Introduction: The $1 Billion Question

When a startup hits unicorn status in under three years, people pay attention. Resolve AI just did exactly that, closing a

Let me set the scene. It's 2 AM on a Wednesday. Your production database is melting down. Your on-call engineer is awake now, but they're staring at a wall of alerts, logs scattered across five different tools, and zero clear idea of what actually broke. They've got maybe 15 minutes before the outage hits customer-facing systems. That's the world Resolve AI is targeting. And based on the funding it just raised, a lot of sophisticated venture capitalists think the company is onto something real.

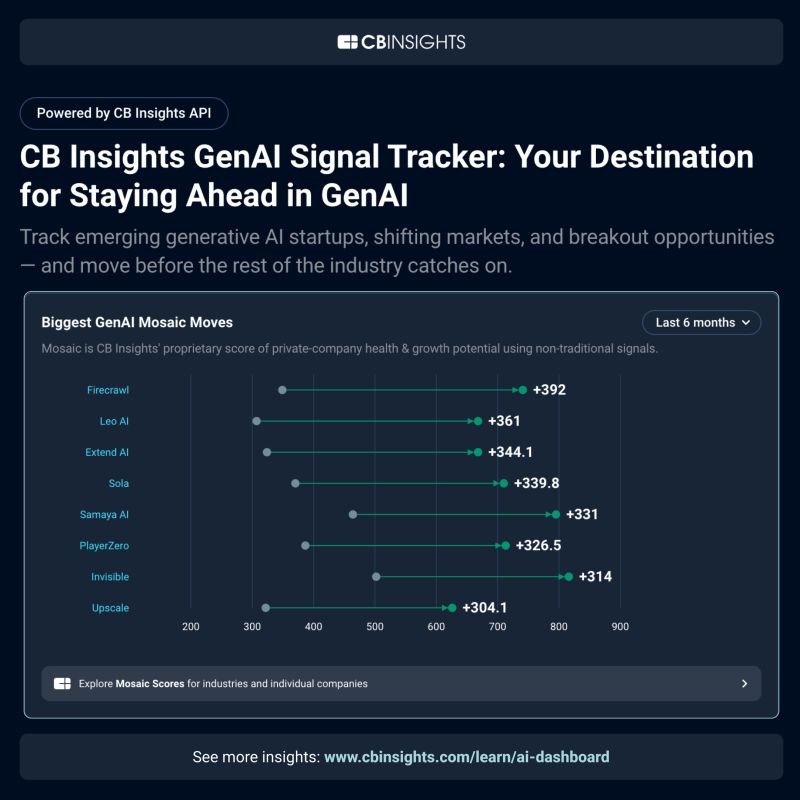

But here's what makes this moment interesting. Resolve AI isn't alone in this space. The category itself, known as AI SRE, is emerging as one of the hottest frontiers in enterprise automation. Sequoia-backed Traversal is attacking the same problem from a different angle. The competition is intensifying. The stakes are massive.

Why does this matter? Because system reliability has become the invisible backbone of modern business. Every minute of downtime costs money, reputation, and customer trust. Historically, fixing these issues has required deeply skilled engineers who command six-figure salaries and live with the stress of emergency pages at 3 AM. What if AI could handle the triage? What if it could identify root causes faster than humans, suggest fixes, or even implement them automatically?

That's the promise Resolve is selling. And based on the confidence venture capitalists just showed, it's a promise that's starting to feel credible.

This article breaks down what Resolve AI is actually doing, why the timing matters, how the broader SRE automation category is developing, and what this funding round tells us about the future of incident response. We'll dig into the founders, the market opportunity, the competitive landscape, and what it means for engineers actually managing systems right now.

TL; DR

- Resolve AI closed a 1 billion valuation, making it a unicorn in under three years

- The round was led by Lightspeed Venture Partners, with participation from Greylock, Unusual Ventures, and other top-tier investors

- Resolve was founded by two former Splunk executives (Spiros Xanthos and Mayank Agarwal) whose previous startup was acquired by Splunk in 2019

- AI SRE is an emerging category focused on automating system reliability engineering tasks, from incident detection to root cause analysis

- The category includes competitors like Sequoia-backed Traversal, signaling this is a genuine market wave, not just one company's moment

- System reliability is now a mission-critical business function, and the labor shortage for experienced SREs is driving demand for AI-powered solutions

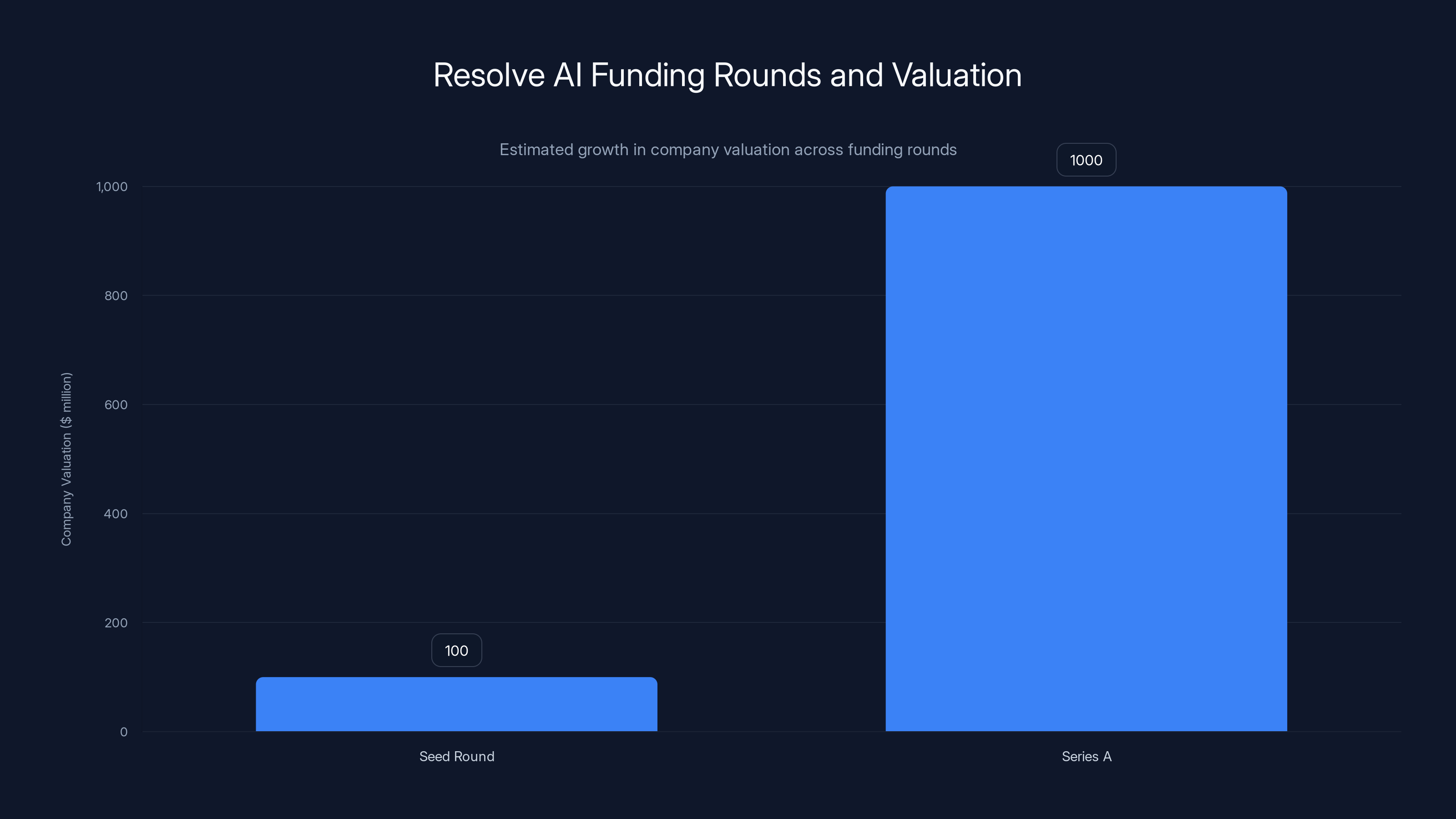

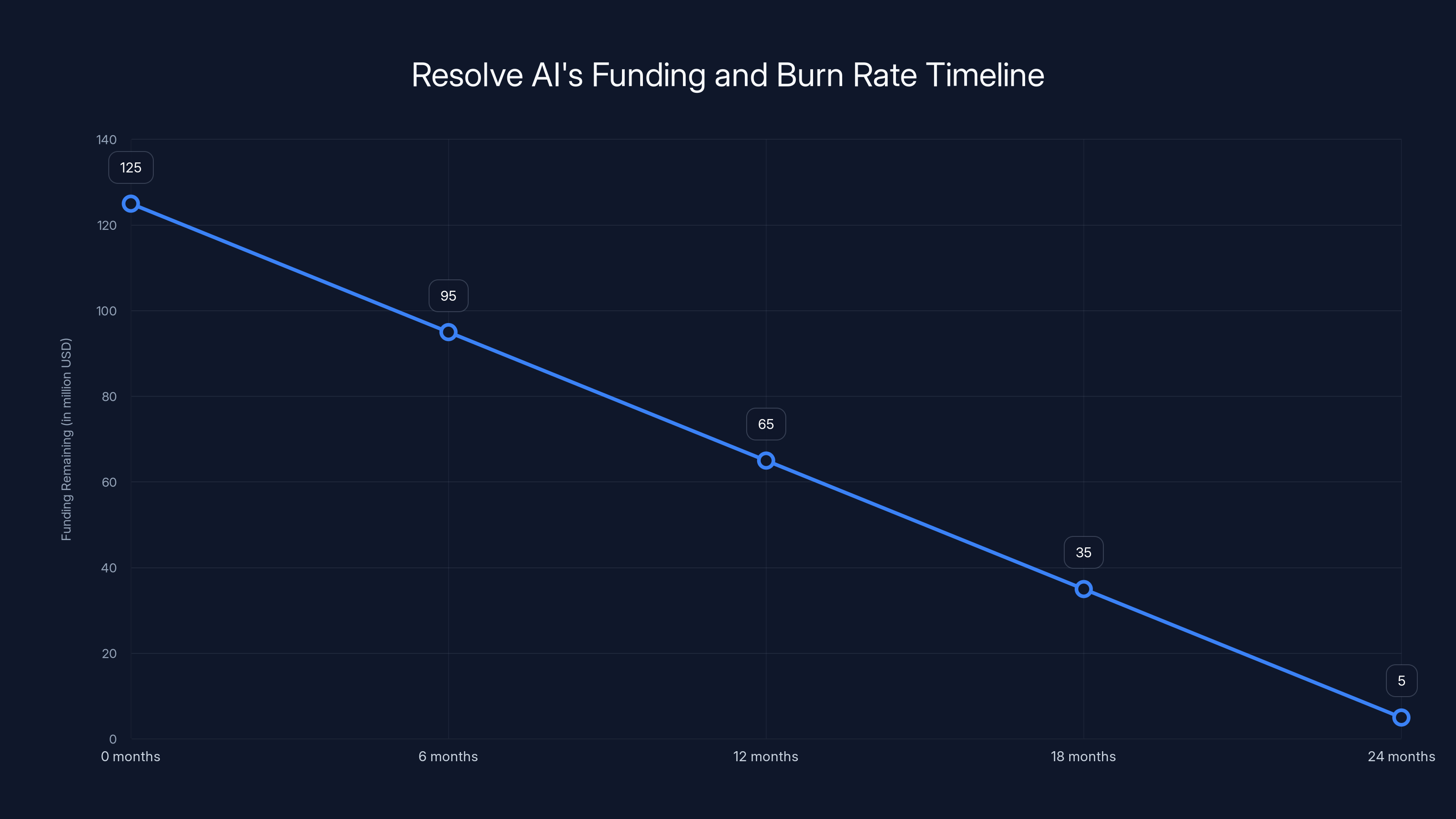

Resolve AI's valuation increased tenfold from

Who Is Resolve AI? Understanding the Founding Team

Resolve AI was founded in early 2024 by two people who've already proven they understand enterprise software and the Splunk ecosystem intimately. Spiros Xanthos and Mayank Agarwal are the founders, and their pedigree matters because it reveals something important about the company's strategic direction and credibility.

Xanthos and Agarwal previously co-founded Omnition, a startup focused on observability and monitoring. The company's strategic timing and technical focus caught the attention of Splunk, which acquired Omnition in 2019. This wasn't a small exit. Splunk was expanding its capabilities in a critical area. And Omnition's founders weren't just technical founders executing on someone else's vision. They understood the deep operational challenges that enterprises face when trying to understand what's happening inside their systems.

Why does this matter? Because when you're trying to automate system reliability engineering, you need founders who know the domain inside out. They need to understand the operational workflows. They need to know what actually matters to an on-call engineer at 2 AM. Xanthos and Agarwal have lived in that world.

After the Splunk acquisition, both founders experienced what it's like to be inside a large software company. They saw how the industry was evolving. They watched Splunk's product roadmap. They understood the gaps and limitations. And apparently, they saw an opportunity that felt big enough to leave and build independently.

The timing of Resolve's founding is interesting too. January 2024 was right in the middle of the AI boom. Large language models had matured enough to be practically useful in enterprise contexts. The infrastructure for fine-tuning and prompt engineering was becoming commoditized. And the SRE community was starting to ask serious questions about how AI could help with their hardest problems.

These aren't first-time founders. They're returning founders with credibility, domain expertise, and a clear vision of what they want to build. That signals to investors that this isn't a speculative bet. It's a calculated move by people who've already successfully navigated the acquisition process and now see a bigger opportunity.

What Is System Reliability Engineering (SRE) and Why Does It Matter?

Before we can understand what Resolve AI is solving for, we need to understand what system reliability engineering actually is. If you're not working in Dev Ops or platform engineering, this might seem like an abstract concept. It's not. It's probably the difference between your favorite apps working reliably and them crashing at the worst possible moments.

SRE is essentially the discipline of keeping complex systems running. But it's more sophisticated than that simple definition suggests. It's about proactively monitoring systems, identifying potential failures before they happen, triaging incidents when they do occur, understanding root causes, and preventing the same failures from recurring.

Traditionally, SRE has been a highly manual discipline. You deploy monitoring tools. You set up alerts. You define runbooks (step-by-step guides for responding to specific incidents). And then you staff a team of engineers who wake up in the middle of the night to follow those runbooks and fix problems. On-call rotations are brutal. The burnout rate is high. And the best SREs are fiercely competitive to recruit because there aren't many people willing to live with the stress and interruptions.

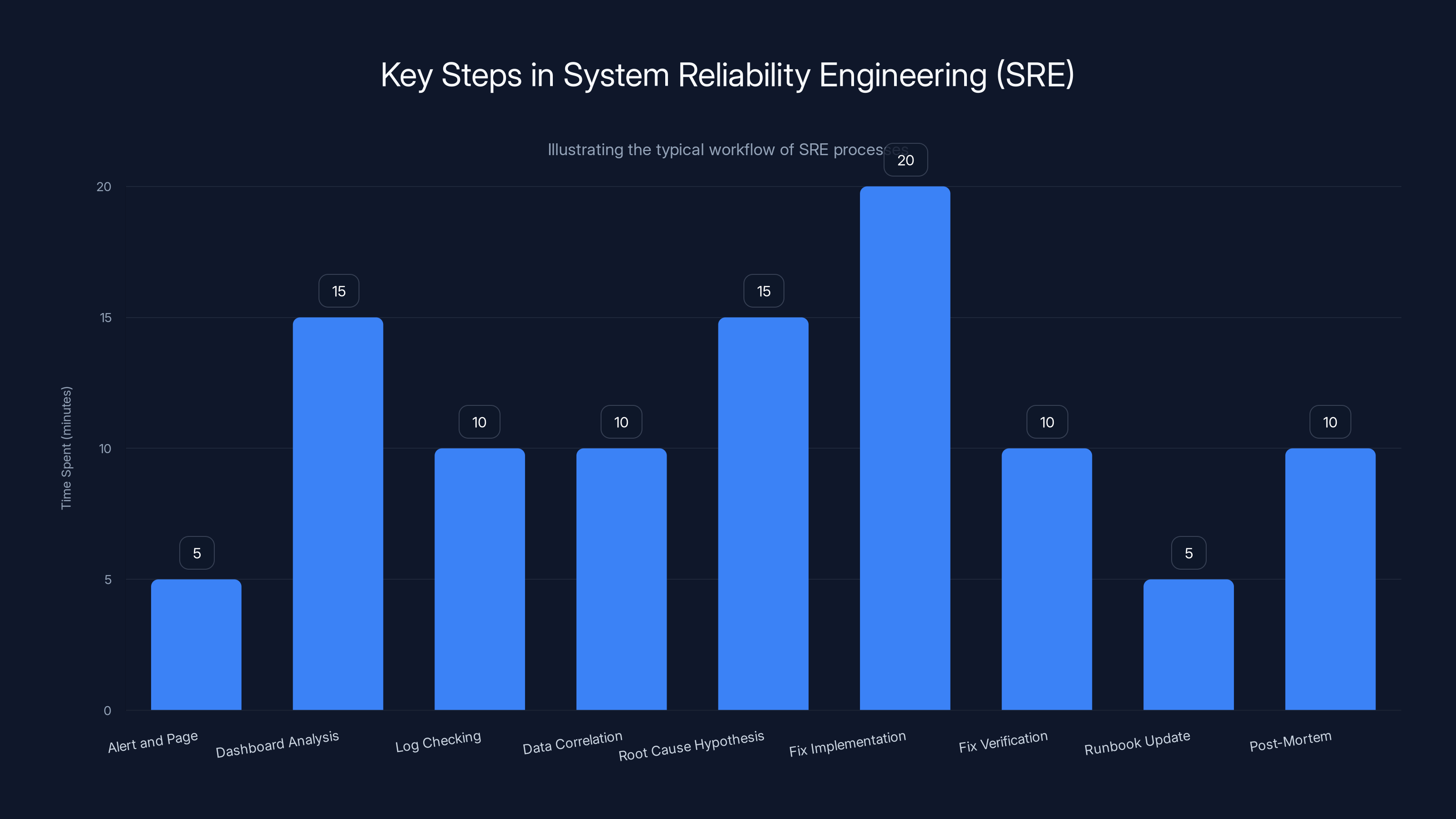

The problem compounds as systems get more complex. A modern cloud application might have dozens of microservices, hundreds of dependencies, and millions of potential failure modes. When something breaks, the incident response workflow looks like this:

- An alert fires (hopefully before customers notice)

- The on-call engineer gets paged

- They log in and look at monitoring dashboards

- They check logs across multiple services

- They try to correlate data to identify what actually broke

- They hypothesize a root cause

- They implement a fix

- They verify the fix worked

- They update runbooks or alerting rules to prevent recurrence

- They write a post-mortem to document what happened

Each step is time-consuming. Steps 3-6, the diagnostic phase, are often the longest. The engineer is essentially playing detective, sifting through data and trying to pattern-match against incidents they've seen before. Meanwhile, the system is still broken. Customers are experiencing issues. The pressure is mounting.

This is the inefficiency that Resolve AI wants to address. If AI could automate the diagnostic phase, suggesting root causes faster and more accurately than humans can identify them, the entire incident response timeline compresses. The on-call engineer becomes more effective. The system gets fixed faster. And critically, the engineer doesn't need to be as deeply specialized in every corner of the system to be effective.

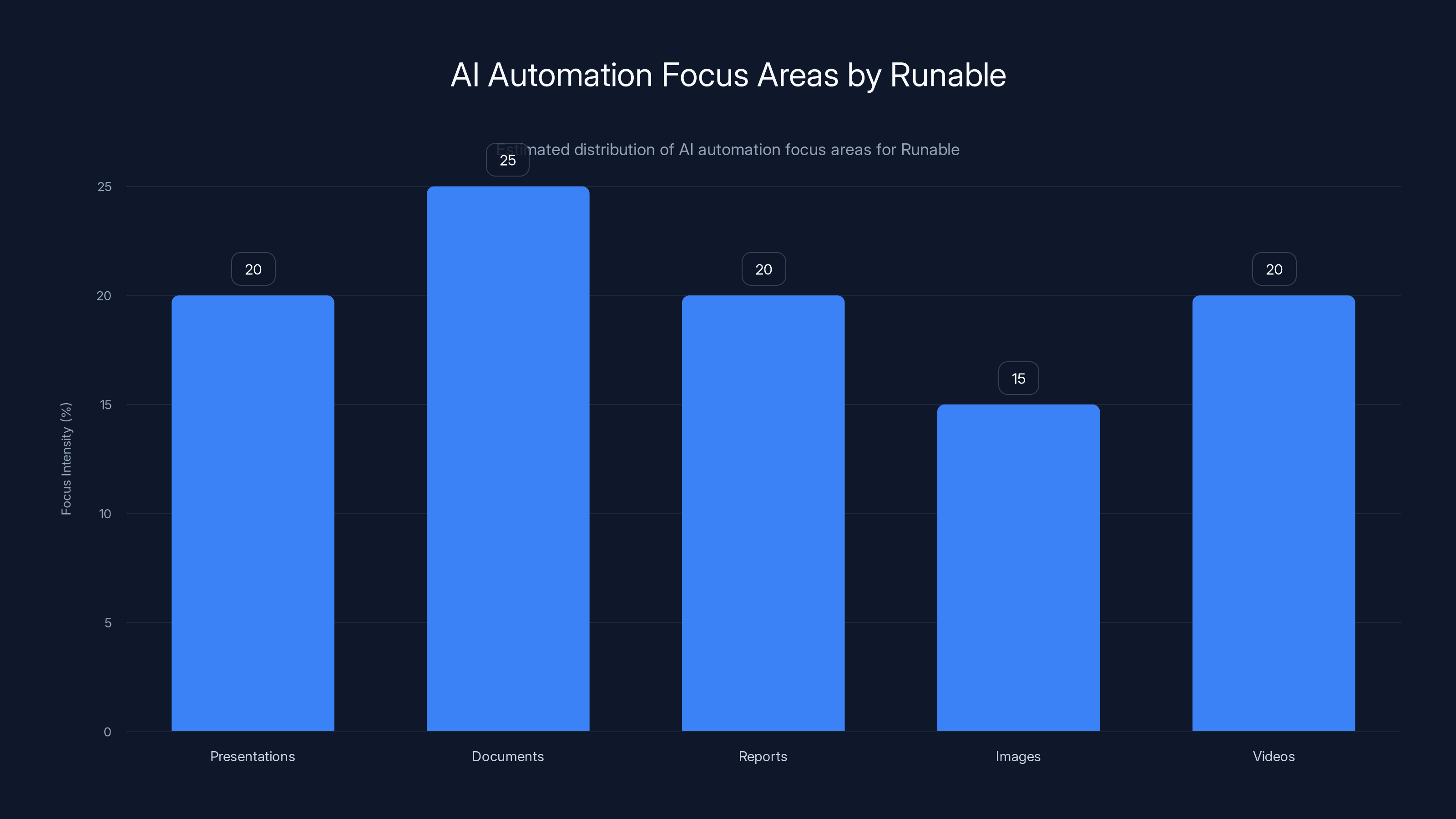

Runable's AI automation efforts are distributed across presentations, documents, reports, images, and videos, with a balanced focus on each area. (Estimated data)

The Market Opportunity: Why AI SRE Is Attracting Unicorn Valuations

For venture capitalists to bet

First, the sheer number of systems that need reliability engineering is massive and growing. Every organization with a cloud footprint now needs to manage system reliability. That includes enterprises, mid-market companies, startups, and even smaller organizations using complex third-party services. The total addressable market (TAM) for SRE tooling is enormous.

Second, the economic incentive is powerful. Downtime is expensive. Gartner and other analyst firms have estimated that enterprise downtime costs range from

Third, the labor problem is acute and getting worse. The SRE talent market is incredibly tight. Not only are experienced SREs hard to find, but they're also expensive and they burn out. If a tool could augment SRE capabilities or even partially automate incident response, the ROI is immediate. Companies would adopt it to either reduce headcount pressure or to make their existing teams more effective. Either way, they're capturing real value.

Fourth, the technical foundations have matured. Large language models have become sophisticated enough to understand context, follow logical reasoning, and generate helpful suggestions. The infrastructure for deploying these models in enterprise environments has commoditized. The vector databases, prompt engineering frameworks, and fine-tuning techniques are well-established. Building an AI SRE tool today is more feasible than it would have been two years ago.

Fifth, there's a timing element. Cloud computing has become the dominant computing paradigm. Observability tooling (the ability to monitor systems) has exploded. Companies like Datadog, New Relic, and others have built massive businesses around helping teams understand what's happening inside their systems. That creates a rich data environment that AI can learn from. The maturity of the observability market unlocks new possibilities for AI-powered automation on top of it.

Let's think about this in market size terms. The global Dev Ops and cloud platform market is worth tens of billions of dollars. SRE tooling is a subset, but it's a critical subset. If Resolve AI can capture even a small percentage of that market, the revenue opportunity is substantial. VCs aren't betting on Resolve becoming a niche player. They're betting it becomes a foundational tool in the SRE stack.

Competitive Landscape: Is This a Category or a One-Company Story?

One of the most important questions to ask about any venture-funded startup is whether the market opportunity is specific to that company or whether it's a broader category wave. If it's the latter, the startup faces more competition but also benefits from collective market education. If it's the former, the company needs to establish dominance quickly.

In Resolve AI's case, there's clear evidence this is a category moment, not just one company's opportunity. The most prominent competitor mentioned is Traversal, which is backed by Sequoia Capital, arguably the most prestigious venture capital firm in the world. Sequoia doesn't typically invest in companies attacking niche markets. When Sequoia backs a startup in an emerging category, it signals that the VCs believe the category itself is legitimate and worth investing in.

Traversal is also attacking the SRE automation problem, though potentially from a different angle or with different positioning. The existence of at least two well-funded competitors in this space suggests we're at the beginning of an industry wave.

But there are also broader competitors to consider, even if they're not explicitly in the "AI SRE" category. Splunk itself, with its massive installed base of customers and resources, is certainly looking at how to incorporate AI into incident response. Datadog, the market-leading observability platform, is also investing heavily in AI features. Large companies like Microsoft Azure and Amazon Web Services have the resources to build similar capabilities directly into their platforms.

So the competitive landscape looks something like this:

Direct Competitors (Pure-play AI SRE):

- Traversal (Sequoia-backed, competing in the same space)

- Various other emerging AI SRE startups likely in stealth mode

Platform Competitors (Large companies with SRE capabilities):

- Splunk (established player, Resolve's founders came from here)

- Datadog (market-leading observability with AI features)

- New Relic

- Dynatrace

- Cloud providers (AWS, Azure, Google Cloud)

Indirect Competitors (Tools that might handle parts of SRE):

- Incident management platforms (Pager Duty, Opsgenie)

- Monitoring tools (Prometheus, Grafana)

- Chat Ops platforms (Slack, Microsoft Teams integrations)

- Custom homegrown solutions

The competitive dynamics here are interesting. Resolve has several advantages: founder credibility, specific focus on the SRE problem, and the ability to move faster than large incumbents. But large incumbents have advantages too: installed user bases, trust, existing relationships, and resources.

Historically, when a large incumbent and a focused startup compete in an emerging category, the outcome depends on several factors. If the startup moves fast and the incumbent is slow to prioritize, the startup wins. If the startup solves the problem dramatically better, the startup wins. If the incumbent integrates the capability into its core product and leverages its distribution, the incumbent wins. Or, frequently, the incumbent acquires the startup.

Understanding the Funding: What the Numbers Tell Us

Let's parse the funding announcement itself, because the details matter and reveal interesting dynamics.

Resolve AI raised

The funding was led by Lightspeed Venture Partners, a top-tier venture firm with significant experience in infrastructure and enterprise software. Lightspeed typically leads rounds when they believe a company has found product-market fit or is close to it. They also typically expect to see companies reach scale within a reasonable timeframe.

The funding round included participation from existing investors, which tells us there was a previous funding round. The mentioned existing investors include Greylock Partners (legendary venture firm), Unusual Ventures, Artisanal Ventures, and others. This is a high-quality investor base. These aren't random angel investors. These are firms that have track records of backing successful enterprise software companies.

Now here's where it gets interesting. According to the Tech Crunch reporting, there was some ambiguity about the structure of the round. Some sources suggested the round might have consisted of multiple tranches at different prices, which would mean the blended valuation was actually lower than

Why does this matter? Because the structure of a funding round can reveal information about investor confidence and pricing dynamics. If multiple investors are buying at different prices, it suggests some investors had less conviction or had different views on the fair valuation. It could also suggest the company was more selective about which investors participated at which valuations.

But if truly 100% of the equity was purchased at $1 billion, it means all investors aligned on the same valuation. That's a strong signal of market consensus about the company's value.

Let's think about what

For math, if venture capitalists are buying at a

The AI SRE market is driven by system demand (30%), economic incentives (25%), labor shortages (25%), and technical maturity (20%). Estimated data.

The Product: What Does Resolve AI Actually Do?

Now let's talk about what Resolve AI actually does. Because at this point, we've covered the funding, the founders, and the market opportunity. But what's the actual product?

Based on the company's positioning and the category it's in, Resolve AI is building automation around the core workflows of system reliability engineering. At a high level, this likely includes:

Incident Detection and Classification: Using AI to understand what type of incident is occurring (database issue, network latency, memory leak, deployment problem, etc.) faster than a human would.

Root Cause Analysis: Using patterns in logs, metrics, and traces to hypothesize what actually caused the problem. This is traditionally one of the most time-consuming parts of incident response.

Automated Triage: Prioritizing which alerts matter and which are noise. Many systems generate thousands of alerts per day, and most of them are not actionable. AI that can filter signal from noise is incredibly valuable.

Remediation Suggestions: Rather than just identifying the problem, suggesting fixes. In some cases, this might mean auto-remediating (automatically taking corrective actions), but more commonly it means suggesting actions the human engineer should take.

Runbook Automation: Automating the execution of standard troubleshooting procedures. If the runbook says "restart the cache service," the AI could potentially do that automatically rather than requiring manual intervention.

Pattern Learning: Over time, learning from past incidents to improve future predictions and recommendations.

The specific mix of these capabilities and the details of how they work would depend on Resolve's proprietary implementation. But this is likely the general shape of what they're building.

One key architectural question is whether Resolve is building this as a standalone platform or as an integration layer on top of existing monitoring and observability tools. Most observability data lives in systems like Datadog, New Relic, Splunk, or others. Resolve probably needs to integrate deeply with those systems to access the data it needs to make intelligent recommendations.

This creates an interesting dynamic. Resolve benefits from the massive investment these observability companies have made in collecting and organizing data. But it also means Resolve is somewhat dependent on those companies' willingness to provide good APIs and data access.

Technical Architecture: How AI Powers Reliability Engineering

To understand how AI actually powers SRE automation, we need to think about the technical architecture and the specific machine learning and LLM techniques being used.

At the core, there are probably multiple AI approaches being combined:

Large Language Models (LLMs): Modern LLMs are excellent at understanding natural language and making logical inferences. When applied to logs and error messages (which are basically natural language), they can extract meaning and context. An LLM could read a log message and understand that a "connection timeout" coupled with "certificate validation failure" probably means an SSL certificate expired.

Time Series Analysis: A lot of the data in observability systems is time-series data (metrics that change over time). Machine learning models trained on time-series data can detect anomalies (deviations from normal patterns) and predict future trends. If a service's CPU usage suddenly spikes from 20% to 95%, time-series analysis can detect that anomaly and flag it.

Graph Analysis: Modern systems are interconnected webs of dependencies. Service A calls Service B which calls Service C. When something breaks, the problem often cascades through these dependencies. Graph-based analysis can model these relationships and help trace the root cause through the dependency graph.

Embeddings and Similarity Matching: By converting incidents, error messages, and logs into vector embeddings, AI can find similar past incidents and apply solutions that worked before. This is essentially pattern matching on steroids.

Rule-Based Systems: Not everything requires machine learning. Some incident response should be purely rule-based ("if X is true, do Y"). Modern systems combine ML with rules for the best of both worlds.

In terms of model architecture, companies in this space are probably using some combination of:

- Fine-tuned LLMs (taking a base model like GPT-4 or an open-source equivalent and training it on incident data)

- Multimodal models (processing text, metrics, traces, and other data types together)

- Ensemble methods (combining predictions from multiple models)

- Retrieval-augmented generation (RAG) (using similar past incidents to inform current recommendations)

The math behind these approaches is sophisticated. Imagine a model that takes dozens of input features (metrics, logs, service dependencies, historical incident patterns) and needs to output a probability distribution over possible root causes. That's a complex optimization problem.

One specific technique that's probably valuable here is prompt engineering. Even without fine-tuning, you can take a base LLM and use clever prompts to make it better at specific tasks. A well-designed prompt might say something like: "You are an experienced SRE with 20 years of incident response experience. Given these logs, metrics, and service dependencies, what is the most likely root cause?" That kind of prompt can significantly improve model performance without any fine-tuning.

The practical deployment of these models in production environments introduces additional complexity. You need to ensure models are inference-efficient (they run fast enough to be useful in real-time incident response). You need to handle drift (as systems change, past patterns become less predictive). You need to maintain human oversight (the AI suggests, but humans decide). And you need robust evaluation (how do you measure whether the AI's suggestions were actually helpful?).

The SRE Market Dynamics: Why Now?

There's a question worth asking: why is Resolve AI happening now? Why didn't this exist five years ago? The answer involves several converging trends.

Cloud Computing Maturity: Five years ago, many companies were still in the early stages of cloud migration. Today, cloud is the default. This means more complex systems, more moving parts, and more incidents.

Observability at Scale: The observability market has matured massively. Companies like Datadog have normalized the idea of collecting and analyzing massive amounts of operational data. That data is the fuel for AI-powered SRE automation.

LLM Sophistication: The capabilities of large language models have exploded in the last 2-3 years. They're now capable of understanding context and making nuanced inferences in ways that weren't possible before.

SRE Labor Shortage: The shortage of experienced SREs has become acute. Companies are struggling to hire and retain SRE talent. This creates strong economic incentive to automate.

Enterprise AI Acceptance: Enterprise customers are past the "is AI real?" question. They're now asking "how do we use AI to solve our specific problems?" That shift makes it much easier to sell AI-powered solutions into enterprise environments.

Open Source Maturity: The ecosystem of open-source tools for LLMs, embeddings, and inference has become robust. This lowers the barrier to building AI applications.

All of these trends had to align for Resolve AI to be viable. Even five years ago, with the same founders and the same idea, the market probably wasn't ready.

Estimated time allocation across typical SRE workflow steps highlights the complexity and time-consuming nature of maintaining system reliability.

Investor Signals: What Lightspeed and Others See

When a top-tier VC like Lightspeed Venture Partners leads a $125 million Series A, they're making a public statement about the investment thesis. Let's unpack what that statement is.

First, Lightspeed sees this as a category-level opportunity, not just a company-specific opportunity. They've clearly evaluated the total addressable market and concluded it's large enough to support a multi-billion-dollar company.

Second, Lightspeed believes Resolve has sustainable competitive advantages. Otherwise, they'd be worried about competition from Traversal or larger incumbents. The fact that they're willing to invest suggests they see defensible advantages (technology, team, market timing, etc.).

Third, Lightspeed is signaling confidence in the founders. Returning founders with successful exits are lower-risk bets than first-time founders. The track record matters.

Fourth, the size of the round ($125M for Series A) suggests Lightspeed sees this as a winner-take-most or winner-take-most market. When VCs write very large checks, they're betting the company will reach significant scale, not modest success.

Fifth, the participation of other high-quality investors (Greylock, Unusual Ventures) suggests this wasn't a solo conviction bet. This is multiple sophisticated investors aligning on a thesis.

There's also a competitive signal here. Lightspeed leading a Series A at

Implications for the Broader SRE Industry

Beyond Resolve AI itself, this funding round has broader implications for how SRE work is going to evolve.

SRE Skills Will Shift: If AI can handle root cause analysis and triage, the skills that matter most become different. Instead of needing engineers who are expert at reading logs and debugging, you need engineers who are good at training and validating AI models. This doesn't mean SREs become obsolete. It means the role transforms.

Consolidation Around Platforms: We're likely to see consolidation around integrated platforms that combine observability, incident management, and AI-powered automation. Companies won't want to stitch together 10 different point solutions. They'll want platforms.

Automation Levels Increase: Over time, we'll see more automation moving from "suggest a fix" to "implement a fix." This requires careful controls and testing, but it's coming.

Operational Transparency Becomes Mandatory: As AI gets better at analyzing operational data, companies will be more incentivized to instrument and monitor everything. The companies with the best observability will have the biggest advantage.

New Risks Emerge: AI-powered automation introduces new risks. What if the AI's recommendation is wrong? What if it conflicts with compliance requirements? Managing AI in safety-critical operations (because outages can have real consequences) becomes important.

Comparable Exits and Valuation Precedents

To understand whether a $1 billion Series A valuation is reasonable, let's look at what happened to similar companies.

Splunk: IPO'd in 2015 at around $20 billion market cap. Today worth significantly more. This is what companies in the observability and SRE space can grow into.

Datadog: IPO'd in 2019 at around

Pager Duty: IPO'd at around

Hashi Corp: IPO'd at around $15 billion valuation. Infrastructure automation is a huge market.

Given these precedents, a

Resolve AI has a projected runway of 25 months with a $5M monthly burn rate. They aim to demonstrate growth and raise Series B within 18-20 months. Estimated data.

Funding and Burn: The Path to Profitability

With $125 million in funding, Resolve AI has enough runway to build a substantial business. But what's the burn rate and path to profitability?

For a Series A company in infrastructure software, typical burn rates are anywhere from $2-10 million per month depending on the size of the team, compensation levels (San Francisco/Bay Area companies are expensive), and growth investments.

Let's do some math. If Resolve is burning

But here's the thing about venture capital math. The funding isn't really about runway per se. It's about being able to invest in growth (hiring, sales, marketing) while building the product and finding product-market fit. If Resolve uses this capital to hire a strong sales and marketing team and starts getting customers at a healthy CAC (customer acquisition cost) to LTV (lifetime value) ratio, they could be approaching profitability much faster than the runway suggests.

The infrastructure software category has strong unit economics when you get them right. High-touch sales with multi-year contracts and strong retention can lead to very profitable businesses at substantial scale.

How Companies Like Runable Are Thinking About AI Automation

While Resolve AI is focused on system reliability engineering specifically, there's a broader wave of AI automation across enterprise software. Platforms like Runable are demonstrating how AI can automate repetitive, high-value workflows across different domains.

Runable offers AI-powered automation for creating presentations, documents, reports, images, and videos, starting at just $9/month. The approach is similar to what Resolve is doing: take a domain that typically requires skilled humans, apply AI and automation, and dramatically reduce the time and effort required.

Where Resolve focuses on operations teams, Runable focuses on marketing, product, and business teams. But the underlying principle is identical: AI is becoming good enough to automate high-value work that previously required human expertise.

This suggests we're at the beginning of a broader trend. Across enterprise software, domain-specific AI automation tools are going to multiply. Each tool will become a unicorn candidate if it finds a large enough market. The venture capitalists who recognized the SRE opportunity are probably also looking for similar opportunities in other domains.

Use Case: Automate incident report generation and runbook documentation, letting your team focus on actual problem-solving instead of paperwork.

Try Runable For FreeThe Post-Mortems Problem: Why Automation Matters

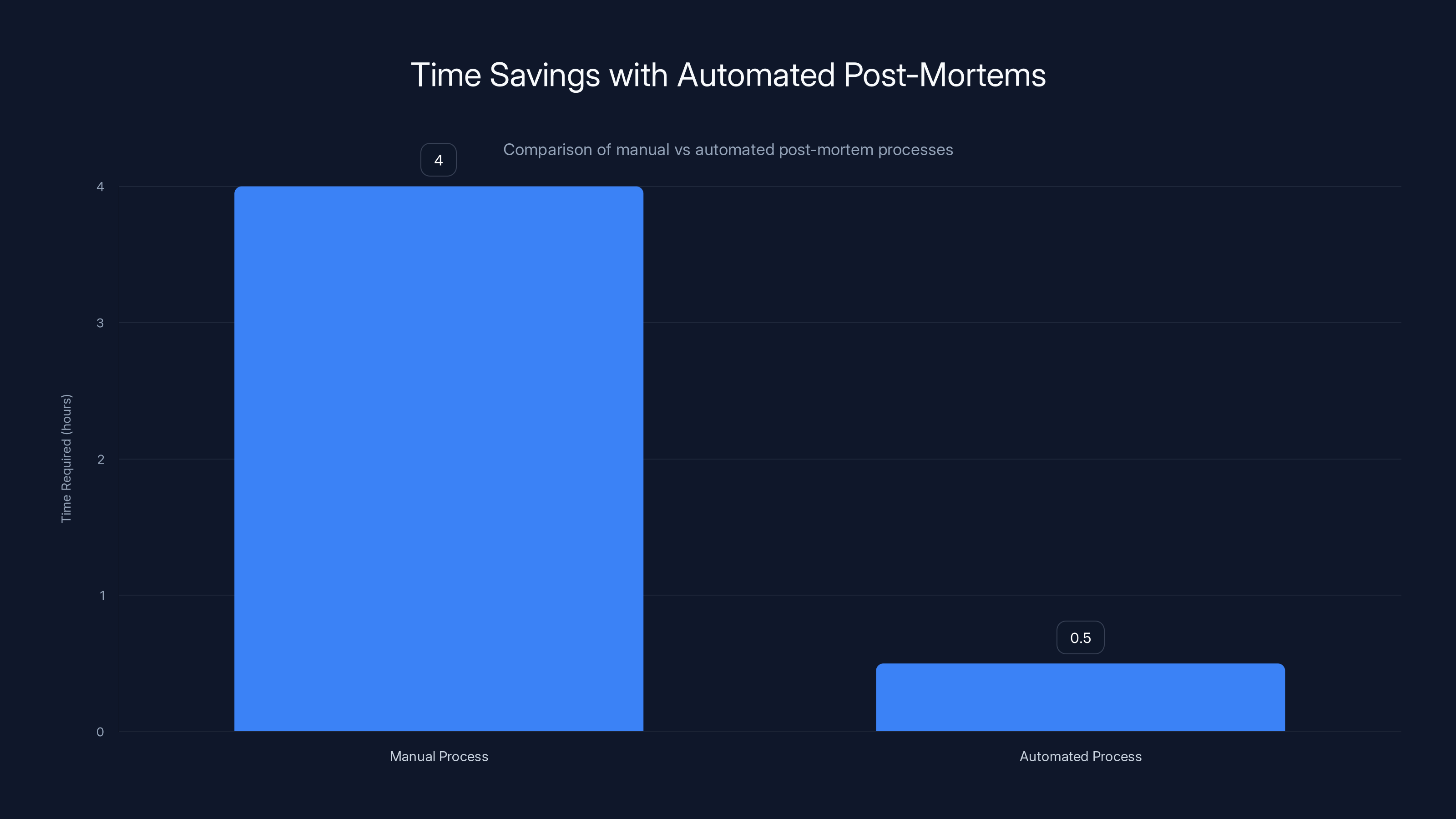

Here's a specific problem that Resolve AI and automation-focused tools solve well: the post-mortem problem.

After every significant incident, responsible teams conduct a post-mortem (root cause analysis review). This is a structured conversation where the team discusses what went wrong, why it went wrong, how they detected it, and what systemic changes prevent recurrence.

Post-mortems are important. But they're also incredibly time-consuming and require gathering data from multiple systems. Someone has to pull logs, extract metrics, annotate timelines, write up findings, and distribute the report. Even for a small incident, this can take 2-4 hours of engineer time.

Imagine if an AI system automatically gathered all the data needed for a post-mortem, identified the timeline, extracted key log entries, and drafted an initial analysis. The humans would still review it, validate it, and add judgment. But you've compressed 4 hours of manual work into 30 minutes of review and annotation.

Multiply that across a large organization that has dozens of incidents per month, and you're talking about hundreds of hours of engineer time freed up annually. At $200+/hour all-in cost for an engineer, that's significant savings.

But more importantly, the real value isn't the time savings. It's the learning. Better post-mortems lead to better prevention. Better prevention leads to fewer incidents. Fewer incidents means less on-call stress, fewer customer impacts, and ultimately, more reliable systems.

Automating post-mortems reduces the time required from 4 hours to 30 minutes, freeing up significant engineer time for other tasks. Estimated data based on typical scenarios.

Challenges Resolve AI Will Face

For all the promise of AI-powered SRE, there are real challenges Resolve AI needs to solve.

False Positives Are Expensive: If the AI recommends the wrong fix and the engineer implements it, that's worse than no recommendation at all. Building AI that the user trusts is hard. You need to get the accuracy very high before anyone will actually use your recommendations in production.

Explainability Matters: Engineers don't just need recommendations. They need to understand why the AI recommended something. If the system says "restart the database" but won't explain why, engineers won't use it. Building interpretable AI systems is harder than building accurate ones.

Customization Requirements: Every organization's systems are different. The AI needs to learn from their specific data. This requires easy onboarding and fine-tuning capabilities. Generic pre-trained models won't be good enough.

Integration Complexity: Resolve needs to work with dozens of different monitoring and observability platforms (Datadog, New Relic, Splunk, Prometheus, etc.). Each integration is engineering work. Getting all these integrations right is a massive undertaking.

Edge Cases: SRE work involves edge cases and novel problems. Machine learning is good at solving problems it's seen before. Novel incidents are harder. The system needs to gracefully degrade to "alert the human" mode.

Trust and Safety: As the system becomes more capable and starts auto-remediating (automatically fixing things), the stakes go up. A mistake could propagate across systems. Resolve needs to build in extensive controls and safety measures.

Regulatory and Compliance: Some organizations operate in regulated industries where changes to production systems need to be logged, approved, and auditable. Automation needs to respect these constraints.

The Competitive Response

We can expect existing players to respond to this threat and opportunity.

Datadog will likely build more AI-powered features into their platform. They already have the data. They have customer relationships. They can move relatively quickly.

Splunk has the resources and expertise. The founders came from Splunk, which means Splunk knows what Resolve is doing and has the option to build competitive features or acquire Resolve if it wants to.

New Relic and Dynatrace will also invest in this area.

Cloud providers like AWS, Azure, and Google Cloud may build AI SRE features directly into their platforms. They have the customers, the data, and the resources.

The likely outcome is a mix of these scenarios: some players build it themselves, some acquire startups like Resolve, and some partner. The market will be fragmented, with different approaches winning in different customer segments.

Customer Economics: Why They'll Buy

From a customer perspective, why would they adopt Resolve AI?

1. MTTR Reduction: MTTR (Mean Time To Recovery) is the gold standard metric for SRE. If Resolve can reduce MTTR by even 30%, that's immediately valuable.

2. Reduced On-Call Burden: If on-call engineers can resolve incidents faster or get better suggestions, they work fewer hours on incidents. This improves retention.

3. Scalability: A team with AI assistance can manage more systems than a team without it. This lets companies scale SRE operations without proportionally scaling headcount.

4. Consistency: Humans are inconsistent. Some incidents get thoroughly investigated. Others are handled with quick fixes. AI provides consistency.

5. Learning: The system learns from incidents and gets better over time. The longer a customer uses Resolve, the better it becomes for their specific systems.

These are compelling value propositions. Enterprise customers will pay premium prices for even modest improvements in these metrics.

Looking Forward: The 5-Year Trajectory

If we're right about the category and Resolve executes well, what might the next 5 years look like?

Year 1-2 (Current): Product development, early customer acquisition, establishing product-market fit. Resolve focuses on building the core automation capabilities and landing initial enterprise customers.

Year 2-3: Rapid customer growth as product stabilizes and word of mouth spreads. Likely Series B funding round at $2-3B valuation. Expansion into adjacent use cases (maybe broader platform reliability, not just SRE).

Year 3-4: Consolidation of market position. Likely acquisition by a larger player (Splunk, Datadog, etc.) or continued path to IPO if the company wants to stay independent.

Year 5+: At scale, either as an independent company approaching IPO or as a division of an acquirer.

These timelines are speculative, but they're based on historical patterns of how infrastructure software companies evolve.

What This Signals About the AI Startup Landscape

The Resolve AI funding round tells us several important things about the broader AI startup landscape in 2025.

First: Domain-specific AI is winning over generic AI. Nobody is funding Open AI competitors anymore. The money is going to companies that take AI and apply it to specific, valuable problems in specific industries.

Second: Enterprise AI is accelerating. The customers exist. The willingness to pay exists. The only question is execution. Venture capitalists are confident they can execute, which is why the checks are so large.

Third: The team matters more than the idea. Resolve is getting funded because Xanthos and Agarwal have proven they can execute in this domain. The same idea from first-time founders would struggle.

Fourth: Market timing is crucial. This could not have happened 5 years ago. The infrastructure (cloud, observability, LLMs) had to mature first. Now that it has, the opportunities are opening up.

Fifth: Unicorn valuations are more common but also more volatile. A

The Broader Automation Trend

Resolve AI is one data point in a much larger trend toward AI-powered automation across enterprise software. From customer service (chatbots) to sales (lead scoring) to finance (expense categorization), the pattern is the same: identify a high-value, repetitive task that requires human judgment, apply AI and automation, and dramatically improve efficiency.

The companies that win this game are going to create tremendous value. The venture capitalists who recognize the opportunities early and back strong teams are going to see outsized returns.

The people whose jobs are most affected (SREs, in this case) are going to need to evolve their skills and focus on higher-value work. This is disruptive in the short term but creates opportunities in the long term for those who adapt.

The Path Forward for Resolve AI

Resolve AI has validated the market opportunity and secured significant capital. The next phase is execution.

The key milestones are:

- Product stability: Make sure the AI is accurate and reliable enough for production use

- Customer traction: Land blue-chip enterprise customers and establish case studies

- Integration depth: Get seamless integration with all the major observability platforms

- Automation breadth: Expand from incident response to cover more SRE workflows

- Profitability path: Demonstrate a clear path to profitability (if that's the plan)

If Resolve executes on these, the company will almost certainly hit a Series B funding round within 18-24 months, likely at a

For founders, the win conditions are clear. For customers, the opportunity is equally clear: a tool that could transform how their operations teams work. For venture capitalists, the bet is on a massive category opportunity with experienced founders and strong market timing.

FAQ

What is Resolve AI and what does it do?

Resolve AI is an AI-powered platform that automates system reliability engineering (SRE) tasks. It helps identify root causes of system outages faster, suggests fixes for incidents, and helps SRE teams troubleshoot production issues more efficiently. Founded in early 2024 by former Splunk executives, the company uses machine learning and large language models to understand what's breaking in systems and recommend how to fix it.

Why did Resolve AI raise $125 million at a unicorn valuation so quickly?

Resolve hit unicorn status ($1 billion valuation) in a Series A because the combination of experienced founders, a large market opportunity, strong product-market signals, and perfect timing created investor confidence. The SRE automation market is massive, the founders have proven track records, and large language models have just matured enough to make this kind of automation practical. Top-tier VCs like Lightspeed Venture Partners believe the company can grow into a multi-billion-dollar business.

How does Resolve AI compare to its competitors like Traversal?

Both Resolve and Traversal (backed by Sequoia Capital) are attacking the same AI SRE automation market from similar angles. The exact competitive differentiation comes down to product specifics, team capabilities, and go-to-market strategy. Having multiple well-funded competitors actually validates that this is a real category opportunity rather than a single company's success story. Ultimately, both could succeed by serving different customer segments or use cases.

What is system reliability engineering and why is it such a big market?

System Reliability Engineering (SRE) is the discipline of keeping complex software systems running reliably. It involves monitoring systems, responding to incidents, understanding root causes, and preventing future failures. It's a big market because every modern company runs on complex systems, downtime is expensive, SRE talent is scarce and expensive, and there's strong demand for tools that automate or improve SRE workflows. The market opportunity is estimated at tens of billions of dollars.

Will AI automate SRE jobs out of existence?

Not entirely. AI will change the nature of SRE work significantly, making routine diagnosis and triage faster, but SRE as a discipline will remain critical. The work will shift from "debug this outage" to "train and validate AI models" and "decide when to trust automation." Additionally, novel incidents, systems architecture decisions, and engineering judgment will still require human experts. SREs who adapt and learn to work effectively with AI will remain in high demand.

What's the path to profitability for Resolve AI at a $1 billion valuation?

For an infrastructure software company at Resolve's scale, profitability typically comes through a combination of happy path assumptions: capturing a significant portion of the SRE automation market, achieving strong unit economics (customer acquisition cost relative to lifetime value), and leveraging the AI platform across multiple use cases. With

How does AI actually help with incident response?

AI helps incident response by analyzing logs, metrics, and system dependencies to identify patterns humans might miss, correlating data across multiple systems to pinpoint root causes faster, suggesting relevant previous incidents and their solutions, automating routine diagnostics and triage, and in some cases, executing remediation steps automatically. The net effect is reducing MTTR (Mean Time To Recovery), reducing on-call burden, and improving system reliability overall.

Why are venture capitalists so excited about Resolve AI?

VCs are excited because several trends align perfectly: cloud computing and system complexity have created massive demand for SRE tooling, LLMs have matured enough to be practical for specific enterprise problems, the SRE labor shortage creates willingness to pay, the founders have proven track records, and the category shows signs of becoming a winner-take-most market where the leader could be worth $10-50B. These are the ingredients for a venture capital "home run."

What are the biggest risks for Resolve AI?

Key risks include: execution risk (building AI that's accurate and trustworthy enough for production use), competitive response from larger incumbents like Splunk or Datadog, integration complexity (needing to work with dozens of monitoring platforms), customer adoption challenges (changing how teams work is hard), and the possibility that the market opportunity proves smaller than anticipated. Additionally, any high-profile failures of AI recommendations could damage customer trust and slow adoption.

How is this part of the broader AI automation trend?

Resolve AI is one example of a category-level trend where AI is being applied to specific, valuable enterprise problems. Other examples include AI for customer support, sales forecasting, financial analysis, and document generation. The common pattern is: identify a high-value task requiring human expertise, apply large language models and machine learning, automate routine decisions, and dramatically improve efficiency. Resolve is specifically targeting the SRE domain, but the same approach is being applied across enterprise software.

Final Thoughts: The Moment We're Living In

Resolve AI's

For SRE teams, this is a moment of transformation. The tools available to manage system reliability are about to get dramatically more powerful. For venture capitalists, this is an opportunity to back what could become a multi-billion-dollar company in an emerging category. For enterprises, this is the beginning of a shift in how operations work.

The next few years will tell whether Resolve actually executes on the promise or whether the valuation was overblown. But even if Resolve itself stumbles, the category of AI SRE automation is real. Other players will emerge. The market will grow. The infrastructure software industry is in the midst of an AI-driven transformation, and we're still in the early innings.

For anyone building, investing in, or using enterprise software, this is a moment worth watching closely.

Key Takeaways

- Resolve AI achieved unicorn status (125M Series A led by Lightspeed Venture Partners, signaling major investor confidence in AI SRE automation

- The company was founded by two Splunk veterans whose previous startup (Omnition) was acquired in 2019, bringing credible domain expertise to SRE automation

- AI SRE is an emerging category with multiple well-funded competitors (Traversal backed by Sequoia), indicating this is a genuine market wave, not just one company's success

- System reliability is increasingly mission-critical, expensive to maintain manually, and creating $billions in total addressable market opportunity for AI-powered automation

- Large incumbents like Splunk, Datadog, and cloud providers will likely compete aggressively, potentially through acquisition or building competitive features

Related Articles

- A16z's $1.7B AI Infrastructure Bet: Where Tech's Future is Going [2025]

- ElevenLabs 11B Valuation [2025]

- Nvidia's $100B OpenAI Gamble: What's Really Happening Behind Closed Doors [2025]

- Notepad++ China Hack: What Happened & How to Protect Yourself [2025]

- Microsoft's Security Leadership Shift: What Gallot's Return Means [2025]

- Infostealer Malware Now Targets Mac as Threats Expand [2025]

![Resolve AI's $125M Series A: The SRE Automation Race Heats Up [2025]](https://tryrunable.com/blog/resolve-ai-s-125m-series-a-the-sre-automation-race-heats-up-/image-1-1770243018299.jpg)