Tesla's Strategic Pivot: From EVs to Autonomous Machines

For nearly two decades, Tesla defined itself through electric vehicles. The company that made EVs cool, profitable, and genuinely desirable. But something fundamental shifted recently, and it's not what most people expected.

Elon Musk just announced that Tesla is effectively abandoning its traditional EV lineup. The Model S and Model X, two of Tesla's original flagship vehicles that helped establish the company's credibility in the premium market, are being discontinued. Not updated. Not refreshed. Killed off entirely.

The reason? Making space for robots.

This isn't a minor product adjustment or a temporary pause. This is Tesla making a public statement: the company that put electric vehicles on the global map no longer sees vehicle manufacturing as its primary business. The real money, the real impact, the real future lies in humanoid robotics and autonomous systems.

That's seismic. And it tells you everything about where the technology industry thinks the next trillion dollars will be made.

When a company kills its bestselling products, you pay attention. When that company is Tesla, and the products being killed have defined an entire industry category, you listen even harder.

The Problem With Tesla's EV Business Model

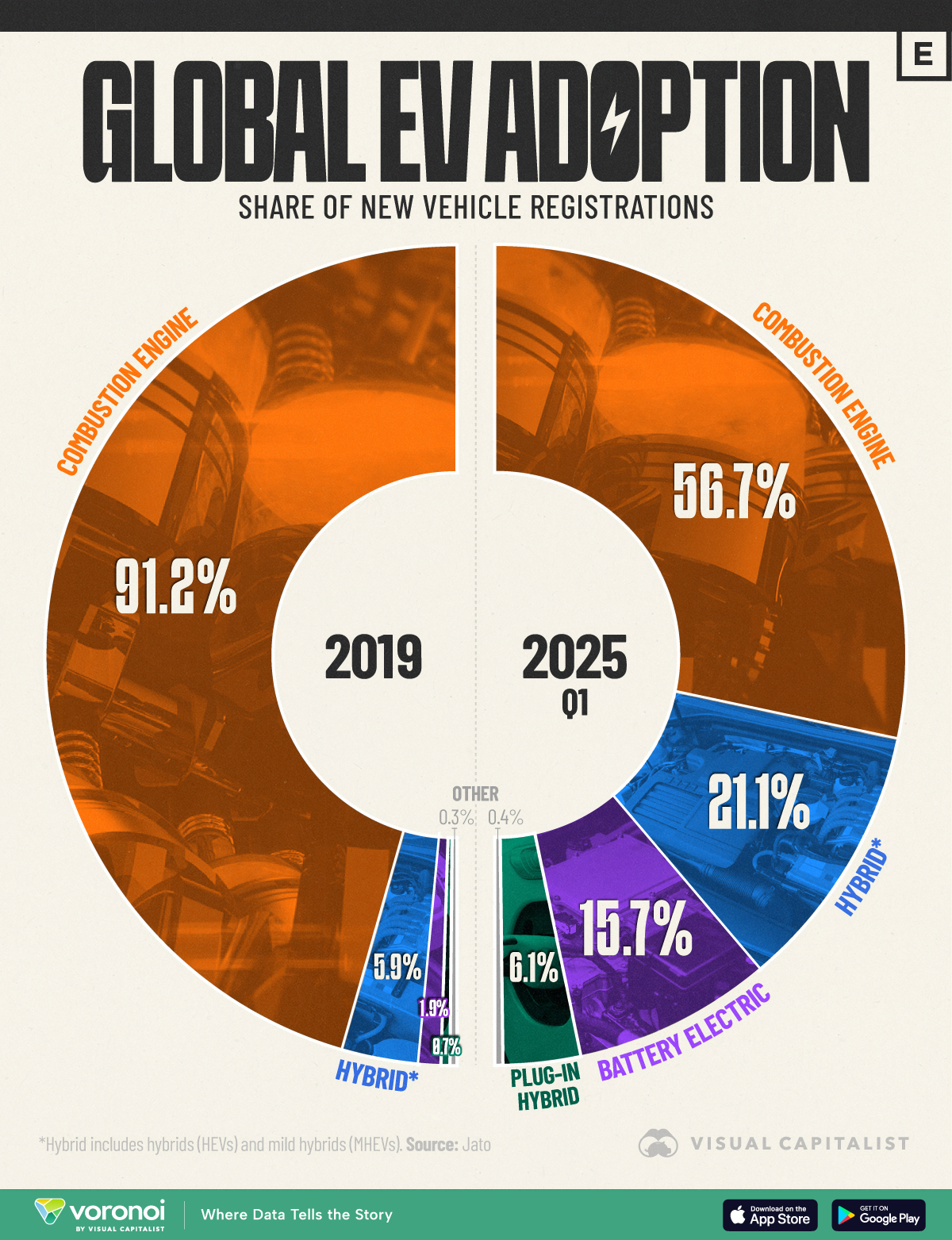

Here's the thing people don't talk about openly: the electric vehicle market is becoming commoditized. Fast.

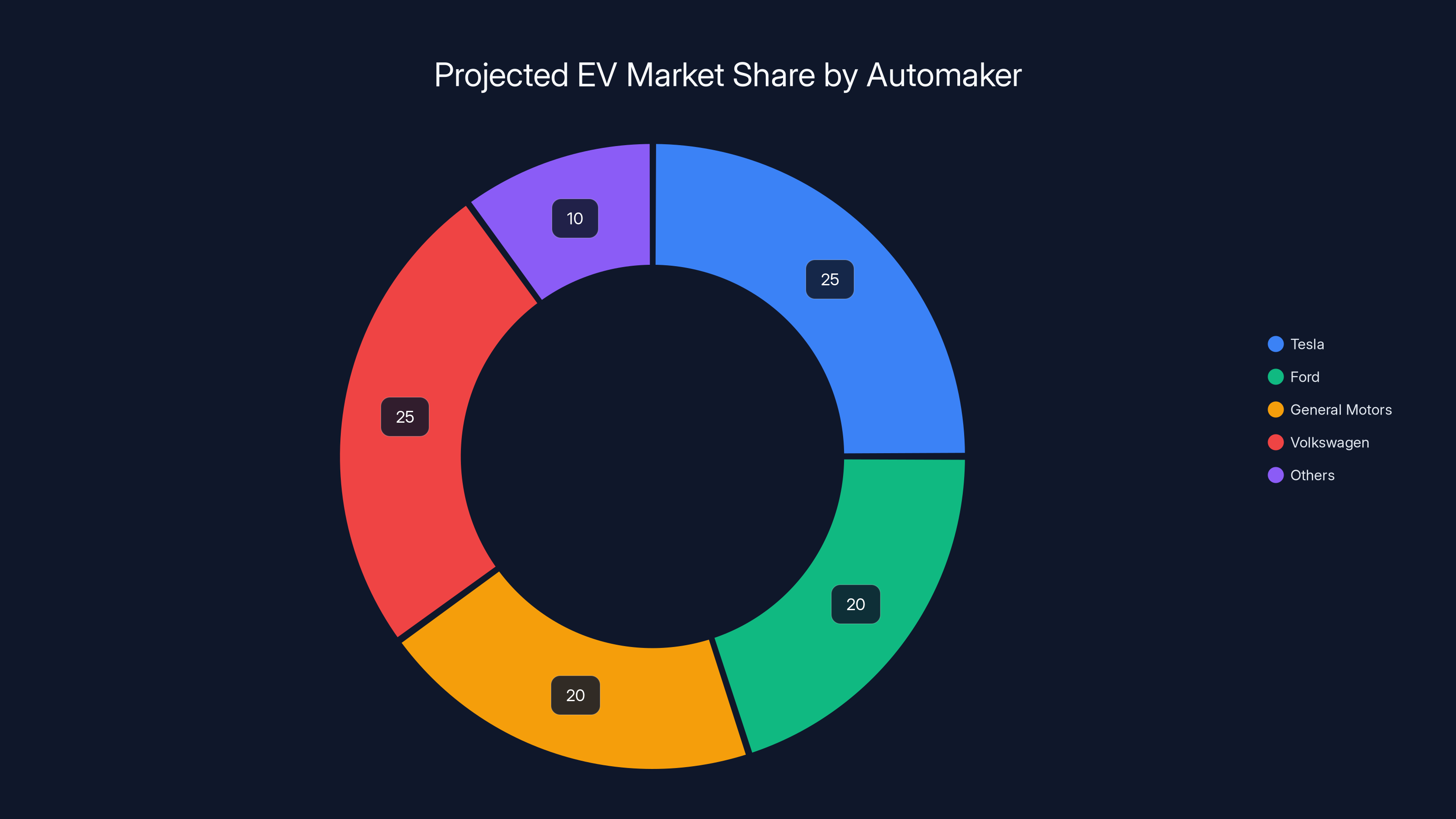

When Tesla launched the Model S in 2012, they had virtually no competition. Now? Every major automaker has an EV strategy. Mercedes has the EQS. Porsche has the Taycan. BMW has the i7. Audi has the e-tron GT. Even traditional manufacturers like Volkswagen, General Motors, and Ford are deploying capital at scale to build competitive electric vehicles.

The EV market is growing, sure. But margins are compressing. Competition is intense. Manufacturing scale matters more than innovation advantage anymore. It's becoming a game where the biggest player with the most efficient factory wins, not the company with the best technology.

Tesla's original competitive moat was technology superiority: better batteries, better motors, better software. Now? Nearly every major automaker has access to comparable battery technology. Software capabilities are converging. The differentiation that made Tesla special—the reason people paid premiums for a Model S—is eroding.

Meanwhile, the Model S and Model X have been Tesla's lowest-volume products for years. The Model 3 and Model Y dominate Tesla's sales mix. The flagship models, once the company's flagship statement about what was possible with electric powertrains, have become niche luxury products competing directly against established players in a market where Tesla no longer has a natural advantage.

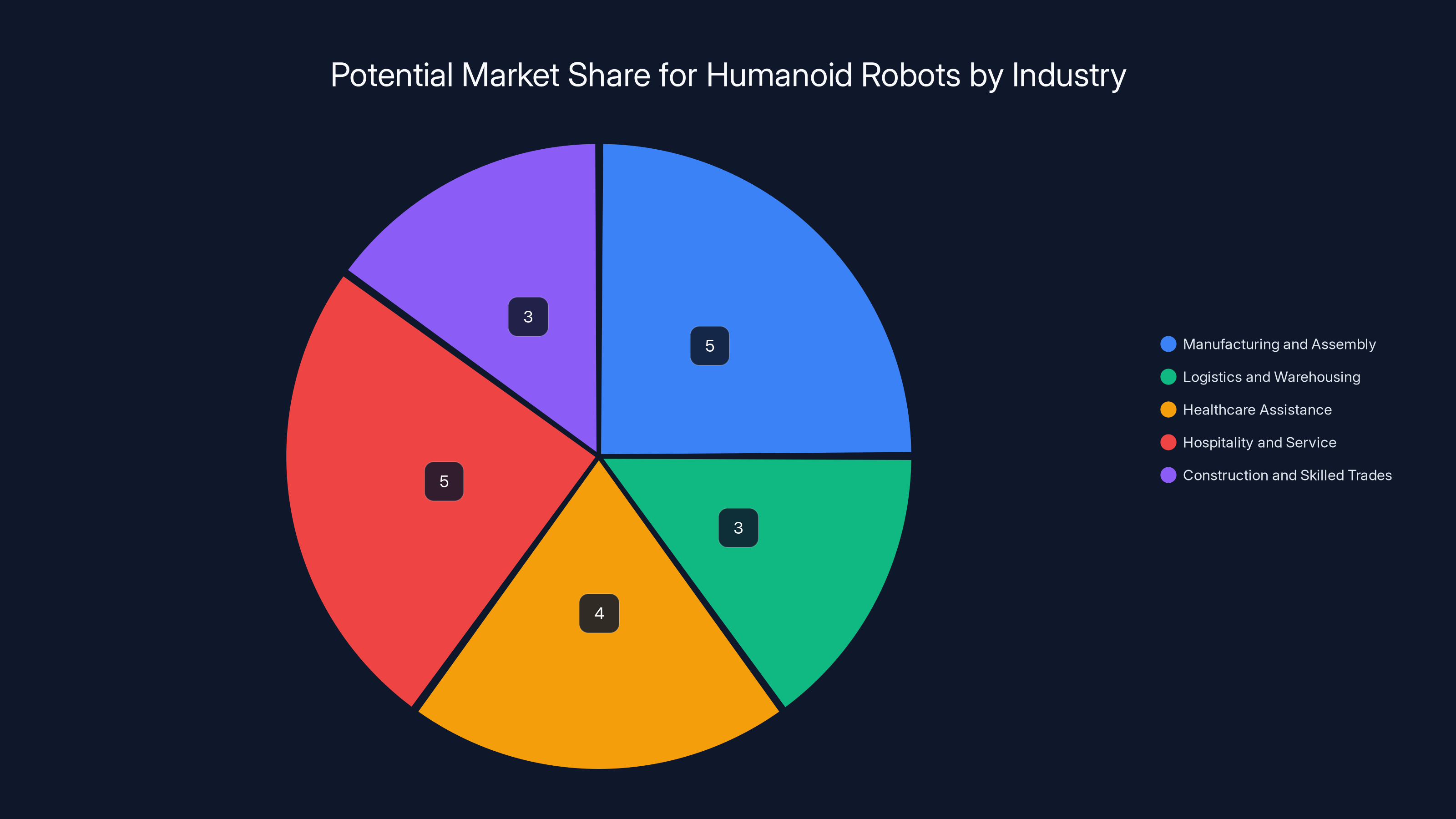

The potential market for humanoid robots could reach over $20 trillion, with significant opportunities in manufacturing, healthcare, and hospitality. (Estimated data)

Why Humanoid Robots Are the Bigger Prize

Let's do some basic math on the market opportunity.

Globally, the automotive industry generates roughly $2 trillion in annual revenue. It's massive, established, and competitive. Growth rates hover in the low single digits. Margins are under pressure. Capital intensity is brutal.

Now consider the global labor market. There are roughly 3.5 billion people in the worldwide workforce. Automation—particularly humanoid robots that can perform tasks currently requiring human labor—could theoretically address a market opportunity that dwarfs automotive.

Consider just a few categories where human labor currently dominates:

Manufacturing and assembly: Factories worldwide employ tens of millions. Humanoid robots that can perform precision assembly work currently done by human hands would instantly create a multi-trillion-dollar replacement opportunity.

Logistics and warehousing: The global logistics industry employs roughly 8 million people in the US alone. Robots that can pick, pack, sort, and transport goods could eliminate the need for a significant portion of that workforce.

Healthcare assistance: Aging populations in developed nations are driving massive demand for care workers. Humanoid robots that could assist elderly patients, perform basic care tasks, and provide companionship represent an enormous addressable market.

Hospitality and service: Hotels, restaurants, and retail establishments employ hundreds of millions globally. A humanoid robot that can take orders, deliver food, clean spaces, and interact with customers has utility across an enormous range of businesses.

Construction and skilled trades: Labor shortages in construction are acute. Humanoid robots that could perform dangerous or repetitive tasks on job sites would be instantly valuable.

The addressable market for humanoid robots isn't

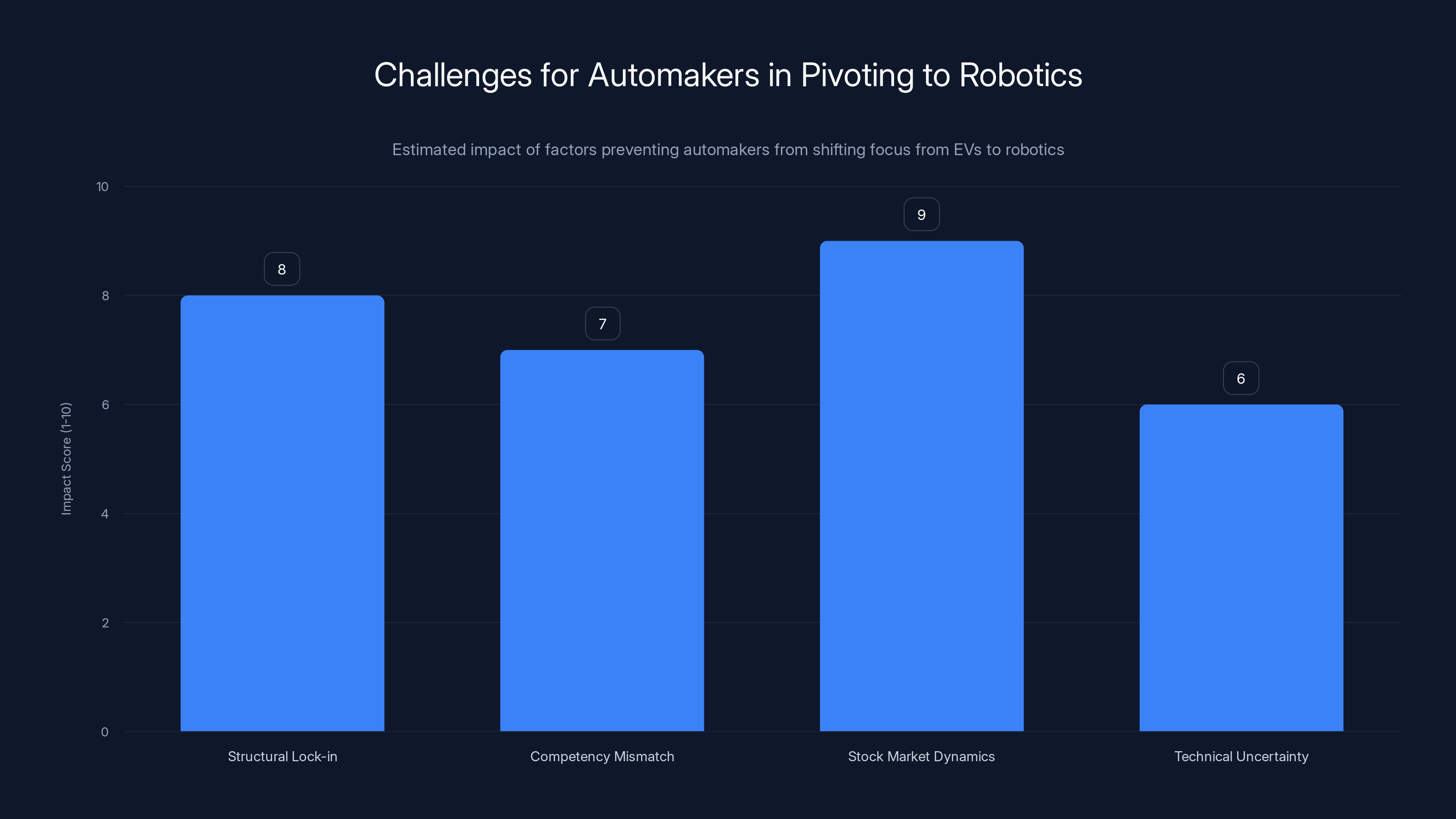

Estimated data shows stock market dynamics as the most significant barrier for automakers considering a pivot to robotics, followed closely by structural lock-in and competency mismatch.

What Killed the Model S and Model X?

The official narrative from Tesla is that discontinuing these models frees up manufacturing capacity. That's technically true. It's also incomplete.

The real story: Tesla's Berlin and Austin factories were supposed to revolutionize vehicle manufacturing with radical cost reduction through vertical integration and automated production. Instead, they've been problematic. The Berlin factory has struggled with ramping production. The Austin facility has faced challenges hitting efficiency targets.

Meanwhile, the Model S and Model X require complex body designs and manufacturing processes. They're not simple to build. The Model 3 and Model Y have simpler architectures, higher production volume, and better unit economics.

Removing the Model S and Model X from the production roadmap does several things simultaneously:

-

Simplifies manufacturing complexity: Fewer SKUs means lower complexity in factory operations. This improves efficiency metrics across the board.

-

Redirects capital toward robotics facilities: Factory space, equipment, and engineering talent previously allocated to legacy products can migrate toward robotics research and manufacturing.

-

Makes a psychological statement: This move signals to investors, engineers, and competitors that Tesla has moved on. The EV era, for Tesla at least, is over.

-

Buys time for autonomous systems: Rather than compete in a commoditizing EV market, Tesla can focus on autonomous driving capabilities—technology that will matter far more when humanoid robots are actually deployed at scale.

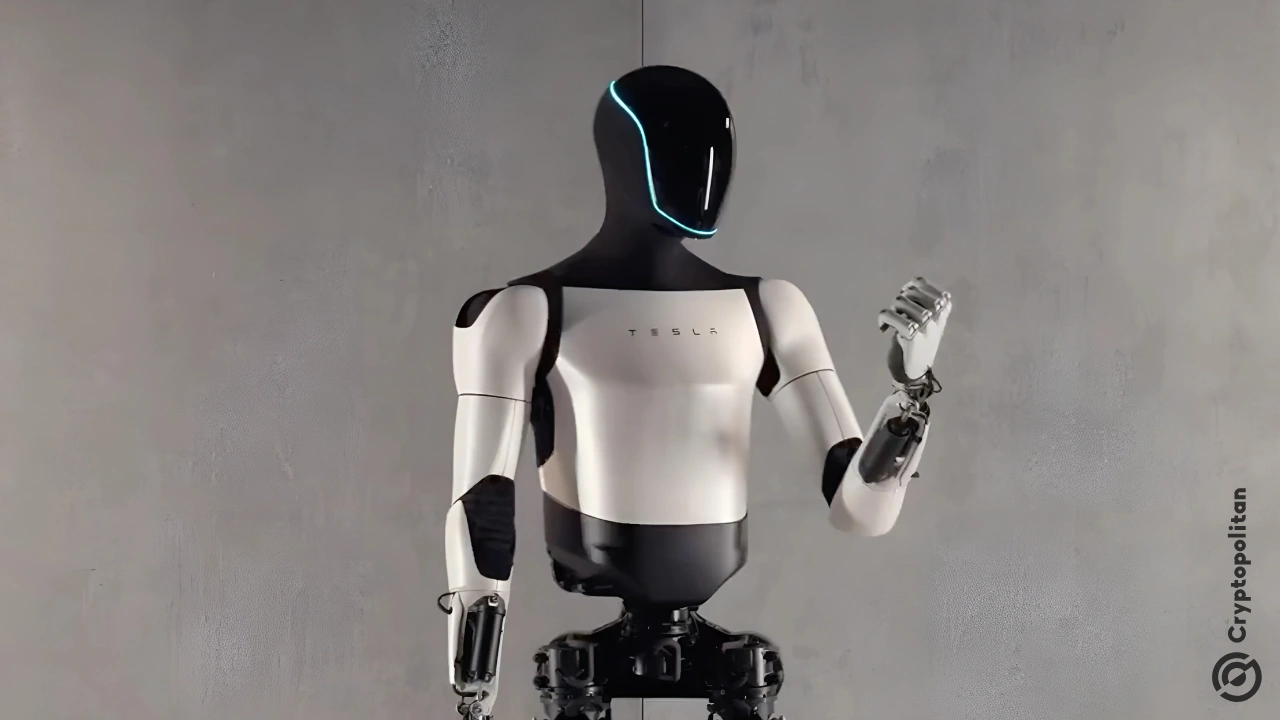

The Tesla Bot and Optimus Program

Tesla's humanoid robot project, branded as Optimus, represents the company's most audacious bet since the original Model S launch.

Unlike specialized robots designed for specific tasks (like manufacturing arms), Optimus is meant to be general-purpose. It should theoretically be able to perform a wide range of tasks across different contexts. Pick up an object. Place it in another location. Respond to voice commands. Adapt to novel environments.

This is exponentially harder than building specialized robots. The robotics industry has known how to build task-specific machines for decades. Getting humanoid robots to work across diverse tasks requires solving problems in computer vision, natural language processing, motion planning, and real-world object manipulation that remain genuinely difficult.

Tesla's strategy appears to be leveraging its existing AI capabilities—developed initially for autonomous driving—and redirecting them toward robotics. The computer vision systems that helped Tesla build autopilot are being adapted to let robots understand physical environments. The neural networks that process driver input are being repurposed to let robots understand human instructions.

This is actually clever. Tesla has spent over a decade building AI infrastructure at massive scale. That's not wasted effort if you're building robots. It's actually a significant head start.

Estimated data shows Tesla, Ford, GM, and Volkswagen each holding significant portions of the EV market, with Tesla focusing on robotics for future growth.

The Autonomous Driving Connection

Many people see Tesla's autonomous driving efforts as separate from robotics. They're not. They're intimately connected.

Why? Because the fundamental capability underlying autonomous driving—understanding complex real-world environments and making decisions in real-time—is identical to what humanoid robots need.

A car using Full Self-Driving capability must:

- Perceive its environment: Process camera feeds, radar data, ultrasonic sensors, and lidar information in real-time.

- Understand context: Recognize that a sign means "stop," that a red traffic light requires waiting, that a pedestrian stepping into the street changes the appropriate action.

- Make predictions: Anticipate what other vehicles, cyclists, and pedestrians will do next.

- Execute motor control: Convert high-level decisions ("accelerate," "turn left," "brake") into precise motor inputs.

A humanoid robot must do essentially the same things:

- Perceive its environment: Understand physical spaces, object locations, and what's happening around them.

- Understand context: Recognize that a human said "pick up that object," that reaching for something requires moving in a specific way, that obstacles in the path require planning.

- Make predictions: Anticipate how humans will react, how objects will move when manipulated, how surfaces will respond to applied force.

- Execute motor control: Convert high-level instructions into precise motor movements across dozens of joints.

The underlying AI stack is remarkably similar. Tesla's years of investment in autonomous driving aren't wasted when pivoting to robotics. They're foundational.

Why Other Automakers Haven't Done This

You might wonder: if robotics is so obviously the bigger prize, why haven't other automakers abandoned EVs and pivoted to robots?

Several reasons:

Structural lock-in: Traditional automakers have massive manufacturing infrastructure optimized for vehicle production. Telling a CEO that Tesla is abandoning cars for robots is a very different conversation when your company is already committed to a $100 billion EV transition. The sunk cost fallacy is powerful.

Competency mismatch: Building cars is fundamentally different from building robots. General Motors, Ford, and Volkswagen are brilliant at manufacturing at scale, supply chain optimization, and dealer networks. None of that helps when building humanoid robots. They'd be starting from zero in a domain where Tesla actually has a head start.

Stock market dynamics: Traditional automakers are not companies that shock the market with radical pivots. Their shareholders expect execution within defined strategies. Announcing that Ford is abandoning EVs to pursue humanoid robots would tank the stock instantly. Tesla gets away with radical strategy shifts because investors fundamentally expect radical strategy shifts from Musk.

Technical uncertainty: Humanoid robotics is genuinely hard. It might not work at scale. It might take 20 years instead of 5. Traditional automakers are in the business of shipping products. They can't afford to make huge bets on technologies that might not pan out.

Tesla, freed from the constraints that bind traditional automakers, can afford the technical risk because the upside is enormous.

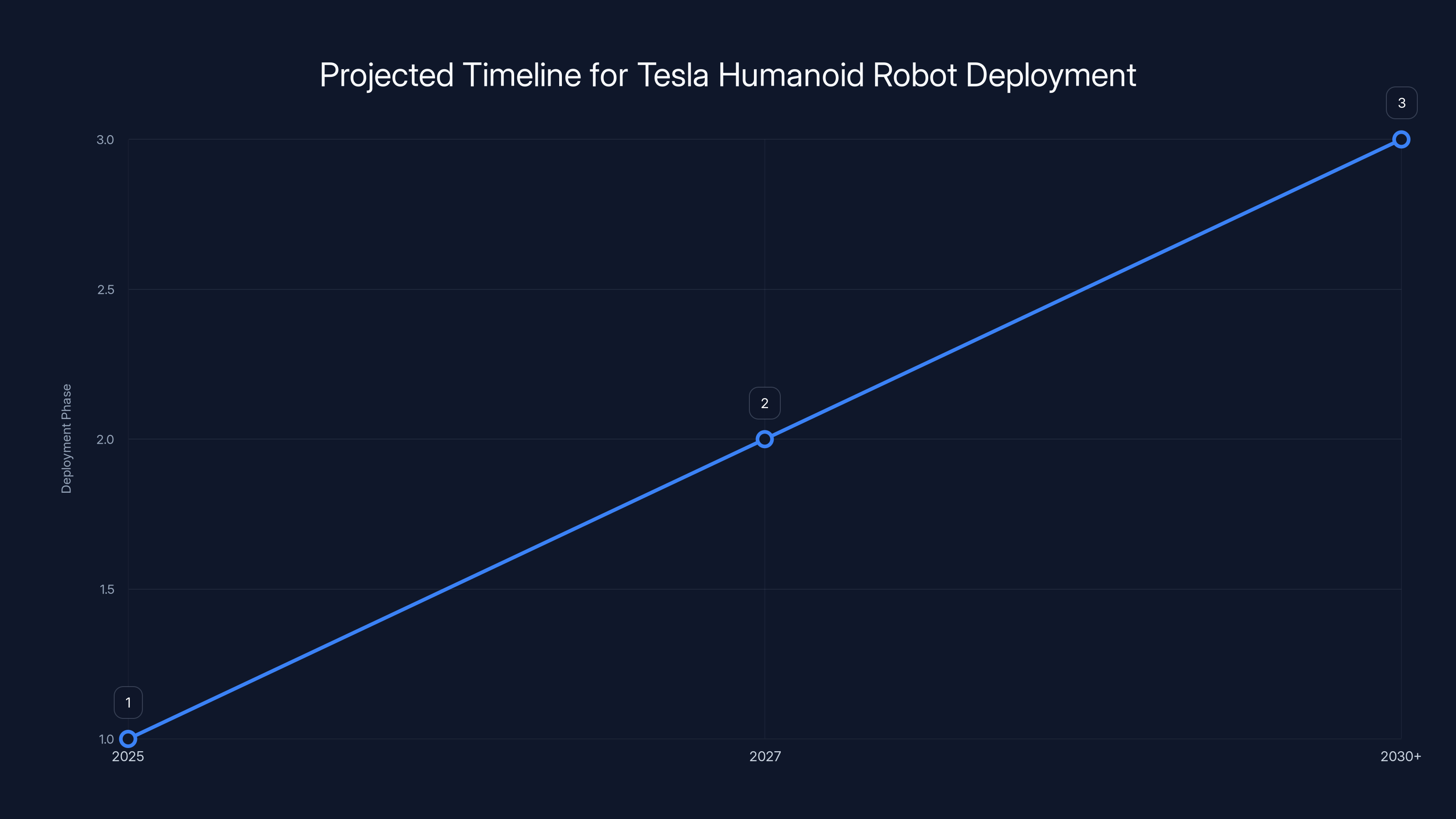

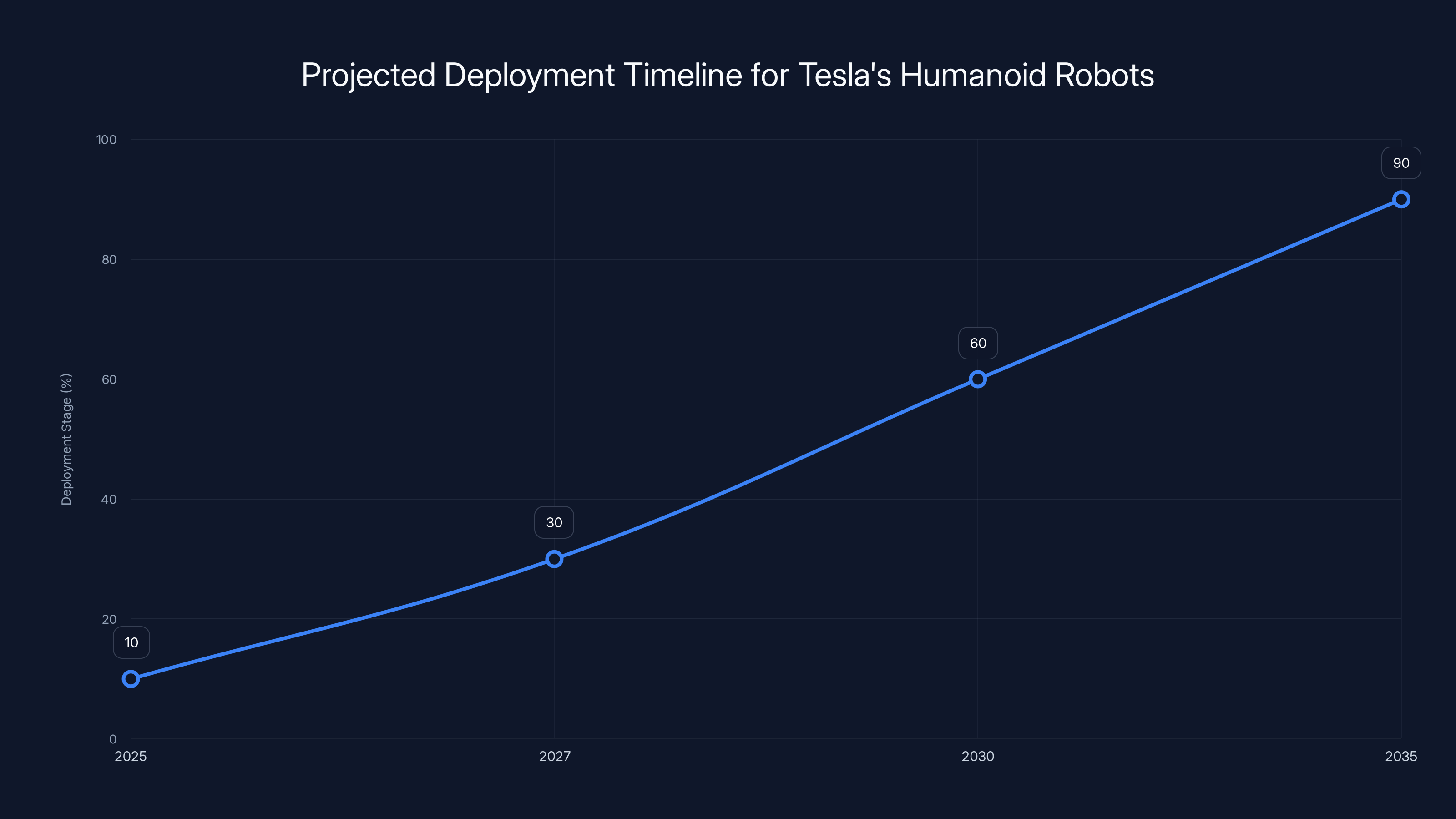

Tesla's humanoid robots are expected to start limited deployment in 2025, with broader applications by 2030+. Estimated data based on current projections.

The Manufacturing Angle

Here's something important: Tesla's Berlin and Austin factories represent a radical manufacturing philosophy.

Traditional factories separate design iterations by months or years. You design something, commit to tooling, build thousands of units, then iterate. This made sense when changing a production line cost millions and took months.

Tesla's newer factories were designed with continuous change in mind. The idea being that you could iterate production processes in weeks or days, not months. You could experiment with new approaches, measure the impact, and scale what works.

This philosophy is actually better suited for robotics manufacturing than vehicle manufacturing.

Why? Because robots are essentially computers with appendages. The core AI software updates continuously. Hardware components can be revised and improved rapidly. Manufacturing processes can evolve based on learnings from deployed robots.

Traditional vehicle manufacturing requires heavy tooling and long production runs because the physics of vehicle assembly haven't fundamentally changed in a century. Stamping metal, welding bodies, assembling components—these are understood sciences.

Robot manufacturing is still in the innovation phase. Being able to pivot manufacturing approaches quickly, learn from deployed units, and iterate hardware based on real-world feedback is a massive advantage.

Tesla's Berlin and Austin factories—optimized for manufacturing philosophy rather than traditional processes—actually become more valuable assets when repurposed toward robotics than they were for building Model S or Model X vehicles.

The Timeline Question

One legitimate question: when does this actually happen?

Musk has a reputation for optimistic timelines. He said Teslas would be fully autonomous "next year" for roughly seven consecutive years. That context matters when evaluating claims about when Optimus will be deployed at meaningful scale.

But even accounting for Musk's historical optimism, the timeline seems concrete on two fronts:

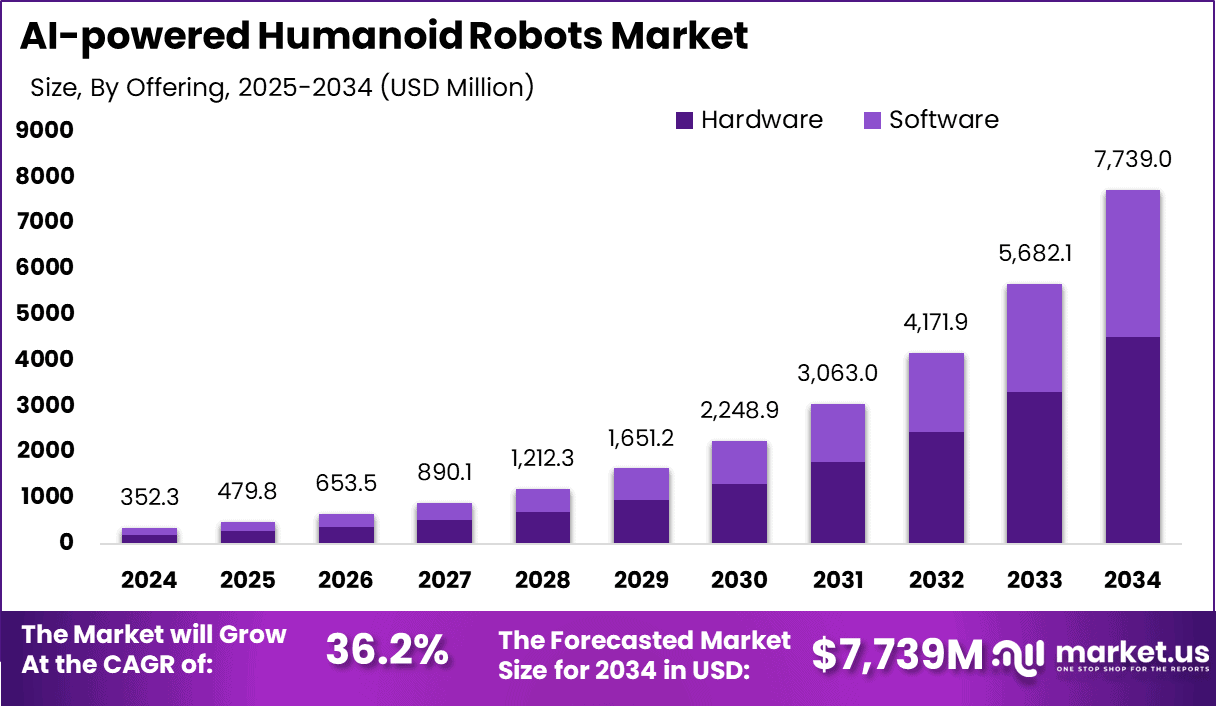

Near-term (2025-2027): Expect to see proto humanoid robots deployed in Tesla factories, performing tasks currently done by humans. Initial applications will be structured environments—factory floors—where controlling variables is easier. These won't be general-purpose robots. They'll be specialized for specific manufacturing tasks.

Medium-term (2027-2030): Robots deployed in semi-structured environments like warehouses, logistics facilities, and hospitality settings. As capabilities improve and costs decline, early adopters in labor-intensive industries will begin purchasing or leasing robots.

Long-term (2030+): General-purpose humanoid robots available for broader market applications. This is speculative, but the theoretical endpoint is robots capable of handling diverse tasks across different environments.

The key metric to watch isn't Musk's timeline predictions. It's unit shipments and deployment rates. When robots move from prototypes and press releases to actual shipments to actual customers, the strategic shift becomes real rather than theoretical.

Estimated data shows a gradual increase in deployment, starting with factory-specific robots in 2025, expanding to semi-structured environments by 2027, and reaching broader applications by 2030 and beyond.

Implications for the Automotive Industry

Let's be clear about what this means:

Tesla's pivot doesn't signal an immediate crisis for traditional automakers. The EV market is still growing. Customers still want electric vehicles. Ford, General Motors, Volkswagen, and others will continue selling millions of EVs for the foreseeable future.

But it does signal a shift in where the truly transformative opportunities lie. And it reveals something important about how Tesla thinks about competition and the future.

Traditional automakers are optimizing for EV market share. Tesla has moved on. It's betting the next $50 billion on robotics rather than squeezing another 5% market share from the EV market.

That's not arrogance, though it might look like that from the outside. It's a mathematical bet. If humanoid robots work, if they achieve meaningful cost reductions and capability improvements, if they actually displace human labor across industries—then competing for EV market share looks like competing for deck chairs on a ship that's being eclipsed.

From Tesla's perspective, why invest another $30 billion trying to beat Volkswagen's EV manufacturing efficiency when the real opportunity is building the robots that will eventually make traditional vehicle manufacturing obsolete?

Investment and Capital Allocation

This pivot is already evident in how Tesla allocates capital.

Rather than announcing mega-factories in new geographies—the play that would make sense if EVs remained the long-term strategy—Tesla is investing heavily in AI infrastructure. The Austin facility is being optimized for robotics development. Engineering talent is being redirected toward humanoid robot development rather than new EV platforms.

If you were an investor and you believed Tesla's story, you'd adjust how you value the company. Traditional automaker valuations are based primarily on vehicle volume and margin assumptions. Tesla's valuation increasingly depends on robotics deployments and AI capabilities—metrics that are far harder to predict but potentially much larger if things work out.

This explains why Tesla's stock has remained resilient despite increased competition in EVs. The market is increasingly pricing in the robot bet, not the car business.

What Comes Next for the Model S and Model X

There's a possibility—perhaps even a probability—that the Model S and Model X aren't dead forever. They might be revived years from now, either by Tesla under different circumstances or by other manufacturers.

But for now, killing the flagship models accomplishes something important: it forces the organization to commit. No ambiguity. No "we'll continue supporting both approaches." The company is all-in on the pivot.

When organizations say they're pivoting but continue funding their old business lines, they rarely succeed at the pivot. Splitting resources leads to both suffering. By actually discontinuing the Model S and Model X, Tesla is signaling to its organization, its investors, and its competitors: we've made the choice. Everything else is about execution.

This is what separates companies that genuinely transform from companies that talk about transformation. Transformation requires sacrifice. Tesla is sacrificing iconic products that defined the company's early success.

The Broader Technology Pivot

Tesla's shift from EVs to robots isn't happening in isolation. It's part of a broader technology industry pivot toward artificial intelligence and autonomous systems.

Companies across sectors are recognizing that the next wave of value creation doesn't come from optimizing existing products. It comes from automating away entire categories of human work.

Not every company is equipped to make that pivot. But the ones that can—companies with AI expertise, manufacturing capabilities, capital reserves, and engineering talent—will pursue it aggressively.

Tesla happens to have all four in abundance. The company that made electric vehicles credible is now betting everything on machines that can think.

Whether that bet works is still genuinely uncertain. Humanoid robotics is harder than autonomous vehicles. Harder than EVs. Harder than most problems the company has tackled so far.

But the willingness to make the bet, to kill successful products, to redirect resources entirely—that's the behavior of a company that understands where the future value actually lies.

The Competitive Landscape Shifts

Assuming Tesla's robotics transition succeeds—and that's a big assumption—it creates an interesting competitive situation.

Traditional automakers would face a choice: continue optimizing EV manufacturing, or attempt to build robotics capabilities from scratch. Neither option is particularly attractive. Competing on EVs against Tesla's remaining EV products (Model 3, Model Y) means going head-to-head against a company with established scale, supply chain expertise, and brand power.

Pivoting to robotics means entering a completely different market where Tesla has a head start but where success isn't guaranteed.

Some automakers might partner with robotics companies or AI firms rather than building in-house. Others might focus on vehicle manufacturing efficiency and let others handle robotics.

But the competitive game has fundamentally changed. It's no longer just about making better, cheaper, more efficient electric vehicles. It's about positioning for a future where humanoid robots are major contributors to economic productivity.

Lessons in Strategic Clarity

Tesla's move teaches something important about strategy at scale.

Most organizations try to be incrementally better at everything they currently do. Tesla occasionally asks a more fundamental question: should we even be doing this?

Killing the Model S and Model X was not a minor adjustment. These weren't failing products. The Model S still has a cult following. Demand is stable. But they represented the future that Tesla's leadership believes is behind us.

That clarity—the willingness to abandon successful products because they believe they've correctly identified the future—is rare. Most executives are too risk-averse, too invested in existing business models, too worried about next quarter's numbers.

Tesla's shift suggests a long-term perspective that assumes robots and automation will reshape every industry fundamentally. Everything else is optimizing the furniture on a ship being rebuilt from the hull up.

Whether that perspective is correct will become clear over the next decade. But the strategy itself—however bold or reckless it might seem—is strategically coherent. Nothing about Tesla's pivot is contradictory. Everything points in the same direction: the EV era was the warm-up. The real game is robots and AI.

The Humanoid Robot Future

If Tesla's strategy works out, the next 20 years look dramatically different from the past 20.

The past 20 years were about electrifying transportation. Cars, trucks, buses—everything on wheels—shifted from internal combustion to electric motors. It was massive, but it was fundamentally a substitution play: electric engines instead of fossil fuels.

The next 20 years, if Tesla is right, will be about automation of human labor. Not just in factories, but everywhere. Humanoid robots handling logistics, healthcare, hospitality, construction, manufacturing, and tasks we haven't even imagined yet.

That's not a substitution play. That's a transformation play. The implications—economic, social, political—are enormous.

Tesla is betting the company that it understands what that future looks like and that it can help build it. By killing the Model S and Model X, the company is literally putting its money where its mouth is.

TL; DR

- Tesla discontinued the Model S and Model X to shift manufacturing focus away from traditional EVs toward humanoid robotics development

- The EV market is commoditizing with new competitors from every major automaker reducing Tesla's technology advantage and margin potential

- Humanoid robots represent a vastly larger addressable market than electric vehicles, potentially worth $20+ trillion across all labor-intensive industries

- Tesla's autonomous driving AI infrastructure translates directly to humanoid robot development, making this pivot strategically coherent

- The strategy signals a long-term bet on automation and AI rather than continued competition in the increasingly crowded EV market

FAQ

Why would Tesla kill successful products like the Model S and Model X?

Tesla's leadership believes the future of value creation lies in humanoid robotics, not electric vehicles. The Model S and Model X, while profitable, are increasingly commoditized as competitors like Porsche, Mercedes, and BMW offer comparable EVs. By discontinuing these models, Tesla frees up manufacturing capacity, simplifies production complexity, and signals organizational commitment to the robotics pivot. The move is fundamentally about redirecting resources from a maturing market toward an emerging opportunity with potentially much larger long-term value.

How does autonomous driving relate to humanoid robotics?

The underlying AI capabilities required for autonomous vehicles—perceiving complex environments, understanding context, making real-time decisions, and executing motor control—are nearly identical to what humanoid robots need. Tesla's over a decade of investment in Full Self-Driving AI infrastructure, computer vision systems, and neural networks for decision-making transfer directly to robotics development. The autonomous driving effort wasn't wasted on a different path; it was foundational R&D for the robot transition.

When will Tesla humanoid robots actually be deployed at scale?

Near-term deployments (2025-2027) will likely be limited to Tesla's own factories, handling specific manufacturing tasks in controlled environments. Medium-term (2027-2030), we may see robots in semi-structured environments like warehouses and logistics facilities. Genuine general-purpose deployment across diverse industries is probably a 2030+ scenario. These timelines should be treated cautiously given Musk's historical pattern of optimistic predictions, but the trajectory appears concrete based on capital allocation and organizational priorities.

What does this mean for other automakers competing with Tesla?

Traditional automakers face a difficult choice. They can continue optimizing electric vehicle manufacturing, competing against Tesla's remaining models (Model 3, Model Y) and emerging Chinese competitors like BYD. Alternatively, they can attempt to build robotics and AI capabilities from scratch—a domain where Tesla has structural advantages. Most legacy automakers will likely continue EV production while selectively investing in AI and automation partnerships rather than wholesale strategic pivots like Tesla's.

Could the Model S and Model X be revived in the future?

Yes, though it's not likely in the near term. If Teslas humanoid robot bet fails, the company might return to vehicle focus. Alternatively, if cost curves improve dramatically, Tesla could revive these models as much simpler, lower-cost products designed for different market segments. But for now, the discontinuation signals genuine strategic commitment to the robot transition rather than a temporary pause.

How does Tesla's manufacturing philosophy support robotics development?

Tesla's Berlin and Austin facilities were designed for continuous iteration and rapid process changes rather than traditional rigid manufacturing. This philosophy works better for robotics than vehicles—robots are software-defined machines that iterate quickly based on AI improvements and field feedback, whereas vehicle manufacturing has been largely solved through standardized processes. The factories originally optimized for radical EV manufacturing innovation become even more valuable when applied to robotics development.

Is the market big enough for both EVs and humanoid robots?

Yes, absolutely. The EV market will remain substantial for decades. But the robotics opportunity, if successful, dwarfs it. The global labor market is worth roughly 10-20 times more than the automotive market. If humanoid robots can perform meaningful portions of that work, the market opportunity is essentially unlimited. Tesla's strategy assumes it can capture enough of that robotics opportunity to justify abandoning EV market share pursuit.

What would indicate Tesla's robotics strategy is actually working?

Watch for unit shipments of Optimus robots to customers outside Tesla's own operations. The first time meaningful numbers of robots ship to third-party customers and start delivering measurable ROI, the strategy transitions from aspirational to real. Also monitor deployment breadth—expanding from factories into logistics, hospitality, and other sectors would indicate capability maturation.

Why haven't other companies made this pivot?

Structural lock-in prevents traditional automakers from pivoting. They have committed $100+ billion to EV transitions. Humanoid robotics is a domain where they lack competency. Stock market dynamics punish radical strategy shifts. Technical uncertainty makes it risky. Tesla's unique position—as a company investors expect to pursue radical pivots, with existing AI and manufacturing capabilities, and with a leader willing to sacrifice near-term results for long-term bets—enables this move.

What are the risks of Tesla's robotics pivot?

Humanoid robotics is genuinely difficult. Creating robots that work reliably across diverse environments and tasks remains unsolved. The timeline could extend well beyond Musk's predictions. Competitors with better robotics expertise (Boston Dynamics, etc.) might ultimately prove superior. The capital requirements could exceed expectations. Tesla could fail at this bet while having abandoned its successful EV business. These risks are real, which is why the pivot requires genuine organizational confidence.

Key Takeaways

- Tesla discontinued its iconic Model S and Model X to redirect manufacturing capacity and organizational focus entirely toward humanoid robotics development

- The EV market is becoming commoditized with new competitors from major automakers eroding Tesla's original technology advantage and margin potential

- Humanoid robots address a labor market worth $20+ trillion across industries—potentially 10x larger than the automotive industry itself

- Tesla's decade of autonomous driving AI research translates directly to humanoid robot capabilities in perception, planning, and motor control

- The strategic pivot represents genuine organizational commitment, with Tesla sacrificing successful products to pursue an uncertain but potentially transformative opportunity

Related Articles

- Tesla Discontinuing Model S and Model X for Optimus Robots [2025]

- Tesla's $2B xAI Investment: What It Means for AI and Robotics [2025]

- Tesla Discontinues Model S and X to Focus on Optimus Robots [2025]

- Tesla's 2025 Revenue Decline: What Went Wrong [2025]

- Tesla Optimus Gen 3: Everything About the 2026 Humanoid Robot [2025]

- AI Pro Tools & Platforms: Complete Guide to Enterprise AI [2025]

![Tesla is No Longer an EV Company: Elon Musk's Pivot to Robotics [2025]](https://tryrunable.com/blog/tesla-is-no-longer-an-ev-company-elon-musk-s-pivot-to-roboti/image-1-1769692066194.jpg)