China's Technological Dominance: Understanding the Chinese Century

You're living in it, even if you haven't realized it yet. The Chinese Century isn't some distant future scenario buried in think tank reports. It's happening right now, across every industry that matters. From the batteries powering your electric vehicle to the solar panels generating clean energy to the robotics automating global manufacturing, China has stopped playing catch-up. It's now setting the pace.

When people talk about the future, they often picture Silicon Valley founders, MIT labs, and American innovation driving humanity forward. But that narrative is increasingly disconnected from reality. China is out-building the West at scales that feel almost surreal. Construction projects that would take years in New York or London get completed in days. Solar capacity is being deployed faster than Western analysts can update their spreadsheets. AI research coming out of Chinese labs is matching—and in some cases exceeding—what emerges from Stanford and Berkeley.

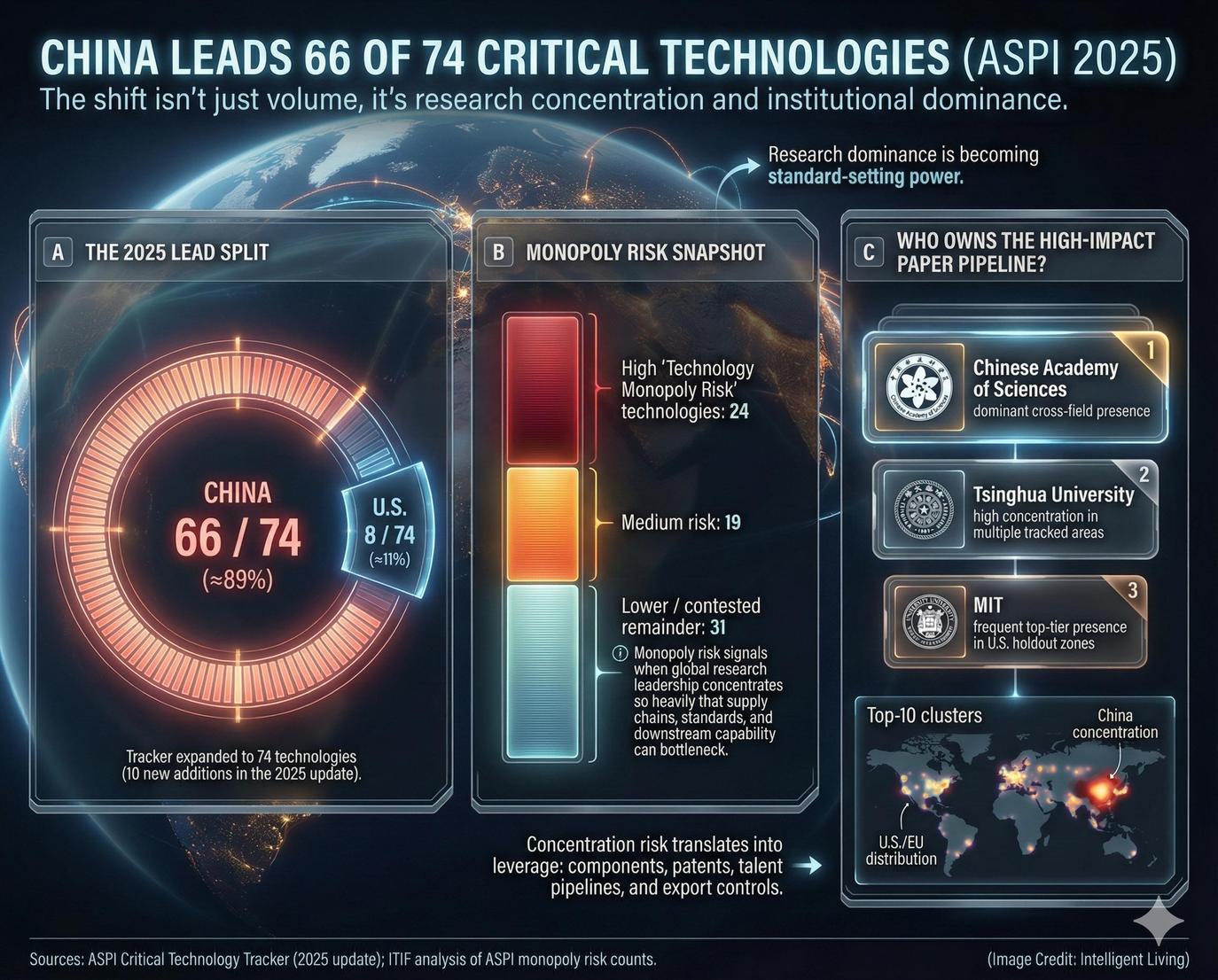

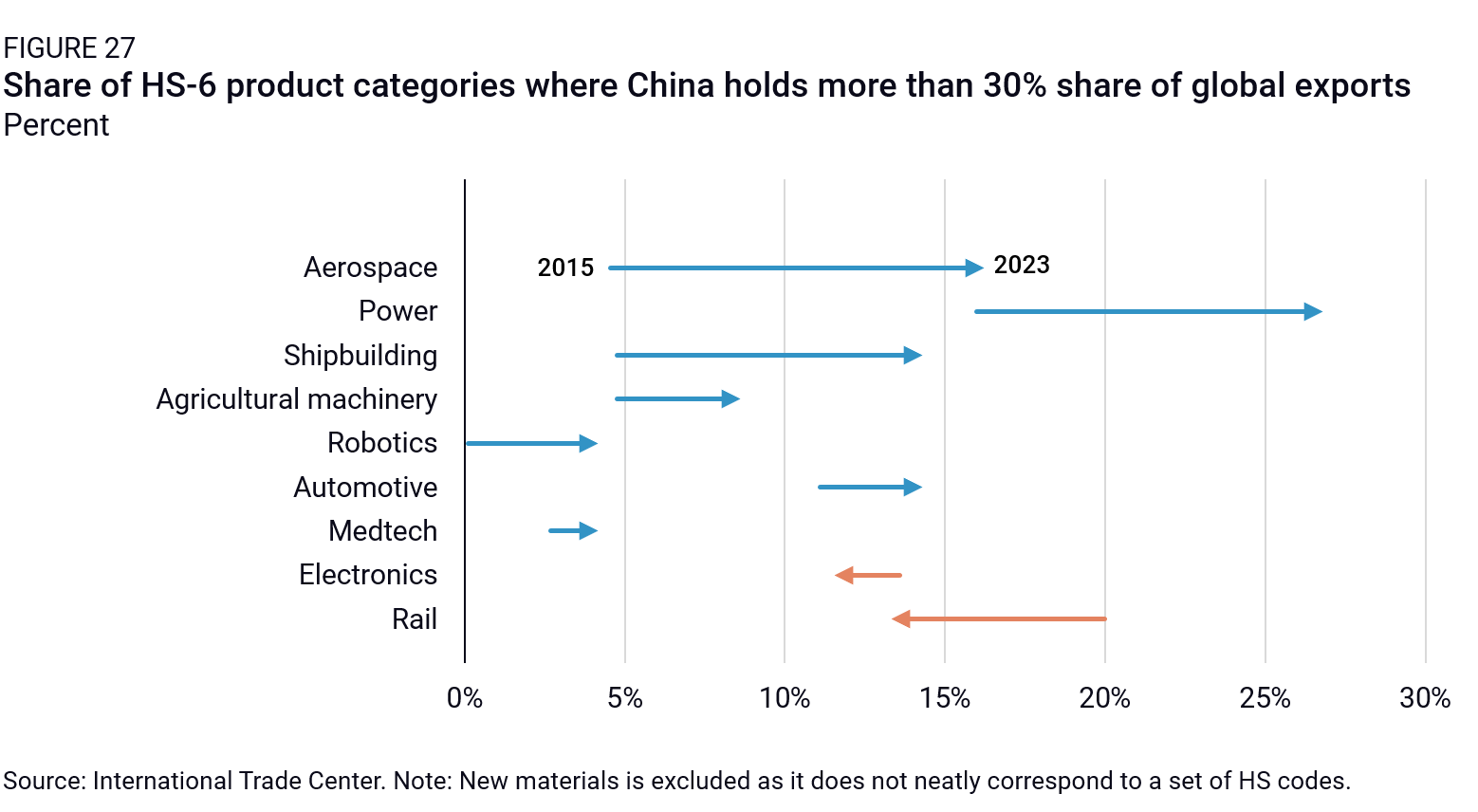

This isn't about China being "catching up" anymore. That framing is obsolete. The question isn't whether China will dominate certain technological sectors. It's which sectors it won't dominate, and how the rest of the world adapts to that reality.

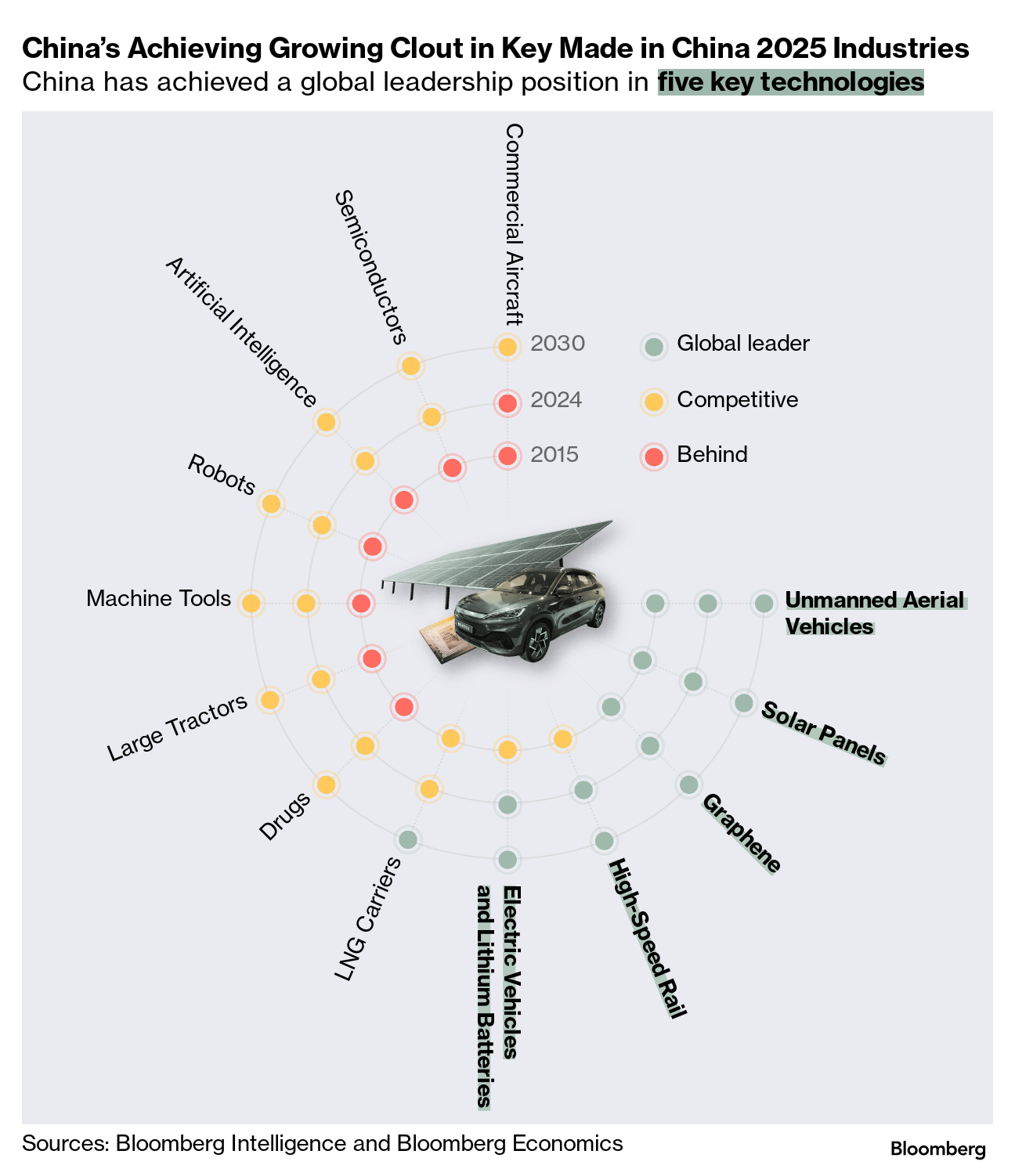

What makes this moment particularly significant is how comprehensive China's technological advantage has become. It's not isolated to one or two industries. Chinese companies are leading in semiconductor manufacturing efficiency, renewable energy deployment, AI model development, robotics integration, battery chemistry innovation, and e-commerce infrastructure. The breadth of this dominance is what separates this era from previous technological shifts.

Understanding this transformation requires moving past the headlines about trade wars and geopolitical tensions. You need to look at the actual data, the concrete metrics, and the structural advantages China has built. That's what this article examines: the real foundations of China's technological edge, where it's most concentrated, how it got here, and what it signals about the global future.

TL; DR

- China leads globally in solar manufacturing capacity, deploying more renewable energy annually than the entire US consumes from all sources

- Chinese AI labs are producing cutting-edge models that compete directly with American equivalents, particularly in language models and computer vision

- Battery and EV manufacturing dominance gives China control over critical supply chains for the global transition to electric vehicles

- Speed of deployment and execution allows China to implement technological solutions years ahead of Western competitors

- Structural advantages in manufacturing scale create feedback loops where dominance in one sector reinforces dominance in adjacent sectors

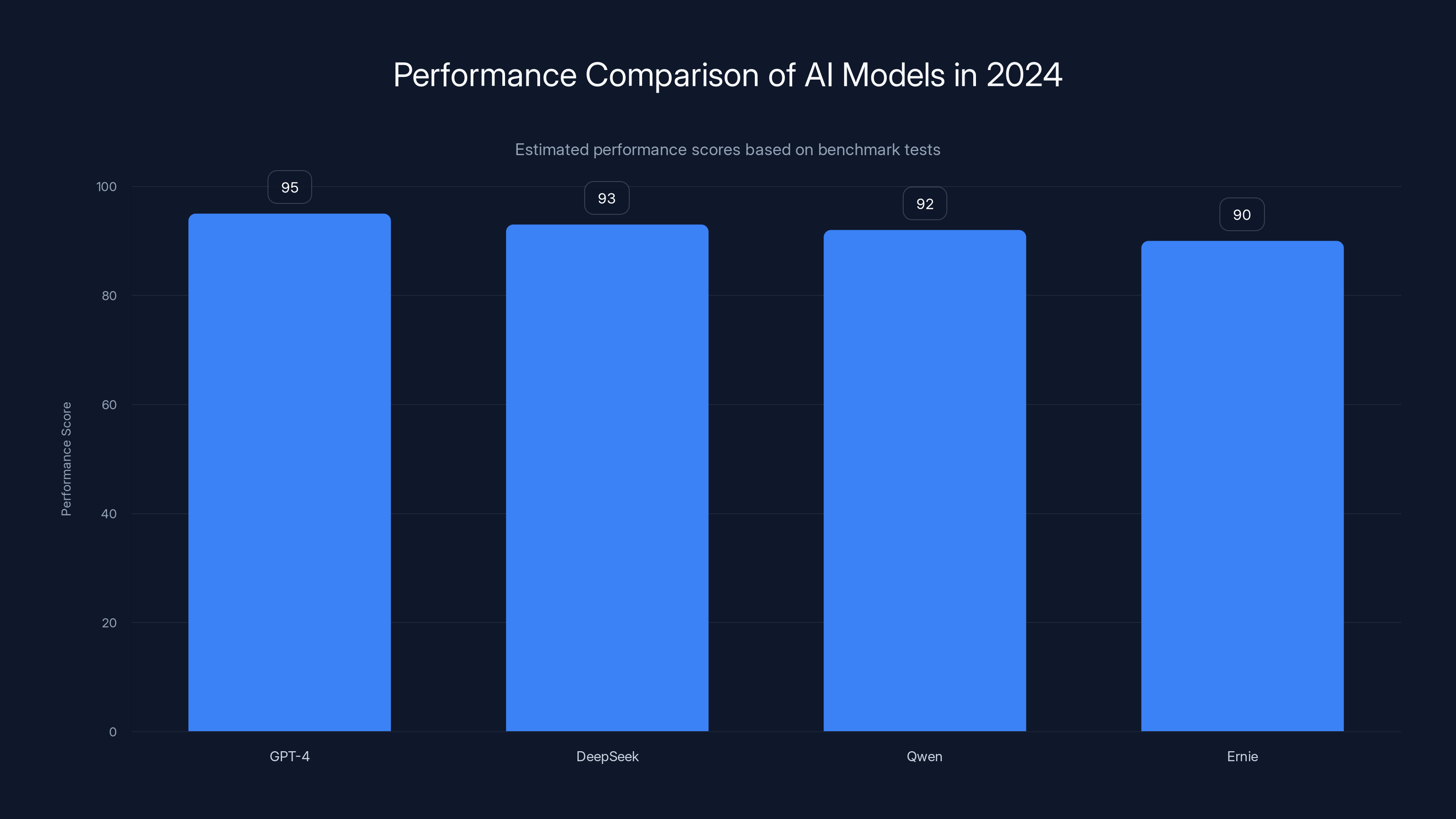

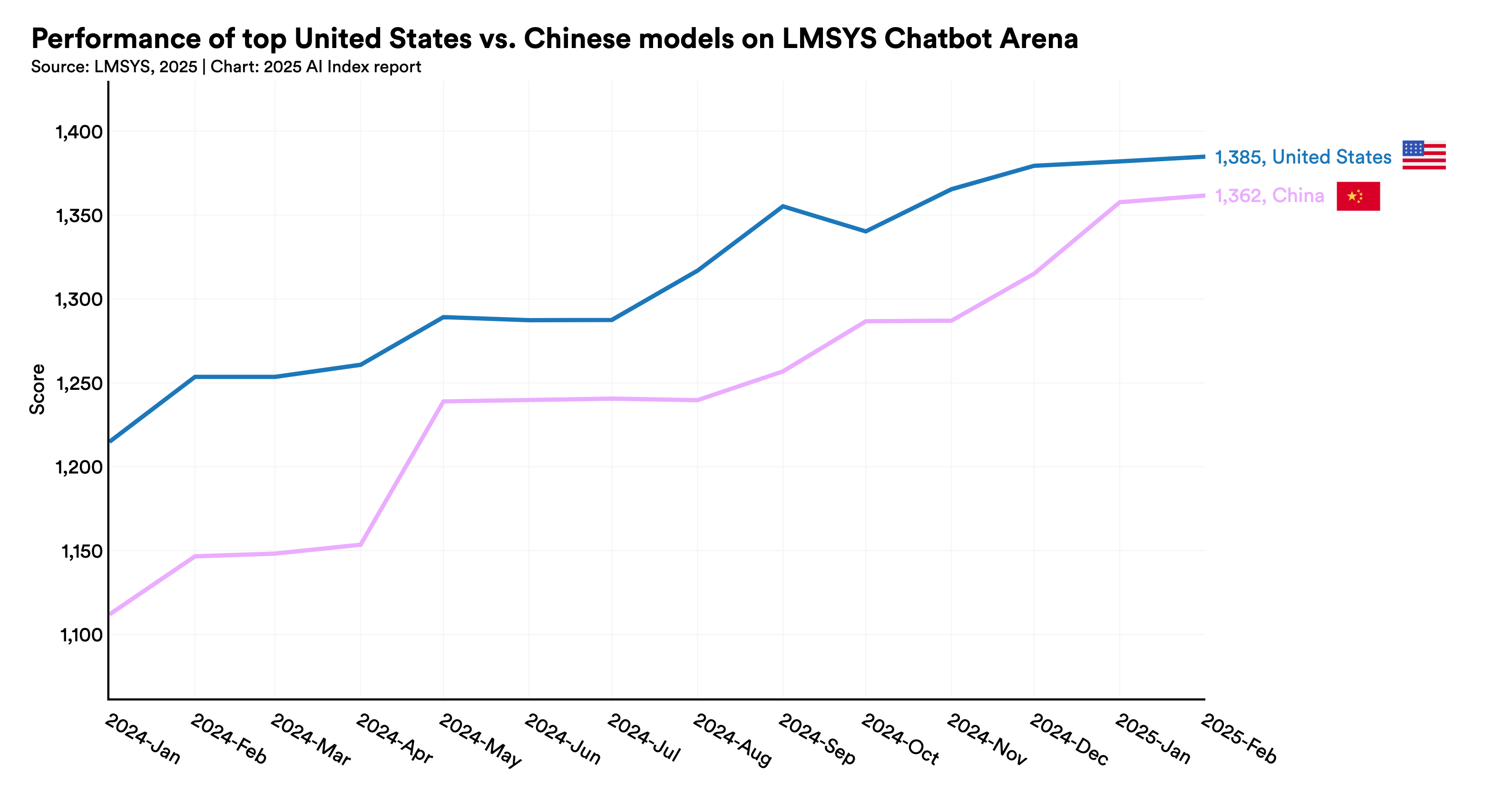

By late 2024, Chinese models like DeepSeek and Qwen were matching GPT-4 in benchmark performance, indicating a significant shift in AI leadership. Estimated data.

The Energy Revolution: Why China Controls Tomorrow's Power Grid

Solar Dominance and Renewable Capacity

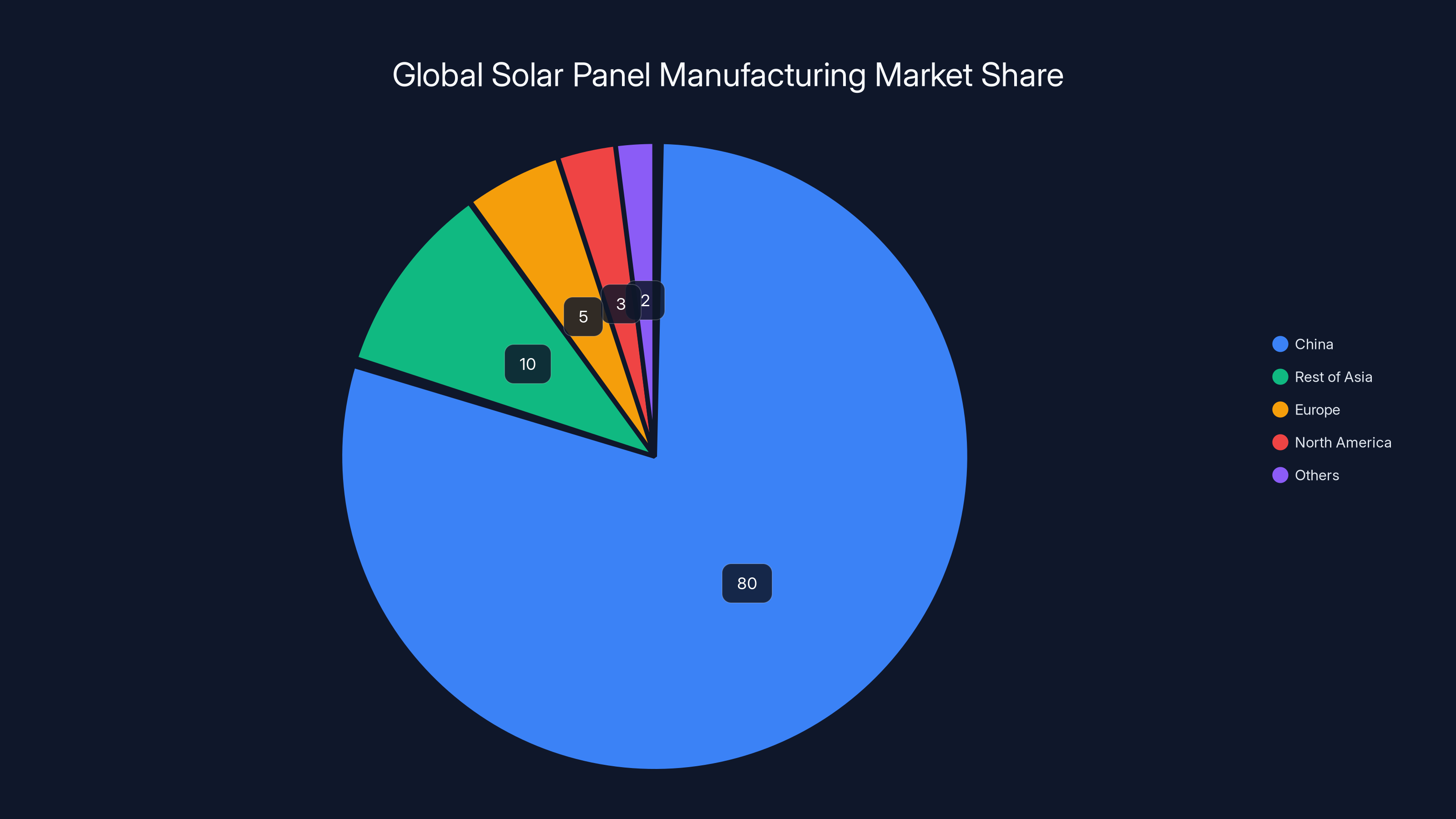

China's solar manufacturing capability is almost impossible to overstate. The numbers are staggering enough to feel unreal, which is probably why most people outside the energy sector don't grasp what's actually happening.

China controls roughly 80% of global solar panel manufacturing. That's not a competitive market where multiple countries contribute roughly equally. That's dominance. In 2024, China installed more solar capacity in a single year than the entire cumulative installed solar capacity in the United States. Let that sink in. One year in one country exceeds the entire historical output of the world's largest developed economy.

The manufacturing process illustrates why this dominance is so difficult to challenge. Solar panel production involves creating polysilicon (the raw material), manufacturing wafers, assembling cells, and integrating them into complete panels. China has invested heavily in every single step of this value chain. Chinese companies have the largest polysilicon refineries, the most advanced manufacturing equipment, and the expertise to scale production to incredible volumes.

The cost advantages are significant. Chinese solar panels cost 60-70% less than Western alternatives for equivalent performance. This isn't because of corner-cutting or lower quality. It's because of scale, manufacturing efficiency, supply chain integration, and the ability to operate with lower profit margins while still achieving healthy returns on massive volumes.

What's particularly clever about China's strategy is how it weaponized subsidies and strategic investment early on. When the solar industry was nascent in the 2000s, Western companies treated it as a niche market. China identified it as a future cornerstone of global energy infrastructure and poured resources into building capacity. By the time Western companies realized the market opportunity, Chinese manufacturers had already achieved such massive economies of scale that competition became nearly impossible.

Battery Chemistry and EV Manufacturing

Batteries are the actual constraint on the electric vehicle revolution. A better engine design doesn't help if you can't power it. China understood this dependency early and invested accordingly.

Chinese companies dominate the supply chain for lithium-ion batteries at every stage. They control mining operations, processing facilities, cathode and anode manufacturing, cell assembly, and battery pack integration. When electric vehicles transition from luxury products to mainstream transportation (which is already happening in China), battery manufacturing becomes the bottleneck. China positioned itself to control that bottleneck.

The numbers reflect this dominance. Chinese battery manufacturers produce roughly 60% of global battery capacity. In 2024, Chinese EV production exceeded 10 million units annually. For context, all of Europe and North America combined produced roughly 9 million EVs in the same period.

What makes this particularly significant is the feedback loop it creates. As Chinese EV manufacturers produce more vehicles, they negotiate better battery prices due to volume. As costs decrease, more consumers buy EVs, which drives more battery production. Meanwhile, Western competitors pay higher prices for batteries from the same suppliers, making their vehicles less competitive on price. The cost disadvantage is structural, not temporary.

Cathodic chemistry is another area where Chinese research is advancing faster. Lithium iron phosphate (LFP) batteries, which are cheaper and safer than nickel-based alternatives, were pioneered in China. Chinese manufacturers have optimized LFP chemistry to the point where they're becoming standard in global EV markets. The CATL company alone (a Chinese battery manufacturer) produces more battery capacity than all Western competitors combined.

Grid-Scale Storage and Distributed Energy Systems

Beyond generation and transportation, China is also dominating the storage and distribution layer of the energy ecosystem. Grid-scale battery storage is crucial for managing variable renewable energy sources. Wind and solar are intermittent, so you need storage to smooth out supply fluctuations.

China's approach to grid storage is comprehensive. They're deploying pumped hydro storage, compressed air storage, thermal storage, and increasingly, battery storage at scales that dwarf Western efforts. In 2024, China deployed more grid-scale battery storage than had existed cumulatively worldwide just three years prior.

This matters because energy storage is the missing piece that makes 100% renewable grids viable. Countries and regions that can't solve the storage problem can't transition fully away from fossil fuels. China is solving it, which means it can run grids on renewables while Western countries remain partially dependent on gas and coal due to storage constraints.

The practical impact is that China can build renewable-powered manufacturing facilities with no fossil fuel dependency. A semiconductor fab or battery factory powered entirely by renewable energy and backed by grid storage is qualitatively different from one that needs natural gas when the sun isn't shining. It changes operational costs, regulatory requirements, and environmental footprints.

China controls 80% of the global solar panel manufacturing market, showcasing its dominance in the renewable energy sector. Estimated data.

AI and Machine Learning: The Race Nobody Thought China Was Winning

Large Language Models and Foundation Models

For years, the narrative around AI was straightforward: America leads, China copies, everyone else follows. That narrative has become dangerously outdated.

Chinese AI labs are now producing large language models and foundation models that aren't inferior copies. They're competitive with American models in meaningful ways. Deep Seek, Alibaba's Qwen, Baidu's Ernie, and others are trained on comparable scale, achieving similar or better performance on specific benchmarks, and in some cases, deploying novel architectural innovations.

The progress has been rapid enough that it surprised even people paying close attention. In 2023, most serious AI researchers would have confidently stated that GPT-4 and other American models held a decisive lead. By late 2024, that confidence had evaporated. Chinese models like Qwen and Deep Seek were matching GPT-4 performance on benchmark tests that were supposed to demonstrate American superiority.

How did this happen so fast? Several factors converged. First, Chinese AI researchers have access to the same academic papers and open-source codebases as American researchers. The underlying science isn't proprietary. Second, Chinese companies have massive compute resources. Alibaba, Tencent, Baidu, and others have invested heavily in GPU clusters and custom silicon for AI training. Third, Chinese companies aren't constrained by some of the safety and alignment concerns that slow down Western development. Whether you view that as an advantage or a risk depends on your perspective, but it's undeniably true.

The practical impact is that Chinese companies now have in-house AI capabilities competitive with American models. They don't need to license GPT or pay Open AI for API access. They can build their own models, integrate them into products, and iterate rapidly without external dependencies.

Computer Vision and Multimodal AI

Beyond language models, Chinese AI research is particularly advanced in computer vision and multimodal systems. This matters because vision AI has more immediate commercial applications than pure language modeling.

Facial recognition is an area where China has significant expertise. Surveillance systems powered by facial recognition have been deployed across the country, which means Chinese companies have access to training data and real-world operational experience that American companies can only dream about. The data advantage in computer vision is massive. The more images your system processes and learns from, the better it becomes. Chinese surveillance systems are processing billions of faces and real-world conditions continuously.

Object detection, scene understanding, and spatial reasoning are other areas where Chinese computer vision has advanced rapidly. These capabilities have direct applications in autonomous vehicles, robotics, manufacturing quality control, and agricultural monitoring.

Multimodal AI—systems that process text, images, video, and audio together—is an area where Chinese labs have made genuine innovations. The architecture and training approaches coming from Chinese research groups are sometimes cleaner and more efficient than Western alternatives.

What's particularly interesting is how this translates to products. Chinese e-commerce platforms use computer vision at scales that American companies don't attempt. Taobao and similar platforms use vision AI for product recommendation, image search, and fraud detection at volumes that mean they're constantly refining their models with real-world data.

Generative AI for Specific Domains

While Western generative AI has focused on general-purpose models (Chat GPT that does everything), Chinese AI companies have invested more in domain-specific models. They've built generative AI for medical imaging, drug discovery, industrial design, semiconductor design, and materials science.

The reasoning is straightforward: general-purpose AI sounds impressive but makes money in narrow applications. A specialized model for medical diagnosis that's 5% more accurate than general-purpose alternatives can generate enormous value by improving outcomes and reducing errors. Chinese companies optimized for this commercial reality.

Domain-specific models also require less data to fine-tune if you start with a good foundation model. Chinese labs have built these foundation models and are now rapidly creating specialized variants. The speed of adaptation is creating compounding advantages.

Advanced Manufacturing and Robotics Integration

Robotics Density and Manufacturing Automation

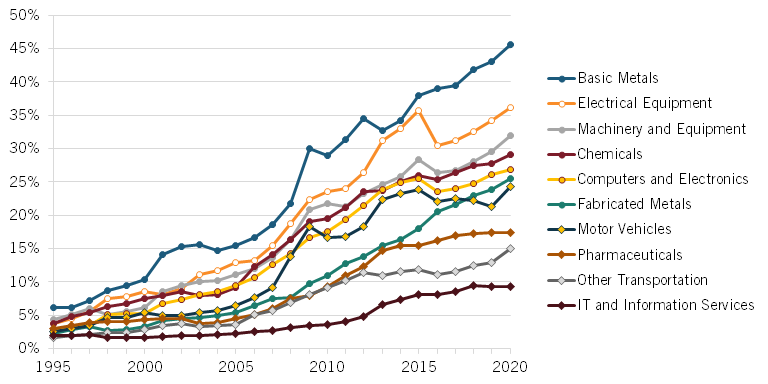

China's advantage in manufacturing isn't just about labor costs anymore (labor costs have risen in China, which forces automation). It's about the integration of robotics into manufacturing at scales and speeds that other countries haven't matched.

Robotics manufacturers like ABB and FANUC sell robots globally, but what matters is how many robots China is deploying. Chinese factories are installing industrial robots at rates that far exceed global trends. The robot density (number of robots per 10,000 factory workers) is highest in China among major manufacturing countries.

More robots means higher productivity, fewer defects, and the ability to produce consistent quality at massive volumes. It also means China can maintain manufacturing competitiveness even as labor costs rise. Automation erases the labor cost advantage over time, but only if you automate. China did.

The robot types matter too. China is increasingly deploying collaborative robots (cobots) that work alongside humans, rather than replacing them entirely. This allows for flexibility and rapid retooling, which is crucial for contract manufacturing where specifications change frequently.

Vertical Integration in Electronics Manufacturing

China's dominance in electronics manufacturing is partly about robotics, but more fundamentally about vertical integration. A single Chinese manufacturing company might control the supply chain from raw materials through finished products.

BYD, for example, is primarily known as an EV manufacturer. But BYD also manufactures batteries, semiconductors, power electronics, LED components, and precision mechanical parts. They don't just assemble vehicles from externally sourced parts. They control the entire value chain internally.

This vertical integration creates massive cost advantages. When you control every layer from raw materials to finished product, you eliminate markups at each step. More importantly, you can optimize the entire chain holistically rather than optimizing each component in isolation.

For comparison, most Western automotive and electronics companies outsource heavily. Tesla is the most vertically integrated American EV manufacturer, but even Tesla doesn't control as much of the supply chain as BYD does. The structural advantage becomes visible in unit economics. BYD can produce an EV profitably at price points where Western competitors lose money.

Semiconductor Manufacturing Precision

While China still imports high-end semiconductors (for cutting-edge AI chips and high-performance processors), it's making rapid progress in manufacturing lower-cost, high-volume chips. SMIC, a Chinese semiconductor manufacturer, is advancing in process node technology and volume capacity.

The geopolitical implications are significant. Western sanctions restrict China's access to the most advanced chip manufacturing equipment. Yet Chinese companies are slowly working around these restrictions through domestic innovation and equipment development. The progress is slower than with unrestricted access, but it's steady.

For most applications (which don't require the most advanced chip nodes), Chinese manufacturing can already meet demand domestically. This reduces dependency on Taiwan and other external suppliers for critical supply chains.

Estimated data shows that semiconductor project approvals in China are significantly faster, taking about 1.5 years compared to 3 years in Western countries. This speed provides a competitive advantage for Chinese companies.

Infrastructure and Deployment Speed

Construction Speed and Scale

One of the most visible differences between China and the West is how fast things get built. There are countless videos of enormous buildings rising in days or weeks. This isn't magical. It's a combination of factors: regulatory streamlining, pre-fabrication, large-scale labor mobilization, and willingness to work around environmental concerns.

The practical impact is that infrastructure that would take Western countries a decade to plan, approve, and build gets completed in China in months. A power plant, a highway, a research facility, a manufacturing complex—these get built faster in China.

For technology infrastructure this matters enormously. New data centers, manufacturing facilities, and research labs get deployed at speeds that provide competitive advantages. A AI company can build out compute capacity in China in a fraction of the time it would take in the US or Europe.

This speed advantage is compounding over time. If China builds new infrastructure twice as fast as Western countries, and both invest at roughly the same rate, China ends up with twice as much infrastructure in the same period. The accumulation of advantages is substantial.

5G and Telecommunications Infrastructure

China deployed 5G infrastructure nationwide years ahead of most Western countries. Huawei, a Chinese telecommunications company, became the largest 5G infrastructure provider globally (though Western countries increasingly restrict its use due to security concerns).

The practical implication is that Chinese consumers and businesses have access to 5G networks while Western counterparts still rely primarily on 4G. This matters for real-time applications, autonomous vehicles, industrial Io T, and any technology where latency is critical.

The speed of deployment created a vicious cycle: companies building 5G applications in China have access to working 5G networks for testing and optimization. Companies in the West without widespread 5G deployment have to work with limited networks. The companies with real-world deployment experience build better applications, which makes the network more valuable, which accelerates further deployment.

Data Center and Cloud Infrastructure

Alibaba and Tencent operate cloud platforms at scales comparable to AWS and Azure. They have advantages in terms of regulatory environment (they face less scrutiny for expanding capacity) and capital availability. New data centers in China get built and deployed faster than in the West.

More data center capacity means more capacity for AI training, more capacity for hosting applications, and more ability to serve customers without capacity constraints. Western cloud providers regularly sell out of capacity for high-demand resources (like GPUs for AI workloads). Chinese cloud providers are expanding capacity faster and can accommodate demand more readily.

Semiconductor Supply Chain Control

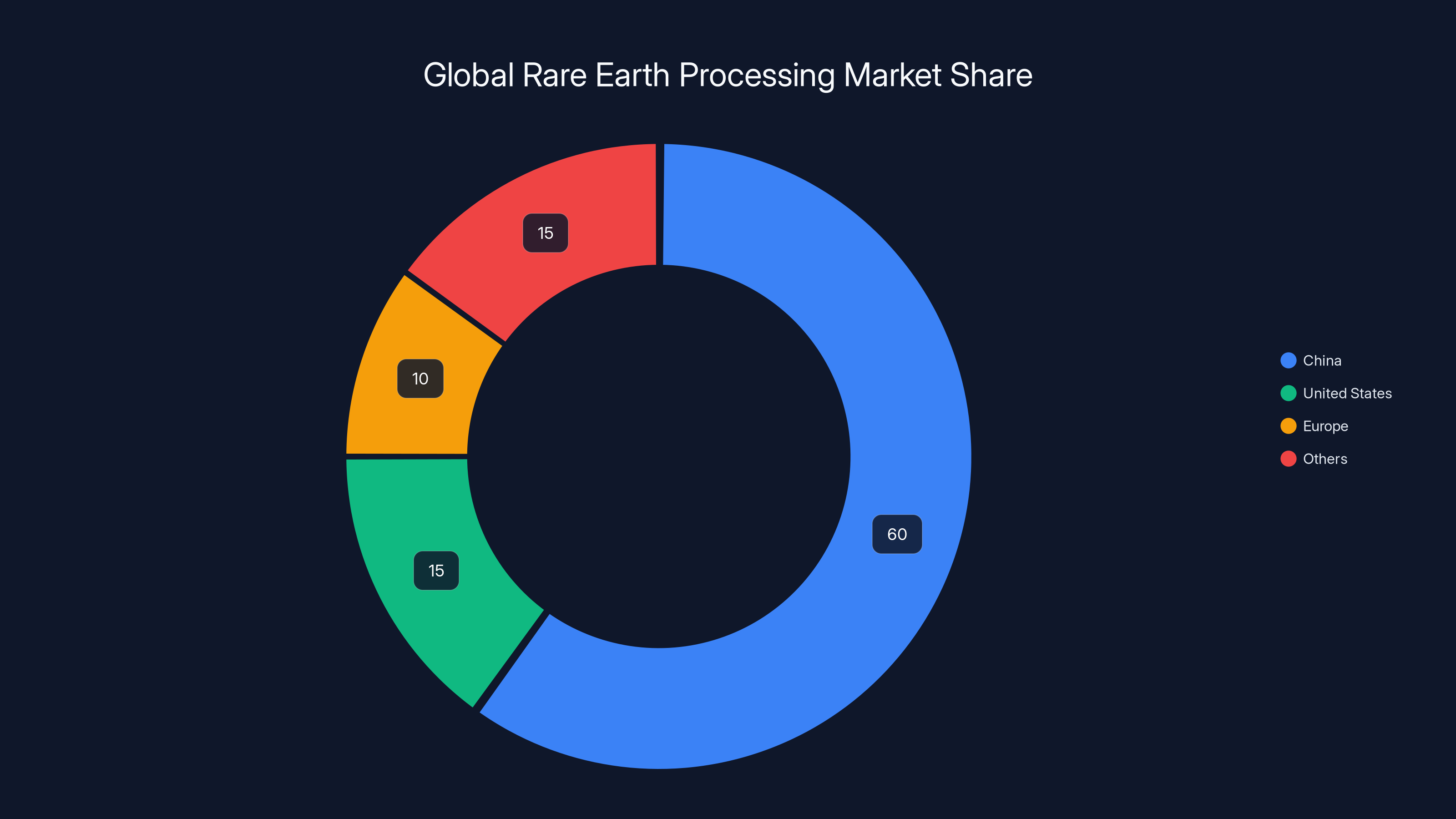

Rare Earth Elements and Processing

One of the most significant but least visible aspects of Chinese technological dominance is control over rare earth elements. These elements are critical for semiconductors, defense systems, medical imaging, and renewable energy.

China produces roughly 70% of the world's rare earth elements and processes over 80% of rare earth ore globally. This isn't because China has a natural monopoly on rare earth deposits. It's because China invested in mining and processing capacity when few other countries cared about these materials.

Rare earth processing is dirty, difficult work that requires significant capital investment and environmental tolerance. Western countries, with stricter environmental regulations, gradually outsourced rare earth processing to China. Now China controls the supply chain and can restrict access if geopolitical tensions escalate.

The semiconductor implications are direct. Many semiconductor components require rare earth elements. Without secure supply chains for these materials, semiconductor manufacturing can't scale. China effectively has veto power over rare earth access for other countries' semiconductor industries.

Advanced Packaging and Integration

Semiconductor packaging—the process of integrating chips into functional units—is an area where Chinese companies are advancing rapidly. Advanced packaging (chiplets, 3D integration, advanced interconnect) is becoming increasingly important for performance and cost.

Companies like TSMC (Taiwan) remain the gold standard for high-end semiconductor manufacturing, but Chinese companies are progressing in packaging and assembly technologies. These companies can package and test chips at high volumes, which is crucial for manufacturing at scale.

As semiconductor manufacturing becomes more specialized (design, fabrication, packaging, assembly are increasingly separate companies), control over any critical step becomes valuable. China's advancement in packaging reduces dependency on Western companies for this crucial stage.

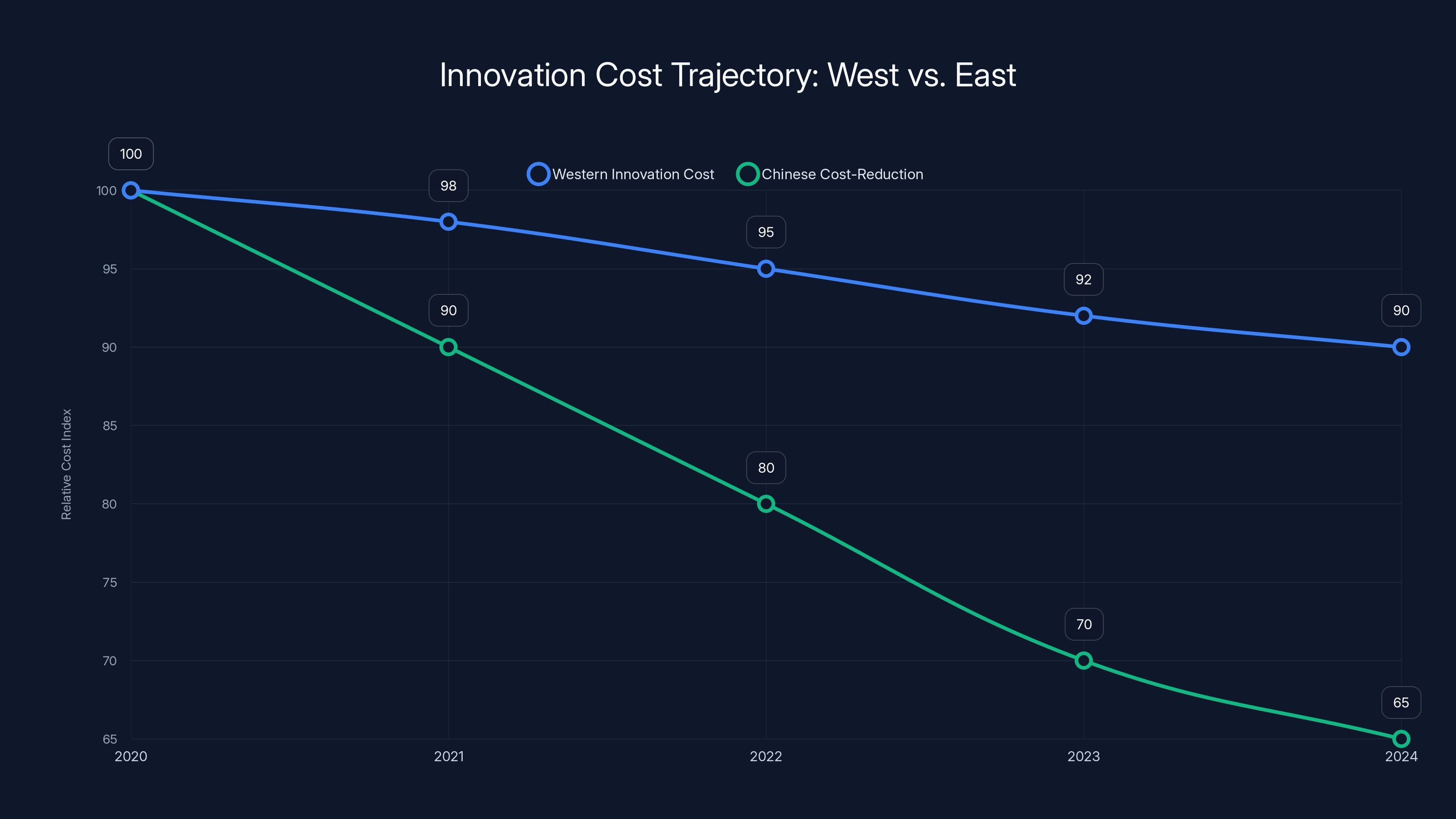

The chart illustrates the estimated cost trajectory of Western innovation focusing on capability improvements versus Chinese innovation focusing on cost reduction. Chinese cost-reduction strategies show a steeper decline, highlighting their efficiency in reducing production costs over time. Estimated data.

Cultural and Consumer Technology Innovation

Mobile Payment and Fintech Infrastructure

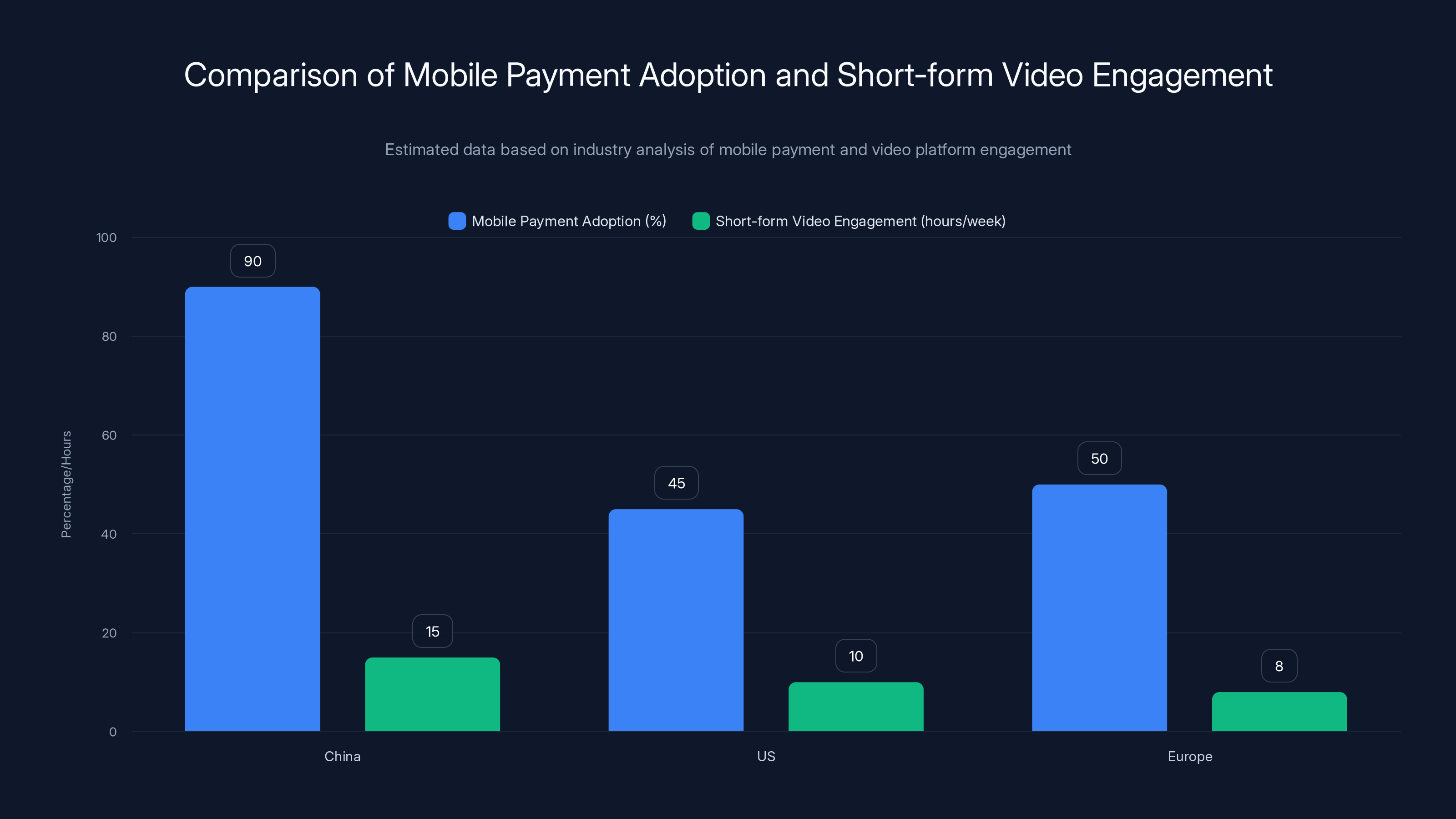

China's mobile payment ecosystem is decades ahead of the West. Alipay and We Chat Pay have made cash and credit cards nearly obsolete in major Chinese cities. The infrastructure is more advanced, faster, and more comprehensive than anything available in the US or Europe.

This creates data advantages. Every transaction generates data about consumer behavior, preferences, and patterns. Aggregated at scale, this data enables sophisticated analysis and prediction. Companies building on top of this infrastructure have better signals for personalization and targeting than competitors working with less comprehensive payment data.

The fintech implications are substantial. Digital currencies, real-time payment networks, fraud detection systems, and lending platforms built on top of superior payment infrastructure have structural advantages. Chinese fintech companies are now competing globally with these advantages.

Short-form Video and Content Algorithms

Byte Dance, owner of Tik Tok, has created arguably the most sophisticated content recommendation algorithm in the world. The algorithm that decides which video to show each user next is a core competitive advantage for Tik Tok globally.

The algorithm's sophistication comes from two sources: advanced machine learning and an enormous dataset of user engagement. Tik Tok's user base generates billions of pieces of engagement data daily (watches, skips, repeats, shares). This data trains and refines the recommendation algorithm continuously.

The algorithm advantage translates to user retention. Tik Tok's engagement metrics and time-spent-on-platform exceed Instagram, You Tube, and other competitors. This shouldn't be surprising given the algorithm's sophistication. But it also means Tik Tok's parent company collects more data and can train better algorithms. The advantage compounds.

Western competitors have tried to replicate Tik Tok's approach. Instagram Reels and You Tube Shorts use similar short-form video formats. But they haven't achieved equivalent recommendation sophistication. Part of this is technical execution, but part is also that they don't have equivalent dataset sizes for training their algorithms.

E-commerce Platform Sophistication

Chinese e-commerce platforms (Taobao, Shopee, Pinduoduo) have built infrastructure and features that Western platforms lack. The integration of livestream shopping, social commerce, and real-time vendor interaction is more advanced in China than in the US or Europe.

These platforms are also more sophisticated in terms of logistics coordination. They predict demand by location, pre-position inventory, and coordinate deliveries at scales that Western e-commerce companies don't attempt. The result is faster delivery and higher customer satisfaction.

The competitive advantage extends to seller tools. Small sellers on Taobao have access to AI-powered tools for pricing optimization, demand forecasting, and customer service automation. These tools are more advanced than what Western e-commerce sellers get access to. The better tools make sellers more profitable, which means they invest more in their stores, which means the platform grows faster.

The Structural Advantages: Why This Dominance Persists

Capital Availability and Long-Term Investment Patience

Chinese companies and the government have effectively unlimited capital for strategic technology investments. This removes a constraint that Western companies face: the pressure to deliver quarterly returns.

A Western semiconductor company faces pressure from investors to hit quarterly earnings targets. A Chinese semiconductor company faces pressure from the government to achieve strategic goals. These are different constraints with different implications.

Long-term development of hard technologies (semiconductors, advanced manufacturing, materials science) requires willingness to lose money for years while capabilities develop. Chinese entities have this willingness. Western companies often don't, especially if public investors are involved.

The practical result is that China can invest in moonshot projects that might take 10+ years to produce returns. Western competitors can't compete with that timeline. By the time Western companies conclude a project is worth pursuing, Chinese companies are already years ahead with operational experience.

Regulatory Streamlining and Execution Speed

Building a new semiconductor fab in China involves fewer regulatory hurdles than in Western countries. Environmental impact assessments, zoning approvals, and environmental compliance are faster and less stringent in China.

This isn't necessarily an advantage in absolute terms (environmental damage is real). But in competitive terms, it's absolutely an advantage. A project that takes 18 months to approve in Shanghai might take 3 years to approve in Phoenix. The company that builds two fabs while competitors are still getting approval for one will dominate over time.

Regulatory velocity creates structural advantages that compound. Fast-executing companies in China can experiment, iterate, and scale faster than slow-executing companies in regulated markets. Over enough time, the difference becomes decisive.

Talent Access and STEM Education

China produces more STEM graduates annually than the US. This isn't close. The sheer volume of physics, chemistry, materials science, and engineering graduates means Chinese companies have deeper talent pools.

Talent advantages matter particularly in technology where the gap between average and excellent is enormous. A materials scientist who understands advanced battery chemistry at the edge of the field is far more valuable than an adequate materials scientist. Chinese companies have easier access to dozens of such specialists.

The talent advantage is most pronounced in manufacturing and materials science—areas where theoretical expertise translates directly to production improvements. This is less true in pure research, where the top 10% of researchers worldwide can access jobs globally. But for the 50-90th percentile range, Chinese companies have advantages.

Supply Chain Agility

Chinese manufacturing networks are integrated in ways that Western supply chains aren't. Suppliers are often geographically concentrated, share infrastructure, and have deep relationships.

When demand spikes, Chinese manufacturers can mobilize suppliers rapidly. When components become scarce, alternate suppliers can be brought online faster because the network is denser. When innovation happens in one part of the supply chain, others can incorporate it quickly because communication is easier.

Western supply chains are more distributed and globalized. They're resilient in some ways (diversification reduces single-point failures) but less agile in others. Mobilizing suppliers or rapidly scaling production is slower when suppliers are spread across multiple continents.

The COVID-19 pandemic illustrated this difference. Chinese manufacturers bounced back from COVID disruptions faster than Western competitors, partly due to supply chain agility. The advantage persisted in the post-pandemic period.

China leads in both mobile payment adoption and short-form video engagement, with estimated 90% adoption rate and 15 hours of video engagement per week. Estimated data.

Where China Isn't Dominant (Yet)

Pure Research and Fundamental Science

For cutting-edge theoretical research in physics, mathematics, and foundational computer science, American universities and research institutions remain dominant globally. The research output from Harvard, Stanford, MIT, Caltech, and similar institutions sets the frontier.

China's research universities are advancing, but they're not yet at the frontier for fundamental research. This matters because fundamental breakthroughs enable applied advances years later. Being behind on fundamental research today means being slower on applied problems in 5-10 years.

That said, China is catching up. Investment in research universities is increasing. Partnerships with leading researchers in other countries are improving. Within a decade, Chinese research institutions might match or exceed American institutions in fundamental research output.

Software Architecture and Large-Scale Systems

Internet-scale software systems require architectural sophistication that took American companies years to develop. Companies like Google, Amazon, Meta, and Microsoft have been building planetary-scale systems for 15+ years. Their accumulated expertise in distributed systems, fault tolerance, and scaling is unmatched.

Chinese internet companies have built sophisticated systems, but they're partly built on the architectural patterns American companies pioneered. Chinese companies are innovating in specific domains, but they're not yet ahead of the curve on fundamental architecture.

This advantage is most visible in cloud infrastructure. AWS remains more sophisticated and comprehensive than Alibaba Cloud, despite Alibaba's scale. The architectural decisions made in AWS's early years created advantages that persist today.

That said, Alibaba and Tencent are catching up. Within 5-10 years, the gap will likely narrow significantly.

Biotech and Pharmaceuticals

While China is advancing in biotech, regulatory barriers and IP considerations mean Western companies still lead in drug development and clinical trials. The expertise required to navigate FDA approval, clinical trial design, and pharmaceutical manufacturing is concentrated in the West.

China is investing heavily in biotech and building capabilities rapidly. Chinese biotech startups are attracting top talent and capital. Within a decade, China will likely be competitive in biotech. But for now, the advantage remains Western.

The Geopolitical Implications and Dependency Chains

Rare Earths and Critical Materials Leverage

China's control over rare earth processing gives it geopolitical leverage. If tensions escalate between China and Western countries, China could restrict exports of rare earths. This would cripple semiconductor manufacturing, renewable energy production, and defense systems in the West.

Western countries are aware of this dependency and are working to develop alternate supply chains. But building rare earth mining and processing infrastructure takes years and billions in investment. The window for reducing this vulnerability is closing. At some point, the dependency becomes so embedded that it's difficult to change.

Semiconductor Supply Chain Risks

Most advanced semiconductor manufacturing is concentrated in Taiwan (TSMC) with some in South Korea and the US. If Taiwan's political status changes, global semiconductor supply could be disrupted catastrophically. China would have leverage not just over rare earths but over the most advanced semiconductors.

Western countries are trying to build domestic semiconductor capacity through heavy subsidies and industrial policy. But TSMC's lead in advanced nodes is so significant that domestic alternatives won't match its capabilities for many years.

The practical implication is that advanced semiconductor supply remains a geopolitical vulnerability for the West. China is aware of this and investing in semiconductor technology to reduce dependence on Taiwan while Western countries develop domestic alternatives. The next 5-10 years will likely see significant investment in semiconductor manufacturing in the US and Europe.

Energy Independence and Climate Leverage

China's dominance in solar and battery manufacturing means it's approaching energy independence for electricity generation. As renewable energy becomes cheaper (driven partly by Chinese manufacturing cost reductions), countries worldwide will transition to renewables powered by Chinese equipment.

This creates subtle geopolitical leverage. A country that imports 70% of its solar panels is dependent on the exporting country's supply chain decisions. If China prioritizes domestic demand during shortages, international customers lose access. The leverage is less direct than military power but potentially more consequential for long-term economic development.

China controls an estimated 60% of global rare earth processing, highlighting its geopolitical leverage. Estimated data.

What This Means for Innovation and Competition

The Innovation Cycle Shifting East

Historically, technology innovation flowed from West to East. America and Europe innovated; China manufactured. The innovation cycle is now bidirectional. Chinese companies innovate, Western companies copy. Sometimes Western companies innovate first, but increasingly, Chinese companies are first movers in specific domains.

In AI, the innovation cycle is now genuinely open. Chinese labs innovate on language models; Western labs respond. Western labs innovate on multimodal systems; Chinese labs respond. Neither is clearly ahead; both are advancing rapidly.

The shift toward bidirectional innovation has implications for how companies and countries approach R&D. Countries that assume they have a permanent innovation advantage are likely to be surprised. The competitive dynamics are shifting.

Cost-Driven Innovation

China's manufacturing dominance drove innovation in cost reduction and production efficiency. This might sound unglamorous compared to American innovation in new features and capabilities, but cost innovation is often more consequential.

When you figure out how to manufacture something 30% cheaper than competitors, you dominate the market. Volume increases, you achieve additional economies of scale, costs drop further, competitors can't compete, market consolidation accelerates. This is the dynamic that's playing out in solar, batteries, EVs, and increasingly in semiconductors.

Western innovation tends toward capability-focused (faster, smarter, more features). Chinese innovation tends toward cost-focused (cheaper, more reliable, higher volume). Both approaches are valuable. But cost innovation is more democratizing. It makes technology affordable to more people globally.

Specialization and Supply Chain Dependencies

As China dominates certain industries, global supply chains become increasingly dependent on Chinese suppliers. This creates vulnerability but also efficiency. A world where batteries are manufactured in China and electric vehicles are assembled globally is more efficient than a world where each country manufactures components domestically.

The challenge for Western countries and companies is managing this dependency. Complete insulation from Chinese supply chains is impossible (costs would be prohibitive). But concentration of dependencies in a few critical areas creates risk.

The next 5-10 years will likely see Western countries investing heavily in supply chain diversification and domestic capacity for critical components. This is inefficient in pure economic terms but necessary for geopolitical security.

The Chinese Century Narrative: Is It Exaggerated?

Real Data vs. Hype

Some of the "Chinese Century" narrative is genuine, based on real data about manufacturing capacity, deployment speed, and technological advancement. Some of it is hype, driven by media narratives and geopolitical anxiety.

The reality is more nuanced than either "China dominates everything" or "Western companies are still ahead." China is dominant in specific sectors (solar, batteries, EVs, e-commerce, short-form video) and advancing rapidly in others (semiconductors, AI, robotics). Western companies remain dominant in others (cloud infrastructure, pharmaceuticals, aircraft manufacturing, many software categories).

The genuine story is that competition is becoming more intense, advantages are less permanent, and technological development is becoming more distributed geographically. This is net-positive for innovation and consumers but creates challenges for companies and countries assuming permanent advantages.

Economic Constraints on Chinese Growth

China faces real economic constraints that might slow technological dominance. Labor costs are rising, which reduces manufacturing cost advantages. Debt levels are elevated, which might constrain capital investment. Demographic challenges (aging population, low birth rates) will reduce workforce growth and economic dynamism.

These constraints are real, but they're longer-term challenges. For the next 5-10 years, Chinese companies have enough capital, talent, and momentum to maintain technological advantages. The constraints become more binding 10-20 years out.

Western companies shouldn't assume Chinese companies will falter due to these constraints. But they also shouldn't assume Chinese dominance is inevitable. The next 10 years will be intensely competitive with uncertain outcomes in specific sectors.

Strategic Responses: What Western Companies and Countries Are Doing

Industrial Policy and Government Investment

Western governments are recognizing that leaving technology development entirely to private companies might not produce sufficient domestic capacity and capabilities. The CHIPS Act in the US, battery investment in Europe, and semiconductor development programs worldwide represent attempts to build strategic capacity.

These programs are slow (government-directed technology development is rarely fast) and expensive. But they're necessary responses to the recognition that China is competing on multiple fronts simultaneously and building structural advantages.

Talent Attraction and University Investment

Western universities and companies are investing in talent, trying to attract researchers and engineers from around the world. The assumption is that concentrating talent in Western institutions will maintain innovation advantages.

This works to some extent. Top researchers are genuinely attracted to institutions with resources, prestige, and opportunity. But as Chinese universities and companies improve, the talent attraction advantage erodes. Chinese researchers can increasingly pursue cutting-edge work in China with comparable resources and prestige.

Partnership and Collaboration

Some Western companies are partnering with Chinese companies for manufacturing, distribution, and market access. Others are being forced to share IP as a condition for accessing Chinese markets. These partnerships create complexity: Chinese partners learn and eventually become competitors.

But partnerships also enable innovation. Combining American research capability with Chinese manufacturing and market access often produces better outcomes than either could achieve independently. The challenge is managing partnerships without inadvertently transferring strategic advantages.

Predictions for the Next Decade

AI Parity in Most Domains

Within 5 years, Chinese AI labs will be matching American labs in most domains. The gap might persist in specific niches (certain types of robotics, some semiconductor applications), but broad parity is likely.

This isn't a prediction that Chinese AI will be superior. But rough equality in capabilities across most domains is probable. The practical implication is that companies building AI products won't have an American advantage just because American AI is theoretically superior. Competition on implementation and integration will matter more.

EVs and Battery Manufacturing Consolidation

The EV market will consolidate around a few global players, mostly Chinese. Established automakers will survive by partnering with Chinese battery manufacturers or becoming battery suppliers themselves. The economics of EV manufacturing favor scale and vertical integration—both Chinese strengths.

Within 10 years, the global automotive industry will be significantly restructured with Chinese companies holding larger market share than today. Western automakers will survive but in more limited roles (premium markets, niche applications).

Semiconductor Competition and Dependency Persistence

China will continue advancing in semiconductor manufacturing but won't match TSMC in advanced nodes within a decade. However, China won't need to. Semiconductor commoditization means most demand is for less advanced, high-volume chips. China can manufacture these domestically, reducing dependency on Taiwan for non-cutting-edge applications.

The geopolitical risk around semiconductor supply will persist for many years. Taiwan's centrality to advanced semiconductor manufacturing means geopolitical tensions directly impact global supply. This risk won't be resolved in the next decade.

Renewable Energy Deployment Acceleration

China's domination of solar and battery manufacturing means renewable energy will deploy globally faster and cheaper than previously expected. This accelerates decarbonization but also increases dependency on Chinese supply chains for energy infrastructure.

By 2035, most new electricity generation worldwide will be renewable, powered partly by Chinese equipment. This will fundamentally reshape energy geopolitics and accelerate industrial electrification and decarbonization.

What Businesses and Investors Should Do

Supply Chain Audit and Dependency Mapping

Businesses should map their supply chains and identify critical dependencies on Chinese suppliers or manufacturers. Understand where you have single-point failures and where alternatives exist.

This doesn't necessarily mean replacing Chinese suppliers. But it means understanding risks and planning alternatives if geopolitical tensions escalate or supply disruptions occur.

Strategic Technology Partnerships

Consider partnerships with Chinese technology companies in areas where they have advantages (manufacturing, cost reduction, AI). These partnerships accelerate capability development but require careful IP management.

The challenge is gaining access to Chinese advantages without losing proprietary information. Structure partnerships with clear IP boundaries and consider geographic staging (share non-critical IP first, gain trust, expand partnership scope).

Investment in Automation and Efficiency

Chinese manufacturers' cost advantages partly come from automation and production efficiency. Western manufacturers should invest in comparable automation. It's expensive and requires operational discipline, but it's necessary for competitiveness.

Talent Investment

Invest in recruiting and retaining engineering and research talent. This is expensive (good researchers cost far more than average workers) but essential for innovation. Companies without strong technical talent will struggle to compete regardless of geographic location.

FAQ

What does "the Chinese Century" actually mean?

The Chinese Century refers to a period where China leads in technological innovation, manufacturing capability, and economic influence across multiple domains. It doesn't necessarily mean America is declining, but rather that technological advantage, economic dynamism, and geopolitical influence are more distributed. China is dominant in specific high-value sectors (batteries, solar, EVs, AI, e-commerce) and advancing rapidly in others. The concept suggests that the 21st century will see more balanced competition between China and the West compared to the 20th century's American dominance.

Is China actually ahead of the US in AI, or is this exaggerated?

It's neither fully true nor exaggerated. Chinese AI labs are now producing models (Qwen, Deep Seek) that are competitive with American models (GPT-4, Claude) on many benchmarks. In some specific domains (computer vision, domain-specific models), Chinese AI is arguably ahead. In others (reasoning, frontier capabilities), American AI has slight advantages. The gap is narrowing rapidly. The practical reality is that Chinese companies have in-house AI capabilities and don't need to license American models. This is a significant shift from 2-3 years ago when American AI dominance was unquestioned.

How much of China's dominance comes from low labor costs versus technological superiority?

Labor costs matter less than they did 10-15 years ago. Chinese labor costs have risen significantly. China's current advantages come more from manufacturing scale, supply chain integration, automation, and rapid execution. Cost advantages today are more about operational efficiency (lower waste, better logistics, higher utilization) than worker wages. Going forward, as labor costs continue rising in China, technological advantages will matter more. This is why Chinese companies are investing heavily in automation and AI—to maintain competitiveness as labor cost advantages erode.

Can the West compete with Chinese manufacturing dominance?

Partially. The West can maintain dominance in high-skill, high-value manufacturing (precision instruments, advanced materials, specialized electronics). But for high-volume commodity manufacturing (solar panels, basic semiconductors, simple batteries), competing with China is extremely difficult. The volume scales, supply chain integration, and cost structures in China are hard to replicate. Western strategy should focus on specialization in high-value products and accepting that commodity manufacturing will largely happen in China. This isn't necessarily bad—it's efficient from an economic perspective, though it creates geopolitical risks.

What should countries do about rare earth dependency on China?

Countries should invest in domestic rare earth mining and processing capacity. This is expensive and environmentally challenging, but the geopolitical risk of dependency warrants the investment. Simultaneously, invest in research for rare earth substitutes (materials that perform similarly without rare earths). In the short term (5-10 years), rare earth dependency on China is likely to persist. In the longer term, reducing dependency is possible but requires sustained investment.

Will China's dominance in technology last forever?

No. Dominance in specific sectors might persist for a decade or more, but eventually, advantages erode as other countries develop capabilities and Chinese advantages (cost, scale, speed) are matched. History suggests technology leadership rotates: Britain dominated industrial manufacturing, America dominated electronics and software, China is dominating specific manufacturing sectors. But no country maintains technological dominance indefinitely. The next cycle of dominance will likely involve multiple centers: America, China, possibly India, Europe. Competition will remain intense, but total dominance will be temporary.

Conclusion: Adaptation Over Alarm

The Chinese Century isn't a prediction that everything manufacturing and technological will happen in China forever. It's a description of the current moment and the next decade, when China has accumulated structural advantages across multiple industries simultaneously.

For businesses, this means auditing supply chains, building partnerships with Chinese companies where beneficial, and investing in areas where Western advantages persist. It doesn't mean panic about Chinese competition, but it does mean taking Chinese competitors seriously and adapting strategies accordingly.

For countries, this means investing in technology development and talent, building strategic manufacturing capacity in critical sectors, and managing dependencies on Chinese supply chains. It means acknowledging that innovation is now distributed geographically and that maintaining technological relevance requires sustained investment and talent attraction.

For individuals, this means understanding that the global competition for technological dominance is intensifying and that technological leadership is shifting eastward in specific domains. This reshapes career opportunities, industry dynamics, and long-term economic growth trajectories. It also means appreciating that Chinese technological advances benefit global consumers through lower costs and faster innovation cycles.

The Chinese Century narrative, when examined carefully with actual data rather than geopolitical anxiety, shows something more specific than "China is taking over." It shows that technological competition is becoming more intense, advantages are becoming more specific and less permanent, and global innovation is increasingly distributed.

This isn't a cause for alarm so much as a call for adaptation. Companies and countries that recognize Chinese competitive advantages and adapt strategies accordingly will thrive. Those that assume traditional advantages will persist indefinitely will struggle.

The next decade will be defined by intense competition across technological frontiers, with victory going to whoever executes best in specific domains. The winner won't be a single country but rather companies and countries that recognize changing competitive dynamics and adapt rapidly.

For those paying attention, understanding China's genuine technological dominance is essential for strategic planning, investment decisions, and long-term positioning. The future is being built right now in Chinese factories, research labs, and manufacturing centers. Ignoring this reality is dangerous. Engaging with it strategically is essential.

Key Takeaways

- China controls approximately 80% of global solar panel manufacturing and deployed more solar capacity in 2024 than total cumulative U.S. installation

- Chinese AI labs now produce models (Qwen, DeepSeek) competitive with American equivalents (GPT-4, Claude) on multiple benchmarks, eliminating previous U.S. dominance

- Battery manufacturing dominance gives China control over EV supply chains, with Chinese companies producing 10+ million EVs annually versus 9 million for Europe and North America combined

- Structural advantages in capital availability, regulatory speed, talent access, and supply chain integration enable rapid innovation cycles and market dominance persistence

- Western companies must audit supply chain dependencies, invest in strategic automation, and develop partnerships with Chinese counterparts to remain competitive in the next decade

Related Articles

- The End of Cheap Phones: Why Prices Are Rising 30% in 2025

- Starlink vs Iran's Internet Shutdown: The Cat-and-Mouse Game [2025]

- PC Sales Downturn 2026: Why Memory Prices Are Skyrocketing [2025]

- Samsung TV Price Hikes: AI Chip Shortage Impact [2025]

- Deploy Your First AI Agent Yourself: The Complete Hands-On Guide [2025]

- Starlink's Free Internet Push in Venezuela: What It Means [2025]

![China's Technological Dominance: The Chinese Century Explained [2025]](https://tryrunable.com/blog/china-s-technological-dominance-the-chinese-century-explaine/image-1-1768480760775.jpg)