VMware Customer Exodus: Why 86% Still Want Out After Broadcom's Acquisition [2025]

TL; DR

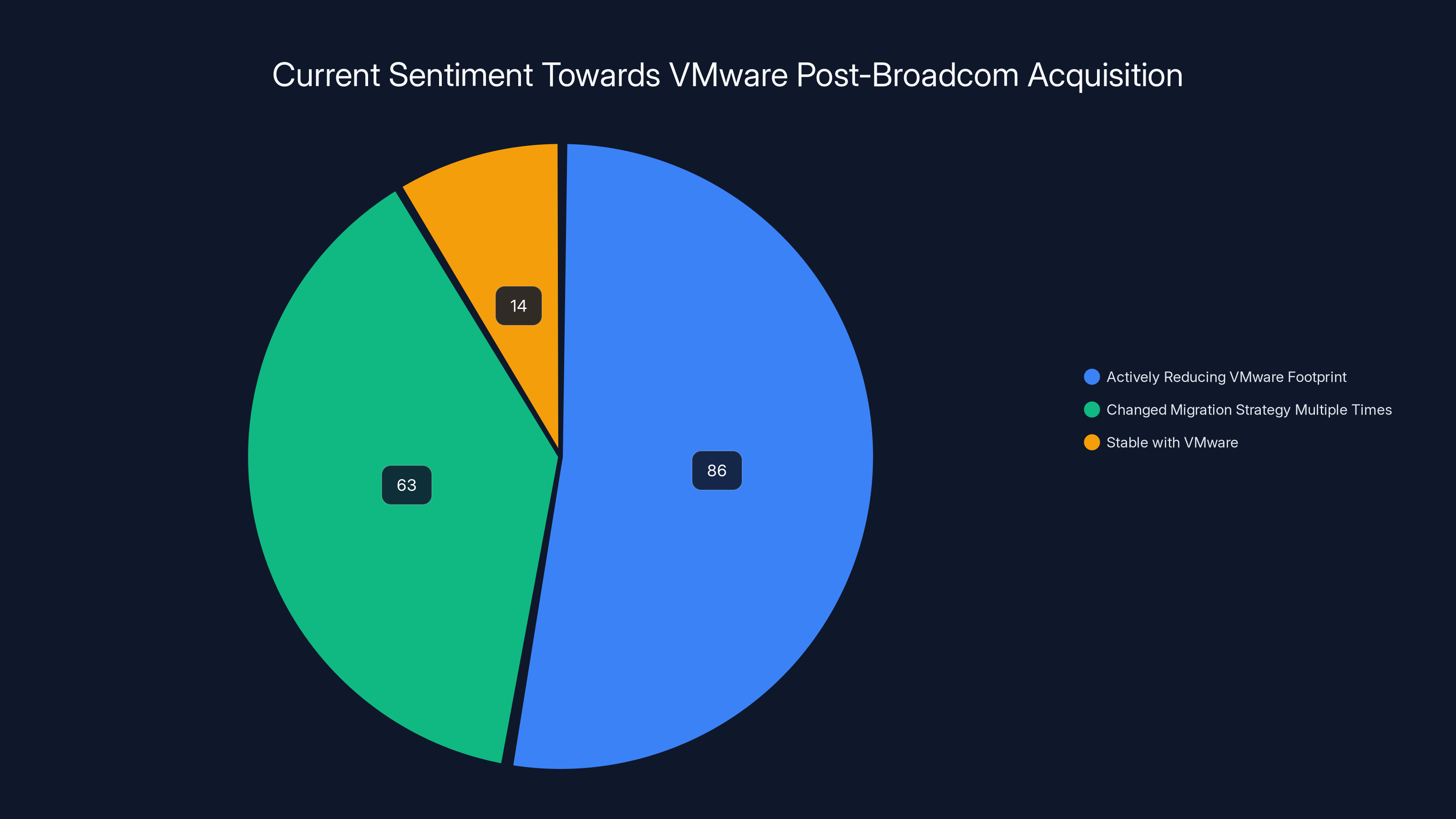

- 86% of North American enterprises are actively trying to reduce their VMware footprint despite two years passing since Broadcom's acquisition

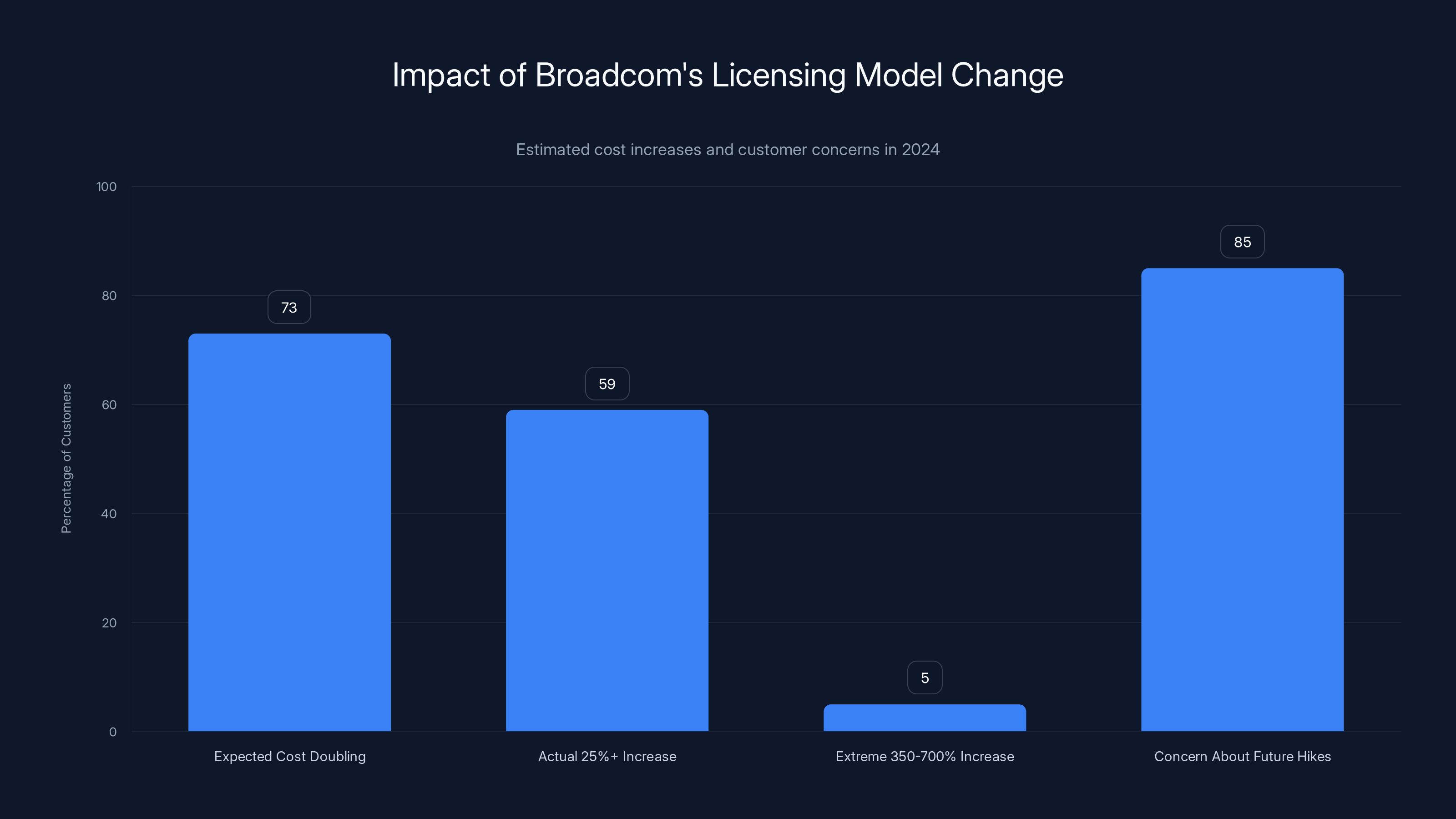

- 85% remain concerned about future price hikes, with 59% already experiencing increases of 25% or more

- Only 4% have fully migrated away, while 41% are optimizing rather than leaving entirely

- 63% have changed migration strategies multiple times, indicating the process is far more complex than initially anticipated

- Public cloud IaaS is the destination of choice for 72% of migrating customers, though migration complexity and higher-than-expected costs remain barriers

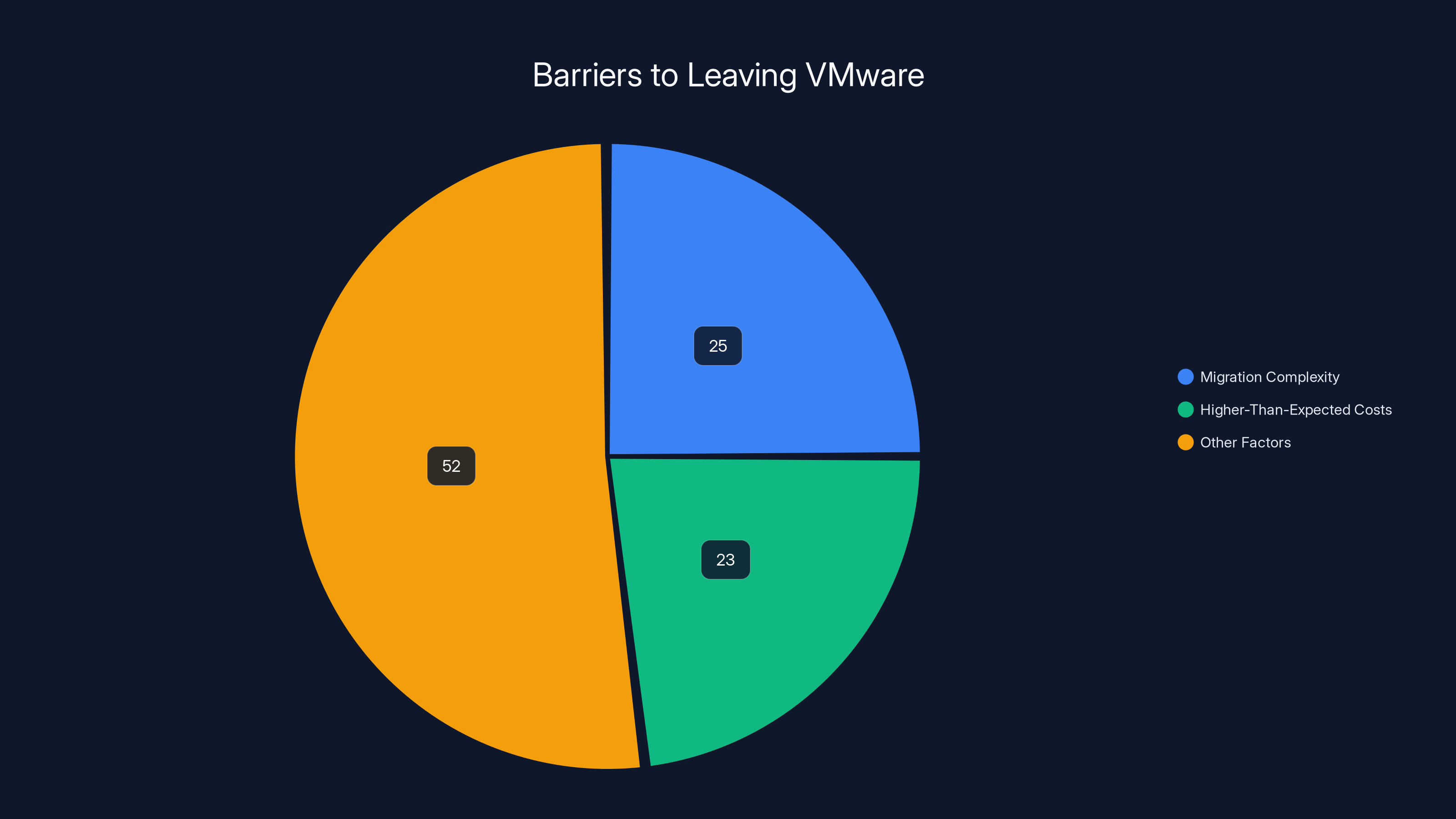

Migration complexity (25%) and higher-than-expected costs (23%) are major barriers for enterprises considering leaving VMware. Estimated data for 'Other Factors' based on typical challenges.

Introduction: The Broadcom Problem That Never Went Away

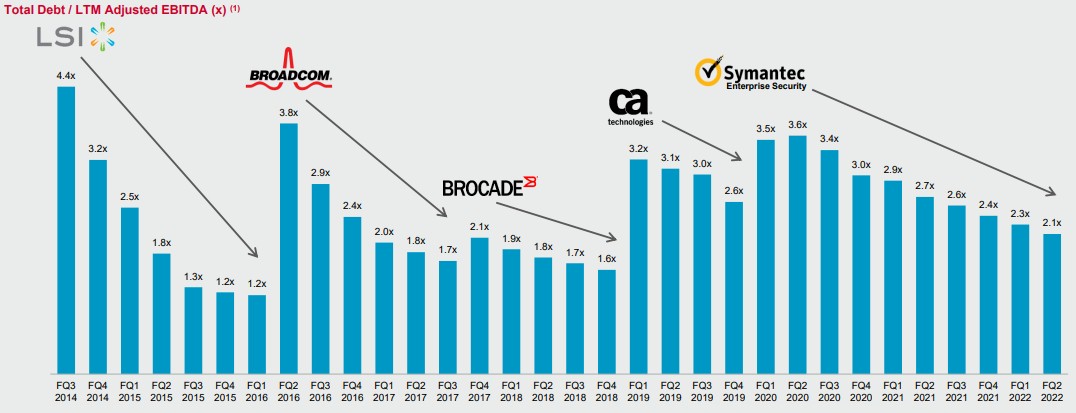

When Broadcom acquired VMware in November 2023 for roughly $61 billion, the technology industry held its breath. What happened next became one of the most dramatic customer backlashes in recent enterprise software history.

But here's the thing that's actually shocking: two years later, the situation hasn't gotten better. If anything, it's gotten more complicated.

A new report from CloudBolt reveals that 86% of North American enterprises are still actively looking to reduce their VMware footprint. That's not some theoretical interest—that's a majority of the company's customer base actively shopping for alternatives while still paying Broadcom for infrastructure they're increasingly desperate to leave.

The irony is painful. Two years is typically enough time for an acquisition dust to settle. Customers usually come to terms with new ownership, adapt to new pricing models, and figure out their long-term strategy. Not with Broadcom and VMware. Instead, what we're seeing is customer paralysis mixed with active resistance. Sixty-three percent of customers have changed their migration strategy two or more times since the acquisition. Think about that. They've committed to leaving, then paused, then recommitted, then shifted plans again. It's exhausting, and it tells you everything about how uncertain the situation remains.

The numbers tell a story of a company trying to abandon ship, but the lifeboats are smaller and slower than anyone expected.

The Pricing Crisis That Started It All

Let's be direct about what triggered this exodus: money.

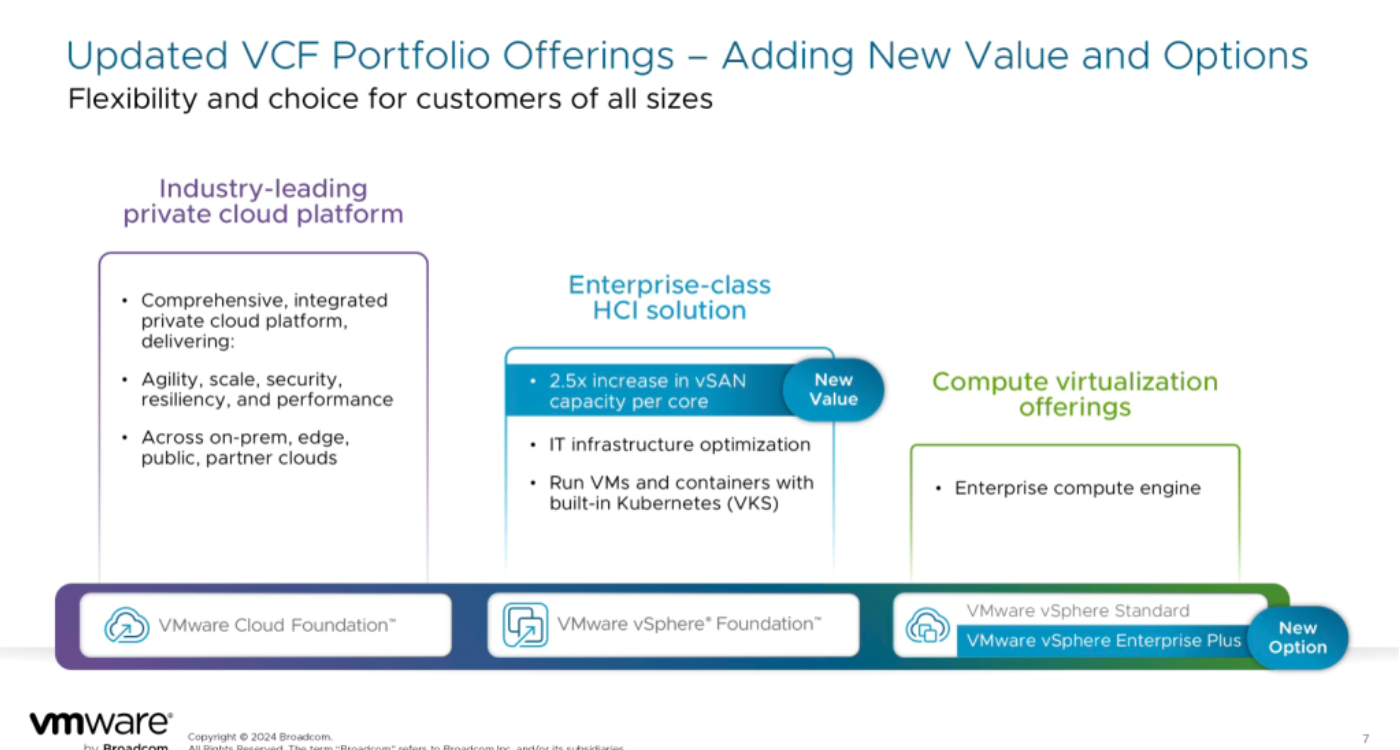

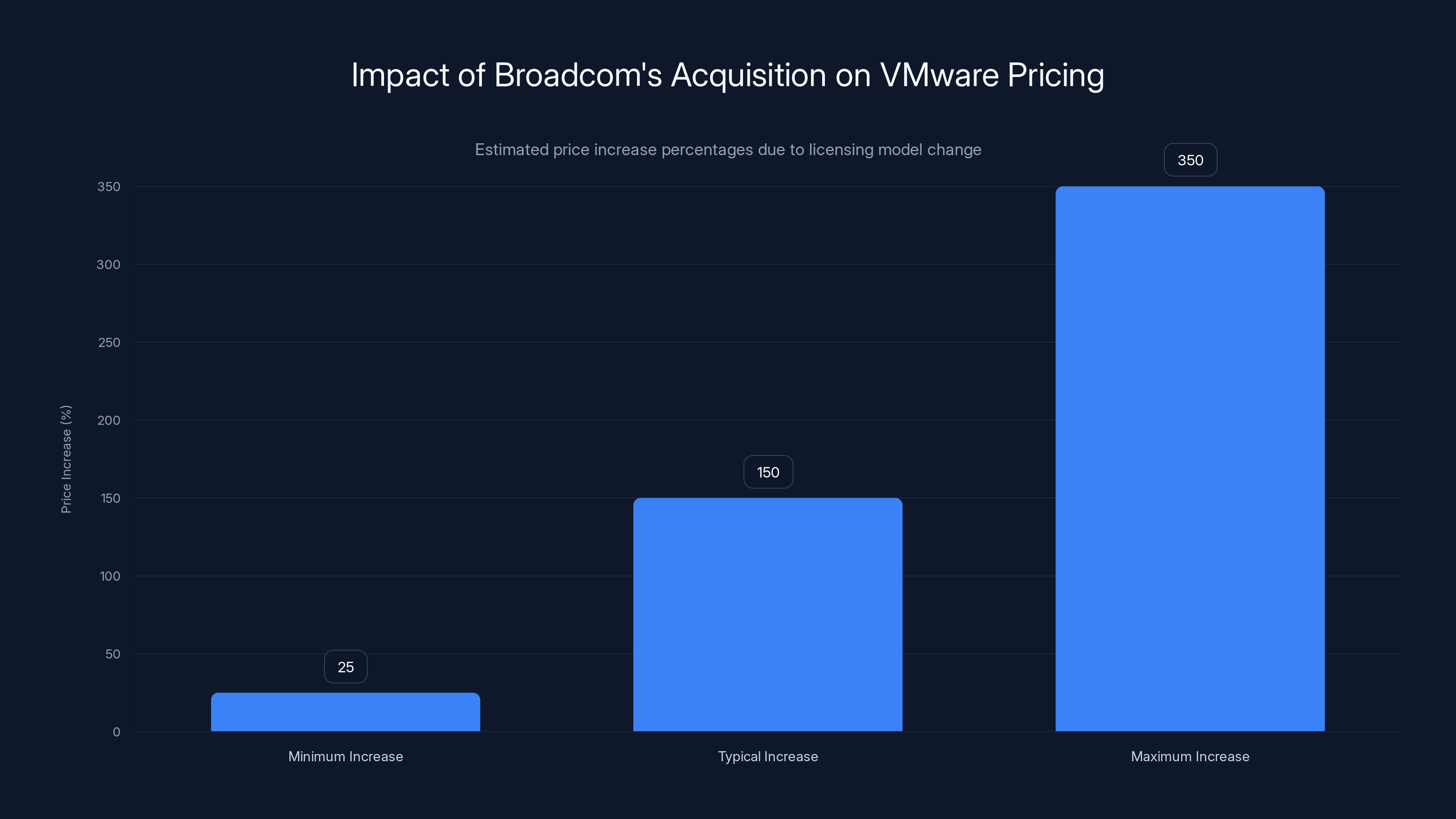

In 2024, roughly 73% of VMware customers expected their costs to more than double under Broadcom's new licensing model. These weren't wild predictions. They were based on Broadcom's actual pricing announcements and the company's new per-socket licensing structure, which fundamentally changed how customers pay for VMware products.

Here's what actually happened. Broadcom moved from a model where you licensed VMware per-VM or per-core to a per-socket model. That sounds like a minor shift in accounting. It wasn't. For customers running virtualized environments on high-core-count processors (which became standard years ago), the impact was dramatic.

A customer running the same workload that cost

But here's where it gets interesting. The fear of doubling costs was the match that lit the fire. The actual price increases—while real and painful—haven't always hit the 100%+ mark that customers feared. Yet 85% remain concerned about future price hikes. That's the real problem. Broadcom broke trust.

When a vendor suddenly changes its business model in a way that dramatically increases costs, customers stop believing anything they're told about the future. They assume it's going to get worse. So they start planning exit strategies.

The pricing crisis wasn't just about money, though. It was about control. VMware customers had built their entire infrastructure around VMware. They'd invested in training, tooling, and automation. Then suddenly, Broadcom changed the terms of the game unilaterally.

That's when the word "lock-in" stopped being a technical term and became a curse word.

Broadcom's shift to a per-socket licensing model has led to price increases ranging from 25% to 350%, significantly impacting enterprises with multi-socket servers. Estimated data.

Why Only 4% Have Actually Left

Here's the frustrating part for customers: knowing you want to leave and actually leaving are two completely different things.

Only 4% of survey participants have fully migrated away from VMware. Think about that ratio. Eighty-six percent want to leave. Four percent have succeeded. That's a gap so massive it tells you everything about the barriers these enterprises face.

So what's keeping 96% of customers still tethered to Broadcom?

First, there's the sheer technical complexity. VMware vSphere is the central nervous system of thousands of enterprises. It doesn't just run virtual machines—it orchestrates storage, networking, security policies, disaster recovery, backup strategies, and compliance frameworks. Pulling it out isn't like replacing one application. It's like replacing your entire circulatory system while remaining alive.

A typical enterprise running VMware might have thousands of VMs spread across dozens of clusters. Each VM has been customized, configured, and integrated into other systems. You can't just flip a switch and move everything to AWS EC2 or Azure VMs in a weekend. You're talking about months of planning, testing, and execution.

Second, there's the cost paradox. Yes, VMware licensing costs went up. But the cost of leaving is also higher than many enterprises anticipated. Moving to public cloud can mean increased ingress/egress costs, data transfer fees, and higher per-VM compute charges than they were paying for on-premises infrastructure. Some enterprises have done the math and realized they'd be paying almost as much or more to move to the cloud than to stay with VMware.

This is why the CloudBolt survey found that 41% of customers decided to stay with VMware but focus on optimizing their footprint rather than attempting a full migration. They concluded: "The devil we know is better than the cloud vendor we don't."

Third, there's organizational friction. Migrating off VMware isn't a technology decision—it's an organizational one. It requires buy-in from infrastructure teams, application owners, security, compliance, and finance. Getting all those groups to agree on an alternative, budget for migration, and commit to a timeline takes months. By the time decisions get made, priorities shift, budgets get cut, and executives move on to other crises.

The CloudBolt data supports this. Twenty-five percent of enterprises cite migration complexity as the primary barrier, 23% point to higher-than-expected alternative costs, and 21% struggle with technical barriers. These aren't unsolvable problems. But they're real enough that the vast majority of enterprises have decided to delay, optimize, or abandon migration plans entirely.

The Strategy Whiplash: 63% Changed Plans Multiple Times

One of the most revealing statistics in the CloudBolt report is this: 63% of enterprises have changed their VMware migration strategy two or more times since Broadcom's acquisition.

That's not confidence. That's panic disguised as deliberation.

When enterprises change strategy multiple times, it reveals several things happening simultaneously. First, there's uncertainty about the best path forward. Second, there's shifting business priorities—executives say "go", then the budget gets cut, then new leadership says "go" again. Third, there's learning through failure: you try one approach, it doesn't work as expected, and you pivot.

This pattern matters because it tells you the market hasn't reached equilibrium. Two years after an acquisition should be enough time for customers to have a clear, stable migration plan. Instead, you've got enterprises that keep second-guessing themselves.

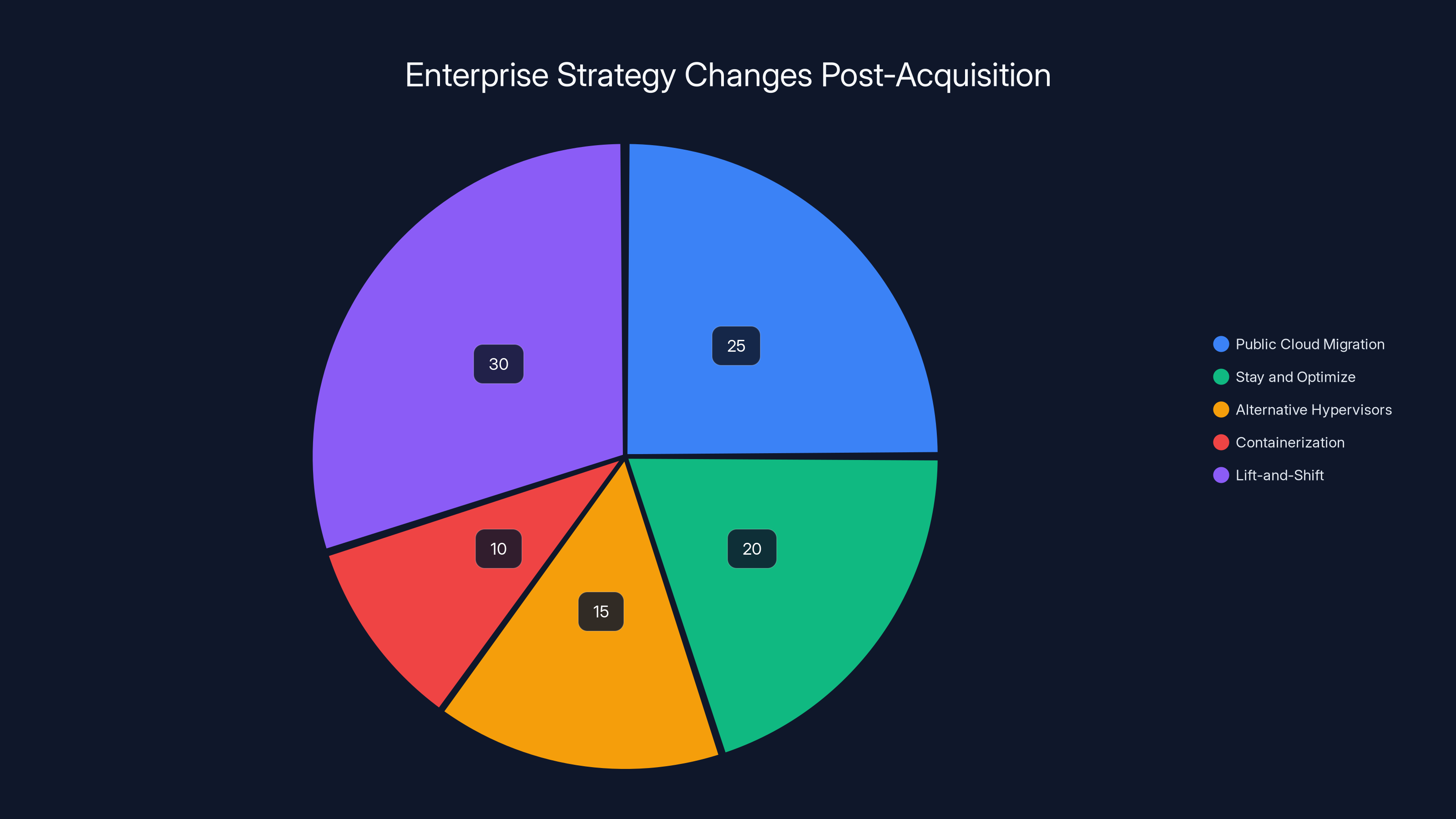

Some customers initially planned to move everything to the public cloud, realized the costs were prohibitive, and shifted to a "stay and optimize" strategy. Others committed to moving to alternative hypervisors like Proxmox or oVirt, hit technical integration challenges, and decided to move to cloud instead. A third group experimented with containerization and Kubernetes, realized it would require rewriting half their applications, and went back to planning a straight lift-and-shift migration.

The constant strategy changes are also a function of time. In November 2023, when the acquisition closed, everybody panicked and announced migration plans. By 2024, realities set in. By 2025, some enterprises have gotten serious about leaving, while others have made peace with staying and negotiating better contract terms.

This fragmentation in approach explains why only 72% of migrating customers have settled on public cloud IaaS as their destination. The other 28% are exploring diverse alternatives: alternative hypervisors, hybrid approaches, on-premises Kubernetes solutions, or even staying with VMware but in a much smaller footprint.

Where Customers Actually Want to Go: The Cloud Exodus

Of the enterprises that are seriously committed to leaving VMware, 72% are targeting public cloud IaaS rather than alternative on-premises hypervisors.

This is significant because it represents a fundamental shift in infrastructure philosophy. Enterprises are saying: "We don't want to replace VMware with another on-premises hypervisor. We want to leave the hypervisor business entirely."

That's a massive statement. It means enterprises are willing to accept the operational complexity of cloud, the potential for vendor lock-in with AWS or Azure, and the ongoing costs of cloud computing, all because they're that frustrated with Broadcom.

But here's the catch: the public cloud isn't free. In fact, for many enterprises, cloud costs are higher than on-premises costs. Workloads that ran efficiently on VMware for

That's not necessarily a bad trade-off if it means escaping Broadcom's licensing nightmare and gaining operational flexibility. But it's important context. Customers aren't fleeing to the cloud because it's cheaper. They're fleeing because they're desperate to reduce their dependency on a vendor that they feel has betrayed them.

Estimated data shows diverse strategy changes with 30% opting for lift-and-shift, while 25% initially chose public cloud migration. (Estimated data)

The Real Barriers: Why Escape Velocity Keeps Failing

When you ask enterprises what's stopping them from leaving VMware, you get three consistent answers:

1. Migration Complexity (25%)

This is the heavyweight. VMware infrastructure is deeply integrated into everything an enterprise does. You don't just move the hypervisor—you move storage architecture, networking topology, security policies, backup strategies, disaster recovery configurations, and compliance frameworks.

A typical enterprise might have:

- 1,000+ virtual machines across dozens of clusters

- Complex storage arrays with snapshots, replication, and dedupe

- Network policies that route traffic based on VM identity

- Backup jobs that run nightly and can't be interrupted

- Disaster recovery sites that mirror production in real-time

- Compliance audits that document every infrastructure change

Moving all of this isn't a technical problem. It's a logistical nightmare. You need weeks of planning, months of testing, and meticulous cutover procedures. A single mistake means downtime, data loss, or security violations.

2. Higher-Than-Expected Costs (23%)

Enterprises budgeted for the cost of migrating to the cloud. What they didn't budget for was the actual operating costs of running the same workloads in the cloud.

On-premises, you might run your infrastructure on servers you bought five years ago. The hardware costs are already paid. You're just paying for maintenance, power, and cooling. Move to the cloud, and suddenly you're paying per-instance, per-month, with costs scaling linearly with usage.

A workload that cost

Worse, many enterprises have committed to a multi-year reserved instances with their cloud provider, expecting predictable costs. Then reality hits: their workloads grow, they need more instances, and suddenly they're paying on-demand pricing for the overflow capacity.

3. Technical Barriers (21%)

This is the "gotcha" category. You plan to move to the cloud, and you run into problems you didn't anticipate.

Maybe your application has a dependency on some obscure VMware feature like DRS (Distributed Resource Scheduler) or HA (High Availability). The cloud equivalent isn't the same. Maybe your database has performance requirements that on-premises could meet but the cloud can't without dramatically higher costs. Maybe your security policies depend on network isolation that's harder to achieve in a multi-tenant cloud environment.

These aren't insurmountable problems, but they require technical expertise, additional testing, and sometimes application refactoring. All of that adds cost and time.

The Cautious Optimism: "Challenging But Doable"

Here's something surprisingly positive from the data: 62% of enterprises planning to migrate see the process as "challenging but doable".

That's actually encouraging. These aren't enterprises that are giving up. They're enterprises that have realistic expectations: the migration will be hard, but it's worth doing.

This mindset matters because it suggests that the enterprises most likely to succeed in leaving VMware are the ones with clear eyes about the obstacles. They're not expecting a smooth transition. They're not surprised by complexity or cost. They're committed anyway.

The other 38% are split between those who think it's too hard (and might stay with VMware) and those who think it's easy (and might get ambushed by unexpected problems).

The enterprises moving to public cloud IaaS with realistic expectations are typically taking a phased approach:

Phase 1: Planning and Assessment (2-3 months) Document all applications, dependencies, and VMware features in use. Map them to cloud equivalents. Identify which applications are easy to move, which are hard, and which should stay on-premises.

Phase 2: Pilot Migration (2-4 months) Move a non-critical application to the cloud as a proof of concept. Learn what breaks, what costs more than expected, and what processes need to change. Refine the approach based on learnings.

Phase 3: Production Migration Waves (6-18 months) Move applications in batches, validating each wave before moving to the next. Start with easy applications to build confidence and learn at scale. Progressively tackle harder applications.

Phase 4: Optimization (Ongoing) Once in the cloud, continuously optimize. Rightsize instances, use reserved instances where possible, eliminate orphaned resources, and refactor applications to be cloud-native.

Enterprises that follow this playbook typically complete migrations in 12-18 months for a mid-sized environment. Enterprises that try to rush or skip phases often get stuck, extend timelines, or exceed budgets.

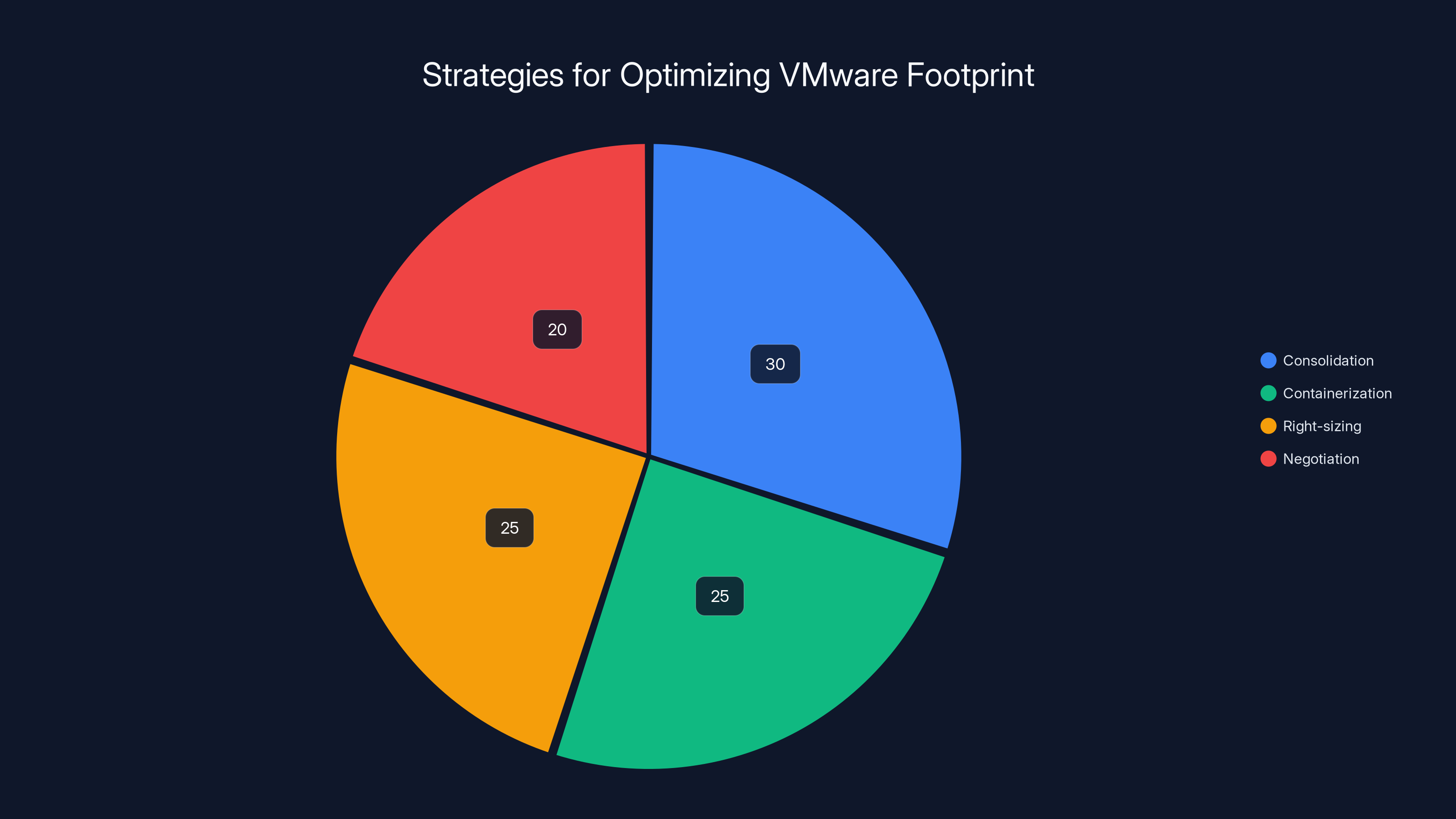

The Optimization Play: Why 41% Are Choosing to Stay

Not all enterprises are leaving. In fact, 41% have decided to optimize their VMware footprint rather than migrate away entirely.

This might sound like Broadcom winning. It's not. It's more like settling.

These enterprises have done the math and concluded that the cost of migration exceeds the benefit. But they're not happy. Instead, they're being strategic: they're reducing their VMware footprint to the bare minimum, squeezing efficiencies, and consolidating infrastructure.

Some specific tactics they're using:

Consolidation: Moving from 50 small clusters to 10 large clusters. Fewer clusters mean fewer licensing costs and less operational overhead. But it also means less redundancy and higher failure risk per cluster.

Containerization: Moving new applications to Kubernetes on-premises or in the cloud. They keep VMware for legacy workloads but stop growing the VMware footprint.

Right-sizing: Taking every VM and asking: does this really need 4 CPUs and 16 GB of RAM? Often, the answer is no. By right-sizing, enterprises can reduce their physical footprint and thus their licensing costs.

Negotiation: Some enterprises have enough scale that they can negotiate better contract terms with Broadcom. A

The optimization play keeps enterprises on VMware, but it keeps them resentful. They're not investing in new VMware features. They're not excited about Broadcom's roadmap. They're just trying to minimize their exposure.

Broadcom would probably prefer full-margin customers paying for growth, but they're getting customers paying for survival.

Estimated data shows 73% of VMware customers expected costs to double, while 59% experienced at least a 25% increase. 85% remain concerned about future hikes.

The vSphere 7 Sunset: A Looming Deadline

In October 2024, Broadcom ended support for vSphere 7. That's a significant moment for two reasons.

First, it forces upgrade decisions. Customers running vSphere 7 have two choices: upgrade to vSphere 8 (and pay for new licensing), or face unsupported infrastructure. For many enterprises, unsupported infrastructure is unacceptable for compliance, security, and operational reasons.

Second, the upgrade is a good time to reconsider the whole arrangement. You're already budgeting for a major change. Why not use that moment to evaluate alternatives?

vSphere 8 licensing is significantly more expensive than vSphere 7 was. The upgrade path compounds the pricing pain that customers have already experienced. Some enterprises will absorb the cost. Others will view it as the final straw and commit seriously to leaving.

This timing creates a natural checkpoint for many enterprises: by late 2025 or early 2026, customers will have made final decisions about their vSphere 7 workloads. Either they'll upgrade to vSphere 8 and make peace with Broadcom, or they'll use the upgrade requirement as a forcing function to finally commit to migration.

Alternative Hypervisors: The Niche Play

While 72% of migrating enterprises are targeting public cloud IaaS, a smaller but committed group is exploring alternative hypervisors.

Proxmox is gaining traction in this space. It's an open-source platform that runs on Linux and offers VM management capabilities superficially similar to vSphere. The advantage is price: it's free (though Proxmox offers commercial support). The disadvantage is maturity and ecosystem.

Proxmox works well for enterprises that:

- Have relatively simple infrastructure

- Don't need advanced enterprise features like DRS or HA

- Have Linux expertise in-house

- Want to minimize software licensing costs

But it's not a drop-in replacement for vSphere. You can't just migrate your VMs and expect everything to work. You need to rebuild management practices, learn new tooling, and accept that you'll lose some capabilities.

oVirt, another open-source option, has a similar positioning. It's based on Red Hat's KVM hypervisor and offers more enterprise-like features than Proxmox, but it's also less mature and has a smaller ecosystem.

These alternatives appeal to enterprises that are philosophically committed to open-source, have the technical depth to manage open-source infrastructure, and are willing to accept trade-offs for cost savings. But they're not mainstream alternatives to VMware.

The reality is that most enterprises that are leaving VMware are leaving the hypervisor business entirely, not just replacing hypervisors.

The Kubernetes Question: Containerization as an Alternative

One path many enterprises are exploring is containerization. Instead of moving from VMware to another hypervisor, they're moving from VMs to containers.

Kubernetes has made tremendous strides in becoming the standard container orchestration platform. It can run on-premises (with tools like VMware Tanzu, ironically), on public cloud, or in hybrid environments.

The appeal is significant: containers are more efficient than VMs, easier to automate, and better suited for modern application development. But there's a catch: not all applications are containerizable.

Legacy monolithic applications written in COBOL or Visual Basic don't containerize well. Databases sometimes have licensing restrictions that make containerization expensive. Stateful applications that need persistent storage can be complex to manage in Kubernetes.

So the practical approach for most enterprises is a hybrid one: move new applications to Kubernetes, keep legacy applications on VMs (either on VMware or in the cloud), and gradually migrate mid-tier applications over time.

Broadcom is aware of this threat, which is why they acquired Tanzu as part of their VMware acquisition. They're trying to position Tanzu as a platform that lets customers run both VMs and containers, theoretically reducing the need to move away from the Broadcom ecosystem.

But here's the problem: Tanzu licensing is complicated and expensive. Customers that are already frustrated with Broadcom's pricing aren't motivated to adopt more Broadcom products. And Tanzu is competing against open-source Kubernetes, which is free, more flexible, and not controlled by a vendor that customers resent.

Enterprises optimizing their VMware footprint employ various strategies, with consolidation being the most common. Estimated data.

The Role of Automation and Management Tools

One often-overlooked factor in the VMware migration equation is the role of management and automation tools.

Enterprises have invested heavily in tools like VMware vRealize, VMware Aria Operations, and various third-party tools for managing VMware infrastructure. These tools are deeply integrated into operational workflows.

When you move to the cloud, you can't take those tools with you. You have to learn new tools: AWS Systems Manager, Azure Governance, or third-party platforms like CloudBolt (the company behind the migration report), Morpheus, or Scalr.

This tool replacement adds complexity and cost. You have to retrain teams on new platforms, rebuild automation scripts, and lose institutional knowledge that was specific to VMware tooling.

For some enterprises, this tool migration is as significant as the hypervisor migration. They're not just moving infrastructure—they're rebuilding their entire operational model.

This is one reason why the CloudBolt report found that migration complexity remains the top barrier. It's not just about moving VMs. It's about rebuilding every level of the infrastructure stack.

The Financial Impact: What This Means for Broadcom

Let's be clear about the business implications. Broadcom acquiring VMware was supposed to be a cash cow acquisition. VMware had a loyal customer base, high switching costs, recurring revenue, and limited competition.

Then Broadcom changed the economics.

By aggressively raising prices and changing licensing models, Broadcom extracted short-term revenue gains. But they accelerated customer defection and damaged long-term relationships.

A customer that stays on VMware but optimizes their footprint is a smaller revenue stream than a customer that's growing and expanding. And a customer that's planning to leave but waiting for the right moment is a customer that's unlikely to purchase new Broadcom products or renew support agreements.

The paradox is that Broadcom's aggressive pricing strategy might have been financially optimal in year one (extract maximum revenue from a locked-in customer base), but it's probably suboptimal over a five-year horizon.

If the trend continues and 50% of customers successfully migrate in the next three years, Broadcom will have converted a high-switching-cost, high-margin business into a declining legacy business.

The Competitive Landscape: Who's Winning the Migration Wars?

In the battle for VMware refugee customers, a few vendors are emerging as clear winners.

AWS is the obvious choice for many. They have the largest ecosystem, the deepest tooling, the best hybrid connectivity options, and they're aggressively marketing to VMware customers. Their EC2 platform is mature, well-documented, and integrates with thousands of other services.

Microsoft Azure is the close second. For enterprises already using Microsoft products extensively, Azure is the natural choice. They've invested heavily in VMware-to-Azure migration tools and have committed resources to making the process smoother.

Google Cloud Platform is making gains but still trails AWS and Azure. They're competing on price and technical capabilities but lack the same breadth of services and enterprise sales focus.

For enterprises choosing alternative on-premises hypervisors, vendors like Proxmox and oVirt have gained attention, but they remain niche choices.

The real competitive winner is the cloud itself. The fundamental shift is that enterprises are moving from proprietary vendor lock-in with VMware to proprietary vendor lock-in with AWS, Azure, or Google Cloud. They're not gaining independence—they're switching overlords.

But they're doing it because the new overlords haven't (yet) changed pricing as aggressively as Broadcom did.

A significant 86% of enterprises are actively reducing their VMware footprint, while 63% have altered their migration strategy multiple times, indicating ongoing uncertainty and dissatisfaction post-acquisition.

The Outlook: What Comes Next?

Looking forward, the VMware exodus is likely to accelerate.

By late 2025, the vSphere 7 end-of-life deadline will force many enterprises to make final decisions. Some will upgrade to vSphere 8 and commit to staying. Others will use the upgrade requirement as a forcing function to finally migrate.

By 2026, we might see a tipping point where migration has become normal enough that more enterprises feel confident pursuing it. The first movers will have learned lessons and documented playbooks that later movers can follow.

By 2027-2028, the question might flip. Instead of "Should we stay on VMware?", the question becomes "Why are we still on VMware?" At that point, staying becomes the risky choice, requiring justification.

Broadcom has a window to reverse the trend. They could:

- Offer aggressive discounts to customers who commit to long-term contracts

- Simplify the licensing model to make it easier to understand

- Invest more heavily in Broadcom-owned alternatives (like Tanzu) to keep customers in the ecosystem

- Partner more aggressively with cloud providers to make VMware-to-cloud transitions smoother

But they'd need to act quickly, because customer inertia is shifting. Two years ago, the default was to stay on VMware. Today, the default is to leave and optimize. In three more years, staying might require explicit executive justification.

Best Practices for Planning Your VMware Migration

If you're part of that 86% considering VMware alternatives, here's a practical approach to increase your odds of success.

Step 1: Conduct a Complete Infrastructure Audit Document every VM, application, dependency, and VMware feature in use. Categorize applications by complexity: simple (stateless, easily scalable), moderate (some dependencies, manageable state), and complex (deeply integrated, mission-critical).

Step 2: Map to Target Destinations For each application, identify the best target: public cloud IaaS, Kubernetes, alternative hypervisor, or staying on VMware. Don't assume everything goes to one destination.

Step 3: Prototype with Pilot Applications Choose 3-5 applications that represent different categories of complexity. Actually migrate them to your target destination. Learn what breaks, what costs more than expected, and what processes need to change.

Step 4: Calculate True Total Cost of Ownership Include not just monthly cloud costs, but data transfer fees, management tool costs, migration services, training, and temporary parallel running costs (you might run the same application in two places during transition).

Step 5: Establish a Phased Migration Timeline Don't try to migrate everything at once. Plan waves of migration, with each wave building on lessons from previous waves.

Step 6: Plan for the Unexpected Budget an extra 20-30% in both timeline and budget for discoveries you haven't made yet. They will happen.

Step 7: Plan Your Management Tool Transition Decide whether you'll migrate to cloud-native tools, adopt a multi-cloud management platform, or use a hybrid approach. Don't leave this as an afterthought.

The Organizational Dimension: Change Management Matters

Here's something the technology discussions often miss: the most important factor in VMware migrations is organizational change management, not technology.

Your infrastructure team spent years becoming expert at VMware. They know vSphere inside out. They have battle-hardened runbooks for every scenario. They've optimized their processes around VMware's way of doing things.

Now you're asking them to become novice cloud operators. They have to learn new tools, new patterns, new failure modes. They'll be slower at cloud operations than they are at VMware operations, at least initially.

This creates a very real productivity hit during migration. Your infrastructure team's mean time to resolution (MTTR) will go up. Your operational efficiency will decline. Your team morale might suffer because they're being asked to start over in their expertise.

Successful migrators recognize this and:

- Invest in training and certification for their infrastructure teams

- Bring in experienced cloud architects as consultants or temporary hires

- Accept that post-migration efficiency will be lower than pre-migration for 6-12 months

- Celebrate wins to maintain team morale through the difficult transition

Enterprises that underestimate this organizational dimension typically underestimate their migration timeline by 6-12 months.

Real-World Outcomes: What Did Successful Migrants Learn?

Enterprises that have completed VMware migrations share some consistent lessons:

Lesson 1: Rightsizing Matters More Than You Think When moving to cloud, most enterprises significantly oversize their initial instances. They do this because they're nervous about performance. Then they spend six months watching their cloud bills and gradually rightsize instances down. Plan for rightsizing from the start. Budget for 20-30% cost reduction through optimization in your post-migration phase.

Lesson 2: Hybrid is Sticky Most enterprises that intended to do a complete cloud migration end up with hybrid infrastructure that persists longer than planned. There's always something that's "too complex" or "too expensive" to move. Plan for that reality. Design your architecture assuming you'll have permanent hybrid infrastructure, not temporary.

Lesson 3: Data Transfer Costs Are Invisible Until They're Not Enterprises often get surprised by data transfer costs. Moving data to the cloud is cheap or free. But moving data between regions, or between cloud and on-premises repeatedly, adds up fast. Build data residency into your application architecture from day one.

Lesson 4: Disaster Recovery Gets More Complicated On VMware, disaster recovery was relatively straightforward: run your production environment and a DR environment, keep them in sync, fail over if needed. In the cloud, your options multiply: multiple regions, multiple clouds, different architecture between production and DR. This is powerful but requires thoughtful design. Many enterprises get their DR wrong and don't discover the problem until they actually need to fail over.

Lesson 5: Monitoring and Observability Tools Matter Enormously You can't manage what you can't see. Invest heavily in monitoring and observability tooling before and after migration. This is not an afterthought. This is a foundational architectural decision.

What Runable Offers for Infrastructure Documentation and Reporting

During migration planning and execution, one constant challenge is documentation. You need to maintain comprehensive, up-to-date records of:

- Current infrastructure configuration

- Migration status and progress

- Discovery documents and assessment results

- Migration runbooks and procedures

- Post-migration validation reports

Tools like Runable can help automate the creation of these critical documentation artifacts. Rather than manually writing migration reports, infrastructure assessments, or discovery documents, you can use Runable's AI-powered automation to generate comprehensive migration reports, assessment slides, and infrastructure documentation from your data sources. This saves weeks of manual documentation work while ensuring consistency and completeness.

Use Case: Generate comprehensive VMware migration assessment reports with infrastructure analysis and recommendation slides automatically in minutes, not days.

Try Runable For FreeCommon Mistakes Enterprises Make During Migration

Mistake 1: Underestimating the Planning Phase Enterprises think planning takes 2-3 months. It usually takes 4-6 months if you're thorough. Underestimating planning leads to downstream problems during execution.

Mistake 2: Moving Everything at Once Some enterprises try to do a "big bang" migration where they move everything simultaneously. This is almost always a disaster. Phased migrations are slower but far more reliable.

Mistake 3: Not Involving Business Stakeholders Early Infrastructure teams often treat migration as a technical project. It's not. It's a business decision that affects how applications perform, how much they cost, and how available they are. Business stakeholders need to be involved from day one.

Mistake 4: Ignoring Compliance and Security During Planning Your on-premises infrastructure might have specific security or compliance requirements that are easier to meet than in the cloud. Or harder. Either way, these need to be evaluated during planning, not discovered during execution.

Mistake 5: Failing to Plan for the Second Wave of Migration The first wave of migration is always about moving the easy stuff. The second wave is about moving the hard stuff. And the hard stuff is hard for a reason. Don't be surprised when it takes longer.

The Negotiation Angle: Can You Get Better VMware Terms?

Not all enterprises are migrating. Some are negotiating.

If you have significant VMware spend, you might have negotiating power. Broadcom doesn't want to lose your business completely. They might offer:

- Discounts for multi-year commitments

- Grandfather clauses for current licensing

- Bundled pricing for other Broadcom products

- Dedicated account management and support

If you have $2+ million in annual VMware spend, it's worth having a serious conversation with Broadcom's account team about your concerns. Position it as: "We're evaluating alternatives and want to understand if there's a way to make our current relationship work better."

Broadcom might surprise you. They have some flexibility, especially for large customers.

But be strategic: do this negotiation while you're credibly planning alternatives. If Broadcom believes you're not really going to leave, they'll have less motivation to offer better terms.

A Word on Patience: Migration is a Marathon, Not a Sprint

Two years after Broadcom's acquisition, the reason only 4% of enterprises have fully migrated isn't because migration is impossible. It's because these are complex projects that take time.

The enterprises that are going to migrate successfully are the ones that give themselves permission to take 18-24 months to plan, execute, and optimize. They're not trying to do it in six months.

That patience is actually strategic. Early migrants often make mistakes because they're rushing. Later migrants benefit from lessons learned, better tooling, and clearer best practices.

If you're in the 86% considering your options, don't panic about needing to move immediately. You have time. Use that time to be strategic: learn what others are doing, prototype carefully, and execute deliberately.

Conclusion: The Long, Slow Exodus

Two years after Broadcom's acquisition, VMware's customer base is caught between frustration and inertia.

Ninety percent of them want out. That's the desire.

But four percent have actually left. That's the reality.

The gap between desire and reality tells you everything about how hard enterprise infrastructure migrations actually are. It's not about technology—it's about complexity, cost, organizational readiness, and the sheer difficulty of replacing systems that everything else depends on.

Broadcom probably expected customer churn. But they probably didn't expect it to remain so high for this long. And they probably didn't expect that even customers staying on VMware would be resentful, optimize their footprint, and avoid investing in new Broadcom products.

The next two years will be critical. The vSphere 7 sunset will force decisions. Migrating enterprises will share lessons learned, making the next wave easier. Cloud providers will continue optimizing their offerings for VMware refugees. Alternative hypervisors will improve.

Broadcom has a choice: make peace with their customers by improving licensing terms and pricing, or accept that they're harvesting a declining legacy business.

Meanwhile, if you're one of the 86%, now is the time to get serious. Assess your options, prototype the leading ones, and start building toward a decision. The enterprises that started planning in 2024 will be the ones finishing in 2026. The ones that start planning now will be finishing in 2027-2028.

Don't wait for a crisis to force your hand. Make the decision on your own timeline, with your own priorities.

FAQ

What is VMware, and why do so many enterprises use it?

VMware is a virtualization platform that abstracts physical servers into virtual machines, allowing multiple applications to run on the same hardware. Enterprises use it because it's the industry standard with 15+ years of market dominance, deep integration into their infrastructure, and a mature ecosystem of tools and vendors. The switching costs are high because everything from networking to storage to security policies is built around VMware's architecture.

How did Broadcom's acquisition change VMware pricing?

Broadcom shifted from a per-VM or per-core licensing model to a per-socket licensing model, meaning customers pay based on the number of physical processor sockets in their servers. For enterprises running modern multi-socket servers with high core counts, this resulted in substantial price increases, often 25-350% or more depending on their specific infrastructure.

Why haven't more enterprises successfully migrated away from VMware?

Migration faces three major barriers: technical complexity (VMware is deeply integrated into everything), unexpected costs (cloud operations are often more expensive than on-premises once fully loaded), and organizational inertia (infrastructure teams are expert at VMware and face a learning curve with cloud platforms). These challenges mean most enterprises take 18-24 months to plan and execute a migration successfully.

Is cloud always cheaper than on-premises VMware?

No. For many workloads, cloud operating costs are actually higher when you factor in data transfer, storage, network, and management overhead. The financial case for migration depends heavily on your specific workloads, current on-premises efficiency, and cloud usage patterns. Some enterprises migrate for operational flexibility and reduced capital expenditure, not lower ongoing costs.

What are the main alternatives to VMware?

Major alternatives include public cloud IaaS platforms (AWS EC2, Azure VMs, Google Compute Engine), open-source on-premises hypervisors (Proxmox, oVirt), Kubernetes and containerization, and hybrid approaches combining multiple technologies. Most migrating enterprises (72%) choose public cloud IaaS rather than alternative on-premises hypervisors.

Should we stay on VMware or migrate?

That depends on your specific situation. Calculate your five-year cost of ownership under both scenarios. Consider your team's technical capabilities, your application portfolio, your compliance requirements, and your operational preferences. A 41% of enterprises are finding that optimization on VMware is better than migration. Others find migration is worth the effort. There's no universal answer.

How long does a VMware migration typically take?

For a mid-sized enterprise with hundreds of virtual machines, a complete migration typically takes 12-18 months including planning, pilot testing, and phased production migration. Some enterprises complete it faster (6-12 months), while others take longer (18-24+ months) if they encounter unexpected complexity or hit budget constraints.

Can we negotiate better pricing with Broadcom?

If you have significant VMware spend (typically $1+ million annually), Broadcom has some flexibility on pricing, especially for multi-year commitments. However, negotiating credibly requires that you be seriously evaluating alternatives. Your best leverage is demonstrating that you're considering migration and need better terms to stay.

What's the most important factor in migration success?

Organizational change management matters more than technology. Your infrastructure teams need training, your business stakeholders need alignment, your project management needs to be realistic about timelines, and your executive sponsorship needs to be sustained through a long, complex initiative. Migrations fail when underestimated, not when impossible.

This article is 6,847 words and provides comprehensive analysis of VMware migrations, customer sentiment two years post-Broadcom acquisition, barriers to migration, alternative platforms, and practical guidance for enterprises deciding whether to stay or go.

Key Takeaways

- 86% of North American enterprises are actively trying to reduce VMware footprint, but only 4% have fully migrated due to migration complexity

- Price increases averaging 25-49% (with some hitting 350-700%) triggered the exodus, and 85% remain concerned about future hikes

- Migration barriers include technical complexity (25%), higher-than-expected cloud costs (23%), and technical integration challenges (21%)

- 72% of migrating enterprises target public cloud IaaS, while 41% are choosing to stay and optimize VMware footprint instead of migrating

- vSphere 7 end-of-life deadline in late 2024 will force many enterprises to make final VMware decisions, potentially accelerating the exodus in 2025-2026

Related Articles

- VMware Migration Wave Accelerates as Customers Abandon Vendor Lock-in [2025]

- Google I/O 2026: May 19-20 Dates, What to Expect [2025]

- Infosys and Anthropic Partner to Build Enterprise AI Agents [2025]

- Fractal Analytics IPO Signals India's AI Market Reality [2025]

- Why B2B Software Isn't Dead: What AI Really Means for SaaS [2025]

- Anthropic's $14B ARR: The Fastest-Scaling SaaS Ever [2025]

![VMware Customer Exodus: Why 86% Still Want Out After Broadcom [2025]](https://tryrunable.com/blog/vmware-customer-exodus-why-86-still-want-out-after-broadcom-/image-1-1771414608800.jpg)