Netflix's Warner Bros. Acquisition: The $82.7B Megadeal Explained [2025]

Imagine waking up one December morning to find out that the streaming landscape just shifted entirely. That's what happened when Netflix announced it was acquiring Warner Bros. Discovery's film, television, and streaming assets for approximately $82.7 billion. This wasn't just another corporate merger. This was the entertainment industry's equivalent of a continental collision.

The deal brings together Netflix's 325 million subscribers with HBO, HBO Max, and the legendary Warner Bros. catalog including Game of Thrones, Harry Potter, and DC Comics properties. If you think about the implications for a second, you realize this fundamentally changes how movies get made, how TV shows are distributed, and ultimately, what stories make it to your screen.

We're talking about consolidating some of the most iconic franchises in entertainment history under one roof. The sheer market power alone is staggering. But the real question everyone's asking? What does this mean for consumers, for independent creators, for the future of streaming?

This article breaks down everything you need to understand about this historic deal: how it happened, why it happened, what's at stake, and where it goes from here. We'll walk through the competitive bidding process that got Netflix to the finish line, the regulatory hurdles it still faces, and what industry insiders are actually worried about.

TL; DR

- Netflix is acquiring Warner Bros. Discovery's entertainment assets for $82.7 billion in an all-cash deal announced in December 2025

- The deal combines massive streaming libraries, including HBO, HBO Max, Game of Thrones, Harry Potter, and DC Comics under one platform

- Regulatory approval remains uncertain, with lawmakers raising antitrust concerns about market consolidation and potential consumer harm

- Paramount remains a contender, offering $108 billion but facing skepticism from WBD's board over debt concerns

- Industry opposition is intense, with the Writers Guild and content creators warning about job losses, higher prices, and reduced creative diversity

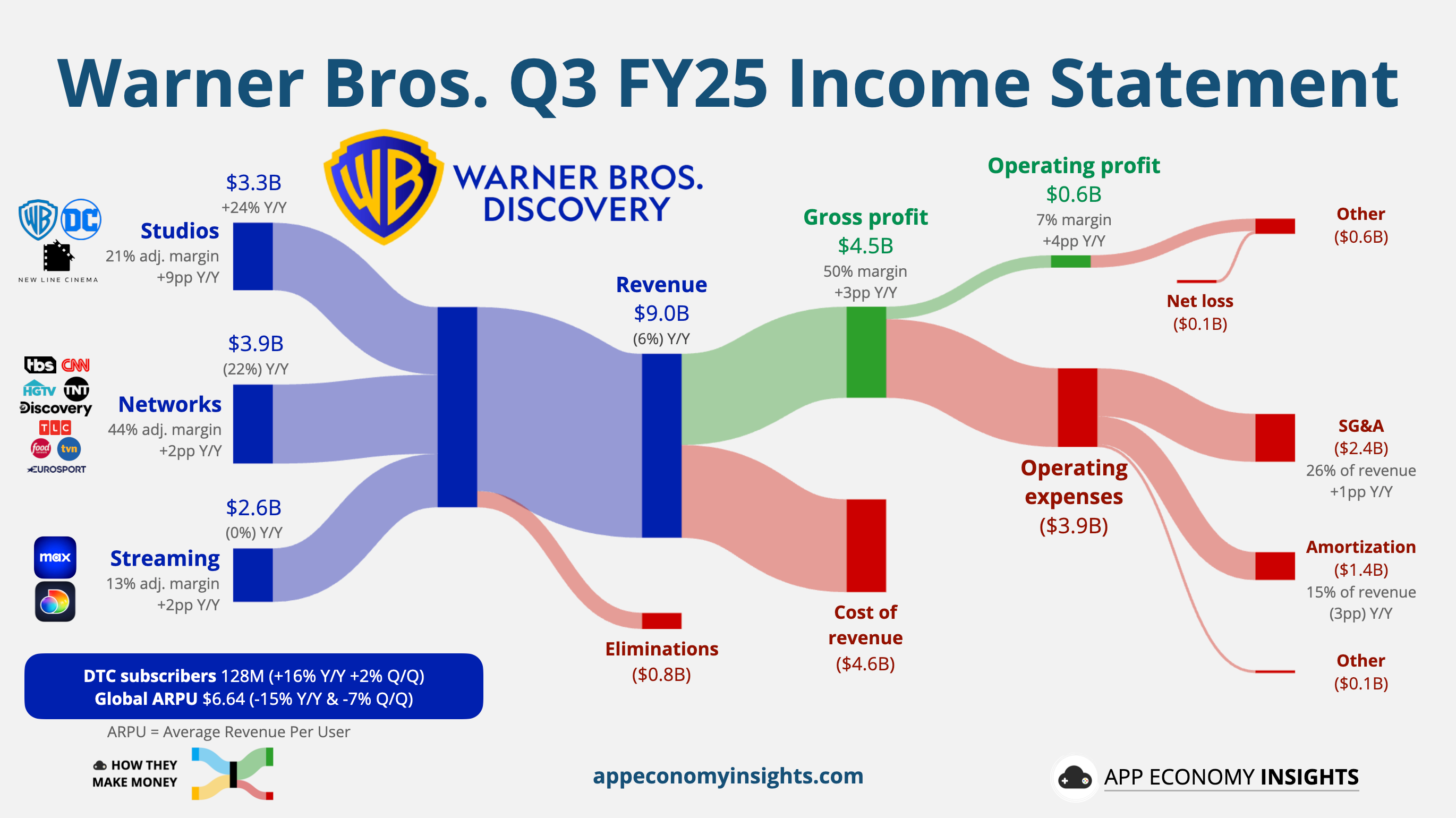

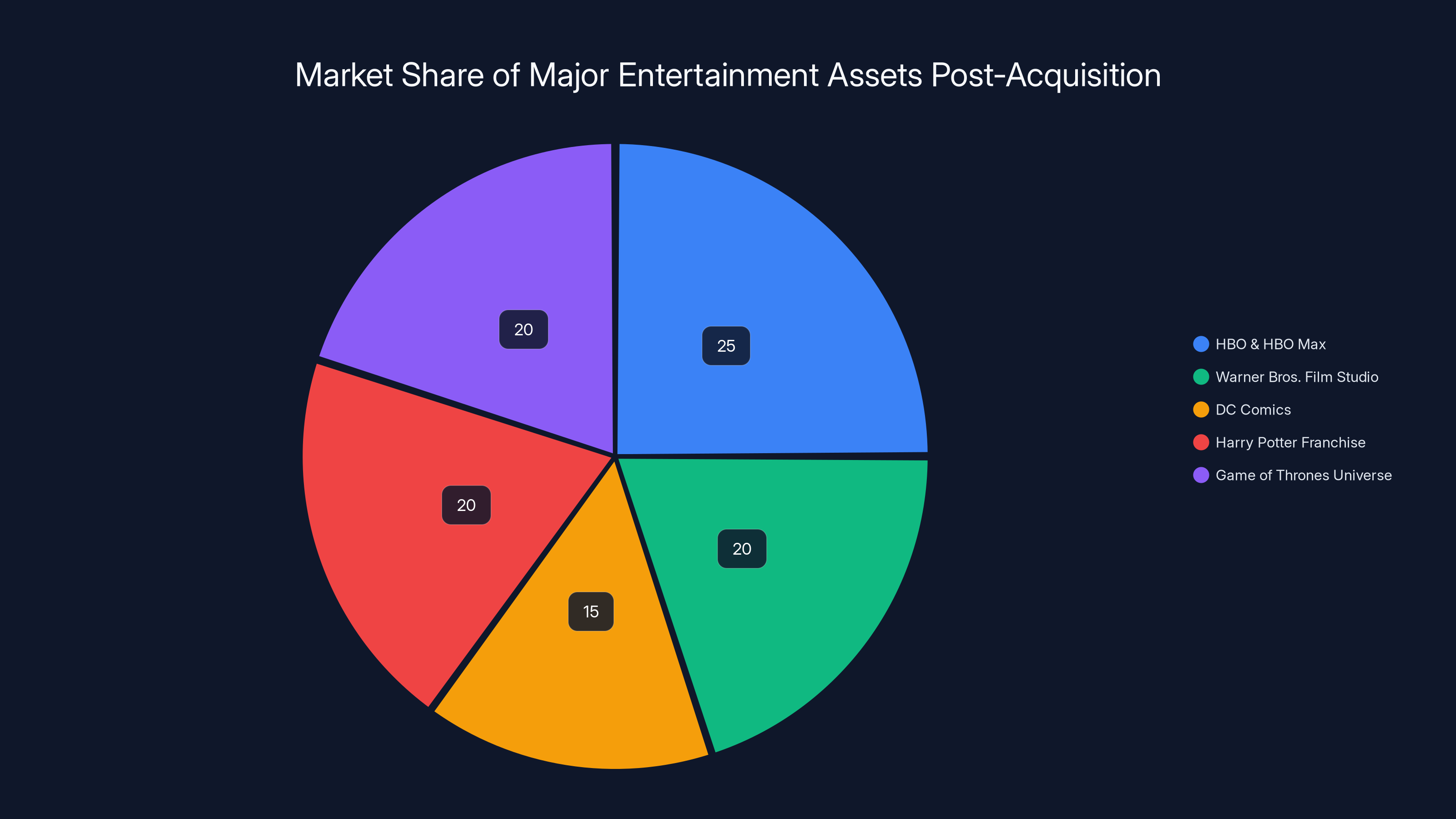

Estimated data shows that HBO & HBO Max and the Harry Potter franchise each represent 20% of the major assets acquired by Netflix, with Warner Bros. Film Studio and Game of Thrones Universe each accounting for 20%, and DC Comics making up 15%.

The Genesis: How We Got Here

This acquisition didn't materialize overnight. Understanding the deal requires rewinding about 18 months to when Warner Bros. Discovery started quietly drowning in debt.

Warner Bros. Discovery emerged from the 2022 merger between Warner Media and Discovery Inc., and almost immediately things got messy. The company inherited $55 billion in debt, and the streaming wars weren't getting any cheaper. While Netflix was becoming profitable on its streaming business alone, WBD was hemorrhaging cash trying to compete with multiple platforms simultaneously.

The real problem? Cable television revenue, which historically propped up WBD's financial health, collapsed faster than anyone anticipated. Younger viewers abandoned cable entirely. That created a massive revenue gap that HBO Max, despite its growing subscriber base, simply couldn't fill fast enough. Streaming requires entirely different unit economics than traditional media, and WBD found itself caught between two dying and transforming business models.

By fall 2025, the company's leadership realized they had limited options. They could continue burning cash, hope for a turnaround, or sell. They chose to explore a sale.

What followed was whispered conversations between WBD executives and potential acquirers. Multiple players were interested. Apple was mentioned in speculation. Comcast entered the picture. But it was Paramount that initially seemed like the strongest contender.

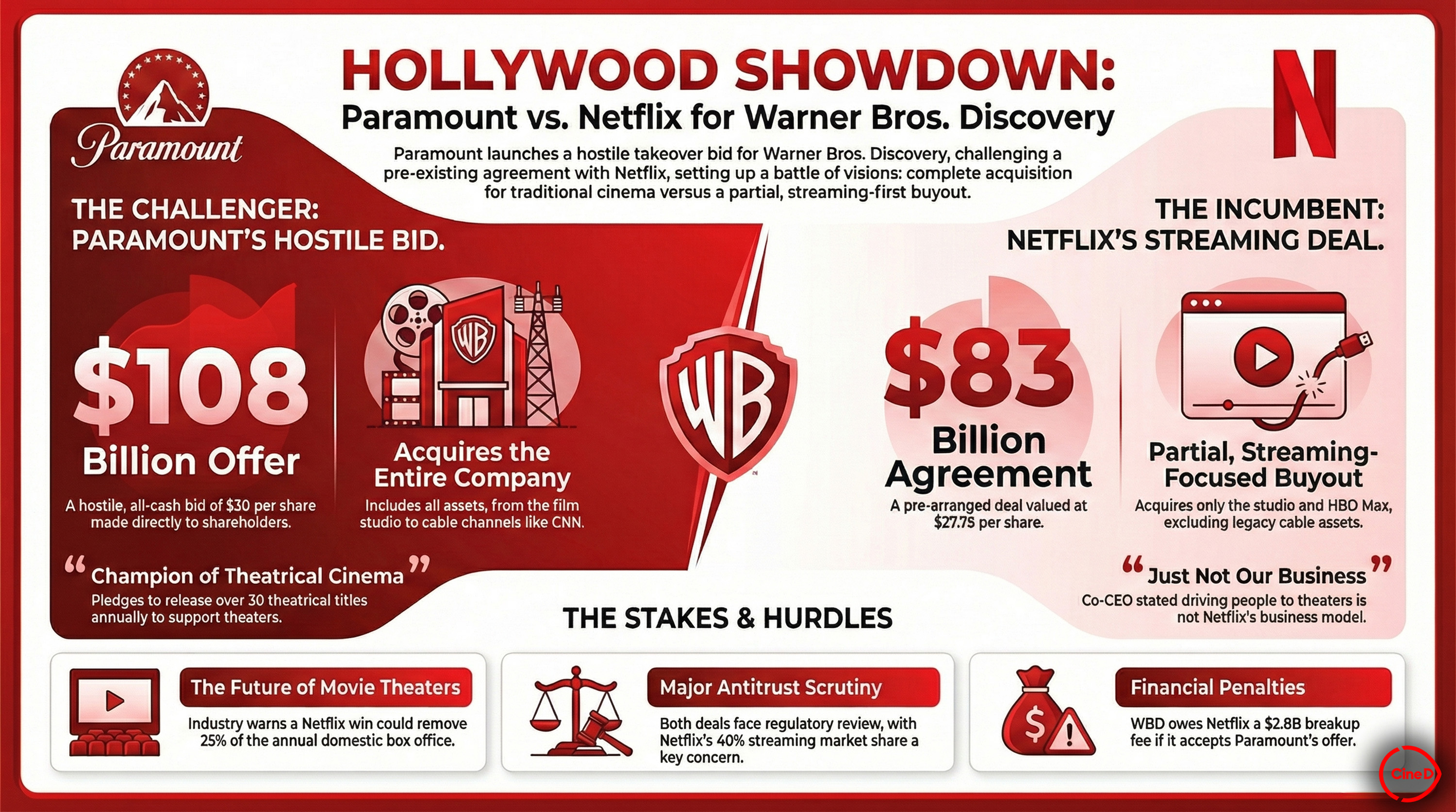

The Bidding War: Paramount vs. Netflix

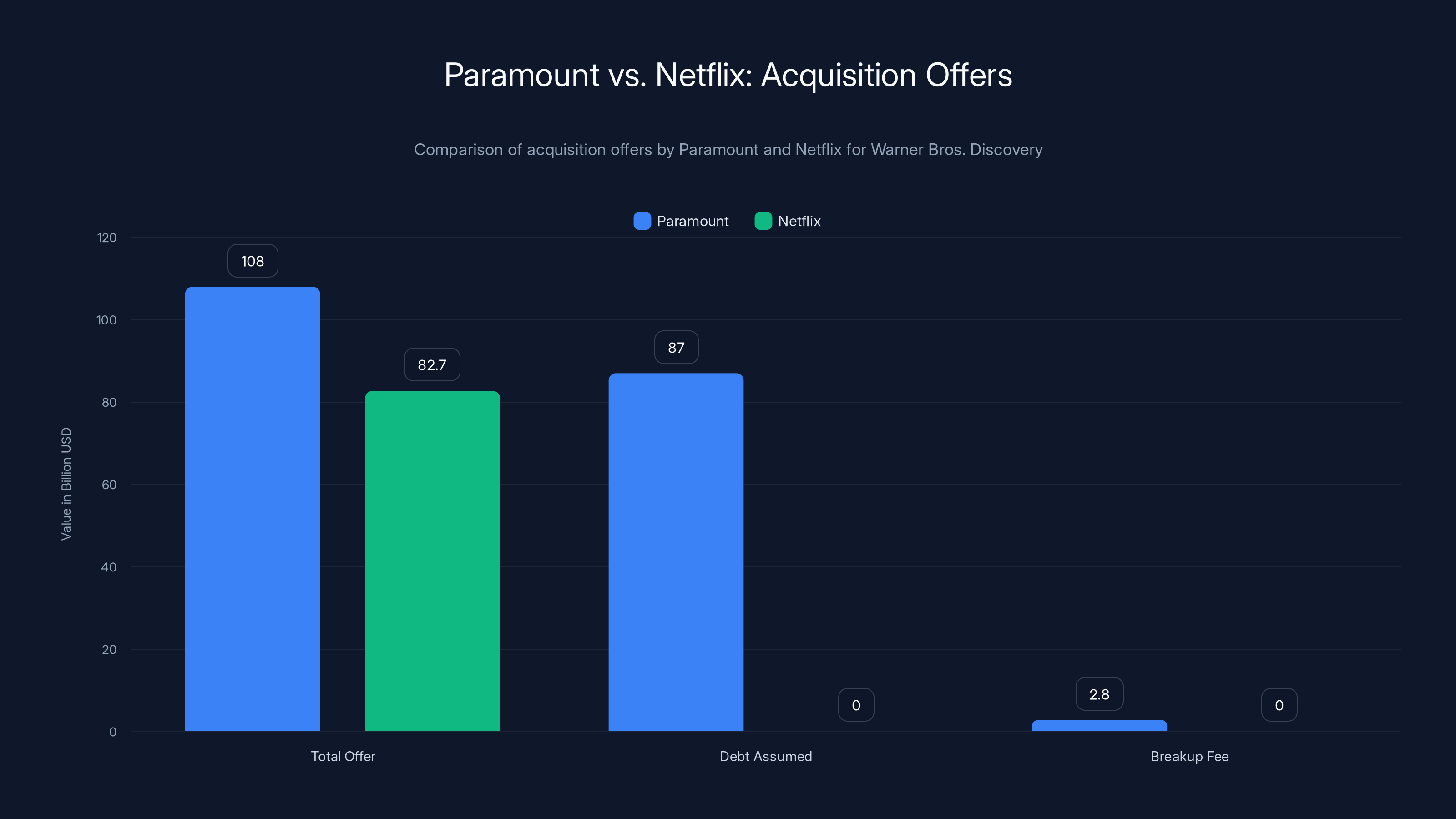

Paramount's position made intuitive sense. As another media conglomerate with existing distribution capabilities and production assets, an acquisition could theoretically create synergies that a pure-play streaming company couldn't achieve. Paramount's offer came in at approximately $108 billion.

Here's where it gets complicated. That

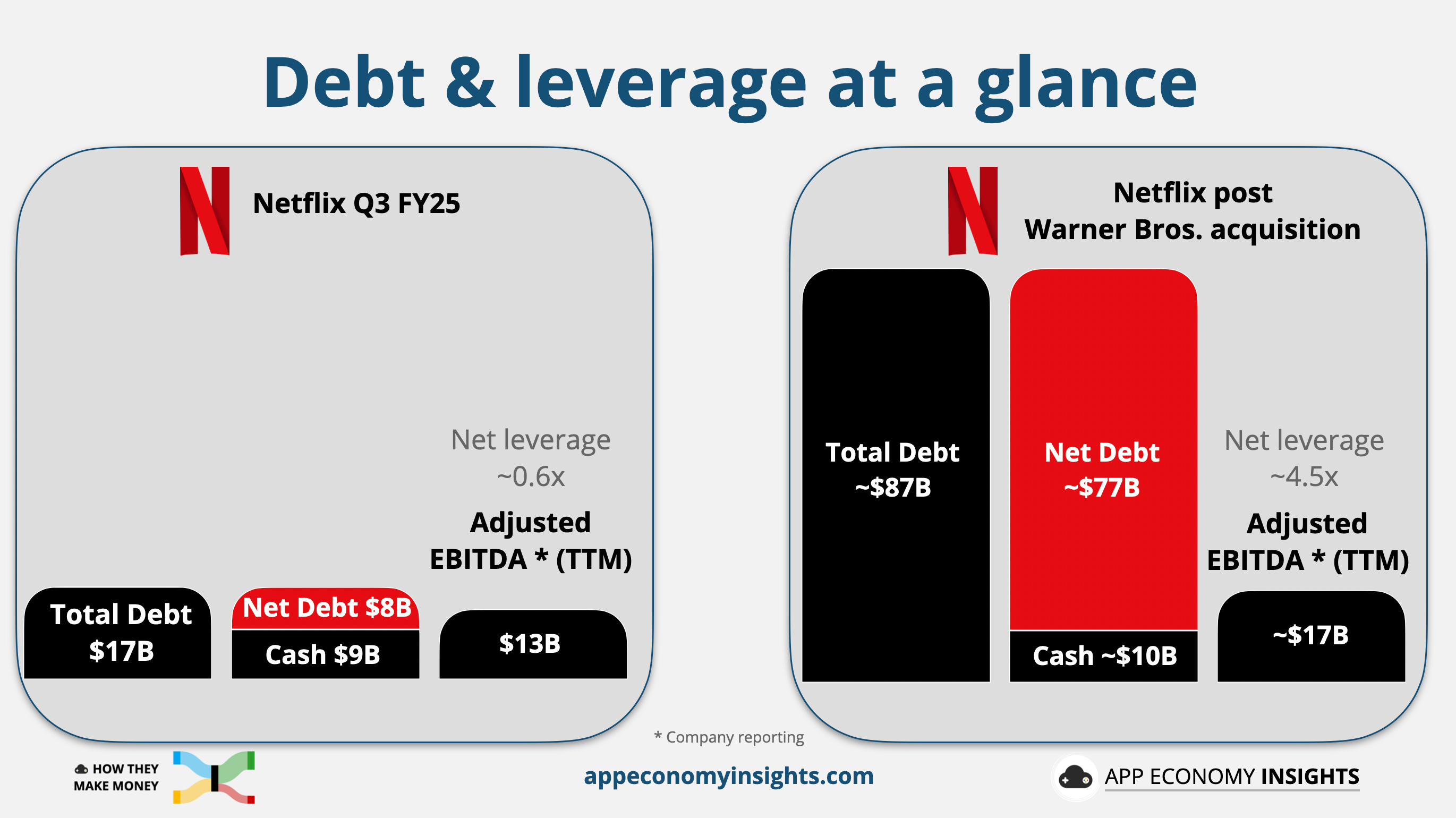

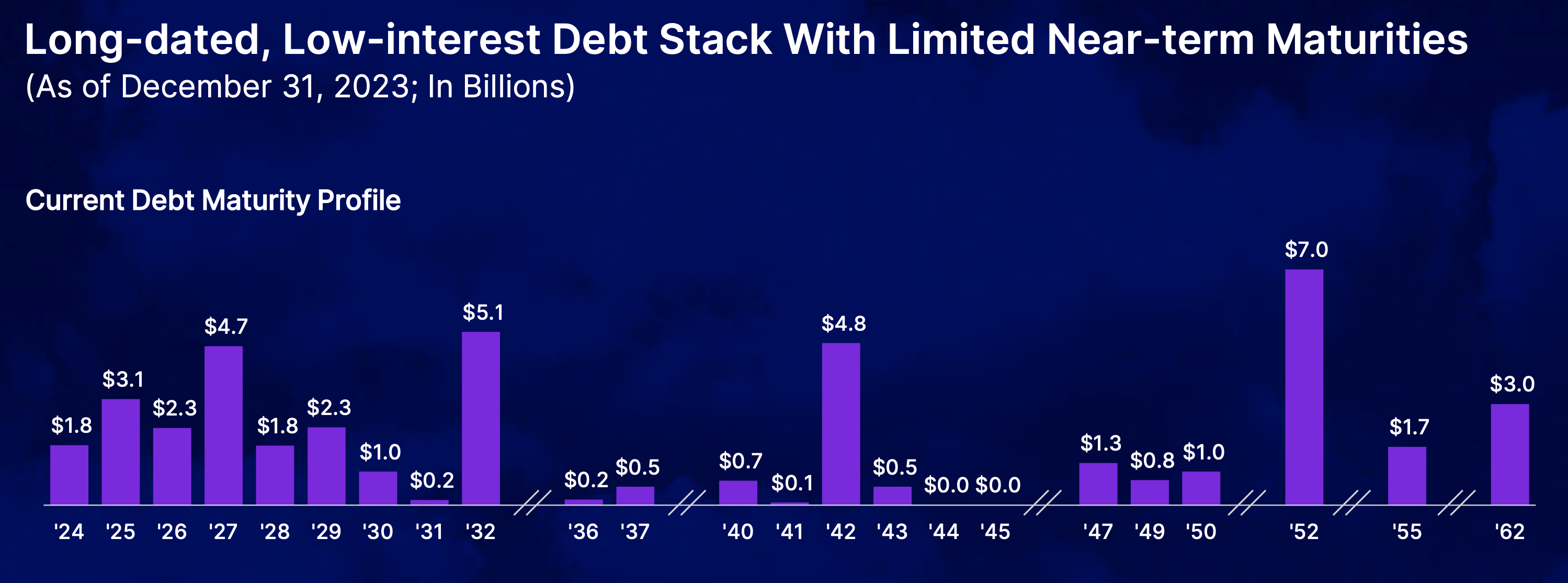

Paramount was offering to acquire the entire Warner Bros. Discovery company, including its debt obligations. That meant the combined entity would carry roughly $87 billion in total debt. WBD's board looked at those numbers and essentially said no thanks. The risk profile was simply too high. They could have a bigger number on paper while simultaneously creating a weaker company burdened by crippling debt service obligations.

Netflix's offer was surgical by comparison. It focused specifically on the jewel assets: the film studios, television production, streaming services, and the content library. Netflix wasn't taking on WBD's debt. It was taking what worked and leaving the rest.

But Paramount wasn't done fighting. The company kept sweetening its offer throughout the fall and winter, demonstrating that they genuinely believed they could make the deal work. In January, Paramount filed a lawsuit seeking disclosure about Netflix's deal terms, clearly trying to find weaknesses in the offer. A month later, they added a new wrinkle: a quarterly "ticking fee" of

It was an aggressive move, but WBD's board stood firm. The Netflix offer had won.

Paramount's offer was larger at

The Financial Architecture: Understanding the $82.7 Billion

Let's break down what

For perspective, that's a significant premium on WBD's stock price just months earlier. Netflix is essentially paying for the optionality and certainty of not having debt obligations hanging over the transaction.

Consider the math from WBD shareholders' perspective. They could take Paramount's offer for a larger headline number while watching their investment dilute in a heavily leveraged combined company that would struggle with interest payments. Or they could take Netflix's smaller but cleaner offer for immediate liquidity. The rational choice became obvious.

The all-cash component is particularly important because it signals Netflix's confidence and removes one potential obstacle to regulatory approval. There's no financing contingency. Netflix has the capital, and they're putting it on the table.

Of course, Netflix isn't actually sitting on $82.7 billion in loose cash. This deal will be financed through a combination of cash on hand, debt issuance, and potentially other creative structures. But from a market perspective, the all-cash framing matters. It shows seriousness.

What Netflix Actually Gets

When Netflix closes this acquisition, what exactly are they buying? It's worth itemizing because the Warner Bros. portfolio is almost comically valuable.

First, there's HBO and HBO Max. These aren't just streaming services; they're brands that have accumulated decades of prestige and subscriber loyalty. HBO's original content legacy runs from The Wire to Game of Thrones to Succession. That's not replicable overnight. HBO Max brings millions of subscribers who are already accustomed to paying premium prices for streaming content.

Then there's the Warner Bros. film studio. This is a production facility that's been making movies since 1923. They have established relationships with talent, directors, and producers. They have the infrastructure to make tentpole blockbusters.

The DC Comics intellectual property is probably the single most valuable asset in the entire deal. DC includes Superman, Batman, Wonder Woman, and properties that could generate franchises for decades if managed properly. Netflix has been struggling to build franchise IP from scratch. Now they're buying one of the two major comic universes in Hollywood.

Then there's the Harry Potter franchise. Even though the films are completed, the universe is expanding. There are Fantastic Beasts films, stage plays, and potentially new storylines. That's a generational IP asset.

We can't forget about the back catalog: thousands of films and TV shows across every genre. Some are decades old, some are recent, but collectively they represent a library that took 100 years to build. For a streaming platform, library depth is everything.

Regulatory Scrutiny: The Real Obstacle

If Netflix thought they could close this deal by late 2025 or early 2026, they're probably reconsidering that timeline. Regulatory scrutiny is intense, and it's only increasing.

In November, Senators Elizabeth Warren, Bernie Sanders, and Richard Blumenthal sent a letter to the Justice Department's Antitrust Division raising concerns. Their central argument: this merger would give Netflix excessive power to raise prices and stifle competition.

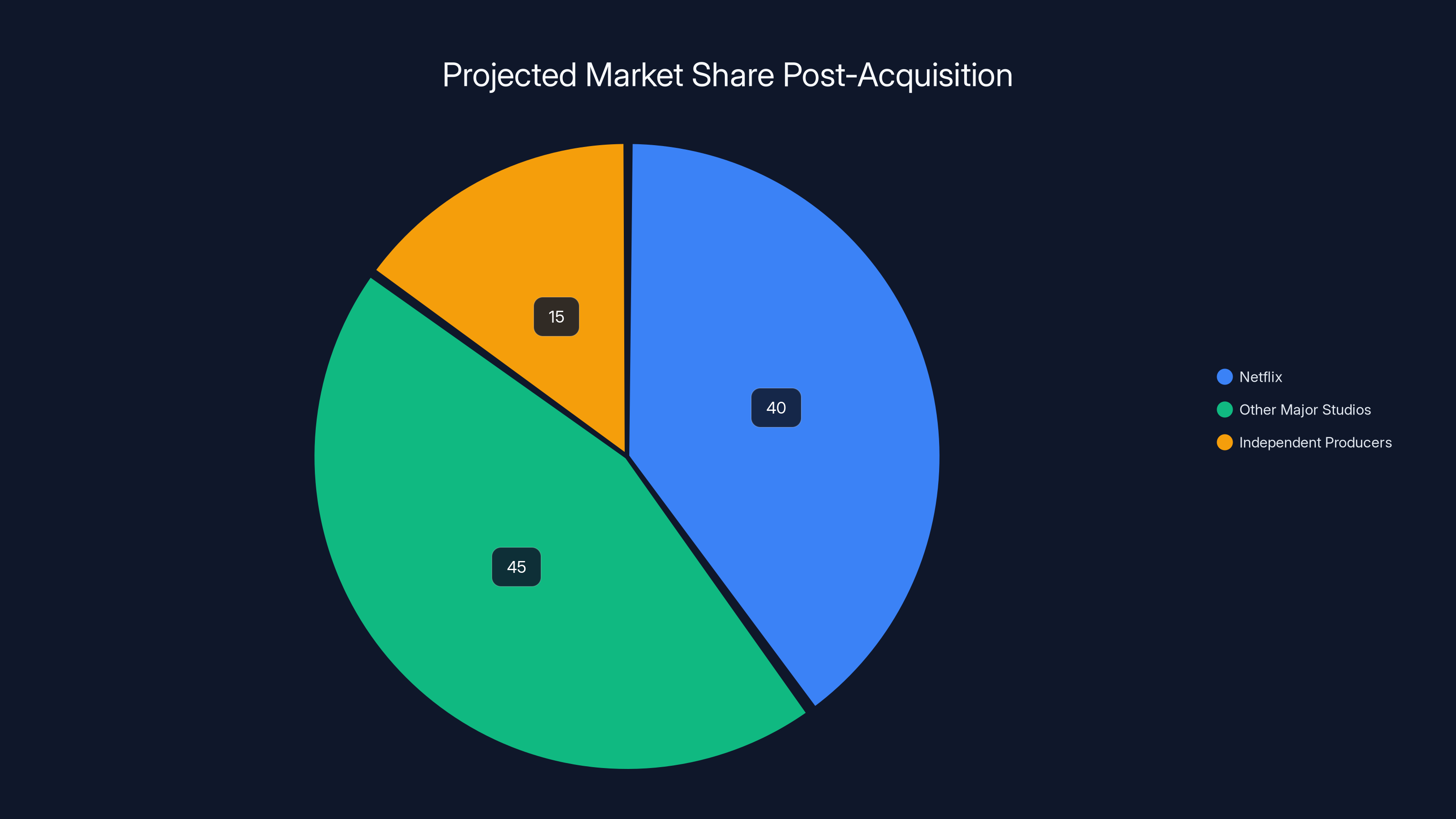

They're not entirely wrong. Post-acquisition, Netflix would control something like 40% of scripted television content production in the United States. It would hold exclusive rights to some of the industry's most valuable franchises. It would have the production capacity to simultaneously serve its own platform while potentially producing for competitors (or choosing not to).

The Federal Trade Commission and Department of Justice have been particularly skeptical of media consolidation in recent years. There's a political appetite for aggressive antitrust enforcement that didn't exist a decade ago.

Netflix co-CEO Ted Sarandos is scheduled to testify before a Senate committee specifically about this deal. That's not a formality. That's a signal that lawmakers are taking this seriously enough to grill the CEO directly.

If regulators block the deal, Netflix faces a $5.8 billion breakup fee. That's expensive but not catastrophic. But for WBD shareholders, a blocked deal creates massive uncertainty about what happens next.

Estimated data shows that while Netflix gains approximately

Entertainment Industry Opposition

Outside regulatory circles, the entertainment industry has largely united against this deal.

The Writers Guild of America has been vocal about antitrust concerns. They're worried about what happens to writers and showrunners when a single company controls so much content production and distribution. Will Netflix squeeze budgets? Will they demand exclusivity deals that prevent writers from working elsewhere?

Independent producers are raising similar concerns. If Netflix controls HBO, Warner Bros., and its own production arm, where do independent filmmakers shop their projects? What leverage do they have in negotiations?

Directors and cinematographers are worried about release windows and theatrical exhibition. Historically, movies had exclusive theatrical runs before coming to home viewing. Netflix has been gradually eliminating that window. With HBO and Warner Bros. under the same roof, that window could shrink dramatically or disappear entirely.

Smaller streaming platforms like Peacock and Paramount+ are alarmed because Warner Bros. currently produces content for them. Will those arrangements continue or end? If they end, those platforms lose important content sources.

There's also a broader concern about creative diversity. When a single company controls so much production capacity, there's a tendency to greenlight safer, more commercially proven concepts. Independent voices and experimental content become harder to fund.

Job Losses and Industry Consolidation

One of the most concrete concerns is employment. Media consolidation historically leads to job losses as duplicate functions get eliminated.

Consider the redundancies. Warner Bros. has executives managing film production. HBO has executives managing television production. Netflix has its own content leadership. When these merge, you don't need three separate chains of command. You're probably looking at hundreds of high-level positions being eliminated.

Then there are physical redundancies. Warner Bros. owns production facilities. HBO owns production facilities. Netflix is building production facilities globally. Some of these will be consolidated or shut down.

The Writers Guild is particularly concerned about writers and showrunners being squeezed. If Netflix can greenlight a show from its own production company, why pay top dollar for writers compared to its own staff writers? The dynamic shifts.

Location-based production is at risk too. A lot of Warner Bros. and HBO production happens in specific geographic locations (Georgia, California, New York). Netflix is more distributed globally. As consolidation happens, some regional production hubs might lose significant work.

We're probably looking at somewhere in the range of 5,000 to 10,000 job losses across the combined organization over 18 months post-close. That's not apocalyptic for the industry, but it's real pain for real people.

Content Strategy and Release Windows

One of the most contentious issues is how Netflix will handle theatrical release windows for Warner Bros. films.

Ted Sarandos has publicly committed to maintaining theatrical release windows for films already in the pipeline. He's not going to abruptly pull a tentpole Warner Bros. film from theaters to stream it exclusively on Netflix. That would create too much industry backlash.

But he's also hinted that over time, release windows will shrink. Maybe instead of 45 days exclusively in theaters, it becomes 30 days. Maybe it becomes simultaneous theatrical and streaming release.

From Netflix's perspective, the logic is sound. If they own the content, why share revenue with theaters? Why let consumers watch the film in multiplexes when they could watch it on Netflix and Netflix captures the full consumer surplus?

From the theatrical industry's perspective, this is existential. Movie theaters have been struggling since streaming became ubiquitous. If major studio films start bypassing theaters or coming to streaming almost immediately, theater chains will continue to consolidate and close.

This is where the deal gets philosophically interesting. Netflix could genuinely believe they're optimizing for consumer value (watch at home, no ticket costs, included in subscription). Theaters would argue they're destroying a century-old cultural institution. Both perspectives have merit.

Sarandos will probably split the difference. Maintain windows for a few years, gradually compress them, and eventually move to a hybrid model. But the details will matter enormously for independent theaters and regional cinema circuits.

Post-acquisition, Netflix is projected to control 40% of scripted TV content production in the U.S., raising concerns about market dominance. (Estimated data)

International Implications

What often gets overlooked in these deals is the international dimension.

Warner Bros. and HBO have extensive content licensing deals across global markets. If Netflix changes those arrangements, you could see friction with international partners. Some countries have content quotas or local production requirements. WBD's existing arrangements might give Netflix preferential treatment or create conflicts.

For example, in Europe, certain regulations require platforms to invest in local European content. WBD has existing commitments. Netflix inheriting those commitments changes the economics of their European strategy.

Then there's the question of library licensing. Some countries might have exclusive licensing arrangements for Warner Bros. content that prevent Netflix from controlling it. These agreements might need to be renegotiated, which could be expensive.

India, Latin America, and Southeast Asia have their own content ecosystems. Warner Bros. sometimes produces content specifically for those markets or licenses content locally. Netflix's approach to those regions might be different from WBD's approach.

International regulatory scrutiny is also a factor. The UK, EU, and other jurisdictions have their own antitrust authorities. Netflix might face challenges to the deal in multiple countries simultaneously.

Streaming Market Consolidation Trend

This deal doesn't exist in a vacuum. It's part of a broader consolidation trend in streaming.

Over the past three years, we've seen Disney+ and Hulu merge, Paramount+ consolidate Paramount's content, Amazon strengthen its content position, and Apple aggressively expand Apple TV+.

Netflix's move to acquire Warner Bros. is essentially the biggest consolidation move yet. It signals that the era of pure-play streaming companies is ending. The future belongs to vertically integrated media companies that own content, production, and distribution.

That's a significant shift from where we were five years ago, when Netflix was primarily a distribution platform licensing content from studios. Now Netflix is becoming a studio with distribution.

This has implications for the competitive landscape. If you're Comcast or Paramount trying to compete, you're now facing a Netflix that owns DC Comics, Harry Potter, and Game of Thrones. The bar for competing got much higher.

Some analysts argue this is necessary. With content costs spiraling upward, maybe only vertically integrated giants can survive. Others argue it's devastating for creative diversity and consumer choice.

Consumer Impact: Pricing and Content Availability

Ultimately, what matters to Netflix subscribers is simple: what do I pay and what do I watch?

The immediate answer is probably not much change. Netflix isn't going to abruptly raise prices on existing subscribers. That would create backlash.

But over time, expect pricing to move up. Netflix will have absorbed billions in content production costs and acquisition costs. Those need to be recovered somehow. Premium tiers will likely become more expensive. Ad-supported tiers might become the default.

What about content availability? This is where it gets interesting. Warner Bros. content that's currently licensed to other platforms might eventually migrate to Netflix. Not overnight, because existing licensing agreements have terms, but gradually.

Consumers who are paying for HBO Max might question why they need to continue after their subscription consolidates into Netflix. Presumably, Netflix will offer a path for HBO Max subscribers to migrate to Netflix, probably at a discount or as part of bundled pricing.

For cord-cutters and streaming-only consumers, this could actually be convenient. Everything in one place. No juggling multiple subscriptions. But it also means less choice and arguably less leverage for consumers to negotiate better pricing.

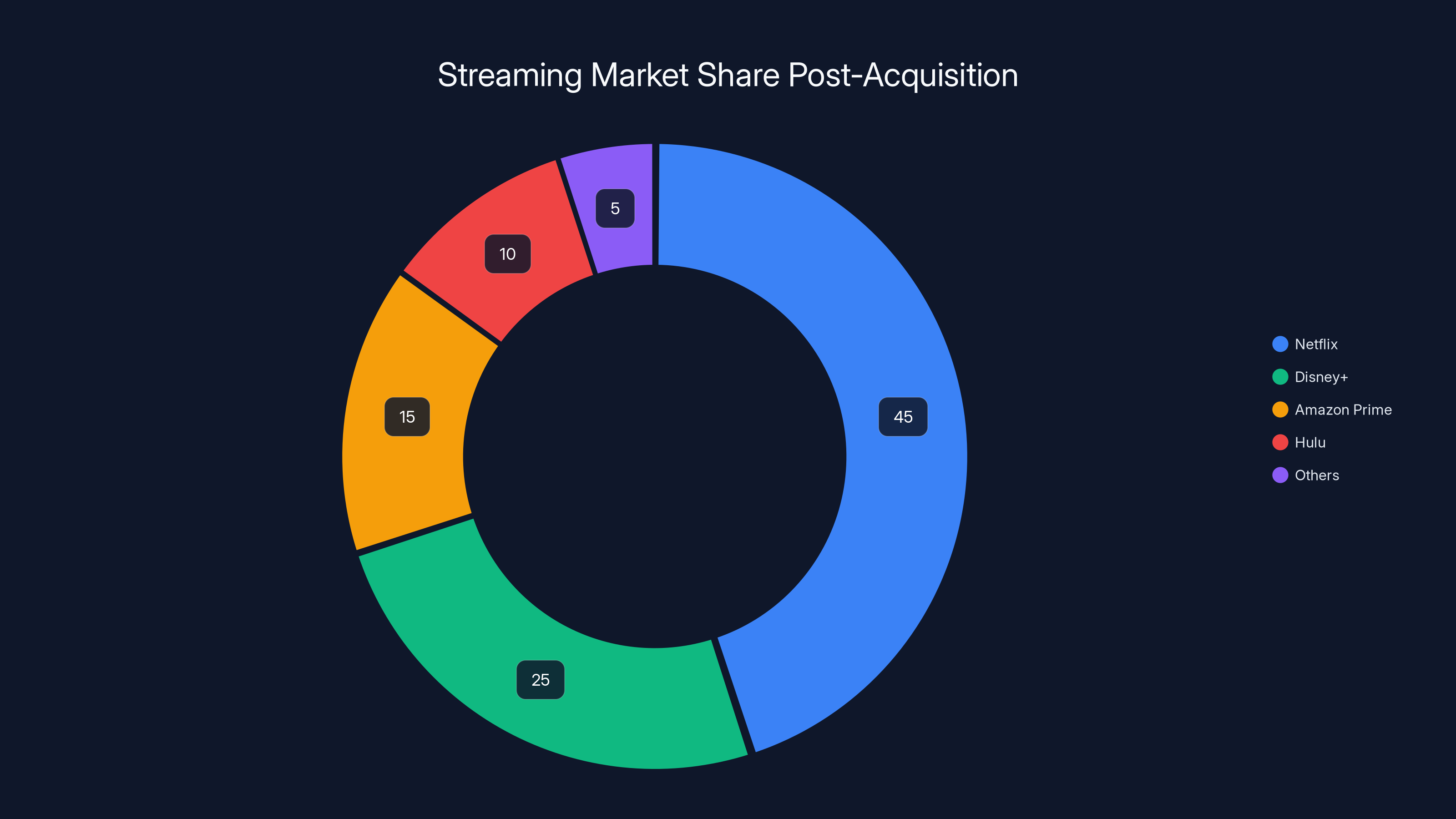

Estimated data shows Netflix holding a dominant 45% market share post-acquisition, reshaping the streaming landscape significantly.

Talent Implications: Creators and Production Partners

If you're a filmmaker, writer, or showrunner shopping a project, this deal changes your options.

Historically, if you had a pitch, you could shop it to multiple studios: Warner Bros., Paramount, Disney, etc. They'd compete for your project, which benefited creators through higher budgets and better terms.

With Netflix owning Warner Bros., you've lost one independent buyer. There are still other studios, but the market is thinner.

For established talent with leverage, this is probably okay. A-list directors and A-list writers can still command strong deals. But for emerging talent without huge track records, having fewer independent studios to shop to could be problematic.

Production companies that have dealt with Warner Bros. need to reassess. Will Netflix maintain those relationships or consolidate on its own production apparatus? Some will win from this consolidation, others will lose.

Netflix has been gradually building an in-house production capability over the past five years. Acquiring Warner Bros.' production infrastructure accelerates that. Eventually, Netflix might not need external production partners for as much content.

Financial Implications for Netflix

Let's look at what this deal does to Netflix's financial picture.

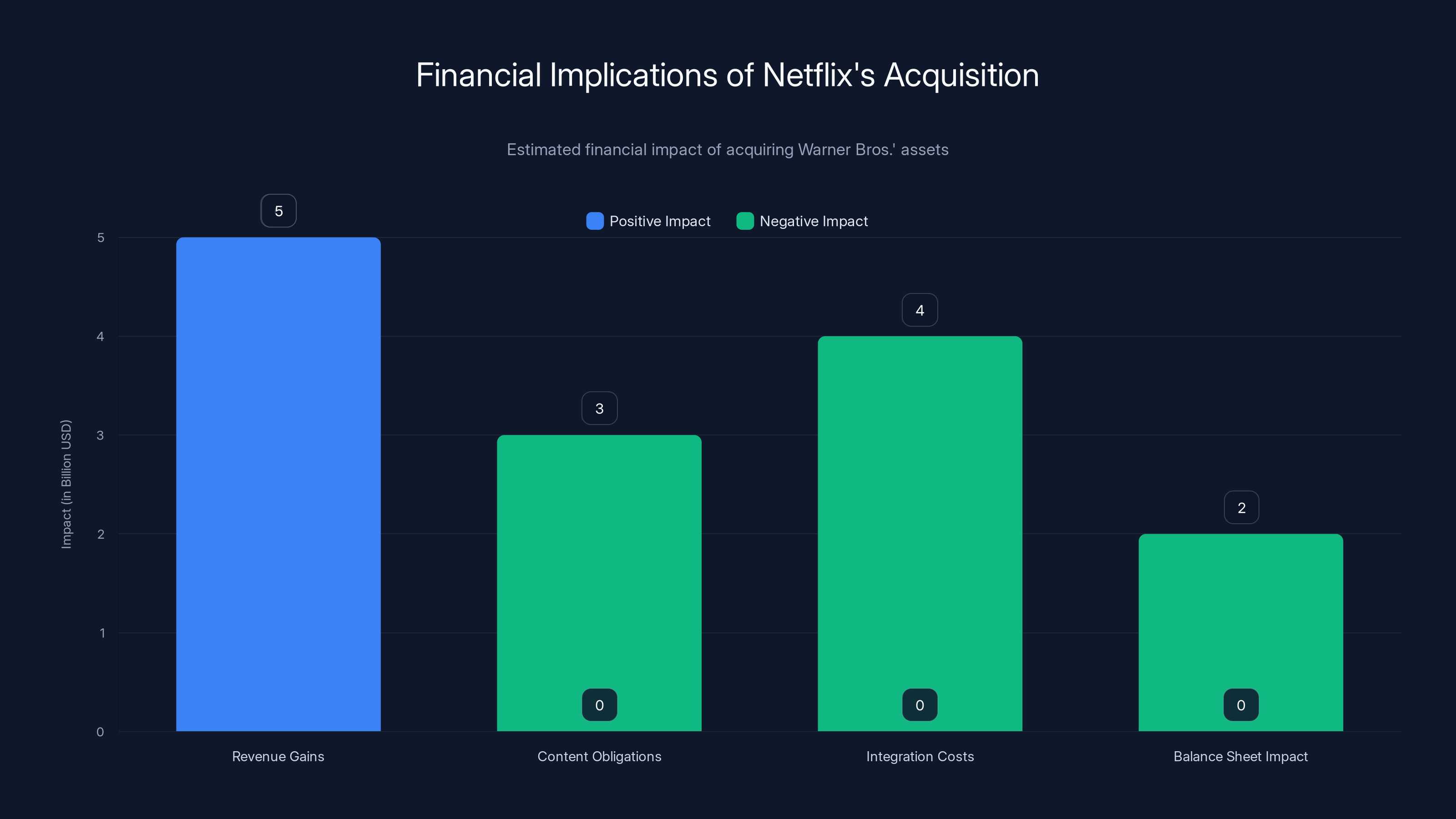

On the revenue side, Netflix gains access to Warner Bros.' content library and production capabilities. That's valuable, but it also creates leverage with content partners who previously licensed to multiple platforms.

On the cost side, Netflix takes on content obligations. Warner Bros. has existing production deals and content commitments. Some of those might not align with Netflix's strategy, creating costs they'd prefer not to carry.

Then there's integration costs. Merging two massive organizations isn't cheap. You're looking at duplicate infrastructure elimination, IT system integration, corporate function consolidation. That's probably $2-5 billion in one-time costs over 18-24 months.

The acquisition also impacts Netflix's balance sheet. They're taking on debt or using cash that could have been deployed elsewhere. That has opportunity costs.

But the strategic argument is that long-term value creation more than justifies these costs. Netflix gets control of more IP, more production capacity, and more leverage in the market. That's worth the near-term financial pain.

Timeline and Closing Conditions

Warner Bros. Discovery shareholders approved the deal in principle, but closing is contingent on regulatory approval.

The current expected timeline is sometime in 2026, probably mid-to-late 2026 if everything goes smoothly. If regulators drag their feet or request remedies, it could extend into 2027.

Paramount has negotiated a ticking fee, so there's actually financial pressure for Netflix to close reasonably quickly. For every quarter past December 31, 2026, that the deal doesn't close, Paramount gets $0.25 per WBD share, which adds up to real money across 325 million shares outstanding.

If regulators block the deal outright, Netflix pays a $5.8 billion breakup fee. That's expensive, but Netflix can absorb it. For WBD shareholders, though, it creates massive uncertainty about what happens next. Do they revisit Paramount's offer? Seek other buyers? Go independent?

Strategic Alternatives If the Deal Fails

What happens if this deal dies?

For Netflix, it's not catastrophic. They lose $5.8 billion, which stings, but doesn't destroy their business model. They continue building content and production capacity organically.

For WBD shareholders, it's worse. They've been waiting months for a deal to close. If it fails, they're back to square one. The stock likely declines. Paramount probably renews its offer, but at a lower price given the market has moved. Or they might seek other buyers entirely.

Possible alternatives: Could Apple or Amazon acquire WBD instead? Theoretically yes, but both are focused on different strategies. Apple wants premium original content. Amazon wants content to drive Prime Video. Neither probably wants the entire Warner Bros. apparatus.

Could WBD go private? Potentially. A private equity consortium could acquire it, squeeze costs, improve the balance sheet, and eventually re-IPO it. But that's a five-to-seven-year process.

Most likely, if Netflix's deal fails, WBD ends up independent, continuing to operate HBO and HBO Max while trying to deleverage its balance sheet over time. It's not ideal for shareholders, but it's survivable.

Precedent in Media M&A

This deal is being called the largest entertainment acquisition ever. Is it really?

Historically, the biggest media deals were massive but in different contexts. The Viacom-CBS merger, the AT&T-Time Warner merger, the Disney-Fox deal. But those happened in different regulatory and market environments.

The Disney-Fox deal in 2019 faced antitrust scrutiny but ultimately closed. Netflix-WBD is different though. Netflix already controls a huge portion of streaming. Adding Warner Bros. makes them unquestionably dominant.

The AT&T-Time Warner deal faced significant regulatory opposition but eventually closed under the Trump administration. Current administrations have been more skeptical of large media consolidation.

What's unprecedented about Netflix-WBD is the sheer scope of content ownership consolidation. This isn't just combining companies; it's consolidating a huge chunk of the creative economy under one roof.

What Experts Are Actually Saying

Media analysts are divided.

Some argue this is necessary for Netflix to compete long-term. Content costs are escalating. Libraries matter. Owning more content gives Netflix more leverage and more value.

Others worry that this signals the end of competitive streaming. If Netflix, Disney, Amazon, and Apple each own massive libraries and production capabilities, where does independent content come from? How do new creators break through?

Law and economics scholars are particularly concerned about the market power implications. A post-merger Netflix would have significant control over what content gets made, how it's distributed, and at what price consumers access it.

Workforce advocates worry about consolidation leading to permanent staff reductions and worse working conditions for content creators and production workers.

Content creators themselves are split. Some see opportunity (Netflix owns their content, ensuring broad distribution). Others see risk (Netflix has leverage over them and can demand better terms).

The Road Ahead: What Comes Next

Assuming the deal closes (and that's still a meaningful assumption), what does Netflix look like post-acquisition?

First, there will be organizational restructuring. Duplicate functions merge. Redundant leadership goes. This takes 6-12 months.

Second, content strategy consolidates. Netflix figures out what to produce where, what to greenlight, what to shelf. This is strategic but painful for projects that don't fit the Netflix model.

Third, platform integration happens gradually. HBO Max doesn't disappear immediately, but eventually subscribers migrate to Netflix. The HBO brand stays (probably), but as a Netflix product.

Fourth, release window strategy evolves. Theatrical windows compress. More simultaneous releases or quicker transitions to streaming happen.

Fifth, international partnerships recalibrate. Netflix figures out what content commitments it's inheriting and what it wants to modify.

Longer term, this deal signals Netflix's vision: they want to own their content stack from production to distribution. That's a different business model from where they started.

FAQ

What is the Netflix-Warner Bros. Discovery acquisition?

This is Netflix's acquisition of Warner Bros. Discovery's film, television, and streaming assets for approximately $82.7 billion announced in December 2025. The deal includes HBO, HBO Max, Warner Bros. film studios, DC Comics, Harry Potter franchises, and thousands of films and TV shows across the entire library. It's being called the most historic entertainment megadeal ever, fundamentally consolidating significant creative assets under a single company.

How did Netflix win the bidding war against Paramount?

Paramount offered approximately

What major properties does Netflix gain through this acquisition?

Netflix acquires HBO and HBO Max streaming services, the Warner Bros. film studio established in 1923, DC Comics intellectual properties (Superman, Batman, Wonder Woman), the Harry Potter franchise, Game of Thrones and its universe, and thousands of films and television shows spanning decades of content production. This gives Netflix control of multiple generational franchises and an extensive content library that took 100 years to build.

What regulatory challenges does the deal face?

The deal faces significant antitrust scrutiny from U. S. lawmakers and regulators who worry that Netflix acquiring Warner Bros. would give it excessive market power. Senators including Elizabeth Warren, Bernie Sanders, and Richard Blumenthal have voiced concerns to the Justice Department about market consolidation, and Netflix co-CEO Ted Sarandos has been scheduled to testify before Senate committees about the deal.

Why is the entertainment industry opposing this acquisition?

The Writers Guild of America, independent producers, and theater operators worry about job losses, reduced creative diversity, tighter release windows for theatrical films, and diminished bargaining power for creators. They also fear that Netflix-controlled content production will squeeze budgets, demand exclusivity, and limit opportunities for independent filmmakers and writers to shop projects to competing studios.

How does this deal affect consumer pricing and content availability?

Netflix is unlikely to increase prices immediately on existing subscribers, but longer-term pricing will probably rise to recover acquisition costs. Content that Warner Bros. currently licenses to other platforms may eventually migrate to Netflix as existing agreements expire. For consumers, the consolidation could mean everything in one subscription but less platform competition and potentially less pricing leverage.

What happens if regulators block this deal?

If regulators block the acquisition, Netflix faces a $5.8 billion breakup fee but retains its existing business model. Warner Bros. Discovery shareholders face uncertainty about alternative buyers, might revisit Paramount's lower offer, or could attempt to operate independently while managing significant debt. The deal blocking would delay consolidation in the streaming industry but not prevent it entirely.

How does Netflix plan to handle theatrical release windows for Warner Bros. films?

Netflix CEO Ted Sarandos committed to maintaining theatrical release windows for films already in production, but indicated that over time, release windows will likely shorten. This could mean transition from traditional 45-day theatrical exclusivity to 30-day windows or simultaneous theatrical and streaming releases, which concerns the theatrical exhibition industry.

Why is this deal considered more significant than previous media mergers?

This deal consolidates unprecedented amounts of entertainment production and distribution under a single company. Netflix would control approximately 40% of scripted television content production in the U. S. and exclusive rights to multiple generational franchises. Unlike previous media mergers that combined different types of companies, Netflix-WBD combines complementary streaming and production assets, creating a vertically integrated entertainment giant.

What does this deal signal about the future of streaming?

The acquisition signals the end of pure-play streaming companies and the rise of vertically integrated media giants that own content, production facilities, and distribution platforms. It suggests that competing in streaming long-term requires controlling significant IP and production capacity, which may reduce the ability for new entrants or independent creators to compete effectively in the streaming ecosystem.

The Bottom Line

The Netflix-Warner Bros. Discovery deal represents a watershed moment for the entertainment industry. We're transitioning from an era where streaming platforms licensed content to one where they own the means of production entirely.

For Netflix, this is a calculated bet that controlling more content, more production capacity, and more valuable IP creates long-term competitive advantages worth the near-term financial and integration costs. They're essentially betting that the streaming market eventually consolidates around a few vertically integrated giants.

For the broader industry, this is unsettling. Independent creators have fewer buyers. Consumers might pay less per month but have less choice overall. Workers face potential layoffs as redundancies consolidate. Theaters face shortened windows or simultaneous releases.

Regulatory approval is genuinely uncertain. Unlike previous mega-deals, this one faces skepticism from lawmakers who explicitly worry about market power and consumer harm. If regulators impose significant conditions on the deal or block it entirely, Netflix will adjust, but the streaming industry's consolidation story continues regardless.

What makes this deal historically significant isn't just its size. It's that it represents a fundamental shift in how entertainment gets produced, financed, and distributed. Netflix isn't just becoming a bigger company. They're becoming a different kind of company entirely.

Whether that's positive or negative depends entirely on your perspective. For Netflix shareholders, probably positive. For independent creators, probably negative. For consumers, it's complex: more convenience in one place, but less leverage and less choice.

The deal will likely close sometime in 2026, probably mid-to-late year if regulatory challenges don't significantly delay it. What happens post-close will define the streaming landscape for the next decade.

Key Takeaways

- Netflix acquired Warner Bros. Discovery's entertainment assets for $82.7 billion in an all-cash deal, bringing HBO, HBO Max, Game of Thrones, Harry Potter, and DC Comics under one platform

- Netflix's lower offer won over Paramount's $108 billion because it avoided massive debt obligations, making WBD's board choose financial stability over headline numbers

- The deal consolidates approximately 40% of scripted television content production under Netflix control, triggering significant regulatory scrutiny and antitrust concerns from Congress

- Industry opposition includes job loss concerns (5,000-10,000 positions), reduced creative diversity, theatrical release window compression, and diminished bargaining power for independent creators and smaller platforms

- Regulatory approval remains uncertain with Netflix CEO scheduled to testify before Senate committees; if blocked, Netflix faces a $5.8 billion breakup fee but continues its streaming business unchanged

Related Articles

- Netflix's $82.7B Warner Bros. Acquisition: What You Need to Know [2025]

- HBO Max UK Launch 2025: Everything You Need to Know [2025]

- Netflix vs. Paramount: The $108B Streaming War Reshaping Hollywood [2025]

- Netflix's $82.7B Warner Bros Deal: The Streaming Wars Heat Up [2025]

- Netflix's $82B Warner Bros Deal: What It Means for Movie Theaters [2025]

- Paramount Skydance's Lawsuit Against Warner Bros. Discovery [2025]

![Netflix's Warner Bros. Acquisition: The $82.7B Megadeal Explained [2025]](https://tryrunable.com/blog/netflix-s-warner-bros-acquisition-the-82-7b-megadeal-explain/image-1-1770739596387.jpg)