The $1.4 Trillion Question: Is Your SaaS Business Capturing This Growth?

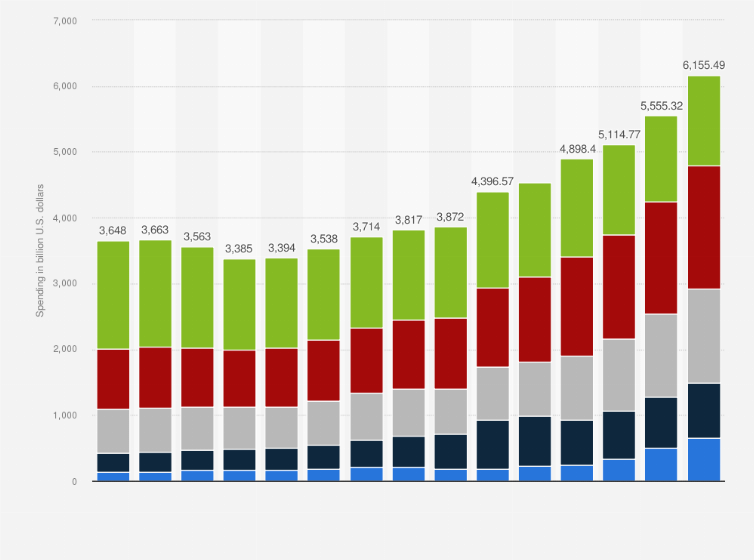

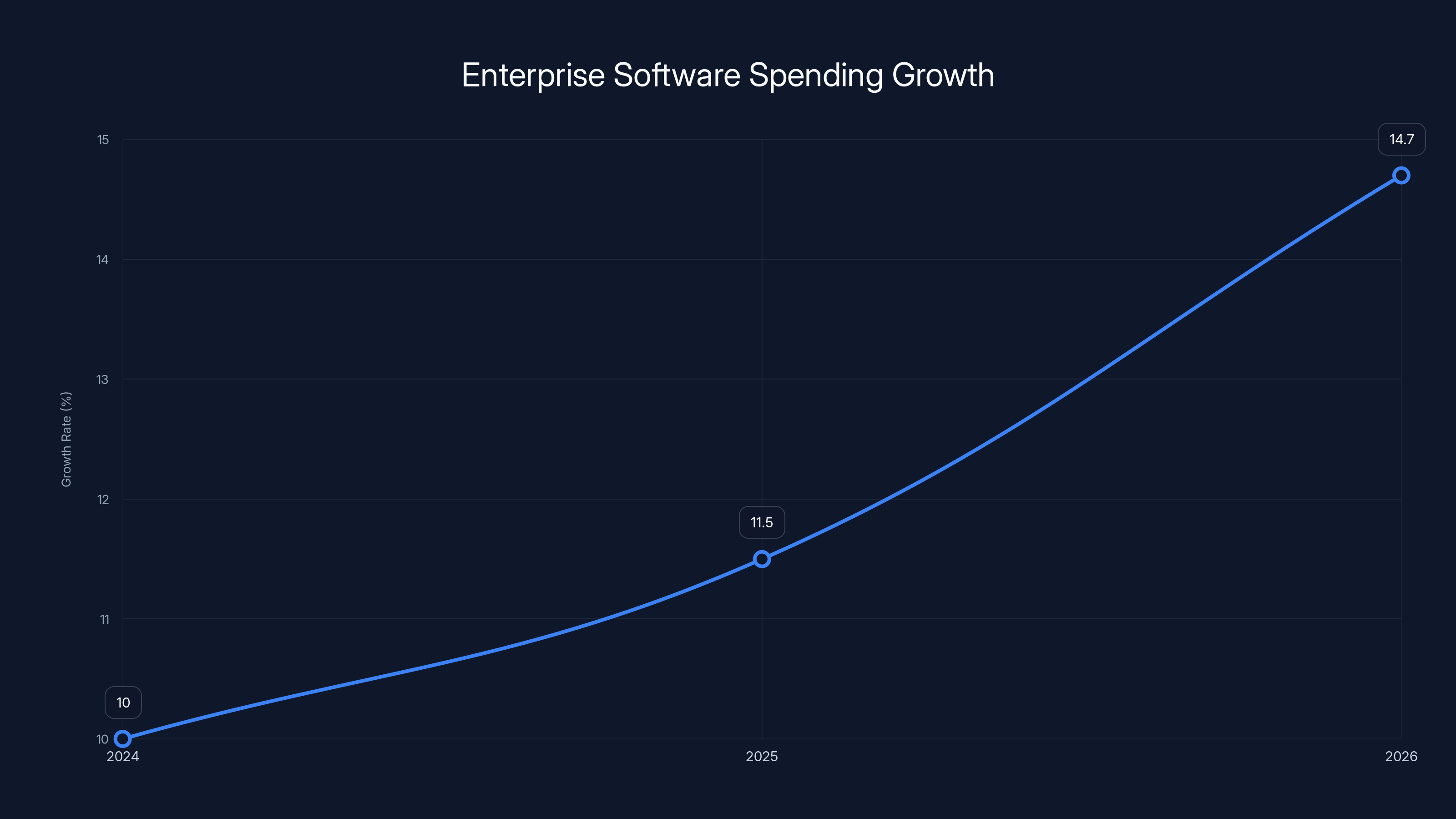

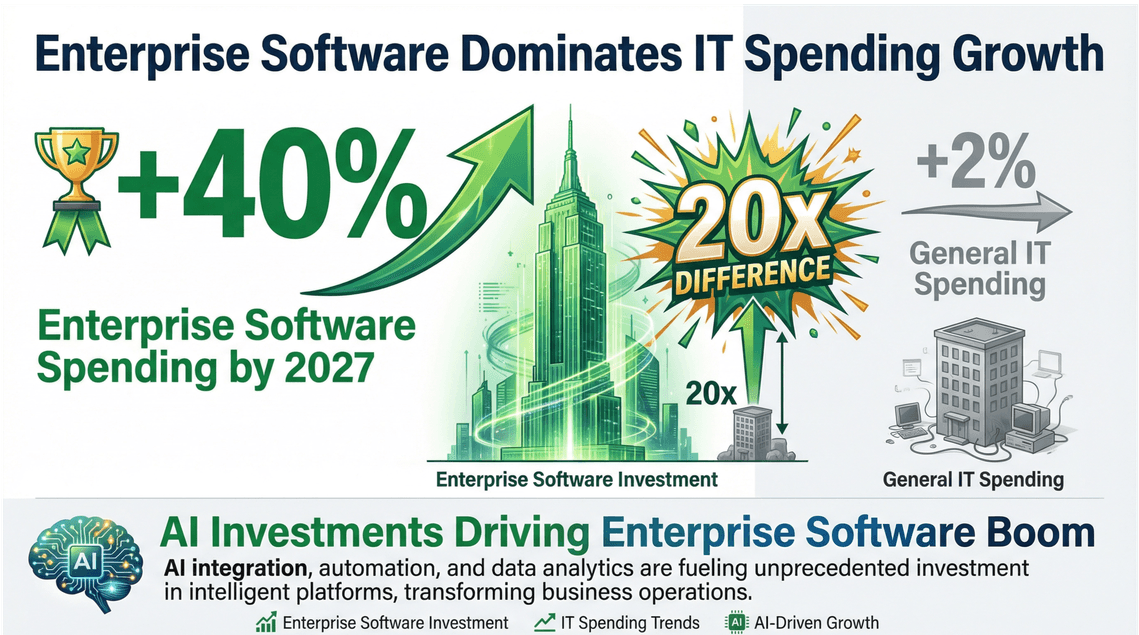

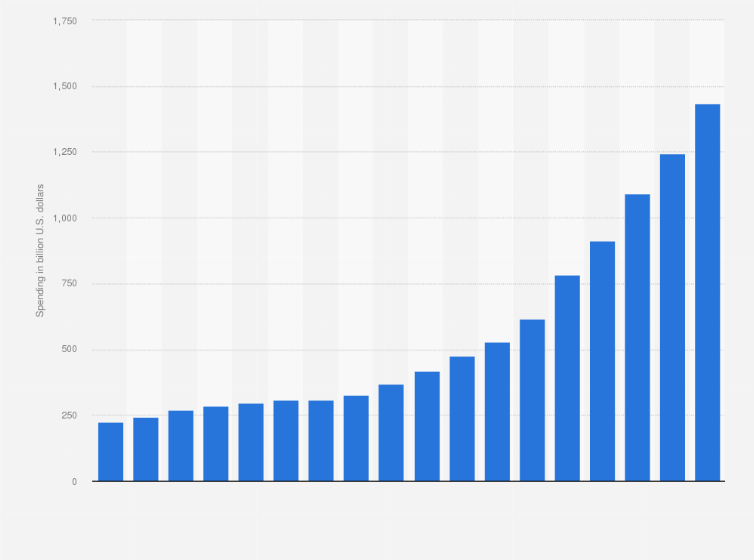

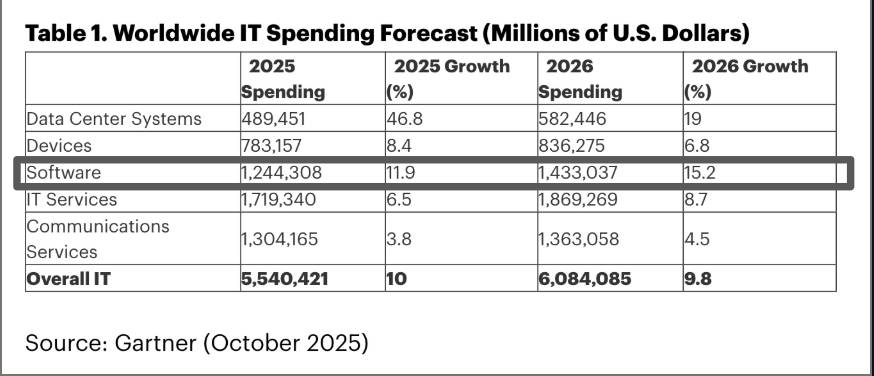

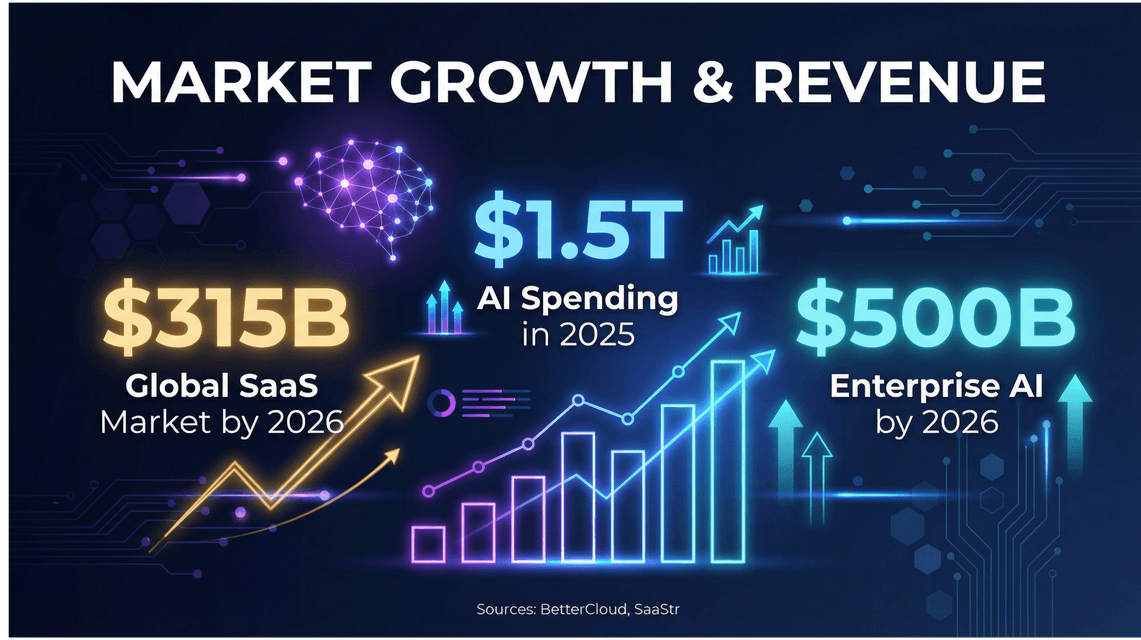

Here's something wild: enterprise software spending just hit $1.4 trillion in 2026. That's not a typo. And it's growing at 14.7% year-over-year.

For context, that's faster growth than the overall IT market. Faster than what most SaaS founders are actually growing at. If you're not hitting that 14.7% number, you're losing share to someone else. Someone's taking your slice of this pie.

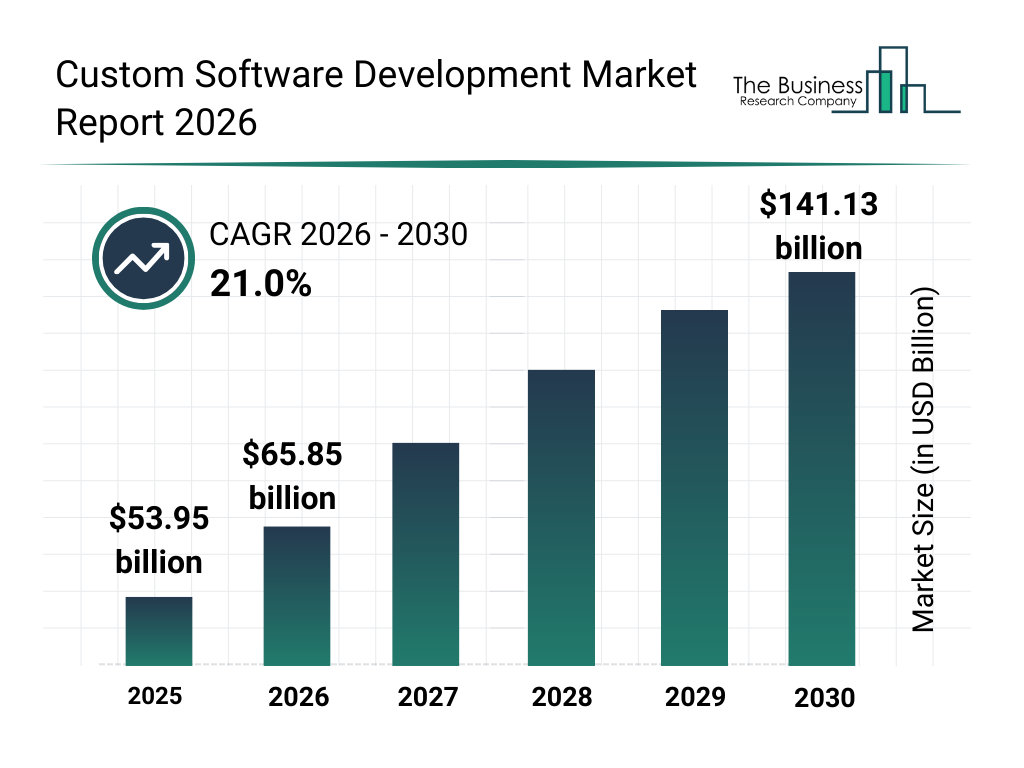

I know what you're thinking. AI hype has cooled off. Enterprises are skeptical of Gen AI promises. Budget approvals are harder to get. All true. But here's the plot twist: software spending is actually accelerating, not decelerating. It jumped from 11.5% growth in 2025 to 14.7% in 2026. That acceleration happened during the AI disillusionment phase, not despite it.

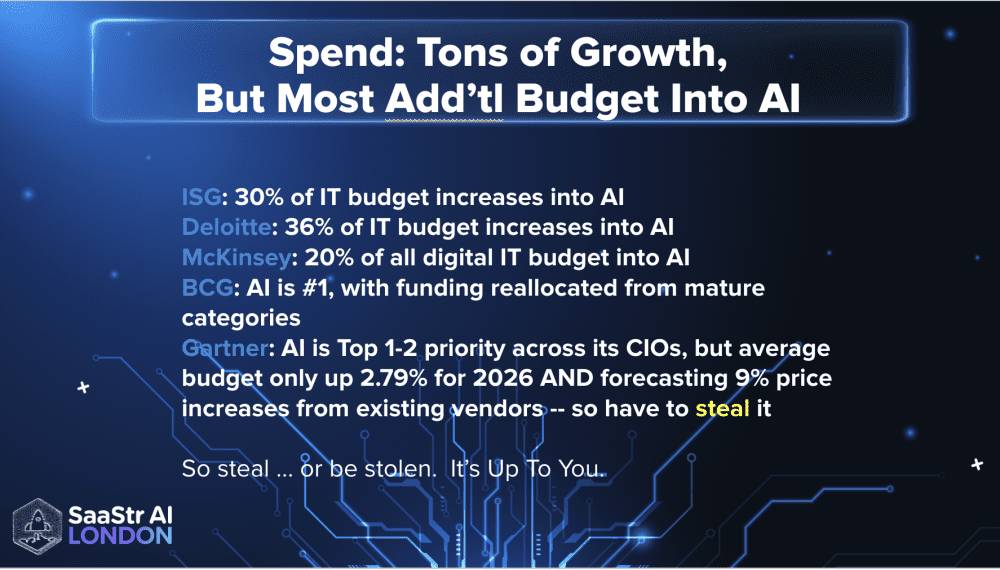

Why? Because AI features aren't optional anymore. They're baked into the products enterprises already own. Every renewal now includes AI. Every module costs more. The pricing paradigm has fundamentally shifted.

This is the most important market dynamic for B2B founders right now, and most aren't paying attention to it.

Let me break down what's actually happening, why it matters, and how to capitalize on it before your competitors do.

TL; DR

- Software spending hit $1.4 trillion in 2026, growing 14.7% despite Gen AI hype cooling

- AI model spending alone is growing 80.8%, now accounting for a larger share of total software budgets

- If your SaaS company isn't growing at least 14.7%, you're losing market share to competitors capturing this TAM expansion

- $180 billion in net new software spending is being deployed in 2026 alone—more incremental spend than the entire software market from 15 years ago

- The pricing paradigm has permanently shifted: AI features are now bundled into renewals, enabling higher ACV and expansion revenue

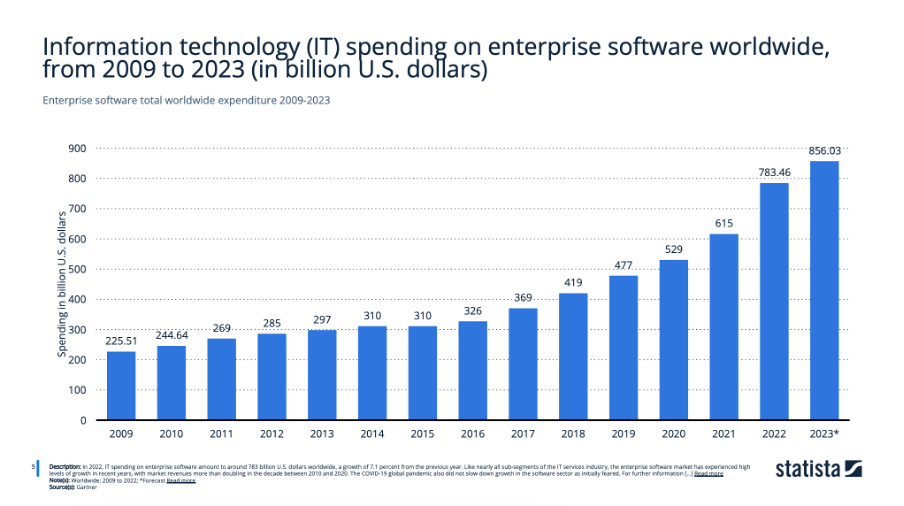

Estimated data shows that application software accounts for the largest portion of the $1.4 trillion software spending forecast, followed by infrastructure software. Estimated data.

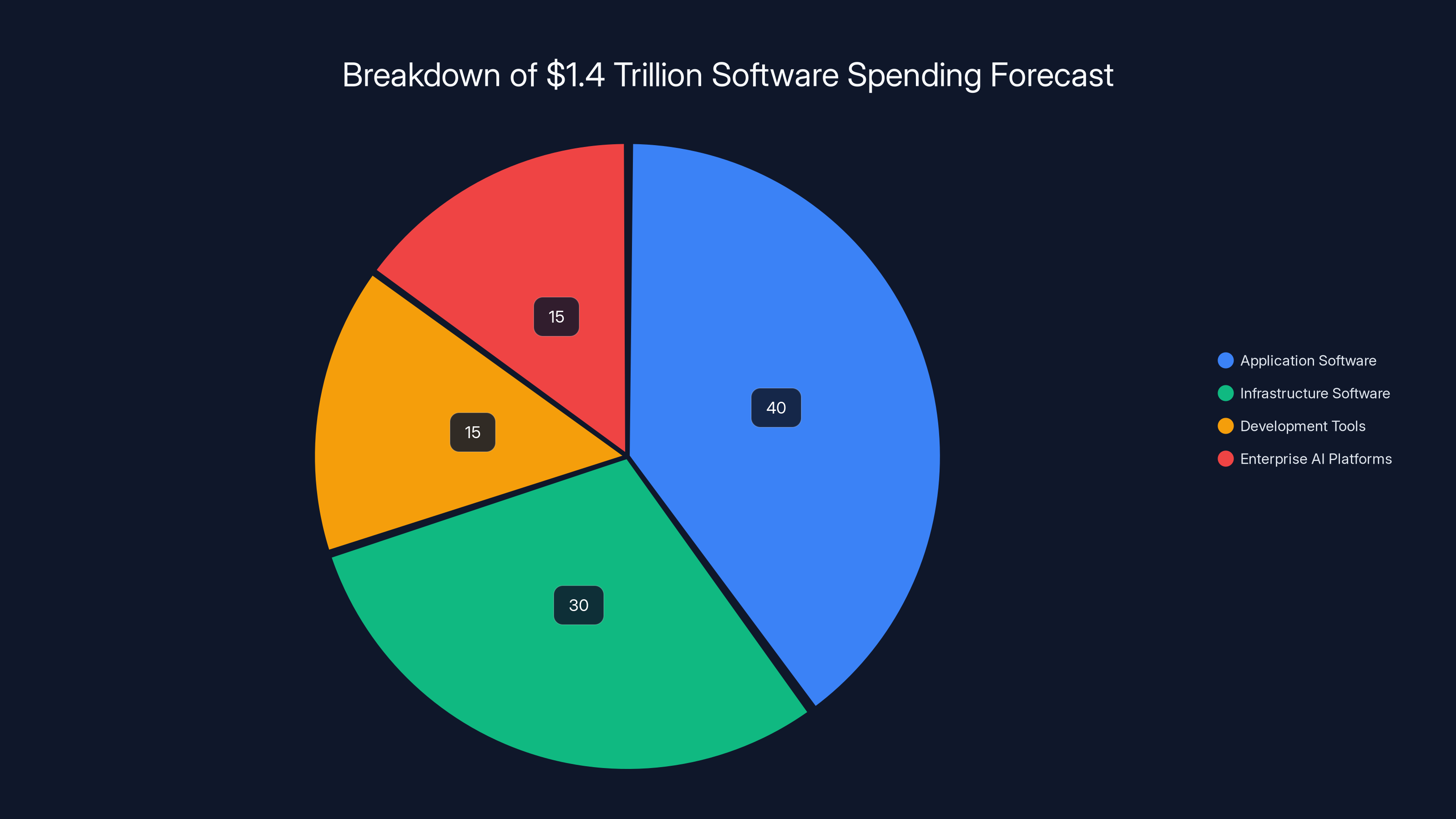

Understanding the $6.15 Trillion IT Spending Forecast

Before we focus on software, context matters. Gartner's total IT spending projection for 2026 is

Not this time.

The total IT spending forecast went up 0.07 trillion dollars in a single quarter. That's a $70 billion upward revision driven entirely by accelerating AI infrastructure investment. When the consensus is revised upward on such a massive scale, it signals something seismic is happening at the infrastructure layer.

Data center spending alone surpassed

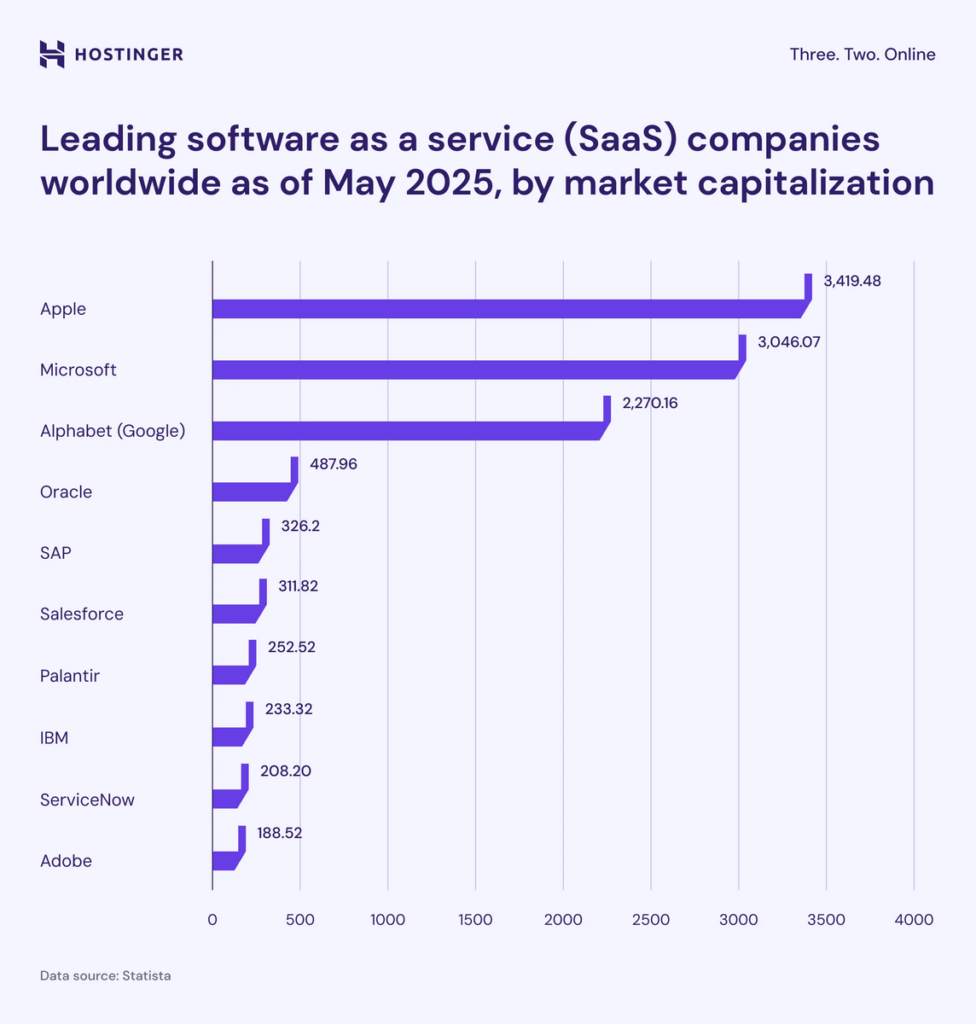

Hyperscale cloud providers (Amazon, Google, Microsoft, Meta, Tesla, Oracle, Apple, and smaller players) are driving this. They're deploying AI infrastructure at a pace that consistently surprises analysts. Every quarter, capital expenditure for these companies exceeds prior guidance. The AI infrastructure arms race isn't slowing down. It's entering a new phase.

But here's what matters for B2B founders: this infrastructure spending creates demand for software that runs on top of it. New capabilities enable new products. New products justify new budgets. New budgets flow to vendors who can innovate fastest.

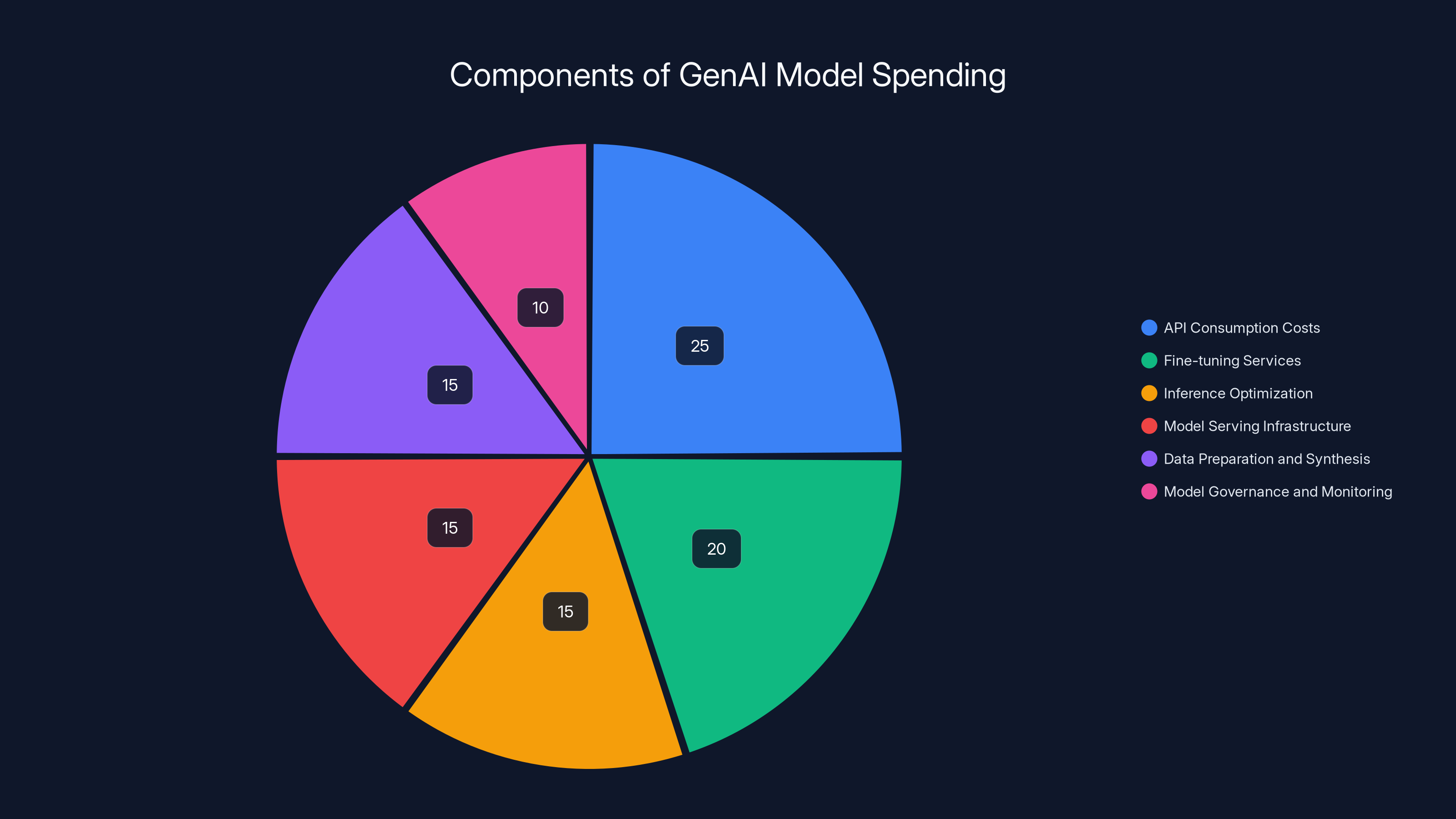

Estimated data shows API consumption costs as the largest component of GenAI model spending, followed by fine-tuning services and inference optimization. Estimated data.

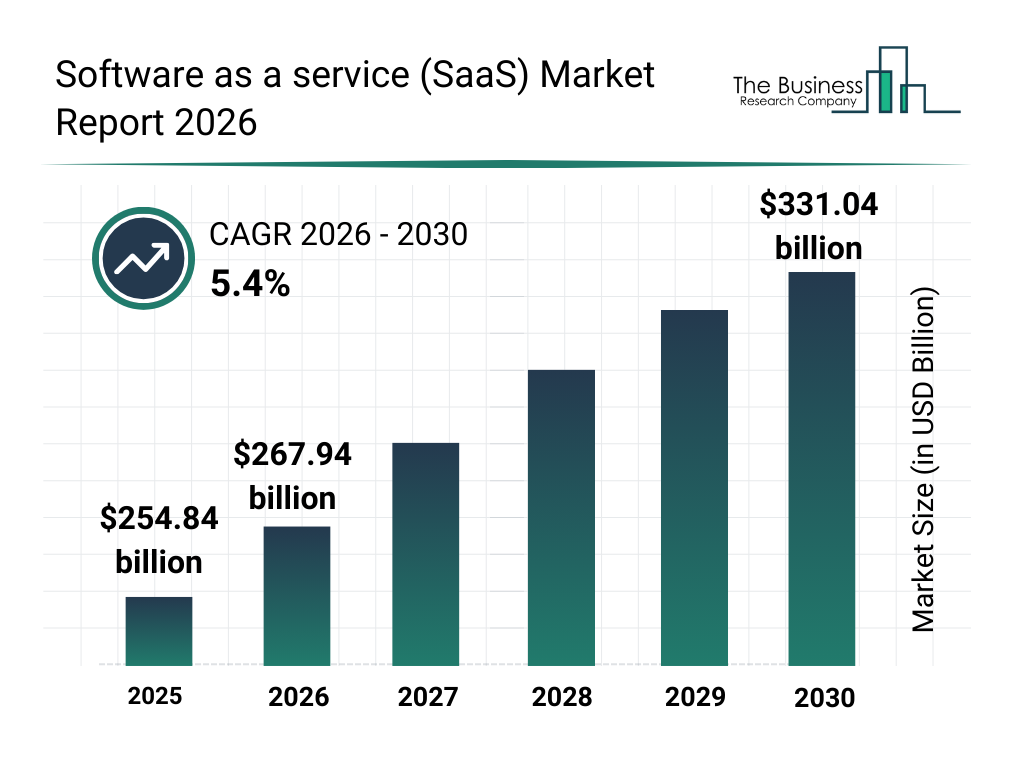

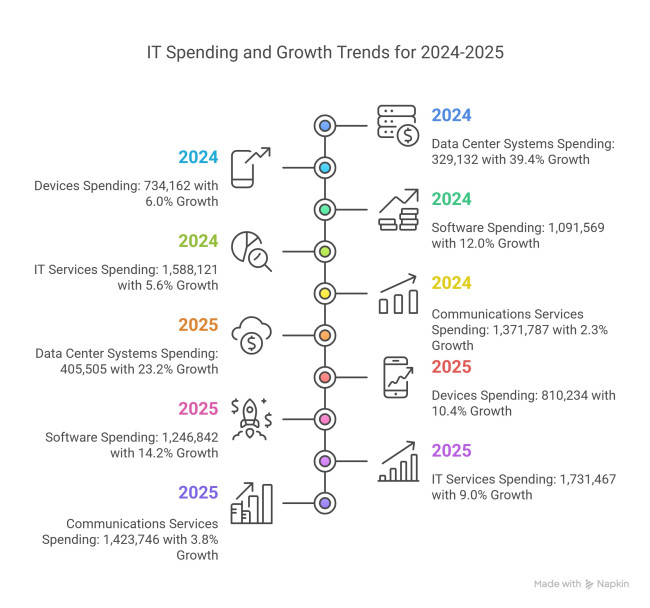

The Software Spending Acceleration: 11.5% to 14.7% in One Year

Let's focus on what actually matters for SaaS founders: the software line item.

Software spending grew 11.5% in 2025. In 2026, it accelerated to 14.7%. That acceleration happened while Gen AI hype was cooling into what Gartner calls the "trough of disillusionment." Budget scrutiny was increasing. ROI questions were getting tougher. Yet growth accelerated.

This seems counterintuitive until you understand why it's happening.

Enterprise buyers stopped asking whether they should adopt AI. They started asking which AI features come with their existing software. The decision shifted from "do we invest in Gen AI" to "which vendors are shipping AI fastest." That shift is permanent and profound.

Every software renewal now includes AI-powered features that weren't there a year ago. Every new module is positioned as "AI-enhanced." Every upgrade conversation now centers on new AI capabilities. The vendors shipping AI features fastest are winning renewals at higher prices and faster expansion cycles.

This is why growth accelerated even as hype cooled. The adoption of AI became implicit rather than explicit. Instead of buying AI as a separate line item, enterprises now buy it bundled into products they already own.

The numbers tell this story clearly. Gen AI model spending is projected to grow 80.8% in 2026. That's roughly 5.5 times the overall software market growth rate. Gen AI is now claiming 1.8 percentage points more of the total software market than it did in 2025. We're approaching a point—if we haven't already crossed it—where more software spending goes to AI-enhanced products than to products without AI.

That's not a niche trend anymore. That's a market-wide realignment.

The $1.4 Trillion Opportunity: Breaking Down the Market

Software spending of $1.4 trillion growing at 14.7% sounds abstract until you translate it into absolute dollars.

14.7% of

For perspective on this number: the entire global software market in 2010 was roughly $180 billion. That's how much incremental spending is being deployed in a single year right now. A decade worth of market growth is happening in one year.

That $180 billion needs to go somewhere. It's distributed across:

Application Software (the largest category where most SaaS companies compete):

- CRM platforms and customer engagement tools

- Enterprise resource planning (ERP) systems

- Human resources and talent management software

- Financial planning and analysis tools

- Business intelligence and analytics platforms

- Collaboration and communication tools

- Supply chain and logistics software

- Industry-specific vertical solutions

Infrastructure Software (where platform companies and databases compete):

- Cloud database and data warehouse platforms

- Container orchestration and Kubernetes tools

- API management and integration platforms

- Security and compliance software

- Monitoring, observability, and logging platforms

- Message queues and event streaming infrastructure

Development Tools and Platforms (where smaller, specialized vendors compete):

- AI development frameworks and platforms

- Low-code and no-code development tools

- Version control and CI/CD platforms

- Testing and quality assurance tools

- Code generation and AI pair programming assistants

Enterprise AI Software (the fastest-growing subcategory):

- Generative AI platforms and model serving infrastructure

- Machine learning operations (MLOps) tools

- Data preparation and feature engineering platforms

- AI governance, risk, and compliance tools

- Industry-specific AI applications

The distribution of this $180 billion isn't equal. It flows toward vendors solving immediate, measurable problems. It flows to companies shipping AI features monthly, not quarterly. It flows to vendors with land-and-expand motions that increase ACV faster than the market growth rate.

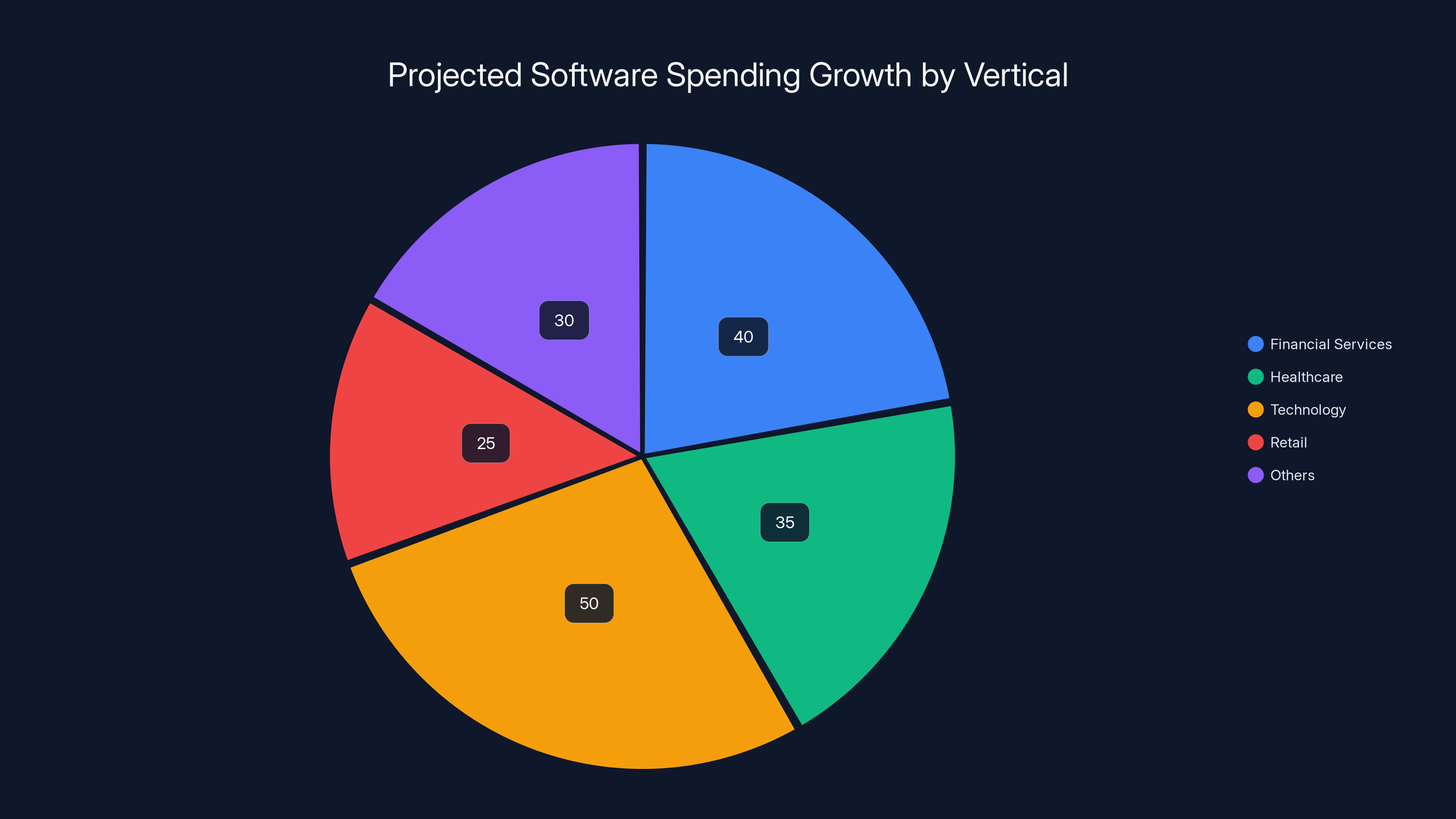

Financial services and healthcare are projected to capture significant portions of the $180 billion incremental software spending, driven by strong growth in these sectors. Estimated data.

Why the October-to-February Revision Downward Is Actually Bullish

Gartner revised the software spending growth forecast down from 15.2% to 14.7% between their October 2025 projection and February 2026 update.

This looks like bad news. It's not. Here's why.

The October forecast was built during the Q4 2025 budget flush. Enterprises were racing to deploy capital before year-end. Some of that demand got pulled forward. Companies deployed software budgets early to clear 2025 spending and avoid carrying capital over. That artificially inflated the Q4 2025 number.

The revised 14.7% reflects what actually happens when the holiday budget rush ends. It's more sustainable. It's a more realistic picture of actual year-round software spending than the October projection.

Moreover, 14.7% growth on a $1.4 trillion base is still extraordinary. This is the second-fastest growing category in all of IT, outpaced only by data center systems at 31.7%. If you're a founder and your company is growing slower than 14.7%, you're losing share. The market is expanding at double-digit rates, and losing ground is a choice.

Here's another way to think about it: the revised forecast down from 15.2% to 14.7% resulted in zero contraction of total software spending. The base is still $1.4 trillion, still up substantially from 2025. The percentage revision doesn't change the absolute dollar amount being deployed.

If anything, the revised forecast is more credible because it factors in actual Q1 2026 data and early quarter trends that weren't available in October. Credibility is bullish.

Data Center Spending: The AI Infrastructure Arms Race

To understand enterprise software spending, you need to understand what's happening at the infrastructure layer.

Data center systems are growing 31.7% in 2026. That's roughly 2.1 times the software growth rate. For every dollar going to software, more than two dollars are going to infrastructure. This ratio tells you something crucial: enterprises are making massive bets that AI infrastructure demand is here to stay.

Data center spending surpassed

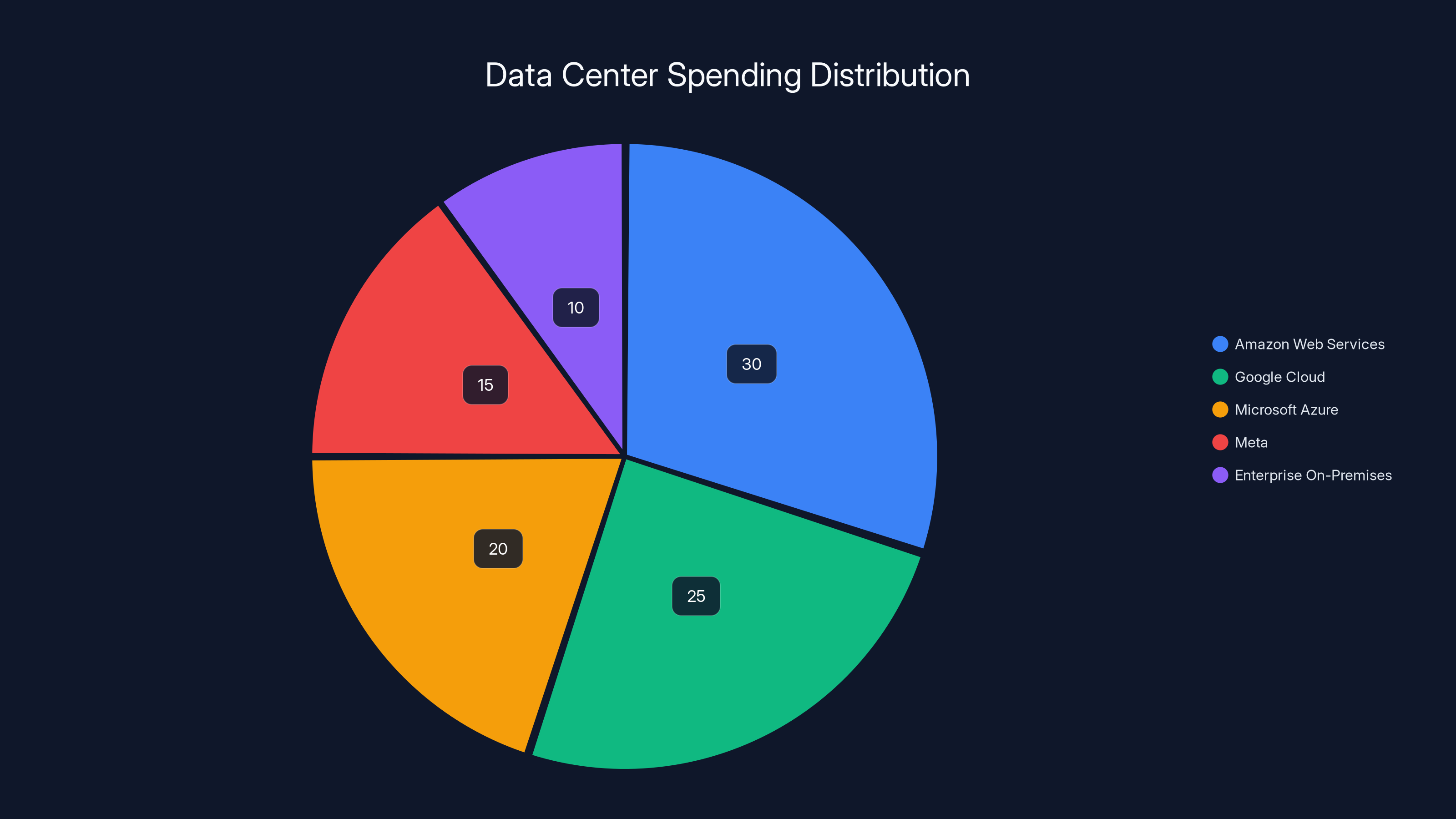

Who's buying this infrastructure? Hyperscale cloud providers first and foremost. Amazon Web Services, Google Cloud, Microsoft Azure, and Meta's internal infrastructure teams are responsible for the majority of this spending. They're building AI capacity for their own platforms, their customers' workloads, and future demand they haven't monetized yet.

But enterprise on-premises AI infrastructure is also growing. Large companies in finance, healthcare, pharmaceuticals, manufacturing, and energy are building private AI infrastructure. They want inference capability on their networks, not dependent on cloud provider APIs.

This infrastructure spending is the foundation for everything downstream. New capabilities enable new software features. New features justify higher prices. Higher prices flow to vendors shipping those features fastest.

If you're building SaaS products, understand this: the data center spending acceleration is a leading indicator of software spending potential. More infrastructure means more compute available. More compute enables more software features. More features justify higher prices and faster customer adoption.

Vendors with AI roadmaps aligned to emerging infrastructure capabilities will capture disproportionate share of the $180 billion in incremental software spending.

Enterprise software spending is projected to grow from 10.0% in 2024 to 14.7% in 2026, indicating an accelerating trend despite AI market challenges. Estimated data.

Devices and Telecom: Where Software Spending Outpaces Everything Else

To see how extraordinary software spending growth is, compare it to other IT categories.

Devices (phones, PCs, tablets, wearables) are growing just 6.1% on a $836 billion base. Growth is actually decelerating from 2025 due to rising memory prices and pulled-forward demand from 2024. Consumer devices are mature. Enterprise devices are stable. Replacement cycles are stretching out.

Telecom spending is growing even slower. Telecom is the slowest-growing category in IT, as it has been for years. Network capacity is abundant. Competition is fierce. Price compression is constant. Telecom spending will tick up modestly, but nobody's building careers or companies around telecom growth.

ITServices spending is growing steadily, but not explosively. Consulting, implementation, and managed services are growing in the 8-11% range. It's a steady, reliable category, but it's not where the growth action is.

The message is clear: infrastructure and software are eating everything. Devices are stagnant. Telecom is moribund. Services are plodding along. But software? Software is where the capital is flowing. Software is where the innovation is happening. Software is where enterprise value is being created.

If you're a founder, this is where the opportunity is.

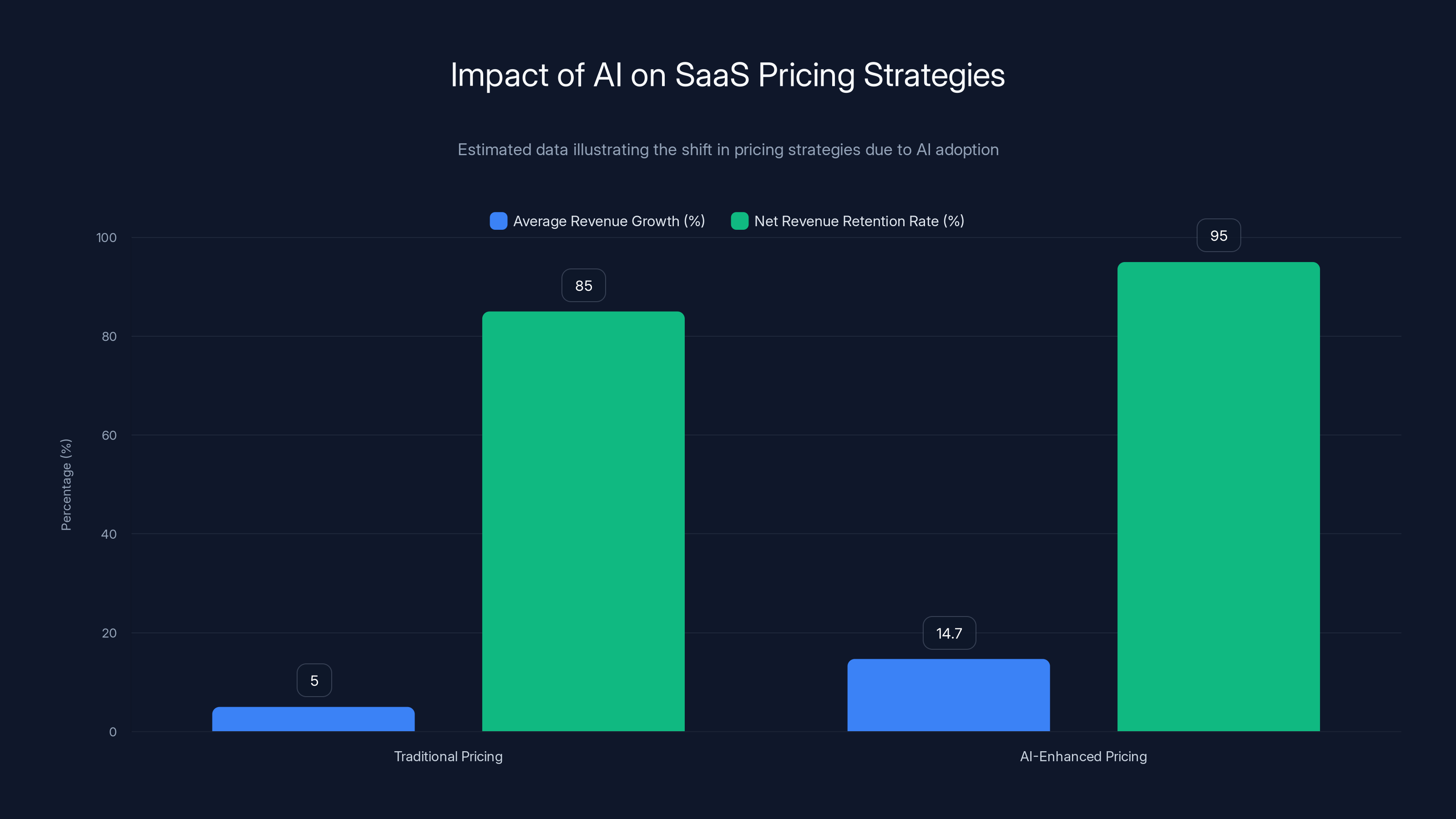

The Pricing Paradigm Shift: How AI Changed ACV Forever

One of the most important and least discussed changes in the SaaS market is the shift in pricing architecture driven by AI adoption.

Traditionally, SaaS companies competed on per-seat pricing, per-usage pricing, or tiered feature-based pricing. Add-on modules cost more. Premium tiers enabled more features. But the pricing structure was relatively transparent and competitive.

AI changed this. Here's how.

When companies started adding AI features to existing products, they didn't carve out a separate SKU. They bundled AI into existing renewals and positioned it as a value-add justifying price increases. The customer isn't paying more for "AI." They're paying more because the product is now more valuable.

This pricing architecture is significantly more powerful than traditional software licensing because:

-

It's justified by clear value delivery. AI features that save customers time, reduce errors, or improve decision-making have measurable ROI. Renewal conversations now center on ROI, not feature counts.

-

It's defensible against competition. If you're shipping new AI features every month and competitors are shipping them quarterly, price increases are justified. You're changing the product faster than alternatives.

-

It enables faster ACV growth. Instead of waiting for customers to grow into higher-tier plans, you can increase pricing at renewal by anchoring on new AI value. Expansion revenue accelerates.

-

It creates stickiness. Customers who've built workflows around your AI features are harder to displace. Switching costs increase.

This pricing shift is responsible for a material portion of the 14.7% software growth rate. It's not just that more vendors are getting adopted. It's that each vendor is extracting more revenue per customer.

When you add the effect of more vendors being adopted (land) to the effect of higher ACV per customer (expand), you get 14.7% market growth.

This has profound implications for your pricing strategy. If you're still using 2023-era pricing architecture, you're leaving 15-25% revenue on the table.

AI-enhanced pricing strategies have significantly increased average revenue growth and net revenue retention rates compared to traditional pricing models. (Estimated data)

Vertical-Specific Software Spending: Where Growth Is Actually Happening

The $1.4 trillion software number masks significant variance by industry vertical. Some verticals are growing 8-10%. Others are growing 18-20%. Your strategy should be oriented toward high-growth verticals where budget is actually flowing.

Financial Services (highest growth in 2026): Banks, insurance companies, investment firms, and fintech companies are investing heavily in AI-powered trading systems, risk modeling, fraud detection, and customer service automation. Regulatory technology (Reg Tech) is growing faster than core banking software. Pricing pressures are easing as AI enables new revenue opportunities. Software spending growth in financial services: 17-19%.

Healthcare (strong growth continuing): Healthcare systems are deploying AI diagnostic tools, clinical decision support, revenue cycle automation, and patient engagement platforms. Electronic health record (EHR) vendors are adding AI capabilities as fast as they can ship. Regulatory uncertainty around FDA clearance for certain AI tools is slowing adoption in some categories, but not enough to dampen overall growth. Healthcare IT spending growth: 15-17%.

Manufacturing (steady, growing demand): Manufacturers are using AI for predictive maintenance, quality control, supply chain optimization, and production scheduling. Industrial AI is moving from experimental to production. Vendors with solutions that fit existing manufacturing execution systems (MES) are winning. Manufacturing software spending growth: 13-15%.

Retail and E-Commerce (accelerating): Retail is deploying AI for demand forecasting, inventory optimization, personalization, and customer service. The shift to omnichannel retail is driving software spending growth. Smaller retailers are adopting AI via SaaS platforms rather than building internal tools. Retail software spending growth: 16-18%.

Energy and Utilities (steady): Energy companies are investing in AI for grid optimization, predictive maintenance, and renewable energy integration. The energy transition is creating demand for new software categories. But growth is more steady than explosive. Energy software spending growth: 12-14%.

Technology and Software (slowest growth): Software companies spending on software. Meta spending on infrastructure software. Growth in this vertical is slower because the industry is already highly penetrated with tools. Most growth in this vertical comes from existing vendors adding AI, not new categories. Technology company software spending growth: 10-12%.

The variance across verticals is 8-9 percentage points. If you're in a low-growth vertical, winning market share is harder. If you're in a high-growth vertical, you can grow slower than the category and still gain share.

Map your customer base by vertical. Understand which verticals are receiving budget increases. Shift your sales and product strategy toward those verticals.

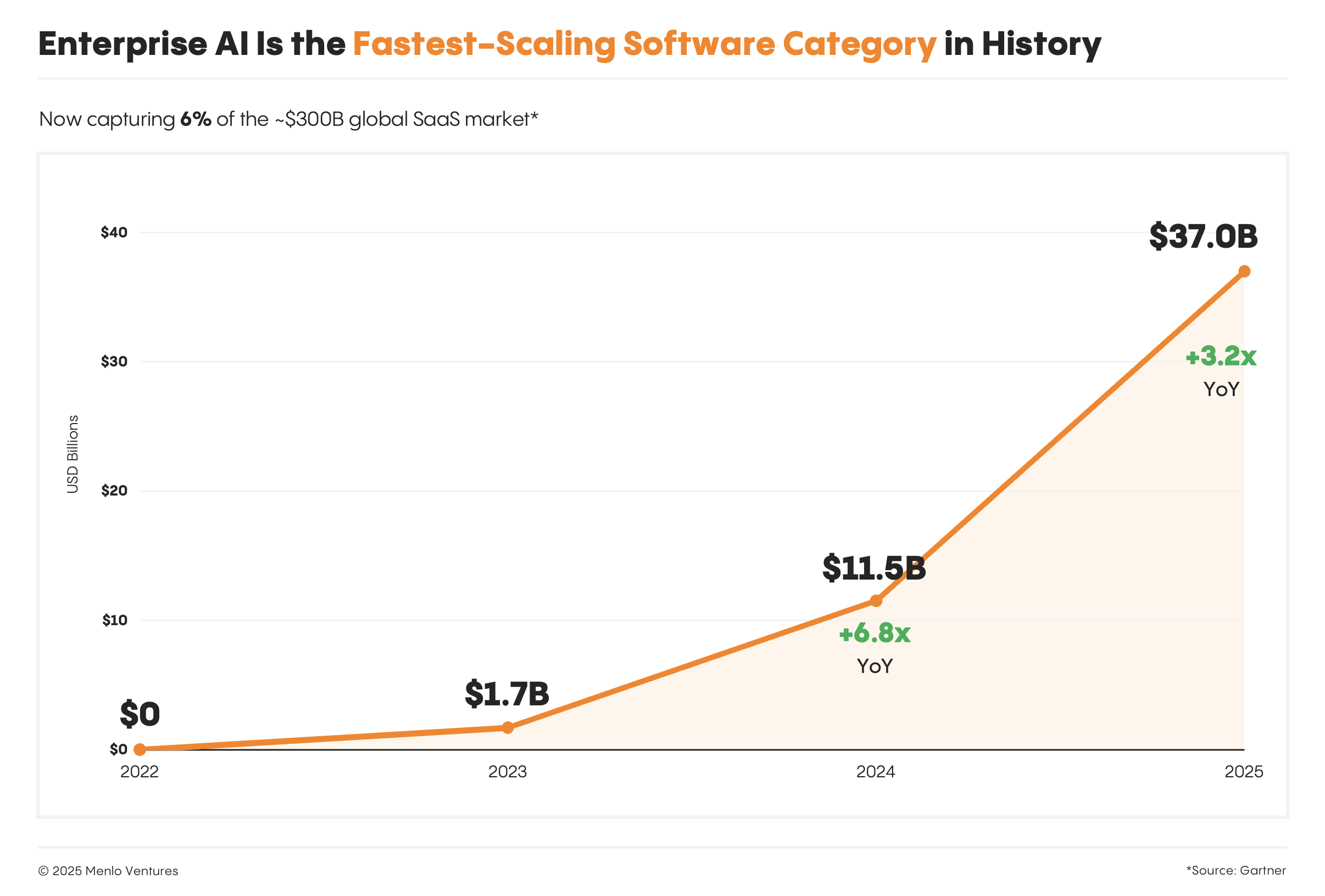

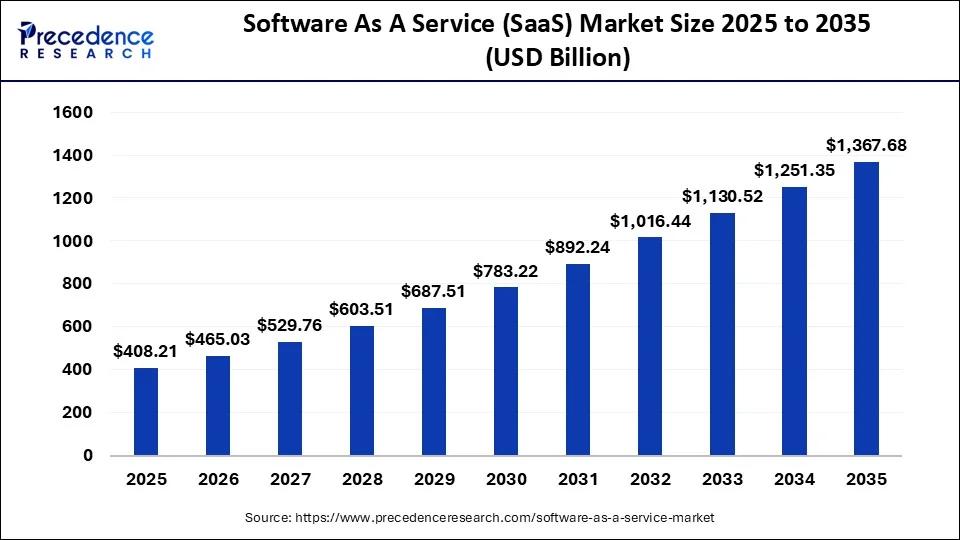

Gen AI Model Spending: 80.8% Growth and Rising

Embedded in the $1.4 trillion software spending number is a category growing five times faster than the market.

Gen AI model spending is projected to grow 80.8% in 2026. That's not a typo. Some categories within AI are growing faster. Foundation model APIs, fine-tuning services, and inference optimization tools are all growing 100%+ annually.

What does Gen AI model spending include?

- API consumption costs from OpenAI, Google, Anthropic, Meta, and other foundation model providers.

- Fine-tuning services where enterprises customize models for domain-specific tasks.

- Inference optimization platforms that reduce the cost of running models at scale.

- Model serving infrastructure like vLLM, vLLAM, and other open-source inference optimization systems.

- Data preparation and synthesis for training custom models or retrieval-augmented generation (RAG) systems.

- Model governance and monitoring tools that track model performance, detect drift, and manage responsible AI compliance.

This category is growing because:

First, adoption is expanding. More companies are integrating generative AI into more products. Adoption curves for new technology categories are S-curves. We're still in the early acceleration phase.

Second, usage per customer is increasing. Teams that started with one AI feature using one API are now using multiple models across multiple workflows. API bills are growing faster than customer count.

Third, enterprises are building more custom models. As companies mature their AI capabilities, they're moving beyond prompt engineering into fine-tuning and eventually full model training. The entire machine learning stack is being monetized.

Fourth, inference costs are falling but volume is exploding. Even as model costs per token drop 30-40% year-over-year, total usage is growing 200%+. The volume effect dominates the price effect.

Gen AI model spending is now large enough that it's the fastest-growing segment in enterprise software spending. It's claiming share from traditional software categories. It's generating new revenue streams for vendors who own model infrastructure.

If you're not tracking your Gen AI model spending as a separate budget line item, your CFO should be asking why. If you're not pricing your product to account for model API costs, your margin model is broken.

Hyperscale cloud providers like AWS, Google Cloud, and Microsoft Azure dominate data center spending, with significant investments also from Meta and enterprise on-premises infrastructure. (Estimated data)

CAC, ACV, and Unit Economics in a 14.7% Growing Market

Here's what the 14.7% software growth rate means for your unit economics.

If the market is growing 14.7%, your CAC efficiency matters more than ever. If you're spending the same to acquire customers as your competitors, but you're converting at 80% their rate, you'll die in a growing market. Growth magnifies unit economics. Good unit economics in a growing market become great. Bad unit economics become fatal.

With $180 billion in incremental software spending being deployed, there's room for inefficiency. But not for long. As more competitors recognize the TAM expansion, they'll increase sales and marketing investment to capture share. This drives down conversion rates industry-wide. CAC increases. To maintain growth rate higher than market growth, you need supernormal unit economics.

How do you achieve this?

First, land in high-growth verticals where pricing power is strong. Financial services and healthcare software spending is growing faster than average. Your CAC is the same, but ACV is higher. Unit economics work.

Second, build expansion revenue motions that exceed 1.2x net revenue retention. If your new ACV from existing customers outpaces churn and price compression, your expansion revenue becomes competitive advantage. Most SaaS companies rely on land-and-expand. The best companies rely on expand-and-land. Existing customers fund new customer acquisition.

Third, implement AI features that reduce churn and increase ACV. This isn't about bandwagon riding. It's about understanding that enterprises are budgeting for AI features. If you're shipping them, you capture budget allocation. If you're not, competitors do.

Fourth, optimize your sales process for the current macro environment. Deal cycles are extending. Budget scrutiny is increasing. But total budget is growing. Your sales process should emphasize ROI quantification, not feature counts. Help prospects see how your product captures value from the $180 billion incremental software spending.

The math is simple. Market growth rate is 14.7%. If your company is growing slower than 14.7%, you're losing share. To grow faster than the market, you need better unit economics than your peers. Better unit economics come from executing on the motions above better than alternatives.

International Software Spending: Regional Variance You Can't Ignore

The $1.4 trillion global software spending number includes geographic variance that fundamentally impacts market opportunity.

North America (45% of global software spending, growth rate 15-16%): The US and Canada are investing heavily in AI infrastructure and software. Enterprise software budgets are largest here. Pricing power is strongest. Competition is fiercest. If you're a founder in North America and not expanding international, you're missing 55% of the market.

Europe (28% of global software spending, growth rate 13-14%): European software spending is growing slower than North America due to regulatory complexity (GDPR, AI Act), economic headwinds, and more fragmented buyer bases. But growth is still solid. European enterprises are cautious on Gen AI due to regulatory risk, but they're still buying AI-enhanced productivity tools. The gap between North American and European growth rates is widening.

Asia-Pacific (23% of global software spending, growth rate 16-18%): APAC is the fastest-growing region. India, China, Southeast Asia, and Japan are all investing heavily in software infrastructure. Indian software companies are building AI capabilities fast. Chinese software companies have unique competitive advantages in inference optimization. This region is where the highest growth rates are, but market penetration is still lower. The opportunity is largest here.

Rest of World (4% of global software spending, growth rate 12-13%): Latin America, Middle East, Africa are growing but still small in absolute dollars. Not a primary focus for most SaaS companies, but important for specific verticals (banking in Brazil, manufacturing in Mexico, retail in Middle East).

The regional variance matters because it impacts your pricing power, ACV, and expansion revenue potential. A dollar of annual recurring revenue in North America is worth 1.3x a dollar in APAC due to higher pricing power and lower competitive intensity.

If you're raising capital, investors care about your geographic exposure. Too much concentration in North America and you're seen as a mature company with limited growth runway. Too much in APAC and you're seen as having execution risk and collection challenges.

Optimal is balanced geographic exposure with higher growth rates in APAC offsetting more mature markets in North America.

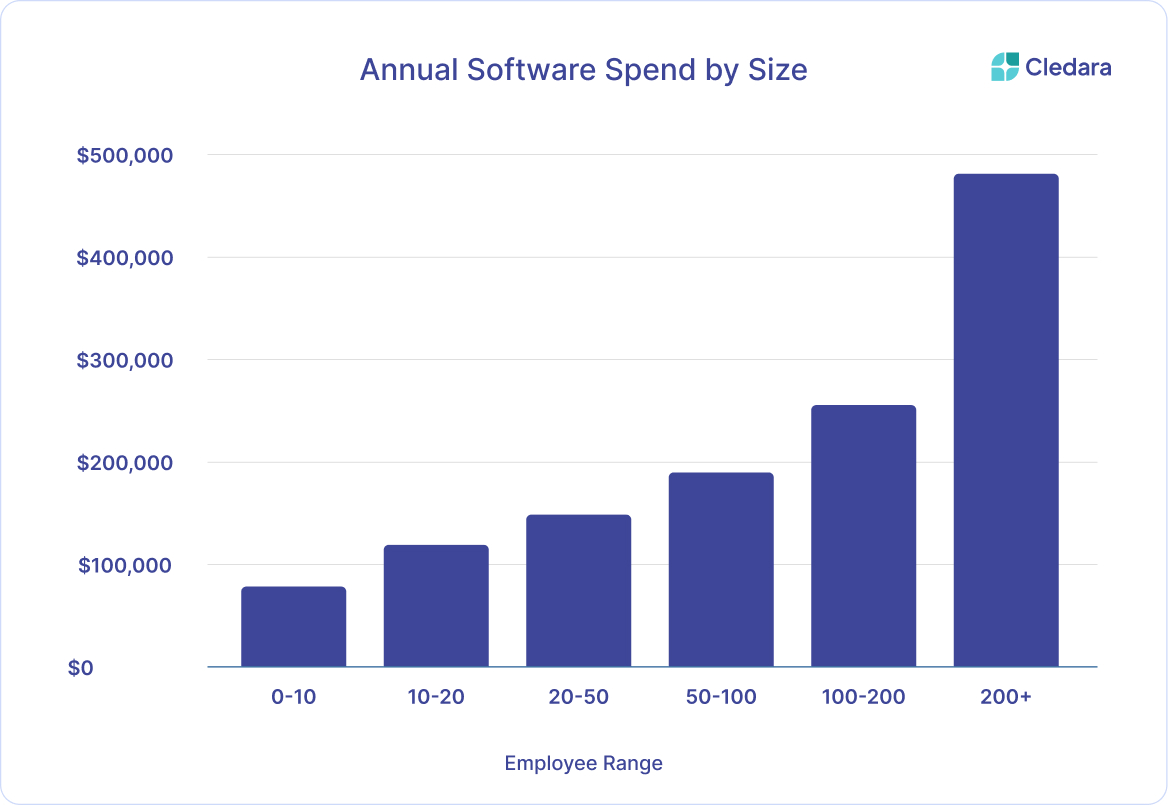

The Role of SMB vs. Enterprise Software Spending

The $1.4 trillion software spending number is distributed across company sizes, and the distribution is shifting.

Enterprise software (1,000+ employees) represents roughly 55-60% of total software spending. Enterprise companies have defined procurement processes, larger budgets, longer sales cycles, and higher price sensitivity on a per-unit basis but less on absolute spend. Enterprise software spending is growing 13-15%.

Mid-market software (100-999 employees) represents roughly 25-30% of total software spending. Mid-market is experiencing the fastest growth because digitalization is still accelerating for this segment. Companies are moving from spreadsheets and disparate tools to integrated platforms. Mid-market software spending is growing 16-18%.

SMB software (under 100 employees) represents roughly 10-15% of total software spending. SMBs are increasingly adopting SaaS, but spending per company is lower. SMB growth is 12-14%, lower than mid-market because market penetration is already high for basic tools.

The growth differential between mid-market and enterprise is shifting where capital flows. Mid-market software vendors are growing faster than enterprise vendors. If you're enterprise-focused, you have higher ACV but slower market growth. If you're mid-market focused, you have lower ACV but faster market growth.

The optimal strategy is to start mid-market and expand upmarket as product matures. You capture the higher-growth segment first, then establish a position in the slower-growing but higher-ACV enterprise segment.

AI-Native vs. AI-Added Software: The Category Shift

Within the software spending growth, a critical distinction is emerging between AI-native products and traditional products with AI added.

AI-Added Software is traditional software with generative AI features bolted on. CRM systems with AI email drafting. Spreadsheets with natural language formula generation. Project management tools with AI task suggestions. These products are capturing the current wave of software spending growth because they already have installed bases and enterprise relationships.

AI-Added Software is growing 12-16% depending on the category.

AI-Native Software is software designed from the ground up with AI as the primary value proposition. Code generation assistants that replace manual coding. AI-powered analytics platforms that replace dashboard building. Autonomous design tools that replace designer involvement. These products are growing 25-35%+ annually, but they're starting from smaller bases.

The capital allocation question for enterprises is whether to fund new AI-native categories or AI-enhance existing platforms. The answer is they're doing both. Budget allocation is shifting toward AI-native in specific categories where the performance advantage is indisputable (code generation, design, analytics), but most spending is still flowing to established vendors adding AI features.

For founders, the implication is clear: if you're building AI-native, you're fighting for share in a high-growth category but starting from zero. If you're adding AI to an existing category, you're growing slower than pure AI-native but from a larger base. The optimal strategy is to find categories where AI-native solutions are achieving adoption but not yet dominant, then compete on execution speed and feature velocity.

Why 14.7% Matters More Than Market Size

It's easy to get lost in the trillion-dollar number. The more important number is the growth rate.

14.7% growth means the software market is expanding by roughly $200 billion annually. Some of that is coming from new vendors entering categories. Most is coming from existing vendors taking more share and expanding within existing customers.

If your company is growing 14.7%, you're keeping pace with the market but gaining zero share. If you're growing 20%, you're gaining 5.3 percentage points of share each year. If you're growing 30%, you're gaining 15.3 percentage points.

Over a ten-year period, a company growing at 30% annually will be 18x larger than a company growing at 14.7%. That difference is compounding. A three-to-five year startup needs to be growing materially faster than market growth to justify venture capital returns.

The 14.7% number is your baseline growth hurdle. Below that and you're a mature, slow-growth category. At that rate and you're expanding share. Above that and you're winning.

For founders raising capital, this is the first number investors look at. "You're growing 22%" sounds impressive until you realize the market is growing 14.7%. Your company is growing 7.3 points faster, which is good but not exceptional. Investors are comparing you to others in your category. If the category average is 18%, your 22% growth is impressive. If the category average is 25%, your 22% is concerning.

Understand where your category falls on the growth spectrum. Understand how you compare to peer companies in your category. That's where your growth benchmarking actually lives.

Capturing Your Share: Where to Actually Focus

All this analysis of software spending trends means nothing if you don't translate it into action.

Here's how to actually capture share of this growth:

First, audit your product roadmap for AI velocity. Every major feature released in the next 12 months should involve AI in some way. This isn't about hype. It's about acknowledging that 50%+ of the incremental software spending is going to companies with credible AI roadmaps. If your roadmap doesn't reflect this, your pricing power and renewal conversations will suffer.

Second, measure your growth by vertical. Don't measure company growth as a monolithic number. Measure growth by vertical market. Identify which verticals are growing faster than 14.7%. Shift sales resources toward those verticals. Slow growth in your largest vertical but you're growing 30% in financial services? Move headcount to financial services.

Third, focus on net revenue retention above 120%. The margin between companies growing at market rate and companies winning market share is expansion revenue. If your net revenue retention is 110%, you're probably declining in share. If it's 125%+, you're capturing material share.

Fourth, implement dynamic pricing informed by segment value. Different customer segments capture different value from your product. Different verticals have different budgets. Price accordingly. If financial services software spending is growing 19% and your pricing is generic, you're leaving 30-40% revenue on the table.

Fifth, build land-and-expand motions that leverage AI value. Customers who start with one product module or use case should expand to adjacent use cases through new AI features. If you're shipping new features monthly and customers are adopting them, expansion becomes automatic. If you're shipping quarterly, customers might not even know about the new features.

These five actions translate macro trends into actual revenue growth.

Competitive Intensity: What Rising Software Spending Means

One final reality check: rising software spending attracts competition.

When the market is growing 14.7%, venture capital flows toward companies in that market. When venture capital flows in, the competitive landscape changes. Pricing pressure increases. Sales processes become more complex. Differentiation becomes more critical.

This isn't new. It's the same dynamic that happens in any expanding market. But founders often miss the implications.

If you're a SaaS founder in a 14.7% growing market and you're not planning for 2-3 new well-funded competitors entering your space in 2026, you're not thinking clearly. They will have capital. They will hire sales people. They will target your accounts. They will undercut your pricing.

How do you survive this?

First, build moats faster than competitors can. Feature parity is inevitable. Build embedding depth (APIs, SDKs, webhooks, plugins) that increases switching costs. Build network effects if possible. Build data effects that improve with scale.

Second, focus on unit economics and efficiency. Your competitors will have capital, but they'll burn it on growth before achieving profitability. If your CAC is 30% lower and your ACV is 20% higher, you'll out-survive them.

Third, don't match their pricing. When competitors enter with lower prices, resist the urge to match. Instead, differentiate on value. Higher prices signal quality and confidence. Lower prices signal desperation.

Fourth, accelerate your go-to-market expansion. If a competitor enters in North America, expand internationally faster. If they focus on enterprise, expand into mid-market. If they compete on feature breadth, compete on integration depth. Make it harder for them to follow your playbook.

Rising tide lifts all boats, but it also brings new predators. Prepare accordingly.

The Next 12 Months: What to Watch

The software spending forecast for 2026 is $1.4 trillion growing at 14.7%. What should you pay attention to in the next 12 months to understand how this actually plays out?

Watch Gen AI model spending. If it grows faster than 80.8%, the valuation multiples on AI infrastructure companies will re-rate upward. If it grows slower, we're in a moderation phase. This is your leading indicator for whether enterprise AI budgets are real or hype.

Watch cloud provider capital expenditure. AWS, Google Cloud, and Azure capex guidance will tell you whether infrastructure demand justifies the software spending forecast. If hyperscalers are cutting capex, software spending will follow with a 2-3 quarter lag.

Watch enterprise software company guidance. Public SaaS companies give guidance for next quarter and next year. Track whether they're raising growth guidance or cutting it. If the largest software companies are optimistic, the macro is real.

Watch mid-market software vendor funding. Watch how much venture capital flows to companies focused on mid-market software. If capital is flowing to mid-market, that confirms the thesis that mid-market is the highest-growth segment.

Watch your own metrics. Track your net revenue retention, your CAC efficiency, your Sales Qualified Lead flow, your win rates against specific competitors. These metrics will tell you whether you're capturing share of the software spending expansion or losing it.

Macro trends are interesting intellectually, but they matter only if they translate to your revenue growth. Use the $1.4 trillion forecast to inform strategy, not to justify inaction.

FAQ

What does the $1.4 trillion software spending forecast include?

The $1.4 trillion includes all commercial software spending across application software (CRM, ERP, HCM, BI, collaboration tools), infrastructure software (databases, container orchestration, API management, security), development tools, and enterprise AI platforms. It includes both on-premises and cloud spending, both perpetual licenses and SaaS subscriptions. It does not include internal software development spending (R&D) by enterprises, only spending on third-party software products and platforms.

How is the 14.7% growth rate calculated?

Gartner calculates the software spending growth rate by tracking actual spending in 2025 as reported through surveys, analyst conversations, and market data, then projecting 2026 spending based on enterprise budget plans, historical spending patterns, and macro economic assumptions. The 14.7% is the year-over-year percentage increase from 2025 spending to 2026 spending. It's weighted by market size, so large categories carry more weight than small ones.

Why is software spending growth accelerating while AI hype is cooling?

Software spending is accelerating because AI features have moved from being optional add-ons to being standard components of enterprise software products. When enterprises renew their software licenses, they now expect AI capabilities to be included. This shifts budgeting from "should we buy AI" to "which vendors are shipping AI fastest." The acceleration reflects the mainstream adoption of AI features across software categories, not peak hype.

How does this spending trend affect SaaS pricing power?

The spending acceleration enables SaaS companies to increase prices faster than in the past because they're bundling new AI capabilities into renewals. Instead of competing on feature parity, companies can compete on AI velocity and quality. This shifts the value proposition from "how many features" to "how good is this AI capability." Vendors shipping monthly AI releases have pricing power to increase ACV 15-25% at renewal. Vendors shipping quarterly have pricing power to increase 5-10%.

Should I focus on building new AI features or optimizing existing products?

The answer depends on your product category and competitive position. If you're in a category where competitors are shipping monthly AI releases and you're shipping quarterly, AI feature velocity is your constraint. Focus on shipping. If you're in a category where most competitors have basic AI features and you have none, building any credible AI capability is a priority. But "building features for feature's sake" is different from "building features that reduce customer costs, reduce errors, or improve decision-making." Focus on the latter, whether or not it involves AI.

Which verticals should I focus on for growth?

Verticals growing faster than 14.7% (financial services at 17-19%, healthcare at 15-17%, retail at 16-18%) are expanding budgets faster than others. Entering high-growth verticals earlier than competitors gives you market share advantage. However, entering verticals where you lack domain expertise is risky. The optimal strategy is to identify one high-growth vertical where you have unfair advantage (existing customer base, domain expertise, product fit), then expand into that vertical aggressively before competitors do.

Is the forecast likely to be revised down again like it was from 15.2% to 14.7%?

The revision from 15.2% to 14.7% came because of pulled-forward spending in Q4 2025. Early 2026 data should clarify whether the revised forecast is accurate or will be adjusted further. If Q1 2026 software spending comes in stronger than forecasted, the forecast will be revised up. If it comes in weaker, further downgrades are possible. The uncertainty around software spending is lower than infrastructure spending because software contracts are more predictable, but there's still 1-2 percentage points of forecast variance depending on macro conditions. Plan for 12-16% growth in your category, not a fixed 14.7%.

Conclusion: The Window Won't Stay Open Forever

Enterprise software spending hit $1.4 trillion in 2026. It's growing at 14.7%. That's not a typo or exaggeration. That's real capital being deployed by real companies for real software products.

For B2B founders, this is as close to a tailwind as you get. The market is expanding. Budgets are increasing. The TAM is growing. But the window won't stay open forever. As more capital flows into the space, competition will intensify. Price pressure will increase. Differentiation will become harder to achieve.

The founders winning right now are the ones who:

-

Understood the shift early. They recognized that enterprise budgets were expanding and positioned their products accordingly. They weren't waiting for the next board update to take this seriously.

-

Focused on the highest-growth segments. They identified which verticals and customer segments were expanding fastest and concentrated resources there. They didn't spread themselves thin across all segments equally.

-

Executed on AI features relentlessly. They didn't ask whether AI was important. They asked which AI capabilities would deliver the most value to their customers and shipped them monthly. This velocity became competitive advantage.

-

Built expansion revenue motions that captured growth. They recognized that the 14.7% growth was coming from existing customers expanding spend, not just new customers adopting products. They built sales and product strategies around expansion.

-

Maintained unit economics discipline. They resisted the urge to burn cash on growth just because capital was available. They stayed focused on CAC efficiency and ACV expansion. This discipline will matter when the growth rate eventually normalizes.

The $1.4 trillion opportunity is real. Whether you capture your share depends on executing these five things better than alternatives. The market is expanding. Now you have to execute.

Grab your share before competitors do.

Key Takeaways

- $1.4 trillion enterprise software spending growing at 14.7% in 2026—if your SaaS company isn't hitting this growth rate, you're losing share

- Software growth is accelerating not because AI hype is intensifying, but because AI features are now baked into enterprise renewals, permanently shifting pricing power upward

- $180 billion in net new software spending is being deployed in 2026 alone—more incremental spend than the entire software market from 15 years ago

- GenAI model spending is growing 80.8%, roughly 5.5x the overall software growth rate, and is now claiming larger share of total software budgets than non-AI products

- Mid-market software is growing 16-18% (fastest), financial services and healthcare are growing 15-19%, while enterprise and technology segments grow 11-14%—vertical concentration determines growth trajectory

Related Articles

- AI-Led Growth: The Third Era of B2B SaaS [2025]

- Why B2B Software Survives the AI Era: Atlassian's Growth Blueprint [2025]

- Cohere's $240M ARR Milestone: The IPO Race Heating Up [2025]

- How to Get Into a16z's Speedrun Accelerator: Insider Strategies [2025]

- Why AI GTM Tools Still Fall Short of Cursor and Replit [2025]

- Higgsfield's $1.3B Valuation: Inside the AI Video Revolution [2025]

![Enterprise Software Spending Hit $1.4 Trillion in 2026: What It Means for SaaS [2025]](https://tryrunable.com/blog/enterprise-software-spending-hit-1-4-trillion-in-2026-what-i/image-1-1771247404893.jpg)