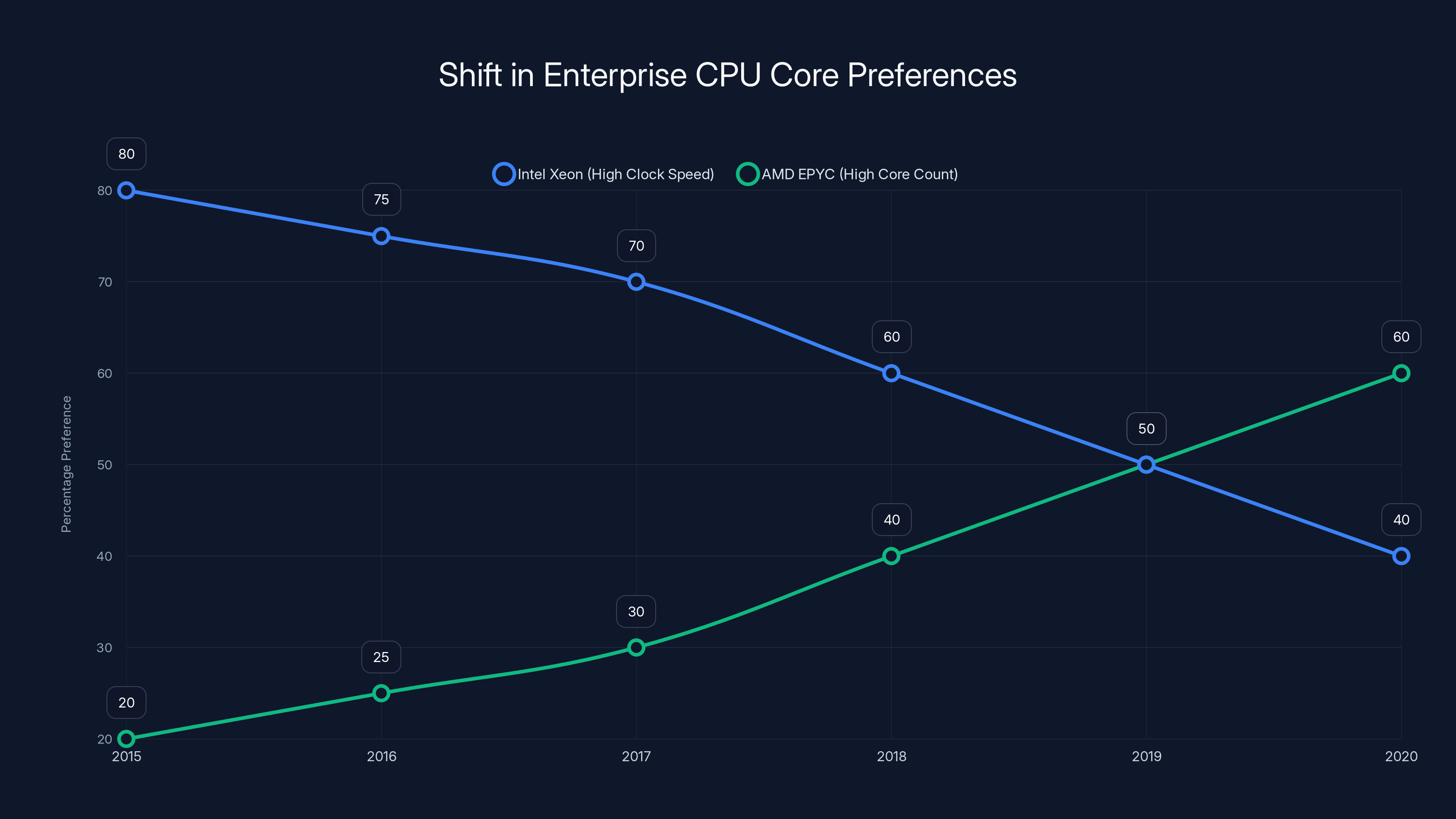

The shift from Intel Xeon to AMD EPYC in enterprise data centers began around 2017, with AMD gaining significant preference by 2020 due to its higher core count and power efficiency. Estimated data.

The Manufacturing Misstep That Started It All

Intel's decline didn't happen overnight. It started with a single, critical mistake: underestimating the importance of process technology leadership.

Around 2015-2017, Intel's manufacturing roadmap hit a wall. The company had successfully transitioned to smaller process nodes (7nm, 5nm) on schedule, but the jump to 10nm took far longer than expected. This seems like a minor technical issue, but it wasn't. It meant AMD could catch up.

AMD took a different approach. Instead of trying to match Intel's transistor density on every chip, they licensed process technology from TSMC, a specialized foundry. This gave AMD flexibility. They could iterate faster, try different designs, and push new architectures more frequently than Intel's traditional approach allowed.

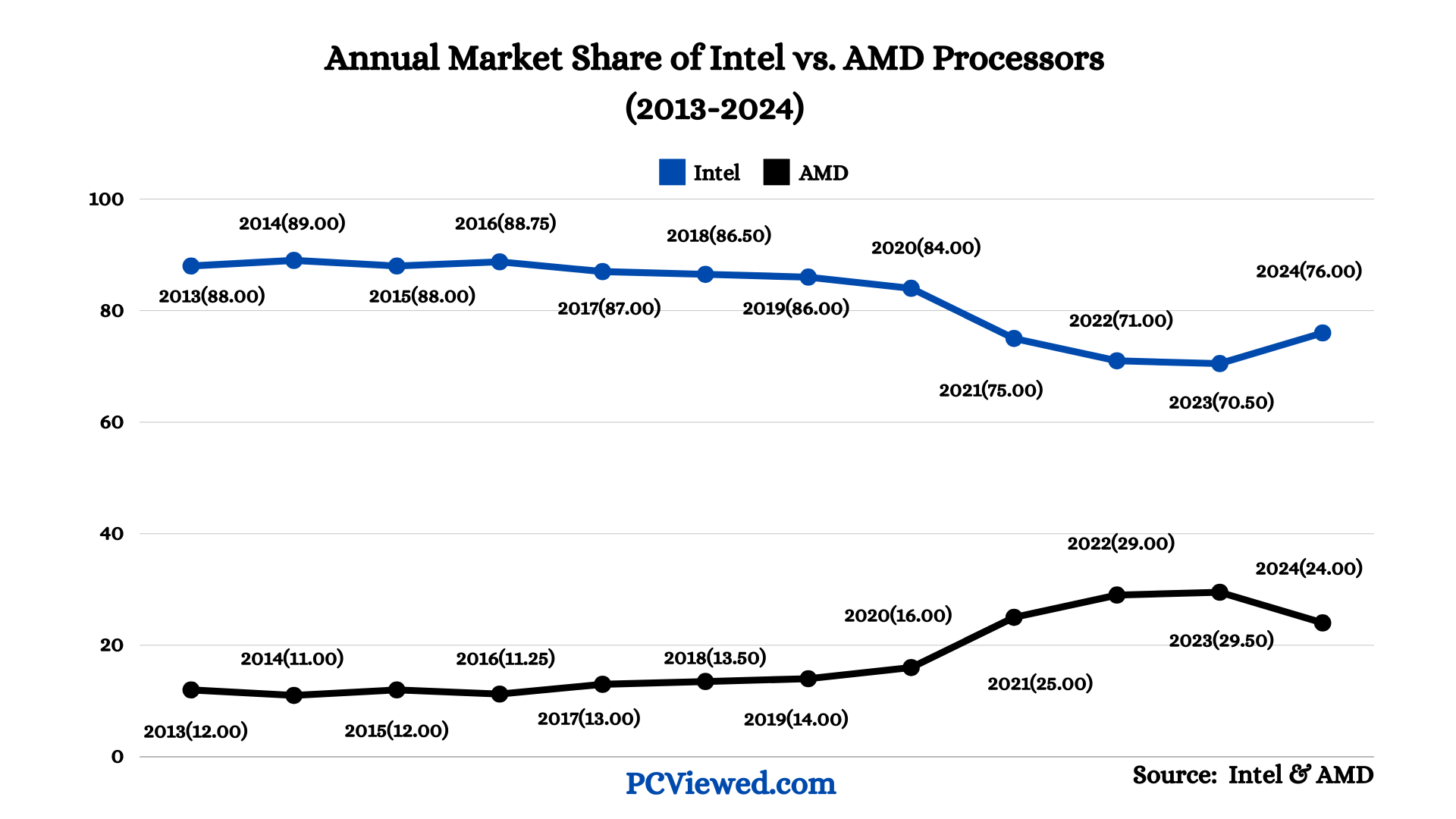

When AMD launched their Ryzen CPUs in 2017, they didn't just match Intel's performance. They matched it at lower prices. The Ryzen 7 1800X had 8 cores and cost

OEM and enthusiast reviewers noticed. Overnight, Intel's halo effect dimmed.

But the desktop market was just the beginning. The real inflection point came in servers.

When Enterprises Started Paying Attention to Core Counts

For years, server CPU selection was almost tribal. Your company standardized on Intel Xeon processors. You tested applications on them. Your vendors optimized for them. Switching to AMD meant re-testing, re-certifying, and re-training your teams. The switching cost was high enough that Intel could charge premium prices and customers paid without complaint.

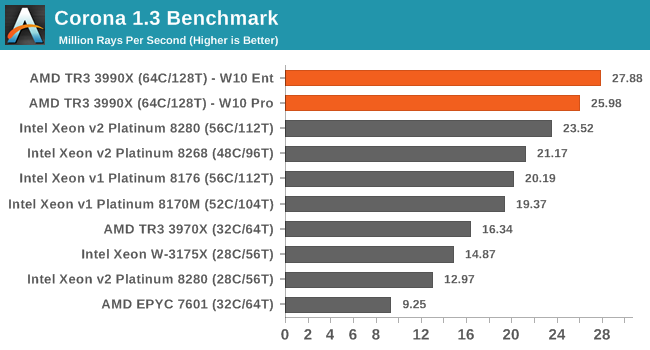

Then, around 2017-2018, this changed. Cloud providers like Google, Amazon, and Microsoft started asking a different question: what if we could run our workloads on more cores with better power efficiency?

AMD's first EPYC processor family, Naples, arrived in 2017 with a radical design. Instead of trying to cram 8-16 high-clock-speed cores onto a single chip, Naples offered 32 cores. The per-core clock speed was slightly lower than Intel's Xeon, but the total throughput per server was higher. And critically, Naples consumed 40-50% less power than comparable Intel systems.

For a hyperscale data center running millions of servers, a 40% reduction in power consumption translates to millions in annual savings. Suddenly, the switching cost disappeared. It wasn't even a trade-off anymore—it was an obvious business decision.

Cloud hosting providers moved first. AWS launched Graviton chips (ARM-based, but the principle is the same). Google published benchmarks showing EPYC advantage. Microsoft quietly started deploying EPYC in Azure regions. By 2020, it was clear: the cloud had shifted to AMD.

Enterprise data centers followed more slowly, but they followed. Banks, insurance companies, and tech firms began EPYC pilots. Many found that their application performance actually improved—not because EPYC's per-core performance was better, but because having more cores meant better parallelization of workloads.

Intel's response was slow. The company kept releasing Xeon chips with higher clock speeds, but the market was asking for different things: more cores, lower power, better per-watt efficiency. Intel's roadmap wasn't aligned to that demand.

AMD's server market share increased significantly from under 2% in 2018 to 30% in 2025, while Intel's share decreased from 97% to 72%. Estimated data.

Desktop Market Collapse: When Thermal Issues Killed Momentum

Desktops told a slightly different story, though the ending was similar.

Intel's 12th-generation Alder Lake processors (2021) introduced a hybrid P-core/E-core design. Performance cores handled demanding tasks, efficiency cores handled background work. On paper, it was brilliant. In practice, it worked—until it didn't.

As reviewers started stress-testing 13th-gen Raptor Lake and 14th-gen Arrow Lake chips, they discovered a pattern. Under heavy sustained load, these CPUs would throttle aggressively. Some samples were reporting thermal warnings at 105°C+, well above comfort levels. Power consumption crept above 250W in some scenarios. Older Intel platforms, designed for 65-95W TDP assumptions, were running hot and loud.

AMD's Ryzen processors in the same era maintained better thermal profiles. The 7950X would run at 85°C under full load and max out around 162W. It was simply more comfortable to own, quieter to run, and cheaper to cool.

DIY builders noticed immediately. Forums lit up with testimonies about switching to Ryzen. OEM manufacturers—Corsair, ASUS, Lian Li—reported surging interest in Ryzen builds. By 2022-2023, AMD's desktop market share crossed 30% for the first time.

Integrators who had built on Intel for a decade suddenly found that AMD machines were easier to build, cooler to run, and cost less overall. The switching cost inverted. Now it was more expensive to stay with Intel.

Intel tried to address this in later refreshes, but the damage was done. Ryzen had seized momentum and market share, and momentum is hard to buy back.

The Numbers That Tell the Real Story

Let's look at actual market data, not rhetoric.

According to Mercury Research and industry analysts, AMD's penetration rates shifted dramatically across all segments:

Server Segment:

- 2019: Intel 97% unit share, AMD under 2%

- 2025: Intel 72% unit share, AMD 28%

- Intel's server shipments fell from 12 million units annually (2019) to under 8.5 million (2025)

- AMD's EPYC shipments grew proportionally

Revenue Impact (the number that matters to Intel's CFO):

- AMD's EPYC revenue climbed from under 3.5 billion by 2025

- Intel's Xeon revenue, while still larger, faced margin compression as customers negotiated harder

- Intel's overall server business revenue share fell from roughly 95% to 61%

Desktop Segment:

- AMD unit shipments: 3 million per quarter (2017) → 35 million per quarter (2025)

- AMD market share: Under 5% (2017) → Over 30% (2025)

- Intel maintained majority share but lost pricing power and gross margins

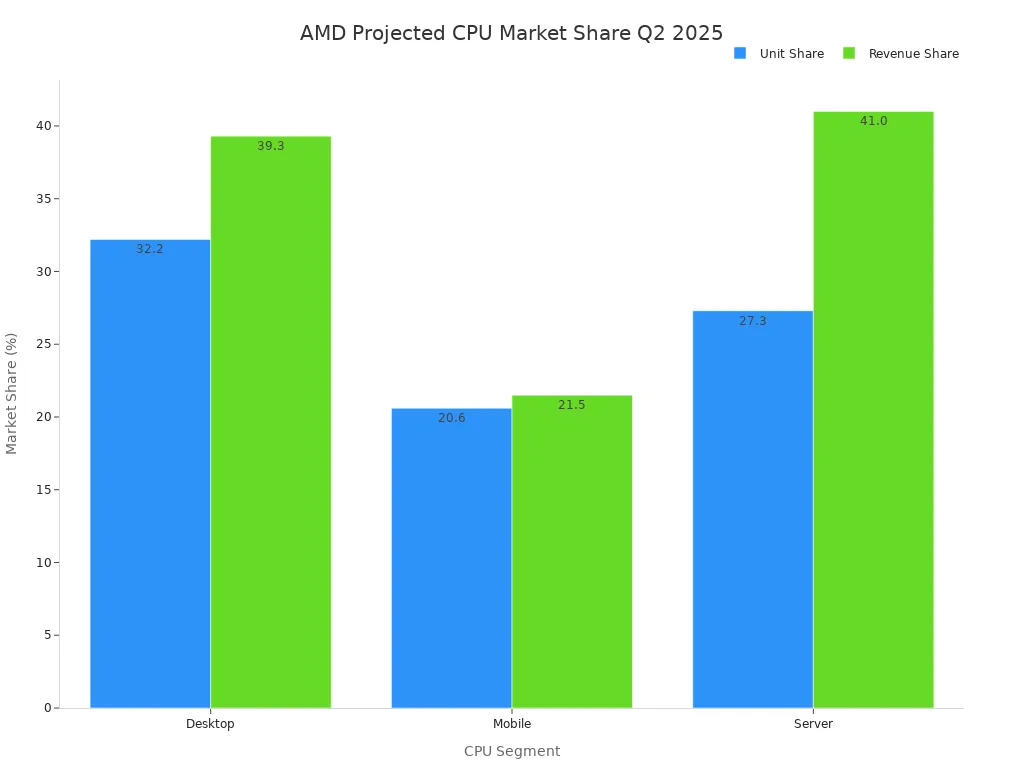

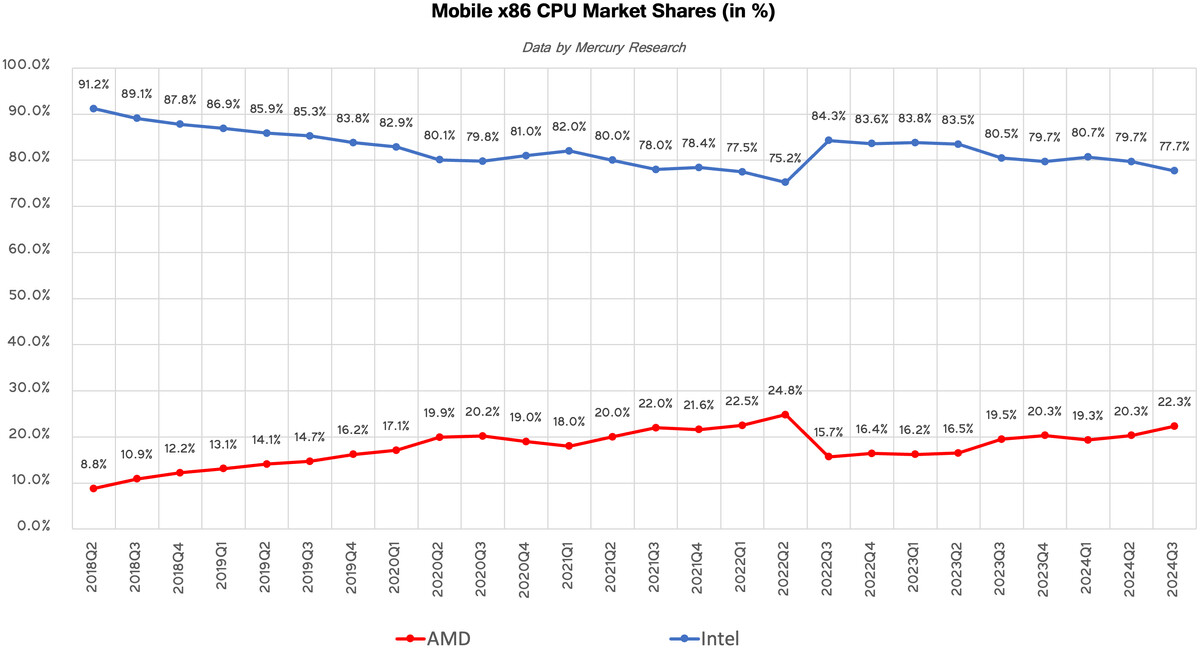

Notebook Segment:

- This is one area where Intel held ground better, partly due to Apple's transition to ARM (which hurt both Intel and AMD equally)

- AMD gained to roughly 20% share in Windows notebooks, but the total addressable market shrank

These numbers represent the largest shift in processor market structure since AMD's first Athlon in 1999.

Intel's market share in server processors grew significantly from 1980 to 2019, reaching a peak of 97% in 2019. This reflects Intel's dominance in the industry over several decades. (Estimated data)

Technology Convergence: Why Core Count Became King

The shift wasn't just about momentum or Intel stumbling. It was about fundamental changes in how workloads evolved.

In the 1990s and 2000s, single-threaded performance was king. Applications were written in ways that benefited from faster clocks. Database queries ran on single cores. Web servers used thread pools to distribute work. The world was optimized for fast, single-threaded execution.

By the 2010s, this changed. Modern databases use SIMD instructions and vectorization. Web frameworks spawn worker processes that scale across all available cores. Machine learning workloads are embarrassingly parallel. Data science pipelines process terabytes with parallel algorithms.

For these workloads, having 32 cores at 3.5 GHz is better than having 8 cores at 4.5 GHz. You get better throughput. You get better parallelization. You get better power efficiency.

AMD's architecture aligned with this shift. They were optimizing for the workloads that mattered to the market. Intel was still optimizing for the workloads that used to matter.

This is a subtle but crucial point. AMD didn't beat Intel by being better at Intel's game. They beat Intel by recognizing that the game had changed.

The Zen Architecture: How AMD Built a Better Mousetrap

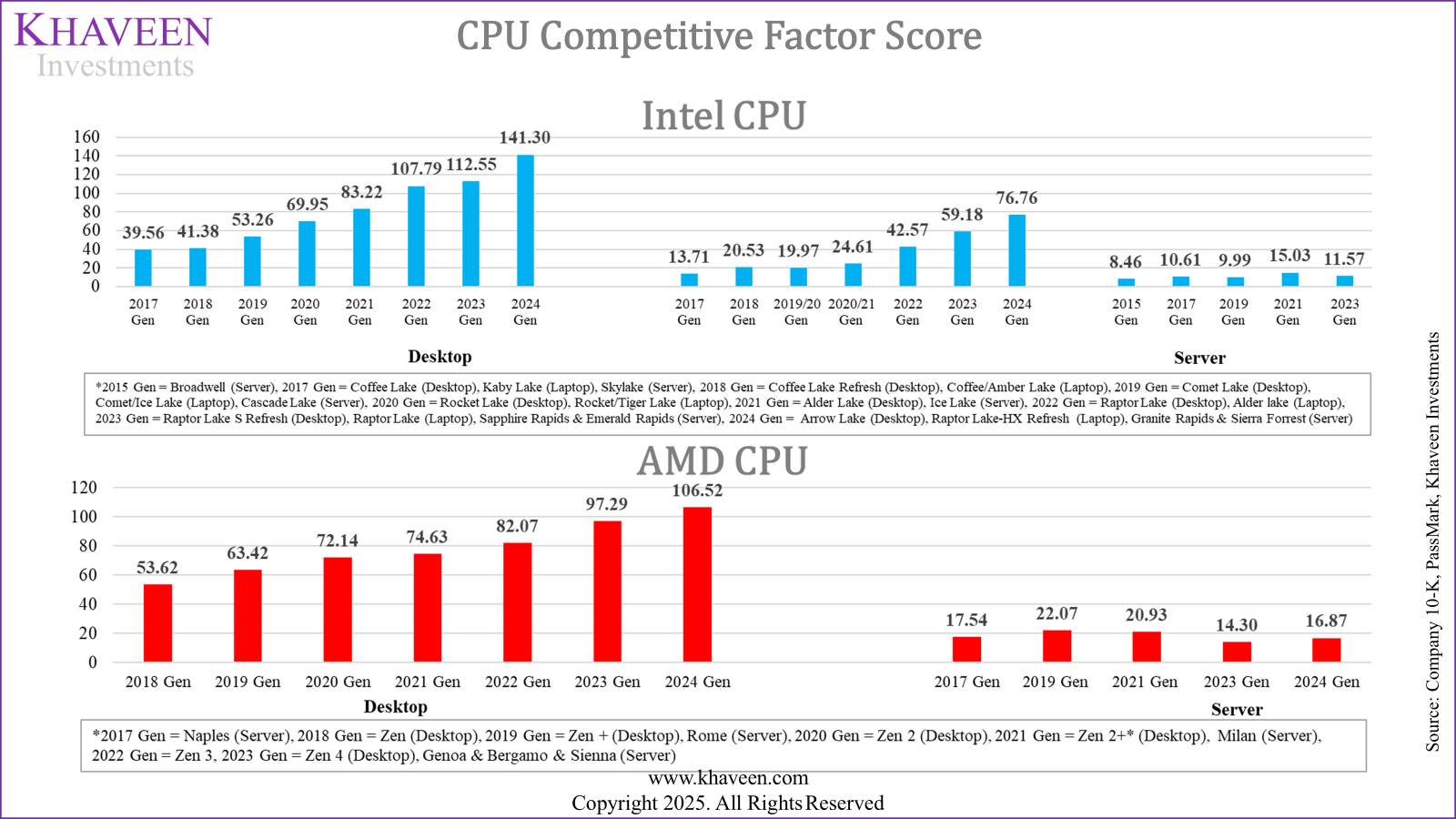

AMD's secret weapon was the Zen architecture, first introduced in 2017 and continuously refined through Zen 2, Zen 3, and Zen 4.

Zen was different from Intel's approach in several ways:

Modular Design. Zen processors use chiplets—smaller cores that can be manufactured and combined independently. This gave AMD flexibility to offer 8-core, 16-core, and 32-core variants from the same production line. Intel had to design separate chips for different core counts, which was expensive and rigid.

Infinity Fabric. AMD's chiplets communicate through a proprietary interconnect. This solved a hard problem: how do you connect multiple cores without latency killing performance? AMD solved it better than Intel's traditional approaches, allowing efficient scaling to 64+ cores.

Power Efficiency. Zen was designed from the ground up to be efficient. Lower voltage operation. Better instruction scheduling. Smarter cache hierarchies. All of this meant AMD could deliver performance with lower power consumption.

Iterative Improvement. Zen 2, Zen 3, and Zen 4 each brought incremental improvements without requiring architectural overhauls. This allowed AMD to maintain momentum—releasing new products frequently without the massive R&D costs that Intel's approach required.

By 2021, Zen 3 had reached parity with Intel's latest Xeon processors in pure per-core performance. By 2023, Zen 4 was faster in many metrics. But the gap was never the point. The point was that AMD offered comparable performance at better power efficiency, cheaper price, and more flexibility.

Intel's counter was the Xeon Scalable line, which improved each generation. But Intel's architecture made radical changes difficult. Their monolithic design meant that switching core counts required completely new chips and new validation cycles. By the time Intel responded to market demand, AMD had already captured the segments Intel was slow to address.

AMD's market share in both server and desktop segments has increased significantly from 2019 to 2025, marking a major shift in the processor market structure.

Why Switching to AMD Actually Saved Money

Let's do the math on what a data center operator saw.

Assume a 100-server deployment comparing Intel Xeon Platinum 8480 vs. AMD EPYC 9654:

Hardware Cost:

- Intel system: 1,200,000

- AMD system: 950,000

- Savings: $250,000

Power Cost (assuming $0.10 per kWh, 3-year lifecycle):

- Intel: 400W × 100 servers × 24 hrs × 365 days × 3 yrs × 105,120

- AMD: 240W × 100 servers × 24 hrs × 365 days × 3 yrs × 63,072

- Savings: $42,048

Cooling Cost (rough estimate, $50/kW/year):

- Intel: 40 kW × 3 years × 6,000

- AMD: 24 kW × 3 years × 3,600

- Savings: $2,400

Total 3-Year Savings: ~$295,000

For a 100-server deployment, that's $2,950 per server over three years. At that scale, the business case for AMD is overwhelming. Add in the fact that AMD's performance was competitive or better, and the decision made itself.

Internet-scale companies running hundreds of thousands of servers? The savings are in the hundreds of millions. That's why Google, Amazon, and Microsoft all shifted toward AMD (and their own custom chips).

Intel's Response: Too Little, Too Late

Intel didn't ignore the threat. The company spent billions to recover.

14th-Generation Raptor Lake. Intel's refresh attempted to address thermal concerns. They backed off clock speeds slightly, improved power delivery, and optimized for better efficiency. The results were mixed. Performance improved, but so did power consumption in some scenarios. The messaging was confused.

Intel Xeon W9 Series. Intel tried a high-core-count Xeon to compete with EPYC. But it shipped later than EPYC's equivalent, cost more, and consumed more power. Market share continued bleeding.

Arrow Lake. Intel's newest generation (2024) includes optimizations for AI workloads and a completely redesigned core efficiency. Early reviews show promise, but the momentum advantage belongs to AMD. Customers who switched 2-3 years ago have already amortized their transition costs. Why switch back?

Foundry Strategy. Intel's announcement that they'll use external foundries (TSMC) for some production was a major strategic shift. It signals that Intel can't maintain its traditional vertically integrated model. This is a long-term play with questionable near-term benefits.

The honest assessment: Intel is still a major player. The company still ships enormous volumes of processors. But they've lost the ability to set prices and control customer decisions. Market leadership belonged to Intel. Now it's contested.

Intel's server market share dropped from 97% in 2019 to 72% by 2025, while AMD's share increased from 3% to 28%, indicating a significant shift in market dynamics.

The Role of Cloud Providers and System Integrators

Intel's decline wasn't just about better technology. It was about how decisions got made in large organizations.

Cloud providers moved first because they had the most to gain from cost savings and the resources to validate new platforms. When AWS launched EC2 instances with EPYC, they published benchmarks. When Google did the same, customers trusted that EPYC was validated. Cloud providers' purchasing power forced Intel to negotiate harder, which signaled to smaller enterprises that AMD was now a legitimate option.

System integrators—Dell, HPE, Lenovo—followed market demand. They started offering AMD systems alongside Intel. For customers, this meant something critical: AMD was now a mainstream choice, not a risky alternative.

Technology vendors that had optimized exclusively for Intel began testing on AMD. Database vendors published EPYC benchmark results. Enterprise software vendors certified compatibility. This flywheel effect accelerated adoption.

Once certification and validation reached critical mass, the remaining objections dissolved. Organizations could switch to AMD without risk of incompatibility or lack of support.

This is how technology markets actually work. It's not just about raw performance. It's about ecosystem participation, customer validation, and perceived risk reduction.

Segment-by-Segment Breakdown: Where AMD Won and Where Intel Held

The shift wasn't uniform across all markets. Understanding these segments reveals important nuances.

Hyperscale Data Centers (Cloud Providers)

AMD won decisively here. Power efficiency, core count, and economies of scale made EPYC the default choice for new deployments. Intel still ships servers here, but mostly for specific AI workloads or customer preference. Market share: AMD 40%+, Intel 50-60%.

Enterprise Data Centers

AMD captured 25-35% share here, but the split was more even than hyperscale. Enterprises tend to be more conservative. Many standardized on Intel years ago and saw no reason to switch existing infrastructure. But new deployments increasingly chose AMD.

High-Performance Computing (HPC)

Intel maintained stronger position here through specific optimizations. But AMD's EPYC made significant inroads. Share roughly 50-50 between Intel and AMD, with both improving performance generation-over-generation.

AI/Machine Learning

Intel tried to claim advantage here with 5th-Gen Xeon's AI extensions. AMD fired back with EPYC Genoa's matrix math capabilities. This market is still fluid and depends heavily on software stack optimizations. Market share roughly 50-50, volatile.

Consumer Desktop

AMD won decisively. The Ryzen 7000-series and 9000-series CPUs captured 30-40% share from AMD's previous 5%. Intel's response has been to focus on budget CPUs, where they maintain advantage. But premium segment belongs to AMD.

Laptops/Notebooks

This is Intel's relative strength area, though AMD is growing. The market contracted significantly due to smartphone usage and Apple's ARM transition, which hurt both companies. AMD estimated at 20-25% of Windows notebooks.

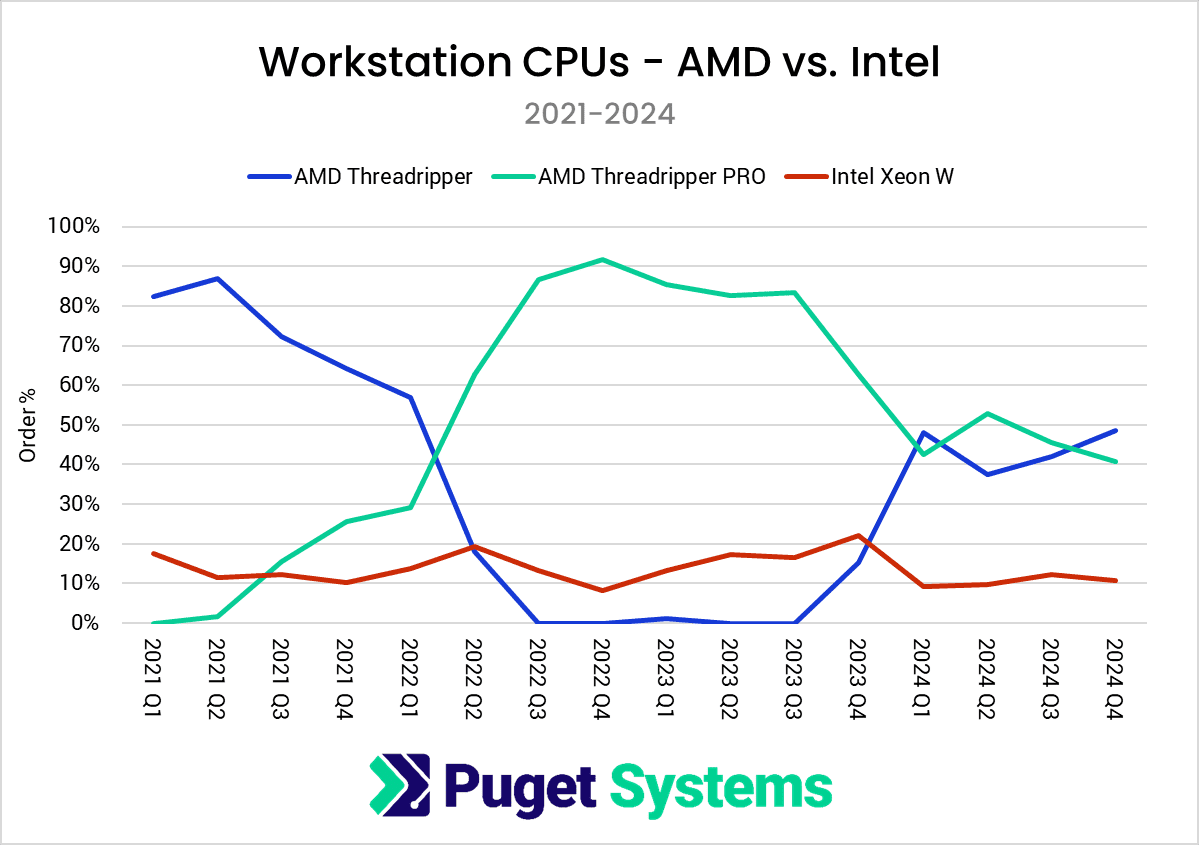

Workstations (CAD, Video Editing, Content Creation)

AMD has been aggressive here, particularly with Threadripper line. 30% share and growing. Intel's Xeon W-series competes, but AMD's value proposition is compelling.

The Competitive Landscape: Intel vs AMD vs ARM

The processor market in 2025 is three-way competitive in ways it wasn't in 2010.

Intel remains the largest, but faces existential questions. Their manufacturing roadmap is uncertain. Their architecture is playing catch-up to AMD. Their gross margins are compressing. But they still have engineer talent, capital, and customer relationships. They're not going anywhere, but they're no longer unchallenged.

AMD is ascendant but faces its own challenges. Can they maintain manufacturing leadership with TSMC? Can they execute on their Zen 5 roadmap without delays? The market expects continued growth, but growth expectations are brutal if they miss.

ARM (via Apple Silicon, Nvidia Graviton, and others) is taking share in specific segments. Apple's M-series chips have decimated Intel in laptops. Nvidia is pushing ARM-based server chips. But x86 compatibility and software ecosystem still dominate most markets.

For customers, this three-way competition is a gift. Prices are lower, performance is higher, and vendors are motivated to innovate.

What This Means for Enterprise IT Decisions Today

If you're evaluating processors for a new deployment in 2025, here's what the market shift means practically:

For Servers: AMD EPYC is now the mainstream choice. Intel Xeon is still viable, particularly for specific workloads or existing standardization. But if you're starting fresh, AMD's price, power, and performance advantages are real. Evaluate both, but expect AMD to win on TCO.

For Desktops/Workstations: Ryzen is now the go-to for performance builds. Budget buyers can still find value in Intel, but performance-per-dollar belongs to AMD. Adoption is high enough that compatibility is non-issue.

For Laptops: Intel still has advantages in battery life on some models, but AMD's mobile chips are competitive and closing the gap. This market is more about OEM choices and OS optimization than raw processor capability.

For Specialized Workloads: AI, HPC, and specialized applications may benefit from specific optimizations on either platform. Benchmark before committing. Both companies are investing heavily in AI features.

The strategic lesson: lock-in is dead. When AMD was weak, Intel could charge high prices and customers had to accept it. Now, every two years of vendor inaction costs them market share. This competitive intensity benefits everyone except the vendors' profit margins.

Future Projections: Where Does This Go Next?

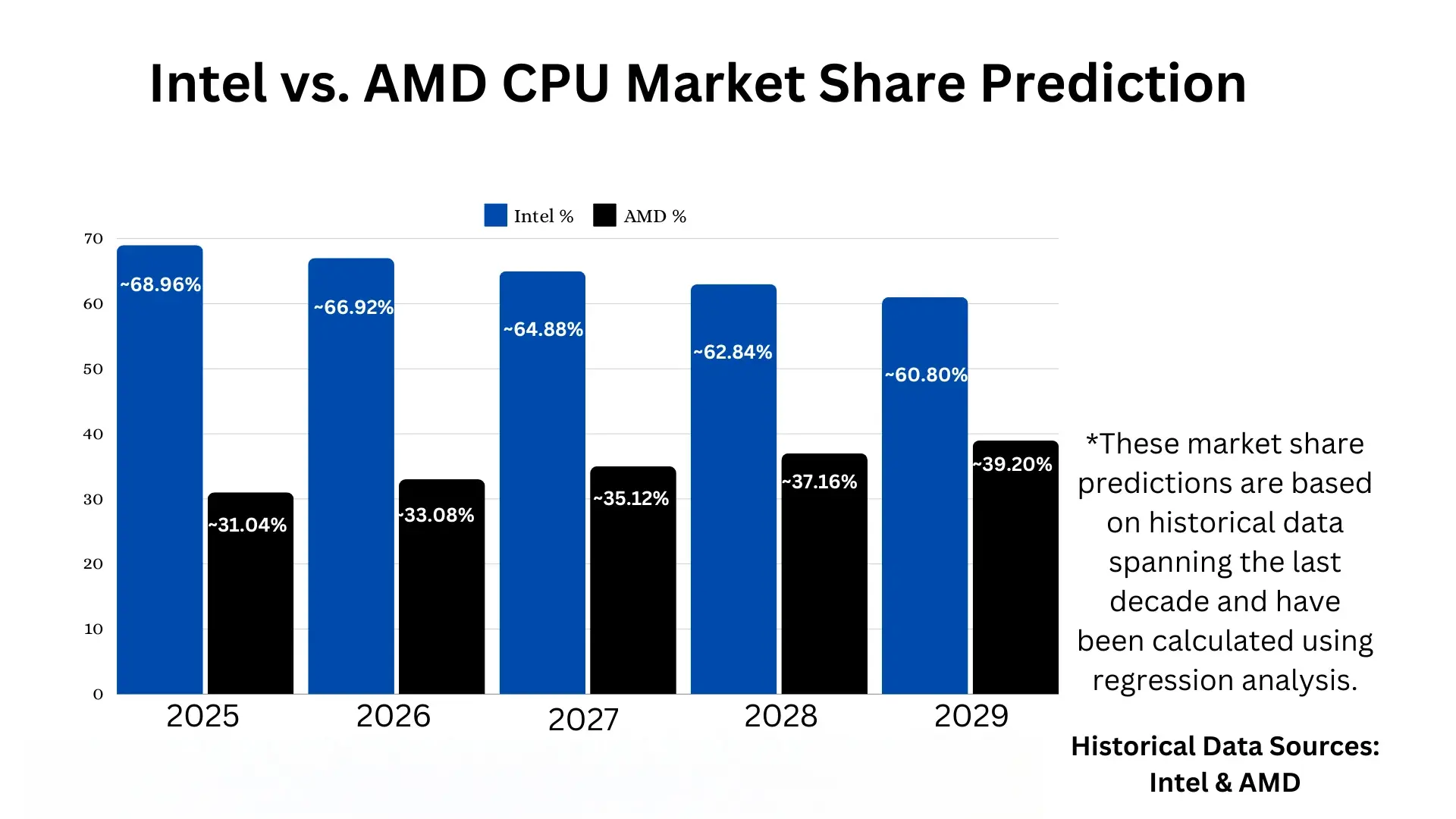

Industry analysts project AMD's server market share could exceed 35% by 2026-2027 if current trends continue.

What could change this trajectory?

Intel's Foundry Strategy. If Intel successfully manufactures bleeding-edge chips at external foundries and solves their execution issues, they could regain momentum. This is possible but uncertain.

New Architectures. Both companies are working on post-Zen, post-Raptor Lake architectures. If Intel's next-generation delivers dramatic performance gains, they could win back customers. But the clock is ticking.

AI Acceleration. If specialized AI co-processors become more important than general-purpose cores, the entire competition could shift. Nvidia's dominance in AI accelerators means neither Intel nor AMD has clear advantage here.

Custom Chips. Major cloud providers are increasingly building their own processors (Google TPU, AWS Graviton, Microsoft Maia). This could compress both Intel's and AMD's share in hyperscale by 10-15 points over five years.

Power Limits. Data center power density is approaching physical limits. Whoever innovates the most efficient core architecture over the next 3-5 years will win. This could favor AMD (historically more efficient) or Intel (if their new foundry partners enable better designs).

Most likely scenario: AMD maintains or slightly grows server share to 32-35%. Desktop market stabilizes around current levels with AMD at 30-35%. Intel fights to maintain 60% server share while stabilizing desktop. Specialists (ARM, custom chips) capture 5-10% of specific segments.

The days of 95% market share for any x86 vendor are over. The market has mature enough that competition is structural, not accidental.

The Broader Lesson: How Market Leaders Fall

Intel's decline offers a case study in how market dominance can erode despite a company's best efforts.

The elements were classic:

-

Underestimation of competition. Intel spent years believing AMD couldn't match their execution. By the time they recognized the threat, AMD had momentum.

-

Structural constraints. Intel's vertically integrated manufacturing made them inflexible. AMD's partnership with TSMC gave them options. The faster organization won.

-

Market shift. Intel optimized for single-threaded performance and clock speed. The market shifted toward parallelism and efficiency. Intel's roadmap wasn't aligned to this shift.

-

Technology stumbles. Manufacturing delays (10nm to 7nm transition) gave AMD the opening they needed. Thermal issues (Raptor Lake throttling) killed momentum in desktops.

-

Ecosystem effects. Once cloud providers and integrators started offering AMD, the switching cost inverted. This accelerated adoption beyond what raw performance differences would suggest.

No company, no matter how dominant, is immune to this pattern. Apple faced it with smartphones. Microsoft faced it with mobile. Intel faced it with processors. The only constant is change, and the winners are those who recognize and adapt to it fastest.

Practical Takeaways for Builders and System Architects

If you're designing systems or infrastructure today, what does this market shift mean for you?

Performance Parity: AMD and Intel processors are now functionally equivalent for most workloads. A decade ago, Intel's performance advantage was real and measurable. Today, it's marginal or non-existent. Make your choice based on price, power, and ecosystem fit, not performance.

Power Budgeting: If power consumption is a design constraint (and it usually is in data centers), AMD's efficiency advantage is concrete and measurable. Expect 15-20% lower power consumption with comparable performance.

Flexibility: AMD's modular design (chiplets) gives more flexibility in core count and configuration. If your workload needs 16 or 32 cores specifically, AMD may have a better fit.

Vendor Lock-In: The days of being locked into one vendor are over. You can deploy AMD today and switch to Intel for the next refresh if circumstances change. Use this to your advantage in negotiations.

Certification: Both ecosystems are mature enough that compatibility issues are rare. Run your benchmarks, validate performance, and don't assume one vendor's advantage without testing.

FAQ

What caused Intel's market share decline in servers?

Intel's decline was caused by multiple factors: manufacturing delays in the 10nm-to-7nm transition that allowed AMD to catch up, the shift in workloads toward multi-core processing where AMD's EPYC architecture excelled, and a significant efficiency advantage in AMD's Zen architecture that reduced power consumption. Additionally, cloud providers like AWS and Google began deploying EPYC processors and publishing benchmarks showing competitive or superior performance, which gave customers confidence to switch. By 2019-2020, the efficiency and cost advantage became so compelling that hyperscale data centers shifted decisively toward AMD.

How did AMD's EPYC grow from 2% to 30% market share so quickly?

AMD's rapid EPYC adoption happened because the market fundamentally shifted its priorities. Cloud providers and enterprises started optimizing for total cost of ownership rather than just per-core performance. EPYC offered 32-64 cores with lower power consumption, which meant better throughput per server and lower operational costs. Once Google, Amazon, and Microsoft began public EPYC deployments, other enterprises felt comfortable switching. The modular chiplet design also allowed AMD to scale easily from 8 to 96 cores, giving customers more options than Intel's more limited offerings.

Why did thermal issues matter so much for Intel in the desktop market?

Thermal issues compound costs in unexpected ways. A CPU that runs hotter requires better cooling solutions, which increases case size requirements, power supply headroom, and noise levels. The Intel 13th and 14th generation chips' throttling behavior meant that advertised performance wasn't always achievable under sustained loads. This made DIY builders and integrators frustrated because they couldn't achieve the performance they paid for without investing in expensive cooling solutions. AMD's cooler-running Ryzen processors delivered advertised performance without these thermal compromises, making them the simpler and cheaper choice overall.

Is Intel still competitive with AMD today?

Yes, Intel remains highly competitive, but the dynamics have shifted fundamentally. Intel's 14th and upcoming Arrow Lake processors offer comparable performance to AMD's latest EPYC and Ryzen chips. In some specific metrics like single-threaded performance or AI workloads with specific software optimizations, Intel remains strong. However, AMD's advantages in power efficiency, core count flexibility, and price competitiveness mean that new deployments increasingly choose AMD. Both vendors are capable and actively innovating. The difference is that Intel can no longer dictate terms.

What's the impact on pricing and margins?

AMD's growth has compressed pricing across the industry. Intel's gross margins on server and desktop processors have declined significantly. In the server market, processors that cost

Could Intel recover its server market dominance?

It's theoretically possible but would require several things to align: perfect execution on new architectures, successful transition to external foundries for leading-edge manufacturing, and a market shift back toward Intel's strengths in single-threaded performance. However, AMD's momentum is strong, and catching up after losing 25 percentage points of market share would take 3-5 years of flawless execution. More likely, Intel stabilizes its server share at 55-65% while AMD holds 30-40%, with specialized processors (custom chips, ARM variants) capturing the remainder.

What about AMD's vulnerabilities as their market share grows?

AMD's risks are execution-based: can they maintain manufacturing leadership at TSMC as volumes scale? Can they deliver on their Zen 5 roadmap without delays? Can they maintain pricing power as competitors respond aggressively? There's also the risk that new architectures (quantum computing, photonic computing, or entirely new paradigms) could disrupt both AMD and Intel equally. Additionally, if custom chips from hyperscalers (Google, Amazon, Meta) capture more server workloads, both Intel and AMD could see their total addressable market shrink.

How does ARM factor into the x86 processor competition?

ARM's role is growing but primarily in specialized segments rather than competing head-to-head with x86 processors. Apple's M-series chips dominate premium laptops. Amazon's Graviton chips compete in cloud servers for specific workloads. But ARM suffers from a critical disadvantage: the lack of a mature software ecosystem for enterprise workloads. Most enterprise applications are optimized for x86 (Intel or AMD), making ARM adoption risky for organizations. x86 will likely remain dominant for enterprise computing for at least another decade, though ARM's share will grow in cloud and consumer segments.

Conclusion: A Market Finally Finding Equilibrium

Intel's dominance wasn't built on luck or accidents. The company executed at an elite level for 30+ years. But markets change. Workloads evolve. Technology shifts. When one company dominates for that long, it's almost inevitable that complacency creeps in, and that's what happened.

AMD's rise isn't just about better products. It's about market forces working correctly. When one vendor had 97% of servers, pricing was inefficient, innovation was slower than it should have been, and customer choice was limited. Now, with AMD capturing 28-30% of the market, both vendors are forced to innovate harder, price more competitively, and listen more carefully to customer needs.

This is good for the industry. This is good for customers. It's bad for Intel's profit margins and market cap, but that's how capitalism is supposed to work.

The question isn't whether AMD can maintain this growth. They've already won the market shift. The real question is what comes next. Will Intel recover lost ground? Will new architectures disrupt both x86 vendors equally? Will power consumption constraints force everyone toward different design paradigms?

Those questions will define the next era of computing. For now, the historical shift is clear: Intel dominated for 30 years. AMD is now the growth vendor in servers and a co-leader in desktops. The era of a single dominant processor vendor is over. The market is finally competitive in the way it should have been all along.

Key Takeaways

- AMD's EPYC server processors grew from under 2% market share in 2018 to nearly 30% by 2025, while Intel's share collapsed from 97% to 72%

- Power efficiency became the primary driver: AMD's Zen architecture consumes 40% less power than Intel Xeon, translating to $42,000+ savings per 100 servers over three years

- Desktop market saw similar shift as thermal issues with Intel's 13th-14th gen processors (105°C throttling) pushed 30%+ market share to AMD's Ryzen

- AMD's modular chiplet design enabled flexible core counts (8-96 cores) from the same production line, while Intel's monolithic design required separate chip development

- Cloud providers like AWS, Google, and Microsoft moved first to EPYC, creating ecosystem validation that accelerated enterprise adoption and made switching costs irrelevant

Related Articles

- Intel Core Ultra Series 3 Launch Delayed by Supply Crunch [2025]

- The New York Times Crossplay: Building the First Two-Player Game [2025]

- AMD Ryzen 7 9850X3D: Release Date, Price & Gaming Performance [2025]

- Neurophos Optical AI Chips: How $110M Unlocks Next-Gen Computing [2025]

- Nvidia's $1.8T AI Revolution: Why 2025 is the Once-in-a-Lifetime Infrastructure Boom [2025]

- How Cloud Storage Transforms Sports Content Strategy: Wasabi & Liverpool FC [2025]

![AMD vs Intel: Market Share Shift in Servers & Desktops [2025]](https://tryrunable.com/blog/amd-vs-intel-market-share-shift-in-servers-desktops-2025/image-1-1769209605622.jpg)