The Ocean Data Crisis Nobody Talks About

We've mapped the surface of Mars better than we've mapped the ocean floor. Seriously. Satellites give us incredible visibility into sea surface temperatures, algae blooms, and weather patterns, but they're essentially looking at a two-dimensional sheet. Dive a hundred meters down, and you're flying blind.

This knowledge gap affects everything. Fisheries can't predict where their catch will move. Climate scientists struggle to understand ocean circulation patterns that drive global weather. The Navy can't reliably detect submarines. Offshore wind farms operate without real-time data on subsurface currents that could damage installations. Weather forecasters make predictions based on educated guesses about water temperature distribution rather than actual measurements.

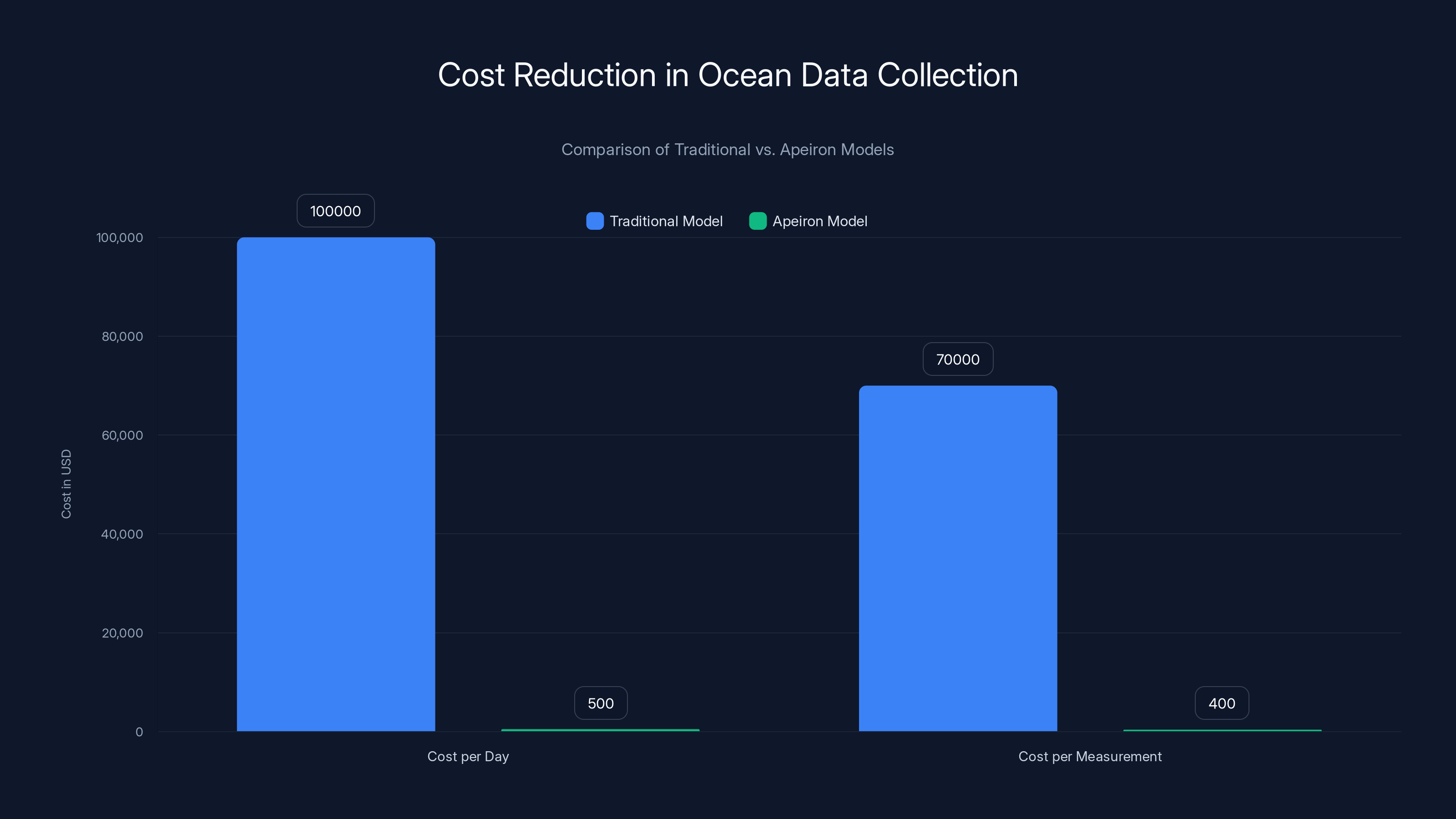

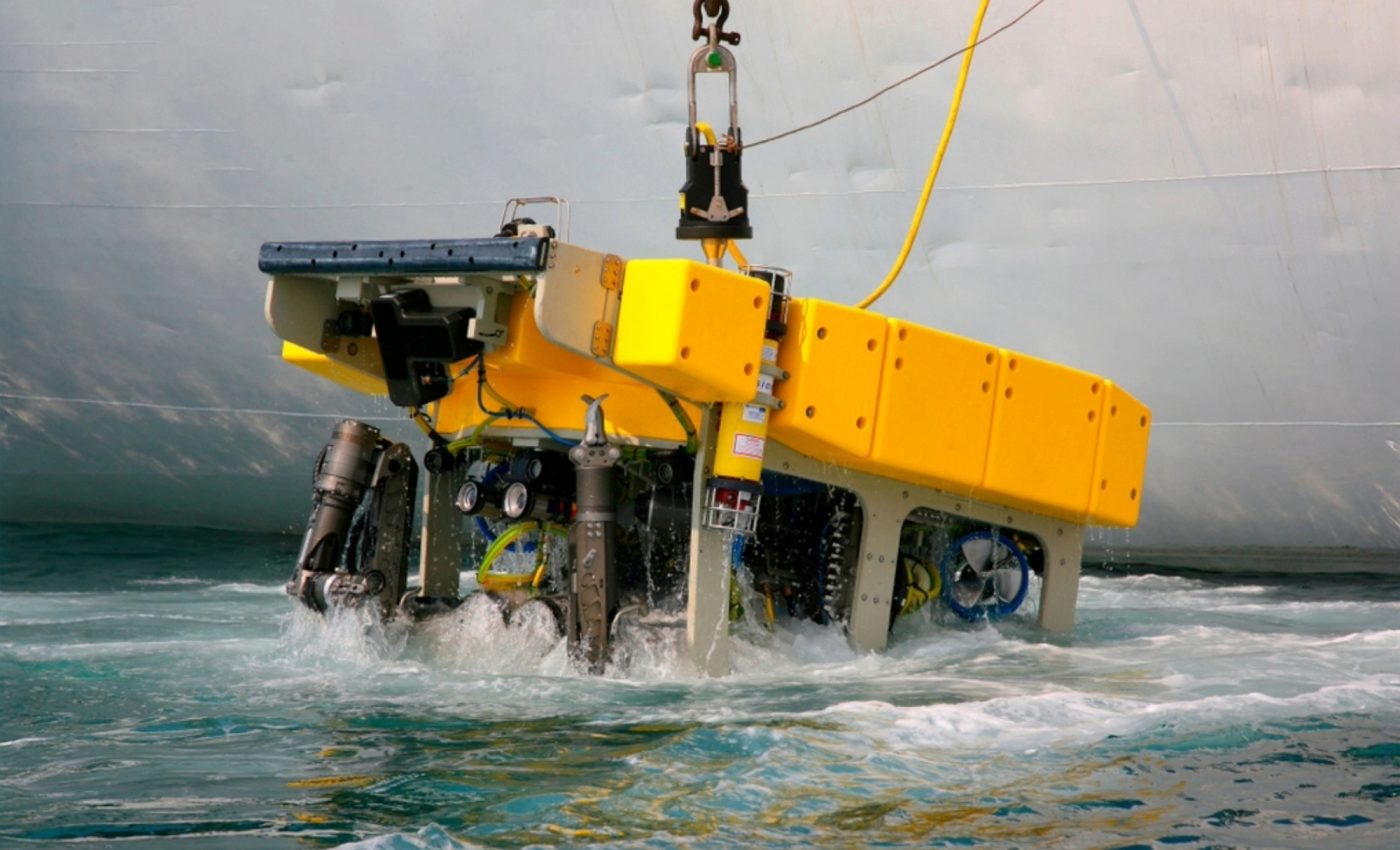

The problem isn't that we don't want the data. It's that getting it has always been absurdly expensive and slow. Traditional ocean monitoring relies on research ships, and a single day on a research vessel costs $100,000. These ships move at a crawl. A team gets maybe a few snapshot measurements per deployment, then has to wait weeks or months for the next expedition. It's like trying to understand traffic patterns by asking someone to drive through the city once per month.

Ravi Pappu founded Apeiron Labs in 2022 specifically to solve this problem. His background gave him unique insight. As CTO of In-Q-Tel, the CIA's venture capital arm, Pappu watched ocean data gaps become a persistent national security concern. Every meeting with defense agencies circled back to the same problem: we don't know what's happening underwater.

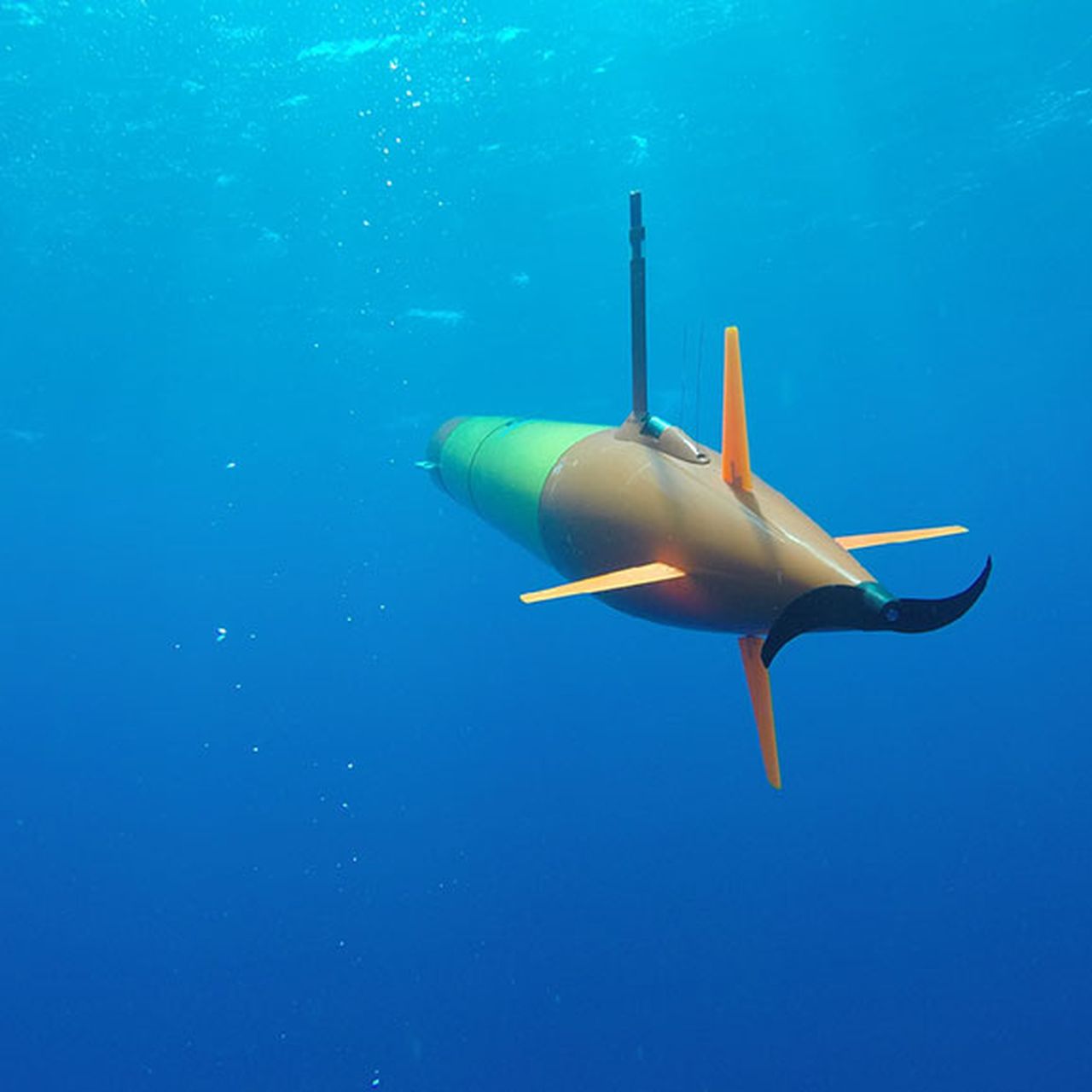

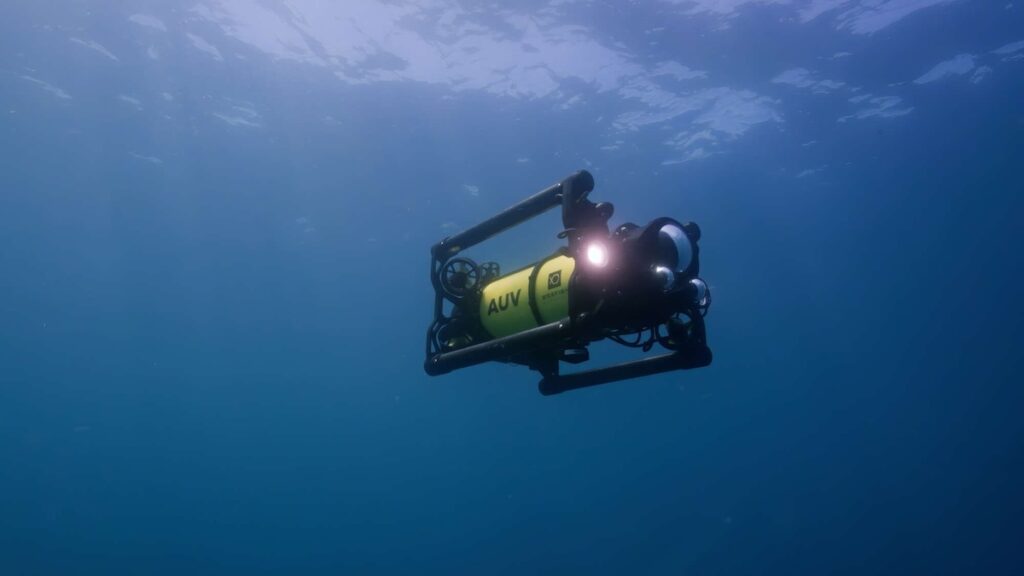

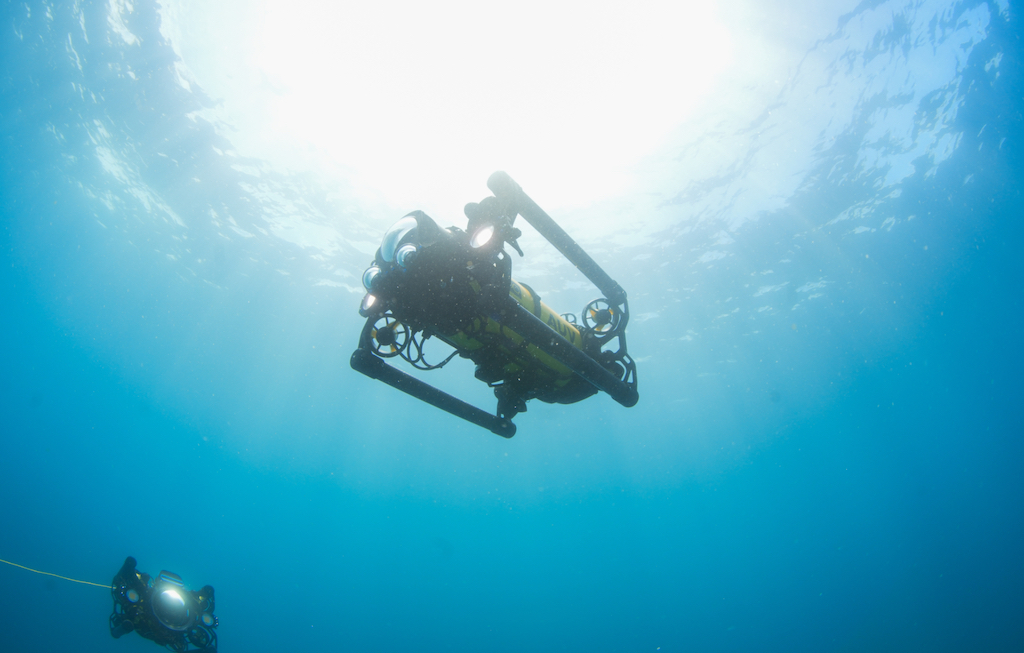

Apeiron's solution is elegantly simple. Instead of deploying expensive ships, deploy autonomous underwater vehicles (AUVs) that are cheap enough to deploy by the dozens. These aren't the massive, deep-ocean exploration robots you might imagine. They're three-foot-long tubes, about five inches in diameter, weighing just over 20 pounds. Small enough to deploy from a boat or airplane. Small enough that they fit inside existing U.S. Navy launch equipment.

The funding news validates the opportunity. In early 2026, Apeiron closed a $29 million Series A round led by Dyne Ventures, RA Capital Management, and S2G Investments. Assembly Ventures, Bay Bridge Ventures, and TFX Capital joined the round. That's not just money. That's validation from investors who specialize in climate tech, defense innovation, and deep science.

But the real story isn't just about raising capital. It's about fundamentally changing the cost equation for ocean data.

How Apeiron's Autonomous Vehicles Actually Work

Understand the mechanics, and you understand why this approach scales where traditional methods don't.

Each Apeiron AUV is built for one job: dive down, measure things, come back up, and repeat. The vehicle descends 400 meters (about 1,300 feet) into the water column, collecting data on temperature, salinity, and acoustics once or twice per day. Four hundred meters might not sound like much compared to the 11,000-meter depths of the Mariana Trench, but it covers the zones where most ocean activity happens. Most marine life, fisheries, and water circulation dynamics occur in the upper 500 meters.

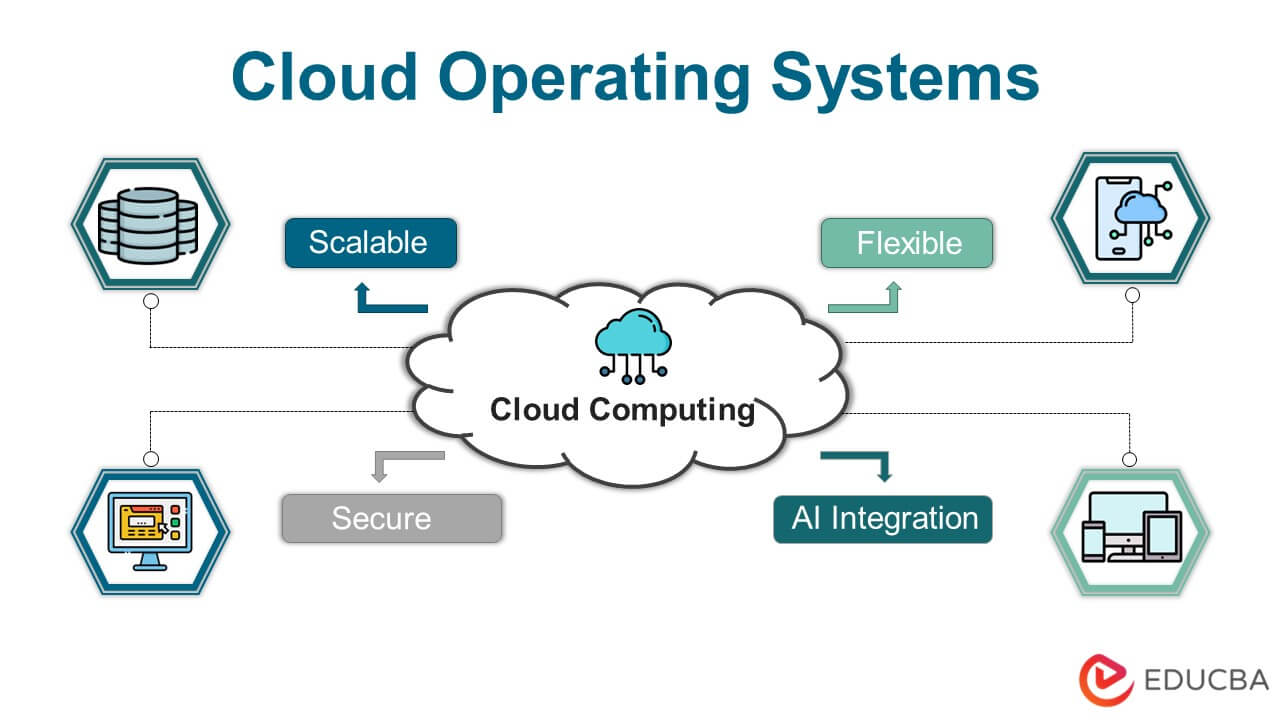

The vehicle is essentially a buoyant torpedo with sensors and communication systems. It has no cables, no tethers, no mother ship. Once it hits the water, it uses acoustic signals and dead reckoning to understand its position. Then it connects to Apeiron's cloud-based operating system and starts uploading data.

This is where the elegance kicks in. While the AUV is diving, Apeiron's software isn't idle. It runs predictive models of the ocean, using everything known about water circulation, temperature gradients, and current patterns to predict where that vehicle will surface. It's not a guess. It's a calculated prediction based on ocean dynamics.

When the AUV breaches and reconnects, Apeiron's system does something clever: it incorporates the new real-world measurements to refine its predictive models. Each dive makes the next prediction more accurate. Over time, with enough deployed vehicles, the system builds an increasingly precise digital twin of ocean conditions.

The vehicles are spaced 10 to 20 kilometers apart, forming a line or array. This creates something traditional methods can't achieve: persistent, high-resolution monitoring. Instead of a ship's single-point measurement during a brief expedition, you get continuous data streams from dozens of locations simultaneously.

The Cloud Operating System That Makes It Work

The vehicles themselves are just the hardware layer. The real product is the software platform that coordinates, interprets, and acts on the data they collect.

Apeiron's cloud system does several things in parallel. First, it manages the fleets. Which vehicles should dive now? Which should stay at the surface? Which need maintenance? The system can optimize deployment based on weather, currents, power levels, and data-collection priorities. A fishery interested in tracking temperature changes off the coast gets different vehicle behavior than a military client listening for submarines.

Second, the system contextualizes the data. Raw sensor readings are just numbers. Apeiron's platform converts them into actionable intelligence. Are water temperatures warmer than the 10-year average? Is that consistent with ocean models? What does it suggest about fish migration? The system flags anomalies and trends automatically.

Third, the system learns. Machine learning models trained on historical ocean data improve as new measurements come in. The predictive models that guide vehicle deployment get better. The anomaly detection systems become more sensitive. This is data science at scale, running continuously across all deployed vehicles.

Sensors and What They Measure

Apeiron vehicles carry multiple sensors, each capturing different aspects of ocean conditions.

Temperature sensors are foundational. Water temperature drives ocean circulation, affects marine life distribution, and influences weather patterns. Apeiron vehicles measure temperature at multiple depths as they descend and ascend, creating a vertical profile through the water column.

Salinity sensors measure dissolved salt concentration. Salinity changes affect water density, which drives deep-ocean currents. It's less glamorous than temperature, but it's crucial for understanding long-term ocean dynamics. Freshwater inputs from rivers and ice melt create salinity gradients that oceanographers track.

Acoustic sensors pick up sound. The ocean is surprisingly noisy. Ships create noise pollution. Marine animals communicate acoustically. Submarines are detectable through acoustic signatures. For military applications, this is the critical sensor. For marine biology and fisheries, acoustic data reveals species presence and behavior.

The combination of these three data streams creates a rich picture of ocean conditions that satellite-only systems simply can't capture.

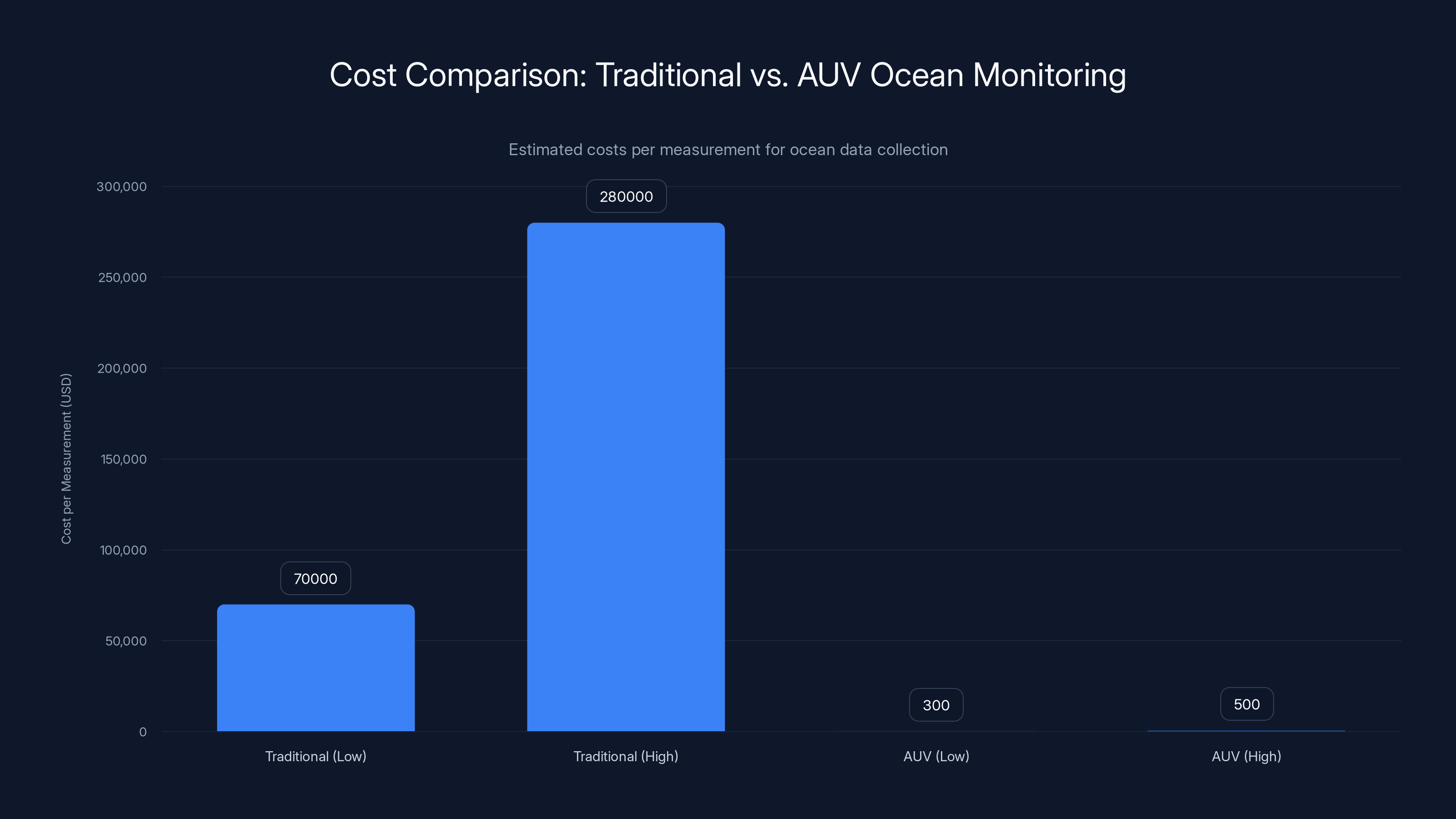

Apeiron's model dramatically reduces costs, with per measurement costs dropping from

The Cost Revolution: From $100K per Day to Scalable Economics

Apeiron's core claim is striking: they've reduced the cost of collecting ocean data by a factor of 100 compared to ship-based methods. Pappu has publicly stated his goal is hitting a 1,000-fold reduction within the next year.

Let's actually do the math here, because the numbers are revealing.

The Traditional Cost Model

A research vessel costs roughly

During that month-long expedition, you might get 10 to 20 detailed measurements at various depths. That's roughly

The cost per data point is staggering. The time lag is worse.

The Apeiron Model

Apeiron vehicles cost approximately

Deploy 50 vehicles, and you've spent

Five years of continuous operation on those 50 vehicles costs roughly

Cost per measurement: roughly

Moreover, there's no waiting. You get real-time data streams instead of waiting for an expedition. The value compounds because decision-makers can react to ocean conditions instead of reacting to last month's measurements.

Reaching the 1,000-Fold Goal

How do you get from a 100-fold reduction to 1,000 times cheaper?

Scale is the answer. Manufacturing costs drop dramatically when production volumes increase. A

Second, platform efficiencies improve. Apeiron's cloud system gets cheaper to operate per vehicle as the fleet grows. The software cost gets amortized across more users.

Third, battery technology improves. Current AUVs rely on lithium-ion batteries, which have gotten 30% cheaper over the past decade. Emerging solid-state and alternative battery chemistries could cut costs further.

Reach a state where deploying 1,000 vehicles costs less than operating a single research ship, and suddenly, persistent ocean monitoring becomes standard operating procedure for everyone from fisheries to climate agencies.

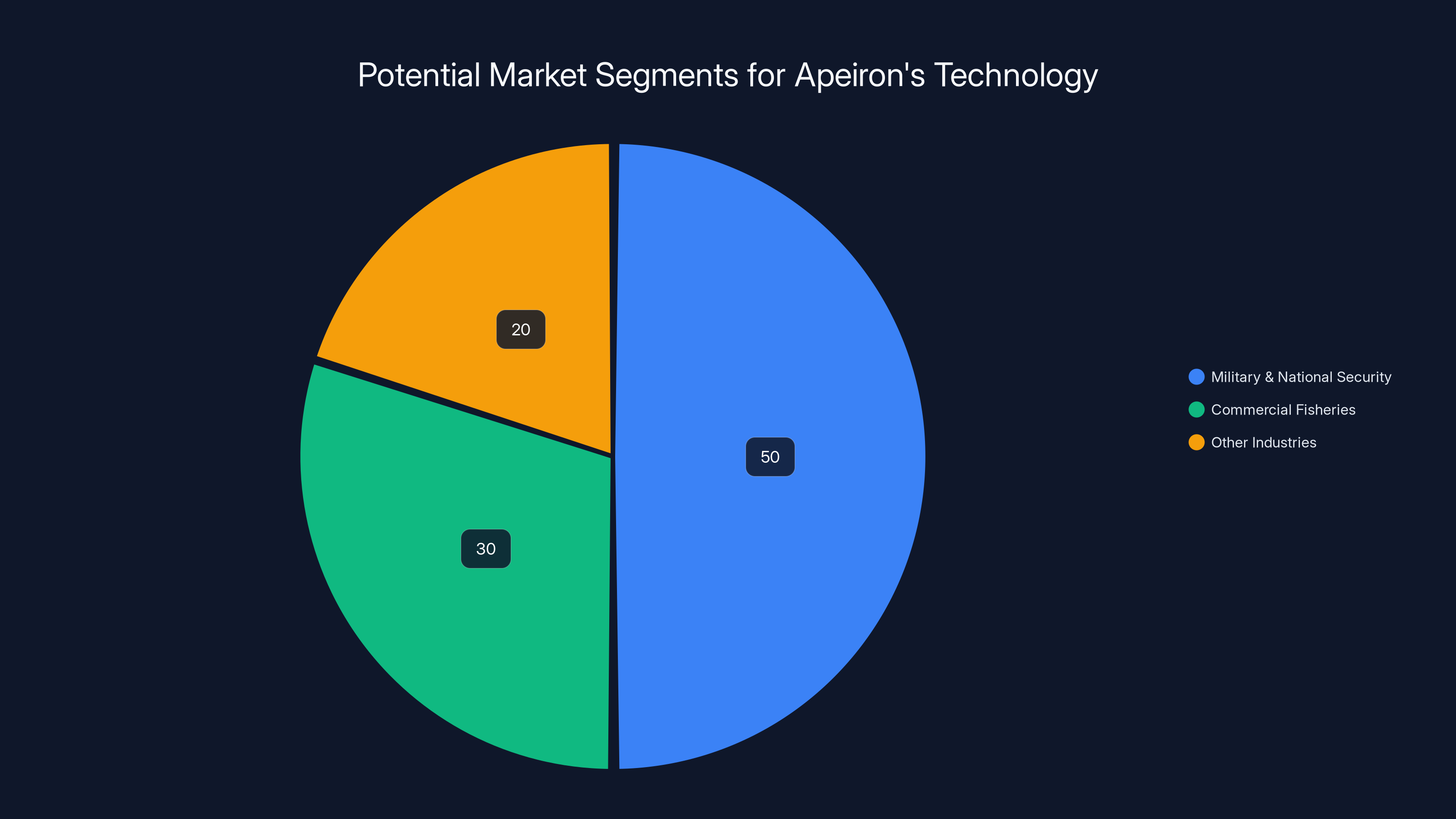

Real-World Use Cases: Who Actually Needs This Data?

The addressable market for Apeiron's technology spans multiple industries, each with different but equally compelling needs.

Military and National Security Applications

The U.S. Navy's interest in subsurface ocean monitoring isn't casual. Modern submarines are designed to be acoustically quiet, making them difficult to detect. However, submarines create disturbances in water temperature, salinity, and acoustic properties. A network of acoustic-sensing AUVs positioned strategically offshore could detect submarine presence without active sonar.

This has massive implications for coastal defense. Instead of deploying expensive surface ships or P-8 Poseidon patrol aircraft on constant watch, a persistent network of autonomous sensors watches 24/7. The economics become compelling quickly.

Apeiron's vehicles fit U.S. Navy launch equipment specifications, which suggests deliberate design for military deployment. Pappu mentioned both "civilian and defense customers" during the Series A announcement. Defensenutics (military applications) likely represent a significant revenue portion, even if they're rarely discussed publicly.

Commercial Fisheries

Fish move in response to water temperature and salinity. Tuna congregate where temperature gradients create feeding zones. Salmon migrate along specific thermal corridors. A commercial fishing fleet with access to real-time subsurface temperature and salinity data has a massive advantage over competitors relying on historical patterns or surface observations.

Currently, fishing fleets use various methods to locate fish: satellite data on sea surface temperature, acoustic surveys, and experience. But these are indirect proxies for where fish actually are. Real-time subsurface data is a game-changer.

Imagine a scenario where a fishing fleet deploys Apeiron vehicles along their traditional grounds. The fleet gets continuous data on water conditions. When the system detects a favorable temperature gradient where fish typically congregate, the fleet can redirect vessels in hours instead of days. Catch rates improve. Fuel costs drop. Profitability increases significantly.

For commercial fleets with annual budgets in the tens of millions, investing in an Apeiron array becomes an easy ROI calculation.

Climate and Oceanographic Research

Major research institutions want continuous, high-resolution ocean data. Understanding ocean circulation, tracking changes in water properties, monitoring the impact of climate change—all of this requires the kind of persistent monitoring that AUV networks enable.

Traditionally, research institutions have relied on a patchwork of monitoring approaches: fixed buoys (expensive, break frequently), research ships (episodic), and satellites (surface-only). Apeiron arrays fill critical gaps, allowing researchers to maintain stations continuously without ship support.

Institutions like Scripps Institution of Oceanography and the National Oceanic and Atmospheric Administration would be logical customers. Continuous data on ocean conditions directly informs climate models, weather prediction accuracy, and understanding of long-term environmental trends.

Offshore Wind and Renewable Energy

Offshore wind installations are sensitive to ocean currents and water conditions. Installation sites need detailed subsurface characterization before construction. Operating wind farms need real-time data on conditions that might damage installations or affect performance.

Traditional survey methods for wind farm sites involve expensive ship-based campaigns. An Apeiron array could provide continuous monitoring for a fraction of the cost. Companies developing offshore wind projects would benefit from the detailed environmental baseline that persistent monitoring provides.

Coastal Engineering and Port Management

Ports need to understand sediment movement, current patterns, and water properties. Dredging operations depend on knowing the full water column, not just surface observations. Harbor masters planning operations benefit from detailed subsurface data.

Apeiron's vehicles could be deployed to provide the data ports need without the cost and disruption of regular ship-based surveys.

Military and national security applications are estimated to constitute the largest market segment for Apeiron's technology, followed by commercial fisheries. Estimated data.

The Cube Sat Analogy: Why This Comparison Matters

Pappu's reference to Cube Sats is revealing. It shows how he thinks about Apeiron's role in the broader ecosystem.

Cube Sats are small, standardized satellites that revolutionized space. Instead of building massive, expensive satellites that cost hundreds of millions, teams can build Cube Sats for millions or tens of millions. Launch costs dropped as rockets learned to carry multiple small satellites. The proliferation of Cube Sats has transformed everything from communications to Earth observation.

Apeiron aspires to be the Cube Sat equivalent for ocean monitoring. Instead of few expensive research missions, many cheap autonomous missions. Instead of episodic data collection, persistent monitoring. Instead of concentrating expertise and equipment, distributing it.

The analogy works because both are about democratizing access to data. Before Cube Sats, satellite monitoring was the domain of government agencies and massive corporations. Now, universities and startups can afford satellite data. Similarly, before Apeiron, ocean monitoring was the domain of well-funded institutions. Soon, any organization needing subsurface ocean data will afford to deploy arrays.

This matters for innovation. When technology becomes accessible and affordable, people find unexpected uses. Cube Sats led to new Earth observation applications nobody anticipated. Apeiron's AUVs will likely do the same.

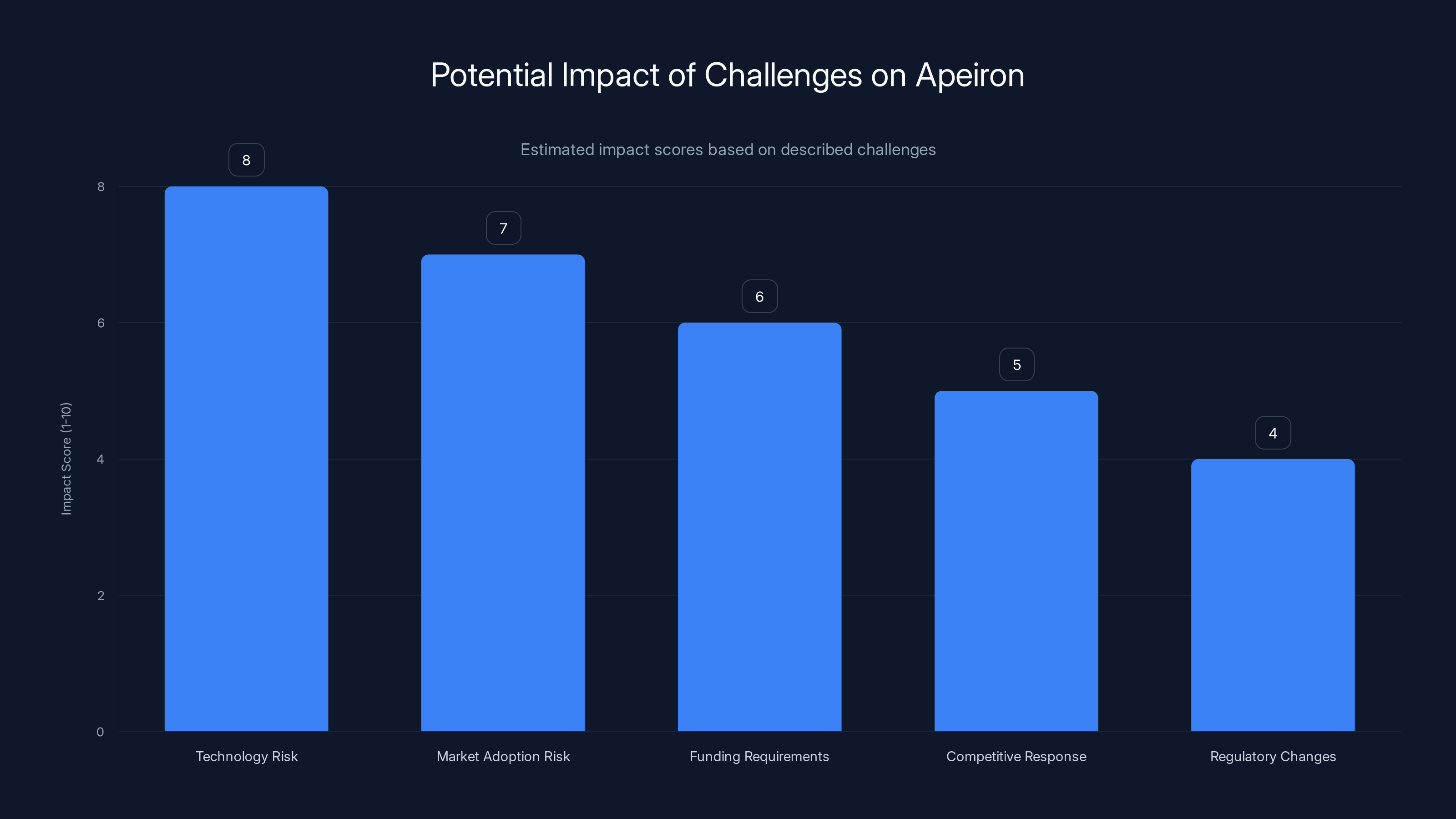

Technical Challenges: What's Harder Than It Sounds

The Apeiron pitch is elegant, but building it involves solving problems that aren't immediately obvious.

Acoustic Communication in a Hostile Medium

Water is a terrible medium for electromagnetic communication. Radio and Wi-Fi don't work underwater. Apeiron's vehicles use acoustic communication, which means using sound waves to transmit data.

Acoustic communication in the ocean is slow, unreliable, and limited by the acoustic environment. Sound propagates differently depending on water temperature, salinity, and depth. In shallow, turbulent coastal waters, acoustic signals reflect and refract unpredictably. In deep, stable water, signals can travel kilometers, but the data rate is slow—kilobits per second, not megabits per second.

Apeiron's system has to compensate for acoustic communication's limitations. The vehicles can't stream video back in real-time. They buffer data and transmit efficiently packaged summaries. The cloud system manages expectations, scheduling transmissions when conditions are optimal.

Power Management and Battery Life

An autonomous vehicle diving 400 meters and staying deployed for months needs reliable power. Batteries are the constraint.

Lithium-ion batteries power most AUVs, but even efficient vehicles burn through charge. A vehicle operating daily for a month might need to resurface for battery charges or recycling every few weeks. Solar charging systems for underwater vehicles exist but have limited efficiency at depth.

Apeiron has likely optimized power consumption ruthlessly. The vehicles are small and efficient by design. Sleep modes during standby periods. Predictive deployment reduces unnecessary diving. But power remains a limiting factor for deployment duration.

Biofouling and Environmental Durability

Biofouling—the accumulation of algae, barnacles, and marine life on submerged equipment—degrades sensor accuracy and increases drag. A vehicle that starts with accurate salinity sensors might have degraded readings after a month of deployment as growth accumulates.

Apeiron's vehicles need coatings and materials that resist biofouling. Copper-based anti-fouling systems work but add cost and environmental concerns. The vehicles need durable materials that withstand corrosive saltwater while remaining lightweight.

Data Redundancy and Loss Prevention

An autonomous vehicle operating independently for weeks with unreliable acoustic communication can lose data. A system crash, a communication failure, a lost transmission—any of these could mean wasted data collection.

Apeiron's system needs robust data management. Multiple transmission attempts. Data stored locally on the vehicle. Compression and redundancy coding to ensure critical information survives communication losses. These aren't exotic problems, but they require thoughtful engineering.

Market Size and Growth Potential

How big is the addressable market for autonomous ocean monitoring?

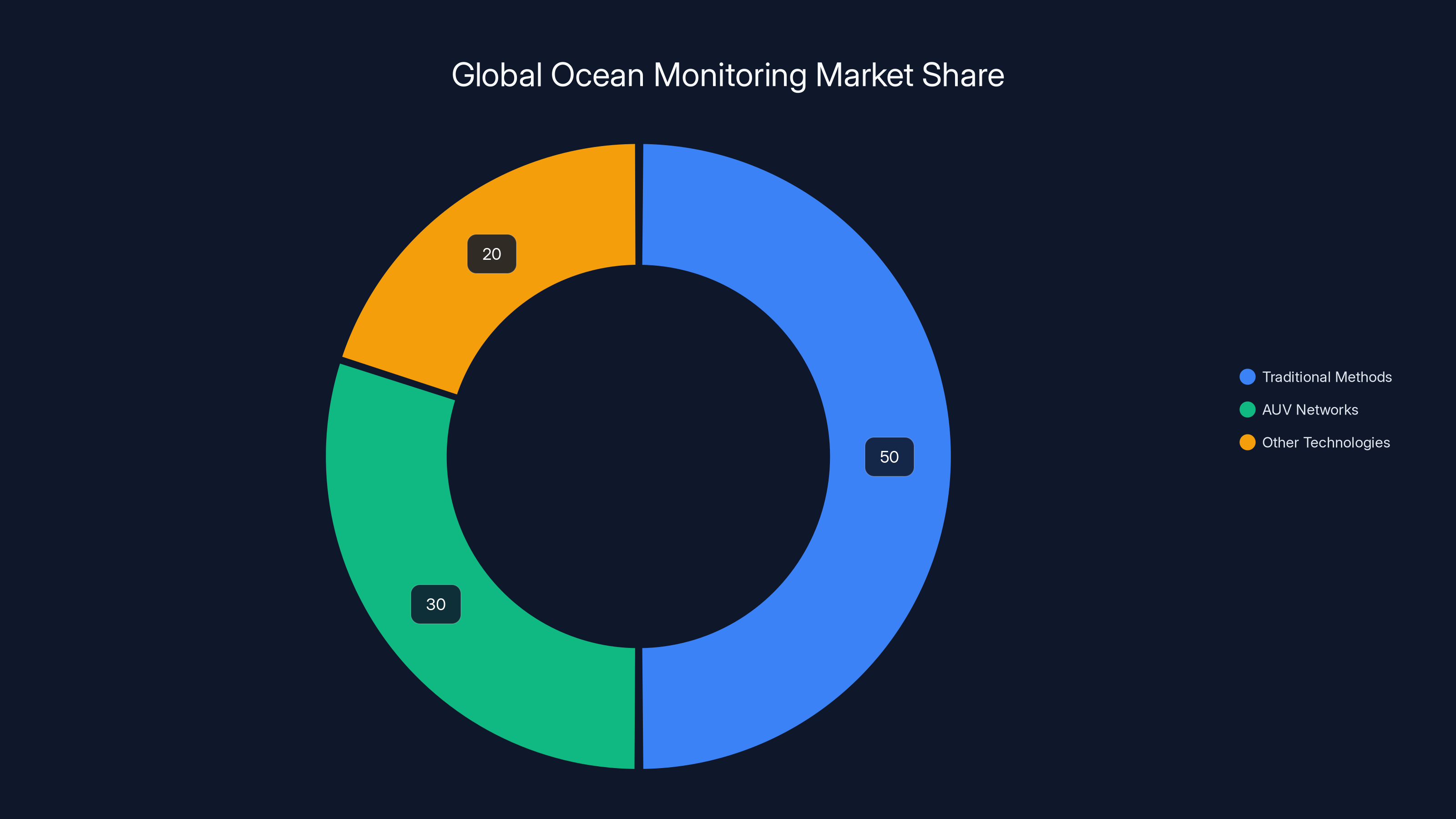

Global Ocean Monitoring Market

The global marine research equipment market is valued at roughly

Apeiron's approach is so much cheaper than traditional methods that it doesn't just capture market share—it expands the market. Activities that were economically unviable with ship-based monitoring become viable with AUV networks.

Comparable Markets and Scaling Paths

Look at drone markets for comparison. Commercial drone market has grown from near-zero in 2012 to $60+ billion in 2024. That growth happened because drones made aerial data collection affordable and accessible.

Ocean monitoring has similar dynamics. The total addressable market could be $20+ billion annually if Apeiron achieves 1,000-fold cost reductions. That's the scale of the opportunity.

Competition and Market Dynamics

Apeiron isn't alone in this space. Other companies are developing autonomous underwater vehicles. Companies like Ocean Science and HII Dynamics build ocean monitoring equipment. However, most focus on specialized applications or niche markets.

Apeiron's advantage is specifically designed, cost-optimized AUVs coupled with a cloud operating system that manages fleets and contextualizes data. The combination is difficult to replicate. A competitor would need to match both the hardware efficiency and software sophistication simultaneously.

AUV networks, like those developed by Apeiron, are estimated to capture 30% of the ocean monitoring market, reflecting a shift towards more cost-effective and scalable solutions. Estimated data.

The Funding Round and What It Signals

The $29 million Series A round reveals several things about Apeiron's trajectory and investor confidence.

Investor Composition Tells a Story

Dyne Ventures is an early-stage venture firm focused on deep science and climate tech. They invest in companies solving fundamental problems, not me-too products. Their lead position signals they see Apeiron as a foundational technology, not a niche play.

RA Capital brings significant credibility. They focus on healthcare and life sciences but have expanded into climate tech and deep technology. Their involvement suggests Apeiron has institutional-grade execution.

S2G Investments focuses specifically on sustainable agriculture and related industries. Their participation signals fisheries and aquaculture are identified as key markets. This is probably more than passive participation—they likely see pathways to deploying Apeiron technology in their portfolio companies.

Assembly, Bay Bridge, and TFX are strong tier-two investors with deep networks and operational experience.

Collectively, this isn't a roster of generalist VCs chasing hot trends. These are specialized investors who understand deep tech, climate, and strategic markets. They're not expecting 10x returns in three years. They're comfortable with longer timelines and technical complexity.

Valuation and Runway

The

At this capital level and assuming reasonable burn rates for a hardware startup, Apeiron has 3+ years of runway without needing additional funding. That's sufficient time to scale customer acquisition, optimize manufacturing, and approach profitability.

Manufacturing and Scaling Challenges

Hardware companies face scaling challenges that pure software companies don't. Apeiron needs to address several manufacturing and supply chain questions as it scales.

Component Sourcing

An AUV is essentially a specialized piece of embedded systems. It needs:

- A pressure-resistant hull (typically cast aluminum or composite)

- Embedded computing systems (boards, processors, memory)

- Sensors (temperature, salinity, acoustic)

- Batteries (lithium-ion cells)

- Communication systems (acoustic modems)

- Actuators (thrusters, buoyancy controllers)

Some components are commodity items available from multiple suppliers. Others are specialized, with limited sources. The acoustic modem market, for instance, is dominated by a handful of manufacturers. A supply chain disruption affecting acoustic modems could bottleneck AUV production.

Successful scaling requires either securing long-term component contracts or developing in-house capabilities for critical components.

Manufacturing Strategy

Apeiron could manufacture vehicles in-house or use contract manufacturers. In-house manufacturing provides quality control and intellectual property protection but requires significant capital investment. Contract manufacturers offer flexibility but create dependency relationships and IP risks.

For the initial scale-up (hundreds to thousands of units annually), contract manufacturing partnerships make sense. Established electronics manufacturers have experience producing specialized hardware and can scale rapidly. Apeiron likely focuses on design, assembly quality assurance, and cloud platform development while outsourcing production to partners.

Quality Control and Reliability

A vehicle deployed for months in harsh ocean conditions needs extraordinary reliability. Manufacturing quality directly impacts performance. A single defect could render a vehicle useless for its mission.

Apeiron's QA processes are probably as rigorous as aerospace manufacturing. Every vehicle likely undergoes pressure testing, sensor calibration verification, and acoustic communication validation before deployment. This adds to manufacturing costs but is non-negotiable for customer confidence.

The Role of Cloud Software and Data Intelligence

The hardware is only half the story. Apeiron's competitive advantage extends significantly into software.

Fleet Management and Optimization

The cloud platform needs to manage potentially hundreds or thousands of vehicles. This is a complex scheduling problem. Given weather conditions, battery levels, data-collection priorities, and equipment maintenance needs, which vehicles should dive now? Which should rest? Which need servicing?

Apeiron's platform uses optimization algorithms to maximize data collection while respecting vehicle constraints. This is similar to fleet management software used in robotics, but with ocean-specific constraints and requirements.

Machine Learning and Predictive Models

As vehicles collect data, machine learning models improve. The system learns correlations between subsurface conditions and surface observations. It learns seasonal patterns. It learns how to predict vehicle surfacing locations more accurately.

These improvements compound. Early deployments produce decent data. As the system learns, subsequent deployments produce increasingly valuable data. The platform becomes more intelligent with use.

Data Integration and Contextual Analysis

Apeiron vehicles alone produce useful data. Integrated with satellite data, historical records, and oceanographic models, the data becomes transformative.

The platform likely integrates with existing oceanographic databases, satellite data feeds, and weather models. This integration transforms raw AUV measurements into actionable intelligence. A fishery customer doesn't want raw salinity values—they want "optimal fishing locations based on current conditions." The platform provides that translation.

APIs and Third-Party Integration

Apeiron's future involves partnering with marine software providers, research institutions, and commercial customers. APIs exposing fleet data and analysis results enable broader ecosystem integration. A fisheries management software provider, for instance, could integrate Apeiron data feeds directly into their platform.

This API-first approach aligns Apeiron's model with modern SaaS conventions and creates network effects. More integrations increase platform value. Increased value attracts more customers and partners.

Apeiron's AUVs significantly reduce ocean monitoring costs from

Regulatory and Permitting Considerations

Deploying underwater equipment isn't like launching a drone. Various regulatory frameworks govern ocean use, environmental protection, and international waters.

U.S. Coastal Zone Regulations

In U.S. waters, the Army Corps of Engineers oversees certain aspects of coastal structures. Deploying AUV arrays might require permits under various coastal zone management regulations. Environmental assessments may be necessary to ensure vehicle deployment doesn't harm marine life.

These regulatory hurdles are manageable but add timeline and cost to deployments. Apeiron likely has environmental consultants on staff or on retainer to navigate permitting in different jurisdictions.

International Waters and Sovereignty

Ocean monitoring in international waters (beyond 200 nautical miles from shore) involves different legal frameworks. Various international treaties govern ocean use, though enforcement is weak. For defense applications, international deployment is more sensitive than for civilian applications.

Apeiron's defense customer base suggests they're aware of and managing these considerations. International deployments probably require inter-agency coordination.

Environmental Impact Assessments

Large-scale AUV deployments might trigger environmental impact concerns. Does deploying hundreds of autonomous vehicles affect marine life? Does the acoustic communication disrupt marine mammals? What's the battery recycling and disposal story?

Apeiron needs robust environmental impact data and management protocols. This probably includes independent environmental reviews and collaboration with marine conservation organizations.

Future Roadmap and Product Evolution

Where does Apeiron go from here? What's the multi-year vision?

Deeper Water Capabilities

Current Apeiron vehicles operate to 400 meters. Deep-ocean monitoring (1,000+ meters) requires different designs and significantly more engineering. Pressure increases exponentially with depth. Materials that work at 400 meters fail at 2,000 meters.

However, deep-water markets exist. Submarine detection, deep-ocean current monitoring, and research in deep-sea zones all need subsurface data. Apeiron will likely develop deeper-rated variants, though the cost will increase significantly.

Enhanced Sensor Suites

Current Apeiron vehicles measure temperature, salinity, and acoustics. Future versions might include:

- Optical sensors for water clarity and plankton detection

- Chemical sensors for dissolved oxygen, pH, and nutrient levels

- Biological sensors for detecting specific organisms or toxins

- Electromagnetic sensors for geological surveys

Each additional sensor adds cost and complexity. Apeiron will likely offer modular sensor packages, allowing customers to configure vehicles for their specific needs.

Improved Communication

Acoustic communication is slow and unreliable. Future vehicles might supplement acoustic communication with alternative methods:

- Satellite communication via buoys that vehicles tow to the surface

- RF over distance for near-shore applications

- Swarm communication where vehicles relay data through other vehicles in the array

Improving communication bandwidth would reduce latency in data delivery, enabling more responsive fleet management.

Autonomous Swarms and Cooperative Behavior

Current vehicles operate somewhat independently. Future vehicles might coordinate more tightly, with groups of vehicles working cooperatively to accomplish tasks. This swarm robotics approach could enable new capabilities: coordinated measurements across wider areas, redundant sampling for reliability, and dynamic array reconfiguration.

Swarm behavior requires significant software advances but would be transformative for ocean monitoring efficiency.

Broader Industry Impact and Implications

Apeiron's success has implications beyond the company itself. It signals a shift in how critical infrastructure and scientific inquiry work.

The Decentralization of Monitoring

Historically, critical monitoring required centralized expertise and expensive infrastructure. Getting ocean data meant requesting access to a research ship operated by a major institution. Getting atmospheric data meant relying on government meteorological agencies.

Autonomous systems democratize monitoring. Organizations can deploy arrays without institutional support. Data becomes distributed and accessible rather than centralized and gated. This shifts power and insight to downstream users.

Implication for Marine Policy and Management

Better ocean data enables better policy. Marine managers making decisions about fishing regulations, shipping routes, or environmental protection need good information. When that information was scarce and expensive, decisions were made with uncertainty. Abundant, inexpensive ocean data changes that calculus.

We should expect more data-driven marine policy. That's generally positive for sustainable ocean management, though it does create winners and losers. Commercial interests that relied on information asymmetries might find their advantages eroded when everyone has access to the same ocean data.

Implications for Climate Science

Ocean monitoring is central to understanding climate change. Oceans absorb vast quantities of heat and carbon dioxide. Understanding how that process works, and how it's changing, is critical to climate science.

Apeiron's persistent, high-resolution monitoring enables better climate models. Scientists can understand ocean circulation changes, temperature trends, and carbon cycle dynamics with much greater precision. Over time, this should improve climate prediction accuracy and our ability to detect and respond to climate changes.

Implications for Military and National Security

Advanced naval powers are expanding underwater surveillance capabilities. Autonomous vehicles represent a cost-effective approach to persistent coastal monitoring. Nations that deploy advanced AUV networks gain significant intelligence advantages.

This probably accelerates a broader trend toward autonomous systems in military applications. If unmanned underwater vehicles are effective and affordable, militaries will invest in them. This has strategic implications for naval power balance and potentially raises arms control concerns.

Technology risk poses the highest potential impact on Apeiron's success, followed by market adoption challenges. Estimated data based on narrative.

The Investment Thesis and Why This Matters Now

Apeiron's timing is interesting. Why is ocean monitoring receiving venture capital attention now?

Climate Change Urgency

Climate change makes ocean monitoring more important. Understanding how oceans are changing is essential for climate response. Investment in climate tech has accelerated dramatically in recent years, and ocean monitoring is increasingly seen as critical infrastructure for climate adaptation.

Drone and Robotics Maturity

Apeiron benefits from decades of drone and robotics development. Miniaturized sensors, embedded computing, battery technology, and autonomous systems have all matured in other contexts. Apeiron applies proven technologies to ocean problems.

Economic Incentives Alignment

Commercial interests in ocean data have grown. Fisheries, offshore energy companies, and logistics firms all benefit from better ocean information. This creates revenue opportunities that pure research funding doesn't provide. Apeiron can build a sustainable business, not just a grant-dependent research program.

Geopolitical Competition

U.S. defense interests in persistent ocean monitoring create demand. This isn't new, but it's increasingly recognized as a capability gap. Autonomy offers a solution that expensive ship-based monitoring doesn't. Investment in companies like Apeiron aligns with broader strategic interests in maintaining technological advantage.

Comparing Apeiron to Traditional and Alternative Approaches

Understanding Apeiron's advantages requires understanding what came before and what alternatives exist.

Research Ships: The Status Quo

Cost: $100,000/day Data collection: Episodic, once per month or quarter Coverage: Single location or limited area Data resolution: Good vertical resolution from a few locations Real-time capability: Delayed by days or weeks

Research ships are the traditional approach. They produce high-quality data but are expensive and slow.

Fixed Buoys: The Current Supplement

Cost:

Fixed buoys provide continuous data but only at fixed locations. They're useful where you know exactly where you need monitoring. They're problematic for large-area monitoring or exploring new regions.

Satellite Remote Sensing: The Surface-Only Approach

Cost: Amortized across many users, effectively cheap Data collection: Continuous global coverage Coverage: Global Data resolution: Surface-only, can't measure subsurface properties Real-time capability: Yes, continuous

Satellites excel at surface monitoring but are fundamentally limited to what you can see from space. Subsurface ocean properties are invisible to satellites.

Apeiron AUVs: The New Approach

Cost:

Apeiron combines advantages of multiple approaches: continuous collection like buoys, spatial coverage like ship-based surveys, and cost-effectiveness beyond traditional approaches.

Why Apeiron Wins

The key advantage is the combination of cost, resolution, and coverage. No existing approach provides all three simultaneously:

- Research ships: High cost, small coverage

- Buoys: Low coverage, fixed locations

- Satellites: Surface-only

- Apeiron AUVs: Good cost, good coverage, subsurface measurement

The closest competitor would be advanced buoy networks, but buoys cost

Key Financial Metrics and Growth Expectations

Assuming Apeiron's Series A round values the company at $100+ million (not unusual for well-funded deep tech startups), what growth trajectory might we expect?

Unit Economics

Assuming an Apeiron AUV costs $20,000 to build and sell, and a 3-year contract with an average customer involves deploying 20 vehicles:

- Revenue per customer: 200,000 SaaS over 3 years = $600,000

- Gross margin: Roughly 60-70% (hardware at 50% margin, SaaS at 85%+)

- Customer acquisition cost: 100,000 (sales, marketing, integration)

- Payback period: 12-18 months

These unit economics support reasonable growth. A customer acquisition cost of

Revenue Projections

Year 1 (2026): Likely

These are estimates, but they suggest Apeiron could reach meaningful scale within 3-4 years. At $50M revenue with 70% gross margin, the company becomes genuinely profitable and valuable.

Exit Scenarios

Several potential exit paths exist for Apeiron:

Acquisition by large marine/defense contractors: Companies like Huntington Ingalls Industries or Lockheed Martin might acquire Apeiron for its autonomous vehicle and cloud platform technology.

Acquisition by marine research institutions or governments: NOAA or research universities might acquire Apeiron to operationalize ocean monitoring.

IPO: If Apeiron reaches substantial revenue and profitability, IPO becomes viable. A software + hardware company with

Remain independent: If Apeiron builds a sustainable business with recurring SaaS revenue, the founders might choose to remain independent and profitable rather than pursue acquisition.

Apeiron's projected revenue growth suggests a significant increase from

Challenges and Potential Headwinds

Apeiron faces real challenges that could slow growth or impact success.

Technology Risk

Acoustic communication is finicky. Salt water is hostile. Extended underwater deployment is hard. If Apeiron vehicles experience reliability issues at scale, customer confidence erodes. A fleet of vehicles with 80% uptime is unusable. Customers need 95%+ reliability.

Massive scaling of production could introduce quality control issues. A manufacturing defect affecting a percentage of units could be devastating if vehicles fail in the field.

Market Adoption Risk

Many potential customers still rely on traditional methods. Shifting to autonomous vehicles requires trust, training, and integration with existing workflows. Adoption might be slower than projections. Customers might require extensive pilots before committing.

Funding and Capital Requirements

Hardware companies burn capital. Manufacturing, inventory, and customer support are expensive. Apeiron's $40M+ in funding is substantial, but scaling production to serve a meaningful market might require additional funding. If capital markets tighten, follow-on rounds could be difficult.

Competitive Response

Larger companies with existing ocean monitoring or defense capabilities might respond to Apeiron's success. A company like Ocean Science with established relationships could accelerate competitive products. A defense contractor might acquire competitors to bundle capabilities. Apeiron's window to establish market leadership before facing serious competition is limited.

Regulatory Changes

Increased regulation around autonomous vehicles, ocean deployment, or environmental impact could increase costs or slow deployments. Apeiron's ability to navigate regulatory environments will be critical.

The Sustainability and Environmental Angle

Apeiron positions itself as part of the climate tech and sustainable ocean monitoring space. There's legitimate environmental reasoning here, though also business incentives.

Environmental Benefits of Autonomous Monitoring

Traditional research ships consume massive fuel quantities. A 3-week expedition might burn 100,000+ gallons of fuel. That's carbon emissions, particulate pollution, and ecosystem disruption from shipping activities.

Apeiron vehicles, once deployed, require minimal ongoing fuel. They operate on battery power, which can potentially be charged renewably. Replacing ship-based monitoring with autonomous vehicles reduces the environmental footprint of ocean science.

This is genuine, though the environmental benefit requires proper battery recycling and end-of-life management. If Apeiron vehicles end up as e-waste in the ocean, the environmental calculus becomes negative.

Monitoring as Environmental Protection

Better ocean data enables better environmental protection. Understanding fish populations, tracking pollution, monitoring marine ecosystem health—all of this becomes possible with persistent monitoring. Apeiron's technology supports evidence-based ocean conservation.

Fisheries that use Apeiron data can fish more sustainably. They understand fish populations and can adjust harvest rates accordingly. Climate scientists using Apeiron data improve understanding of ocean changes. Environmental managers protecting marine ecosystems benefit from detailed environmental monitoring.

The Business-Sustainability Alignment

Apeiron's business interests and environmental interests align reasonably well. The company benefits from being positioned as enabling environmental protection and climate science. Customers often have sustainability mandates themselves. This alignment attracts capital, talent, and customers.

Where Underwater Robotics Are Heading

Apeiron is part of a broader robotics and autonomy trend. Understanding that context clarifies where Apeiron fits and where the industry is heading.

The Autonomy Revolution

Autonomous systems are spreading across industries. Drones are standard in agriculture, infrastructure inspection, and delivery. Autonomous vehicles are in testing for terrestrial transportation. Apeiron extends this trend to ocean environments.

The common thread is cost reduction and capability expansion. Autonomy enables previously impossible applications because it removes the most expensive component—human operators.

Sensor Proliferation

Sensor costs have dropped 10-100x over the past decade. Miniaturized sensors for temperature, pressure, chemical analysis, and imaging are commodity items. This enables distributed sensing approaches like Apeiron's. You can deploy 100 cheap sensors where you previously deployed 1 expensive sensor.

Edge Computing and Distributed Intelligence

Apeiron vehicles process data locally before transmission. This reduces communication bandwidth requirements. Future systems will process more data at the edge, with cloud systems providing coordination and long-term analysis.

This trend extends beyond Apeiron. Edge computing is becoming standard across IoT, robotics, and autonomous systems.

Swarm Robotics and Coordination

Managing hundreds or thousands of autonomous vehicles requires sophisticated coordination algorithms. Apeiron's current system manages fleets, but future systems will enable true swarm behavior where vehicles coordinate tightly and adapt dynamically.

Research in swarm robotics is advancing rapidly. Applications are expanding beyond military drones to include environmental monitoring, disaster response, and exploration.

What We Don't Know (Yet)

Apeiron's announcement raises questions that don't have public answers.

Actual Production Capacity

How many vehicles can Apeiron manufacture annually? Is the company already at capacity, or is there runway for production expansion? This determines how quickly they can serve customers and grow revenue.

Customer Base and Revenue

How many customers does Apeiron have? What's current annual revenue? The company hasn't disclosed these figures. Investors and partners likely know, but public information is limited. Profitability timeline depends on answers to these questions.

Vehicle Reliability in Field Conditions

Theory and practice diverge. Do Apeiron vehicles actually achieve their design specifications in real ocean conditions? Early deployments show promise, but extensive operational data would reveal weaknesses. How are customers actually using these systems? What failure modes are emerging?

Competitive Positioning

How is Apeiron's technology differentiated versus competitors? There's likely significant proprietary innovation in the cloud platform, algorithms, and manufacturing processes. Details of these advantages aren't public.

International and Military Deployments

Apeiron explicitly mentioned defense customers. How significant is the defense revenue? Are vehicles being deployed internationally? What strategic implications does this have? Military applications are typically confidential, so details won't be public.

Lessons for the Broader Climate Tech and Defense Innovation Space

Apeiron's success offers lessons applicable to other hardware startups and deep tech companies.

The Importance of Problem Selection

Apeiron solved a genuinely important, expensive problem. Ocean monitoring is genuinely difficult and expensive with current methods. A cheaper solution has obvious value. This differs from startups solving problems nobody really has. Starting with a real problem drives customer demand.

The Value of Distributed Solutions

Apeiron didn't try to build a bigger, better research ship. Instead, it distributed the problem. Dozens of cheap autonomous vehicles beat one expensive ship for most use cases. This distributing pattern appears across successful companies: Amazon distributed retail through many small warehouses, Tesla distributed energy through many small batteries.

Hardware + Software Integration

Apeiron's vehicles alone are useful but limited. The cloud operating system transforms them into a platform. Successful hardware companies increasingly combine physical products with software platforms. The software captures defensibility and recurring revenue.

Strategic Investor Alignment

Apeiron's investors aren't passive capital providers. S2G Investments brings fisheries expertise. Dyne Ventures brings deep science connections. Strategic investors accelerate growth beyond what capital alone provides.

Conclusion: Why Apeiron Matters

Apeiron Labs represents more than just another hardware startup. It's a signal that fundamental scientific problems—problems that seemed intractable—can be solved through technological innovation and distributed approaches.

The ocean has been the frontier we haven't conquered not because it's impossible, but because the tools were wrong. Apeiron offers better tools. Deploy enough of them, and suddenly you have the persistent, high-resolution ocean monitoring that's been impossible for decades.

The $29 million Series A funding validates this opportunity. The investor roster—Dyne Ventures, RA Capital, S2G Investments—suggests this is serious capital from serious investors who understand deep technology and climate markets.

Where does this lead? If Apeiron executes, ocean monitoring becomes a solved problem. Research institutions can study ocean conditions with unprecedented detail. Fisheries can operate more sustainably with real-time data. Defense agencies can maintain persistent awareness of strategic ocean regions. Climate scientists understand ocean circulation and temperature trends with precision that improves climate models.

The ripple effects extend further. Better ocean data informs policy. Sustainable fisheries become possible. Climate science becomes more reliable. International competition for ocean monitoring capabilities intensifies. The strategic balance in underwater domains shifts.

None of this is guaranteed. Hardware is hard. Scale is hard. Customers might not adopt as quickly as projections suggest. Competitors might catch up faster than expected.

But if Apeiron succeeds—if they hit the 1,000-fold cost reduction and deploy fleets across the globe—they'll have fundamentally transformed how we observe and understand the planet. And they'll have validated a model where expensive, episodic scientific monitoring gets replaced by cheap, continuous autonomous monitoring.

That's not just a business opportunity. That's a shift in how science and decision-making work at scale.

FAQ

What are autonomous underwater vehicles (AUVs) and how do they work?

Autonomous underwater vehicles are unmanned submarines that operate independently without cables or remote control. Apeiron's AUVs dive to 400 meters, collect data on temperature, salinity, and acoustics, then return to the surface and transmit data via acoustic communication to a cloud-based operating system. The vehicles use embedded computing to navigate, manage power, and optimize data collection without human intervention.

Why is subsurface ocean data so difficult and expensive to collect traditionally?

Traditional ocean monitoring relies on research ships that cost approximately

How does Apeiron reduce ocean monitoring costs by 100-fold?

Apeiron achieves cost reduction through several mechanisms. First, AUVs are deployed once and operate autonomously for months, eliminating daily operational costs of research ships. Second, a fleet of dozens of vehicles provides continuous, distributed monitoring instead of episodic measurements. Third, manufacturing at scale reduces per-unit costs. The combined effect reduces cost per measurement from

What specific data do Apeiron vehicles collect and why does it matter?

Apeiron vehicles measure three key parameters: water temperature, salinity, and acoustic signatures. Temperature affects ocean circulation and marine life distribution. Salinity drives water density gradients that influence deep-ocean currents. Acoustic data reveals submarine presence and marine animal activity. Together, these measurements provide crucial context for climate science, fisheries management, and military applications.

Who are the primary customers for Apeiron's technology?

Apeiron serves multiple markets: defense agencies interested in coastal monitoring and submarine detection; commercial fisheries wanting real-time temperature and salinity data to optimize catch locations; research institutions studying climate change and ocean dynamics; offshore wind farm developers needing subsurface characterization; and port authorities managing coastal operations. The company explicitly mentioned both civilian and defense customers.

How does Apeiron's cloud operating system add value beyond the vehicles themselves?

The cloud platform orchestrates fleet deployment, predicts vehicle surfacing locations using ocean models, incorporates new measurements to refine predictive models, contextualizes raw sensor data into actionable intelligence, and manages power and maintenance schedules. Machine learning improvements compound as the system collects more data. APIs enable integration with third-party marine software, creating ecosystem value that extends beyond Apeiron's direct products.

What technical challenges does Apeiron face in scaling production?

Apeiron must overcome acoustic communication limitations in challenging water conditions, manage battery life for extended deployments, address biofouling that degrades sensor accuracy, ensure reliability sufficient for months-long independent operation, and navigate manufacturing scalability for specialized components like acoustic modems and pressure-resistant hulls. Quality control is critical because a single defect renders an expensive vehicle unusable.

What does the $29 million Series A funding signal about Apeiron's prospects?

The funding round led by climate-focused investors like Dyne Ventures, specialized investors like RA Capital, and agriculture-focused investors like S2G Investments suggests confidence in long-term market potential. The investor composition indicates Apeiron is viewed as foundational infrastructure rather than a niche product. The capital level provides 3+ years of runway to scale manufacturing and customer acquisition without requiring immediate profitability.

How does Apeiron's approach compare to alternative ocean monitoring methods?

Research ships provide high-quality but episodic data at very high cost. Fixed buoys provide continuous data but only at specific locations. Satellites provide global coverage but only surface-level data. Apeiron AUVs combine advantages: distributed spatial coverage like ships, continuous collection like buoys, and subsurface measurement capability that satellites lack. The combination of cost, coverage, and data resolution makes Apeiron's approach superior for most ocean monitoring applications.

What are the regulatory and permitting challenges for large-scale AUV deployments?

Deploying underwater equipment in U.S. coastal waters requires navigation through Army Corps of Engineers permitting, coastal zone management regulations, and environmental impact assessments. International deployments involve complex maritime law and sovereignty considerations. Environmental concerns about acoustic communication disturbing marine mammals and battery disposal require proactive management. Apeiron likely has environmental consultants managing these regulatory pathways.

What's the broader strategic significance of Apeiron's success for ocean science and climate monitoring?

Apeiron represents democratization of ocean monitoring. When ocean data becomes abundant and cheap, scientific understanding improves, policy decisions improve, and environmental protection becomes evidence-based rather than guesswork-based. This shifts the power balance from centralized research institutions to distributed users. It accelerates climate science by improving ocean data availability. It enables sustainable fisheries through real-time stock monitoring. The strategic implications extend to national security, as persistent ocean monitoring becomes a critical capability.

Key Takeaways

- Apeiron's autonomous underwater vehicles reduce ocean monitoring costs by 100-fold compared to research ships (280K per measurement down to500)

- Distributed AUV fleets provide continuous subsurface data across multiple locations simultaneously, impossible with traditional episodic ship-based surveys

- The $29M Series A from climate and deep tech investors signals major confidence in persistent, autonomous ocean monitoring as critical infrastructure

- Addressable market spans defense (submarine detection), fisheries (stock tracking), climate research (ocean dynamics), and offshore energy (subsurface conditions)

- Competing with traditional research ships, fixed buoys, and satellite monitoring, Apeiron uniquely combines low cost, spatial coverage, and subsurface measurement capability

Related Articles

- Ocean Robots in Category 5 Hurricanes: Oshen's Breakthrough [2025]

- Inside Moltbook: The AI-Only Social Network Where Reality Blurs [2025]

- Humans Infiltrating AI Bot Networks: The Moltbook Saga [2025]

- OpenClaw AI Agent: Complete Guide to the Trending Tool [2025]

- HomeBoost Energy Audit App: Cut Utility Bills Smart [2025]

- Tesla is No Longer an EV Company: Elon Musk's Pivot to Robotics [2025]

![Apeiron Labs Autonomous Underwater Robots: Ocean Data Revolution [2025]](https://tryrunable.com/blog/apeiron-labs-autonomous-underwater-robots-ocean-data-revolut/image-1-1770216010655.jpg)