How Complyance Is Redefining Enterprise Risk Management with AI

Richa Kaul starts conversations the way most people end them. At parties, she's the person helping friends fix their phone privacy settings, walking them through settings menus and explaining why location tracking matters. But somewhere between the third phone config consultation and the hundredth conversation about data breaches making headlines, she realized something: helping individuals manage their own privacy was solving the wrong problem.

The real data security crisis wasn't in people's pockets. It was in the servers of Fortune 500 companies.

So she built Complyance, an AI-native compliance platform designed to help enterprises automate the governance, risk, and compliance (GRC) work that currently consumes entire teams. On Wednesday in February 2025, the startup announced a $20 million Series A round led by Google Ventures (GV), validating a simple but powerful thesis: the way companies manage compliance is broken, and AI can fix it.

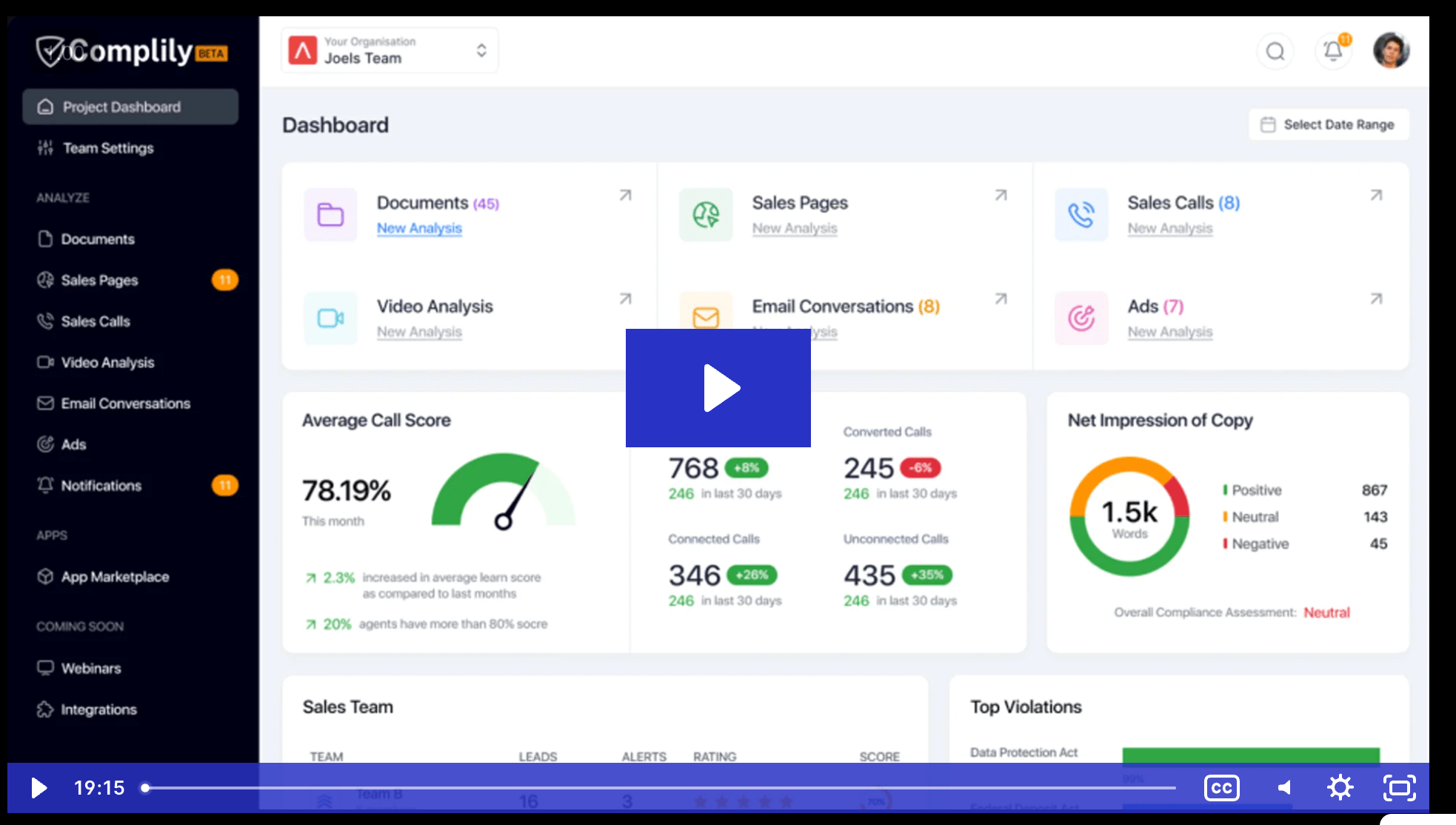

This isn't another feature-stacked enterprise tool. Complyance is fundamentally different from what's dominated the GRC space for the last decade. The company was built from the ground up as AI-native, meaning artificial intelligence isn't bolted on top of an existing platform. Instead, it lives at the core, automating tasks that currently consume months of manual work and reducing them to seconds.

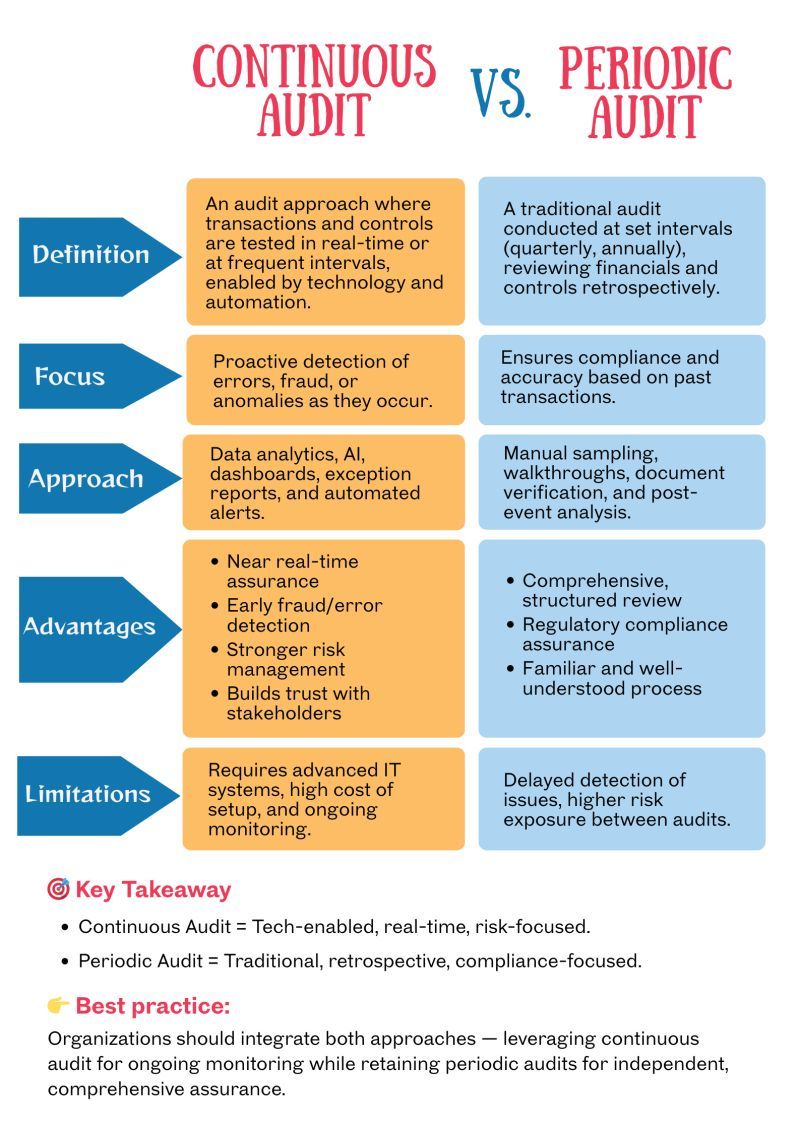

What makes this moment significant goes beyond just another Series A. The funding validates a broader shift happening in enterprise software: companies are moving from reactive, audit-based compliance to continuous, proactive risk management. They're tired of the annual audit cycle. They're tired of the manual spreadsheets. And they're ready to replace it with something that actually works at scale.

TL; DR

- $20M Series A led by Google Ventures validates Complyance's AI-native approach to enterprise compliance automation

- Real-time risk detection replaces annual audits, flagging issues in seconds instead of weeks or months

- Existing incumbents like Archer and Service Now are scrambling because they layered AI on top of legacy platforms, not built it from scratch

- Fortune 500 traction proves the market is ready for continuous compliance over reactive auditing

- The funding includes strategic angels from Anthropic and Mastercard, signaling both AI credibility and real enterprise adoption

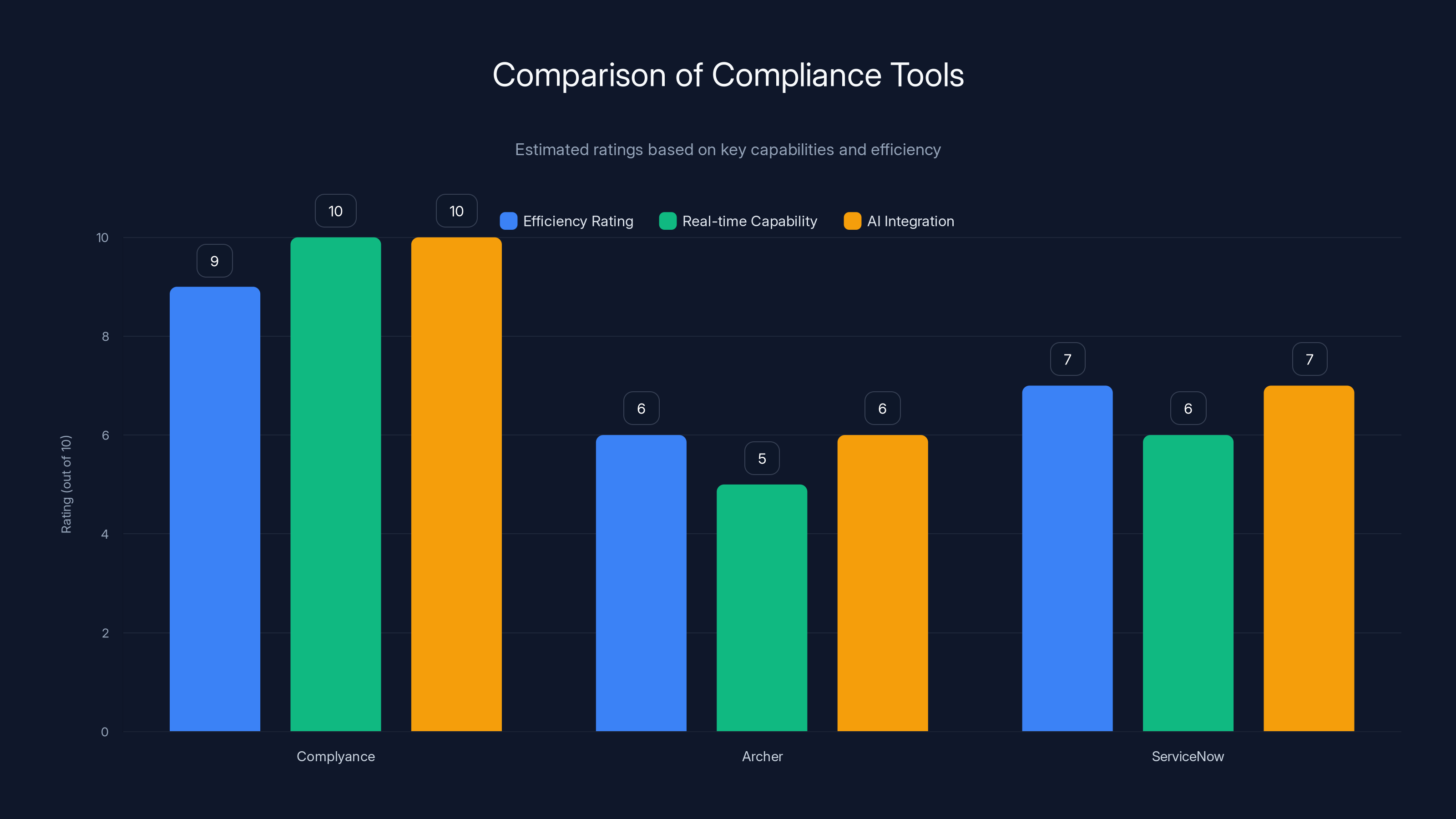

Complyance outperforms Archer and ServiceNow in efficiency, real-time capabilities, and AI integration due to its AI-native architecture. (Estimated data)

The Broken Status Quo: Why Annual Audits Don't Work Anymore

Picture this: It's October. A compliance manager at a mid-sized financial services firm opens a spreadsheet. It has 47 tabs. Some of them haven't been updated since March. She schedules a meeting with the engineering team to request data access. They're in the middle of shipping a feature. She waits two weeks for a response. Meanwhile, new data is flowing through the system every second, and nobody knows if it's compliant with the latest regulations.

This is the reality of modern enterprise compliance. Companies operate under the assumption that they can validate everything once a year, run an audit in a few weeks, fix whatever breaks, and call it secure. The math doesn't work. Regulations change. Data flows constantly. Risk is continuous. But the tools treating it as an annual checkbox have dominated the market for over a decade.

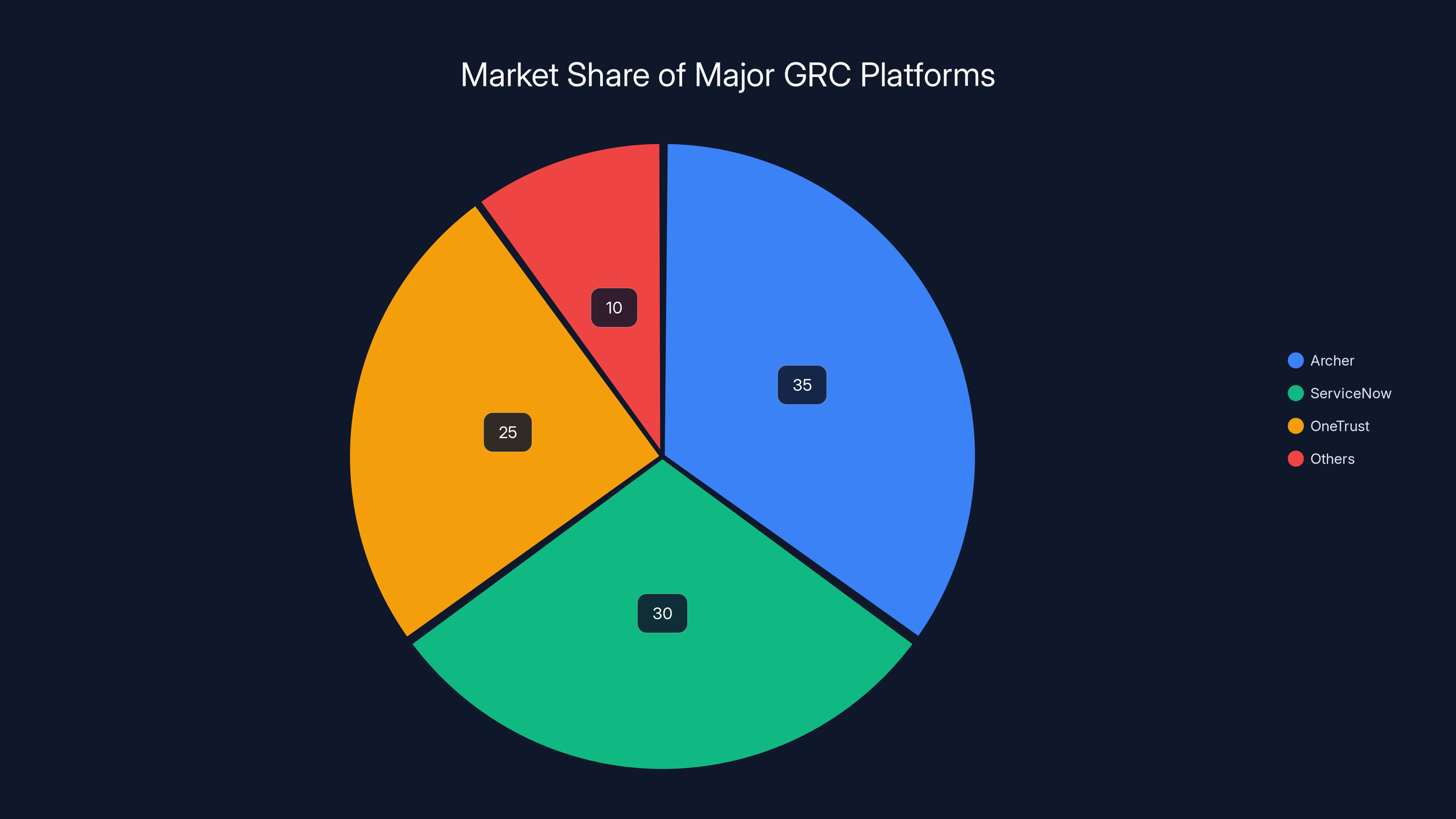

The big players in GRC space include Archer (owned by Broadcom), Service Now's GRC module, and One Trust. Together, they control most of the enterprise compliance market. But they all share a fundamental architectural problem: they were built in an era before AI, and now they're trying to staple machine learning on top of legacy systems designed for manual workflows.

Think about it like this. You can't bolt a Tesla motor onto a 1994 Honda Civic and expect it to perform like a Tesla. The frame doesn't support the acceleration. The brakes aren't rated for the speed. The cooling system will overheat. You end up with something that's marginally better than stock, but fundamentally constrained by its original design.

That's what's happening with legacy GRC platforms. Archer, Service Now, One Trust, they're all trying to add AI features to systems built for quarterly manual reviews. The result is AI features that are useful but not transformative. They make the existing process slightly faster, but they don't reimagine what the process could be.

Complyance starts from a different foundation. There is no legacy manual workflow underneath. The entire platform is designed around AI agents running continuous checks, autonomous risk assessment, and real-time alerts. When a data event happens, the AI evaluates it instantly against the company's specific compliance criteria. It doesn't wait for a human to schedule a check. It doesn't require data to be manually compiled into a report. It just happens.

The global compliance management market is projected to grow from

Understanding AI-Native Compliance Architecture

The distinction between "AI-native" and "AI-enabled" matters more than most people realize. When a company says it's added AI to their platform, you should ask: Is AI central to how the system works, or is it optional?

With One Trust or Archer, you can still use the platform exactly the way you did five years ago. You log in, you fill out forms, you manually assign tasks, you wait for status updates. AI might suggest something in a sidebar, but the core workflow is unchanged. That's AI-enabled.

With Complyance, you can't actually use the platform without engaging with AI because the AI is doing the core work. You don't manually run checks and compile reports. The AI runs continuous checks. You don't manually assess vendor risk by calling vendors and asking questions. The AI profiles vendor risk autonomously. You don't sit in meetings debating whether something is compliant. The AI flags what needs human review.

This architectural difference creates compounding advantages. The AI learns what matters to your specific organization because it's designed to adapt to your custom criteria. It processes data at machine speed, not human speed. It never gets tired, never skips a step, never forgets to follow up.

Richa Kaul explained this clearly in the original announcement: "The AI basically automates a number of manual tasks. It uses AI to do custom checks on data coming in against their own specific criteria and risk thresholds." That's not software that helps humans do what they already do. That's software that does something humans can't do efficiently: continuous, real-time compliance validation.

How the Complyance AI Actually Works

Understanding what Complyance does requires walking through a concrete scenario. Let's say you're a healthcare company subject to HIPAA regulations. Your patient data moves through multiple systems every single day. Your data pipes feed into analysis tools, gets backed up to third-party services, flows through integrations with partner organizations. Some of that data is sensitive. Some of it can be anonymized. Some of it shouldn't leave certain geographic regions.

With traditional compliance tools, you'd document these requirements once a year, then manually audit them quarterly. You'd generate reports. You'd schedule meetings to review findings. You'd estimate remediation timelines. Meanwhile, your data is flowing, potentially violating compliance requirements for weeks or months before you discover the breach.

With Complyance, you configure your compliance criteria once: "Patient data cannot be stored outside the United States," "Genetic information must be encrypted before leaving our servers," "Third-party vendors must maintain SOC 2 compliance." The AI agents take those rules and embed them into the data flow itself. Every single data event gets validated in real-time. The moment something violates a rule, the system flags it.

The flagging isn't just a notification. The AI context helps explain what happened, why it matters, and what should be done about it. Instead of a compliance manager spending four hours investigating an alert, the investigation is already done. The AI has traced the data path, identified the root cause, and presented options for remediation.

This approach compresses months of work into seconds. Kaul mentioned this explicitly: "These risk reviews can take weeks or months when done manually... Tools like Complyance hope to make this process more efficient by using technology to run continuous checks in seconds, so companies never have to wonder if they are in data compliance."

The vendor risk assessment piece works similarly. Instead of manually contacting third-party vendors with security questionnaires and waiting for responses, Complyance's AI agents can autonomously assess vendor risk using available data. They examine factors like the vendor's track record, their public disclosures, their certifications, their infrastructure. They don't replace vendor questionnaires entirely, but they dramatically reduce the back-and-forth and provide intelligence that makes the questionnaire process faster and more targeted.

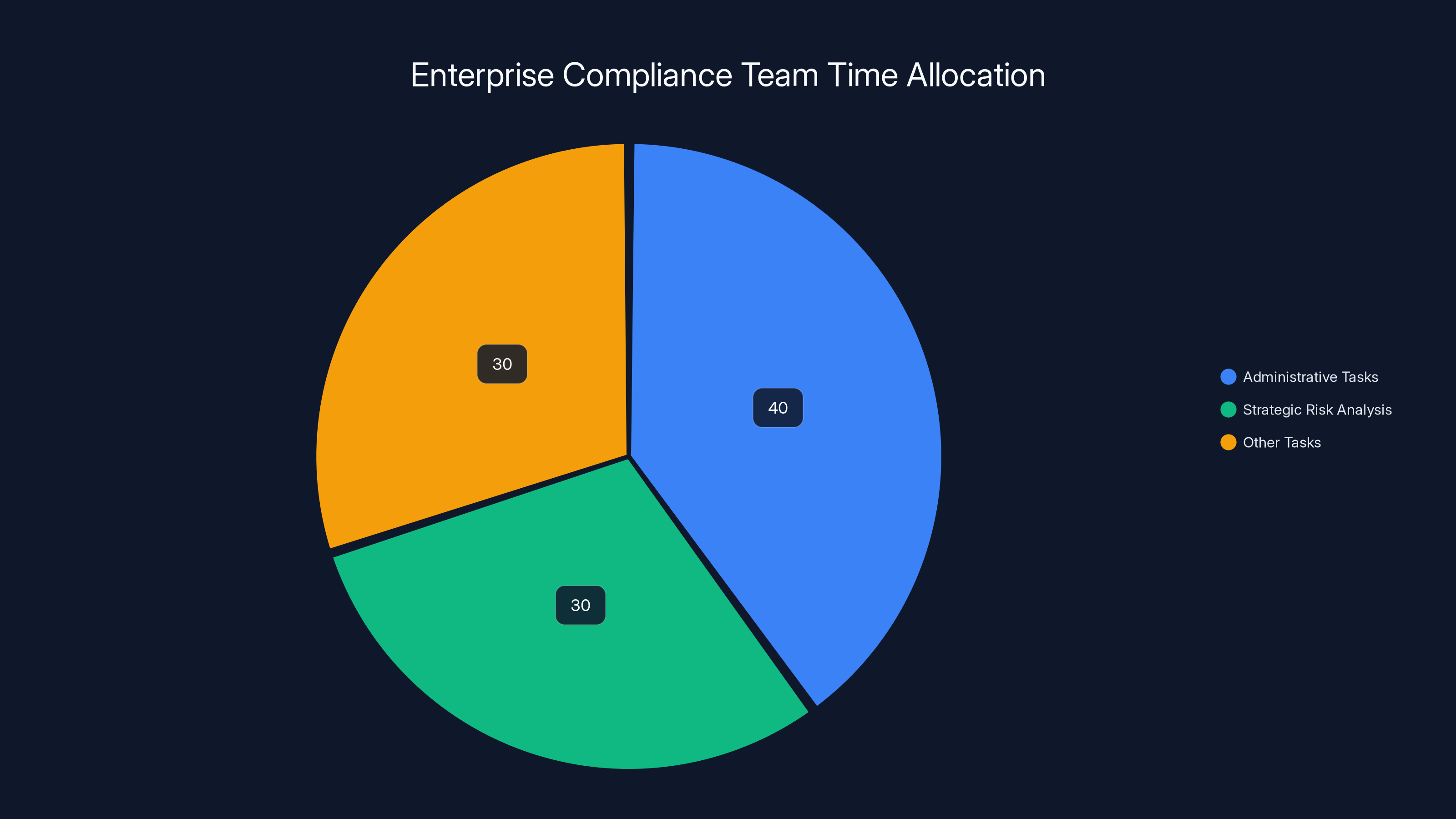

Compliance teams spend an estimated 40% of their time on administrative tasks, which could be automated, leaving less time for strategic risk analysis. Estimated data.

The Market Problem: Why Enterprises Are Desperate for This

The market for GRC software is massive because compliance is expensive and mandatory. Every regulated industry—financial services, healthcare, technology, manufacturing—has mandatory compliance requirements. HIPAA, GDPR, SOX, CCPA, PCI-DSS, the list goes on. Violating these regulations carries fines that can reach millions of dollars, plus reputational damage, potential jail time for executives, and loss of customer trust.

Because the consequences are severe, companies allocate significant resources to compliance. They hire dedicated teams. They buy expensive software platforms. They engage consulting firms. The enterprise GRC market is worth billions of dollars annually, and it's growing.

But here's the frustrating part for companies spending all that money: the tools they're buying don't actually keep them compliant. They provide a false sense of security through paperwork. You run an audit. You document your controls. You file your compliance reports. And then in the gaps between those formal checkpoints, things go wrong. Data flows where it shouldn't. Vendors' security status changes and nobody knows. Regulations are updated and your systems aren't adjusted. Employees follow old procedures instead of updated policies.

The existing tools are optimized for generating audit evidence, not for actually preventing compliance failures. They're designed around the audit cycle because that's how compliance has historically been validated. You demonstrate compliance to a third party once a year, and if you pass, you're good until next year.

But the world has changed. Regulations are more complex. Breach detection takes months, which means your compliance footprint is invisible to you for months. Cyber threats are constant. Data moves faster. Integrations multiply. The attack surface keeps expanding. Operating under an annual compliance model is like checking your car's oil once a year and assuming it's never getting low in between. It doesn't work.

Enterprises are hungry for tools that give them actual visibility and control. They want to know, right now, whether they're compliant. They want to know when things change. They want to reduce the time between a compliance failure and discovering it. That's why Complyance's pitch resonates so powerfully.

Competitive Landscape: Why Incumbents Are Vulnerable

So why hasn't Service Now dominated the compliance space the way they've dominated IT service management? Why hasn't Archer become the obvious choice for every regulated company?

Because incumbents have a fundamental disadvantage against purpose-built competitors: legacy architecture. When you've built a billion-dollar product serving thousands of customers, you can't radically redesign it without breaking those thousand customers. Every architectural decision becomes a constraint. Every new feature has to integrate with existing systems built a decade ago. Your salesforce expects to sell the product the same way they've always sold it.

One Trust raised over $600 million in funding. They're well-resourced. They have strong enterprise relationships. But they're still building AI features on top of a platform that was designed for manual workflows. The result is capable software, but not transformative software.

Complyance, operating under three years old and just now going to market, has no legacy constraints. They can build exactly what modern enterprises need without worrying about backward compatibility. They can design the entire workflow around continuous AI validation because they're not trying to preserve a user base that's used to quarterly manual reviews.

This is a pattern we've seen repeatedly in enterprise software: Salesforce displaced on-premise CRM solutions, Slack displaced email as the primary communication tool, Figma disrupted design software, Notion challenged Confluence. In each case, the incumbent had superior market position, higher revenue, more customers, and still lost to a competitor with superior architecture designed for the modern era.

Complyance is positioned to follow the same pattern in GRC. Not because they have more resources than Service Now or Archer—they don't. But because they have better architecture, designed for continuous compliance instead of annual audits.

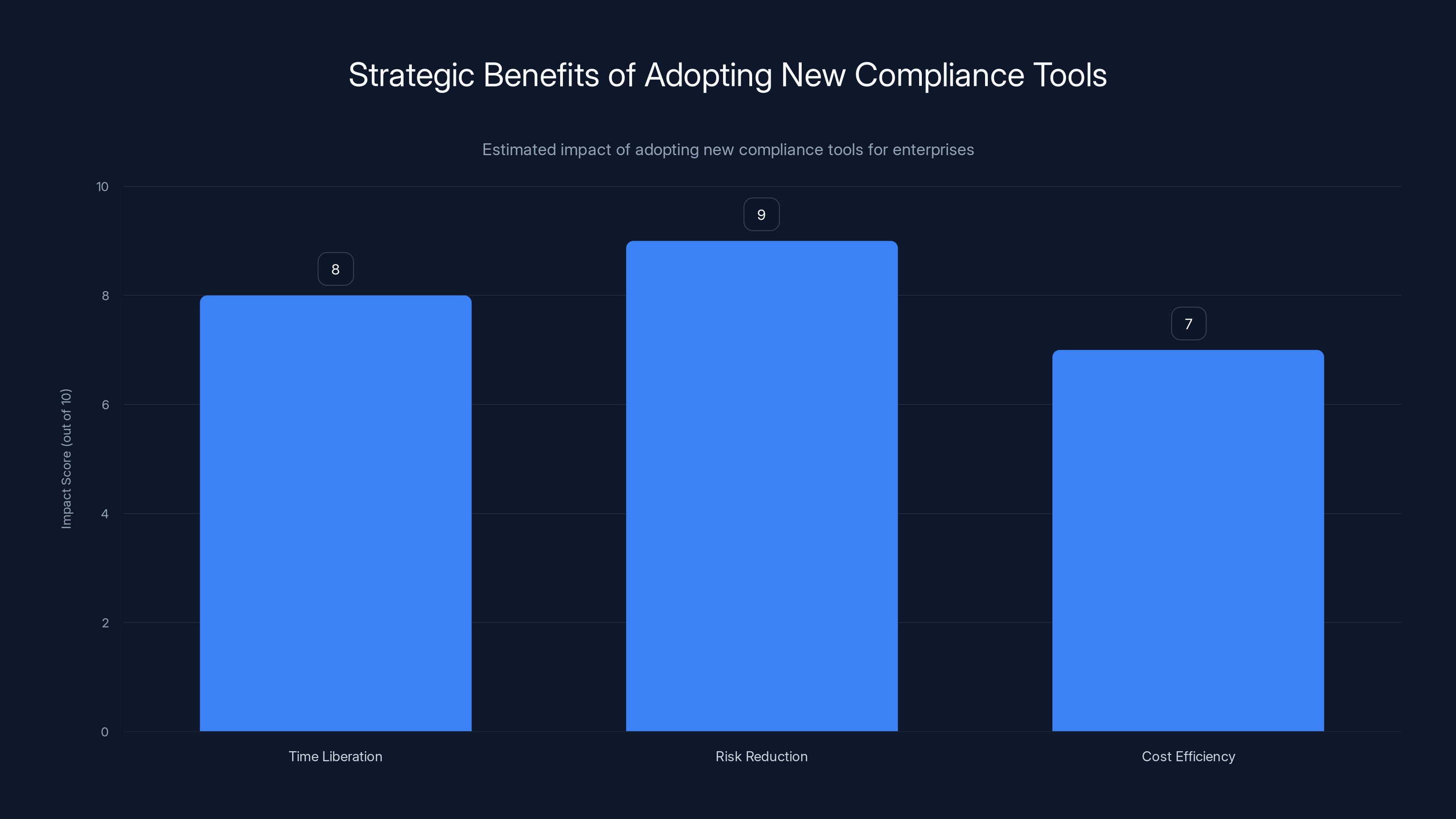

Enterprises find significant strategic value in adopting new compliance tools, with risk reduction scoring the highest impact. Estimated data.

Series A Details: What the Funding Round Tells Us

The $20 million Series A round is significant not just for the amount, but for who led it and who participated.

Google Ventures leading the round is a statement. GV invests in companies they believe will shape the future of their respective markets. They have skin in the game with a company like Complyance because Google's own compliance obligations are enormous. Google operates across hundreds of jurisdictions with different regulations. Google's cloud business serves regulated customers in healthcare, finance, and government. They understand enterprise compliance pain intimately. When GV leads a round in a compliance automation platform, they're signaling deep confidence in both the market opportunity and the team's ability to execute.

The participation of Speedinvest, an early-stage investor based in Berlin and Vienna, suggests geographic expansion plans. Speedinvest has relationships across European enterprises, and GDPR is creating urgent compliance needs across the continent. Adding Speedinvest to the cap table signals an intention to build European traction.

Everywhere Ventures, who also participated, focuses on companies building for global markets. Their participation reinforces that Complyance isn't just solving a North American problem but a global compliance automation opportunity.

But the most interesting participants are the angel investors from Anthropic and Mastercard. These aren't just money. They're credibility markers.

Anthropic is one of the leading AI safety and capability research companies. Having Anthropic employees backing Complyance signals that the AI implementation is sophisticated. This isn't a company using off-the-shelf large language models in naive ways. It's a company with serious AI technical depth.

Mastercard is perhaps more interesting. Mastercard is one of the most heavily regulated companies in the world. PCI-DSS compliance alone is a massive organizational requirement. Having Mastercard angels on the cap table suggests that the company sees Complyance as solving real problems they experience. When a Fortune 500 company with deep compliance expertise invests in your company, it's a strong signal that your product works for serious enterprises.

Together, the Series A round raised total funding to

Fortune 500 Validation and the Beachhead Market

Kaul declined to specify how many customers Complyance has, but confirmed that the company works with a few Fortune 500 companies. In a Series A announcement, that's a specific choice. If they had 50 Fortune 500 customers, they'd say that. The fact that they mentioned "a few" suggests the number is in the low single digits, which is actually a normal position for a new platform targeting large enterprises.

What matters is that Fortune 500 companies are willing to adopt a new, unproven compliance platform. That's not a trivial accomplishment. Large enterprises are incredibly conservative about compliance tooling because getting it wrong creates existential risk. They don't switch compliance platforms lightly. They don't beta test with critical business functions.

For a startup barely a year into product launch to have multiple Fortune 500 customers validates several things:

First, the product actually works. It doesn't just sound good in a demo. It actually handles the complexity of real enterprise compliance requirements.

Second, the company has credibility in the enterprise sales process. Getting past procurement, security, compliance, and finance teams at a Fortune 500 company requires more than good technology. You need strong references, demonstrated expertise, and answers to incredibly detailed questions about data security, redundancy, uptime requirements, and so on.

Third, the product solves pain that's urgent enough to overcome enterprise software inertia. Companies don't rip out existing compliance platforms unless the new platform solves a problem they can't tolerate anymore. The fact that Complyance has gained Fortune 500 traction suggests they're solving something that Archer, Service Now, and One Trust aren't addressing adequately.

AI-native architecture and purpose-built platforms are leading trends reshaping the enterprise software market. Estimated data.

How Complyance Fits Into the Broader AI Automation Wave

Complyance isn't an isolated phenomenon. It's part of a much larger wave of AI automation reshaping enterprise software across categories.

Consider what's happened in other knowledge work categories recently. Perplexity disrupted search by using AI to synthesize answers instead of just ranking web pages. Anthropic's Claude is being embedded as a co-worker in companies trying to automate customer support, internal workflows, and content creation. Git Hub's Copilot has shifted how developers write code. Zapier and Make are using AI to help non-technical people build complex automations without coding.

In each case, AI isn't just making existing processes faster. It's fundamentally changing what work gets done and how. Instead of a developer writing code, Copilot generates code and the developer reviews and refines it. Instead of a support agent manually responding to tickets, Claude generates draft responses and the agent adjusts them. Instead of a compliance manager manually auditing controls, Complyance continuously validates them.

This shift is creating an opportunity for startups to build purpose-built platforms that take advantage of modern AI capabilities. Complyance is essentially saying: "What if we completely reimagined compliance automation around AI as a core capability, rather than compliance automation as a core capability with AI as a feature?"

That inversion is powerful. It opens up possibilities that weren't viable with human-speed workflows. Continuous validation instead of periodic audits. Real-time alerts instead of weekly reports. Predictive risk flagging instead of reactive incident response.

The Compliance Automation Opportunity: Market Size and Growth

The GRC software market is substantial and growing. Industry analysts estimate the global compliance management market at approximately $8-10 billion annually, with growth rates of 10-12% per year. That growth is accelerating because:

Regulatory expansion: New regulations keep emerging. AI regulations are being written right now. As AI gets embedded in more business processes, companies will need to prove their AI systems are compliant with requirements around bias, transparency, and auditability.

Cross-jurisdiction complexity: Global companies operate across dozens of jurisdictions, each with different requirements. A company serving customers in the EU, UK, US, Canada, Australia, and Singapore has to comply with GDPR, CCPA, PIPEDA, SOX, CCPA, NDB, and a dozen other acronyms, each with overlapping but different requirements.

Data proliferation: Companies are generating more data, storing it in more places, and integrating it with more services. Each data flow creates new compliance surface area. Each integration creates new risks. The explosion of Saa S services means companies are connecting to hundreds of third-party vendors, each introducing security and compliance risk.

Breach consequences escalating: As breach detection and enforcement improve, penalties are increasing. The average cost of a data breach in 2024 was approximately $4.45 million according to IBM's annual report. That's up 10% from 2023. Companies are willing to invest heavily in compliance tools because the cost of non-compliance is astronomical.

Talent shortage: Finding and retaining experienced compliance professionals is challenging. The skill set requires understanding both business operations and regulatory requirements. The job is often thankless—you're preventing problems that are invisible, so you never get credit for the disasters you prevent. Automation that lets existing compliance teams accomplish more is incredibly attractive to enterprises.

All of these factors create a market that's hungry for better tools. Complyance is entering that market at a moment when the pain is most acute and enterprises are most willing to switch from incumbent platforms.

Archer, ServiceNow, and OneTrust dominate the GRC market, holding a combined estimated 90% share. Estimated data.

Automation Capabilities: What Complyance Can Actually Do

Beyond just understanding the strategic position, it's worth examining the specific capabilities that make Complyance different.

Custom criteria matching: The system doesn't just check for generic compliance requirements. It learns your organization's specific compliance criteria and automatically checks data against those criteria. This is critical because compliance isn't one-size-fits-all. A healthcare company's compliance requirements are completely different from a fintech company's requirements, which are completely different from a manufacturing company's requirements. Complyance's AI adapts to your specific context.

Risk threshold automation: Compliance isn't binary. Some things are absolute violations. Some things are acceptable with additional controls. Some things require additional review. Complyance allows organizations to define their own risk tolerance and let the AI apply those thresholds automatically. Instead of every finding being escalated to a human for judgment, the AI applies judgment according to your organization's risk appetite.

Third-party risk assessment: Vendor management is one of the most time-consuming and important compliance functions. Organizations have to assess vendor security, audit vendor controls, and track vendor compliance over time. Complyance automates much of this by using AI to autonomously assess vendor risk using available data, then intelligently targeting manual assessment efforts toward the highest-risk vendors.

Continuous monitoring: Rather than periodic audits, Complyance monitors compliance continuously. Every data event, every system change, every new integration gets evaluated in real-time. This means compliance is never out of date. If something changes, you know immediately.

Audit trail generation: Compliance often requires proof that you were monitoring and enforcing controls. Complyance automatically generates detailed audit trails showing what was checked, what was found, what actions were taken. This makes audit preparation dramatically faster.

These capabilities compound. Taken together, they transform compliance from a project that happens quarterly to a continuous state that's maintained automatically.

The Strategic Value for Enterprises: Why They're Adopting

Why would a Fortune 500 company, already invested in Archer or Service Now or One Trust, decide to switch to a startup they've never heard of?

The answer comes down to three strategic benefits.

Time liberation: Compliance teams can spend less time chasing alerts and compiling reports, and more time on strategic initiatives. Instead of a compliance manager spending 40% of their time on administrative tasks, maybe they're spending 10%. That's time they get back for things like designing better compliance processes, building better controls, or working on strategic initiatives like entering new markets where compliance is particularly critical.

Risk reduction: The ability to detect compliance failures in hours rather than months dramatically reduces the window of exposure. If you catch a compliance breach immediately, you can remediate it immediately and limit the damage. If you catch it six months later during an audit, the damage is already done. Continuous monitoring moves the needle on risk in a meaningful way.

Cost efficiency: Compliance spending is often uncapped because the cost of non-compliance is so high. But within that uncapped budget, enterprises prefer tools that let them accomplish more with the same headcount. Complyance allows organizations to automate work that would otherwise require hiring more compliance professionals.

For a Fortune 500 company, each of these benefits is worth millions of dollars annually. The total addressable market opportunity is enormous.

Competitive Response: How Incumbents Will React

One useful question: How will the incumbents respond to Complyance?

They have several options, none of them easy.

Option 1: Ignore it and hope it fails. This is what many incumbents tried with disruptive startups in their categories. It rarely works. Complyance is well-funded, has strong enterprise traction, and is solving a real problem. Ignoring it is a path to losing market share gradually.

Option 2: Acquire it. This is a more likely response. Archer (Broadcom), Service Now, and One Trust all have significant cash and M&A experience. A

Option 3: Build competing AI-native products. This is what the incumbents should do, but it's incredibly difficult. Building an AI-native compliance platform from scratch requires scrapping years of architectural decisions. You can't do it without alienating existing customers who expect the existing product to stay familiar. It requires a completely separate product line, which requires separate sales teams, separate product teams, and cannibalization of your existing product revenue.

Option 4: Improve their AI features on top of existing platforms. This is what most incumbents will actually do. They'll invest in better AI features, better integrations, better automation. But it won't be transformative because the underlying architecture is still constraint. Their AI will be somewhat better, but they'll never achieve the architectural purity that Complyance has.

Historically, incumbent software companies have chosen option 2 (acquisition) or option 4 (incremental improvement). Rarely do they successfully execute option 3 (rebuild) because the organizational incentives don't align. Building a separate product cannibializes existing revenue. Existing sales teams resist selling a new product that replaces their bread and butter.

For Complyance, that's good news. It means they have runway to establish themselves before facing serious competitive pressure from the incumbents' own improved offerings.

Implications for the Broader Enterprise Software Market

Complyance's Series A is significant beyond just compliance automation. It signals several important trends in enterprise software.

First: Purpose-built beats general-purpose. Service Now tried to be everything—IT service management, human resources, customer service, compliance. They succeeded spectacularly in IT service management, did well in HR, and remained mediocre in the others. Complyance is built specifically for compliance. That focus creates advantages that general-purpose platforms struggle to match.

Second: AI-native architecture matters. Companies that build with AI as a core capability from the beginning will outperform companies that bolt AI on top of existing systems. This will create opportunities for new startups in many categories: sales (Gong, Outreach), marketing (Jasper, Copy.ai), operations (Torq, Automation Anywhere), finance (Planful), supply chain (Element Logic), and dozens of others. In each category, the AI-native players will gain ground on the incumbents.

Third: The automation wave is accelerating. We're moving past the era of AI being a cool addition to software. We're entering an era where AI is expected to be standard. Companies that haven't figured out how to incorporate AI into their product will lose customers to companies that have. This creates a shift in competitive dynamics where the ability to incorporate AI is a table stakes competitive requirement.

Fourth: Enterprise software valuations are shifting. Complyance has raised

The Path Forward: What Success Looks Like for Complyance

For a Series A startup to become successful at scale, they need to hit several milestones. In the next 18-24 months, Complyance will likely focus on:

Customer expansion: Growing the Fortune 500 customer base from a few to a dozen or more. Each Fortune 500 customer serves as a reference for additional Fortune 500 prospects. Once you have five Fortune 500 customers, selling to ten is much easier. Kaul likely has a target of 10-20 Fortune 500 customers by Series B.

Industry verticalization: Building compliance solutions tailored to specific regulated industries. Healthcare compliance is different from financial services compliance, which is different from government contractor compliance. Building vertical-specific solutions will accelerate adoption.

International expansion: GDPR compliance in Europe is a massive pain point. Building specific capabilities for European enterprises and establishing European operations will unlock significant growth.

Integration ecosystem: Compliance doesn't exist in isolation. It connects to data governance tools, identity management platforms, security tools, and many other systems. Building deep integrations with the tools enterprises already use will increase stickiness.

Series B in 18-24 months: The natural follow-up is a Series B round, likely in the range of $50-75 million, that funds geographic expansion, product development, and sales team growth.

Broader Implications for AI in Enterprise Software

Complyance is part of a larger shift happening across enterprise software. For the last decade, enterprise software has been focused on user experience, mobile support, cloud deployment, and integration. The next decade will be focused on AI automation.

The companies that build AI-native solutions designed around automation as a core capability will gain competitive advantages that are difficult to overcome. They won't be faster at the old way of doing things. They'll enable completely new ways of doing things.

Complyance is a proof point. They're not slightly better at compliance checking. They're fundamentally changing what compliance checking can be. They're moving from "How do we make audits faster?" to "How do we make breaches impossible?" That's a different question that requires a different product.

We'll see this pattern repeated across compliance (Complyance), software security (maybe someone building AI-native SAST), IT operations (maybe someone building AI-native observability), finance operations (someone building AI-native accounting), HR operations (someone building AI-native people operations), and many other categories.

The incumbents will respond with better AI features and strategic acquisitions. They'll maintain market share for years because switching costs are high and they have existing relationships. But eventually, the gap between a general-purpose platform with good AI features and an AI-native platform with purpose-built architecture will become too wide to close.

Complyance's $20 million Series A validates that the market agrees with this thesis. The funding signals that investors believe purpose-built, AI-native compliance automation will eventually displace Archer, Service Now, and One Trust in significant segments of the market.

FAQ

What is Complyance and how is it different from existing compliance tools?

Complyance is an AI-native compliance automation platform designed to help enterprises manage governance, risk, and compliance (GRC) requirements. Unlike incumbent solutions like Archer or Service Now that bolt AI features onto legacy platforms designed for manual workflows, Complyance was built from the ground up with AI as the core computational engine. This architectural difference allows Complyance to provide continuous, real-time compliance validation rather than periodic manual audits.

How much funding did Complyance raise in its Series A?

Complyance raised

What are the key capabilities of Complyance's AI agents?

Complyance's AI agents handle several critical compliance functions: they run continuous checks on incoming data against custom compliance criteria defined by the organization, assess and flag compliance risks in real-time, autonomously evaluate third-party vendor risk using available data, generate detailed audit trails for regulatory proof, and adapt to organizational-specific risk thresholds and tolerance levels. These capabilities operate continuously rather than periodically, compressing work that traditionally takes weeks or months into seconds.

Why would companies switch from Service Now or Archer to Complyance?

Enterprises are adopting Complyance because it delivers three strategic advantages: it liberates compliance teams from administrative busywork (reducing the time spent on manual tasks from 40% to approximately 10%), it dramatically reduces the window of compliance exposure by detecting failures in hours rather than months, and it enables more efficient use of compliance resources through automation. The Fortune 500 customers already using Complyance are apparently finding these benefits substantial enough to justify switching from established platforms.

How does continuous compliance monitoring work in practice?

Continuous compliance monitoring operates by embedding compliance rules into the data flow itself. Rather than waiting for a quarterly audit, Complyance evaluates every data event in real-time against your organization's compliance criteria. If a piece of patient data is about to be stored in a non-compliant location, the system identifies and flags it immediately. If a vendor's compliance status changes, the system detects it. If a data integration violates a compliance rule, the AI identifies the root cause and presents remediation options. This real-time validation means compliance is never out of date.

What industries benefit most from Complyance's platform?

While Complyance is applicable to any regulated industry, certain sectors benefit most from real-time compliance automation: healthcare companies subject to HIPAA, financial services companies under PCI-DSS and SOX regulations, technology companies handling GDPR and CCPA data, government contractors with Fed RAMP requirements, and any enterprise operating across multiple jurisdictions with overlapping compliance requirements. Healthcare and financial services represent the largest addressable markets because they have the strictest compliance requirements and the highest penalties for violations.

How does Complyance handle vendor risk assessment?

Complyance uses AI agents to autonomously assess third-party vendor risk by examining available data such as vendor track records, public security disclosures, relevant certifications, infrastructure details, and historical compliance issues. Rather than requiring compliance teams to manually contact vendors with security questionnaires and wait for responses, the AI provides an initial risk assessment that helps organizations prioritize which vendors require deeper manual evaluation. This intelligent targeting of manual assessment effort means teams can evaluate more vendors more thoroughly without increasing headcount.

What makes AI-native architecture superior to legacy compliance platforms with added AI features?

AI-native architecture differs fundamentally from traditional AI-enabled platforms. With legacy platforms like One Trust or Archer, you can still use the software the exact way you did five years ago through manual workflows. AI features are supplementary. With AI-native architecture, the AI is central to how the system works. You cannot use Complyance without engaging with AI because the AI is doing the core compliance validation work. This allows AI-native platforms to reimagine workflows completely around automation rather than incrementally improve existing human-centered processes. The result is transformative rather than incremental improvement.

What does the Series A funding mean for Complyance's future?

The $20 million Series A led by Google Ventures validates several aspects of Complyance's business: the market opportunity in enterprise compliance automation is large and urgent, the AI-native approach addresses real pain points in the market, and the team has demonstrated ability to build and sell to enterprise customers including Fortune 500 companies. The funding will likely accelerate customer acquisition, fund product development for industry-specific solutions, support international expansion particularly in Europe where GDPR creates urgent compliance needs, and strengthen the go-to-market organization. A Series B round in 18-24 months is the natural follow-up milestone.

How does Complyance generate value compared to hiring additional compliance staff?

Complyance provides value through a different mechanism than adding headcount. Rather than hiring more compliance professionals to handle administrative work, organizations use Complyance to automate the administrative work itself. The same team that previously spent 40% of their time on manual data compilation and audit preparation can now spend that time on strategic initiatives: designing better controls, improving compliance processes, or supporting business growth in new markets. Over a typical enterprise career at a large company, each compliance professional represents approximately

What competitive advantages does Complyance have against Archer, Service Now, and One Trust?

Complyance has three structural competitive advantages: first, AI-native architecture that wasn't constrained by legacy design decisions; second, built-in continuous automation rather than periodic manual workflows; and third, a product designed from inception around modern AI capabilities. The incumbents have larger installed bases, deeper enterprise relationships, and more revenue, but they're architecturally constrained by systems built for a different era. Complyance's narrow focus on compliance automation contrasts with Service Now's sprawl across multiple business functions and One Trust's broader governance focus. This focus advantage, combined with AI-native design, creates a compelling value proposition for enterprises frustrated with legacy tool limitations.

Final Thoughts: The Compliance Automation Era

Complyance's $20 million Series A marks a transition point in enterprise software. For the last decade, the software industry has focused on making people more productive: better interfaces, cloud deployment, mobile support, integrations. The next decade will focus on replacing people's work with automation.

Compliance is a perfect proving ground for this transition. Compliance work is rule-based, repeatable, and creates severe consequences when done poorly. These characteristics make it ideal for AI automation. Complyance is demonstrating that you can build a sophisticated enterprise software company around the premise that AI doesn't assist humans doing compliance work—AI does the compliance work, and humans provide oversight.

This is a different model than enterprise software has traditionally operated under. It requires different thinking about user experience, product architecture, and go-to-market strategy. But it's a model that creates genuine value for enterprises because it reduces headcount, lowers risk, and frees up talented people to do more strategic work.

If Complyance executes well on the opportunity in front of them, they'll eventually dominate the compliance automation space the way Slack eventually dominated workplace messaging and Figma disrupted design software. The incumbents will fight to preserve their market position, and some will succeed through acquisition or aggressive AI investment. But the trend toward AI-native, automation-first enterprise software seems inevitable.

Complyance is early evidence that the trend is real, the market is ready, and the opportunities are substantial. The next few years will reveal whether they can execute at scale.

Key Takeaways

- Complyance raised $20 million Series A led by Google Ventures, validating AI-native compliance automation as a major market opportunity

- AI-native architecture enables continuous real-time compliance checking instead of quarterly manual audits, compressing detection time from months to seconds

- Fortune 500 companies are adopting Complyance, signaling that enterprise software incumbents' layered AI features can't compete with purpose-built AI-first platforms

- The compliance automation market is growing 10-12% annually as regulations expand, breach penalties escalate, and enterprises seek to reduce compliance exposure

- Legacy GRC platforms like ServiceNow and Archer face structural disadvantage: they're architecturally constrained by systems designed for manual workflows, not AI automation

Related Articles

- OpenAI Frontier: The Complete Guide to AI Agent Management [2025]

- Resolve AI's $125M Series A: The SRE Automation Race Heats Up [2025]

- Discord's Age Verification Disaster: How a Privacy Policy Sparked Mass Exodus [2025]

- Discord Age Verification 2025: Complete Guide to New Requirements [2025]

- India's New Deepfake Rules: What Platforms Must Know [2026]

- UK's Light-Touch App Store Regulation: What It Means for Apple and Google [2025]

![Complyance Raises $20M Series A: How AI Is Reshaping Enterprise Compliance [2025]](https://tryrunable.com/blog/complyance-raises-20m-series-a-how-ai-is-reshaping-enterpris/image-1-1770820699729.jpg)