Canva's $4 Billion Milestone: The AI-Powered Design Revolution

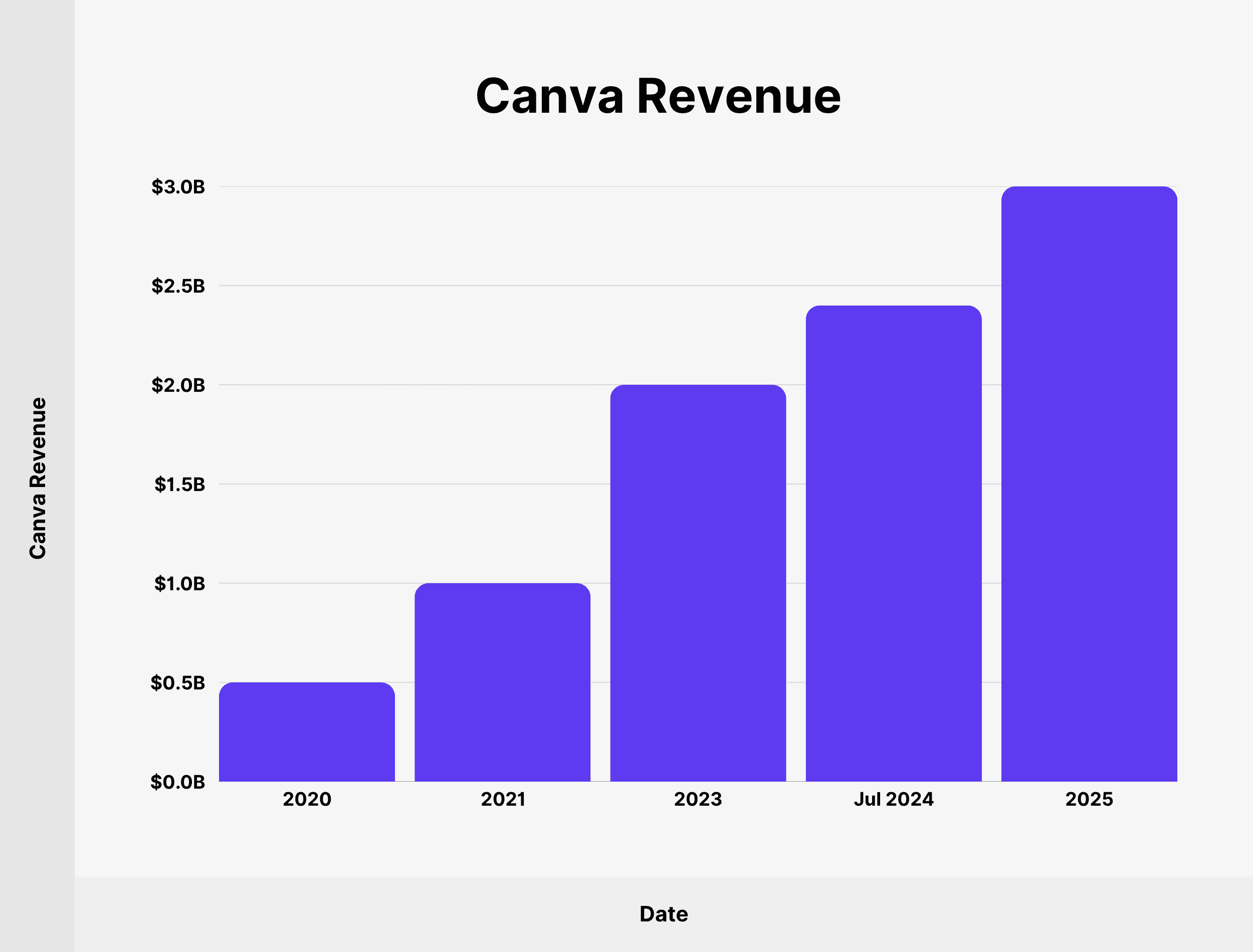

Canva just crossed a threshold that most software companies never reach. The company announced it hit $4 billion in annual recurring revenue by the end of 2025, powered by 265 million monthly active users and 31 million paid subscribers. But here's what's actually interesting: the majority of that growth came from a place that didn't exist five years ago.

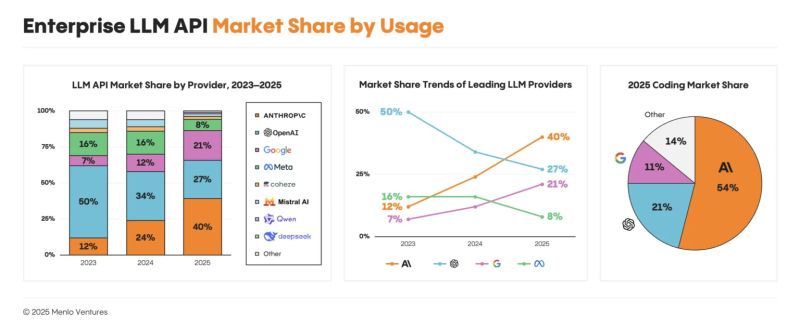

The referral traffic from large language models like Chat GPT and Claude is now a double-digit percentage of Canva's total acquisition engine. That's not just a footnote in their growth story. That's a fundamental shift in how users discover and use creative software. When you ask Chat GPT to help you design something, there's a solid chance it tells you to use Canva. That's worth billions.

What started as a simple online design tool for people who couldn't use Photoshop has transformed into something far more ambitious. Canva is no longer competing just on features or ease of use. They're competing on whether they can become the default creative layer for AI-powered applications themselves.

This transformation didn't happen overnight. It required deliberate choices about where to invest, who to acquire, and most importantly, how to position themselves as AI became central to everything. Let's break down what actually happened here, what it means for the creative software market, and why this moment matters more than the headline revenue number suggests.

The Numbers Behind the Growth

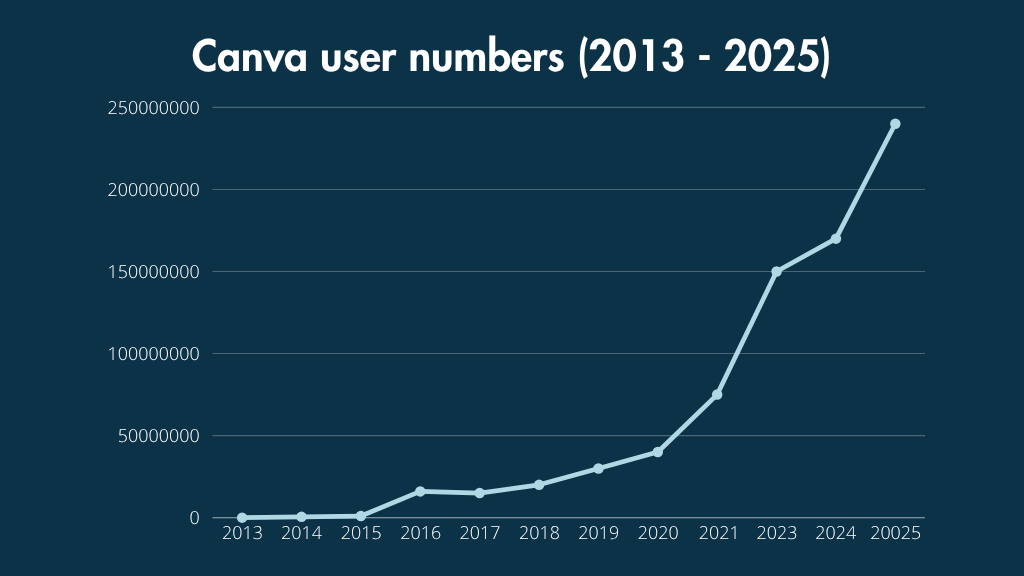

Take a step back and look at the scale here. 265 million monthly active users puts Canva in the same conversation as Spotify, Discord, and Figma combined for certain metrics. That's not just a big number. That's a network effect waiting to explode.

The 20% increase in monthly active users during 2025 is solid growth, but it's actually the composition of that growth that's telling. Canva's business isn't just getting bigger. It's getting wealthier. The company now has 31 million paid users, which means roughly 12% of their user base converts to paying customers. For comparison, most freemium software hovers around 2-5%.

But the real story hides inside those numbers. Canva's B2B business, which targets companies with 25+ seats, grew by 100% and now generates $500 million in ARR alone. That's one-eighth of their entire revenue stream from enterprise customers. Twelve months ago, that segment wasn't growing at 100%. Something changed.

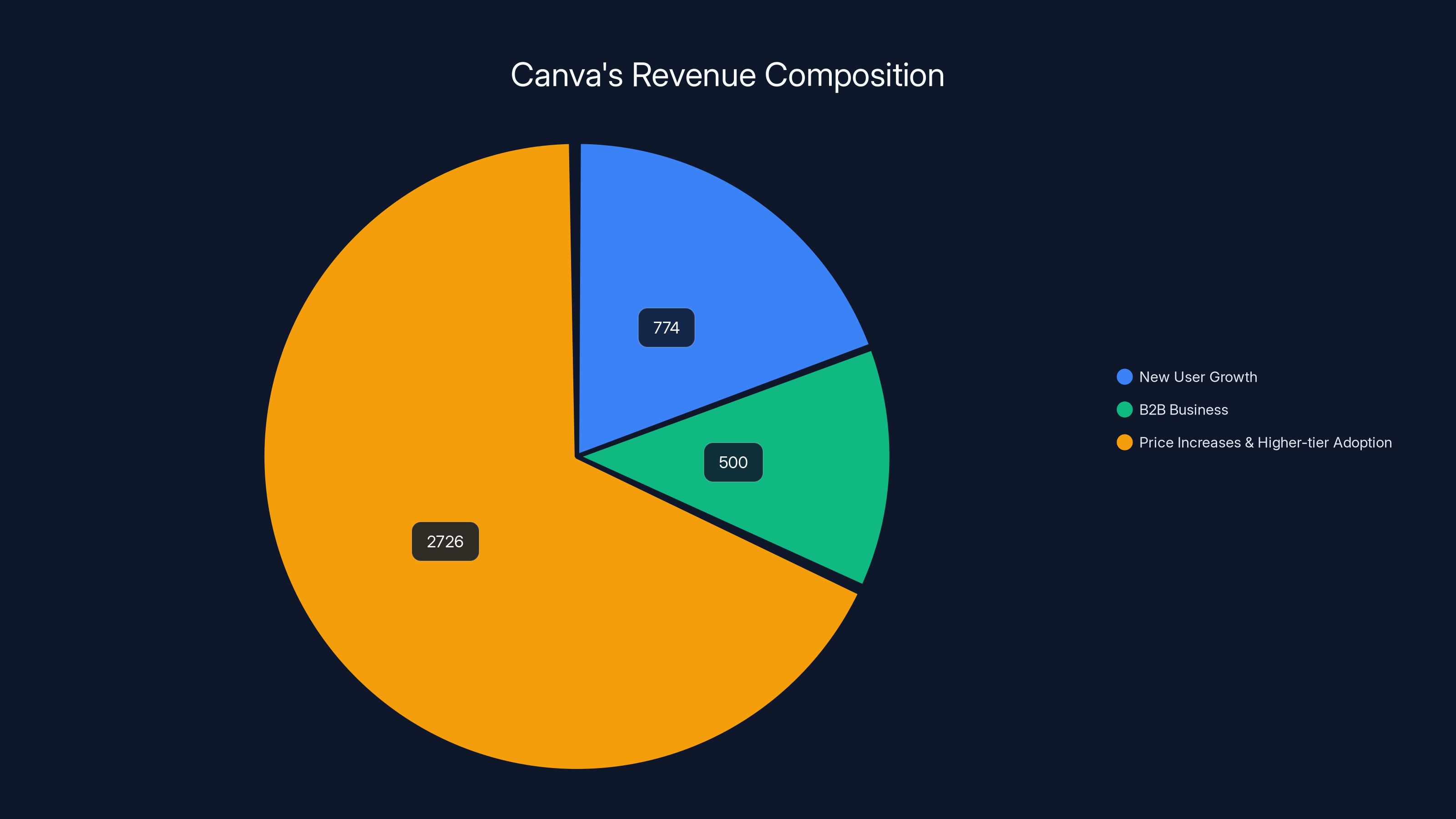

Let's look at what's driving this mathematically. If Canva added roughly 50 million monthly active users last year (20% of 265 million), and converted them at their average 12% rate, that's 6 million new paid users. At an average revenue per user of roughly

But that doesn't explain the full $4 billion. The remaining growth came from price increases, higher-tier adoption, and the B2B explosion. This is the typical SaaS growth formula: acquire more users, convert more of them, and increase what they're willing to pay.

The Geographic Expansion Strategy

Canva's expansion into emerging markets reveals something important about their growth thesis. They're introducing lower-priced subscription tiers in countries like Pakistan, Uruguay, Morocco, and Jamaica. This isn't just about being nice to international users. This is revenue optimization at scale.

A subscription that costs $10/month in the United States represents a different purchasing commitment than the same subscription in Pakistan, where the average wage is significantly lower. Canva figured this out and decided to capture that market with localized pricing rather than lose it entirely to piracy or free alternatives.

The North American market still represents the majority of their revenue, which makes sense given purchasing power and user density. But the growth in international markets is the real flag plant. When growth is concentrated in high-income countries, you've got a ceiling. When growth is spreading into emerging markets, you've found a much larger TAM.

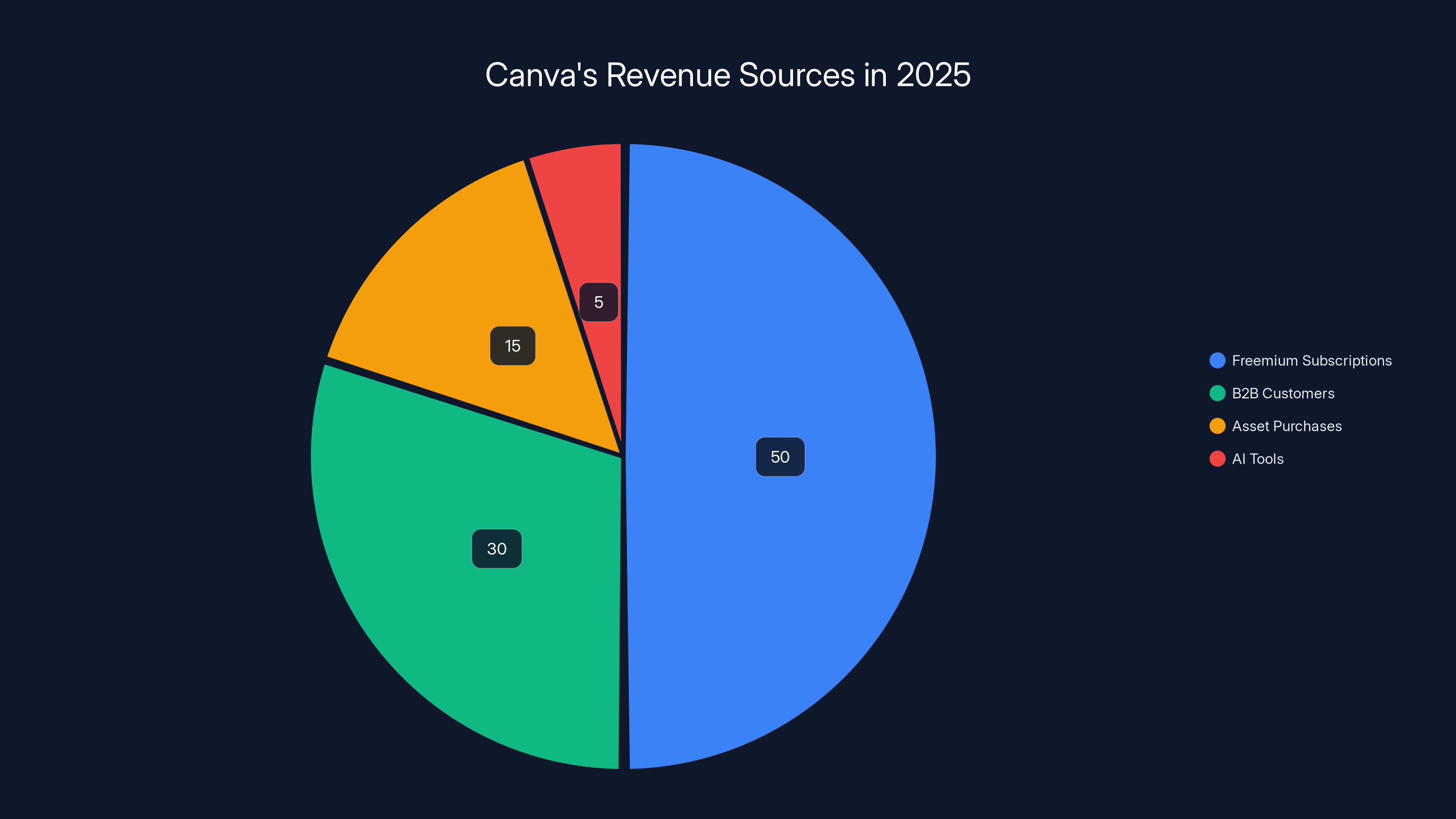

Canva's revenue in 2025 is primarily driven by freemium subscriptions (50%) and B2B customers (30%), with asset purchases and AI tools contributing smaller shares. (Estimated data)

AI Tools as the Growth Engine

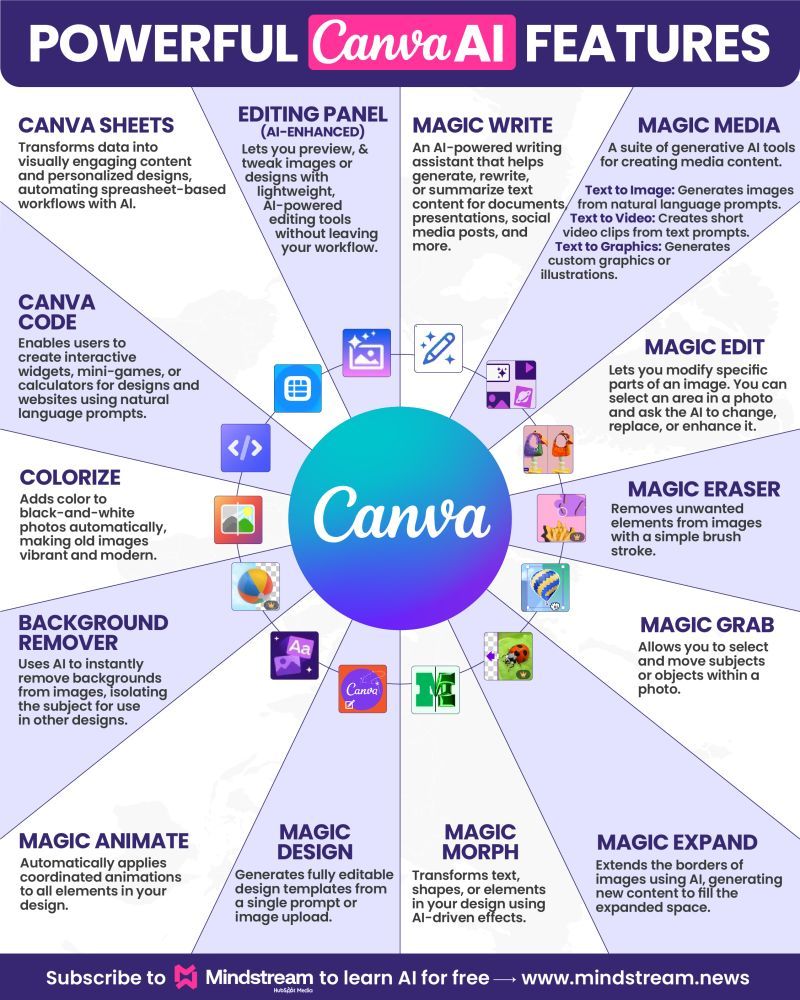

Canva launched an AI-powered tool that lets users create mini apps and websites using natural language prompts. It's not a revolutionary technology. It's not something that required 20 PhDs to build. But it works, and more importantly, it found product-market fit incredibly fast.

The number: 10 million monthly active users are now using this AI tool. That's not 10 million all-time activations. That's 10 million people using it every single month. For context, that's roughly the size of the entire user base of some major design tools.

This is how you know an AI feature has gone from "nice experiment" to "core product." When a standalone feature gets to 10 million MAU in a single year, you're looking at something that's changing user behavior. People aren't using Canva and then trying the AI tool as an afterthought. People are opening Canva to use the AI tool.

Canva's leadership explicitly stated they're inverting their product strategy. Instead of "a design platform with AI tools bolted on," they're now building "an AI platform with design tools alongside it." That's not just marketing language. That's a fundamental repositioning.

Think about what that means for product development. Your machine learning teams become central, not peripheral. Your API strategy changes because now other applications need to call your AI engine. Your interface design shifts from "where do we put the AI button" to "how do we make AI the primary interaction model."

The Integration Play: Becoming the Default Creator Tool

Canva has deeply integrated with Chat GPT and Claude. By October 2025, users had more than 26 million conversations with the Canva app inside Chat GPT. That's not an acronym that sounds impressive. That's actual engagement at scale.

More importantly, Canva was ranked as one of the top 10 referred domains from Chat GPT itself. When you ask Chat GPT to help you design something, it recommends Canva. This is the kind of placement that used to require millions in ad spending. They got it by building something useful.

Here's what most people miss about this integration: it's not symmetric. Canva integrated into Chat GPT, which means they're upstream of the LLM. When someone uses Chat GPT to design something, they're not leaving the LLM and going to Canva as a separate step. They're using Canva as an extension of the LLM experience. That's a fundamentally different relationship than a clickthrough from a search result.

The Claude integration follows the same pattern. Canva isn't just a tool you go to when you decide you need to design something. It's becoming a tool that AI systems recommend as part of their native capabilities.

This matters because it changes acquisition economics entirely. Search engine marketing has a unit cost. You bid for keywords, you get a click-through, you convert to a user. LLM referral traffic has no bid. There's no cost per click. The cost is entirely in the product quality and the relationship with the LLM provider.

Canva's

The LLM Referral Traffic Phenomenon

Canva's co-founder and COO Cliff Obrecht said something crucial that got buried in the reporting: LLM referrals now represent double-digit percentages of their total traffic acquisition. That's not small. That's not an experimental channel. That's a meaningful portion of how millions of people now discover and use their product.

To contextualize this, Google search has been the primary acquisition channel for web-based software for 20 years. SEO, paid search, organic search—all the effort in the industry for two decades has been optimizing for the search algorithm. Now there's a new algorithm that's sending traffic, and it's powered by language models instead of Page Rank.

Canva's strategy for this channel is deliberate. They're allocating resources specifically to ensure they show up in LLM search results. They're doing SEO in the traditional sense, but they're also doing something new. They're optimizing for what Obrecht calls the "LLM top of the funnel."

What does that mean in practice? When you ask Chat GPT "How do I make a YouTube thumbnail," the LLM needs to:

- Generate a helpful response with steps

- Recognize that Canva is a relevant tool

- Include Canva in that response

- Make sure the user clicks through

Canva has invested in all four of these things. They've built integrations so Chat GPT can actually launch Canva directly from the chat interface. They've ensured their public documentation is discoverable and relevant. They've structured their product so that the AI recommendation actually solves the user's problem.

The Comparison to Traditional Search

Canva learned how to dominate Google search years ago. They understood search intent. A user searching for "poster template" or "Instagram story design" had a specific need, and Canva delivered a specific solution. That understanding built a massive user base.

Now they're applying that same thinking to LLMs. But the optimization surface is different. Instead of optimizing for keyword density and backlinks, you're optimizing for relevance to what an LLM might recommend and usefulness in accomplishing the downstream task.

The advantage is that LLM referrals are potentially more qualified than search traffic. When Chat GPT recommends Canva, the user has already contextualized what they need to do. They're not in "I'll browse around" mode. They're in "I need to create this specific thing" mode. That's a much better starting point for conversion.

How Canva Evolved from Design Tool to AI Platform

The narrative that Canva tells publicly has shifted dramatically in the last 18 months. They went from "we're the easiest way for non-designers to create professional designs" to "we're an AI-powered creative platform that happens to have design tools."

This is more than messaging. This is how the product is being built. In the old version of Canva, AI was a feature. "Our magic resize" AI or "our smart suggestions." Useful, but supplementary. In the new version, AI is the substrate.

Consider the product development implications. When AI is central:

- Your APIs become critical. Other applications need to call your AI engine.

- Your training data becomes critical. You need high-quality design examples and user intent signals.

- Your speed becomes critical. An AI request that takes 10 seconds is useless.

- Your safety becomes critical. A generated design that includes something inappropriate tanks the user experience.

Canva has been investing heavily in all four of these areas. Their recent product launches have emphasized AI-first tools like the app and website builder that uses prompts instead of clicks.

The Mini Apps and Website Builder

The tool that lets users create mini apps and websites using AI went from launch to 10 million monthly active users in what appears to be less than a year. For a tool that requires no design experience and very little technical knowledge, the adoption curve is staggering.

Why would someone use Canva to build a website instead of Webflow, Wix, or WordPress? Because they can describe what they want in English and get something usable in minutes. The friction has been reduced to nearly zero.

This is the product strategy that's actually winning in the AI era. Not "we built an AI model that's better than everyone else's." But "we removed the technical barrier to entry so completely that the average person can accomplish something that previously required a specialist."

The data point to track here is whether this feature cannibalizes revenue from their traditional design business or expands it. Early signals suggest expansion. Users who build a website in Canva then use Canva to design the graphics for that website. The tools are complementary, not competing.

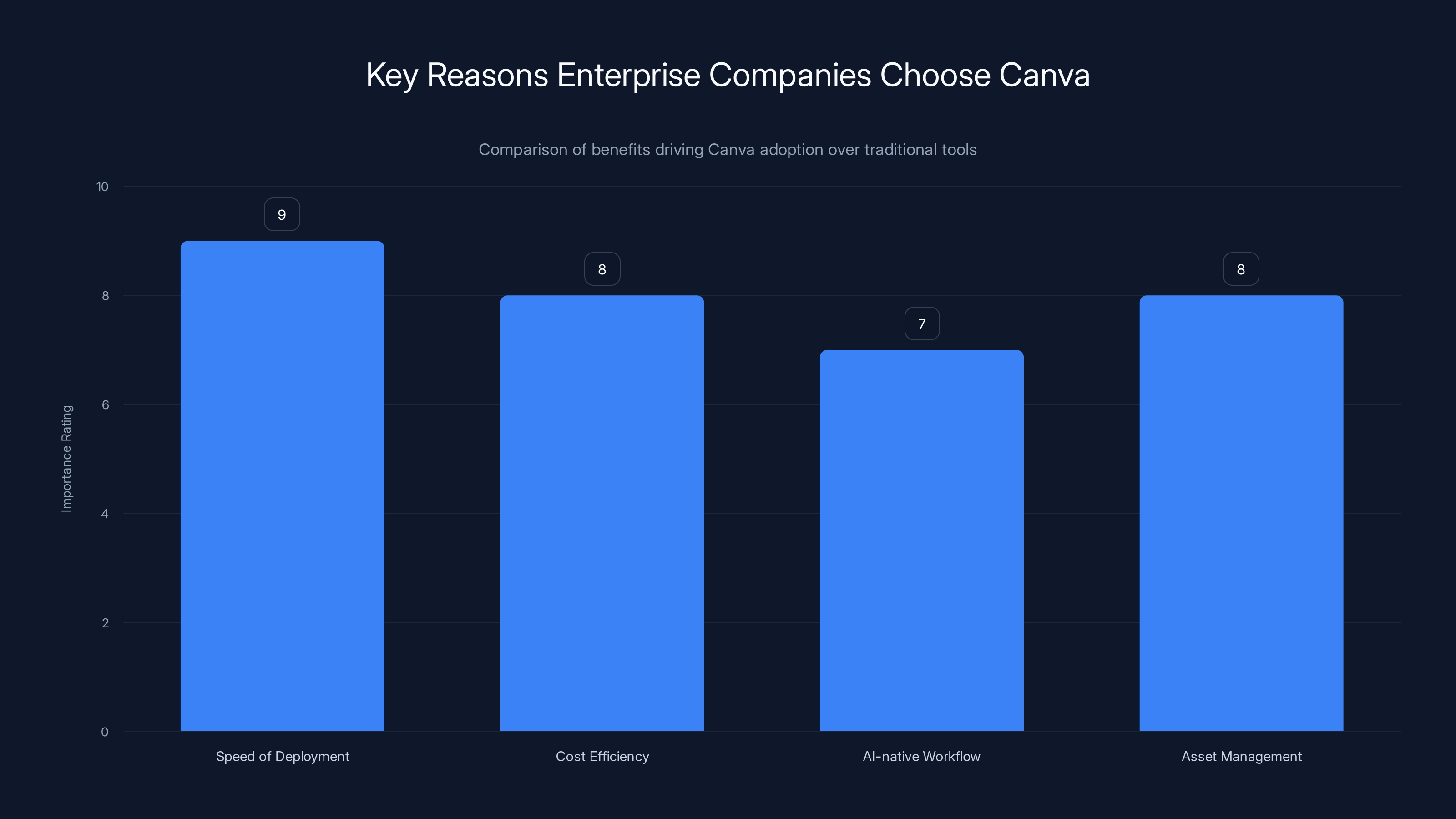

Enterprise companies prioritize speed of deployment and cost efficiency when choosing Canva over traditional design tools. Estimated data.

Competitive Pressures: Adobe, Freepik, and Apple

Canva doesn't exist in a vacuum. They're facing pressure from companies that have way more resources and far longer histories in the creative space.

Adobe is the 800-pound gorilla in creative software. Photoshop, Illustrator, Premiere Pro—Adobe has the installed base, the feature depth, and the brand recognition. But Adobe is also trying to evolve into an AI company while managing a legacy product line. That's a much harder problem than starting as an AI company.

Freepik represents a different kind of competition. Freepik is aggregating design assets (templates, stock images, icons) and layering AI on top. Their model is "show me everything that's relevant, then let AI help you pick." It's competitive because design assets are table stakes, and Freepik has massive asset libraries.

Then there's Apple, which announced the Creator Studio, a bundle of creative tools (Final Cut Pro, Logic Pro, Pixelmator Pro, Motion, Compressor, Main Stage) for $12.99 per month. This is price competition, bundling strategy, and the fact that Apple can afford to lose money on creative software in order to lock people into the ecosystem.

Canva's response to these pressures is interesting because they're not trying to out-feature everyone. They're trying to out-friction everyone. Can they make creating design easier than opening Final Cut Pro? Yes. Can they make it faster than learning Photoshop? Obviously. Can they do it in a way that works inside Chat GPT and Claude? Yes, and their competitors are years behind on that.

The B2B Explosion: Why Enterprise Customers Are Going All-In

The $500 million in ARR from B2B customers with 25+ seats, representing a 100% year-over-year growth, tells you something important about how companies are using Canva at scale.

B2B adoption of design tools is not new. What's new is that mid-market and enterprise companies are choosing Canva as their primary design platform instead of relegating it to "the cheaper option for simple graphics." Marketing teams, social media teams, HR teams—all kinds of internal teams are using Canva as their primary tool.

Why would an enterprise company that could afford Adobe Creative Cloud or custom design solutions choose Canva? Several reasons:

Speed of deployment: A mid-market company with 50 people can have everyone using Canva on day one. No server setup. No license management complexity. No training required beyond "hey, here's an account."

Cost efficiency: At scale, Canva's B2B pricing is cheaper than equivalent Adobe licensing. The math works out for any company with more than 50 active design users.

AI-native workflow: Canva's AI tools mean less work for overloaded design and marketing teams. If you can generate 80% of what you need with AI and then tweak it, that's time saved at scale.

Asset management: Canva's ability to create brand-consistent designs at scale, with brand asset management, appeals to larger companies that care about consistency.

The enterprise TAM here is substantial. There are millions of companies with 25+ employees. Most of them create marketing materials, internal presentations, social content. Most of them currently use a mix of tools (Canva for simple stuff, Adobe for complex stuff, PowerPoint for everything else). Canva's bet is that they can consolidate all of that into one platform.

The ROI Calculation for Enterprise Buyers

For a 100-person company, the math is roughly:

- Design tool costs today: 50 people using Adobe (33,000/year

- Design tool costs with Canva: 100 people using Canva (18,000/year

- Time saved from AI: 500 hours/year at 37,500 in labor

- Net savings: $52,500/year

That's a conservative estimate that doesn't even account for faster time-to-market or fewer design bottlenecks. For a company that creates a lot of marketing content, the savings are even more dramatic.

Once you explain that ROI in a sales call, enterprise deals close faster. That's why B2B is growing at 100%.

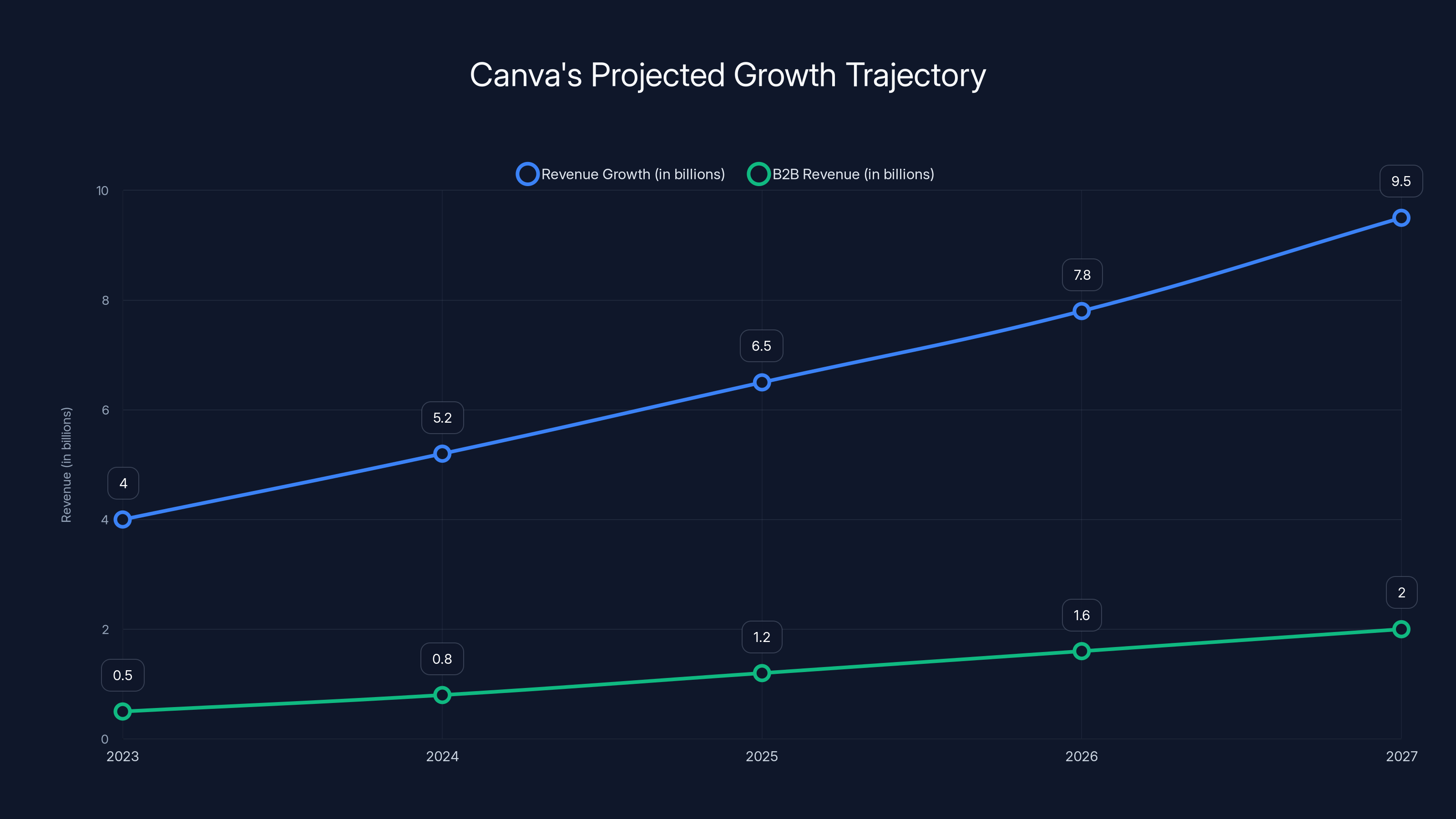

Canva's strategic investments in AI and enterprise solutions are projected to sustain a 15-20% annual growth, potentially reaching $9.5 billion in revenue by 2027. Estimated data based on current trends.

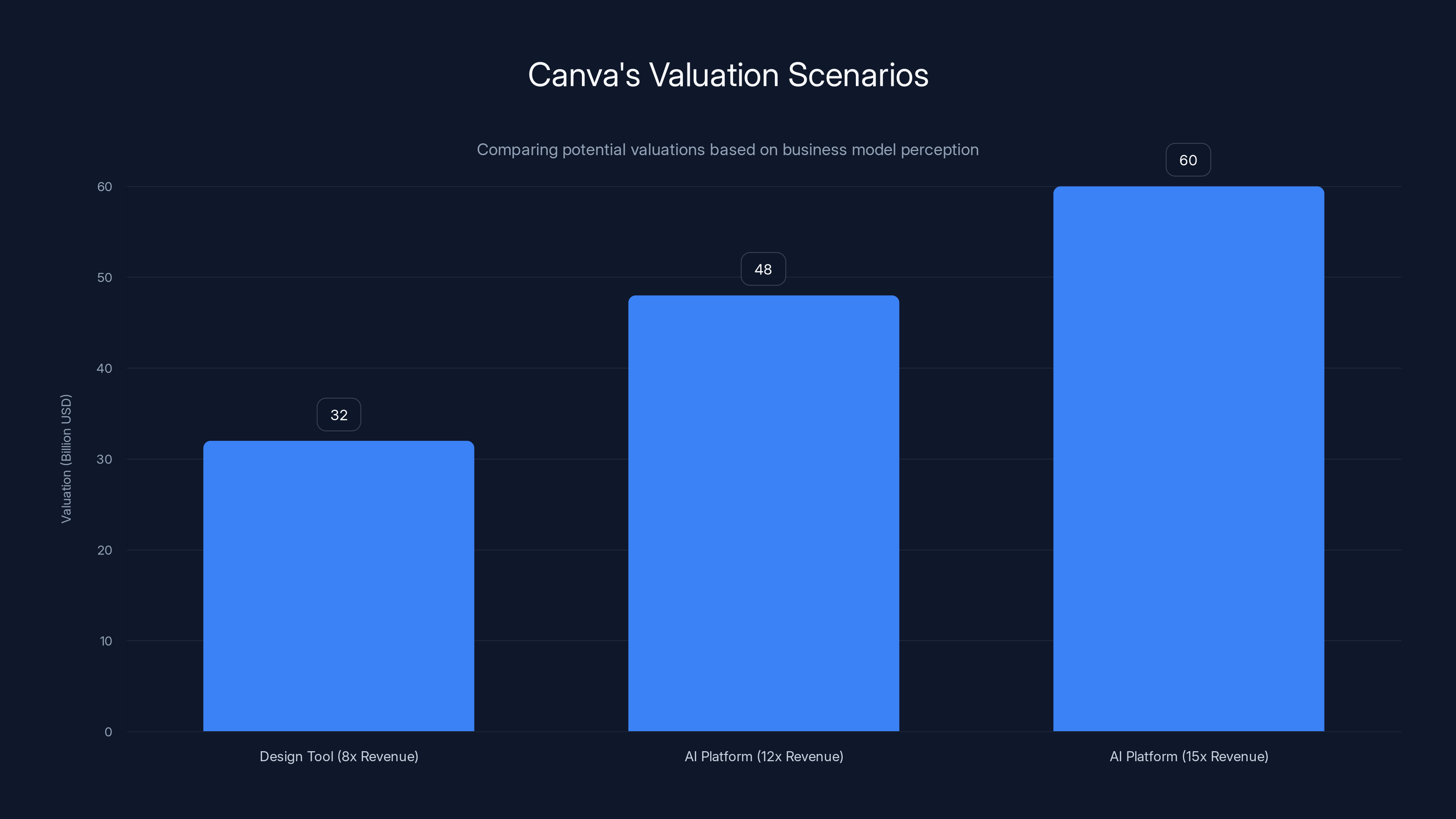

The Valuation Question: $42 Billion and Going Public

Canva was last valued at $42 billion in a secondary share sale. For context, that's more than Adobe's entire market cap at various points in history. It's more than the market cap of most public software companies.

The company has indicated plans to go public in the next "couple of years." IPO timing is strategic and depends on market conditions, but the signal is clear: Canva's leadership believes they've built something that public markets will value at even higher numbers.

When Canva goes public, the market will need to reconcile several facts:

- They're growing fast: 20% user growth + 100% B2B growth + strong net dollar retention suggests continued acceleration.

- They're profitable: Companies at this scale and growth rate are typically profitable or close to it. Canva has indicated strong unit economics.

- They have competition: But most of their competitors are either entrenched in different markets (Adobe) or not yet profitable (Figma, which is private).

- They're AI-dependent: The growth story depends partly on LLM referral traffic and the continued adoption of their AI tools.

The valuation will probably be determined by how much investors believe in the AI platform thesis. Is Canva a design tool company that's adding AI features, or is it an AI platform that happens to have design tools? That framing changes the valuation multiple significantly.

If Canva is thought of as a design tool, the comparable might be Adobe Creative Cloud—trading at roughly 8x revenue. At

If Canva is thought of as an AI platform with high growth and strong retention, the comparable might be other AI-enabled software platforms trading at 12-15x revenue. That suggests a $48-60 billion valuation at current revenue levels, with growth-based upside above that.

Public market investors will probably split the difference and price it somewhere between $35-45 billion at IPO, with the trajectory depending heavily on 2026 growth numbers.

The Strategic Implications: Where This Matters

Canva's growth trajectory and strategic focus have implications that extend far beyond just one company.

For AI developers: This shows the massive opportunity in making AI accessible to non-technical users. The companies that wrap AI in simple interfaces will win over the companies that build sophisticated models but bad UX.

For design tools: The traditional defensibility of design software—feature depth, learning curve, installed base—is being disrupted by AI-first tools that reduce friction. Expect faster product cycles and more emphasis on speed and simplicity.

For LLM providers: Chat GPT, Claude, and other LLMs depend on integrations with useful tools. Canva's success shows that being the first relevant tool to integrate deeply with major LLMs creates a moat. Expect more companies to prioritize LLM integrations.

For SaaS business models: The B2B growth and pricing strategy show that penetrating enterprise customers with a simple, AI-powered tool is viable. You don't need a sales team as big as Salesforce if your product sells itself.

Canva's rapid growth to

The User Experience Revolution

What most reports on Canva miss is that they've fundamentally solved a UX problem that's haunted creative software forever: the blank canvas problem.

When you open Photoshop, Illustrator, or even Figma, you get a blank canvas. Now what? Do you know exactly what you want to build? For 90% of users, the answer is no. They have a vague idea and need the tool to scaffold them toward it.

Canva solved this first with templates. Instead of a blank canvas, you get thousands of templates. Pick one, edit it. Problem solved for most users.

Now they're solving it again with AI. Instead of templates, you type a description. The AI generates something close to what you want. You edit it. Done. For the 90% of users who just need something that looks good, this is dramatically easier.

The remaining 10% of users who need pixel-perfect control and deep feature access will still use Photoshop or Figma. But that's okay. Canva doesn't need to be the only tool. They just need to be the first tool most people try, and the tool most people finish within.

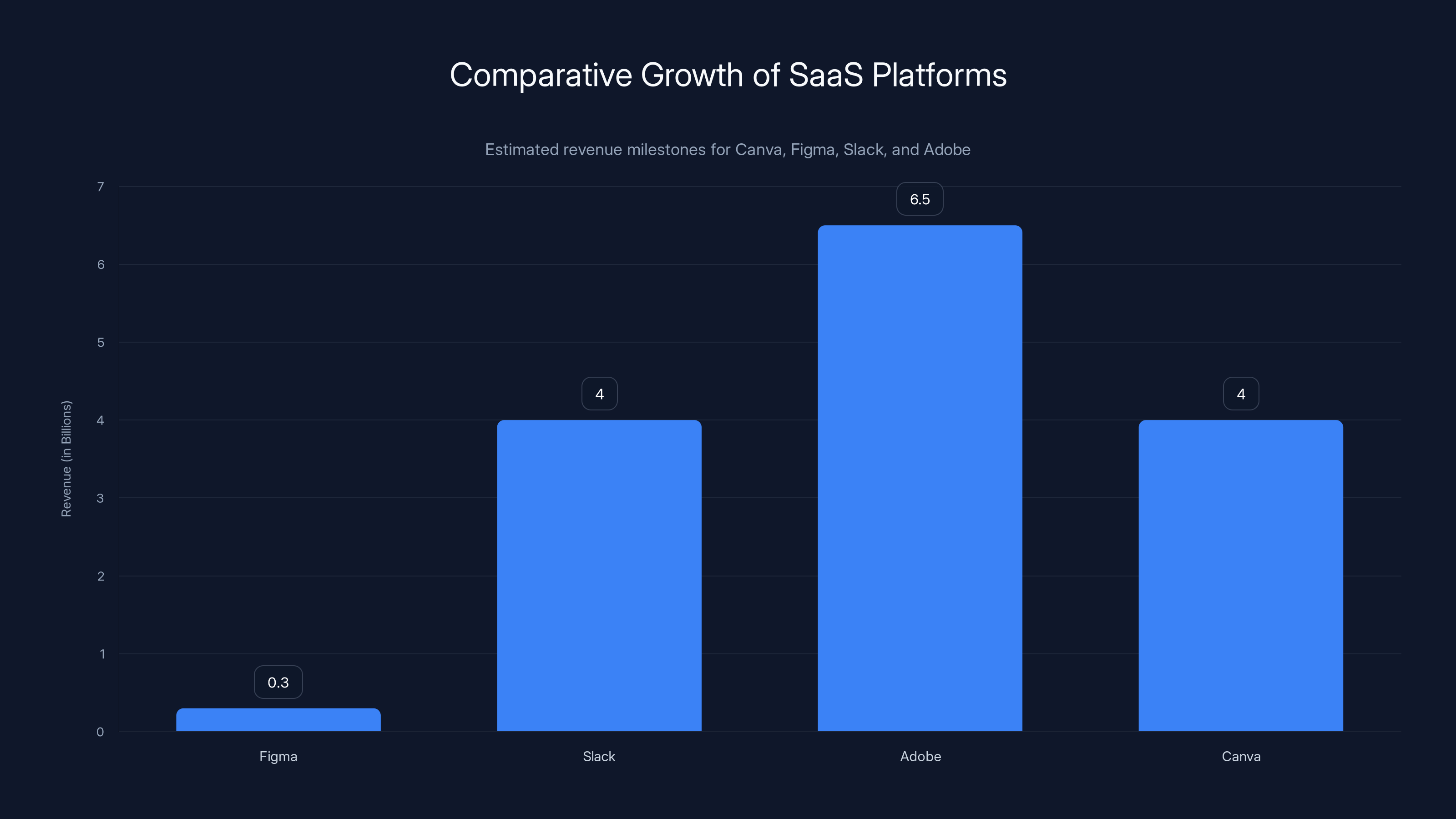

Industry Benchmarks and Comparative Growth

To understand how fast Canva is growing, let's compare to other SaaS platforms at similar revenue levels:

Figma reached

Slack reached $4 billion in revenue after roughly 10 years. Canva is reaching it faster, and Slack had a much longer sales cycle because they sold to enterprises from day one.

Stripe is approaching $30B in valuation but is not a public company, so revenue figures are unclear. However, private data suggests they've taken longer to scale than Canva.

The comparison that matters most is Adobe. Adobe's cloud business is generating roughly

That comparison suggests Canva's growth rate is not just fast. It's genuinely exceptional in the history of software.

Canva's valuation could range from

The Data Advantage Canva Has Built

What most people underestimate about Canva is the data advantage they've built. 265 million monthly active users creating designs generates an enormous amount of signal about:

- What designs work

- What color combinations are aesthetically pleasing

- What layouts convert for different use cases

- What fonts pair well together

- How users search for design solutions

All of that data has been fed into their AI models. Canva's image generation and design suggestion models have been trained on 265 million users' worth of real design behavior. That's not theoretical data. That's actual human preference data.

Compare that to a generic image generation model trained on the internet. Those models don't know if a design is actually good. They just know if it's close to some training data. Canva's models know if a design will actually work because they've seen millions of successful designs.

This is a defensible moat that most observers miss. You can copy Canva's feature. You can copy their pricing. But you can't copy their training data without spending years building a user base.

Pricing Strategy and International Markets

Canva's approach to pricing in different markets reveals something important about their long-term strategy. They're not trying to maximize revenue in every market. They're trying to maximize adoption in every market.

A Pakistani user paying $5/month is worth more than a Pakistani user pirating Photoshop or using free alternatives. Over time, as that user's income grows or as they recommend Canva to teams with higher budgets, that low-price user becomes a high-value user.

This is the classic "embrace the market, build the network, extract value later" strategy. It's what YouTube did in emerging markets. It's what Netflix did. Canva is doing the same thing with design.

The localization strategy also suggests they're thinking about Canva as a platform, not just a tool. A platform needs to be accessible in many markets and price points. A tool can focus on the highest-margin segment.

The Integration Economy and Ecosystem Strategy

Canva's integrations with Chat GPT and Claude are just the beginning of a broader ecosystem strategy. The company is positioning themselves as:

- A backend for creative tasks inside other applications

- A frontend for AI-generated content

- An asset library for design systems

- A workflow layer for team-based creative work

Each of these positions creates different types of lock-in and defensibility. If you're an LLM provider, you want Canva integrated so users can create things. If you're an enterprise, you want Canva as your design system so teams stay consistent. If you're a developer, you want to call Canva's API so your application can generate designs.

That's the kind of positioning that leads to multi-billion-dollar exits or IPOs.

Challenges on the Horizon

Canva's growth is real, but there are legitimate challenges ahead.

LLM dependency: If Chat GPT loses market share to Claude or other models, or if OpenAI changes how they allow integrations, Canva's referral traffic could be affected. They've diversified somewhat by integrating with Claude, but concentration risk remains.

Generative AI commoditization: Image generation is becoming table stakes. Figma added it. Adobe is adding it. As AI generation quality becomes similar across tools, the differentiation shrinks. Canva will need to stay ahead on user experience.

Enterprise selling complexity: As Canva sells more to enterprises, they'll need to invest in sales, customer success, and professional services. That's a different cost structure than self-serve consumer software.

Regulation: AI-generated content is facing regulatory scrutiny in various jurisdictions. If Canva's image generation tools face restrictions due to training data questions or output concerns, it could slow adoption.

Competition at scale: As Canva's TAM grows, more competitors will move into the space with better funding and resources. Adobe could pivot more aggressively. New entrants could build pure AI-first design tools.

None of these are deal-killers, but they're worth watching as the company scales.

What Happens Next: The 2026-2028 Outlook

If Canva maintains even 15-20% growth over the next two years, they'll likely reach $5-6 billion in ARR by 2027. At that scale, the company would be among the top 50 SaaS companies by revenue.

The question then becomes: what's the TAM?

The creative software market (design, video, audio) is probably $50-100 billion globally. Canva is trying to own a significant portion of that by being simpler and more accessible than the incumbents. They might eventually own 10-20% of that market.

But the bigger opportunity might be outside of "creative software" as a category. If Canva becomes the de facto design layer for every AI application, they might own 2-5% of the entire SaaS market. That's a $1-3 trillion market, so even small percentage points matter.

The company is clearly betting on the latter. Their focus on LLM integrations, API access, and B2B adoption all point to being infrastructure, not just a tool.

FAQ

What is Canva's core business model?

Canva operates on a freemium subscription model where free users get basic design templates and features, while paid subscribers (

How is Canva using AI to drive growth?

Canva has integrated AI throughout its platform to lower the barrier to creating professional-looking designs. Their AI image generation tool, text-to-design capabilities, and magic resize features automatically adjust designs for different formats. The company also launched an AI-powered website and mini-app builder that lets users describe what they want and have AI generate it. This has reached 10 million monthly active users, showing rapid adoption of AI-first creation methods rather than traditional template-based design.

What role do LLM referrals play in Canva's growth?

Large language models like Chat GPT and Claude are now a significant acquisition channel for Canva, representing double-digit percentages of their total traffic referrals. Canva has deep integrations with Chat GPT, which led to over 26 million conversations with the Canva app by October 2025. When users ask Chat GPT for design help, the AI typically recommends Canva, and users can launch Canva directly from the chat. This represents a fundamentally different acquisition model than traditional search marketing, with no cost-per-click but requiring deep product-level integration.

Why is Canva's B2B business growing so fast?

Canva's B2B revenue grew 100% in 2025 because mid-market and enterprise companies realize that Canva can replace expensive Adobe subscriptions while being easier to deploy and use. For a 100-person company, switching to Canva can save $30,000+ annually in software costs while saving additional hours through AI-powered design generation. Companies also value Canva's brand asset management and the ability to ensure consistency across all employee-generated marketing materials without needing a centralized design team.

What competitive advantages does Canva have over Adobe and other design tools?

Canva's main advantages are simplicity, speed, and AI-native design. Most users don't need Photoshop's depth; they need something that works fast. Canva's integration with LLMs creates a moat because users discover Canva through Chat GPT and Claude. The company also has enormous datasets from 265 million monthly users, which inform their AI models about what designs actually work. Adobe is trying to add AI to legacy software, which is harder than building AI-first. Additionally, Canva's B2B pricing and deployment are simpler than Adobe's enterprise licensing.

When is Canva planning to go public?

Canva's leadership has indicated plans to go public within the next "couple of years" from late 2025, which suggests an IPO timeframe of 2026-2027. The company was last valued at

How does Canva differentiate from Figma?

Canva and Figma serve different markets. Figma is built for professional designers and design teams collaborating on complex projects. Canva is built for the 95% of people who just need something that looks good quickly. Figma has deeper features but a steeper learning curve. Canva has simpler features but can accomplish most common tasks faster. Additionally, Canva has integrated deeply with LLMs, which Figma hasn't prioritized yet. For professional designers, Figma remains the better choice. For marketing teams, social media managers, and non-designers, Canva is typically faster and cheaper.

What is Canva's geographic revenue distribution?

Canva's revenue is still concentrated in North America, which represents the majority of their revenue due to higher purchasing power and user density. However, they're aggressively expanding into emerging markets by introducing lower-priced subscription tiers in countries like Pakistan, Uruguay, Morocco, and Jamaica. This localized pricing strategy aims to maximize adoption globally rather than extract maximum revenue from each market, which is a long-term TAM expansion play. As emerging markets grow economically, users acquired at lower price points become higher-value customers.

What's the actual TAM (Total Addressable Market) for Canva?

Canva operates in multiple overlapping TAMs. The immediate market is creative software (design, video, audio), worth an estimated

What risks could affect Canva's continued growth?

Key risks include LLM dependency (if Chat GPT loses market share or changes integration policies), generative AI commoditization as competitors add similar capabilities, increased regulatory scrutiny around AI-generated content training data, the need to build enterprise sales and support infrastructure (increasing costs), and intensifying competition from well-funded competitors. The company is also dependent on maintaining innovation velocity in AI-powered features to stay ahead of competitors. None of these are deal-killers, but they're significant enough that investors will monitor them closely during the IPO process.

How does Canva's $4 billion ARR compare to other SaaS platforms?

Canva's

Conclusion: The Design Platform of the AI Era

Canva's $4 billion revenue milestone isn't just a number. It represents a fundamental shift in how creative work is being done. The company has successfully repositioned itself from "the easy design tool for non-designers" to "the AI-powered creative platform that happens to have design tools."

That repositioning required making deliberate bets: invest in AI rather than just add AI features. Integrate deeply with LLMs rather than just optimize for search. Build for enterprise scale rather than just serve consumers. Expand globally with localized pricing rather than maximize revenue in high-income countries.

Most companies that have a hit product try to optimize and extract as much value as possible. Canva did the opposite. They reinvested profits, took strategic risks, and positioned for a market that didn't fully exist yet. That's the move that turns a billion-dollar company into a tens-of-billions-dollar company.

The next question is whether that trajectory continues. Can they maintain 15-20% growth as they scale? Can they expand B2B revenue to $1 billion+ annually? Can they stay ahead of competitors who are investing billions in AI capabilities? Can they navigate an IPO without losing the product agility that got them here?

Those are the questions that will determine whether Canva becomes a

For anyone building creative software, competing with creative tools, or trying to understand how AI is changing software markets, Canva's growth trajectory is the case study to watch. They've figured out something fundamental: make the thing so simple and so useful that millions of people choose to use it without being forced to. Then build the business around that product reality rather than the other way around.

That formula doesn't work forever. But at $4 billion in revenue with 20% user growth and 100% B2B growth, Canva's still in the phase where it works very well.

Key Takeaways

- Canva hit $4 billion ARR with 265 million monthly users, growing 20% YoY through AI adoption and LLM integrations

- LLM referral traffic (ChatGPT, Claude) now represents double-digit percentages of acquisition, with Canva as a top 10 referred domain

- B2B business exploded 100% YoY to $500M ARR, showing enterprises are consolidating design tools to Canva for cost savings and simplicity

- The company inverted its product strategy from 'design platform with AI tools' to 'AI platform with design tools,' reaching 10M MAU on AI features

- At $42 billion valuation with plans to IPO in next 2 years, Canva's positioning as AI infrastructure rather than just design software determines valuation multiples

Related Articles

- Enterprise Software Spending Hit $1.4 Trillion in 2026: What It Means for SaaS [2025]

- The AI Agent 90/10 Rule: When to Build vs Buy SaaS [2025]

- VMware Customer Exodus: Why 86% Still Want Out After Broadcom [2025]

- WordPress AI Assistant: Complete Guide to Site Building [2025]

- Infosys and Anthropic Partner to Build Enterprise AI Agents [2025]

- Fractal Analytics IPO Signals India's AI Market Reality [2025]

![Canva Hits $4B Revenue as LLM Traffic Explodes [2025]](https://tryrunable.com/blog/canva-hits-4b-revenue-as-llm-traffic-explodes-2025/image-1-1771425503074.jpg)